How to find a child trust fund

How to find lost Child Trust Funds and manage savings

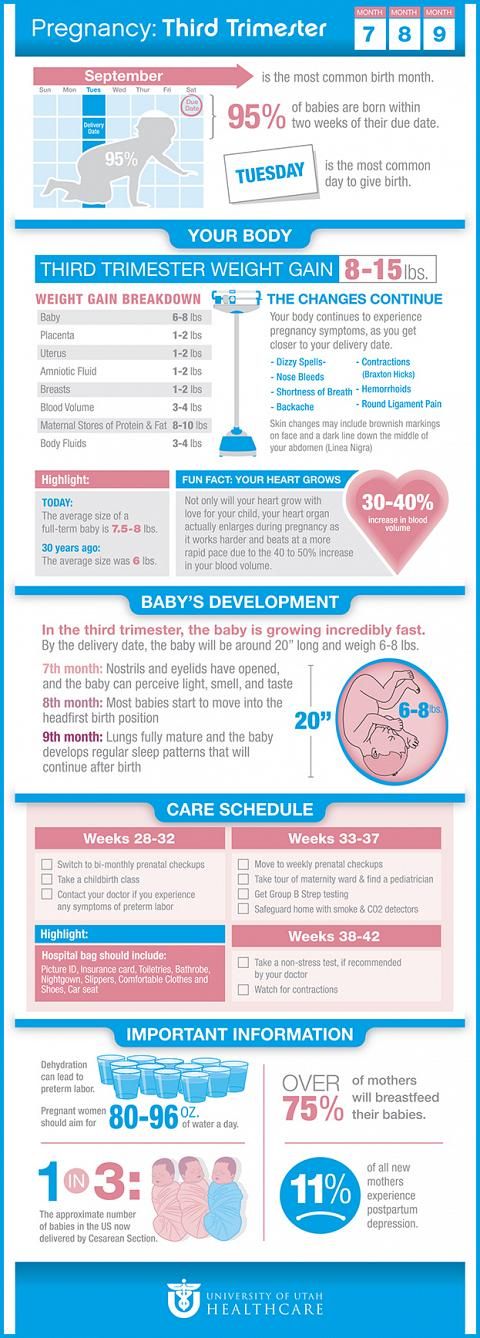

More than 114,000 teenagers in the UK could be missing out on the opportunity to unlock their share of £171.4 million worth of savings in Child Trust Fund accounts, according to new research from investment platform Hargreaves Lansdown.

The first Child Trust Fund accounts were launched in 2005 and made available to all children in the UK born between 1 September 2002 and 2 January 2011. They began to mature on 1 September 2020, as the first recipients turned 18. Since then, around 720,000 of the 6.3 million registered Child Trust Fund accounts have matured.

After accounts mature, the owners gain full control of the money. They can choose to withdraw their savings or transfer them into an adult savings account or ISA.

Unfortunately, an estimated one million people are out of touch with their Child Trust Fund accounts and may not receive notification that they have savings waiting to be withdrawn. This means that teenagers in the UK could be missing out on a windfall. The average Child Trust Fund account has a holding of £1,500.

While some account holders may have lost track of their funds when they changed addresses, others may be unaware that one was opened in the first place. Around 30% of Child Trust Fund accounts were set up on behalf of children by HM Revenue and Customs (HMRC). But some parents and guardians may have missed the notification that an account was opened for their child.

We want to help connect people with their funds. Here, we explain how a Child Trust Fund works, how to trace a lost Child Trust Fund (or find out if you, or your child, have one) and what savings options are available for matured Child Trust Fund accounts.

What is a Child Trust Fund?

A Child Trust Fund is a long-term, tax-free savings account offered to children born between 1 September 2002 and 2 January 2011. They were introduced by the government to encourage parents and guardians to save for their children’s future. The government contributed £250 towards each Child Trust Fund account, or £500 for low-income households, on opening the account and then another £250 or £500 on the child’s seventh birthday.

New accounts are no longer available, as Child Trust Funds were replaced by Junior ISAs (JISA).

Up to £9,000 can be saved into an existing Child Trust Fund each year until the account matures. The financial year for a Child Trust Fund starts on a child’s birthday and ends the day before their next.

Anyone can deposit into a Child Trust Fund, including parents, grandparents and guardians.

The child named on the account can start to manage their Child Trust Fund from the age of 16. They will gain full access to the account once they turn 18 and can start to withdraw money or move their savings to another type of account.

There are three types of Child Trust Fund accounts:

- Cash Child Trust Funds: Hold cash and pay interest on the total amount of savings.

- Stakeholder Child Trust Funds: Invest money on the stock market with additional rules such as a maximum charges cap.

- Shares-based Child Trust Funds: Invest in stocks and shares but without additional stakeholder CTF rules.

» MORE: Find out how to choose the best child savings account

Finding a lost Child Trust Fund

With one million Child Trust Fund accounts estimated to be missing, you are not alone if you think you’ve lost the details for one.

Tracking down an account is really simple: you can trace a lost Child Trust Fund online by submitting a request form on Gov.uk.

You will need a Government Gateway ID and password before you can fill out the form. It only takes a few minutes to set up an account if you don’t already have one.

If you are a parent or guardian looking on behalf of your child, you will need one of the following details:

- The child’s unique reference number (which can be found on the annual Child Trust Fund account statement).

- The child’s National Insurance number.

If you are looking for your own trust fund, your National Insurance number is all you’ll need.

HMRC usually sends a response about your account within three weeks of your request.

Don't worry if you can't find your unique reference number or don't have a National Insurance number, you should still be able to submit a request through Gov.uk, while some Child Trust Fund providers offer an online search tool.

Should you transfer a Child Trust Fund to a Junior ISA?

Child Trust Funds were discontinued in 2011 and replaced by Junior ISAs. A Junior ISA is a tax-free savings account for children under the age of 18.

It is important to note that you can only transfer a Child Trust Fund to a Junior ISA before a child turns 18. Once the Child Trust Fund matures on their 18th birthday, they will have to transfer the money to another savings product, such as an adult ISA.

There are two types of Junior ISAs for children:

- Cash Junior ISA: Only lets you save cash.

- Stocks and shares Junior ISA: You can invest in stocks and shares without paying tax on the capital or dividends you receive.

Your child can open one or both types of Junior ISA. In the 2021/22 tax year, up to £9,000 can be saved into a Junior ISA and anyone can pay into the account. This £9,000 limit is across all JISA product types your child may have and not per account.

In the 2021/22 tax year, up to £9,000 can be saved into a Junior ISA and anyone can pay into the account. This £9,000 limit is across all JISA product types your child may have and not per account.

It may be worth transferring a Child Trust Fund to a Junior ISA if you are not happy with the interest you earn on the account or the provider fees are more than you want to pay.

If your child’s Child Trust Fund is invested, then check whether there will be any exit fees if you transfer.

Junior ISAs tend to pay higher interest and there is more product choice available.

What happens when a Child Trust Fund matures?

A Child Trust Fund matures when a child turns 18. This means that they will have total control over the money in the account.

Although it may be tempting to spend the cash, a Child Trust Fund could be a great first step towards long-term financial goals, such as:

- Saving for a mortgage deposit

- Starting a rainy day fund

- Buying a car

- Saving for retirement

There are several savings products that could help young savers once they turn 18 years old:

- Cash ISA: A cash ISA is a tax-free savings account that lets you save up to £20,000 each financial year.

- Stocks and shares ISA: Stocks and shares ISAs allow you to save up to £20,000 in investments in each financial year tax-free. You can also combine a cash ISA with a stocks and shares ISA up to £20,000.

- Lifetime ISA: A Lifetime ISA (LISA) is a tax-free savings account designed to help people who are 18 and over but under 40 save for retirement or to buy their first home.

- Savings accounts: There are lots of different types of savings accounts, including easy access and regular accounts, that let you earn interest on your money.

» MORE: Is an ISA or savings account better for your finances?

WARNING: We cannot tell you if any form of investing is right for you. Depending on your choice of investment your capital can be at risk and you may get back less than originally paid in.

Image source: Getty Images

Child trust funds | MoneyHelper

A Child Trust Fund is a savings account for children born between 1 September 2002 and 2 January 2011. They’ve since been replaced by Junior ISAs, but those with existing Child Trust Fund accounts or vouchers can still keep their accounts and pay in.

Find out more about how a Child Trust Fund works and what you could do with the funds in your account if you have one.

What’s in this guide

- What is a Child Trust Fund and who has one?

- Finding a Child Trust Fund account

- How a Child Trust Fund works

- Types of Child Trust Fund

- Adding money to the account and family member payments to a Child Trust Fund

- What about Child Trust Funds and young people with disabilities?

- If you want to change the Child Trust Fund account that HMRC set up for you

- What is a Junior ISA and should I switch my Child Trust Fund into one?

- I’m 18 or over and have a Child Trust Fund.

What should I do with the money in it?

What should I do with the money in it?

What is a Child Trust Fund and who has one?

A Child Trust Fund (CTF) isa long-term tax-free saving account for children. They were designed to encourage children to become savers for their future adult life. You cannot apply for a new CTF because this government scheme is now closed but you can keep an existing CTF. CTF’s were available to all children born in the UK whose parents were awarded Child Benefit between 1 September 2002 and 2 January 2011.

All money earned on the CTF is tax-free, including capital gains, interest payments and any other money earned on the account. This means all the money in the fund belongs to the account holder and none of it will be lost in tax deductions.

The first CTFs matured in September 2020, when the oldest account holders turned 18. The last CTFs will mature in 2029. On maturity, CTFs s can either be cashed in or transferred into an adult ISA.

On maturity, CTFs s can either be cashed in or transferred into an adult ISA.

If you’re 18 or over and have money in a Child Trust Fund, find out more about your options

Back to top

Finding a Child Trust Fund account

Child Trust Funds can be lost to the young person they were set up for. This can be because HMRC set up the account with a starter payment amount on their behalf (if the parents didn’t open one), or because it has been forgotten and the parents have not updated their address.

However, lost accounts can easily be located. You can find out where a lost Child Trust Fund, even if you don’t know the provider.

If you already have a Government Gateway user ID and password, you could fill in the HMRC online form at GOV.UK (Opens in a new window)

HMRC will send you details of the Child Trust Fund provider by post within three weeks of receiving your request.

Alternatively, you can use the Share Foundation to help you find your Child Trust Fund account for free (Opens in a new window). You might find this useful if your provider has changed or if you grew up in care.

Back to top

How a Child Trust Fund works

When CTF’s became available, HMRC sent the parents or guardians of qualifying children a starting payment voucher of £250 (or £500 if you were on a low income). This voucher could then be used to set up a Child Trust Fund account in the child’s name.

If you didn’t use the voucher within one year, HMRC would set up a Child Trust Fund account in your child’s name on your behalf.

Money in a Child Trust Fund account belongs to the child and is ‘locked in’ until they turn 18.

When a child or young person turns 16 years old, they can legally take over responsibility for their Child Trust Fund account and can make decisions about the fund (such as switching to another provider or transferring it to a Junior ISA). They can do this by contacting their Child Trust Fund provider.

They can do this by contacting their Child Trust Fund provider.

When the account-holder turns 18 years old, they can access and withdraw the money in their Child Trust Fund account.

Back to top

Types of Child Trust Fund

There were three types of account that could be opened with the voucher:

1. Cash Child Trust Fund

This is where you can make deposits just as you would for a bank or building society account, which can earn tax-free interest.

2. Stakeholder Child Trust Fund

This is where the savings in the account are put into a wide mix of stock market investments. There are a set of rules to reduce financial risk (including that the money would gradually be moved to lower-risk investments when the child reaches 13 and a cap on the annual charge).

Stakeholder Child Trust Funds are charged based on the value of the fund and capped at a maximum charge of 1.5% a year.

A child will have a stakeholder Child Trust Fund account, opened by HMRC on the child’s behalf, if their parent(s) failed to open a Child Trust Fund account within a year of receiving a payment voucher.

3. Shares-based Child Trust Fund

This is where most or all the money is invested in shares, but without the protections of a stakeholder account. The savings in the account could be put into the stock market via an investment fund of your choice or select your own investments.

Back to top

Adding money to the account and family member payments to a Child Trust Fund

Anyone can pay money in to a CTF including parents, family members and friends. This is up to a total limit of £9,000 (2022/23) each year, with the child’s birthday considered the start of the year.

The amount of money in a child’s Child Trust Fund doesn’t affect any benefits or tax credits the child’s parent/guardian receives.

Child Trust Funds for Children in Care

Some children looked after by local authorities have a Child Trust Fund account set up on their behalf.

If a child has been in the care of a local authority and was born between 1 September 2002 and 2 January 2011, they could have a Child Trust Fund account.

The Share Foundation acts as the registered contact for Child Trust Fund accounts for children and young people who are care-experienced and manages them for the child or young person. The Share Foundation run both the Child Trust Fund and the Junior ISA schemes for children and young people in care.

The Share Foundation will write to the account holder about two months before they turn 16, telling them how to become the registered contact for their Child Trust Fund account.

Back to top

What about Child Trust Funds and young people with disabilities?

Some young people with a disability might not have the mental capacity to manage the money in their Child Trust Fund.

If your child doesn’t have mental capacity, then you as their parent(s)/carer(s) will need to apply to the Court of Protection to act as your child’s Deputy.

A Deputy is someone, usually a family member, who is appointed by the court to manage and make day-to-day decisions about someone’s finances. Without this, you won’t be able to manage the account when your child turns 18. This is because they legally become an adult and the money belongs to them.

At the moment, applying to the Court of Protection can be expensive. This is because there’s a court fee of £365 – and legal costs, if a solicitor is used. There might also be delays to the process due to the coronavirus pandemic.

It’s important to get legal advice if you want to apply to the Court of Protection so you understand all of the options. Solicitors might provide you with a free initial discussion.

However, the government announced on 1 December 2020 that all parents or guardians of children or young people who lack mental capacity can ask for court fees to be waived or refunded when seeking access to a Child Trust Fund.

Back to top

If you want to change the Child Trust Fund account that HMRC set up for you

If HMRC set up a Child Trust Fund account for your child, you can change to a Child Trust Fund provider or account of your choice. You can do this at any time.

Make sure you ask providers about any fees charged for running the account. Also ask about making further contributions. You can pay as little as £10 into a stakeholder account, but some providers might require larger payments for other accounts.

If you’re looking to change your Child Trust Fund provider, also be wary of scams, which are designed to get hold of your money and can come in many forms.

Back to top

What is a Junior ISA and should I switch my Child Trust Fund into one?

An alternative to switching Child Trust Fund providers is to switch your Child Trust Fund into a Junior ISA.

If you have a Child Trust Fund you can’t have a Junior ISA at the same time. But you can transfer your Child Trust Fund into a Junior ISA.

You don’t have to transfer a Child Trust Fund into a Junior ISA. However, a Junior ISA can work out better for your child’s savings in the long term.

Junior ISAs generally offer more choice and better value, whether it’s higher interest rates on their cash accounts or lower annual fund management charges.

You can’t transfer back to a Child Trust Fund when you’ve switched to a Junior ISA. So it’s important to check that you’re getting the best possible deal in terms of investment returns and fees.

So it’s important to check that you’re getting the best possible deal in terms of investment returns and fees.

Back to top

I’m 18 or over and have a Child Trust Fund. What should I do with the money in it?

If you’re 18 years old or over, you can access the money in your Child Trust Fund account.

To access the money you will need to contact your Child Trust Fund provider. If you don't know who that is, read the section above on 'Finding a Child Trust Fund account'.

It’s your money, and it’s up to you what you do with it.

One option to consider is to continue saving your money. This could be by, for example, transferring your money into an adult savings account or an adult ISA. As your savings build up, they’ll grow faster – so your money makes money.

You might want to save regularly and build up your fund for a deposit towards a property purchase or a rental deposit.

The money in your Child Trust Fund could also provide an excellent foundation for building a ‘rainy day fund’ to make sure you have money available for emergencies or sudden expenses.

Putting money away now means you’re covered for an expense you didn’t see coming, reducing your need to borrow. For example, if you were to suddenly lose your job, need a new phone or need emergency dental treatment – that’s when a rainy day fund would be handy.

What happens when my Child Trust Fund matures?

If you have a Child Trust Fund but do not inform your provider what you would like to do with the money in it when it matures, the money will be held in a 'protected account' until you contact your provider.

Interest earned on funds in a 'protected account' will remain tax-free, and any terms and conditions that applied to your Child Trust Fund before it matured will still apply.

Back to top

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

Family trust - how to create a trust fund in Russia

This article will be of interest to wealthy Russians and residents of the CIS who need to create a trust fund. It describes a very simple way to quickly create a reliable family trust abroad.

This can be done in just a few days with the help of a special financial contract, detailed below. This decision will immediately protect the family's financial assets from claims by third parties, increasing the capital created year after year. nine0003

It is also important that this contract allows you to effectively pass on the inheritance to the next generations of the family. And at the same time, what is important - without paying inheritance taxes.

Finally, the contract allows you to make partial withdrawals of funds from the created fund at any time. These may be occasional withdrawals, or regular annuities to meet the family's running expenses. And even so, the capital in the trust is able to grow. Detailed calculations can be found in the article below.

And even so, the capital in the trust is able to grow. Detailed calculations can be found in the article below.

Why you need a family trust

How to create a dynastic trust in Russia

Trust fund for children with Manulife Global Generation

Financial parameters of a family trust

How to deposit money into a trust

Sources of capital growth

How you can use the money of a trust

How does a trust fund work when investing an amount of 1.000.000 USD

How to start a family trust fund MGG

Wealthy people have long sought a solution to two important problems. And the first task is to secure your assets. nine0003

After all, creditors, business partners, former spouses and the state, for various reasons, can claim the assets that a person owns. And if you somehow refuse to own assets, while retaining control over them, then it will be impossible to foreclose on these assets.

The second important task is the transfer of assets to the next generations of the family. Children, and then grandchildren and great-grandchildren.

Children, and then grandchildren and great-grandchildren.

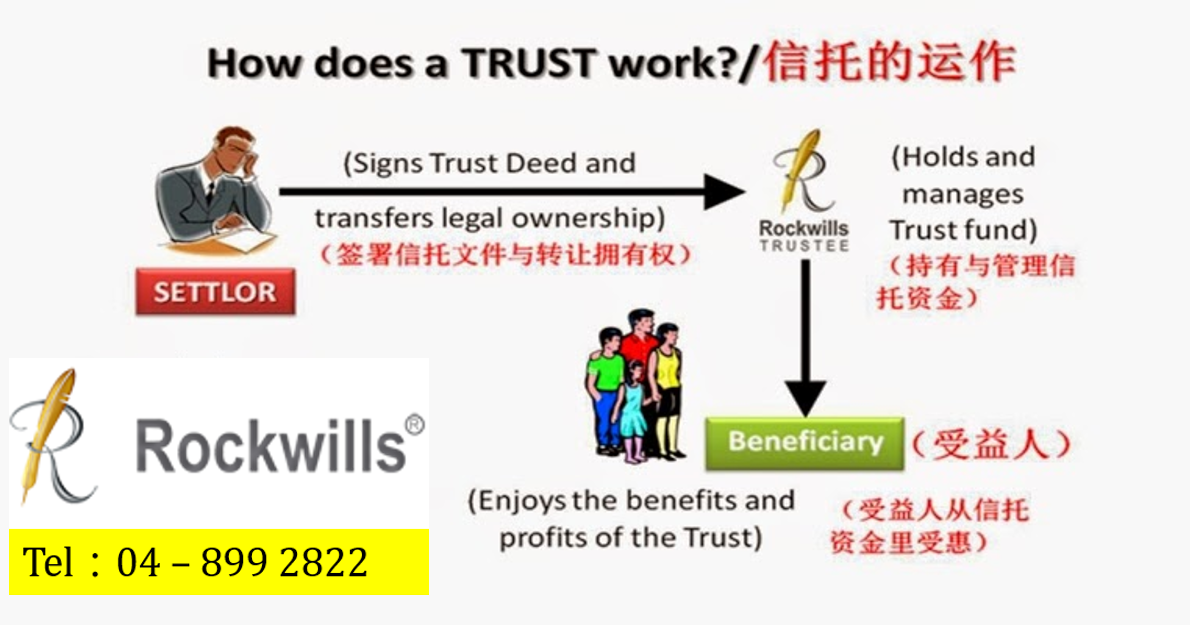

It is these two tasks that the classical trust fund solves. To do this, the founder transfers assets to the trust, and thereby ceases to own them. This is how the first task of protecting assets is solved. You cannot deprive a person of what does not belong to him. nine0003

The trustee will then manage the trust. And he will carry out this management in the interests of the beneficiaries, who were appointed by the founder of the trust.

And when the trust terminates, then all the property constituting it passes into the possession of the beneficiaries. Thus, solving the problem of transferring assets to the next generations of the family.

However, the classical implementation of this approach is not so simple. Because the legislation on trust funds is very complicated.

In addition, the work of family trust must be paid for. This can be quite a decent amount of fixed, annual expenses - which will have to be paid for decades. And in this regard, the question arises - is there an easier way to create your own trust fund in Russia? nine0003

And in this regard, the question arises - is there an easier way to create your own trust fund in Russia? nine0003

Yes, there is a way. And it is suitable for those cases when it is necessary to transfer the capital of the family to the family trust. Let me emphasize that we are talking about financial resources. Different solutions will be needed to protect and transfer physical property to children.

An easy-to-implement trust fund to protect family wealth and pass it on to the next generation - described later in this article.

You can use a special insurance contract to create a family trust. Which was specifically designed to protect and increase the financial assets of the family. And also - to most effectively transfer the accumulated wealth to the next generations of the family. nine0003

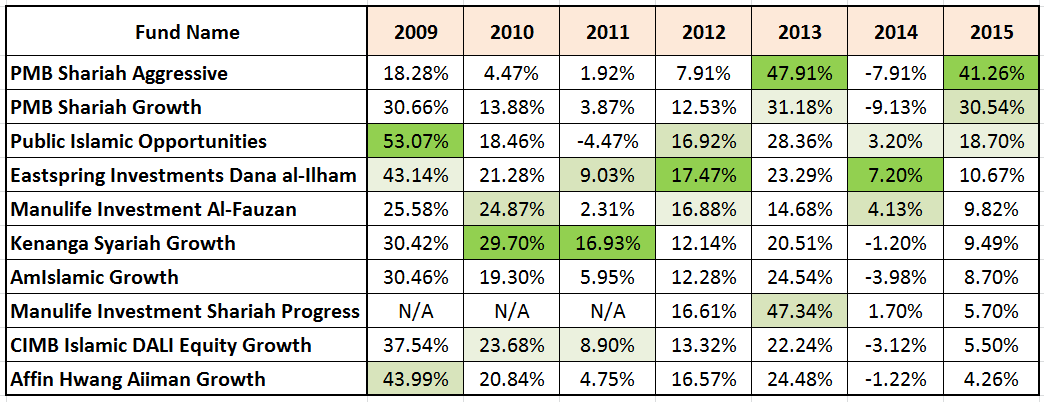

This contract is offered by the renowned Canadian company Manulife. It is one of the largest financial companies both in Canada and worldwide. Which has high ratings from leading rating agencies. To isolate, protect and increase the family capital, Manulife has developed a special contract, which is called the Manulife Global Generation (MGG).

To isolate, protect and increase the family capital, Manulife has developed a special contract, which is called the Manulife Global Generation (MGG).

Play my video about how this contract allows you to create a family trust:

Let's look at the main features of this contract to understand how it allows you to create a family trust fund.

Manulife Global Generation is a life insurance contract. After the opening of the contract, its owner contributes to the plan those funds that he would like to place in the family trust fund.

Manulife pays annual dividends on the funds contributed to the contract. Since quite significant amounts usually come into the family trust, over time, the capital in the contract begins to grow noticeably. nine0003

This is due to the constant accrual of dividends on invested funds. Which over time begin to increase capital exponentially. This is how the problem of increasing the funds that make up the family fund is solved.

This is how the problem of increasing the funds that make up the family fund is solved.

How is family wealth protected in a trust fund for children? Legally, the Manulife Global Generation contract is a life insurance policy. Therefore, funds in this policy cannot be foreclosed due to third party claims. This ensures the protection of financial assets belonging to the family. nine0003

And most importantly, if we are talking about generational planning. How can this tool be used to transfer assets to future generations of the family?

The Manulife Global Generation contract has a unique option for this. It allows you to change the insured person. And the number of such replacements is not limited. What does this mean for long-term financial planning purposes?

Let's say at 45 the head of the family opened the MGG plan. And he contributed a large amount there to create a trust fund for children and grandchildren. 30 years have passed - and during this time the invested capital has grown many times (below, the draft contract with real numbers is discussed in detail). nine0003

nine0003

And then, at the age of 75, the father decided to give his son the funds accumulated in the family trust. As well as the management of this capital.

To do this, the father only needs to give an order to change the insured person. And when the son becomes insured instead of the father, he will already become the full owner of all the funds accumulated in the contract. And he will appoint his son as the beneficiary of the family trust - who is the grandson of the original owner of the contract.

Having become the owner of the contract, the son will be able to manage the created capital and spend it if necessary. And when the son becomes mature, he will be able to transfer ownership of the policy and the accumulated capital to the grandson of the original owner of the contract. To do this, the son will replace the insured person in the contract with the grandson. Which in turn will change the beneficiary to a great-grandson. nine0003

So, placing family capital in a special Manulife Global Generation policy allows you to protect capital from third-party claims, increase capital through accrued dividends and interest on them - as well as effectively transfer the inheritance to the next generations of the family.

Such a contract can last 121 years. Please note that 121 is NOT the maximum age for the person who originally opened the contract. This is the maximum duration of the contract from the date of its opening. nine0003

Thus, the capital of the family can be reliably protected by this contract for more than a century, passing by inheritance from father to son. And increasing due to accrued dividends and interest on invested funds.

A policy can be passed down many times from generation to generation. And for the 121-year period of its existence, to meet the needs of three, four - and maybe five generations of the family.

Let's take a closer look at how this happens.

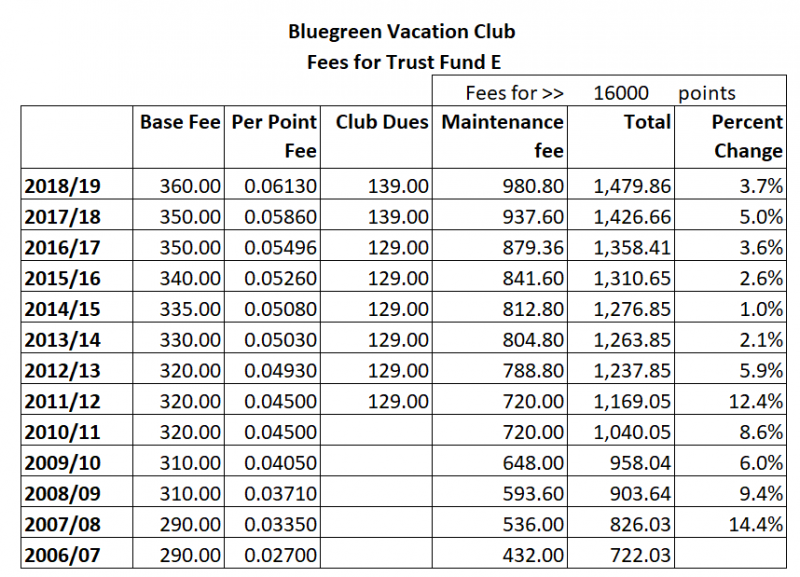

You can see the most important financial parameters of this contract on the slide below - and then I will comment on them:

basic parameters of the MGG family trust plan

The contract has a minimum contribution amount, as well as a maximum investment in the contract. The minimum contribution to this plan is 500,000 USD. This amount can be paid in a lump sum. Or - at the request of a person, it is divided into 5 or 10 annual payments into a contract.

The minimum contribution to this plan is 500,000 USD. This amount can be paid in a lump sum. Or - at the request of a person, it is divided into 5 or 10 annual payments into a contract.

The maximum plan contribution for a one-time payment is $7,500,000. If a person plans to make annual contributions to the contract, then the total contribution should not exceed 20,000,000 USD. nine0003

The policy can only be opened in US dollars. The age of a person at the time of issuing the policy with a lump-sum payment should be from six months to 75 years. For 5-year installments, the age of the applicant must be from 6 months to 70 years, and for 10-year installments, the age of the contract holder must be from six months to 65 years.

There are three ways to contribute to your Manulife Global Generation family trust. The first option is a one-time contribution of the entire amount of capital to the contract. Along with this, installment payments for 5 years, or for 10 years are possible. nine0003

nine0003

For example, the contract owner would like to set up a trust fund for children and contribute $1,000,000 to it. If this amount is already available, then it can be contributed to the plan by a single transfer of a million dollars to your insurance contract.

If the entire amount is not available at the moment, then a person can open a contract with contributions in installments for 5 years. And each year contribute 200,000 USD to your contract.

Finally, you can choose a 10-year installment plan. And then in the next 10 years it will be necessary to contribute 100,000 USD annually to the plan. nine0003

Fee payment scheme must be selected before contract issuance. Once the policy is issued, it will no longer be possible to change the funding option of the policy.

Manulife Global Generation is a participating life insurance policy. The term "participating" means that Manulife distributes the profit received from the investment of contributions among clients in the form of insurance dividends.

Dividends are accrued in accordance with Canadian law on profit-sharing accounts under life insurance. According to the law, in the form of insurance dividends, the insurer is obliged to distribute among customers 97.5% return on investment. And only 2.5% of declared dividends can be used for administrative expenses of the insurer.

It should be noted that the contract does not guarantee the amount of insurance dividends. Therefore, the amount of dividends may vary from year to year due to the current level of interest rates, the situation in the financial markets and the results of Manulife's investments.

The current insurance dividend is around 4% in US dollars. Which is quite a lot compared to interest rates on deposit accounts, which actually tend to zero. nine0003

Dividends are declared annually. And after the accrual of dividends, the profit received becomes part of the savings of the insurance contract.

In addition to dividends, the owner of the contract also receives interest on the paid dividends, which also increases the amount of savings in the family trust fund. Interest is accrued on all dividends that are accumulated in the policy.

Interest is accrued on all dividends that are accumulated in the policy.

Finally, the policy provides for a terminal bonus. The amount of this payment is not guaranteed, and it is made at:

- expiration of the policy (121 years have passed since the issuance of the contract), or

- cancellation of the policy - the person decided to terminate his policy and take all the savings in the contract, or

- the death of the insured.

The terminal bonus also increases the final savings in the contract. And as an indicative value, because this parameter is not guaranteed, the terminal bonus is indicated in the draft contract. Which we will discuss below. nine0003

Easily implemented through a Manulife Global Generation contract, the Family Trust Fund provides several options for accessing the funds placed in it.

Over time, the MGG policy has the potential for very significant savings. And you can use these tools in the following ways.

- Withdrawals from accumulated dividends

Dividends accrued annually are the most important source of growth in the cash value of the policy. If desired, the owner of the contract can withdraw all or part of the accrued dividends. And use these tools to solve current problems. nine0003

- Loans against the cash value of the policy

The policyholder may at any time request a loan from the company against the cash value of the policy. And then a certain percentage will be charged on the loan taken.

The difference from the previous method is that when taking a loan, a person does not reduce the amount of accrued dividends in his policy. And therefore, interest will be charged by the insurer on all dividends accumulated in the policy. But at the same time, the owner of the contract will need to pay interest on the use of the loan taken from the insurance company. nine0003

The interest rate on a loan varies over time and may change at any time. Loans and their interest rates are reflected in the cash value of the policy. However, this will in no way affect the payment of dividends and their accumulation.

Loans and their interest rates are reflected in the cash value of the policy. However, this will in no way affect the payment of dividends and their accumulation.

- Partial Withdrawals

The policyholder may also make partial withdrawals from his contract. In this sense, a policy is a lot like a bank account. Part of the funds contributed to the insurance policy can be withdrawn without terminating the contract. nine0003

The minimum amount of a loan or partial withdrawal from the policy is 10,000 USD.

- Cancellation of the policy

Finally, the contract holder can cancel the policy at any time and receive all the money accumulated in the policy. However, it is worth remembering here that in the first few years after the policy is issued, its redemption amount may be less than the contributions made to the contract.

Let's look at an example of how a family trust fund created with the help of Manulife Global Generation can work with a one-time investment of $1,000,000. I explain the numbers below in detail in my video - include my story:

I explain the numbers below in detail in my video - include my story:

Prior to the issuance of the contract, each client receives a draft policy, which reflects the guaranteed values and expected parameters of the policy.

The project below is for a 45 year old:

Let's briefly review the tenth year of the plan. This line is underlined in red.

The first two columns are guaranteed plan parameters. The company is required by law to provide them to the customer. The company guarantees that the contract will work no worse than these values. Which are calculated in the most negative scenario - financial markets are falling, interest rates are extremely low, investments bring minimal income. nine0003

In this scenario, the guaranteed amount of savings in the tenth year of the policy is 1.046.805 USD. And the payment on the death of the owner of the contract this year will be exactly the same. Above, these numbers are highlighted in blue.

Above, these numbers are highlighted in blue.

In fact, the probability of such a scenario is extremely small. It is most likely that the contract will work as described on the right side of the table. Manulife calculates the expected savings in the contract based on the results of previous years. Assuming that similar results will be obtained in the future. However, it must be remembered here that the results of the right-hand side of the calculation are only assumed. And they are not guaranteed by contract. nine0003

So, assuming that after 10 years of the contract, the amount accumulated in the contract will already be 1.344.302 USD. And the payment at the death of the owner of the contract this year will be exactly the same amount. In the calculations above, these numbers are marked with a green rectangle.

However, 10 years for such contracts is a very short time. After all, it is intended for several generations of the family. And so we would be interested to see how the plan works for longer periods:

We see that after 20 years the money put into the contract more than doubles. And now let's see what capital will be created in the policy by the 75th anniversary of the person who opened the contract:

And now let's see what capital will be created in the policy by the 75th anniversary of the person who opened the contract:

We see that this capital will presumably amount to 3.772.868 dollars. Which, without paying inheritance taxes, a person can easily and quickly transfer to his child. Simply by changing the insured in your Manulife Global Generation contract. nine0003

This money will never leave the family. They are in a family trust fund. Which is managed by the person who is currently the insured person.

Let's not forget that the money accumulated in the policy can be used. For example, the contract owner can withdraw the necessary amount from the plan at a time. Or create an annuity to secure a retirement income. Which, if we wish, will not end with the death of the original owner of the contract. This will happen if he passes the policy to the next generation in advance. nine0003

A similar scenario is shown on the slide below:

A person opened a trust fund with Manulife Global Generation and invested a one million dollar lump sum into the plan at one time. After that, 21 years passed, and the owner of the contract ended his career.

After that, 21 years passed, and the owner of the contract ended his career.

And starting from the 22nd year of the contract, the person began to withdraw from the plan an amount of 118,048 dollars annually. To secure your retirement annuity. Later, at some point, the person passed this contract to his child. And from that moment on, the child is already the beneficiary of the family trust. nine0003

When the father passed away, the child continued to withdraw funds from the contract in the amount of $118,048 annually to pay for current needs. And so it went on for 70 years (!) in a row - from the 22nd to the 92nd year of the existence of the policy. Then the withdrawals from the contract ceased.

Thus, during these 70 years, 8,263,360 dollars were withdrawn from the policy by the family. As a result, by the end of the 92nd year of the policy in the contract, even with such significant withdrawals, it is expected that 10,824,073 dollars will be accumulated. Which in 20 years, by the end of the policy, will turn into 28. 121.664 dollars of savings belonging to the family. nine0003

121.664 dollars of savings belonging to the family. nine0003

That's what an invincible cash flow can create for your family with proper financial planning, and the use of modern financial tools.

As already mentioned, Manulife Global Generation is legally a life insurance policy. This contract is opened in a standard way by submitting an insurance application to Manulife.

There is a very important and positive moment here. The Manulife Global Generation application does not include any questions about the health status of the prospective client. How is it that life insurance companies always ask their future clients about their health status? nine0003

The fact is that life insurance in our usual sense is not actually in the contracts of Manulife Global Generation. This contract is designed to manage the wealth of the family for many generations. And it is clothed in the legal form of life insurance because this form of contract is most convenient for solving the tasks facing it.

After all, the payment on the death of the insured is actually equal to the capital that has already been created in the contract. Therefore, Manulife Insurance does not bear any financial risk in connection with the death of the owner of the contract. And in this regard, the future client does not need to answer questions of a medical nature, as well as undergo a medical examination before issuing a Manulife Global Generation contract. nine0003

In fact, when opening a contract, its owner opens a special account in an insurance shell for a period of 121 years. And puts on it funds that will pass from generation to generation of the family. Therefore, the age and health of the account holder does not play any role here.

In this regard, the parameters of the contract will not depend on the age of the insured. The figures in the draft policy for both the baby and the mature person will be the same.

And since no medical examination is required before the policy is issued, the contract is issued very quickly. The processing of the submitted application takes 2-3 days, and then within a maximum of 5 working days the company will decide on the issuance of the policy. Thus, the creation of a family trust will take approximately 7 working days. nine0003

The processing of the submitted application takes 2-3 days, and then within a maximum of 5 working days the company will decide on the issuance of the policy. Thus, the creation of a family trust will take approximately 7 working days. nine0003

And a few words about the cost of setting up a family trust fund with Manulife Global Generation. To create a family trust, you only need to apply to Manulife. And then deposit the desired amount into the contract at a time or in installments.

Let me remind you that the contribution to the contract can range from 500.000 USD to 20 million USD. At the same time, all the funds contributed to the plan constitute the savings of the family, on which dividends and interest are accrued year after year.

There are no additional costs associated with this approach to establishing a family trust.

To sum it up

Manulife Global Generation is a handy tool for quickly and at virtually zero cost to create a family trust fund to protect and grow wealth - and to pass it on to the next generations of the family. I hope that by the end of the article you already understand how to create a trust fund in Russia for a child.

I hope that by the end of the article you already understand how to create a trust fund in Russia for a child.

Manulife Global Generation gives you the opportunity to plan for the future of the family for several generations to come. And allows wealth to accumulate under the protection of the policy. The transfer of assets to the next generation is accomplished by simply replacing the insured. There are no inheritance taxes involved. There is no limit to the number of such replacements, so family wealth can be passed on to many subsequent generations. nine0003

The cash value of the policy increases significantly over the years. And the family has several ways to use these funds. This may be the withdrawal of accrued dividends, a loan secured by the cash value of the policy, partial withdrawals from the contract, or cancellation of the policy with the receipt of all funds accumulated in the contract.

This is a very convenient solution for wealthy people who are interested in generational planning and the transfer of created assets to children and grandchildren. With the help of the Manulife Global Generation contract, you can instantly create a family trust with a significant cash fund. And to ensure its protection, as well as reliable investment of funds - so that capital grows in the interests of future generations. nine0003

With the help of the Manulife Global Generation contract, you can instantly create a family trust with a significant cash fund. And to ensure its protection, as well as reliable investment of funds - so that capital grows in the interests of future generations. nine0003

And if you need advice on the topic and a draft contract, just write to me in a convenient messenger to arrange our online meeting:

Vladimir Avdenin,

financial consultant

The article uses materials from Joseph Lazerson ( Joseph Lazerson)

Read more:

how to open a trust fund bank account in 2021 - expert guidance

There are many ways to secure the financial future of your loved ones. Starting a trust fund is a great way to help your children and everyone you care about achieve financial success in the future. nine0003

A trust account is also not usually reserved for the very wealthy. In fact, regardless of your net worth, you can set up a trust fund to ensure that your loved ones manage and distribute your assets in a certain way.

Most banks have trust departments where consumers can open a trust account. A trust fund account allows an individual or entity to manage account assets on behalf of a third party or beneficiary, such as for college tuition or property taxes. nine0003

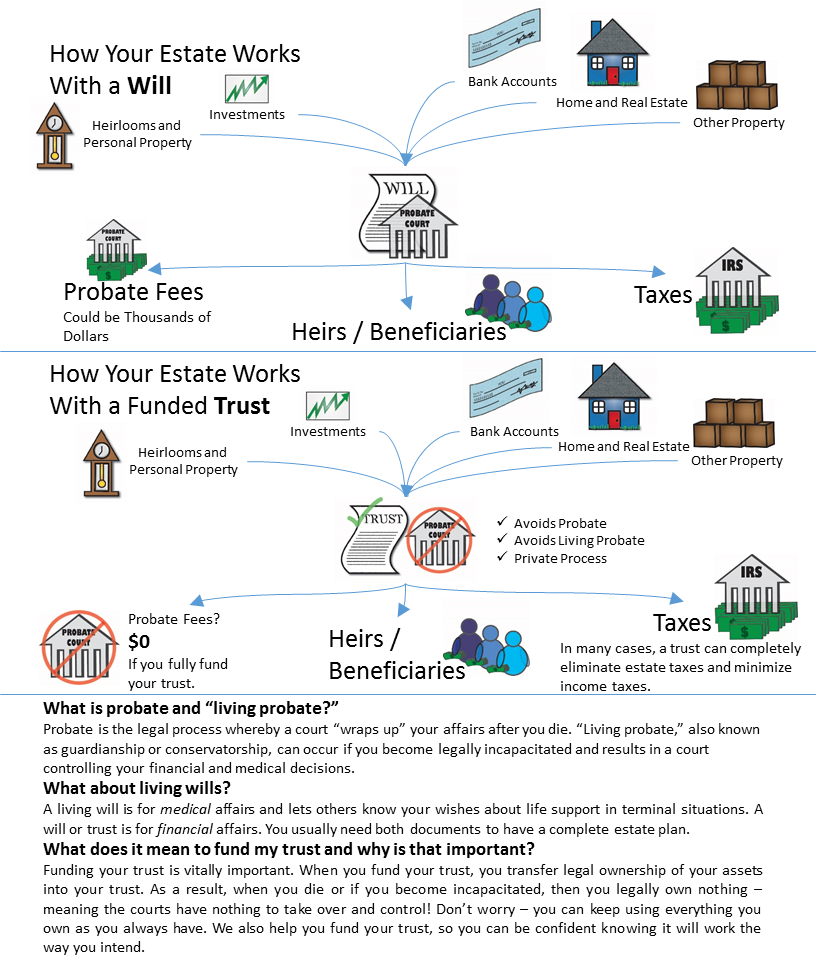

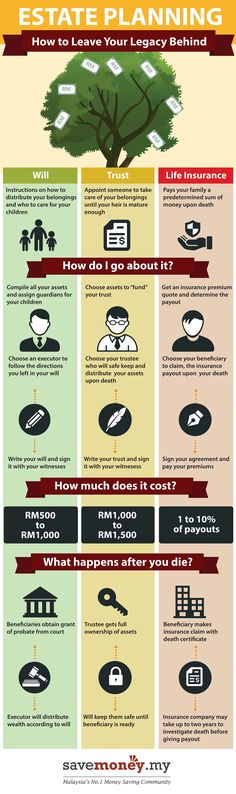

One of the most significant benefits of a trust account is that it allows the settlor of the trust, known as the "grantor", to determine his own rules for handling and distributing his assets to beneficiaries. Wills, which can be costly and time-consuming, are often avoided with trust accounts.

In this post, we'll look at what a trust is, who the parties to a trust are, why you might need one, and how to set up a trust. nine0003

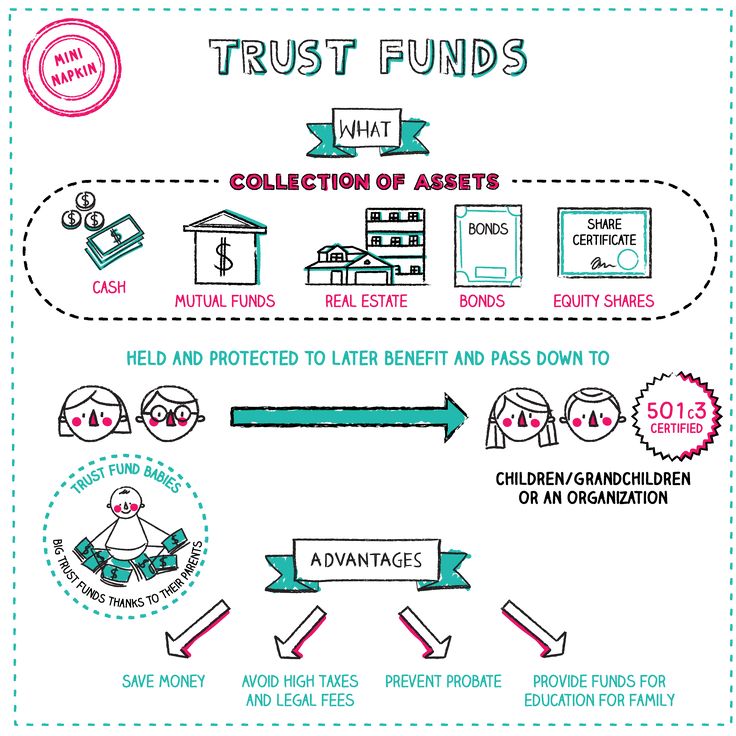

What does a trust fund mean?

A trust can be defined as a relationship arising whenever a person known as a trustee is compelled by equity and law to hold property received from the grantor for the benefit of other persons or some authorized entity known as the beneficiary .

A trust fund is also defined as an agreement in which a person gives the other party the legal authority to manage their assets for the benefit of another person. The instrument of a trust fund can be real estate, bonds, mutual funds, or even stocks. nine0003

The instrument of a trust fund can be real estate, bonds, mutual funds, or even stocks. nine0003

The person creating the trust is called the settlor, and the person for whom it is created is called the beneficiary. Trust funds can be formed for charities or causes you care about, not just your children.

Read also: What is a trust account? Overview and operation

How does a trust fund work?

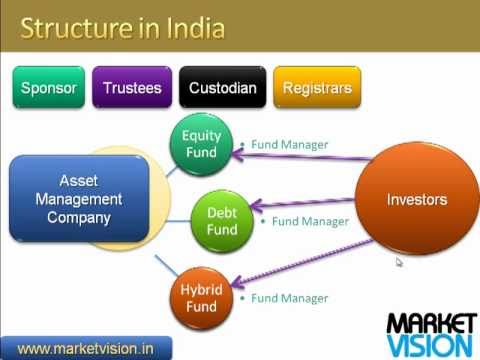

There are three persons in a trust fund: the trustee, the trustee and the beneficiary. A trustee is a person who creates a trust fund and contributes his or her assets to it. A trustee is a person or organization in charge of assets. nine0003

The principal is working with a lawyer to set up a trust fund. You can also hire a financial advisor to help you allocate your assets properly. The trustee, who is usually a family member or financial institution, is appointed by the donor.

The grantor must additionally identify the beneficiary, such as their children or grandchildren, a business partner, or a charitable organization. The terms of the trust fund are also developed by the grantor and the lawyer. The grantor's assets will be included in the agreement, as well as how they will be divided. nine0003

The terms of the trust fund are also developed by the grantor and the lawyer. The grantor's assets will be included in the agreement, as well as how they will be divided. nine0003

Other estate planning instruments such as trust funds are not the same. They allow the grantor to specify how and when the assets of the trust will be distributed to the beneficiary. As a trustee, you can distribute funds to a recipient each year or as a lump sum when the recipient reaches a certain age.

The grantor may even indicate that the funds will be used for major expenses such as college tuition or a down payment on a house. nine0003

A waste clause is a common element of a trust fund. This prohibits the beneficiary from using the assets of the trust fund to pay off liabilities. Thus, even if the beneficiary spends all his money and goes into heavy debt, his creditors will not be able to touch his trust fund.

Benefits of a trust fund

A trust fund has several benefits, but perhaps the most important is the control it gives you over the management of your assets. Trust funds can ensure that your assets are properly cared for until your beneficiaries reach the age of majority, as well as avoid probate. nine0003

Trust funds can ensure that your assets are properly cared for until your beneficiaries reach the age of majority, as well as avoid probate. nine0003

Trust money can also be used to allocate funds for specific purposes, such as health care or education.

If you are a Trust Fund beneficiary, the most significant benefit will likely be the financial assistance you receive. While it's hard to think about inheriting anything from a loved one, a trust fund can be quite helpful for your financial circumstances.

Trust funds can also help you save time and money by avoiding the time and emotional stress associated with lengthy probate litigation. nine0003

See also: HEIR TRUSTEE

Other benefits of setting up a trust include:

Control over your wealth : You have complete control over the terms of the trust, including when and to whom payments are made. Even in complex scenarios, such as children from multiple marriages, you can create a revocable trust so that the assets of the trust remain available to you for your entire life, while specifying who will receive the remaining assets. nine0003

nine0003

Protecting your legacy : A properly executed trust can help protect your estate from creditors to your heirs or beneficiaries who may be financially insecure.

Confidentiality and Will Savings : Will is a public document; a trust can allow assets to go beyond the will and remain private, and potentially reduce the amount lost in legal fees and taxes in the process. nine0003

Types of Trust Funds

The following types of Trust Funds are distinguished:

- Blind Trust Fund

- Single Trust Fund

- General Trust Fund

No.1. Blind Trust Fund

The recipient of a blind trust fund does not know the identity of the trustee or responsible person. The blind trustee has full control over the management of the trust until the funds are paid. nine0003

Blind trust funds are typically used when an individual wishes to avoid a conflict of interest, such as when the trust is related to a business or investment. Blind trusts can also be used to add an extra layer of privacy to the management of a trust.

Blind trusts can also be used to add an extra layer of privacy to the management of a trust.

No. 2 Single Trust Fund

A mutual trust fund is a form of mutual fund structure that allows income to be transferred directly to the client (who will be the beneficiary). Mutual trust investors can maximize their payout without reinvesting their earnings in the fund. nine0003

Mutual trust funds may invest in securities, stocks and bonds, among other things. Rather than being used as a real estate planning tool, they are more commonly used by investors as a tax shelter method.

No. 3 General trust fund

A financial institution administers a general trust fund on behalf of a group of individuals. General trust funds are similar to mutual funds in that they are only open to people who have trust accounts. nine0003

General trust funds are no longer as popular as they once were, as other types of trusts and investments may offer more benefits. Now they are considered as a specialized investment structure.

Read also: LIVING TRUST: overview, cost, patterns, pros and cons (+ writing guide)

What is the purpose of a trust fund?

Here is a summary of what a trust fund is for. Let's imagine that you have been fine with your finances for a long time, and you realized that no one lives forever, so you want to provide your children or loved ones with a financial pillow. nine0003

However, you need something that won't ruin these people's lives; because wealth can destroy people if they are not held accountable.

Instead of giving them all at once, you consult with a lawyer and establish criteria that must be met before specific assets are distributed. Because you have worked so hard for this, the creation of a trust gives you the power to make those decisions.

How much does it cost to set up a trust fund?

A lawyer will likely charge between $5.00 and $7,000 to set up a trust, depending on the complexity of your financial situation. For example, some situations may require a revocable trust for some assets and an irrevocable trust for others. nine0003

nine0003

A comprehensive estate plan (which may include a will, power of attorney, living will, health care power of attorney, and changes in ownership of certain assets) will be more expensive than a single trust document.

While you can build trust yourself with self-help books or online instructions, it's usually tricky and complicated.

The right help, whether it's through online services or checking your trust with a lawyer, can give you the peace of mind you need to know you're doing the right thing. nine0003

Read also: Prosper Loans: A detailed overview of 2022 and how it works

How to open a trust fund bank account - expert guidance

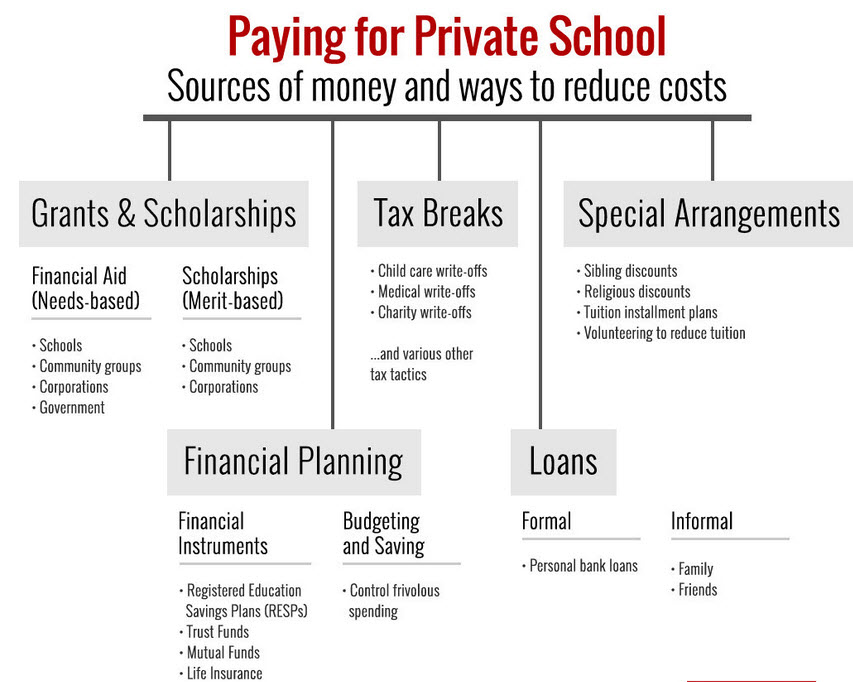

Here is a step-by-step guide to setting up trust:

- Choose the right type of trust

- trust specifics

- Make trust official

- Trust must be funded

- Register your trust fund with the Internal Revenue Service (IRS)

#1.

Choose the right type of trust

Choose the right type of trust Think about the purpose of a trust before you set it up. Once you have established your goals and objectives, you can decide what type of trust to base your decision on.

Once you have chosen the right type of trust, you will need to keep track of what assets you will place in the trust, how the assets will be managed and distributed, and who will be the beneficiaries and trustees. Consider how long the trust will last and under what conditions it will end. nine0003

No. 2. Describe the specifics of the trust

You must again create the four components of the trust fund. Here is a summary of what each entails:

Granto r: The grantor is the person whose name is held in trust.

Beneficiary: The person or persons who are to receive the assets of the trust.

Property and assets: This is the contents of the trust that will eventually be distributed to the beneficiaries. nine0003

nine0003

Trustee: The wishes of the grantor are carried out by the trustee, who is the trustee of the trust. As long as the donor is alive, it could be them. However, they should choose a new confidant to maintain their trust and fulfill their wishes if they become disabled or die.

#3.Trust the officials

Several websites provide DIY trust services, but they are rarely safe. Because trusts can be complex, most trustees hire a competent real estate or trust attorney. If it's convenient for you, ask friends, family and colleagues for recommendations; if you are working with a financial advisor, he or she should also be able to point you in the right direction. nine0003

Lawyers familiar with state trust laws can be found in state bar associations and local governments. You should look into prices as well as reviews because fees can vary greatly. Check to see if your company provides low-cost property planning services as part of its employee benefits package.

To establish the details of the trust you have settled on, your attorney will prepare a trust deed, trust deed, or trust deed. nine0003

An article can be simple or complex, short or long. This depends on the form of the trust, the assets in the trust and the number of beneficiaries named in the trust.

You must sign the deed of trust in front of a notary when your attorneys have completed it. Some states require trust papers to be filed with the state; a lawyer can advise you if you need to do this and how to do it.

No. 4. Trust must be funded

It's time to fund your trust once you've established it. Take your trust documents to a bank or financial institution and open a trust fund bank account in the name of the trust. Names and contact details of authorized persons will be required. You can make a one-time deposit or deposit funds in trust over a specified period of time. Eventually, the assets are transferred to the fund.

No. 5. Register your trust fund with the Internal Revenue Service (IRS).

nine0335

nine0335 You must register your trust fund for tax purposes after it has been created. Among other things, for tax returns and financial reporting, each trust often requires its own taxpayer identification number (TIN).

This is the same as EIN (Employer Identification Number) or SSN (Social Security Number) (SSN). The IRS website makes it easy to file online, but if you prefer printouts, you can download and mail Form SS-4. nine0003

How to set up a child trust

There are usually a number of steps involved in setting up a child trust.

Below is an example of some of the steps you need to take if you want to invest in a children's trust fund:

- Decide on the trust assets

- Select a trustee

- Identify beneficiaries

- Draw up a trust agreement 9012 Settling a trust

- 121

- Sign a trust

- Pay stamp duty if you need to

- Create a name for your trust

- Apply for ABN and TFN

- Create a bank account

balance of a trust are exempt from paying taxes on disbursements.

The Internal Revenue Service (IRS) believes that this money was already taxed before it was transferred to the trust. nine0003

The Internal Revenue Service (IRS) believes that this money was already taxed before it was transferred to the trust. nine0003 Interest that accrues in a trust is taxed as income of either the beneficiary or the trust itself if money is invested in it.

The Trust is required to pay taxes on any interest income it earns and does not distribute after the end of the financial year. Interest income from a trust is taxed by the beneficiary who receives it.

The amount awarded to the beneficiary is calculated first using the current year's income and then the accumulated principal. nine0003

This is usually the initial deposit plus any additional contributions plus any income in excess of the amount provided. The trust or beneficiary may be liable for capital gains of this amount. To the extent of the trust distribution deduction, the entire amount given to and for the benefit of the beneficiary is taxable to him or her.

There will be a will trust

A living trust is often advertised as a way to "avoid a will" after you die. A will is a court-controlled process of administering your estate and transferring your estate after your death in accordance with the terms of your will. nine0003

A will is a court-controlled process of administering your estate and transferring your estate after your death in accordance with the terms of your will. nine0003

A will is rarely the disaster its critics suggest. Also, even without the costs of setting up a living trust, many forms of ownership regularly fall outside the probate process.

Real estate, bank or brokerage accounts held in a joint name with the right to inherit, and life insurance or pension plan assets that pass to a specified beneficiary at the direction of, and not at your will.

Conclusion

Although it is very easy to set up trusts, it is very important that they are effective and that they are part of a broader financial strategy. While there is a wealth of information available online, it is a good idea to consult with a competent professional such as a lawyer, accountant, tax advisor, or estate planner before setting up any trust agency to ensure the best possible outcome for you and your family. or your business. nine0003

or your business. nine0003

Trust Fund FAQs

Who benefits from a trust fund?

Among the many uses and benefits of trusts is ongoing professional asset management; reduction of tax liabilities and probate expenses; holding assets outside the surviving spouse's estate while providing income for life; caring for people with special needs; and protection against bad financial decisions.

Why don't we trust the foundation, baby?

A trust may be set up for a child by the parents, but in most cases such a trust can only be accessed by the beneficiary when he or she reaches a certain age. An infant trust fund is simply a fund set up by a parent to hold assets such as cash or investments.

Must a trust fund be capitalised?

Yes, the trust fund must be capitalized. Capitalization is an accounting approach in which costs are recognized as part of the cost of an asset and expensed over the useful life of the asset. nine0003

Are trust funds a public record?

A trust fund is not a public record; it is not possible to obtain a trust document from a government official, agency, or anyone who is not a beneficiary and has no right to know the terms of your trust.