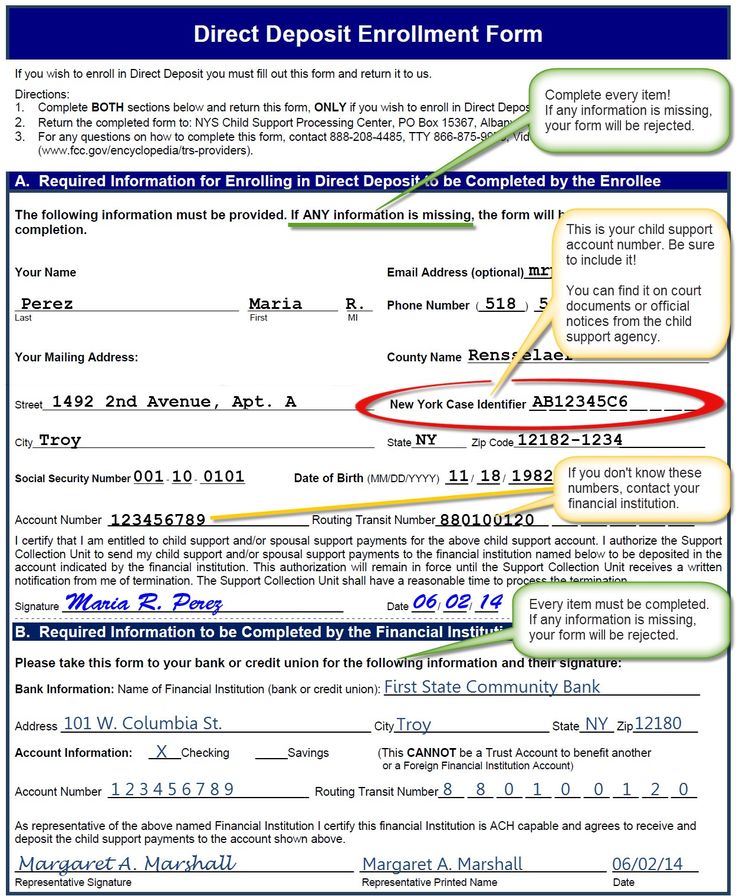

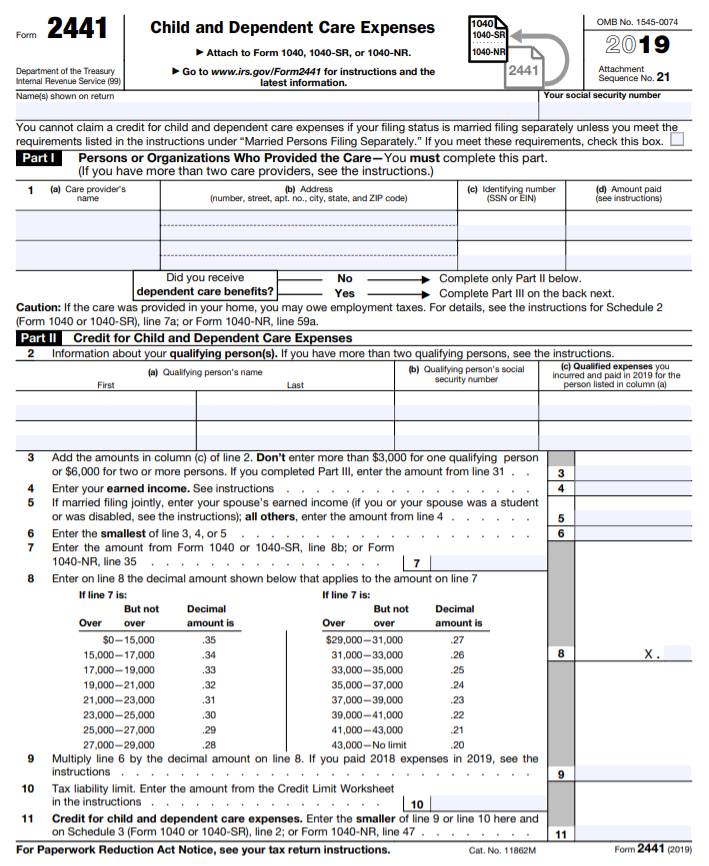

How to fill child tax credit form

Child Tax Credit Schedule 8812

Editor’s Note: The article below outlines the rules for the Child Tax Credit for tax years beyond 2021. To find rules that apply for 2021, check out our Child Tax Credit stimulus changes article.

Ever heard of the Child Tax Credit? This credit is claimed by millions of American parents with the goal of offsetting the costs of raising a child. The Child Tax Credit is worth up to $3,000/$3,600 for each qualifying child.

Is the Child Tax Credit Refundable?

This credit can be both a nonrefundable and a refundable tax credit. The refundable portion of the Child Tax Credit is called the Additional Child Tax Credit.

Who Qualifies for the Child Tax Credit?

The Child Tax Credit qualifying child eligibility includes the following:

- The qualifying child must be under age 17 at the end of the year.

- The qualifying child must be one of these:

- U.S. citizen

- U.S. national

- U.

S. resident

The taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and Social Security number authentication factors as well.

Divorced and Separated Parents

The Child Tax Credit requirements apply to divorced or separated parents. However, if the parents have a qualifying agreement for the noncustodial parent to claim the child, the noncustodial parent who claims the child as a dependent is eligible to claim the Child Tax Credit.

A parent can claim the child tax credit if their filing status is Married Filing Separately.

Income Phase-outThe Child Tax Credit amounts change as your modified adjusted gross income (AGI) increases. In fact, once you reach a certain threshold, the credit decreases or phases out.

And the credit is reduced $50 for every $1,000 — or fraction thereof — that your modified AGI is more than:

- $200,000 if filing as single, head of household, or qualifying widow(er)

- $400,000 if married filing jointly

- $200,000 if married filing separately

For the purpose of this credit, your modified adjusted gross income (MAGI) is your AGI plus excluded foreign earned income, possession income, and foreign housing.

Additional Child Tax Credit

If your Child Tax Credit is limited because of your tax liability, you might be able to claim the additional Child Tax Credit. To qualify, one of these must apply:

- Your earned income must be more than $2,500 for 2019

- You must have three or more qualifying children.

If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of the earned income threshold, $2,500.

If you have three or more qualifying children, you can either:

- Claim a refundable credit of the net Social Security and Medicare tax you paid in excess of your Earned Income Credit (EIC), if any

- Use the 15% method described earlier

The maximum refundable portion of the credit is limited to $1,400 per qualifying child.

More Child Tax Credit Requirements and Rules

You can’t carry forward any portion of the Child Tax Credit to future tax years. You need to claim the nonrefundable credits in a certain order to get the most benefit. You might need to calculate other credits first to properly apply the credit.

You might need to calculate other credits first to properly apply the credit.

While the maximum credit is $2,000 total per qualifying child, taxpayers who don’t have that much tax liability may instead be subject to the lower $1,400 refundable credit limit.

To Learn More About schedule 8812

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H&R Block to help you complete your Schedule 8812.

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $2,000 for each qualifying child. To get a Child Tax Credit refund, you must earn more than $2,500.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. Eligible parents and caregivers can claim a credit up to $2,000 for each child under 17 on their tax return.

Eligible parents and caregivers can claim a credit up to $2,000 for each child under 17 on their tax return.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

- Can I still get the 2021 Expanded Child Tax Credit?

Depending on your income and family size, the CTC is worth up to $2,000 per qualifying child. Up to $1,500 is refundable. CTC amounts start to phase-out when you make $200,000 (head of household) or $400,000 (married couples). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you can get up to $1,500 back in your tax refund.

There are three main requirements to claim the CTC:

- Income: You need to have more than $2,500 in earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be under 17 on December 31, 2022.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be continuous. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN.

This is a change from previous years when children could have an SSN or an ITIN.

This is a change from previous years when children could have an SSN or an ITIN. - Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

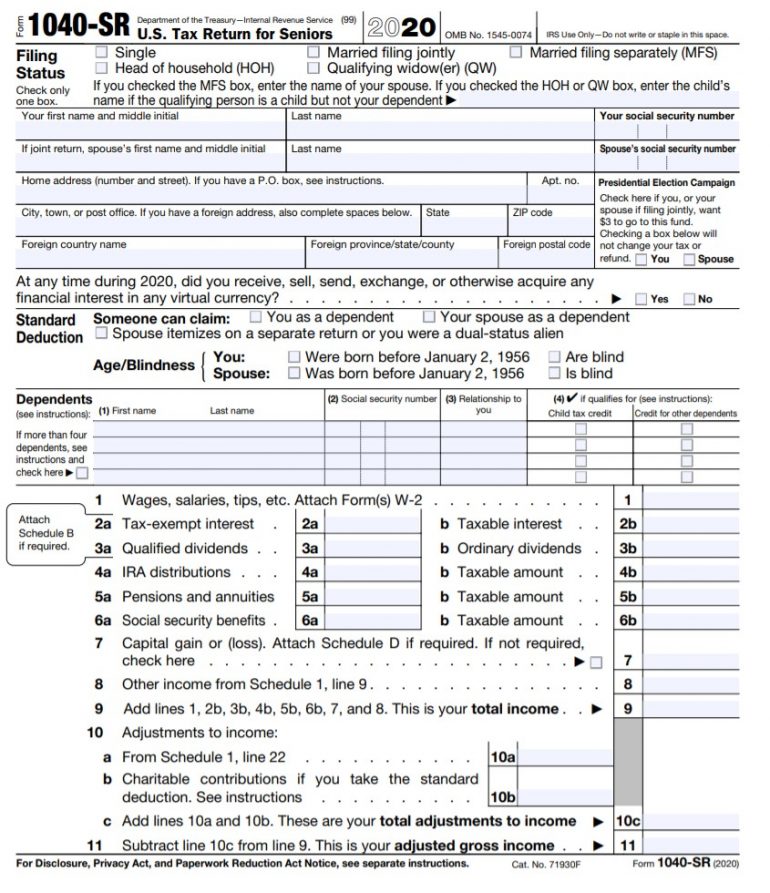

File a 2022 tax return with Schedule 8812 “Additional Child Tax Credit.”

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. These include Volunteer Income Tax Assistance (VITA), GetYourRefund.org and MyFreeTaxes. com.

com.

Yes. It’s not too late to claim your 2021 Expanded Child Tax Credit if you haven’t already. To claim your 2021 Child Tax Credit, you must file a 2021 tax return by April 18, 2025. If you filed a 2021 tax return but didn’t get the Child Tax Credit and were eligible for it, you can amend your tax return.

Contact your local Volunteer Income Tax Assistance (VITA) site to see if they file 2021 tax returns. You can also use GetYourRefund.org.

Learn more about filing prior year tax returns.

The latest

Congress has passed several economic relief measures to support people through the COVID-19…

By Reagan Van Coutren, 2022 Get It Back Campaign Intern You can file…

These are the income guidelines and credit amounts to claim the Earned Income…

How to get a certificate of non-receipt of a tax deduction

05. 05.2021

05.2021

Such a certificate is needed if for some reason you terminated the insurance contract ahead of schedule and did not receive a tax deduction from the state. If you have a debt, a certificate will help you clear it.

Why debt arises

If you did not receive a tax deduction, you do not need to pay the debt.

nine0002 The appearance of debt is a standard security measure on the part of the state, so that those who receive the deduction immediately return it.A certificate of non-receipt of a tax deduction can be obtained from the tax office in person or online.

Step 1

Get a certificate from the tax office

Step 2

Send information to us

How to get a tax certificate online

You can get help online in a few minutes. You must have an account on nalog.ru or on State Services. nine0003

- Log in to your personal tax office

- Go to the section "Life situations"

- Select the relevant certificate

- Fill in all fields of the application

Go to nalog. ru and log in to your personal account: using your login and password, using an electronic signature, or through your account on the State Services.

ru and log in to your personal account: using your login and password, using an electronic signature, or through your account on the State Services.

Next, find "All life situations" and click on "Request help and other documents."

Click on "Get a certificate confirming the fact of receipt (non-receipt) of a social deduction. nine0003

It is important to fill out the application correctly - a sample of the correct certificate and how its fields should be filled in can be viewed here.

The tax office will send you a certificate in several files. Please send us all the files you receive from the tax office.

How to get a certificate from the tax office

You can get a certificate from the tax office at the place of residence ( it will take about 30 times longer than getting help online ).

There are often errors in certificates - check it after receiving it without leaving the tax office.

Sample certificate can be viewed here.

- Choose the nearest tax office

- Prepare document package

- Apply in person or by Russian Post

- Wait until the help is ready

It is not necessary to apply to the inspection at the permanent registration address. Choose the nearest inspection to you.

Will need to submit:

- A copy of the life insurance contract - can be downloaded in your personal account

- A copy of payment documents confirming the payment of contributions - can be downloaded in your personal account

- A written application for a certificate - the form will be provided at the tax office

A package of documents can be sent by mail. Send them by registered mail with acknowledgment of receipt and a description of the attachment. nine0003

This takes some time. You will be told more about the terms in the tax service. After receiving the certificate, be sure to check it against this sample.

You will be told more about the terms in the tax service. After receiving the certificate, be sure to check it against this sample.

Send us a certificate in your Personal Account or Russian Post

- To send online:

- To send by Russian Post:

Log in to the Renaissance Life Personal Account, go to the Applications and Documents section, click Apply. Select the question "Cancel the insurance contract". Fill in the fields and upload all the files sent to you by the tax office. nine0015 The Tax Service will send you a certificate with several files. Please send us all the files that you receive from the tax office, without them we will not be able to accept the electronic document.

Send a certificate by registered mail with a description of the attachment to the address: Russia, 115114, Moscow, Derbenevskaya embankment, 7, building 22, floor 4, room 13, com. 11 for OOO SK Renaissance Life

The debt will be canceled ~ within a month after we receive the documents. nine0028

nine0028

Documents for deduction | Tax refund

Tuition deduction

- Information about deduction

- Deduction process

- List of documents for deduction

- For the education of children

- Examples of calculation of deduction

- Filling samples 3-NDFL

- Receipt through employer

- If there is no income

Updated on 03/23/2021

In order to apply for a tax deduction for education, you will need the following documents and information:

- Tax return form 3-NDFL original declaration is submitted to the IFTS.

- Passport or a document replacing it. Certified copies of the first pages of the passport (basic information + registration pages) are submitted to the IFTS.

- Statement of income in the form 2-NDFL. nine0157 You can get this certificate from your employer. original of certificate 2-NDFL is submitted to the IFTS.

Note: if you worked in several places during the year, you will need certificates from all employers. - Application for a tax refund with details of the account to which the tax authority will transfer money to you. original application is submitted to the IFTS.

- Agreement with an educational institution , which specifies the cost of education. A certified copy of the contract is submitted to the IFTS. nine0170 Note: if the cost of training has increased since the conclusion of the original contract, then it is required to provide documents confirming this increase. Such a document is usually an additional agreement to the contract.

- School license confirming its status. A certified copy of the license is submitted to the IFTS.

Note: if the details of the license of the educational institution are specified in the training agreement, then the provision of a license is not mandatory. nine0036 - Payment documents confirming the fact of payment for tuition (usually these are payment orders, receipts or cashier's checks with cash receipts). Certified copies of payment documents are submitted to the IFTS.

When applying for tax deduction for the education of children additionally provided:

- copy of the child's birth certificate ;

- certificate from educational institution confirming the child's full-time education (required if the contract does not indicate the form of education). 9 are submitted to the IFTS0156 original reference.

- copy of marriage certificate (required if the documents are issued for one spouse, and the child's education deduction is received by the other)

When applying for tax deduction for brother/sister additionally provided:

- copy of their own birth certificate ;

- copy of birth certificate of brother/sister ;

- certificate from an educational institution , confirming full-time study (required if the contract does not indicate the form of study).