How to file for unpaid child support

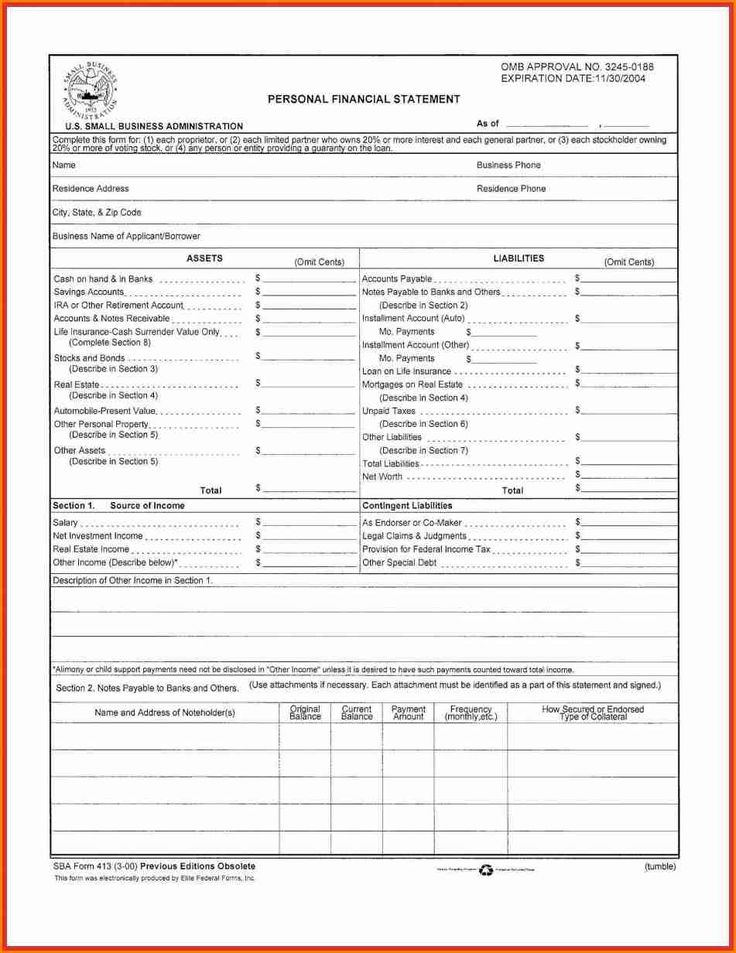

Child Support Forms | Office of the Attorney General

These forms allow parents, families, and employers to provide the Child Support Division with additional information so we can better serve you.

All child support forms are categorized and linked below as downloadable files. Select the category you need to see the corresponding forms.

- Paternity

- Military

- Paying or Receiving Child Support

- Safety

- Child Support Administrative Review

- Child Support Enforcement

- License Suspension

- Medical Support

- State Directory of New Hires

- Release of Information

Paternity

Parent Survey on the Acknowledgement of Paternity (AOP)

This form is to be completed after the AOP has been signed or a person has declined to sign the AOP.

View the form in English

View the form in Spanish

Application for New Birth Certificate Based on Parentage

The VS-166 - Application for a New Birth Certificate based on Parentage form is used to add, remove, or replace information regarding the parents listed on the original birth certificate. Click on the link to find the form on the Texas Department of State Health Services website.

View the form

Military

Military Affidavit

This form is used as proof to the court that a custodial or noncustodial parent is in the military.

View the form

Paying or Receiving Child Support

Arrears Payment Incentive Program

This form is used by a delinquent noncustodial parent to reduce amounts owed to the State of Texas.

View the form in English

View the form in Spanish

Direct Deposit Authorization Form (1TAC 55.803)

This form is used to set up direct deposit for child support payments.

View the form in English

View the form in Spanish

Request for Warrant Cancellation

This form is used to stop payment on a warrant (check) that has been lost or damaged.

View the form in English

View the form in Spanish

Child Support Review Questionnaire

This form provides the Child Support Division information about a custodial or noncustodial parent when a case review is requested.

View the form in English

View the form in Spanish

Custodial Parent’s Certification of Direct Payments

This form is used to document child and medical support payments made directly to a custodial parent by a noncustodial parent (in any form).

View the form in English

View the form in Spanish

Noncustodial Parent’s Certification of Direct Payments

This form is used to document child and medical support payments a noncustodial parent makes directly to the custodial parent (in any form).

View the form in English

View the form in Spanish

Safety

Request for Nondisclosure

This form is used to report a parent’s safety concerns on a child support case and request the Child Support Division not disclose any identifying information to the other parent.

View the form

Child Support Administrative Review

Request for Administrative Review (1 TAC 55.101(f)(2))

This form is completed by a noncustodial parent to contest a claim of past-due child support and request a review of their case.

View the form in English

View the form in Spanish

Administrative Review - Distribution of Child Support Payments (1 TAC 55.141(e))

This form is used by a custodial parent, who is a current or former Temporary Assistance for Needy Families (TANF) recipient, to request an Administrative Review hearing to resolve disputed issues concerning distribution of payments.

View the form in English

View the form in Spanish

Child Support Enforcement

Notice of Application for Judicial Writ of Withholding (1 TAC 55.111)

This form is used to notify an employer to withhold wages from a noncustodial parent when they have past-due child support.

View the form

Motion to Stay (1 TAC 55.112)

This form is used by noncustodial parents to contest a Judicial Writ of Withholding.

View the form

Employer's Motion for Hearing on Applicability of Income Withholding for Support (1 TAC 55.115)

This form is used by an employer to request judicial determination about an employee’s wage withholding.

View the form

Notice of Administrative Writ of Withholding - (1 TAC 55.116(a))

This form is sent to the noncustodial parent by the Child Support Division to inform them that withholding has begun and to provide information on how they can contest the withholding.

View the form

Request for Issuance of Income Withholding for Support (1 TAC 55 .117)

This form is used to request the issuance of income withholding for support.

View the form

Federally Mandated Income Withholding for Support (IWO) (1 TAC 55.118(b))

This form is used to notify an employer of a specified amount of child support to be paid by withholding income from an employee's paycheck. This form (provided by the Office of Child Support Enforcement OCSE) is used to notify an employer of a specified amount of child support to be paid by withholding income from an employee's paycheck. This form is federally mandated for use in IV-D and non IV-D cases. (OMB 0970-0154)

View the form

Notice of Lien (1 TAC 55.

119(a))

119(a)) This form serves notice that a custodial parent has placed a lien on a noncustodial parent’s property for unpaid child support. The lien shows a right to keep possession of property belonging to the noncustodial parent until they pay their owed child support.

View the form

Release of Child Support Lien (1 TAC 55.119(b))

This form is used to lift the lien on a noncustodial parent’s property after they have paid their owed child support.

View the form

Partial Release of Child Support Lien (1 TAC 55.119(c))

This form is used by a custodial parent to lift the lien only on the specific property of the noncustodial parent, as listed on the form. It does not prevent action to collect from other property owned by the noncustodial parent.

View the form

Record of Support Order(1 TAC 55.121)

This form is used by counties to provide the record of support data needed by the state case registry.

View the form

Record of Support Order with Application (1 TAC 55.

121)

121)This form is used by counties to provide the record of support order data needed by the state case registry. Effective September 1, 2021, this form must be used by the following counties that participate in the Integrated Child Support System: Bexar, Cameron, Dallas, Ector, El Paso, Gregg, Harris, Harrison, Hidalgo, Lubbock, Midland, Panola, Smith, Tarrant, Taylor, Travis, Webb, and Wichita.

View the form

License Suspension

Administrative Notice of Filing of Petition to Suspend License (1 TAC 55.203(a))

This form notifies a noncustodial parent who owes past due child support that an action to suspend their driver’s license has been filed.

View the form

Notice of Filing of Petition to Suspend License (1 TAC 55.203(f))

This form is sent to a noncustodial parent alerting them that an action to suspend their license has been filed.

View the form

Administrative Petition to Suspend License (1 TAC 55.203(b))

This form is used to outline a noncustodial parent’s court-ordered child support repayment schedule that must be followed before their license is reinstated.

View the form

Petition to Suspend License (1 TAC 55.203(f))

This form shows a noncustodial parent’s court-ordered child support repayment schedule that must be followed before their license is reinstated.

View the form

Notice of Filing of Petition to Suspend License (1 TAC 55.203(f))

This form is sent to a noncustodial parent alerting them that an action to suspend their license has been filed.

View the form

Request for Hearing (1 TAC 55.203(c))

This form is used by a noncustodial parent to request a hearing to contest a petition to suspend their license.

View the form

Notification to Licensing Authority Order Suspending License (1 TAC 55.203(d))

This form is sent by the Office of the Attorney General to the licensing authority to request action is taken to suspend a noncustodial parent’s license.

View the form

Notification to Licensing Authority Order Vacating or Staying Suspension of License (1 TAC 55.

203(e))

203(e))This form is sent by the Office of the Attorney General to the licensing authority to notify them that a noncustodial parent’s license may be reinstated.

View the form

Medical Support

National Medical Support Notice (1TAC 55.120(a))

This form notifies an employee that they are obligated by a court or administrative child support order to provide health care coverage for the child identified.

View the form

Request for Review of National Medical Support Notice (1 TAC 55.120(b))

This form is used by an employee to contest withholding based upon a mistake of fact.

View the form

Termination of National Medical Support Notice (1 TAC 55.120(c))

This form notifies employers when there is no longer a judicially or administratively ordered obligation for an employee to provide health care coverage for the listed child(ren).

View the form

State Directory of New Hires

Texas Employer New Hire Reporting (1 TAC 55.

303(c)(1)(B))

303(c)(1)(B))This form is used by employers to report the details of newly hired employees.

View the form

Release of Information

Authorization for Release of Information (1 TAC 55.803)

This form is used to authorize another party to receive information about your child support case or payments on your behalf.

View the form in English

View the form in Spanish

Revocation of Authorization for Release of Information (1 TAC 55.803)

This form is used to revoke an existing authorization to release information and/or child support payments to another party.

View form in English

View the form in Spanish

How to Collect Child Support Arrears

Learn all about child support arrears, including the many ways to collect, whether owing support affects visitation, and how you can get help.

One parent's failure to pay court-ordered child support can result in financial struggles for the other parent—and for the child—who depends on the payments. Fortunately, parents have a legal right to help from law enforcement or other government officials when it comes to collecting past-due child support.

Fortunately, parents have a legal right to help from law enforcement or other government officials when it comes to collecting past-due child support.

Ways to Enforce Child Support

The first step in collecting child support from the "obligor" (the parent who's supposed to pay) is figuring out where to go for assistance. You can't enforce a child support order on your own—you must go through the proper legal channels.

The exact government agency or law enforcement department you'll need to contact to enforce your child support order(s) and collect past-due support depends on the laws where you live. In most areas, orders are enforced by the local department of child support services. (You can get more information about how child support is enforced where you live by contacting your state's child support agency.)

Child support agencies have many tools for enforcing child support. Here's a breakdown of some of the most common methods these agencies use when attempting to collect past-due child support.

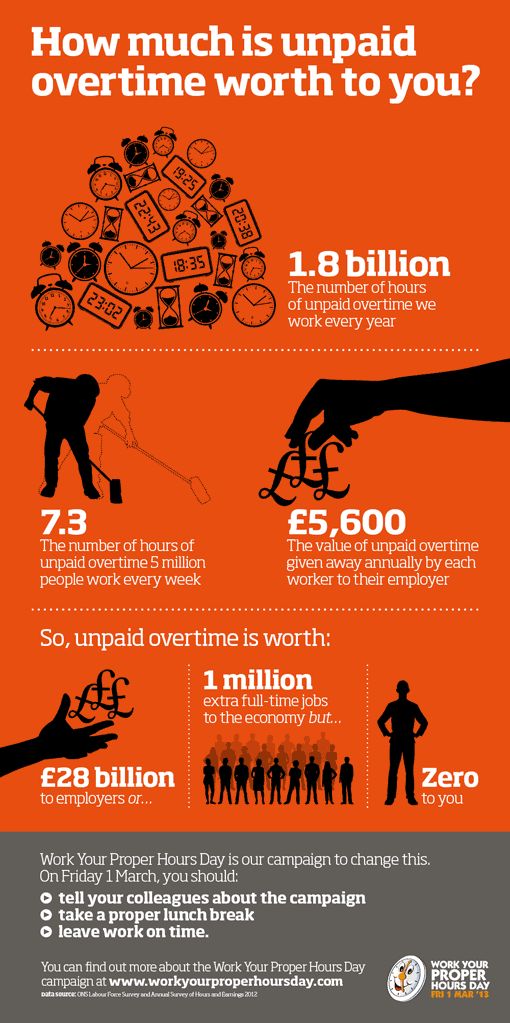

1. Income Withholding

By law, all child support orders include the enforcement tool of immediate income withholding, which is sometimes called "wage garnishment" or "income assignment." The state can order the obligor's employer to deduct the amount owed in child support from the obligor's paycheck and send it to the local child support office or directly to the custodial parent. Employers are required to deduct the payment from the obligor's paycheck just like any other payroll deduction (such as income tax or social security).

This method is very effective when the obligor has a regular job. However, income withholding often isn't the best enforcement method when the obligor parent changes jobs often, is self-employed, or is unemployed—income withholding requires that the obligor has a steady, predictable paycheck that an employer can draw funds from.

2. Tax Offsets

State child support agencies can also report parents who haven't paid child support to federal and state tax agencies.

Under the federal Treasury Offset Program, state child support enforcement agencies can report parents who fail to pay child support to the federal Treasury Department. The Treasury Department can then intercept (take) refund payments for federal tax returns and other government payments (such as the coronavirus stimulus payment) and apply the money toward overdue child support.

Sometimes a parent who owes child support receives a refund based on a joint tax return—perhaps because they have remarried and filed a joint tax return with the new spouse. In most states, the parent who's owed support can collect only from the portion of the return that is based on the obligor's income. Note, though, that community property laws might affect whether a new spouse's share of the tax return can be applied toward the obligor's unpaid child support. (For more information about how tax offsets can be taken against tax returns where you live and how you can make sure the IRS takes only the obligor's share of the tax return, see the IRS's instructions for Form 8379 (Injured Spouse Allocation). )

)

Every state that collects income tax is required to offset state income tax refunds when a parent owes child support. Similar to the situation with federal tax refunds, most states can withhold money only from the portion of the return that is based on the obligor's income if the obligor has remarried and is filing a joint tax return. (Check out IRS Publication 555 (03/2020), Community Property, for more information.)

3. Liens

If the obligor parent owns real estate or certain other types of property (like a car), child support payments can be enforced by placing a lien on the property. Every state has its own laws on who can file a child support lien. In some states, the parent who's owed money can file the lien; in others, only a child support agency can file one. The holder of a lien has a claim on the property, and the obligor usually can't sell the property without paying off the lien. Sometimes, a lien might even give its holder the right to force a sale of the property to pay off the lien.

One of the downsides of a lien is that it doesn't lead to an immediate payment. The parent who's owed support usually has to wait until the obligor sells the property or is able to pay off the lien without a sale.

4. Attachments

Another option for a child support enforcement agency is to "attach" or seize property of the obligor to cover the unpaid child support. In that situation, the obligor parent will have to either sell the item, and apply the proceeds to unpaid child support, or transfer ownership of the item to the custodial parent.

5. Freezing Bank Accounts

State child support agencies have the power to freeze accounts that an obligor has at certain financial institutions (such as banks, credit unions, and insurance companies). When a child support agency freezes an obligor's bank or other financial account, the obligor can't use the account until the debt is paid off. In some states, after the account has been frozen for a period of time (such as 30 days) and the obligor still hasn't paid the debt, the financial institution can seize (withdraw) the amount owed from the obligor's account and send it directly to the child support agency.

6. Revoking Licenses

One of the most effective ways of obtaining past-due child support payments is to have the state revoke or suspend an obligor's driver's license. State child support agencies also have the power to order that the state withhold, suspend, or even revoke the professional license—such as a medical, legal, cosmetic, or real estate broker license—of a parent who owes child support.

For obligors who are sincerely attempting to earn money to pay back child support, losing a driver's or business license might actually make it harder for the custodial parent to collect. After all, that license is usually critical to the person's ability to make money. For other obligors, though, losing a driver's license or a professional license is a powerful incentive to pay the amount due.

7. Withholding Other Income Payments

Typical income isn't the only kind of money that state agencies can withhold to cover unpaid child support (see #1 above). The state agency can also order that payments be withheld from all of the following:

- commission income

- employment bonuses

- pension benefits

- retirement accounts

- workers' compensation

- disability benefits

- veterans' benefits, and

- military pay.

8. Going to Court

When none of these enforcement methods work, the state child support agency can take the case to court. A judge can then find the obligor in contempt of court, which might result in fines or even jail time.

9. Authorities in Other Places

The Uniform Interstate Family Support Act allows parents to pursue collection processes across state lines, though the specifics of the laws that states have adopted according to the Act can differ. But long story short, parents who are owed child support aren't stopped from getting it just because the other parent lives in another state.

And if an obligor who owes more than $2,500 in child support is in another country, the U.S. Department of State can refuse to issue or renew the obligor's passport. Sometimes, the child support agency can attempt to get a federal warrant, which gives the Department of State the power to revoke the passport of and arrest the obligor when the obligor attempts to re-enter the United States.

Retroactive Child Support vs. Child Support Arrears

"Retroactive child support" and "arrears" describe kinds of child support that an obligor can owe. The difference between the two is important to understand when trying to collect.

Retroactive Child Support

Retroactive child support is the amount of support an obligor owes before the court issues a support order. In many states, the court will hold the owing parent responsible for paying child support beginning on the date that a request for a child support order was made.

Because it can take weeks or months before the judge issues a final child support order, allowing retroactive support makes sure that the period of time between the request and the order is accounted for. With retroactive child support, any delays in the child support process don't affect the amount of child support.

Child Support Arrears

Once a child support order is in place, the obligor parent must pay the full amount of support ordered each month or risk being in "arrears. " Child support arrears—also known as "back" child support—is the difference between what a parent is ordered to pay and what the parent has actually paid. Child support arrears can begin to add up only after a court has issued a child support order. In most states, child support arrears can accrue interest at a 10% or higher annual rate.

" Child support arrears—also known as "back" child support—is the difference between what a parent is ordered to pay and what the parent has actually paid. Child support arrears can begin to add up only after a court has issued a child support order. In most states, child support arrears can accrue interest at a 10% or higher annual rate.

Courts don't differentiate between a large amount of arrears and a small amount, and once any amount of arrears accumulates, the custodial parent can seek enforcement of the child support order.

Child Support Modification: Changes Based on a Parent's Ability to Pay

Not every parent's failure to pay child support is intentional. In many cases of child support arrears, parents have legitimate reasons for being unable to work, such as a physical or mental disability.

In cases where a parent doesn't have income, the court must be flexible with its child support guidelines and adjust the order to an amount that's reasonable under the circumstances. When a parent requests an amount that's different than the state's calculations, the court must provide a written explanation for the reasons why the judge approved or denied the request.

When a parent requests an amount that's different than the state's calculations, the court must provide a written explanation for the reasons why the judge approved or denied the request.

Adjustments to an order aren't always permanent, and the court can review your case any time necessary. For example, if the obligor gets a new source of income or employment, you can ask the court to review the order. Although every state's modification process is different, most states require the requesting parent to prove that the current order is no longer appropriate.

If you're looking to modify child support, you might want to get help from a lawyer. (See below for information on finding legal help.)

Does Owing Child Support Affect Visitation?

While it's true that noncustodial parents must financially support their children, a custodial parent can't deny custody or parenting time for nonpayment of support.

If a custodial parent denies visitation to an obligor parent, the obligor can file a motion (request) in court to enforce the custody order. Although the court will likely enforce the existing custody order, the judge might also use the hearing as an opportunity to address the obligor's failure to pay support.

Although the court will likely enforce the existing custody order, the judge might also use the hearing as an opportunity to address the obligor's failure to pay support.

This situation is another where a parent might benefit from the help of a family law attorney.

Getting Legal Help Collecting Child Support

For a parent looking for enforcement of a child support order, the cost of obtaining professional help might be a concern. Fortunately, the costs of working with your state's child support enforcement services are minimal. There might be an application fee (usually around $20), and, as of 2021, if you receive at least $550 in child support each year, there is a federally required annual service fee of $35. You might be able to request a waiver of these fees if you can't afford them.

Although child support enforcement is almost always handled by a state agency, if you think you might need to hire a lawyer, you can contact an experienced family law attorney for help. Many attorneys offer one free initial consultation, which will give you an idea of how much the attorney will charge to represent you. And even if you have to pay for a consultation, it might provide you with enough information to proceed on your own.

Many attorneys offer one free initial consultation, which will give you an idea of how much the attorney will charge to represent you. And even if you have to pay for a consultation, it might provide you with enough information to proceed on your own.

If you can't afford attorneys' fees, you might try contacting your state or county bar association to determine if it has a list of attorneys who offer pro-bono (free) representation. Also, low-income families might qualify for free or low-cost legal help from a legal aid organization.

If alimony debts have accumulated...

Veronika Salnikova

Lawyer, partner of Yakovlev & Partners

June 16, 2021

Tips

Pay attention to the date of publication of the material: the information may be outdated due to changes in legislation or law enforcement practice.

How to collect them, what threatens the parent-debtor and in what case will he be released from liability?

Through which court to collect alimony from a father with many children?

“In 2018, the Magistrate's Court ruled to collect alimony from her husband for the maintenance of two minor children. In 2020, we had twins. Currently, the marriage is not dissolved. Tell me where to apply (to the world or district court) and how to file an application to collect alimony for twins?

In 2020, we had twins. Currently, the marriage is not dissolved. Tell me where to apply (to the world or district court) and how to file an application to collect alimony for twins?

Alimony (funds for the maintenance of minor children) can be collected through the court in the order of writ or action proceedings. Writ proceedings are a simplified procedure for collecting alimony in the Magistrate's Court. When filing an application, the court issues a court order without summoning the plaintiff and the defendant. Claim proceedings are carried out in the district court with the summons of the parties.

As a general rule, if the parent-debtor already pays child support, then they should be collected on other children through the district court. The mother of twins needs to apply to the district court at her place of residence or the defendant.

You can file a claim with an attorney. In addition, sample applications are often placed in courts. You can use this sample, detailing your situation and attaching supporting documents.

(Answers to other questions of alimony recipients and their payers can be found in the articles "On child support - in detail", "On the payment of alimony - on real examples", "Cross-border alimony").

What threatens a parent for non-payment of alimony?

For late payment or non-payment of alimony in full, the debtor parent may be held liable - administrative (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation) or criminal (Article 157 of the Criminal Code of the Russian Federation).

Bailiffs bring to administrative responsibility negligent parents. This is possible in the event of non-payment without good reason of funds for the maintenance of children according to a judicial act, a court order or an agreement on the payment of alimony. The court already attracts criminal liability for malicious evasion from the fulfillment of maintenance obligations of parents.

On April 27, 2021, the Plenum of the Supreme Court of the Russian Federation approved a resolution stating that “violation of a judicial act or agreement on the payment of alimony should be understood as non-payment of alimony in the amount, on time and in the manner established by this decision or agreement. ” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

In which case will the debtor parent be released from liability despite the child support debt?

If the parent-debtor has good reasons for which he cannot pay child support in the prescribed amount, he has the right to go to court and ask to change the procedure for collection. In the presence of such reasons, the debtor may be released from liability.

Valid reasons may be recognized such circumstances in which non-payment of alimony occurred regardless of the will of their payer: his illness (incapacity for work), his military service on conscription, force majeure circumstances, the fault of other persons, for example, non-payment of wages by the employer, delay or incorrect transfer bank of funds to the recipient of alimony.

The list of reasons that may be recognized as valid for exemption from liability is not exhaustive. In all cases, the judge must assess whether specific circumstances can be attributed to the number of good reasons for non-payment of alimony.

How do bailiffs force persistent non-payers to fulfill maintenance obligations?

If the parent does not just evade the payment of alimony, but hides and prevents their collection, i.e. becomes a malicious defaulter, the bailiffs start the procedure for searching for the debtor. But they can do this only if there is a statement from the alimony claimant. During the search, bailiffs try to locate the debtor and his property in order to bring him to justice and force him to fulfill maintenance obligations. How do they do it?

Bailiffs are endowed with special powers. They have the right:

- to receive personal data from the internal affairs authorities, tax authorities, the Pension Fund, registry offices, traffic police;

- check information through the customs authorities;

- check in banks information about accounts, deposits, securities;

- to interview relatives, friends, colleagues - everyone who has information about the non-payer;

- to carry out a visit to the location of the debtor's property for its examination and evaluation;

- use information obtained through the involvement of a private detective bureau or from open sources, including those posted on personal pages on social networks.

When conducting search and search activities, the bailiff interacts with employees of other units of the FSSP, the traffic police, and the police to use the information they have. If the debtor is found outside the territory that belongs to the department that accepted the application of the alimony collector, the bailiff in charge of the case is obliged to transfer it to a colleague whose jurisdiction allows further search and search work to be continued.

How to properly sue for non-payment of child support

Cases when a parent refuses to support his child and pay child support are common. However, before making such a decision, the alimony payer must remember that there is a penalty in the legislation for non-payment of alimony, and that such actions can end for the debtor not only in a fine, but also in arrest.

If the father decides to avoid paying child support, the other parent needs to know how to sue for non-payment of child support. 9Ol000

9Ol000

Court proceedings in the case

What exactly needs to be done to make the debtor liable for non-payment of alimony? To recover unpaid child support, the other parent must follow the following procedure:

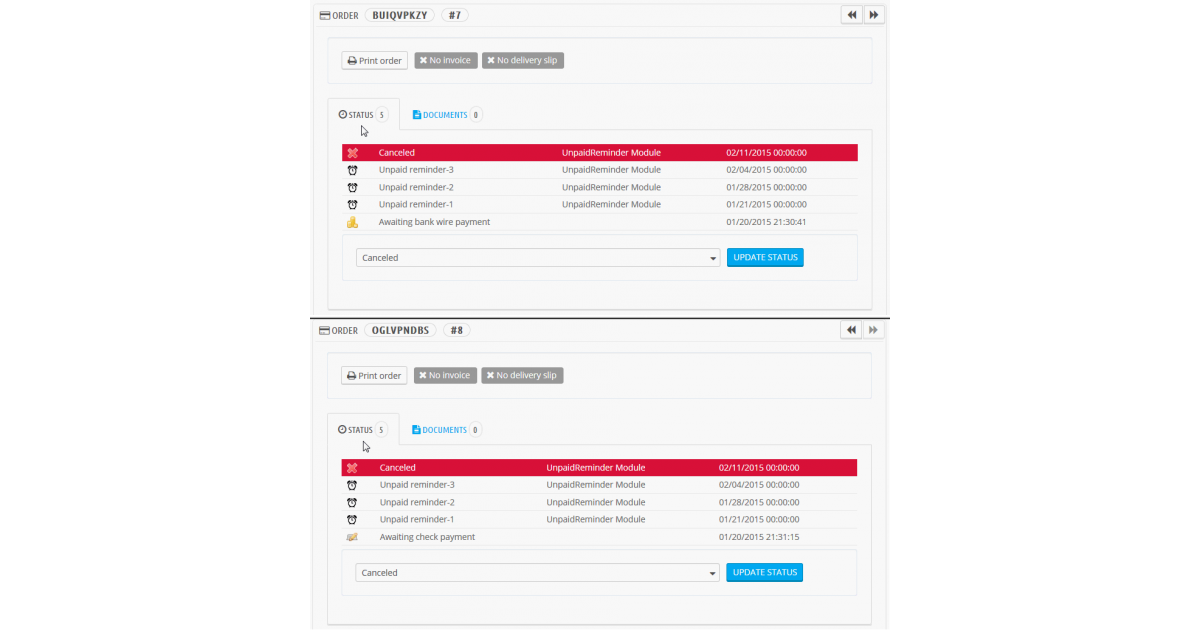

- Application for the calculation of child support Application for the issuance of a court order First of all, the mother of the child must apply to the court with a statement of claim for the recovery of arrears in the payment of alimony. After the judge conducts the proceedings on the case, the plaintiff will be issued a writ of execution, which, after notifying the debtor of such a court decision, must be transferred to the bailiff service.

- Within 10 days from the date of receipt of the writ of execution, bailiffs begin proceedings on the case. The duty of these specialists is to apply all necessary measures to ensure that the defaulter repays the existing debt.

- If the actions taken by the bailiffs did not bring the expected result, then the alimony payer who evades his obligation to maintain a minor child is subject to civil, administrative or criminal liability.

However, first, the bailiff must warn the debtor twice about what consequences await him in case of refusal to pay the existing debt. Only after that, the specialist collects all the necessary documents, which reflect the amount of debt, the timing of delays in payments, the place of work of the debtor and other sources of his income, as well as the reasons for non-payment of alimony.

Based on the collected documents, criminal proceedings are initiated. - Another common situation is when the bailiff does not take any active steps to collect the debt from the defaulter and hold him accountable. In this case, the alimony recipient has the right to expedite this process and make it more efficient.

The easiest option is to file a bailiff with an application to bring the perpetrator to justice. If this document does not force the specialist to act, the next step is to file a complaint against the action or inaction of the bailiff.

Expert opinion

Marina Bespalaya

In 2011 she graduated from the University of Internal Affairs with a degree in law. In 2013, a master's degree course, specialty "lawyer". In 2010-2011, a course at Portland State University (USA) at the Faculty of Criminal Law and Criminology. Since 2011 - a practicing lawyer.

In 2013, a master's degree course, specialty "lawyer". In 2010-2011, a course at Portland State University (USA) at the Faculty of Criminal Law and Criminology. Since 2011 - a practicing lawyer.

The Civil Procedure Code fixes that the maximum duration of the consideration of a court dispute is:

- in the world instance - up to two months;

- 90 days - in the federal district court.

These deadlines may be suspended with subsequent renewal if there is a need for additional examinations and activities.

Drawing up an application for non-payment of alimony for a bailiff

than to take active action, the second parent must find out the exact amount of the debt.

The bailiff is responsible for calculating the amount of maintenance debt. However, if the specialist for some reason does not perform this calculation, the recipient must take the initiative and submit an application to the bailiff for the calculation of alimony arrears.

A sample application for calculating the amount of alimony arrears for a bailiff can be downloaded here.

The applicant draws up this document in any form, relying only on the basic requirements for its preparation, in particular:

- The heading of the application must contain information about the addressee: the name of the service, address, as well as the bailiff who is engaged in enforcement proceedings in this case.

- The header should contain information about the applicant: full name, address and contact phone number.

- In the field for indicating the name of the document, "Application for the calculation of alimony arrears" must be indicated.

- At the next stage, it is necessary to state the circumstances of the incident: data on the exactor and payer of alimony, the date when the corresponding court decision was made, the date of opening of the executive incident in the case, the dates and amount of cash payments transferred to the child.

- Next, you need to indicate your request - to calculate the debt for alimony.

- The final step in drawing up the document is the applicant's signature and the date the document was submitted to the bailiff service.

Based on the results of consideration of the received application, the bailiff makes a decision on the calculation of the debt for the payment of alimony. The parent is issued a certificate containing the following information:

8 800 511-75-68

For residents of Moscow and Moscow Region

For residents of St. Petersburg and the region

- Date and amount of receipt of maintenance payments.

- Amount of debt for alimony.

The received document can be used as evidence when applying to the court with a statement of claim for the recovery of debt on monetary obligations to a minor child.

Drawing up an application for a court order and debt collection

After receiving a certificate from the bailiff indicating the exact amount of the child support debt, the parent has the right to apply to the court to recover this money.

To do this, an application is made for issuing a court order for the collection of alimony debt. Requirements for the execution of this document are contained in the Civil Procedure Code of the Russian Federation.

- The title of the document must indicate the name of the court that will deal with the application.

- It should also contain information about the recoverer and the payer: full name, place of residence, contact details, place of work (for the alimony payer).

- At the next stage, it is necessary to state all the circumstances (what maintenance obligations are there, the amount of the debt), as well as the requirement for the court (to recover all amounts of the debt from the defaulter).

- The text of the application must contain a link to documents confirming the existence of grounds for collecting alimony (court decision, agreement on alimony), as well as confirming the existence of a debt (certificate from a bailiff).

- At the end of the application, a list of attachments to the claim must be submitted (copy of passport, copy of marriage or divorce certificate, copy of certificate of employment, copy of certificate of family composition).

- Date and signature of the applicant.

An application for issuing a court order to recover debt from a maintenance defaulter is submitted to the Magistrate's Court at the place of permanent residence of the applicant. This can be done both independently and through a representative, subject to a power of attorney certified by a notary.

The received statement of claim is considered in court within 5 days. In such cases, the court session is not held, which means that the parties are not invited to the court. Based on the results of the consideration of the case, a court order is sent to the alimony payer and the recipient.

In accordance with Russian law, he has the right to challenge the order within 10 days from the date of issuance of the document. In the absence of such objections, the case is transferred to the bailiffs, who will deal with the collection of the debt.

A sample application for a court order can be downloaded here.

Application for malicious non-payment of alimony

If there are signs of a crime in the actions of the non-payer - malicious evasion from payment of alimony, such a violator may be held liable under the criminal law. Moreover, in addition to punishment, he will also have to pay the entire amount of the debt accumulated during the period of non-payment.

Moreover, in addition to punishment, he will also have to pay the entire amount of the debt accumulated during the period of non-payment.

The bailiff, who deals with the proceedings on the case of non-payment of alimony, has the right to initiate a case of malicious evasion of his duties to provide for a minor child. However, if the specialist for some reason does not make such a decision, the second parent himself can initiate the start of this process. To do this, you must send a bailiff a statement drawn up in any form.

Requirements for filling out the application

The header of the document must contain information about the recipient - the name of the bailiff service, the full name of the specialist involved in this case. Also, the applicant must be indicated here - full name, address of residence, contact phone number.

The next part of the application is the name of the document. It should indicate "Application for criminal prosecution for malicious evasion of payment of alimony. " Some experts advise here to indicate information about the non-payer: his full name, contact details, address of permanent residence, place of work.

" Some experts advise here to indicate information about the non-payer: his full name, contact details, address of permanent residence, place of work.

In the main part of the document, it is necessary to state all the circumstances of the case, namely:

- Information about when exactly the maintenance agreement was concluded or the court decision was made to impose on the parent the obligation to support his child in the form of alimony.

- In what amount and with what regularity the allowance must be paid.

- When and in what amounts the alimony was transferred.

- Amount of arrears in the payment of alimony at the present time.

In the final part of the document, it is necessary to indicate the requirement to bring the guilty person to criminal liability for malicious evasion from paying alimony.

Based on the application received, the bailiff must initiate the commencement of criminal proceedings. After the initial events, the case is transferred to the court.