How to figure out child tax credit

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Our opinions are our own. Here is a list of our partners and here's how we make money.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents. " Check the IRS website for more information.

" Check the IRS website for more information.

How to calculate the child tax credit

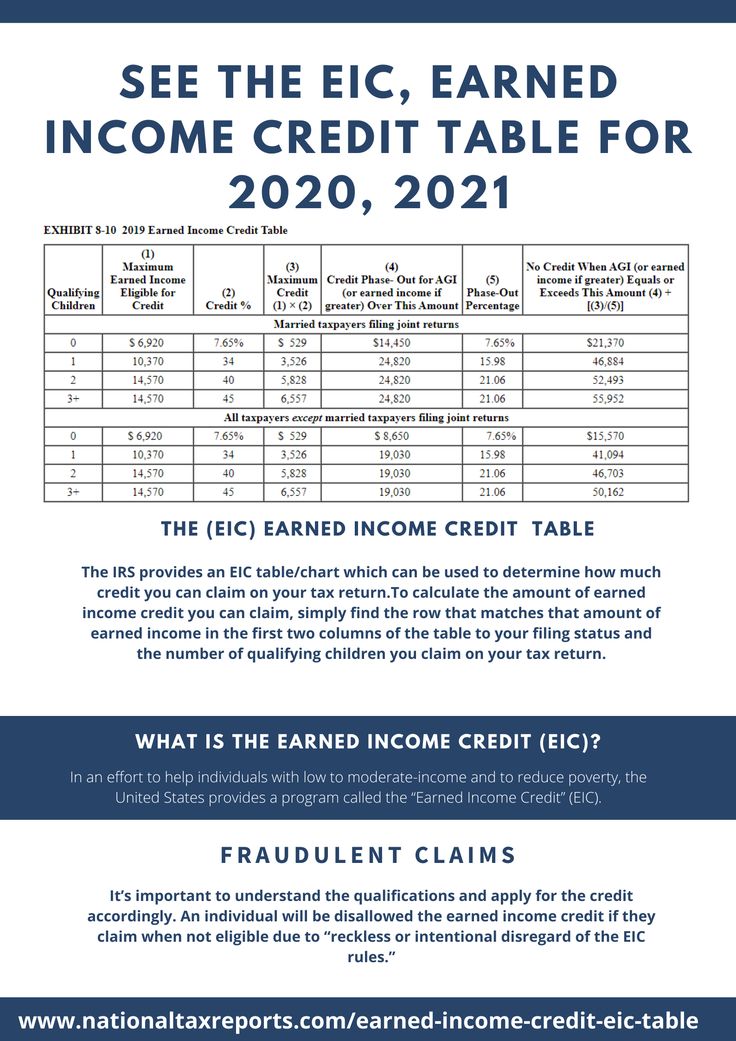

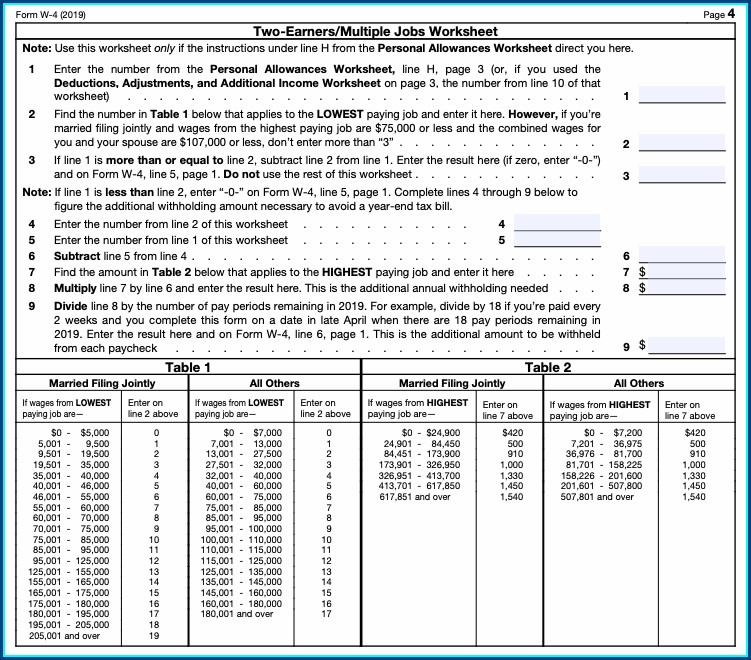

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

How to claim the credit

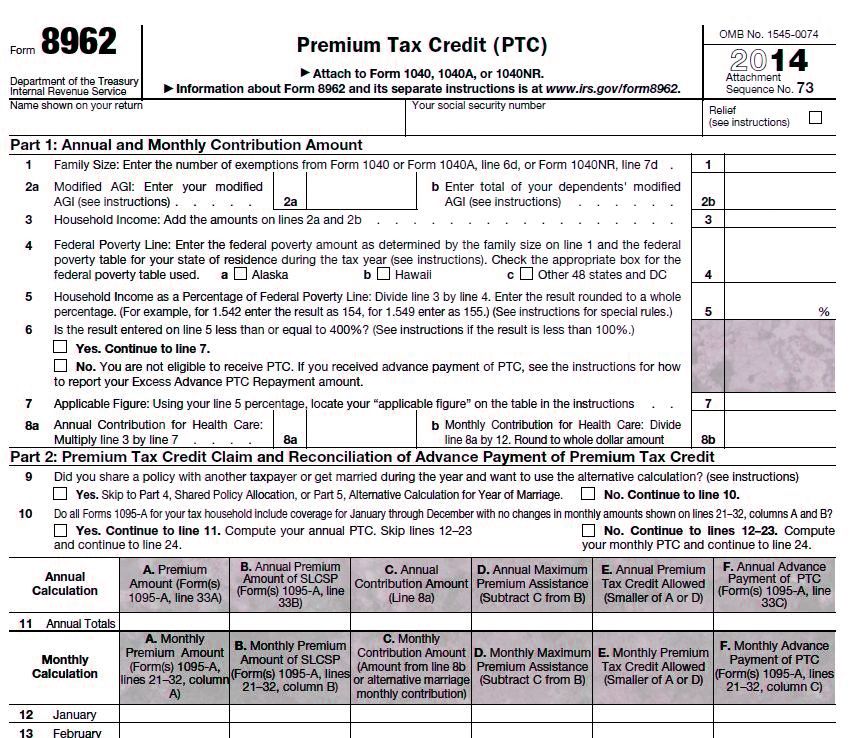

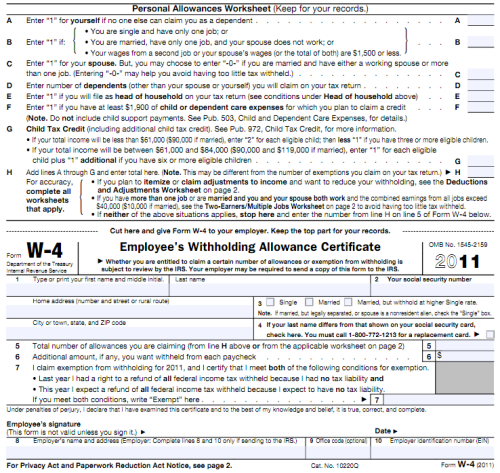

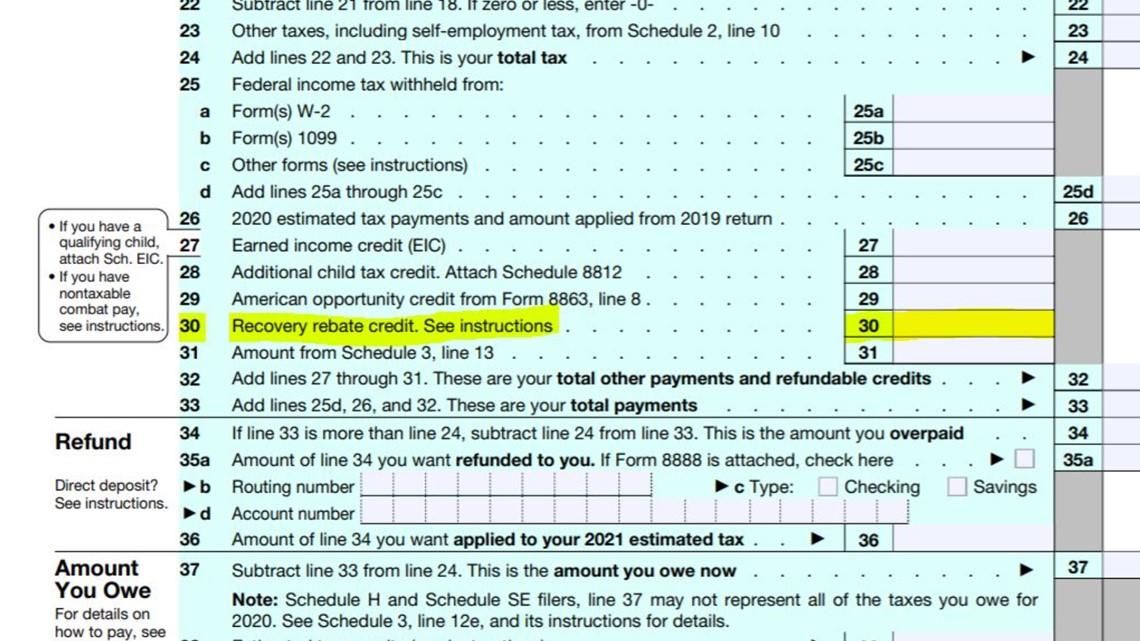

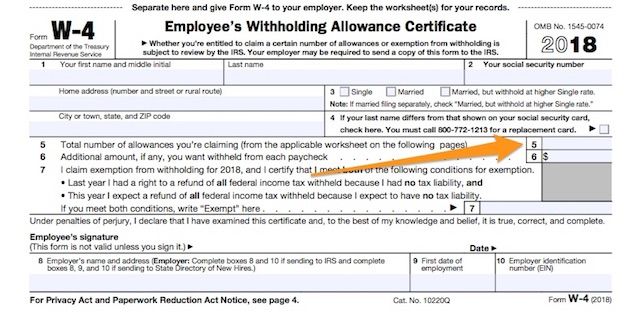

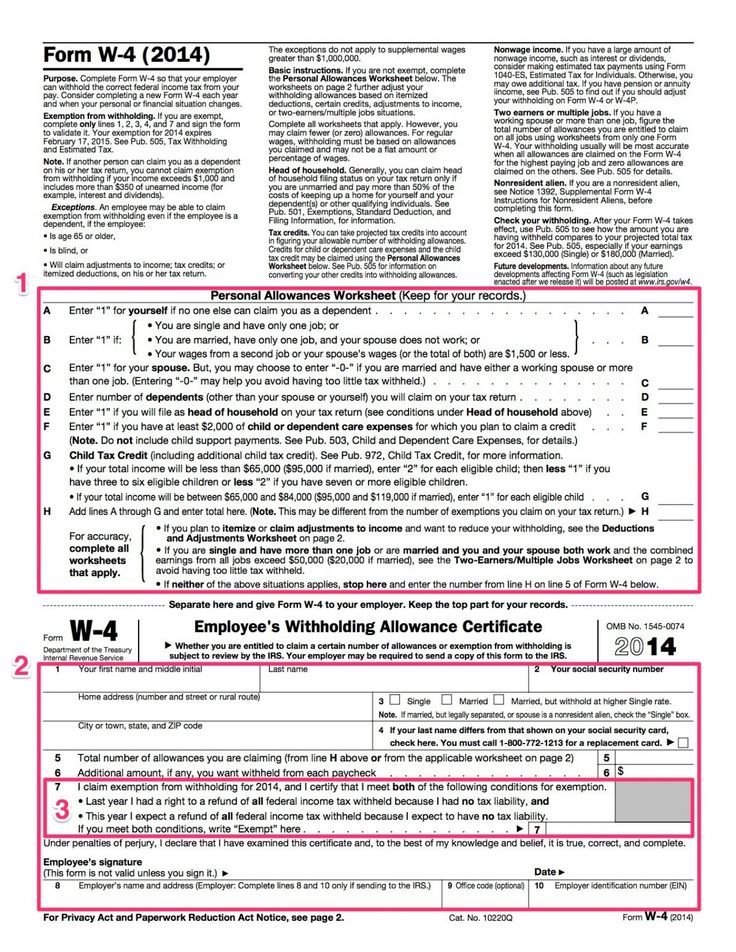

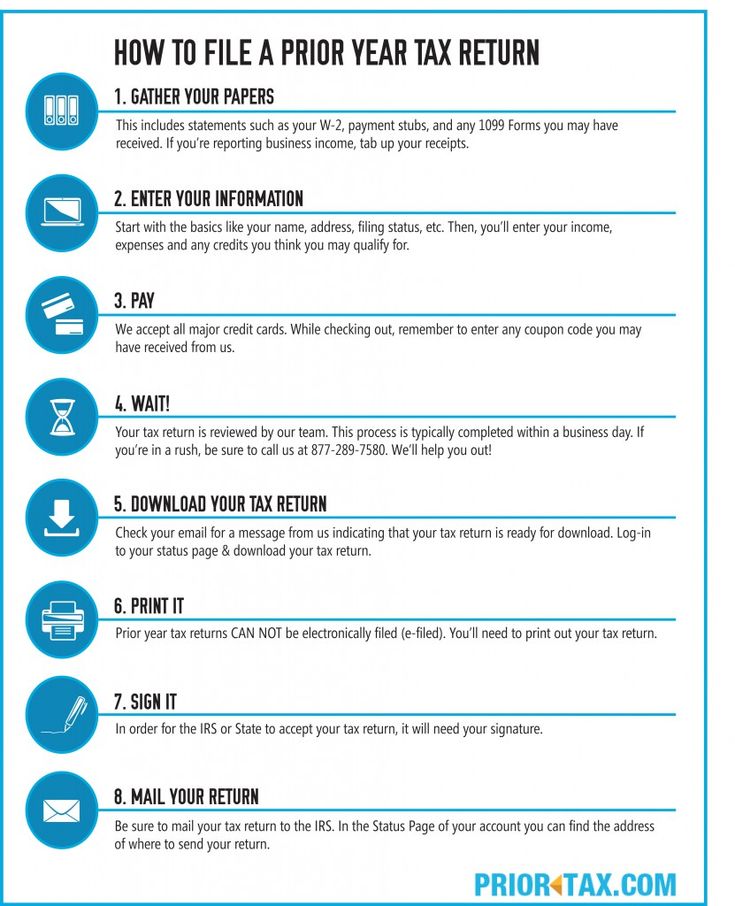

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

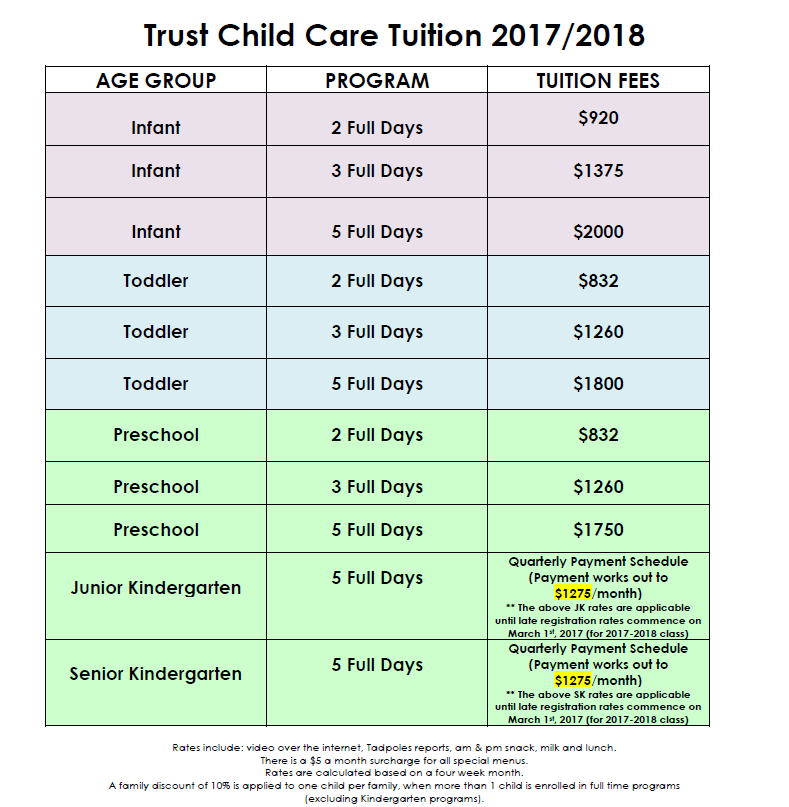

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll also need to make sure your child has a Social Security number by the due date of your 2022 return (including extensions).

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

2021 Child Tax Credit Calculator

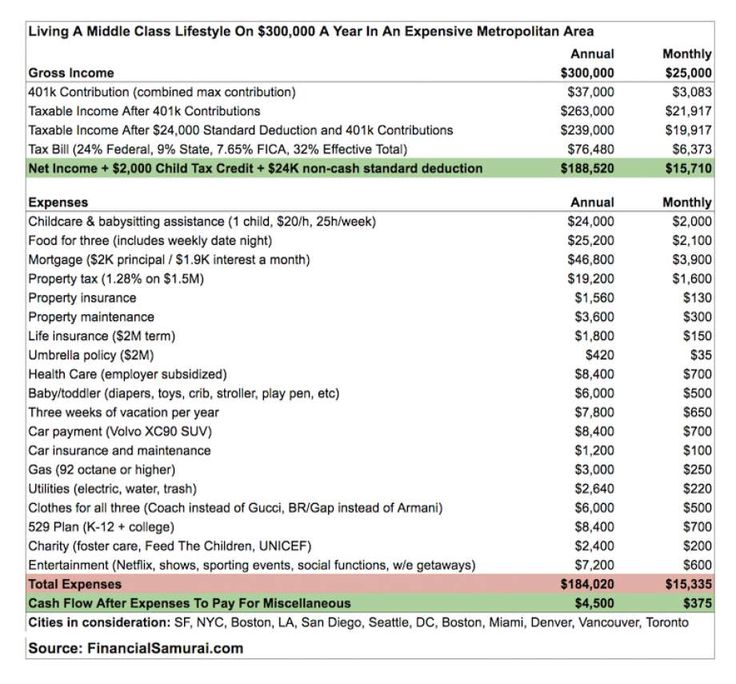

Big changes were made to the child tax credit for the 2021 tax year. The two most significant changes impact the credit amount and how parents receive the credit. First, the credit amount was temporarily increased from $2,000 per child to $3,000 per child ($3,600 for children 5 years old and younger). Second, it authorized advance payments to eligible families from July to December 2021. Half the total credit amount was paid in advance with the monthly payments last year, while the other half is claimed on the 2021 tax return that you file this year. (These changes only apply for the 2021 tax year.)

The two most significant changes impact the credit amount and how parents receive the credit. First, the credit amount was temporarily increased from $2,000 per child to $3,000 per child ($3,600 for children 5 years old and younger). Second, it authorized advance payments to eligible families from July to December 2021. Half the total credit amount was paid in advance with the monthly payments last year, while the other half is claimed on the 2021 tax return that you file this year. (These changes only apply for the 2021 tax year.)

However, not everyone will get the additional credit amount. And some families won't get any child tax credit at all. That's because the credit is reduced – and possibly eliminated – for people with an income above a certain amount. In fact, there are two "phase-out" rules in play – one just for the extra $1,000 (or $1,600) amount and one for the remaining credit. That makes calculating the total child tax credit (and the monthly payments you should have gotten last year) very tricky.

But don't worry – we've got you covered. If you want to see how large your credit will be, simply answer the four questions in the calculator below and we'll give you a customized estimate of (1) the amount you should have received each month last year from July to December, and (2) how much you can claim as a child tax credit on your 2021 tax return, which is due April 18, 2022, for most people. It's that easy!

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

(Note: Results assume you received six monthly child tax credit payments last year.)

Pre-2021 Child Tax Credit Amount

For the 2020 tax year, the child tax credit was $2,000 per qualifying child. It was gradually phased-out (but not below zero) for joint filers with a modified adjusted gross income (AGI) of $400,000 or more and for other taxpayers with a modified AGI of $200,000 or more.

It was gradually phased-out (but not below zero) for joint filers with a modified adjusted gross income (AGI) of $400,000 or more and for other taxpayers with a modified AGI of $200,000 or more.

(For purposes of the child tax credit, modified AGI is the amount of adjusted gross income shown on Line 11 of your 2020 Form 1040 or Line 8b of your 2019 Form 1040, plus any amount excluded from gross income on your tax return as foreign earned income; foreign housing expenses; or as income from sources within Puerto Rico, Guam, American Samoa or the Northern Mariana Islands.)

New Phase-Out Scheme for 2021

For 2021, the increase (i.e., the extra $1,000 or $1,600) is gradually phased-out for joint filers with a modified AGI of $150,000 or more, head-of-household filers with a modified AGI of $112,500 or more, and all other taxpayers with a modified AGI of $75,000 or more. However, the increase can't be reduced below zero (other limitations to this reduction will apply as well).

After any reduction of the increased credit amount is calculated, the pre-existing phase-out is then applied to the remaining credit amount. So, for joint filers with a modified AGI of $400,000 or more and other taxpayers with a modified AGI of $200,000 or more, the credit is subject to an additional reduction – possibly to $0.

Reconciliation of Advance Payments

When you fill out your Form 1040 this year, you'll have to compare the total amount of advance child tax credit payments that you received in 2021 with the amount of the actual child tax credit that you can claim on your 2021 return.

For most people, the amount of the credit will exceed the advance payments you received. If this is the case, you can claim the excess credit on your 2021 return. However, if the IRS paid you too much in monthly payments last year (i.e., more than the child tax credit you're entitled to claim for 2021), you might have to pay back some of the money. Parents with 2021 modified AGI no greater than $40,000 (single filers), $50,000 (head-of-household filers), or$60,000 (joint filers) won't have to repay any child tax credit overpayments. However, families with a modified AGI from $40,000 to $80,000 (single filers), $50,000 to $100,000 (head-of-household filers), or $60,000 to $120,000 (joint filers) will need to repay a portion of any overpayment. Parents with modified AGIs above those amounts will have to pay back the entire overpayment.

However, families with a modified AGI from $40,000 to $80,000 (single filers), $50,000 to $100,000 (head-of-household filers), or $60,000 to $120,000 (joint filers) will need to repay a portion of any overpayment. Parents with modified AGIs above those amounts will have to pay back the entire overpayment.

For more information on the 2021 child tax credit, see Child Tax Credit FAQs for Your 2021 Tax Return.

Stay on Top of Personal Finance Developments

Follow Kiplinger for the latest news and insights on important personal finance matters. Stay with us on:

email. Sign up free for our daily Kiplinger Today e-newsletter .

social media. Follow us on Instagram , Twitter and Facebook .

podcasts. Subscribe free to our weekly Your Money's Worth podcast on Apple Podcasts , Google , Spotify .

Individual income tax in Kazakhstan 2023: how to calculate

Published:

- nine0019 Two thousand tenge: Pixabay

- scholarship;

- dividends and winnings;

- individual entrepreneur income and pension payments;

- forgiven debt.

- Add up the entire income of an individual in the understanding of Article 319 of the Tax Code of the Republic of Kazakhstan.

- Subtract those that, according to Article 341 of the Tax Code of the Republic of Kazakhstan, are classified as non-taxable income.

- Subtract from the balance the deductions for OPV and ESHI, the standard monthly deduction of 14 MCI and other deductions provided by law (882 MCI for war and labor veterans, disabled people, disabled children and their parents or guardians; up to 94 MCI - expenses for medicine, except for cosmetology; voluntary pension contributions).

- For the remaining amount, apply the IIT rate provided for by the Tax Code of the Republic of Kazakhstan (from January 1, 2023 for all types of income - 10%).

- From salary 200 thousand tenge should pay 10% of mandatory pension contributions (OPV, part 1 of article 25 of the Law of the Republic of Kazakhstan "On Pension Provision in the Republic of Kazakhstan"): 200,000 × 10% = 20,000 tenge; nine0008

- Also, from a salary of 200 thousand tenge, it is necessary to pay 2% of contributions for compulsory social health insurance (VOSMI, part 1 of article 28 of the Law of the Republic of Kazakhstan “On Compulsory Social Health Insurance”): 200,000 × 2% = 4,000 tenge;

- The amount of CPC and ESHI should be deducted (apply a deduction) from the amount of income: 200,000—20,000—4,000=176,000 tenge;

- The standard deduction in the amount of 14 MCI (in 2023 - 3,450 tenge) should be deducted from the balance in accordance with Article 346 of the Tax Code of the Republic of Kazakhstan: 176,000—14×3,450=176,000—48,300=127,700 tenge; nine0008

- The remaining amount after all deductions should be subject to the IIT rate of 10%: 127,700×10%=12,770 tenge.

-

Chinese calendar

nine0019 -

French Diet

-

Medical methods

The Tax Code of the Republic of Kazakhstan provides for an individual income tax, which is levied on most Kazakhstanis. In 2023, new PIT rates will come into effect. In order not to have problems with the tax, you should know how to calculate and pay individual income tax in Kazakhstan .

In 2023, new PIT rates will come into effect. In order not to have problems with the tax, you should know how to calculate and pay individual income tax in Kazakhstan .

What is PIT in Kazakhstan?

Individual income tax (IPT) is one of the types of taxes, a direct tax, provided for by the tax legislation of Kazakhstan (Tax Code). Such a tax is inherent in all tax systems of the world and is most fairly correlated with the income of a particular person. nine0005

Who pays income tax in Kazakhstan? The circle of persons who are obliged to pay PIT is defined by Article 316 of the Tax Code of the Republic of Kazakhstan. Income tax must be paid by all individuals who have income, including citizens of the Republic of Kazakhstan, foreigners or stateless persons who are considered residents of Kazakhstan. PIT is also paid by individual entrepreneurs, with the exception of individual entrepreneurs who pay a single land tax under a special tax regime (SNR).

As the information and analytical portal PRO1C explains, parents, guardians, foster parents, children with disabilities and disabled since childhood, individuals with disabilities are not exempt from paying the PIT.:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/07-02-2021/t_19b2d28161ef497a9c73691a93aac68b_name_t_03ab5cd0d18a4ffc9ab18b1860700783_name_image.jpg) But under Article 346 of the Tax Code of the Republic of Kazakhstan, they have the right to an additional tax deduction in the amount of 882 MCI per calendar year. nine0005

But under Article 346 of the Tax Code of the Republic of Kazakhstan, they have the right to an additional tax deduction in the amount of 882 MCI per calendar year. nine0005

It is important to understand that in most cases an individual does not calculate, withhold and transfer the PIT to the budget. This is what the tax agent does. For example, for an employee, the tax agent will be his employer, who will transfer the taxes due under the law from the employee’s salary.

Although wages remain the most common type of income subject to personal income tax, other incomes are also subject to personal income tax. According to Article 321 of the Tax Code, among other taxable income:

You should know that according to Article 319 of the Tax Code, a number of incomes are not included in the annual income of an individual. Among them are official compensation for business trips, field allowances, the cost of overalls, medical examinations and professional vaccinations, and more than 40 items.

Among them are official compensation for business trips, field allowances, the cost of overalls, medical examinations and professional vaccinations, and more than 40 items.

Taxpayers and tax agents should pay attention to changes in the tax rate. The Law of the Republic of Kazakhstan No. 135 dated July 11, 2022 introduced changes to the CIT rates. If earlier Article 320 of the Tax Code provided for a rate of 5% for dividends and a rate of 10% for all other income, then from January 1, 2023, the PIT rate is unified for all types of income and is 10%. nine0005

How to calculate income tax in Kazakhstan in 2023?

Everyone can calculate the IIT on their own. To get the exact figure that should be paid as a personal income tax, make the following calculations:

For greater clarity of the algorithm, consider the following example for calculating the amount of IIT with a salary of 200 thousand tenge of a citizen of the Republic of Kazakhstan who is not entitled to special types of deductions:

As can be seen from the example above, from a salary of 200,000 tenge, IIT 12,770 tenge should be paid, which is about 6.4% of income. The total tax burden will be: 20,000 (OPV) + 4,000 (VOSMI) + 12,770 (IPT) = 36,770 tenge, or about 18.4% with a salary of 200,000.

algorithm for its calculation. Thanks to this, you can accurately understand how much taxes will be withheld from income in favor of the state. A timely noticed error in the calculations of the tax agent will help to avoid sanctions from the revenue authorities. nine0005

Original article: https://www.nur.kz/nurfin/personal/1776367-individualnyj-podohodnyj-nalog-v-kazahstane-kak-rasscitat/

Child gender calculator

On this page we present the most popular methods among the people. Of course, these methods are not based on serious scientific developments and do not give a 100% guarantee, so it makes sense to perceive such calculations more as entertainment. nine0087

nine0087

The birth of a child is always a miracle. Whoever is born: a boy or a girl, for the parents it will be the most beloved person in the world. And yet, most potential mothers and fathers, planning the birth of a baby, would not refuse the opportunity to "program" the sex of the unborn child.

Calculation of the sex of the unborn child

Husband's Age nine0002 Age of the wife

Month of ConceptionJanuaryFebruaryMarchAprilMayJuneJulyAugustSeptemberOctoberNovemberDecember

Do you have children together? No Boy Girl Boy and girl Two boys Two girls

Does the spouse have siblings? NoBrotherSisterBrother and sisterTwo brothersTwo sisters

Intensity of sexual life 1-2 times a week More often than 2 times a week Less than once a week

Your diet is dominated by Dairy products, vegetables and nuts Meat, mushrooms, potatoes, pickles Mixed diet

Most likely you will have:

This calculator is based on the famous Chinese table and allows you to calculate the sex of the child by the date of conception and the woman's age. On our own behalf, we can add that the administration of the Nova Clinic website tested the effectiveness of the method by calculating the sex of children born in our center, and in most cases, oddly enough, received the correct answer from the calculator.

On our own behalf, we can add that the administration of the Nova Clinic website tested the effectiveness of the method by calculating the sex of children born in our center, and in most cases, oddly enough, received the correct answer from the calculator.

Enter the number of completed years between 18 and 55

Calculation of the sex of the unborn child

Mother's age18192021222324252627282930313233343536373839404142434445

Month of ConceptionJanuaryFebruaryMarchAprilMayJuneJulyAugustSeptemberOctoberNovemberDecember

Most likely you will have:

This technique, which appeared in the second half of the 20th century, is based on the assertion that spermatozoa carrying the male Y chromosome are more mobile, but less viable. At the same time, germ cells that carry the X chromosome move more slowly, but at the same time they can survive in the female body for a longer time. Thus, if sexual intercourse occurs at the time of ovulation, the probability of having a boy increases, if a girl is born a long time before it. In addition, the change in the vaginal environment plays a role, which gradually changes from alkaline to acidic (that is, more aggressive and harmful to spermatozoa with the Y chromosome). nine0005

Thus, if sexual intercourse occurs at the time of ovulation, the probability of having a boy increases, if a girl is born a long time before it. In addition, the change in the vaginal environment plays a role, which gradually changes from alkaline to acidic (that is, more aggressive and harmful to spermatozoa with the Y chromosome). nine0005

It is believed that an active sexual life of spouses contributes to the conception of a son, and a more moderate one - to a daughter. We proceed from the fact that spermatozoa with a Y-chromosome are less tenacious. Thus, in the ejaculate of a man after prolonged abstinence, there is a greater number of spermatozoa with the X chromosome. In addition, rare sexual intercourse contributes to a decrease in sperm motility (which is why spermogram delivery requires some preparation, in particular, abstinence for no more than a week), which means that the chances that sperm carrying the X chromosome will be the first to reach the eggs increase even more. nine0005

nine0005

It was the experts from France, Jacques Laurent and Joseph Stolkowski, who came to the conclusion that the diet can have a direct impact on the likelihood of conceiving a female or male child. As a result of the research they have developed a special diet. According to this method, in order to conceive a girl, it is required to eat onions, eggplants, cucumbers, beets, carrots, green peas, capsicum, nuts and dairy products for at least 2 months before the alleged conception. Accordingly, those couples who dream of an heir should focus on meat dishes, mushrooms, potatoes and tropical fruits. In other words, in the first case, the body should receive a maximum of calcium and magnesium, in the second - sodium and potassium. According to unverified data, the effectiveness of this method is about eighty percent. nine0005

How to calculate the sex of the child "by the stars"? If you are planning the birth of a daughter, then at the time of conception, the Moon should be in any of the so-called female zodiac signs (Pisces, Taurus, Cancer, Virgo, Scorpio, Capricorn). Accordingly, if you dream of a son, wait until the Moon is in Aries, Gemini, Leo, Libra, Sagittarius or Aquarius.

Accordingly, if you dream of a son, wait until the Moon is in Aries, Gemini, Leo, Libra, Sagittarius or Aquarius.

If you believe the creators of this technique, then in the human body there is a cyclic renewal of blood, which has a direct impact on the sex of the unborn baby. Moreover, in men, the blood is updated every four years, and in women - once every three years. The calculation assumes that one of the parents, whose blood at the time of conception will be “younger”, will “transmit” their gender to the child. By the way, if a woman has a negative Rh factor, the result should be interpreted exactly the opposite. To find out the result, divide the age of a woman by 3, men - by 4. The authors also suggest taking into account the dates of serious blood loss (surgery, bleeding), and in this case, the countdown should be from this moment. It is logical to assume that sometimes the results of division may coincide. In this case, the authors state, you will have twins. nine0005

You can also determine the sex of the child using purely medical methods. However, these studies have nothing to do with forecasting and "programming". The most common and accurate is the determination of the sex of the child by ultrasound - after 20 weeks, in most cases, the doctor will be able to give you accurate information. Recently, a method is also gaining popularity that allows you to find out the sex of the child after the 7th week of pregnancy by analyzing the blood of a pregnant woman. The study is based on the fact that the mother's blood contains a small amount of fetal DNA, and if Y chromosomes are found, it can be argued that a boy is expected. During the IVF cycle, PGD can be performed - preimplantation genetic diagnosis. This method allows you to test embryos for the presence of certain chromosomal abnormalities and find out the sex of the unborn child. If there are sex-linked hereditary diseases in the family, embryos of only a certain gender are transferred into the uterine cavity. However, Russian law prohibits the choice of the sex of the child in the absence of medical indications.

However, these studies have nothing to do with forecasting and "programming". The most common and accurate is the determination of the sex of the child by ultrasound - after 20 weeks, in most cases, the doctor will be able to give you accurate information. Recently, a method is also gaining popularity that allows you to find out the sex of the child after the 7th week of pregnancy by analyzing the blood of a pregnant woman. The study is based on the fact that the mother's blood contains a small amount of fetal DNA, and if Y chromosomes are found, it can be argued that a boy is expected. During the IVF cycle, PGD can be performed - preimplantation genetic diagnosis. This method allows you to test embryos for the presence of certain chromosomal abnormalities and find out the sex of the unborn child. If there are sex-linked hereditary diseases in the family, embryos of only a certain gender are transferred into the uterine cavity. However, Russian law prohibits the choice of the sex of the child in the absence of medical indications.