How to calculate child maintenance

How much child maintenance should I pay?

If you and your ex-partner have children, you’re both expected to continue to pay towards their costs after you separate. And often that means one parent will pay the other. You can agree this between you or, if you can’t agree, ask the Child Maintenance Service to calculate the amount.

What’s in this guide

- Arranging child maintenance yourselves

- How much are you expected to pay?

- When does child maintenance stop?

- How your income affects how much you pay

- How the number of children affects how much you pay

- How shared care affects child maintenance

- Paying for children from another relationship

Arranging child maintenance yourselves

If you and the other parent are arranging child maintenance between you, you’re free to decide the amount one parent pays the other. This is referred to as a family-based arrangement.

While the Child Maintenance Service doesn’t need to be involved if you do this, it’s a good idea to check the amount you agree against what they would assess it to be.

It’s important to think about what you’d like to include in this payment and how you’d like to pay:

- Do you want to pay a fixed regular amount or will you vary it to help with extra expenses throughout the year?

- Do you want to cover the cost of things like school uniform, activities or holidays?

- Do you want to pay a percentage of your earnings? If your earnings fluctuate, this might be helpful to you but it would mean the amount of child support is less predictable.

Back to top

How much are you expected to pay?

If you can’t agree how much child maintenance one parent should pay the other, you can ask the Child Maintenance Service to calculate it for you.

They’ll take into account:

- how many children you have

- the paying parent’s income

- how much time children spend with the paying parent

- whether the paying parent is paying child maintenance for other children.

Back to top

When does child maintenance stop?

You’re normally expected to pay child maintenance until your child is 16, or until they’re 20 if they’re in school or college full-time studying for:

- A-levels

- Highers, or

- equivalent.

Child maintenance might stop earlier – for example, if one parent dies or the child no longer qualifies for child benefit.

Back to top

How your income affects how much you pay

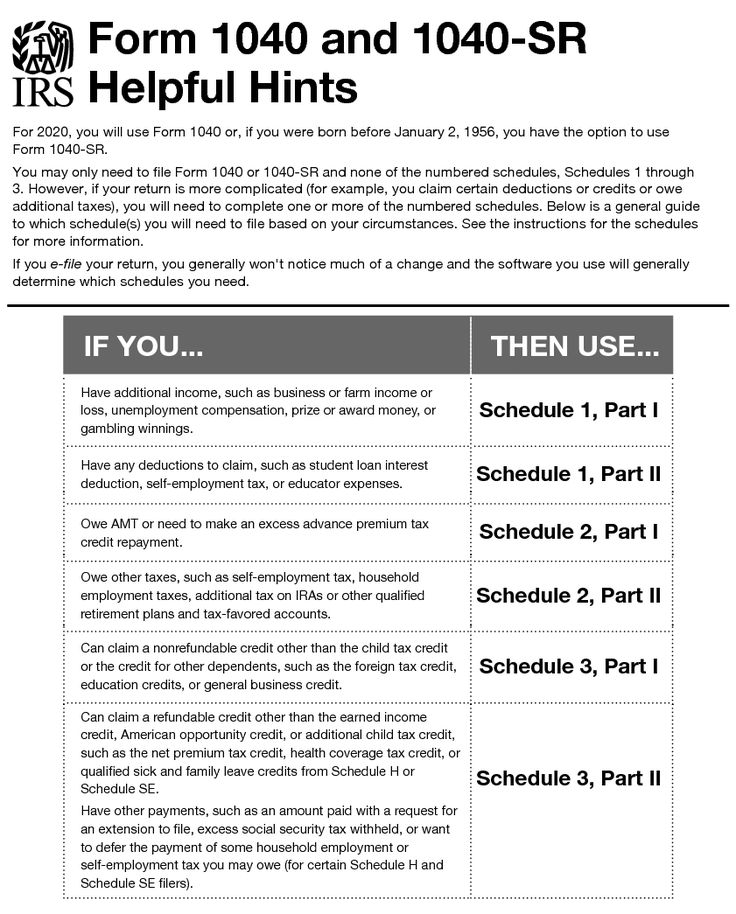

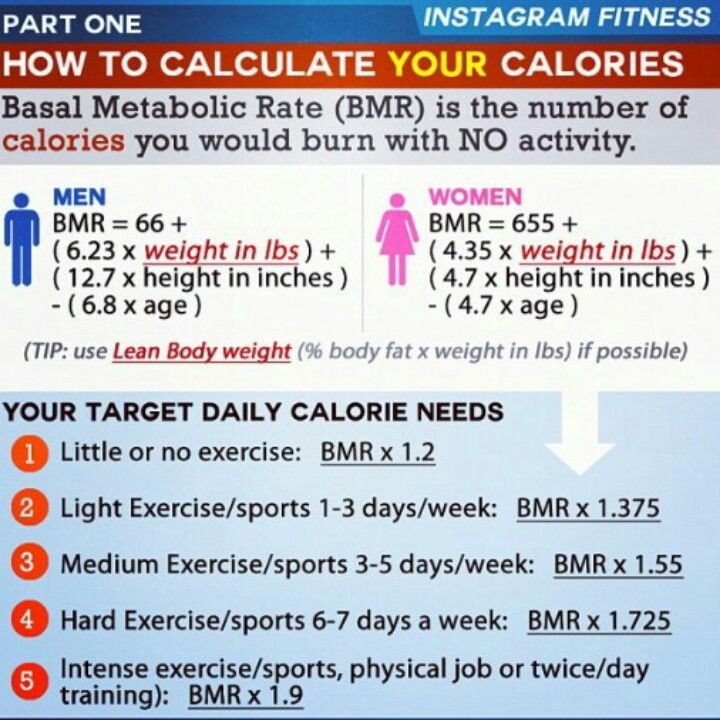

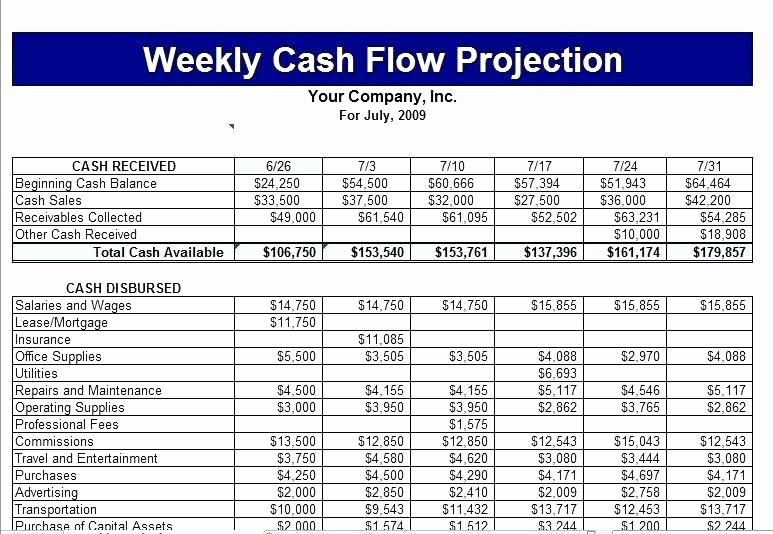

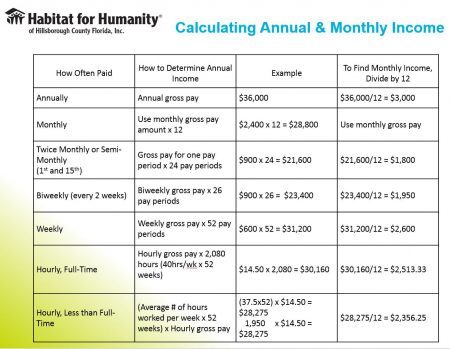

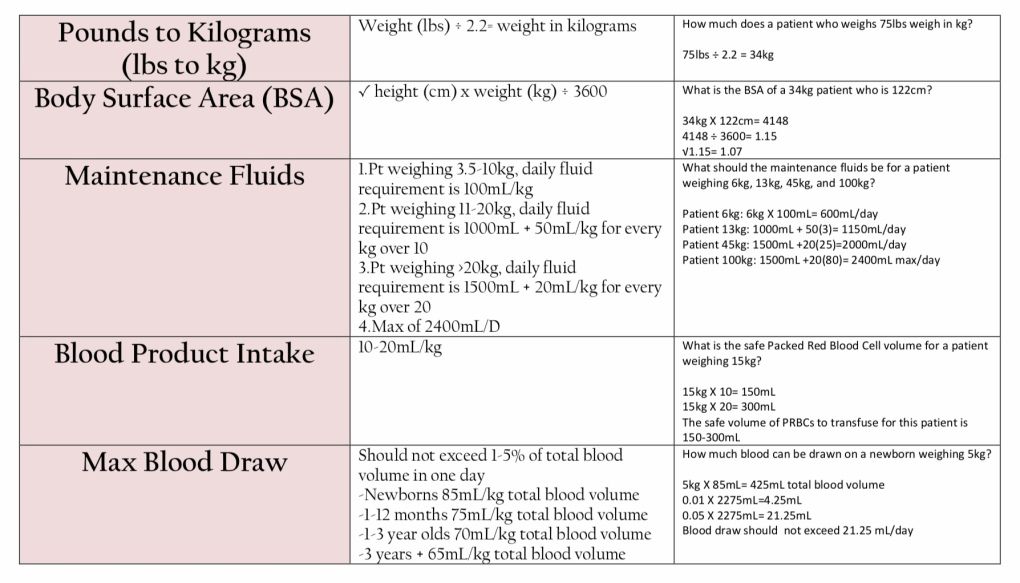

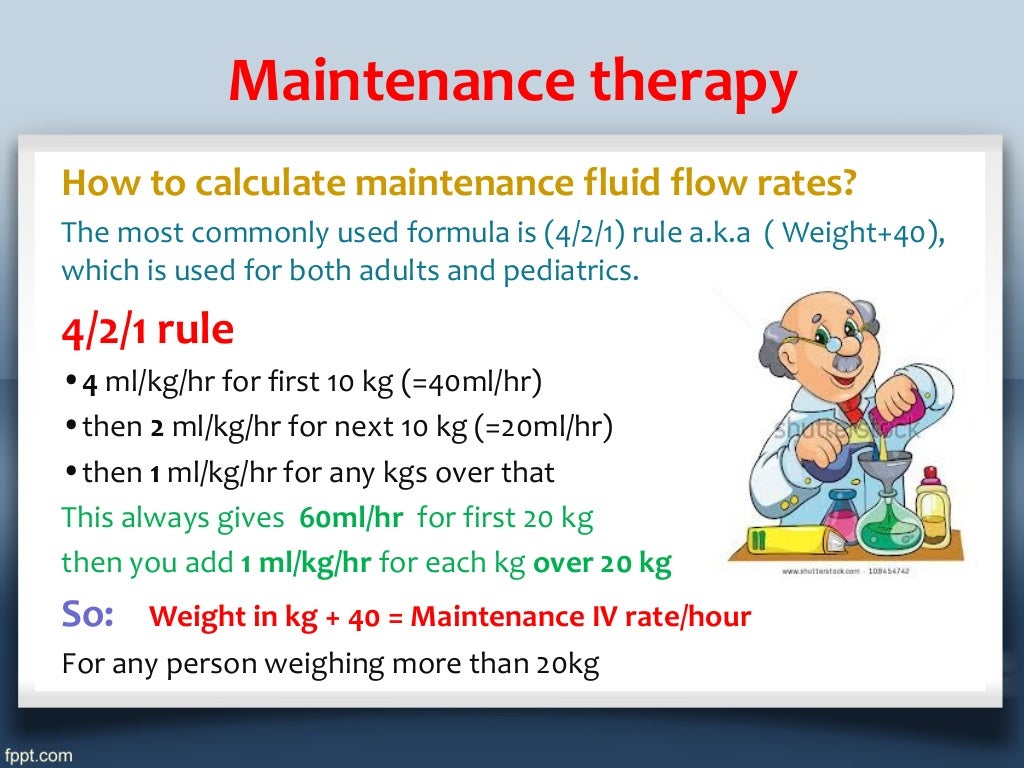

There are different child maintenance rates according to the paying parent’s gross weekly income – this means how much you receive before things like tax and National Insurance are taken off.

Child maintenance amounts based on weekly pay

|

Unknown |

Default |

£38 for one child, £51 for two children, £61 for three or more children |

|

Below £7 |

Nil |

You don’t pay any child maintenance |

|

Between £7 and £100 or if you’re on benefits |

Flat |

£7 a week |

|

Between £100. |

Reduced |

Use the child maintenance calculator |

|

Between £200 and £3,000 |

Basic |

Use the child maintenance calculator |

(2021 figures - see GOV.UK for more information. )

)

If your gross weekly income is more than £3,000, you can apply to the court to make a child maintenance ‘top-up’ order.

But before the court will deal with your application, they’ll need to see a Child Maintenance Service calculation showing this.

Back to top

How the number of children affects how much you pay

If you’re paying child maintenance and you’re on the basic rate of child maintenance, the amount you pay will depend on the number of children you’re being asked to pay for.

The figures below assume that your children stay with the parent who receives child maintenance all the time.

On the basic rate, if you’re paying for:

- one child, you’ll pay 12% of your gross weekly income

- two children, you’ll pay 16% of your gross weekly income

- three or more children, you’ll pay 19% of your gross weekly income.

Back to top

How shared care affects child maintenance

Many parents decide to share the care of their children.

If your children spend some time with the paying parent, this will reduce the amount of child maintenance he or she pays.

There are different ‘bands’ which determine how much child maintenance is reduced by.

The amount of child maintenance is reduced for each child who spends time with the paying parent.

If over the year your child is with the paying parent between:

- 52 and 103 nights: child maintenance is reduced by 1/7th for each child

- 104 and 155 nights: child maintenance is reduced by 2/7th for each child

- 156 and 174 nights: child maintenance is reduced by 3/7th for each child

- 175 nights or more nights: child maintenance is reduced by 50%, plus an extra £7 a week reduction for each child.

Back to top

Paying for children from another relationship

If the paying parent’s gross weekly income is between £200 and £3,000, and they pay child maintenance for other children, this is taken into account when working out how much they should pay.

The Child Maintenance Service simply reduces the amount of weekly income that it takes into account. For example, if the paying parent is paying for:

- one other child, their weekly income will be reduced by 11%

- two other children, their weekly income will be reduced by 14%

- three or more other children, their weekly income will be reduced by 16%.

Back to top

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

Calculate child maintenance | nidirect

You can use the online calculator to find out how much child maintenance you might pay or receive. The calculated amounts are guidance only for parents living apart. Use the calculations to decide about applying to CMS, making a family-based agreement or asking for a Consent Order.

Service options

If you contacted Child Maintenance Choices and discussed your options with them, you may wish to make an application for statutory child maintenance.

If after having spoken with the Choices Team you would like to consider your options further before making a decision, contact Child Maintenance Service.

- Child Maintenance Service

How to use the calculator

To use the calculator you'll need to know:

- the paying parent's gross weekly income

- the number of children the maintenance is to be paid for

- the number of nights, on average, the paying parent has the child(children) for each year

- the number of other children living in the paying parent’s household

The calculator can give you an indication of the amount of maintenance that might be payable.

The amount of child maintenance worked out by the online calculator may be different from that which the statutory maintenance service works out and asked a paying parent to pay, or the amount that has been agreed in court as part of a consent order.

This should not be used as grounds for appealing against a decision or for asking a court to change a consent order.

- Calculate child maintenance (GOV.UK website)

Circumstances not covered by online calculator

There are a number of circumstances which are not covered by the online calculator.

These include:

- when the paying parent's income is greater than £3,000 per week

- paying parents who receive a benefit

- cases where maintenance will be shared between two or more parents with care

- Other financial commitments in child maintenance cases

Translation help

How to translate this pageHelp improve this page - send your feedback

You must have JavaScript enabled to use this form.

What do you want to do?report a problem

leave feedback

ask a question

Report a problemWhich problem did you find on this page? (Tick all that apply)

A link, button or video is not working

There is a spelling mistake

Information is missing, outdated or wrong

I can't find what I'm looking for

Another issue

Messages

Tell us more about the problem you're having with the nidirect website.

Enter your feedback

What is your question about?Choose a topic for your question: - Select -AnglingBenefitsBirth certificatesBlue BadgeCareersCompensation due to a road problemChild MaintenanceCivil partnership certificatesCoronavirus (COVID-19)COVID vaccination certificateCriminal record checks (AccessNI)Death certificatesEducational Maintenance AllowanceEmployment rightsHigh Street Spend Local SchemeMarriage certificatesMotoringnidirect accountPassportsPenalty Charge NoticesPensionsPRONI - historical recordsRates or property valuationProblems with roads and streetsSmartpassMy question is about something else

What to do next

How is the amount of alimony determined? | Juristaitab

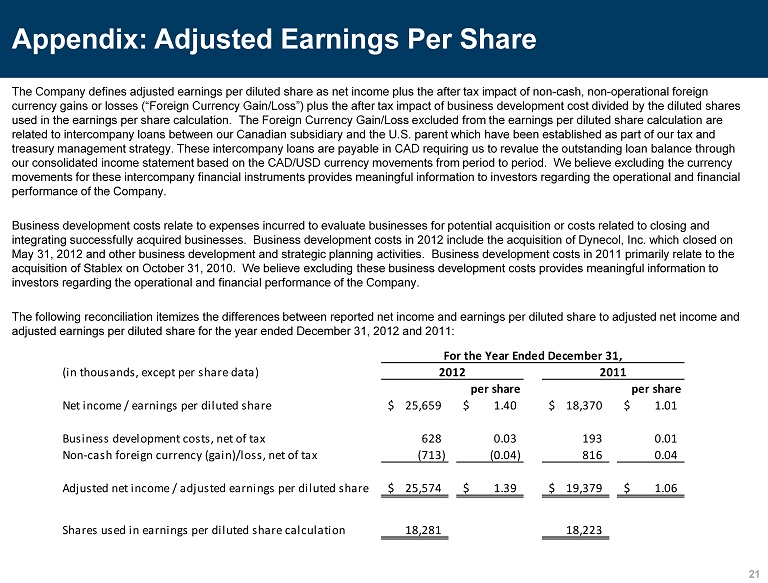

From now on, the subsistence minimum is separated from the so-called minimum wage, which has raised the subsistence minimum every year until now. HUGO lawyer Vahur Kõlvart explains the nature of the new system below.

In the future, minimum child support will have five different components.

A base amount of at least 200 euros per child, indexed annually to the previous year's consumer price index (which will be officially published by Statistics Estonia on 1 April). After indexation, the base amount resulting from indexation in the previous year is considered the base amount for the next year.

3% of the country's average monthly gross salary for the previous year is added (which is also officially published by Statistics Estonia on 1 April).

Number of children supported in one family - in this case, the amount of maintenance for subsequent children is reduced by 15 percent compared to the amount of maintenance for the first child. The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years.

Family allowances - in comparison with the past, the law clearly states that the parent is not obliged to support the child to the extent that the needs of the child can be met by the child allowance and the multi-family allowance. If the benefit claimant receives these benefits, half of the benefit is deducted from the allowance for each child. However, if the recipient of the benefit is a payer, this amount is added to the alimony.

If the benefit claimant receives these benefits, half of the benefit is deducted from the allowance for each child. However, if the recipient of the benefit is a payer, this amount is added to the alimony.

Child living together - if the child lives with the parent who pays support for an average of at least 7 days per month per year, the amount of support is reduced in proportion to the time spent with the obliging parent. Therefore, if the child lives equally with both parents, maintenance can only be collected if this is due to the greater needs of the child, a significant difference in the income of the parents, or an uneven distribution of expenses related to the child between the parents.

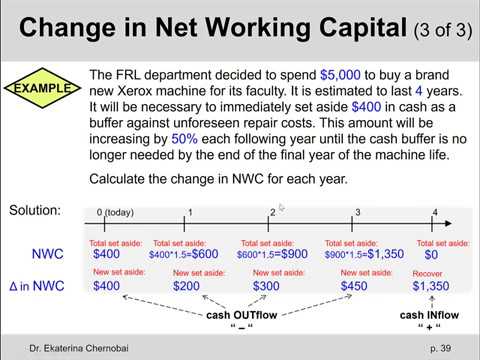

Example:

The child lives with the mother, stays with the father for an average of 10 days per month, and a child allowance of 60 euros is paid to the account of the child's mother. The minimum allowance per child is 70.43 euros.

Base amount: 200 euros 3% of the average salary for the previous year: the average gross salary in 2020 was 1448 euros per month, of which 3% is 43.44 euros.

Family allowances: half of the child allowance is deducted from the parent's maintenance obligations (60/2=30), then the amount of maintenance is 213.44 euros (243.44-30).

Cohabitation: If the child lives with the parent in charge of maintenance between 7 and 15 days per month, the amount of maintenance may be further reduced according to the number of those days. The basis is how many percent of the time the child spends with the parent responsible for child support. 15 days count as half a month. In this example, the child spends 10 days or 66.7% of the required time (10/15) with the parent responsible for child support. Subtracting the necessary time from the maintenance of one parent, we get 70.43 euros (216.59-(216.59*0.667)).

Using the Department of Justice's child support calculator, each parent can calculate the minimum amount of child support the court is likely to award in their case.

until what age do they pay, how much percentage of income can they withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under 18 years old and has not yet become fully capable by decision of the guardianship authority or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of I, II, III groups and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.

0054

0054 - wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances. marriage or within five years thereafter, and the spouses have been married for a long time.0054

Alimony can also be received by:

- disabled parents who need help, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient means for this, if they cannot receive alimony from their parents.

After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones; - incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones. This rule does not apply to guardians, trustees and adoptive parents;

- social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members.

Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

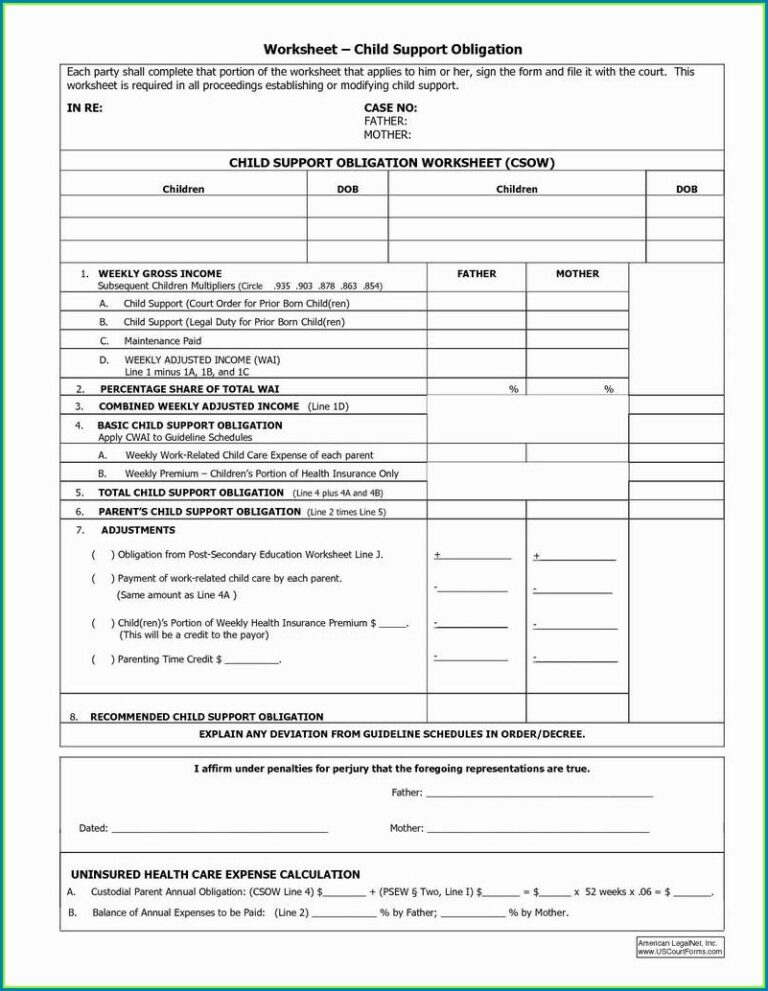

3. What documents are needed to apply for child support?

The statement of claim for the payment of alimony must be accompanied by:

- copies of it - one for the judge, the defendant and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- single housing document and certificates of income of all family members;

- calculation of the amount you expect to receive as alimony. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is assigned from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

In exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, unless the child gets married earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated.

01 and £199.99

01 and £199.99