How much is child tax credit in uk

Child tax credits - how much you can get

Menu Search

This advice applies to England

Universal Credit has replaced child tax credits for most people. Before you make a claim, you should check if you can get child tax credits. You might need to claim Universal Credit instead.

If you’re responsible for any children or young people born before 6 April 2017, you can get up to £3,480 a year in child tax credits for your first child and up to £2,935 a year for each of your other children until they turn 16.

You can keep claiming until they’re 20 if they stay in approved education or training.

If you have any children after 6 April 2017, you can only get child tax credits for them if they're your first or second child. You could get £2,935 a year for each child.

There are some exceptions to this rule, for example if you’re expecting twins or triplets - check the exceptions on GOV.UK.

You don't need to be working to claim child tax credits - how much you'll get depends on your circumstances. To work out your claim, HMRC looks at:

- your income from the previous tax year (what you earned for the 12 months up to 5 April)

- how many children, or young people in approved education or training live with you

- when your children were born

- if any of these children or young people are disabled

You won’t know exactly how much you’ll get in tax credits until your claim is processed - this can take up to 5 weeks.

If you're 18 or over, you can use the Turn2us benefits calculator before you apply to work out how much you can get. You’ll need to provide details of your income, working hours and childcare.

You’ll need to provide details of your income, working hours and childcare.

If you’d prefer to work this out with an adviser, contact your nearest Citizens Advice.

Check when you’ll get cost of living payments

In September 2022, the government made a cost of living payment to people getting child tax credits.

The government will give everyone claiming child tax credits a second cost of living payment of £324. You’ll get this between 23 November 2022 and 30 November 2022.

To get this payment you must get child tax credits covering any time between 26 August 2022 and 25 September 2022.

You’ll only get the second cost of living payment once - even if you get more than 1 benefit.

If you haven’t had your first cost of living payment, and you think you should contact HMRC.

Check how to contact HMRC on GOV.UK.

If your child is disabled

You’ll get extra child tax credits for each child or young person you’re responsible for who either:

- gets Disability Living Allowance (DLA) or Personal Independence Payment (PIP)

- is certified blind (or is within 28 weeks of your claim)

This will be £3,545 a year extra, on top of the normal amount, or £4,975 if they get either:

- the highest rate of the care component of DLA

- the enhanced rate of the daily living component of PIP

Additional feedback

Help us improve our website

Take 3 minutes to tell us if you found what you needed on our website. Your feedback will help us give millions of people the information they need.

Your feedback will help us give millions of people the information they need.

Yes No

Leave this name field blankLeave this address field blank

Why wasn't this advice helpful?It isn't relevant to my situation

It doesn't have enough detail

I can't work out what I should do next

I don't understand

Please tell us more about why our advice didn't help.

We can't reply, so if you need help with a problem find out how you can get advice from us.

You've reached the 3000 character limit.

Did this advice help?

Thank you, your feedback has been submitted.Additional feedback

Take 3 minutes to tell us if you found what you needed on our website. Your feedback will help us give millions of people the information they need.

Child Tax Credit | MoneyHelper

Child Tax Credit is a benefit that helps with the costs of raising a child if you’re on a low income. It’s being replaced by Universal Credit, so most people who need help with these costs now have to make a claim for Universal Credit instead.

What’s in this guide

- Universal Credit and Child Tax Credit

- If you’re already claiming Child Tax Credit

- Tax Credits and income changes

Universal Credit and Child Tax Credit

Child Tax Credit is one of six benefits being replaced by Universal Credit.

Unless you’re currently getting Working Tax Credit, you can no longer make a new claim for Child Tax Credit and must apply for the child element of Universal Credit instead.

On Universal Credit, you might be able to claim back up to 85% of eligible childcare costs. In 2022/23 this is up to a maximum of £646.35 for one child, or £1,108.04 for two or more children.

This is compared with the 70% you could claim for childcare costs on Child Tax Credit.

To get the childcare costs element, you must:

- be in paid work, or

- have an offer of paid work that’s due to start before the end of your next Universal Credit monthly assessment period.

If you’re in a couple, your partner must also be in paid work. This is unless they can’t provide childcare because of a limited capability for work, or they’re caring for a severely disabled person.

You can claim the child element of Universal Credit for all qualifying children born before 6 April 2017.

If your children were born on or after 6 April 2017, you’ll only be able to claim for the first two. This is unless you had a multiple birth – or there are other limited exceptions.

Back to top

If you’re already claiming Child Tax Credit

You’ll have to move to Universal Credit at some point.

How and when you move depends on whether you have to make a new claim because of a change in circumstances, or are asked to claim Universal Credit by the Department for Work and Pensions (DWP).

If nothing changes in your life that means you have to claim Universal Credit, DWP will contact you when it's time to move so there is no need for you to do anything until then.

If you have a change in circumstances

You must tell HMRC within 30 days if you have a change of circumstances that could affect your Child Tax Credit. For example:

For example:

- losing or getting a job

- having a baby

- a partner moving in or out.

This might mean you’ll have to make a new claim for Universal Credit. HMRC will tell you what you need to do.

Call the Tax Credit Helpline on 0345 300 3900 to let them know about any changes to your circumstances.

Keeping your tax credits up to date

You need to renew your tax credits claim by 31 July every year if you want to keep getting them.

HMRC will write to you telling you what you need to do to renew your tax credits.

You should get your pack in May or June. The deadline to respond is usually 31 July each year.

If you don’t get your renewal pack, you’ll need to contact the Tax Credit helpline on 0345 300 3900. Do this as soon as you can to make sure you can meet the deadline.

If you miss the deadline

- You’ll be sent a ‘statement of account’, telling you your tax credits will stop.

Any provisional payments you get will be classed as an overpayment and will need to be repaid.

Any provisional payments you get will be classed as an overpayment and will need to be repaid. - Contact HMRC within 30 days of the date on your statement of account. A renewal can then be processed to reinstate your claim back to 6 April.

- If you contact HMRC later than 30 days after you get your statement of account, you’ll only be able to have tax credits reinstated where you can show you have ‘good cause’ for renewing late. You’ll need to contact them by 31 January. Your claim will then be treated as if it was made on 6 April.

- If your claim isn’t reinstated, or you don’t contact HMRC after getting your statement of account, your tax credits payments will stop. And you’ll have to pay back the tax credits you’ve received since 6 April 2020.

If HMRC stops your payments

You might be able to apply for Universal Credit if you‘re under State Pension age (or your partner is). Or you might be able to apply for Pension Credit instead if you (and your partner) are over State Pension age.

Or you might be able to apply for Pension Credit instead if you (and your partner) are over State Pension age.

Renewing your claim for tax credits

When you renew your claim, make sure you use the official HMRC phone number, website and correspondence. This is because around the deadline time there is often an increase in scammers who often target people likely to be reapplying.

You can manage and renew your tax credits at GOV.UK (Opens in a new window)

There’s also online help available to support you. This includes webchat to help try and answer queries around renewing.

Or call HMRC on 0345 300 3900. But be aware that this line can get very busy in the days leading up to the deadline, so give yourself plenty of time.

There’s also a dedicated team to support the most vulnerable customers who can’t go online. People who HMRC know need this support will be contacted by the support team.

Always let HMRC know if your circumstances change at any time during the year. For example, if your income changes, your child leaves home or you move house.

This is because you might have to claim Universal Credit instead.

Back to top

Tax Credits and income changes

If your income goes up by £2,500 or more and you delay telling HMRC or wait until the next time your claim is due to be re-assessed, you might find you’ve been overpaid tax credits.

You’ll be asked to pay this extra money back. This will be either by reducing your future tax credits, or by direct payments if your tax credits have stopped.

To avoid this bill, it’s even more important to tell HMRC within 30 days of when you get the extra money.

It’ll be easier for your tax credits to be adjusted, and decrease the chance you’ll be chased for over-payments later.

It also works the other way. If your income falls by £2,500 or more, you might be entitled to more tax credits.

If you’re asked to repay tax credits and will struggle to pay, speak to HMRC as soon as you can.

Back to top

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

Taxation in the UK: how much individuals, investors and entrepreneurs pay

Content:

- Taxes for individuals

- Important for investors

- For company owners

- Benefits for innovative start-ups

Taxes for individuals

How tax links with the UK are formed

The UK has a special approach to determining the status of a taxpayer. It depends not only on the tax residence of an individual, but also on his domicile (place of permanent residence).

It depends not only on the tax residence of an individual, but also on his domicile (place of permanent residence).

A person can be recognized as a tax resident according to a number of criteria, the key of which is the actual stay in the country for at least 183 days during the tax period

If a resident is also a British domicile, he also pays tax on all his worldwide income. There is a double tax treaty between the UK and Russia, so you don't have to pay the same tax twice.

If a person is simply a resident without domicile status, he receives a special exemption that allows him to not pay tax on his foreign income. But only on the condition that he does not import them into the UK.

“Practice shows that a significant number of people who settled in the UK from Russia and the CIS countries do not have British domicile,” says Dmitry Zapol, partner at IFS Consultants. – For example, a businessman who has moved to London, earning interest on a deposit in a Russian bank, dividends from his Russian LLC, profit from the sale of property in Russia or, say, profit from the sale of securities in Switzerland, can completely avoid British taxation in relation to the said amounts.

Income tax

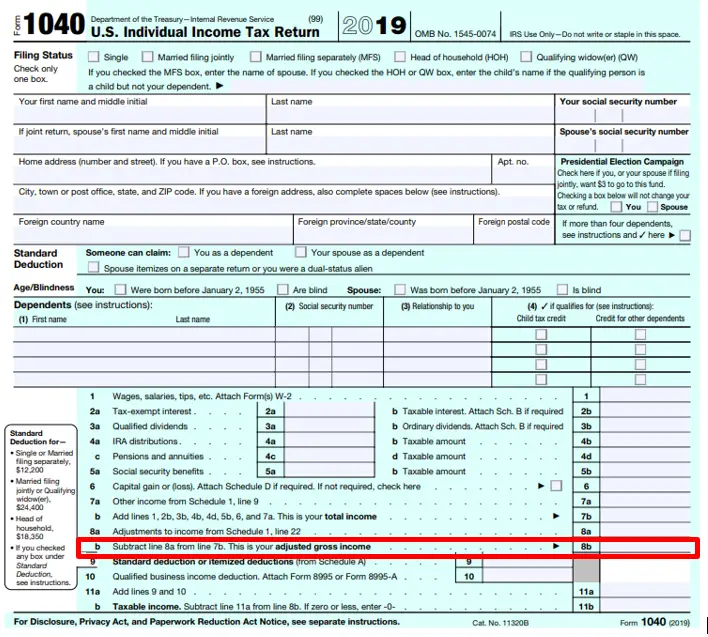

Income is taxed, which includes salaries, bonuses, pensions and savings account interest. The tax period for income tax is valid from April 6 of the current year to April 5 of the next.

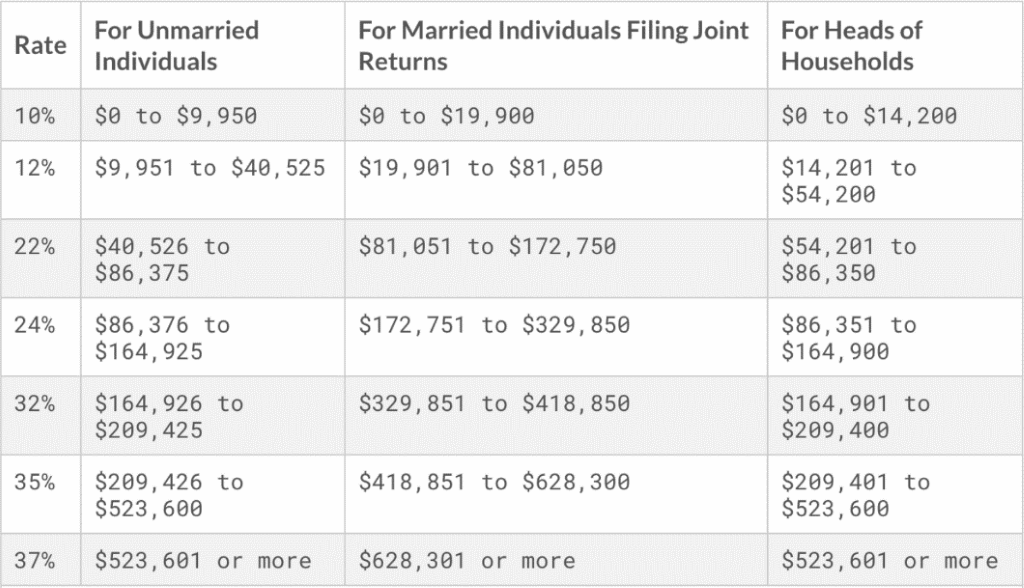

Salaries in the UK are often stated without taxes, so it is important to be able to calculate the income that will be left on hand. The income of an individual is taxed on a progressive scale. Interest rates in 2021/2022:

- Up to £12,570 ($17,482) - 0%

- From £12,571 ($17,483) to £50,270 ($69,914) - 20%

- From £50,271 ($69,915) to £150,000 ($208,616) - 40%

- Over £150,000 ($208,616) - 45%

Rates are indexed annually. In Scotland, the scale is slightly different.

For income over £100,000, the tax-free base is reduced.

If you earn less than £12,570 in a year, for example, after working for several months rather than the full tax period, you do not need to pay income tax. If more, pay tax only on the part of your income that exceeds £12,570.

If more, pay tax only on the part of your income that exceeds £12,570.

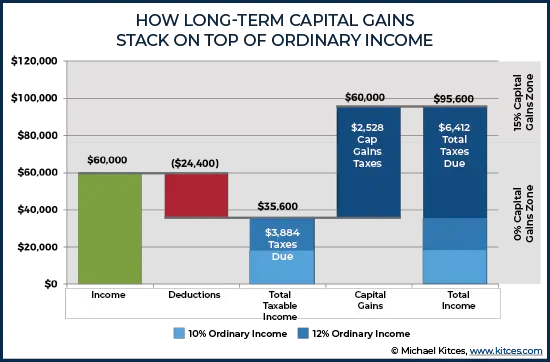

Example: Let's calculate tax for a salary of £60,000 per year. Income of £12,570 is not taxed, the part of income from £12,571 to £50,270 will be subject to a 20% tax rate, and from £50,271 to £60,000 - 40%:

12,570 x 0% + 37,700 x 20% + 9,730 x 40% = £11,432 (income tax)

Not taxed: the first £1,000 from self-employment and rental property, dividends up to £2,000, individual savings accounts (ISA) and national savings certificates.

Insurance premium

The insurance premium is also deducted from the income, which goes to the formation of state benefits and pensions. It is mandatory for employees with wages above £184 per week and for the self-employed with incomes above £6,515, and voluntary contributions can also be paid.

Premium rate (different for self-employed):

- From £184 to £967 per week (from £797 to £4189 per month) - 12%

- Over £967 per week (£4,189 per month) - 2%

In our example, the following will be deducted from the patch:

9564 x 0% + 40,704 x 12% + 9,732 x 2% = 4,884 + 195 = £5,079 (insurance premium)

Thus, after deduction of income tax and insurance premium net income will remain £43,489. To calculate, you can use a ready-made calculator.

To calculate, you can use a ready-made calculator.

Both the income tax and the insurance premium are paid by the employer.

Important for investors

Capital gains tax

In the United Kingdom there is a separate income tax on the sale of any asset such as securities or real estate.

Taxable above £12,300. For most assets, the income tax rate is 20%, for residential property (except for the main residence) - 28%.

Venture investment

Four lucrative venture capital investment schemes are available for investors to help small and medium businesses:

- The Enterprise Investment Scheme (EIS) is a scheme for mid-level startups aimed at business growth.

- The Seed Enterprise Investment Scheme (SEIS) - for companies at an early stage of development.

- Social Investment Tax Relief (SITR) - social entrepreneurship.

- Venture capital trust (VCT) is an analogue of an investment trust that lends money to small companies that are not listed on the stock exchange.

| Maximum annual investment for which reimbursement can be claimed | Percentage of investments for which income tax refund can be requested | |

| EIS | £1m (or £2m if at least £1m of this amount is invested in knowledge-intensive companies) | thirty% |

| SEIS | £100,000 | fifty% |

| SITR | £1m | thirty% |

| VCT | £200,000 | thirty% |

Capital gains tax is not payable on the sale of shares. Under the SEIS scheme, the benefit is valid for 50% of the shares, for the rest - for 100%.

Under the SEIS scheme, the benefit is valid for 50% of the shares, for the rest - for 100%.

Purchase of property

Buyer of property in the UK must pay stamp duty. “If real estate is bought by an individual, the tax rate will vary from 0 to 17% depending on the purchase price, immigration status and whether or not you have other residential real estate,” says Natalia German, head of Homeapp's overseas real estate department.

The standard rate for residential properties is progressive: up to £125,000 no tax is charged, then from 2% to 12%. If you already own a property, an additional 3% of the purchase price will be charged as a second home tax. Foreign buyers, non-residents, pay an additional 2% on the entire amount.

You can avoid tax if you buy your first home up to £300,000. Also, the tax is not paid when buying a package of identical apartments in the same complex of buildings and for some types of land.

Stamp duty. Source: Wikipedia

Legal entities pay a flat rate of 15% for properties over £500,000. Residential properties are subject to an additional 3%.

You can calculate the amount of tax for different conditions using the calculator.

Property ownership and renting

Unlike many other countries, the UK does not have an annual property tax for individuals. It is paid only by companies that own residential real estate.

“The amount of tax depends on the value of the property at the date of purchase and is revised to reflect its market value (every 5 years). If the property is rented out, then the company is exempt from paying tax, but must submit a tax return on income received from the lease,” Natalya German specifies.

All homeowners or renters pay council tax, which varies by location. However, there is a rather large list of benefits: students and recipients of social benefits do not pay tax, and owners of second homes and empty real estate can qualify for a discount.

Real estate rental income is taxed in the same way as other types of income of individuals and legal entities. However, the costs associated with the maintenance of real estate are deducted from taxation: agents' fees, property insurance, utilities, etc. If you are an income tax company, you can claim interest on real estate loans as an eligible expense.

Company owners

Corporate tax

An analogue of Russian income tax is corporate tax in the amount of 19%. From April 1, 2023 (beginning of the financial year) the basic rate will increase to 25%, but for companies with a profit of less than £50,000 it will remain at the same level.

Corporate tax is charged on profits from doing business and selling assets. It is paid by limited liability companies and any foreign company headquartered or represented in the UK.

Resident companies are subject to corporate tax on all sources of income, regardless of the country in which it was received

“We have chosen the UK as the country in which we have our first head office, as the FCA (Financial Conduct Authority or UK Financial Conduct Authority) license is one of the most authoritative in the world.

In terms of taxation, we have the same conditions as any other company,” says Vladimir Polyakov, Head of Sales at the international payment provider Ecommpay.

If the company is not a resident, then it pays tax only on those incomes that relate to its activities directly in the UK. The tax must be paid no later than 9 months and 1 day after the end of the company's reporting period - usually the same 12 months as the financial year covered by your annual accounts.

“If your company's reporting period does not coincide with the financial year in England, you need to be very careful,” points out Vladimir Polyakov. — For example, if your reporting period runs from January 1, 2021 to December 31, 2021, you must pay corporate tax according to the following scheme:

- From January 1 to March 31, 2021, the 2020/21 rate (19%) applies

- From April 1 to December 31, 2021, the 2021/22 rate (19%) applies

In this example, the bet sizes are the same, but in other cases they may differ.

VAT

VAT registration is required if the annual turnover of the business exceeds £85,000. You can also do it voluntarily, for example, for a tax refund on the purchase of office equipment or for reputational purposes.

The standard VAT rate is 20%, for some categories of goods it is reduced to 5%, for most children's goods the tax rate is 0%.

Innovative start-up incentives

The UK location is especially beneficial for start-ups that work on innovative projects in science and technology. R&D companies are exempt from paying tax.

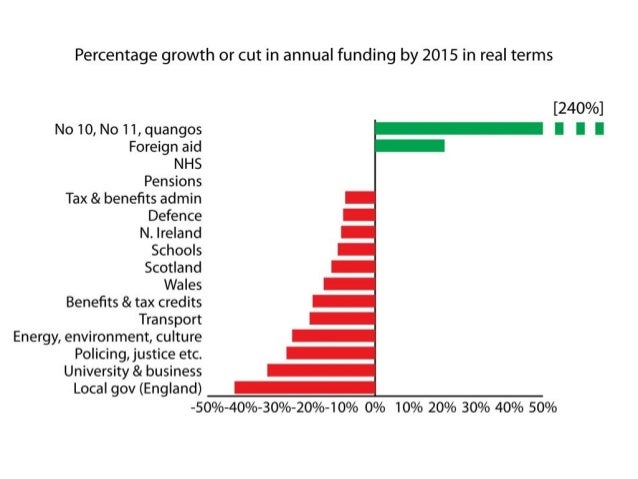

To qualify for the exemption, the company must have less than 500 employees, a turnover of less than 100 million euros, or a total balance sheet of less than 86 million euros. “For every pound a company spends on science-intensive development, it has the right to increase its spending by 240%. We are talking about really science-intensive developments, the assessment of innovativeness of costs is carried out by independent bodies, ”specifies Dmitry Zapol, partner at IFS Consultants, LL.M (Tax), ADIT (Aff.).

We are talking about really science-intensive developments, the assessment of innovativeness of costs is carried out by independent bodies, ”specifies Dmitry Zapol, partner at IFS Consultants, LL.M (Tax), ADIT (Aff.).

The UK is also actively promoting investor support for small businesses. The EIS and SEIS programs give startups a good chance of attracting investments because they are not taxed.

Cover: IR Stone/ Shutterstock

Parents Kindergartens Not Kamamni

- Katerina Arkharova

- Russian Service BBC, London

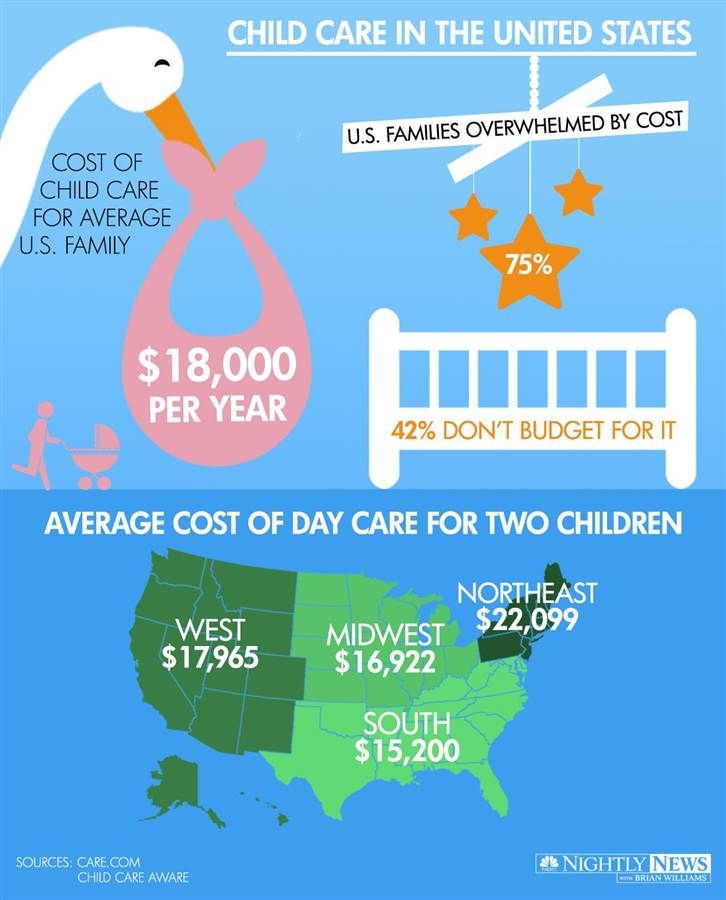

Another study, also conducted by the Daycare Trust this year, found that 25 hours per week spent by a child under two years of age in kindergarten would cost more than £5,000 ($7,900) per day. year. But it's all over England. In London, prices are, of course, higher, and average about 1.2 thousand pounds (1.9 thousand dollars) per month for an ordinary kindergarten, and for a privileged one, they can reach up to 4 thousand.

Skip the Podcast and continue reading.

Podcast

What was that?

We quickly, simply and clearly explain what happened, why it's important and what's next.

episodes

The end of the story Podcast

There are practically no free kindergartens and nurseries in Britain, except for some children's groups, where you can "turn over" the child exclusively in the morning hours, that is, until noon.

"Our research has shown that over the past 10 years, the cost of childcare has risen year on year," says Keith Groucutt, division director at the Daycare Trust. the financial burden has skyrocketed. With a quarter of those surveyed living in debt because of childcare costs, it's clear that for many families, work is not worth it."

Thus, Britons with children now face a serious problem: is it economically profitable for them to go to work, given rising prices and almost static wages?

Last year, 32,000 new mothers chose not to return to work because of the high cost of childcare, according to insurance chief Louise Colli of Aviva Insurance Company.

Unrealizable goals?

At the same time, experts point out that both for the economy and for the younger generation, it is much better for both parents to work, and it is precisely this goal - building a healthy working society - that was recently announced from high government tribunes, in particular, as a reaction to the pogroms that took place in English cities.

The authorities will, of course, provide some cash assistance for children, depending on a number of factors, such as the parents' income, the number of children, and whether the family is complete or incomplete.

For example, low-income families can receive a childcare allowance of up to £122.50 per month for one child and £210 for two or more children, but considering the above figures for kindergarten, it becomes clear that this help is very relative.

There are also so-called "Children's Vouchers", a scheme whereby a monthly amount is deducted from a parent's salary before income tax and social security contributions, and is transferred directly to the preschool's account.

In addition, the severity of the problem decreases somewhat as soon as the child enters school, and in Britain this happens quite early - as early as five years. To help the British parent and a rather long school day, lasting until 15:30.

But what to do after that, because work usually doesn't end that early, and there are no free after-hours groups - you have to pay for everything that happens after the last bell of the day has rung.

Children's charities found in their survey that 47% of low-income families have reduced spending on children's clubs compared to 22% of families with higher incomes, and it is children from a poorer background that fall into various risk groups - in many ways just due to the abundance of free time and lack of interests.

"We urge the government to allocate more funds for childcare so that people can benefit from work. Because, as it turned out in the course of our research, if this problem is not addressed, then the government's plans to return people to work and make work justify themselves , will remain unrealizable," said Kate Groutt of the Daycare Trust.

"Cheap social buffer"

What about grandparents, can't they come to the rescue of their children and look after their grandchildren?

However, on this issue, too, Britain lags behind the European countries. According to a report last year by Grandparents Plus, in collaboration with the Beth Johnson Foundation and the Institute of Gerontology at King's College London, only one in three new mothers relies on their parents for this.

In addition, the British government does not financially encourage the older generation to care for their grandchildren, as is done in other European countries, where, for example, parents can transfer part of their paid leave to care for a sick child to grandparents, who sometimes even receive some monetary reward from the authorities for their services.

However, in Britain since April 2011, second-generation parents caring for their grandchildren can receive compensation on a social security card.

However, they are not eligible for other parental benefits such as child vouchers or the ability to work flexible hours.

Experts from the Institute for Family and Educational Problems also warn that poor grandparents are often simply exploited by the state as a "cheap social buffer in childcare."

But it is precisely in this social stratum that early pregnancies occur more often, modern families living on welfare, consisting of "one parent", are formed, and people become grandparents long before retirement.

"These working-class women, who have been trying to balance family and work for decades, suddenly find out for themselves that life does not get easier with the advent of grandchildren," explains Professor Katherine Reik from the Institute for Family and Educational Problems. will contribute to the welfare of their grandchildren, but they do not want this to be imposed on them from above by a state that either completely ignores their help or takes it for granted.