How old can you claim a child on taxes

Rules for Claiming Dependents on Taxes

Editor’s Note: Relationship changes and job loss can all affect who is living in your house and, therefore, claiming dependents on your tax return. Here are the most important rules that you need to know about claiming dependents before preparing your taxes this year.

Few things are more important than family. These are the people we share special memories with…the people we rely on when we hit tough spots.

However, sometimes you are the family member who helps others out. Maybe your grandmother couldn’t live safely on her own anymore, so she moved in with you this year. Maybe your uncle lost his job so he’s been staying with you.

This is what family is about – helping each other, regardless of the burden. But the extra expense of additional family members can put a financial strain on you. The rising costs of food, electricity, gas, and water can all add up quickly.

Special Rules for Claiming Dependents on Tax Returns

There are a few rules to help you navigate claiming dependents on tax returns – and decide who you should and shouldn’t claim as tax dependents:

The DOs: Who Can I Claim as a Dependent?

You can only claim dependents who are either a qualifying child or a qualifying relative.

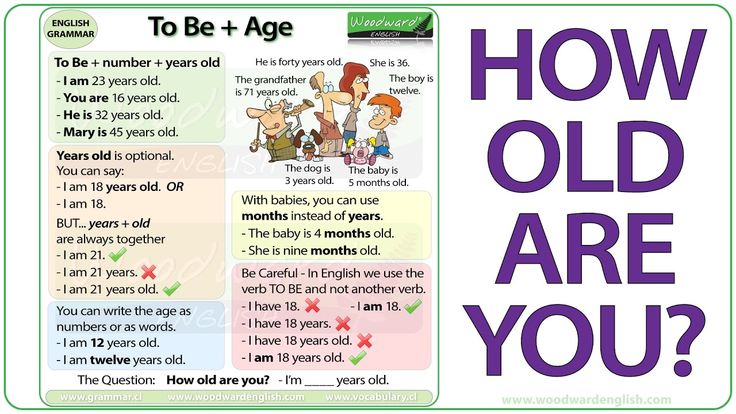

DO claim all qualifying children that were born or adopted within the tax year. Even if your child was born on December 31, your child may be able to be claimed as a dependent on your taxes. To qualify as a dependent, the child must:

- Be under age 19, a full-time student under age 24 or permanently and totally disabled;

- Not provide more than one-half of the child’s own total support; and

- Live with you for more than half of the year.

DO claim certain family members (such as parents, grandparents, aunts or uncles, nieces or nephews) as qualifying relatives. You should claim certain family members only if:

- You provided more than half of the person’s total support for the year;

- They aren’t yours or another taxpayer’s qualifying child; and

- The relative’s gross income is less than the personal exemption amount (which is $4,200 for 2019).

All dependents must be a United States citizen, resident alien of the United States, or resident of Mexico or Canada (with certain adopted children as an exception) and can’t file a joint return (unless it’s to receive a claim of refund of taxes withheld or estimated taxes paid). You can’t claim a dependent if you or your spouse (if filing jointly) could be claimed as a dependent by another taxpayer.

You can’t claim a dependent if you or your spouse (if filing jointly) could be claimed as a dependent by another taxpayer.

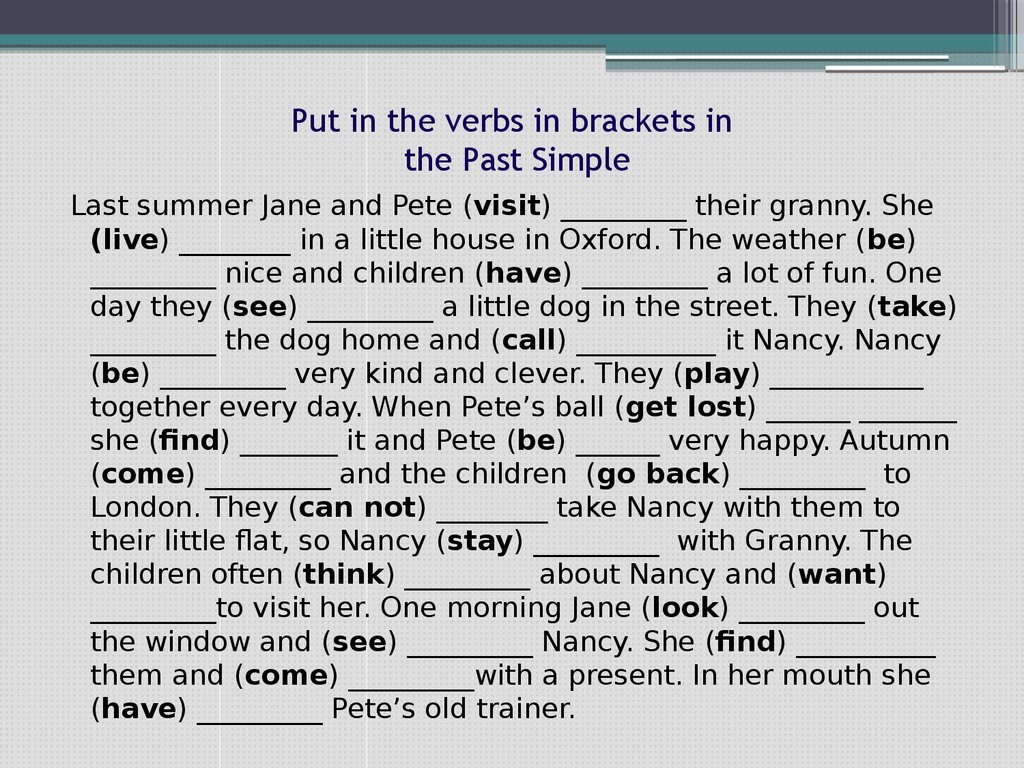

The DON’Ts: Rules for Claiming a Dependent

DON’T claim a child that has lived with you for less than six months of the year. Unless the child was born within the tax year, the child must have lived with you at least six months of the tax year to fall under the qualifying child rules. If you have a child that lives with each of the child’s parents separately for different portions of the year, the parent that cares for the child longer should claim the child as a dependent unless the custodial parent in the divorce has a signed Form 8332. There is an exception to the six-month rule for claiming a qualifying relative, but only if the child can’t be claimed as a qualifying child of any other taxpayer.

DON’T attempt to claim a child for whom you have paid child support, but lives with you for less than half the year unless you have a Form 8332 signed by the custodial parent.

Help is at Your Fingertips

For additional assistance with the tax rules for claiming a dependent, H&R Block has your back.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H&R Block to help you navigate the rules for claiming a dependent family member on your taxes.

How Long Do Kids Stay Dependents?

Once you are a parent, you never stop being a parent. You stayed up with your kids when they had the flu, helped them study for the ACT, cheered them on at their graduation. You have been there for their highs, lows, and everything in between. You will continue to care, love, and support your children for the rest of your life.

But will there ever be a time they can fly away from the nest?

According to the federal government, the answer is yes!

From the time your children were born, you claimed them as dependents on your federal and state taxes, which has saved you money on your taxes over the years. The decision to claim children as dependents rests on a myriad of factors, let’s see how those could affect you this year.

The decision to claim children as dependents rests on a myriad of factors, let’s see how those could affect you this year.

In the Nest – How Long You Can Claim

The federal government allows you to claim dependent children until they are 19. This age limit is extended to 24 if they attend college. If your child is over 24 but not earning much income, they can be claimed as a qualifying relative if they meet the income limits and/or if they are permanently disabled. It is important to know that there is no age limit if your child is permanently disabled.

Other factors that contribute to your ability to claim your children as dependents are:

- Amount of time your children live with you

- Your child must live with you for at least 6 months before you can claim them as a dependent.

- Financial support

- If your child makes more than half of their own support during the tax year, they cannot be claimed as a dependent. This support consists of housing, food, education, medical care, insurance, and recreational spending.

- If your child makes more than half of their own support during the tax year, they cannot be claimed as a dependent. This support consists of housing, food, education, medical care, insurance, and recreational spending.

- Marital Status

- If you are not married and the child lived with you and the other parent half of the time, the person with the highest adjusted gross income will often take the deduction. This, however, can be negotiated.

- If you pay child support but the child lives with you for less than half of the year, you cannot claim the child as a dependent unless you have a signed Form 8332.

Still unclear if you can claim your child as a dependent? The IRS has a questionnaire here you can use to find out. Simply answer a few questions and the IRS will tell you whether or not you are eligible to claim a person as your dependent on your taxes.

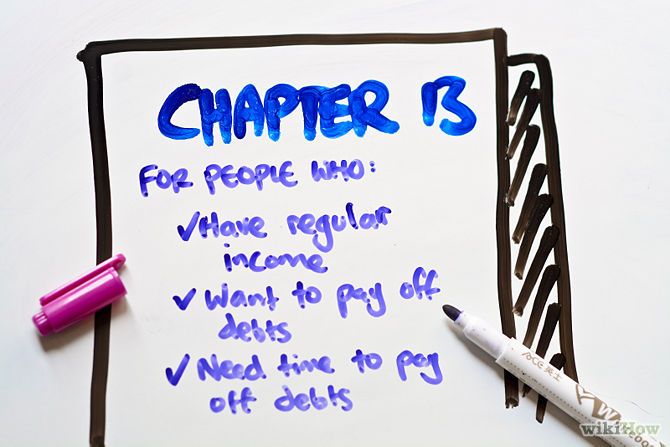

For many families, the longer they are able to claim their children as dependents the better it will be. But the new Tax Cuts and Job Act has changed the way parents claim dependents. Prior to 2018, parents were able to receive a personal exemption that reduced taxable income. For example, in 2017, a married couple filing jointly could take a $4,050 exemption for themselves and each dependent. The new tax law has suspended that exemption benefit from 2018-2025. This means that parents will need to use other tax exemptions to help make up for the loss of the child exemptions.

For example, in 2017, a married couple filing jointly could take a $4,050 exemption for themselves and each dependent. The new tax law has suspended that exemption benefit from 2018-2025. This means that parents will need to use other tax exemptions to help make up for the loss of the child exemptions.

Out of the Nest

Since the exemption for dependents is suspended until 2025, parents have to look for other tax credits and deductions that can help them on their tax bill. Here are a couple of credits to keep an eye on.

This is just one of the many examples of how our comprehensive tax planning creates value for our clients. See other important tax planning topics on our website, here.

- Earned Income Credit

- This credit is based on the amount of money you earn in a tax year. Designed to benefit low to medium income families with children, this credit will allow you access to a certain amount of money based on your income and the number of children you have.

$6,431 is the maximum earned income credit available for 2018 for three children and parents earning no more than $54,884. For two children the maximum credit is $5,716 with an income threshold of $51,492. $3,461 is the maximum credit for one child with the parents’ income being less than $46,010. Remember, for any credit, your child must pass the qualifying child test.

$6,431 is the maximum earned income credit available for 2018 for three children and parents earning no more than $54,884. For two children the maximum credit is $5,716 with an income threshold of $51,492. $3,461 is the maximum credit for one child with the parents’ income being less than $46,010. Remember, for any credit, your child must pass the qualifying child test.

- This credit is based on the amount of money you earn in a tax year. Designed to benefit low to medium income families with children, this credit will allow you access to a certain amount of money based on your income and the number of children you have.

- Child Tax Credit

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child. A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased.

- If your child does not qualify for the tax credit, the new tax code does offer a $500 benefit per child.

This is a non-refundable tax credit which means that the credit is limited to the tax liability and nothing is refunded.

This is a non-refundable tax credit which means that the credit is limited to the tax liability and nothing is refunded.

The new Tax Cuts and Jobs Act has changed the way parents will claim dependents in 2018. Therefore it is important to understand the nuances of the IRS qualifying system, exemptions that may or may not be applicable, and the other forms of tax credits available to you.

Related Video – Claiming College Students as Dependents

If you want personal advice on how to claim your dependents, contact us!

Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

should a minor child pay personal property tax

I recently paid tax for an apartment and realized that it should also be charged for children's shares. But I do not receive any letters from the tax office and do not know how much to pay. I personally do not really want to go to the tax office.

I personally do not really want to go to the tax office.

Do I have to pay tax on these shares and how can I find out the amount?

Irina Polovodova

lawyer

Author profile

As soon as you allocated shares to the children, they became the same owners of the apartment as you are. An apartment is a taxable property, and property tax is charged for all its owners, regardless of age. nine0003

You may not have received a child wealth tax notice because you allotted shares in 2021: tax for the year is due by December 1 of the following year. That is, you will see accruals for 2021 in 2022. If you allocated shares in 2020 or earlier, but did not receive anything, then there is also an explanation for this.

I'll tell you more about how the system works, how to find out about children's taxes and how to pay them correctly.

Why a child must pay taxes

A child cannot know about property taxes and pay them. But formally, if a share in property is registered to him, he is considered a taxpayer at any age. nine0003

But formally, if a share in property is registered to him, he is considered a taxpayer at any age. nine0003

Art. 400 of the Tax Code of the Russian Federation

At the same time, it does not matter whether the parents received a certificate of assignment of a TIN to the child or not. As soon as the tax office receives information from Rosreestr that the child has become the owner of the property, the TIN appears automatically.

There is no direct obligation of adults to pay property tax for a child in the law, but there is a broader rule: any taxpayer can act through his representative. In the case of a child, parents, adoptive parents, guardians can pay taxes. nine0003

Art. 45 of the Tax Code of the Russian Federation

The legislation divides children into two groups: minors, that is, up to 14 years old, and from 14 to 18 years old. Parents manage the property of a minor, which means that you still have to pay tax on his behalf. Children from 14 to 18 years old, with the consent of their parents, can independently manage their property and pay taxes.

Art. 26, 28 of the Civil Code of the Russian Federation

If the property tax is not paid, then it does not matter at what age the child is: the tax office will send a demand to pay the debt to parents, guardians or adoptive parents. nine0003

When a child may not pay property tax

There are situations when a child may not pay property tax.

So, children with disabilities, including from childhood, and recipients of a pension, for example, for the loss of a breadwinner, may not pay tax on one piece of real estate. If such a child owns several objects - for example, a share in the parents' apartment and the grandmother's apartment - property tax needs to be paid only for one share of choice.

Who can not pay taxes on property and land or pay less: 7 categories of beneficiaries

This is called a tax credit. To receive it, you need to send an application to the tax office and attach documents that confirm the benefit.

Art. 407 of the Tax Code of the Russian Federation

Regions have the right to independently expand the list of tax benefits. Information about this can usually be found on the website of the Federal Tax Service if you select your subject.

Information about this can usually be found on the website of the Federal Tax Service if you select your subject.

Letter of the Federal Tax Service of Russia dated May 13, 2020 No. BS-4-2-21/779

How to find out about the amount of taxes on a child

There is a concept of tax secrecy, and the tax office is not entitled to transfer data on children's taxes to third parties. That is, children's taxes will not be reflected in notifications for adults, and they may not talk about accruals over the phone either. That is why you will not see the amounts of taxes for children in your personal account on the website of the tax authority or in notifications that come to your name. nine0003

Taxes on the child's property will be in the notifications that the Federal Tax Service will by default send to the name of the child at the address of his registration. But the most convenient way to receive tax payments for a child is to register a personal taxpayer account for him and receive notifications there.

There are two ways to do this:

- apply to any tax office with a passport and a child's birth certificate. The tax office will immediately issue a username and password from the child's personal account; nine0062

- register a child for public services. After that, through public services, it will be possible to automatically enter the taxpayer's personal account. You don’t have to go to the tax office, but to register for public services, you need to go through the identity verification procedure - through the MFC or online banking. This method is suitable when the child is already 14 years old or more.

/newborn-documents/

What documents does a newborn need

What to do if the tax notice has not arrived

Notices of the need to pay property taxes are sent out in August-September. You need to pay before December 1, and the tax service must notify all payers no later than 30 days before this deadline. So, if the notification has not arrived by November 1, it is better to find out for yourself where it is and how much you owe.

So, if the notification has not arrived by November 1, it is better to find out for yourself where it is and how much you owe.

Art. 52 NK RF

The specified terms are the same for all types of notifications - both paper and electronic. As soon as you have registered a taxpayer's personal account, notifications stop coming by mail automatically. Rarely, but it happens that notifications do not come to your personal account either - as a rule, this is the result of some kind of error. nine0003

/zabral-dengi-za-imuschestvo/

How to save on property taxes

If the notification has not arrived, you can get it:

- in person at the tax office. Take your passport and child's birth certificate. The notification must be issued immediately against receipt;

- at the MFC. The same documents are needed. The notification must be issued within 5 days after the application is submitted. You will have to come to the MFC twice: to write an application and then receive a notification.

There is only one case when a tax notice should not officially come, although property tax is charged - if the tax amount for the year is less than 100 R. For example, children have very small shares in an apartment, and the tax for them is also small. The receipt will be sent when taxes accumulate for a large amount or after three years.

What to do? 10/27/17

There are no letters from the tax office, what should I do?

If you have a taxpayer's personal account, but you want to receive additional paper receipts, file an application for this with the tax office. This function in the taxpayer's personal account is called "Notification of the need to receive documents on paper". It can be found in the section "Life situations" → "Other situations" → "Receive documents on paper"How to properly pay property taxes for a child

Pay taxes for a child in the same way as for an adult. You can do this in the taxpayer's personal account, on the portal of the Federal Tax Service, public services, at banks, at the post office, at the MFC or through a payment terminal.

The fastest way to pay is by UIN, barcode or QR code. All of them are unique for each payment, and you do not need to enter details, payment amounts and payer data.

In the personal account of the child taxpayer, all payment and payer data will also be generated automatically, so it is impossible to make a mistake. nine0003

/deadline/

Pay your property tax

If you pay otherwise, it's important not to make the payment in your name. Otherwise, the money will go to the adult's taxes, and the child's property tax will not be paid. In such cases, the purpose of the payment indicates: "Payment of tax for ..." and indicate the data of the child.

Knowing the UIN, you can pay taxes even without notification. To obtain a UIN, an application is made on the website of the Federal Tax Service, where they indicate their and the child's data and ask to issue a UIN. The tax authorities should send the number 9 in response0018 What happens if you do not pay property tax The deadline for paying property taxes is no later than December 1. This is what threatens if you do not pay the tax on time.

This is what threatens if you do not pay the tax on time.

Fines for each day of delay from December 2. Although the interest rate on taxes is small - 1/300 of the key rate of the Central Bank, which is 7.5% per annum as of November 2021 - it still increases the defaulter's debt. For example, with a debt of 5000 R per month, about 40 R will run up.

Art. 45, 69, 70 Tax Code of the Russian Federation

Claim for debt payment. IFTS will issue a claim within three months after December 1. The document will come by mail. It must be completed within 8 business days.

Court order. The tax office will receive an order - and the children's debt will be collected from parents, guardians or adoptive parents in a simplified court order. The judge will consider the documents without calling the parties and satisfy the requirement of the Federal Tax Service. The money will be written off from the accounts of both parents, adoptive parents or guardians, because according to the law they are equally responsible for the child. nine0003

cl. 1 art. 61, paragraph 1 of Art. 80 SK RF

Art. 1 of Law No. 45-FZ

Previously, the tax office filed a lawsuit against the representatives of the debtor child and thus returned the debt.

For example, in June 2015, the tax inspectorate of the Ryazan region sued the parents of a child who had 1/2 share of non-residential premises. The family did not pay the tax, although they received notices and requests to pay it. The court recovered from the parents the child's tax debt, late payment interest and court costs, dividing everything equally. nine0003

What is the result

In your situation, I would recommend doing this:

- Go to the tax office and take the username and password to access the personal account of the child taxpayer.

- If there is a debt, pay it right away so that you do not have to pay penalties. The debt may accumulate, and it will be collected from you in a simplified manner - you will only find out about this after the money is debited from the card.

- In the future, control accruals through the taxpayer's personal account. nine0062

What to do? Readers ask - experts answer

Ask your question

who should pay and how, benefits

Are property taxes charged on a minor child, who pays them and who is entitled to benefits?

Photo: New Africa\shutterstock

Under Russian law, homeowners are subject to property tax. Often, parents who give their children a share in an apartment may have a question: is the tax charged to the child if he is a co-owner, and who pays it. nine0003

Lawyers told how the issue of real estate taxation in relation to minors is regulated.

Do children have to pay property tax

adv.rbc.ru

The apartment tax is a tax on the property of individuals. The order of its taxation is established by Ch. 32 of the Tax Code of Russia. The chapter does not contain provisions that children who are owners of taxable property are exempted from paying it. “In this regard, children under the apartment tax bear the same tax liability as adults,” explained Nikolay Pivovarov, a member of the Russian Bar Association. nine0003

Art. 400 of the Tax Code of the Russian Federation, taxpayers of the property tax of natural persons are persons who have the right to own property, regardless of the age of these persons.

Who pays tax for a child

Tax authorities are well aware that, as a general rule, children do not have any income due to their age. At the same time, the Tax Code of the Russian Federation does not contain a direct rule that would oblige parents to pay taxes for their children.

Nikolai Pivovarov, member of the Russian Bar Association:

— Parents and guardians are the representatives of children by virtue of the law, including before the tax authorities. Therefore, although children are obligated to pay apartment tax, it is their parents or guardians who will most likely be held liable for non-payment of it. The provisions of the Tax Code of the Russian Federation on the legal representation of taxpayers - individuals and par. 4 p. 1 art. 45 of the Tax Code of the Russian Federation, according to which the tax can be paid by another person.

How to pay tax for a child

When paying tax for a child, in the purpose of payment, you must specify information for which object and for which person the funds are transferred. If problems arise, you can always write a clarifying letter to the tax authority. This applies to payments by both parents and guardians - there are no differences, explained David Kapianidze, partner in the tax practice of BMS Law Firm.