How much will my tax return be with one child

2021 Child Tax Credit Calculator

Big changes were made to the child tax credit for the 2021 tax year. The two most significant changes impact the credit amount and how parents receive the credit. First, the credit amount was temporarily increased from $2,000 per child to $3,000 per child ($3,600 for children 5 years old and younger). Second, it authorized advance payments to eligible families from July to December 2021. Half the total credit amount was paid in advance with the monthly payments last year, while the other half is claimed on the 2021 tax return that you file this year. (These changes only apply for the 2021 tax year.)

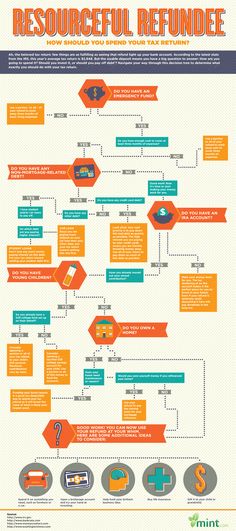

However, not everyone will get the additional credit amount. And some families won't get any child tax credit at all. That's because the credit is reduced – and possibly eliminated – for people with an income above a certain amount. In fact, there are two "phase-out" rules in play – one just for the extra $1,000 (or $1,600) amount and one for the remaining credit. That makes calculating the total child tax credit (and the monthly payments you should have gotten last year) very tricky.

But don't worry – we've got you covered. If you want to see how large your credit will be, simply answer the four questions in the calculator below and we'll give you a customized estimate of (1) the amount you should have received each month last year from July to December, and (2) how much you can claim as a child tax credit on your 2021 tax return, which is due April 18, 2022, for most people. It's that easy!

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of Kiplinger’s expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of Kiplinger’s expert advice - straight to your e-mail.

(Note: Results assume you received six monthly child tax credit payments last year. )

)

Pre-2021 Child Tax Credit Amount

For the 2020 tax year, the child tax credit was $2,000 per qualifying child. It was gradually phased-out (but not below zero) for joint filers with a modified adjusted gross income (AGI) of $400,000 or more and for other taxpayers with a modified AGI of $200,000 or more.

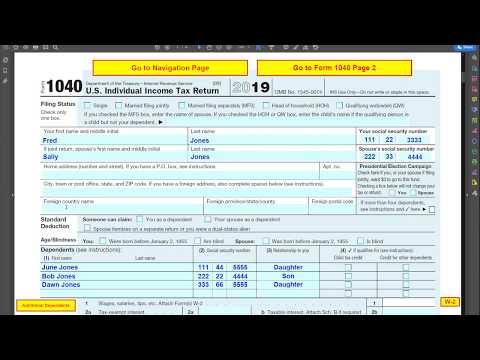

(For purposes of the child tax credit, modified AGI is the amount of adjusted gross income shown on Line 11 of your 2020 Form 1040 or Line 8b of your 2019 Form 1040, plus any amount excluded from gross income on your tax return as foreign earned income; foreign housing expenses; or as income from sources within Puerto Rico, Guam, American Samoa or the Northern Mariana Islands.)

New Phase-Out Scheme for 2021

For 2021, the increase (i.e., the extra $1,000 or $1,600) is gradually phased-out for joint filers with a modified AGI of $150,000 or more, head-of-household filers with a modified AGI of $112,500 or more, and all other taxpayers with a modified AGI of $75,000 or more. However, the increase can't be reduced below zero (other limitations to this reduction will apply as well).

However, the increase can't be reduced below zero (other limitations to this reduction will apply as well).

After any reduction of the increased credit amount is calculated, the pre-existing phase-out is then applied to the remaining credit amount. So, for joint filers with a modified AGI of $400,000 or more and other taxpayers with a modified AGI of $200,000 or more, the credit is subject to an additional reduction – possibly to $0.

Reconciliation of Advance Payments

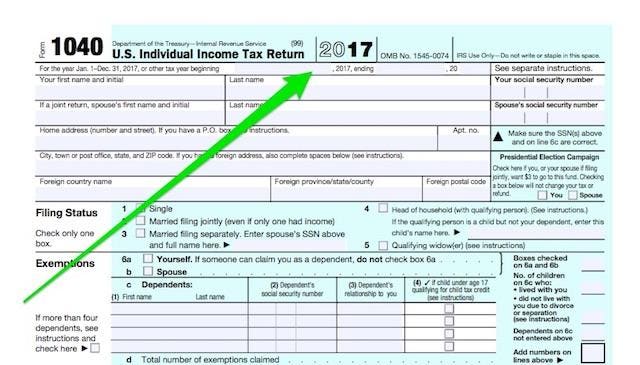

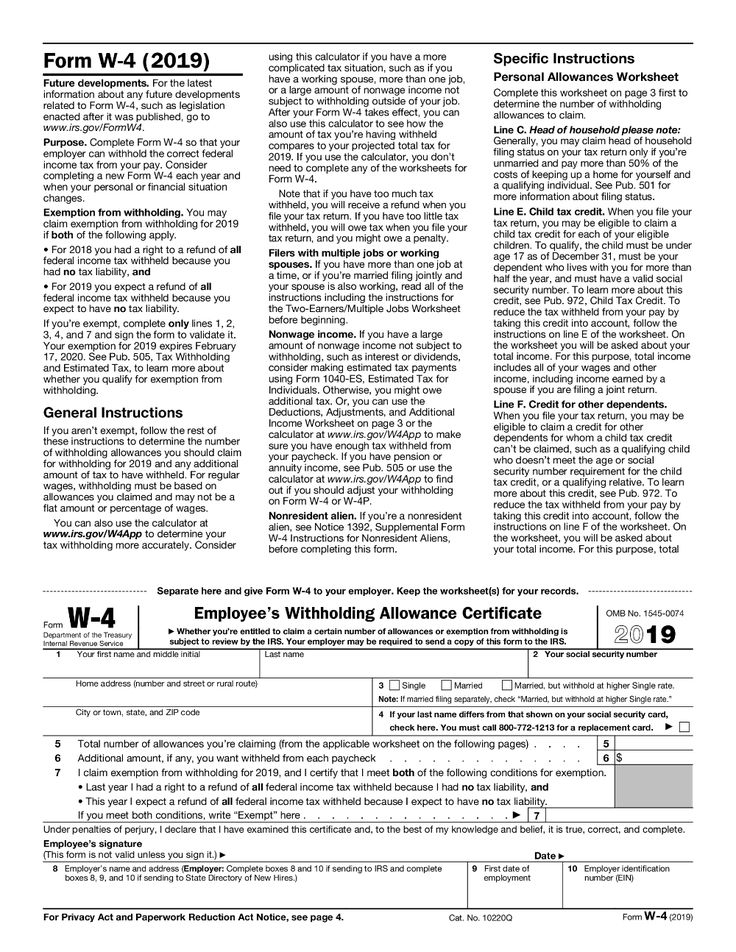

When you fill out your Form 1040 this year, you'll have to compare the total amount of advance child tax credit payments that you received in 2021 with the amount of the actual child tax credit that you can claim on your 2021 return.

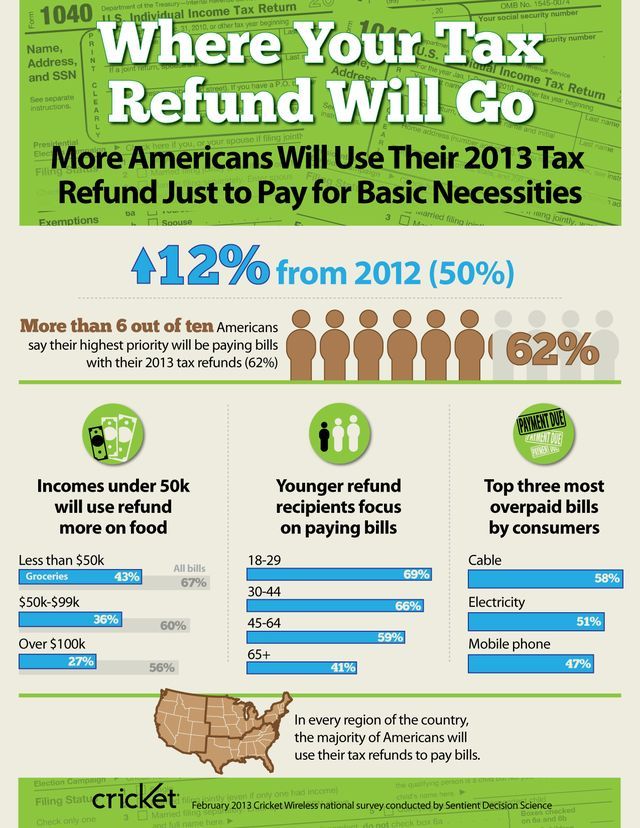

For most people, the amount of the credit will exceed the advance payments you received. If this is the case, you can claim the excess credit on your 2021 return. However, if the IRS paid you too much in monthly payments last year (i.e., more than the child tax credit you're entitled to claim for 2021), you might have to pay back some of the money. Parents with 2021 modified AGI no greater than $40,000 (single filers), $50,000 (head-of-household filers), or$60,000 (joint filers) won't have to repay any child tax credit overpayments. However, families with a modified AGI from $40,000 to $80,000 (single filers), $50,000 to $100,000 (head-of-household filers), or $60,000 to $120,000 (joint filers) will need to repay a portion of any overpayment. Parents with modified AGIs above those amounts will have to pay back the entire overpayment.

Parents with 2021 modified AGI no greater than $40,000 (single filers), $50,000 (head-of-household filers), or$60,000 (joint filers) won't have to repay any child tax credit overpayments. However, families with a modified AGI from $40,000 to $80,000 (single filers), $50,000 to $100,000 (head-of-household filers), or $60,000 to $120,000 (joint filers) will need to repay a portion of any overpayment. Parents with modified AGIs above those amounts will have to pay back the entire overpayment.

For more information on the 2021 child tax credit, see Child Tax Credit FAQs for Your 2021 Tax Return.

Stay on Top of Personal Finance Developments

Follow Kiplinger for the latest news and insights on important personal finance matters. Stay with us on:

email. Sign up free for our daily Kiplinger Today e-newsletter .

social media. Follow us on Instagram , Twitter and Facebook .

podcasts. Subscribe free to our weekly Your Money's Worth podcast on Apple Podcasts , Google , Spotify .

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

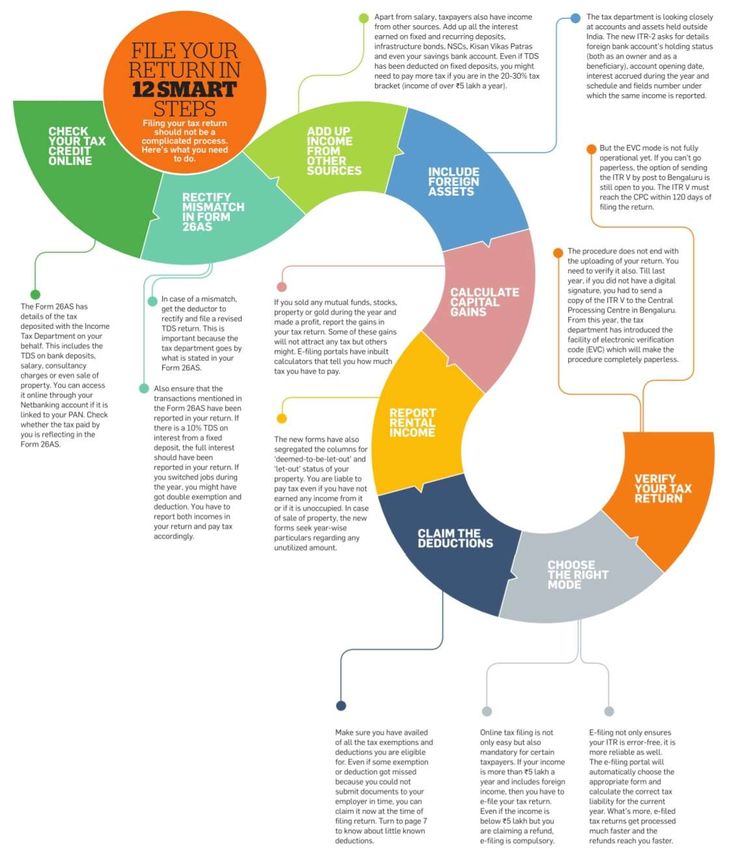

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

Tax classes in Germany in 2022

What are the German tax classes. What are they for and how much tax depends on them.

When it comes to taxes, it usually comes to mind that they are very high in Germany. This is not true.

A significant part of deductions from income is not taxes, but social payments:

- health insurance,

- unemployment insurance contributions,

- from helplessness,

- to the pension fund.

Together fees take 20% of the salary. The structure of the German salary is discussed in detail in the article on gross and net pay in Germany.

In addition, the German Einkommensteuer income tax is levied on a progressive scale. Those who make good money pay more.

But that's not all. Germany has many different tax incentives. It is important to know how to use them.

Tax deductions depending on class

The main relaxations in Germany are related to tax classes - Steuerklasse. Thanks to the classes, German family workers receive relief from the monetary burden on their gross wages.

Classes are assigned to every person working in Germany, determining the annual value of the Steuerfreibetrag tax-free amount. Each option has its own deduction.

The tax class is entered on the Lohnsteuerkarte payroll card. The card is not issued to the employee, but is an electronic record in the central database.

The employee receives an identification number in the database from the German tax office Finanzamt - IDN. When applying for a job, the IDN is reported to the new employer. The firm's HR department will access the electronic tax card and levy Lohnsteuer payroll tax on a monthly basis, taking into account the employee's tax class.

When applying for a job, the IDN is reported to the new employer. The firm's HR department will access the electronic tax card and levy Lohnsteuer payroll tax on a monthly basis, taking into account the employee's tax class.

First tax class - Steuerklasse I

Assigned:

- by default in the first year of operation in Germany

- single, without family and children

- if the person is in the process of divorce and lives separately

- when the spouse lives abroad

- widowed workers in the second year after the death of a spouse

When a foreigner comes to work in Germany, he automatically receives first class until the family arrives and registers at the place of residence.

The German tax system is complex and multi-tiered

The employee receives 9984€ exempt from taxation. The specified amount is deducted from the annual salary and taxes are paid from the rest. With monthly payments, the deduction is taken into account. At the end of the year, no recalculation is required due to the tax-exempt amount.

At the end of the year, no recalculation is required due to the tax-exempt amount.

First class paying employees are not required to file a tax return in Germany. But he has the right to fill out the declaration voluntarily, which often leads to the return of part of the paid.

Second

Assigned to single parents if:

- father or mother lives with the child in the same dwelling

- the rules for receiving child benefit in Germany are fulfilled - Kindergeld

- parent is not married

- the worker really lives alone, without roommates

The class is not issued automatically, you must request a change by filling out the form. And the registration of the second adult in the apartment, on the contrary, automatically leads to a change to the first.

To the tax-free 9984€ is added another 4008€ for heavy bachelor parental share. For the second and subsequent children, 240 € are added to the bonus.

If a single mother in 2022 with one child earns 13992€ per year, she does not pay salary tax. If more, the fee is paid on the amount exceeding the limit.

If more, the fee is paid on the amount exceeding the limit.

Read more about state benefits for single parents in Germany.

Third-Fourth-Fifth

Intended for family workers.

The third is beneficial when one of the spouses does not work at all or earns on MiniJob terms.

The base deduction for a holder of the third class is doubled. But another family member forfeits the tax-free amount by forcibly filing in the fifth. One of the couple gets the opportunity to write off the tax base immediately 19968€.

If both work, you need to look at what is more profitable - to have a third class for one of the spouses or better if both remain at the base 9984 €.

Then you can take the fourth. It looks like the first one, only intended for families. It only makes sense if both spouses work and earn about the same.

The fourth also allows you to share the total family tax break disproportionately. For example, a husband takes half of his wife's deduction.

The fifth is assigned to the spouse of the one who chose the third. The tax is collected from the entire amount of the annual salary.

Sixth

In case a person works in several jobs. On one of the jobs of choice, one of the five classes listed above is entered in the tax card, and on others, the sixth is automatically assigned.

Does not contain any tax-free amounts at all. This is the most disadvantageous class.

Explanations and hints

Filing a tax return through a Russian-speaking lawyer

Tax lawyer Evgeny Shevtsov will fill out and file an income tax return in Germany, taking into account immigration nuances. An approximate estimate of the amount of the return is free! Pass

QUESTIONNAIRE

- Each employee has the right to change class once a year.

- To receive a refund for recalculation, you must complete and send a tax return.

- If, when considering the declaration, it turns out that changing the class is more profitable, the tax is recalculated for the entire year back and all the "excess" is returned.

- Special programs are available to help you complete your tax return and choose between family classes. But without the experience of filling out and knowledge of German, it is difficult to use programs.

- The relaxations do not end there. There are many other completely legal opportunities to remove part of the income from the taxable base.

01-01-2022, Stepan Babkin

FAQ

Ask your own question

Cannot find 'faq' template with page 'detail'

Enter part of the name or address:

MFC Leninsky district

432017, Ulyanovsk region, Ulyanovsk, Goncharova street, 11MFC Zavolzhsky district

433000, Ulyanovsk region, Ulyanovsk, Sozidateley pr-kt, building 17aMFC Zasviyazhsky district Zheleznodorozhny district (Minaeva 6)

432017, Ulyanovsk region, Ulyanovsk, Minaeva street, 6MFC Dimitrovgrad

433507, Ulyanovsk region, Dimitrovgrad, Lenina pr-kt, 16 AMFC Melekessky district

433505, Ulyanovsk region, st. Oktyabrskaya, 64MFC Novomalyklinsky district

Oktyabrskaya, 64MFC Novomalyklinsky district

433560, Ulyanovsk region, Novomalyklinsky district, Novaya Malykla village, Kooperativnaya street, 26MFC Staromaynsky district

433460, Ulyanovsk region, Staromainsky district, Staraya Maina rp, Builders street, 3MFC Cherdaklinsky district

433400, Ulyanovsk region, Cherdaklinskaya region -n, Cherdakly rp, Sovetskaya street, 7MFC Novoulyanovsk

433300, Ulyanovsk region, Novoulyanovsk, Ulyanovsk street, 18MFC Sengileevsky district

433380, Ulyanovsk region, Sengileevsky district, Sengiley, Krasnoarmeiskaya street, 53MFC Ulyanovsk district

433310, Ulyanovsk region, Ulyanovsk district, Isheevka rp, Lenina street, 32MFC Tsilninsky district

433610, Ulyanovsk region, Tsilninsky district, Bolshoe Nagatkino village, Kuibysheva street, 10MFC Mainsky district

433130, Mainsky district, Ulyanovsk region n, Maina rp, Chapaeva st., 1MFC Terengulsky district

433360, Ulyanovsk region, Terengulsky district, Terenga rp, Evstifeeva st.