How much tax refund per child 2023

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Your First Look at 2023 Tax Brackets, Deductions, and Credits (3)

The US Bureau of Labor Statistics reported that the consumer price index increased just 0.1% for August after no change in July. However, inflation remains a concern because over the last 12 months, the index rose 8.3% before seasonal adjustment. And those rates could impact your 2023 tax picture.

The CPI measures the cost of goods and services in urban areas—in other words, your cost of living. It’s the most widely used measure of inflation since, as prices go up, the purchasing power of your dollar goes down. This is important information for taxpayers because the Tax Code provides for mandatory annual adjustments to certain tax items based on inflation.

(For more on inflation and the CPI, including a look at how the chained CPI works, check out this previous article.)

Bloomberg Tax’s projected US tax rates forecast that inflation-adjusted amounts in the tax code will increase by roughly 7.1% from 2022, more than double last year’s increase of 3%. What will inflation mean for your 2023 tax picture? “We predict that inflation-adjusted amounts in the tax code will increase significantly in 2023 compared to prior years due to the economic environment,” said Heather Rothman, vice president for Analysis & Content at Bloomberg Tax.

Here’s how that translates into dollars.

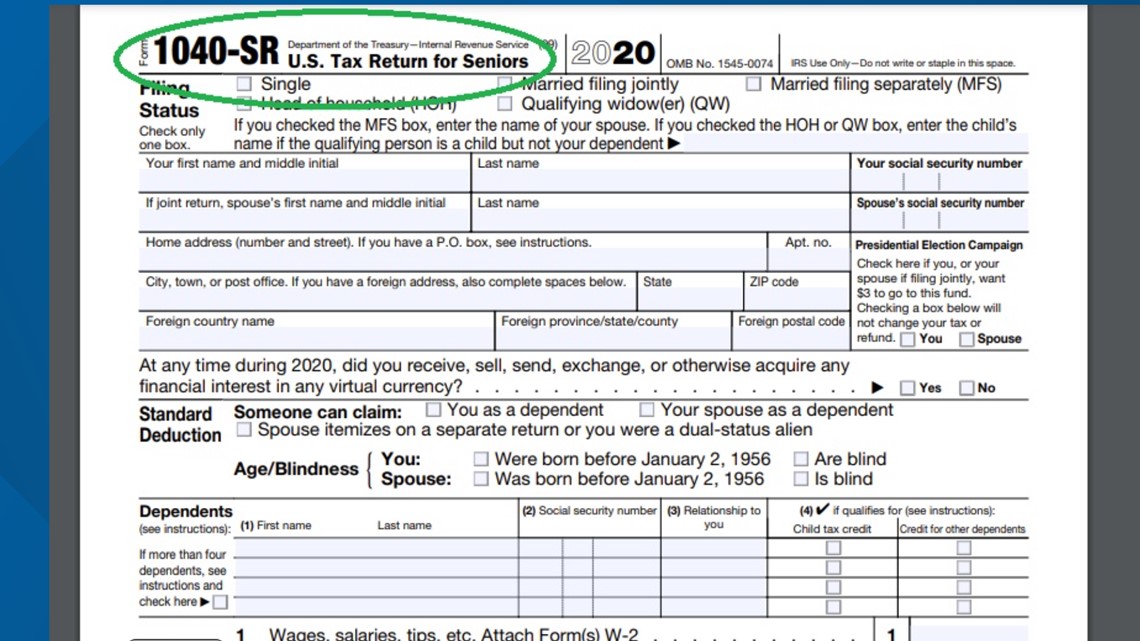

2023 Standard Deduction

For one, taxpayers will see a bump in the standard deductions. Since the doubling of the deduction due to tax reform, today, nearly 90% of taxpayers file using the standard deduction.

Married taxpayers were entitled to a standard deduction of $25,900 in 2022—that number is expected to jump to $27,700 in 2023. Single and married individuals filing separately will see the standard deduction rise to $13,850, up from $12,950 in 2022. Heads of households will also see a boost to $20,800, up from $19,400 in 2022.

Single and married individuals filing separately will see the standard deduction rise to $13,850, up from $12,950 in 2022. Heads of households will also see a boost to $20,800, up from $19,400 in 2022.

The additional standard deduction for blind people and senior citizens will be $1,500 for married individuals and $1,850 for singles and heads of household in 2023.

Bloomberg also predicts that the standard deduction for taxpayers who may be claimed as a dependent by another taxpayer will be the greater of $1,250 or the sum of $400 plus the individual’s earned income.

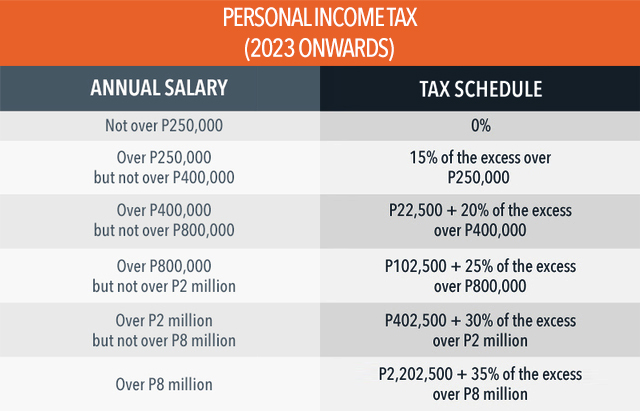

2023 Tax Brackets

Tax brackets are also expanding. You can take advantage of these early numbers now. As Rothman noted, “Taxpayers and advisers can use our projections to begin their 2023 tax planning before the IRS publishes the official 2023 inflation-adjusted amounts later this year.”

Here’s how those are expected to look.

Individual Taxpayers

Married Taxpayers Filing Jointly

Married Taxpayers Filing Separately

Heads of Household

Capital Gains

As with income tax rates, the actual capital gains rates don’t change from year to year, but the brackets will widen in 2023. Short-term capital gains rates—for assets held less than a year—are the same as your income tax rates. But favorable long-term capital gain rates are dependent on your taxable income. Generally, the higher your income, the higher the rate.

Short-term capital gains rates—for assets held less than a year—are the same as your income tax rates. But favorable long-term capital gain rates are dependent on your taxable income. Generally, the higher your income, the higher the rate.

Here are the projected maximum zero rate and projected maximum 15% rate amounts for 2023:

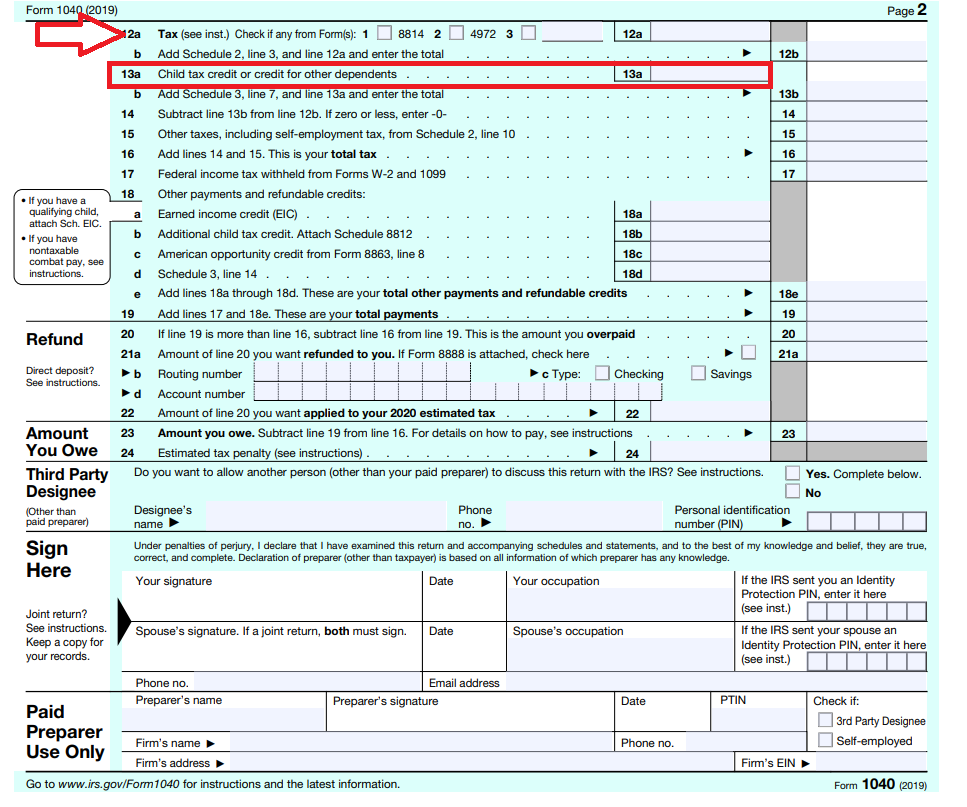

Child Tax Credit

For the tax year 2021, the child tax credit amount increased from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18. The entire amount was also refundable. However, the enhanced version of the credit disappeared in 2022—a version of the child tax credit remains in place for 2022 and 2023.

The 2023 credit amount will remain at the original $2,000 per qualifying child since it is not adjusted for inflation. However, the maximum refundable portion of the credit for a qualifying child is adjusted for inflation and is expected to be $1,600 in 2023.

Federal Estate & Gift Tax

Federal estate and gift tax numbers are moving, too. For 2023, the unified credit amount used to calculate the personal exemption will bump to $12,920,000 (or $25,840,000 for married couples). The annual exclusion for gifts is also expected to move up $1,000 to $17,000 in 2023.

For 2023, the unified credit amount used to calculate the personal exemption will bump to $12,920,000 (or $25,840,000 for married couples). The annual exclusion for gifts is also expected to move up $1,000 to $17,000 in 2023.

(For more on how the federal estate and gift tax system works, check out this previous article.)

What It Means for 2023

Wider tax brackets and increased exemptions and credits typically mean lower tax bills for most taxpayers, which is a good thing. But remember that this isn’t a bone being tossed to voters; it’s a statutory increase due to inflation.

And keep in mind that these are projections for the tax year 2023, beginning Jan. 1, 2023—the numbers you’ll use to prepare your tax return in 2024. These are not the tax rates and other numbers for 2022 that you’ll use to prepare your tax return in 2023.

Finally, remember that these are just projections. The IRS will publish the official tax brackets and other tax numbers for 2023 later this year—typically in October—and we’ll share those when available.

The 2023 tax projections are just one of the features available from Bloomberg Tax. The full report with additional projections is available for free here.

This is a regular column from Kelly Phillips Erb, the Taxgirl. Erb offers commentary on the latest in tax news, tax law, and tax policy. Look for Erb’s column every week from Bloomberg Tax and follow her on Twitter at @taxgirl.

Income tax refund for treatment - Paid services - Samara Regional Ophthalmological Hospital named after. T.I. Eroshevsky

Dear patients! We draw your attention to the fact that when receiving paid medical services in SOKOB them. T.I.Eroshevsky You have the right to receive a social tax deduction in respect of the amounts paid for medical services and a refund of part of the tax paid.

WHO CAN APPLY FOR A TAX DREDUCTION?

According to the Tax Code of the Russian Federation, the deduction is provided to working citizens of the Russian Federation and paying income tax.

Clause 3 of Article 219 of the Tax Code of the Russian Federation provides a deduction to the taxpayer in the amount paid by the taxpayer in the tax period for medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, to him, his spouse, parents, children (including adopted) under the age of 18, a ward under the age of 18 (in accordance with the list of medical services approved by the Government of the Russian Federation), as well as in the amount of the cost of medicines for medical use prescribed by the attending physician and purchased by the taxpayer at his own expense .

When applying the social tax deduction provided for in this subparagraph, the amounts of insurance premiums paid by the taxpayer in the tax period under voluntary personal insurance agreements, as well as under voluntary insurance agreements of his spouse, parents, children (including adopted ones) in under the age of 18, wards under the age of 18, concluded by him with insurance organizations that have licenses to conduct the relevant type of activity, providing for the payment by such insurance organizations of exclusively medical services.

WHAT IS A TAX DELEGATION?

PIT (personal income tax) is an amount that reduces the tax base (the amount of income subject to personal income tax). This reduction results in a reduction in the amount of tax.

Documents confirming the actual expenses for treatment and medical care are any settlement and payment documents, from which it is clear that payment was made to a medical institution for the treatment and medical care of a particular employee and member (s) of his family.

You can check the procedure for issuing a tax deduction at: www.nalog.ru or in the taxpayer's personal account.

IS IT POSSIBLE TO REFUND INCOME TAX WHEN PAYING TREATMENT TO RELATIVES?

Yes, in accordance with art. 219 of the Tax Code of the Russian Federation, a social tax deduction can be granted to persons who have incurred expenses not only for their own treatment, but also for the treatment of close relatives (children under 18, parents, spouses).

In this case, it is important to remember that the contract for the provision of medical services, payment documents and a certificate of payment for medical services must be executed in the name of the taxpayer - the applicant for payments.

The contract for the provision of medical services must specify who is the customer (payer) and recipient of the services.

In addition to the standard package of documents, the following documents must be attached to the application to the tax authorities:

- A copy of the marriage certificate, if the taxpayer paid for medical services provided to the spouse.

- A copy of the taxpayer's birth certificate, if the taxpayer paid for medical services provided to his parent.

- A copy of the birth certificate of the child (children) of the taxpayer, if the taxpayer paid for medical services provided to their children under the age of 18.

HOW TO OBTAIN A CERTIFICATE ON PAYMENT FOR MEDICAL SERVICES IN GBUZ "SOKOB named after T. I. Eroshevsky"?

I. Eroshevsky"?

To obtain a certificate of payment for medical services for tax deductions, you must contact the accounting department of the SOKOB named after T.I. Eroshevsky at the address: st. Novo-Sadovaya, 158, main building, 1st floor on weekdays from 9.00 to 12.00.

Accounting contact phone: (846) 323-00-21.

You must have:

- passport,

- contract for the provision of medical services,

- payment documents confirming the fact of payment for services,

- TIN certificate.

The certificate will be issued to you on the day you apply.

Patients of the T.I. Eroshevsky Sokob who live outside the Samara region can obtain a certificate without their personal presence. You can send us scans of the documents indicated above by e-mail [email protected] (in the subject of the letter, be sure to indicate "request for obtaining a certificate to the tax authorities" and the city). In this case, you can receive a prepared certificate and copies of the institution's license in person or by mail. If you are expected to receive it by mail, please indicate your postal address and zip code.

In this case, you can receive a prepared certificate and copies of the institution's license in person or by mail. If you are expected to receive it by mail, please indicate your postal address and zip code.

Annual tax return accounting method » PITax.pl

▪ Zaktualizowano: 13 grudnia 2020. ▪ Autor: Redakcja PITax.pl

Spis treści

- Annual tax return accounting method

- What is the tax amount?

- Tax calculation method

- What benefits can be deducted from the annual tax?

- When and how to pay tax?

- When and how to get a tax refund?

Methodology for accounting for the annual tax return

There are three options for calculating PIT-37 or PIT-36:

-

Only for yourself (individually),

-

For yourself and your spouse (together with your spouse), 9003, 9003

-

As a single parent.

Spouses can calculate bills together if:

-

Were married during the entire previous year (since January 1),

-

During the entire previous year, there was a property community between them,

-

None of the spouses was in charge of the department covered by a one-time, unified tax or tax card.

-

A citizen of Ukraine has a Polish tax residence.

The co-settlement option also applies to an income tax settlement with a deceased spouse, i.e. when we were married before the start of the tax year and our spouse died during the tax year, or we remained married during the tax year and our spouse died after a tax year before filing a tax return. In this situation, we can also present a joint settlement.

| Attention! If one of the spouses is from Ukraine and does not have a Polish tax residence, then there is no possibility of a joint settlement, in which case two separate tax returns must be filed. |

For example, as well as a family with one parent, a taxpayer who brings up children who:

-

Minors (under 18), regardless of whether these children earn income or how high they are.

-

They receive a social pension or care allowance, regardless of the children's income.

-

They are under 25 and still studying or studying and in the reporting year they did not receive an income (taxable under the tax scale or taxed at 19%) higher than PLN 3089 (this income does not include pensions).

A citizen of Ukraine who has a Polish tax residence can pay as a single parent, even if the child is in Ukraine or was born before the taxpayer acquired Polish tax residence.

Paying taxes together with a spouse or as a parent is more beneficial than an individual settlement because then the tax is calculated on a smaller amount.

What is the tax amount?

There are three types of taxation. Tax rates depend on the type of income.

-

Taxation under the tax scale 17.75%, 32%, on general terms - income from work, orders, pensions, economic activity, unregistered activity, from abroad, minor children and others (PIT-36, PIT- 37).

The amount of tax reduction in PIT calculations for 2019 is:

1) 1 420 PLN - for the tax base not exceeding 8 000 PLN,

2) for the calculation of tax and PL00 8) over PLN 13,000: PLN 1,420 minus the amount calculated according to the formula: PLN 871.70 × (tax base - PLN 8,000) ÷ PLN 5,000.

3) for tax calculation above PLN 13,000 and not more than PLN 85,528 - PLN 548.30 calculated according to the formula: PLN 548.30 × (tax calculation basis – PLN 85 528) ÷ PLN 41 472

5) for a tax base exceeding PLN 127,000 – tax reduction without amount.

Attention! Persons under the age of 26 whose earnings under an employment contract and commission did not exceed PLN 35,636.67 in 2019 are exempt from paying tax.

Tax calculation method

1. Turnover – tax-deductible expenses = income.

2. Income - social security contributions - deductions from income = taxable amount.

3. Calculate the tax specified in the field above on the tax base.

4. Taxable amount - health insurance premiums - tax credits = tax debt (tax liability).

If the tax due is higher than the advance payments received by the employer, we have tax to pay, and if it is higher, we have an overpayment of tax and the office is required to return the excess amount.

C) Flat tax rate 19% - income from business activities, sale of real estate, cryptocurrencies, securities (PIT-36L, PIT-38, PIT-39)

For the above sources of income, the tax is 19% of income.

In this case, deductible taxes include all expenses related to generating income. There are no statutory amounts here. It is important that expenses are related to income. For example, such expenses include:

-

For the sale of real estate - expenses that increase the value of real estate incurred during its possession (for example, expenses for finishing the premises, inheritance and gift taxes paid, expenses for press advertising, commissions for agencies, etc.)

-

For capital income, cryptocurrencies are, for example, expenses for the purchase of securities sold, brokerage commissions, etc.).

-

For business - purchase of goods, office expenses, accounting services.

-

Detailed instructions for completing Forms PIT-36, 36L, 38, 39 can be found on the website; https://pomoc. pitax. pl/

C) Flat-rate taxation - for business transactions for which this method of taxation was chosen at the time of creation or during the conduct of business (PIT-28).

The tax amount depends on the type of business. Their amount is specified in the Law on Flat Income Tax on Certain Income Received by Individuals. The amount of tax is from 2 to 20% of the income received. The tax base is income. For a flat rate, the tax is not taxable.

What benefits can be deducted from the annual tax?

Benefits reduce the tax paid or increase the tax refund. Therefore, it is worth including them in your annual tax return. We distinguish between tax deductions and income. The right to deduct benefits on your annual tax return is not determined by citizenship.

Highlights deducted from income in 2020 (income tax for 2019) include:

-

Donations

-

in public interest,

-

for Religious purposes,

- 901 church care,

-

For blood donation purposes, i.e. blood or plasma donation.

-

Educational and professional training purposes

Donations must be made by organizations located in the countries of the European Union or the European Economic Area. Therefore, a donation made to an institution located in Ukraine cannot be deducted.

-

Rehabilitation assistance - expenses incurred by or for the rehabilitation of a disabled person to facilitate the daily functioning of such a person.

-

Internet allowance - for people who settled this benefit for the first time or settled it a year ago.

-

Individual Retirement Account Benefit (IKZE) - payments to an individual retirement account to save money for retirement,

-

Refund of unjustifiably collected benefits that previously increased taxable income, such as the return of ZUS.

-

Development assistance - expenses incurred for research and development in development.

-

Interest rate cuts - for people who started qualifying apartment investments during benefit years, housing costs incurred during the benefit period may be deducted.

Tax incentives also include:

-

Child benefit – a family benefit for parents raising children.

Important! A parent who earns income in Poland has the right to deduct family allowance even if he is not a Polish citizen. In addition, the child is not required to be in Poland. The fact of payment of income in Poland gives the right to the payment of child benefit.

-

Housing allowance – deduction of expenses for systematic savings in a savings account based on an agreement entered into before 2002.

-

Benefit for foreigners - assistance to people who worked abroad and paid taxes there.

When and how to pay tax?

The tax arising from the annual tax return (line "Must be paid") must be paid by the end of April (before the end of February in the case of PIT-28). You do not need to pay tax at the same time as filing/sending your PIT to the tax office. PIT can be sent, for example, in March, and the tax is paid no later than 30.04.

The tax can be paid in cash (at the office cash desk, by bank transfer) or in non-cash form, for example, from a bank account via the Internet.

The tax must be paid using a micro tax account. Its number can be found on the government website podatki.gov.pl or obtained from any tax office by indicating the NIP or PESEL number.

If a foreigner is still waiting for a decision on granting PESEL, he can pay value added tax from the tax micro-account of the tax office in accordance with the list of bank account numbers of the tax authorities of the National Tax Administration (effective from January 1, 2020).

-