How much tax credit per child 2023

2023 Child Tax Credit Legal Guide

What is the Child Tax Credit?

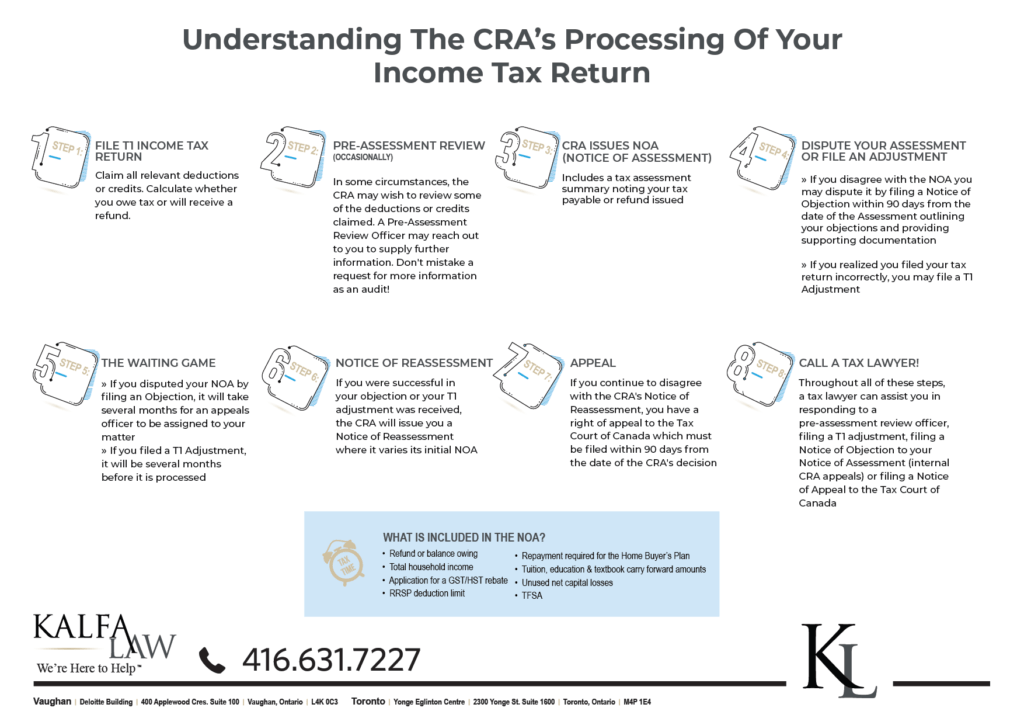

The Child Tax Credit uses a parent’s modified adjusted gross income to provide a partially refundable tax credit for the 2023 tax year. A partially refundable credit means that you can receive a portion of the credit even if you do not have income tax liabilities for the tax year. This means that if a parent qualifies for the credit and files taxes, they may claim the credit.

Can all parents claim the Child Tax Credit?

No. Parents are required to file taxes and qualify under residency requirements and income limits in order to claim the Child Tax Credit.

Parents who have their main home in the U.S. for more than half of the year and have children who are 16 or younger on the last day of the year meet the residency requirement. U.S. military personnel and federal employees assigned outside of the U.S. also qualify.

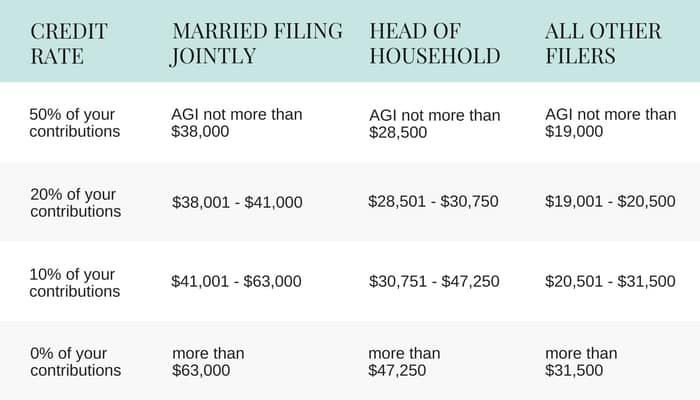

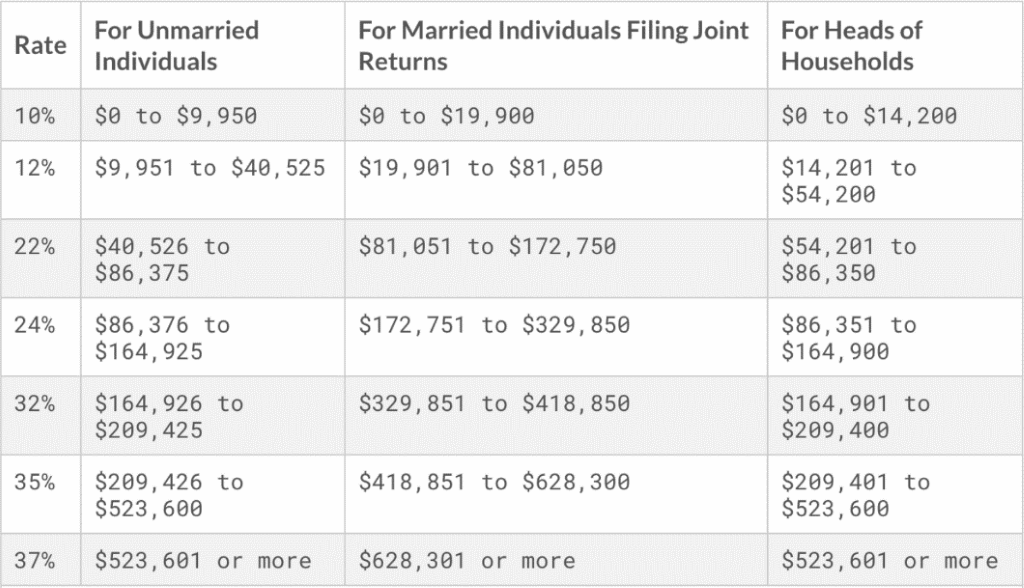

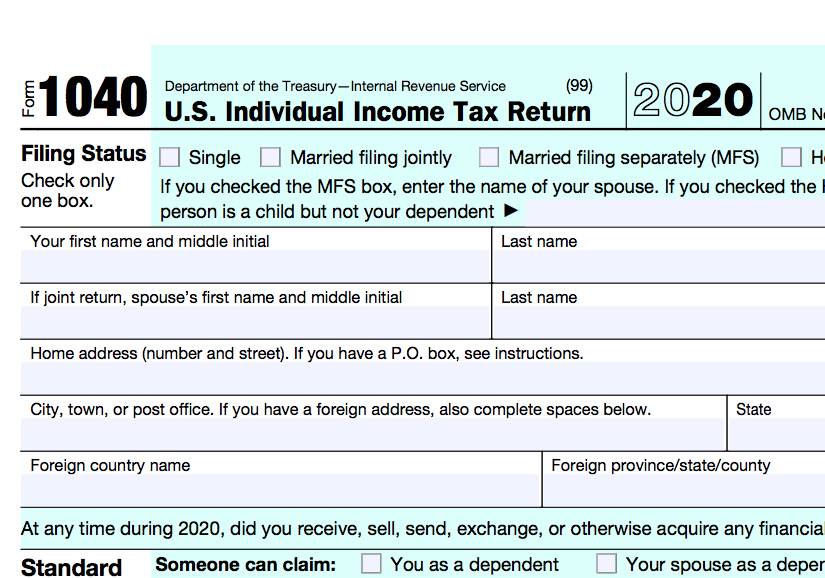

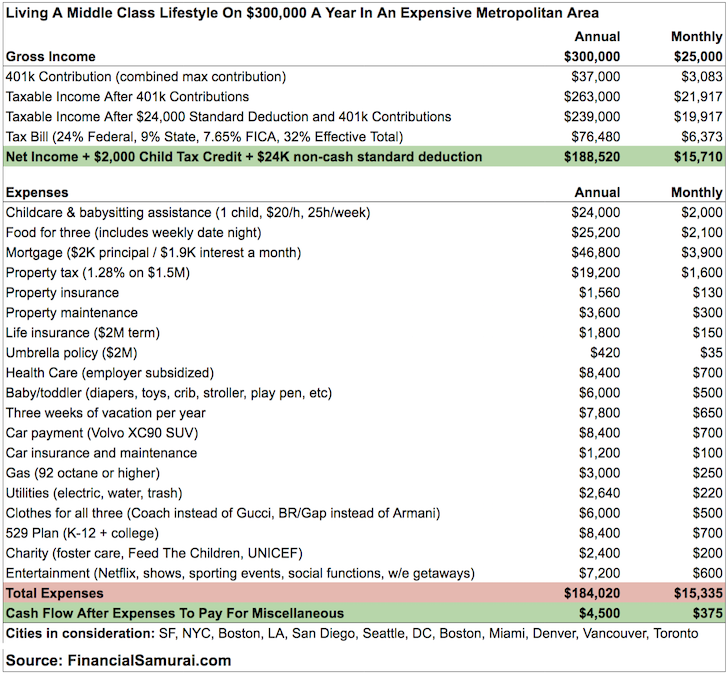

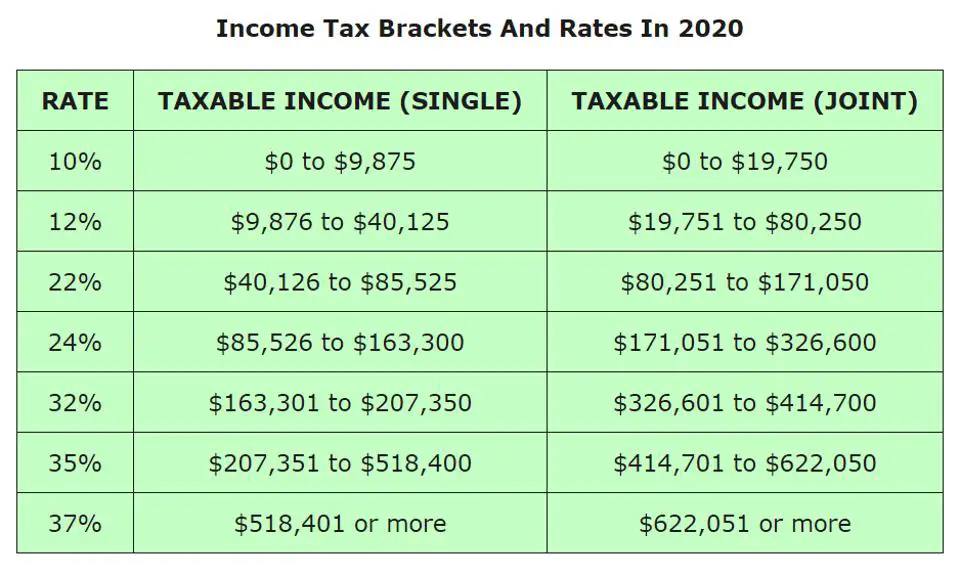

There are income limits that apply to the Child Tax Credit. At the time of the writing of this article, for 2023, a qualifying parent is required to have the following modified adjusted gross income (MAGI):

- $200,000 or less for those who file single, head of household, or married filing separately.

- $400,000 or less for those who file married filing jointly.

If taxpayers exceed those income limits, the credit is reduced by $50 for each $1,000 of additional income above the threshold until the credit is reduced to $0.

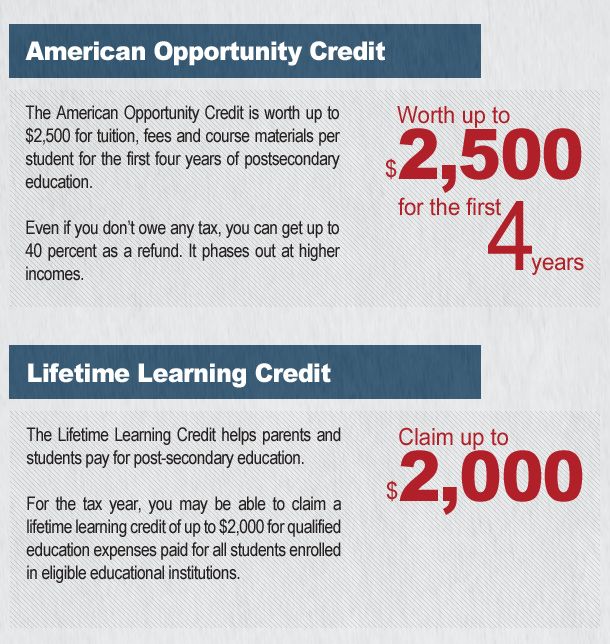

How much is the Child Tax Credit and what changed in 2023?

Unless legislation is passed, some of the temporary changes that were made to the Child Tax Credit in 2021 will not apply in 2023. Some of the changes for 2023 include:

- The credit amount is reduced to $2,000.

- No portion of the credit is available in advance.

In 2021, the Child Tax Credit was available for children that were 17 or younger at the end of the tax year. In 2023, children who are 16 or younger at the end of the tax year qualify for the Child Tax Credit.

Are cash payments available for the Child Tax Credit?

No. For a portion of 2021, the IRS paid part of the Child Tax Credit in advance. Those advance payments were not available during 2022 and are not slated to be available for 2023. There are, however, ongoing political efforts to renew the monthly Child Tax Credit payments, but a change does not look likely at this point.

Do co-parents that share custody and support 50/50 both get the Child Tax Credit?

No. If parents file taxes separately, the parent that claims the child as a dependent on their tax return receives the credit. If parents file separately and both try to claim the child as a dependent, the IRS only recognizes one parent’s claim. In these situations, the parent with whom the child primarily lives is typically the one who the IRS allows to claim the child as a dependent. In short, there is one credit for each child.

Often, joint child custody agreements with income tax provisions control who receives the credit. These agreements can, however, provide for alternating years or other creative solutions to ensure both parents share the tax benefits.

These agreements can, however, provide for alternating years or other creative solutions to ensure both parents share the tax benefits.

Will the Child Tax Credit affect public benefits?

The Child Tax Credit has no impact on any public benefits. Even more, the Child Tax Credit is not subject to offset for overdue taxes or other federal or state debts that taxpayers or their spouses owe. However, money owed for child support may continue to offset these credits.

To learn more about the Child Tax Credit, other tax breaks, or to get some tax legal help, reach out to a Rocket Lawyer network attorney.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The Child Tax Credit will help all families succeed.

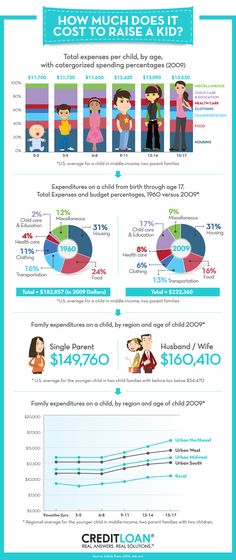

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6).

If they signed up by July:

If they signed up by July: - Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

who is entitled to, conditions for receiving payments by families with children under 17

Ekaterina Miroshkina

economist

Author profile

On January 1, 2023, a new allowance for families with children will appear. At first it was called universal, now it is single. A new type of state support will seriously change the system for calculating payments to families with children. And although the principle of appointment is similar to the already existing benefits from 8 to 17 years old, parents need to figure it out again. Now the concepts of "comprehensive means assessment", "zero income rule", "children's living wage" and "property security" will affect more families. nine0003

At first it was called universal, now it is single. A new type of state support will seriously change the system for calculating payments to families with children. And although the principle of appointment is similar to the already existing benefits from 8 to 17 years old, parents need to figure it out again. Now the concepts of "comprehensive means assessment", "zero income rule", "children's living wage" and "property security" will affect more families. nine0003

Several reviews will be devoted to the unified allowance for children and pregnant women. This is about the main conditions.

What I will tell you about

- What is the single allowance

- Who is entitled to the single allowance from 2023

- How much is the single allowance paid

- How to calculate the average per capita income of the family

- Whose incomes are taken into account in the calculation 9015 when assessing means

- What income is not taken into account for a single benefit

- How property is taken into account for a single allowance

- What is the zero income rule

- What reasons confirm the lack of income

- How to apply for a single allowance from 2023

What is a single allowance

is a new monthly allowance state support. It will be possible to receive it:

It will be possible to receive it:

- When pregnant - if you register up to 12 weeks.

- For children from birth to 17 years of age. nine0016

What benefits will be replaced by a single

| Benefit until 2023 | Size until 2023 | Who appointed | Conditions until 2023 |

|---|---|---|---|

| When registering before 12 weeks of pregnancy | 50% of the subsistence level of the able-bodied population in the region | PFR | Income not more than PM per capita, comprehensive means assessment | nine0061

| Care for up to a year and a half unemployed | Fixed amount — 7677.81 Р | PFR | One of the parents with any income |

| For the first child up to 3 years | 100% of the subsistence minimum for children in the region | Social security - from the budget | Income of not more than two PM for the working-age population in the region, without a comprehensive means assessment |

| For the second child up to 3 years | 100% of the subsistence minimum for children in the region | PFR - from mother capital | Income of not more than two PM for the working-age population in the region, without a comprehensive means assessment |

| For the third or subsequent child up to 3 years | 100% of the subsistence minimum for children in the region | Social security - from the budget | In 76 regions, according to their rules |

| For children from 3 to 7 years old | nine0065 50, 75 or 100% of the subsistence minimum for children in the regionSocial security - from the budget | Income not more than PM per capita, comprehensive means assessment | |

| For children from 8 to 17 years old | 50, 75 or 100% of the subsistence minimum for children in the region | PFR | Income not more than PM per capita, comprehensive means assessment |

When registering up to 12 weeks

Pregnancy

Until 2023

50%of the subsistence minimum of the working population in the region

who set

,PFR

Conditions up to 2023

income no more than PM per capita, a comprehensive assessment of need

for care to before one and a half years unemployed

Amount until 2023

Fixed amount - 7677. 81 R

81 R

Who appointed

PFR

Conditions until 2023

to one of the parents with any income

for the first child up to 3 years old

Until 2023

100%of the subsistence minimum for children in the region

Who appointed

Social Protection - from the budget

Conditions up to 2023

Income of not more than two PM for the working-age population in the region, without a comprehensive means test

For the second child up to 3 years old

Size until 2023

100% of the subsistence minimum for children in the region

who set

PFR - from the capital

Conditions up to 2023

income of not more than two PM for the working population in the region, without a comprehensive assessment of a need for

for a third or subsequent child under 3 years old

Until 2023

100% of the subsistence minimum for children in the region

Who appointed

Social protection - from the budget

Conditions until 2023

In 76 regions, according to their rules

for children from 3 to 7 years old

Until 2023

50, 75 or 100%of the subsistence level for children in the region

Who appointed

Social Protection - from the budget

Conditions up to 2023

Income no more PM per capita, comprehensive means assessment

For children from 8 to 17 years old

Amount until 2023

50, 75 or 100% of the subsistence minimum for children in the region

Who appointed0002 PFR

Conditions until 2023

Income not more than PM per capita, comprehensive means assessment

This entire list will now replace or combine the single allowance for children and pregnant women. It is assigned according to general rules, and the Social Fund of the Russian Federation will pay it - it will appear as a result of the merger of the FSS and the PFR.

It is assigned according to general rules, and the Social Fund of the Russian Federation will pay it - it will appear as a result of the merger of the FSS and the PFR.

The amount of the benefit is not fixed, as in some cases now. It will depend on the need of the family and will be 50, 75 or 100% of the subsistence minimum. nine0003

The rules will change from 2023, but there will be a transitional period for a few more years with the option to choose the old conditions.

First things first.

So, the family had several benefits with different conditions of assignment. One will appear - with the same.

Who is entitled to a single allowance from 2023

The new allowance will be assigned to citizens of the Russian Federation for children who also have Russian citizenship, taking into account a comprehensive need assessment. This term combines three conditions:

- The average per capita family income in the billing period is not more than the subsistence level per capita.

- The property of family members is included in the established list. For example, if a family has an apartment and a house, this is not a reason for refusal. But if two cars are a reason, even with a low income.

- Adult family members had earned income or an objective reason for its absence. For example, if the wife is on maternity leave and the husband is not working, the allowance will not be assigned due to the man’s zero income. nine0016

Details of each of the three conditions will follow.

Now it is important to understand the essence: now, from the birth of a child, the needs of the family will be taken into account. Until 2023, these rules apply only to maternity benefits and children aged 3 to 7 and 8 to 17 years old.

For example, in 2022, any mother, even if she has never worked, receives a fixed amount of care for up to a year and a half. According to the new rules, family income and property will be taken into account from the birth of a child. And if they exceed the established minimum, a single allowance is not assigned. And if the family keeps within the limits, it will be able to receive even more than before. nine0003

And if they exceed the established minimum, a single allowance is not assigned. And if the family keeps within the limits, it will be able to receive even more than before. nine0003

Transition period

Children born before 12/31/2022 can receive benefits under the old rules - at the discretion of the parents. There is a transitional period for them. Therefore, in 2023, a mother will still be able to receive a care allowance or payment for up to 3 years under the same conditions, without a comprehensive means assessment.

How much is the single allowance

The single allowance will be 50, 75 or 100% of the subsistence minimum in the region. For pregnant women, the minimum for the working-age population is taken as the basis. For children - installed on the child. nine0003

The exact amount of the allowance depends on the need of the family.

Single allowance per child

| Subsistence minimum share | Terms of appointment |

|---|---|

| 50% | Basic size |

| 75% | Increased amount - if, when assigning the base amount, the average per capita income did not reach the subsistence level per capita |

| 100% | The maximum amount - if, when an increased amount was assigned, the average per capita income still did not reach the subsistence level per capita |

The cost of living of the subsistence level

The conditions for the appointment

50%

Basic size

75%

increased size - if the basic amount of the average per capita income did not reach the livestock minim nine0003

The maximum amount - if, when assigning an increased amount, the average per capita income still has not reached the subsistence level per capita

Until 2023, payments are assigned according to the same principle for children from 3 to 7 and from 8 to 17 years. Nothing will change for them.

Nothing will change for them.

But the amount of benefits for pregnant women and children under 3 years old may change.

Previously, pregnant women could only receive 50% of the living wage. Now they will receive 50, 75 or 100%, that is, the allowance can double. nine0003

There were two guaranteed benefits for children under 3 years old:

- up to one and a half years - 7678 R, a fixed amount for non-working parents;

- up to 3 years old - 100% of children's PM for the first child.

See what happens.

Now, up to 3 years, you can receive 50, 75 or 100% of the subsistence minimum, taking into account a comprehensive means assessment. This means that one unemployed mother, who previously would have received R 7678 for a year and a half, will now easily receive R 14 000 per month for the same child. And another mother, who counted on a fixed minimum amount, may not receive a single allowance, because the family has two cars or her husband has zero income. nine0003

nine0003

Considering the transition period, you can still choose the old rules. But this will only affect children born before 2023. And for those who will be born in 2023, it will be exactly like this: the need assessment, taking into account income and property, comes to the fore for state support.

Maternal Capital Payments - for any child

Even if a family is not eligible for a single allowance due to property and income, it can apply for up to 3 years of maternity capital payments. Until 2023, they are assigned only to the second child. And from 2023 - for anyone. And without a comprehensive means assessment. The main criterion is the average per capita income of no more than two regional subsistence levels. nine0003

There will be a separate analysis about this payment.

How to calculate the average per capita family income

Average per capita income = Income of all family members in the billing period / 12 / Number of family members

And now, attention, the most important change: the billing period for a single benefit is 12 months preceding one month to a month appeals.

Previously, four months were counted - and parents complained: the financial situation worsened, and the remote settlement period does not give the right to the allowance. nine0003

Billing periods when applying in 2023

| Application submission | Income accounting |

|---|---|

| January 2023 | December 2021 - November 2022 |

| February 2023 | January 2022 - December 2022 |

| March 2023 | February 2022 - January 2023 |

| April 2023 | March 2022 - February 2023 | nine0061

| May 2023 | April 2022 - March 2023 |

| June 2023 | May 2022 - April 2023 |

| July 2023 | June 2022 - May 2023 |

| August 2023 | July 2022 - June 2023 |

| September 2023 | August 2022 - July 2023 |

| October 2023 | September 2022 - August 2023 |

| November 2023 | October 2022 - September 2023 |

| December 2023 | November 2022 - October 2023 |

Application Application

Accounting for income

January 2023

December 2022

February 200002 April 2022 - December 2023 9000 - February 9000 9000 - February 9000 9000 - February 9000 9000 - February 9000 9000 - February 9000. 2023

2023

March 2022 - February 2023

May 2023

April 2022 - March 2023

June 2023

May 2022 - April 2023

July 2023

June 2022 - May 2023 9000 August 2022 - July 2023

October 2023

September 2022 - August 2023

November 2023

October 2022 - September 2023

December 2023

November 2022 - October 2023

9000 9000 9000 9000002 When applying in January 2023, income for the period from December 2021 to November 2022 is taken into account.

Whose income is taken into account in the calculation

Total income includes salary and other income: child under 17 years of age.

The family does not include:

- Persons deprived of parental rights to this child.

- Persons on full state support, except for children under guardianship.

- Conscripts without a contract.

- Deprived of liberty or in custody.

- Compulsory treatment by court order.

- Declared missing or dead.

- Wanted.

What's new in Russian laws

And how it will affect your money. A short letter with analysis of new laws - once a month in your mail. Free of charge

What incomes are taken into account when assessing means

According to federal rules, the list is as follows:

- Salary, bonuses, monetary allowance, payment for services - before taxes.

- Pensions and benefits.

- Scholarships and payments on academic leave for medical reasons.

- Alimony received.

- Payment to successors under pension insurance. nine0016

- Dividends and interest on operations with securities and derivative financial instruments — net of expenses.

- Interest on bank deposits.

- Compensation for state and public duties.

- Business income less expenses and earmarked grants.

- Income from the sale and rental of property.

- Income from author's order contracts.

- Income from self-employment and patent - without deducting expenses.

- Retired judges for life.

- One-time allowance upon dismissal from military service.

- Income from sources abroad.

- Income from winnings in lotteries and sweepstakes.

Income is taken into account before taxes. Income in foreign currency is converted into rubles at the exchange rate of the Central Bank on the day of receipt.

A different list will be set for Moscow. There, the rules will be different - as with payments from 8 to 17 years. In other regions, the general procedure applies. nine0003

The movement of money on accounts at the federal level is not taken into account.

What incomes are not taken into account for the single allowance

When assessing the need, the following incomes of family members are not taken into account:

- Monthly allowance for a pregnant woman for past periods.

- Monthly care allowance for up to a year and a half for the unemployed.

- Monthly allowance for children up to 3 years of age.

- Monthly payments from 3 to 7 and from 8 to 17 for previous periods for the same child. nine0016

- Single allowance for past periods for the same child.

- One-time financial assistance from local budgets in connection with emergencies or terrorist attacks.

- Payments for the care of children with disabilities and disabled people from childhood of the first group.

- Allowances and alimony for children from 18 or 23 years old - according to the conditions of the regions.

- Payments under a social contract.

- Target funds for full payment for housing or transport within the framework of social support.

- Capital to pay for housing or rehabilitation facilities. nine0016

- Regional maternity capital.

- Personal income tax returned with the help of deductions through the employer or on declaration.

- Burial allowance.

- Compensation for damage to life, health and property.

- Compensation for the purchase of rehabilitation equipment for family members with disabilities.

- Compensation for keeping guide dogs.

- Compensation for the installation of a tombstone.

- One-time payments to military personnel and members of their families in compensation for damage to life and health due to hostilities. nine0016

- One-time assistance for the treatment of a child.

Paid alimony and mortgage payments are not excluded from family income.

In case of loss of employment, there is no special procedure for accounting for income for 2023. But for the mobilized, there is an exception: all their incomes are not taken into account in the calculation.

How property is taken into account for the purpose of a single allowance

When assessing the need, real estate, transport and interest on deposits are taken into account. If the family has an excess on at least one of the points, the single allowance will be denied. nine0003

If the family has an excess on at least one of the points, the single allowance will be denied. nine0003

Family property restrictions

| Type of property | May have | Not included in valuation |

|---|---|---|

| Housing | One apartment of any area. Or several apartments, if the total area for each family member is not more than 24 m². One house of any area. Or several houses, if each family member has no more than 40 m² | Unfit for habitation. Occupied by a sick family member if it is not possible to live together. nine0003 Provided to a large family under a social program or fully paid for with targeted subsidies. Cumulative shares for all family members within 1/3 of the total area. Housing under arrest and with a ban on registration actions. Housing for foster children |

| Non-residential premises | One dacha - with the designation "garden house". One garage or parking place. Or two - for a large family, as well as if the family has a person with a disability or a car received under a social program or fully paid for with targeted subsidies. nine0003 One non-residential premises | Outbuildings on plots for individual housing construction, private households. Common property in apartment buildings |

| Plots | Land with a total area of up to 0.25 hectares if the applicant lives in a city or up to 1 ha if he lives in a village | Plots of large families under social support programs or fully paid for with targeted subsidies. Far East hectare | nine0061

| Transport | One car. Or two, if the family has many children, a family member has a disability, or a car was received through state support. One motorcycle. Or two - under the same conditions as with a car. If the machine has an engine more than 250 hp. | For machines with a capacity of 250 hp or more. with. and not older than 5 years, only a family with four or more children can receive a payment. nine0002 Transportation of foster children |

| Money | Interest on deposits and bank accounts - no more than 14,375 R in the billing period | Income on deposits closed 6 months before the month of circulation or earlier |

You can have

One apartment of any size. Or several apartments, if the total area for each family member is not more than 24 m².

One house of any area. Or several houses, if each family member has no more than 40 m²

Not included in the assessment

Unfit for habitation.

Occupied by a sick family member if it is not possible to live together.

Provided to a large family under a social program or fully paid for with targeted subsidies.

Cumulative shares for all family members within 1/3 of the total area.

Housing under arrest and with a ban on registration actions.

Housing for foster children

Non-residential premises

Possible to have

One dacha - with the designation "garden house".

One garage or parking space. Or two - for a large family, as well as if the family has a person with a disability or a car received under a social program or fully paid for with targeted subsidies.

One non-residential premises

Not taken into account when assessing

Outbuildings on plots for individual housing construction, private household

Common property in apartment buildings

Plots

May have

Land with a total area of up to 0. 25 ha if the applicant lives in a city or up to 1 ha if the applicant lives in a village

25 ha if the applicant lives in a city or up to 1 ha if the applicant lives in a village

Not taken into account in the assessment

Far Eastern hectare

Transport

You can have

One car. Or two, if the family has many children, a family member has a disability, or a car was received through state support.

One motorcycle. Or two - under the same conditions as with a car. nine0003

If the machine has an engine more than 250 hp. with. less than 5 years old, there will be no payout - even if this car is the only one in the family

Not taken into account when assessing

with. and not older than 5 years, only a family with four or more children can receive a payment.

Transportation of children under guardianship

Money

You can have

Interest on deposits and bank accounts - no more than 14,375 R in the billing period

Not taken into account when assessing

Income from deposits closed 6 months before the month of circulation or earlier

The property of all family members in the aggregate is taken into account. If property restrictions are not met, this is grounds for denial of any income.

If property restrictions are not met, this is grounds for denial of any income.

For example, a family has an apartment, a house, a dacha, a garage and a car. Property will not be a reason for refusing a single allowance, even if the housing is large.

Another family has two apartments - but each family member has 15 m². This is less than the limit, there are no grounds for refusal. nine0003

And the third family has two cars and one mortgaged apartment. She will be denied benefits because of transport: only large families can have two cars.

What is the zero income rule

Another important point: a single allowance is assigned only to families that had earned income in the billing period or have a justification for its absence. The list of such good reasons for zero income is approved by the rules.

Here's how it works in practice:

- Determine the composition of the family. Let's say two people are over 18 years old - husband and wife.

nine0016

nine0016 - We take the billing period. For example, from December 2021 to November 2022.

- Checking spouses' earnings. The husband has a salary for the entire billing period. Or income from self-employment for November. He does not need to confirm good reasons. But the wife's income is only benefits, it is not labor income. She will have to justify the lack of income. Suitable, for example, having many children or caring for a child up to 3 years old. If there is no good reason, the allowance will be denied regardless of income and property. nine0016

It is enough to have earned income even in one month of the billing period.

Any of the following incomes is considered to be labor income:

What reasons confirm the lack of income

Confirm 10 months in advance. For 10 or more months of the billing period, you can have one or more reasons from this list:

- Child care up to 3 years.

- Disability of a child under 18

- Care of the elderly or disabled.

- Full-time education up to 23 years without scholarship.

- Own treatment or care for a sick child for more than 3 months.

- Military service and 3 months after demobilization.

- Imprisonment and 3 months after release.

- Unemployment accounting - no more than 6 months in the billing period.

Valid reasons are taken into account for a full month, regardless of the date of occurrence. Even if the care for the elderly is issued on October 20, it is considered that the good cause is confirmed for the whole of October. nine0003

Have in the billing period or when applying. There are good reasons that you can have at any time in the billing period or at the time of the application:

- Large family status for one of the family members.

- Single parent status of a child under 18 years of age.

- The status of the mobilized.

- Belonging to the indigenous peoples of the North, Siberia and the Far East.

For example, in the billing period, mother had no income. She also could not confirm good reasons for this period. But then the child's father died, with whom the mother was divorced, and she became the only parent. Now you can immediately apply for a single allowance, despite zero income. nine0003

Being pregnant. For pregnant women, the zero income rule does not apply under the following conditions:

- The reference period was 6 or more months of pregnancy.

- On the day of application for benefits, the pregnancy was 12 weeks or more.

This means that when applying later than 12 weeks, a woman will not be refused in any case due to zero income. But for other reasons - they can.

How to apply for a single benefit from 2023

Perhaps, at the end of December, a form for preliminary submission of applications will appear on public services. Until she is gone. In any case, it will be possible to send an application only from January 1. In 2022, a single allowance has not yet been assigned, but you can apply for those that are in effect now.

Until she is gone. In any case, it will be possible to send an application only from January 1. In 2022, a single allowance has not yet been assigned, but you can apply for those that are in effect now.

An application for a single allowance from 2023 can be submitted:

- through public services;

- in social fund client services;

- at the MFC.

Due to the holidays, offline methods will only be available from 9January. But an online application can be submitted even immediately after the chimes.

Consideration period - up to 35 business days. If documents are needed, they must be brought in person within 10 working days. Nothing can be attached to public services. Therefore, carefully indicate the address: if there is a permanent and temporary registration, choose the region where you can come in person.

Transfer of benefits - until the 25th day of the next month: to the Mir card, an account without a card or by postal order.

How to ask a question?

Leave questions about the single allowance in a special section. I'll try to answer everything.

New rules for payment from maternity capital and features of the unified benefit for pregnant women - in the following sections.

News that concerns everyone is in our telegram channel. Subscribe to keep abreast of what is happening: @tinkoffjournal.

Tax deduction for dental services

In accordance with Article 219 of the Tax Code of the Russian Federation, a taxpayer is entitled to a tax deduction in the amount paid for medical services. nine0003

Are there tax deductions for dental treatment?

Yes, you are eligible for a dental tax credit when you pay for dental services. The deduction can be granted to you if you paid for the treatment of your parents, your spouse (s), your children under 18 years of age.

What do I need to get a dental tax credit?

We list the main conditions for the return of tax for dental treatment:

- the dental organization must have a license for medical activities

- The taxpayer must receive 13% taxable income in the year the dental care payment is made (only a tax deduction is possible for dental treatment for employed people - unemployed and those who do not have 13% taxable income (for example, women in decree) they will not be able to return money for dental treatment through the tax office)

- the statute of limitations for the refund of dental treatment tax - 3 years has not passed

Documents required to receive a tax deduction:

In the event of a refund of personal income tax for dental treatment through the tax office, the following documents must be submitted to the Federal Tax Service Inspectorate:

1. certificate of income 2 personal income tax (original, issued by the taxpayer's employer) dental clinic)

certificate of income 2 personal income tax (original, issued by the taxpayer's employer) dental clinic)

3. personal income tax return 3 (filled in by the taxpayer)

4. contract with a medical institution (copy) and/or other documents confirming treatment

5. checks (copy)

6. dental clinic license (copy, issued by the clinic, not always needed)

spouse or child)

8. You may need a copy of your passport, TIN of the taxpayer. The inspection officer can request original documents for verification, you need to be ready to provide them

Download the form "Application for the issuance of a tax certificate" nine1000Open "Example of filling out a form for a certificate of payment for medical services"

Tax deduction for treatment: do you need a license or not?

As mentioned above, in order to receive a deduction for treatment, it is necessary that the medical organization or individual entrepreneur have the appropriate licenses issued in the prescribed manner.

But “at the same time, this does not mean that in order to receive a social tax deduction, taxpayers must submit to the tax authority, along with other necessary documents, copies of such licenses” (Letter of the Federal Tax Service of August 31, 2006 N SAE-6-04 / 876@). nine0003

The Letter goes on to discuss cases where copies of licenses are not needed. Thus, when a reference to the details of a license is contained in the contract for treatment itself or in a certificate of payment for medical services, “tax authorities are not recommended to require the taxpayer to submit copies of the relevant licenses. If the tax authority has grounds for checking whether a medical organization has a license, it is necessary to send a request to this medical institution or to the appropriate licensing authority. nine0003

If the details of the license (license number, date of issue, validity period and issuing authority) are specified in the certificate of payment for medical services or in the contract, then it is not necessary to submit a copy of the license to the Federal Tax Service.

How to order a tax deduction certificate (certificate of payment for medical services)?

1. To do this, you need to fill out an application form. You can fill it out at the clinic itself or download it on our website (it is attached below) and send it by e-mail [email protected]

Download the form "Application for the issuance of a tax certificate"2. If you submitted your application by e-mail, be sure to call the clinic and make sure that the letter was received by e-mail. address

Important: when filling out the application, indicate your full name, not initials!Terms of issuing certificates:

Usually, the term for issuing a certificate in our clinic is 10-15 days, but sometimes faster, depending on the workload. In any case, when the certificate is ready, you will receive a call at the phone number that you indicate in the application. nine0003

Frequently asked questions:

1.

with. less than 5 years old, there will be no payout - even if this car is the only one in the family

with. less than 5 years old, there will be no payout - even if this car is the only one in the family