How much should father pay for child support

How Much Should A Father Pay In Child Support?

While fathers may be ordered to pay children, mothers may question just how much they are supposed to be settling in child support. If you have been through the Texas family law courts fighting for help for your children, you will be familiar with how the process works.

If you have not, it is essential to know that without an order that mandates child support payment, either pay is not obligated to make child support payments. If you have no charges in place but are in need, your beginning starts in a Texas family law court.

Once a judge has ordered a parent to provide child support, there is not much that can be done to deviate from this order. Some parents may question the amount of child support they have been ordered to pay, but you should know that amount was not picked up randomly.

To begin, you will need to understand why child support is ordered, what it covers, and who will be awarded the child support in your Texas family law case.

The noncustodial parent, or the parent who does not have custody of the child the majority of the time, is the parent who is responsible for paying child support. They are known as “obligors,” meaning they are legally bound to the custodial parent to pay for child support. The custodial parent is the parent who has custody of the child the majority of the time.

If you have been ordered to pay child support, you should know it was collected for the child’s best interest. In Texas, we use the “Best Interest of the Child” standard to determine what conservatorship, possession and access, and child support should be ordered.

Your child support payments are paid to support the necessities of your child’s life. These include shelter, clothing, and food. Although all your child support will cover other nonessential, necessary expenses can include uninsured medical costs, educational fees, or extracurricular expenses. As custodial parents receiving child support, they will likely work to make all of these expenses work within what they are receiving in child support and their equal contributions to the child’s resources.

As custodial parents receiving child support, they will likely work to make all of these expenses work within what they are receiving in child support and their equal contributions to the child’s resources.

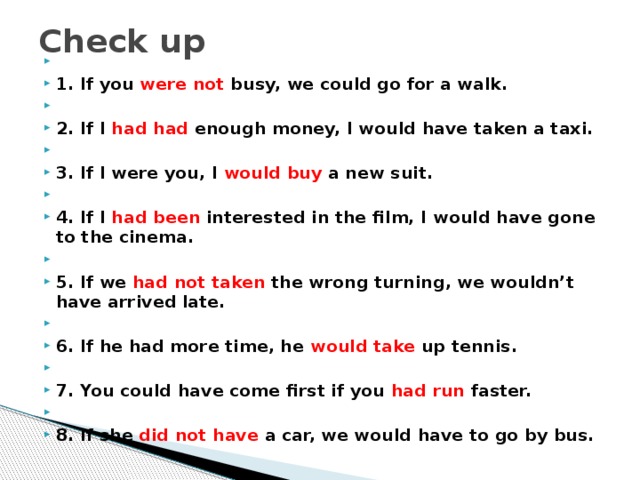

As it is with every state, Texas has its rigid statutory guidelines to calculate how much child support a parent should be paying. There are only guidelines, and every case has different circumstances and factors to consider when ordering child support. That being said, a judge can always order below or above guideline child support depending on the situation. The parties themselves can also agree upon an amount deviating from the guidelines.

Payments are calculated as a percentage of the obligor’s monthly net income up to the first $9,200 per month of that income. This maximum net income was changed in September 2019 and will be altered every six years as the economy changes. The monthly net income is calculated by taking the obligor’s monthly gross income and subtracting all deductions. These deductions can include federal income taxes, union dues, medicare and social security taxes, and insurance premiums.

These deductions can include federal income taxes, union dues, medicare and social security taxes, and insurance premiums.

After you have calculated your net monthly income depending on how many children you have, how much of your net monthly payment will go as child support. A breakdown of the rates per child are as follows:

Number of Children | Support Percentage |

1 | 20% |

2 | 25% |

3 | 30% |

4 | 35% |

If you have over four children, it will be calculated at %40 of your net monthly income.

What If I Don’t Have A Job?Most parents believe that if they don’t have a job, they will have no obligation to pay child support, but this could not be false. The Texas Family Code Section 154. 068 states that a parent with no net resources can represent income equal to the minimum wage for a standard 40-hour workweek.

068 states that a parent with no net resources can represent income equal to the minimum wage for a standard 40-hour workweek.

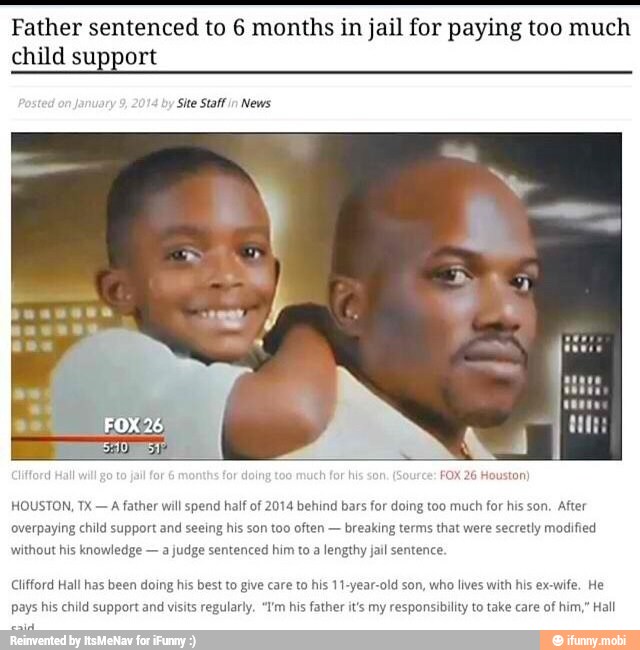

If you violate your child support order, the custodial parent can proceed through any child support enforcement options. These enforcements can include fines, jail time, or garnishment of wages. However, to avoid the occurring of child support payments not being paid, there are options to help ensure that the court orders are followed, and they include:

- Withholding Wages- the parent’s employer is noticed to automatically withhold the parent’s child support amounts from their wages. That money is then sent to the child support office, which will then disburse that money to the custodial parent.

- Contempt- A violating parent can be held in contempt, which means being placed in jail and on community supervision for up to 5 years.

The parent can also be ordered to pay the attorney fees incurred from the enforcement action.

The parent can also be ordered to pay the attorney fees incurred from the enforcement action. - Money Judgements- The amount of unpaid child support can be reduced to many judgments that accumulate interest.

- License Suspension- If you fail to pay child support for more than 90 days, the courts can order the suspension of any license you have.

If there are significant changes in circumstance that have hindered your ability to pay your child support, such as a loss of a job, you may be eligible for a child support modification. In this modification, a family law judge will evaluate and consider these circumstances that may warrant a reduction in your child support. Any changes in child support payments that a judge has not ordered could land you in a bit of trouble. Therefore, all legalities surrounding your children should be handled in a court of law.

In summary, child support is ordered because it is in the best interest of your child. Your payments will help give your child a stable childhood. Now that you understand how your child support will be calculated, you will not second guess that your prices are for the benefit of your child.

If you still have questions about your child support or need help clarifying what your child support order means, please do not hesitate to contact our office to set up your FREE 30-minute consultation. Our expert attorneys will be glad to serve you and help you with all your family law matters. Thank you for reading into today’s blog.

How much is child support in your state?

A typical parent's payment can vary by over $700 a month from state to state

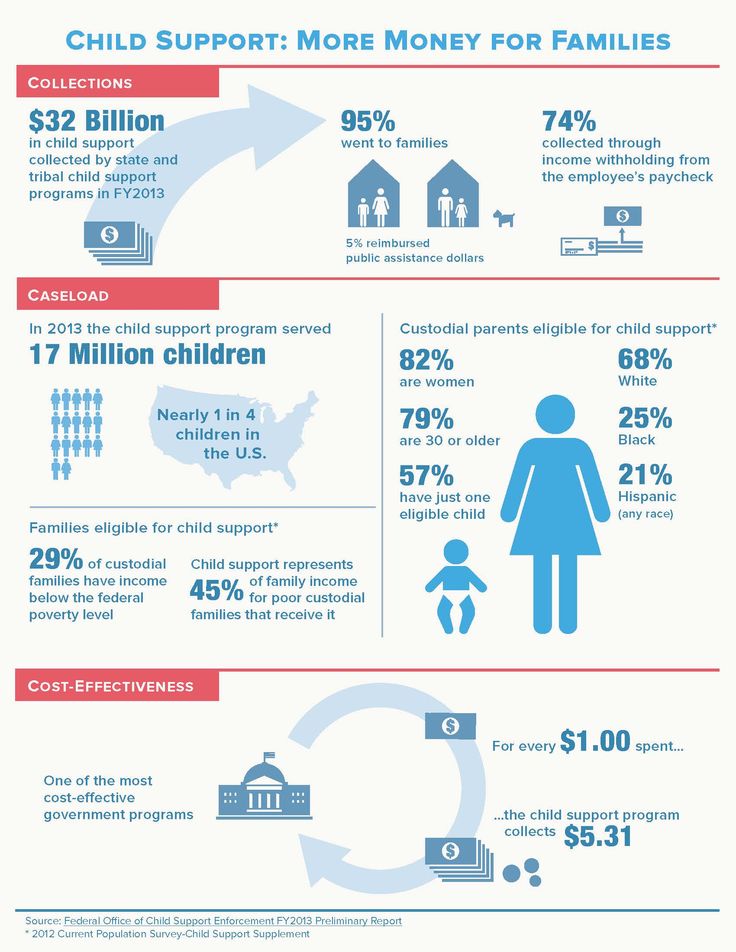

June 10, 2019 — The size of your child support payment depends heavily on where you live, according to research from Custody X Change.

Download high resolution map: PNG | JPG Use image with attribution

A parent can pay three times as much as one who lives in a state just six hours away, despite their circumstances being otherwise equal. When a Virginia parent would pay $400 a month in child support, a Massachusetts parent in the same situation would pay nearly $1,200, per state guidelines.

When a Virginia parent would pay $400 a month in child support, a Massachusetts parent in the same situation would pay nearly $1,200, per state guidelines.

The study looks at a hypothetical family with two children, ages 7 and 10. The mother has 65 percent of parenting time (the most common timeshare awarded to a U.S. mother, according to previous research). She makes $45,000 a year, while the father makes $55,000 (based on data about typical parental incomes from Pew Research Center).

Researchers entered this information into each state's child support formula to discover that the father's payment could range from $402 a month to $1,187 a month. (See the full table of state rankings at the end of this page.) Nationally, he would pay an average of $721 monthly.

These totals reflect how much a state presumes the noncustodial parent should pay (the "guideline" amount), but judges have the discretion to award different amounts based on evidence. In some cases, parents can decide together how much support will be exchanged.

The study does not utilize any data from Custody X Change users.

"Child support is complex," said Ben Coltrin, Custody X Change co-founder and president. "States don't want to set a payment too low, leaving a child's needs unmet. At the same time, they don't want to set a payment so high that the parent can't afford it. We hope this data furthers dialogue about how to determine the right support for each family."

Cost of living, political leaning don't explain the variation

Perhaps surprisingly, the research revealed that child support rates don't significantly correlate with a state's cost of living.

Of the five most expensive states to live in — Hawaii, New York, California, New Jersey and Maryland — one (Hawaii) ranks among the 10 highest child support calculations in the study, but two (New Jersey and Maryland) rank among the lowest 10 calculations.

Meanwhile, Massachusetts, which awards the highest support payment for this family, has the seventh highest cost of living in the nation. Virginia has a comparable cost of living (12th highest in the U.S.), yet awards the least support.

Virginia has a comparable cost of living (12th highest in the U.S.), yet awards the least support.

Download high resolution graph: PNG | JPG Use image with attribution

Political leaning also fails to provide an explanation for the variation in support. Average awards from Republican and Democratic states for this mother are just $13 apart ($702 and $715 a month, respectively).

Four states only consider one parent's income, award $100 more monthly

Only four states don't consider the mother's income when calculating this family's child support:

- Arkansas

- Mississippi

- North Dakota

- Texas

In these states, the family's child support payment is $100 higher than in the rest of the country, on average. Whereas these states award the family an average of $813 monthly, the other 46 states award $713 on average.

Historically, many states calculated child support by taking a percentage of money earned by the parent who spent less time with the child. As the number of working mothers has ballooned in recent decades, most states have moved to formulas that factor in both parents' incomes. Arkansas will become the latest state to make this move, by March.

As the number of working mothers has ballooned in recent decades, most states have moved to formulas that factor in both parents' incomes. Arkansas will become the latest state to make this move, by March.

For the family in the study, formulas that look only at the father's earnings produce high totals. This is because they don't consider that the hypothetical parents have similar income levels.

If the mother's income were to drop, the presumed awards in the same four states could be among the lowest in the country; they would remain static while the awards in other states would increase.

Rocky Mountain region awards the lowest payment, New England the highest

The Rocky Mountain region awards this mother the least child support: $556 a month, on average.

New England awards the most; at $928 a month, its average is 67 percent higher than that of the Rocky Mountain region. Vermont is a New England outlier, with the 12th lowest payment in the nation ($519), but it's not enough to knock New England out of the top spot.

Download high resolution map: PNG | JPG Use image with attribution

For a full breakdown of calculations by region, visit the appendix.

Different approaches to setting guidelines may be behind variation

The federal government requires every state to develop child support guidelines, which help courts determine the appropriate award in any case. The government introduced this requirement in the 1980s after studies showed major inconsistencies in how judges were awarding support, both within and among states.

States choose how to set their guidelines. A few have worked with researchers to measure the cost of raising a child there. Others have used existing research (which may employ data from another state or at the national level), or they haven't referred specifically to any evidence. The difference in approaches likely contributes to the difference in awards across the country.

"We hope this data furthers dialogue about how to determine the right support for each family. "

"

-Ben Coltrin, Custody X Change President

Even among states that point to research, the studies they consult vary in methodology and age. The most common source is the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics. Since it doesn't offer data at the state level, some states have adjusted its data to try to match their cost of living. Other state-specific modifications to data and models further add to the lack of uniformity in awards across the U.S.

By law, each state must convene a panel to review its guidelines every four years.

Child support debate continues to evolve

Most states have overhauled their child support formulas significantly as American families have changed. Guidelines once assumed mothers worked less than fathers, if at all. In addition, they were often based on the presumption that parents had at one point been married to each other.

Today, much of the debate around child support concentrates on finding an amount that provides for the child without leaving the paying parent destitute. Some states have found that lowering payments or forgiving outstanding payments can increase overall child support collection numbers, as the payers are better able to afford their obligation.

Some states have found that lowering payments or forgiving outstanding payments can increase overall child support collection numbers, as the payers are better able to afford their obligation.

State by state rankings

| Rank | State | Award |

| # 1 | Massachusetts | $1,187 |

| # 2 | Nevada | $1,146 |

| # 3 | New Hampshire | $1,035 |

| # 4 | Rhode Island | $1,014 |

| # 5 | Hawaii | $1,014 |

| # 6 | Connecticut | $987 |

| # 7 | Nebraska | $975 |

| # 8 | Kansas | $955 |

| # 9 | North Dakota | $953 |

| # 10 | Washington | $901 |

| # 11 | New York | $895 |

| # 12 | South Dakota | $890 |

| # 13 | Illinois | $885 |

| # 14 | Pennsylvania | $875 |

| # 15 | Louisiana | $873 |

| # 16 | Georgia | $868 |

| # 17 | North Carolina | $840 |

| Rank | State | Award |

| # 18 | Arkansas | $824 |

| # 19 | Maine | $823 |

| # 20 | Ohio | $774 |

| # 21 | Kentucky | $767 |

| # 22 | South Carolina | $760 |

| # 23 | Texas | $759 |

| # 24 | Alabama | $758 |

| # 25 | New Mexico | $735 |

| # 26 | Iowa | $733 |

| # 27 | Utah | $729 |

| # 28 | Minnesota | $716 |

| # 29 | Mississippi | $715 |

| # 30 | Michigan | $666 |

| # 31 | Wisconsin | $623 |

| # 32 | Montana | $612 |

| # 33 | California | $566 |

| # 34 | Missouri | $556 |

| Rank | State | Award |

| # 35 | Florida | $544 |

| # 36 | Arizona | $534 |

| # 37 | Oklahoma | $532 |

| # 38 | Alaska | $527 |

| # 39 | Vermont | $519 |

| # 40 | Tennessee | $503 |

| # 41 | Colorado | $494 |

| # 42 | Wyoming | $484 |

| # 43 | Maryland | $480 |

| # 44 | Delaware | $463 |

| # 45 | Idaho | $463 |

| # 46 | Indiana | $425 |

| # 47 | New Jersey | $424 |

| # 48 | Oregon | $421 |

| # 49 | West Virginia | $403 |

| # 50 | Virginia | $402 |

*States that round to the same whole number are ranked based on their decimals.

For more information on the study, see the appendix.

Who is obliged to pay alimony?

home

Free legal assistance and legal information for the population

Legal information and legal education of citizens

Alimony obligations

Who is required to pay child support?

1. Parents

In accordance with Article 80 of the Family Code of the Russian Federation, parents are required to support their minor children.

Parents must pay child support

- minor children;

- children left without their care;

- Disabled adult children who need help.

Parents have the right to conclude an agreement on the maintenance of their minor children ( agreement on the payment of alimony ), which must be notarized. The agreement establishes the amount of alimony at the discretion of the parties, but it cannot be less than the amount that can be recovered in court.

In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from parents in court.

In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other parental income.

In accordance with article 83 of the Family Code of the Russian Federation p in the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obliged to pay alimony has irregular, fluctuating earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the recovery of alimony in a share of earnings and (or) other income of the parent is impossible, difficult or materially violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis, in a fixed amount of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed amount of money.

The amount of a fixed sum of money based on is determined by the court from the maximum possible preservation of the child's previous level of his security, taking into account the financial and marital status of the parties and other noteworthy circumstances.

Article 84 of the Family Code of the Russian Federation fixes that alimony for children left without parental care are collected only through the court . The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the guardian or custodian of the child, his adoptive parents or transferred to the account of the organization in which the child is (educational, medical organizations, social service organizations, etc.).

In accordance with article 85 of the Family Code of the Russian Federation, alimony in favor of disabled adult children who need assistance can be obtained on the basis of a notarized child support agreement. In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

2. Able-bodied adult children

In accordance with Article 87 of the Family Code of the Russian Federation, able-bodied adult children are required to support their disabled parents who need help. An exception is made by parents deprived of parental rights, to whom children are not obliged to pay alimony.

Alimony can be paid either on the basis of a notarized agreement between parents and children, or on the basis of a court decision. The court sets the amount of alimony in a fixed amount of money , payable monthly, taking into account all the circumstances of the case, including taking into account the financial and marital status of parents and children.

3. Spouses, including former spouses

This issue is regulated by chapter 14 of the Family Code of the Russian Federation.

Spouses or ex-spouses may enter into an agreement on the payment of alimony, which must be certified by a notary. In this case, the amount of alimony is determined in the agreement at the discretion of the parties.

If such support is refused and there is no agreement between the spouses on the payment of alimony, the right to demand the provision of alimony in court from the other spouse who has the necessary means for this, have:

- disabled needy spouse;

- wife during pregnancy and within three years from the date of birth of a common child;

- a needy spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I.

In accordance with Article 90 of the Family Code of the Russian Federation, the right to demand the provision of alimony in court from a former spouse who has the necessary funds for this has:

- ex-wife during pregnancy and within three years from the date of birth of a common child;

- a needy ex-spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I;

- a disabled needy ex-spouse who became disabled before the dissolution of the marriage or within a year from the date of the dissolution of the marriage;

- a needy ex-spouse who has reached retirement age no later than five years after the dissolution of the marriage, if the spouses have been married for a long time.

In the absence of an agreement between spouses (former spouses) on the payment of alimony, the amount of alimony levied on a spouse (former spouse) in a judicial proceeding is determined by the court based on the financial and marital status of spouses (former spouses) and other noteworthy interests of the parties in a fixed amount of money payable monthly.

4. Other family members who may be required to pay child support

- able-bodied adult brothers and sisters

In accordance with Article 93 of the Family Code of the Russian Federation, able-bodied adult brothers and sisters may be payers of alimony to the following persons:

- minor brothers and sisters, provided that they do not have the opportunity to receive maintenance from their parents;

- disabled adult brothers and sisters, provided that they are unable to receive maintenance from their able-bodied adult children, spouses (former spouses) or parents.

- grandparents

In accordance with Article 94 of the Family Code of the Russian Federation, the following have the right to receive alimony in court:

- minor grandchildren in need of assistance in case of impossibility to receive maintenance from their parents;

- adult disabled grandchildren in need of assistance, if they cannot receive maintenance from their spouses (former spouses) or from their parents.

- tons able-bodied adult grandchildren

In accordance with Article 95 of the Family Code of the Russian Federation, able-bodied adult grandchildren may be payers of alimony disabled grandparents in need of assistance , provided that the latter are unable to receive maintenance from their adult able-bodied children or spouses.

- t able-bodied adult pupils

In accordance with Article 96 of the Family Code of the Russian Federation, able-bodied adult pupils (except for those who were under guardianship or guardianship, as well as being raised in foster families) may be payers of alimony to disabled persons who carried out the actual upbringing and maintenance of pupils until they reach 18 years of age with provided that they do not have the opportunity to receive maintenance from their adult able-bodied children or from spouses (former spouses).

Who is obliged to pay maintenance and how much? - Lawyer in Samara and Moscow

Alimony must be paid by the following persons: parents; able-bodied adult children; spouses, including former ones; other family members (under certain conditions).

1. Parents

Parents are required to support their minor children (clause 1, article 80 of the RF IC).

At the same time, even if a parent is disabled, limited in parental rights due to health reasons, the law does not provide for any exceptions regarding the fulfillment of this obligation for him (Question 18 of the Information of the Ministry of Justice of Russia dated 07/20/2015).

Parents must pay maintenance:

- for minor children;

- to children left without their care;

- disabled adult children who need help.

Alimony in favor of minor children can be paid on the basis of an agreement certified by a notary. In this case, the amount of alimony is determined at the discretion of the parties, but it cannot be less than the amount that can be recovered by the court.

If an agreement on the payment of alimony for minor children has not been concluded, they can be collected in court. The amount of alimony to be paid monthly will be determined by the court. As a general rule, the amount of alimony is: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents. However, taking into account the financial, marital status of the parties and other circumstances, such as disability, disability, the child's entrepreneurial activity, the court may increase or decrease the size of these shares.

In certain cases, when the collection of alimony as a percentage of earnings is impossible, the court may establish alimony in a fixed amount (Articles 80, 81, 83, 99, 100 of the RF IC).

The amount of alimony is established by the court, taking into account the alimony collected from the debtor on the basis of a court decision (court order) for other minor children (clause 1 of Section III of the Review of Judicial Practice, approved by the Presidium of the Supreme Court of the Russian Federation on May 13, 2015).

Alimony for children left without parental care is collected only through the court. The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the guardian or guardian of the child, his adoptive parents, or transferred to the account of the organization in which the child is located (educational institution, medical organization, social service organization, etc.) (Article 84 of the RF IC).

Child support for disabled adult children who need assistance can be obtained on the basis of a notarized child support agreement. In it, the parties at their discretion determine their size. If there is no agreement, then alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When collecting alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied (Article 85 of the RF IC).

Please note!

To resolve a legal dispute, you may need qualified legal assistance from a specialist, the cost of which, depending on the complexity of the case, the amount of the claim and other factors, may be significant. In the case of representing your interests in court, a notarized power of attorney for a representative may be required (Articles 185, 185.1 of the Civil Code of the Russian Federation; Part 2 of Article 53 of the Code of Civil Procedure of the Russian Federation).

2. Able-bodied adult children

They are obliged to support their disabled parents who need help. The exception is parents who are deprived of parental rights. They don't need to pay child support.

In addition, if the parents shied away from their duties, then when the parents apply to the court with a claim for the recovery of alimony, adult children have the right to ask the court to refuse to award alimony.

There is no minimum amount of maintenance for disabled parents.

If maintenance is paid on the basis of an agreement between a parent and a child, certified by a notary, then their amount is set in the agreement. In this case, the parties to the agreement determine the amount of alimony independently.

If an agreement on the payment of alimony has not been concluded, then alimony can be collected from the child through the courts. He will establish the amount of alimony in a fixed amount of money, which will have to be paid monthly, taking into account all the circumstances of the case, including taking into account the financial and marital status of parents and children (Article 87 of the RF IC).

3. Spouses, including former spouses

Spouses or former spouses may enter into an agreement on the payment of alimony, which must be certified by a notary. In this case, the amount of alimony is determined in the agreement at the discretion of the parties.

If such an agreement has not been concluded, then the following persons are entitled to demand from the spouse or former spouse the payment of alimony in court (clause 2 of article 89, clause 1 of article 90 of the RF IC):

- wife or ex-wife during the period pregnancy and within three years from the date of birth of a common child;

- a needy spouse or ex-spouse who takes care of a common disabled child until he reaches 18 years of age or for a common child - a disabled child of group I;

- an incapacitated needy spouse;

- a disabled needy ex-spouse who became disabled before the dissolution of the marriage or within a year from the date of its dissolution;

- a needy ex-spouse who has reached retirement age no later than five years after the dissolution of the marriage, if the spouses have been married for a long time.

To pay child support, a spouse or former spouse must have the means to do so.

There is no minimum amount of alimony paid by a spouse or former spouse.

The court determines their amount in a fixed amount of money based on the financial and marital status of the spouses (former spouses) and other interests of the parties that deserve attention.

It should be noted that spouses are or were persons whose marriage was registered in the registry office (clause 2, article 10 of the RF IC).

4. Other family members who may be obligated to pay alimony, and the conditions for such payment (Articles 93-98 of the RF IC)

4.1. Able-bodied adult brothers and sisters may be payers of alimony to the following persons:

- to minor brothers and sisters, provided that they are unable to receive maintenance from their parents;

- disabled adult brothers and sisters, provided that they are unable to receive maintenance from their able-bodied adult children, spouses (former spouses) or parents.

4.2. Grandparents may be payers of alimony to the following persons:

- minor grandchildren, provided that they are unable to receive maintenance from their parents;

- disabled adult grandchildren, provided that they are unable to receive maintenance from their spouses (former spouses) or from their parents.

The consideration of these requirements is carried out in the order of action proceedings, since the plaintiff must prove that the child does not have the opportunity to receive maintenance from the parents, he needs material assistance, and the specified category of relatives has the necessary means for this (paragraph 4 of Section V of the Review of Judicial Practice, approved by the Presidium of the Supreme Court of the Russian Federation on May 13, 2015).

4.3. Able-bodied adult grandchildren may be payers of alimony to the following persons:

disabled grandparents in need of assistance, provided that they are unable to receive maintenance from their adult able-bodied children or from spouses (former spouses).

4.4. Able-bodied adult pupils (except those who were under guardianship or guardianship, as well as being raised in foster families) may be payers of alimony to the following persons:

disabled persons who carried out the actual upbringing and maintenance of pupils until they reach the age of 18, provided that they are not able to receive maintenance from their adult able-bodied children or from spouses (former spouses).

4.5. Able-bodied adult stepsons and stepdaughters may be payers of alimony to the following persons:

disabled stepfather and stepmother, provided that they are unable to receive maintenance from their adult able-bodied children or spouses (former spouses).

These citizens can pay alimony on the basis of an agreement on the payment of alimony, certified by a notary. In this case, the amount of alimony is determined at the discretion of the parties and is prescribed in the agreement.

If there is no such agreement, you must go to court to collect child support.

To pay child support, all of the payers listed above must have the means to do so.

There is no minimum amount of alimony paid by the family members listed above.

The amount of alimony is determined by the court, taking into account the financial and marital status of the alimony payer and recipient, as well as other circumstances. Alimony is set in a fixed amount of money and paid monthly.

Please note!

Alimony received is not subject to personal income tax (clause 5, article 217 of the Tax Code of the Russian Federation).

In addition, if a parent pays child support, he has the right to receive a tax deduction for personal income tax for children (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

Remember, at any stage of a family dispute, the Legal Center for Family Affairs of Attorney Anatoly Antonov is ready to provide you with legal support. Call us by phone in Samara + 7 (846) 212-99-71 right now and sign up for a consultation at a convenient time for you.