How much per child on taxes 2023

The Child Tax Credit - The White House

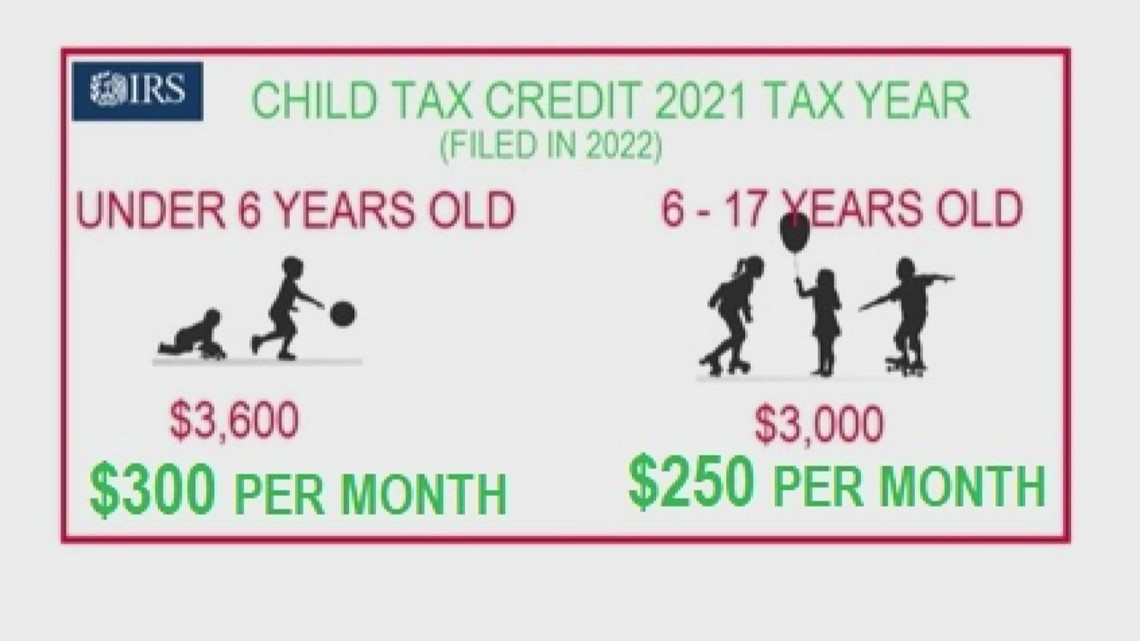

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

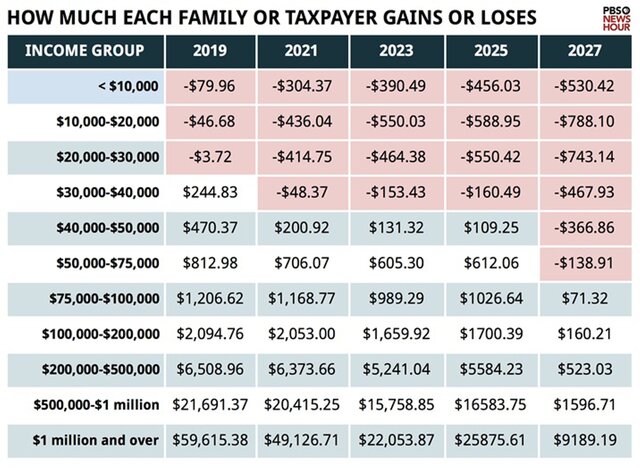

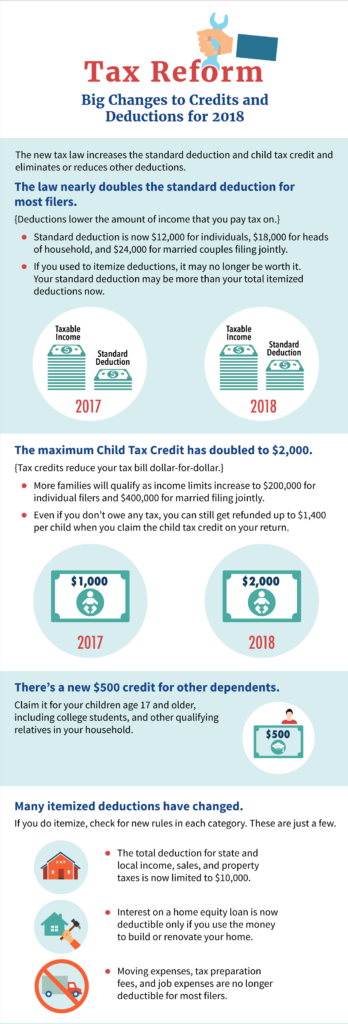

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U. S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

New procedure for taxation of property of organizations | Federal Tax Service of Russia

What's new in 2020?

- A declarative procedure for granting benefits on transport and land taxes for organizations is introduced (More.

..)

..) - It is possible to conduct a reconciliation with the tax authority, taking into account all registered objects (More...)

- One corporate property tax return - for all objects to one Inspectorate (More...)

What's new for 2021?

- Transport and land tax declarations are canceled for organizations (More...)

- Uniform deadlines for the payment of transport and land taxes for organizations are established - no later than March 1 (More...)

- The obligation to submit reports on the presence of vehicles and (or) land plots recognized by the organization as objects of taxation is introduced (More...)

What's new for 2022?

- A declarative procedure for granting property tax exemptions for Russian organizations is introduced in respect of objects, the tax base for which is determined as their cadastral value (More.

..)

..) - It is possible to reconcile with the tax authority information about objects of taxation, the tax base for which is determined as their cadastral value (More...)

- Uniform deadlines for the payment of all property taxes of organizations are established (More...)

What's new for 2023?

- Property tax declarations for Russian organizations are canceled in respect of objects, the tax base for which is determined as their cadastral value (More...)

- For all property taxes for Russian organizations, tax reporting has been canceled, with the exception of objects, the tax base for which is determined based on the average annual cost (More...)

Declarative procedure for granting tax benefits for transport and land taxes of organizations

What is the declarative procedure for granting tax benefits for transport and land taxes of organizations?

From the 2020 tax period Federal Law No. 63-FZ dated April 15, 2019 “On Amendments to Part Two of the Tax Code of the Russian Federation and Article 9 of the Federal Law “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation on Taxes and Fees” introduced a declarative procedure for granting tax benefits to taxpayers-organizations for transport and land taxes.

63-FZ dated April 15, 2019 “On Amendments to Part Two of the Tax Code of the Russian Federation and Article 9 of the Federal Law “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation on Taxes and Fees” introduced a declarative procedure for granting tax benefits to taxpayers-organizations for transport and land taxes.

An application for a tax benefit is filled out by a taxpayer on the basis of documents confirming the right to a tax benefit for the period of its validity specified in the application and submitted to any tax authority. If the tax inspectorate does not have such documents, then, according to the information indicated in the application, it requests information confirming the right to a benefit from the persons and bodies that have them, then informs the taxpayer about the results.

For the period during 2020 in the event of termination of the organization through liquidation or reorganization, as well as for the tax periods preceding 2020, organizations declare tax benefits, as before, in declarations for transport and land taxes.

How to reconcile information about objects of taxation of organizations

Why is reconciliation of information about objects necessary?

Clauses 16, 17, 25 and 26 of Article 1 of Federal Law No. 63-FZ dated April 15, 2019 “On Amendments to Part Two of the Tax Code of the Russian Federation” and Article 9 of the Federal Law “On Amendments to Parts the first and second of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation on taxes and fees”, canceling the submission of tax returns for transport tax and land tax to the tax authorities for the tax period of 2020 and subsequent tax periods.

At the same time, a procedure is introduced for sending taxpayer-organizations (their separate subdivisions) reports from tax authorities on the calculated amount of the specified taxes.

In order to prepare for the entry into force of the above legal provisions, taxpayers-organizations that have objects of taxation for transport and (or) land taxes may, at their discretion, apply to the tax inspectorates at the location of these objects for reconciliation of the information contained in the Unified State Register of Taxpayers , about the specified objects.

For reconciliation, it is advisable to request from the tax authority an extract from the Unified State Register of Taxpayers about your organization, indicating all registered vehicles and land plots. This extract is provided free of charge.

In case of discrepancies between the information contained in the Unified State Register of Taxpayers and the information of the bodies (organizations, officials) that carry out state registration of vehicles, state cadastral registration and state registration of rights to real estate, incl. the State Register of Vehicles, the Register of Small Vessels, the State Ship Register, the Russian International Register of Vessels, the Russian Open Register of Ships, the State Register of Civil Aircraft of the Russian Federation, the Unified State Register of Rights to Aircraft and Transactions Therewith, the Unified State Register of Real Estate and other state information resources (registries), it is advisable to report this to the tax authority at the location of the real estate (land) and the vehicle, indicating the information in respect of which discrepancies have been identified (if possible, supporting documents on the characteristics of the relevant objects can be attached to this message) .

After verification (verification) of the submitted information, the tax authority will take measures to update the information of the Unified State Register of Taxpayers if there are grounds provided for in Articles 83, 84 of the Tax Code of the Russian Federation, about which the taxpayer will be informed.

How to apply for reconciliation of information about objects?

Go Letter of the Federal Tax Service of Russia dated January 16, 2020 No. BS-4-21/452@ “On Ensuring the Reconciliation of Information on Vehicles and Land Plots of Organizations”

Go Letter of the Federal Tax Service of Russia dated January 21, 2020 No. BS-4-21/790@ “On tax authorities authorized to reconcile information on objects of taxation”

How to get an extract from the Unified State Register of Taxpayers for reconciliation of information?

Go Letter of the Federal Tax Service of Russia No. BS-4-21/452@ dated January 16, 2020 “On Ensuring the Reconciliation of Information on Vehicles and Land Plots of Organizations”

Simplified procedure for filing a tax return for corporate property tax

What is the simplified procedure for filing a tax return for corporate property tax

From the tax period of 2020, a taxpayer for corporate property tax (hereinafter referred to as tax), registered with several tax authorities at the location of real estate belonging to him, the tax base for which is defined as their average annual value, in the territory of a constituent entity of the Russian Federation, is entitled to submit a tax declaration for tax in respect of all such real estate objects to one of the indicated tax authorities of their choice, notifying the tax authority for the constituent entity of the Russian Federation.

A notice of the procedure for submitting a tax return to a tax authority in the territory of a constituent entity of the Russian Federation is submitted annually before March 1 of the year that is the tax period in which paragraph 1.1 applies. Art. 386 of the Tax Code of the Russian Federation, the procedure for submitting a tax return. It is not allowed to change the procedure for submitting a tax return chosen by a taxpayer during a tax period.

Thus, instead of several tax authorities, you can choose one to submit your tax return.

The above provisions do not apply if the law of the subject of the Russian Federation establishes the norms for tax deductions to local budgets.

Non-declarative procedure for taxation of vehicles and land plots of organizations

What is the non-declarative procedure for taxation of vehicles and land plots of organizations?

Clauses 16, 17, 25 and 26 of Article 1 of the Federal Law of April 15, 2019 come into force from the tax period of 2021No. 63-FZ “On Amending Part Two of the Tax Code of the Russian Federation and Article 9 of the Federal Law “On Amending Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation on Taxes and Fees”, canceling the obligation to submit to tax authorities of tax returns for transport tax and land tax for the tax period 2020 and subsequent tax periods.

63-FZ “On Amending Part Two of the Tax Code of the Russian Federation and Article 9 of the Federal Law “On Amending Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation on Taxes and Fees”, canceling the obligation to submit to tax authorities of tax returns for transport tax and land tax for the tax period 2020 and subsequent tax periods.

Simultaneously, from 2021, a procedure will be introduced for sending taxpayer-organizations (their separate subdivisions) notifications of tax authorities on the calculated amount of these taxes (paragraphs 4-7 of Article 363 and paragraph 5 of Article 397 of the Tax Code of the Russian Federation).

During 2021, the tax authorities will ensure that tax returns (adjusted tax returns) for transport tax and land tax are accepted only for tax periods prior to 2020, as well as revised tax returns if the original tax returns were submitted within 2020 in case of reorganization of the organization.

In addition, from the tax period of 2021, paragraphs 68, 77 of Article 2 of the Federal Law of 29.09.2019 No. 325-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” establishes uniform terms for the payment of transport and land taxes: taxes are payable by taxpaying organizations no later than March 1 of the year following the expired tax period; advance tax payments are subject to payment by taxpaying organizations no later than the last day of the month following the expired reporting period.

Obligation to submit a report on the presence of an organization of vehicles and (or) land recognized as objects of taxation

Tax returns for transport tax and land tax are not submitted to the tax authorities for the tax period of 2020 and subsequent tax periods (Part 9, Article 3 of Federal Law No. 63-FZ of April 15, 2019). At the same time, in order to ensure the completeness of the payment of transport and land taxes by taxpayers-organizations, the tax authorities transmit (send) to the said taxpayers (their separate subdivisions) reports on the amounts of these taxes calculated by the tax authorities.

From 2021, taxpaying organizations are required to send a notification to the tax authority of their choice about the presence of vehicles and (or) land plots that are recognized as objects of taxation for the relevant taxes (hereinafter referred to as the Notification), if they do not receive a notification about the calculated tax by the authority on the amount of transport tax and (or) a report on the amount of land tax calculated by the tax authority in relation to the specified objects of taxation for the period of their possession.

Message with copies of documents confirming the state registration of vehicles and (or) title (title certifying) documents for land plots is submitted to the tax authority in respect of each object of taxation once until December 31 of the year following the expired tax period .

The notice is not submitted to the tax authority if the organization was given (sent) a notice on the amount of transport tax calculated by the tax authority and (or) a notice on the amount of land tax calculated by the tax authority in relation to this object or if the organization submitted an application to the tax authority on granting a tax benefit for transport tax and (or) an application for granting a tax benefit for land tax in relation to the relevant object of taxation.

Illegal failure to submit (late submission) by the taxpayer to the tax authority of the Message entails a fine in the amount of 20 percent of the unpaid amount of tax in relation to the vehicle or land plot for which the Message was not submitted (lately submitted) (clause 3 of article 129.1 of the Tax code of the Russian Federation).

APPLICATION PROCEDURE FOR PROVIDING TAX BENEFITS ON PROPERTY TAX FOR RUSSIAN ORGANIZATIONS IN RELATION TO OBJECTS FOR WHICH THE TAX BASE FOR WHICH IS DETERMINED AS THEIR CADASTRAL VALUE

From the tax period of 2022, Federal Law No. 305-FZ dated July 2, 2021 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” introduced a declarative procedure for granting tax benefits for taxpayers - Russian organizations in in relation to objects, the tax base for which is determined as their cadastral value.

An application for a tax benefit is filled out by a taxpayer on the basis of documents confirming the right to a tax benefit for the period of its validity specified in the application and submitted to any tax authority. If the tax authority does not have such documents, then, according to the information specified in the application, it requests information confirming the right to the benefit from the persons and authorities that have them, then informs the taxpayer about the results.

If the tax authority does not have such documents, then, according to the information specified in the application, it requests information confirming the right to the benefit from the persons and authorities that have them, then informs the taxpayer about the results.

Submission of an application, consideration by the tax authority of such an application, sending a notice to the taxpayer of the granting of a tax benefit or a notice of refusal to grant a tax benefit are carried out in the manner similar to the procedure provided for in paragraph 3 of Article 361.1 of the Tax Code of the Russian Federation.

For the period during 2022 in the event of termination of an organization through liquidation or reorganization, as well as for tax periods preceding 2022, organizations declare tax benefits, as before, in their corporate property tax returns.

HOW TO VERIFY WITH THE TAX AUTHORITY INFORMATION ON TAXATION OBJECTS, THE TAX BASE FOR WHICH IS DETERMINED AS THEIR CADASTRAL VALUE 07/02/2021 No.

305-FZ "On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation", according to which taxpayers - Russian organizations do not include information about objects of taxation in the tax return on property tax of organizations, tax the base for which is determined as their cadastral value.

305-FZ "On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation", according to which taxpayers - Russian organizations do not include information about objects of taxation in the tax return on property tax of organizations, tax the base for which is determined as their cadastral value. At the same time, a procedure is introduced for sending Russian organizations notifications from tax authorities on the calculated amount of the specified tax.

To prepare for the entry into force of the above provisions, taxpayers - organizations may apply to the tax authority at the location of the said objects of taxation for reconciliation of the information contained in the Unified State Register of Taxpayers about the said objects.

For reconciliation, it is advisable to request from the tax authority an extract from the Unified State Register of Taxpayers about your organization, indicating all registered real estate objects. This extract is provided free of charge.

This extract is provided free of charge.

In case of discrepancies between the information contained in the Unified State Register of Taxpayers and the information of the bodies (organizations, officials) that carry out state cadastral registration and state registration of rights to real estate, incl. of the Unified State Register of Real Estate and other state information resources (registers, cadastres, lists, etc.), please report this to the tax authority at the location of the real estate, indicating the information in respect of which discrepancies have been identified (if possible, this message can be attach supporting documents on the characteristics of the relevant objects).

After verification (verification) of the submitted information, the tax authority will take measures to update the information of the Unified State Register of Taxpayers if there are grounds provided for in Articles 83, 84 of the Tax Code of the Russian Federation, about which the taxpayer will be informed.

How to apply for reconciliation of information about objects?

- Letter of the Federal Tax Service of Russia dated January 16, 2020 No. BS-4-21/452@ “On Ensuring the Reconciliation of Information on Vehicles and Land Plots of Organizations”

- Letter of the Federal Tax Service of Russia dated January 21, 2020 No. BS-4-21/790@ “On tax authorities authorized to reconcile information on objects of taxation”

- Letter of the Federal Tax Service of Russia dated August 10, 2021 No. SD-4-21/11246@ “On some issues of implementing the Plan of milestone events of the project “Non-declaration administration of corporate property tax”

How to get an extract from the Unified State Register of Taxpayers to verify information?

- Letter of the Federal Tax Service of Russia No. BS-4-21/452@ dated January 16, 2020 “On Ensuring the Reconciliation of Information on Vehicles and Land Plots of Organizations”

1 st.

363, paragraph 1 of Art. 383, paragraph 1 of Art. 397 of the Tax Code of the Russian Federation, starting from the tax period of 2022, transport tax, corporate property tax and land tax organizations must pay no later than March 1 of the year following the expired tax period.

363, paragraph 1 of Art. 383, paragraph 1 of Art. 397 of the Tax Code of the Russian Federation, starting from the tax period of 2022, transport tax, corporate property tax and land tax organizations must pay no later than March 1 of the year following the expired tax period. Advance payments for these taxes (unless they are canceled by the laws of the constituent entities of the Russian Federation or regulatory legal acts of municipalities) - no later than the last day of the month following the expired reporting period.

PROPERTY TAX DECLARATIONS FOR RUSSIAN ORGANIZATIONS IN RELATION TO OBJECTS, THE TAX BASE FOR WHICH IS DETERMINED AS THEIR CADASTRAL VALUE

Effective January 1, 2023 in subsequent parts 22 of the tax period 2023 10 of Federal Law No. 305-FZ of 02.07.2021 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation”, according to which taxpayers - Russian organizations do not include information about objects of taxation, the tax base for which is determined as their cadastral value.

If the taxpayer - a Russian organization in the past tax period had only the above objects of taxation, the tax return is not submitted.

In order to ensure the completeness of tax payment in relation to the above objects of taxation, the preparation, transfer (sending) by the tax authorities to taxpayers - Russian organizations of reports on the amounts of tax calculated by the tax authorities in relation to such objects of taxation, the submission by such taxpayers of explanations and (or) documents to the tax authorities confirming the correctness of the calculation, the completeness and timeliness of tax payment, the validity of the application of reduced tax rates, tax benefits or the existence of grounds for tax exemption, consideration of explanations and (or) documents and transmission (sending) of updated reports on the calculated tax amounts are carried out in the manner and terms similar to the procedure and terms provided for in paragraphs 4 - 7 of Article 363 of the Tax Code of the Russian Federation.

for all property taxes for Russian organizations, tax reports were canceled, with the exception of objects, the tax base for which is determined on the basis of the average annual cost of

from January 1, 2021. Normitable administration of transport tax and land tax of organizations was introduced (part 9 of Article 3 of the Federal Law dated April 15, 2019 No. 63-FZ).

From January 1, 2023, non-declaration administration of the corporate property tax was introduced in respect of objects, the tax base for which is determined based on their cadastral value (Part 17 of Article 10 of Federal Law No. 305-FZ of July 2, 2021).

Useful materials

Commentary on Federal Law No. 63-FZ of April 15, 2019 (on property taxation) (Tax Policy and Practice No. 6, 2019)

pdf (3,211 kb)

Commentary on Federal Law dated September 29, 2019 No. 325-FZ "On Amendments to Parts One and Two of the Tax Code of the Russian Federation (on property taxation)" (Tax Policy and Practice No. 11, 2019)

11, 2019)

pdf (1,369 kb)

Non-declarative the procedure for administering the taxation of vehicles and land plots of organizations: a commentary on the key regulatory legal acts of the Federal Tax Service (Tax Policy and Practice No. 2, 2020)

pdf (3,002 kb)

Declarative procedure for granting benefits for transport and land taxes of organizations and other novelties in property taxation from 2020 (Tax Policy and Practice No. 2, 2020)

pdf (2,434 kb)

Single tax payment : what it is and how it works

YesterdayLikbezOwn business

As planned, it should become easier for business, but not the fact

Share

0What is a single tax payment

The single tax payment (UTP) is an opportunity of the Tax Code of the Russian Federation, article 45.2 “Single tax payment of an organization, individual entrepreneur. A special procedure for the payment (transfer) of taxes, fees, insurance premiums, penalties, fines, interest” for businesses to transfer the money that they must give to the state in one transaction. This applies to taxes and debts on them, contributions, penalties and so on. To do this, you need to deposit funds to a special account of the Federal Treasury, from which the tax office itself will write off everything in the right categories.

This applies to taxes and debts on them, contributions, penalties and so on. To do this, you need to deposit funds to a special account of the Federal Treasury, from which the tax office itself will write off everything in the right categories.

In 2022, the UNP was introduced as an experiment Federal Law No. 263-FZ dated July 14, 2022 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation”. Businesses could join it of their own free will. To do this, it was necessary to submit a notification to the tax office this spring. However, from 2023 the single tax payment will become mandatory, so the topic becomes of general interest.

How the single tax payment works

A company or individual entrepreneur transfers funds to a special account. You don't have to do it all at once, you can move them gradually. It’s just that by the day the tax office starts debiting money from the account, there should be a sufficient amount on it.

In addition, notification must be sent to the Federal Tax Service Order of the Federal Tax Service of Russia No. ED-7-8/[email protected] dated March 02, 2022 “On Approval of the Form for Notification of Calculated Taxes, Advance Tax Payments, Insurance Contributions, and format of its presentation in electronic form” with the amount of taxes and contributions that you have to pay. At the same time, a separate document is filled out for each of them, that is, paperwork is still enough, although one payment will need to be prepared.

ED-7-8/[email protected] dated March 02, 2022 “On Approval of the Form for Notification of Calculated Taxes, Advance Tax Payments, Insurance Contributions, and format of its presentation in electronic form” with the amount of taxes and contributions that you have to pay. At the same time, a separate document is filled out for each of them, that is, paperwork is still enough, although one payment will need to be prepared.

Notifications are submitted before the 25th day of the month in which the tax is due. The payment deadline is the 28th. With regard to taxes and contributions for employees, before the 28th, you need to pay what is accrued from the 23rd of the last month to the 22nd of the current month.

Next comes the tax office. She will write off money from the account for different purposes in the following order:

- Arrears - from earliest to latest, if any.

- Taxes, fees, insurance premiums - first with an earlier payment date, then with a later one.

- Fines.

- Interest.

- Fines.

If there are not enough funds in the account to cover all taxes and contributions, the money will be distributed between them proportionally.

Will it become easier for business after the transition to the EPP

Yes and no. Instead of payment orders, you will have to fill out notifications, which is somewhat easier, as well as send everything to one account. However, it will be more difficult to manage money on your own due to the order in which funds are debited. For example, if a company has debts and an amount that is exactly enough for taxes and contributions, then earlier it could pay the second one first, and then deal with the first one. This will not work from 2023. The debt will be paid off - and then a new one will arise.

Another concern is interaction with automatic tax services. Now, in terms of technology, the Federal Tax Service has stepped far ahead. Working with it has become easier and more enjoyable, because many issues can be resolved remotely. However, there is no insurance against the fact that something will be counted incorrectly and written off. As a result, the company will have to deal with the situation. In addition, due to a mistake, debts can arise, because few people can afford to keep money in a special tax account with a margin.

However, there is no insurance against the fact that something will be counted incorrectly and written off. As a result, the company will have to deal with the situation. In addition, due to a mistake, debts can arise, because few people can afford to keep money in a special tax account with a margin.

But basically there is no choice, so it remains to accept the inevitable and work with what is.

Is it possible to return the overpayment for a single tax payment

This is allowed. The movement of funds can be tracked online. If there is something left on the account after all write-offs, it is possible to return the money or set it off against third-party taxes.

In order for the amount to be transferred to you, you must submit a corresponding application entrepreneur, and the format for submitting an application for the return of funds transferred to the budget system of the Russian Federation as a single tax payment of an organization, an individual entrepreneur, in electronic form.