How much money should i save for my child

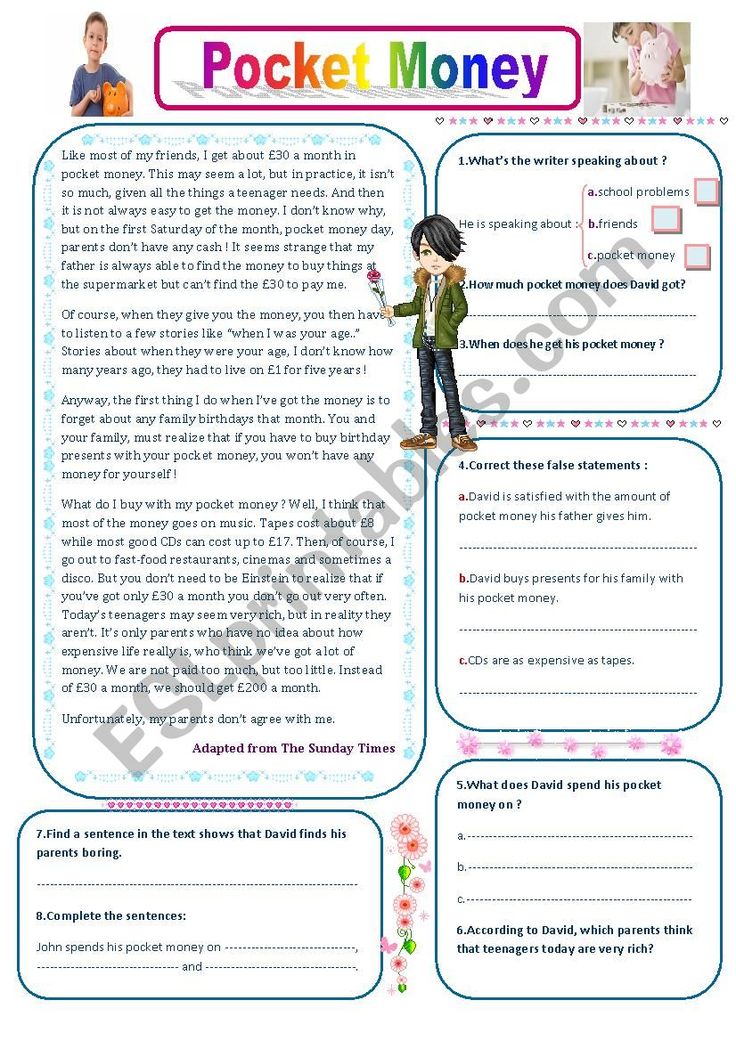

How much your kids could have by 18 if you invest for them now

Amy Engelsman | Twenty20

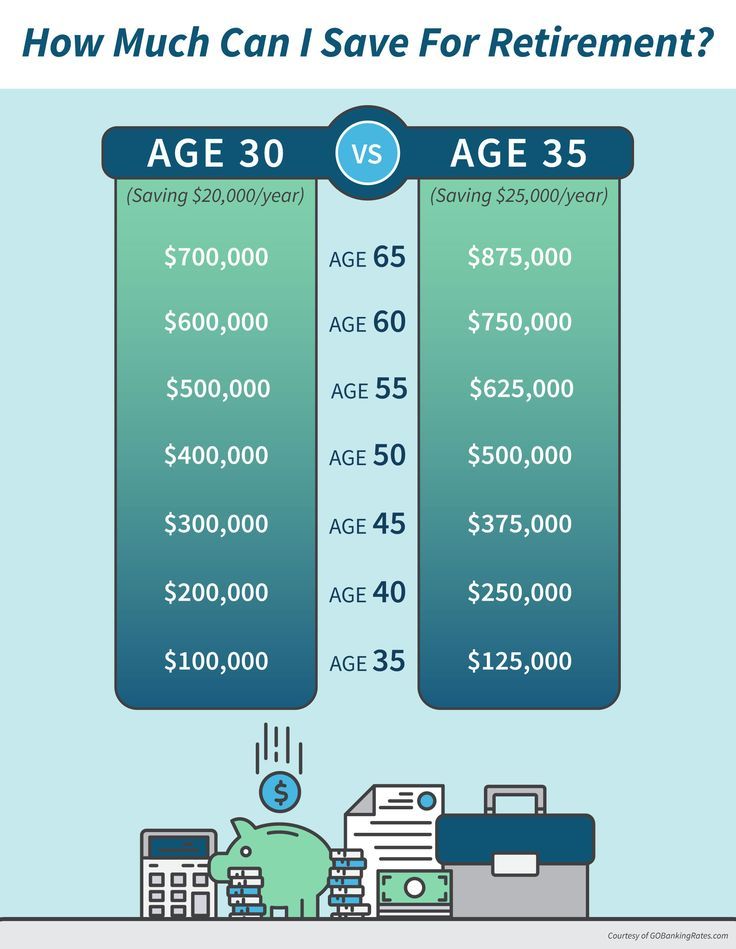

Thanks to the power of compound interest, the earlier you start investing, the easier it is to build wealth. And while we can't go back in time and start saving earlier ourselves, we can help our children by starting to invest on their behalf when they're young.

If you're a parent or planning to become one soon, you can take advantage of compound interest to set your child up for financial success.

"If given the choice between 20 years experience and expertise vs. 20 years extra time for compounding, I'd take the time," Josh Brown, CEO of investment advisory firm Ritholtz Wealth Management, said in a recent video on his YouTube channel.

More from Grow

3 books to help teach kids about money while they're still young

3 fun ways parents can teach kids about investing

Retirement calculator: How much money you need to have saved

Try our calculator below to see how much money your child could have by age 18 based on how much you invest and when you start. If you want see in more detail how time can help you grow your money, you can use our compound interest calculator.

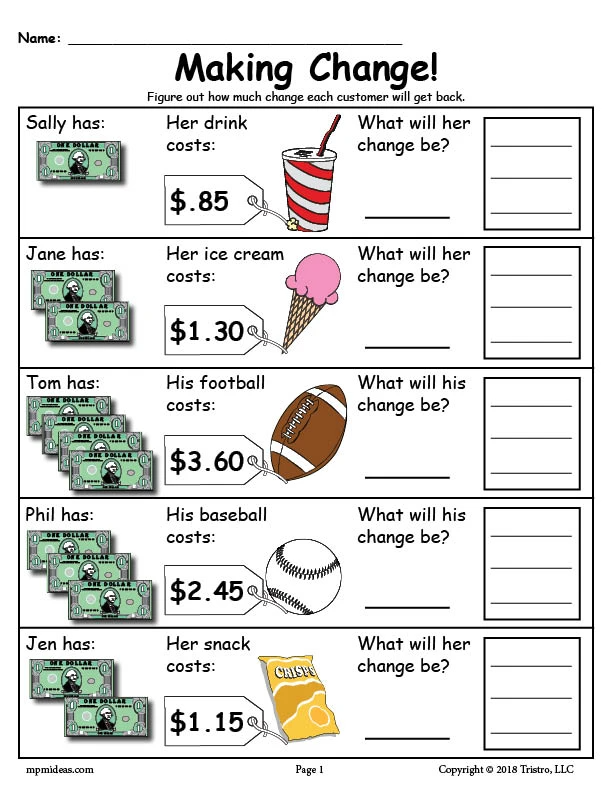

Because of compounding, time can be more valuable than money, so even a little money can go a long way. For example, investing just $1 per day from birth can lead to more than $13,000 by the time your child turns 18 and may be ready to go to college or to start a career.

If you wait until your child is 5 years old to make the same investment, that total falls by almost half, to just $7,700, even though you've invested just $1,800 less.

So, while setting up a savings account for your child has perks, you will likely see a far greater return on your money if you put your funds in an investment account. Your options include a tax-advantaged 529 plan, "the primary vehicle of choice" for saving for college, according to Justin Halverson, a financial advisor at Minnesota-based Great Waters Financial, and a custodial brokerage account.

Currently, the best rate offered on a high-yield savings account is around 1%, while the annualized annual return of the S&P 500 over the past 50 years is about 10%.

Even if the stock market doesn't produce annual returns that strong over the next two decades, you are still likely to make more money off an investment than you would from a savings account.

You can also use the account to help teach your child the importance of investing for the future. According to a report last year from Morning Consult, half of adults between the ages of 18 and 34 are not saving for retirement at all, and only 39% of those who are saving started in their 20s. By providing your children with a solid foundation in financial topics, you can give them a head start on reaching money goals throughout their lives.

If your children wind up not needing the money for educational or early career expenses, they could also benefit from leaving the investments to grow. A $5 daily investment from birth through age 18 could be worth $2 million by age 67. In other words, your child could eventually become a millionaire without even investing any of their own money.

The article "How Much Money Your Kids Could Have at Age 18 If You Invest for Them Now" originially published on Grow+Acorns.

Check out: CNBC Make It is NOW STREAMING on Peacock. Find our original programming in the Channels section.

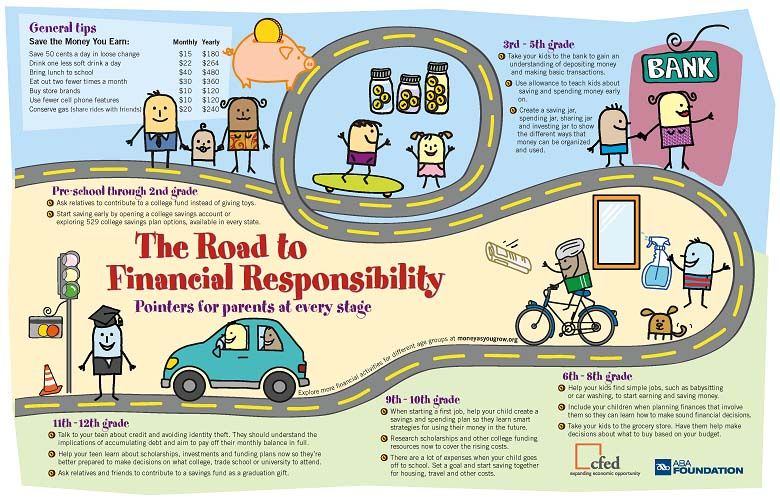

How Much Should You Be Saving for Your Child's College Education?

Seeing the price of college education today can cause sticker shock for a lot of parents, and rightfully so — if you're willing to spend money on attending a four-year public college, it will cost $10,560 on average per year, according to the College Board. The sticker price of one year at a four-year private college will cost you a whopping $37,650 on average. Though the average cost of attending college is less than the sticker price because of college scholarships and grant aid, paying for higher education is still no small feat.

It can be hard to know where to start, especially when you have more immediate financial priorities like paying for childcare and rent. However, having a plan and investing early is crucial in making sure that you or your child won't be forced to take out student loans and then be on the hook for paying off that debt down the line.

Select spoke to higher education expert and author of How to Appeal for More College Financial Aid Mark Kantrowitz about how much money parents should aim to invest for their child's education, when they should start and where they should put their money.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Start early and with whatever you can

The most important part of saving for college is investing as early as possible. Since compound interest is interest earned on both the initial investment and the interest you've accumulated, your gains will be much larger if you start investing at birth.

You can think about it like this: With compound interest, an initial investment of $1,000 will yield earnings of $100 after one year if there's a 10% interest rate that's compounded annually. Your second year, you'll earn an additional $110 because you'll be receiving 10% interest on the $1,100 you've accumulated.

Kantrowitz recommends the one-third rule as a rough guide for how much parents should be saving: one-third of the cost of a four-year college education will come from parent's income and financial aid, one-third from savings and investments and one-third from student loans. Once you decide what percentage of your child's college education you're willing to fund, you'll have to figure out how much that will cost you each month.

According to Kantrowitz, about one-third of your college savings will come from your investments if you start investing at birth. However, if you start investing when your child is in high school, only one-tenth of your college savings will come from your investments. In other words, your college savings will be nearly three times bigger if you started investing at birth than if you started in high school.

In other words, your college savings will be nearly three times bigger if you started investing at birth than if you started in high school.

The cost of college rises by roughly a factor of three every 17 years, so if your child is a baby now, you should aim to invest the current cost of a four-year college education over the span of the next 18 years.

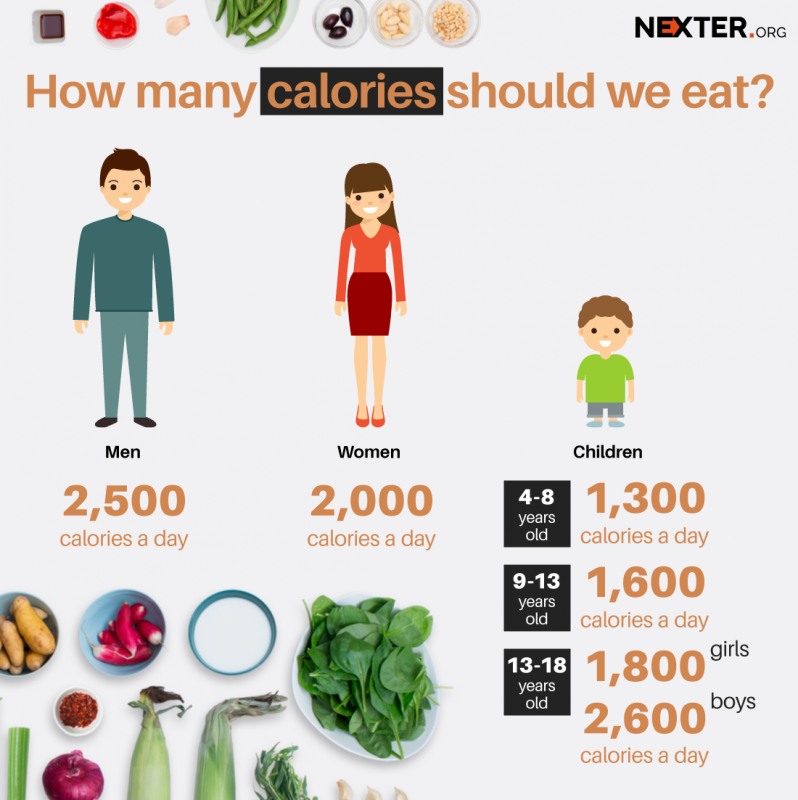

For example, if you want your child to attend a four-year in-state public college, the current cost of attendance (this includes tuition, fees and room and board) for one year is $26,820, according to the College Board. You'll have to invest roughly $300 every month starting at birth to send your child to a four-year in-state public college (assuming a 3% inflation rate), according to Kantrowitz. For a private non-profit college, you'll have to invest $600 a month.

If your investments yield a 6% rate of return each year, you'll earn roughly enough money to cover 1/3 of your child's total college costs once they're 18.

While this may seem like a lot, investing any amount of money each month is a good idea. Set up automatic transfers to your investment account so you don't have the temptation to spend the money once it's in your checking account. And if you can't put a lot away right now, over time, you can ramp up your monthly contributions — it's essential to start investing early to take advantage of compound interest.

Set up automatic transfers to your investment account so you don't have the temptation to spend the money once it's in your checking account. And if you can't put a lot away right now, over time, you can ramp up your monthly contributions — it's essential to start investing early to take advantage of compound interest.

Where should you invest your money?

If you're investing for college you should consider opening a 529 savings plan or a state-sponsored investment account exclusively used for investing for school. With 529 savings plans, individuals can use the money they withdraw for college and K-12 tuition and other qualified educational expenses without paying income tax on any investment gains.

529 savings plans contain a variety of different funds such as mutual funds, bonds funds and ETFs. They are generally recommended for investing for college because of the tax benefits people get from them: You can contribute up to $15,000 tax-free (for single tax-filers) and your earnings will grow tax-free.

States offer different 529 savings plans, and you don't need to be a resident of that state in order to qualify for an account. However, certain states may offer tax benefits for in-state contributions. For example, in New York, in-state residents have tax-deductible contributions, so residents can reduce the amount of their taxable income if they invest in a 529 savings plan.

You can also opt to invest for your child's education using a brokerage account or a 529 prepaid tuition plan. These, however, are less popular options.

If you opt for a 529 prepaid tuition plan, you pay for tuition at certain colleges at today's rate. By doing so, you're hedging against inflation and rising tuition costs. While you can transfer your funds if your child chooses to attend a different college, prepaid tuition plans have their drawbacks: there are only 18 state-sponsored plans that offer this, you have to be an in-state resident and they don't cover additional educational expenses like 529 savings plans do.

You might also consider investing your money in a brokerage account through companies like TD Ameritrade, E*TRADE or Vanguard. If you go this route, however, you'll forgo some of the tax benefits that you'd get if you invested in a 529 savings plan. Namely, you'll have to pay tax when you sell any of your funds or stocks that have grown in value.

Bottom line

There's no denying that the cost of college is rising rapidly — even the thought of paying it can be daunting for many parents. However, parents should start saving as early as they can so they can reap more profits from their investments.

Once parents determine what percentage of their child's college education they're willing to pay for, they can create a plan for their monthly contributions. They'll have the option of investing in a 529 savings plan, a brokerage account or a prepaid tuition plan, but they'll likely get the most tax benefits and flexibility from a 529 savings plan.

Catch up on Select's in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.

Read more

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

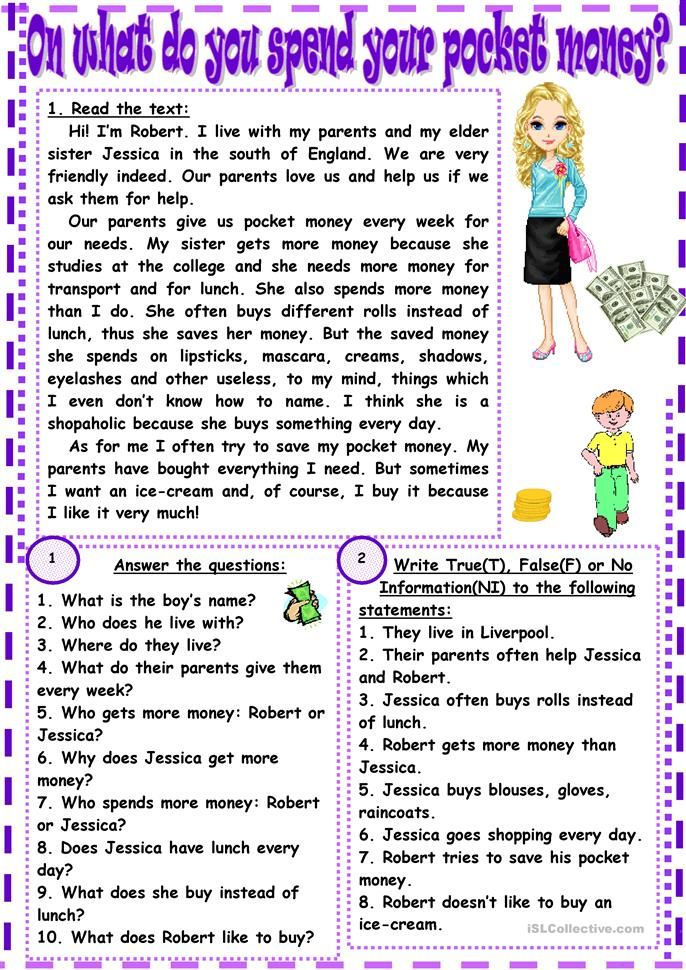

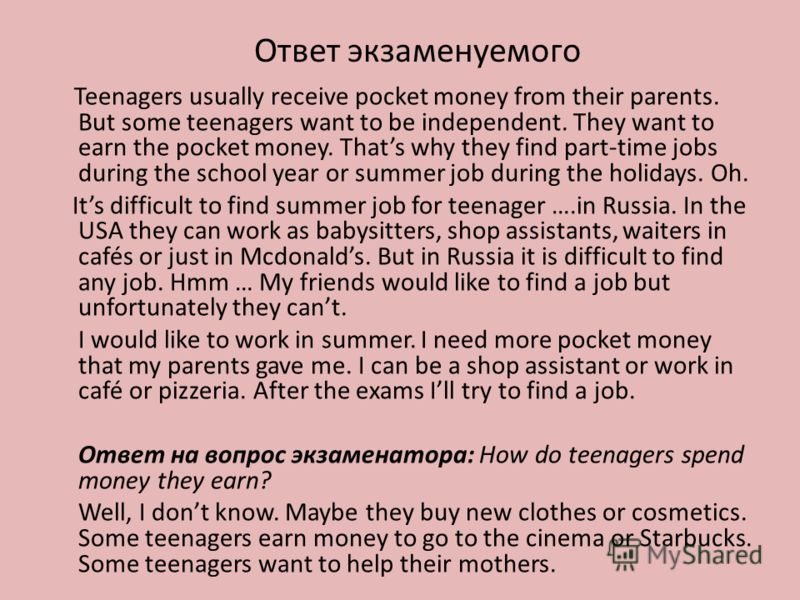

How much pocket money does a teenager need?

- Victoria Skatsskaya

- BBC News Ukraine

Author photo, Moses Vega/UNSPLASH

When my son was four to five years old , it was always sincerely surprised, if I were surprising She said that I had no money for this purchase. He pointed to at the nearest ATM and offered to take as many of them as needed. nine0016

Somewhere between the ages of six and eight, two painful realizations come in turn. Firstly, money is a limited resource, and secondly, it is limited for everyone in different ways.

With the onset of adolescence, children not only fully understand the basics of economics, but also actively interact with finance.

- Being alone: why do Ukrainian children bully their peers?

- What should children know about sexual abuse?

It was then that parents began to seriously think about how much pocket money to give to their children, how to control expenses, how to teach children not to squander what they earned with sweat and blood, and most importantly, not to become victims of fraud. nine0011

OK, how much?

Almost all parents interviewed by BBC News Ukraine are sure that their children need pocket money, but the amount, of course, depends on age and place of residence.

Senior students in Kyiv receive an average of 50-60 hryvnia per day. Depending on the needs of the child (breakfasts, travel, small daily expenses), the amount can vary from 30 to 80 hryvnia.

Some people think that children's expenses should be controlled. “Children initially have a false idea that you can and should buy everything,” says the mother of 11-year-old Ksenia. nine0011

However, the experience of most parents shows that when children gain a certain financial independence, their attitude towards money changes.

When they realize that the amount is limited, they start saving, says Raisa Fedorovskaya, head of the EMA Academy at the Ukrainian Interbank Association EMA and mother of two.

Image copyright, Getty Images

"I got a card, agreed that I transfer money once a month," says Irina, mother of 16-year-old Daniil. leaves the card for some of his purposes. nine0011

"Rich Dad Poor Dad"

These first savings, as well as gifts from grandparents and relatives, make up the child's first capital.

For some, it immediately sells for chocolates, chewing gum and all sorts of little things, others save up money for a serious purchase.

It is not uncommon for a small spender and an economical future financier to peacefully coexist in the same family.

- Why children are picky eaters and what to do about it

"The maturity of a child is evidenced by how he decides what to spend money on, - says Nikolai, father of two sons aged 7 and 14. - It is important to realize that when choosing, you always sacrifice something for the sake of another."

If the younger son does not keep money for a long time, the man says, the older one does not throw it to the wind.

Moreover, he seriously took up increasing his capital: he sells unnecessary things on OLX, conducts online consultations on the Internet, earns money by shooting videos, saves pocket money that he is given during his trips. nine0011

Recently, the guy was at a sports competition in Germany, Nikolai recalls, where he quickly realized that a deposit was returned for empty bottles in the store, and having collected them at the stadium after the competition, he earned 100 euros.

Image copyright IMDb

Some children show an entrepreneurial streak from early childhood.

"Our son noticed that the school cafeteria closes at four o'clock," says Olga, the mother of first grader Nikita. "With his pocket money, he used to buy several packs of waffles for 5 hryvnias in the morning, and in the afternoon he sold them to the class for 20 hryvnias." nine0011

Seven-year-old Egor invented a recipe for "magic glue" and shared it with his classmates for money.

And then he hired them, and the whole class sold their alchemical invention to other schoolchildren, says the boy's father. True, the teacher soon stopped the business.

However, other children may be completely indifferent to money. The mother of 10-year-old George notes that her son can have 100 UAH in his wallet for weeks, he does not spend them on anything.

"But not everyone needs to be a businessman, someone needs to be a philologist or a biologist," concludes the mother of two daughters, Tatyana.

However, both parents and professionals agree that children need to be taught financial literacy.

- Will today's children become a generation of polyglots

And it lies not only in the realization that money is not taken out of thin air, but also in understanding the principles of investing and creating your own business.

For children of primary school age, the book of the German financial consultant Bodo Schaefer, "A Dog Called Mani, or the ABC of Money", is best told about this. nine0011

Teenagers may be interested in the best-selling book "Rich Dad Poor Dad" by American entrepreneur and investor Robert Kiyosaki.

Instead of the common phrase "I can't afford it yet", the author suggests asking yourself "how can I afford it", thus changing the type of your thinking.

Image copyright, Unsplash

Photo caption,In adolescence, an important indicator of external "coolness" is branded clothing, the latest smartphone model or expensive headphones

According to the candidate of psychological sciences, child psychologist Yulia Svyatenko, children in general adequately understand the financial capabilities of their parents.

They can help with their savings to buy together, for example, an expensive tablet, because they know that this is a big expense for the family.

But it is worth remembering, the psychologist adds, that "in adolescence, the indicator of "coolness" is important for them, and, as a rule, it is determined not by intellectual abilities, but by appearance - it is branded clothes, the latest smartphone model or expensive headphones. " nine0011

- "You are nothing": children who constantly hear voices

"Over time, this attitude changes," the specialist reassures, "but until this happens, parents will have to compromise."

100 hryvnias for 10 points

Many parents solve this situation by letting their children work for their own needs.

However, most Ukrainian mothers and fathers do not pay for grades or homework. After all, as the mother of four children, Natalia, noted, "help around the house is important for the family, for family relationships, and education is important for themselves. " nine0011

" nine0011

However, for some special achievements - participation in competitions or a school olympiad, victory in a competition or just a breakthrough in learning - a reward is important.

It could be a family trip to the cinema or cafe for younger children, or money for a teenager.

The author of the photo, Unsplash

Caption to the photo,Fathers can reward a child with a penny for achievement in education or sports

According to psychologist Yulia Svyatenko, monetary rewards for good grades are not a problem in and of themselves. nine0011

"This issue is resolved individually, according to the traditions of the family. I know parents who offered their child 100 hryvnia for 10 points, 110 for 11 points, and so on, but this was only a few weeks," says the specialist.

Such motivation really does not last long, it is rather a way to push for a certain result, and then other incentives appear.

The father of 16-year-old Ivan shared that he pays his son 50 hryvnias for washing dishes every evening.

"He wanted a new computer for himself," the man explained. nine0011

It also teaches you to count money, he adds. Ivan, who is seriously involved in karate, also works as a judge and coach in junior groups, his father says.

However, Ukrainian teenagers actually don't have many opportunities to earn money, Yaroslav, a 19-year-old student from Lvov, believes.

From the age of 18 they become sales assistants, baristas, assistants in grocery stores, perform simple repairs of equipment.

- What will children born in space be like? nine0004

There are fewer options for high school students. "This is usually the distribution of advertisements near the subway, 30-50 hryvnia per hour," Yaroslav explains.

High school students can also receive income from scholarships for winning all-Ukrainian Olympiads or the competition of scientific works of the Academy of Sciences, sports scholarships (about 600 hryvnias), prize money for winning sports competitions.

And overseas?

Their peers across the ocean have a radically different situation. nine0011

"In high school in the US, almost all children work," explains Irina, the mother of 15-year-old Ilya, who moved to the United States five years ago.

"Ilya worked full-time in the workshop with hybrid batteries for cars in the summer and taught a little. In the middle of the school year, you can’t work 40 hours, so all that’s left is teaching: English via Skype and live piano lessons for children aged 9-10," says woman.

"He earned himself a powerful computer and was happy to buy it, now he is collecting it for a car. He will turn 16 in September and will be able to drive by himself, without adults. Insurance for novice drivers is expensive, because it is a serious expense." nine0011

Image copyright, Getty Images

Caption before photo,In US high school, almost all children work, even full-time in summer

According to Irina, the attitude to work in the US is quite different. If a student does not work at all, he or she is lazy. It's just not possible. Many people work 2-3 jobs. "Hard-working" (hard-working) is perhaps the best characteristic," she concludes.

If a student does not work at all, he or she is lazy. It's just not possible. Many people work 2-3 jobs. "Hard-working" (hard-working) is perhaps the best characteristic," she concludes.

German teenagers also have to earn extra money. "Washing neighbors' windows, sitting with children, walking dogs. Neighbors mutually support such work for educational purposes,” says Elena, who often visits Germany for work.

Parents help with big purchases and rent. You have to earn money for everything else (but the training system gives you such an opportunity).

Elena also remembers an Austrian family she knows who is raising two teenage daughters.

"Girls are given pocket money for a month, a little more than for breakfast and transportation."

"Once every two years the family goes on a big trip to Australia or the USA. The girls have to save money and earn money for the ticket." nine0011

Victoria, a mother of two teenagers (a son of 15 and a daughter of 13), who has been living in Spain for a long time, says that her son covers all his needs by himself.

He sells books and comics on the Internet and was recently able to buy himself a computer monitor.

But in general, in Spain, parents are required by law to support their children until their first job, which sometimes happens at 35.

"Therefore, no one is rushing into an adult, financially independent life," says Tatiana, who moved to Spain a few years ago from Ukraine. nine0011

When money is a risk

Financial independence of a teenager is associated with certain risks - from buying junk food that parents usually forbid (chips, cola, fast food), to spending money on cigarettes, alcohol, sweepstakes or gaming clubs.

Some children are more prone to certain temptations, says family psychologist Yulia Svyatenko.

But adolescents in general, regardless of family status or wealth, try illegal things, including drugs. nine0011

If computer games are forbidden in the family, children can go to clubs or arrange money with classmates to play them.

In this case, the ban is not an option, the psychologist believes - you need to talk with the child. You can allow games at home as a reward for the work done, but at a certain time and with strict control.

Author of photo, IMDb

Caption to photo,Pidlіtki zagal, regardless of the status of good motherland, trying to protect speech, narcotic speech zocrema (on the photo - a frame from the TV series "Euphoria")

"Parents need to understand that adolescence is a period of crisis," adds the specialist. She advises parents to remember themselves at this age, and most importantly, to be in friendly, trusting relationships with their child.

Another question is if a teenager constantly takes money without permission. This may be a sign of addiction - drug or gambling, then this is a different range of problems that need to be addressed with specialists.

According to Raisa Fedorovskaya of the Ukrainian Interbank Association EMA, shopping on the Internet, popular among teenagers, on the Amazon website, is also dangerous. nine0011

nine0011

Not knowing the Ukrainian legislation, they can purchase goods prohibited in Ukraine on the site, which they will not receive later. These are, for example, pens with sound recording, which we consider to be spy equipment, or fireworks.

Children also need to be taught how to use the Internet safely.

Tell them that before entering their personal data, it is necessary to check the site, explains Raisa Fedorovskaya.

To do this, the specialist advises entering the name of the site and the word "scammers" in the search, as well as carefully reading reviews about the site and the seller before making a purchase on the Internet. nine0011

If parents issue a bank card to their children, they should teach them how to use the ATM correctly, for example, cover the keyboard when entering a PIN code, and much more.

Financial literacy has already appeared in schools, but, according to Fedorovskaya, it is important to teach children about cyber hygiene first of all.

In general, both parents and professionals believe that teenagers quickly learn to manage money consciously. And a certain financial freedom will only benefit the child. nine0011

This is confirmed by a small anonymous survey conducted by BBC News Ukraine with the participation of 50 high school students from Kyiv.

To the question "what would you spend 10 thousand dollars on if you suddenly got it?", most of the children answered that they would put it in the bank in order to leave it to study or buy an apartment.

Someone would give half to their parents or go on a trip with their family.

And someone would save them for the realization of a dream.

Follow our news at Twitter and Telegram

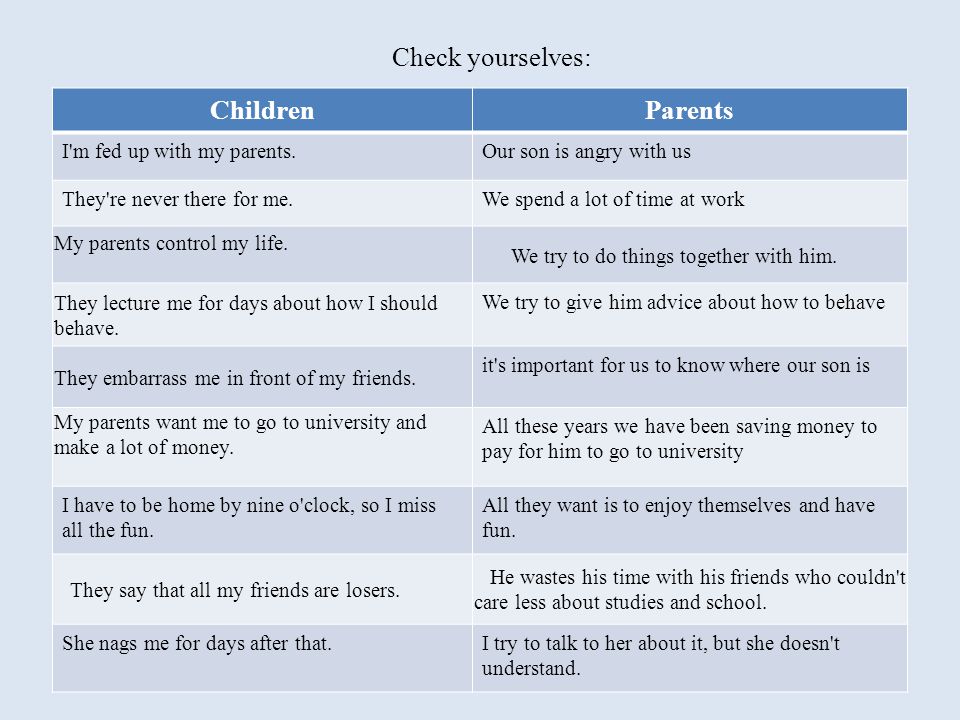

Expenses: mandatory, fixed, variable, occasional and other

- Personal/family budget planning

- Expenses: mandatory, fixed, variable, incidental and other

- Income: fixed, occasional, investment and other

- How to learn to regularly save money nine0253 Reserve fund in case of unforeseen events

Expenses: Mandatory, Fixed, Variable, Incidental and Other

When planning a budget, it is important to be clear about which expenses in it are absolutely necessary and which ones we would just like to afford.

Mandatory expenses are such payments, the timing and amount of which we cannot influence

(at least it can't be done quickly): nine0011

- taxes;

- payments on loans;

- payment for utilities and/or rental housing;

- payment for kindergarten, etc.

Often, in a difficult financial situation, such payments are postponed, thinking to pay off the debt later, but it is infinitely impossible to do this: penalties and fines are added to the amount of the principal debt. Over time, the case may go to court, the seizure of part of the property to pay off the debt, and in case of debt on housing and communal services - disconnection from the relevant services (for example, electricity and sewerage). nine0011

The next group of expenses is fixed

Everyone needs something to eat, something to wear, use transport and communication services. Some need to constantly buy medicines. It is impossible to reduce these costs to zero, but to some extent their size still depends on us: we can choose food and clothes, change modes of transport, tariffs and telecom operators. All other expenses, in fact, depend on our capabilities and desires. This does not mean that they should be immediately abandoned completely. They determine the quality of our life, our psychological state may depend on them. But if money is already scarce, it is better to neglect such expenses or postpone them for a while - there will be no catastrophe. nine0011

It is impossible to reduce these costs to zero, but to some extent their size still depends on us: we can choose food and clothes, change modes of transport, tariffs and telecom operators. All other expenses, in fact, depend on our capabilities and desires. This does not mean that they should be immediately abandoned completely. They determine the quality of our life, our psychological state may depend on them. But if money is already scarce, it is better to neglect such expenses or postpone them for a while - there will be no catastrophe. nine0011

Part of the expenses can be called variable - they have to be made relatively rarely

This includes, for example, the purchase of furniture, household appliances and electronics, vacation expenses or apartment renovations. Often we are talking about expenses that cannot be afforded “from one salary”, which means that they need to be planned in advance, gradually saving money. Consumer loans for these purposes are often too expensive.

Try to form a separate “fund” for “random purposes”, the money from which you will not spend monthly nine0011

We make some of the optional expenses completely by accident. We either did not plan to do them, but the temptation turned out to be too great, or we planned later, but suddenly an opportunity turned up. In some situations, these expenses are quite rational (for example, when the product you need is sold at a big discount), and in some situations, they bring only short-term happiness of the purchase.

Try to form a separate “fund” for “random purposes”, the money from which you will not spend monthly and beyond which you will never go (for this purpose, you can use a bank deposit with the possibility of partial withdrawal of funds without loss of interest). Such a decision is a compromise between the objective need to control costs and the desire to provide yourself with psychological comfort: if you constantly deny yourself spontaneous actions, you can feel insecure. nine0011

nine0011

Money for entertainment and small pleasures is another type of optional expenses that can be allocated in the budget as a separate line. It is better to form it according to the residual principle - after you have determined how much you will spend on everything else, and directed part of the funds for long-term savings.

Personal experience

Calculating your own expenses is an extremely exciting activity, although not as simple as it seems. You will have to overcome laziness and develop the habit of constantly writing down your purchases. I downloaded a special program to my phone and fill it with information immediately after paying at the checkout. By the way, I know that many people write down their expenses, but the point is not to write them down, but what to do with these figures later. One of my colleagues, for example, used the notes for educational purposes. She showed her son: they say, that's how much I spend on you, and you have to study well and enter a university for a budget place. nine0011

nine0011

But this is not the only way to use expense records. As a result, I received data that is really useful for me and for my family.

Food inflation, about which so much is written, turned out to be noticeable for us, but not catastrophic. The largest item of expenditure for our household is food - about every fourth ruble spent is spent on it. At the same time, over the past two years, this amount has grown by as much as 22%. Or only by 22% - after all, if you count according to Rosstat, then it should have turned out much more. Although, maybe we, without noticing it, have changed our preferences. In general, we are great - we know how to live within our means. nine0011

Interestingly, utility bills, including telephone and internet, grew by only 3.5% in two years. Obviously, LED lamps, turning on the washing machine and dishwasher at night, when the tariff is more profitable, and other good habits, obviously played a role. I will continue to follow the latest in science and technology!

Our expenses for children are not so great, at least for now: the eldest girl is 2. 5 years old, the boy has just been born. But here it plays a big role whether to feed the baby with breast milk or mixtures, whether the baby is healthy or requires constant supervision of doctors, etc. And it is also important whether the family has left diapers from the older generation! nine0011

5 years old, the boy has just been born. But here it plays a big role whether to feed the baby with breast milk or mixtures, whether the baby is healthy or requires constant supervision of doctors, etc. And it is also important whether the family has left diapers from the older generation! nine0011

In connection with the beginning of the summer season, the issue of giving has become relevant. We don’t have our own yet, and we decided to occupy our parents’ dacha. They do not mind, but it immediately turned out that putting it in order so that you can live with two small children is a big expense. It took to buy some furniture, to patch the roof ... In general, it ran decently. Could we rent a dacha already “with all conveniences” for the whole summer for this money? It probably wouldn't cost more. Yes, and it’s stupid to give your money to strangers - it’s better to invest in your parents’ farm. As they themselves like to repeat: “The grandchildren will get everything!” nine0011

I also analyzed the costs of mobile communications, as I like to follow tariff changes and choose the most advantageous combinations of services and options.