How much is your tax return with a child

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

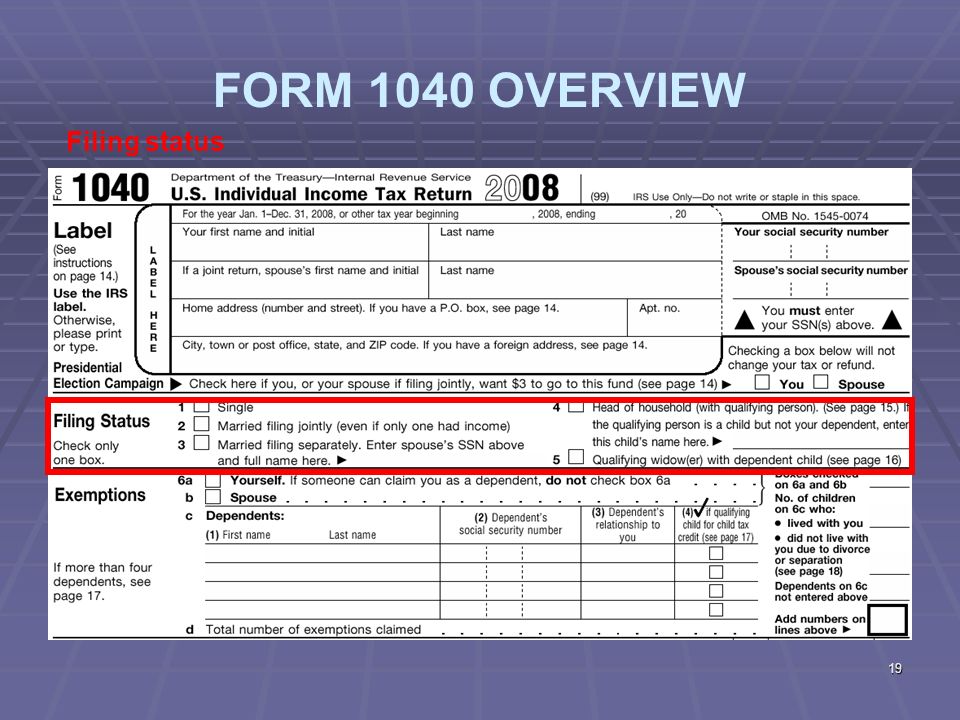

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

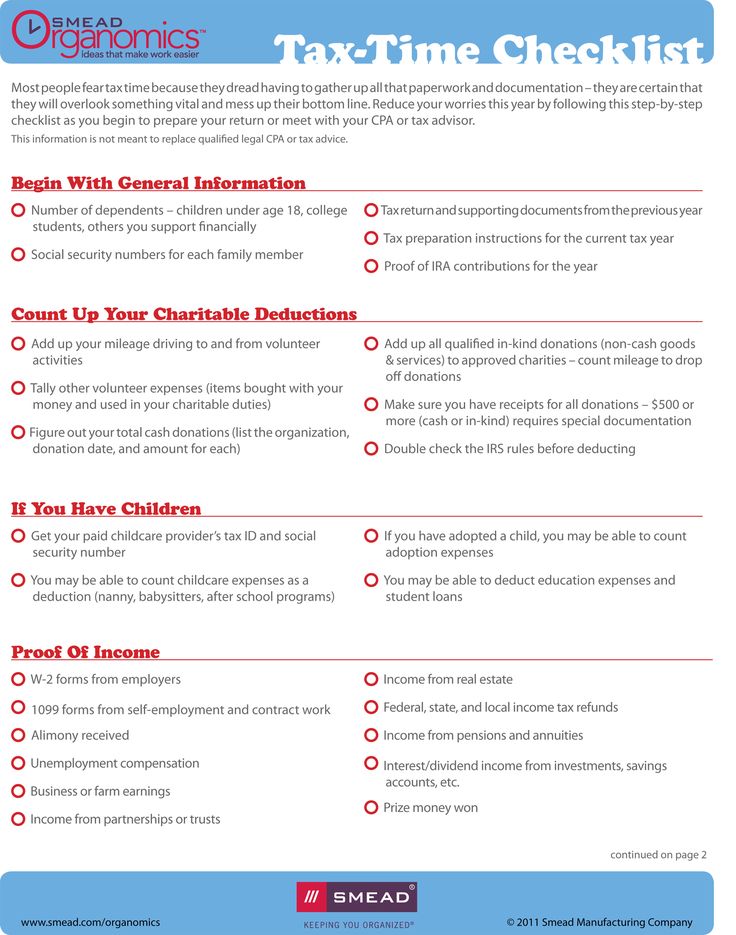

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

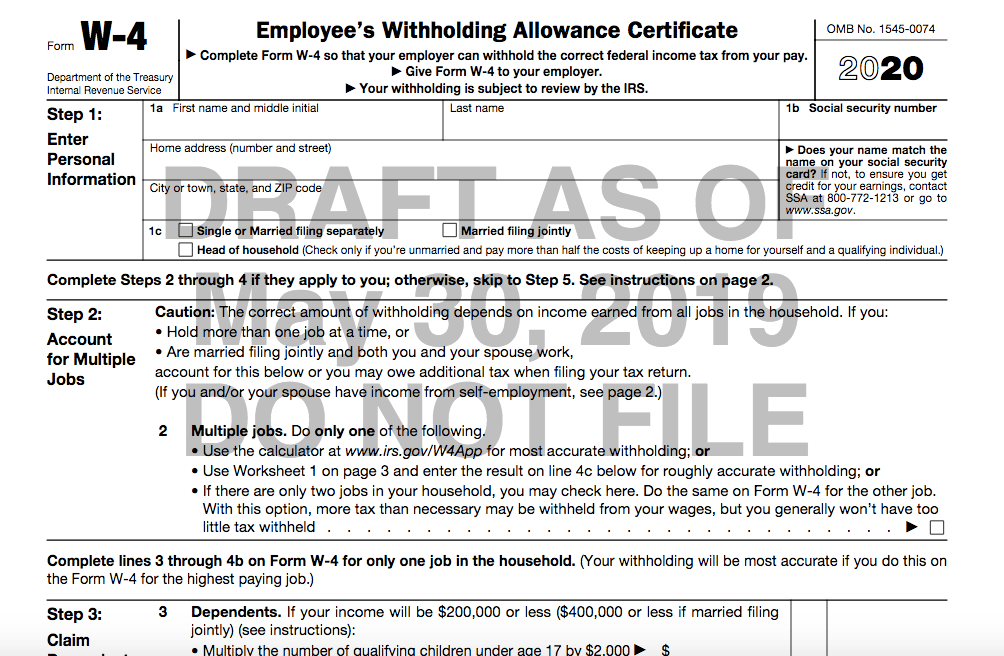

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

Tax return | Handbook Germany

Work

Updated 08/03/2022

A tax return is needed in order to file information about the most important tax for you - income. You pay it from the income that you earned during the year. This could be your salary (if you are an employee), your income (if you are self-employed), and also, for example, interest accrued on your savings or rental income. For detailed information on the different types of taxes, see the chapter on the German tax system.

You pay it from the income that you earned during the year. This could be your salary (if you are an employee), your income (if you are self-employed), and also, for example, interest accrued on your savings or rental income. For detailed information on the different types of taxes, see the chapter on the German tax system.

The tax return is submitted to the tax office (Finanzamt) once a year. Whether you have to file a declaration depends on various factors. The basic rule says: self-employed and entrepreneurs are obliged to submit it and must personally take care of the information provided by the tax office about their income and transfer all necessary taxes. If you are an employee, then your employer will do all this for you - the tax will be deducted from your salary. In this case, as a rule, you do not have to file a tax return. But even if you are not obliged to do so, filing a declaration in many cases still pays off. Perhaps you overpaid taxes last year and you can get some of the money back.

Listen

What should I know?

Income tax (Einkommenssteuer) is the most important tax in Germany. It is he who brings the greatest revenue to the state budget and is paid by both employees and self-employed. There are seven types of income on which you must pay income tax. This is income from

- freelancing

- employment activities

- from activities of private enterprises

- agriculture and forestry

- capital

- lease and hire

- as well as other income specified in the Income Tax Law, such as pensions.

You do not have to pay income tax on some income. This includes, among other things, childcare benefits (Elterngeld), unemployment benefits, BAföG benefits or scholarships. The same rule applies to those who work for a Mini-Job or whose income does not exceed the basic non-taxable minimum (Grundfreibetrag). The basic non-taxable minimum is adjusted every year and currently stands at 10. 347 euros (2022). If your income does not exceed this amount, you do not have to pay income tax. In all other cases, the following rule applies: everyone who lives in Germany and earns money, must pay income tax. This provision also applies to refugees and asylum seekers.

347 euros (2022). If your income does not exceed this amount, you do not have to pay income tax. In all other cases, the following rule applies: everyone who lives in Germany and earns money, must pay income tax. This provision also applies to refugees and asylum seekers.

Please note : If you are registered in Germany, you must pay taxes on all your income. This may include the income that you earned abroad. So that you do not have to pay taxes twice, there is a so-called Double Tax Treaty (Doppelbesteuerungsabkommen). Detailed information about it can be found on the website of the Federal Ministry of Finance in German and English.

It depends on how much you earn. In general, the following rule applies: the more you earn, the greater the amount of income tax. With the help of the tax calculator, you can independently calculate how much income tax you will have to pay. On the website www.brutto-netto-rechner.info you will find a tax calculator, which can also be used in English.

If you are retired, it all depends on what your total income is in total: the pension itself and additional income (for example, from rent or income from interest). If your income exceeds the basic non-taxable minimum (Grundfreibetrag), you must pay pension tax. The same applies to students. Anyone who earns more than the basic non-taxable minimum must pay taxes. By working on a Mini-Job, you can regularly earn up to 450 euros per month. If your total income does not exceed this amount, you generally do not have to pay taxes. Unemployment benefits are not taxed. However, it must be shown on the tax return.

If you have freelancing income, you must file a tax return. The situation is different for hired workers. Since their income tax is automatically deducted from their salary to the tax office (Finanzamt) every month, in most cases they are not required to file a tax return. However, there are exceptions:

- You and your spouse are both employed and have chosen a combination of tax classes III and V.

For more information about tax classes, see the What are tax classes section?

For more information about tax classes, see the What are tax classes section? - You or your spouse have registered a non-taxable minimum (Freibetrag) with the tax office, for example for studies, disability or travel expenses.

- You have additional income without payroll tax (Lohnsteuerabzug), for example from renting an apartment, and this income exceeds 410 euros per year.

- You received wages from multiple employers and were not taxed.

- In addition to your regular wages, you also received wage compensation, such as child care allowance (Elterngeld), disability allowance (Krankengeld) or unemployment allowance (Arbeitslosengeld).

- You got divorced and remarried/remarried in the same year.

- You have received compensation (Abfindung).

- You have retained losses from previous years.

- You have a spouse with limited tax liability living outside of Germany in one of the EU countries and have entered his/her details in your electronic tax card.

In all of these cases, you must file a tax return.

Some retirees may also be required to file a tax return. For example, if this is required by the tax office or if your total gross income exceeds the basic non-taxable minimum (Grundfreibetrag).

Most employees are not required to file a tax return. However, in some cases it makes sense to do so voluntarily. After all, you can deduct certain expenses from the tax. This means that you will tell the tax office (Finanzamt) on your tax return (Steuererklärung) what expenses you have incurred. The tax office adds up these expenses and deducts them from your annual income. After that, you will only need to pay tax on the remaining amount. This is your so-called "taxable income" (zu versteuerndes Einkommen). For more information, visit the Lohnsteuerhilfeverein website - www.vlh.de.

Tax benefits provided by the state can be divided into three categories:

- Advertising expenses (Werbungskosten): These are expenses related to professional activities, such as travel and training, education.

- Special expenses (Sonderausgaben): These are private expenses, such as donations, contributions to health and disability insurance, or childcare costs. For more information, see What Tax Benefits Are Available for Families?.

- Unforeseen expenses (Außergewöhnliche Belastungen): These are unforeseen expenses that you have to incur due to illness, for example.

All of these expenses must be reported on your tax return. Supporting documents, such as invoices and checks, do not need to be submitted with the tax return. However, you should keep them in case the tax office asks you to show them. If you are unable to do the calculations yourself, please contact a tax advisor (Steuerberater*in) or ask the Lohnsteuerhilfeverein for assistance by providing them with all the necessary documents to complete your tax return.

To make it easier for the tax office and for you to file your tax return, there are so-called "Pauschalbeträge". You can use them without having to provide supporting documents. You can find information on which "Pauschalbeträge" are available at www.vlh.de.

You can use them without having to provide supporting documents. You can find information on which "Pauschalbeträge" are available at www.vlh.de.

Various tax incentives are available to support families.

- Child care allowance (Elterngeld): If you have to work less after having a child, the state will help you financially by paying child care allowance. Its size depends on your income. You can increase your benefit by changing your tax class. As soon as you know that you will have a child, as a couple you can consult on this issue. The spouse who goes on maternity leave must generally choose tax class III. To change the tax class, you need to act quickly. An application for a tax class change must be submitted at least seven months before the so-called "maternity protection" (Mutterschutz) comes into effect. More information about this can be found on the Stiftung Warentest website. Please note that Parental Allowance is not taxable, but it is used to calculate your tax rate.

- Child allowance (Kindergeld) / tax-free minimum for children ( Freibeträge für Kinder): For each child, parents receive a benefit of at least 219 euros. To receive it, you need to submit an application for a child benefit to the family fund (Familienkasse). You can find more information in the fact sheet "Child Benefit". For information on recognized refugees, see the fact sheet Child Benefit for Asylum Eligible and Recognized Refugees. In addition, low-paid workers can additionally apply for a child allowance. You will find information on what conditions must be met for this on the website of the employment agency. In addition, there is also a tax-free minimum for children (Kinderfreibetrag). You have the option of either receiving child support or the tax-free minimum for children. You must file your tax return with an Anlage Kind for each child you have. After that, the tax office (Finanzamt) will check which option is the most beneficial for you. You can receive the application form for a child directly from the tax office or you can download it online, for example, at steuertipps.

de.

de. - Care costs (Betreuungskosten) / education ( Ausbildungskosten): The state will also help you with reimbursement for childcare costs. Thus, you can deduct two-thirds of your childcare costs as special expenses from tax. In addition, in some cases, you may also include the cost of your child's maintenance and vocational training as a contingency expense. If your adult child is in vocational training and does not live with you, you may be able to get advice about covering the cost of their education.

- Single parent benefits (Entlastungsbetrag für Alleinerziehende) If you are a single mother or father and qualify for child support or the tax-free minimum for children, you can also receive single parent benefits.

- Joint return for spouses and partners : Spouses and those in a registered partnership (Lebenspartnerschaft) can file a joint tax return. This is beneficial if one of the partners earns significantly more than the other.

To do this, you can simply file a joint tax return, and on page 1 of the main form, mark “Zusammenveranlagung” with a cross.

To do this, you can simply file a joint tax return, and on page 1 of the main form, mark “Zusammenveranlagung” with a cross. - Expenses for caring for a family member (Pflege-Pauschalbetrag): If you are caring for a family member, you can claim your expenses as a tax deduction. This will lower your taxable income.

For more information on tax benefits for families, please visit the Family Portal of the Ministry of Family.

In general, tax incentives provided by the state can be divided into three categories:

- Advertising expenses (Werbungskosten) : These are expenses related to professional activities, such as commuting, education and training.

- Special expenses (Sonderausgaben) : These are private expenses, such as donations, health and disability insurance contributions, or child care expenses.

- Unforeseen expenses (Außergewöhnliche Belastungen) : These are unforeseen expenses that you have to pay due to illness, for example.

All of these expenses must be reported on your tax return. Supporting documents, such as invoices and checks, do not need to be submitted with the tax return. However, you should keep them in case the tax office asks you to show them.

To make it easier for the tax office and for you to file your tax return, there are so-called "Pauschalbeträge". You can use them without having to provide supporting documents. You can find information on which "Pauschalbeträge" are available at www.vlh.de.

As a self-employed person, you can also deduct work-related expenses from tax. This could be the cost of buying a new laptop, travel or entertainment expenses, travel expenses, mobile phone expenses, office supplies you need for work, or office expenses. Small purchases can be credited immediately, more expensive items usually need to be written off over several years. Planning ahead for these purchases will save you some tax money. If you are self-employed, it makes sense for you to seek the help of a tax advisor (Steuerberater*in). They know exactly what expenses you can and cannot deduct from tax. Their services are paid. But you can deduct those expenses from tax again next year.

They know exactly what expenses you can and cannot deduct from tax. Their services are paid. But you can deduct those expenses from tax again next year.

If you are self-employed, have income from agriculture and forestry, or are self-employed, you must file your tax return electronically. This is done through the Internet portal of the German tax authority Elster. There you must register with your tax identification number (Steueridentifikationsnummer) and email address and be authenticated. Don't do this at the last minute, as the authentication process takes several days. You can also file your tax return electronically and through paid programs. They tend to be easier to work with than Elster.

Employees can file their tax return electronically voluntarily. If, along with their wages, they had other income or, for example, child care allowance (Elterngeld) or unemployment benefit in excess of 410 euros per year, they are required to file a tax return electronically.

If you would like to complete your tax return by hand and send it by post or bring it in person to the tax office (Finanzamt), you can obtain the forms from the tax office or download them online at formulare-bfinv.de. You can find the tax office that is responsible specifically for you using the index of government agencies.

Please note: Tax return-related supporting documents do not normally need to be sent to the tax office. However, you must keep these documents. In case of questions, the tax office may require you to present these documents within ten years from the date of filing the tax return.

If you are required to file a tax return, you must do so by July 31st of the following year. If your tax return is being prepared by a tax advisor (Steuerberater*in) or specialists from the Lohnsteuerhilfeverein, you have more time to spare. The last day of delivery in this case will be the last day of February after the next year. Please note: tax returns for 2021 can be filed later as an exception. The deadline has been extended until October 31, 2022. If you are filing your tax return with the help of Lohnsteuerhilfeverein or a tax advisor, you have until 31 August 2023. For the 2022 tax return, the deadline will also be extended in due course.

The deadline has been extended until October 31, 2022. If you are filing your tax return with the help of Lohnsteuerhilfeverein or a tax advisor, you have until 31 August 2023. For the 2022 tax return, the deadline will also be extended in due course.

In exceptional cases, you can submit a written application to the tax office to request an extension of the deadline for filing a tax return. To do this, you must provide a convincing justification for your request for an extension and provide a new tax filing date. However, the tax inspectorate is not required to give its consent to this.

If you file your tax return voluntarily, you have four years to do so.

If you miss your tax return deadline, the tax office (Finanzamt) may charge a late fee. Whether this will be done depends on the tax officer. However, be aware that if you file your tax return less than 14 months after the end of the year for which you are filing, you will still have to pay late fees. This can cost you dearly. According to §152 of the Regulation on the Collection of Taxes, Fees and Duties (Abgabenordnung), the penalty fee is 0.25% of the amount of tax, minus advance payments and the amount of applicable tax deductions for each started month of delay, but not less than 25 euros per month.

According to §152 of the Regulation on the Collection of Taxes, Fees and Duties (Abgabenordnung), the penalty fee is 0.25% of the amount of tax, minus advance payments and the amount of applicable tax deductions for each started month of delay, but not less than 25 euros per month.

In addition, the tax office may impose an administrative fine. The amount of the fine is usually between 100 and 500 euros, and the demand for payment is sent by post.

You are responsible for paying taxes and properly reporting your income to the tax office (Finanzamt). The only exception is income tax (Lohnsteuer), which is automatically deducted from your salary. If you do not pay taxes or pay less than necessary, or you try to deceive the tax office, this is tax evasion (Steuerhinterziehung). Tax evaders face fines and, in particularly serious cases, up to 10 years in prison. If you are not sure that you can properly complete your tax return yourself, you can seek help. For more information, see the Who can help me with my tax return? section.

If you do not want to complete your tax return yourself and free of charge using Elster's tax administration program, you have a number of options.

- The most cost-effective solution is tax software. There are various vendors selling such programs. On the website finanztip.de you will find an overview of the programs offered. SteuerGo offers its software in different languages.

- If you do not wish to complete your tax return yourself, you can contact the Lohnsteuerhilfeverein or a tax advisor (Steuerberater*in.) A list of tax advisors can be found, for example, at steuerberater.de. The amount of his remuneration is regulated by the Tax Advice Fee Regulations. It also depends on the amount of work. The services of the Lohnsteuerhilfeverein are more cost effective than the services of tax advisors, but they are not authorized to advise the self-employed and business owners. If you are an employee and want to be assisted by the Lohnsteuerhilfeverein, you must become a member of the association and pay a membership fee.

The membership fee depends on your income. You can find such an association near you, for example, on the website of the organization Bundesverband Lohnsteuerhilfe e.V.. And although you will have to pay for professional help in preparing a tax return, this will still allow you to save on taxes, and the self-employed will also avoid mistakes.

The membership fee depends on your income. You can find such an association near you, for example, on the website of the organization Bundesverband Lohnsteuerhilfe e.V.. And although you will have to pay for professional help in preparing a tax return, this will still allow you to save on taxes, and the self-employed will also avoid mistakes.

Important: Tax software, Lohnsteuerhilfeverein and tax advisor fees can also be deducted from tax.

Is it necessary to file 3-personal income tax for a minor child \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Is it necessary to file 3-personal income tax for a minor child

Compilation of the most important documents on request free for 2 days

Open the document in your system

(Letter of the Federal Tax Service of Russia dated December 14, 2021 N BS-19-11 / 420@) Attention is drawn to the fact that parents (adoptive parents, guardians, trustees), as legal representatives of minor children who own real estate subject to taxation, fulfill the obligation to payment of personal income tax in respect of the income received from the sale of this property, in particular, from the sale of shares in an apartment owned by minor children, and on behalf of the children submit tax returns form 3-NDFL to the tax authority.