How much do you get for child support in california

California Child Support Laws - Support Calculation, Enforcement, and More

Child support is an ongoing payment by a non-custodial parent to assist with the financial support of their children. Child support payments are often determined during the process of dissolution of a marriage through divorce, though the only requirements for requesting child support payments are establishment of paternity and maternity.

Child support is handled on a state level, and California has a set of specific child support guidelines. On this page you can learn about how child support is calculated in California, how custody split and extraordinary costs affect child support payments, and more.

California uses the "income share" method for calculating child support payments, which is designed to ensure that both the custodial and non-custodial parents contribute to their child's upkeep.

California's child support formula directly accounts for parents who share custody of a child, and support payment amounts are connected to the custody split. Other special situations accounted for under California's child support law include childcare costs and extraordinary medical costs. These costs may be additions to the basic California child support order.

If the court orders a phasein of child support payments, and the court finds evidence that the obligor violated the phasein payment schedule or intentionally lowered their income for paying child support, the court can order the immediate payment of the full formula amount of child support and the difference in the amount of support that would have been due without the phasein schedule and the amount of support due with the phasein, in addition to any other penalties provided for by law.

Whenever the court grants a request for a phasein payment schedule, they will declare the following in writing:

- The specific reasons why

- how the immediate imposition of the full monthly amount would create hardship for the obligor

- how this extraordinary hardship on the obligor would outweigh the hardship caused to the supported children through the temporary phasein of the full amount of support

In any proceeding where there is an issue for the support of a child or a child for whom support is authorized, the court can order either or both parents to pay an amount that is necessary for the support of the child.

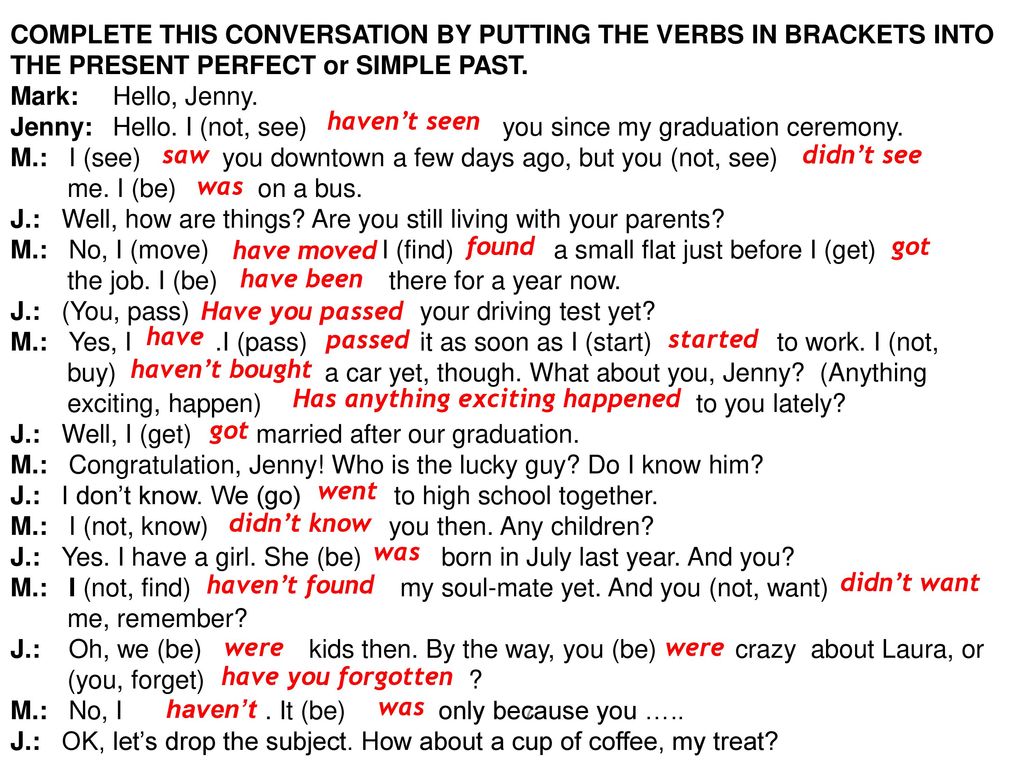

Child support can be arranged out of court by a mutual support agreement between the parents, or can be decided in California family court through a child support order. In California, a number of factors are taken into account when determining the amount of child support to be paid in court. Here is an explanation of the two most common methods used to calculate basic child support amounts.

Income Share MethodUnder the income share model, the court uses economic tables to estimate the total monthly cost of raising the children. The non-custodial parent pays a percentage of the calculated cost that is based on their proportional share of both parents' combined income.

Example: The non-custodial parent of one child has an income of $2,000 per month, and the custodial parent has an income of $1,000 per month. The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66. 6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

California does use the income share method to calculate child support

Percentage Of Income MethodThis method of calculating child support is simple - a set percentage of the non-custodial parent's income is paid monthly to the custodial parent to cover basic child support expenses. The percentage paid may stay the same, or vary if the non-custodial parent's income changes.

Example: The non-custodial parent of one child has an income of $2,000 per month. The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent. Therefore, the non-custodial parent pays $500 per month in child support. If the non-custodial parent's monthly income changes, the dollar amount they pay in child support will change as well.

California does not use the percentage of income method to calculate child support

California Child Support FAQ

- How does having shared custody of the child affect child support in California?

- How are extraordinary medical costs treated by child support in California?

- How are child care costs treated by child support in California?

- Does child support cover college education expenses in California?

- How is child support enforced in California?

- What are child support arrears?

- How are child support payments taxed in California?

How does having shared custody of the child affect child support in California?

All states have a method of modifying the amount of child support owed in cases where the custody agreement provides for joint or shared custody of a child between both parents.

California law accounts for shared custody of a child directly in the child support formula used to calculate payment amounts. This means that, in cases where custody is shared, the amount of child support paid by the paying parent will be reduced according to the amount of time they have custody of the child.

This means that, in cases where custody is shared, the amount of child support paid by the paying parent will be reduced according to the amount of time they have custody of the child.

How are extraordinary medical costs treated by child support in California?

California has specialized guidelines for the sharing of a child's extraordinary medical care costs that are separate from, and in addition to, basic child support payments. Extraordinary medical costs are generally costs generated by things such as illness, hospital visits, or costly procedures such as getting braces.

California treats extraordinary medical care costs as a "mandatory deduction" for basic child support. This means that if the non-custodial parent pays child care costs, the portion of the total monthly child care costs attributed to the custodial partner are deducted from the noncustodial partner's monthly child support payment. If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

How are child care costs treated by child support in California?

Due to the high costs of child care for a single payment, California has specialized guidelines that consider child care costs separately from the general costs of raising a child for the purposes of calculating child support payments.

California treats child care costs as a "mandatory deduction" for basic child support. This means that if the non-custodial parent pays child care costs, the portion of the total monthly child care costs attributed to the custodial partner are deducted from the noncustodial partner's monthly child support payment. If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

Does child support cover college education expenses in California?

While the state of California has no explicit requirement for college expenses to be covered under child support, support for college expense by the non-custodial parent may be voluntarily agreed to by both parties, after which it is contractually enforceable.

How is child support enforced in California?

In the state of California, child support is enforced by the state child support agency. The state agency handles the location of non-custodial parents, enforcement of support orders, and the handling of unpaid child support arrears.

What are child support arrears?

Child support arrears are the amount of child support that is delinquent, or unpaid, by the noncustodial parent to the custodial parent. Child support arrears may be collected by the state through wage garnishment, bank levy. withholding of California welfare benefits, or other collection methods.

How are child support payments taxed in California?

Under IRS guidelines, the recepient of child support does not need to pay federal tax on child support payments, and the payer of child support cannot deduct their child support payments. This differs from the federal taxation of alimony payments, which are treated as taxable income by the receiver and are deductible by the payor. California tax law may vary on tax treatment of child support.

California tax law may vary on tax treatment of child support.

Calculating Child Support in California

Learn how child support works in California, including how support is calculated, reasons for departing from the guideline, support agreements, and modifying support amounts.

If you're splitting up with your child's (or children's) other parent (or you were never a couple), among your most pressing questions will be whether you'll pay or receive support for your child—and, if so, how much the child support will be. Like all states, California has a uniform guideline for calculating child support. But unlike some other states, California's guideline isn't based just on the parents' incomes. It's a complicated formula that also takes into account how much time each parent spends with the child.

Whether parents agree on support or a judge has to decide for them, the rules in the state's guideline will still apply. So it's important to understand the basics of how child support works in California, including how to get help collecting support and how to change the amount of support you're already paying or receiving.

- What Is the California Child Support Calculator?

- Applying California's Child Support Guideline

- Gathering the Information for the Child Support Calculation

- The Guideline Formula

- How California's Guideline Applies to More Than One Child

- When a Parent Who Earns Less Must Pay Child Support

- Child Support Add-Ons Under the California Guideline

- When Child Support May Be Different Than the Guideline Amount

- Allowed Reasons for Deviating from the Child Support Guideline

- Guideline Departures Must Follow California's Child Support Policies

- Requirements for Child Support Agreements

- How Long Does Child Support Last in California?

- How to Apply for or Collect Child Support

- How to Request a Change in Child Support

What Is the California Child Support Calculator?

California provides an online child support calculator that you can use to estimate the amount of support that might apply in your case. But you should know that a judge could very well order a different amount of support in your case, after taking into account various factors allowed under California law.

But you should know that a judge could very well order a different amount of support in your case, after taking into account various factors allowed under California law.

We'll discuss those factors below, as well as explain the numbers that go into the child support calculator. That way, you can be better prepared when gathering all the information you'll need to use the calculator. And if you believe a different amount of support would be more appropriate, you'll have the context to back up your argument.

As a general rule, the greater the difference between the parents' incomes and the less time the higher-earning parent spends with the children, the more child support that parent will owe.

Applying California's Child Support Guideline

As you'll see below, California's formula for calculating child support is very complicated. However, the basic outline is fairly straightforward: As a general rule, the greater the difference between the parents' incomes and the less time the higher-earning parent spends with the children, the more child support that parent will owe.

The formula is used whenever child support needs to be calculated as part of a court case, including:

- divorces (known as "dissolution of marriage" in California)

- support cases involving unmarried parents

- dissolution of domestic partnerships, and

- requests to modify existing support orders.

Gathering the Information for the Child Support Calculation

Before you can calculate the amount of child support, you must gather certain information:

- each parent's gross income and net disposable income

- the percentage of time each child will spend with each parent, and

- other necessary costs for the child (more below on those additional costs).

Gross income includes:

- wages, salaries, self-employment income, commissions, and bonuses

- business income (gross receipts minus operating expenses) and income from rental properties

- pensions

- investment income, such as dividends, interest, and annuities

- certain benefits, including workers' compensation, disability, social security, and unemployment insurance

- spousal support received from a previous marriage to another person (but not child support received for children from a different relationship), and

- if the judge decides it's appropriate, employee benefits that reduce living expenses.

In some cases, California judges may "impute" income to parents who've intentionally lowered their actual income to avoid their duty to support their children, by considering their "earning capacity" along with their actual income. (Cal. Fam. Code § 4058 (2022).)

To figure net disposable income, you'll subtract a number of items from gross income, including:

- actual state and federal income taxes (not necessarily the withholding amount), as well as taxes for Social Security and Medicare

- mandatory payroll deductions for union dues, retirement, or state disability insurance

- health insurance premiums for the parent and children

- child support or spousal support (alimony) payments for someone who's not a part of the current case (such as for children from a previous relationship or an ex from a previous marriage), and

- a deduction for "extreme financial hardship," when a judge finds that it's necessary for reasons like a parent's extraordinary health expenses.

(Cal. Fam. Code §§ 4059, 4060, 4070, 4071 (2022).)

The guideline presumes that parents with primary physical custody will directly contribute a significant part of their resources to supporting their children. (Cal. Fam. Code Cal. Fam. Code § 4053, 4058, 4059, 4070, 4071 (2022).)

The Guideline Formula

The formula California uses to calculate child support is: CS = K (HN - (H%)(TN)).

Here's what the letters mean:

- CS is the child support amount. This is what the formula will calculate once you've plugged in all of your information. The amount will be for one child. (See below for how to multiply that number when you have two or more children.)

- K is the amount of the parents' combined total income that must be devoted to child support. That amount is calculated under another formula that takes into account how much the parents earn and on how much time the higher-earning parent spends with the child, applying stepped-up percentages as income levels go up.

- HN stands for high net—the higher-earning parent's net monthly disposable income.

- H% is the approximate percentage of time that the high earner has or will have primary physical responsibility for the children compared to the other parent. When parents have different time-sharing arrangements for different children, H% equals the average of the approximate percentages of time the high earner parent spends with each child.

- TN is the combined total net monthly disposable income of both parents.

(Cal. Fam. Code § 4055 (2022).)

How California's Guideline Applies to More Than One Child

After calculating the guideline amount for one child, you won't simply multiply the result by the number of children covered by the support order. Instead, the guideline provides specific multipliers, such as:

- for two children: multiply the support amount (CS in the formula) by 1.6

- for three children: multiply by 2

- for four children: multiply by 2.

3, and

3, and - for five children: multiply by 2.5.

The law provides multipliers for up to 10 kids. These multipliers sometimes change, but the state's online calculator should include the current numbers. (Cal. Fam. Code § 4055(b)(4) (2022).)

When a Parent Who Earns Less Must Pay Child Support

Traditionally, mothers had physical custody of their children after divorce, while fathers earned more and paid child support. The gender pay gap persists, but it's much more common in contemporary divorced families for both parents to spend significant time with their kids.

Higher-earning parents are still typically the ones who pay child support. However, the formula in California's guideline sometimes results in a negative amount of child support. When that happens, the lower-earning parent generally pays that amount to the high earner. (Cal. Fam. Code § 4055(b)(5) (2022).)

For example, say there isn't a big difference between the parents' earnings, and the higher-earning parent has the children more than half of the time. If the formula results in −$200 for the amount of child support, the low earner would have to pay $200 a month to the high earner—unless the low earner can justify a different result based on the legal reasons for departing from the guideline (discussed below).

If the formula results in −$200 for the amount of child support, the low earner would have to pay $200 a month to the high earner—unless the low earner can justify a different result based on the legal reasons for departing from the guideline (discussed below).

In addition to the basic child support guideline amount, parents might be required to contribute to certain expenses for the children's benefit.

Child Support Add-Ons Under the California Guideline

In addition to the basic guideline support amount, parents might be required to contribute to certain expenses for the children's benefit. Some of these add-ons are mandatory, while others are discretionary (meaning they're up to the judge).

As additional child support, judges must order parents to pay:

- any child care costs that are needed because of a parent's job or education (as long as the education or training is reasonably necessary to gain employment skills), and

- reasonable uninsured health care expenses for the child.

When it's appropriate, judges may order parents to pay additional support for:

- expenses related to a child's special needs, including educational needs, and

- travel expenses for visitation.

(Cal. Fam. Code § 4062 (2022).)

When a judge orders child support add-ons, the parents will generally contribute an equal amount for those additional expenses. However, a judge may order the parents to contribute unequal amounts when a parent provides documentation showing that the different apportionment would be more appropriate under the circumstances. For example, if one parent makes far less than the other, a judge may order the high earner to pay more than half of the child care costs that are needed for both of them to work outside the home.

If an unequal allocation is warranted, the judge will first calculate the standard guideline amount and then apportion the add-ons between the parents in proportion to their net disposable incomes—after making allowed adjustments to income, including for spousal support payments. (Cal. Fam. Code § 4061 (2022).

(Cal. Fam. Code § 4061 (2022).

When Child Support May Be Different Than the Guideline Amount

California law presumes that the amount of child support calculated under the guideline formula will be proper in any individual case, but it does allow for departures from the guideline amount in some situations.

Allowed Reasons for Deviating from the Child Support Guideline

If you want to argue for a different amount of support, you'll need to present evidence to convince a judge that application of the guideline would be "unjust or inappropriate" because of the special circumstances in your case, including:

- you and the other parent have agreed on a different amount of support and have met the legal requirements for that agreement (discussed below)

- the parent being ordered to pay child support has an extraordinarily high income and the guideline amount would be more than the children need

- one parent isn't contributing to the children's needs at a level that matches that parent's custodial time

- both parents have roughly equal time with the children, but one parent has to pay a much lower or higher percentage of income for housing than the other parent

- you've deferred the sale of the family home after divorce, and the rental value is more than the mortgage payments, property taxes, and insurance

- you will have different time-sharing arrangements for different children

- your children have special medical or other needs that require more support, or

- your children have more than two legal parents (which is allowed under California law).

(Cal. Fam. Code § 4057 (2022).)

Guideline Departures Must Follow California's Child Support Policies

In addition to proving that applying the guideline would be inappropriate for one of the reasons listed in the law, you'll also need to demonstrate that the departure from the guideline would be consistent with the basic child support principles in California law, including the following:

- The children's interests are the top priority under the guideline, and they should share both of their parents' standard of living. That means it could be appropriate if child support payments improve the living standard in the entire household where the children live most of the time.

- Child support orders must ensure that the amount of support is enough to reflect the high costs of raising a family in California and the state's relatively high standard of living, compared to other states.

- When both parents have a significant amount of time with their children, the amount of support should also reflect the increased costs of raising kids in two homes, and it should minimize any differences between the living standards in those homes.

(Cal. Fam. Code §§ 4053, 4057 (2022).)

Requirements for Child Support Agreements

Parents may—and usually do—agree with each other about the amount of child support, either as part of an overall marital settlement agreement or just on the support issue. To do that in your case, you can start out by using the state's calculator to estimate the guideline amount of support. Then, if you want to negotiate for any adjustments to that amount, you could apply the rules (discussed above) for deviating from the guideline.

Be aware, however, that you will need to submit your agreement (or "stipulation") to the court for approval. If the agreed amount of support is below the guideline amount, the judge won't approve it unless you and the other parent(s) declare that:

- the agreed amount of support will be in the children's best interests and be enough to meet their needs

- you know and understand your rights when it comes to child support

- you weren't forced or coerced into signing the agreement, and

- neither parent is receiving or has applied for public assistance.

(Cal. Fam. Code § 4065 (2022).)

Thanks to the guideline, it's usually easier to reach an agreement on the amount of child support than other issues in divorce. But negotiations about support often get tangled up with decisions about the exact amount of timeshare—because that will affect the child support calculations. If you and your spouse are having trouble working out agreements on these issues, you may turn to mediation for help.

How Long Does Child Support Last in California?

Generally, the legal obligation to pay child support lasts until the child turns 18. There are exceptions to that cut-off, including:

- If an 18-year-old is still a full-time high school student, the support duty continues until age 19.

- Parents may agree to pay some form of child support beyond age 18 or high school graduation. For instance, some parents agree to contribute to their children's college educations.

- Parents are legally obligated to provide as much support as they can for their adult children who are incapacitated to such an extent that they can't earn a living, and who don't have other sufficient means of support.

(Cal. Fam. Code §§ 3901, 3910 (2022).)

How to Apply for or Collect Child Support

If you're seeking child support when your marriage is ending, you'll simply make the request in the petition and other paperwork when you file for divorce in California. You can also apply for temporary child support while your case is proceeding.

When you aren't married to your child's other parent, you may apply for child support services from the California Child Support Services Agency. If needed, the agency may also help you establish the child's legal parentage. It may also provide assistance with collecting and enforcing child support in California.

How to Request a Change in Child Support

Once a child support order is in place, it's not necessarily set in stone. Judges may order a change (called a "modification") in child support whenever they believe it's necessary. If the existing order was based on both parents' agreement for a below-guideline amount of support, one parent may request an increase in support at any time, without showing that their situation has changed. (Cal. Fam. Code §§ 3651, 4065(d) (2022).)

(Cal. Fam. Code §§ 3651, 4065(d) (2022).)

In all other situations, however, California courts have consistently held that anyone requesting a modification must show that there has been a significant change in circumstances that requires a different amount of support. Usually, judges will grant a modification when the changed circumstances would justify an increase or decrease of 20% or $50 per month, whichever is less.

Some common reasons for modifying support include when:

- a parent has involuntarily lost a job or income

- a parent is making more money than before

- there's been a change in the amount of time each parent is caring for the child or children

- a parent needs to support a new child with a different partner, or

- one parent has been incarcerated.

Keep in mind that when one parent requests a child support modification, the judge must consider both parents' current financial situations and time-share with the child. That could lead to unexpected results—for instance, when the primary custodial parent has also seen an income reduction.

Your local child support agency will provide a review of your case (for free) to see if a modification is justified. Even if the agency denies your request, you may still ask a judge to modify the support order. Your local Family Law Facilitator or a family law attorney can help with your request.

Page not found - portal Vashfinansy.rf

Moscow

Your city:

Moscow

PartnersFor media

Rus Eng

Financial Literacy Week

2021 Check your financial literacy level

Learn to manage

personal finance Learn

how to protect your

rights Financial

calculators How to

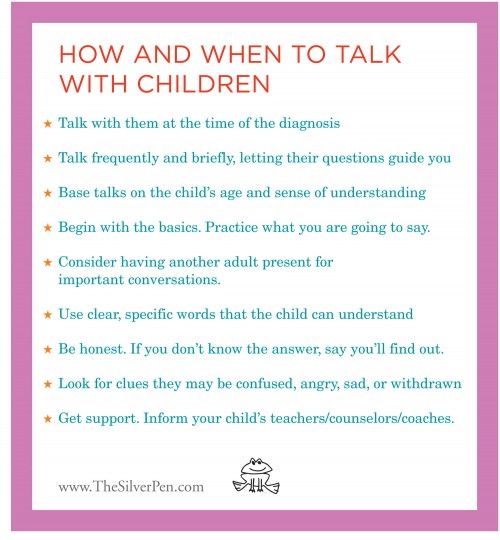

talk to children

about money

Starting October 1, 2021, you can read up-to-date materials on financial literacy on the website

MOIFINANCE. RF

The page you requested is not on our site.

You may have mistyped the address or followed the wrong link.

- check spelling;

- use the main page;

- use the search above;

- use the site map.

- Contacts

- site `s map

- Terms of use of materials

- introductory course

- home bookkeeping

- Debts and loans

- Finance and Housing

- Work and salary

- family and money

- Rights and obligations

- Unseen circumstances

- Secure old age

- Save and increase

- Glossary of financial terms

- Question? Answer!

- Expert opinion

- life hacks

- Consumer loan calculator

- Personal Savings Plan Calculator

- Mortgage Calculator

- Deposit calculator with interest capitalization

- Emergency Loan Calculator

- Financial arithmetic for schoolchildren

- Financial Literacy for Students

- Financial Literacy for Adults

- How financially literate are you?

- Literary classics

- Tests of the site "I want to know"

- Parents

- For teachers

- Researchers

- Children and youth

- financial institutions

- Adults

- Pensioners

- For project participants

- Methodological centers

- Federal methodological center for financial literacy of the system of general and secondary vocational education

- Federal Network Methodological Center for Advanced Training of University Teachers and Development of Financial Literacy Programs for Students

- Federal Consulting and Methodological Center for Improving the Financial Literacy of the Adult Population

- materials

- Parents

- Teachers

- Researchers

- Children and youth

- Financial institutions

- Adults

- Pensioners

- For project participants

- For teachers

- Events calendar

- Magazine "Befriend

with Finance" - Strategy

- New

UMK- Description

- Final release

- Media publications

- TV stories

- Media Gallery

- Teaching materials for students in grades 2-3

- Teaching materials for 4th grade students

- Teaching materials for students in grades 5-7

- Teaching materials for students in grades 8-9

- Methodological materials for students in grades 10-11

- Educational and methodological materials for students in grades 10-11 of the socio-economic profile

- Teaching materials for students of secondary vocational education

- Educational and methodological materials for pupils of organizations for orphans and children left without parental care

- Materials for

regional

and city

portals- Students and young professionals

- Adult Compilation

- For pensioners and citizens of pre-retirement age

- Information about COVID-19

- Library

- rural

financial

festival - Rating

Regions of Russia

- Press center

Before her ex-husband, the sister is proud, she doesn’t need anything, she can handle it herself.

From the outside, you will listen, so Masha is like an iron lady with us - all by herself, so strong and independent. And she does not need alimony, and she does not need help.

If it were so, there would be no questions. But it's all a sham. She can hang noodles about her independence to her friends in social networks and her ex-husband.

In fact, my sister would have gone around the world with outstretched hands long ago if my parents and I hadn't supported her. It is difficult to be very independent on maternity leave.

Masha left her husband with a scandal when their child was seven months old. She says that the reason is the complete lack of help from her husband.

Her husband says that Masha went crazy because after two jobs he has no time to take care of the baby at all, he would have time to sleep.

You can understand both, the problem can be solved, but the sister did not want to solve anything humanly. She collected the child and returned to her parents with the child.

It was inconvenient for everyone, but Masha should not be put outside with a baby in her arms. Yes, and the parents had the hope that the sister would cool down and return to her husband.

But this did not happen, although the son-in-law went to Masha every day after work, trying to reconcile. His sister did not want to listen to him, stating that he had already shown his attitude towards them with the child.

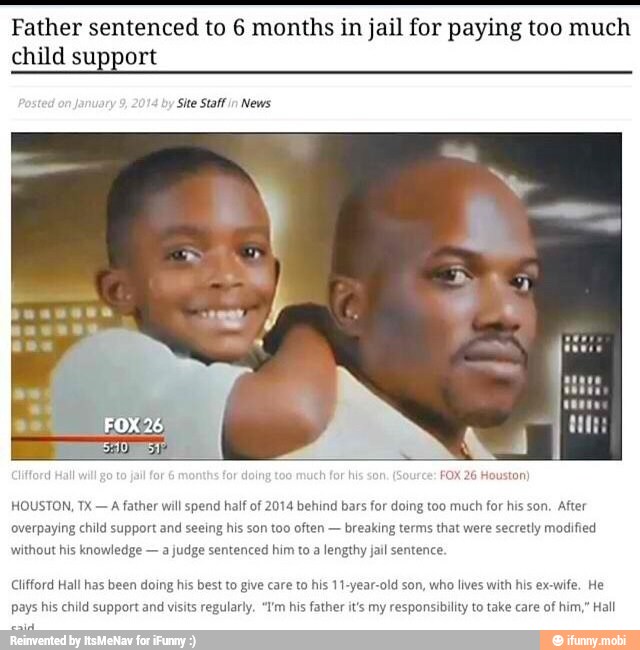

She filed for divorce, proudly refusing alimony and stating that she did not need anything from her ex-husband, she could handle it herself.

I don't know how she was going to manage on her own. My sister sat on the neck of her parents, and I helped them, because they themselves were not doing well with finances.

Mom had a heart attack a couple of years ago, she needs to take medicine, dad has diabetes, he also needs medicine, a certain diet.

And on top of it all, a sister with a child and stupid principles. She herself does not earn a penny, because she managed to quit her job while pregnant, but she was not hired for a new one. She went on maternity leave unemployed.

In social networks, quotes about strong women who go through life alone and achieve everything themselves. She communicates with the father of the child through her teeth, trying in every possible way to complicate his communication with the baby.

About the alimony that her husband is ready to pay her, she pathetically refuses. Like, she doesn’t need anything, everything is fine with her, she can raise the child herself.

Only mother was left without sanatorium treatment, and father cannot put a crown - there is no money, everything goes to his beloved daughter and grandson. The sister doesn't think about it.

My sister doesn't think about the fact that the renovations in my apartment have stopped, the kitchen is still a concrete box.