How much is the universal child care benefit

Universal child care could boost women’s earnings by $130 billion

MoMo Productions | DigitalVision | Getty Images

Since last February, over 2.3 million women have dropped out of the workforce, compared to just 1.8 million men who left the labor force between February 2020 and 2021, according to data compiled by the National Women's Law Center. And many of those women are still unemployed because they are caring for children who are not in school or daycare.

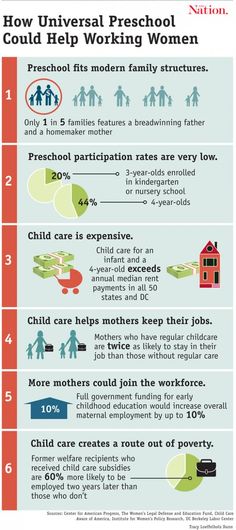

New research from Columbia University and the National Women's Law Center finds that a universal child-care system — one that provides affordable, reliable child care from birth to age 13 — would not only help many of those out-of-work employees get back into the workforce, but would also dramatically increase the lifetime earnings and security of women across the country.

An average woman with two children could see a $97,000 increase in her lifetime earnings under universal child care, according to the report. Collectively, about 1.3 million women in the U.S. could experience about a $130 billion boost in income over their lifetimes.

Overall, the number of women working full-time would increase by 17% if the U.S. expanded access to stable and consistent child care. The number of women working without a college degree would jump by about 31%.

"When there's an increased investment in child care, there's a measured increase in women's labor force participation," says Melissa Boteach, vice president of income security and child care/early learning at the National Women's Law Center. The highest gains can be seen for women in their 30s and 40s, since those are the decades when women are most likely to raise children, she adds.

This increase in workforce participation and lifetime earnings could also lead to a significant impact on women's retirement situations, the report finds. Women would have an additional $20,000 in private savings on average and about $10,000 more in Social Security benefits. That adds up to about $160 per month in additional funding in retirement, the report finds.

That adds up to about $160 per month in additional funding in retirement, the report finds.

Source: National Women's Law Center

Those extra earnings could especially help improve the financial situations of older women, who are more likely to experience poverty later in life than men. "Senior women have significantly higher poverty rates than senior men because of all the discrimination and all of the financial challenges that compound over their lives [and] stick with them in retirement," Boteach adds.

But child-care reform could reduce poverty among senior women by about 21%, the report finds.

The report's projections are based on a model of universal child care that provides stable and consistent care to children from birth to age 13. Under the model, child-care costs would not exceed 7% of a family's annual income and child-care workers would earn a livable wage rather than the pre-pandemic average of $11.65 an hour.

These policies would dramatically impact low-income women and women of color. Currently, women who earn lower incomes typically spend about a third of their take-home pay on child care, Boteach says. That can affect a family's choices around whether one or both parents work. If a parent needs to stay at home or reduce their hours to care for children, it's generally going to be the woman, she explains.

Currently, women who earn lower incomes typically spend about a third of their take-home pay on child care, Boteach says. That can affect a family's choices around whether one or both parents work. If a parent needs to stay at home or reduce their hours to care for children, it's generally going to be the woman, she explains.

When talking about economic solutions that will improve the workforce and reduce poverty, child care is probably not top of mind, Boteach says. But the findings show that child care is an economic driver that can be used to improve financial stability throughout women's lives.

"If we start with this generation of women and start investing in their ability to be breadwinners and caregivers, then you will see the fruit of that 30 years from now," Boteach says.

Check out: Meet the middle-aged millennial: Homeowner, debt-burdened and turning 40

Don't miss: For many older millennials, student loan debt delayed buying homes, starting families and pursuing creative careers

What Democrats mean by ‘universal child care’ in the Build Back Better Act

Minnesota child care providers are struggling to keep their electricity on and their doors open. Families are struggling to pay for their services. It’s a chicken-and-the-egg scenario for many providers: If they pay their workers more, the cost for families will go up and they’ll lose business. If they pay their already low-wage workers less, they’ll lose workers and the ability to take care of all of their enrolled kids.

Families are struggling to pay for their services. It’s a chicken-and-the-egg scenario for many providers: If they pay their workers more, the cost for families will go up and they’ll lose business. If they pay their already low-wage workers less, they’ll lose workers and the ability to take care of all of their enrolled kids.

Democrats are looking to solve — or at least help solve — this child care dilemma as part of the Build Back Better Act, their $3.5 trillion federal spending bill. Among a host of new policies and programs in the bill are several new federal funding streams aimed at providing what advocates are calling “universal child care.”

The plans are ambitious. “This is the biggest thing to happen to the early childhood field ever in our country’s history, that [universal child care] is even being debated right now at this scale,” said Clare Sanford, government relations chair for the Minnesota Child Care Association.

But the child care industry is complicated. What, exactly, do Democrats mean when they say they’re delivering universal child care to American families?

What, exactly, do Democrats mean when they say they’re delivering universal child care to American families?

Article continues after advertisement

How will Congress achieve universal child care?”

In general, the plans outlined in the Build Back Better Act achieve “universal” child care by significantly increasing the amount of funding provided by the federal government to states to subsidize citizens’ child care costs. The funds appropriated for this program are so far expected to be $20 billion for fiscal year 2022, $30 billion for 2023, and $40 billion for 2024 to remain available through 2027.

While most states, including Minnesota, already have programs that subsidize child care for low-income families, the Build Back Better Act creates new programs that subsidize child care for all families.

“The money is not going into existing programs that states already have. It is creating new funding streams,” said Sanford, who has been working with lawmakers on some child care sections of the Build Back Better Act. “There are existing government structures that federal money flows through to families and child care providers at the state level. But the way this bill is written, those will be vastly overhauled and two brand new funding streams will be created at the federal level.”

“There are existing government structures that federal money flows through to families and child care providers at the state level. But the way this bill is written, those will be vastly overhauled and two brand new funding streams will be created at the federal level.”

MinnPost photo by Craig Lassig

Rep. Ilhan Omar

The new federal programs would still consider a family’s income when determining the level of subsidy, but the subsidies for all families would be more generous than under the current system. An amendment to the bill introduced by Fifth District Rep. Ilhan Omar, who is the whip of the Congressional Progressive Caucus, establishes caps for the amount of a family’s annual income spent on child care, with no family paying more than seven percent of their income.As for what types of child care is eligible for the programs, the bill would cover both large institutional child care and family-based child care programs, according to Minnesota Sen. Tina Smith, a long-time advocate for expanded child care who is following the legislation in the House closely.

“This was designed specifically to not push out family providers, specifically to recognize and respect the crucial role that they provide,” Smith said.

Sen. Tina Smith

The bill also outlines plans for universal preschool in which each state would receive “100 percent of the State’s expenditures in the year for preschool services.”There is other child-care related spending in the bill’s current form, as well, including a permanent expansion of the Child and Dependent Care Tax Credit and an expansion of the Child Tax Credit, $15 billion for child care facilities, and the establishment of a Child Care Wage Grant program to increase wages for child care providers, among other investments that support working families.

During the House Ways and Means Committee’s markup of the bill, chairman Richard Neal (D-MA) said that this bill would “help raise the floor for child care provider pay” by investing in child care wage grants for small businesses.

Article continues after advertisement

The Build Back Better Act outlines a grant program that reserves nearly $1. 5 billion for awarding grants to qualifying child care providers who need the funds to offset operating costs and provide “competitive wages, benefits, and other supportive services, including transportation, child care, dependent care, workplace accommodations, and workplace health and safety protections.” A grant awarded under this program will last for 3 years, and can be renewed.

5 billion for awarding grants to qualifying child care providers who need the funds to offset operating costs and provide “competitive wages, benefits, and other supportive services, including transportation, child care, dependent care, workplace accommodations, and workplace health and safety protections.” A grant awarded under this program will last for 3 years, and can be renewed.

Is it enough?

All that new spending might still not be enough to meet child care needs, according to the Minnesota Child Care Association’s Sanford. Even if every family is able to afford child care thanks to the subsidies, there will not be enough spots at child care facilities to keep up with the new demand.

A report by the Minnesota Center for Rural Policy and Development found that “most rural regions” in Minnesota are “child care deserts,” meaning that there are not enough providers to fulfill the demand for child care in those areas. Providers and advocates are hoping that the Build Back Better Act will give enough money to states so that providers can raise wages for their workers and cover operating expenses. Some say that grants from earlier this year — both for providers and for families — have already run dry.

Some say that grants from earlier this year — both for providers and for families — have already run dry.

“A lot of families had gotten off waiting lists [for scholarships] this spring, but it was like if your application happened to be at the top of the pile you got funding,” said Christina Valdez, director of Listos Preschool & Child Care in Rochester. “Now, they’re back to long waiting lists again.”

For now, the economics of the child care industry are tough for providers. Valdez said that the caregivers at Listos, a bilingual child care provider, make around $18 per hour, and the company is unable to sponsor health insurance.

“If you’re not getting health care through your spouse, it’s really hard to get good health care…so it really puts you in a hard position,” Valdez said.

Mary Solheim, director of Playschool Child Care Center in Maplewood, said that Playschool has been operating at a loss for the last two years.

“We’ve done a lot of decreasing of the excess expenses,” Solheim said. “Payroll is the thing we always pay first, and everything else becomes what we try to prioritize.” Solheim said her Playschool location has had to put off paying essential bills like electricity in order to pay their workers.

“Payroll is the thing we always pay first, and everything else becomes what we try to prioritize.” Solheim said her Playschool location has had to put off paying essential bills like electricity in order to pay their workers.

Article continues after advertisement

These providers expressed hope that with more federal money in the system, conditions could improve for families and workers alike.

“I just really feel like we have a true opportunity right now to make huge changes,” Valdez said. “We know that spending money on children ages zero to five is going to have a lifetime, positive impact. We know that. I mean, it’s a good investment. And so I want to see real, true changes being made that will really benefit families, children and early educators.”

90,000 The new universal allowance will be paid for children from birth to 17 years of age. To whom and how will they count? Illustration: Vera Revina / "Clerk" The bill passed the first reading in the State Duma.

Another draft law amends the laws on child benefits and materiel. From 2023, old benefits will not be assigned. But those who already receive them can choose to continue receiving the old benefit or switch to the new one.

One instead of five

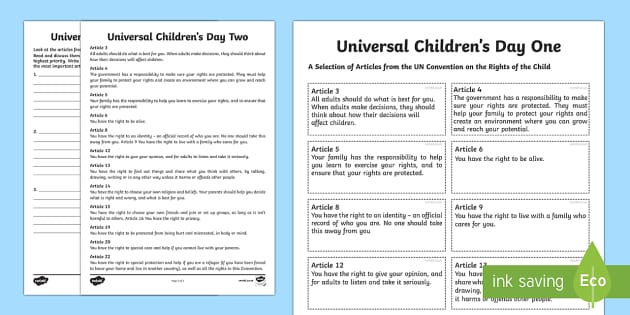

The universal allowance will replace the following allowances:

- for pregnant;

- for caring for a child up to 1.5 years old;

- for a child under 3 years old;

- for a child from 3 to 7 years old;

- for a child from 8 to 17 years old.

And for all these benefits now different rules. For example, the allowance for a child under 3 years old is paid for the first child from the budget, and for the second - from the mother's capital, and the third child is not paid everywhere (such a payment is regional).

Universal allowance will pay for all children, regardless of the order of birth , that is, for the first, and for the second, and for the third, etc.

Conditions and size

The universal allowance will be paid if the income of the family is below 1 regional subsistence level per person.

At the same time, the availability of property, income from deposits will be taken into account. There will also be a so-called zero income rule. That is, benefits will be paid only to those who have income, but it is small. Those who simply do not work without a good reason will not receive benefits.

This zero income rule still exists today.

The Ministry of Labor explained that income must be in at least one month out of 12. That is, it is not necessary that all 12 months be with income.

The billing period for Universal Benefit is 12 months prior to 1 month before the month of application.

Look in our table for which period the income will be taken into account.

| Application Month | Billing period |

| January 2023 | December 2021 - November 2022 |

| February 2023 | January 2022 - December 2022 |

| March 2023 | February 2022 - January 2023 |

| April 2023 | March 2022 - February 2023 |

| May 2023 | April 2022 - March 2023 |

| June 2023 | May 2022 - April 2023 |

| July 2023 | June 2022 - May 2023 |

| August 2023 | July 2022 - June 2023 |

| September 2023 | August 2022 - July 2023 |

| October 2023 | September 2022 - August 2023 |

| November 2023 | October 2022 - September 2023 |

| December 2023 | November 2022 - October 2023 |

Benefit - 50%, 75% or 100% of the subsistence minimum.

First, 50% is assigned, income is calculated taking into account benefits. If it is still below the subsistence minimum, then they pay 75%. If even with such an allowance, the family income is still below the MP, then a benefit of 100% of the MP is assigned.

Benefit for caring for a child up to 1.5 years old

Working parents will continue to receive child care allowance up to 1.5 years. It does not convert to universal.

It will still need to be issued through the employer.

But for non-working parents , this allowance will be included in the universal.

But only the poor will pay it. Now there is no such condition.

If the child was born before December 31, 2022 , then you can receive the allowance for non-working parents until the child reaches 1.5 years. That is, for children born before 12/31/2022 there will be an opportunity to choose a benefit (according to the old rules or according to the new ones), and for children born from 01/01/2023 there will be only a universal benefit.

Recall that now the PFR pays benefits up to 1.5 years to non-working parents. Previously paid by Social Security.

Allowance for children up to 3 years

As part of the universal allowance, this allowance will be paid for all children, regardless of the order of birth.

In addition, now the allowance is paid for the second child from the mother's capital. This payment will remain together with the universal allowance. It will be possible to receive it not only for the second child, but also for the first, third, etc.

That is, it will be possible to receive simultaneously 2 payments - and universal allowance , and allowance for a child up to 3 years from maternity capital .

The condition for payment from maternity capital is the family income is not higher than 2 RM per person.

Benefit for pregnant women

Now pregnant women receive 50% of the subsistence minimum. From 2023, the allowance will be from 50% to 100% of the PM (depending on family income).

From 2023, the allowance will be from 50% to 100% of the PM (depending on family income).

The universal allowance will be assigned after the term 12 weeks . But they will pay, including for the past time - from the day of registration, but not earlier than 6 weeks .

Moreover, they will pay for a full month, even if it is registered in the middle or at the end of the month.

Six in one. For Ulyanovsk families will introduce a universal allowance

The audio tag is not supported by your browser.

From January 1, 2023, a unified comprehensive support will start working, which will affect both future parents and those who are raising children under 17 years old. This innovation will facilitate the procedure for processing payments, and for some it will increase its size. Read more in the material ulpravda.ru.

The universal allowance will unite existing support measures for families with children - from a woman's pregnancy to the child's 17th birthday. The operator of the universal benefit will be the Social Fund of Russia. This structure, we recall, will also appear at the beginning of next year, combining the PFR and the Social Insurance Fund.

The operator of the universal benefit will be the Social Fund of Russia. This structure, we recall, will also appear at the beginning of next year, combining the PFR and the Social Insurance Fund.

What does the universal allowance include?

- monthly allowance for a woman registered with a medical organization in the early stages of pregnancy;

- allowance for the care of a child under 1.5 years of age to citizens who are not subject to compulsory social insurance in case of temporary disability and in connection with motherhood;

- monthly payment in connection with the birth (adoption) of the first child up to the age of 3 years;

- monthly payment in connection with the birth (adoption) of the third and subsequent child until he reaches the age of 3 years;

- monthly cash payment for a child aged 3 to 7 years inclusive;

- monthly cash payment for a child aged 8 to 17 years.

All of them rely on families with an average per capita income below one regional subsistence minimum (PM). Benefits will be assigned using a comprehensive means assessment. A similar mechanism is now in place when calculating payments for children from 3 to 8 years old and from 8 to 17 years old. The amount will depend on the size of the family income gap and will be 50%, 75% or 100% of the regional PM.

Benefits will be assigned using a comprehensive means assessment. A similar mechanism is now in place when calculating payments for children from 3 to 8 years old and from 8 to 17 years old. The amount will depend on the size of the family income gap and will be 50%, 75% or 100% of the regional PM.

“To calculate the average per capita income, all incomes of family members in the billing period are summed up, and then the resulting amount is divided by 12 months and by the number of family members,” the Ulyanovsk Region Ministry of Social Welfare and Family Policy said.

The billing period for income will now be 12 months prior to one month prior to the month of application. Thus, the period of accounting for income will approach the date of the payment. In comparison, the current calculation period for some benefits is 12 months prior to 4 months prior to application, and for benefits for a child under 3 years of age is 12 months prior to 6 months prior to application.

What are the advantages of the universal allowance?

- there are uniform rules for payments from the moment of expectation of a child until his 17th birthday;

- you can receive support from the budget for children under 3 years old, regardless of the order of his birth;

- support will be increased for pregnant women who registered early - the allowance will be assigned in the amount of 50, 75 or 100% of the regional subsistence level of an able-bodied citizen.

- in addition, you can apply for a payment from maternity capital for all children under 3 years old, regardless of the order of birth, if the family income is less than two living wages per person.

But it is worth remembering that the payment from maternity capital is assigned without a comprehensive need assessment.

How to apply for a new allowance?

You must submit one application online through the public services portal, or personally come to the MFC or the Social Fund of Russia.