How much is the tax credit for one child

The Child Tax Credit - The White House

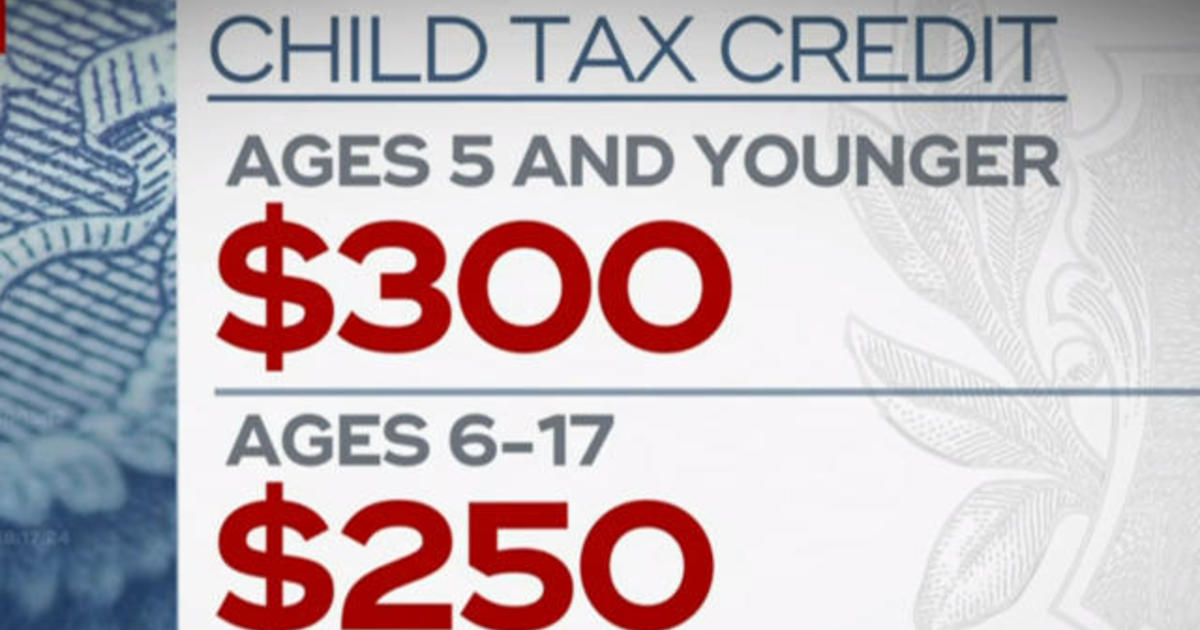

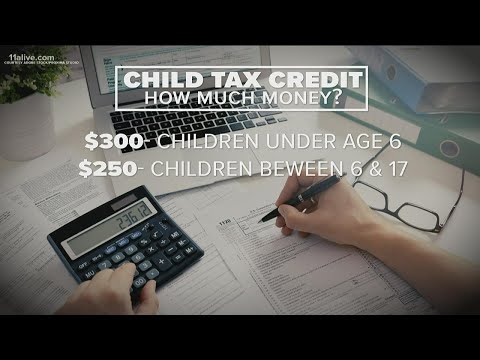

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

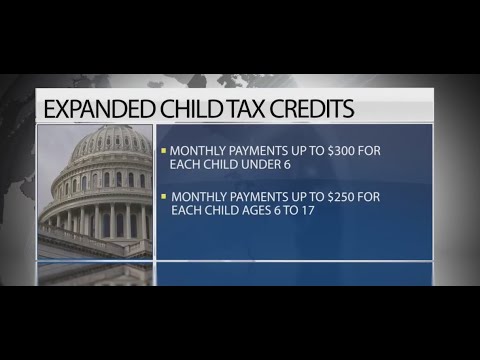

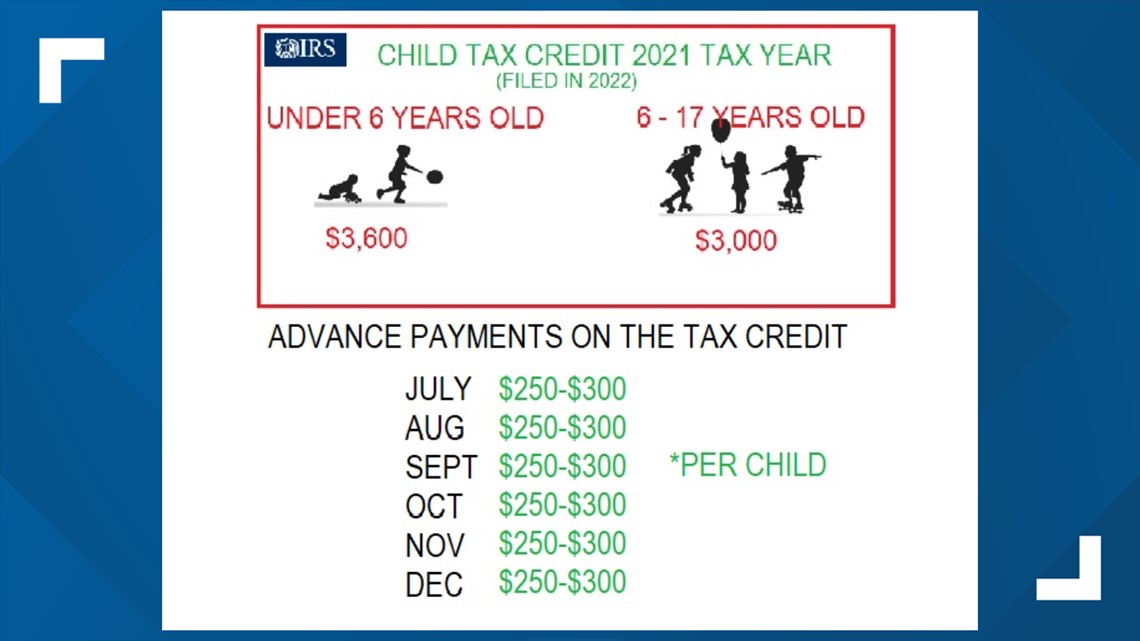

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

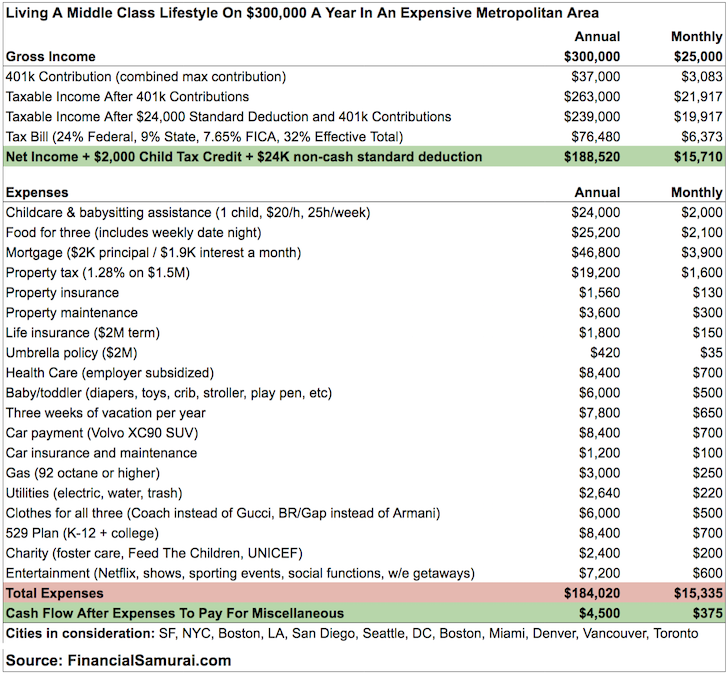

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2021 Child Tax Credit: Definition, FAQs & How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

The child tax credit has grown to up to $3,600 for the 2021 tax year. Here’s a primer on who qualifies, when to expect Letter 6419 and how to reconcile the advance credit on your taxes.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

- What is the child tax credit?

- Who qualifies for the child tax credit?

- How much you can get per child

- How the child tax credit will affect your taxes

- Will you have to pay back the child tax credit?

Table of Contents

- What is the child tax credit?

- Who qualifies for the child tax credit?

- How much you can get per child

- How the child tax credit will affect your taxes

- Will you have to pay back the child tax credit?

- Estimate your child tax credit amount

What is the child tax credit?

The child tax credit, or CTC, is an annual tax credit available to taxpayers with qualifying dependent children. It was first introduced as part of the Taxpayer Relief Act of 1997 and has played an important role in providing financial support for American taxpayers with children.

It was first introduced as part of the Taxpayer Relief Act of 1997 and has played an important role in providing financial support for American taxpayers with children.

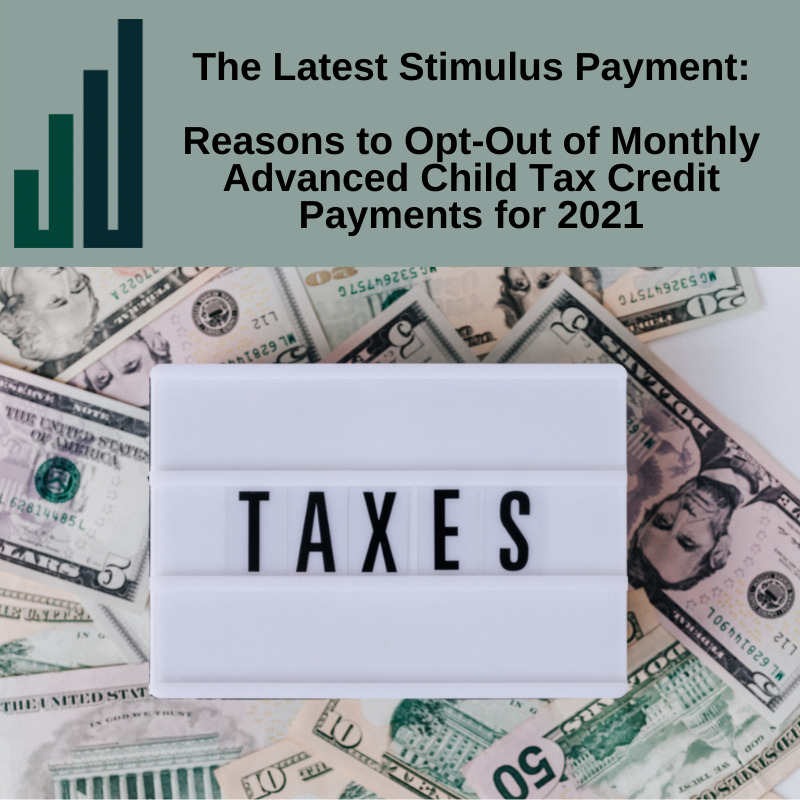

The tax credit — normally up to $2,000 per qualifying dependent — was expanded to a maximum of $3,600 in 2021 as part of the American Rescue Plan (the coronavirus relief package that took effect in March). And, for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December of 2021.

🤓Nerdy Tip

By the end of January, all recipients of the advance child tax credit payments should receive Letter 6419, which will provide a breakdown of all the advance payments disbursed to you. The IRS has asked taxpayers to use the letter to reconcile the credit on their 2021 returns. If you suspect your Letter 6419 states an inaccurate advance payment total, the IRS advises visiting your IRS online account for the most up-to-date information.

Who qualifies for the child tax credit?

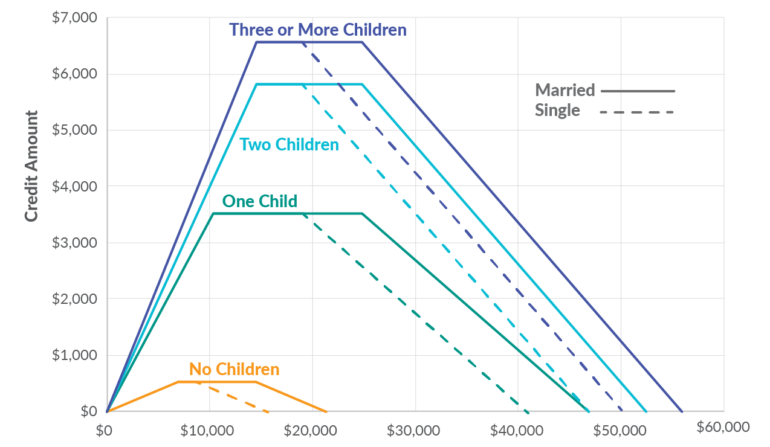

For the 2021 tax year, you can take full advantage of the expanded credit if your modified adjusted gross income is under $75,000 for single filers, $112,500 for heads of household, and $150,000 for those married filing jointly.

The credit begins to phase out above those thresholds.

First phaseout: Income exceeds the above thresholds but is below $400,000 (married filing jointly) or $200,000 (all other filing statuses). Your total credit per child can be reduced by $50 for each $1,000 (or a fraction thereof). This phaseout will not reduce your credit below $2,000 per child.

Second phaseout: Income exceeds $400,000 (married filing jointly) or $200,000 (other filing statuses). The phaseout will continue docking $50 per each $1,000 and begin to reduce your credit per child below $2,000. You may be disqualified from the credit altogether.

Some of the other eligibility requirements for the child tax credit include:

You must have provided at least half of the child’s support during the last year, and the child must have lived with you for at least half the year (there are some exceptions to this rule; the IRS has the details here).

The child cannot file a joint tax return.

You must have lived in the U.S. for more than half the year (or, if filing jointly, one spouse must have had a main home in the U.S. for more than half the year).

The IRS has a tool to check your eligibility.

How much you can get per child

For the 2021 tax year, the child tax credit offers:

Up to $3,000 per qualifying dependent child 17 or younger on Dec. 31, 2021.

Up to $3,600 per qualifying dependent child under 6 on Dec. 31, 2021.

If you took advantage of the advance payments, the IRS most likely sent half of the credit in the form of monthly payments from July through December of 2021. Those with qualifying dependents 17 or younger might have received up to $250 monthly per qualifying dependent and those with children 5 or younger might have received up to $300 monthly per qualifying dependent.

» MORE: See who qualifies as a tax dependent

How the child tax credit will affect your taxes

For the 2021 tax year, the CTC is fully refundable — that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to get a tax refund check for anything left over. How much of the credit you claim on your 2021 return will depend on whether you opted in for advance payments, how much you received as an advance, as well as your tax-filing circumstances.

If you received advance payments

Letter 6419 contains a detailed summary of the money you received from the advance CTC payments. It also confirms the number of qualifying dependents the IRS used to calculate those advance payments. This information will help you to reconcile the credit when you file your return.

If you opted out of advance payments

If you opted out of the advance payments before the first one was disbursed in July, claiming the credit on your return will likely be much simpler. When you file, you'll simply confirm that you're eligible for the credit and then claim the full amount you're entitled to based on your 2021 income and number of qualifying dependents.

When you file, you'll simply confirm that you're eligible for the credit and then claim the full amount you're entitled to based on your 2021 income and number of qualifying dependents.

If you don't normally file taxes

Low-income families who may not normally file a tax return had the option to sign up for advance payments using the IRS's non-filers sign-up tool. To claim the balance (or the full credit if you didn't receive the advance payments), you'll need to file a return this year.

» MORE: Learn more about IRS Free File — plus other ways to get free tax prep or help

Will you have to pay back the child tax credit?

First, some good news. The child tax credit is not considered taxable income. It's a credit, which means it can lower your tax bill or potentially result in a refund. However, things get a little tricky if it turns out that you were overpaid on your advance payment.

The advance payments were a prepayment of the 2021 tax credit you would normally claim in full during filing season. But because half of the credit was sent out early, the IRS likely used your most recent tax return (2020 or older) to determine how much of an advance to send you each month. So, if your financial or personal circumstances (such as your filing status, income, custody arrangements or residency status) have changed in 2021, there's a chance you might have received more of an advance than you're actually eligible for. A few ways this could play out:

But because half of the credit was sent out early, the IRS likely used your most recent tax return (2020 or older) to determine how much of an advance to send you each month. So, if your financial or personal circumstances (such as your filing status, income, custody arrangements or residency status) have changed in 2021, there's a chance you might have received more of an advance than you're actually eligible for. A few ways this could play out:

Let's say you received advance payments totaling $1,500 for your qualifying dependent based on your 2020 income. However, your income has increased significantly in 2021, making you eligible only for a reduced credit. The excess paid out to you is considered an overpayment.

Another example: You're a single filer with one dependent who lived in the U.S. in 2020. The IRS then sent you advance payments based on that information, which you accepted. However, in 2021, you actually lived outside of the U.

S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

If it turns out that you were given more of an advance than you were eligible for, you’ll need to report it as additional income tax to the IRS on your 2021 return. That additional income tax will either reduce your refund or potentially increase your tax bill.

Some people who were overpaid may also be eligible for repayment protection, meaning they won't need to repay the IRS. You can learn more about who qualifies on the IRS website. If you're unsure how to reconcile your credit or believe you may have been overpaid, quality tax software or working with a professional tax preparer can help you to reconcile your credit before the tax-filing deadline.

» MORE: How to find a tax preparer near you

Frequently asked questions

I had a baby in 2021. Am I eligible for the CTC?

Yes. Parents of newborns in 2021 are eligible for the child tax credit. You can claim the credit when you file your 2021 return.

Parents of newborns in 2021 are eligible for the child tax credit. You can claim the credit when you file your 2021 return.

The child tax credit update portal shows that a payment was issued, but I didn't receive it. What steps do I take?

If the child tax credit update portal and your IRS online account show that you were issued a payment that you did not actually receive, you can call the IRS to report the missing payment and request a trace at 800-908-4184 (7 am to 7 pm local time).

The agency urges you to have the following information on hand when you call: the payment date, payment method, status, and the amount listed in the CTC update portal.

If the IRS determines that the payment was not received by you or returned to the agency, the IRS will update its records, and those who are eligible can claim the missing amount on their 2021 return.

Are the advance child tax credit payments permanent?

No. Legislation to extend the enhanced credit amount and advance payment structure has not been passed. For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent.

For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent.

Is the child tax credit taxable?

No, the child tax credit is not considered income and therefore is not taxable. However, if the IRS overpaid you (i.e., the amount you received is more than you can claim), you may need to reconcile the overpayment on your 2021 tax return.

Estimate your child tax credit amount

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Tax deduction for children - Raiffeisenbank R-Media Blog

The state returns part of the income tax paid to parents. Every child under 18 is entitled to a standard tax deduction. For the first and second child - 1,400 ₽ per month, for subsequent children - 3,000 ₽. Article 218 of the Tax Code of the Russian Federation

Every child under 18 is entitled to a standard tax deduction. For the first and second child - 1,400 ₽ per month, for subsequent children - 3,000 ₽. Article 218 of the Tax Code of the Russian Federation

can be received until he is 24 years old.

By law, older children are counted on a priority basis. For example, you have two older adults and independent children, for whom you no longer receive a deduction, but for a third schoolchild, the deduction will still be 3,000 ₽.

If the spouses have a child from early marriages, then their joint child will be considered the third.

Who is entitled to the deduction

Citizens who officially support children can receive a tax deduction:

- blood parents,

- stepfather / stepmother,

- adoptive parents,

- guardians,

- trustees,

- parents deprived of parental rights if they continue to participate in the maintenance of the child - letter of the Federal Tax Service dated 13.

01.2014 No. BS-2-11/13@.

01.2014 No. BS-2-11/13@.

Each parent can exercise the right to the deduction. A necessary condition for this is official income, from which 13% income tax is paid.

Non-working mothers, students, pensioners, individual entrepreneurs on the simplified tax system, UTII or patent do not pay income tax, therefore they will not be able to use the tax deduction. And individual entrepreneurs on the general taxation system pay personal income tax, therefore they have the right to a deduction.

Double deduction

Single parent, guardian, adoptive parent, custodian or adoptive parent receives double the deduction. The basis for double deduction will be:

- death of a parent;

- legal fact of missing;

- the actual absence of the father since the birth of the child: a dash in the column "father" in the birth certificate or an entry from the words of the mother;

- deprivation of the second parent of parental rights if he does not participate in the maintenance of the child.

But divorced parents are not entitled to a double deduction even in case of non-payment of alimony.

Deduction for a disabled child

If you are raising a child with a disability of the first or second group, then the amount of the tax deduction is higher:

- 12,000 ₽ - if you are a parent, parent's spouse or adoptive parent;

- 6000 ₽ - if you are a guardian, guardian, foster parent, spouse of a foster parent.

Increased and basic deductions are summed up. This means that if your second child is disabled, then the tax deduction for him will be: 1400 + 12,000 = 13,400 ₽.

If a disabled child was born the third or subsequent, then the amount of the deduction for him: 3,000 ₽ + 12,000 ₽ = 15,000 ₽, and the total deduction for three children will be: 1,400 ₽ + 1,400 ₽ + 15,000 ₽ = 17,800 ₽.

How much will I save

The law provides not for the return of the indicated amounts, but for the reduction of the taxable base by these amounts. This means that each parent can save per month:

This means that each parent can save per month:

- per child: 1,400×13% = 182 ₽

- for two children: (1,400 + 1,400) x 13% = 364 ₽

- for three children: (1,400 + 1,400 + 3,000) x 13% = 754 ₽

- for four children: (1,400 + 1,400 + 3,000 + 3,000) x 13% = 1144 ₽

- for the first or second disabled child: (12,000 + 1,400) x 13% = 1,742 ₽

- for a third or subsequent disabled child: (12,000 + 3,000) x 13% = 1,950 ₽

Example.

Evgenia has three children - 11, 8 and 5 years old. Her salary is 40,000 ₽. If she has not filed an application for a tax deduction for children, then the employer calculates personal income tax at 13% of the total amount of income: 40,000 ₽ x 13% = 5,200 ₽, and will pay 34,800 ₽ in her hands.

If Evgenia has submitted an application and documents for a child deduction, then the tax will be calculated not from the entire amount, but minus the tax-free amounts for children:

personal income tax = (40,000 ₽ - 1400 ₽ - 1400 ₽ - 3000 ₽) % = 4446 ₽.

Evgeny will receive 35,554 ₽, which is 754 ₽ more.

How to get a deduction

It's not difficult. Write an application to the employer for a standard tax deduction for children and attach copies of documents for the deduction:

- passport;

- birth or adoption certificate of a child;

- certificate of the child's disability, if necessary;

- certificate from an educational institution stating that the child is a full-time student if the child is a student.

If you are a single parent:

- death certificate of the other parent;

- extract from the court decision on recognizing the other parent as missing;

- certificate of the birth of a child, compiled from the words of the mother at her request in the form No. 25 - Decree of the Government of the Russian Federation of 10/31/1998 No. 1274.

If you are a guardian or guardian:

- decision of the guardianship and guardianship authority or an extract from the decision to establish guardianship or guardianship over the child;

- agreement on the implementation of guardianship or guardianship;

- agreement on foster family.

The deduction can only be made with one employer, even if you work at several jobs at the same time. The application is submitted once. Only a certificate of a child's full-time education at an educational institution is updated annually if he is already 18 years old.

Maximum amount for deduction

The law protects the interests of low-income citizens, therefore, it contains a limitation - the deduction for children is provided until the amount of your income for the current year exceeds 350,000 ₽.

Example.

The amount of 5800 ₽ will be deducted from Evgenia's salary before taxation from January to August inclusive. In August, taxable income for the current year will reach 350,000 ₽, so from September until the end of the year, tax will be calculated on the entire amount. And from the new year, Evgenia will again receive a deduction.[/framegrey]

How to get a deduction back if you didn’t get one

If you didn’t receive your deductions or received them in a smaller amount than you were due, you can return them when you file your tax return with the tax office in your place of residence, but only for the last three of the year.

Submit to the tax authority at the place of residence a completed tax return with an application for a standard tax. At the same time, you need to:

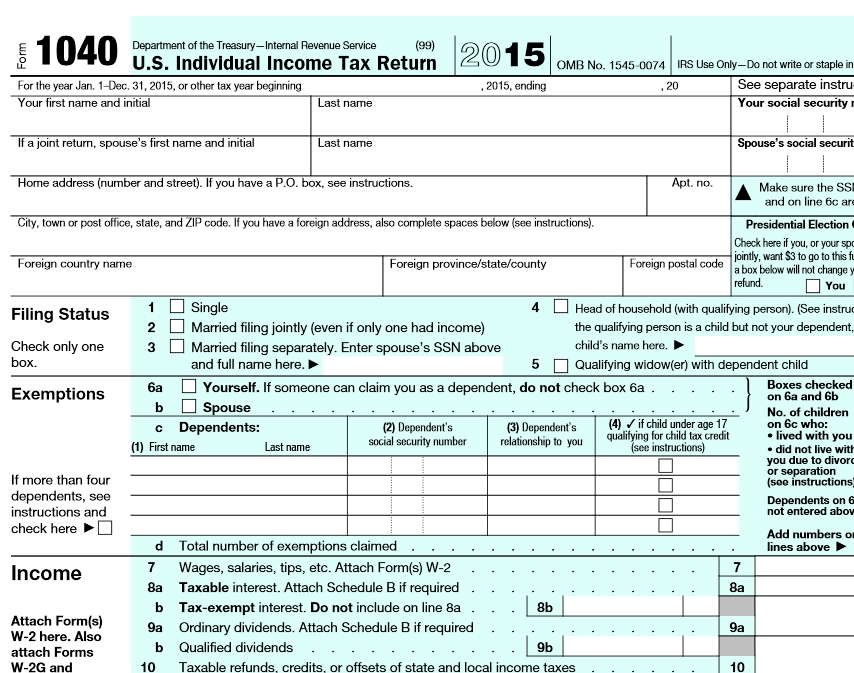

- At the end of the year, fill out a tax return in the form 3-NDFL.

- Obtain a certificate from the accounting department at the place of work on the amounts of accrued and withheld taxes for the required years in the form 2-NDFL.

- Attach copies of documents confirming the right to receive a deduction for children.

A desk audit will take 3 months. If the decision on the application is positive, then the amount of overpaid tax will be returned within a month to the bank account you specified in the application.

Things to remember

- A child tax deduction can be received from birth until the age of 18 or until the age of 24 if the child continues full-time education.

- Adult children for whom you no longer receive a deduction are still counted in the queue.

- You will receive a deduction for children until the amount of income for the current year exceeds 350,000 ₽.

- Each parent is entitled to deductions.

- An application for a deduction is submitted to the accounting department once - next year the deduction will be calculated automatically.

- If you did not receive a deduction for children, then it can be returned when filing a tax return, but only for the last three years.

Personal or joint: division of property upon divorce

Illustration: Pravo.ru/Peter Kozlov

According to family law, what is acquired by spouses in marriage is divided in half. But this does not always happen in practice. For example, a husband bought a plot before marriage, and built a house on it with his wife. Or the spouse sold her apartment and invested in common real estate. In these cases, the court departs from the rule of "equality of shares". You can also lose part of your personal property during a divorce, for example, inherited.

Only since the beginning of the year, 3031 lawsuits on the division of property between spouses have been submitted to the courts. The majority of such disputes were considered by the Moscow City Court (133 cases), a little less cases turned out to be in the proceedings of the authorities of the Stavropol Territory, Bashkiria and the Sverdlovsk Region (according to the Сaselook.ru system for lawyers as of September 17, 2020). The property issue of the ex-spouses had to be resolved by the appellate and cassation instances, problems in practice arise when the courts need to deviate from the general rule "everything in half", and divide the property acquired in marriage in different shares.

Mother's capital is not divided

Couples face difficulties if they partially bought property not at the expense of common funds, says Anna Artamonova, partner at AB EMPP EMPP federal rating. Group Arbitration proceedings (medium and small disputes - mid market) Group Family and inheritance law Group environmental law Group TMT (telecommunications, media and technology) Group Corporate/M&A (high market) Group Criminal law 15th place By revenue per lawyer (less than 30 lawyers) 33rd place By revenue Company Profile For example, they invested maternity capital, such a dispute arose between Irina and Andrey Makarov*. The wife filed a lawsuit against her ex-husband to share an apartment acquired in marriage. They bought the disputed housing on credit, part of it was repaid with matkapital. The court of first instance and the appeal decided that the entire apartment should be divided, but the Supreme Court recalled that in this case it is necessary to determine the shares minus the maternity capital. The Board indicated that the funds of the certificate are not subject to division, since they are not common property, but have a designated purpose (by virtue of paragraph 2 of article 34 of the UK) (case No. 18-KG19-57).

The wife filed a lawsuit against her ex-husband to share an apartment acquired in marriage. They bought the disputed housing on credit, part of it was repaid with matkapital. The court of first instance and the appeal decided that the entire apartment should be divided, but the Supreme Court recalled that in this case it is necessary to determine the shares minus the maternity capital. The Board indicated that the funds of the certificate are not subject to division, since they are not common property, but have a designated purpose (by virtue of paragraph 2 of article 34 of the UK) (case No. 18-KG19-57).

The position of the courts on this issue has been formed, says Anastasia Rastorgueva, senior partner at Barshchevsky and Partners Barshchevsky & Partners federal rating. Group Dispute resolution in courts of general jurisdiction Group Arbitration proceedings (medium and small disputes - mid market) . According to the law, children must be allocated a share, respectively, in case of divorce and division of property, the spouses no longer divide the entire apartment among themselves, but only that part of it that remains after the deduction of the children's share. The "Review of judicial practice in cases related to the implementation of the right to maternity (family) capital" is devoted to this issue. Despite this, the courts of first instance do not always make the "correct" decision. It is up to the higher courts to correct them. For example, in cases No. 2-2841/17 and No. 2-3/2018

According to the law, children must be allocated a share, respectively, in case of divorce and division of property, the spouses no longer divide the entire apartment among themselves, but only that part of it that remains after the deduction of the children's share. The "Review of judicial practice in cases related to the implementation of the right to maternity (family) capital" is devoted to this issue. Despite this, the courts of first instance do not always make the "correct" decision. It is up to the higher courts to correct them. For example, in cases No. 2-2841/17 and No. 2-3/2018

During a divorce, the unused certificate itself is not divided, clarifies Irina Oreshkina lawyer S&K Vertical S&K Vertical federal rating. Group Bankruptcy (including disputes) (mid market) Group Arbitration proceedings (large disputes - high market) Group Dispute resolution in courts of general jurisdiction Group Family and inheritance law Group Private equity 3rd place By revenue per lawyer (more than 30 lawyers) 10th place By revenue 24th place By number of lawyers Company Profile . It remains with the person in whose name it is issued. Usually the mother of the child.

It remains with the person in whose name it is issued. Usually the mother of the child.

"Mortgage" real estate

Not only the property or material values of the spouses are recognized as common, but also obligations, says Svetlana Ivanova from FTL Advisers FTL Advisors federal rating. Group Family and inheritance law Group Compliance Group Corporate/M&A (mid market) Group Private equity Group Tax consulting and disputes (Tax consulting) . For example, a loan spent on family needs. As for the mortgage, Rastorguyeva clarifies, the property, the apartment itself, is divided in the same proportion as the debt for it (this principle contains paragraph 3 of article 39SC).

If one of the spouses proves that he made the majority of the loan from personal funds, the court may increase his share in the apartment and, accordingly, reduce the amount of the debt. By the same principle, you can get the whole apartment, as happened in case No. 2-809/2016. Alina and Oleg Kataev* took out a mortgage to buy an apartment. But it was paid both in marriage and after its dissolution only by the spouse. She asked the court to transfer the disputed property to her ownership, while providing receipts for the payment of monthly payments as evidence. The fact that the mortgage debt was extinguished only by the spouse was confirmed by the husband. The Leninsky District Court of Tomsk satisfied Kataeva's claim, the parties did not appeal the decision.

According to Rastorguyeva, if the former spouse can still count on most or all of the mortgage apartment, then it will not be possible to recover (if only one of the partners pays off the mortgage) the amount paid from the ex-husband or wife - the courts will consider that the payment was made from common funds. At the same time, Artamonova says, there are no legal mechanisms to force the former spouse-co-borrower to pay half of the monthly mortgage payment. A good way of financial protection in this case is a prenuptial agreement. It may concern exclusively the procedure for paying a mortgage and distributing real estate between owners after the loan is repaid or in the event of a divorce. For example, it is possible to link the size of shares in real estate in proportion to the amount of funds paid to the bank after the termination of the marriage by each of the spouses, the expert concluded.

At the same time, Artamonova says, there are no legal mechanisms to force the former spouse-co-borrower to pay half of the monthly mortgage payment. A good way of financial protection in this case is a prenuptial agreement. It may concern exclusively the procedure for paying a mortgage and distributing real estate between owners after the loan is repaid or in the event of a divorce. For example, it is possible to link the size of shares in real estate in proportion to the amount of funds paid to the bank after the termination of the marriage by each of the spouses, the expert concluded.

Inherited

Property that one of the spouses inherited is not subject to division (according to paragraph 1 of article 36 of the UK), but there is an exception to this rule: if it was improved at the expense of common funds. This is stated in Art. 37 SC. At the same time, Ivanova clarifies, the courts take into account not the amount of investments, but the increase in the value of this property. But this needs to be proven.

But this needs to be proven.

Case No. 11-6249/2013 illustrates the situation. Throughout their life together, the couple made several repairs in the apartment, which the husband inherited. This helped raise the price of real estate, the ex-wife considered. But the court did not take her side: “There is no evidence that investments increased the value of the property, which means that it cannot be recognized as joint property.” A similar position was taken by the Naro-Fominsk City Court of the Moscow Region in case No. 2-3835/2019he pointed out that the price of the house would increase significantly if there was a major overhaul or other significant reorganization of the object. In both disputes, the plaintiffs failed to prove the increase in the value of the property - the courts decided so.

The practice of recognizing inherited property as joint property is rather disappointing. Basically, the courts refuse due to lack of evidence of material investments or a significant increase in cost.

Svetlana Ivanova, FTL Advisers lawyer FTL Advisors federal rating. Group Family and inheritance law Group Compliance Group Corporate/M&A (mid market) Group Private equity Group Tax consulting and disputes (Tax consulting)

Premarital assets

The property that belonged to each of the spouses before marriage is his property (according to Article 36 of the UK). It would seem that everything is easy, says Alina Laktionova, lawyer YuK Mitra Miter Regional ranking. Group Bankruptcy (including disputes) Group Tax advice and disputes Group Land law/Commercial real estate/Construction , but in practice the application of the article causes difficulties.

A difficult situation is if one of the spouses bought a plot before marriage, and after that, together with his wife or husband, he built a house on it. This happened in case No. 2-1408/2018) Alan Burangulov* bought a small rural house before the wedding. Then they tore it down and built a new one. Having married, they, together with his wife, continued the reconstruction, as a result, the area of \u200b\u200bthe building increased several times. The court of first instance considered that the disputed property was his personal property and was not subject to division upon divorce. The appeal, on the contrary, decided to divide everything equally. The case reached the Supreme Court, which took a different position: it is necessary to assess the value of the house before Safiullin entered into marriage and, in accordance with this, divide the shares of the parties. At the same time, the issue of dividing the house, and not the plot that remained to the spouse, was resolved in the case. In this case, according to Artamonova, the land will remain with the original owner, since it is a personal asset. But the buildings should be divided between the spouses.

In this case, according to Artamonova, the land will remain with the original owner, since it is a personal asset. But the buildings should be divided between the spouses.

Another thing, says Artamonova, is if the plot is received by one of the spouses free of charge, from the local government, that is, transferred to unlimited use. It is not equated to a gratuitous transaction in the sense of Art. 36 SC. Therefore, the free transfer of a land plot is not a basis for classifying it as personal property, the Supreme Court came to this conclusion in case No. As it was in case No. 2-456/2018. The wife sold the “premarital” apartment, and 5 days later she paid for the equity participation agreement in the new facility. The housing bought with her money cannot be considered common, concluded the collegium for civil affairs of the Armed Forces.

Another similar dispute reached the Constitutional Court. The husband bought the apartment before marriage, but it had an encumbrance - the obligation of life maintenance with a dependent. After the divorce, the husband tried through the court to admit that the ex-wife had lost the right to use the living quarters. But she did not agree with this and filed a counterclaim. In it, she asked to divide the disputed apartment in half. She argued this by the fact that they paid the payments under the life maintenance agreement with a dependent together. The situation is not standard, there is no direct regulation. The courts of lower instances refused the ex-wife. Then she turned to the CC. He regarded the obligations of the spouse, fulfilled at the expense of common funds, as unjust enrichment at the expense of the second spouse (No. 352-O-O).

After the divorce, the husband tried through the court to admit that the ex-wife had lost the right to use the living quarters. But she did not agree with this and filed a counterclaim. In it, she asked to divide the disputed apartment in half. She argued this by the fact that they paid the payments under the life maintenance agreement with a dependent together. The situation is not standard, there is no direct regulation. The courts of lower instances refused the ex-wife. Then she turned to the CC. He regarded the obligations of the spouse, fulfilled at the expense of common funds, as unjust enrichment at the expense of the second spouse (No. 352-O-O).

Unfortunately, despite the decision of the Constitutional Court, the practice is negative and the second spouse, who bears the burden of fulfilling obligations jointly, often does not have the right to compensation in proportion to his share in the common property of the spouses. Which doesn't seem fair to me.

Alina Laktionova, lawyer YUK Mitra Miter Regional ranking. Group Bankruptcy (including disputes) Group Tax advice and disputes Group Land law/Commercial real estate/Construction

Group Bankruptcy (including disputes) Group Tax advice and disputes Group Land law/Commercial real estate/Construction

Experts: SK is outdated

According to Artamonova, the Family Code, adopted back in 1995, is outdated and does not sufficiently regulate the property relations of spouses in modern realities. Therefore, the expert believes, a lot of questions arise when dividing property. Including when jointly acquired is not divided equally. The law indicates that the court may release from equality of shares (clause 2, article 39 of the UK), but does not determine the situations when this is possible.

In order to eliminate gaps and update the norms, amendments have been made to the State Duma to simplify the division of property. While the bill is under consideration and approved by the State Duma in the first reading.

While the bill is under consideration and approved by the State Duma in the first reading.

The initiative was initiated by Pavel Krasheninnikov, Chairman of the State Duma Committee on State Building and Legislation, and Tamara Pletneva, Head of the Committee on Family Affairs of the Lower House of Parliament.

The main change is that the Family Code proposes to consolidate the concept of common property of spouses, that is, everything acquired in marriage will be considered as a whole complex (both property and debts). Now, according to the initiators, the same spouses file several lawsuits for the division of property. When, within the framework of one case, shares in real estate are established, and after a while in another, the found assets or the alienated car.

Alexandra Stirmanova lawyer ABS&K Vertical S&K Vertical federal rating. Group Bankruptcy (including disputes) (mid market) Group Arbitration proceedings (large disputes - high market) Group Dispute resolution in courts of general jurisdiction Group Family and inheritance law Group Private equity 3rd place By revenue per lawyer (more than 30 lawyers) 10th place By revenue 24th place By number of lawyers Company Profile believes that the court in this case will need to take an active position in identifying the property, which means that the time for considering the case in connection with this may increase. Another question, the expert continues, is that if one of the spouses found out about the presence of other property acquired during the marriage, after the consideration of the case on the division of property? Obviously, changes should take into account the existence of such situations.

Another question, the expert continues, is that if one of the spouses found out about the presence of other property acquired during the marriage, after the consideration of the case on the division of property? Obviously, changes should take into account the existence of such situations.

Another change concerns paragraph 2 of Art. 34 of the UK, they plan to remove the phrase "acquired at the expense of general income" from it. This will give the norm a broader meaning.

Rastorguyeva is wary of this change. According to her, if the amendments are adopted, then the sold personal property and those bought with this money already in marriage will be recognized as "common". Now it is considered personal.

The State Duma is still planning to deal with the issue in October, and perhaps a completely different document will come out. So far, experts generally support it. “It [the bill] will have a positive effect on law enforcement practice and, obviously, will reduce the number of disputes,” Stirmanova concluded.