How much is the standard deduction for a child

How Children Affect Your Taxes

Taxes

6 Min Read | Feb 17, 2022

By Ramsey Solutions

By Ramsey Solutions

Children are a blessing. Even when they test you (looking at you, threenagers and teenagers), you wouldn’t trade them for anything.

You know what else kids are? Expensive. From buying thousands of diapers to saving for college, it all adds up. And fast.

Even Uncle Sam knows how expensive raising kids can be. That’s why parents are eligible for a slew of tax breaks. But you have to pay close attention—the 2017 tax reform bill made some changes to how your dependents impact your taxes. Let’s take a look.

1. Child Tax Credit

In the new, tax-reform world, the Child Tax Credit is now $2,000 per child under the age of 17—with an income limit of $400,000 for married couples ($200,000 for individuals).1

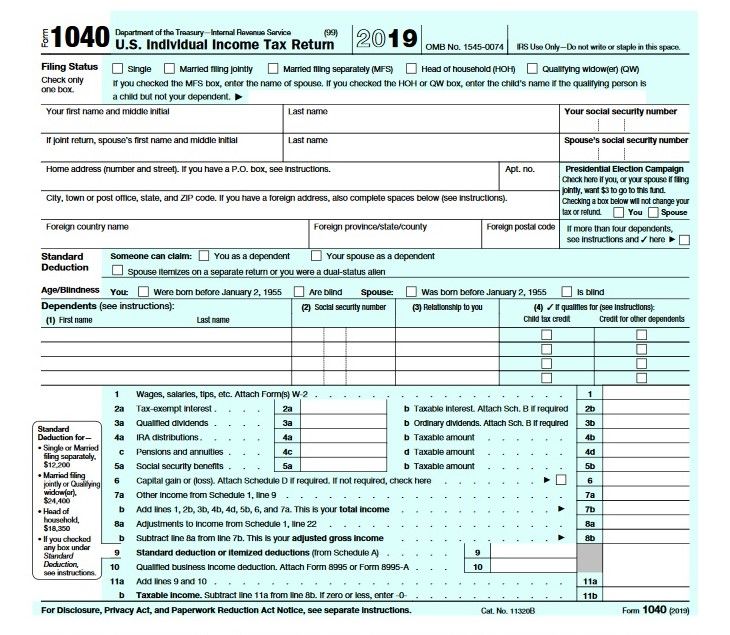

Here’s how the tax credit works. Let’s say you have a family of four: Mom and Dad and their two kids, Kenny and Jenny. Together, Mom and Dad bring home $100,000 and they plan to take the standard deduction.

Taxes shouldn’t be this complicated. Connect with a RamseyTrusted tax advisor.

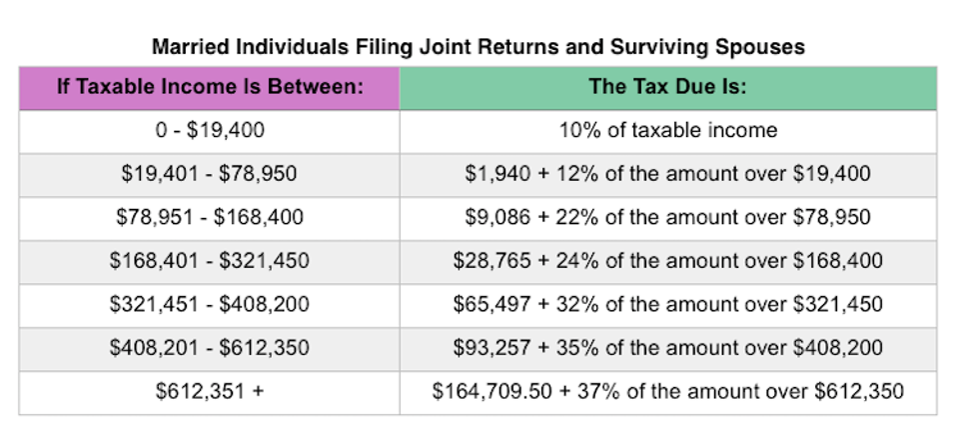

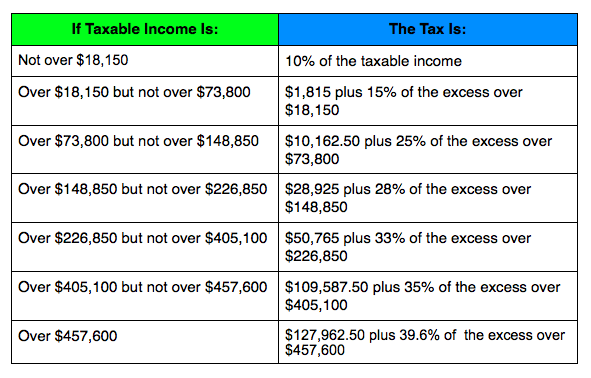

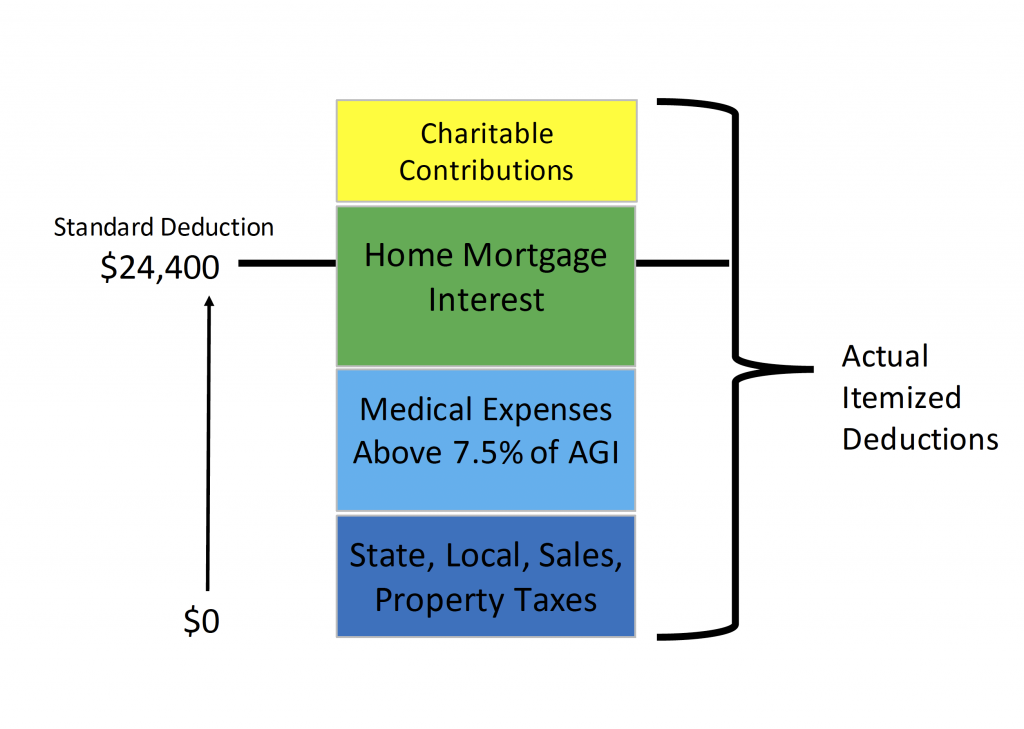

They would get the standard deduction of $24,800, which would make their adjusted gross income $75,200 ($100,000 - $24,800 = $75,200). Based on fancy tax bracket stuff, their tax for that income level is about $8,600.2 So, applying the $4,000 Child Tax Credit ($2,000 apiece for Kenny and Jenny) would bring down how much tax they have to pay to around $4,600.

Pretty sweet, right?

In the new, tax-reform world, the Child Tax Credit is now $2,000 per child under the age of 17—with an income limit of $400,000 for married couples ($200,000 for individuals).

2. Adoption Credit and Exclusions

If you adopted a child this year, congratulations on your new addition! Not only did your family grow, there’s also a good chance you’re eligible for the Adoption Credit. This credit covers up to $14,300 of your expenses per adopted child.3 According to the IRS, qualified adoption expenses include:

This credit covers up to $14,300 of your expenses per adopted child.3 According to the IRS, qualified adoption expenses include:

If the credit is larger than your tax bill, you may not get the whole amount back this year. But you can use the remainder on your future tax bills for up to five years.

Also, if your employer provides adoption assistance, you can exclude that amount from your income up to the $14,300 amount. Here’s the thing though—you can’t claim the credit and the exclusion for the same expenses. You can, however, combine both the exclusion and the credit to get the entire $14,300.4

The Adoption Credit covers up to $14,080 of your expenses per adopted child.

Here’s how this works. You spend $10,000 on adoption expenses to bring home your beautiful new bundle of joy. Your employer has a really great adoption assistance program and kicks in $4,000. You exclude the $4,000 from your income. Now, you subtract $4,000 from the overall $10,000 that you would have used on the tax credit, leaving you a maximum $6,000 Adoption Credit ($10,000 - $4,000 = $6,000). And don’t forget to add the Child Tax Credit and any childcare expenses now that you’re a parent!

Now, you subtract $4,000 from the overall $10,000 that you would have used on the tax credit, leaving you a maximum $6,000 Adoption Credit ($10,000 - $4,000 = $6,000). And don’t forget to add the Child Tax Credit and any childcare expenses now that you’re a parent!

Remember, there is an income limit for the Adoption Credit or the exclusion. If you make less than $214,520, you’re eligible for the full amount. You qualify for a reduced amount between $214,520 and $254,520, and it’s eliminated completely at $254,520 and up.5

3. Child and Dependent Care Credit

Did you pay someone to care for your child so you could work or look for a job? You could qualify for the Child and Dependent Care Credit! This credit can help you claim 20–35% (depending on your taxable income) of some of your childcare costs—up to $3,000 for one child (under the age of 13) or up to $6,000 for two or more.6

Let’s say you have one kid, and last year you spent $2,500 on childcare and your taxable income was $50,000. Based on your income, you’d be eligible to claim 20% of those costs, leaving you with a pretty nice $500 tax credit. That’s more than chump change!

Based on your income, you’d be eligible to claim 20% of those costs, leaving you with a pretty nice $500 tax credit. That’s more than chump change!

The Child Care Credit can help you claim 20–35% (depending on your taxable income) of some of your childcare costs—up to $3,000 for one child or up to $6,000 for two or more.

Qualifying childcare expenses include more than just day care. Don’t forget about nanny services, after-school care and summer day camps! Just make sure you have the name, address and taxpayer identification number for each care provider you’ve used.

4. Single Parent Filing As Head of Household

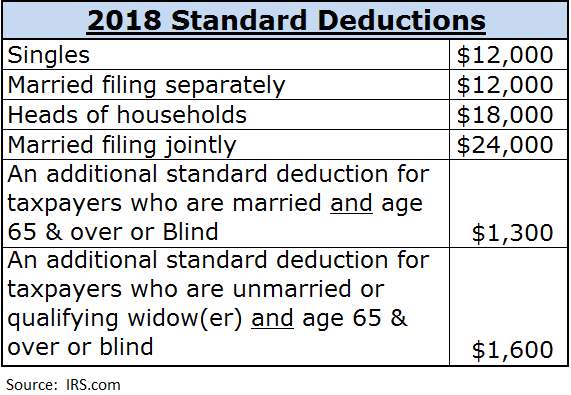

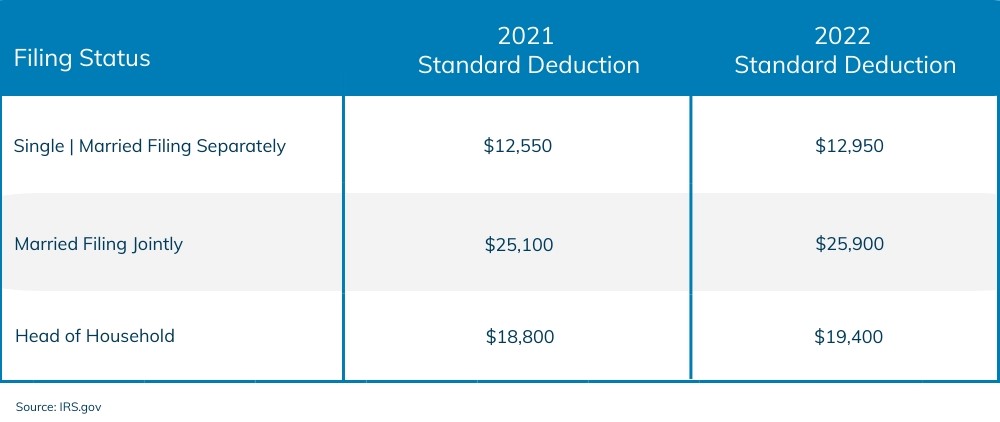

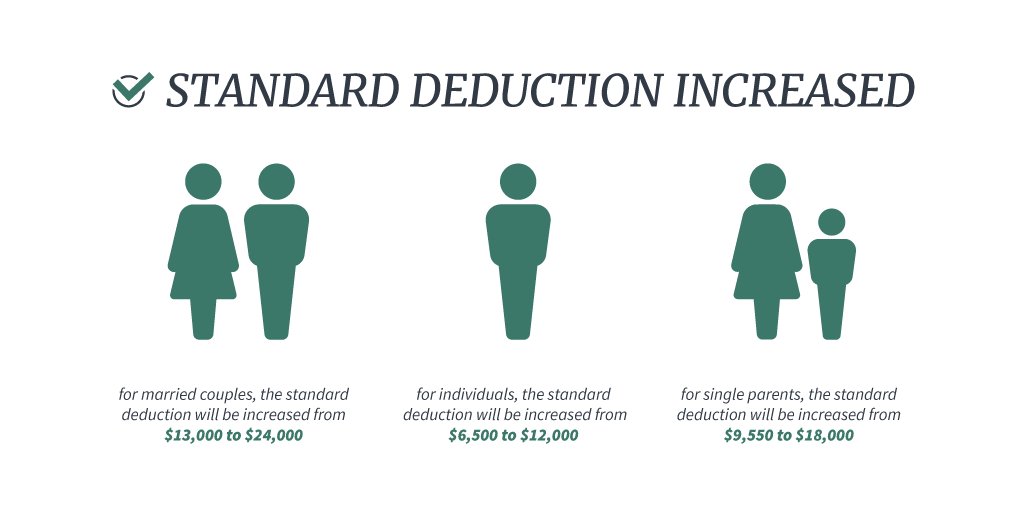

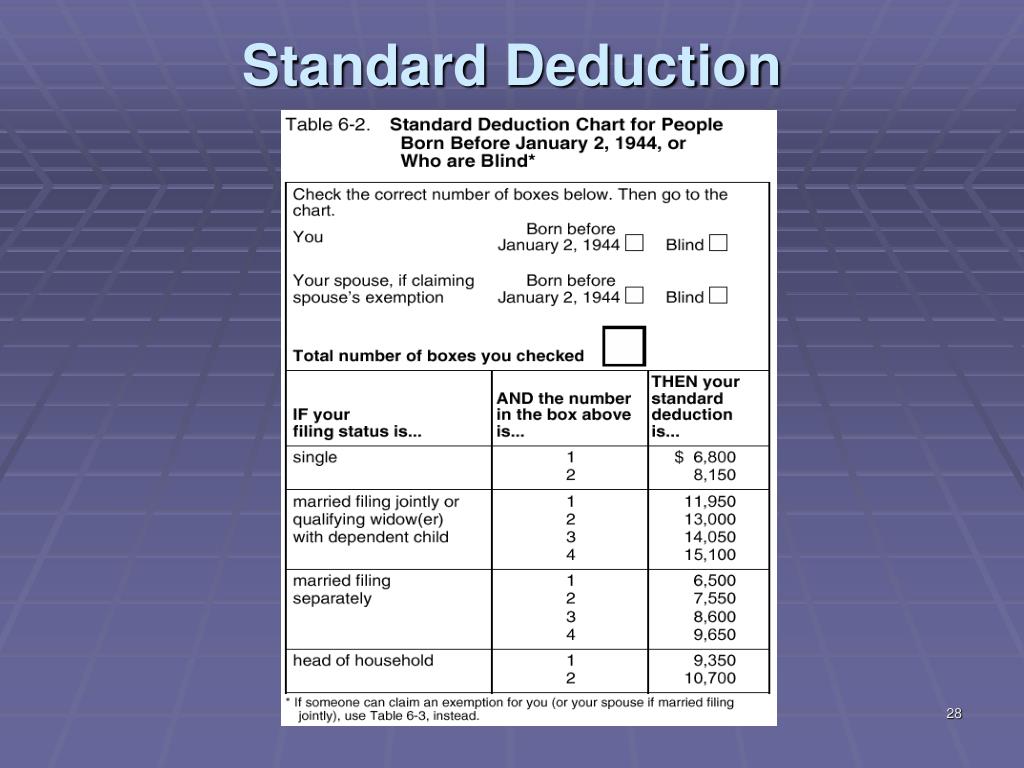

If you’re a single parent, in most cases you can file as head of household. Not only could that lower your tax rate, it also allows you to take a higher standard deduction. For example, if you file as head of household in 2020, your standard deduction will be $18,650, compared to just $12,400 for a single person. 7 That’s a whopping $6,250 difference!

7 That’s a whopping $6,250 difference!

If you’re a single parent, in most cases you can file as head of household. If you file as head of household, your standard deduction will be $18,350, compared to just $12,200 for a single person.

5. American Opportunity Tax Credit

Got kids in college? Help them stay out of student debt and catch a break on your taxes with the American Opportunity Tax Credit (AOTC). The credit applies to any qualified education expenses, such as:

-

Tuition

-

School fees

-

Required textbooks

The credit covers 100% of education expenses up to $2,000 and 25% of the next $2,000 after that. For all you math majors out there, that means you could get a maximum credit of $2,500. There is an income limit of $160,000 for married couples, and above that it starts to phase out. Once you make more than $180,000 you can’t claim the credit.8

Once you make more than $180,000 you can’t claim the credit.8

6. Tax Advantaged College Savings

While we’re talking college, did you know there are certain types of college savings programs that are tax exempt? That’s right, you can save for your kids’ college tax-free with an Education Savings Account (ESA) or a 529 plan!

Before you start saving up that college fund, though, we recommend you do the following:

-

Make sure you’re out of debt (a 15-year fixed-rate mortgage is okay).

-

Have an emergency fund of three to six months’ worth of expenses.

-

Contribute 15% of your income toward retirement savings.

If you’re ready to take the first step toward saving for your kids’ education, get in touch with one of our SmartVestor Pros to get started.

Don’t Miss Out on Tax Savings

If you’re confident you can handle your own taxes and just want easy-to-use tax software, check out Ramsey SmartTax—we make filing your taxes easy and affordable.

But if you’d rather not squeeze doing your own taxes into an already jam-packed schedule, try one of our tax Endorsed Local Providers (ELPs). We only accept certified public accountants (CPAs) and enrolled agents (EAs) who are experts on taxes. Working with a pro gives you confidence that you’ve done your taxes correctly and taken advantage of all of the savings you’ve earned.

Find your tax pro today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

File Your Taxes With a Trusted Pro

Connect With a ProFile Your Taxes With a Trusted Pro

Need help with your taxes year-round? RamseyTrusted tax pros can help.

Connect With a Pro

File Your Taxes With a Trusted Pro

Need help with your taxes year-round? RamseyTrusted tax pros can help.

Connect With a Pro

Tax Deductions and Credits For Parents With Dependent Kids

Your kids can be beneficial at tax time; that doesn't mean they'll sort your tax receipts or refill your coffee, but those charming children may help you qualify for some valuable tax benefits. The IRS defines a dependent as a qualifying child or qualifying relative. In most cases, a child can be claimed as a dependent in the year they were born or adopted.

The easiest and most accurate way to find out who you can claim as a dependent on your tax return and what tax credits and deductions you qualify for is to start a free tax return on eFile.com. Based on your answers to the tax questions, we will determine whether or not you can claim the person as a dependent and find all the tax deductions and credits you qualify for so you don't have to do the work!

Dependent Credits on your Tax Return

Below, find the tax credits that your dependent may qualify you for. These are calculated on your return, not your dependent's return, if you claim them. You receive these credits to offset your tax liability (or taxes owed) and potentially receive the refundable portion back as a tax refund.

These are calculated on your return, not your dependent's return, if you claim them. You receive these credits to offset your tax liability (or taxes owed) and potentially receive the refundable portion back as a tax refund.

Child Tax Credit Advance Payment and Amounts

Important: The Enhanced Child Tax Credit for 2021 went through some changes to help parents get some extra help for raising children. This includes an increased credit amount, age threshold change, and the removal of the minimum earned income requirement. Here are the particulars:

The Advance Child Tax Credit for 2021 or AdvCTC, as part of the American Rescue Plan Act, is a refundable tax credit. It is an advance payment of a tax credit you qualify for on your 2021 tax return due on Tax Day, April 18, 2022.

- The tax credit amounts will increase for many qualifying taxpayers, giving parents or guardians up to $3,600 per child.

- Unlike the regular Child Tax Credit, there is no 2021 taxable income requirement to be eligible to claim the advance child tax credit.

The advance Child Tax Credit for qualifying children is a fully refundable credit. As a U.S. Citizen with a U.S. address for at least half of 2021, you could benefit from the credit even if you do not owe taxes or have earned income.

The advance Child Tax Credit for qualifying children is a fully refundable credit. As a U.S. Citizen with a U.S. address for at least half of 2021, you could benefit from the credit even if you do not owe taxes or have earned income. - Qualified recipients will have the option to receive monthly direct payments as part of the Child Tax Credit from the IRS during 2021 before filing your 2021 Tax Return in 2022.

- These advance payments will not be reduced or offset for overdue taxes or other federal/state debts that taxpayers or their spouses owe, but it is not exempt from garnishment. It may, however, be subject to offset for tax debts if/when claimed on the 2021 return as a tax refund.

You may be able to get a Child Tax Credit for each of your qualifying children under age 18. This partially-refundable credit is intended to offset the cost of raising children. The maximum amount you can get for each child is $3,000 per child for children over the age of six and $3,600 for children under the age of six for Tax Year 2021. If you do not benefit from the full amount of the Child Tax Credit (because the credit is greater than the amount of income taxes you owe for the year), you may be eligible for the refundable tax credit known as the Additional Child Tax Credit.

If you do not benefit from the full amount of the Child Tax Credit (because the credit is greater than the amount of income taxes you owe for the year), you may be eligible for the refundable tax credit known as the Additional Child Tax Credit.

eFile Tax Tip: Use our FREE "CHILDucator" Child Tax Credit tax tool to find out whether or not you qualify to claim the Child Tax Credit on your tax return.

Credit for Other Dependents

Dependents who do not qualify for the Child Tax Credit may still qualify you for the Credit for Other Dependents. This is a non-refundable tax credit up to $500 per qualifying person. The qualifying dependent must be a U.S. citizen, U.S. national, or U.S. resident alien.

eFile Tax Tip: Use our FREE "RELucator" qualifying relative educator tool to find out whether or not you qualify to claim the Credit for Other Dependents on your tax return.

Child and Dependent Care Tax Credit

You may be able to claim the non-refundable Child and Dependent Care Credit if you pay someone to care for your child or children under age 13 so that you can work or look for work. For 2021 Returns, the American Rescue Plan Act made the credit substantially more generous, up to $4,000 for some or all of the expenses you paid to the care provider for one qualifying person and $8,000 for two or more qualifying person, and potentially refundable, so you might not have to owe taxes to claim the credit (so long as you meet the other requirements). The credit is based on your yearly income and the number of children.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a fully refundable tax credit for low-income people who work and have earned income from wages, self-employment, or farming. The EITC reduces the amount of tax you owe and may also give you a tax refund. If you have one or more dependent, you will see a higher amount with each dependent based on your income.

If you have one or more dependent, you will see a higher amount with each dependent based on your income.

Important: The 2021 EIC went through some changes to give single taxpayers with no dependents a more beneficial credit.

eFile Tax Tip: Use our FREE "EICucator" Earned Income Tax Credit tax tool to find out whether or not you qualify to claim the EIC credit on your tax return and how much your credit might be.

Adoption Tax Credit

You may be able to take the non-refundable Adoption Tax Credit for qualifying expenses you paid to adopt a child. The maximum adoption credit for 2021 returns is $14,440 per child. These expenses include adoption fees, attorney fees, court costs, traveling expenses (including lodging and meals while away from home), and other expenses directly related to the adoption. When you prepare and e-File your tax return on eFile.com, you can enter your adoption expenses and we will automatically prepare and report your Adoption Tax Credit on Form 8839 - eFileIT - and it will be e-Filed with your return. If you are claiming the Adoption Credit and need to include adoption-related documents, you can print your return from your eFile.com account mail it in with your documents.

If you are claiming the Adoption Credit and need to include adoption-related documents, you can print your return from your eFile.com account mail it in with your documents.

American Opportunity Education Credit

Unfortunately, there are not many credits or deductions for older dependents, such as college students. If you claim your dependent child under 24 who is enrolled full-time in school, you are eligible for one of a few options. These are tax credits that, if your student dependent does not claim on their own, are claimable on your tax return.

You can claim the American Opportunity Credit if your child is in his or her first four years of post-secondary school. The maximum amount you can claim is $2,500 per eligible student, per year, and the credit is 40% refundable. This is the most beneficial credit for education expenses and can help offset the many costs of attending hire education. The credit is calculated for you on eFile. com and the refundable portion is included in your tax refund.

com and the refundable portion is included in your tax refund.

Lifetime Learning Education Credit

If your dependent doesn't qualify for the American Opportunity Credit because he or she already completed four years of post-secondary school, you may be able to claim the Lifetime Learning Credit. The amount of the credit is 20% of the first $10,000 of combined post-secondary tuition and fees you paid for your dependent child and is non-refundable. The per year (not per child) total should be no more than $2,000. Though you cannot claim both education tax credits for one student, you can claim one of the credits for one student and the other credit for another student.

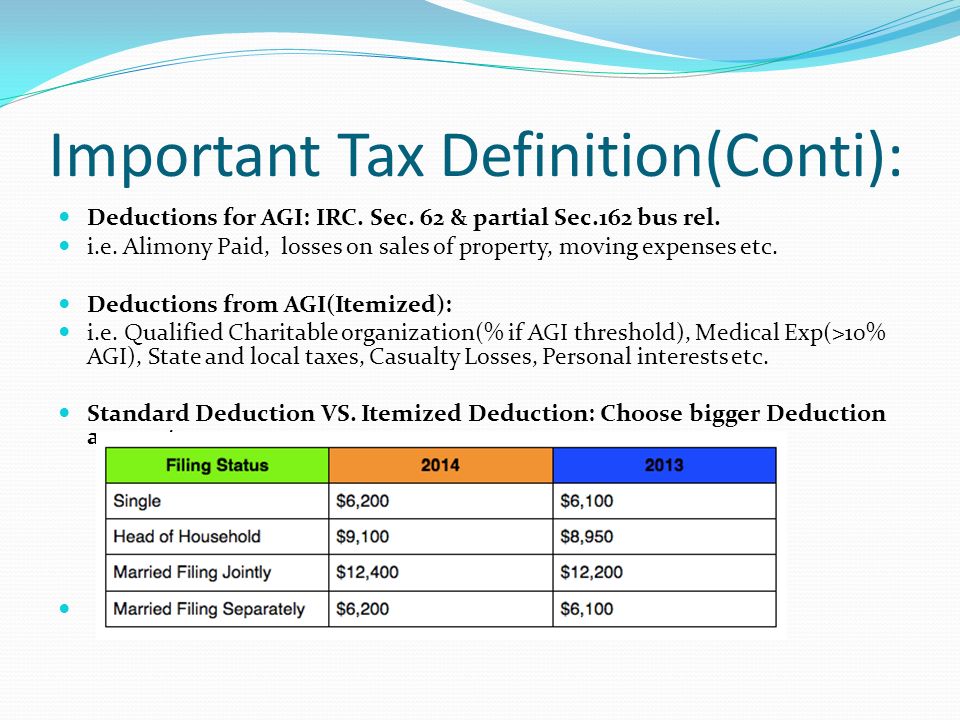

Tax Deductions to Claim with Dependents

Tax deductions work differently than tax credits. They both, however, serve to lower your tax liability and increase your refund. When you prepare and e-file your return on eFile.com, we will find all the deductions you may be able to claim on your return when you claim one or more qualified dependent.

Student Loan Interest Education Tax Deduction

You may be able to claim the Student Loan Interest Deduction for interest paid on a qualified student loan, even if you choose to claim a student tax credit. If you decide to claim the deduction, you could reduce your taxable income by up to $2,500 of the student loan interest you have paid for your dependent child. You don't need to itemize your deductions to claim this.

Tuition and Fees Education Deduction

Based on your tax information, eFile.com will let you know if the Tuition and Fees Deduction is more beneficial than claiming one of the other education tax credits. Generally, the credits tend to show better results, but the deduction may be used if it decreases your tax liability and/or increases your refund. This deduction applies for single taxpayers with an Adjusted Gross Income (AGI) or $80,000 or less and $160,000 or less for taxpayers filing jointly.

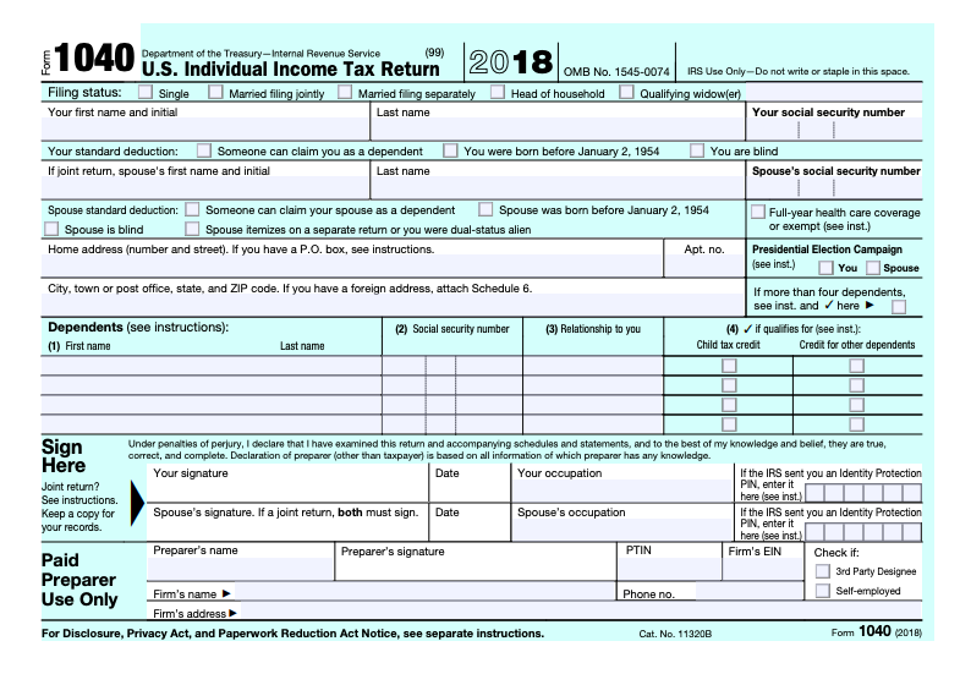

Standard Deduction and Head of Household

The single or Head of Household (HOH) filing status on your tax return has a direct impact on the standard deduction amount you will be eligible for. You do not have to worry about the amount as it will be applied based on your filing status by the eFile.com tax app when you prepare and eFile your taxes.

eFile Tax Tip: Use our FREE "HOHucator" Head Of Household tax tool to find out whether or not you qualify as Head of Household as a single taxpayer.

Dependent Income

Keep in mind that even though you might claim a dependent on your tax return, you do not claim any income they earned from working. If your dependent has income, they may be required to file a tax return. If this is the case, you may not be able to claim the person as a dependent based on various factors:

- Total earned income

- Filing status

- Age, AND

- Amount of support you have provided for your dependent during the tax year.

However, you might be able claim the person as an IRS Qualifying Relative based on the factors above (limits and qualifications vary).

See how a dependent files a tax return.

Dependent Investment Income

However, according to the IRS, you may be able to qualify to include your dependent's investment income on your tax return. Your dependent will not be required to file a return if you choose to do this. You can do this if you meet the following conditions:

- Dependent was under 19 years old (or under 24 years old if he or she was a full-time student) at the end of the tax year.

- Dependent total gross income was less than $10,000.

- Dependent income is only from dividends and interest (includes capital gains distributions and Alaska Permanent Fund dividends.

- Dependent didn't file a joint return for the tax year.

- Your child is required to file a return (unless you qualify to include the child's income on your return).

- No federal income tax was withheld from your dependent's income under the backup withholding rules.

- No estimated tax payment was made for the year and no overpayment from the previous year (or from any amended return) was applied to the current tax year under your dependent's name and Social Security Number.

- You are the parent whose tax return must be used when applying the special tax rules for children.

To apply for the election to include your child's investment income on your tax return, when you prepare your return on eFile.com, you can complete Form 8814, Parents' Election To Report Child's Interest and Dividends, and eFileIT with your return. Please note that if you choose to include your child's investment income on your tax return, your tax rate may increase (in comparison to filing a separate return for your child) and you cannot claim certain deductions (such as itemized deductions).

However, under certain circumstances, a child’s investment income may be taxed at your tax rate (as a parent) if all the following factors apply:

- Your child’s investment income was more than $2,200 for the entire tax year,

- Your child is required to file a tax return,

- Your child was either:

- Under 18 years of age at the end of the year,

- Under 18 years of age at the end of the year and didn't have earned income that was more than half of his or her support, OR

- A full-time student over the age of 18 and under 24 years of age at the end of the tax year and did not have earned income that was more than half of his or her support.

- At least one of the child’s parents was alive at the end of the year, AND

- The child didn't file a joint return for the tax year.

If all of the factors above apply to the child with investment income and you don't or can't choose to include the income on your return, Form 8615, Tax for Certain Children Who Have Investment Income of More Than $2,200 - eFileIT - must be completed and attached to your child's tax return.

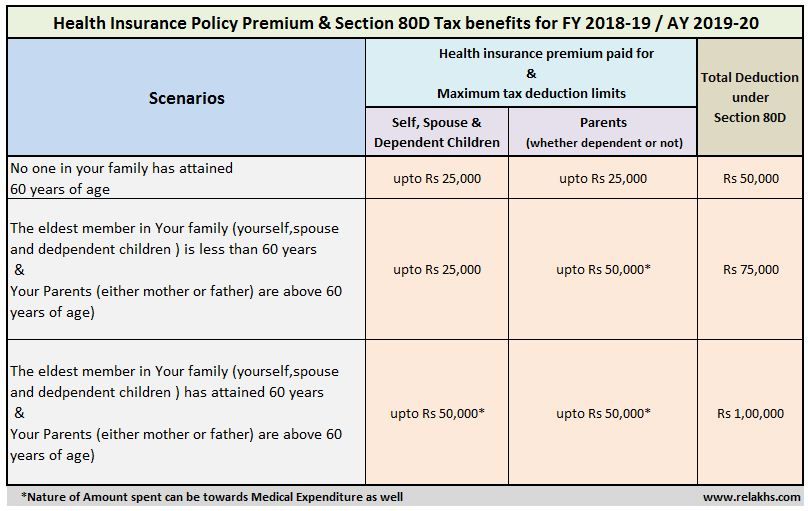

Health Insurance Deduction for Children of Self-Employed Individuals

If you were self-employed (for example, a sole proprietor or an independent contractor) and you paid for health insurance, you may be able to deduct any premiums you paid for coverage for any child of yours who was under age 27 at the end of the year, even if the child was not your dependent.

In order to qualify for the deduction, one of the following statements must apply to you:

- You were self-employed and had a net profit for the tax year reported on Schedule C (Profit or Loss From Business) or Schedule F (Profit or Loss From Farming).

- You were a partner with net earnings from self-employment for the tax year reported on Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.), in box 14, code A. This schedule is for Form 1065 (U.S. Return of Partnership Income).

- You used one of the optional methods to figure your net earnings from self-employment on Schedule SE (Self-Employment Tax).

- You received wages from an S corporation in which you were a more-than-2% shareholder (Health insurance premiums paid or reimbursed by the S corporation are shown as wages on Form W-2, Wage and Tax Statement).

The insurance plan must be established under your business. Alternatively, it could be considered for establishment, as discussed in the following statements:

- If you are a self-employed individual filing a eFileIT Schedule C or F, a policy can be either in the name of the business or in your name.

- For partners, a policy can be either in the partnership's name or the partner's name.

You can either pay the premiums yourself or your partnership can pay them and report the amounts on eFileIT Schedule K-1 (for Form 1065) as guaranteed payments to be included in your total gross income. However, if the policy is in your name and you paid the premiums yourself, the partnership must reimburse you and report the premium amounts on Schedule K-1 (Form 1065) as guaranteed payments to be included in your total gross income. Otherwise, the insurance plan will not be considered to be established under your business.

You can either pay the premiums yourself or your partnership can pay them and report the amounts on eFileIT Schedule K-1 (for Form 1065) as guaranteed payments to be included in your total gross income. However, if the policy is in your name and you paid the premiums yourself, the partnership must reimburse you and report the premium amounts on Schedule K-1 (Form 1065) as guaranteed payments to be included in your total gross income. Otherwise, the insurance plan will not be considered to be established under your business. - For more-than-2% shareholders, a policy can be either in the S corporation's name or in the shareholder's name. You can either pay the premiums yourself or your S corporation can pay them and report the amounts on a Form W-2 as wages to be included in your total income. However, if the policy is in your name and you paid the premiums yourself, the S corporation must reimburse you and report the amounts on a Form W-2 as wages to be included in your total income.

Otherwise, the insurance plan will not be considered to be established under your business.

Otherwise, the insurance plan will not be considered to be established under your business.

Medicare premiums you voluntarily paid to obtain insurance in your name that is similar to qualifying private health insurance can be used to figure the self-employed health insurance deduction. If you previously filed returns without using Medicare premiums to figure the deduction, you can file tax amendments to redo the deduction. However, amounts paid for health insurance coverage from retirement plan distributions that were nontaxable because you are a retired public safety officer cannot be used to figure the deduction.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Schedule of payment of child benefits in November 2022 from the Pension Fund and Social Security

work). Recall that the majority of PFR social payments in all regions of Russia are now provided according to a single regulation, and most recipients of child benefits are transferred on the same day - the 3rd day of each month (a single payment day from the PFR).

Recall that the majority of PFR social payments in all regions of Russia are now provided according to a single regulation, and most recipients of child benefits are transferred on the same day - the 3rd day of each month (a single payment day from the PFR).

Thus, the non-working holiday on November 4 (National Unity Day) for most families will not affect the timing of receiving monthly payments from the Pension Fund. In other cases, if the date of receipt of some benefit according to the established schedule falls on the 4th day, it must be transferred ahead of schedule .

Attention!

❗ Subscribe to our channel "Child Benefits" in Telegram to always know what payments and benefits you are entitled to. Subscribe >>>

When will payments from 8 to 17 years and other benefits from the PFR come in November 2022

cards are delivered once a month on the 3rd day of , and through the postal service delivery of funds occurs according to the established schedule from the 1st to the 25th day of the month .

At the same time, monthly payments from maternity capital for children under 3 years old are made according to a separate schedule - they are transferred by until the 26th of , while the date of funding in different regions of may differ .

Taking into account this schedule, the November 4 holiday may affect the timing of the receipt of monthly payments to families with children from the PFR only in two cases - if these benefits are delivered to the family through post offices or if we are talking about monthly payments from maternity capital, while the date of receipt of these benefits falls on the 4th of . In such cases, the payment for the holiday on November 4, will be made ahead of schedule - on the previous business day.

In all other cases, payments for children from the Pension Fund must be transferred within the usual time frame according to the approved schedule. In this case, you should expect the transfer of money before the end of the corresponding day. If payments did not arrive on the set day , the next day you can contact the PFR hotline in your region for clarification.

In this case, you should expect the transfer of money before the end of the corresponding day. If payments did not arrive on the set day , the next day you can contact the PFR hotline in your region for clarification.

When child benefits come from social protection

In most regions, payments for children, which are transferred by social protection authorities, do not have fixed dates and are made0005 as funding becomes available (only certain regions have their own payment days). Therefore, they can be transferred to on any working day until the 26th day of the month .

Please note that due to the introduction of universal benefits from January 1, 2023, the list of regional child benefits that are transferred by social security authorities may be reduced in the coming months (it will also no longer be possible to issue federal payments up to 3 years for the first child and 3 to 7 years old).

A three-room apartment in honor of the wedding is a truly royal gift for the young. Not everyone is so lucky. Is not it?

Not everyone is so lucky. Is not it?

But Anton and Natasha were lucky. The mother of the bride turned out to be extraordinarily generous - in front of all the honest people and on camera, she presented the newlyweds with the keys to the cherished apartment.

It's hard to imagine how delighted Anton was - after all, now you don't have to fight all your life for every penny to pay off the mortgage. The housing issue has been resolved once and for all. Happy newlyweds with special zeal rushed to equip the family nest.

In order to #make repairs on the highest level, the #spouses even got loans. Fortunately, everything was fine with the work, so all the debts were distributed on time. But the apartment was furnished expensively and tastefully. Unfortunately, Anton did not think to keep all the receipts and receipts.

So-so present

Anton and Natasha lived happily ever after, until one day they decided to get a divorce. What really happened there between husband and wife is unknown. Anton expected to share the apartment with Natasha in half. But it was not there. The mother-in-law immediately showed up and declared that she was the owner of this apartment, and Anton would get a shish with butter.

What really happened there between husband and wife is unknown. Anton expected to share the apartment with Natasha in half. But it was not there. The mother-in-law immediately showed up and declared that she was the owner of this apartment, and Anton would get a shish with butter.

And then the man realized what a mess he was in. But it’s true, the mother-in-law gave a three-room apartment only in words, handing over the key to the newlyweds. There were no documents confirming the fact of donation. But after all, Anton lived here for more than 15 years, paid for utilities, did #repairs for which he paid #loans. And the offended husband was sure that he had the right to a share in this apartment.

Court with mother-in-law

Desperate to resolve the issue peacefully, the man went to court.

Anton even added a wedding film to the case, in which you can clearly see and hear how the mother-in-law “gives” an apartment to the young.

Some guests even came to the court to support Anton and testify - yes, they say, the mother-in-law really gave. But what did she give? Keys, nothing more.

But what did she give? Keys, nothing more.

It turns out that the woman actually let the spouses live in her apartment for some time. That's what this donation meant.

According to the law, Natasha's mother had to draw up a deed of gift from a notary. At the same time, in order for the apartment to become common, it was necessary to give half to the wife and half to the husband. If the mother-in-law gave the apartment only to her daughter, Anton would also not be able to sue the share, since the donated property is not divided.

Image: https://en.freepik.com/photos/weddingHow it all ended

Anton lost the first hearing, then filed an appeal and lost again. The law was on the side of the mother-in-law. Among other things, it turned out that the woman did not even say out loud at what address she was giving the apartment. Perhaps the mother-in-law meant other housing altogether?

He also failed to prove in court that Anton invested large amounts of money in this apartment, since not a single check was preserved.