How much is the child tax benefit in bc

B.C. family benefit - Province of British Columbia

The B.C. family benefit provides a tax-free monthly payment to families with children under the age of 18.

Last updated: November 3, 2022

On this page

- About the benefit

- How to apply for the benefit

- Regular monthly benefit amount

- Temporary enhanced monthly benefit

About the benefit

The B.C. family benefit (previously called the B.C. child opportunity benefit) is administered by the Canada Revenue Agency (CRA) for the Province.

Each month, eligible families with children under the age of 18 receive the benefit payments as a combined payment with the Canada child benefit.

How to apply for the benefit

If your child is registered for the Canada child benefit, they're automatically registered for the B.C. family benefit. No action is required.

If your child is not registered for the Canada child benefit, you need to apply for the Canada child benefit.

The CRA uses the information from your Canada child benefit registration to determine your eligibility for the B.C. family benefit (or the B.C. child opportunity benefit).

If you’re eligible, the amount of the payments is calculated automatically by the CRA based on information from the personal tax returns you (and your spouse or common-law partner) have filed.

If your child started living with you before October 2020, you may receive the former B.C. early childhood tax benefit when you apply for the Canada child benefit. However, you may need to provide the CRA with additional information to receive benefit payments for periods more than 11 months ago.

To receive the B.C. family benefit, you (and your spouse or common-law partner) must file a T1 Income Tax and Benefit Return.

Regular monthly benefit amount

Numbers on this page have been rounded. Some actual monthly payments may vary due to rounding.

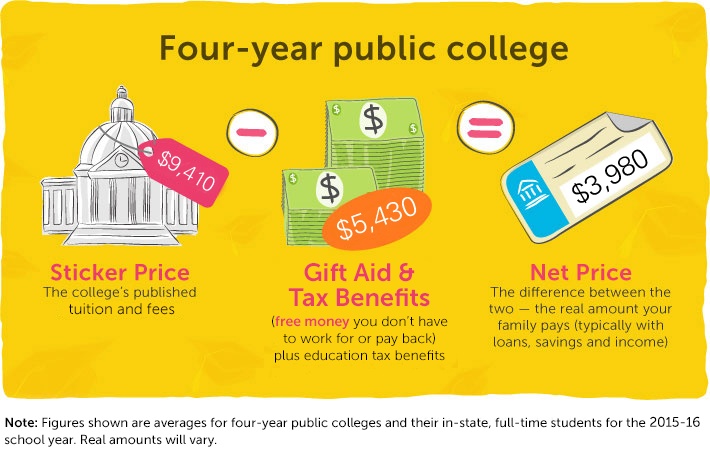

For the July 2022 to June 2023 benefit period, the maximum benefit B. C. families may receive is:

C. families may receive is:

- $133.33 per month for your first child

- $83.33 per month for your second child

- $66.67 per month for each additional child

Calculate your benefit amount

To find out your monthly benefit amount, you can:

- Use the federal child and family benefits calculator

- Use B.C.'s example calculations based on net income

Note: The federal child and family benefits calculator has not been updated to reflect the renaming of the B.C. family benefit and the three-month enhancement of the benefits.

Net income: $25,806 or less

If your adjusted family net income for the 2021 taxation year is $25,806 or less, you’ll receive the maximum benefit amount.

Net income: $25,806 to $82,578

If your adjusted family net income for the 2021 taxation year is more than $25,806 but less than $82,578, the benefit is reduced by 0.33% (1/300th) of the portion of income over $25,806 until it is reduced to the minimum benefit of:

- $58.

33 per month for your first child

33 per month for your first child - $56.67 per month for your second child

- $55 per month for each additional child

Example calculation (Net income: $25,806 to $82,578)

You have two children and your adjusted family net income for the 2021 taxation year is $72,210.

The maximum you can get for your first child is $133.33 per month and the maximum you can get for your second child is $83.33 per month. The total maximum monthly benefit you can get is $216.66.

Because your adjusted family income is more than $25,806 but less than $82,578, your regular monthly benefit will be a reduced amount. To calculate the reduction amount, you need to calculate the portion of income over $25,806 and then divide that amount by 300.

$72,210 minus $25,806 = $46,404

Divided by 300 = $154.68

That reduction amount is subtracted from your maximum benefit amount:

$216.66 minus $154.68 = $61.98

However, since your income is less than $82,578, you’ll receive a minimum monthly benefit of $115 ($58. 33 for your first child plus $56.67 for your second child).

33 for your first child plus $56.67 for your second child).

Therefore, your monthly benefit amount is $115.

Net income: $82,578 or higher

If your adjusted family net income for the 2021 taxation year is $82,578 or higher, the maximum benefit you can receive is:

- $58.33 per month for your first child

- $56.67 per month for your second child

- $55 per month for each additional child

Those amounts are reduced by 0.33% (1/300th) of the portion of income over $82,578 until it's reduced to zero.

Example calculation (Net income: $82,578 or higher)

You have one child and your adjusted family net income for the 2021 taxation year is $105,000.

The maximum you can get for your child is $58.33 per month.

This amount is reduced by 0.33% of the portion of your income over $82,578. To calculate the reduction amount, you need to calculate the portion of income over $82,578 and then divide that amount by 300.

$105,000 minus $82,578 = $22,422

Divided by 300 = $74. 74

74

That reduction amount is subtracted from your maximum benefit amount:

$58.33 minus $74.74 = - $16.41

Your benefit amount is $0 per month for your child.

Note: When the calculation results in zero or a negative number, your benefit amount is zero.

Families with shared custody

If you share custody of a child with another person, you'll receive half the amount you’d receive for the child if you had full custody of that child.

For example, if your adjusted family net income is $25,000 and you have sole custody of one child ($1,600) and share custody of another child ($1,000 x ½ ), you'll receive a total annual benefit of $2,100.

Previous threshold amounts

The adjusted family net income threshold amounts are indexed to inflation each year.

| Base year (tax return) | Benefit period | Maximum benefit received if income less than | Reduced benefit with guaranteed minimum amount if income between | Reduced benefit (no guaranteed minimum amount) if income more than |

|---|---|---|---|---|

| 2020 | July 2021 to June 2022 | $25,275 | $25,275 and $80,880 | $80,880 |

| 2019 | October 2020 to June 2021 | $25,000 | $25,000 and $80,000 | $80,000 |

Temporary enhanced monthly benefit

The B. C. government is providing a temporary benefit enhancement of up to $175 per child for the period January 2023 to March 2023 (up to $58.33 per month).

C. government is providing a temporary benefit enhancement of up to $175 per child for the period January 2023 to March 2023 (up to $58.33 per month).

For eligible families with an adjusted family net income between $25,806 and $82,578, the minimum enhancement is $150 per child ($50 per month).

- The enhancement will be combined with your regular monthly benefit amounts into one payment for January 2023, February 2023 and March 2023

- You may receive the January 2023, February 2023 and March 2023 benefit payments even if you don't receive the B.C. family benefit for other months because of your family net income

Recalculating your benefit amount with the enhanced amounts

The maximum monthly benefit amount B.C. families may receive for January 2023, February 2023 and March 2023, including the temporary benefit enhancement is:

- $191.66 per month for your first child

- $141.67 per month for your second child

- $125 per month for each additional child

Net income: $25,806 or less

If your adjusted family net income for the 2021 taxation year is $25,806 or less, you’ll receive the maximum enhanced benefit amount.

Net income: $25,806 to $82,578

If your adjusted family net income for the 2021 taxation year is more than $25,806 but less than $82,578, the monthly enhanced benefit for January to March 2023 is reduced by 0.33% (1/300th) of the portion of income over $25,806. However, you’ll receive a minimum of:

- $108.33 per month for your first child

- $106.67 per month for your second child

- $105 per month for each additional child

Example calculation (Net income: $25,806 to $82,578)

This example uses the same scenario as the example under the regular monthly benefit section, but uses the enhanced benefit amounts for January 2023, February 2023 and March 2023.

You have two children and your adjusted family net income for the 2021 taxation year is $72,210.

The maximum you can get for your first child is $191.66 per month and the maximum you can get for your second child is $141.67 per month. The total maximum monthly enhanced benefit you can get is $333. 33.

33.

Because your adjusted family net income is more than $25,806 but less than $82,578, your monthly enhanced benefit amount will be a reduced amount, but not less than the enhanced minimum amount.

To calculate the reduction amount, you need to calculate the portion of income over $25,806 and then divide that amount by 300.

$72,210 minus $25,806 = $46,404

Divided by 300 = $154.68

That reduction amount is subtracted from your maximum monthly enhanced benefit:

$333.33 minus $154.68 = $178.65

However, since your income is less than $82,578, you’ll receive a minimum benefit of $215 ($108.33 for your first child plus $106.67 for your second child).

Therefore, your benefit amount is $215 for each of January 2023, February 2023 and March 2023.

Net income: $82,578 or higher

If your adjusted family net income for the 2021 taxation year is $82,578 or more, the maximum benefit you can receive is:

- $108.33 per month for your first child

- $106.

67 per month for your second child

67 per month for your second child - $105 per month for each additional child

Those amounts are reduced by 0.33% (1/300th) of the portion of income over $82,578 until it's reduced to zero.

Example calculation (Net income: $82,578 or higher)

This example uses the same scenario as the example under the regular monthly benefit section, but uses the enhanced benefit amounts for January 2023, February 2023 and March 2023.

You have one child. Your adjusted family net income for the 2021 taxation year is $105,000.

The maximum you can get for your child is $108.33 per month.

This amount is reduced by 0.33% of the portion of your income over $82,578. To calculate the reduction amount, you need to calculate the portion of income over $82,578 and then divide that amount by 300.

$105,000 minus $82,578 = $22,422

Divided by 300 = $74.74

That reduction amount is subtracted from your maximum benefit amount:

$108.33 minus $74. 74 = $33.59

74 = $33.59

Your benefit amount is $33.59 for each of January 2023, February 2023 and March 2023.

Note: When the calculation results in zero or a negative number, your benefit amount is zero.

What is the Canada Child Benefit?

Raising kids can be expensive, but qualifying families can receive tax-free monthly payments from the government to help with some of the costs.

Known as the Canada Child Benefit, the amount your family gets will depend on factors like household income, family size, and province or territory of residence. Fortunately, the process of applying for this assistance is straightforward and quick.

What is the Canada Child Benefit?

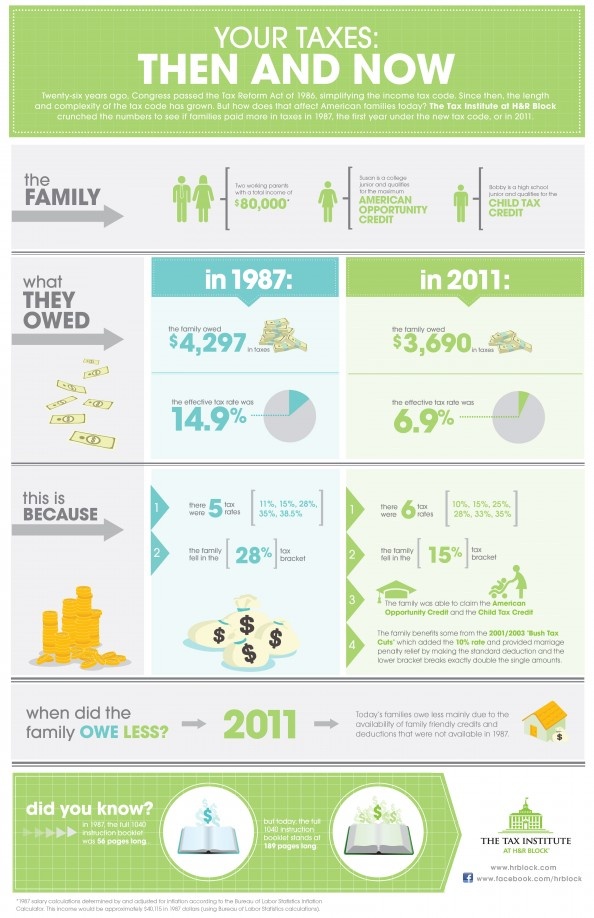

In 2016, the Canada Child Benefit, or CCB, replaced the Canada Child Tax Benefit, or CCTB. The government made this change to make more money available to parents with lower incomes.

The CCB is a tax-free monthly payment made directly to families with children under 18 years old. It’s handled by the Canada Revenue Agency (CRA), but you don’t need to include it on your income tax return — you just need to file your income taxes every year.

It’s handled by the Canada Revenue Agency (CRA), but you don’t need to include it on your income tax return — you just need to file your income taxes every year.

If you’re eligible, the CCB payments you receive may include additional benefits for your children, including a child disability benefit and provincial and territorial benefits.

» MORE: What Canadian employees should know about T4 slips

How much is the Canada child benefit?

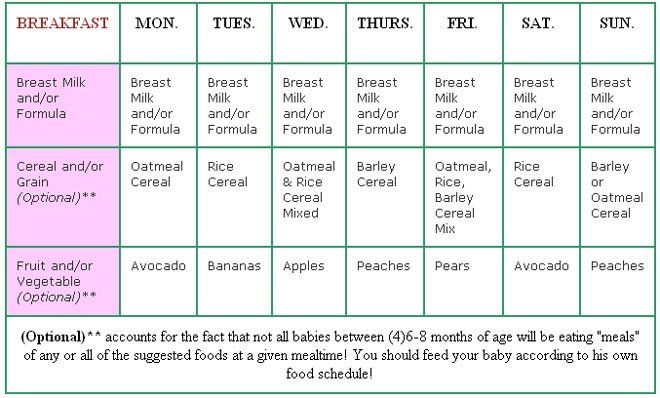

Monthly CCB payments are based on:

- The number of children in your care.

- The age of the children.

- Your marital status.

- Your adjusted family net income (AFNI) from the previous year’s tax return.

If your AFNI is less than $32,028, you can receive up to the following amounts per child:

- Under six years of age: $6,833 per year ($569.41 per month)

- Six to 17 years of age: $5,765 per year ($480.41 per month)

Since the CCB is meant to deliver assistance to lower-income families, payments start to decrease if your AFNI exceeds $32,028. Additionally, if you’re over this income threshold, the CCB is reduced for each additional child you have.

Additionally, if you’re over this income threshold, the CCB is reduced for each additional child you have.

Admittedly, CCB calculations and adjustments can be a bit complicated. However, the Government of Canada has an online CCB calculator that can help you estimate exactly how much CCB you’ll receive each month.

Payments are recalculated every July based on the previous year’s tax return. The government also adjusts the maximum payout for the CCB every year to account for inflation.

There’s also a young child supplement that’s paid out four times a year to families with children under the age of six. To get this benefit, you must file your income taxes.

» MORE: What is a kids bank account?

Canada child benefit eligibility

To qualify for the CCB, you, your spouse, or your common-law partner must be a Canadian citizen, permanent resident, protected person, or an Indigenous person as defined under the Indian Act. You may also qualify as a temporary resident in Canada for the past 18 months who has a valid permit with resident status for the following month.

You must also meet the following conditions:

- You live with at least one child under the age of 18.

- You’re the person primarily responsible for the child’s care.

- You’re a Canadian resident for tax purposes.

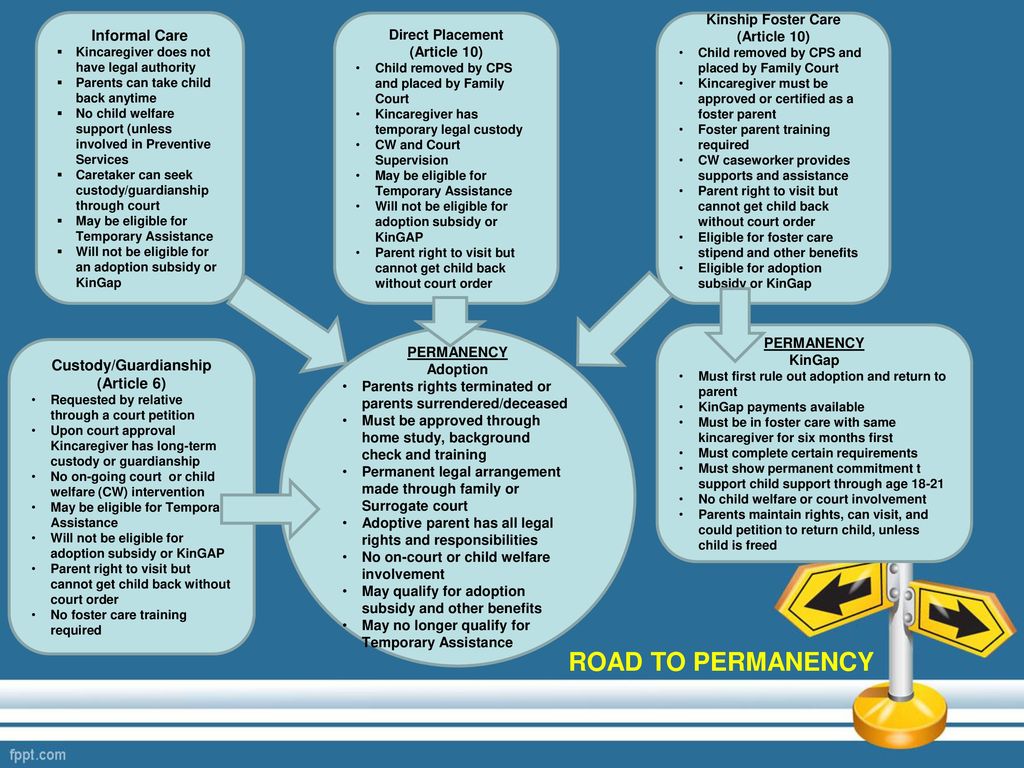

If you have a foster child or care for a child under a kinship or close relationship program, you would only get the CCB if you’re not receiving funds from the Children’s Special Allowances, or CSA, program.

Only one person — the individual primarily responsible for the child’s care — should apply for the CCB. To determine who fills that role in a household with two parents or guardians, ask yourself the following:

- Who takes care of the child’s daily activities and needs?

- Who makes sure the child’s medical needs are met?

- Who arranges child care when needed?

If two individuals share the responsibilities equally and one of them is female, the CRA assumes she is primarily responsible for the child’s care. Therefore, the female parent should apply for the CCB. The female parent can sign a letter stating that the other parent is primarily responsible, however, in which case, the other parent would apply for the CCB.

Therefore, the female parent should apply for the CCB. The female parent can sign a letter stating that the other parent is primarily responsible, however, in which case, the other parent would apply for the CCB.

In the case of same-sex parents, one parent should apply for the CCB for all the children.

If you’re in a joint custody situation, the CRA will calculate how much each parent qualifies for based on your custody arrangement.

» MORE: How does Canada’s Registered Disability Savings Plan (RDSP) work?

How to claim the Canada Child Benefit

You can apply for the CCB as soon as a child is born or starts to live with you, or you begin to meet the eligibility requirements.

For example, you can apply for the CCB when you register the birth of your newborn child, usually at the hospital or birthing centre. As long as you provide your consent and social insurance number (SIN), the CRA will get your information.

If you didn’t apply when the child was born, you can apply online via My Account (your personal CRA account) or by mail.

CCB payments are made monthly via direct deposit or cheque. As long as you file your taxes every year and continue to meet the eligibility requirements, you’ll continue to get the CCB.

British Columbia tax system - taxation of Canadian companies and individuals (VAT, income and capital gains tax). Canadian tax treaties.

Expand all entries Collapse all entries

Canadian residents pay income tax on their worldwide income, while non-residents pay income tax on Canadian source income.

Income tax is levied at the federal level and at the level of 10 provinces and 3 territories.

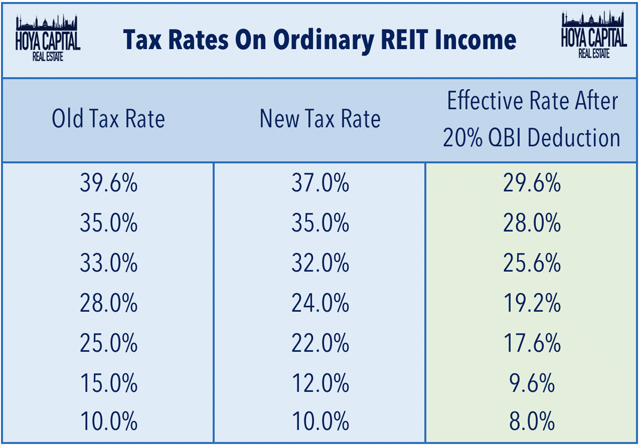

Federal tax is levied on a progressive scale:

- on income up to 49,020 CAD - at a rate of 15%;

- from 49,020 to 98,040 CAD - at a rate of 20.5%;

- from 98,040 to 151,978 CAD - at a rate of 26%;

- from 151,978 to 216,511 CAD - at a rate of 29%;

- over 216 511 CAD - at a rate of 33%.

Provinces and territories set their own tax rates and income levels to which they apply. Rates are also progressive, ranging from 4% to almost 26% depending on income level and province or territory. The definition of taxable income is the same as the federal one, with the exception of Quebec.

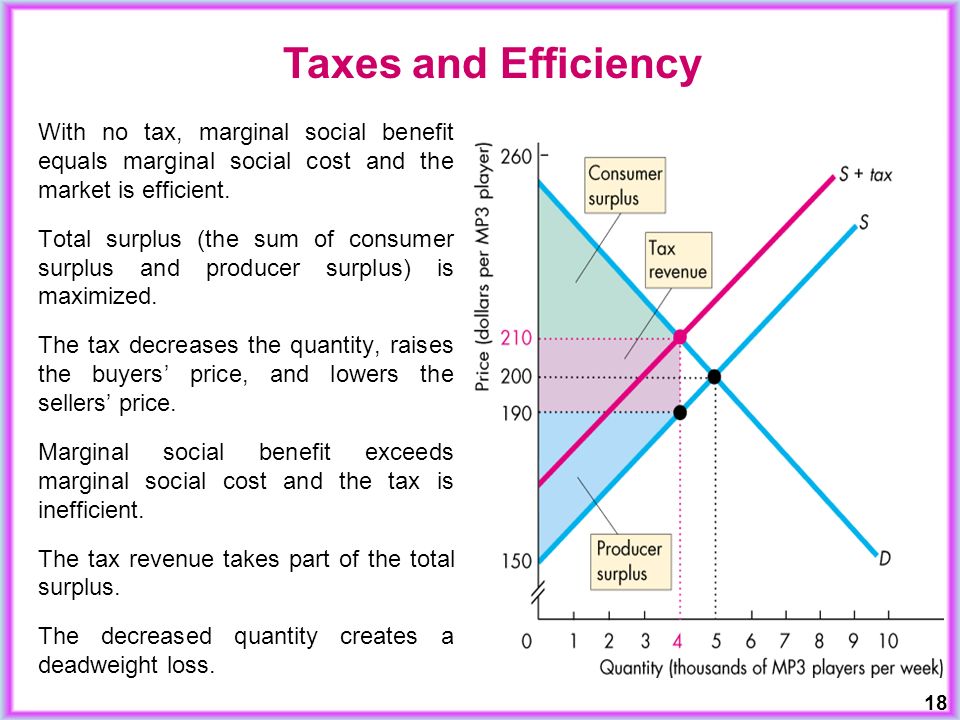

There is also a specially calculated minimum alternative tax payable if it is higher than the regular tax. The minimum alternative tax may be credited in future periods against the ordinary tax if the ordinary tax exceeds the minimum alternative tax.

Half of the profit from the sale of assets is included in income taxable at the normal tax rates. There are special rules for accounting for tax purposes profits from the sale of shares and dividends.

Canadian companies are taxed on their worldwide income, non-resident companies are taxed on Canadian source income.

The base federal tax rate is 38%. It is reduced to 28% for income generated within a province or territory of Canada. There are reduced rates for small companies, for manufacturing companies, etc. For income generated in the province/territory, it also levies a regional income tax, the rates of which vary from, in general, from 2% to 16% depending on the size of the profit and provinces/territories.

There are reduced rates for small companies, for manufacturing companies, etc. For income generated in the province/territory, it also levies a regional income tax, the rates of which vary from, in general, from 2% to 16% depending on the size of the profit and provinces/territories.

Half of the profit from the sale of assets is included in income taxable at the normal tax rates. There are special rules for accounting for tax purposes profits from the sale of shares and dividends. Dividends from Canadian companies are, as a general rule, not subject to withholding tax from the Canadian company.

Foreign affiliated company – a foreign company with at least 1% ownership by a Canadian resident and at least 10% jointly with related parties. With more than 50% ownership, a foreign company is recognized as controlled.

Certain types of income of a foreign affiliate are included in the taxable income of the taxpayer. Usually these are some types of income from property, passive income with a number of exceptions, certain types of income from capital gains.

Withholding tax on dividends and royalties is withheld at the rate of 25%. Interest paid to unrelated parties is not subject to withholding tax.

Tax may be withheld on certain other types of income.

Tax rates may be reduced under double tax treaties (DTAs).

The federal GST rate is 5%. GST is similar to VAT. A similar tax may also apply at the provincial level. So five provinces levy HST (Harmonized Sales Tax) under rules similar to GST at rates of 13% - 15%. Quebec levies a similar tax on certain transactions at a rate of around 10%. Some other provinces have introduced provincial retail sales taxes with their own rules and rates.

Property taxes are levied at the municipal and provincial/territory levels.

Tax is levied at the provincial and territorial level, in general, at rates of 0.02% - 3%, rates are generally higher for non-residents, they may be subject to additional tax.

Canada has 96 Double Tax Treaty (DTC) agreements and 12 Tax Information Exchange Agreement (TIEA) agreements with the following jurisdictions:

96 DTCs: Australia, Austria, Azerbaijan, Algeria, Argentina, Armenia, Bangladesh, Barbados, Belgium, Ivory Coast, Bulgaria, Brazil, United Kingdom, Hungary, Venezuela, Vietnam, Gabon, Guyana, Germany, Hong Kong, Greece, Denmark , Dominican Republic, Egypt, Zambia, Zimbabwe, Israel, India, Indonesia, Jordan, Ireland, Iceland, Spain, Italy, Kazakhstan, Cameroon, Kenya, Cyprus, China, Colombia, Kuwait, Kyrgyzstan, Latvia, Lebanon, Lithuania, Luxembourg, Madagascar , Malaysia, Malta, Morocco, Mexico, Moldova, Mongolia, Namibia, Nigeria, Netherlands, New Zealand, Norway, UAE, Oman, Pakistan, Papua New Guinea, Peru, Poland, Portugal, Russian Federation, Romania, Republic of Korea, Serbia, Singapore, Senegal, Slovakia, Slovenia, USA, Thailand, Taiwan, Tanzania, Trinidad and Tobago, Tunisia, Turkey, Uzbekistan, Ukraine, Philippines, Finland, France, Croatia, Czech Republic, Chile, Sri Lanka, Switzerland, Sweden, Ecuador, Estonia , South Africa, Jamaica, Japan.

12 TIEAs: Anguilla, Bahamas, Bermuda, Dominica, Cayman Islands, Netherlands Antilles, Isle of Man, San Marino, Saint Maarten, Saint Vincent and the Grenadines, Saint Kitts and Nevis, Turks and Caicos.

In addition, Canada has signed and ratified the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting, MLI) The multilateral convention entered into force for Canada on December 1, 2019of the year.

In general, there is no restriction on foreign exchange transactions.

Canada Child Benefit

Canadian Child Benefit Features

A unique program created with the assistance of the

Canadian Federal Government,

and the Provincial and Territory Governments.

National Childhood Insurance Program.

Canada Child Tax Benefit.

Canadians often refer to their social security system as the “social security system”. Assistance programs are designed for all sectors of society, especially for minors, the unemployed and the elderly. Child allowance introduced from January 1993 years old It is paid to low- and middle-income families with children under the age of 18. The amount of the benefit depends on the total annual income of the family, as follows:

Child allowance introduced from January 1993 years old It is paid to low- and middle-income families with children under the age of 18. The amount of the benefit depends on the total annual income of the family, as follows:

In Canada, the minimum tax-free family income is $20,435 Canadian dollars per year and qualifies for National Child Benefit (NCB) assistance from the state.

Families with annual incomes below $20,435 are eligible for government assistance of:

1) $266.67 per month ($3,200 per year) for first child;

2) $247.92 per month ($2.975 per year) for second child;

3) $248.33 per month ($2,980 per year) for the third and each child up to the 7th in the family.

Families with an annual income of $20,435 to $36,378 and more than 3 children receive an allowance for the 3rd and each subsequent child (up to the 7th).

Families with more than 4 children raise the minimum annual income cap to $36,378.

Families with one and two children with annual incomes between $36,378 and $99,128 are also eligible for indexed child support.

Larger families are eligible for indexed child support even if the income is $99,128.

Do you know the law, rules, procedures and policies of immigration?

How does the National Child Benefit (NCB) system work?

The NCB program is a combination of 2 elements: a monthly federal allowance for each child in low-income families and additional provincial benefits and payments (health insurance, transportation benefits, social benefits and numerous budgetary grants for sports sections for children and etc.).

Achievement of the Welfare Social Benefit level, the so-called “Welfare Wall”.

The National Childhood Insurance system is closely related to the taxation system, if the family income exceeds the allowable tax-free minimum, then this affects the amount of the child allowance issued and may threaten with the deprivation of some social benefits, such as compulsory health insurance, benefits for receiving free dental services, free medicines, etc.