How much is social security benefits for a child

Benefits Planner: Retirement | Benefits For Your Family

If you’re getting Social Security retirement benefits, some members of your family may also qualify to receive benefits on your record. If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount. These Social Security payments to family members will not decrease the amount of your retirement benefit.

Maximum Family Benefits

There is a limit to the amount we can pay your family. The total varies, depending on your benefit amount and the number of qualifying family members on your record. Generally, the total amount you and your family can receive is about 150 to 180 percent of your full retirement benefit.

If you have a divorced spouse who qualifies for benefits, it will not affect the amount of benefits you or your family may receive.

Benefits For Your Spouse

Even if they have never worked under Social Security, your spouse may be eligible for benefits if they are at least 62 years of age and you are receiving retirement or disability benefits. Your spouse can also qualify for Medicare at age 65.

How Much Will My Spouse Receive?

If your spouse qualifies for benefits on their own record, we will pay that amount first. If the benefit on your record is higher, they will get an additional amount on your record so that the combination of benefits equals that higher amount.

The benefits for your spouse do not include any delayed retirement credits you may receive.

If they begin receiving benefits:

- Between age 62 and their full retirement age, the amount is permanently reduced by a percentage based on the number of months up to their full retirement age.

- If your spouse is under full retirement age and:

- Work while receiving benefits, the retirement earnings test may affect their benefits.

- Also qualifies on their own record, their application will include both benefits.

- At their full retirement age, the spouse’s benefit cannot exceed one-half of your full retirement amount.

If your spouse was born before January 2, 1954, and has already reached full retirement age, they can choose to receive only the spouse's benefit and delay receiving their own retirement benefit until a later date. If your spouse is full retirement age and applying for spouse’s benefits only, they can apply online by using the retirement application.

If your spouse’s birthday is January 2, 1954 or later, the option to take only one benefit at full retirement age no longer exists. If your spouse files for one benefit, they will be effectively filing for all retirement or spousal benefits.

If your spouse will receive a pension for work not covered by Social Security such as government employment, the amount of their Social Security benefits on your record may be reduced.

Your spouse can also receive spouse's benefits at any age if they are caring for your child under age 16 or who became disabled before age 22, and is entitled to benefits.

Benefits paid to your spouse will not decrease your retirement benefit. In fact, the value of the benefits they may receive, added to your own, may help you decide if taking your benefits sooner may be more advantageous.

Benefits For Your Children

When you qualify for Social Security retirement benefits, your children may also qualify to receive benefits on your record. Your eligible child can be your biological child, adopted child, or stepchild. A dependent grandchild may also qualify.

To receive benefits, the child must:

- Be unmarried.

- Be under age 18.

- Be 18-19 years old and a full-time student (no higher than grade 12).

- Be 18 or older and disabled from a disability that started before age 22.

Benefits stop when children reach age 18 unless they are disabled. However, if the child is still a full-time student at a secondary (or elementary) school at age 18, benefits will continue until the child graduates or until two months after the child becomes age 19, whichever is first.

Benefits paid for your child will not decrease your retirement benefit. In fact, the value of the benefits they may receive, added to your own, may help you decide if taking your benefits sooner may be more advantageous.

If Your Child Works

If a child on your record works while receiving benefits, the same earnings limits apply to them as apply to you.

If your child is eligible for benefits this year and is also working, you can use our Retirement Earnings Test Calculator to see how those earnings would affect the child's benefit payments.

Your child's earnings affect only their own benefits. They do not affect your benefits or those of any other beneficiaries on your record.

Benefits For Your Divorced Spouse

If you are divorced, your ex-spouse can receive benefits based on your record (even if you have remarried) if:

- Your marriage lasted 10 years or longer.

- Your ex-spouse is unmarried.

- Your ex-spouse is age 62 or older.

- The benefit that your ex-spouse is entitled to receive based on their own work is less than the benefit they would receive based on your work.

- You are entitled to Social Security retirement or disability benefits.

How Much Will Your Divorced Spouse Receive

If you have not applied for retirement benefits, but can qualify for them, your ex-spouse can receive benefits on your record if you have been divorced for at least two continuous years.

If your ex-spouse is eligible for retirement benefits on their own record, we will pay that amount first. If the benefit on your record is higher, they will get an additional amount on your record so that the combination of benefits equals that higher amount.

If your ex-spouse was born before January 2, 1954, and has already reached full retirement age, they can choose to receive only the divorced spouse’s benefit and delay receiving their own retirement benefit until a later date.

If your ex-spouse’s birthday is January 2, 1954 or later, the option to take only one benefit at full retirement age no longer exists. If your ex-spouse files for one benefit, they will be effectively filing for all retirement or spousal benefits.

If Your Ex-Spouse Works

If your ex-spouse continues to work while receiving benefits, the same earnings limits apply to them as apply to you. If your ex-spouse is eligible for benefits this year and is also working, you can use our retirement earnings test calculator to see how those earnings would affect those benefit payments.

If your ex-spouse will also receive a pension based on work not covered by Social Security, such as government work, their Social Security benefit on your record may be affected.

The amount of benefits your divorced spouse gets has no effect on the amount of benefits you or your current spouse may receive.

If You Remarry

If you remarry, your ex-spouse will still be eligible for benefits if they meet the requirements.

If your former spouse is deceased and you need information about possible survivors benefits, please read, Surviving Divorced Spouse.

How Do You Apply?

You can apply online by using our Social Security Retirement/Medicare Benefit Application to apply for retirement, spouse's, divorced spouse's or Medicare benefits.

If you and your spouse apply online for retirement benefits at the same time, or if your spouse applies online after you start receiving benefits, we will check their eligibility for benefits as a spouse. If they are qualified, the online application will automatically include a request for spousal benefits on your record.

If your spouse applies for benefits, they need to be ready to supply the information we need to approve their application for these benefits:

- Information You Need To Apply For Retirement Benefits Or Medicare.

- Information You Need to Apply for Spouse's or Divorced Spouse's Benefits.

Parents and Guardians | SSA

With you through life’s journey...

The makeup of American families has changed in the last 20 to 30 years. Today, family units are diverse, rich in culture, and may include two parents, same-sex parents, only one parent, grandparents, and other relatives. Social Security knows that whether single parent, blended, diverse, small or large, every family is important.

For more than 80 years, Social Security has helped families secure today and tomorrow by providing financial benefits, tools, and programs that help support millions throughout life’s journey. Our programs and services have evolved to meet your unique family needs and especially the children in your care.

We are there from day one

Getting your child a Social Security number should be near the top of the list of things you need to do as a new parent or guardian. Your child's Social Security number is the first step in ensuring valuable protection for any benefits they may be eligible for in the future.

You’ll need your child’s Social Security number to claim them as a dependent on your income tax return or open a bank account in the child’s name and buy savings bonds. Your child’s Social Security number is also necessary to obtain medical coverage or apply for any kind of government services for your child.

Most people apply for their child’s Social Security number at birth, usually at the hospital. When the time comes for your child’s first job, the number is already in place. For more information on getting your child a Social Security number and card, check out Social Security Numbers for Children.

A fun bonus of assigning Social Security numbers at birth is that we know the most popular baby names, which we announce each year. On our website, you can find the top baby names for the last 100 years.

We’re there with support if you’re raising a grandchild…

More and more grandparents are finding themselves raising their grandchildren. Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

To receive this benefit, your grandchild must have begun living with you before age 18 and received at least one half of his or her support from you for the year before the month you became entitled to retirement or disability insurance benefits, or died. Also, the natural parent(s) of the child must not be making regular contributions to his or her support.

If your grandchild was born during the one-year period, you must have lived with and provided at least one-half of the child's support for substantially the entire period from the date of birth to the month you became entitled to benefits.

Your grandchild may qualify for benefits under these circumstances, even if he or she is a step-grandchild. However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

We’re there when they get their first job

Once your child starts working and throughout their career, employers will verify their Social Security number to help reduce fraud and improve the accuracy of their earnings records.

Employers collect FICA, or Federal Insurance Contributions Act withholdings, and report earnings electronically. This is how we verify earnings and is how your child earns Social Security retirement, disability, and survivors coverage.

Once they turn 18, they can open a my Social Security account and watch their personal earnings and future benefits grow over time.

We’re there to help if disability strikes…

As a working parent, your earnings can become a source of Social Security protection for your family. If you retire or become disabled and unable to work, your earnings would be partially replaced by your monthly Social Security benefit payments.

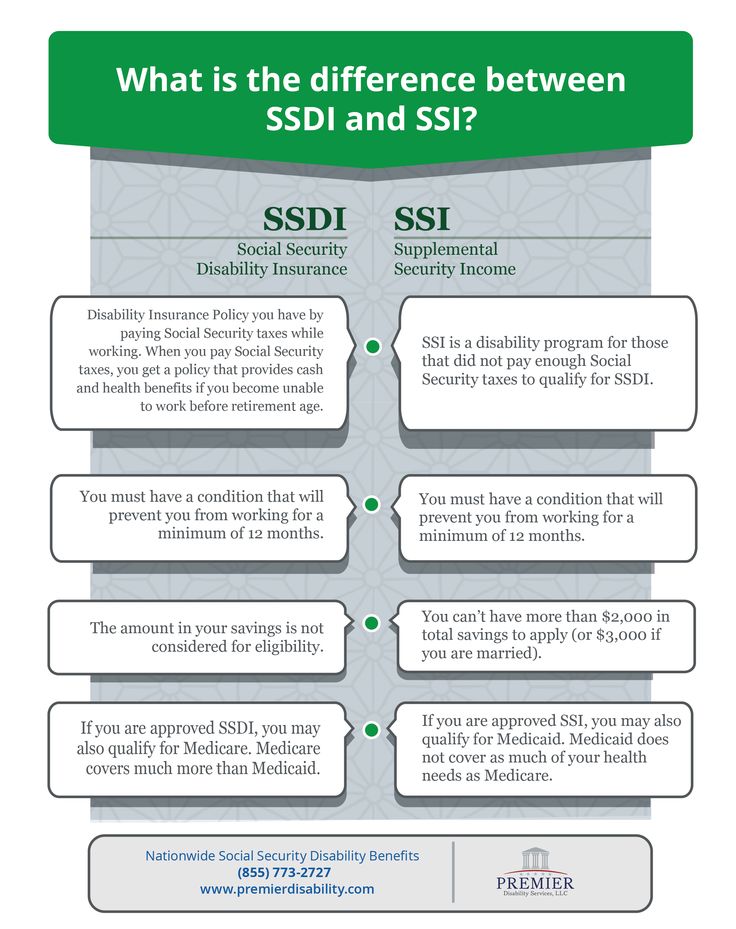

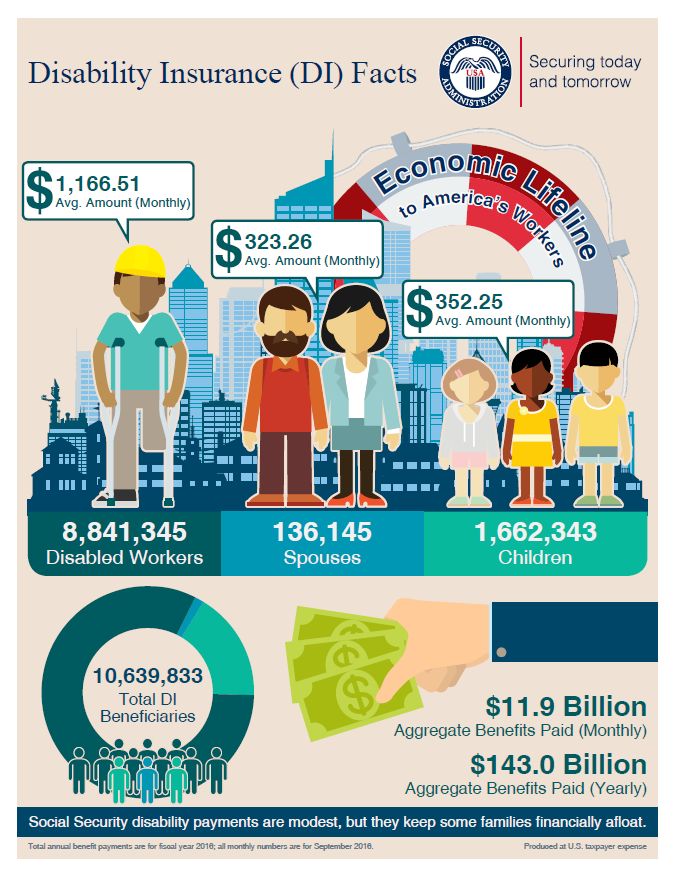

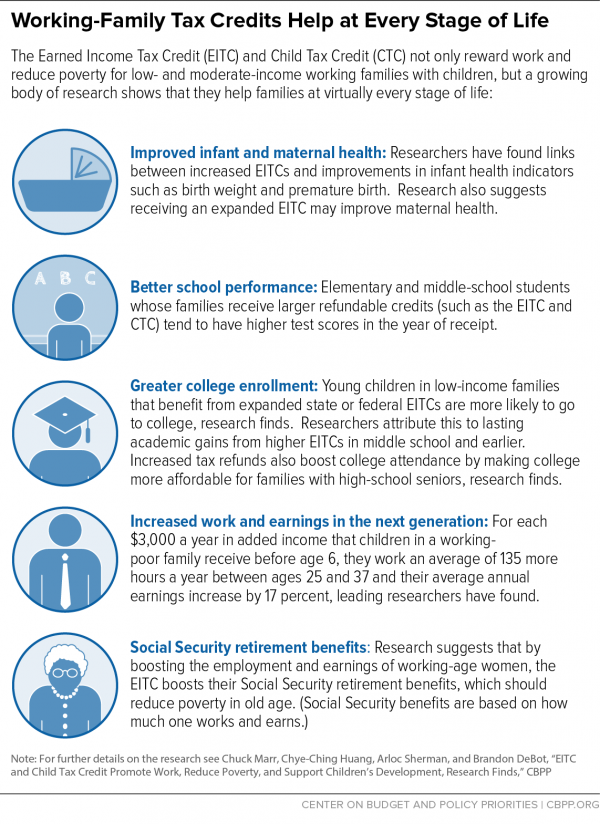

A child who is disabled may depend on your help for a lifetime. When you start receiving Social Security retirement or disability benefits, your family members also may be eligible for payments. If you are a parent, caregiver, or representative of a child younger than age 18 who has a disability, your child may be eligible for Supplemental Security Income (SSI) payments. More information is provided in the Benefits for Children with Disabilities booklet.

For children 18 years or older who have been disabled before the age of 22 and continue to be disabled, Social Security benefits may be paid to them if you retire, become disabled, or die. Social Security benefits for disabled children may continue as long as they are unable to work because of their disability.

Additionally, you can find information on the specific benefits and qualifications in the Disability Benefits publication.

We’re there to provide comfort during difficult times…

The loss of a parent or guardian can be both emotionally and financially difficult. Social Security helps by providing benefits to help stabilize the family’s financial future. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits.

Social Security helps by providing benefits to help stabilize the family’s financial future. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits.

In fact, 98 of every 100 children could get benefits if a working parent dies. And Social Security pays more benefits to children than any other federal program.

Providing protection for parents too…

Even if you have never worked in a job covered by Social Security, as a parent, there are two ways that you may still qualify for benefits.

- If you are a parent and take care of your child who receives Social Security benefits and is under age 18, you can get benefits until your child reaches age 16. Your child's benefit will continue until he or she reaches age 18, or 19 if he or she is still in school full time. Your monthly payments stop with the child’s 16th birthday, unless your child is disabled and stays in your care.

- If you are a parent who receives most of your support from your adult child, and your child dies, Social Security also pays monthly benefits to you under the following conditions:

- You must be at least 62 years old and must not have remarried since the worker (your child)'s death

- You cannot be entitled to your own, higher Social Security benefit; and

- You must be able to show that you received one-half of your financial support from the worker at the time of their death. You must submit this proof of support to Social Security within two years of the worker's death.

We are there for those who need it most…

The Supplemental Security Income (SSI) program helps children with qualifying disabilities by providing critical financial assistance. Children and youth with specific medical conditions—whose families meet certain income and resource limits—can receive SSI from birth until age 18.

If you think your child or someone you know could be eligible for SSI, visit our webpage SSI Eligibility for Children to learn more and apply.

Assisting Youths with Disabilities Transition to Adulthood

The transition to adulthood is one of the most important periods in life’s journey. For foster children living with a disability, it can be even more challenging. Turning 18 triggers an important change in SSI benefits: Social Security must make a new determination on their SSI eligibility using the adult disability standards. About one-in-three such beneficiaries lose their SSI benefits.

For more information, please visit our spotlight page.

Page not found — State government institution “Regional Center for Social Protection of the Population” of Zabaykalsky Krai

404

Page not found

This page does not exist

Ask a question

×

Make an appointment

Full name

e-mail (required)

Phone (required)

Direction of application

issuance of a certificate of recognition of a family as poor issuance of a certificate of recognition of a family with many children EDV in large families EDV from 3 to 7 years one-time payment for the FIRST child monthly monetary compensation for major repairs to citizens aged 70 and 80 years monthly monetary compensation for housing and communal services (benefits) monthly allowance for the FIRST child under 418 FZZhKU for families with many children other measures of social support (explain in the 'Message' field) provision of state social assistance registration of documents for conferring the title of 'Veteran of Labour' allowance for a large family for children from 0 to 3 years old allowance for a child regional maternity capital subsidy for housing and communal services 9Ol000 )

- I give my consent to the processing of personal data

- I give my consent to receive a response to the specified e-mail.

mail

mail

The procedure for receiving and considering applications is carried out in accordance with the Federal Law of the Russian Federation “On the procedure for considering applications from citizens of the Russian Federation No. 59-FZ of May 2, 2006.

In your appeal, you must indicate your last name, first name, patronymic (the last one, if available), e-mail, to which the answer should be sent, notification of the redirection of the appeal.

If the written request does not indicate the name of the citizen who sent the request and the e-mail to which the response should be sent, the response to the request is not given.

A written appeal is subject to mandatory registration within three days from the date of receipt by a state body, local government body or official.

A written appeal received by a state body, a local government body or an official in accordance with their competence is considered within 30 days from the date of registration of the written appeal.

In exceptional cases, the head of a state body or local self-government body, an official or an authorized person has the right to extend the period for considering an application by no more than 30 days, notifying the citizen who sent the application about the extension of the period for considering it.

×

Official website of the OGKU "Department of social protection of the population in the Taishet region"

| No. | Types of payment | Terms of payment |

| SOCIAL SUPPORT FOR CHILDREN | ||

| Monthly | ||

| 1

| Funds for the maintenance of a child under guardianship (guardianship) - 11057 | from the 3rd to the 26th of the current month |

| 2 | Funds for the maintenance of a child placed in foster care - 11057 | 3rd to 26th of the current month |

| 3 | Cash allowance for each adopted child - 4,800 | 3rd to 26th of the current month |

| 4 | Payment of social benefits to large families - 216. | 3rd to 26th of the current month |

| 5 | Monthly cash payment in case of the birth of a third or subsequent children from the day the child reaches the age of one and a half years until the child reaches the age of three years - 11057 | 3rd to 26th of the current month |

| 6 | Monthly allowance for caring for a child up to 1.5 years old 1 child - 4050.92 2 and following - 8101.85 | until the 30th day of the current month |

| 7 | Monthly allowance for a child of a conscripted soldier - 14663.00 | until the 30th day of the current month

|

| Quarterly | ||

| 1 | Benefit for a child under 16 (18) years old in the Irkutsk region, the amount of benefits for 3 months, in accordance with the preferential category; - single mother - 1836 - parent of a child living with him - 918 - parent of a child of a serviceman living with him who is doing military service on conscription - 1377 - parent of a child cohabiting with him, whose parents evade payment of alimony - 1377 | |

| One-time | ||

| 1 | One-time allowance for the pregnant wife of a conscripted military serviceman - 34213. | during the month |

| 2 | One-time allowance for the birth of a child - 21604.95 | during the month |

| 3 | Payment for the simultaneous birth of two or more children - 35,000 for each | no later than 2 months from the date of the decision on the appointment |

| 4 | Payment at the birth of a child to low-income families whose average per capita income is below two times the subsistence minimum - 10,000 | no later than 2 months from the date of the decision on the appointment of |

| 5 | 1 time in 2 years providing an allowance for the purchase of a set of clothes and sports uniforms for children to attend school classes - 1081. | 1 time in 2 years |

| SOCIAL SUPPORT MEASURES PAYED TO CERTAIN CATEGORIES OF CITIZENS | ||

| Monthly | ||

| 1 | - EDV Children of the Great Patriotic War - 500 - Labor Veterans - 525 - Non-working pensioners - 499 - Rehabilitated persons and persons affected by political repression - 477 - Home front workers - 525 | 3rd to 26th of the current month |

| 2 | Supplement to pension for servicemen who became disabled due to military injury Disabled people of group I - 6325.64 Group II disabled - 5060. Disabled group III - 4111.65 | from the 3rd to the 26th of the current month |

| 3 | Additional monthly material support for personal pensioners Republican - 4744.22 local - 3162.84

| 3rd to 26th of the current month |

| 4 | Cash payment to the pension for services to the Irkutsk region - 10 000 | 3rd to 26th of the current month |

| 5 | Seniority pension - 11 576 | 3rd to 26th of the current month |

| Annual | ||

| 1 | Payment to citizens awarded with the badge "Honorary Donor of Russia" or the badge "Honorary Donor of the USSR" - 14570. | |

30 for each child

30 for each child  67

67  50

50  51

51