How much is full child tax credit

The Child Tax Credit | The White House

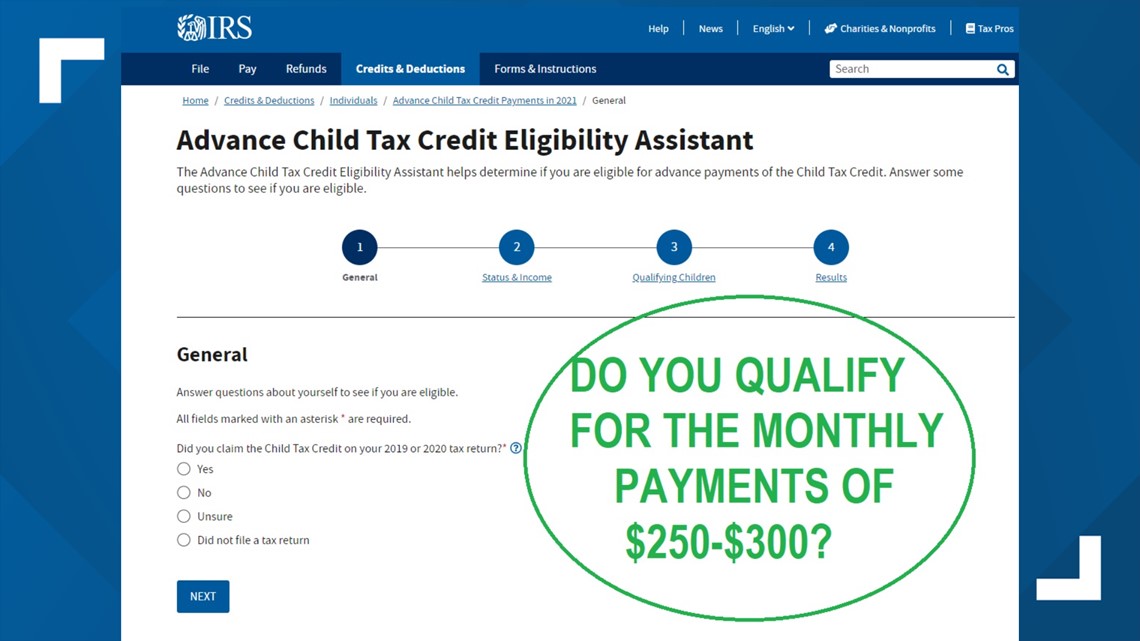

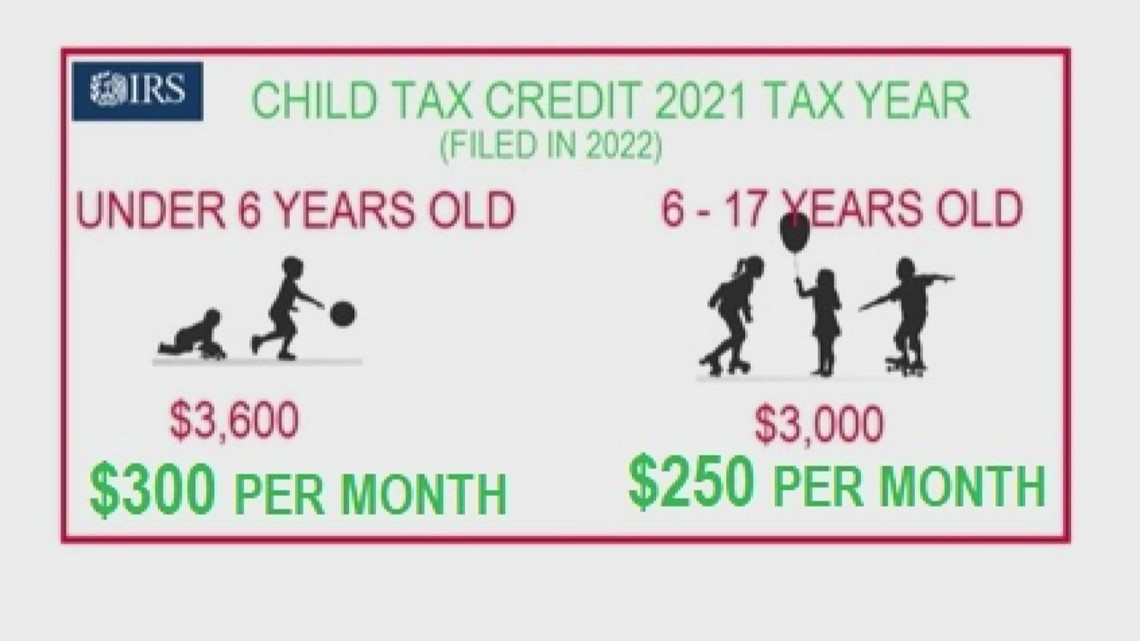

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

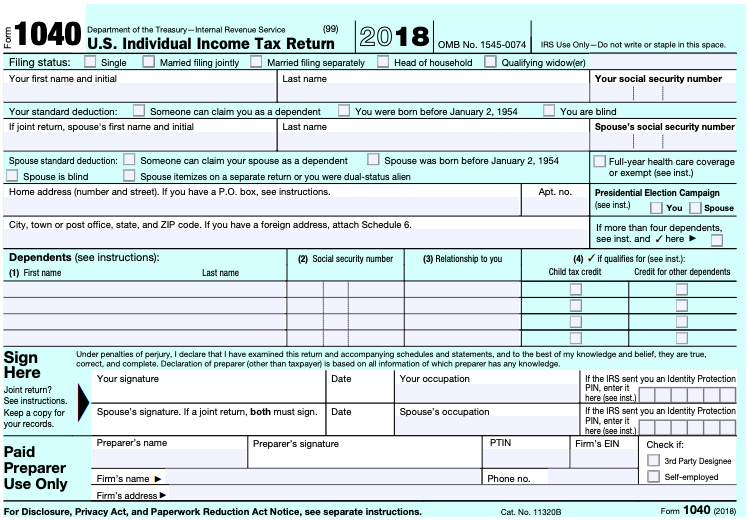

- How to claim the CTC

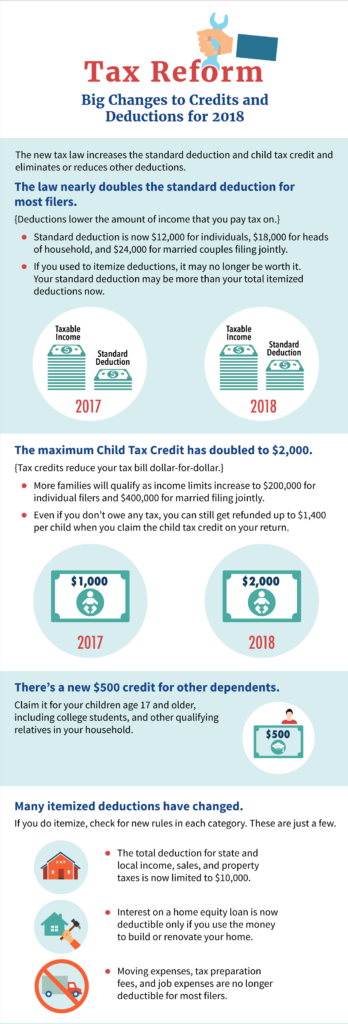

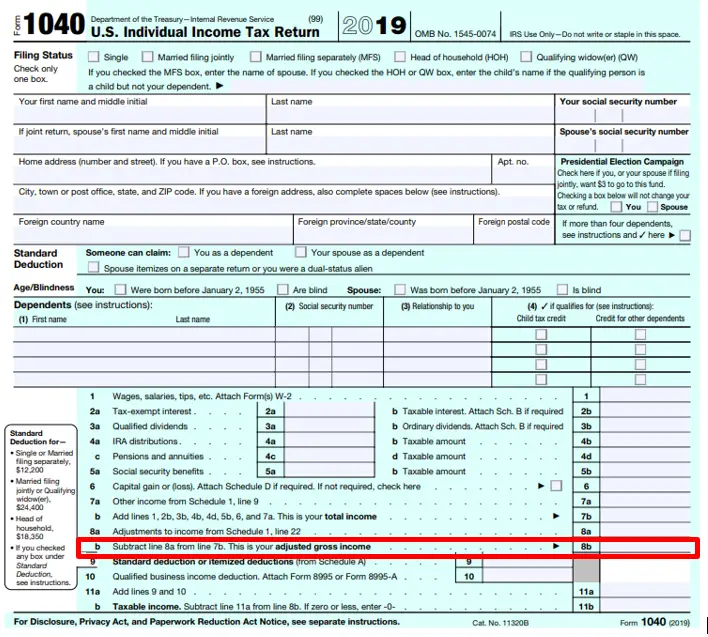

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

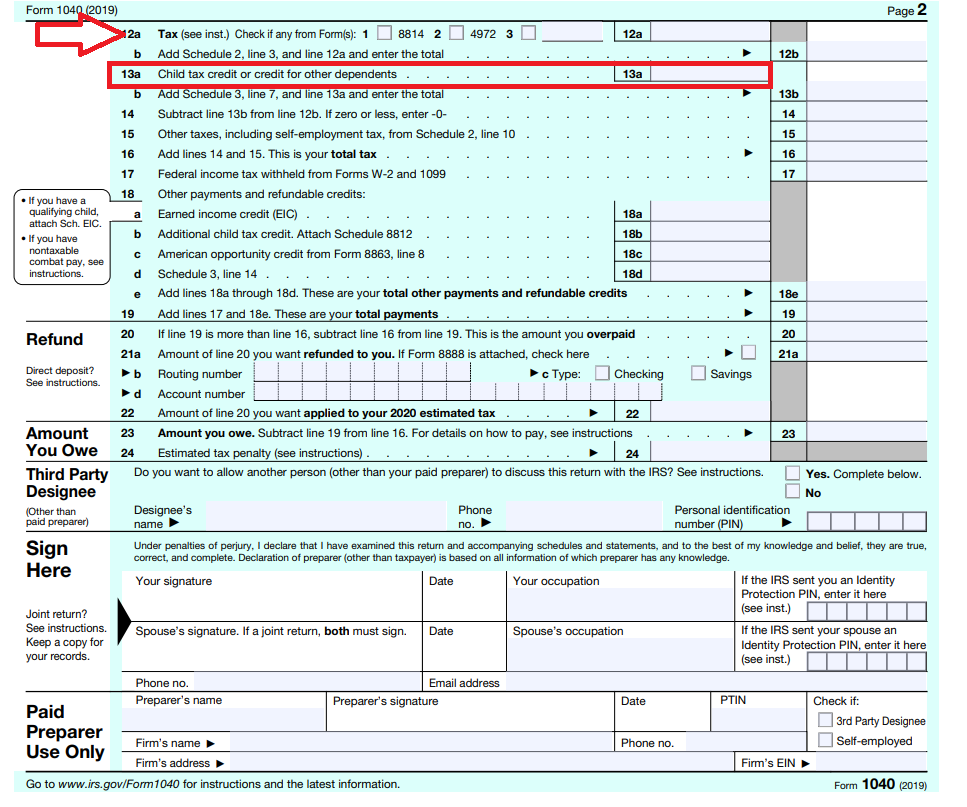

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

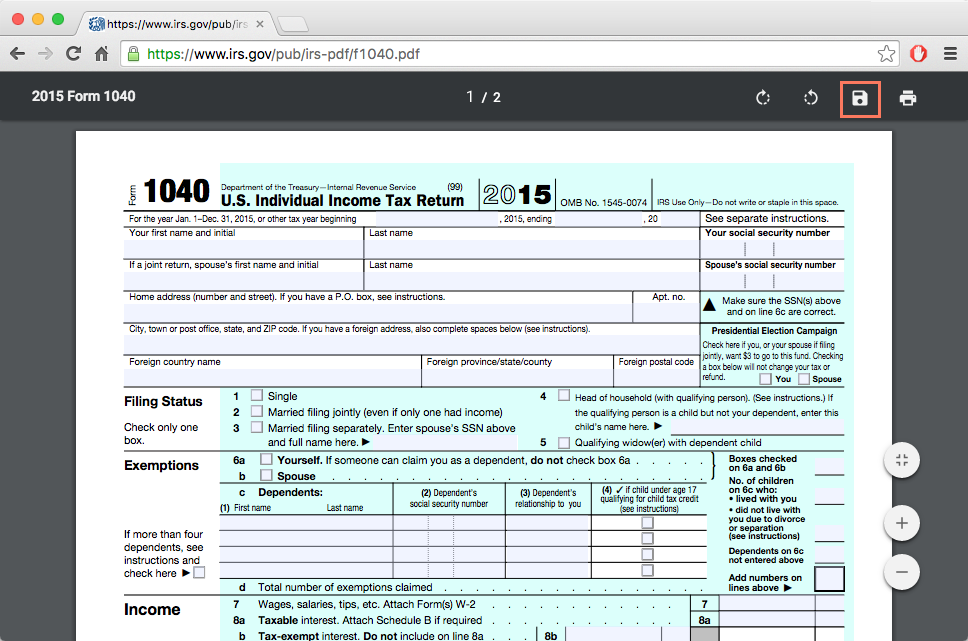

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Tysheonia Edwards, 2022 Get It Back Campaign Intern Identity theft happens when…

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

Tax deduction - Medline Clinic in Barnaul

Have you paid taxes? Take them back to the state!

A significant part of the Russian population pays taxes. However, this amount can be reduced. There is a tax deduction for this. What's this? When making such a deduction, the state reduces the amount from which taxes are paid. It is also called the return of a certain part of the previously paid personal income tax (personal income tax) when buying real estate, spending on treatment or training. It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

However, this amount can be reduced. There is a tax deduction for this. What's this? When making such a deduction, the state reduces the amount from which taxes are paid. It is also called the return of a certain part of the previously paid personal income tax (personal income tax) when buying real estate, spending on treatment or training. It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

What expenses can be included in the deduction for treatment

The following expenses can be included in the deduction:

- Medical services - tests, examinations, doctor's appointments, procedures in paid clinics. Provided that you paid for it, that is, the services are not under the CHI policy, but at your expense.

- Prescribed medicines. Starting in 2019, you can get a deduction for the cost of any drug, not just those on the government's list.

- Expensive treatment. This is the only type of medical expenses for which there is no limit: any amount is accepted for deduction without restrictions. Types of expensive treatment are in a special list, this is followed by a medical organization when it issues a certificate of the cost of services.

- Contributions under the VHI agreement.

Relatives for which the deduction for treatment is given

The deduction for treatment can be received not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives, but not any, but only from a limited list.

Here is a complete list of relatives whose treatment can be included in your tax deduction:

- Parents. The deduction will be given only when paying for the treatment of their parents. If you pay for the spouse's parents or adoptive parents, the tax will not be refunded. There are no parental requirements.

They can work under an employment contract, or they can be pensioners, unemployed or self-employed individual entrepreneurs.

They can work under an employment contract, or they can be pensioners, unemployed or self-employed individual entrepreneurs. - Children or wards under 18 years of age. The deduction for treatment is only for your children. If you pay for tests and examinations of your spouse's children, even when they are fully supported, personal income tax cannot be returned. There is also an important condition regarding age: the child must be no more than 18 years old. Moreover, the fact of studying at a full-time university does not extend this age to 24 years: this is possible with education, but with treatment - only up to 18 years.

- Spouses. If a husband pays for his wife, he can get a deduction. And the wife will return the tax when paying for the treatment of her husband. But the marriage must be officially registered. A certificate of payment for medical services and checks for the purchase of drugs can be issued to any spouse: their expenses are still considered general.

You cannot get a deduction for other relatives. Unlike training, there are no siblings on this list. If you pay for dental treatment or surgery for your sister, you will not receive a deduction. For grandparents, common-law spouse, children of the wife from the first marriage, nephews or mother-in-law, the tax cannot be refunded.

The list of relatives is closed and there can be no additional conditions.

How to return money for treatment

How much money can be returned when paying for the treatment of relatives

Cost limit. The deduction for treatment has a limit - 120,000 R per year. This is a general limit for several social deductions, for example, it also includes tuition costs. 120,000 R is a restriction not for each type of expense, but for all.

Here are the expenses that will be included in the limit:

- Training.

- Treatment.

- DMS.

- Voluntary contributions to pensions.

- Voluntary life insurance.

- Additional contributions to the funded part of the pension.

- Independent qualification assessment.

When paying for the treatment of relatives, an additional deduction will not be given: both your own and their expenses must be included in this limit.

120,000 R does not include only the cost of educating children - there is a separate limit of 50,000 R for each child - and expensive types of treatment that are accepted for deduction without taking into account the limit. There is also a social deduction for charity, but it has separate conditions and the limit is calculated as a percentage.

How much money will be returned

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax office will not return more money than the personal income tax paid for the year. Let's look at an example:

Vasily works as a manager and receives 40,000 R per month. In a year, he earned 480,000 R. He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In a year, he earned 480,000 R. He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In 2015, he spent 80,000 RUR on treatment. Vasily collected documents and applied for a tax deduction. After submitting the application, the tax authority will deduct the amount of treatment from Vasily’s income for the year and recalculate his personal income tax: (480,000 − 80,000) × 0.13 = 52,000 R.

It turns out that Vasily had to pay 52,000 R, but in fact he paid 62,400 R. The tax office will return the overpayment to him: 62,400 − 52,000 = 10,400 R.

The deduction can be made within three years following the year of treatment payment.

This money will go directly to the card, but you will have to wait.

How to draw up documents if you pay for relatives

- For your spouse. When paying for the treatment of a husband or wife, documents can be issued to anyone. The contract and receipts can be in the name of the husband or wife, it does not matter for the deduction.

It is believed that they have everything in common. The same expenses can be deducted by either spouse, but only by one. They can also be divided among themselves, this helps to return more tax, taking into account the limit.

It is believed that they have everything in common. The same expenses can be deducted by either spouse, but only by one. They can also be divided among themselves, this helps to return more tax, taking into account the limit.

- For children and parents. Payment documents must be issued to the person who pays and wants to receive a deduction. If receipts and a certificate are issued to the mother, the son will not be given a deduction for these expenses. Although you can try to resolve this issue with the help of a conventional written power of attorney. The contract for medical services should contain a wording from which it is clear that it is concluded with this person - the one who claims the deduction - for the treatment of this relative. But if this did not work out, this usually does not interfere with the return of the tax. The tax first of all looks at payment documents and a certificate. This is really important.

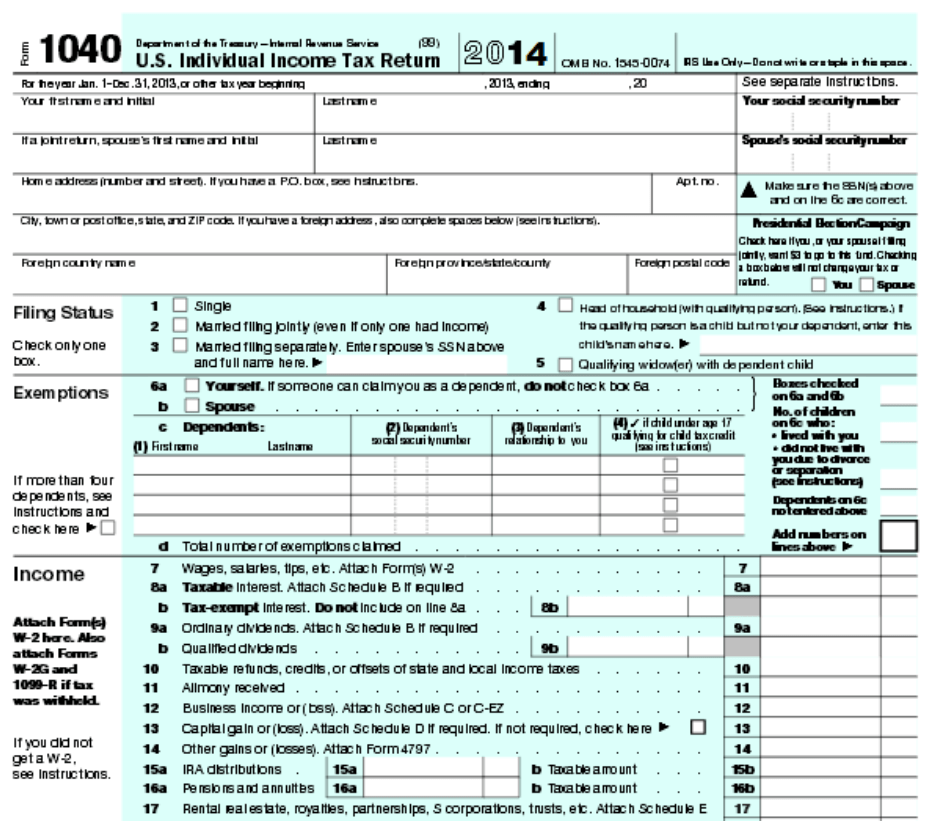

How to return personal income tax from the costs of treatment for the past year

For the past year, you can return the tax only on the declaration. Through the employer return only in the current year.

Here is the instruction:

- Get medical bills. This is a special document, it must be issued by the organization to which you paid for the treatment. Now everything is stored electronically, so usually you don’t even need to show receipts. The help will indicate the code - "1" or "2". If it is "1", then you need to take into account the limit, if "2" - the entire amount will be deducted.

- Make copies of documents that confirm your relationship: birth and marriage certificates.

- Fill out the 3-personal income tax declaration in your personal account on the nalog.ru website. It can be filled out in a special program or handed in on paper, but through the site - this is the easiest, fastest and most convenient way that will insure you against mistakes and speed up the check. Scans or photographs of documents must be attached to the declaration.

To receive documents for a tax deduction, you can apply to the administrator-cashier at our Center or send a request electronically by filling out the form below.

Dear patients, when filling out the form, be sure to indicate:

- contact details

- period for which documents must be submitted

- list of required documents

Tax deduction application form

Sergey

Hello, I was treated at the clinic with my own problem, which was helped by a wonderful surgeon, coloproctologist Galyatin Denis Olegovich. Many thanks to the team of the clinic "Medline". All health!

Vladimir

I want to express my gratitude to Denis Olegovich Galyatin for a successful and easy operation and my quick recovery. A very good center and excellent specialists! Thank you all! I recommend 100% to everyone who has a problem in urology and proctology.

all clinic reviews

Germany: How to save a lot of money on taxes in the new year

Society 718

Share

com / @stefamerpik

com / @stefamerpik The Bundestag passed the law on annual taxation. Tax breaks, increased tax-free benefits and similar measures should make life easier for taxpayers by 3.16 billion euros next year and by about 6.9billion euros by 2026. That's what the law says.

What happens to the allowance for working from home?

The flat rate for the home office, introduced due to the coronavirus pandemic, will be increased from five to six euros per day. This is combined with the home office flat rate on the tax return to be six euros per day (previously five). It can also be requested for up to 210 days (previously 120 days). Thus, the maximum amount that can be declared for taxation is increased to 1260 euros.

The home office allowance introduced during the pandemic will be canceled and increased from five to six euros per day. As a result, the daily fixed rate will be six euros (previously five). It can also be claimed within 210 days (previously 120 days). Thus, the maximum amount that can be claimed for tax purposes is increased to EUR 1,260.

It can also be claimed within 210 days (previously 120 days). Thus, the maximum amount that can be claimed for tax purposes is increased to EUR 1,260.

The requirement for a home office to take advantage of the flat rate has also been relaxed. The tax deduction is now possible regardless of whether the activity takes place in a work nook or home office, and regardless of whether another workplace exists, such as in a company office.

What amounts of taxes and benefits will be increased?

The tax relief on capital income will increase. In the future, single people will be exempt from income tax on income from interest and dividends up to 1,000 euros, and married couples up to 2,000 euros. So far, the so-called lump sum for savers has been 801 and 1,602 euros. In addition, the fixed employee allowance for income-related promotional expenses will increase from €1,200 to €1,230, while the single parent allowance will increase by €252.

The education allowance for adult children who study and no longer live in their parent's home will also be increased from 924 euros to 1,200 euros.

What will happen to the pension?

Starting next year, the cost of old age benefits will be fully deductible from the tax base - to avoid double taxation. Previously, such an innovation was envisaged only from 2025. In addition, the supplement to the basic pension will be tax-exempt retroactively from 1 January 2021.

When can new residential buildings be depreciated?

Depreciation of new residential buildings is accelerating - thus, all buildings are usually depreciated over 33 years. This measure will be applied already to houses put into operation starting from January. To this end, the so-called linear depreciation rate for depreciation of residential buildings will be increased from two to three percent.

Special depreciation will continue in the rental sector, but it will be linked to climate-friendly construction. 5% of production costs can be deducted from the tax within four years if the very high standard of an energy efficient house 40 is maintained and the construction cost does not exceed 4,800 euros per square meter.

How can an excess profit tax help in the energy crisis?

Oil and gas, coal and refining companies must contribute to the energy crisis limited to fiscal 2022 and 2023. This implements the EU requirement. Income exceeding the average by 20% compared to previous years is taxed at a rate of 33%. The revenue, estimated at between one and three billion euros, is intended to finance lower electricity prices for consumers.

Can the savings from the slowdown in gas prices be maintained?

In the case of individuals with higher incomes, part of the assistance provided under the December emergency relief and gas and heating price deceleration will be collected again. This should only apply to those taxpayers who also continue to pay the solidarity surcharge. For them, taxable income will increase by the amount of the benefit.

This measure is considered as social compensation, since people with higher incomes are less dependent on benefits. It is expected that the revenue will be about 850 million euros. It is also planned to make a single tax rate on the price of electricity for pension recipients

It is expected that the revenue will be about 850 million euros. It is also planned to make a single tax rate on the price of electricity for pension recipients

Can you save money using renewable energy?

Revenues from small solar systems are retroactively tax-exempt from the beginning of 2022. From 2023, the 19% sales tax will not apply to the purchase and installation of photovoltaic systems up to 30 kilowatts and energy storage systems. This is intended to facilitate the transition to solar energy in private homes.

However, at the request of the federal states, the tax benefits are not limited to solar systems on residential buildings. Photovoltaic systems up to 15 kilowatts on buildings primarily used for business purposes are also eligible.

Will the heirs have to pay more?

The transfer of real estate - for example, through gifts and inheritance - can become more expensive. Changes to the Valuation Law could mean that from the beginning of 2023 the taxable value of real estate must be increased. The goal is an appraisal close to market value. As a result, inheritance tax, gift tax and land transfer tax can go up.

The goal is an appraisal close to market value. As a result, inheritance tax, gift tax and land transfer tax can go up.

How should climate money be paid in the future?

For the first time, a direct payment channel will be created for the possibility of receiving state assistance using a tax identification number. To do this, the tax ID must be linked to a saved bank account earmarked for future government benefits such as climate money, one-time crisis payments, or emergency relief in the event of natural disasters.

Germany speaks about it:

From Kaliningrad by plane to Russia. How to quickly, reliably and cheaply get from Germany to Russia

RSV virus: "The situation in children's hospitals is catastrophic throughout Germany"

Two-thirds of gas compensation goes to those who do not need funds

New scanners at the airport ─ control will be faster

Who is waiting for additional support from the federal and state

Lack of Internet access splits society

How and when the country's residents will receive the December aid

Housing allowances will increase from 180 euros to 370 euros, but delays are expected

How much additional money will the residents of the reforms bring

Why the garage cannot be used as a storage room

Subscribe

Germany Russia Kaliningrad Germany news Pensions taxes Money Children Energy A crisis Gas

- 29th of November

Dmitry Davydov proposed a method for re-educating drivers without OSAGO

- 10th of November

Named the economic effect of high technology in the fight against crime

- the 3rd of November

How to replenish the budget and improve road safety: Dmitry Davydov's ideas

What else to read

-

Military expert Rozhin explained why there was a pause with the use of "Geranium"

28303

Alexander Shlyapnikov

-

Ukrainian air defense hits Moldovan villages: Chisinau disappointed Kyiv

11710

Marina Perevozkina

-

An infrastructure object mysteriously exploded in Krivoy Rog

20357

Karina Alekseeva

-

Rubber fruits and a limping Basque: filming a "New Year's light" looked sad

A photo 11893

Irina Bobrova

-

Pugachev and Galkin were threatened with deprivation of Israeli citizenship

36327

Elizaveta Sapkova

What to read:More materials

In the regions

-

Razvozhaev: Kyiv tried to repeat the terrorist attack seven years ago

24853

CrimeaPhoto: //t.