How much is earned income credit per child 2023

Earned Income Credit (EITC): Definition, Who Qualifies

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

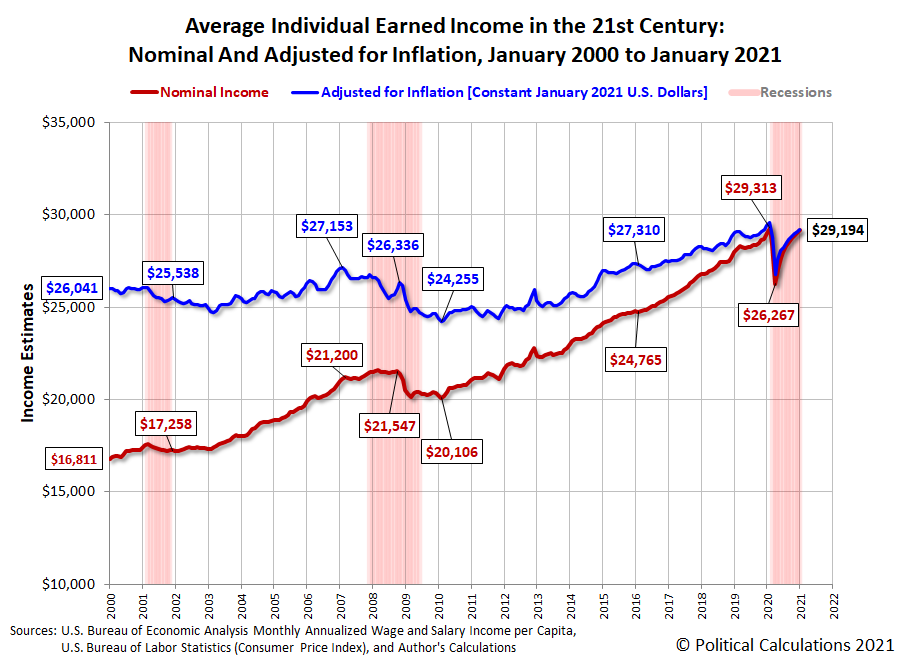

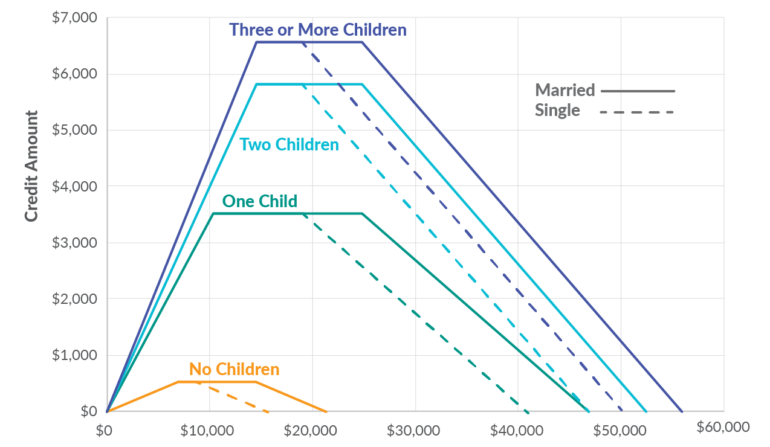

In general, the less you earn, the larger the credit. Families with children often qualify for the largest credits.

Written by Sabrina Parys, Tina Orem

Reviewed by

Lei Han

At NerdWallet, we have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

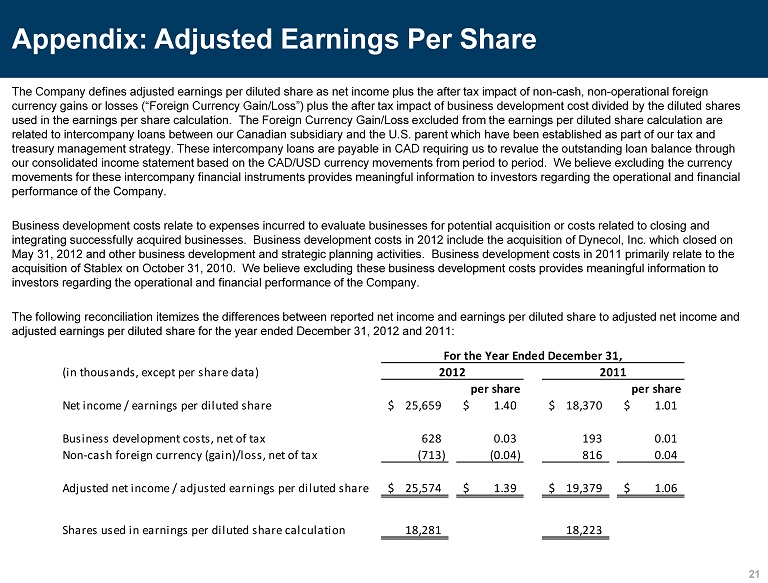

What is the earned income tax credit (EITC)?

The earned income tax credit, also known as the EITC or EIC, is a refundable tax credit for low- and moderate-income workers.

For the 2022 tax year, the earned income credit ranges from $560 to $6,935 depending on tax-filing status, income and number of children. In 2023, the credit will be worth $600 to $7,430. People without children can qualify.

If you fall within the guidelines for the credit, be sure to claim it on your return when you do your taxes. And if you didn’t claim the earned income credit when you filed your taxes in the last three years but think you qualified for it, the IRS encourages you to file an amended tax return so you can get that money back.

Internal Revenue Service

. How to Claim the Earned Income Tax Credit (EITC).

Accessed Oct 20, 2022.

View all sources

How does the earned income tax credit work?

Here are some quick facts about the earned income tax credit:

For the 2022 tax year (the tax return you'll file in 2023), the earned income credit ranges from $560 to $6,935 depending on your filing status and how many children you have.

You don't have to have a child in order to claim the earned income credit.

The earned income tax credit doesn't just cut the amount of tax you owe — the EITC could also score you a refund, and in some cases, a refund that's more than what you actually paid in taxes.

If you claim the EITC, the IRS cannot issue your refund until mid-February by law.

Internal Revenue Service

.

Earned Income Tax Credit (EITC).

Earned Income Tax Credit (EITC).Accessed Oct 20, 2022.

View all sources

Income limit for the earned income credit (EIC)

Below are the maximum earned income tax credit amounts, plus the max you can earn before losing the benefit altogether.

2022 Earned Income Tax Credit

(for taxes due in April 2023)

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$16,480 | $22,610 | ||

$3,733 | $43,492 | $49,622 | |

$6,164 | $49,399 | $55,529 | |

3 or more | $6,935 | $53,057 | $59,187 |

Both your earned income and your adjusted gross income each have to be below the levels in the table.

In general, the less you earn, the larger the earned income credit.

Your earned income usually includes job wages, salary, tips and other taxable pay you get from your employer. Your adjusted gross income is your earned income minus certain deductions.

2023 Earned Income Tax Credit

(for taxes due in April 2024)

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$17,640 | $24,210 | ||

$3,995 | $46,560 | $53,120 | |

$6,604 | $52,918 | $59,478 | |

3 or more | $7,430 | $56,838 | $63,398 |

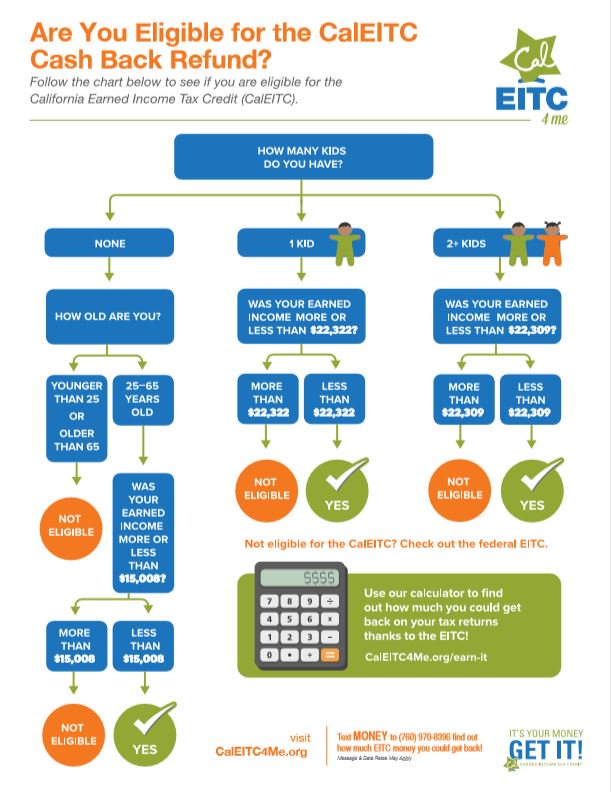

Who qualifies for the earned income tax credit?

Besides staying below the income thresholds noted above, there are other qualification rules and requirements. Here are the big eligibility rules, but you can also check out our quiz below for a quick read on whether you might qualify for the earned income credit.

Here are the big eligibility rules, but you can also check out our quiz below for a quick read on whether you might qualify for the earned income credit.

You must have at least $1 of earned income (pensions and unemployment don't count).

Your investment income must be $10,300 or less in 2022. In 2023, it can't exceed $11,000.

You can qualify for the EITC if you’re separated but still married. To do so, you can’t file a joint tax return and your child must live with you for more than half the year. You also must have not lived with your spouse during the last six months or you must have a separation agreement or decree.

There are special EIC rules for members of the military and the clergy, as well as for people who have disability income or who have children with disabilities.

Kids and the earned income credit

If you claim one or more children as part of your earned income credit, each must pass certain tests to qualify:

The child can be your son, daughter, adopted child, stepchild, foster child or grandchild.

The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children (your niece or nephew).

The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children (your niece or nephew).The child must be under 19 at the end of the year and younger than you or your spouse if you're filing jointly, OR the child must be under 24 if he or she was a full-time student. There's no age limit for kids who are permanently and totally disabled.

The child must have lived with you or your spouse in the United States for more than half the year.

For each child you're claiming with the EITC, you’ll also need:

If you don't have kids

You may be able to get the EITC if you don’t have a qualifying child but meet the income requirements for your filing status. To qualify, you typically must meet three more conditions:

You must have resided in the United States for more than half the year.

No one can claim you as a dependent or qualifying child on their tax return.

You must be at least 24 if you were a student for at least five months of the year, 18 if you were in foster care any time after turning 14 or were homeless in any taxable year, and at least 19 otherwise.

Consequences of an EIC-related error

Not only does an error on your tax form delay the EIC part of your refund — sometimes for several months — but it also means the IRS could deny the entire earned income credit.

If the IRS denies your whole EIC claim:

You must pay back any EIC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information to Claim Earned Income Credit After Disallowance," before you can claim the EIC again.

You could be banned from claiming EITC for the next two years if the IRS finds you filed your return with “reckless or intentional disregard of the rules.”

You could be banned from claiming EITC for the next 10 years if the IRS finds you filed your return fraudulently.

Most tax software walks you through the EITC with a series of interview questions, greatly simplifying the process. (Plus, if you qualify for the EITC, you might be able to get free tax software.) But remember: Even if someone else prepares your return for you, the IRS holds you responsible for all information on any return you submit.

Past years' earned income tax credit

If you need the income thresholds and credit amounts from past years, take a look back.

2020 tax year

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$15,820 | $21,710 | ||

$3,584 | $41,756 | $47,646 | |

$5,920 | $47,440 | $53,330 | |

3 or more | $6,660 | $50,954 | $56,844 |

You can use either your 2019 income or 2020 income to calculate your EITC — you might opt to use whichever number gets you the bigger EITC.

2021 tax year

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$1,502 | $21,430 | $27,380 | |

$3,618 | $42,158 | $48,108 | |

$5,980 | $47,915 | $53,865 | |

3 or more | $6,728 | $51,464 | $57,414 |

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

2022-2023 Earned Income Tax Credit (EITC) Qualification and Income Limit Tables – Latest News and Updates

Updated:

[Updated with 2023 IRS adjustments] Below are the latest Earned Income Tax Credit (EITC) tables and income qualification thresholds adjusted for recent tax years and new legislation.

These limits are adjusted annually in line with inflation and other government mandates. The EITC will return to normal levels following a temporary expansion of eligibility rules and amounts during the pandemic years.

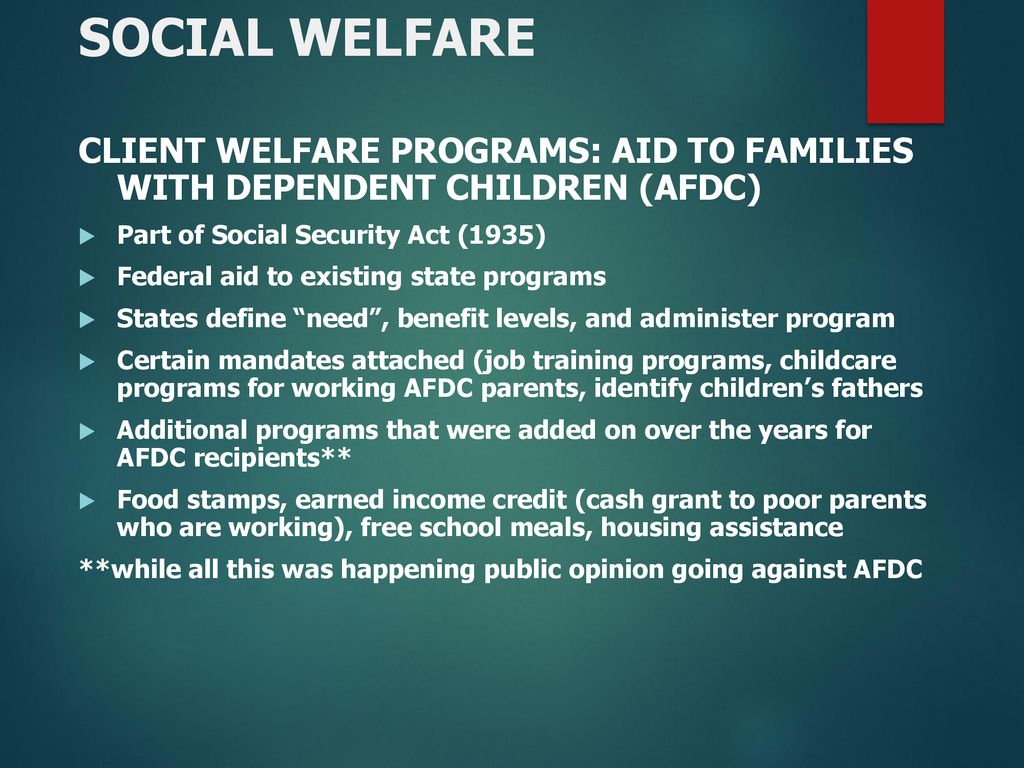

The EITC supplements the wages of low income workers, and especially working mothers, lifting more children out of poverty than any other single federal program.

Nearly 25 million tax returns claimed the earned income tax credit according to IRS data, which has also meant long refund delays for many tax payers claiming this credit

TurboTax Free Edition: $0 Fed. $0 State. $0 to File. Claim Your Refund

$0 State. $0 to File. Claim Your Refund

Covered in this Article:

Final 2022 EITC tables (for 2023 tax filings)

The IRS has released the latest inflation adjusted EITC tables which are shown below. The main difference to 2021 levels is that the expanded ranges and amounts available (via Biden’s ARPA bill) to childless workers won’t be available in 2022.

You will notice the considerable decrease shown in the 2022 tables versus those in 2021.

There was a possibility that the 2021-2022 EITC expansion would be extended via Biden’s original Build Back Better plan; however the EITC (and CTC) expansion was not part of the final bill (Inflation Reduction Act) that was eventually passed.

| 2022 EIC Qualification Item | No Children | With 1 Child | With 2 Children | With 3+ Children |

|---|---|---|---|---|

| 1. Max. 2022 Earned Income Tax Credit Amount | $560 | $3,733 | $6,164 | $6,935 |

2. Earned Income Base Amount required to get maximum credit Earned Income Base Amount required to get maximum credit | $7,320 | $10,980 | $15,410 | $15,410 |

| 3. Phaseout Threshold Amount Begins (for Single, SS, or HoH) | $9,160 | $20,130 | $20,130 | $20,130 |

| 4. Income (AGI) Maximum When Credit Eligibility Ends (for Single, SS, or HoH) | $16,480 | $43,492 | $49,399 | $53,057 |

| 5. Phaseout Threshold Amount Begins (for Married Filing Jointly) | $15,290 | $26,260 | $26,260 | $26,260 |

| 6. Income (AGI) Maximum When Credit Eligibility Ends (for Married Filing Jointly) | $22,610 | $49,622 | $55,529 | $59,187 |

Get the latest money, tax and stimulus news directly in your inbox

How to read the EITC tables:

The maximum earned income credit allowed/payable for the given tax year is shown in line 1. To start claiming this credit you must have at least $1 of earned income, with line 2 showing the minimum amount of earned income required to get the maximum earned income tax credit.

To start claiming this credit you must have at least $1 of earned income, with line 2 showing the minimum amount of earned income required to get the maximum earned income tax credit.

The amount of credit you receive or qualify for varies based on income and number of children so will differ from person to person. Earned income includes all the taxable income such as Wages, salaries, and tips, certain disability benefits and self-employment earnings.

The “Phaseout Threshold Amount Begins“ (lines 3 and 5 depending on filing status) and “Phaseout Amount When Credit Ends” (lines 4 and 6 depending on filing status) are the adjusted gross income (AGI) ranges from where the EITC begins to phase out to where it reaches $0, or the income at or above which no credit is allowed.

Or said another way you need to earn between $1 and the amounts in line 4 or 6 (based on filing status) to get at least some of the EIC. If your income is between lines 2 and 4 (single filer, HoH or SS) or lines 2 and 5 (married) then you get the FULL EIC for the year.

If your income is between lines 2 and 4 (single filer, HoH or SS) or lines 2 and 5 (married) then you get the FULL EIC for the year.

Scenario 1: Sara has an earned income of $1,200 for the year – Sara would be entitled to a partial credit since she her earned income is less than the “Earned Income required to get the maximum credit (lower limit)” per line 2. The minimum amount of earnings to get a partial credit is $1. The amount of credit would vary based on the number of qualifying children.

Scenario 2: Megan has 1 child and an earned income of 14,000 for the year – Megan is entitled to the full EIC credit for a single filer with 2 children since her earned income is above the “Earned Income required to get the maximum credit (lower limit” on line 2) but below the “Starting Threshold Phaseout Amount” on line 3.

Scenario 3: Joe and Mary have an earned income of $45,000 and 2 children – Joe and Mary would be entitled to a partial EIC credit for a married couple with 2 children since their earned income is above the “Starting Threshold Phaseout Amount (Married Filing Jointly)” on line 5 but below the maximum eligibility amount (for Married Filing Jointly) on line 6.

Scenario 4: Kobe and Lina have earned income of $120,000 for the year and 3 children – They would not be entitled to the credit at all since their earned income is above the maximum eligibility income amount on line 6

See IRS publication 596 or use online tax providers like TurboTax or H&R Block to get a free estimate of the specific credit amount you would be entitled to.

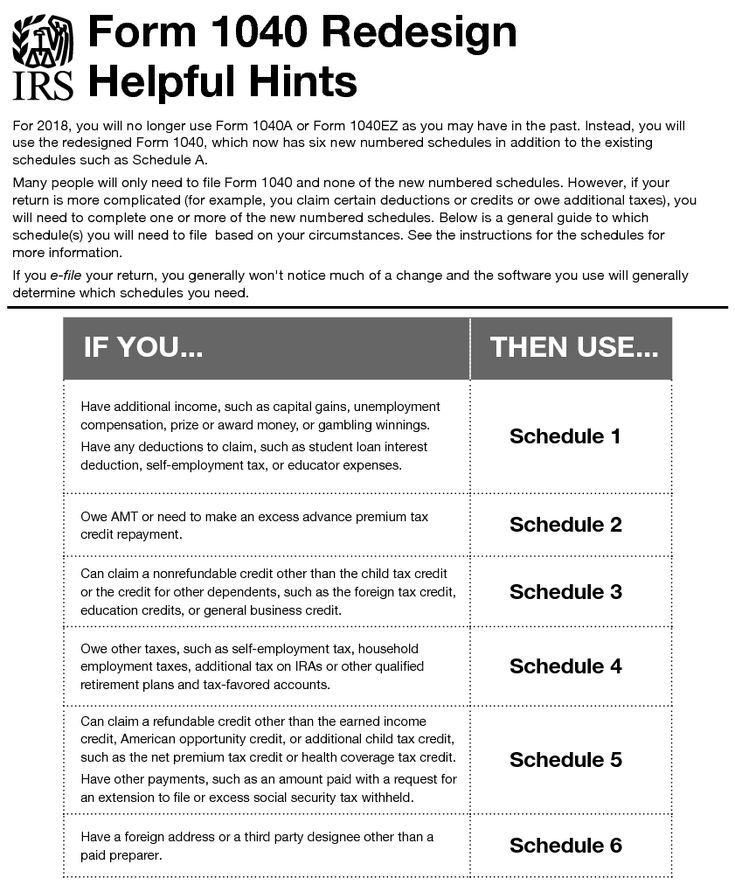

Filing a Tax Return with the Earned Income Tax Credit (EITC) and PATH Act

You have to file a tax return with the IRS to claim the EITC, even if you owe no tax or are not required to file. You can get help with figuring the EIC and other qualifying criteria by following instructions in IRS publication 596 or using online tax filing software which can also help you work through figuring your credit eligibility and determine the amount you would receive.

As with past years, tax payers who claim the EITC and the Child Tax Credit will several weeks of delay in receiving refunds due to PATH act provisions. This lifts by mid to late February allowing millions of refunds to be issued.

This lifts by mid to late February allowing millions of refunds to be issued.

2023 EITC tables (for 2024 tax filings)

The IRS has released the inflation-adjusted 2023 EITC income threshold tables, which will be applicable from Jan 2023 and used when filing returns in 2024. In line with rising inflation the credit and eligibility income thresholds all increased.

| 2023 EIC Qualification Item | No Children | With 1 Child | With 2 Children | With 3+ Children |

|---|---|---|---|---|

| 1. Max 2023 Earned Income Tax Credit Amount | $600 | $3,995 | $6,604 | $7,430 |

| 2. Earned Income Base Amount required to get maximum credit | $7,840 | $11,750 | $16,510 | $16,510 |

| 3. Phaseout Threshold Amount Begins (for Single, SS, or HoH) | $9,800 | $21,560 | $21,560 | $21,560 |

| 4. Income (AGI) Maximum When Credit Eligibility Ends (for Single, SS, or HoH) | $17,640 | $46,560 | $52,918 | $56,838 |

5. Phaseout Threshold Amount Begins (for Married Filing Jointly) Phaseout Threshold Amount Begins (for Married Filing Jointly) | $16,370 | $28,120 | $28,120 | $28,120 |

| 6. Income (AGI) Maximum When Credit Eligibility Ends (for Married Filing Jointly) | $24,210 | $53,120 | $59,478 | $63,398 |

The EITC won’t be allowed if a taxpayer’s qualified investment income exceeds $11,000 in 2023.

2021-2022 Earned Income Tax Credit ARPA Expansion

Under the Biden ARPA package, the EITC was temporarily modified to provided greater coverage for childless workers and also boost the maximum credit in 2021 to $1,502 from the already inflation adjusted $543 for childless workers. The benefit will be realized in larger refunds when taxpayers file their 2021 returns in 2022.

The ARPA bill also raises the qualifying income level to $9,820 at which the earned income tax credit reaches its maximum, as well as changing the income phaseout level to begin at $11,610 for individuals (no children) tax filers.

There are also provisions that permanently increase the maximum investment income threshold to $10,000 (vs. existing $3,650) that can be excluded for counting towards EIC qualification. This limit will be adjusted for inflation. See the tables below for updated 2021 Earned Income tables, which you can compare to 2020 and 2019 levels in earlier updates below.

Prior years’ age limits for the EITC were also scrapped, meaning that any worker over 19 who meets income guidelines would qualify for the credit. Previously, only workers ages 25 to 64 could claim it.

The above changes are in addition to the expanded CTC and $1400 dependent stimulus checks also passed in the Biden ARPA stimulus package to help low and middle income families.

2022 Tax Refunds Larger Due to Expanded EIC

The EITC expansion for the 2021 tax year, especially for childless workers whose benefit nearly tripled, means that millions more will likely see large refunds in their 2022 filings. See more in this article.

See more in this article.

| Income Qualification Item | No Children | With 1 Child | With 2 Children | With 3+ Children |

|---|---|---|---|---|

| 1. Max. 2021 Earned Income Tax Credit Amount | $1,502 | $3,618 | $5,980 | $6,728 |

| 2. Earned Income Base Amount required to get maximum credit | $9,820 | $10,640 | $14,950 | $14,950 |

| 3. Phaseout Threshold Amount Begins (for Single, SS, or HoH) | $11,610 | $19,520 | $19,520 | $19,520 |

| 4. Income (AGI) Maximum When Credit Eligibility Ends (for Single, SS, or HoH) | $21,430 | $42,158 | $47,915 | $51,464 |

| 5. Phaseout Threshold Amount Begins (for Married Filing Jointly) | $17,550 | $25,470 | $25,470 | $25,470 |

| 6. Income (AGI) Maximum When Credit Eligibility Ends (for Married Filing Jointly) | $27,380 | $48,108 | $53,865 | $57,414 |

Using 2019 Income Levels for 2020 and 2021 EITC Eligibility (Look Back Provision)

Note that for 2020 tax filings in 2021, Congress passed legislation in multiple COVID relief bills that allows you to use 2019 income levels to apply for the EITC in your 2020 return and 2021 return.

This is to address the pandemic driven economic slowdown and job or income losses for taxpayers who may not have qualified for the EITC if their 2020 or 2021 income (AGI) was used to figure their EITC. Tax software providers like TurboTax have updated their software to account for this change.

Earned Income Tax Credit (EITC) Relief : If your earned income was higher in 2019 than in 2020 or 2021, you can use the 2019 amount to figure your EITC for 2020 and 2021. This temporary relief would allow tax payers to qualify or get a potentially larger refund in their 2020 and 2021 tax filings.

IRS

2020 Earned Income Tax Credit (EIC) Table

| Income Qualification Item | No Children | With 1 Child | With 2 Children | With 3+ Children |

|---|---|---|---|---|

| 1. Max. 2020 Earned Income Tax Credit Amount | $538 | $3,584 | $5,920 | $6,660 |

2. Earned Income Base required to get maximum credit Earned Income Base required to get maximum credit | $7,100 | $10,640 | $14,950 | $14,950 |

| 3. Phaseout Threshold Amount Begins (for Single, SS, or Head of Household) | $8,790 | $19,330 | $19,330 | $19,330 |

| 4. Income (AGI) Maximum When Credit Eligibility Ends (for Single, SS, or Head of Household) | $15,820 | $41,756 | $47,440 | $50,594 |

| 5. Phaseout Threshold Amount Begins (for Married Filing Jointly) | $14,680 | $25,220 | $25,220 | $25,220 |

| 6. Income (AGI) Maximum When Credit Eligibility Ends (for Married Filing Jointly) | $21,710 | $47,646 | $53,330 | $56,844 |

2019 Earned Income Tax Credit (for Returns Filed in 2020)

| Income Qualification Item | No Children | With 1 Child | With 2 Children | With 3+ Children |

|---|---|---|---|---|

1. Max. 2019 Earned Income Tax Credit Amount Max. 2019 Earned Income Tax Credit Amount | $529 | $3,526 | $5,828 | $6,557 |

| 2. Earned Income (lower limit) required to get maximum credit | $6,800 | $10,200 | $14,320 | $14,320 |

| 4. Income (AGI) Maximum When Credit Eligibility Ends (for Single, SS, or Head of Household) | $15,570 | $41,094 | $46,703 | $50,162 |

| 6. Income (AGI) Maximum When Credit Eligibility Ends (for Married Filing Jointly) | $21,370 | $46,884 | $52,493 | $55,952 |

2018 Earned Income Tax Credit (for Returns Filed in 2019)

| Income Qualification Item | No Children | With 1 Child | With 2 Children | With 3+ Children |

|---|---|---|---|---|

| 1. Max. 2018 Earned Income Tax Credit Amount | $520 | $3,468 | $5,728 | $6,444 |

2. Earned Income (lower limit) required to get maximum credit Earned Income (lower limit) required to get maximum credit | $6,800 | $10,200 | $14,320 | $14,320 |

| 3. Phaseout Threshold Amount Begins (for Single, SS, or Head of Household) | $8,510 | $18,700 | $18,700 | $18,700 |

| 4. Phaseout Amount When Credit Ends (for Single, SS, or Head of Household) | $15,310 | $40,402 | $45,898 | $49.298 |

| 5. Phaseout Threshold Amount Begins (for Married Filing Jointly) | $14,200 | $24,400 | $24,400 | $24,400 |

| 6. Phaseout Amount When Credit Ends (for Married Filing Jointly) | $21,000 | $46,102 | $51,598 | $54,998 |

Subscribe via email or follow us on Facebook, Twitter or YouTube to get the latest news and updates

Types of family benefits | Sotsiaalkindlustusamet

You are here

Home Children, families Applicants for family benefits Types of family benefits

If a child is born dead or die within 70 days

Parents have the right to birth benefit and parental compensation if the child is born dead or die in within 70 days.

Childbirth allowance

One of the parents is also entitled to childbirth allowance in case of stillbirth from the 22nd week of pregnancy. The allowance is one-time, in the amount of 320 euros. The right to receive childbirth allowance arises on the day the child is born.

Parental benefit

If the mother works and is entitled to compensation for temporary disability

From April 1, 2022, a working mother is entitled to maternity leave and parental benefit to the mother for 100 consecutive calendar days starting from the 22nd week of pregnancy if the child is stillborn or dies within 70 calendar days. During this period, the mother is covered by health insurance.

If a mother started exercising her right to mother's parental benefit before the child was stillborn, she is entitled to mother's parental benefit and maternity leave for a total of 100 calendar days. For example, if a mother took maternity leave 70 calendar days before the birth of a child and started exercising her right to parental compensation to the mother after the birth of the child. dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

An exception is also made here for mothers who, by the day of the child's death, have already used the mother's parental benefit in the amount of more than 70 calendar days. In this case, the mother is entitled to the mother's parental benefit additionally within 30 consecutive calendar days from the day following the day of the child's death. This means that no matter how many days the mother managed to use the mother's parental benefit by the day of the child's death, 30 calendar days of parental leave and parental benefit are guaranteed from the day of the child's death.

If the child dies at the time when the mother has managed to start using the already distributed parental benefit, the mother is re-registered as a recipient of the mother's parental benefit.

If the mother is not working

From April 1, 2022, a non-working mother is entitled to receive mother's parental benefit within 30 consecutive calendar days from the day following the day of the child's death, i.e. parental benefit cannot be received distributed by day over a long period of time, but if desired, you must use all 30 days in a row. During this period, the mother is covered by health insurance.

Fathers

From April 1, 2022, the father is entitled to paternity leave and father's parental benefit for 30 consecutive calendar days after the death of the child, regardless of whether the father used the right to paternity leave and father's parental benefit before the estimated date of birth of the child or before the death of the child. Father's parental benefit cannot be received on a daily basis over a long period of time, but if desired, all 30 days in a row must be used. In the case of fathers, there is no difference between granting and paying parental benefit, regardless of whether the father is working or not.

In order to receive family benefits, parents do not need to contact us and apply themselves. The Department of Social Insurance automatically obtains stillbirth information by exchanging data between the health information system and the social protection information system so that it is also possible to proactively offer family benefits to bereaved parents.

Additional parental paternity benefit is a type of benefit paid to fathers to enable them to take a greater part in the upbringing of their children. For working fathers, this is also accompanied by a 30-day leave from the employer.

For how long is compensation paid and for how long should it be scheduled?

You can receive additional parental benefit for a father for a total of 30 days, and not necessarily in a row (that is, the benefit can be received in installments). Supplemental parental benefit to the father can be received both during the period when the mother receives the parental allowance or the birth allowance (30 days before the expected date of birth of the child), and later.

The father is entitled to additional parental benefit until the child reaches the age of 3 or until the father receives regular parental benefit. Paternity leave cannot be separated from the receipt of compensation. If the father wishes to receive regular parental benefit without receiving additional parental benefit but does not notify us of the waiver of paternity leave, the Social Insurance Board will not be able to grant parental benefit until the father confirms his wish to waive paternity leave or use his. To fully waive paternity leave, you must submit an application to us.

Employment during paternity leave

While on paternity leave, the father must take a break from work at all his employers. The period of vacation use is entered in the Employment Register. During paternity leave, the father should not work and receive income! The principle of regular parental benefit does not apply, so the amount of parental benefit is not reduced when a maximum of half of the compensation has been received.

In accordance with the Law on Employment Contracts, an employer may refuse to grant leave if the notice of the desire to receive it is less than 14 days and for a period of less than 7 calendar days. Supplementary parental benefit to the father within the meaning of the Employment Contracts Act is a normal rest period, therefore, being on paternity leave does not adversely affect the calculation of annual leave and these days are considered working days when determining annual leave. Like being on vacation, parental leave does not reduce seniority.

Non-working fathers (including also self-employed persons (FIE) or representatives of the so-called liberal professions (e.g. notaries, bailiffs, sworn translators, auditors, bankrupt bailiffs), as well as persons working on the basis of a contract assignments and work contracts, etc. under the law of obligations, or members of the governing body of a legal entity) also receive additional parental benefit to the father for 30 calendar days. It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

How to apply?

Be sure to talk to your child's mother and, if you have an employment relationship, also to your employer before applying. It must be borne in mind that the employer may refuse to grant a vacation of less than 7 days if you notify him less than 14 days in advance. If the employer agrees, there are no restrictions on our part - you can go on vacation from any day.

The application for additional parental benefit is made through the self-service environment. If you wish to take advantage of the leave until the birth of the child, you must indicate the personal code of the child's mother and the expected date of his birth. After the baby is born, you will find a pre-filled offer in the self-service environment. If you are unable to use the self-service environment, please contact us at [email protected].

If you are registered in the Employment Register as a person with a valid employment relationship, you will need to provide your employer's email address. You should also include the email address of the mother of the child. The self-service system will send them a notice of your leave application and put it on hold for 5 days. You don't need to do anything else.

The employer and the child's mother have 5 working days to tell us if they disagree with your leave application. If your employer or the child's mother does not submit their objections, the system will automatically enter a leave note in the Employment Register after 5 working days.

We will calculate the amount of your compensation and pay it to you at the beginning of the next month (the payout date is the 8th of each month).

How is paternity leave calculated?

Additional parental benefit to the father is calculated according to the same rules as regular parental benefit.

To calculate the benefit, we first subtract the 9 full calendar months prior to the birth of the child (i. e. the average length of pregnancy, whether the child was born on time, premature or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

e. the average length of pregnancy, whether the child was born on time, premature or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

The amount of compensation depends on the amount of social tax paid on the income received. Since the income is calculated based on the social tax paid during the 12 months of the reporting period, the amount based on the reporting period may differ from the exact income received at that time, so it is worth paying attention to the social tax paid during this period. You can read more about how parental benefits are calculated here. You can also use the parental benefit calculator (informative).

The minimum rate of parental benefit is the minimum wage rate of the previous calendar year in effect on 1 January (584 euros in 2022). The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

Example 1: During the period taken as the basis for the calculation, the father earned 1,500 euros per month. He went on paternity leave from January 14, 2021 to February 13, 2021, thus being on paternity leave for 30 consecutive days. Consequently, he was on parental leave for 17 days in January and 13 days in February. In January, the amount of his additional parental benefit amounted to (1500/31×17) 822.58 euros, in February - (1500/28×13) 696.43 euros.

Example 2: During the period taken as the basis for the calculation, the father earned 1200 euros per month. He took one week of paternity leave in January 2021, two weeks in February and the remaining 9 days in March. Thus, the amount of his additional parental benefit amounted to (1200/31×7) 270.97 euros in January, (1200/28×14) 600 euros in February and (1200/31×9) 348. 39 euros in March .

39 euros in March .

Other things to remember:

If several children were born in a family after 1 July 2020 at short intervals, then the right to 30 days of paternity leave and / or additional parental benefit to the father arises in connection with each child. Compensation / leave for each child should be used at different times - leave cannot be received at one time for all children, nor can multiple compensation be received in one period.

Twins are subject to one period, regardless of the number of twins.

If the family wants the father to receive both regular parental allowance and additional parental benefit to the father in succession, the first 30 days are always considered to be the period of additional parental benefit to the father. The father can start receiving regular parental allowance from the day when the child is at least 70 days old and the mother's maternity sheet is closed.

If you are on sick leave, it is recommended that you interrupt your paternity leave by notifying the Social Insurance Board as soon as possible. If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

Starting on September 1, 2019 no longer assigned a child care fee

- due to children who were born on September 1, 2019, , , child care fee is no longer charged for a newborn baby or any other child growing up in the family . The state will gradually link the available funds with the new parental benefit system in the period 2020-2022.

- For all families where a child is born no later than August 31, 2019, we assign and pay a child care fee on the previous basis.

- Also for those who have already been assigned a childcare allowance as of August 31, 2019, we will continue to pay benefits .

We will continue paying the child care allowance until it ends, but no later than August 31, 2024.

At the same time, only one parent in the family is entitled to child care allowance (after the end of receiving parental benefit), if the family grows:

- child under 3 years old – EUR 38.36 per month for each child under 3 years old.

In addition, we pay a lower childcare allowance for children aged 3 to 8 if:

- from 3 to 8 years - 19.18 euros per month also for a child aged 3 to 8 years;

- There are 3 or more children in the family receiving child benefit – EUR 19.18 per month for each child aged 3 to 8 years.

If your child turns 8 in first grade, we will pay child care until the end of first grade, which is August 31st. If the child turns 8 in the second grade, or if the child is not in school, we will pay Child Care Allowance until the end of the month in which the child's birthday is.

Being on parental leave and receiving childcare allowance may be someone else instead of the child's parent. However, there is a rule that the amount of child care allowance paid to such a person cannot exceed 115.08 euros per month in total.

Example . The family has three children: aged 2 years, 3 years and 6 years. For a 2-year-old child, a child care allowance is paid in the amount of 38.36 euros per month. For a 3- and 6-year-old child, child care allowance is paid under the condition that in a family with three or more children, all children under the age of 8 will receive child care allowance. The amount of the child care allowance paid for both a 3-year-old and a 6-year-old child is 19,18 euros per child.

In total, the child care allowance is paid to the family in the amount of 38.36 + 19.18 + 19.18 = 76.72 euros per month.

In addition, such a family is paid a child allowance for each child, which is 60 euros for the first and second child, and 100 euros for the third child, for a total of 220 euros per month. Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

The right to receive child care allowance arises after the end of receipt of parental benefit . However, we still recommend that you apply for child care allowance or agree to receive it as soon as you submit your initial application for family benefits. In this way, after the end of the payment of the parental benefit, we will be able to immediately begin the payment of the child care allowance.

However, keep in mind that if one of the parents leaves his job for parental leave, he is also entitled to the childcare allowance. Parental leave can be obtained from the employer.

The state pays social tax for the recipient of the child care allowance, and thus health insurance is provided by the state to the parent to whom we pay the child care allowance! You can read more about health insurance HERE.

Parental benefit and child care allowance are not paid simultaneously to the same family.