How much is cost to raise a child

Cost of Raising a Child

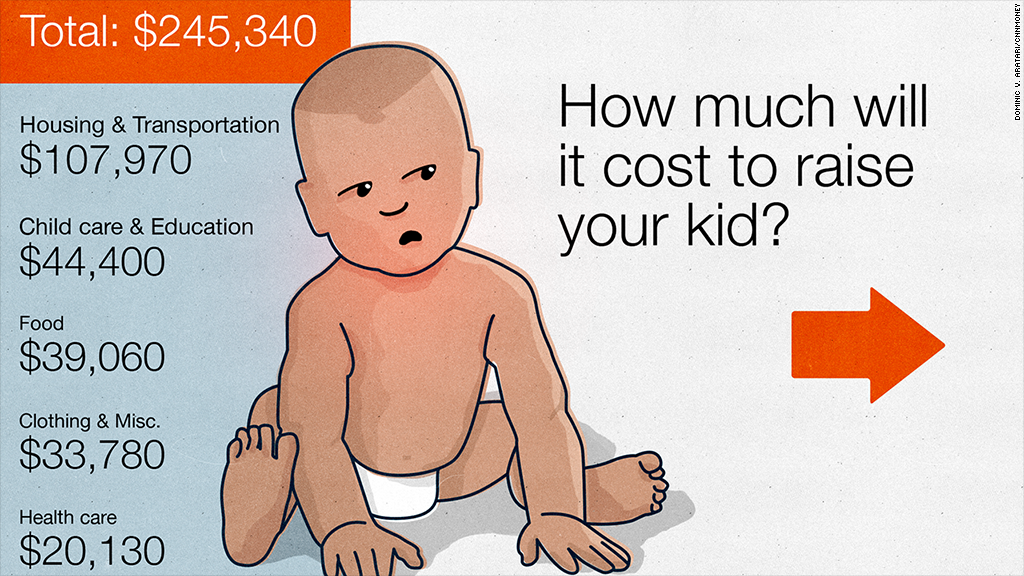

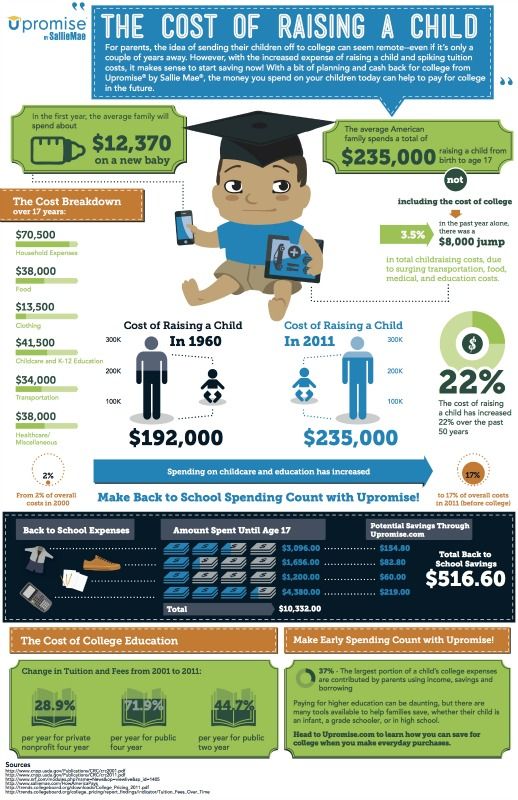

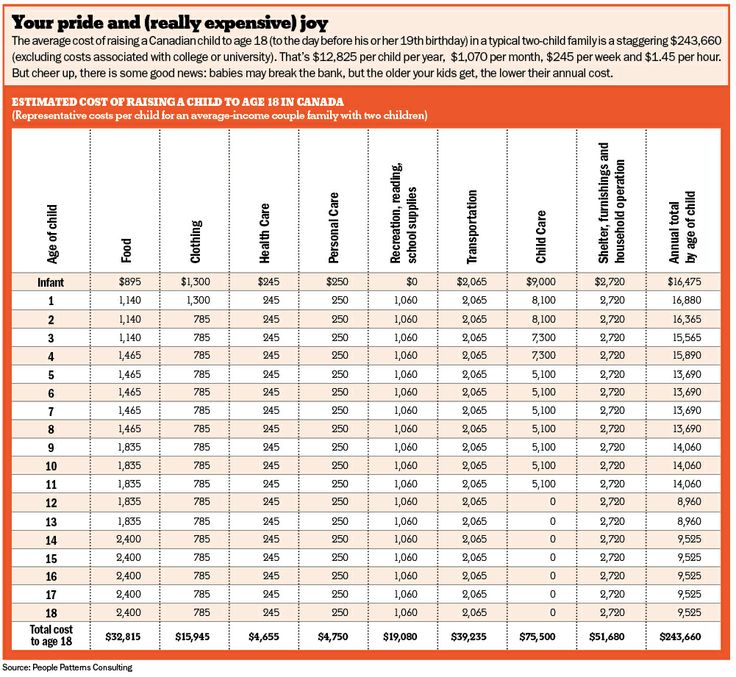

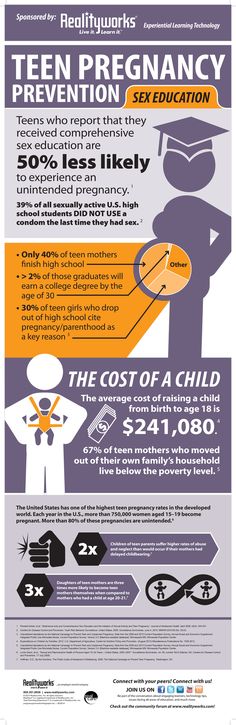

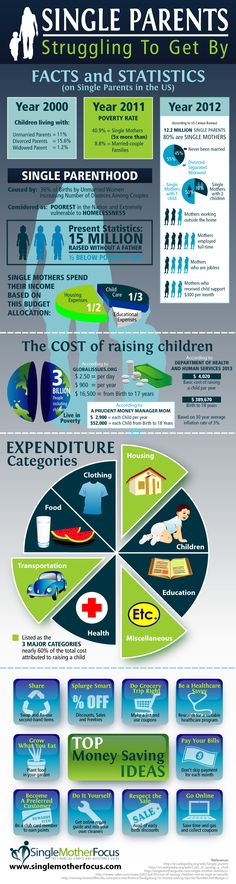

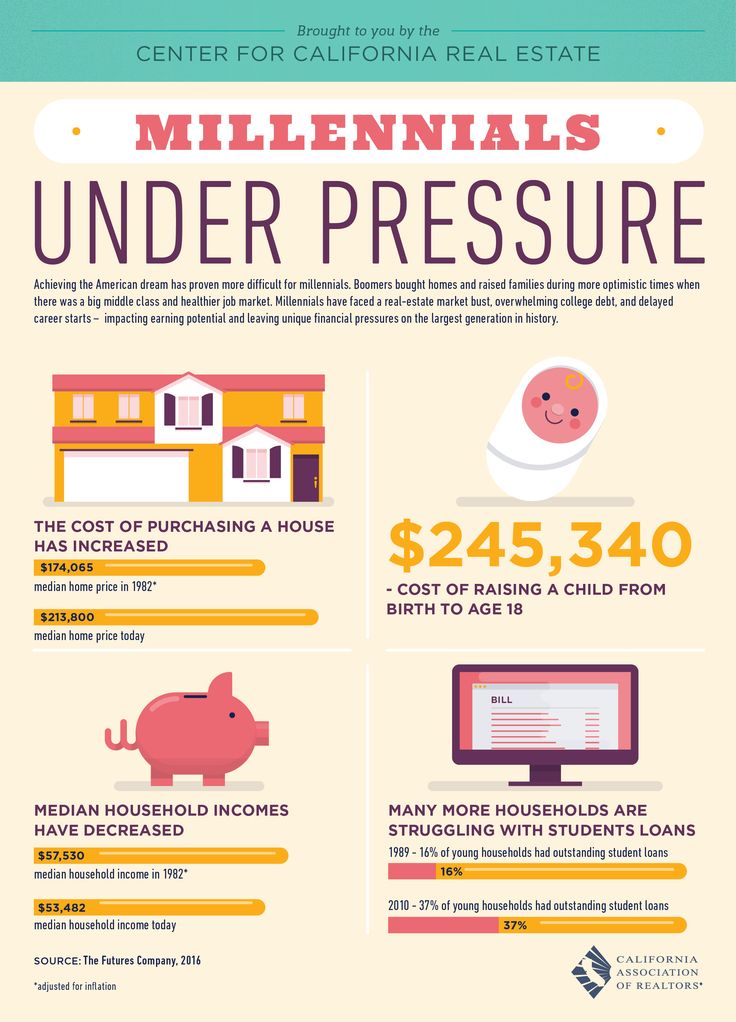

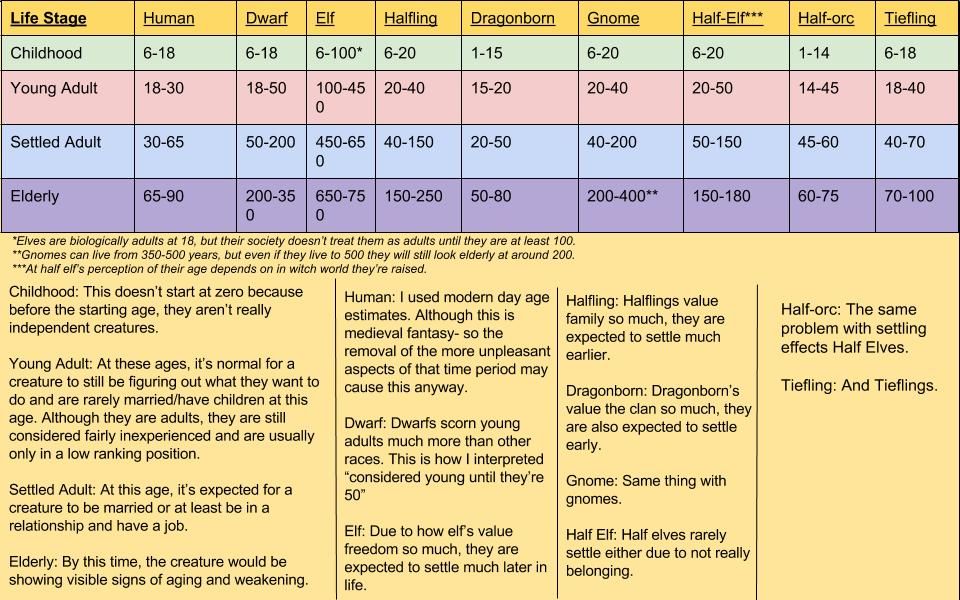

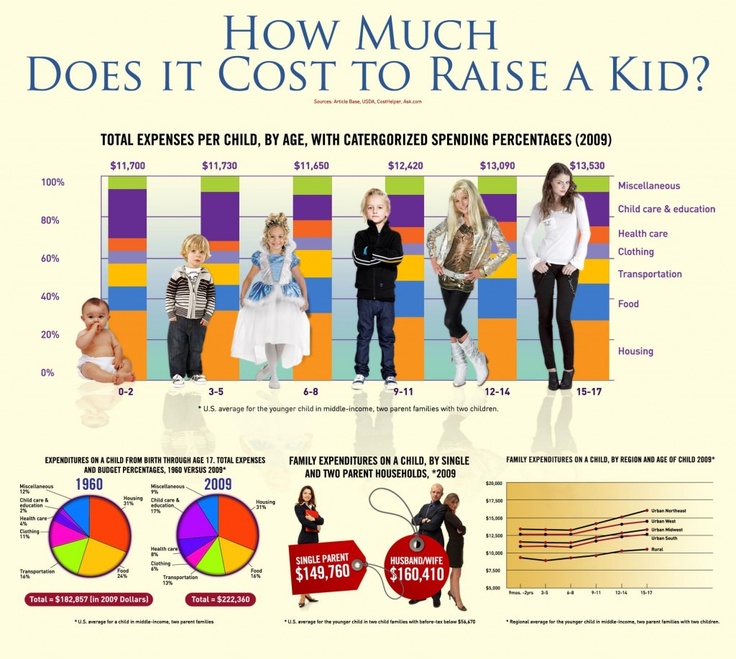

How much does it cost to have a baby and raise them? A 2015 study done by the USDA found that it cost an estimated $233,610 to raise two children from birth to age 17 in a middle-income family with two parents. That figure, adjusted for inflation, is just over a quarter of a million dollars at $286,000 in 2022. Shouldering the cost of raising children can be an additional pressure on parents, especially as costs continue to rise. Here’s what you need to know.

How much does it cost to have a baby?

Having a child is an undeniably major life change. Women and families today may be more anxious to understand how life and their financial situation might change with a baby, whether anticipated or unplanned. Here are just some of the expected costs related to having and raising a baby:

Insurance Life- The average cost of powdered formula is around $400-$800 per month for babies who are exclusively fed on formula. This cost could be different depending on your situation, such as if your baby needs special formula, if there is a formula shortage or recall or if your baby is also fed breast milk.

(Babycenter.com)

- A study by the Kaiser Family Foundation found that the total costs associated with being pregnant, experiencing childbirth and postpartum care averaged $18,865. (Kaiser Family Foundation)

- That same study found that average vaginal deliveries cost $14,768, with $2,655 paid out of pocket, while the average cesarean section cost $26,280, with $3,214 paid out of pocket.(Kaiser Family Foundation)

- A home birth could cost between $1,500 to $5,000, but typically isn’t covered by health insurance. (Healthline)

- Adoption and in vitro fertilization (IVF) costs can also vary. One cycle of IVF could range between $4,900 to $30,000 depending how the procedure is performed, while private adoption fees could be between $20,000 to $45,000.

(Healthline)

(Healthline) - The annual cost of childcare for infants to four years old averages about $10,000 per child for center-based care and $8,000 for home-based care. (S. Treasury Department)

- A survey from CNBC found that the weekly cost of a nanny for a single child in 2021 was $694, up from $565 in 2019. An after school sitter in 2021 was $261, slightly higher than the 2019 figure of $243. (CNBC)

- That same study found that parents reported spending more than 20% of their household income on childcare, although 72% reported spending 10% or more. (CNBC)

- With babies going through 6-12 diapers per day, this could mean up to $936 per year, or $18 a week, spent on disposable diapers. (Healthline)

- Getting all the necessary gear for a baby, like strollers, car seats, play pens and carriers, can cost anywhere from $425 to nearly $3,000.

(The Bump)

(The Bump)

How much do school expenses cost?

A major expense when it comes to raising children is the cost of education. Starting with preschool, the average cost per year of tuition can range from $4,460 to $13,158 per year, or about $372-$1,100 per month.

When it comes to kindergarten through high school, parents can choose between public and private schools. For private schools, the Education Data Initiative estimated that tuition costs an average of $12,350 per year. Associated costs, like technology, textbooks, back-to-school supplies and more, could bring that up to $16,050. For a child to be in private school from kindergarten through eighth grade, the estimated cost could be around $208,650.

Public schools don’t charge a tuition fee like private schools, but that doesn’t mean there aren’t costs as well. In 2016, the University of Michigan estimated that it cost $302 per student to play sports, $218 for arts like music, theater or yearbook, and $124 for other clubs. These figures included costs like participation fees, equipment and travel, and may have been increased since due to inflation.

These figures included costs like participation fees, equipment and travel, and may have been increased since due to inflation.

Paying for college

Currently, the average cost of full-time undergraduate tuition for a public university ranges from $10,740 for in-state students and $27,560 for out-of-state students. Parents who choose to pay for college can take advantage of savings plans like the 529 plan. Starting early in your kids’ lives allows you to leverage time to build up savings for your child’s post-high school education.

The school that your child attends matters, too. While they may receive a lower tuition for attending an in-state public school, they may want to go out-of-state as well. Below are the most expensive and cheapest states for out-of-state students attending a 4-year public university:

Insurance LifeFive cheapest states for out-of-state students attending a 4-year public university

- Florida: $4,463 per year

- Wyoming: $4,747 per year

- District of Columbia: $6,020 per year

- Nevada: $6,023 per year

- Utah: $6,700 per year

Five most expensive states for out-of-state students attending a 4-year public university

- New Jersey: $14,360 per year

- Illinois: $14,455 per year

- Pennsylvania: $15,565 per year

- New Hampshire: $16,679 per year

- Vermont: $17,083 per year

Other costs of raising a child

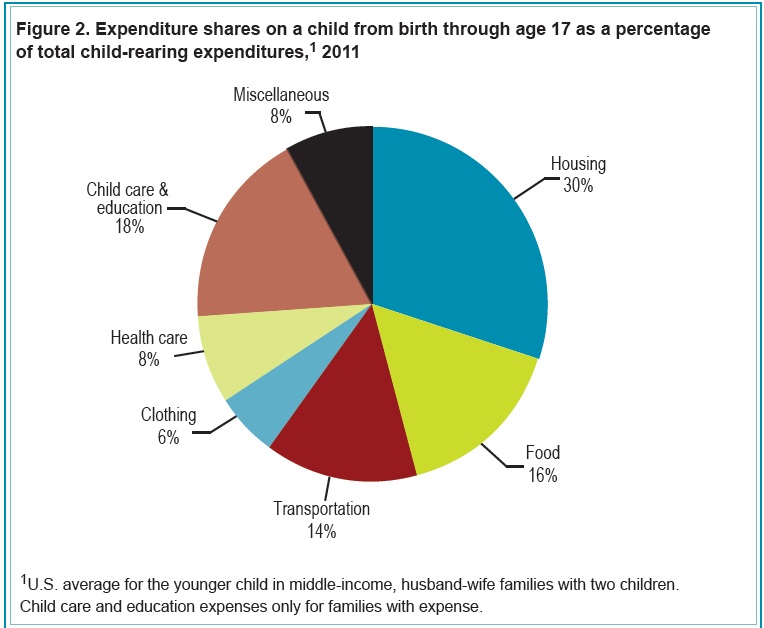

Though housing, food and child care are the highest cost categories related to raising a child to age 18, they are not the only expenses to consider. Other necessities like clothing, education and health care can be expensive. All of these categories should also be considered when factoring in the costs of having and raising a child.

Other necessities like clothing, education and health care can be expensive. All of these categories should also be considered when factoring in the costs of having and raising a child.

As your child gets older and earns their driver’s license, for instance, this could be a significant expense — Bankrate’s research found that adding your 16-year-old to your car insurance policy runs an average of $2,531 per year, although there are some relatively affordable car insurance options available for teens.

Housing

Housing is arguably the most significant expense associated with raising a child. In the USDA report, housing costs make up 29% of the overall cost of raising a baby. The cost of housing varies widely by location and the type of housing you choose. Many parents dream of a suburban house with a white picket fence and enough bedrooms for the entire family.

Based on a $250K dwelling coverage amount, the average cost of home insurance is $1,383 per year, according to 2021 Quadrant Information Services data. This is just one factor in the cost of owning a home; you will also have to consider the cost of a mortgage, utilities and maintenance.

This is just one factor in the cost of owning a home; you will also have to consider the cost of a mortgage, utilities and maintenance.

Food

The cost of food is the second-largest expense, at 18% of the overall cost of raising a child. Over time, food prices have trended up, with food-at-home pricing increasing 12.1% and food-away-from-home pricing increasing by 7.7% from June 2021 to July 2022. The USDA expects rising costs for 2022, with increases as high as 10.0% and 7.5%, respectively.

To eat healthy foods, like high-quality meats and fresh fruits and vegetables, food expenses increase even more. In 2022, the costs for all food categories are expected to increase:

- Meats: +9.0%-10.0%

- Processed fruits and vegetables: +8.5%-9.5%

- Cereals and bakery products:0%-13.0%

Life insurance

Life insurance is crucial for families, especially if your income cannot be easily replaced if the unexpected were to happen. Funeral costs, living and education expenses and more can quickly add up even for those who budget carefully. Because of this, it’s also important to have a plan in the event that you or your partner are no longer able to financially support your children. Some parents rely on life insurance to ensure that, if they were to pass away, their family would be able to maintain their lifestyle and have some financial cushion for the future.

Funeral costs, living and education expenses and more can quickly add up even for those who budget carefully. Because of this, it’s also important to have a plan in the event that you or your partner are no longer able to financially support your children. Some parents rely on life insurance to ensure that, if they were to pass away, their family would be able to maintain their lifestyle and have some financial cushion for the future.

Both parents should consider purchasing adequate life insurance to replace their salary, even for a stay-at-home parent. A recent survey completed by Salary.com estimates the annual salary of a stay-at-home parent at $184,820 per year. In addition, life insurance is typically the least expensive when you are young and healthy, especially if you choose term instead of permanent life insurance.

The bottom line

Raising children is rewarding and fulfilling to many people. But it’s also very expensive these days. Infancy to age 18 is likely to cost you close to a quarter of a million dollars or more as a parent. But by preparing mentally and implementing financial planning strategies, you can be well-equipped to raise your child to adulthood comfortably, even on a budget. Given the ever-growing costs of raising a child, parents thinking of having a baby might want to consider some of the following tips: start early with a budget, try to live below your means, save money wherever possible, shop around for home and auto insurance each year for the best deal and purchase life insurance when you are young and healthy.

But by preparing mentally and implementing financial planning strategies, you can be well-equipped to raise your child to adulthood comfortably, even on a budget. Given the ever-growing costs of raising a child, parents thinking of having a baby might want to consider some of the following tips: start early with a budget, try to live below your means, save money wherever possible, shop around for home and auto insurance each year for the best deal and purchase life insurance when you are young and healthy.

How Much Does It Cost to Raise a Child in the U.S.?

Raising a child can be an emotionally rewarding experience. But it can also be very costly. Statistics from Brookings, an economic think tank, show that the average middle-income family with two children will spend $310,605 to raise a child born in 2015 up to the age of 17. That's a significant jump from the figure published by the U.S. Department of Agriculture (USDA), which estimated the overall cost to be $233,610 in 2017 (using 2015 dollars). Brookings, which cited higher inflation for the rise, assumed an inflation rate of 4% between 2021 to 2032 when it calculated the new cost of raising a child.

Brookings, which cited higher inflation for the rise, assumed an inflation rate of 4% between 2021 to 2032 when it calculated the new cost of raising a child.

If starting a family is in your plans or you already have kids, understanding the costs can make shaping your financial plan easier. We highlight some of the key costs associated with raising children, including housing (the top cost), food, child care, and others.

Key Takeaways

- Middle-income parents will spend an average of $310,605 by the time a child turns 17 between 2015 and 2032.

- The largest expense associated with raising a child is housing, followed by food.

- The cost of child care varies widely and depends on where you live.

- The good news is that each additional child costs less, thanks to economies of scale.

- The cost of raising a child doesn't include costs associated with education.

Housing: 32% of Income

The largest expense associated with the cost of raising children is housing. This can easily make up a sizeable chunk of a parent's budget, especially when you factor in mortgage or rent payments, taxes, insurance, repairs, utilities, maintenance, and basic household goods.

This can easily make up a sizeable chunk of a parent's budget, especially when you factor in mortgage or rent payments, taxes, insurance, repairs, utilities, maintenance, and basic household goods.

According to Consumer Expenditures Data for 2020, the typical household spends a mean amount of $21,409.19 on housing per year. Meanwhile, Census Bureau data shows that the median household income in the U.S. was $67,521 in 2020. Going by these numbers, you could assume that families with children spend roughly 32% of their income on housing.

These numbers offer a broad idea of how much families pay for housing. But it's important to keep in mind that housing costs can vary based on a number of factors, including:

- Geographic area

- Type of dwelling (single-family home, townhouse, condominium, etc.)

- Whether the family rents or owns their home

- Size of the home as it corresponds to family size (i.e. number of bedrooms required based on the number of children and adults)

- Age of the home

Economic conditions can also influence the cost of housing for families. When housing prices rise, that can make it more expensive for families to purchase a home. Likewise, rising inflation can push up rental prices along with increased prices for other consumer goods.

When housing prices rise, that can make it more expensive for families to purchase a home. Likewise, rising inflation can push up rental prices along with increased prices for other consumer goods.

Housing assistance programs can help by providing money to supplement the cost of rent for eligible lower-income families.

Food: 27% of Income

Sustenance tends to be the next major cost for parents. The amount that a family spends varies. It is based on the number of children in the home, household income, geographic region, and preferred diet.

The USDA offers some perspective on how much families may spend on food. Each month, the USDA issues monthly reports on food costs at four different levels: thrifty, low-cost, moderate-cost, and liberal. These reports consider different household sizes with children of different ages. The reference family consists of a male and female adult between the ages of 20 to 50 and two children in the six- to eight-year-old range and the nine to 11-year-old range.

Here's how the average food spending numbers for the reference family add up on a monthly basis, as of November 2021:

- Thrifty plan: $951.70

- Low-cost plan: $1,025.90

- Moderate plan: $1,276.90

- Liberal plan: $1,543.40

At the low end, a typical family of four spends about $11,500 per year on food at home. At the high end, they spend more than $18,500 per year on food. That's around 27% of their income if you're going by the median household income of $67,521 mentioned earlier.

Spending money on food away from home, including dine-in meals at restaurants, take-out meals, and snacks purchased at convenience stores, can inflate food costs for families.

Child Care: 12% to 29% of Income

Child care costs can easily take up a sizable part of parents' budgets each year. The cost of child care in the U.S. ranges from $5,436 to $24,243 annually, according to 2020 figures from the Economic Policy Institute. How much you pay for child care can depend on the type of care needed, the number of children that require care, and where your family lives.

How much you pay for child care can depend on the type of care needed, the number of children that require care, and where your family lives.

For instance, Washington, D.C. residents pay the most. Infant care costs $24,243 annually, which represents about 29% of the median family income for parents in the area. Meanwhile, parents in Mississippi pay the least. Annual child care amounts to $5,436 for an infant and $4,784 for a four-year-old in that state. That represents roughly 12% of the median family income for the state.

Daycare centers may give a discount if you have more than one child enrolled.

What Else Do Families Spend Money on?

Aside from housing, food, child care and education, there are other costs associated with raising children that are important to budget for. Some of the most common things parents may pay for to raise kids include:

- Transportation

- Health care and insurance

- Clothing

- Extracurricular activities

- Sports and hobbies

- School fees for field trips, activities, fundraisers, etc.

- Family trips or vacations

Some of these items could be considered necessary, while others may be wants. How much you spend on these things (if you do at all) can depend on the number of kids you have and what your budget allows. But it's important to consider each and every budget item when determining your personal cost of raising children.

$310,605

The total cost to raise a child born in 2015 to the age of 17 after you factor in an inflation rate of 4%.

The Good and Bad News

There is some good news when it comes to the cost of raising a child in America. Economies of scale also apply to the number of children you have. The USDA points out that each additional child costs less because siblings can share a bedroom and a family can buy food in larger, more cost-effective quantities. And while your offspring might not necessarily like it, clothing and toys can be handed down, and older siblings can often babysit younger ones.

Now with the bad news. The numbers we mentioned above don’t account for the cost of a college education. Higher education can add to the total for parents who help pay for their children's college costs. How much you pay for college can depend on whether your child:

The numbers we mentioned above don’t account for the cost of a college education. Higher education can add to the total for parents who help pay for their children's college costs. How much you pay for college can depend on whether your child:

- Attends a two- or four-year school

- Goes to a public or private university

- Is charged in-state or out-of-state tuition rates (at public universities)

The average annual cost of a public college (in-state) for the 2021-2022 academic year comes in at $22,690 and $51,690 for a private college, according to the College Board. Keep in mind that these figures include the cost of tuition, fees, and room and board. That means saving early and taking advantage of 529 plans or other investment vehicles to keep kids from graduating with a large amount of debt.

Strategies to Reduce Costs When Having a Child

Raising a child can be an emotional rollercoaster. Ask any parent and they'll probably tell you there are both ups and downs. But we understand that the costs associated with the responsibilities of being a parent and raising a child can be draining. So we've highlighted a list of tips that you may want to consider to help you reduce your expenses:

But we understand that the costs associated with the responsibilities of being a parent and raising a child can be draining. So we've highlighted a list of tips that you may want to consider to help you reduce your expenses:

- Plan ahead. It's important to have a good plan in place. This principle is very important with anything you do that costs you money. If you want to have a child and/or are expecting, it's important to get your affairs in order sooner rather than later. Good planning can keep you one step ahead of the game.

- Set aside money for your child. You should save money in an account that is meant just for your child in the same way you would for a rainy day, a major purchase, or retirement. It could be a savings account or a long-term investment vehicle. Dip into this fund if and only when the need arises for expenses related to your child. You should also take advantage of special accounts like 529 plans.

- Look for parent-friendly tax credits and deductions that can reduce your tax liability or help you get some money back like the child tax credit.

- Less is often more. Using some restraint can help you cut down costs, especially in the beginning. After all, babies don't need much other than food, clothing, and a place to sleep.

- Think about the must-haves for your kids rather than the needs. You can probably do without anything that falls into the latter category. Ask yourself whether your 12-year-old really needs the latest gaming console when the last one works perfectly fine.

- Think sustainably. Consider recycling and secondhand. Consider reaching out to family and friends about any clothing they're no longer using. Use cloth diapers rather than disposable ones. Not only will this help you save some money but it can also help you reduce your carbon footprint.

What Is the Average Cost of Raising a Child in the U.S.?

While it can vary due to geography and the cost of child care, $310,605 is the average amount spent on raising a child to age 17 born in 2017. This amount does not include the cost of paying for higher education, which can easily add $80,000 to $100,000+ per child to the total.

How Do the Expenses of Child Rearing Break Down?

Housing is the biggest expense associated with raising kids, followed by paying for food. Following those two categories of expenses, parents spend the most on child care, transportation, health care, clothing, and miscellaneous spending.

What Are the Major Costs of Raising a Child in the U.S.?

The major cost of raising a child is housing. This is followed by food. But some of the other key expenses that most parents don't think about right off the bat include education.

How Can I Reduce the Costs of Raising my Children?

Some of the best ways to reduce the costs of raising a child or children include proper planning and saving exclusively for the little ones. Other tips include looking for parent-friendly tax benefits and keeping a less-is-more attitude in mind. Parents can also keep a check on their budgets by recycling and using secondhand clothing. And of course, try to do away with the needs and stick with the must-haves as the former are often dispensable.

Which State Has the Lowest Child Care Costs?

According to the Economic Policy Institute, the state with the lowest child care costs is Mississippi. Parents pay an average of $5,436 for an infant and $4,784 for a four-year-old in child care each year.

The Bottom Line

Nobody wants to think of their children as just an expense but the financial side of child-rearing can’t be ignored. Understanding the numbers can help you determine if you can afford to have children if you don't have them yet. And if you already have kids, being cost-conscious can help you to make smarter financial decisions so that you can stretch every dollar.

SEB survey: how much does it cost to raise one child

40 per cent. of interviewed parents, who calculated how much it costs to support a child under 18, indicated that the amount ranges from 3,000 to 5,000 euros per year. Another 13 percent indicated that the costs amounted to more than 5,000 euros per year. With monthly expenses of 500 euros or more for 18 years, an amount of more than 100,000 euros is generated, SEB said in a statement.

With monthly expenses of 500 euros or more for 18 years, an amount of more than 100,000 euros is generated, SEB said in a statement.

True, if the child attends a private school, these amounts can increase significantly. A year of education in a private school costs an average of about 6,000 euros per year. And this is without taking into account school meals, which average 5.5-6.5 euros per day, additional paid circles, expenses for excursions, etc. In this case, the amount for raising a child can reach 200 thousand euros.

These expenses increase every year due to inflation. Especially they jumped this year. According to the Department of Statistics in July, the prices of almost all goods and services related to the upbringing of children increased: school meals (17 percent), stationery (14 percent), recreation and culture services, mugs (11 percent), books (5.9 percent), shoes (3.9 percent), clothes (0.9 percent). Many parents have already felt this when in September the children returned to educational institutions and circles.

If the family has not one, but two or more children, the costs will be even higher. True, it’s not worth multiplying by two, because raising a second or third child usually costs parents less than the first - and because of the necessary things already available, clothes, furniture that can be reused, and because of the increase in benefits, discounts.

Mugs are an investment in future abilities

Mugs, whose prices have increased by at least one tenth, according to statistics, are an important part of raising a child. According to the study, half of the parents send their children to one paid circle, a quarter - to two paid circles, and only 7 percent. three of those surveyed. Almost a fifth say they cannot afford to send their children to children's clubs.

"Although education should not be saved, as it is one of the most important areas to invest in when thinking about the future of the child, circles, especially paid ones, should be chosen responsibly so that they not only do not create a financial burden, but also in fact in fact, were related to the child's abilities that you want to develop and which will be useful in the future, "says S. Strotskite-Varne.

Strotskite-Varne.

In addition to clubs, don't forget about additional expenses for concerts, performances, special equipment or clothing, etc.

Food to school from home is still rare

On average, a student spends about 3 euros a day on food at school. However, lately a lunch for one child has risen in price by about 30 percent due to rising food prices. and reaches up to 4 euros (the specific cost of lunch, of course, depends on the school and the dish chosen). Therefore, for a family, meals for a child cost about 60-70 euros per month. If a child stays at school all day and eats several times, expenses can increase by a third.

Half of the parents surveyed say that their children always buy food at school, a third say they occasionally bring food from home, and only 13 percent. always wears his food.

Children are indifferent to fashion - let's use it

Although according to statistics, the prices of clothes and shoes have increased relatively the least, children grow up very quickly, so spending on their clothes and shoes always makes up a large part of the family budget.

More than half of the parents surveyed say they need to update their children's wardrobe every month, a third say they make such purchases three to four times a year, but in this case they spend more money.

Clothing is one of those categories on which we often spend more than we should. According to the study "Household Budget 2021" published by the Department of Statistics, a statistical family of four spends about 104 euros per month on clothes and shoes, and the amount of clothes thrown into textile containers reaches about 1,800 tons in Vilnius alone.

"Young children often don't care what they look like, whether they're wearing new clothes or second-hand clothes, which in many cases can cost five or even ten times less than new," says the SEB expert.

By saving money in this area, we could spend more money on clubs and education, which can have a much greater impact on a child's future than just another new sweater or blouse, emphasizes S. Strockite-Varne.

Commissioned by SEB Bank, the study was conducted by Norstat. In August of this year, 300 parents raising children aged 7-17 (inclusive) were surveyed throughout Lithuania.

When is it too late to raise a child?

Go back

Many people have heard that it is only necessary to raise a child until the age of three, and then, "it's too late." Not so long ago in our country there was an opinion that a child under three years old is not a full-fledged person at all, he has no personality, and it doesn’t matter at all what will happen to him at this moment, because only after three years does the formation of his personality begin , shaping as a person. Now we hear the opposite opinion that “after three years it’s too late to educate”, everything is already laid in the child, everything is formed, and nothing can be changed.

Most likely in the future there may be several other theories, though they are quite enough now, but at the moment teachers and psychologists are of the same opinion about the main stages of child development. At the moment, it is believed that at about the age of 12 it is too late to raise a child, since it is at this age that a child ceases to be considered a child, first he becomes a teenager, then an adult. Those. it is impossible to bring up in a child something that does not exist, but some attempts to do this lead to negative consequences. After all, it is precisely by the age of 12 years (approximately at this age, but for someone it may be earlier or later) that a person requires a different attitude towards himself, not in the literal sense of the word, namely, an attitude as an adult, and not to educate him like a child. Many parents resist this fact, but in any case they have no choice - the attitude must be changed.

At the moment, it is believed that at about the age of 12 it is too late to raise a child, since it is at this age that a child ceases to be considered a child, first he becomes a teenager, then an adult. Those. it is impossible to bring up in a child something that does not exist, but some attempts to do this lead to negative consequences. After all, it is precisely by the age of 12 years (approximately at this age, but for someone it may be earlier or later) that a person requires a different attitude towards himself, not in the literal sense of the word, namely, an attitude as an adult, and not to educate him like a child. Many parents resist this fact, but in any case they have no choice - the attitude must be changed.

Despite the fact that at the age of 12 a child can no longer be called a child, it is still not an adult, it will be possible to consider him an adult from the age of 19-20, or even later. And so many parents always make a big mistake when they treat a teenager like an adult, when they expect adult decisions and actions from him, and vice versa, when they treat a teenager like a child, trying to educate. In general, a person has three states - a child, a teenager, an adult, and not two, as many people think, skipping adolescence. This period is extremely important and it lasts quite a long time, from about 4 to 7 years, this is not a crisis at all, this is a stage of human development.

In general, a person has three states - a child, a teenager, an adult, and not two, as many people think, skipping adolescence. This period is extremely important and it lasts quite a long time, from about 4 to 7 years, this is not a crisis at all, this is a stage of human development.

Of course, within the period from birth to 12 years there are divisions and features. For example, in the prenatal period it is extremely difficult to influence the psyche of a child, but what still penetrates the psyche of an unborn child will remain there forever, and it is practically impossible to change it. Yes, you can correct, direct, but it remains with a person until the very end. It is much easier when the little man has already been born.

After birth and up to three years, is another branch, which also has its divisions, but there is no need to go into this in more detail. Until the child reaches the age of three, the baby lives in his own world, where he begins to lay the main foundation for the development of his personality, at this age he learns basic communication skills, learns the world, gets acquainted with the basic concepts about it, and much more. After three years, the foundation is already there, i.e. the foundation has been built. Of course, separation and clear boundaries up to three, after three do not mean at all that it was at the age of three that the child began to form his own “I”, everything is purely individual, for someone this process may be delayed, and the foundation may be unfinished. But what is, is, we will complete it later ..

After three years, the foundation is already there, i.e. the foundation has been built. Of course, separation and clear boundaries up to three, after three do not mean at all that it was at the age of three that the child began to form his own “I”, everything is purely individual, for someone this process may be delayed, and the foundation may be unfinished. But what is, is, we will complete it later ..

There is an expression in psychology: the worse and more difficult the problem, the more difficult it is to move it. If a child has suffered severe psychological trauma before the age of three, then it is not possible to solve the problem completely and remove the problem itself, you can only try to move it, correct it. The lighter the injury, the much easier it is to move, if not eliminated altogether. In fact, it turns out that the trauma that was not introduced in deep childhood affects adulthood, and the repression of this very trauma occurs when the process of formation has already ended. And quite often, in order to “move” or get rid of the negative consequences, a person turns to a specialist for help, because there is no way to solve the problem on his own, it’s tantamount to cutting out his own appendicitis, having no idea where it is and how to do it. All these facts allow us to assert that even after three years something can be changed, if it is not possible to solve the problem completely, you can at least “move” it in a positive direction. And, as we know, the laws of physics are such that it is much easier to move the problem in the negative direction, down and fall by itself, and in order to raise it up, you need to work hard.

And quite often, in order to “move” or get rid of the negative consequences, a person turns to a specialist for help, because there is no way to solve the problem on his own, it’s tantamount to cutting out his own appendicitis, having no idea where it is and how to do it. All these facts allow us to assert that even after three years something can be changed, if it is not possible to solve the problem completely, you can at least “move” it in a positive direction. And, as we know, the laws of physics are such that it is much easier to move the problem in the negative direction, down and fall by itself, and in order to raise it up, you need to work hard.

Further after three and up to 12 years , (it is worth noting that the age is indicated conditional, approximate) the child is just forming the personality itself, awareness of oneself in society. Those. after three years the child understands his self, then he understands that there is a society, and then he defines himself in it. And it was during this period that the building itself was formed, the thickness of the walls and windows, the size of the building itself and its number of storeys. But in this interval there is still one period - seven years, when up to seven years the child develops only the internal structure of the personality, and after seven - the external, aimed at society (class, school, humanity as a whole) part of the person's personality.

And it was during this period that the building itself was formed, the thickness of the walls and windows, the size of the building itself and its number of storeys. But in this interval there is still one period - seven years, when up to seven years the child develops only the internal structure of the personality, and after seven - the external, aimed at society (class, school, humanity as a whole) part of the person's personality.

After twelve years of , the formation itself has already ended, the period of childhood has ended, and the period of putting into practice begins. This is a period of adaptation to the world, sharpening sharp corners, strengthening walls, growing flower beds. This is a period when it is no longer a child who acquires some kind of independence and independence.

So, now more specifically, at what age can and should a child be raised?

The above suggests that the child does not need to be brought up at all, he will do all this himself, on his own, our goal is not to interfere with the little man to grow and develop.