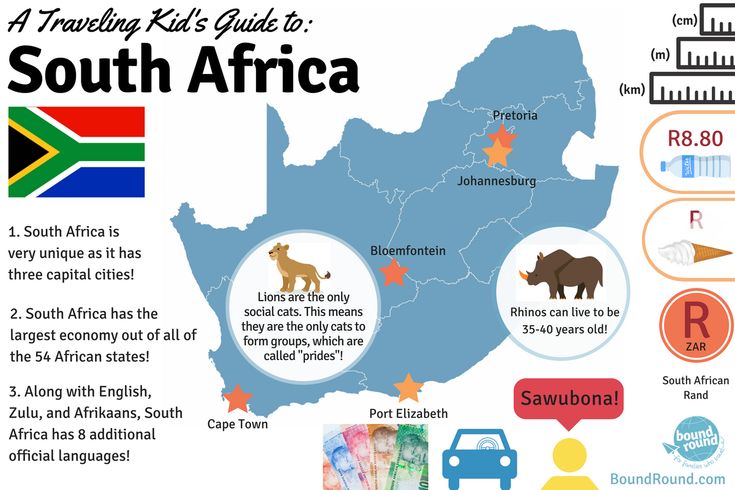

How much is child support in south africa

Average Monthly Child Support Payment

What is the average monthly child support payment in South Africa? And how do you claim support payments? The amount to pay for child maintenance each month is entirely dependent on the income of both parents. Along with a number of other factors. We explore this in a bit more detail below.

How do they Calculate Child Maintenance in South Africa?

There are a number of factors to calculate how much money to pay in terms of maintenance in South Africa. Some of these factors include:

- The standard that the child or children was accustomed to whilst their parents were married or lived together

- The earning capacity of the parents

- The assets of the parents

The first factor is important as many parents neglect to pay for their child support payments. Therefore their children have to suffer as a result of it.

It is also important to note that if you were never married, your partner is still obliged to make maintenance payments.

This however does not seem to be the case with many South African men. As they neglect to make their payments to support their children.

So let me help you work out how much you can expect to pay or can expect from your former partner.

Average Monthly Child Support – Example 1

Say for example you are the proud parent of a 4 year old and both parents earn approximately R5000 a month each. You could estimate that in order to maintain the child each month, they each contribute a total of lets say R1600. Which pays for the child’s food, shelter, clothing, and pre-schooling.

Should for any reason the parents split up and the mother want to claim maintenance, then she could claim up to approximately R1200.

This is because the mother would have to find alternative accommodation and schooling etc. Therefore the portion that she would require to maintain the lifestyle of the child would need to be larger.

Average Monthly Child Support in South Africa – Example 2

If the parents of the same four year old child earn R100,000 a month each. The child has an aupair, own room, expensive schooling and clothing, medical aid. And a lot of other expenses which amount to approximately R25000 a month.

The child has an aupair, own room, expensive schooling and clothing, medical aid. And a lot of other expenses which amount to approximately R25000 a month.

Then the same mother would be able to claim approximately R15 000 a month from the father.

This situation however will be even more complicated if the mother for example has assets to her name that are in the millions. And the father owns only a car worth R100000.

Then the father’s maintenance contribution would amount to much less than the mothers.

This may also interest you: When does Child Maintenance Stop in South Africa?

Claiming Monthly Maintenance in South Africa

It is important to note that the information in this article is purely an explanation. Therefore if you are in the process of getting a divorce. Or want to claim maintenance from a former partner for your child or children. Then the best advice I can give you is to consult with a lawyer.

There are lawyers that specialize in maintenance law. Therefore they would be the best person to seek advice from.

Therefore they would be the best person to seek advice from.

However if you just want to get a feel of what the average monthly child support payment is, there’s one main important thing that you should think about. That is the child or children’s welfare and what is in their best interest.

Once both parties have agreed upon this fact, it should make the maintenance process more simple and hopefully a lot less stressful.

This may interest you: https://www.gov.za/documents/maintenance-act

In Conclusion

As you can see, there are a number of factors that you need to consider. And if you are not able to come to an agreement with your former partner in terms of how much is expected from both of you, then you will have to seek the advise of a lawyer.

If no monthly maintenance payment agreement can be made, then you will have to go to maintenance court. So they will decide upon the amounts that each parent has to contribute.

How to calculate child maintenance

In order to claim for maintenance, you must first determine the reasonable needs of the child on a monthly basis. There is no hard and fast rule, but generally the child’s share of the common expenses in the household is determined by allocating one-part per child and two-parts per adult or older child.

There is no hard and fast rule, but generally the child’s share of the common expenses in the household is determined by allocating one-part per child and two-parts per adult or older child.

The following table may be used as an example of how to calculate these expenses properly where there is a parent and 3 children in the household. In this example, each child will be allocated 20 per cent of the total expense shared by all members of the household.

Only once the child’s reasonable monthly needs have been determined will one be able to establish the contribution that each parent is required to make to meet those needs.

The formula applied in practice to determine this contribution is as follows:

(parent’s gross income) (child’s needs)

_____________________________ _____________

(total gross income of both parents) X 1

= R00. 00 (parent’s contribution)

00 (parent’s contribution)

Maintenance cannot be measured in monetary terms alone. Usually, the parent who cares for the child on a daily basis indirectly contributes towards maintenance because of the time they spend together. Notwithstanding this, both parents still have a financial obligation to pay maintenance in accordance with their means, income and expenditures.

Maintenance may need to be adjusted regularly, depending on the changing needs of the child or the financial position of the parents. Once the need for a change in maintenance arises, whether filing a new application or seeking to vary an existing court order/settlement agreement, the applicant can request that the maintenance court:

- set aside an existing maintenance order;

- make a new maintenance order;

- decrease a current order;

- amend a current order; or

- change an existing order.

Either of the parents can apply to the Magistrate’s Court where the children reside for a variation of the current maintenance order, but only if circumstances change. Examples will be if the father for instance, loses his job or remarries; and, in the mother’s case, where a child may need special care (occupational therapy). It was decided in previous cases that where a father remarries and then has to support a "second" family, this financial obligation shouldn't impact negatively on his "first" family. A father may not raise a defence that the needs of his second wife is a reason to reduce maintenance in respect of the children of his first wife.

Examples will be if the father for instance, loses his job or remarries; and, in the mother’s case, where a child may need special care (occupational therapy). It was decided in previous cases that where a father remarries and then has to support a "second" family, this financial obligation shouldn't impact negatively on his "first" family. A father may not raise a defence that the needs of his second wife is a reason to reduce maintenance in respect of the children of his first wife.

Download our maintenance calculator.

| maintenancedoc.xls |

Entering the South African market: state support for exports

Requirements for documentation, certificates confirming the quality and safety of products imported into South Africa

The main laws governing foreign trade operations in South Africa include:

taxes (Customs and Excise Act, 1964), dedicated to the regulation of imports, exports, prohibition and restrictions on the import of goods, calculation and payment of customs duties, taxes and other fees, determination of the country of origin of goods, customs brokers and agents, and other similar issues. nine0005

nine0005

2. Law on International Trade Administration (International Trade Administration Act, 2002), which provides for the regulation of anti-dumping investigations, determination of the presence of dumping, the normal value of goods, export prices.

3. The Value-Added Tax Act (1991) governs the payment of VAT on goods imported into the country.

4. The Consumer Protection Act (2008) defines the conditions for fair trade, establishes standards for consumer protection, information provision, fair trade practices and other issues related to trading activities in the country. nine0005

5. The Meat Safety Act (2000) regulates the safety and hygiene of meat products, defines standards for slaughterhouses, imports and exports of unprocessed meat.

6. The Banking Act (1990) is the fundamental act governing banking activities in the country, as well as foreign exchange transactions.

7. The Liquor Products Amendment Act, 1989 regulates the production, sale, import and export of certain types of alcoholic products (wine, fruit alcoholic drinks, alcoholic drinks, liqueurs), their composition. nine0005

nine0005

8. Fertilizers, Farm Feeds, Agricultural Remedies, and Stock Remedies Act, 1947 regulates the registration of fertilizers, feed, veterinary drugs, sterilization laboratories, pest control operators , and defines the conditions for prohibiting or restricting the import, sale, purchase, disposal and use of fertilizers, feed and veterinary medicines.

9. Tobacco Products Control Act, 1993) establishes maximum values for the content of tar, nicotine and other substances in tobacco products.

Features of customs control when importing products into the territory of South Africa

South Africa, being a member of the SACU customs union, applies a common external tariff (Common External Tariff, CET), agreed and established by all members of this customs union on the basis of the most favored nation treatment. In some cases, it turns out that this tariff is not always beneficial for individual members of the union. nine0005

The South African tariff is based on the Harmonized Commodity Description and Coding System 2007. A total of 6695 commodity items are defined for 8 characters. The full current current South African Import Tariff can be downloaded from: http://www.sars.gov.za/AllDocs/LegalDoclib/SCEA1964/LAPD-LPrim-Tariff-2012-04%20-%20Schedule%20No%201%20Part% 201%20Chapters%201%20to%2099.pdf

A total of 6695 commodity items are defined for 8 characters. The full current current South African Import Tariff can be downloaded from: http://www.sars.gov.za/AllDocs/LegalDoclib/SCEA1964/LAPD-LPrim-Tariff-2012-04%20-%20Schedule%20No%201%20Part% 201%20Chapters%201%20to%2099.pdf

Member countries of the union periodically review the policy of customs restrictions, adjusting it in accordance with their interests. nine0005

By agreement between the members of the union, the average import tariff rate was reduced from 11.4% in 2002 to 8.1% in 2009. At the same time, the main attention was paid to the transfer of protective measures to the sphere of trade in agricultural products. Thus, the average tariff level for this group of goods was fixed at 10.1% (in 2009), while in 2002 this figure was 9.6%. The average rate on non-agricultural goods was reduced from 11.6% (in 2002) to 7.8% (in 2009).

The tariff structure has also undergone changes towards simplification. Thus, the number of items for which “ad valorem” rates are set in 2009 was increased to 96. 8% from the existing 75% in 2002. The number of commodity items with a fixed import rate was reduced from 1774 (in 2002) to to 98 in 2009. The number of items with specific rates was also reduced from 195 (in 2002) to 109 in 2009.

8% from the existing 75% in 2002. The number of commodity items with a fixed import rate was reduced from 1774 (in 2002) to to 98 in 2009. The number of items with specific rates was also reduced from 195 (in 2002) to 109 in 2009.

Compound tariff rates apply to agricultural products, coal, textiles and footwear. Specific duties are mainly applied to 94 positions of agricultural products, coal, some positions of textile goods. These rates, set on an ad valorem basis, range from 0% to 60%. Combined duties are no longer set by member countries, but there are still a number of tariff lines for which rates are calculated using a formula.

The customs union has an obligation to set tariffs for all member countries of the union on the “ad valorem” principle. The setting of rates by member countries of the union according to other principles may lead to a discrepancy with their individual obligations under the WTO. nine0005

South Africa, in accordance with WTO obligations, has the authority to establish tariff quotas on imports of textiles, clothing and certain types of agricultural products (meat and dairy products, cereals, tea, coffee, tobacco, wine, cotton), although for agricultural products this type no tariffs were applied. Most of the quotas (70%) were determined on a historical basis, 20% were allocated to support small and medium-sized businesses and 10% - for companies participating in the Large-Scale Black Economic Engagement (BBB-EE) program. nine0005

Most of the quotas (70%) were determined on a historical basis, 20% were allocated to support small and medium-sized businesses and 10% - for companies participating in the Large-Scale Black Economic Engagement (BBB-EE) program. nine0005

Normal import tariff rates apply to imports from the Russian Federation, no quota restrictions for any product groups are established.

South Africa applies trade sanctions imposed by the UN Security Council, the African Union or the Southern African Development Community. Restrictions are also introduced in accordance with the international obligations of South Africa (for example, under the Convention on International Trade in Endangered Species of (Wild) Flora and Fauna).

South Africa, as a member of the WTO, actively uses national regulations to protect the internal market, based on the WTO Agreement on the Application of Article VI of the General Agreement on Tariffs and Trade 1994 (Agreement on the Implementation of Article VI of the General Agreement on Tariffs and Trade 1994).

In accordance with the International Trade Administration Act of 2002, in 2003 South Africa established a body - the International Trade Administration Commission (ITAC), whose responsibilities include conducting anti-dumping investigations, determination of the presence of dumping, the normal value of the goods, the export price. nine0005

In calendar year 2017, no anti-dumping investigations were initiated by the South African side. In May 2017, in order to protect national steel producers, an additional duty on the import of hot-rolled flat products was introduced in the amount of 12% for 3 years, with an annual decrease of 2%.

Investigation practices usually indicate the duration of procedures. Thus, according to the investigations, the average time taken for this work was 482 days (240 days for the preliminary investigation and 253 for the final decision). nine0005

Local legislation makes little distinction between local producers and importers. Importers and exporters doing business in South Africa must be registered with the South African Tax Service for tax purposes if the value of goods exceeds 20. 0 thousand rand (approximately 2.0 thousand US dollars). Registration, on average, takes one day, after which the applicant receives a customs code number. This number must be included in all customs declarations. However, it is possible, in case of urgent delivery (export / import) of goods, to use the general number issued by the customs service to registered traders. nine0005

0 thousand rand (approximately 2.0 thousand US dollars). Registration, on average, takes one day, after which the applicant receives a customs code number. This number must be included in all customs declarations. However, it is possible, in case of urgent delivery (export / import) of goods, to use the general number issued by the customs service to registered traders. nine0005

All accompanying documents (bill of lading, commercial invoices, etc.) are submitted to the customs service along with the customs declaration at the port before delivery of the goods. The commercial invoice must contain all the necessary details that allow customs officials to determine the value of the goods for the calculation of customs duties.

Certificate and declaration of country of origin are required in case of preferential treatment or anti-dumping and countervailing duties. An import permit is also required for goods included in the list of products subject to this regulation. nine0005

Goods imported into South Africa are subject to customs duties and local taxes, including VAT, excise (on wine, beer, other alcoholic beverages, fuel, etc. ) and duties (certain types of agricultural products, environmental tax, etc.). P.). Since 2004, a tax (Environmental Levy for Plastic Bags) has been introduced in South Africa on plastic bags and bags, regardless of whether it is produced on the local market or imported, in 2018 it is 12 cents. A special fee is set for certain types of petroleum products, also regardless of whether they are produced on the local market or imported. So, for example, a fee of 3.37 rand per liter is set for gasoline [1]. nine0005

) and duties (certain types of agricultural products, environmental tax, etc.). P.). Since 2004, a tax (Environmental Levy for Plastic Bags) has been introduced in South Africa on plastic bags and bags, regardless of whether it is produced on the local market or imported, in 2018 it is 12 cents. A special fee is set for certain types of petroleum products, also regardless of whether they are produced on the local market or imported. So, for example, a fee of 3.37 rand per liter is set for gasoline [1]. nine0005

As of April 1, 2018, the value added tax (VAT) rate applied to most domestic and imported goods has been increased from 14% to 15%. Products intended for export, some basic food products (dark breads, cornmeal, chicken eggs, milk, fruits and vegetables), some products used in agriculture and farms (feed, seeds, fertilizers, pesticides, veterinary drugs), some types of fuel (paraffin, diesel fuel, gasoline), international transportation of goods and passengers are currently exempt from paying this tax, but this approach may be revised when planning the budget for subsequent years, where zero VAT rates may be abolished. nine0005

nine0005

Value added tax does not apply to financial services, gift goods and services, certain types of educational, transport and housing services. Also, temporary import/export of goods is not subject to this tax.

VAT is charged on the basis of the “local market” for national goods and on the basis of customs FOB (FOB + non-refundable customs duties) + 10% - for imported goods.

Goods imported from the South African Customs Union (SACU) are not subject to customs duties and excises. Preferential treatment is granted to goods from SADC member countries and countries that have bilateral free trade agreements (EU, EFTA, Malawi, Mozambique, Zimbabwe). nine0005

Goods permitted to be temporarily imported into South Africa for the purpose of processing, repairing, refining or enriching, converting or producing goods for export are exempt from customs duties and excises. Goods temporarily imported and then re-exported back to the country from which they were imported are also not subject to payment of import duties.

Goods imported from a bonded bonded warehouse into the country are subject to import duties and taxes. Goods imported for processing in Special Industrial Zones (IDZ) are exempt from taxes and duties. Imported goods can also be brought in under tax refund conditions, provided that they are placed in the Customs Control Areas (CCA), combined with IDZ. nine0005

Certification process

South Africa has a well developed regulatory regime. Many standards have been developed over several decades and reflect product and environmental requirements. The South African Bureau of Standards (SABS)(https://www.sabs.co.za/)) is South Africa's specialized legal agency responsible for promoting and maintaining the standardization and quality of goods and services. SABS is a specialized agency of the Department of Trade and Industry (http://www.dti.gov.za/). His tasks include:

- publication of national standards;

- testing and certification of products and services according to standards;

- development of technical regulations;

- monitoring and ensuring compliance with metrology legislation;

- design promotion;

- conducting training on aspects of standardization.

SABS is nationally accredited by the South African National Accreditation System (SANAS)(http://www.dti.gov.za/agencies/sanas.jsp)) and internationally recognized by the Dutch Raad voor Accreditatie ( RvA)(https://www.rva.nl/). SABS participates in the International Organization of Standardization (ISO) and the International Electrotechnical Commission (IEC) (https://www.iec.ch/)). nine0005

SABS complies with ISO, IEC and CEN standards. United States standards are not valid and are not recognized. British and German industry standards are recognized and taken advantage of in the SABS system for historical and technical reasons.

Standards Act Nr. 29 of 1993 granted SABS the right to participate in consumer protection regulations. All standards are divided into voluntary and mandatory. Only 53 of the approximately 5,000 SABS standards are actually mandatory. However, depending on laws, other standards may also be considered mandatory (for example, electricity standards). nine0005

nine0005

When it comes to consumer protection, SABS takes a tough stance against companies that violate mandatory standards. This comes after the amended Consumer Protection Act 2008, which changed many aspects of business in South Africa as of 1 April 2011, introducing new legislation relating to manufacturers and service providers. This legal framework aims to protect the consumer through control of product obligations, sales and marketing practices, and fairness in consumer contracts. nine0005

Manufacturers have the opportunity to have their products evaluated by SABS. SABS has the right to stop selling products if it receives enough complaints. Although this happens very rarely.

The standards issued by SABS comply with the Environmental Protection Law and apply to all imports and exports. All foreign companies establishing themselves in South Africa must have a certified Environmental Management System (EMS). This certification must be renewed every year to ensure that the company meets South African standards. nine0005

nine0005

The Directorate of Plant Health and Quality at the National Department of Agriculture (https://www.daff.gov.za) is responsible for setting standards for certain agricultural products. These standards cover aspects such as composition, quality, packaging, marketing and labelling, as well as physical, physiological, chemical and microbiological analysis.

Testing, conformity assessment and marking

Mandatory certification in South Africa is mainly for electrical products, drugs and medical products. The main South African organizations involved in conformity assessment are:

- National Metrology Institute of South Africa (NMISA) (http://www.nmisa.org/_layouts/15/start.aspx#/Pages/default.aspx) - National Institute of Metrology of South Africa - develops primary scientific standards for physical quantities.

- South African Bureau of Standards (SABS) (https://www.sabs.co.za) - The South African Bureau of Standards is the government agency that regulates standards. nine0025 - South African National Accreditation System (SANAS) (http://www.dti.gov.za/agencies/sanas.jsp) - South African National Accreditation System.

nine0025 - South African National Accreditation System (SANAS) (http://www.dti.gov.za/agencies/sanas.jsp) - South African National Accreditation System.

- National Regulator of Compulsory Specifications (NRCS)(https://www.nrcs.org.za) - The National Regulator of Compulsory Specifications is a government agency that oversees EHS standards and consumer protection.

South Africa has Compulsory Specifications (CS)(https://www.gov.za/documents/national-regulator-co...)) - these are technical rules - analogues of technical regulations that require product compliance or services to meet health, safety or environmental standards. CS is developed by NRCS. CS establish both the requirements for goods and the procedure for confirming compliance. nine0005

As in other countries, some products do not require mandatory certification, and the guarantee of conformity can be declared by the manufacturer under his own responsibility. However, not all trading partners are ready to cooperate on such terms. Often a trading partner may require assurance of product conformity prior to import. Such a guarantee is usually a certificate of conformity. A manufacturer can be certified and receive the SABS label. To do this, he needs to go through several stages:

Often a trading partner may require assurance of product conformity prior to import. Such a guarantee is usually a certificate of conformity. A manufacturer can be certified and receive the SABS label. To do this, he needs to go through several stages:

- The product must meet SABS / SANS standards

- Then the product is subject to testing

- Your quality system is assessed against ISO 9000 or other quality standards

- If the product and quality system meet the requirements, permission to use the label is issued

- Regular testing of the product is carried out during the year, and feedback is given on the test results

— At least twice a year, the quality management system is audited. nine0025 As a result, the manufacturer receives the SABS label:

South Africa has a well-developed regulatory standards regime that controls labeling requirements for the following product categories:

- chemicals;

- electrical products;

- food and health products;

- engineering products;

- building materials;

- mining;

- services;

- transport;

- cosmetics. nine0005

nine0005

Label content requirements mainly apply to textiles, shoes and handbags, where a permanent label indicating the manufacturer and country of origin must be displayed. This process is carried out by the International Trade Administration Commission of South Africa (International Trade Administration Commission (ITAC) (http://www.itac.org.za/)). Other controlled imports subject to prior assessment (harmful chemicals, pharmaceuticals, bacteriological, nuclear/radioactive and hazardous/volatile substances) are imported by registered importers whose labeling and labeling requirements are determined on an ad hoc basis during product conformity assessment. nine0005

When selling goods at retail, imported technical products must contain safety instructions or other user manuals in English. The user is also provided with information about the official South African service agent for the product and, more rarely, information about the importer of the product. The user manual also contains information about the warranty.

The South African Consumer Protection Act (CPA) in 2011 gives consumers more legal say when making product damage claims. This act puts more responsibility on foreign manufacturers, in addition to their distributors, in case someone sues for damages. It is also allowed to confiscate the assets of a foreign company in South Africa to pay for losses caused by a defective product. The provisions of the CPA are especially important when it comes to labeling. Manufacturers should take extra care with any product that requires a warning label or information sheet explaining the use of the product. Both the local retailer and the manufacturer are responsible for this. nine0025

Amount of child support \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Amount of maintenance for one child

A selection of the most important documents upon request Amount of maintenance per child (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount

- Alimony of individual entrepreneur

- more ...

Forensic practice 8: The amount system ConsultantPlus free for 2 days

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 120 "Termination of maintenance obligations" of the RF IC

(R.B. Kasenov) The court satisfied the plaintiff's claims to invalidate the decision of the bailiff on the calculation of alimony arrears. As the court pointed out, by virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority or in the event that minor children acquire full legal capacity before they reach the age of majority. In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law. nine0005

In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law. nine0005

Register and receive trial access to the ConsultantPlus system free for 2 days

Open the document in your consultantPlus system:

Selection of court decisions for 2019: Article 120 "Continuation of alimony obligations" of the RF

(R. B. Kasenov) By virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority. At the same time, the court order of the justice of the peace did not contain information that the collection of alimony in the amount of 1/3 of the share stops when one of the children reaches the age of majority and then the alimony is subject to collection in the amount of 1/4 of the share. To reduce the amount of alimony established by the court, the bailiff-executor is not entitled to reduce. The reference to the fact that the bailiff had to apply to the court for clarification of the court order, but did not do this, does not indicate the illegality of his actions, since this appeal is a right, and not an obligation, of the bailiff. On the contrary, the debtor, being an interested party of enforcement proceedings, being active, was not deprived of the opportunity to resolve this issue. In addition, the court order contained no ambiguities and did not require clarification. Thus, the court dismissed the claim of the administrative plaintiff to declare illegal the decision on the calculation of the alimony arrears, the obligation to determine the alimony arrears. nine0005

To reduce the amount of alimony established by the court, the bailiff-executor is not entitled to reduce. The reference to the fact that the bailiff had to apply to the court for clarification of the court order, but did not do this, does not indicate the illegality of his actions, since this appeal is a right, and not an obligation, of the bailiff. On the contrary, the debtor, being an interested party of enforcement proceedings, being active, was not deprived of the opportunity to resolve this issue. In addition, the court order contained no ambiguities and did not require clarification. Thus, the court dismissed the claim of the administrative plaintiff to declare illegal the decision on the calculation of the alimony arrears, the obligation to determine the alimony arrears. nine0005

Articles, Comments, answers to questions : the amount of alimony per child

Register and get test access to the consultantPlus system free 2 days

Open the Consultant Pluss:

Situations: someone situation: someone situation: Do I have to pay child support and how much?

("Electronic journal "Azbuka Prava", 2022) If an agreement on the payment of alimony for minor children has not been concluded, they can be collected in court.