How do you qualify for child benefit

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2022 Child Tax Credit: Definition, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

For the 2022 tax year, taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. Sabrina earned a master's degree in publishing at Portland State University.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">aoshe[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. For the 2022 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,500 of that credit may be refundable.

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

A word of warning: In the eyes of the IRS, you’re ultimately responsible for all information you submit, even if someone else prepares your return.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

1. Does the CTC include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

2. I had a baby in 2022. Am I eligible for the CTC?

Yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

3. Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

4. Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

how to get and where to apply for payments for children

Elena Glubko

mother of two children

Author profile

Diana Shigapova

lawyer

This article contains all federal payments and benefits that parents of young children and teenagers can receive.

These are payments from the state. I will tell you what amounts you can count on and what you need for this.

Payments and benefits for a child in 2022

- Allowance for registration in early pregnancy

- Maternity allowance

- One-time payment for the birth of a child

- Monthly allowance for caring for a child up to 1.

5 years

5 years - Monthly allowance for the first and second child up to 3 years

- Monthly payment from 3 years to 7 children

- Monthly allowance for children from 8 to 17 years old

- Maternity capital

What benefits were we silent about? There is still no information here for families in which a child with a disability is brought up. We talked about federal and regional benefits and payments for such families in separate articles:

- Benefits and benefits for large families

- Benefits for a single mother

- Benefits and benefits for a child with a disability

Pregnancy

Monthly allowance upon registration in the antenatal clinic It is beneficial for the state that children are born healthy. For this, a pregnant woman needs to visit a doctor, take tests, do an ultrasound - all this helps to detect and eliminate problems in the development of the child in time. So that pregnant women do not delay a visit to the doctor, the state is ready to pay them money for early registration for pregnancy - up to 12 weeks, but only for those who have a low level of income. nine0003

nine0003

So what? 07/01/21

Pregnancy benefit in 2022: basic conditions

How much. 50% of the subsistence minimum in the region where the woman lives. On average, 7586 R, but depending on the region, the amount will be more or less. For example, in the Belgorod region it is 6372.5 R, and in the Krasnoyarsk Territory - 8420.5 R.

Living wages for the able-bodied population by region

Who is supposed to. Pregnant women can count on this benefit if the following conditions are met:

- The 12th week of pregnancy has come.

- The average per capita income for each family member does not exceed the subsistence level.

- The family does not have "excess property". If a family owns several apartments and their total area is such that each family member has more than 24 m², then the allowance will not be given. Three cars in a family is also grounds for denial of benefits.

- Family members have income or objective reasons why they do not have this income. This is called the "zero income rule": help those who are trying to provide for themselves and their families, and not those who want to live only on benefits. There may be no income, for example, if a woman was on parental leave for up to 3 years. This is a good reason for the lack of income. nine0020

Self-employed women can also receive this allowance if they meet the above conditions.

How to get. To do this, you need to go to the local gynecologist in the first three months and get a card. Then you will need to submit an application through the public services website or in person to the FIU branch of your region.

No proof of pregnancy or income is required. The FIU will request information itself, but sometimes confirmation is required if there is not enough information in the databases. nine0003

You can apply from the 6th week of pregnancy. But the allowance will come only from the 12th week - monthly until the month of childbirth.

But the allowance will come only from the 12th week - monthly until the month of childbirth.

In order to receive benefits on the card, a pregnant woman will have to get a Mir payment system card. Details are indicated in the application.

/pregnancy-money/

All benefits for pregnancy and childbirth

Additional allowance in Moscow for pregnant women. In the capital, pregnant women with a Moscow residence permit who are registered with Moscow medical organizations up to 20 weeks of pregnancy will be paid a lump sum by social security 690 Р.

How parents can get money from the state

We will tell you in the free Glass of Water mailing list: once a week we send a letter about the financial side of parenthood

Pregnancy

Maternity allowance In everyday life, this money is called "maternity". The allowance is paid once before going on maternity leave to compensate the woman for the loss of salary before and after the birth of the child.

According to the law, you can go on maternity leave at 30 weeks - this is the seventh month of pregnancy. In some cases, earlier. At the antenatal clinic, they will write out a sick leave, which will need to be given to the employer, and if the sheet is electronic, then report its number. nine0003

/guide/dekretnyj-otpusk/

How to apply for maternity leave

How much. The minimum amount of maternity leave for those working under an employment contract is 70,324.8 R for the entire period of sick leave, the maximum for 140 days of maternity leave is 360,164 R.

To receive payments, the expectant mother must bring a sick leave or provide the number of an electronic disability certificate. The accounting department will take the data from the sick leave, transfer the information to the FSS, and the latter will pay benefits. Maternity leave can only be obtained in three ways:

- to the Mir card;

- to a bank account to which no card is linked;

- by postal order.

Who is supposed to. All pregnant women working under an employment contract, full-time students, female civil servants, municipal employees, military personnel.

Women who have been laid off can receive benefits if their employer ceased operations and laid off employees, and they were registered with the employment service within a year. True, the amount in this case will be quite symbolic. nine0003

How to get. The allowance is issued on the basis of a sick leave issued by an obstetrician-gynecologist. A woman must write an application addressed to the employer and attach a sick leave to it. Since 2022, this allowance has been transferred without any application at all.

RF GD dated November 23, 2021 No. 2010PDF, 1.2 MB

How to receive a salary while on maternity leave. It is impossible to be on maternity leave and work under an employment contract at the same time, but an employer can conclude a civil law contract with a pregnant employee, according to which she has the right to work remotely. You need to choose one thing. A woman may not go on maternity leave if she does not want to. Or get out of it even immediately after giving birth - if, for example, you are ready to work remotely. nine0003

You need to choose one thing. A woman may not go on maternity leave if she does not want to. Or get out of it even immediately after giving birth - if, for example, you are ready to work remotely. nine0003

A woman with IP status can also receive maternity leave, if she voluntarily insured herself with the FSS. This must be done in the previous year before the year of pregnancy and insurance premiums must be paid. To do this, we multiply the minimum wage by 2.9% - this is the percentage rate of the social insurance contribution. Then we multiply the received amount by 12 months.

/dekret-abroad/

How to go on maternity leave from abroad

To go on maternity leave in 2023 and receive benefits, you need to pay 4833.72 rubles to the FSS in 2022.

The number 4833.62 was taken from the formula: 13,890 R × 2.9% × 12 months, where 13,890 R is the minimum wage from January 1 to May 31, 2022, 2.9% is the contribution rate to the Social Insurance Fund.

In districts and localities where district coefficients are applied to wages, they are also taken into account when calculating the payment in the FSS.

The contribution can be paid in one payment, or in installments, but not before December 31, 2022. When the time comes to apply for maternity leave, the entrepreneur will submit an application for grants and sick leave to the FSS, and in return she will receive 70,324.8 R or a little more on her card if the minimum wage is increased. nine0003

What to do? 07/15/19

How can an individual entrepreneur receive maternity payments?

Maternity benefits are not subject to personal income tax - the expectant mother will receive the entire amount without deducting 13%.

How to get the maximum maternity pay

- You need to work under an employment contract, and the salary should be white, not gray.

- The average monthly salary for two years must not be lower than 78,250 R before deducting personal income tax.

- If you work in several places at the same time, each employer will pay maternity leave, but on the condition that you have worked at another place of work for at least two years. In this case, ask the antenatal clinic to write out a sick leave for each place of work. nine0020

- If you have changed jobs in the last two years, take a salary certificate from your last job in form 182n. Your employer will take this earnings into account when calculating maternity leave.

- If the billing period for maternity leave fell on another maternity or child benefit period, you can replace it with previous years to take into account the salary and get more money. We have a detailed article on how to independently calculate maternity payments. nine0003

At birth

Lump sum at birthWhen a child is born, the state compensates parents for part of the costs. Moreover, one of the parents can receive this money, regardless of who exactly goes on parental leave.

The size of the salary doesn't matter either. Even the unemployed will be paid.

/guide/moneyforborn/

How to get benefits when a child is born

How much. From February 1, 2022 - 20,472.77 R. Guardians, trustees or adoptive parents will receive the same amount. If they take a child over 7 years old, or relatives, or a disabled child, the amount of the payment is 156,428.66 R.

Regional allowances. Regions add their own payments to the lump-sum allowance at the birth of a child. To receive them, one of the parents and the child must be registered in this region.

For example, in the Khanty-Mansiysk Autonomous Okrug - Yugra, when registering the birth of a child in the registry office of the Khanty-Mansi Autonomous Okrug, the region pays 20,000 RUR.

In St. - 46 372 R, for the third and subsequent children - 57 962 R. This card can be used to pay for the purchase of children's goods in most large stores in the city.

Who is supposed to. One of the child's parents. If both work - dad or mom, by choice. If the parents are unemployed, you can also choose who exactly will apply. If only one person works, he will receive the money, there are no options. For example, dad has an employment contract, but mom doesn’t. The allowance will be paid to the father of the child, but the mother will not be able to issue it.

If the parents are not married, the person with whom the child lives will receive the money, regardless of employment. nine0003

How to get. The payment is made by one of the parents at the place of work. A certificate is required from the second parent that he did not receive this payment.

If both parents are unemployed, the allowance is issued in the pension fund at the place of residence.

Regional Newborn Boxes

Newborn Box available in select regions. This is a gift set that is given to parents or adoptive parents upon discharge from the maternity hospital.

This box contains baby clothes, accessories for feeding, swaddling, bathing. nine0003

This box contains baby clothes, accessories for feeding, swaddling, bathing. nine0003 The package varies by region. The conditions for issuance also differ. In Samara, such a gift is given to mothers who have given birth to their first child. In Tatarstan, the set is given to low-income families. In Vologda, you can get a box for every newborn.

What to do? 02/21/19

How to get the status of a low-income family and why

In Moscow, they give a "Sobyanin's box" to all parents, regardless of their place of residence, but subject to two conditions:

- Their children were born in Moscow maternity hospitals.

- They received their birth certificate in Moscow.

You can pick up a set of things "Our Treasure" not only upon discharge, but also at the department of social protection of the population at the place of residence or stay in Moscow of one of the parents. But the term is limited to two months.

You will need to write an application, as well as submit documents that parents did not receive such a set at the maternity hospital.

You will need to write an application, as well as submit documents that parents did not receive such a set at the maternity hospital. From February 18, 2020, instead of a set of things, parents can receive compensation of 20,000 R. The amount is paid for each child born. If at least one of the parents has a registration in Moscow, the payment is processed at the regional department of social protection of the population. nine0003

If there is no registration, and only the birth of a child is registered in Moscow, then parents should contact the My Documents public services center. The decision on payment is made within 10 days, and the payment itself is transferred in the next month.

Additional benefits in Moscow at the birth of a child

One-time compensation payment for reimbursement of expenses in connection with the birth (adoption) of a child. It can be issued by one of the parents, one of the adoptive parents (the only adoptive parent), the child's guardian - Russians, foreign citizens and stateless persons living in Moscow.

To do this, you need to have a Moscow residence permit. nine0003

To do this, you need to have a Moscow residence permit. nine0003 6313 RUR will be paid for the first child, 16 642 RUR each for the second and subsequent ones. In case of birth or adoption of three or more children at the same time, 57 383 RUR will be paid. If both parents are under 36 at the time of the birth of the child and the family income per person is not more than the subsistence minimum, the city will pay an additional 93,570 R for the first child, 130,998 R for the second, 187,140 R for the third and subsequent. Citizens registered in New Moscow will also receive these payments. nine0003

Appendix 1

to the Decree of the Government of Moscow dated May 27, 2021 No. 718-PPUp to 1.5 years

Benefit for caring for a child up to 1.5 yearsWhen a mother's maternity leave is over, the next one may begin - to care for a child. During this period, a parent or other person who sits with a child is assigned an allowance - but only up to one and a half years.

Leave with the preservation of the workplace and position can last up to three years.

Leave with the preservation of the workplace and position can last up to three years. Benefits can be received not only by the employed, but also by the unemployed: difference in amounts and execution. And you can also combine child care and work duties and, in addition to payments from the budget, receive a salary at work. nine0003

/guide/iz-dekreta/

How to get out of the decree

How much. 40% of the average salary for the previous two years. The minimum is 7677.81 R. The maximum in 2022 is 31,282.82 R: such a benefit will be paid if your average salary for 2020 and 2021 is more than 78,250 R. In fact, when assigning benefits, they calculate the average daily earnings - the same way as well as for maternity leave.

Benefits and their calculation data for 2019-2022 - "Consultant Plus"

Who is supposed to. Mother, father or other adult caring for the child. It could also be a grandmother.

Only one person will receive the benefit. Leave can be taken in turn: for example, first mom, then father, and then grandmother.

Only one person will receive the benefit. Leave can be taken in turn: for example, first mom, then father, and then grandmother. How to get. They make payments at the place of work, and if the mother or father is unemployed, an application must be submitted to the social security at the place of residence.

How to get a job and keep your monthly allowance

During parental leave, a mother cannot work full time or she will lose her monthly allowance. At the same time, the law allows you to work part-time or work from home. And there is one trick here. nine0003

Judging by article 93 of the Labor Code of the Russian Federation, part-time work can be considered both part-time and part-time work.

Since a full working day is 8 hours and a full working week is 40 hours, the parties must find an option for the employee to work a little or the prescribed 8 hours every day, but not on all days of the week.

Here it is necessary to take into account the position of the Social Insurance Fund and the Supreme Court - the child care allowance compensates for lost earnings.

If the mother has not lost her earnings, then she has nothing to compensate. Sometimes the assigned allowance is even cancelled. nine0003

If the mother has not lost her earnings, then she has nothing to compensate. Sometimes the assigned allowance is even cancelled. nine0003 /vernula-posobie/

I was laid off on maternity leave, but I was able to keep my allowance

the number of working hours for a woman to earn 60% of her previous salary. More about this has already been written in the article "How to reduce the working day and receive benefits."

Instead of a mother, a father can apply for parental leave plus part-time work in exactly the same way. nine0003

If both spouses do not want to lose their wages, they can apply for an allowance for working grandparents.

Up to 1.5 years

Putin's paymentsOn January 1, 2018, the law on monthly payments to families with children came into force. According to it, you can receive a monthly payment for the first or second child. This is not maternity leave or a child care allowance, but an additional measure of support.

People call the new allowance "Putin's payments". They do not replace, overlap or cancel other benefits. The payment is not provided as a one-time payment, but is paid every month to the bank card of the mother - or father, if the mother has died or she has been deprived of parental rights. nine0003

/money-for-baby/

How I got Putin's payments per child

Putin's allowance is one regional living wage per child per month. When applying for payment in 2022, the allowance will be assigned in the amount of the subsistence minimum for the current year. For example, in Moscow it will be R17,791, in Novosibirsk it will be R14,562, and in Vladivostok it will be R17,628. nine0003

- Parents whose first or second child was born or adopted after January 1, 2018 can receive payments. Guardians can also claim payments - in the event of the death of parents or adoptive parents, they are declared dead, deprivation of parental rights, or in case of cancellation of adoption.

- The applicant must be a citizen of Russia and permanently reside in the territory of the Russian Federation.

- The child must be a Russian citizen. For example, if the birth was in the Russian Federation, but both parents are foreign citizens, then by default the child is not granted Russian citizenship. nine0020

- The average per capita family income for the billing period is no more than two regional living wages for the current year for the able-bodied population. The billing period is 12 months preceding 6 months before the circulation month.

GD of the Novosibirsk Region dated May 31, 2022 No. 250-p

For the first child, the payment is made in social security. On the second - in the pension fund, because it will reduce maternity capital.

The allowance is granted for up to one year, and then it must be extended to two and three years. nine0003

Money can now be received only on the Mir card or on an account that is not linked to any cards.

/benefit-calc/

Calculator of Putin's payments for the first and second child in 2022

Up to 3 years

Monthly allowance for a child up to 3 yearsCompensation for caring for a child up to 3 years is a benefit for parents who care for small children.

How much. 50 R is paid monthly to one of the parents of a child from 1.5 to 3 years. nine0003

Who is supposed to. To one of the parents who worked under an employment contract and went on parental leave.

How to get. From January 1, 2020, this payment was canceled, but not for everyone. It will continue to be available to mothers or fathers of children born before January 1, 2020.

If the child was born after January 1, 2020, the parents will not be able to receive this payment.

Over 3 years old

Monthly allowance for a child from 3 to 7 years nine0051Specific conditions for granting the payment are established by regional authorities, but these conditions must fit into the federal framework.

So what? 03/12/21

Payments from 3 to 7 years will double, and the increase will be assigned retroactively

How much. 50, 75 or 100% of the subsistence minimum for children in the region - depends on the degree of need.

Decree of the President of the Russian Federation of March 20, 2020 No. 199 "On additional measures of state support for families with children"PDF, 143 KB

Who is supposed to. Families with children from 3 to 7 years old inclusive, subject to a number of conditions:

- Parent is a citizen of the Russian Federation permanently residing in the Russian Federation.

- The child is a citizen of the Russian Federation.

- The average per capita family income is not more than the subsistence minimum per capita in the region.

- The property of the family is not more than the established list. For example, a family has only one car and one apartment.

- Family members had income or good reasons for their absence in the billing period. nine0020

How to get. An application for payment can be submitted through public services or social security. To transfer money to the card, "Mir" is suitable. Or you need an account without a card. One of the child's parents can apply for payment.

First, the payment will be assigned for a year, then it can be extended upon application. The money is paid until the child is 8 years old.

Difficult question 04/09/21

How to get a payment for children from 3 to 7 years old in 2022

Over 3 years old

Allowance for a child from 8 to 17 yearsAs of July 1, 2021, the federal allowance for children under 17 years of age has appeared. It is appointed in all regions on the same terms.

How much. The amount of the allowance is 50% of the subsistence minimum for children in the region.

In 2022, this is almost seven thousand per month.

In 2022, this is almost seven thousand per month. The amount of PM in the Russian Federation - "Consultant-plus"

Who is supposed to. Who can get this type of state support:

- The only parent of a child. That is, the second parent died or went missing, the father is listed in the documents according to the mother or is not included in the certificate at all.

- One of the parents in whose favor child support is assigned by court order.

There are also general conditions:

- The applicant has the citizenship of the Russian Federation or a residence permit in Russia.

- The allowance is granted if the average per capita income does not exceed the subsistence level per capita. nine0020

- Family property - within the established list.

- Adult family members have proven income or a good reason for not having it.

From May 1, 2022, complete families with low incomes also receive benefits.

The amount of payment for them is 50%, 75% or 100% of the subsistence minimum for children in the region.

The amount of payment for them is 50%, 75% or 100% of the subsistence minimum for children in the region. 50% - basic amount, all families receive it. If, after his appointment, the family income does not reach the subsistence minimum, 75% of the subsistence minimum per child will be paid. If this is not enough - 100%. Perhaps the allowance for single parents of children from 8 to 17 years old will be canceled - it is less profitable. A new payment is appointed immediately for two months - April and May, but you can apply for it from May 1. nine0003

How to get. You can apply for public services or the FIU. The benefit is assigned for a year, and then extended upon a new application. As part of the verification of the application, documents may be required that will have to be brought in person.

There are also payments for children under 16 in the regions. In practice, such a benefit is not available everywhere, but is usually assigned to low-income families.

For example, in Moscow, single mothers can receive such benefits.

For example, in Moscow, single mothers can receive such benefits. Difficult question 24.08.21

Assets, zero income and timing: difficult questions about child support from 8 to 17

One-time payments

Maternal capitalThis type of state support appeared in 2007, and since 2020 it is assigned even for the first child.

The right to maternity capital is confirmed by a personalized certificate. It can be obtained upon application to the FIU or automatically at public services.

So what? 01/13/22

Starting February 1, 2022, mother's capital will grow by 8.4%

How much. The amount depends on the year of birth of the child and what kind of account he is in the family.

Maternal capital in 2022

When the children were born Amount from 01.02.2022 First and second - until 2020 524 527.  9 R for the second

9 R for the second First - before 2020,

Second - in 2020 or later693 144.1 R for the second First and second - from 2020 524 527.9 R for the first, 168 616.2 R for the second when children

were born from 01.02.2022 9000

The first and second - up to 2020

524 527.9 r for the second

The first - until 2020 or later than

693,144.1 R for the second

First and second — from 2020

524,527.9 R for the first, 168,616.2 R for the second

Money can only be used for the specified purposes:

- Improvement of living conditions.

- Children's education.

- Monthly payments for the second child.

- Mom's funded pension.

- Goods for children with disabilities.

/prava/obyazannosti-matkapital/

Responsibilities when using the mother capital

Who is supposed to.

Usually, the mother capital is received by a woman who has given birth or adopted a child.

Usually, the mother capital is received by a woman who has given birth or adopted a child. If the mother has died or is deprived of parental rights, the certificate will be given to the father or adoptive parent. nine0003

How and where to apply. In the Pension Fund of the Russian Federation or on the public services portal. First you need to get a certificate, and then you need to apply for an order.

There is also regional maternity capital.

We have articles about maternity capital in order to use state support with profit:

- How to spend maternity capital on a mortgage

- Where from 2019 you cannot spend maternity capital

- How to sell an apartment in which maternity capital was invested

- How to spend a matkapital for building a house

- How to calculate a deduction when buying an apartment with a uterus

- How to reduce personal income tax when selling an apartment with a capital

Payments and child benefits in 2022

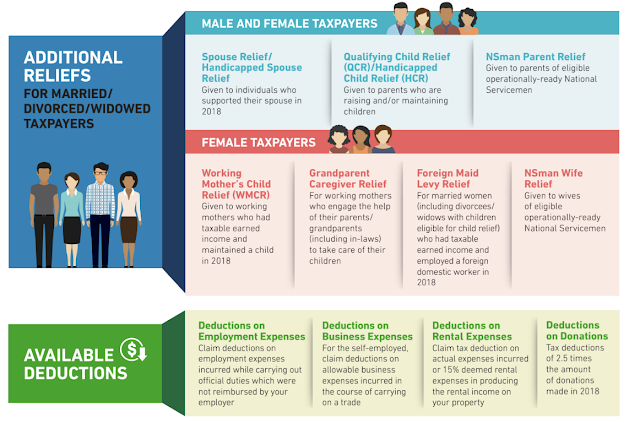

| Minimum size | Maximum size | Are there regional allowances | |

|---|---|---|---|

| Maternity allowance | 70,324. 8 R 8 R | 360 164 Р | - |

| Payment at birth | 20,472.77 R | - | Yes. For example, in St. Petersburg - 34,777 R, in Moscow - 6313 R for the first and 16,642 R for the second, as well as "Sobyanin's box" and "Luzhkov's" payments to a young family |

| Maternity capital | 168616.2 R, 524527.9 R or 693144.1 R | - | Yes. For example, in St. Petersburg, capital is allocated at the birth of a third child |

Pressure allowance

Minimum size

70 324.8 R

Maximum size

9000 360 164 RAre there any regional allowances

9000 --

9000 Payment at birth

9000mal size20,472.77 Р

Maximum size

—

Are there regional allowances

Yes. For example, in St. Petersburg - 34,777 R, in Moscow - 6313 R for the first and 16,642 R for the second, as well as "Sobyanin's box" and "Luzhkov's" payments to a young family

Maternity capital

Minimum size

168 616. 2 R, 524 527.9 r or 693 144.1 P

2 R, 524 527.9 r or 693 144.1 P

The maximum size

-

is there regional allowances

. For example, in St. Petersburg, capital is allocated at the birth of a third child

Monthly payments and benefits for a child in 2022

| Payment | Minimum size | Maximum size | nine0483 Are there regional allowances|

|---|---|---|---|

| Registration allowance at the antenatal clinic | 50% of the regional subsistence minimum for the working-age population | - | Payouts vary by region |

| Child care allowance up to 1.5 years | 7677.81 R per child | 31,282.82 R | - |

| "Putin's payments" up to 3 years | Regional subsistence minimum per child | - | Payouts vary by region |

| Child allowance from 1.5 to 3 years | 50 R if the child was born before 01/01/2020 | - | - |

| Child benefit from 3 to 7 years | 50% of the regional subsistence minimum per child | 100% of the regional subsistence minimum per child | Payouts vary by region |

| Child benefit from 8 to 17 years | 50% of the regional subsistence minimum per child | - | Payouts vary by region |

Manual when registering in the Wondwater Consultation

minimum size

50%of the regional subsistence minimum for the working population

Maximum size

-

Is there any regional allowances

The size of payments depends on the region

A allowance for child care under 1. 5 years old

5 years old

Minimum size

7677.81 r for each child

Maximum size

9000 31 282.82 Rare there regional allowances

-

"Putin's payments" up to 3 years

0002 Are there any regional allowances

Payments depends on the region

A child allowance from 1.5 to 3 years old

Minimum size

50 p if the child was born until 01.01.2020

Maximum size

-

-Are there regional allowances

—

Allowance for a child from 3 to 7 years

Minimum amount

50% of the regional subsistence minimum for a child

Maximum size

100%of the regional subsistence level per child

Is there any regional allowances

Payments depends on the region

Children's allowance from 8 to 17 years old

Minimum size

50%of the regional subsistence minimum per child

Maximum amount

-

Are there any regional allowances

The amount of payments depends on the region

What child benefits can you count on

There are many benefits and payments, there are even more conditions for receiving them - it is easy to get confused in all this.

We have made a test for parents: answer a few questions and find out what types of state support you can count on.

Page not found — State treasury institution “Regional Center for Social Protection of the Population” of Zabaykalsky Krai nine0048 404

Page not found

This page does not exist

Ask a question

×

Make an appointment

Full name

e-mail (mandatory)

Phone (mandatory)

Direction of appeal

issuance of a certificate of recognition of a family as poor between the ages of 70 and 80 monthly monetary compensation for housing and communal services (benefits) monthly allowance for the FIRST child according to 418 FZZhKU for large families for children from 0 to 3 years old child allowanceregional maternity capitalsubsidy for housing and communal services

Unit

Interdistrict branch of the city of Chita and the Chitinsky District District Chita and Chitinsky District

Living District

Centralingino Zhelezelnozhnozhnodornozhnodornovsky

The desired period of time

before dinement of dinner

Message (here you can indicate additional information about your appeal )

- I give my consent to the processing of personal data

- I give my consent to receive a response to the specified e-mail.

mail

mail

The procedure for receiving and considering applications is carried out in accordance with the Federal Law of the Russian Federation “On the procedure for considering applications from citizens of the Russian Federation No. 59-FZ of May 2, 2006.

In your appeal, you must indicate your last name, first name, patronymic (the last one - if available), e-mail, to which the answer should be sent, notification of redirection of the appeal.

If the written request does not indicate the name of the citizen who sent the request and the e-mail to which the response should be sent, the response to the request is not given. nine0248 A written appeal is subject to mandatory registration within three days from the date of receipt by a state body, local government body or official.

A written appeal received by a state body, a local government body or an official in accordance with their competence is considered within 30 days from the date of registration of the written appeal.