How much is a child tax credit in california

California Earned Income Tax Credit and Young Child Tax Credit

Overview

If you have low income and work, you may qualify for the California Earned Income Tax Credit (CalEITC). This credit gives you a refund or reduces your tax owed.

If you qualify for CalEITC and have a child under the age of 6, you may also qualify for the Young Child Tax Credit (YCTC).

Together, these state credits can put hundreds or even thousands of dollars in your pocket.

Filing your state tax return is required to claim both of these credits.

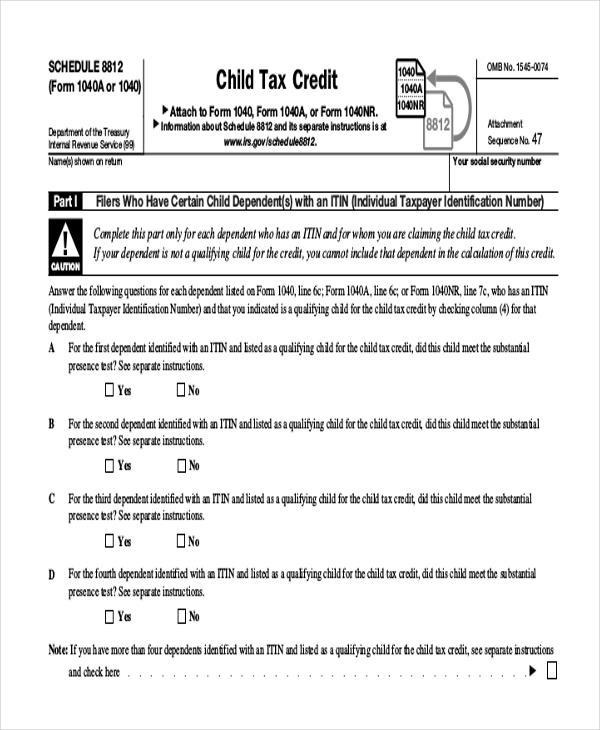

For tax year 2020 forward: Eligibility extends to those with an Individual Taxpayer Identification Number (ITIN)

Changes for married/registered domestic partners filing separately

For tax year 2021 forward, there are new qualifying criteria for taxpayers with the filing status married/registered domestic partners (RDP) who file separately. For details see the Check if you qualify for CalEITC section.

EITC calculator

Find out how much you could get back

Use the EITC calculator for an estimate.

Available in 6 languages.

Estimate my EITC

Check if you qualify for CalEITC

You may qualify for CalEITC if:

- You’re at least 18 years old or have a qualifying child

- You have earned income within certain limits

The amount of CalEITC you may get depends on your income and family size.

You must:

- Have taxable earned income

- Have a valid social security number or individual taxpayer identification number (ITIN) for you, your spouse, and any qualifying children

- Live in California for more than half the year

- Not use married/registered domestic partner (RDP) if filing separately unless you had a qualifying child who lived with you for more than half of 2021, and either of the following apply:

- You lived apart from your spouse/RDP for the last 6 months of 2021, or

- You are legally separated by state law under a written separation agreement or a decree of separate maintenance and you did not live in the same household as your spouse/RDP at the end of 2021

Earned income can be from:

- W-2 wages

- Self-employment

- Salaries, tips

- Other employee wages subject to California withholding

What you'll get

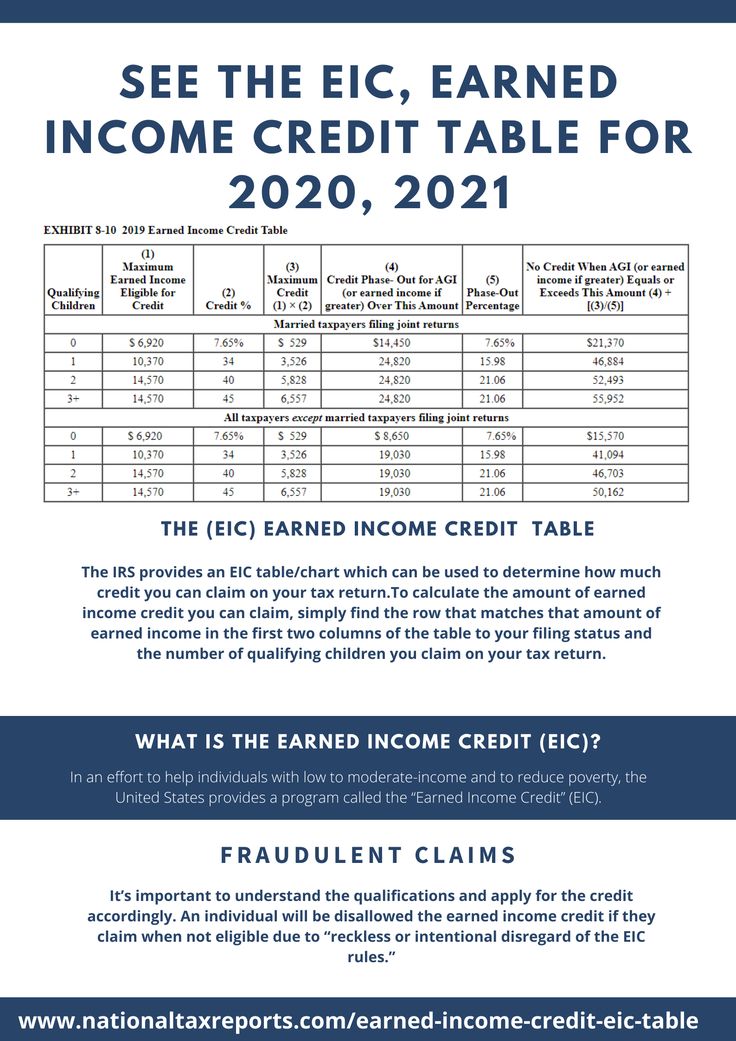

Review the chart below to see how much you may get when you file your tax year 2021 return.

| Number of qualifying children | California maximum income | CalEITC (up to) | IRS EITC (up to) |

|---|---|---|---|

| None | $30,000 | $255 | $1,502 |

| 1 | $30,000 | $1,698 | $3,618 |

| 2 | $30,000 | $2,809 | $5,980 |

| 3 or more | $30,000 | $3,160 | $6,728 |

If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you might qualify for up to $1,000 through the Young Child Tax Credit.

You may go back up to four years to claim CalEITC by filing or amending a state income tax return. Review the charts for past years below to see how much you could get.

2020 CalEITC credit

| Number of qualifying children | California maximum income | CalEITC (up to) | IRS EITC (up to) |

|---|---|---|---|

| None | $30,000 | $243 | $538 |

| 1 | $30,000 | $1,626 | $3,584 |

| 2 | $30,000 | $2,691 | $5,920 |

| 3 or more | $30,000 | $3,027 | $6,660 |

2019 CalEITC credit

| Number of qualifying children | California maximum income | CalEITC (up to) | IRS EITC (up to) |

|---|---|---|---|

| None | $30,000 | $240 | $529 |

| 1 | $30,000 | $1,605 | $3,526 |

| 2 | $30,000 | $2,651 | $5,828 |

| 3 or more | $30,000 | $2,982 | $6,557 |

2018 CalEITC credit

| Number of qualifying children | California maximum income | CalEITC (up to) | IRS EITC (up to) |

|---|---|---|---|

| None | $16,750 | $232 | $519 |

| 1 | $24,950 | $1,554 | $3,461 |

| 2 | $24,950 | $2,559 | $5,716 |

| 3 or more | $24,950 | $2,879 | $6,431 |

2017 CalEITC credit

| Number of qualifying children | California maximum income | CalEITC (up to) | IRS EITC (up to) |

|---|---|---|---|

| None | $15,008 | $223 | $510 |

| 1 | $22,322 | $1,495 | $3,400 |

| 2 | $22,309 | $2,467 | $5,616 |

| 3 or more | $22,302 | $2,775 | $6,318 |

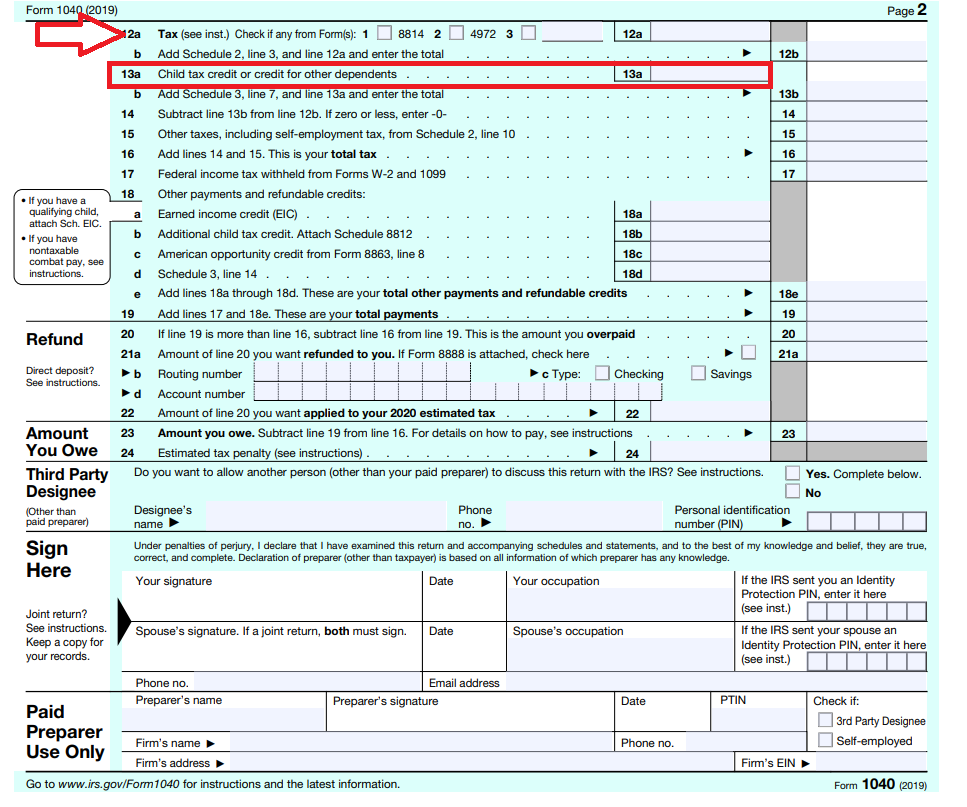

Claim your credit

- Download, complete, and include with your California tax return: California Earned Income Tax Credit (FTB 3514)

- Follow these instructions: 2021 Instructions for Form FTB 3514

You can file your tax return and claim CalEITC using CalFile for free.

Get free tax preparation help

Volunteer Income Tax Assistance (VITA)

Prior year credit information

-

- 2020 CalEITC Credit (FTB 3514)

- 2020 FTB 3514 instructions

-

- 2019 CalEITC Credit (FTB 3514)

- 2019 FTB 3514 instructions

-

- 2018 CalEITC Credit (FTB 3514)

- 2018 FTB 3514 instructions

-

- 2017 CalEITC Credit (FTB 3514)

- 2017 FTB 3514 instructions

Tax professionals

Verify if your client qualifies

Complete and keep copies of the:

- Paid Preparer’s California Earned Income Tax Credit Checklist (FTB 3596)

- CalEITC worksheet

You may be subject to a $500 penalty if you don’t comply with CalEITC requirements.

Federal information

In addition to CalEITC, you may qualify for the federal EITC. Visit IRS Earned Income Tax Credit for more information.

For information on obtaining an ITIN and more, visit IRS ITIN.

Why you got a letter

You may have received a notice from us if:

- We require additional documentation to process your claim

- You didn’t qualify

- We adjusted your claim

Follow the instructions on your notice or contact your tax preparer.

For tax year 2021: FTB has released the EITC Qualification Married/Registered Domestic Partner Filing Separate public service bulletin to address changes in the CalEITC qualifying criteria as well as outline a process for taxpayers that have already filed their 2021 return and will now claim CalEITC/YCTC.

Child and dependent care expenses credit

Overview

You may claim this credit if you paid someone to take care of your:

- Child

- Spouse/Registered Domestic Partner (RDP)

- Dependent

You must have earned income during the year. This credit does not give you a refund.

This credit does not give you a refund.

Check if you qualify

You may qualify if you paid for care while you worked or looked for work.

Child

A child qualifies if they meet all of the following:

- Relationship — must be your:

- Son/daughter

- Stepchild

- Adopted child

- Foster child

- Brother/sister

- Half-brother/half-sister

- Stepbrother/stepsister

- Niece/nephew

- A descendant of one of the above

- Age: Are under 13 years old

- Residency: Lived with you for more than 1/2 the year

- Support: Did not provide more than 1/2 of his/her own support

- Joint Return: Did not file a joint federal or state income tax return

- Citizenship: Are a U.

S. citizen, national, or resident of Canada or Mexico

S. citizen, national, or resident of Canada or Mexico

Spouse/registered domestic partner (RDP)

A spouse/RDP qualifies if they were:

- Mentally or physically incapable of taking care of themselves

- Enrolled as a full-time student during any 5 months of the year

Dependent

A dependent qualifies if they were either:

- Mentally or physically incapable of taking care of themselves

- Would have been your dependent except:

- Their income was more than $4,300

- They filed a joint tax return

- You, or your spouse/RDP (if filing a joint return) could be claimed as a dependent on someone else’s tax return

Additional qualifications

If you have a qualifying person you must also meet all of the following:

- File a joint return (if married)

- Have had the care provided in California

- Paid for care in order to work or look for work

- Have earned income

- The person that provided the care cannot be:

- Your spouse/RDP

- The parent of the child

- You lived in the same house with the qualifying person for more than 1/2 the year

- Your federal adjusted gross income is $100,000 or less

Your child can be the care provider if they are 19 years old or older.

What you'll get

If you qualify, you may only claim expenses up to:

- $3,000 for 1 person

- $6,000 for 2 or more people

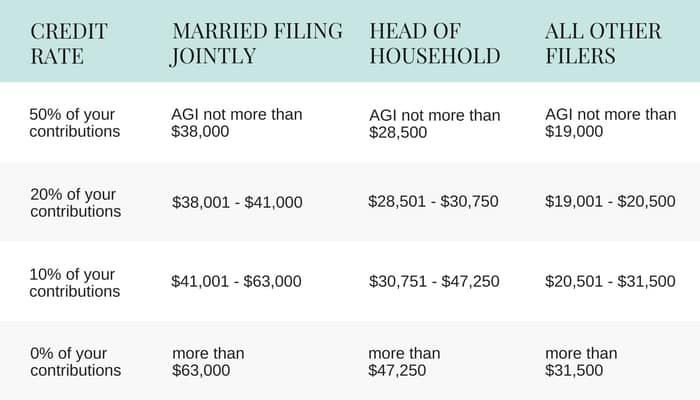

You will receive a percentage of the amount you paid as a credit.

How to claim

- File your income tax return

- Attach Child and Dependent Care Expenses Credit (Form 3506)

- Visit Instructions for form FTB 3506 for more information

Why you got a letter

You may have received a notice from us if:

- We need additional documentation to process your claim

- You did not qualify

- We adjusted your claim

Follow the instructions on your notice or contact your tax preparer.

This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Consult with a translator for official business.

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. If you have any questions related to the information contained in the translation, refer to the English version.

Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. If you have any questions related to the information contained in the translation, refer to the English version.

We translate some pages on the FTB website into Spanish. These pages do not include the Google™ translation application. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page).

We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.

Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For forms and publications, visit the Forms and Publications search tool.

Choose your language

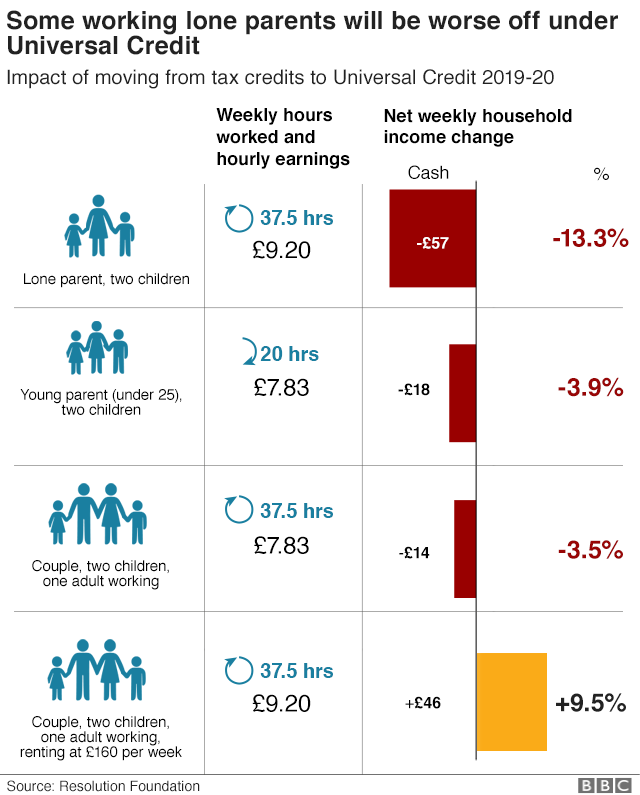

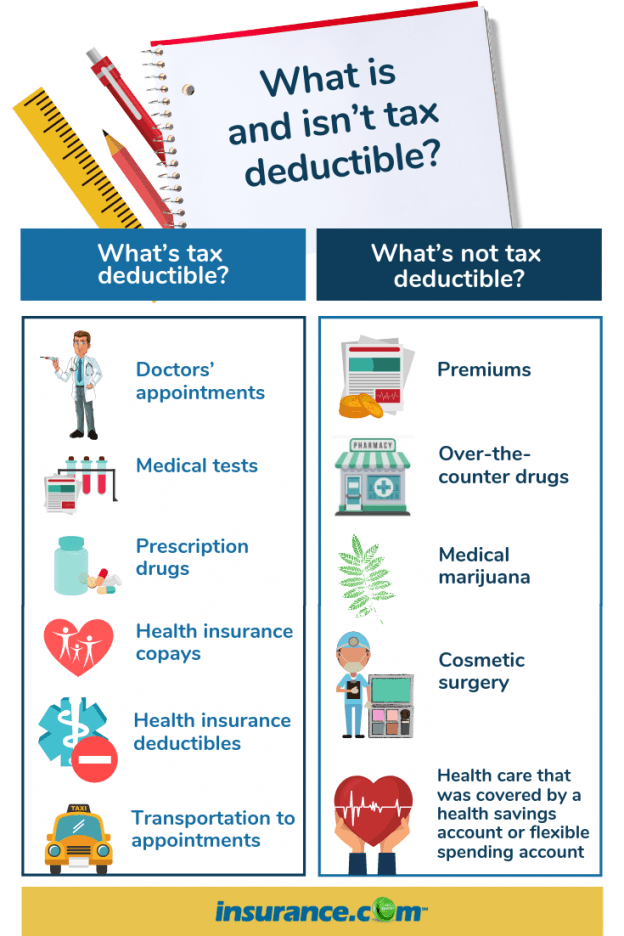

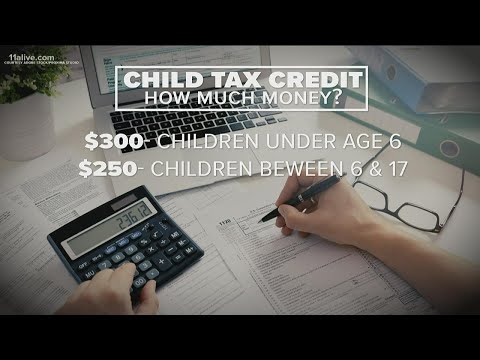

tax deduction - as soon as the heart beats - OfficeLife

Office Life columnist is surprised at the initiative of the Georgia state administration, where they propose to give a tax deduction for children over 6 weeks of pregnancy, and for some reason compares the amount of deductions in one social country and in the USA .

To the famous aphorism of Benjamin Franklin about the inevitability of death and taxes, it is time to make the first amendment. Life and taxes can also be combined. More precisely, life and a tax break for its continuation. You just need to take care of life as soon as it warms up.

Now, many media outlets are vying to discuss the abortion law ( House Bill 481 ), adopted in the US state of Georgia. There are similar bans in the United States in Iowa, Kentucky, Mississippi and Ohio, but in Georgia they outdone them all. Firstly, from January 1, 2020, abortions are prohibited there at a gestational age of more than 6 weeks, that is, when the fetal heart begins to be heard. From this moment on, termination of pregnancy is equated with murder (except in special cases).

But much more interesting is the “second” of the law: the recognition of unborn children as living individuals who deserve full legal recognition with all the ensuing consequences, including tax ones.

Under Georgia law, a woman already carrying a 6-week-old embryo is entitled to a standard income tax deduction.

So, according to Georgia law, a woman already carrying a 6-week-old embryo is entitled to a standard income tax deduction.

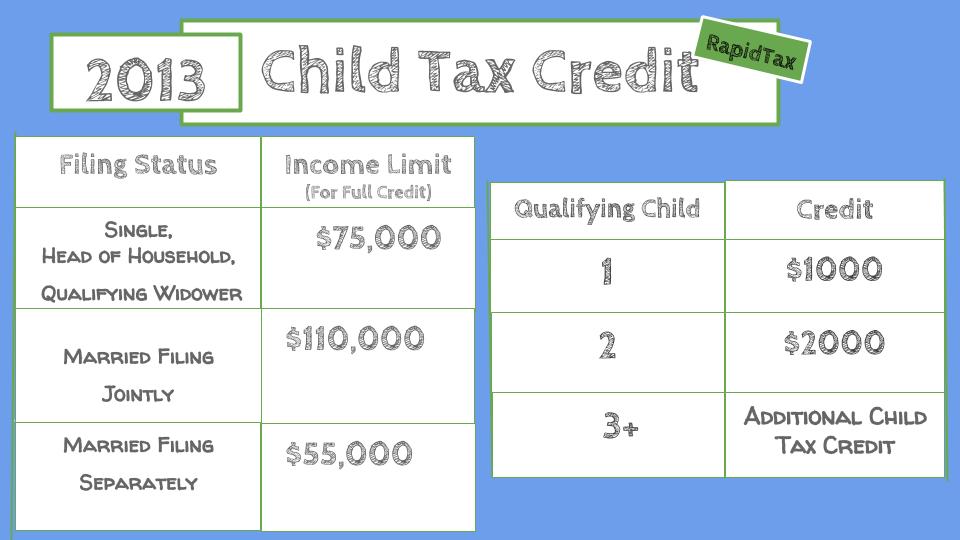

For reference: the tax deduction for children in the United States after the Trump reform is $2,000, and taxpayers with a joint income of up to $400,000 are entitled to it. Individuals who do not qualify for this deduction may apply for a tax credit of $500 per child.

Now let's compare: in Belarus, the standard tax deduction for each parent is 32 rubles per month for a child under 18 and (or) each dependent, if there are two or more children or for a single parent - 61 rubles. Of course, the existing attraction of unheard-of budgetary generosity concerns born children.

In Georgia, the right to a tax deduction is going to be given immediately, as soon as the heartbeat of the embryo becomes audible. This, according to the supporters of the law, will be the legal recognition of his individuality. It remains only to calculate how much such recognition will cost the state.

This, according to the supporters of the law, will be the legal recognition of his individuality. It remains only to calculate how much such recognition will cost the state.

Our law is very simple, but at the same time very significant. It is a declaration that all life has value, all life matters, and all life is worth protecting.Georgia Governor Brian Kemp

Tax protection in this case will be quite complicated. The deduction is expected to be given annually to parents of children conceived in or after April. Gynecologists are already complaining that it will be laborious and costly for them to additionally check all pregnant women who want to file a tax deduction. In addition, 25% of pregnancies end in miscarriage, but the right to deduction is retained, as in the case of a stillbirth. But the authors of the law are sure that these difficulties can be overcome - if there is a desire and money in the budget.

In fairness, we admit that in terms of "maternity" leave, the Yankees are far from us. In the States, a mother can only get 12 weeks of unpaid leave, and even then not earlier than two weeks before the expected date of delivery and provided that she has worked in the company for more than a year. True, a husband has the right to include a non-working wife in a joint tax return and receive a very substantial deduction for her. Because the soulless Americans did not think of something like a "parasite decree". And as for the social orientation of taxes, they are getting interesting...

In the States, a mother can only get 12 weeks of unpaid leave, and even then not earlier than two weeks before the expected date of delivery and provided that she has worked in the company for more than a year. True, a husband has the right to include a non-working wife in a joint tax return and receive a very substantial deduction for her. Because the soulless Americans did not think of something like a "parasite decree". And as for the social orientation of taxes, they are getting interesting...

Photo: flickr.com / Jerry Lai

Personal or joint: division of property in a divorce

Illustration: Pravo.ru/Peter Kozlov

According to family law, what is acquired by spouses in marriage is divided in half. But this does not always happen in practice. For example, a husband bought a plot before marriage, and built a house on it with his wife. Or the spouse sold her apartment and invested in common real estate. In these cases, the court departs from the rule of "equality of shares". You can also lose part of your personal property during a divorce, for example, inherited.

You can also lose part of your personal property during a divorce, for example, inherited. Only since the beginning of the year, 3031 lawsuits on the division of property between spouses have been submitted to the courts. The majority of such disputes were considered by the Moscow City Court (133 cases), a little less cases turned out to be in the proceedings of the authorities of the Stavropol Territory, Bashkiria and the Sverdlovsk Region (according to the Сaselook.ru system for lawyers as of September 17, 2020). The property issue of the ex-spouses had to be resolved by the appellate and cassation instances, problems in practice arise when the courts need to deviate from the general rule "everything in half", and divide the property acquired in marriage in different shares.

Mother's capital is not divided

Couples face difficulties if they partially bought property not at the expense of common funds, says Anna Artamonova, partner at AB EMPP EMPP federal rating. Group Arbitration proceedings (medium and small disputes - mid market) Group Family and inheritance law Group environmental law Group TMT (telecommunications, media and technology) Group Corporate/M&A (high market) Group Criminal law 15th place By revenue per lawyer (less than 30 lawyers) 33rd place By revenue Company profile For example, they invested maternity capital, such a dispute arose between Irina and Andrey Makarov *. The wife filed a lawsuit against her ex-husband to share an apartment acquired in marriage.

Group Arbitration proceedings (medium and small disputes - mid market) Group Family and inheritance law Group environmental law Group TMT (telecommunications, media and technology) Group Corporate/M&A (high market) Group Criminal law 15th place By revenue per lawyer (less than 30 lawyers) 33rd place By revenue Company profile For example, they invested maternity capital, such a dispute arose between Irina and Andrey Makarov *. The wife filed a lawsuit against her ex-husband to share an apartment acquired in marriage. They bought the disputed housing on credit, part of it was repaid with matkapital. The court of first instance and the appeal decided that the entire apartment should be divided, but the Supreme Court recalled that in this case it is necessary to determine the shares minus the maternity capital. The Board indicated that the funds of the certificate are not subject to division, since they are not common property, but have a designated purpose (by virtue of paragraph 2 of article 34 of the UK) (case No. 18-KG19-57).

They bought the disputed housing on credit, part of it was repaid with matkapital. The court of first instance and the appeal decided that the entire apartment should be divided, but the Supreme Court recalled that in this case it is necessary to determine the shares minus the maternity capital. The Board indicated that the funds of the certificate are not subject to division, since they are not common property, but have a designated purpose (by virtue of paragraph 2 of article 34 of the UK) (case No. 18-KG19-57).

The position of the courts on this issue has been formed, says Anastasia Rastorguyeva, Senior Partner at Barshchevsky and Partners Barshchevsky & Partners federal rating. Group Dispute resolution in courts of general jurisdiction Group Arbitration proceedings (medium and small disputes - mid market) . According to the law, children must be allocated a share, respectively, in case of divorce and division of property, the spouses no longer divide the entire apartment among themselves, but only that part of it that remains after the deduction of the children's share. The "Review of judicial practice in cases related to the implementation of the right to maternity (family) capital" is devoted to this issue. Despite this, the courts of first instance do not always make the "correct" decision. It is up to the higher courts to correct them. For example, in cases No. 2-2841/17 and No. 2-3/2018

According to the law, children must be allocated a share, respectively, in case of divorce and division of property, the spouses no longer divide the entire apartment among themselves, but only that part of it that remains after the deduction of the children's share. The "Review of judicial practice in cases related to the implementation of the right to maternity (family) capital" is devoted to this issue. Despite this, the courts of first instance do not always make the "correct" decision. It is up to the higher courts to correct them. For example, in cases No. 2-2841/17 and No. 2-3/2018

During a divorce, the unused certificate itself is not divided, clarifies Irina Oreshkina, lawyer at S&K Vertical S&K Vertical federal rating. Group Bankruptcy (including disputes) (mid market) Group Arbitration proceedings (large disputes - high market) Group Dispute resolution in courts of general jurisdiction Group Family and inheritance law Group Private equity 3rd place By revenue per lawyer (more than 30 lawyers) 10th place By revenue 24th place By number of lawyers Company profile . It remains with the person in whose name it is issued. Usually the mother of the child.

It remains with the person in whose name it is issued. Usually the mother of the child.

"Mortgage" real estate

Not only the property or material values of the spouses, but also obligations are recognized as common, says Svetlana Ivanova from FTL Advisers FTL Advisors federal rating. Group Family and inheritance law Group Compliance Group Corporate/M&A (mid market) Group Private equity Group Tax consulting and disputes (Tax consulting) . For example, a loan spent on family needs. As for the mortgage, Rastorguyeva clarifies, the property, the apartment itself, is divided in the same proportion as the debt for it (this principle contains paragraph 3 of article 39SC).

If one of the spouses proves that he made the majority of the loan from personal funds, the court may increase his share in the apartment and, accordingly, reduce the amount of the debt. By the same principle, you can get the whole apartment, as happened in case No. 2-809/2016. Alina and Oleg Kataev* took out a mortgage to buy an apartment. But it was paid both in marriage and after its dissolution only by the spouse. She asked the court to transfer the disputed property to her ownership, while providing receipts for the payment of monthly payments as evidence. The fact that the mortgage debt was extinguished only by the spouse was confirmed by the husband. The Leninsky District Court of Tomsk satisfied Kataeva's claim, the parties did not appeal the decision.

According to Rastorguyeva, if the former spouse can still count on most or all of the mortgage apartment, then it will not be possible to recover (if only one of the partners pays off the mortgage) the amount paid from the ex-husband or wife - the courts will consider that the payment was made from common funds. At the same time, Artamonova says, there are no legal mechanisms to force the former spouse-co-borrower to pay half of the monthly mortgage payment. A good way of financial protection in this case is a prenuptial agreement. It may concern exclusively the procedure for paying a mortgage and distributing real estate between owners after the loan is repaid or in the event of a divorce. For example, it is possible to link the size of shares in real estate in proportion to the amount of funds paid to the bank after the termination of the marriage by each of the spouses, the expert concluded.

At the same time, Artamonova says, there are no legal mechanisms to force the former spouse-co-borrower to pay half of the monthly mortgage payment. A good way of financial protection in this case is a prenuptial agreement. It may concern exclusively the procedure for paying a mortgage and distributing real estate between owners after the loan is repaid or in the event of a divorce. For example, it is possible to link the size of shares in real estate in proportion to the amount of funds paid to the bank after the termination of the marriage by each of the spouses, the expert concluded.

Inherited

Property that one of the spouses inherited is not subject to division (according to paragraph 1 of article 36 of the UK), but there is an exception to this rule: if it was improved at the expense of common funds. This is stated in Art. 37 SC. At the same time, Ivanova clarifies, the courts take into account not the amount of investments, but the increase in the value of this property./cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png) But this needs to be proven.

But this needs to be proven.

Case No. 11-6249/2013 illustrates the situation. Throughout their life together, the couple made several repairs in the apartment, which the husband inherited. This helped raise the price of real estate, the ex-wife considered. But the court did not take her side: “There is no evidence that investments increased the value of the property, which means that it cannot be recognized as joint property.” A similar position was taken by the Naro-Fominsk City Court of the Moscow Region in case No. 2-3835/2019he pointed out that the price of the house would increase significantly if there was a major overhaul or other significant reorganization of the object. In both disputes, the plaintiffs failed to prove the increase in the value of the property - the courts decided so.

The practice of recognizing inherited property as joint property is rather disappointing. Basically, the courts refuse due to lack of evidence of material investments or a significant increase in cost.

Svetlana Ivanova, FTL Advisers lawyer FTL Advisors federal rating. Group Family and inheritance law Group Compliance Group Corporate/M&A (mid market) Group Private equity Group Tax consulting and disputes (Tax consulting)

Premarital assets

The property that belonged to each of the spouses before marriage is his property (according to Article 36 of the UK). It would seem that everything is easy, says Alina Laktionova, lawyer YuK Mitra Miter Regional ranking. Group Bankruptcy (including disputes) Group Tax advice and disputes Group Land law/Commercial real estate/Construction , but in practice the application of the article causes difficulties.

A difficult situation is if one of the spouses bought a plot before marriage, and after that, together with his wife or husband, he built a house on it. This happened in case No. 2-1408/2018) Alan Burangulov* bought a small rural house before the wedding. Then they tore it down and built a new one. Having married, they, together with his wife, continued the reconstruction, as a result, the area of \u200b\u200bthe building increased several times. The court of first instance considered that the disputed property was his personal property and was not subject to division upon divorce. The appeal, on the contrary, decided to divide everything equally. The case reached the Supreme Court, which took a different position: it is necessary to assess the value of the house before Safiullin entered into marriage and, in accordance with this, divide the shares of the parties. At the same time, the issue of dividing the house, and not the plot that remained to the spouse, was resolved in the case. In this case, according to Artamonova, the land will remain with the original owner, since it is a personal asset. But the buildings should be divided between the spouses.

In this case, according to Artamonova, the land will remain with the original owner, since it is a personal asset. But the buildings should be divided between the spouses.

Another thing, Artamonova says, is if one of the spouses has received the plot free of charge from the local government, that is, it has been transferred for unlimited use. It is not equated to a gratuitous transaction in the sense of Art. 36 SC. Therefore, the free transfer of a land plot is not a basis for classifying it as personal property, the Supreme Court came to this conclusion in case No. As it was in case No. 2-456/2018. The wife sold the “premarital” apartment, and 5 days later she paid for the equity participation agreement in the new facility. The housing bought with her money cannot be considered common, concluded the collegium for civil affairs of the Armed Forces.

Another similar dispute reached the Constitutional Court. The husband bought the apartment before marriage, but it had an encumbrance - the obligation of life maintenance with a dependent. After the divorce, the husband tried through the court to admit that the ex-wife had lost the right to use the living quarters. But she did not agree with this and filed a counterclaim. In it, she asked to divide the disputed apartment in half. She argued this by the fact that they paid the payments under the life maintenance agreement with a dependent together. The situation is not standard, there is no direct regulation. The courts of lower instances refused the ex-wife. Then she turned to the CC. He regarded the obligations of the spouse, fulfilled at the expense of common funds, as unjust enrichment at the expense of the second spouse (No. 352-O-O).

After the divorce, the husband tried through the court to admit that the ex-wife had lost the right to use the living quarters. But she did not agree with this and filed a counterclaim. In it, she asked to divide the disputed apartment in half. She argued this by the fact that they paid the payments under the life maintenance agreement with a dependent together. The situation is not standard, there is no direct regulation. The courts of lower instances refused the ex-wife. Then she turned to the CC. He regarded the obligations of the spouse, fulfilled at the expense of common funds, as unjust enrichment at the expense of the second spouse (No. 352-O-O).

Unfortunately, despite the decision of the Constitutional Court, the practice is negative and the second spouse, who bears the burden of fulfilling obligations jointly, often does not have the right to compensation in proportion to his share in the common property of the spouses. Which doesn't seem fair to me.

Alina Laktionova, lawyer YUK Mitra Miter Regional ranking. Group Bankruptcy (including disputes) Group Tax advice and disputes Group Land law/Commercial real estate/Construction

Group Bankruptcy (including disputes) Group Tax advice and disputes Group Land law/Commercial real estate/Construction

Experts: SK is outdated

According to Artamonova, the Family Code, adopted back in 1995, is outdated and does not sufficiently regulate the property relations of spouses in modern realities. Therefore, the expert believes, a lot of questions arise when dividing property. Including when jointly acquired is not divided equally. The law indicates that the court may release from equality of shares (clause 2, article 39 of the UK), but does not determine the situations when this is possible.

In order to eliminate gaps and update the norms, amendments have been introduced to the State Duma to simplify the division of property. While the bill is under consideration and approved by the State Duma in the first reading.

While the bill is under consideration and approved by the State Duma in the first reading.

The initiative was initiated by Pavel Krasheninnikov, Chairman of the State Duma Committee on State Building and Legislation, and Tamara Pletneva, Head of the Committee on Family Affairs of the Lower House of Parliament.

The main change is that the Family Code proposes to consolidate the concept of common property of spouses, that is, everything acquired in marriage will be considered as a whole complex (both property and debts). Now, according to the initiators, the same spouses file several lawsuits for the division of property. When, within the framework of one case, shares in real estate are established, and after a while in another, the found assets or the alienated car.

Alexandra Stirmanova lawyer ABS&K Vertical S&K Vertical federal rating. Group Bankruptcy (including disputes) (mid market) Group Arbitration proceedings (large disputes - high market) Group Dispute resolution in courts of general jurisdiction Group Family and inheritance law Group Private equity 3rd place By revenue per lawyer (more than 30 lawyers) 10th place By revenue 24th place By number of lawyers Company profile believes that the court in this case will need to take an active position in identifying the property, which means that the time for considering the case in connection with this may increase. Another question, the expert continues, is that if one of the spouses found out about the presence of other property acquired during the marriage, after the consideration of the case on the division of property? Obviously, changes should take into account the existence of such situations.

Another question, the expert continues, is that if one of the spouses found out about the presence of other property acquired during the marriage, after the consideration of the case on the division of property? Obviously, changes should take into account the existence of such situations.

Another change concerns paragraph 2 of Art. 34 of the UK, they plan to remove the phrase "acquired at the expense of general income" from it. This will give the norm a broader meaning.

Rastorguyeva is wary of this change. According to her, if the amendments are adopted, then the sold personal property and those bought with this money already in marriage will be recognized as "common". Now it is considered personal.

The State Duma is still planning to deal with the issue in October, and perhaps the output will be a completely different document. So far, experts generally support it. “It [the bill] will have a positive effect on law enforcement practice and, obviously, will reduce the number of disputes,” Stirmanova concluded.