How much investment income can a child have

Don’t kid around with the kiddie tax

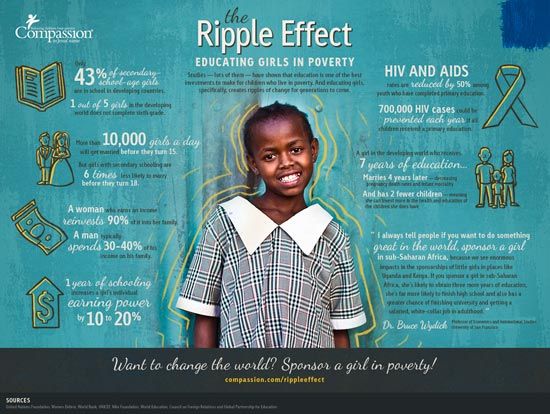

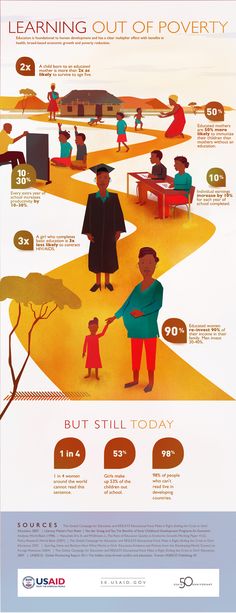

It’s never too early to begin talking to your children about financial planning and the basics of investing. After all, the sooner they understand, the savvier they’ll be about money later in life.

Of course, when it comes to children and investing there are some important issues that you as a parent should also consider to better guide your kids and serve your own financial responsibilities.

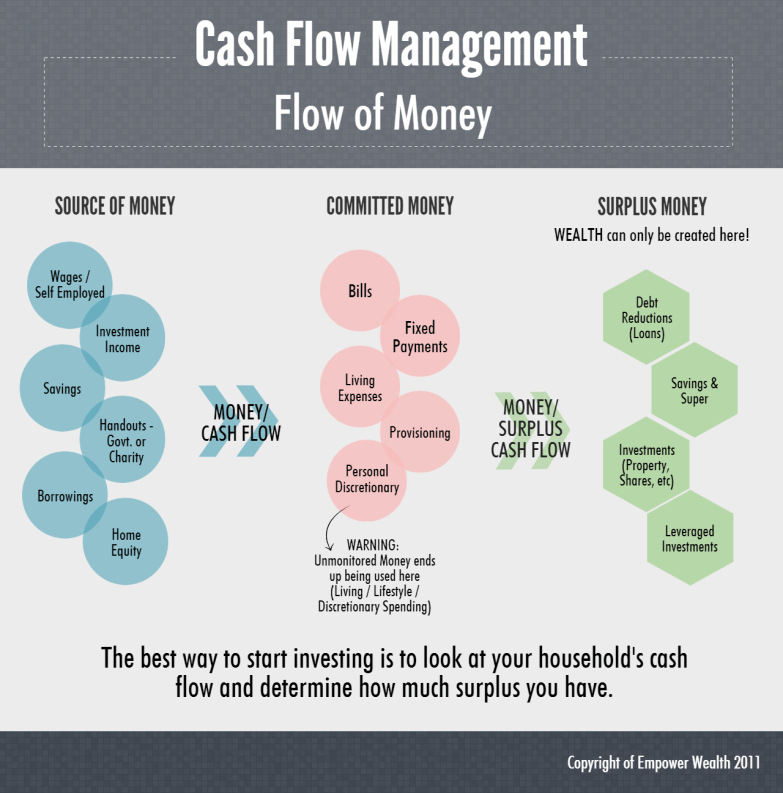

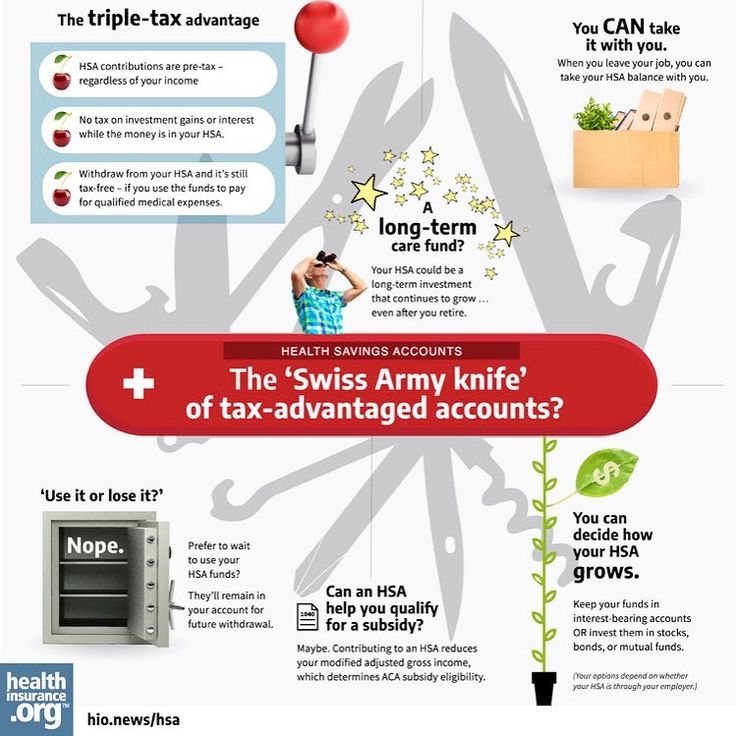

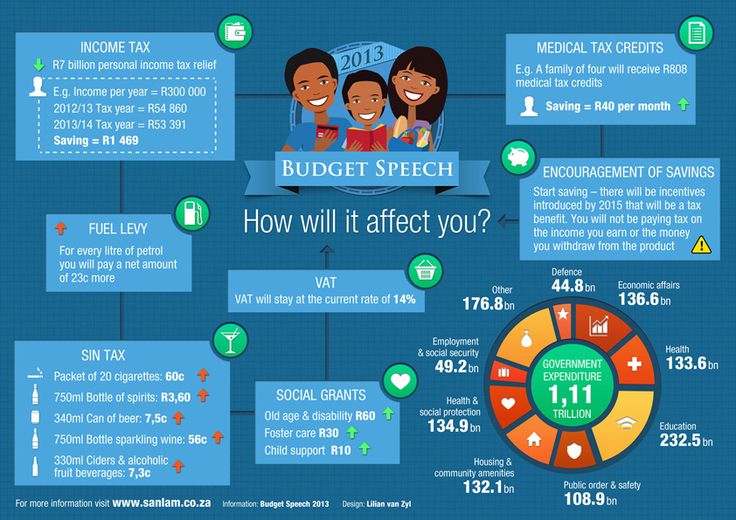

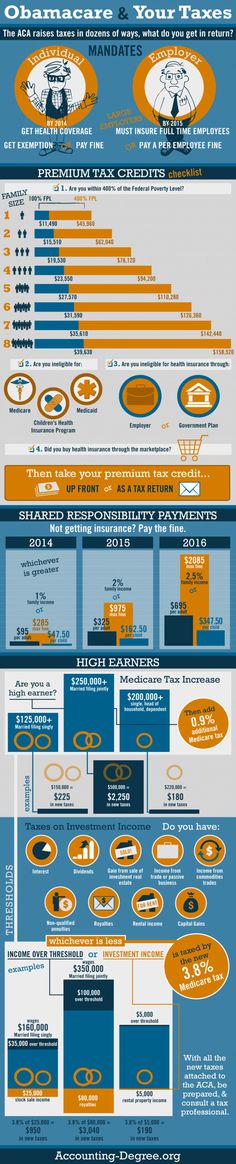

Children who earn income from capital gains, dividends, interest or real estate (which is officially called unearned income to distinguish from wages from a job, for example) can actually have a portion of those earnings taxed—and not at the low children’s rate, but at your much higher marginal tax rate.

That’s because of the kiddie tax. This tax is important for everyone to understand as it relates to larger responsibilities and decisions related to your family’s financial planning. That means you have to think carefully about which investments you put in your children’s names and which ones you don’t.

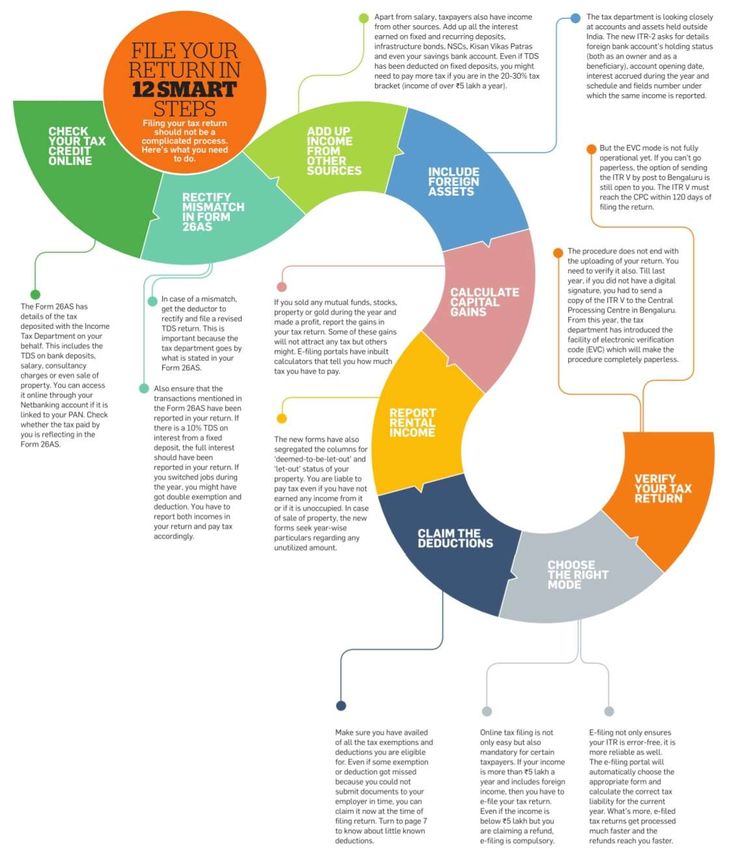

What is the kiddie tax?

The kiddie tax initially applied to the unearned income of children 14 and younger. Thanks to IRS rule changes, the tax now extends to children as old as 19 as long as they’re dependents (and up to 24 years old for fulltime students).

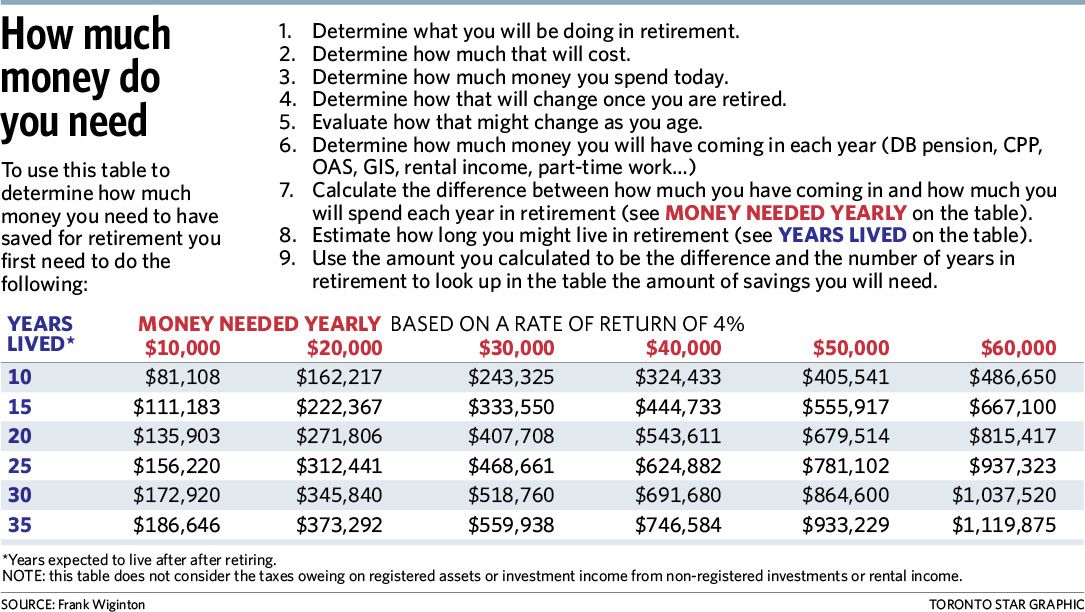

For 2016, the first $1,050 of a child’s investment earnings is untaxed. The following $1,050 of unearned income is subject to the children’s tax rate. Any amount above $2,100 is taxed at the parents’ marginal rate, which can be as high as 39.6 percent. The rule only applies to unearned income. Any income your child earns through a job is taxed at his or her rate.

Any amount above $2,100 is taxed at the parents’ marginal rate, which can be as high as 39.6 percent. The rule only applies to unearned income. Any income your child earns through a job is taxed at his or her rate.

Should your child file a tax return?

You might be tempted to include your child’s unearned income on your own tax return to keep things simple. But depending on your tax status, it could push you into a higher bracket. As a result, you might wind up paying more than if you kept your taxes separate.

Children must file a tax return if their unearned income exceeds $1,050. They must also file if their earned income is higher than the standard deduction ($6,300 for 2016). Even if your son or daughter earned less than $6,300, it might be worth filing a return to claim a refund for any taxes that were withheld.

The rules are different when children have both earned and unearned income. In that case, they must use an intricate set of calculations and comparisons to determine if a child must file a return:

1. First, the IRS asks you to add $350 to your dependent's earned income.

First, the IRS asks you to add $350 to your dependent's earned income.

2. Compare the sum from step 1 to $1,050.

3. Now take the larger of the two numbers from step 2, and compare to $6,300.

4. Then take the smaller of the two numbers from step 3.

5. Now determine the dependent's gross income (the sum of earned plus unearned).

6. If the dependent's gross income is more than the number from 4, the child must file.

Illustrating this through an example: Let’s say your 16-year-old has $5,000 in wages and investment income of $300.

1. Add $350 to earned income: $350 + $5,000 = $5,350

2. Compare the sum from step 1 to $1,050: $5350 > $1,050

3. Take the larger of the numbers from step 2, and compare to $6,300: $5,350 < $6,300

4. Then take the smaller of the two numbers from step 3: $5,350

5. Now determine the dependent's gross income (the sum of earned plus unearned): $5000 + $300 = $5,300

Now determine the dependent's gross income (the sum of earned plus unearned): $5000 + $300 = $5,300

6. If the dependent's gross income is more than the number from 4, the child must file: $5,300 < $5,350

She won’t need to file because her gross income ($5,300) is less than the sum of her earned income plus $350 ($5,350).

On the other hand, if your teen has investment income of $700 and earnings of $500, she will be required to file because those sources of income together ($1200) amount to more than the $1,050 income threshold.

Suffice it to say, the kiddie tax can be complicated, but it has significant implications for both you and your child. A tax professional can help you figure out the right solution for your unique situation.

Plan with purpose

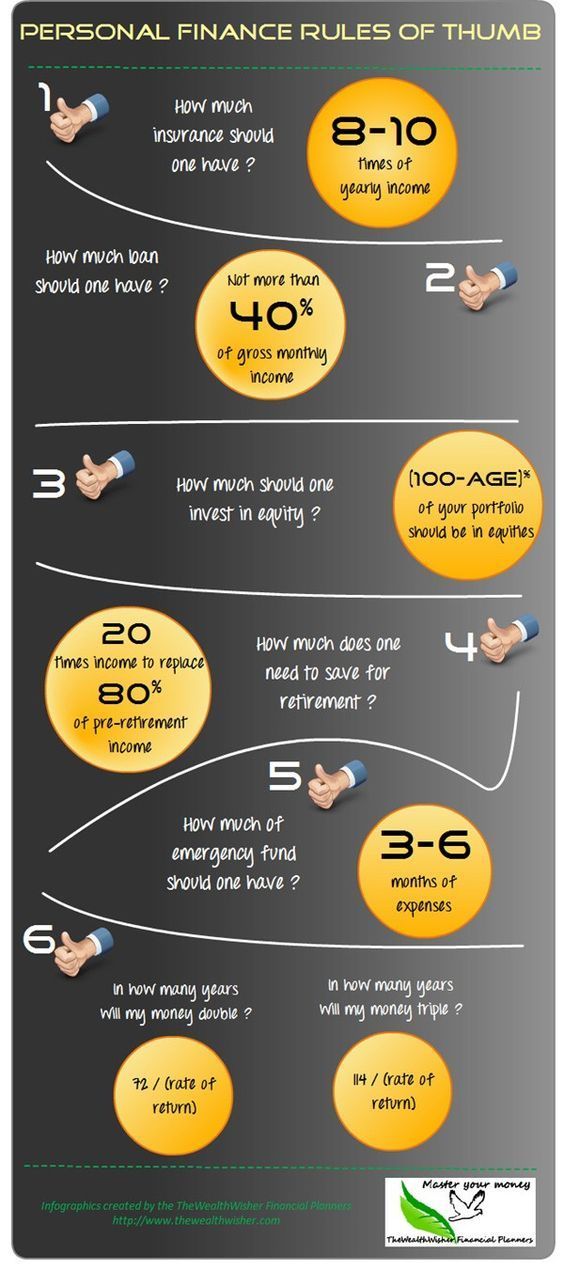

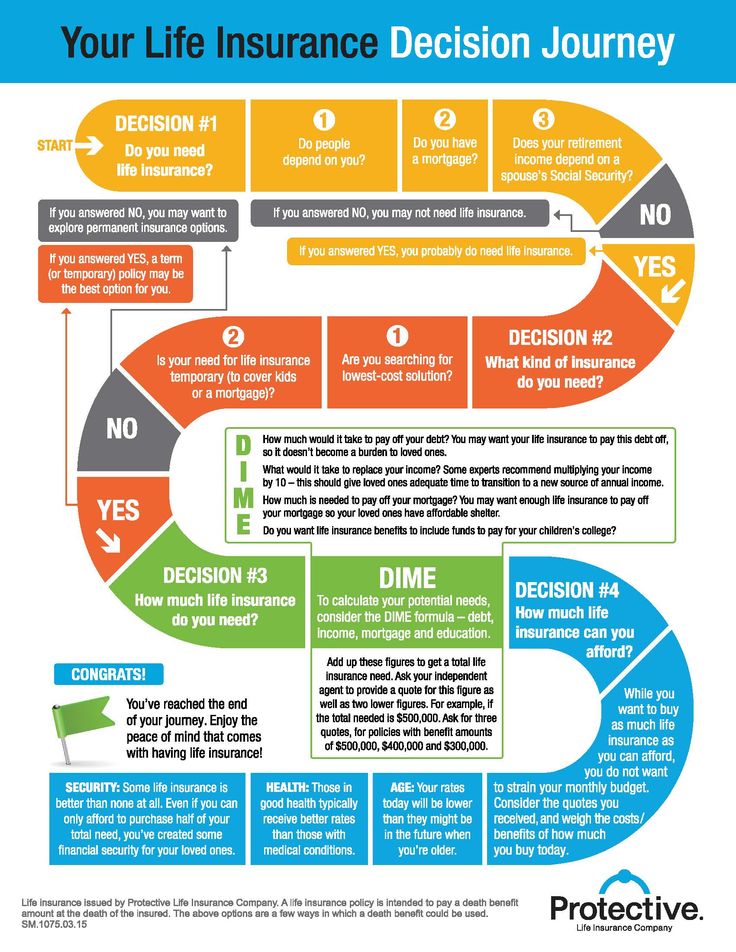

Think strategically about the types of investments you put in your children’s names. To minimize exposure to the kiddie tax, you may want to focus on investments that do not yield dividends and interest until children pass the kiddie tax window. Instead, consider investments whose value appreciates over time but don’t generate much or any tax until they’re sold. A financial advisor could help you understand what those investment types are, but some examples include:

Instead, consider investments whose value appreciates over time but don’t generate much or any tax until they’re sold. A financial advisor could help you understand what those investment types are, but some examples include:

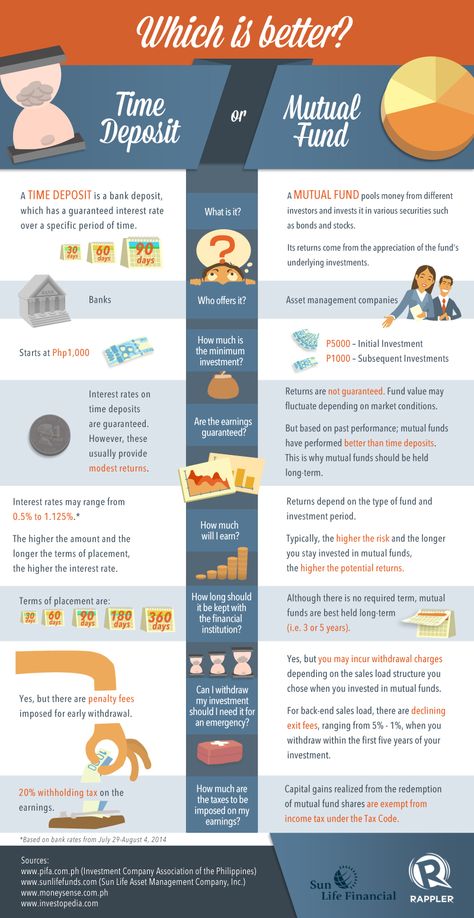

- Growth stocks or mutual funds: Growth companies typically reinvest profits in future growth instead of paying them out as dividends.

- Municipal bonds: Interest from bonds issued by local and state governments is free from federal tax. If the bonds appreciate when they are sold, capital gains tax will be owed.

- Tax-managed mutual funds: Portfolio managers run these funds with the intention of minimizing taxable income.

After all, at the heart of children’s tax considerations is the financial future of your family. With the right information and resources, you can help prepare your family for a more secure financial future.

Schwab MoneyWise | Income Taxes for Children

reii

genlp

Do you need to file a tax return for your child?

Our two cents

Our two cents

For older children, using a tax software program might actually be fun. The icons, graphs, and other visual aids make them simple to use, helping kids visualize where their money is going.

The icons, graphs, and other visual aids make them simple to use, helping kids visualize where their money is going.

If you're a parent, your child's taxable income is inherently linked to yours. In some cases, you may be able to include their income on your tax return. In other cases, they'll have to file their own tax return or you will have to file a separate return on their behalf. Depending on the level of your income, including their income on your tax return may result in higher income tax than if you prepare a separate return for your child.

Whether your child needs to file a tax return depends on a number of factors, including their age and the type of income that is being reported.

Earned and unearned income for a child

In general, your child must file a return if:

-

His or her unearned income (such as investment income from dividends or interest) was more than $1,100 for 2020

-

His or her earned income (income from employment) was more than $12,200 for 2020

-

His or her gross income was more than the larger of $1,100 or your earned income (up to $11,850) plus $350.

See IRS Publication 929 or your tax advisor for more information.

See IRS Publication 929 or your tax advisor for more information. -

He or she has net earnings from self-employment that are $400 or more

Age requirements

The above income amounts apply to any child who:

- Is age 18 or under on December 31 and whose earned income does not exceed half the annual expenses for the child's support, or

- Is a full-time student over 18 and under 24 on December 31 and whose earned income does not exceed half the annual expenses for the child's support.

What about a refund?

Even if your child isn't required to file a tax return, he or she should be sure to do so if he or she is owed a refund.

(0820-0RM3)

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC), offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

This site is designed for U.S. residents. Non-U.S. residents are subject to country-specific restrictions. Learn more about our services for non-U.S. residents.

At what age can you open a brokerage account for a child and start investing? Therefore, parents can easily open deposits for their children, issue cards to them and teach them how to manage money on their own. With the growth of financial literacy, such services are increasingly in demand. But brokers are different.

Formally, there are no prohibitions on investing and opening a child account: the law does not say anywhere that you can use the services of a broker only if the person is 18 years old. But in fact, for a child to gain access to the stock market is difficult and requires effort.

But in fact, for a child to gain access to the stock market is difficult and requires effort.

At what age can children manage money

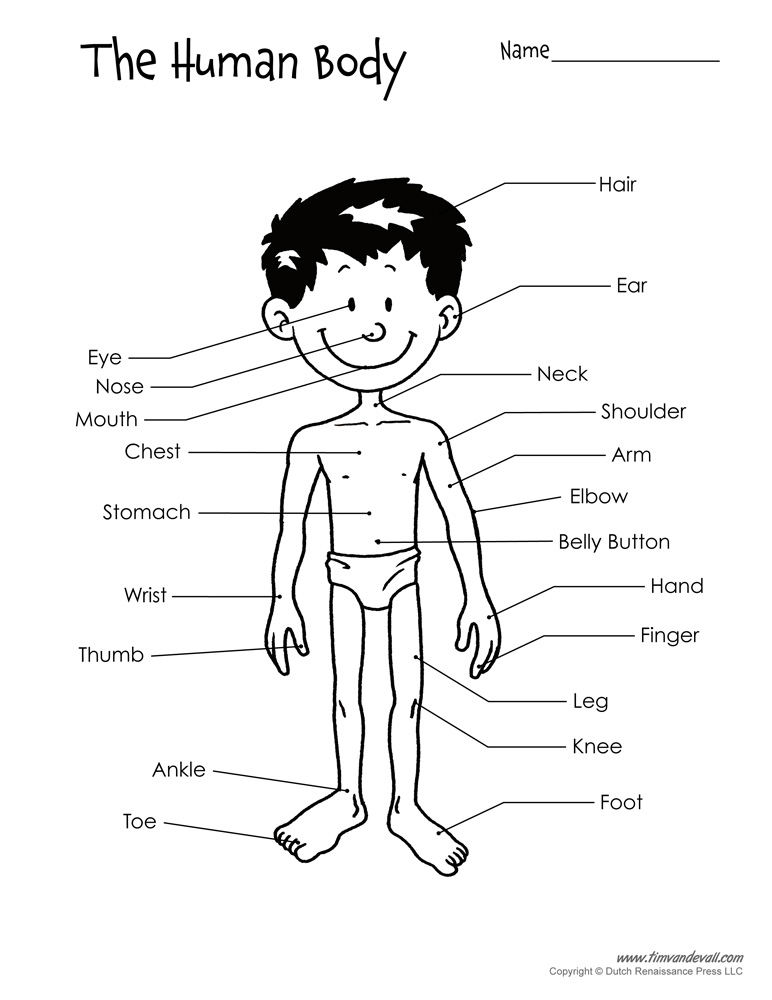

In terms of financial rights, children are divided into two age groups: under 14 and from 14 to 18.

Until the age of 14, the child himself can only make small household transactions. For example, go to the store and buy something. Such operations should not generate income, but it is possible on the stock exchange. In addition, according to the law, until the age of 14, a person does not bear property responsibility for his unsuccessful decisions. It is carried only by legal representatives - a parent, trustee, guardian. This means that they should make all investments for the child.

After the age of 14, a person already has more rights. For example, he can independently dispose of the money he personally earned. But other people's finances or risky operations are possible only with the written consent of the parents. This means that from the age of 14 you can open an investment account. But not all brokers provide such an opportunity. For example, at Newton Investments LLC, the minimum age for joining the regulation is 18 years.

But other people's finances or risky operations are possible only with the written consent of the parents. This means that from the age of 14 you can open an investment account. But not all brokers provide such an opportunity. For example, at Newton Investments LLC, the minimum age for joining the regulation is 18 years.

There is one more complicating moment for exchange transactions - guardianship authorities. Even if the parent gives written consent, trading is considered alienation of someone else's property. In addition, this is a potential deterioration in the financial situation of the child, no matter how old he may be. This means that for any operation, including the payment of commissions, you need to provide the broker with the written consent of both guardianship and the parent. The prices on the stock market for most assets change quickly and unpredictably, which means that a teenager is physically limited in choosing securities.

Even if the parent gives written consent, trading is considered alienation of someone else's property. In addition, this is a potential deterioration in the financial situation of the child, no matter how old he may be. This means that for any operation, including the payment of commissions, you need to provide the broker with the written consent of both guardianship and the parent. The prices on the stock market for most assets change quickly and unpredictably, which means that a teenager is physically limited in choosing securities.

Broker restrictions

Brokers are most often worried about the legal purity of transactions. Therefore, they reinsure themselves and do not open accounts even for emancipated minors. The broker has the right to refuse to serve the investor without giving reasons. The exception is children who have inherited securities.

It turns out that, theoretically, a teenager can open a brokerage account and deposit money into it from the age of 14, but it is difficult and time-consuming for minors to conduct transactions. In practice, brokers simply refuse to conclude an agreement, and parents let their children use their accounts. Therefore, it is best to open a brokerage account at the age of 18, when the child is legally recognized as an adult and receives all rights and obligations.

In practice, brokers simply refuse to conclude an agreement, and parents let their children use their accounts. Therefore, it is best to open a brokerage account at the age of 18, when the child is legally recognized as an adult and receives all rights and obligations.

Anna Nesterova

Author

Share article

French citizenship - all about obtaining a French passport and residence permit for investment

France is a member of the European Union. With a French passport, you can work, do business, study at a school or university in any EU country, Norway, Switzerland, Liechtenstein and Iceland.

With a French passport, you can work, do business, study at a school or university in any EU country, Norway, Switzerland, Liechtenstein and Iceland.

It is comfortable to live in the country not only in Paris. The picturesque landscapes of the Alps, the Loire Valley, the coast of the French Riviera, the lavender fields of Provence combine the beauty of nature and the convenience of civilization. France is in the top 5 countries with the best environment.

We will tell you under what conditions you can get a French passport, how to reduce the time for obtaining citizenship, whether citizenship is obtained by investment, and in which countries it is easier and cheaper to obtain a second citizenship.

Ways to obtain French citizenship for Russians

Marriage. French citizenship is not automatically granted to those who officially register relations with citizens of the country. But this simplifies the procedure for obtaining citizenship: you can apply after four years of residence in France or after five years if the spouses live in another country.

Naturalization. An applicant with a residence permit status is entitled to obtain a permanent residence permit or French citizenship after five years of permanent residence in the country. The main thing is to know French, have a steady income, pay taxes and not have problems with the law.

Origin. The applicant is entitled to obtain French citizenship if he has close relatives with French citizenship or has historical roots. The applicant submits documents confirming kinship to the French consulate or visa center at the place of residence.

Birth or adoption. A child of French citizens automatically acquires citizenship. If the parents do not have French citizenship, the child can acquire citizenship at the age of 18, provided that he was born in France and lived there for at least five years.

The possibility of obtaining a passport at the birth of a child is a myth. In European countries, the principle of the right of blood applies - a child follows the citizenship of his parents.

What you need to know about EU citizenship in order to get a French passport faster

Children adopted by French citizens acquire citizenship if they permanently reside in the country and do not maintain ties with their former parents.

Adult foreigners most often acquire citizenship through marriage or naturalization. Let's talk about these methods.

How to get a second passport for $1000?

None. But we know how to get a passport for investments from $100,000. We talk about the citizenship of the Caribbean countries in a weekly newsletter.

French citizenship through marriage

A foreigner is entitled to apply for French citizenship after marrying a citizen of the country.

This will require four years of marriage if the spouses live in France, and if in another country - five years. When a marriage is contracted abroad, it is registered in the French civil registry.

4 years

period for obtaining French citizenship through marriage

The French spouse gives written consent to citizenship and confirms cohabitation with the spouse.

Applicant takes two tests:

- French level B1.

- Knowledge of the history, culture, traditions and state structure of France.

Spouses must have their own or rented housing and income sufficient to support the whole family.

French citizenship through naturalization

A French passport can be obtained by a law-abiding citizen of another country over 18 who has been living, working and paying taxes in France for five years.

The first step on the path to citizenship is to obtain a residence permit. The status allows you to stay in the country and entitles you to certain activities. For example, work or study.

A residence permit is required for everyone who comes to France for the purpose of staying more than three months. The validity periods of residence permits range from one to ten years. After completion, the status can be extended.

5 years

period for obtaining French citizenship through naturalization

The cost of an application for a residence permit depends on its category: it varies from 269€ for family reunification up to €19 for asylum seekers and veterans.

Applicant must earn income in France and pay taxes. As a rule, the amount of income for each person must be at least the minimum wage (Smic). We will talk about the minimum amount of income further.

The minimum annual income in France for one person in 2021 is 18,655 €.

Documents confirming income:

- employment contract;

- bank statements;

- tax records.

An applicant for French resident status must have their own or rented accommodation, sufficient to accommodate all family members. The minimum living space for two people is 16 m 2 plus 9 m 2 for each additional family member.

Supporting documents for real estate:

- lease agreement or certificate of ownership for housing;

- real estate rent receipts for the last three months;

- latest bill for services for telephone, internet, electricity or gas.

To confirm integration into French society, the applicant takes a test on knowledge of the history, culture and society of France and confirms that he speaks French at B1 level, sufficient for everyday communication.

The Test de Français International, or TFI, is taken at a government-approved language center, ETS Global.

You do not need to take the test if you have a certificate for level B1 of local language courses TCF, TEF, DELF / DALF, DCL or BULATS. Or if the applicant graduated from a school, college or university in the country.

Applicants over 60 are exempt from taking the test. At the same time, they will need to demonstrate language proficiency at B1 level at an interview in the prefecture, which lasts up to an hour and a half and takes place without an interpreter.

Law-abidingness is confirmed by certificates of no criminal record in the countries of citizenship, residence and in France for the last 10 years. Certificates are valid for 180 days from the date of receipt. Documents are translated into French and certified with an apostille.

Citizenship is available after five years of permanent residence in France with residence permit status. To fulfill the condition of permanent residence, one cannot leave the country for more than six months out of ten. For outstanding service in sports, economics, science or art that contribute to the prosperity of France. In this case, the period will be reduced to two years.

For outstanding service in sports, economics, science or art that contribute to the prosperity of France. In this case, the period will be reduced to two years.

Family reunification. If the applicant has family members with permanent residence or citizenship status living in France. The process of obtaining a passport is similar to naturalization, only faster: you can apply for citizenship after three years of residence in the country.

Military service. Citizenship can be obtained by men between 18 and 40 years of age after three years of service in the French Foreign Legion.

University studies. Residence permit for study is issued for up to a year with the right to extend. Graduates of French universities can apply for permanent residence or citizenship after five years of residence in the country. The term will be reduced to two years if the student successfully studies and participates in state programs.

What minimum income must be confirmed for a residence permit and French citizenship

The condition for obtaining a residence permit and French citizenship is to receive an income not lower than the minimum wage (Smic). In some categories of residence permit, the condition for the minimum income is stricter. For example, employees of an innovative startup will need to earn at least twice the minimum wage.

The amount of income includes the amount of salary and monthly bonuses for work results. This does not take into account overtime pay, bonuses for years of service, reimbursement of expenses incurred, bonuses at the end of the year.

Minimum wage in France in 2021

| Salary | Total income | Tax deduction |

|---|---|---|

MINIMILA0085  In addition to the basic documents, the applicant for citizenship through marriage provides a marriage certificate and a signed consent of the spouse to the citizenship of the applicant. If the marriage is concluded abroad, it is registered in the French civil registry. The applicant for naturalization additionally confirms his professional activity and financial situation for the last three years. To obtain citizenship through ancestry, applicants submit the same documents as for citizenship by naturalization. They also need a certificate confirming the French citizenship of a parent or ancestor in a direct line. Students additionally submit a registration card at a French university. They will need to provide a minimum income of €615 per month, which can be supported by a bank statement, letter of guarantee, loan, scholarship or grant funding notice. Documents are translated into French and certified with an apostille. Where to apply for French citizenship and how long to wait for a decision The application for citizenship, along with the necessary documents, is transferred to the prefecture's regional online platform. You can find out which online platform the prefecture is associated with on the website of the Ministry of the Interior. In some prefectures, you need to make an online appointment to submit a dossier and pass an interview, in others, applications are submitted through an agency. The prefectural officer conducts an interview, checks the documents and transfers them to the Ministry of the Interior. The Ministry takes 18 months to 2 years to process an application. If the decision is positive, the applicant receives a certificate of naturalization and then applies for a passport. The fee for issuing a passport is 155 €. The new citizen signs the Charter of Rights and Duties of Citizens of France, takes the oath in a solemn ceremony and receives a French passport. Residence permit in France by investmentA French passport cannot be obtained by investment, but the country has a residence permit program. Investors over 18 years of age, with official income and no criminal record can participate in the residence permit program. Together with them, family members receive the status: spouses, partners without marriage registration, children under 18 years of age. An advantage for the investor's family members is the right to live, work and study in the country, travel within the European Union, and receive medical services. Residence permit for investment in Europe There are three categories of golden visas for investors:

It is not possible to obtain a residence permit in France through investments in securities, bonds or the purchase of a home. Investments in company can be transferred personally or through the investor's company, in which he owns at least 30% of the shares. The main thing is to own at least 10% of the company in which investments are made and provide at least 50 jobs for French citizens. Residence permit card for investment is issued for four years. After that, the status can be extended if the investor's company continues to operate and jobs are saved in it. Investors are not required to live in France permanently and prove language proficiency if they do not want to obtain citizenship. They can apply for citizenship through naturalization under general conditions. To create a business , you will need to approve a competitive business plan. The applicant must have a master's degree or at least five years of professional experience in business. The applicant certifies that he has money to invest in the business plus the money needed to live in the country for a year. In 2021, the living wage for one person is 18,655 € per year. Innovative Startup requires pre-approval from one or more French Tech Visa partner incubators and accelerators. At the same time, it is not necessary to have large funds for investments - partners often finance startups. It is enough to have an amount on deposit of at least the annual subsistence minimum. Residence permit in France for financially independent persons Residence permit for financially independent persons gives the right to live in France, travel without visas within the European Union, receive qualified medical care, study at French universities on the conditions provided for citizens. If the applicant has legal income outside of France, you can get a residence permit card for 12 months and then annually renew up to five years inclusive. Residence permit for financially independent persons in Europe To do this, you need:

The minimum annual income in 2021 is 18,655 € per year. Documents confirm income: an employment contract indicating the position and monthly salary, confirmation of one's own business, or a deposit in a French or international bank. There is no French language requirement for financially independent persons. The condition will arise if the applicant wants to obtain permanent residence or citizenship. Alternatives to French citizenship To obtain French citizenship, you need to live in the country for five years, work, earn income, pay taxes and know French. Some EU countries make it easier for investors to obtain residence permits, permanent residence status and citizenship. With these statuses, you can live, study and work in the chosen state, enjoy the right to visa-free entry to other countries. At the same time, their conditions are often milder than in France: for example, in Malta, investors receive citizenship after one or three years in resident status, they do not have to pass language exams. Maltese Citizenship for Exceptional Merit through Direct Investment requires applicants to naturalize after one or three years in resident status. The amount of investment depends on the term. How to obtain Maltese citizenship Applicants fulfill several investment conditions:

Citizenship does not require a language test. It is allowed to include spouses, children and parents in the application. The average annual increase in the value of real estate in Malta before the pandemic was 5-10%, in resort areas - up to 15-20%. Individual calculation of the cost of citizenship of Malta Make an individual calculation Residence permit in Greece can be obtained for an investment of 250,000 €. Applicants invest in real estate, buy shares or transfer money to a deposit. The money can be returned after five years. How to obtain Greek citizenship With a residence permit in Greece, cosmopolitans travel without visas to the countries of the Schengen area. A Greek passport gives investors additional opportunities: for example, they can move to any EU country using a simplified registration procedure. An example of an investment property in Greece: a penthouse in a residential complex in Glyfada, a kilometer from the Aegean Sea. Area - 128 m², cost - 980,000 € An example of investment property in Greece: a penthouse in a residential complex in Glyfada, a kilometer from the Aegean Sea. Area - 128 m², cost - 980,000 € An example of investment property in Greece: a penthouse in a residential complex in Glyfada, a kilometer from the Aegean Sea. Area — 128 m², price — 980,000 € An example of investment property in Greece: a penthouse in a residential complex in Glyfada, a kilometer from the Aegean Sea. Area - 128 m², cost - 980,000 € An example of investment property in Greece: a penthouse in a residential complex in Glyfada, a kilometer from the Aegean Sea. Area - 128 m², cost - 980,000 € Residence permit in Portugal can be obtained in a few months through participation in the investment program. The minimum investment fee is 250,000 €. An investor with a resident status can live in the country, conduct business and travel around the Schengen countries without visas. There is no requirement for permanent residence: it is enough to spend seven days a year in Portugal. Why buying real estate is the most popular investment option under the Portuguese Golden Visa program An application for a residence permit in Portugal can include a spouse, children under 26 years old, parents over 65 years old. Children and parents must be financially dependent on the investor. Citizenship can be applied for after five years in resident status. To obtain a passport, the investor and his family members take a language exam. FAQHow can a Russian get a French passport? Main ways of obtaining French citizenship:

Adult Russians can obtain French citizenship by naturalization, marriage, pedigree, after studying at a university or after serving in the French army. Is dual citizenship allowed in France? The French can have a second citizenship of another country, so the first will not have to be abandoned. After obtaining French citizenship, a Russian must notify the migration department of the Russian Ministry of Internal Affairs within 60 days. There are restrictions for Russian citizens with a passport of another country. From July 1, 2021, the law prohibiting having a residence permit or citizenship of another country is in force:

Do you have to pay double taxes after getting a French passport? No. Why can French citizenship be denied? Most often they refuse if the applicant did not provide a complete package of documents, attached false documents or false information, the certificates expired, the documents were not translated into French and certified with an apostille. In addition, applicants who:

Is it possible to lose French citizenship? Yes, France is one of the first countries to legally introduce deprivation of citizenship. |

You need to provide certificates of employment, tax status form P 237, income statements and tax notices for the last three years.

You need to provide certificates of employment, tax status form P 237, income statements and tax notices for the last three years.

Not everyone is suitable for this path.

Not everyone is suitable for this path.

The applicant can buy real estate or securities, open a deposit, invest in business, science or culture.

The applicant can buy real estate or securities, open a deposit, invest in business, science or culture.

An agreement on the avoidance of double taxation was signed between Russia and France. To determine tax residence, it is important to live in a particular country for 183 days a year. If you stay in France for longer than this period each year, you are subject to French tax jurisdiction.

An agreement on the avoidance of double taxation was signed between Russia and France. To determine tax residence, it is important to live in a particular country for 183 days a year. If you stay in France for longer than this period each year, you are subject to French tax jurisdiction.