How much do you get back for child care

Your 2021 child care costs could mean $8,000 tax credit

- You may be able to write off 50% of your child care expenses (up to a certain limit), depending on your income.

- The cap on expenses eligible for the child and dependent care tax credit for 2021 is $8,000 for one child or $16,000 for two or more.

- Be sure you know how the tax credit is affected by your dependent care flexible-spending account.

Monkeybusinessimages | Istock | Getty Images

If you paid for child care last year, that expense could be valuable when you prepare your 2021 tax return.

Along with some other tax changes, the "child and dependent care tax credit" was expanded in several ways. The upshot is that many households will get a bigger tax break, and the credit could reach more people than it has before.

In other words, it's worth checking whether you qualify even if you were unable to get the tax break in the past, said Henry Grzes, lead manager for tax practice and ethics with the American Institute of CPAs.

More from Personal Finance:

The 'money talk' couples should have before marriage

8 in 10 consumers pay above sticker price for new car

Here are 3 ways to spend your tax refund this year

The average national cost for an infant in full-time child care is $9,991 annually, according to ValuePenguin research. Generally, the cost of care goes down as the child gets older, although it can still easily run into the thousands of dollars per year depending on where you live and the specific type of care.

The child and dependent care tax credit — which is different from the more familiar child tax credit — generally gives parents some help covering the cost of care for children under age 13 or adult dependents. The expanded version, which was enacted as part of the American Rescue Plan Act almost a year ago, is for last year only and reverts to the previous rules for the 2022 tax season.

The general qualifications didn't change, however. That is, the credit is only available for dependent care provided so that you could go to work or look for work (or, perhaps, attend school). Generally speaking, you (and your spouse, for joint tax returns,) must have earned income during the year to claim the credit.

Generally speaking, you (and your spouse, for joint tax returns,) must have earned income during the year to claim the credit.

watch now

For your 2021 tax return, the cap on the expenses eligible for the credit is $8,000 for one child (up from $3,000) or $16,000 (up from $6,000) for two or more. Additionally, you may be able to write off as much as 50% (up from 35%) of those expenses, depending on your income (details farther down). This means you potentially could get a maximum credit of $4,000 for one child and $8,000 for two or more (up from $1,050 and $2,100, respectively).

And, importantly, the 2021 credit is refundable, which means even if you have no tax liability, you could get the credit in the form of a refund.

Be aware that if you have a dependent care flexible-spending account, the child care expenses you cover through that FSA cannot count toward the tax credit. The money in that account is made pre-tax — meaning you already get a tax benefit.

"You can't double-dip," said Dave Alison, president and founding partner of Prosperity Capital Advisors in Cleveland.

However, there are instances when you may be able to take advantage of both an FSA and the tax credit, Alison said. Generally, for 2021, if your qualified expenses exceeded your FSA reimbursements, the difference could qualify if the total doesn't exceed $8,000 (one child) or $16,000 (two).

For example: If you used $5,000 in FSA dollars yet spent $12,000 in care for your one child, you could use $3,000 — the difference between $5,000 and $8,000 — of the excess toward the tax credit.

Meanwhile, the 50% share of expenses for 2021 is for taxpayers with income of $125,000 or lower. That means, in the above example, you'd get 50% of $3,000, or $1,500, as a credit.

Above that income threshold, the credit begins to phase out, until reaching 20% for income of $183,000 to $400,000; it disappears for income above $438,000.

Before the 2021 change, the maximum of 35% started going lower at income above $15,000 until reaching 20% at about $45,000.

WATCH LIVEWATCH IN THE APP

WATCH LIVEWATCH IN THE APP

How to take advantage of the expanded tax credit for child care costs

Smart Tax Planning

- For your 2021 tax return, the cap on expenses eligible for the child and dependent care tax credit is $8,000 for one child (up from $3,000) or $16,000 (up from $6,000) for two or more.

- Depending on your income, you may be able to write off 50% of those expenses.

- There are instances where you can use this tax credit even if you also have a dependent care flexible spending account.

FatCamera | E+ | Getty Images

Last year's child-care expenses may be worth more at tax time than you realize.

The child and dependent care tax credit, as it's called, was expanded in several ways for 2021 alongside other tax changes. This means many families will get a bigger tax break and the credit could reach a larger swath of households than it had before.

"Even if you may not have qualified for it in the past, you may now," said Henry Grzes, lead manager for tax practice and ethics with the American Institute of CPAs.

The average national cost for an infant in full-time child care is $9,991 annually, according to ValuePenguin research. Generally, the cost of care goes down as the child gets older, although it can still easily run into the thousands of dollars per year depending on where you live and the specific type of care.

The child and dependent care tax credit — which is different from the more familiar child tax credit — generally gives parents some help covering the cost of care for children under age 13 or adult dependents. The expanded version, which was enacted as part of the American Rescue Plan Act last March, is for 2021 only and reverts to the previous rules this year.

The general qualifications didn't change, however. That is, the credit is only available for dependent care provided so that you could go to work or look for work (or, perhaps, attend school). Generally speaking, you (and your spouse, for joint tax returns) must have earned income during the year to claim the credit.

watch now

For your 2021 tax return, the cap on the expenses eligible for the credit is $8,000 for one child (up from $3,000) or $16,000 (up from $6,000) for two or more. Additionally, you may be able to write off up to 50% (up from 35%) of those expenses, depending on your income (details farther down). This means you potentially could get a maximum credit of $4,000 for one child and $8,000 for two or more (up from $1,050 and $2,100, respectively).

This means you potentially could get a maximum credit of $4,000 for one child and $8,000 for two or more (up from $1,050 and $2,100, respectively).

And, importantly, the 2021 credit is refundable — which means that even if you have no tax liability, you could get the credit in the form of a refund.

Be aware that if you have a dependent care flexible spending account, the child-care expenses you cover through that FSA cannot count toward the tax credit. The money in that account is made pre-tax — meaning you already get a tax benefit.

"You can't double dip," said Dave Alison, president and founding partner of Prosperity Capital Advisors in Cleveland.

However, there are instances when you may be able to take advantage of both an FSA and the tax credit, Alison said. Generally, for 2021, if your qualified expenses exceeded your FSA reimbursements, the difference could qualify if the total doesn't exceed $8,000 (one child) or $16,000 (two).

For example: If you used $5,000 in FSA dollars yet spent $12,000 in care for your one child, you could use $3,000 — the difference between $5,000 and $8,000 — of the excess toward the tax credit.

Meanwhile, the 50% share of expenses for 2021 is for taxpayers with income of $125,000 or lower. So in the above example, you'd get 50% of $3,000, or $1,500, as a credit.

Above that income threshold, the credit begins to phase out, until reaching 20% for income of $183,000 to $400,000 and completely disappearing at income above $438,000.

Before the 2021 change, the maximum of 35% started going lower at income above $15,000 until reaching 20% at about $45,000.

watch now

Read More

list of documents, detailed instructions for obtaining

By law, you can be on parental leave for three years.

Diana Shigapova

lawyer

Mothers, fathers or other relatives, while on such leave, receive benefits until the child reaches one and a half years.

We have already written how to calculate maternity payments. In this article I will tell you how benefits are calculated and assigned for a child up to three years old.

What laws govern the granting of allowance for a child up to three years of age

The right to a monthly allowance for child care is guaranteed by the federal law "On State Benefits for Citizens with Children".

The right to a monthly allowance for child care

The same law states that the allowance is paid from the day the leave is granted until the child reaches one and a half years. The law does not say anything about benefits from one and a half to three years.

Duration of payment of the monthly child care allowance

Instead of a benefit from one and a half to three years, mothers or other relatives who have taken parental leave are entitled to compensation - 50 R. But only for children born before 2020.

What has changed in 2020. Families with children born in 2020 and later are no longer paid monthly compensation in the amount of 50 R for children from one and a half to three years old: the presidential decree on the payment of such compensation has become invalid.

So what? 11/26/19

Payments for children under three years of age have been cancelled. What does it mean?

If you already receive 50 R for children under three years old, then you will continue to receive money until the children's third birthday.

Who is entitled to benefits up to three years

In this article, I will talk about mothers, because they are the ones who most often take parental leave.

Allowance up to one and a half years is due to all mothers who care for children. It doesn’t matter if a woman worked under an employment contract or not, she will receive a child care allowance. But the amount of the benefit is different. Here is what affects him:

- The salary that the mother received before pregnancy.

- Family status - for example, a family may be considered indigent.

- The status of the child - for example, a child with a disability.

/papa-mozhet/

How a man can go on maternity leave

A mother without work experience will receive the least, and a mother with a good salary and a special child will receive the most.

I will tell you more about the possible amounts of benefits for a child up to one and a half years below.

Compensation in the amount of 50 R is due only to those who are employed, and provided that the child was born before 2020. This amount is fixed.

Which family is considered poor

In Russia, a poor family is one whose average per capita income per family member is less than the subsistence minimum established in the region of residence.

Determine if the family is poor, as follows:

- Calculate the family income for the last three months from the date of application to social protection. Income includes all salaries, pensions, allowances, scholarships.

- The amount of income divided by 3 is the average monthly family income.

- Divide the average monthly income by the number of family members to get the average per capita family income. It is he who is compared with the subsistence minimum per capita in the region where the family lives.

st. 7 of the Federal Law No. 178 "On State Social Assistance"

For the poor, the state has developed a special program, according to which, in addition to the child care allowance, the mother receives additional money.

Types of allowances for a child up to three years old

A pregnant woman, and then a woman who has given birth, is entitled to a pregnancy and childbirth allowance, child care allowance and sometimes other payments - this depends on the situation in the family.

Maternity payments , or maternity allowance, are due to women who work under an employment contract, and also to those who were fired due to the liquidation of the organization or the termination of the individual entrepreneur.

What to do? 07/15/19

How can an individual entrepreneur receive maternity payments?

In addition to them, individual entrepreneurs who pay contributions to the Social Insurance Fund, the Social Insurance Fund, as well as civil servants, full-time students of universities and colleges can receive maternity payments.

This money is paid once - before maternity leave.

Child allowance is a child care allowance that is paid by the FSS every month until the child reaches one and a half years.

Child allowance up to one and a half years for the unemployed is issued in the Pension Fund of the Russian Federation. A certificate is needed from the second parent that he does not receive such benefits.

If a parent applies for benefits through an employer or the Social Insurance Fund, then certificates from a spouse or other relatives are not needed. Since 2022, the Social Insurance Fund itself determines whether someone already receives an allowance for caring for this child.

Payments to parents of a disabled child . In addition to child care allowance, a mother can apply for a social pension, as well as monthly assistance.

Disability pension and caregiver's benefit are paid up to the age of 18.

Payments to low-income families are provided for by federal and regional legislation. At the federal level, this is a monthly allowance for the first or second child, the so-called Putin's payments. The allowance is not intended specifically for low-income families, but with a high degree of probability, it is the low-income family that will have the right to Putin's payments. This allowance is paid for up to three years.

The allowance is not intended specifically for low-income families, but with a high degree of probability, it is the low-income family that will have the right to Putin's payments. This allowance is paid for up to three years.

In some regions, support measures are provided directly to low-income families with small children. For example, in Moscow, children under three years old from low-income families are paid from 8,896 R to 17,791 R per month.

Other types . There are also additional payments to families in which fathers serve on conscription. They are paid until the child is three years old, but payments stop if the father has served and returned home.

/benefits/

Payments and child benefits in 2022

Who pays the benefits

The allowance for caring for a child up to one and a half years old is paid by the FSS or the PFR. Some employees who have become parents are also entitled to financial assistance from their employers.

FSS. Today, in all regions of the Russian Federation, there is a project for direct payments from the FSS - child care benefits are paid directly by the fund. But, if you are employed, you still need to apply for benefits to the employer: he will transfer the information to the FSS, and he will transfer the money.

PFR. The unemployed and women apply to the pension fund, who were fired during parental leave due to the liquidation of the organization.

/posobiya-roditelyam-bez-raboty/

What child benefits are due to parents without work

Employer. Some corporations and other large employers are developing a company's social policy: they think over when and how they will financially support their employees. Such programs operate, for example, in Gazprom and Tatneft.

Parental leave is often the case when an employer provides financial assistance to employees. That is, a woman receives both child care allowance and financial assistance from the employer.

That is, a woman receives both child care allowance and financial assistance from the employer.

Payments for a child with a disability come from the pension fund. To support low-income families, money is allocated from the federal and regional budgets, but these payments are processed in social security.

The procedure for assigning benefits

Most of the benefits are assigned on a declarative basis - that is, in order for a woman to receive them, she must write an application and provide documents.

Documents for receiving benefits

If a woman works under an employment contract, she needs to bring a child's birth certificate to the accounting department at work. A certificate from the father stating that he did not apply for child care allowance for up to one and a half years, from 2022, it is no longer necessary to submit for work.

You also need to bring a certificate from the previous employer about the amount of wages in order to calculate the allowance if the woman changed jobs during the previous two years.

/guide/moneyforborn/

How to receive payments at the birth of a child

If a woman is unemployed, then she needs to prepare a copy of her passport, a copy of the birth certificate of the child, a copy of the employment record, a certificate of non-receipt of unemployment benefits, as well as a certificate from her father that he did not take leave for child care. The FIU has no information about this, so it needs such a certificate.

If a woman wants to make payments for a low-income family, then in addition to the basic documents, she needs to prepare certificates of her and her husband's income.

Application for benefit is filled in in any form.

Application deadline for benefits up to one and a half years - up to two years of the child. Children up to three years of age can apply for Putin's payments.

Art. 12 of the Federal Law "On compulsory social insurance in case of temporary disability and in connection with motherhood"

Where to submit documents: to the accounting department at the place of work, to the Pension Fund of the Russian Federation, the Social Insurance Fund, social security or the MFC. In some regions, working parents can apply for benefits up to a year and a half through public services.

In some regions, working parents can apply for benefits up to a year and a half through public services.

Amount of benefits

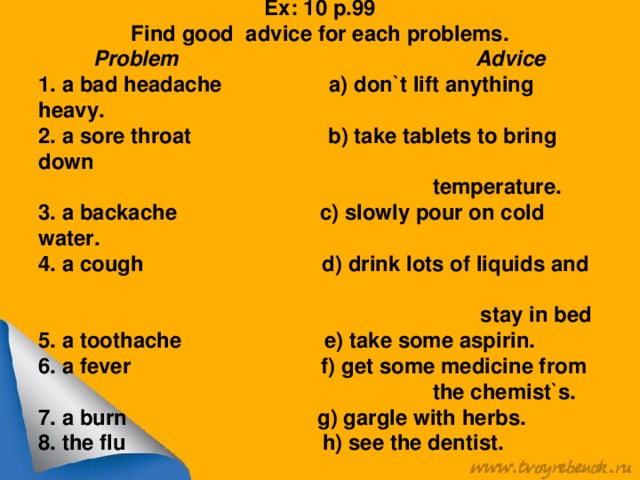

Maternity allowance. The amount of maternity leave is calculated according to one of two formulas: based on salary or based on the minimum wage. The formula is chosen depending on the length of service and the amount of the woman's earnings two years before pregnancy.

Formulas for calculating maternity payments

Formula for calculating maternity payments based on salary in 2022: the woman was on sick leave, on maternity or childcare leave) × number of days of decree

Formula for calculating maternity payments based on the minimum wage from June 2022:

15,279 R × 24 months ÷ 730 days × number of days of the decree

Term of the decree and the amount of payments

| Term | Amount | |

|---|---|---|

| Ordinary decree | 140 days | 70,324. 8 R 8 R |

| Complicated labor | 156 days | 78,361.92 R |

| Multiple pregnancy | 194 days | 97450.08 Р |

Ordinary decree

term

140 days

sum Multiple pregnancy

Term

194 days

Amount

97,450.08 R

Child care allowance . How much they will be paid in 2022 is calculated according to the following formula:

Salary and other labor income for 2020-2021, but not more than 1,878,000 R ÷ 730 days (minus the number of days that a woman was on sick leave or on vacation for pregnancy or on parental leave) × 30.4 × by 40%

In 2022, you should get at least 7677.81 R and no more than 31 282.82 R per month. The maximum for the whole of Russia is the same.

The unemployed and those whose average salary for two years is less than the minimum wage are paid a fixed allowance - 7677. 81 R. This amount is increased by the regional coefficient, if it is applied in the locality.

81 R. This amount is increased by the regional coefficient, if it is applied in the locality.

Putin's payments depend on the subsistence minimum - PM. Families in which the average monthly income per family member is not higher than twice the regional subsistence level are entitled to the subsistence level per child. On average, this is 14,000-15,000 rubles.

Since June 1, 2022, the minimum wage and living wages have grown. As a result, social payments tied to the PM also increased.

Duration of payments

Child care allowance is paid strictly until the child reaches the age of 1 year and 6 months. If this date falls, for example, in the middle of the month, then the amount of the benefit is calculated in proportion to the days.

For example, the child of an unemployed mother turned one and a half years old on 15 June. The allowance will be calculated as follows: 7677.81 R ÷ 30 days × 15 days. The woman will receive 3838.91 rubles.

Putin's payments are paid for a year, after which they must be extended, but no longer than until the child is three years old.

Payments to low-income families continue as long as established in the regional law. For example, in Tatarstan they pay for six months, and then the applicant needs to confirm his need: re-write the application, bring income certificates.

When payments stop

Child care benefits stop in two cases:

- The child is one and a half years old.

- The parent refused the allowance.

All other benefits are terminated in the following cases:

- If the payment period has expired, and the family could no longer prove their need or comply with the conditions prescribed by law.

- If the social security authority found that the family's real income is higher than declared.

- If the child is 3 years old.

What parents say about the fairness of payments

Many people think that the principle by which they determine who and how much to pay is unfair. This is especially true of Putin's payments.

Date of birth . The resentment is connected with the fact that the date of birth of children is prescribed in the law, starting from which the family has the right to the allowance.

/money-for-baby/

How I got Putin's payments for a child

Putin payments can only be issued by families in which a child was born after January 1, 2018. That is, if the child was born on December 31, 2017 or earlier, the parents will not be able to apply for benefits.

There is also a second condition: the child must be the first or second. Parents of babies born after January 1, 2018, but no longer the first or second in a row, cannot issue Putin's payments either.

The criterion of need in the law is quite clear: no more than two living wages established in the region where the family lives. If the income in the family is at least 1 R more, you will not be able to apply for benefits.

Source of payments for the second child . If money is allocated for the first child from the federal budget, then money for payments for the second child is taken from maternity capital. Families have to choose: reduce the amount of maternity capital and receive benefits, or refuse benefits and spend maternity capital for other purposes.

If money is allocated for the first child from the federal budget, then money for payments for the second child is taken from maternity capital. Families have to choose: reduce the amount of maternity capital and receive benefits, or refuse benefits and spend maternity capital for other purposes.

What payments are due to a family with children of a different age

There are many child allowances and payments, the conditions for receiving them are even more - it is easy to get confused in all this. Our test will help you figure it out:

What a woman will receive for a child under three years old

- Pregnancy and childbirth allowance if she works under an employment contract or quit due to the liquidation of the organization or the termination of the individual entrepreneur. And also if he independently pays contributions to the FSS as an individual entrepreneur.

- Monthly allowance for caring for a child up to one and a half years.

- Monthly compensation in the amount of 50 R if employed and the child was born before 2020.

- Putin's payments - one subsistence minimum per child per month, if the average monthly income per family member is not higher than twice the regional subsistence level.

- Monthly allowance for low-income families, if the average per capita income for each family member is less than the subsistence minimum established in the region of residence. The amount of the allowance is set at the regional level.

- Social pension and monthly compensation if the child is disabled.

Employee goes on maternity leave

⚡ All articles / ⚡ Employees

Oleg Varushkin

The Labor Code protects the rights of a pregnant employee: the employer is prohibited from firing her. At the eighth month of pregnancy, she goes on maternity leave. It lasts 140 days: 70 before delivery and 70 after. Maternity leave is replaced by leave to care for a child - usually up to a year and a half. All this time, the employee receives benefits from the FSS. From 2021, in all regions, the fund transfers benefits directly to employees.

Maternity leave is replaced by leave to care for a child - usually up to a year and a half. All this time, the employee receives benefits from the FSS. From 2021, in all regions, the fund transfers benefits directly to employees.

Contents

- Take maternity leave

- From 2021, only the FSS pays benefits

- What benefits

- When the FSS refuses to pay benefits

Take maternity leave

Maternity leave

The employer receives documents from the employee:

1. Sick leave from the antenatal clinic. Remember that along with paper sick-lists, there are electronic ones. They work with them in the personal account of the FSS.

2. Application for maternity leave in any form. It is not necessary to take it before the start of the holiday. You can also after, within 6 months.

Application for maternity leave in any form. It is not necessary to take it before the start of the holiday. You can also after, within 6 months.

Leave lasts 140 days: 70 before the birth and 70 after. Sometimes employees do not apply for vacation and work until the last minute. This is normal: vacation is a right, not a duty. They don't pay benefits only for days of work.

Non-standard situations from the order of the Ministry of Health and Social Development No. 1089N:

- In case of multiple pregnancy, leave is taken at week 28 for 194 days: 84 before delivery and 110 after.

- When a child is adopted, leave is taken from the day of adoption. It ends when the child is 70 days old. If the child is more than 70 days old at the time of adoption, maternity leave is not allowed.

- In case of complicated pregnancy, an additional 16 days are taken. In this case, the employee writes an application to extend the vacation.

When you find out the duration of the vacation, fill out the documents:

— Sign the order to grant the vacation.

- Fill out a personal card (example).

— Fill out the timesheet.

🎁

30 days of the Elbe as a gift

Try all the possibilities of online accounting for free.

I want to try

Leave to care for a child up to 1.5 years old

The employee herself decides whether to take a vacation or go to work. Instead, any working relative can go on parental leave: the child's father, grandmother, grandfather, aunt or uncle. Vacation can be alternated as you like: for example, mom sits with the child for a month, then dad for a month.

For vacations up to one and a half years, the allowance is 40% of the average salary for the previous two years.

To apply for a vacation, ask the employee for documents:

- Application.

- Birth certificate of the child.

- A certificate from the husband's work that he is not on a similar vacation.

Issue the vacation order again, fill in the personal card and time sheet.

Allowed to combine parental leave and work. There are two options here: part-time or part-time. For example, an employee may work 7 hours a day or 4 days a week. The main thing is that the rate should be incomplete. Otherwise, there is a risk that the FSS will refuse to make the payment.

From 2021, only the FSS pays benefits

In 2021, this item is no longer relevant, but just in case, we will explain, in case some old articles on other sites confuse you. Previously, there were two schemes:

- An entrepreneur pays an employee, and then reduces insurance premiums to the Social Insurance Fund.

- FSS pays the employee directly.

The second scheme is a "pilot project", which over time captured more and more regions. In 2021, it was adopted throughout the country, so the employer does not need to pay benefits.

What benefits

Maternity allowance

The amount of the benefit is 100% of the average salary. For calculation, two calendar years are taken before the start of the vacation. For example, in 2021, salaries for 2019 and 2020 are taken into account. The most convenient way is not to calculate in Excel, but to use a special calculator.

For calculation, two calendar years are taken before the start of the vacation. For example, in 2021, salaries for 2019 and 2020 are taken into account. The most convenient way is not to calculate in Excel, but to use a special calculator.

The allowance is granted within 10 days after receiving the documents from the employee. They are paid on the next salary day after the appointment.

At Romashka LLC, salaries are paid on the 11th and 25th of each month. Anna went on maternity leave on October 10. The director calculated her allowance on October 15 and paid it on October 25. He did everything right.

One-time payment at the birth of a child

From February 1, 2022, the allowance is 20,472.77 rubles. Some regions increase the payment at the expense of their budget.

Monthly allowance for caring for a child up to 1.5 years old

The allowance is paid monthly: from the first day of parental leave until the moment when the child turns 1. 5 years old.

5 years old.

The amount of the benefit is 40% of the average salary. For calculation, the salary for the previous two calendar years is taken. For the first child, the minimum payment after June 1, 2022 is 7,677.81 per month, the maximum is 31,282.82 rubles per month. Calculate the allowance in a special calculator so as not to make a mistake.

🎁

New IP - the year of the Elbe as a gift

Year of online accounting at the Premium rate for individual entrepreneurs under 3 months

Try for free

When the Social Insurance Fund refuses to pay benefits

Sometimes the Social Insurance Fund has the right to refuse and not pay benefits for employees. This happens for several reasons:

- Errors in documents: certificate of earnings, certificate of incapacity for work, application for maternity leave.

- Fictitious labor relations. When an employee is hired in the late stages of pregnancy, and she immediately goes on maternity leave, this looks suspicious for the FSS.