How much can i pay my child tax free

How To Hire Your Kids To Save 1,000s In IRS Tax Dollars

UPDATED FOR 2022

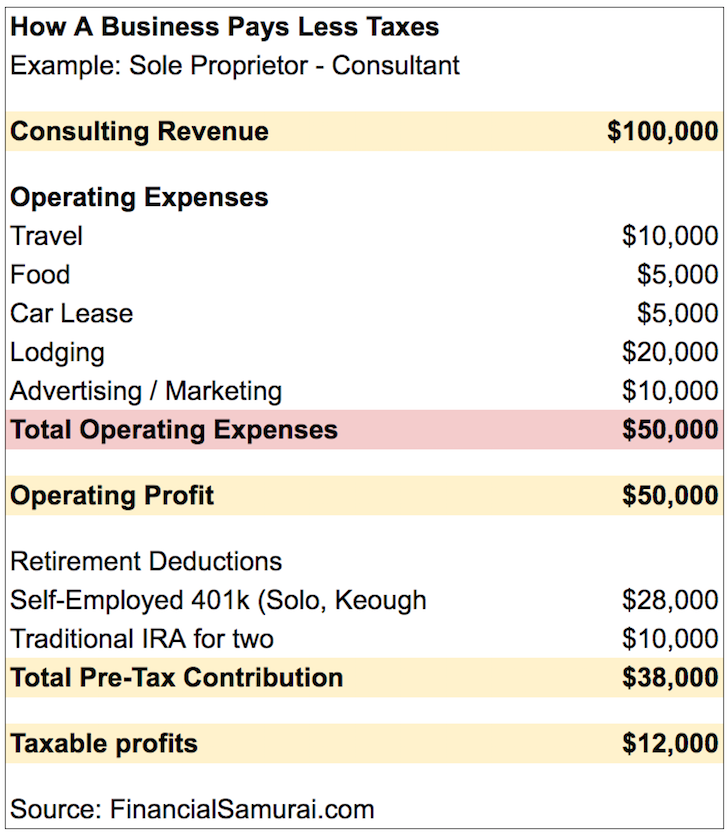

As long as they’re doing legitimate work for your business, you can hire your child tax free and pay each of them up to $12,000 per year tax-free.

It’s true. And all of this while they earn a little money AND start saving for college or that first business. And it’s all tax-free.

So you may want to hire your child(ren) to work in your business. And you want to do it for many good reasons: to teach them about entrepreneurship, develop a strong work ethic, AND for the tax-free income — up to $12,000 per child.

You can hire your kids and pay each of them up to $12,000 per year tax-free. If you hire your son to stuff envelopes and your daughter to update your website then you get to lower your personal income by $24,000! Simply by engaging your children in the family business.

If they stay under this limit, they don’t even have to file a tax return, which means they don’t pay any income tax on it. And you get to deduct their wages, which lowers your business’ taxable income.

BUT WAIT. THERE'S MORE.

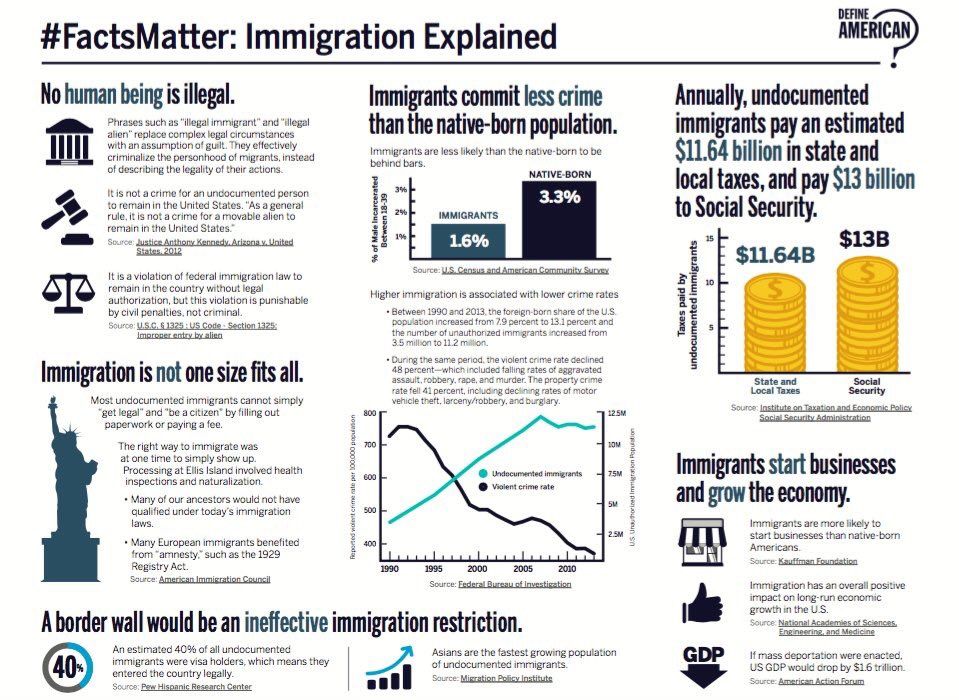

The IRS ACTUALLY Rewards You For It! Source: Publication 929 (2020), Tax Rules for Children and Dependents)

If you have children between the ages of 7 - 22, you can use this strategy to save some money. Here is how it works:

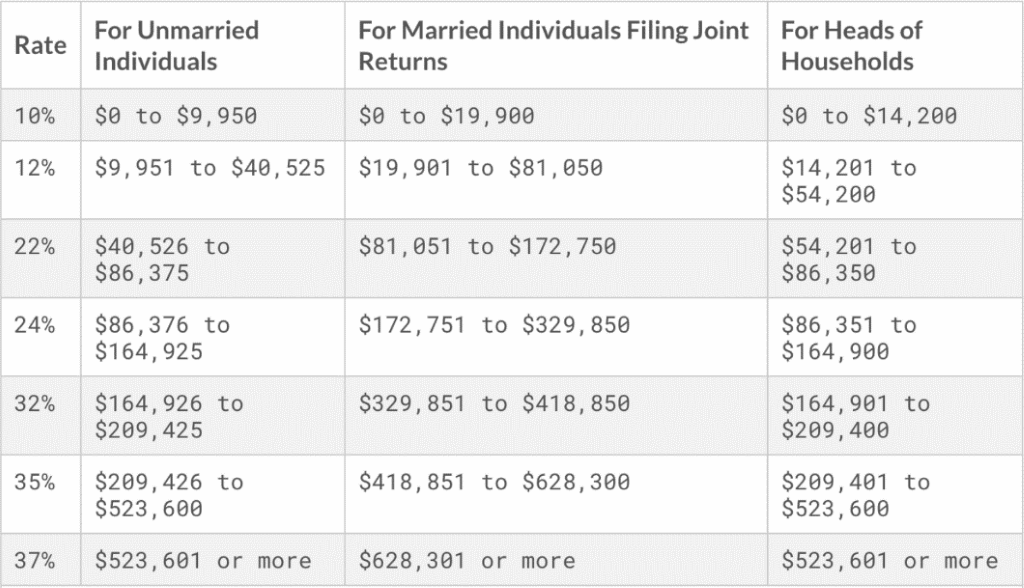

- Each of your children can be employed by your business and paid an annual wage of $12,000. This is an important amount because it is the standard deduction amount for single individuals.

- Your business gets to take a deduction for the payment, thus decreasing your taxable income.

- Your children will then file their own tax return, & since they only made $12,000 they pay no federal income tax because of the standard deduction of $12,000, their taxable income is ZERO.

- So the business gets to take a deduction, but the kids pay no federal income tax. It does not get much easier than that!

This strategy can also be combined with IRA and 401k strategies to really maximize the benefit. For instance, if you paid each child $12K each as salary. You could put $6K into an IRA that is deductible, and you can use their standard deduction to take their taxable income to zero.

In that case, your business can deduct $18K per child, but again, no taxable income.

If you want to save money then hire your kids and make sure you have them actually work!

Keep track of the hours and tasks your children perform and make sure it’s age-appropriate. DOL Rules Regarding Youth & Labor The IRS isn’t going to believe your 5-year-old earned $12,000 analyzing dental records. But that 5-year-old can model those pearly whites in photographs to be used on your website or brochure! It’s easy to document an “image agreement” that pays an ongoing licensing fee right from the start.

Using this strategy, rather than just dumping change into their jar, (money you likely paid personal taxes on) you’ve moved those taxable dollars from your tax rate to your child’s tax rate and bracket, which, is zero, and you still keep the money in the family!.

There are countless jobs kids can do for you, and remember, you can pay them at the SAME RATE you would pay any other employee or outsourced company.

- Cleaning the office

- Washing company cars

- Updating customer lists on the computer

- Simple to advanced Data-entry

- Transcribing video or audio

- Trips to the post office or general errands

- Helping at the office, passing out handouts, and more

- Walking door to door, placing fliers for your business

- Updating your social media accounts (They won’t even equate this as work!)

As Long As Your Kids Are Doing Legitimate Work For Your Business You Can Hire Your Kids.

But then, let’s say after reading the guide, you find out that this strategy “doesn’t work” if your business is a corporation.

The Corporation “Problem,” and Its Simple Solution to Hire You Kids

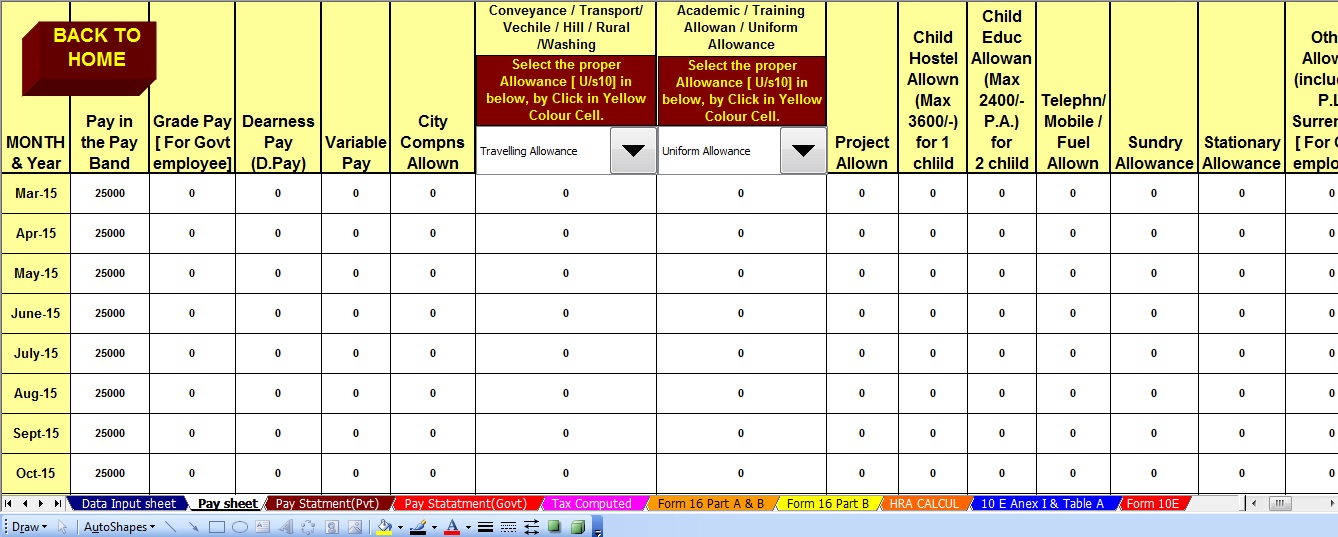

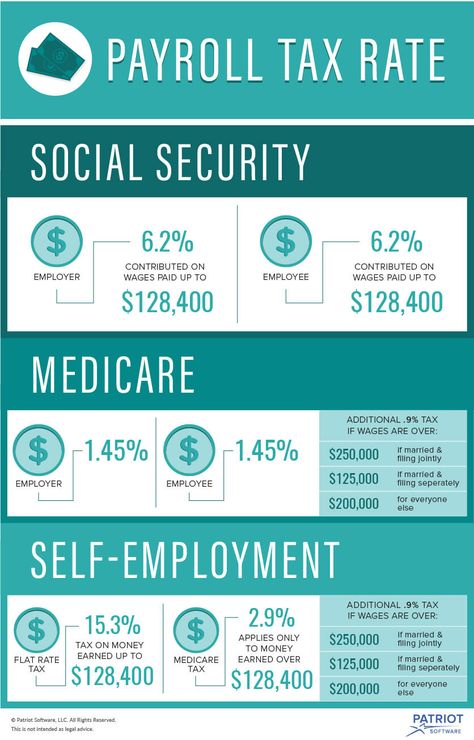

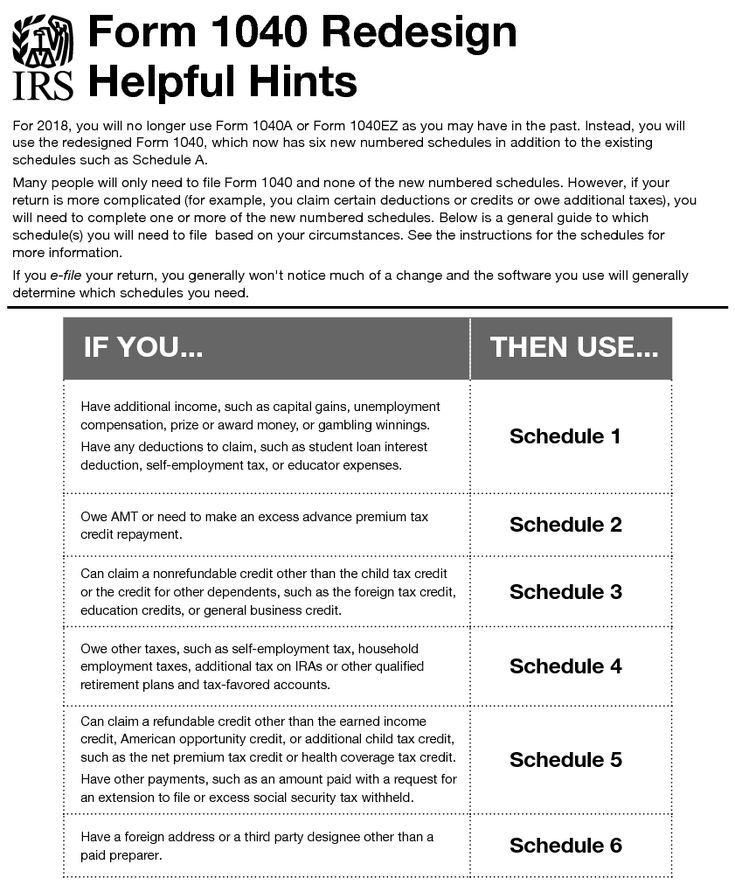

There are different rules for different types of businesses. And that when the owners of a corporation hire their child, there are still payroll taxes like FICA to deal with.

We even pointed this out in your free guide. See for yourself:

FICA tax may not have to be withheld on work performed by a child under the age of 18 while employed by a parent in an unincorporated business (sole-proprietorship, single member LLC or a partnership where the only partners are the child’s parents). However, there is no FICA or FUTA exemption for employing a child in an incorporated business (S or C Corp) or in a partnership that includes non-parent partners. In these cases, the children are subject to the same withholding rules that apply to all other employees.

So you DO NOT have to pay payroll taxes for employing your kids if your business is a sole-proprietorship, a single-member LLC taxed as a disregarded entity, or an LLC taxed as a partnership and owned solely by you and your spouse.

But if your business is a corporation, the IRS’s rules are clear. You must pay payroll taxes on income given to your children.

So are you stuck if your small business is set up as an S or C Corp? Or if you’re planning on switching to an S Corp like we normally recommend for maximum tax advantages?

Well, it turns out there is a workaround.

As one high-profile tax strategist says: in order to lower your tax, just change the facts.

Here’s how to do it:

The Payroll Tax Workaround to Hire Your Kids

If your business is set up as an S or a C corporation, or as a partnership with other non-parent partners, the IRS says you have to withhold payroll taxes when employing your kids.

But there is a way to get around this restriction utilizing a little creativity and a “hybrid” approach.

Instead of paying your children directly from your S Corp, you pay them out of a family management company.

You can create this simple family management company as a Sole Proprietorship separate from your S Corp, and owned by yourself or your spouse.

Its only purpose is to support the operations of your Corporation, which can include the scheduling and monitoring of jobs done by your child(ren) — and all the bookkeeping and documentation necessary to keep the jobs within IRS standards.

The family management company charges the Corporation a management fee for these services and can then pay your child — which removes them from your corporate payroll.

And since the family management company is a Sole Proprietorship owned by a parent, you, or your spouse, it falls under the IRS exemption where payroll taxes don’t have to be withheld.

By following this workaround, you’ve found a way to truly pay your kids $12,000 per year tax-free using nothing but the IRS’s own rules.

For more tax-saving tips check out how my blog on Tax Deductions VS Tax Credits! Then put on your HR hat, because you've got some little new hires to train!

Here’s What You Need to Know Before Hiring Your Child Tax-Free

So far you’ve learned how to pay your children up to $12,950 to work in your business tax-free (updated for 2022)…

… and even a legal workaround to avoid payroll taxes for your kids if your main business is a corporation.

The future looks bright: your kids are earning $12,950 per year tax-free and can help pay for their own expenses where appropriate, save for college and even pay their own way on family vacations.

Plus — all the while they’re developing a strong work ethic, discovering entrepreneurship and learning the value of money.

And on top of that, you’re getting a potential tax savings of $4,700+ per child hired.

But a few questions have come up, so we’re going to answer them right here, right now:

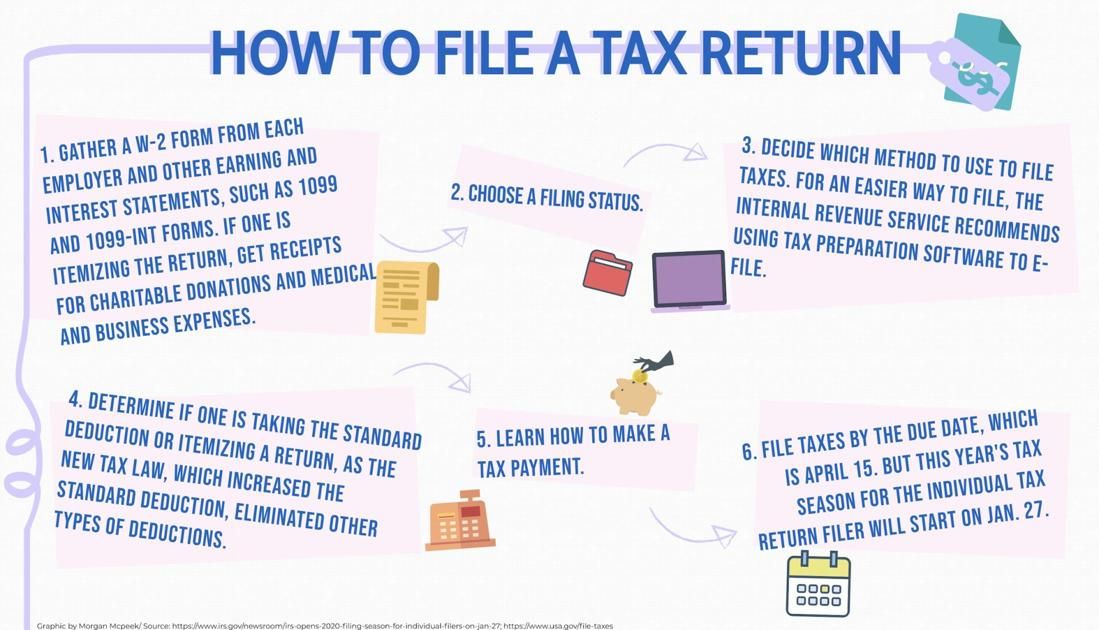

What About the “Kiddie Tax?”

Some business owners have asked us: “What about the ‘kiddie tax’? Aren’t the kids going to end up paying taxes on their income at our rates anyway?”

The answer is no. The IRS does have a kiddie tax rule that taxes children at their parents’ marginal tax rate. But it only applies to unearned or “portfolio” income — and if the children are working in the business, then it’s clearly “earned” income.

What about Children Over the Age of 18?

Another question we’ve been getting is how this strategy works with children over age 18.

If you are paying children (or grandchildren) over the age of 18, the child can still earn up to $12,950 before they owe any income tax. That’s because of the IRS’s standard deduction that everyone gets.

But your child will still owe payroll taxes — that exemption expires when they turn 18.

Also, as an adult, your child legally gets to decide what they spend their money on, so you have lost some control. However, you can still make a deal with your child for them to help pay the family’s bills — especially if they’re still living at home.

Notice that this strategy can also apply to hiring your parents, not just your children. For example, if one or both of your parents moves in with you later in life, they can also earn up to $12,950 before they owe any income taxes — and can also contribute to the family bills if they choose.

What About Using the Money to Save For Your Kid’s College?

Some of our readers have been quick to point out that a child’s income can be put into a qualified plan like an IRA, a Coverdell Education Savings Account or a 529 plan.

And it is true. Since your kids now have “earned” income, they can legally contribute to a Roth or Standard IRA.

Be careful before you jump onto this bandwagon, though. All qualified plans, including the educational varieties, have limitations, rules and features that can make them a less than ideal way to save for your child’s education.

Note: If you haven’t yet read the New York Times bestselling book, Killing Sacred Cows, we highly recommend it.

It’s written by Garrett Gunderson, the Chief Wealth Architect here at Wealth Factory. And in the book, he gives numerous compelling reasons to avoid qualified plans completely.

The book is required reading for all top level clients we work with, and if you’re reading this because you’re on our email list, we’re going to send you a free chapter of the book very soon.

If you absolutely feel you must put your child’s income into an IRA, our savviest clients elect for a Roth IRA. At least that way they can pull out any contributions made before retirement without penalty, whether or not it’s for college or anything else they want the money for.

At least that way they can pull out any contributions made before retirement without penalty, whether or not it’s for college or anything else they want the money for.

It makes no sense to use a regular IRA, though. Why defer paying tax when they’re in a 0% bracket now? They will be in some higher tax bracket as an adult, and then they’ll have to pay taxes on the contributions and any earnings.

One final option that may make sense is to establish a Cash Flow Banking system for each child. There are no restrictions on how much can be put in or how much you can access.

The entire amount will have tax-preferred treatment with no fear of losing money to the stock market (money saved in a Cash Flow Banking system is guaranteed not to lose value).

Plus, the money you take out can be used for any purpose. It can be used for college or after college to finance larger purchases like cars, starting a business or saving for retirement.

We have plenty more to say about Cash Flow Banking, but that’s for another time.

For now, take another look at “32 Jobs Your Child Can Perform in Your Business” and see if there’s a way that you can implement this strategy as soon as possible. (Get the guide here if you don’t already have it.)

And remember, if you’re on our email list we’ll be sending you a free chapter from our NY Times bestselling book, Killing Sacred Cows, very soon. Be on the lookout.

Don’t have our free guide, yet?

Download “32 Jobs Your Child Can Perform in Your Business for Tax-Free Income” and get our daily newsletter.

how to pay, how to find out the TIN of a child, make him a personal account in the tax office and link him to your own apartment. Until the tax office sued her daughter.

In 2012, my husband and I bought an apartment in St. Petersburg and, in order to use maternity capital, we registered shares for our daughters. They are twins, and then they were 3.5 years old. nine0003

For the next 8 years, I paid property tax through my personal account on the website of the Federal Tax Service. I thought that I was paying not only for my share, but also for children. I didn’t know that children, it turns out, have their own TIN from birth, and the tax on their shares is calculated separately. I didn't receive any letters from the tax office either.

I thought that I was paying not only for my share, but also for children. I didn’t know that children, it turns out, have their own TIN from birth, and the tax on their shares is calculated separately. I didn't receive any letters from the tax office either.

As a result, in 2021, I myself accidentally reminded the Federal Tax Service of the shares of my daughters. After that, the tax office sued one of them and demanded to pay property tax for the previous three years. I'll tell you how it all happened and how not to turn a child into a debtor. nine0003

How the tax office remembered her daughter

In 2021, one of the daughters received a disability. By law, children with disabilities may not pay property tax for one apartment, room, house, garage of any size or for shares in them. I decided to apply for this benefit: I thought that the tax for my daughter's share was included in my amount, and I wanted to reduce it.

sub. 3 p. 1 art. 407 of the Tax Code of the Russian Federation

On August 10, 2021, I wrote an application in the personal account of the Federal Tax Service Inspectorate for a property tax exemption. She attached her daughter's birth certificate and a certificate that she received a disability. nine0003

She attached her daughter's birth certificate and a certificate that she received a disability. nine0003

A few days later I was asked to send a scan of the back of the certificate. And a week later I received an answer: the IFTS refused the benefit, because it is due to children with disabilities, and not to their parents.

/zabral-dengi-za-imuschestvo/

How to save money on property taxes

The response of the IFTS was very brief, and at first I did not understand why my daughter was denied a legal benefitI was indignant - I wrote to the tax appeal and demanded to explain why the daughter cannot receive the benefit. A few days later, they answered me that she was still entitled to the benefit. But since disability appeared in 2021, it means that the benefit will be taken into account when they calculate the tax for 2021, that is, in 2022. nine0003

I decided that the first time the tax office had just made a mistake, and calmed down. And the tax office, apparently, began to check her daughter's taxes.

And the tax office, apparently, began to check her daughter's taxes.

How the Federal Tax Service filed a lawsuit against my daughter

On October 11, 2021, I received a registered letter from the Federal Tax Service. It contained a copy of the application that the tax office had already sent to the justice of the peace. The inspectorate asked for a court order in the name of my daughter to collect tax for 2017, 2018 and 2019years.

Taxes for minor children are paid by parents - Federal Tax Service

Meetings are not held in such cases. The tax office submits documents on the debt to the court, the judge considers them without calling the parties and, if he considers them convincing, issues a court order. The taxpayer must fulfill it or demand to cancel it. To do this, it is enough to submit objections to the court within 20 days from the date of receipt of a copy of the order. The judge will cancel it without a trial.

To do this, it is enough to submit objections to the court within 20 days from the date of receipt of a copy of the order. The judge will cancel it without a trial.

paragraph 1 of Art. 46 Tax Code of the Russian Federation

ch. 11.1, part 3 of Art. 123.5 CAS RF

When the taxpayer is a child, the parents or other legal representatives execute the order or send objections to him. If this is not done, money may be deducted from the accounts.

I still haven't received the order. But initially I planned to object to him: I never received notifications that my daughter should pay tax. Later, I learned that if a taxpayer or his representative - for example, a parent of a child - did not receive a tax notice before December 1, then on December 31 of the same year he is obliged to notify the IFTS about this. I didn't. nine0003

Section 2.1 Art. 23, paragraph 4 of Art. 397 NK RF

I also decided that in 2021 the debt should be considered only for 2018-2020. And according to the law, the tax office is not entitled to claim debts for more than three previous tax periods. Then I realized that three years are counted from the date of non-payment of tax.

And according to the law, the tax office is not entitled to claim debts for more than three previous tax periods. Then I realized that three years are counted from the date of non-payment of tax.

Art. 113 NK RF

Let me explain with an example. Until December 1, 2021, I am obliged to pay property tax for 2020. If I do not do this, then from December 1, the countdown on non-payment for 2018, 2019 will beginand 2020 years. Until December 1, 2021 comes, the countdown starts from December 1, 2020. That is, non-payment is considered for the three years before 2020: for 2017, 2018 and 2019. It turns out that the tax office did not violate the law.

In addition, I was embarrassed that the tax inspector dated the application to the justice of the peace on April 29, 2020, and sent the letter with the notification only on October 1, 2021. I decided that he also filed an application for a court order retroactively. But then I found out from lawyers I knew that, most likely, the application was filed in April 2020, and they simply forgot to send me a notice. nine0003

nine0003

/wrong-tax/

The tax office decided that I owe money for someone else's land

The IFTS sent me an application for a court order on October 1, 2021. But the statement itself was dated April 29, 2020. It confused me. At first, I generally decided that the tax office was trying to deceive us and demand tax not for three, but for the previous four years. It would be illegal. Later, I found out that the IFTS did not violate anything - it was I who incorrectly calculated the termsThe letter from the inspection did not contain any calculations or full details for payment. Therefore, I wrote a new appeal: I requested details and receipts, and at the same time clarified why in October 2021 the IFTS filed an application dated April 2020 with the court.

Two weeks later, I received an answer: I was asked to come to the IFTS branch for receipts and promised to give me access to my daughter's personal account. There was no mention of the application to the court at all.

What to do? 12/18/19

My accounts were frozen, but I don’t know why

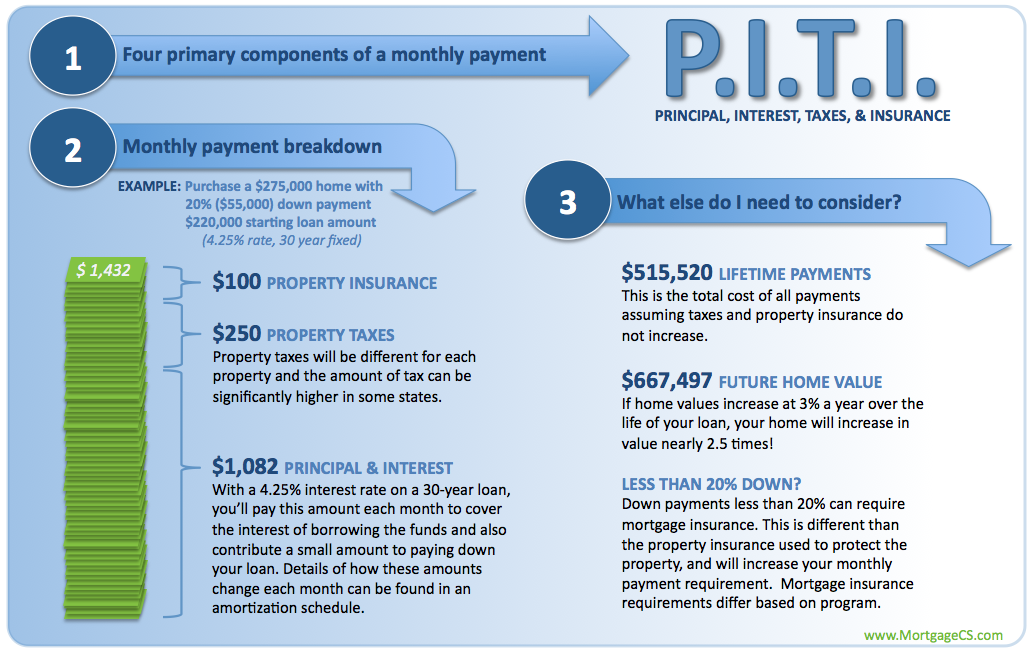

As a result, I paid property tax for children for four years: debt for 2017-2019 and accrued tax for 2020. And I figured out how to do it from the very beginning - I share my instructions. nine0003 In a letter to my new appeal, the Federal Tax Service did not answer the question why the application to the court from 2020 was sent in the fall of 2021. But the inspector told me how to get access to the child’s personal account

How I paid tax for children’s shares

It turned out that that as soon as I registered the children's shares in Rosreestr and registered my daughters in the apartment, the departments sent information about them to the tax office. And she assigned them a TIN and created personal taxpayer accounts.

p. 3 and 4 art. 85 Tax Code of the Russian Federation

I found out the TIN of my daughters on the website of the Federal Tax Service and then decided to order paper certificates of tax registration from the inspection. How to do this, Tinkoff Magazine has already written.

How to do this, Tinkoff Magazine has already written.

TIN became the login for entering the taxpayer's personal account. And in order to get the password, I came to the IFTS with a passport and birth certificates of children. The inspectorate immediately generated and printed passwords.

On the same day, I went to my daughters' personal accounts. There was no evidence that they owned any property - for some reason, the information appeared later. But there were five unread tax notices for 2016-2020. I paid the receipts for 2017-2020. nine0003

So what? 03.03.17

Tax debts can be collected even from those who owe nothing

To find out the TIN of a child, in the request form on the website of the Federal Tax Service, you must specify his data and the number of the birth certificate. The TIN will appear instantly. Such a sheet with a password was given to me by the tax office. When I came home, I immediately changed it. Here are the taxes that are in my daughter's personal account. I did not receive any email notifications

I did not receive any email notifications How to link personal accounts of children to my

While I was writing this article, functionality has expanded in the taxpayer's personal account. Now children's accounts can be linked to the parent's, and the parent will be able to pay their taxes from their account.

You can now pay taxes for minor children in the personal account of the parent's tax office - the Federal Tax Service

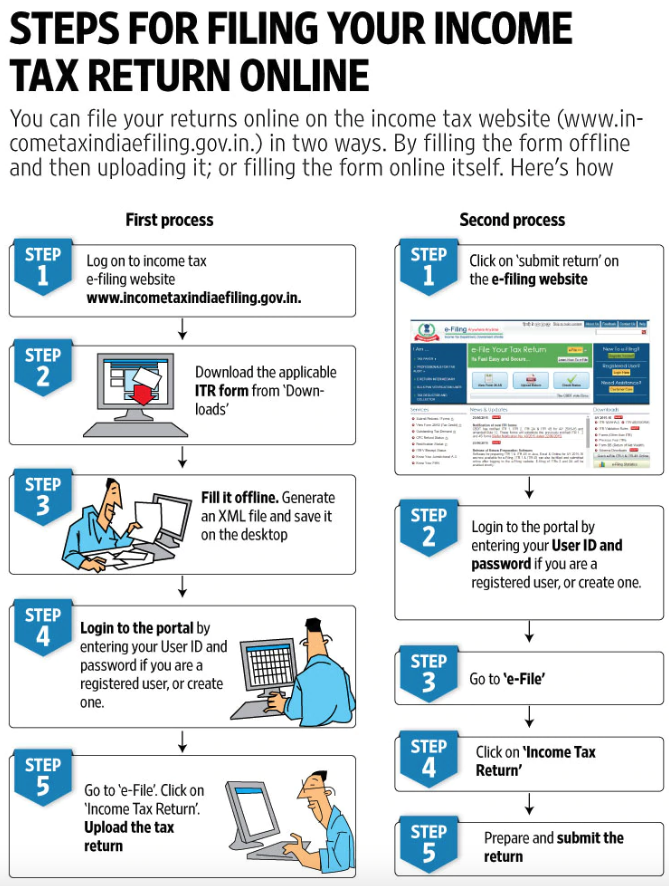

Here's what you need to do:

- Go to your personal taxpayer account.

- Click on your last name, first name and patronymic at the top. The Profile section will open. nine0100

- Find the "Family Sharing" tab there and click on it. A request form to add a child will appear.

- Enter the child's TIN on the form.

- Go to the child's personal account and open "Family Sharing" as well.

- Find a message with a request for access and click the "Confirm" button there.

After that, the child's personal account will be linked to yours, and you can easily and conveniently pay child taxes. To do this, click on the "Taxes" tab and select a child in the drop-down list. nine0003

To do this, click on the "Taxes" tab and select a child in the drop-down list. nine0003

When the child turns 18, his personal account will be automatically unlinked from the parent account.

Finding the Family Sharing tab is not easy. In the "Profile" section, it is on the far right and is not visible at first - you need to scroll through. And the access request form is quite simple - you only need to enter the child's TIN. A request for access will appear in the child's personal account. It needs to be approved. After that, you will appear on the list of legal representatives of the child. To untie your personal account, just click on the red crossWhat I understand about the tax on children's shares

- The IFTS assigns a TIN to a child from birth and creates a taxpayer's personal account.

- As soon as the child becomes the owner of a share in the apartment, he is charged property tax.

- Parents or other legal representatives must pay property tax for the child.

If they do not know about the debt, this does not relieve them of responsibility.

If they do not know about the debt, this does not relieve them of responsibility. - The tax office may collect the debt at any time, but not more than for three previous tax periods. nine0100

App Store: Taxes FL

Screenshots (iPhone)

Description

The service allows an individual taxpayer to control the availability of accruals and tax debts online, to interact with the tax authorities electronically.

The following functions are available in the application:

- getting information about the balance of the UNS

- getting information about the availability of upcoming payments and the recommended payment for replenishment

- viewing information about property objects

- viewing income information

- viewing information on declarations and preparing short scenarios for tax deductions and income statements

- registering services

- obtaining a certificate of unqualified electronic signature

Version 1.49.5

- improvement on the screen for adding popular actions

- correction of a defect in the service "Application for offsetting the amount of overpayment in favor of another person"

- minor improvements and improvements

Ratings and reviews

Ratings: 264.3 thousand

The main function of the application is

I didn’t receive tax receipts this year, but find out through the State Services, Sberbank (search by TIN), etc. impossible, because they only issue tax debts, but this application (like the tax website) turned out to be useful. Paid with Apple Pay. I was a little nervous: for 2 days payments were displayed in the status “waiting for receipt by the tax office”, then for several days they were not displayed at all and were offered to pay again, then for two days they “hung” doubled .

.. on the 7th working day the funds were received by the tax office, everything began to be displayed as necessary. nine0003

Good afternoon. Thanks for the detailed feedback.

Something like this

People, do not swear at the developers.

In state institutions, everything is always through the ass. The head of some department set the task to lay out the application by such and such a time, the argument of the developers-executors that it had not yet been completed, he replied that these were their problems. As a result, by clicking on the rolls, the boss reported to his senior boss that the application was posted on the network and was working stably. A bonus for the boss, a new task for the developers (they finished this one), and corrections are completed depending on free time 🤷♂️

Good afternoon.

Thanks for your feedback and support.

Great app!

Great app.

Everything is clear and to the point.

Works well.

The design is informative and original.

All property is displayed correctly, everything is listed according to the fads,

The application does not freeze.

I recommend it to everyone!

Solid five!

nine0135 Good afternoon. Thanks for your feedback.

The developer GNIVTs, AO indicated that, in accordance with the privacy policy of the application, data may be processed as described below. Detailed information is available in the developer's privacy policy.

Unrelated with user data

The following data may be collected, which is not related to the user's identity:

- Usage data nine0100

- Diagnostics

Sensitive data may be used differently depending on your age, features involved, or other factors.