How long should i let my child have a fever

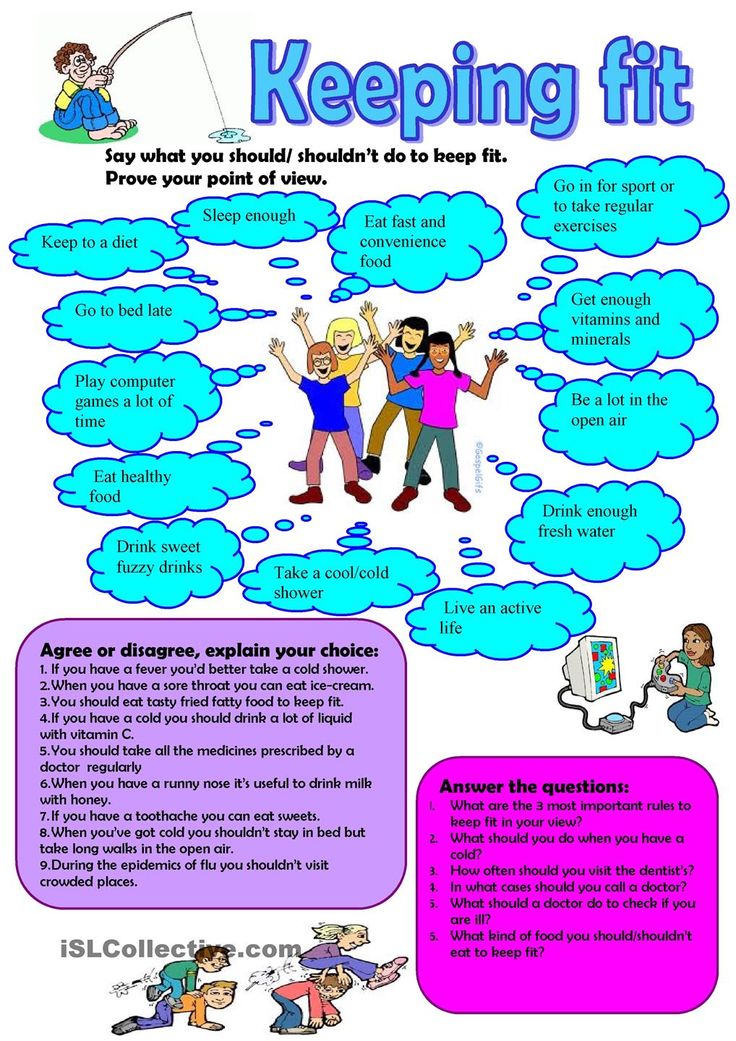

What to Do When Your Kid Has a Fever

Written by R. Morgan Griffin

In this Article

- What You Should Do

- What You Shouldn't Do

- When Should You Call the Doctor?

- Tips to Take Your Child's Temperature

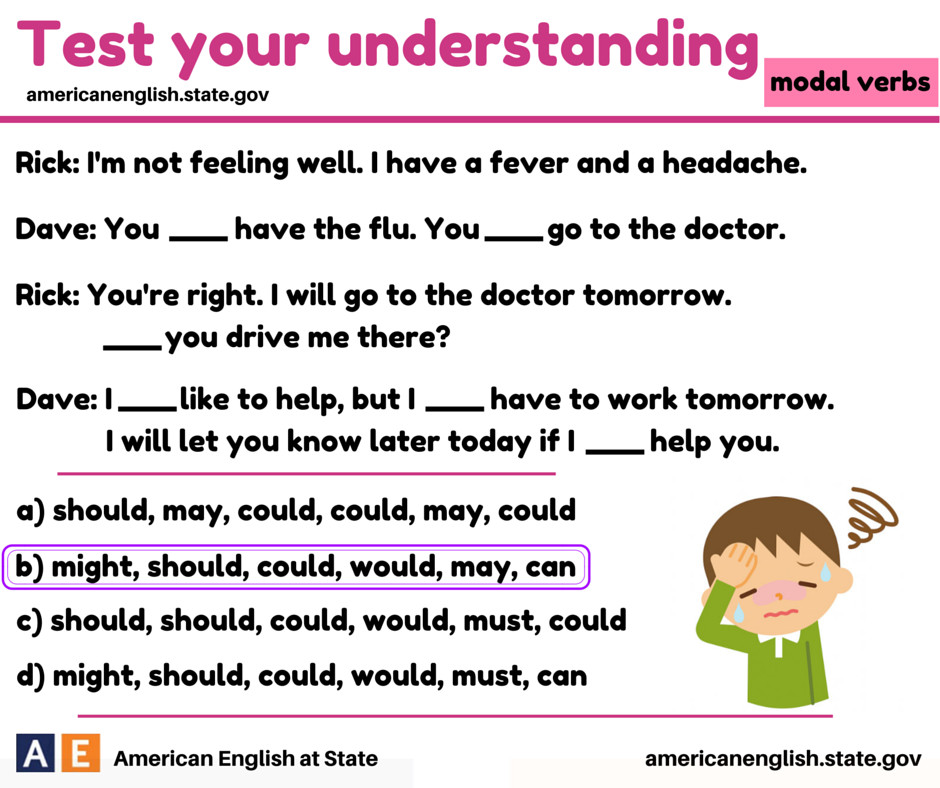

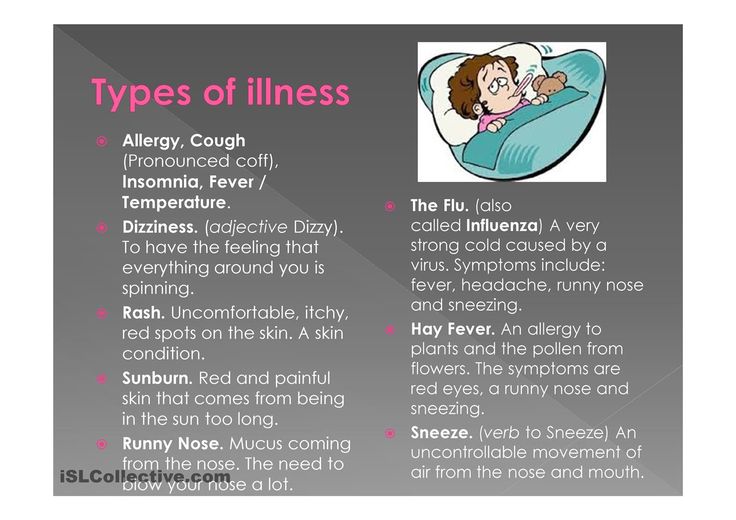

If you're a parent, it's a scene that's all too familiar. You put your hand on your sick child's forehead and it feels warm. Then the thermometer confirms your suspicion: They've got a fever. But if you follow some simple rules you'll make them more comfortable and keep them safe.

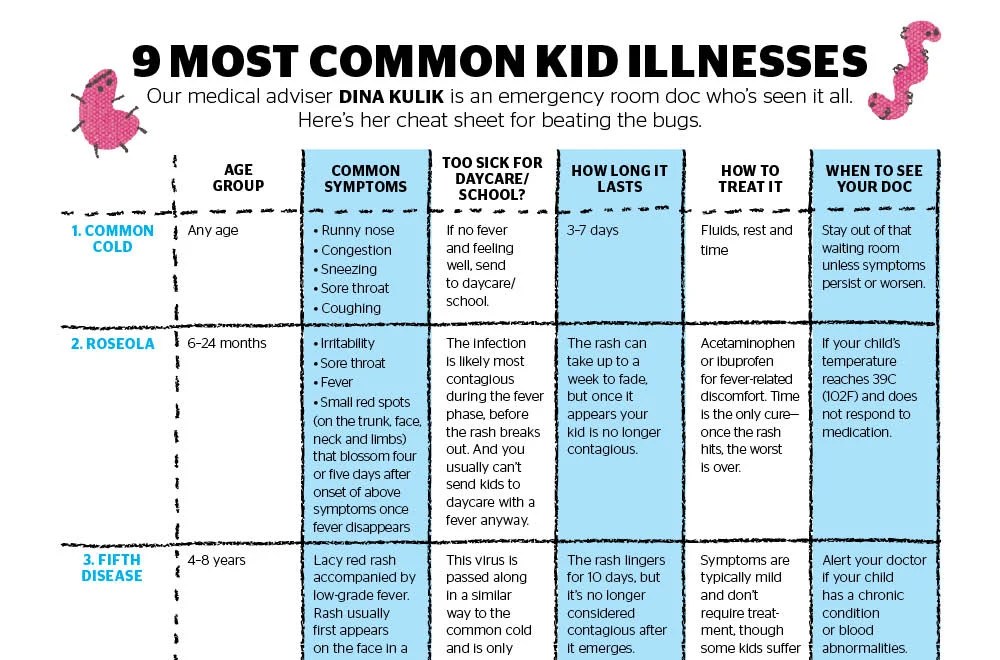

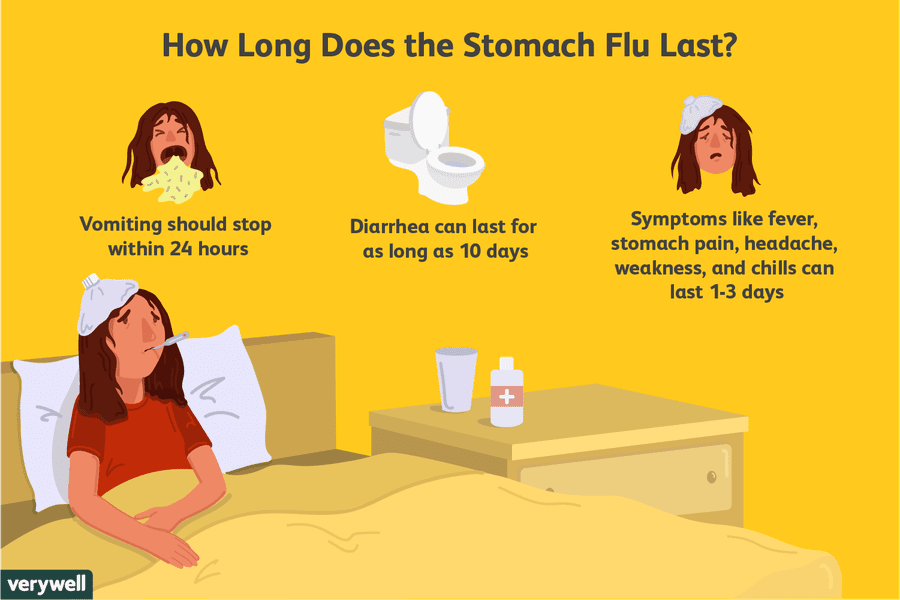

Fever is a defense against infection. Your child's body is raising its temperature to kill the germs. In most cases it's harmless and goes away on its own in 3 days.

What You Should Do

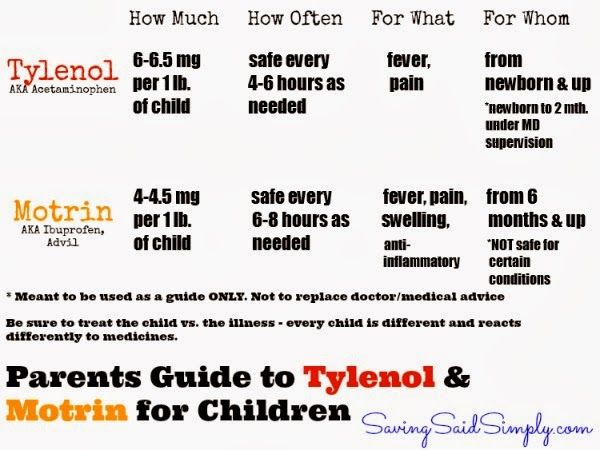

Acetaminophen can lower your child's temperature. If they're older than 2, the dose will be listed on the label. If they're younger, ask your doctor how much to give them.

Another option is ibuprofen if your child is at least 6 months old.

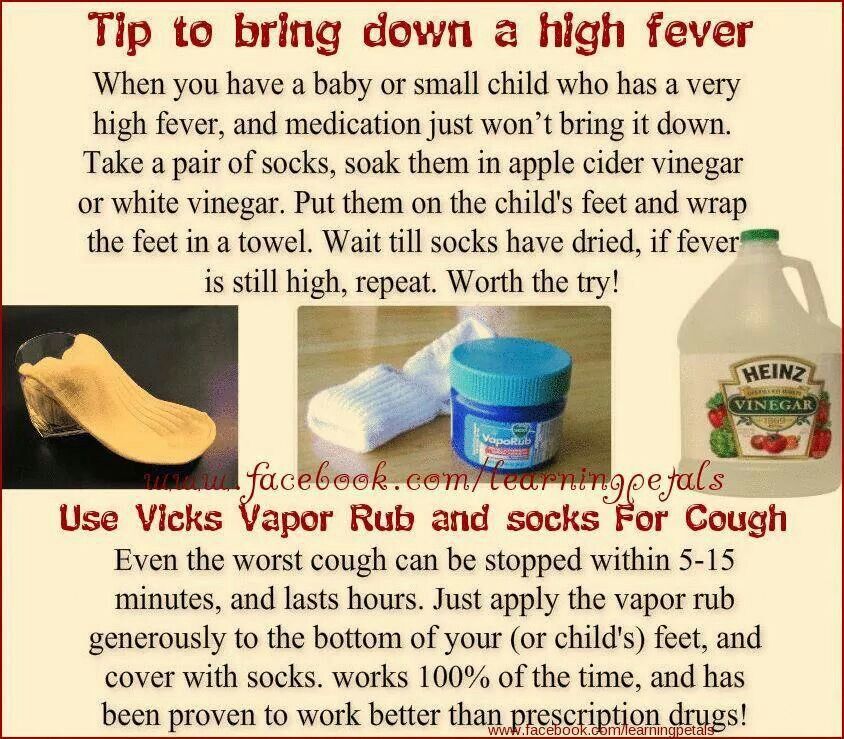

There's a lot you can do to make them feel better. Put a cool compress on their head and keep their room at a moderate temperature -- not too hot and not too cold. Dress them in one layer of light clothing and offer a light blanket. You can also cool them off with a lukewarm sponge bath.

And don't forget -- make sure they drink a lot of fluids.

What You Shouldn't Do

Never give your child aspirin. It can cause a serious condition called Reye’s syndrome.

Avoid combination cold and flu remedies in young kids. They shouldn't be used in children under age 4. In older kids, it’s unclear how well they work.

If you decide to use a cold medicine, check with your pediatrician to be sure your child is old enough for the type of medicine you’re considering. According to the FDA, no child under the age of 2 should be given any kind of cough or cold product that contains a decongestant or antihistamine, and caution should be used even in children who are older than 2. In addition, no child under 4 years of age should be given a product that combines cough and cold medicines. The possible side-effects can be serious and even life-threatening.

In addition, no child under 4 years of age should be given a product that combines cough and cold medicines. The possible side-effects can be serious and even life-threatening.

If the doctor says it’s OK to use a cough or cold medicine, then read the label before you buy and pick the one that most closely matches your child’s symptoms. Don't switch back and forth between different medications without your pediatrician's OK.

Don't use an icy cold bath or rub your child's skin with alcohol. Either can actually drive a fever up.

And even if your child has the chills, don't bundle them up with thick blankets or clothes.

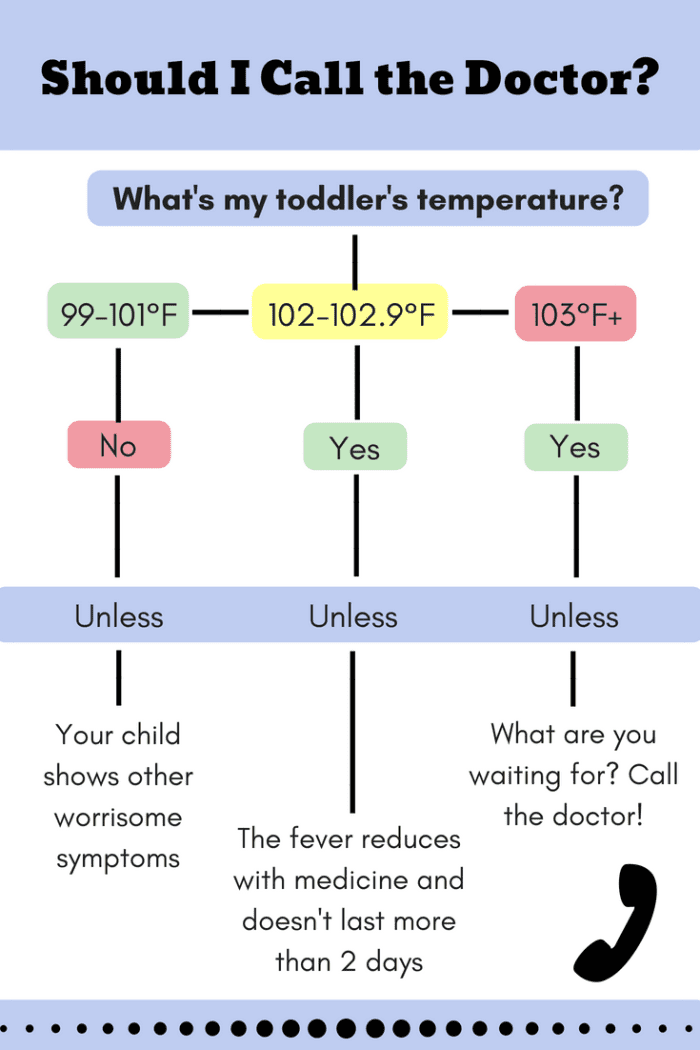

When Should You Call the Doctor?

Usually, you don't need to take your sick child to the doctor. But sometimes fever can be a serious warning sign. Call your pediatrician if your child:

- Has a temperature of 104 F or higher

- Is under 3 months old and has a temperature of 100.4 F or higher

- Has a fever that lasts for more than 72 hours (or more than 24 hours if your child is under age 2)

- Has a fever along with other symptoms such as a stiff neck, extremely sore throat, ear pain, rash, or severe headache

- Has a seizure

- Seems very sick, upset, or unresponsive

Tips to Take Your Child's Temperature

How often do you need to check? That depends on the situation. Ask your pediatrician. Usually, you don't need to take your child's temperature obsessively or wake them up if they're sleeping peacefully. But you should do it if their energy seems low or if your child has a history of seizures with fever.

Ask your pediatrician. Usually, you don't need to take your child's temperature obsessively or wake them up if they're sleeping peacefully. But you should do it if their energy seems low or if your child has a history of seizures with fever.

Which thermometer is best for kids? Digital ones are best. They can be used in their mouth, rectally, or under the arm.

For young children, a rectal temperature is most accurate. If your kids are age 4 to 5 or older, you can probably get a good reading with a thermometer in the mouth. Under the arm is less reliable but it's easier to do. Remember to add a degree to an underarm reading to get a more accurate number.

Children's Health Guide

- The Basics

- Childhood Symptoms

- Common Problems

- Chronic Conditions

Fevers (for Parents) - Nemours KidsHealth

All kids get a fever from time to time. A fever itself usually causes no harm and can actually be a good thing — it's often a sign that the body is fighting an infection.

But when your child wakes in the middle of the night flushed, hot, and sweaty, it's easy to be unsure of what to do next. Should you get out the thermometer? Call the doctor?

Here's more about fevers, including when to contact your doctor.

What Is a Fever?

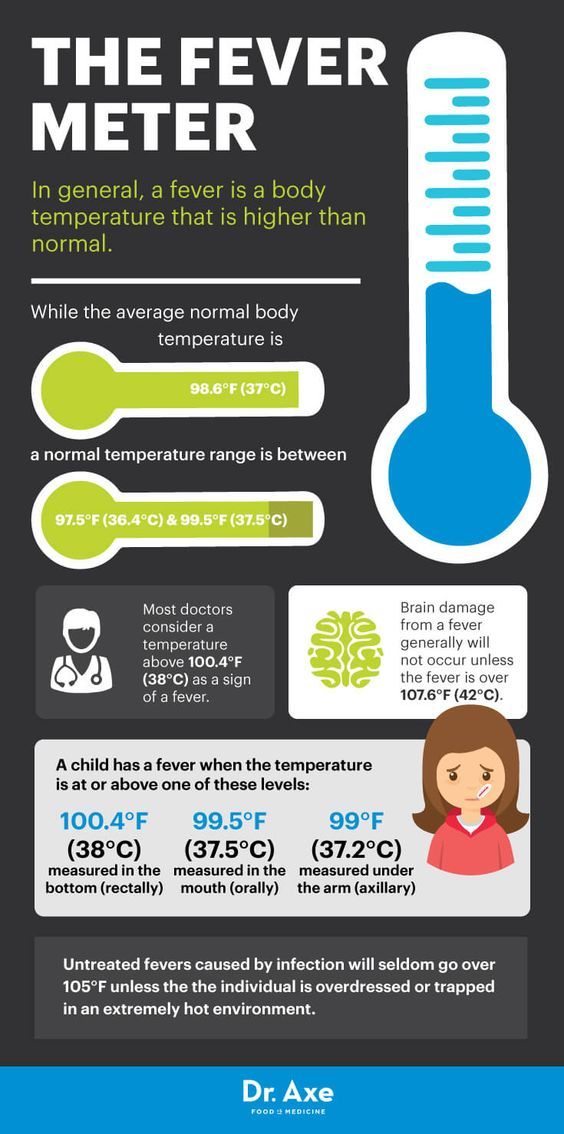

Fever happens when the body's internal "thermostat" raises the body temperature above its normal level. This thermostat is found in a part of the brain called the hypothalamus. The hypothalamus knows what temperature your body should be (usually around 98.6°F/37°C) and will send messages to your body to keep it that way.

Most people's body temperatures change a little bit during the course of the day: It's usually a little lower in the morning and a little higher in the evening and can vary as kids run around, play, and exercise.

Sometimes, though, the hypothalamus will "reset" the body to a higher temperature in response to an infection, illness, or some other cause. Why? Researchers believe that turning up the heat is a way for the body to fight the germs that cause infections, making it a less comfortable place for them.

What Causes Fevers?

It's important to remember that fever by itself is not an illness — it's usually a sign or symptom of another problem.

Fevers can be caused by a few things, including:

Infection: Most fevers are caused by infection or other illness. A fever helps the body fight infections by stimulating natural defense mechanisms.

Overdressing: Infants, especially newborns, may get fevers if they're overbundled or in a hot environment because they don't regulate their body temperature as well as older kids. But because fevers in newborns can indicate a serious infection, even infants who are overdressed must be checked by a doctor if they have a fever.

Immunizations: Babies and kids sometimes get a low-grade fever after getting vaccinated.

Although teething may cause a slight rise in body temperature, it's probably not the cause if a child's temperature is higher than 100°F (37.8°C).

When Is a Fever a Sign of Something Serious?

In healthy kids, not all fevers need to be treated. High fever, though, can make a child uncomfortable and make problems (such as dehydration) worse.

High fever, though, can make a child uncomfortable and make problems (such as dehydration) worse.

Doctors decide on whether to treat a fever by considering both the temperature and a child's overall condition.

Kids whose temperatures are lower than 102°F (38.9°C) often don't need medicine unless they're uncomfortable. There's one important exception: If an infant 3 months or younger has a rectal temperature of 100.4°F (38°C) or higher, call your doctor or go to the emergency department immediately. Even a slight fever can be a sign of a potentially serious infection in very young babies.

If your child is between 3 months and 3 years old and has a fever of 102.2°F (39°C) or higher, call to see if your doctor needs to see your child. For older kids, take behavior and activity level into account. Watching how your child behaves will give you a pretty good idea of whether a minor illness is the cause or if your child should be seen by a doctor.

The illness is probably not serious if your child:

- is still interested in playing

- is eating and drinking well

- is alert and smiling at you

- has a normal skin color

- looks well when his or her temperature comes down

And don't worry too much about a child with a fever who doesn't want to eat. This is very common with infections that cause fever. For kids who still drink and urinate (pee) normally, not eating as much as usual is OK.

Is it a Fever?

A gentle kiss on the forehead or a hand placed lightly on the skin is often enough to give you a hint that your child has a fever. However, this method of taking a temperature (called tactile temperature) won't give an accurate measurement.

Use a reliable digital thermometer to confirm a fever. It's a fever when a child's temperature is at or above one of these levels:

- measured orally (in the mouth): 100°F (37.

8°C)

8°C) - measured rectally (in the bottom): 100.4°F (38°C)

- measured in an axillary position (under the arm): 99°F (37.2°C)

But how high a fever is doesn't tell you much about how sick your child is. A simple cold or other viral infection can sometimes cause a rather high fever (in the 102°–104°F/38.9°–40°C range), but this doesn't usually mean there's a serious problem. In fact, a serious infection, especially in infants, might cause no fever or even a low body temperature (below 97°F or 36.1°C).

Because fevers can rise and fall, a child might have chills as the body's temperature begins to rise. The child may sweat to release extra heat as the temperature starts to drop.

Sometimes kids with a fever breathe faster than usual and may have a faster heart rate. Call the doctor if your child has trouble breathing, is breathing faster than normal, or is still breathing fast after the fever comes down.

p

How Can I Help My Child Feel Better?

Again, not all fevers need to be treated. In most cases, a fever should be treated only if it's causing a child discomfort.

In most cases, a fever should be treated only if it's causing a child discomfort.

Here are ways to ease symptoms that often accompany a fever:

Medicines

If your child is fussy or uncomfortable, you can give acetaminophen or ibuprofen based on the package recommendations for age or weight. (Unless instructed by a doctor, never give aspirin to a child due to its association with Reye syndrome, a rare but potentially fatal disease.) If you don't know the recommended dose or your child is younger than 2 years old, call the doctor to find out how much to give.

Infants younger than 2 months old should not be given any medicine for fever without being checked by a doctor. If your child has any medical problems, check with the doctor to see which medicine is best to use. Remember that fever medicine can temporarily bring a temperature down, but usually won't return it to normal — and it won't treat the underlying reason for the fever.

Home Comfort Measures

Dress your child in lightweight clothing and cover with a light sheet or blanket. Overdressing and overbundling can prevent body heat from escaping and can cause the temperature to rise.

Overdressing and overbundling can prevent body heat from escaping and can cause the temperature to rise.

Make sure your child's bedroom is a comfortable temperature — not too hot or too cold.

While some parents use lukewarm sponge baths to lower fever, this method only helps temporarily, if at all. In fact, sponge baths can make kids uncomfortable. Never use rubbing alcohol (it can cause poisoning when absorbed through the skin) or ice packs/cold baths (they can cause chills that can raise body temperature).

Food and Drinks

Offer plenty of fluids to avoid dehydration because fevers make kids lose fluids more rapidly than usual. Water, soup, ice pops, and flavored gelatin are all good choices. Avoid drinks with caffeine, including colas and tea, because they can make dehydration worse by increasing urination (peeing).

If your child also is vomiting and/or has diarrhea, ask the doctor if you should give an electrolyte (rehydration) solution made especially for kids. You can find these at drugstores and supermarkets. Don't offer sports drinks — they're not made for younger children and the added sugars can make diarrhea worse. Also, limit your child's intake of fruits and apple juice.

You can find these at drugstores and supermarkets. Don't offer sports drinks — they're not made for younger children and the added sugars can make diarrhea worse. Also, limit your child's intake of fruits and apple juice.

In general, let kids eat what they want (in reasonable amounts), but don't force it if they don't feel like it.

Taking it Easy

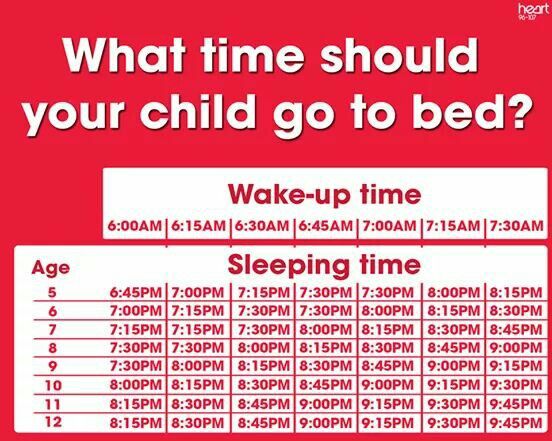

Make sure your child gets plenty of rest. Staying in bed all day isn't necessary, but a sick child should take it easy.

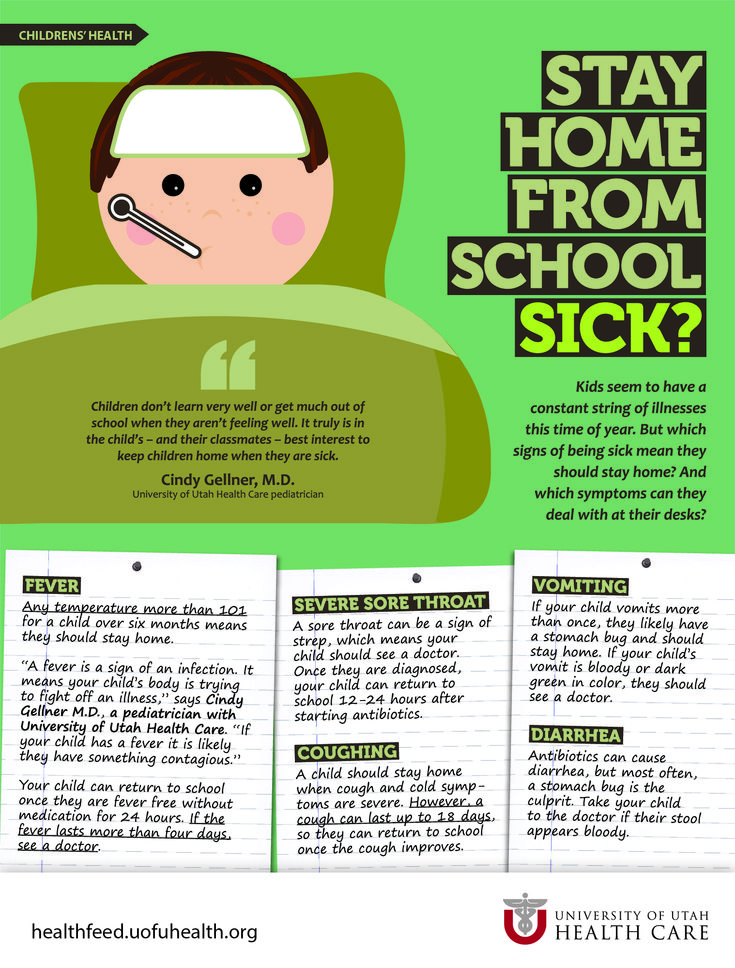

It's best to keep a child with a fever home from school or childcare. Most doctors feel that it's safe to return when the temperature has been normal for 24 hours.

When Should I Call the Doctor?

The exact temperature that should trigger a call to the doctor depends on a child's age, the illness, and whether there are other symptoms with the fever.

Call your doctor if you have an:

- infant younger than 3 months old with a rectal temperature of 100.4°F (38°C) or higher

- older child with a temperature of higher than 102.

2°F (39°C)

2°F (39°C)

Also call if an older child has a fever of lower than 102.2°F (39°C) but also:

- refuses fluids or seems too ill to drink adequately

- has lasting diarrhea or repeated vomiting

- has any signs of dehydration (peeing less than usual, not having tears when crying, less alert and less active than usual)

- has a specific complaint (like a sore throat or earache)

- still has a fever after 24 hours (in kids younger than 2 years old) or 72 hours (in kids 2 years or older)

- is getting fevers a lot, even if they only last a few hours each night

- has a chronic medical problem, such as heart disease, cancer, lupus, or sickle cell disease

- has a rash

- has pain while peeing

Get emergency care if your child shows any of these signs:

- crying that won't stop

- extreme irritability or fussiness

- sluggishness and trouble waking up

- a rash or purple spots that look like bruises on the skin (that were not there before your child got sick)

- blue lips, tongue, or nails

- infant's soft spot on the head seems to be bulging out or sunken in

- stiff neck

- severe headache

- limpness or refusal to move

- trouble breathing that doesn't get better when the nose is cleared

- leaning forward and drooling

- seizure

- moderate to severe belly pain

Also, ask if your doctor has specific guidelines on when to call about a fever.

What Else Should I Know?

All kids get fevers, and in most cases they're completely back to normal within a few days. For older babies and kids, the way they act can be more important than the reading on your thermometer. Everyone gets a little cranky when they have a fever. This is normal and should be expected.

But if you're ever in doubt about what to do or what a fever might mean, or if your child is acting ill in a way that concerns you even if there's no fever, always call your doctor for advice.

Reviewed by: Joanne Murren-Boezem, MD

Date reviewed: September 2018

Three types of parents who prevent their children from growing up

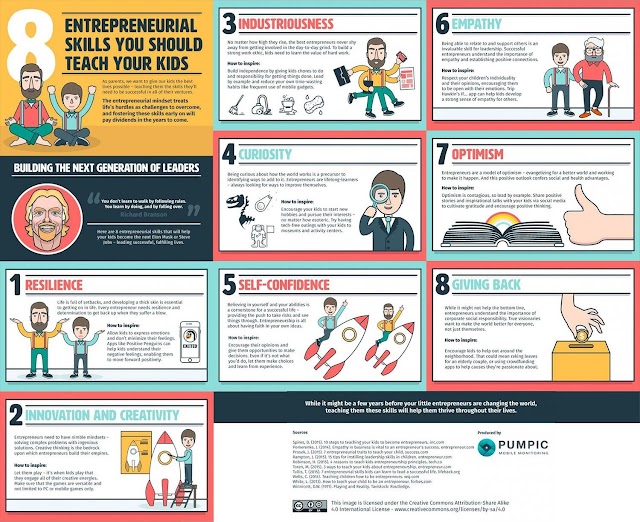

Modern 20-year-olds are accused of excessive infantilism. The reason for this largely lies in the overprotection and micromanagement of their parents. Doctor of Pedagogy and author of Teenager in the House: When You Don't Know What to Say and How to Act Rebecca Derlaine shares how to prepare your kids for adulthood

How to motivate your own children? Where is the line between parental love and total control and guardianship? How to communicate with teenagers? These questions and more are answered by Rebecca Derlaine, a 17-year high school teacher, in Teenager in the House: When You Don't Know What to Say or How to Act. The translation of the book is published by Alpina Publisher in October. Forbes Woman publishes an excerpt about the types of parents who, unwittingly, do not allow their children to grow up.

The translation of the book is published by Alpina Publisher in October. Forbes Woman publishes an excerpt about the types of parents who, unwittingly, do not allow their children to grow up.

Parents who pay for everything

I have taught in schools where parents of students could pay for almost everything. These weren't just wealthy middle or upper class people who are willing to spoil their children - I'm talking about multimillionaires with private jets and five houses.

My student Krystal was from such a family. Her parents made sure that her hair was dyed every six weeks. Her nails were fixed every ten days. She used expensive cosmetics, wore expensive clothes and shoes. On holidays, she went to exotic places and did not know what it was like to fly economy class. She was not even sixteen yet, and she had already received a brand new BMW as a gift - it was waiting for her at the doorstep, decorated with a giant bow.

This was the $60,000 car she learned to drive in, so she crashed it two weeks after getting her license. You ask: and what did her parents do after that? Like what — bought her the next BMW! When the students teased Krystal for being a "caddy" behind the wheel and for having her wrecked car replaced immediately (after all, this is really ridiculous), she lightheartedly replied that she liked the color of the second car better, so everything turned around for the better.

Of course, Krystal did not put the slightest effort into her car, so she was not even upset when she broke it. First, she did nothing to earn money for this car. And since it was one of the many expensive gifts that the girl constantly received, she did not appreciate it at all. Secondly, having broken the car, she was not afraid of the consequences. Mom and dad always rushed to the rescue of Krystal, they had to rush this time too. And it doesn’t matter that she got into an accident because of her own inability: dad’s insurance will cover the damage, and in general, parents should be happy that their daughter was safe. Thirdly, Krystal knew that she would not suffer in any way as a result of her negligence.

Thirdly, Krystal knew that she would not suffer in any way as a result of her negligence.

Another car will be delivered before it experiences any inconvenience, so the problem will be solved for it. In short, she did not value the car, was not responsible for it, and was not afraid of the consequences. However, I can guarantee that the parents were proud of both the support they gave their daughter and the fact that they provided her with a luxurious life.

Is it any wonder that Krystal never worked anywhere and had no household chores. She was rarely scolded for poor performance. If she had problems with her studies, tutors instantly appeared. I don't know what happened to Krystal after graduation, but I can guess. After all, you probably yourself guess what happens to a child who has not been explained: every decision has consequences and sometimes these consequences hurt.

You may not be as rich and indulgent as Crystal's parents, but ask yourself a few questions. Do you pay for your children's every whim without requiring them to somehow earn their privileges and pleasures? Do you allow your teens to think that after they graduate from college or get a job, they will live the same life that you provide them today? Do they have the responsibility and common sense to work to provide for themselves? Do they understand that they will not always be able to afford everything they want? Are they grateful for what you give them, and do they value their things?

Do you pay for your children's every whim without requiring them to somehow earn their privileges and pleasures? Do you allow your teens to think that after they graduate from college or get a job, they will live the same life that you provide them today? Do they have the responsibility and common sense to work to provide for themselves? Do they understand that they will not always be able to afford everything they want? Are they grateful for what you give them, and do they value their things?

Remember, you don't have to be rich to spoil your kids. If you do not teach them gratitude and the right attitude to work, they may end up being spoiled, regardless of the size of the family income.

Parents who treat their teenagers like children

Parents can show this attitude in a variety of ways. As a rule, at the same time they want to show their love for children by doing something nice for them. I am not saying that this is bad, but it is important to understand that doing everything for children is not really love. This situation harms the child and depresses his self-esteem. High school gives you four years to gradually loosen and remove parental control over children, to give them responsibility for their lives. You will always have the opportunity to demonstrate love for children. But doing everything for them is not the right way, and you should not abuse it.

I am not saying that this is bad, but it is important to understand that doing everything for children is not really love. This situation harms the child and depresses his self-esteem. High school gives you four years to gradually loosen and remove parental control over children, to give them responsibility for their lives. You will always have the opportunity to demonstrate love for children. But doing everything for them is not the right way, and you should not abuse it.

Andre loved his parents, especially his mother, who carefully controlled his every step in high school. She packed a bag of food for him to school every day, washed his clothes, cleaned his room, and made his bed for him while he was at school. Mom collected and sorted out her son's portfolio, kept his school diary and remembered the deadline for submitting all his works.

Parents took Andre to the cinema, to figure skating classes, to friends - in general, wherever he needed. Their plans depended on André's schedule, but father and mother were fine with that. Andre, you know, too.

Their plans depended on André's schedule, but father and mother were fine with that. Andre, you know, too.

But what did not suit him was that his parents treated him like a child in other areas of his life. They spoke to him as if he needed a long explanation of every little thing. They didn't ask for his opinion, but simply told him what he should think, based on long family traditions. They always wanted to know where he was and with whom, and called him almost hourly. Andre had to call his parents every time he got out of somewhere and headed for another place: once when he got out, another when he successfully got there. If he had problems at school, his parents intervened immediately and insisted on meeting with the teacher before Andre tried to deal with the situation on his own. In short, the parents completely suppressed the teenager: sometimes out of concern for him or because they always resolved issues in this way. But the main reason was that since Andre's early childhood, they had not loosened the reins.

I had students who needed to contact their parents during the day. What for? I have not the foggiest idea. But imagine the picture: in the middle of the lesson, the phone rings. I go to the student to take the device from him, and whose name do I see on the screen? MOTHER. There was no way in the world I could have guessed why parents would need to tug at their child during lessons. I know mothers who are ready to drop everything and run to school to bring their child a forgotten breakfast. I've seen them pick up kids from school and wait in cars for an hour instead of letting their fourteen-year-old kids get on the school bus and drive home in ten minutes. The level of overprotection is amazing, and children perceive it very painfully.

They love to be taken care of, it's nice to know that their parents care about them, but they hate to be treated like babies. Prepare your kids' favorite meal for dinner, sign them up for driving classes, support their social circles, and keep your home open to their friends.

But please don't take care of them like babies. By doing this, you are doing them a disservice, depriving them of the opportunity to grow up and make decisions on their own.

Parents who do not prepare their children for the future

This group is the easiest to get into, because the time you are destined to spend with your children flies by instantly. It is easiest to do what you have always done, because it takes a lot of effort to think and plan for change. It is unlikely that in your diaries there is an entry like: “Sit down and calmly analyze whether I am coping with my parental responsibilities.” And even more so, it is unlikely that such a record is repeated in it monthly or weekly. I encourage you to reflect regularly on how you are helping your children prepare for an independent future when you can no longer be around to give advice and guidance.

I interviewed more than a hundred of my students, current and former. I asked them one question: in what area do they not feel independent. The most common answer was: "Finance". Did you know that most high school students don't know how to write a check? If their parents set up bank accounts for them, then the children, as a rule, cannot say anything about these accounts. That is, they do not know the amount on the account, they do not know if any fee is charged for servicing these accounts, they are not interested in how much interest has accrued. Most teens don't have their own credit cards, which I understand, because parents are terribly afraid that their children will make expensive purchases, run into debt or fail to top up their account on time and run into huge penalties. This is a real cause for concern, but there is a relatively simple solution to such a problem: before handing a credit card to a child, teach him everything necessary. Start with the main thing - choose a card with a low credit limit for it.

I asked them one question: in what area do they not feel independent. The most common answer was: "Finance". Did you know that most high school students don't know how to write a check? If their parents set up bank accounts for them, then the children, as a rule, cannot say anything about these accounts. That is, they do not know the amount on the account, they do not know if any fee is charged for servicing these accounts, they are not interested in how much interest has accrued. Most teens don't have their own credit cards, which I understand, because parents are terribly afraid that their children will make expensive purchases, run into debt or fail to top up their account on time and run into huge penalties. This is a real cause for concern, but there is a relatively simple solution to such a problem: before handing a credit card to a child, teach him everything necessary. Start with the main thing - choose a card with a low credit limit for it.

There are credit cards designed specifically for schoolchildren, they have a low credit limit, additional protection against hacking and preferential terms for newcomers who forget to pay off their debt on time. Explain to the children how and when to use this card. Treat this explanation as a learning task - that is, every word should be extremely clear.

Explain to the children how and when to use this card. Treat this explanation as a learning task - that is, every word should be extremely clear.

The same applies to the checkbook and debit card. And don't assume, as I once did, that your kids understand the difference between a debit card and a credit card. Probably not. Again, explain to them when to use each of them and when not to. Today's kids love to shop online, and they're bound to use debit cards to do so until you give them all the reasons why they shouldn't. Once in college, most of them will order textbooks online. They need to know how to use a credit card responsibly and how to recognize reliable websites and merchants. In general, kids need to be taught how to handle money properly. This means that they must keep their checks, credit cards, and debit cards in a safe place; review monthly bank statements for errors; save and view receipts for purchases; know the rules and restrictions of your cards and your bank; be able to fill in and out bank orders, etc. It is necessary to discuss with the children where the money comes from and where it goes. Then your children, having entered independent life, will be quite competent in basic financial matters.

It is necessary to discuss with the children where the money comes from and where it goes. Then your children, having entered independent life, will be quite competent in basic financial matters.

If you have not yet explained the "money matter" to them, you should do so as soon as possible. Suppose your children are working, then convince them to set aside a certain amount of each salary, at least five dollars. Explain to them as early and convincingly as possible that this is necessary. There has always been a rule in our family: money must be spent responsibly. However, the child could always spend the donated money as he wanted, unless the donor specified some specific purpose for this money. Your children, like adults, should have the right to receive cash gifts, so give them money from time to time. The main thing is to treat teenagers in financial matters as adults. Let them listen to you and benefit from your experience. Constantly remind them how important it is to handle money properly, but do not deprive them of the opportunity to enjoy unexpected luck. This will teach them that money is a necessity, but it can also bring joy. They must understand that they must first secure what they need, then set aside some amount for the future, and only then spend money on a whim. Imagine how much better our economy would feel if every parent taught this lesson to their children.

This will teach them that money is a necessity, but it can also bring joy. They must understand that they must first secure what they need, then set aside some amount for the future, and only then spend money on a whim. Imagine how much better our economy would feel if every parent taught this lesson to their children.

An added bonus here is that when you trust teenagers with some financial responsibility and freedom, they appreciate your belief in their abilities and try to act like adults.

- “Children have always been marginal family members.” Marina Melia about the problems of upbringing

- Is it possible to succeed in life if you were not loved in childhood

- The generation of anxious parents. How not to take away the taste for life from your child

4 stories on how to learn financial literacy

Financial literacy is a difficult task.

Olesya Vlasova

accumulated stories

Author profile

But you can at least try to get closer to an unattainable ideal: start saving and keep track of your income and expenses, accumulate a financial cushion and invest money correctly. We have collected several stories from readers T—Z, whom a competent approach to finance helped to overcome life's difficulties and achieve results.

We have collected several stories from readers T—Z, whom a competent approach to finance helped to overcome life's difficulties and achieve results.

These are the stories of readers from the S-Z Community. Collected into one material, carefully edited and formatted according to editorial standards.

Story 1. When I thought that a good person must be poor

“My worst habit is not spending money” Age: 30 years

City: Ufa

Revenue: ~ 120 000-130 000 000 000 000 °

Anonymous

, but

childhood does not fit in debt. I grew up in a poor family and most often heard phrases like "no money" or "you have to repay debts." I was taught to save and was not allowed to immediately spend on what I wanted: they suggested that I first think about whether I really need it. This habit has remained with me in my adult life - for a long time I can not decide on a purchase.

I don't remember ever being able to afford to buy something for change. If only it was allowed. They didn’t give money for good grades either: in our family, by default, it was believed that you need to study for “four” and “five”, why give money here?

But I saved up and did it, for example, like this: I took money to buy food at school, but I didn’t have lunch, but I saved the whole amount. Then he bought himself CDs, cassettes, computer games, magazines "Hammer" and "All Stars", cards for accessing the Internet - not everyone will understand, not many will remember. A special pride was a T-shirt with the logo of your favorite band.

I've always known that money doesn't come easy. I didn’t understand why we didn’t have something, but my friends did. After all, their parents work the same way - but for some reason they live better. At that time, the idea was actively promoted in our family that it was impossible to earn big money honestly. So I thought that a good person must be poor.

First earnings. Once at the university, instead of classes, I went to work part-time - just like that, without a special purpose. Huge heavy cabinets and other furniture had to be dragged and loaded. We worked all day, and I got 500 R for it - my first really earned money. I went and bought beer and pizza with them. Where else could they be spent? But then I thought: “Damn it, 500 R for such work! Yes, I drink so much in one evening in a bar. No, I don't want to live like this forever." I gave up all sorts of side jobs and decided to finish my studies normally, because you still have to work hard all your life.

/money-first/

15 ideas where to make your first money

Revaluation. Started working after university. They paid little money, but I didn’t complain, because I was a young student who didn’t know anything yesterday. Three years later, I grew in salary by three or four times and once asked myself the question: “Why are my incomes gradually increasing, and I still live in a dumb rented apartment? Why did I go to the same one and go, but at the same time, at the end of the month, the account is still, as a rule, zero?

So I decided that it was time to buy an apartment - then the money would go at least to it. But first I bought a car - I drive it to this day. I took out a mortgage in a house under construction, and then the fun began. I was torn apart by the fact that I receive 50,000 R, but 20,000 R are immediately withdrawn from my account for a mortgage payment, and I give another 15,000 R for a rented apartment. 15,000 R remains for life and entertainment, of which another 3,000-4,000 R is spent on a car. At that moment, I realized that I needed to do something with personal finances: take part-time jobs, understand where the money goes, and spend it smarter.

But first I bought a car - I drive it to this day. I took out a mortgage in a house under construction, and then the fun began. I was torn apart by the fact that I receive 50,000 R, but 20,000 R are immediately withdrawn from my account for a mortgage payment, and I give another 15,000 R for a rented apartment. 15,000 R remains for life and entertainment, of which another 3,000-4,000 R is spent on a car. At that moment, I realized that I needed to do something with personal finances: take part-time jobs, understand where the money goes, and spend it smarter.

My main goal was to close my mortgage and build a financial cushion because I wanted to quit my job and try my hand at a new profession. At the same time, I started roughly spreading my salary into different accounts: for food, for a car, for a vacation, for a pillow, for a big purchase. This made it easier for me to save money and buy something, since I categorically dislike loans.

Financial error. Once I lent money to relatives to buy an apartment - then I had not yet bought my own. At first, they could not pay me off for a very long time, and then they gave me in installments. As a result, the relationship deteriorated.

At first, they could not pay me off for a very long time, and then they gave me in installments. As a result, the relationship deteriorated.

/dolgi-zlo/

Your own collector: 12 reasons not to lend

Now. I have impostor syndrome, so I can't call myself one hundred percent financially literate. But I can say that I have made some progress towards this, because I keep track of income and expenses, I have no debts, loans, I have accumulated a financial airbag, I spend less than I earn, and in general I get only what I really need.

I'm a simple guy, I don't need to prove anything to anyone by buying a $1500 watch.

I am not a fan of fancy gadgets and cars simply because everyone has them. I have a simple old foreign car, an iPhone SE and sneakers that I bought three years ago.

Now with my salary I can buy a lot without any loans. I'm saving, but I don't get into debt. And in principle, I think that a loan is when you cannot afford something. You're just delaying the execution. And I don't want to feel like I owe someone. To be honest, I don’t understand people who don’t have a mortgage, but they buy a car for 1.5 million, although they already have a car, albeit an old one.

And in principle, I think that a loan is when you cannot afford something. You're just delaying the execution. And I don't want to feel like I owe someone. To be honest, I don’t understand people who don’t have a mortgage, but they buy a car for 1.5 million, although they already have a car, albeit an old one.

All my bad financial habits must have been killed in childhood by my upbringing. Probably my worst habit right now is not spending money. It is very difficult for me to force myself to spend money on my own needs or on something big, especially if I do not see immediate results. Well, I'll buy this sweatshirt, and it will lie like that, because my previous one hasn't torn yet. I don't know what better to call it - conscious consumption or maybe greed?

/sam-sebe-pensiya/

“Your own pension fund”: 7 stories of people who plan to retire early

So far I have saved up a pillow for a year of my life in case I suddenly lose my job or quit. I also set aside a certain amount, but I still don’t know what to invest in. I think to use it for travel, or use it as a contribution to the house, or add to my financial cushion, or upgrade the car. But in the stock market, I have no success: the portfolio hangs around zero plus or minus 2%. I would like to delve deeper into the topic of investments and get more profitability, but so far it doesn’t work out.

I also set aside a certain amount, but I still don’t know what to invest in. I think to use it for travel, or use it as a contribution to the house, or add to my financial cushion, or upgrade the car. But in the stock market, I have no success: the portfolio hangs around zero plus or minus 2%. I would like to delve deeper into the topic of investments and get more profitability, but so far it doesn’t work out.

In general, I dream by the age of 50 or even earlier to stop working and retire through investments.

Advice to your past. Dude, you're doing everything right. Start investing as early as possible, collect dollars before 2013, and buy stocks in March 2020.

Story 2. When you have to move to Moscow to provide for your family

“I had to learn not to save on myself” Age: 44

City: Veliky Novgorod → Moscow

Income: ~ 90,000 R

Nadezhda Romanova

was able to move to Moscow and buy an apartment here

Author profile

Childhood. I grew up in a family with three children and a father who liked to drink. We always lived paycheck to paycheck, and my mother often had to borrow money to make it to paycheck. But she always first of all paid off those who lent us money and paid for the communal apartment. Therefore, the family did not have serious debts.

I grew up in a family with three children and a father who liked to drink. We always lived paycheck to paycheck, and my mother often had to borrow money to make it to paycheck. But she always first of all paid off those who lent us money and paid for the communal apartment. Therefore, the family did not have serious debts.

I realized the value of money in my childhood, seeing how my mother worries about their constant lack. Then there were the terrible 90s, when salaries were constantly delayed, and then the parents' factory finally went bankrupt. From the age of 14, I helped my mother with a part-time job - together we washed the floors in a cafe and in a store, cleaned the yard. And still, there was barely enough money, there were no savings. And those who had them quickly lost them, as in my husband's family. I also saw bandits who then lived on a grand scale with dishonest earnings, littered money right and left. And how early some of them ended up in the cemetery. It was a terrible time.

It was a terrible time.

At the same time, I studied well at school, I learned English myself in six months and entered the bilingual faculty at the Novgorod State University as a psychologist teacher - it was new and the competition was then very big.

/horrible-90/

“Since then I hate chanson and freeze”: 8 stories about what life was like in the nineties

Financial mistake. When I was 17, my mother gave me money for my prom dress. I walked around the market, and I didn’t have enough for anything. And then I saw that someone was playing thimbles. The man in front of me was happily boasting about winning, and it seemed to me that it was so easy - here is the ball, under this cup. As if spellbound, I gave the thimble-maker all my money - and lost it all at once. It was a complete failure and shock. Then I caught up with him, cried, grabbed his sleeves, begged him to give the money, they are for a prom dress. In the end, he took pity and gave them away, but it was terrible.

In the end, he took pity and gave them away, but it was terrible.

And at the age of 19 I once again fell for the same bait in the market. But no one returned the money, and the policeman, to whom I turned, pointing out the scammers, only shrugged his shoulders, saying that she, a fool, gave it away. But I learned my lesson: free cheese is only in a mousetrap.

/bezopasnost-uchebnik/

Course: how to protect yourself from scammers

First earnings. I got my first money of my own in my third year, when I started working as an English tutor. I don't remember what I spent them on. I think these were the most common purchases. I really liked teaching, although I was surprised then how easily parents gave money for language lessons for their children. After all, you can learn it completely free of charge - there would be a desire.

Revaluation. Until 2007, my husband and I lived with our parents. There was no normal work in Novgorod - in any case, we could not find it. Although both my husband and I had a higher education and a permanent job, and I had two of them plus tutoring, the money I earned was still almost not enough for anything. For the first time I went to the south at the age of 30, with my husband and child. Our parents helped us save money for the trip.

There was no normal work in Novgorod - in any case, we could not find it. Although both my husband and I had a higher education and a permanent job, and I had two of them plus tutoring, the money I earned was still almost not enough for anything. For the first time I went to the south at the age of 30, with my husband and child. Our parents helped us save money for the trip.

In 2007 we moved to Moscow and only then did we start planning the budget and putting off the airbag. I was 30, my husband was 35. We had 30,000 R in our pocket to rent housing for the first time, while we were looking for a job. The little son - he was then 4.5 years old - stayed with his grandparents in Novgorod. Separation from the child greatly undermined me, I realized that all diseases are from nerves. But we wanted to change our life and the life of our child, to earn decent money.

I got lucky with a job in the capital only after two months of unsuccessful searches, when I almost despaired. We didn’t have the Internet, so in order to look for a job, I went to sit at the computer in the Lenin Library. We rented a tiny room in Balashikha. It was difficult to get to Moscow from there, a minibus to the nearest metro could take an hour and a half, although without traffic jams the journey took 15 minutes.

We didn’t have the Internet, so in order to look for a job, I went to sit at the computer in the Lenin Library. We rented a tiny room in Balashikha. It was difficult to get to Moscow from there, a minibus to the nearest metro could take an hour and a half, although without traffic jams the journey took 15 minutes.

As a result, I found a job that I never dreamed of: in a good company, with a good salary. Additionally, I was engaged in translations in the same company, and they brought me another salary. In total then I earned 60,000 R. After Novgorod, this seemed like a fabulous income.

But my husband was not so lucky: he worked for a gray salary for a long time in vague offices that did not comply with labor laws. He received about 30,000 R. Then he did not work for almost two years, and we quarreled a lot, because I did not understand how a man in Moscow could not find at least some kind of job - at least a temporary small part-time job.

/moscow-workers/

Before and after: how much people who move to Moscow earn

From my first salary, we bought a laptop on credit and began to save money to rent an apartment in Moscow and transport our son. For housing rent, it was required to pay immediately about 90 000 R - payment for the first month, agent commission and deposit - big money for us at that time. But by May 2008, we still rented our first apartment near the Kuzminki metro station, and our son and my mother came to visit us. Life began to improve.

For housing rent, it was required to pay immediately about 90 000 R - payment for the first month, agent commission and deposit - big money for us at that time. But by May 2008, we still rented our first apartment near the Kuzminki metro station, and our son and my mother came to visit us. Life began to improve.

In the summer of 2008 my son and I went to Turkey for the first time. An all-inclusive vacation for 15 days for two cost 25,000 R. Since then, almost every year we have chosen somewhere. And before that, it seemed stupid to me to spend all the savings on two weeks of rest.

After all, this money can be used to buy a sofa, TV or make repairs.

As soon as the first financial surplus appeared, I opened a deposit. I was happy to take 20-30 thousand to the bank every month and after a short time I saw my first half a million in the account. This spurred me on to keep saving. The financial pillow really gave a sense of control and security for the family. That is why we were able to survive the long unemployment of my husband. But at that time I didn’t plan the budget properly. We just tried not to buy too expensive things, chose economical tours and tickets.

That is why we were able to survive the long unemployment of my husband. But at that time I didn’t plan the budget properly. We just tried not to buy too expensive things, chose economical tours and tickets.

I remember the first time we started shopping in the supermarket with huge carts. They took all sorts of yogurts, fruits, vegetables - and did not even have time to eat them on time. About a third then went into the trash can. And still it was cool, because before it seemed to me that it would never be available to us.

Knowing the value of money, I used to live very economically, buying cheap food and clothes. Now I had to learn to part with my salary more easily and stop saving on myself. Money, they are: easier to leave - easier to come. I needed to realize that it is better to take one, but expensive and high-quality thing, than a lot of nonsense. When I first got hold of Aliexpress, I picked up a bunch of nonsense there, simply because it's cheap. However, I am still prone to impulsive purchases. Only this is no longer clothing and restaurants, but equipment, for example.

Only this is no longer clothing and restaurants, but equipment, for example.

/cost-per-use/

Conscious Consumption Calculator: How much does it cost you to buy

By 2014, I had about three million in my bills. I then built "ladders of deposits", and came out about 15-16% per annum. Interest on deposits reached 25,000 R, that is, they almost completely covered the rent of an apartment and allowed them to save further.

But I wanted a second child and my own home. And we invested in a new building in New Moscow at the excavation stage. We bought an apartment quite spontaneously and the cheapest one, which was enough without a mortgage - a one-bedroom apartment on the first floor. It was a mistake. Things like an apartment should not be bought thoughtlessly. I regretted a hundred times about the first floor, and about the fact that we froze all our money in this project - and after all, immediately after the purchase, the dollar rose sharply in price and interest on deposits rose. It was not for nothing that my supervisor told me several times: “Nadya, buy dollars, don’t keep everything in rubles.” However, it was still important for me to have at least some of my own housing in Moscow.

It was not for nothing that my supervisor told me several times: “Nadya, buy dollars, don’t keep everything in rubles.” However, it was still important for me to have at least some of my own housing in Moscow.

In 2015, the second son was born. Unfortunately, he has a disability. This is a separate, very difficult story. But we realized that one-room apartment would not suit us in any way. In 2018, when the house was handed over, I sold the apartment for 4,500,000 R. After paying taxes, my income for four years was only about 800,000 R. I would have earned more on deposits. At the same time, thank God, we did not lose money, because before that we had generally considered buying an apartment in a project near Moscow, which in the end turned out to be a scam.

In 2018, we had about 5.5 million in our arms and a child with a disability. I decided to look into investment issues. I passed the "Lazy Investor Course", built a financial plan: in a year to buy a car, in three years - an apartment without a mortgage, and then buy a summer house and save up for retirement in order to live on interest. Managed to make some mistakes. For example, I took $2,500 to Alpari to PAMM accounts and lost half of this money.

Managed to make some mistakes. For example, I took $2,500 to Alpari to PAMM accounts and lost half of this money.

Then I opened IIS. 1.5 million parked in bonds at 10%. I bought and then sold Sberbank shares, earning about 20,000 rubles in a month. I was euphoric, it seemed to me that it was so easy to make money on shares. But then the stock market sank, and I was horrified to see the minuses on the accounts. But I invested almost all the hard-earned money in various stocks. In a panic, I sold everything, fixed a small, but minus, and for a long time was afraid to enter the market at all. Waiting for the collapse that everyone predicted.

/investor-engineer/

Reader's portfolio: how to lose 4 salaries on Forex and start trading aggressively on the stock exchange

It took a very long time and it was difficult to choose my first car, in the end it was a six-year-old Opel Meriva. I love it! Yes, a car is an additional cost, but also a huge comfort. Moreover, it is difficult to travel by public transport with a child with a disability. And then for the first time I felt at the helm of my life.

Moreover, it is difficult to travel by public transport with a child with a disability. And then for the first time I felt at the helm of my life.

Now. At the beginning of 2020, due to COVID-19, there was a collapse in the stock market. I carefully entered in April-May, almost still at the very bottom, and it was the right decision. The market began to recover quickly.

We really needed a permanent residence permit in Moscow, which is tied to treatment and disability benefits, so in May-June we began to look at locations for buying an apartment. Were in New Moscow, and in Nekrasovka, and in Maryina. We liked a four-room apartment in the Zapadnoye Biryulyovo district at a very good price - 9million. The low prices were due to the bad reputation of the area, but we liked it here: quiet, spacious and green, all the infrastructure is available, the apartment has a good repair. The railway station is two steps away, it’s 30 minutes for me to go to work, my husband is 50. So we again spontaneously, but already out of great love, stopped at this apartment.

So we again spontaneously, but already out of great love, stopped at this apartment.

We chose and bought with a realtor from the side of the seller, who paid him 450,000 R for services, and we didn’t pay a penny. They did not spend maternity capital, so that in which case it would be possible to sell the apartment without hemorrhoids. We took a mortgage of 2,200,000 R for five years at 7.9%. We could have paid in full, but we didn’t want to close the IIS ahead of schedule and lose the previously received tax deduction. Yes, and the money in the account warms the soul, especially since we are in a great plus for some stocks.

/apartments-in-moscow/

On a black salary and without a clear plan: how to buy your first apartment in Moscow

Since August, real estate prices have been skyrocketing. Our apartment is now worth more than 12 million — we invested just in time. Housing brings a lot of joy. We moved in right away, as the repairs were not bad and the previous owners left us a lot of furniture.

Owning an apartment gives a great sense of security.

Now we have our own apartment and car. The mortgage balance is 1,600,000 R, in 3.5 years we will completely close it. In May of this year, they made an extraordinary payment, reducing the loan term by seven months and the overpayment of interest by 120,000 R. But I won’t do this anymore: I can earn more on shares in four years. We now have about 2,000,000 rubles in our brokerage accounts. In order for everything to be in order with finances, you must always divide your savings into different currencies. Enter the stock market with long-term investments as early as possible, but in small regular amounts. Never take any action in a panic. Buying a house or a car when you no longer doubt that it is this apartment and car that you need. Always have an airbag and be careful with any loans. Now I consider a mortgage a reasonable thing, only if your own down payment is at least 50% of the cost of housing and for a period of not more than 10 years.

In addition, it is important to study the financial market and financial literacy. Be careful with money, but don't save on everything. Money and earnings should bring pleasure. I recommend setting aside 10-20% of all earnings for savings, and 5-10% - definitely for pleasure, relaxation and what brings joy here and now.

/investor-humanitariy/

Reader portfolio: how to start investing and saving for retirement if you are a humanitarian

Story 3. When incomes are not yet very high, but the budget is under control

“You have to look at the financial table with joyful thoughts, then with sad ones” Age: 24 years old

City: Belgorod

Revenue: ~ 50,000 p + scholarships of aspirant 8265 P

Pavel USACHEV

The budget leads and knows how to save

Children. I received regular "income" from my parents, spent this money on movies and chocolates. I had no reason to get to know finance better. All needs were covered by family money.

I had no reason to get to know finance better. All needs were covered by family money.

First earnings. At school, I participated in Olympiads and won several cash prizes. In those years, they could only be credited to a passbook, and it was possible to withdraw money only with a passport at a bank branch. Due to the fact that this is not a quick procedure, it was not possible to accidentally spend everything at once. Therefore, I withdrew money mainly for planned large expenses, such as buying equipment.

As a student, I was financed by my parents, and I followed the budget and never found myself in a situation of complete lack of money. When applying for victories at school olympiads, I was assigned a large scholarship - 17,000 R. So extra money appeared, but only for one semester - the math analysis exam turned out to be too difficult. Incomes fell sharply, but savings remained. I wanted to keep a detailed budget in a mobile application and try not to touch the savings. Since then, for six years now, I have been recording all my purchases and enrollments.

Since then, for six years now, I have been recording all my purchases and enrollments.

The real interest in the topic of finance woke up later, when non-state banks began to advertise interest on the balance and large cashback everywhere. So, cards of five different banks appeared in my wallet. Each time I had to choose which one to pay for the purchase. In addition, I learned the MCC codes of payment terminals in stores.

/fingram-uchebnik/

Course: financial literacy for adults

I also got a sign in which I wrote down information about cashback and about all purchases. I became interested in finding the most profitable option. This is how forecasts for future spending appeared. But now I have lost the desire to waste time looking for an additional percentage of the discount, and banks have complicated the cashback conditions so that it would be unprofitable to have several cards. My shopping table has expanded: now there are financial plans for the next year.

After studying and starting work, I began to set aside 5% of the amount of expenses for the previous period every month. This is a small but very fair amount. Saving according to this principle is easy. Many times I had to withdraw part of my savings, but then I tried to replenish my account back - a kind of interest-free loan. For me and for other members of my family, incomes and expenses fluctuate a lot. We can help each other without bringing the personal situation to a critical one. Therefore, my airbag is not permanent, but not the only one.

/tablichki-uchebnik/

Course: how to improve life with Excel

Reassessment. There was no single moment when I realized the value of money. It happened gradually, along with reflections on a better life. As a student, I lived, or rather, spent the night in a hostel, albeit with cockroaches and somewhere without wallpaper, but for only 300 R per month. At that time, I began to think about my own housing. It turned out that it is very expensive and looks like a luxury.

It turned out that it is very expensive and looks like a luxury.

But an apartment or a house is a basic human need. It's kind of weird to call it luxury.

I think it was from then that I began to realize the value of money. Many good things can be simply bought, but there is still not enough money for everything. Because if income may not grow over time, then personal desires will definitely increase. Although there are ways to get rich without an intermediary in the form of money: win a prize in a competition - of course, having prepared or even studied for several years, provide services in exchange for something, or even accidentally run into a rich virtue, convincing him of his need. However, money is still the most convenient and fastest way to pay. They became a proof of work for me: everyone in the world works not only for themselves, but also exchanges benefits.

Financial errors. My worst financial habit is eating out. I didn’t have a chance to learn how to cook well, and the process itself causes negative emotions: for two hours of cooking, even a second mistake can ruin a dish, but you need to do this almost every day. And besides, after a long cooking time, the food is no longer as tasty as it seemed at the beginning. On the other hand, the atmosphere of the cafe and delicious cakes bring a lot of pleasure and vivacity, for example, to immediately get down to work on a laptop. I try to beat this habit by finding simple recipes and learning, as well as creating a more comfortable working environment at home.

I didn’t have a chance to learn how to cook well, and the process itself causes negative emotions: for two hours of cooking, even a second mistake can ruin a dish, but you need to do this almost every day. And besides, after a long cooking time, the food is no longer as tasty as it seemed at the beginning. On the other hand, the atmosphere of the cafe and delicious cakes bring a lot of pleasure and vivacity, for example, to immediately get down to work on a laptop. I try to beat this habit by finding simple recipes and learning, as well as creating a more comfortable working environment at home.

I do not consider many financial losses and missed opportunities to save as mistakes. It is simply a lack of experience, knowledge, or time. But once there was just a failure - fortunately, we are talking about a small amount. It was in the center of St. Petersburg. Girls in full dress drummer costumes approached me and insistently offered to take a picture. For some reason, it seemed that it was free and just a feature of the cultural capital. I gave my phone into the hands of strangers, and they did a two-minute photo session, and then they began to demand payment and did not give the smartphone back. I was taken aback, but took out my wallet. Along the way, he said that I didn’t need paid photos, and I didn’t have the announced amount of 2000 R. In my wallet I had 1000 R in one bill and another 700 R, which I gave away with the words that this was all I had. But the drummers themselves snatched 1000 R from an open wallet, and then still waited for me to get the missing 300 R from somewhere. I had a couple of minutes to whine that I was a poor student and I needed this thousand. In the end, they gave it to me, and I deleted the photos. I was very ashamed, and I tried to forget this incident.

I gave my phone into the hands of strangers, and they did a two-minute photo session, and then they began to demand payment and did not give the smartphone back. I was taken aback, but took out my wallet. Along the way, he said that I didn’t need paid photos, and I didn’t have the announced amount of 2000 R. In my wallet I had 1000 R in one bill and another 700 R, which I gave away with the words that this was all I had. But the drummers themselves snatched 1000 R from an open wallet, and then still waited for me to get the missing 300 R from somewhere. I had a couple of minutes to whine that I was a poor student and I needed this thousand. In the end, they gave it to me, and I deleted the photos. I was very ashamed, and I tried to forget this incident.

/guide/fingramota/

How to learn how to save and save with a small salary

Now. I do scientific work in astrophysics in several teams with large projects. My main income is fickle and comes from government grants. There is always a great risk that payments for a variety of reasons may end.

There is always a great risk that payments for a variety of reasons may end.

I consider myself financially literate for the current life situation and in comparison with people from my environment. I think so because in recent years I have become interested in the topic of finance, mainly because of reading articles in T-Z: I began to understand investments, laws, taxes and financial nuances of various everyday situations that seemed difficult for ordinary people without an economic education. Now I myself often manage to advise acquaintances on ways to save money, which they did not even suspect. Sometimes the necessary information is remembered by accident: for example, I know by heart the general conditions for OSAGO insurance or for obtaining a tax deduction, although I have never drawn them up myself.

From time to time a hypothetical situation in which I have more money scrolls in my head: it is interesting to think of how I would dispose of it. Compared to some other people with different income levels, I could much more reasonably explain the value and importance of any of my purchases and investments. However, sometimes I have to be upset because of my financial decisions - for example, when spending in certain months greatly exceeds income expectations.

However, sometimes I have to be upset because of my financial decisions - for example, when spending in certain months greatly exceeds income expectations.

/khimik/

“I write applications for grants almost every month”: how much does a chemical scientist earn

Perhaps my main achievement is my general awareness of how money works in different situations. I think I could tell a cool story about managing my budget when I have a high salary and my own housing. But as long as this is not there, you have to balance in the current life circumstances - and look at the financial table now with joyful thoughts, now with sad ones.

Advice to your past. If I could go back in time, I would advise myself to start saving money as early as possible and invest it at interest. Now it would be easier.

Story 4. When income does not grow, but there is more money

"Now I always have money" Age: 35 years old

City: P.

Income: 30,000-40,000 R

Anonymous

used to spend everything he earned

Childhood and first earnings. When I was 14, I got my first job. During the summer holidays, the three of us with friends for a couple of months got a job as laborers at a warehouse base, which was located about 500 meters from our homes. They swept the territory, unloaded cars with ceramic tiles and glue, folded and shifted something in the premises, covered the roof with bitumen. It was hard physical labor, and the salary was, to put it mildly, the cat cried. For the first month at this job, I received 4100 R. I immediately went to the store, bought sweets for my mother, two cans of expensive beer for my father and gave them almost all the remaining money, taking a little for pocket expenses. We didn’t live very well then, I understood this and decided to please my parents. In the second month, I already received 5700 R - there was more work. Of this money, I took 700 R for myself, I don’t remember what I spent it on, and again gave 5000 R to my mother.

Financial errors. I was, it seems, 22-23 years old when I took out a loan for a business in which I did not understand anything, and 100% trusted my two partners. Part of the money, without my knowledge, was sent to something else altogether. The remaining amount was enough to start the business, but without a reserve. Within six months, I got out of this case with debts.

Another major financial mistake of mine was that when I started working - 15 years have passed since then - I did not save a penny, I spent everything.

Revaluation. I used to buy ready-made food in a supermarket, often ate lunch in a cafe, every day, or even several times, I took coffee to go. Now it's not like that. Although he did not completely abandon the above, but all this became many times less. The first thing I saved a lot of money on was catering. For almost three years now, in 90% of cases, I eat food prepared by my own hands. Public catering - only for hunting or for some reason. I rarely buy semi-finished products. It is not very long to make them yourself, but it will turn out to be healthier, tastier and cheaper.

I rarely buy semi-finished products. It is not very long to make them yourself, but it will turn out to be healthier, tastier and cheaper.

We have a fitness bar at work where coffee is brewed. I use an employee discount and take coffee there no more than once a week. There is also a mini-kitchen for employees, where they can store, heat and eat food brought with them, as well as brew ground coffee, a pack of which can be bought at any supermarket. Americano - and I only drink it - including the discount, costs 70 R. A pack of coffee for brewing in a cup is about 200 R for 200 grams. I need about 10 grams per cup. We get 20 cups of 10 R against 1400 R for the same amount of coffee in the bar.

/homemadecoffee/

How much does it cost to make delicious coffee at home? Strongly. But I led a carefree life, and I had no time for that. I spent everything I earned.

And just recently, at the suggestion of one of my regular clients, I read the book "The Richest Man in Babylon. " It describes all the steps that need to be taken at the beginning of the path to financial independence. If our parents had read such books to us in childhood, we would have lived a completely different life.

" It describes all the steps that need to be taken at the beginning of the path to financial independence. If our parents had read such books to us in childhood, we would have lived a completely different life.

I have a friend who earns even more money from his money, dozens of times more than me. Only recently I realized that this is an example that has been before my eyes all my life, but for unknown reasons I did not notice it. Several times I turned to him for advice. Talking to him helps me a lot.

I have made several attempts to start planning my budget and saving some money. Each, except for the last one, ended with me taking all the deferred funds for current expenses. Now I understand that it was just illiterate planning. Sometimes I saved too much of my income and didn’t have enough for my life - after all, I want money to be accumulated at a gigantic pace and a certain amount accumulated as soon as possible (and you can’t jump above your head). Then I suddenly “urgently” needed to buy a “very necessary” thing - here are questions about discipline.

Now. I work as a personal trainer in a gym. The cost of one training session with a client is 1000-1100 R per hour. In the season, before the pandemic and the closure of fitness clubs, I did 70-90 workouts a month. But for a year now, since the opening of the club, I cannot return to the previous results: there are no more than 60 workouts. And since I still pay the club a rent of 20,000 R, I now receive about 30,000-40,000 R per month. Recently earned only 20,000 R, because the clients were on sick leave and on vacation.

According to the study of F-F, I am financially literate by 21 points out of 22 😁

But I still do not consider myself financially literate - I'm just learning. I began to be interested in dealing with personal finance many years ago, but I began to seriously apply my knowledge in practice only after the introduction of the lockdown in 2020.

Now I have a whole income distribution system for four accounts.

Main account - debit card - for daily expenses: groceries, travel expenses, and so on. Every week I replenish the card with a fixed amount, which I calculated in advance. Thus, I solved the problem with impulsive purchases and unnecessary spending.

Two more accounts for savings in rubles and US dollars. Ruble - this is the Investment Bank from Tinkoff Bank, rounding off, interest and cashback are calculated here. I put 20% of my income into these accounts - 10% for each.

And my fourth account serves as a distribution center: initially, all my income goes here. All surpluses after I have transferred the rest of the funds to different accounts remain here. With this money, I make monthly payments - rent at the club, pay for utilities, communications, TV and the Internet, buy clothes and small household goods. I plan larger purchases in advance, taking into account all upcoming expenses, and make them only after all monthly payments.

/fitness-trainer/

"I'm sick - I'm sitting without money": how much does a fitness trainer earn

I finally came to a system that works. Now I always have money. Is always. Previously, I could not boast of this. I no longer use loans and credit cards, and also do not take on debt unless absolutely necessary. I can only lend for things I really need.

Now I always have money. Is always. Previously, I could not boast of this. I no longer use loans and credit cards, and also do not take on debt unless absolutely necessary. I can only lend for things I really need.

The last time I borrowed was over a year ago: I needed 10,000 R for a smartphone with a good camera that I needed for work. The debt was returned before the agreed time. And recently I bought a laptop. I took it from my hands, the condition is like new, but it came out decently cheaper. This was also a planned purchase: I need a laptop for additional work in another area. For now, I am learning on free materials and saving $1,000 for training.

I still have old debts - fines, payment for damages from road accidents, which I gradually pay off. You have to pay a little less than 100,000 R. Climbing up is easier when nothing is pulling you down. And the head works differently.

Advice to your past. Always put some money aside and never get involved in things you don't understand.