How does the 2023 child tax credit work

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

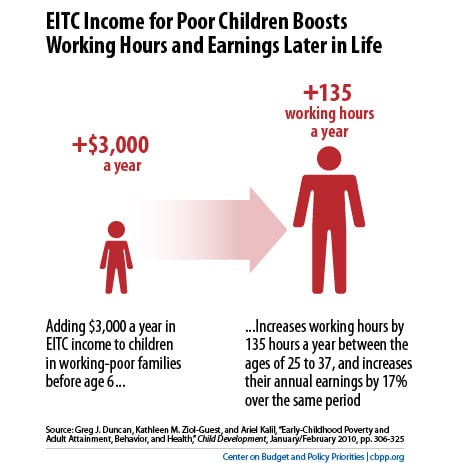

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

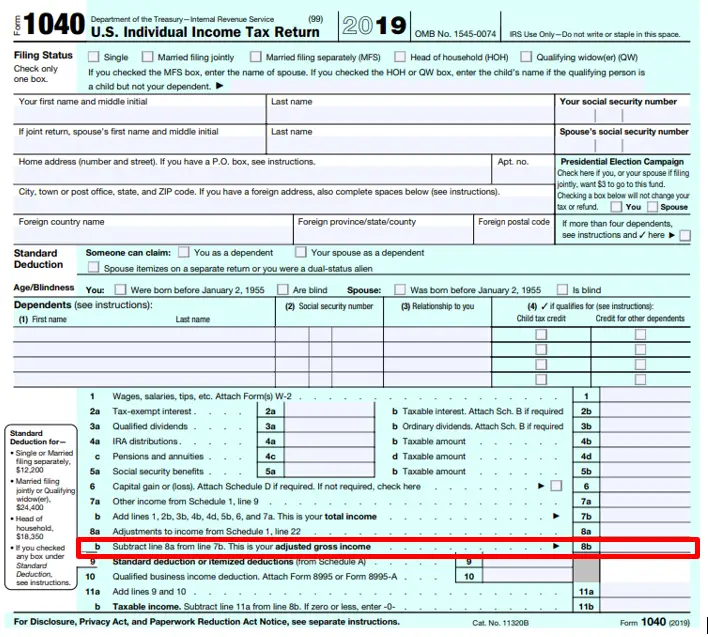

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

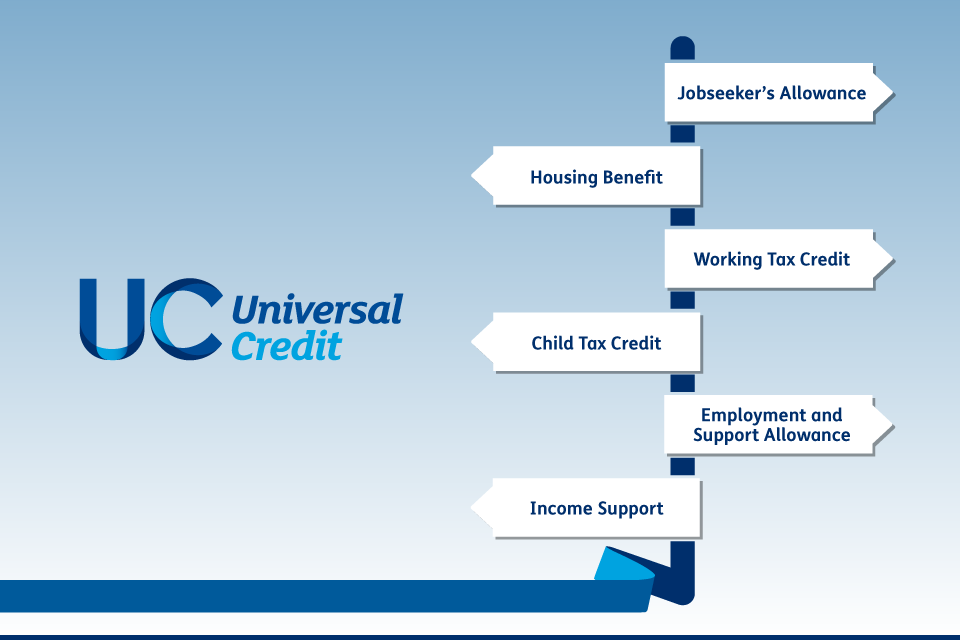

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids.

She’ll receive the rest next spring.

She’ll receive the rest next spring.- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so.

As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Social protection

Social protection

Social payments

Will unused maternity capital be indexed?

Yes, based on actual inflation rate

November 15, 2022

Social protection

Social payments

How to refuse payments for the care of a disabled person in case of going to work?

Need to apply for a waiver to the Pension Fund

November 11, 2022

Social protection

Other support measures

How to learn a new profession for free?

Complete retraining under the federal project "Employment Promotion"

November 5, 2022

Social protection

Other support measures

How to get a housing certificate for citizens of the Russian Federation who are forced to leave the city of Kherson and the right-bank part of the Kherson region?

October 23, 2022

Social protection

Social payments

How to get a lump sum payment to citizens who are forced to leave the city of Kherson and the right-bank part of the Kherson region?

October 23, 2022

Social protection

Other support measures

How to achieve the installation of a ramp for people with limited mobility in the entrance of an apartment building?

You need to contact the social security authorities at the place of residence

October 22, 2022

Social protection

Social payments

What payments are due to fathers in Russia?

They are provided with a number of social guarantees and pension rights

October 16, 2022

Who will be given a preferential mortgage at 3.

3% | e1.ru

3% | e1.ru Today, in a new building, you can buy an apartment with a mortgage at a rate of 3.3% per annum for almost everyone

Photo: Maxim Vorobyov

Share

The year is ending - it's time to close all your business. If someone was waiting for a sign or just the best time to buy a home, the time has come. Firstly, what will happen to preferential mortgages is not yet clear - the authorities have been seriously discussing the possibility of canceling since January. Secondly, the beginning of the year promises a traditional increase in prices for just about everything. But the most important thing is that only until December 31, 2022, you can get a mortgage rate of 3.3% per annum for the entire term for all citizens of Russia. How to get such a rate - right now.

Today, everyone is used to the fact that low mortgage rates are provided either for the first year until the end of the construction of the facility only to families with babies, or specialists of certain IT companies. But the specialized developer Formula Construction decided to do away with it - it will subsidize the mortgage.

But the specialized developer Formula Construction decided to do away with it - it will subsidize the mortgage.

Thanks to an individual agreement with the partner bank PJSC Sberbank, an apartment in the Tikhomirov residential complex can be purchased by all Russian citizens with a mortgage at a rate of 3.3% per annum, for IT specialists it will be from 1.3%, and a family mortgage - 2.3%. Most importantly, this rate will be valid for the entire term of the loan. However, it is necessary to issue a DDU by December 31, 2022.

The construction of the final part of the project will be completed in early 2023, and in early spring it will be possible to receive a tax deduction and celebrate housewarming

Photo: Maxim Vorobyov

Share

Ekaterinburg has a cozy and green microdistrict VIZ. Its attractiveness is that on the one hand it takes about 15 minutes to get to the city center by tram, if you choose a car, you can manage it in 7 minutes. On the other hand, there is a huge pond nearby, which the locals call the sea. Moreover, they rest here all year round: in the summer they sunbathe and ride on boots or yachts; in spring and autumn they drink coffee wrapped in a blanket, like in a movie; and in winter they go skiing, play snowballs and take a bath in the baths on the shore, then to dive into a snowdrift.

On the other hand, there is a huge pond nearby, which the locals call the sea. Moreover, they rest here all year round: in the summer they sunbathe and ride on boots or yachts; in spring and autumn they drink coffee wrapped in a blanket, like in a movie; and in winter they go skiing, play snowballs and take a bath in the baths on the shore, then to dive into a snowdrift.

In winter you can do Nordic walking on the pond

Photo: Maxim Vorobyov

Share

In addition, the microdistrict has a well-developed infrastructure. And in the center of all this, the Tikhomirov residential complex is being built. Within walking distance from the house of the Raduga-Park shopping center with an amusement park, modern private and municipal medical institutions. In the yards across the road there is the mentality gymnasium, besides it, within a ten-minute walk there are five more schools and ten municipal kindergartens. Directly opposite the residential complex "Tikhomirov", the construction of school No. 41 began, which will be able to accept 925 students. It is planned to open a new educational institution in 2024, and it will be built according to the public-private partnership scheme.

Directly opposite the residential complex "Tikhomirov", the construction of school No. 41 began, which will be able to accept 925 students. It is planned to open a new educational institution in 2024, and it will be built according to the public-private partnership scheme.

In the shopping center "Raduga-Park", which is not far from the house, there is a natural park with rocks and a pond. In each picturesque corner there is an attraction, a gazebo or a bench

Photo: Maxim Vorobyov

Share

Residential complex "Tikhomirov" is being built using a monolithic-frame technology. The frame of the house is monolithic, and the walls are brick. Combined facade - plaster and ventilated structure. All this, together with large windows with a five-chamber profile 70 mm wide, keeps the apartment warm. The first stage of the project has already been built, and many of its residents admit that heating, of course, was provided a long time ago, but it was necessary to turn on the batteries only with the advent of the Ural winter.

A thick fur coat made of insulation keeps the apartment quiet and warm

Photo: Maxim Vorobyov

Share

As for engineering systems, the latest developments are also applied here. Video surveillance is responsible for security. Using the IP intercom system, residents can access the image of any camera that is installed on the territory of the house and yard. It also allows you to open the entrance door through the application. Telemetry will save you from monthly writing off meter readings - all data is automatically sent to the management company and returned in the form of a utility bill.

The yard is illuminated by lanterns with energy-saving lamps

Photo: Maxim Vorobyov

Share

Another pleasant moment is the presence of a hall with upholstered furniture and decoration according to the author's design project. Here it is convenient to wait for a taxi or take a courier - safer than at the door of your own apartment.

Here it is convenient to wait for a taxi or take a courier - safer than at the door of your own apartment.

There is also a bookshelf in the lobby

Photo: Maxim Vorobyov

Share

The Tikhomirov Residential Complex is one of the few projects at VIZ that implements the concept of a yard without cars. For cars there is a multi-level parking.

This round building with elements of constructivism is a parking lot. This decision made it possible to protect cars from unnecessary winds and snow, while maintaining the aesthetic appearance of the project

Photo: Maxim Vorobyov

Share

The walking area is also closed to outsiders. In summer, the yard is filled with greenery and lush hydrangeas. In winter, the view is not worse. There are walking paths, a workout complex and playgrounds for children of different ages. Toddlers have a sandpit under a canopy, a safe swing and a wall for drawing with crayons. For older children, their own spaces are organized.

Toddlers have a sandpit under a canopy, a safe swing and a wall for drawing with crayons. For older children, their own spaces are organized.

In summer the yard turns into a picturesque square

Photo: Maxim Vorobyov

Share

All playground equipment is made of natural wood and made in Europe

Photo: Maxim Vorobyov

designed for a large collection Share

where you can choose an apartment not only by the number of rooms, but also by the footage.You can choose a comfortable one-room apartment with a kitchen-living room

Scheme: SZ "Construction Formula"

Share

A summer lounge area can be arranged on a luxurious loggia

Scheme: SZ "Construction Formula"

Share

own room, and everyone can gather together in the kitchen-living room

Scheme: SZ "Construction Formula"

Share

A big plus of the residential complex "Tikhomirov" is that all apartments are handed over with a high-quality fine finish.

All that remains is to remove the protective film from the windows, install a kitchen set, screw in the light bulbs and make tea to admire the new apartment

Photo: Maksim Vorobyov

Share

Plumbing while finishing the apartment is in the film

Photo: Maxim Vorobyov

Share

Details about the project and current prices can be found on the website zhktihomirov.rf and in the sales office.