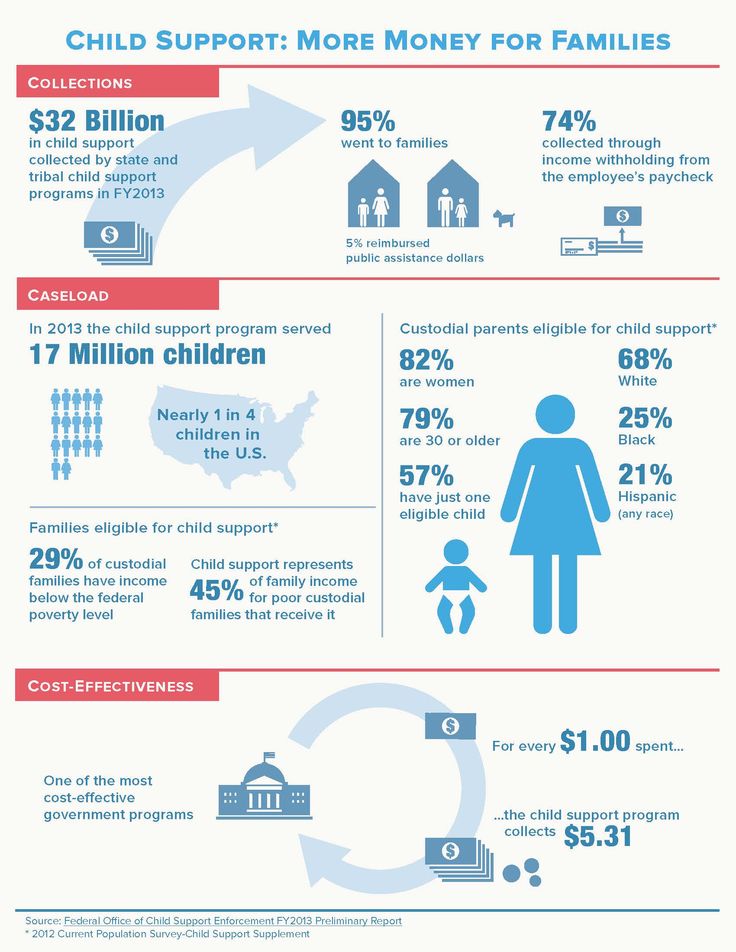

How does income withholding work for child support

Processing an Income Withholding Order or Notice

Topics:

- General Information

- Important Points to Remember

- Processing the Order/Notice

- Intergovernmental/Interstate IWOs

- Withholding Calculations

- Withholding Examples

- Pre-tax Deduction

- Value of Fringe/Non-cash Benefits

- Special Situations

- Multiple Income Withholding Orders - Same Employee and Same Child

- Multiple Income Withholding Orders - Same Employee and Different Children

- Not Enough Money to Withhold Full Ordered Amount

- IRS Tax Levy and Child Support

- Other Garnishments and Child Support

- Terminations of Employment

- Bankruptcy and Child Support

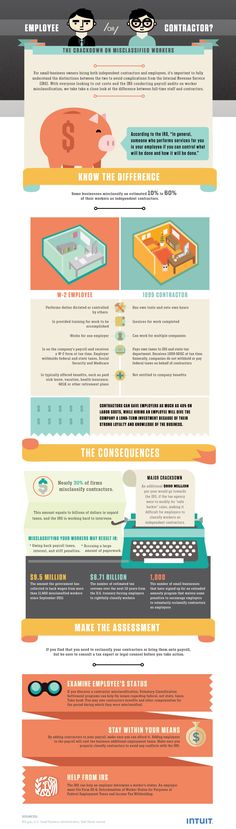

- Nonemployees/Independent Contractors

- Additional Information for Federal Agencies

- Withhold from Regular Pay and Benefits

- Regulations and Statutes for Income Allocation

- Questions

General Information

This information applies to you if you are:

- an employer - private or federal agency

- an income withholder who makes payments to non-employees or independent contractors

Income withholding is a deduction of a payment for child support from a parent’s income. This order can be from a court or administratively ordered by a child support agency.

Back to Top

Important Points to Remember

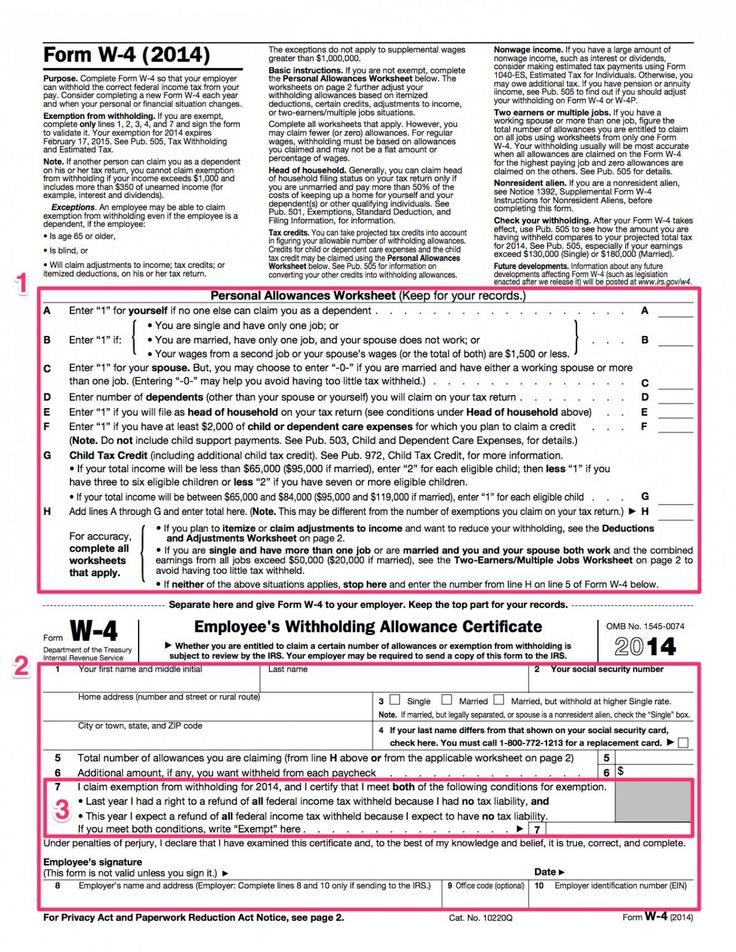

- As an employer or income withholder, you must honor an income withholding order for child support if the sender uses the Office of Management and Budget (OMB) form, Income Withholding for Support (IWO) (OMB-0970-0154) (PDF). The IWO Instructions (PDF) explain what each field means.

- You must withhold child support before all other garnishments, except an Internal Revenue Service (IRS) tax levy entered before the date the underlying child support order was established.

- You must withhold a higher percentage of the employee’s or obligor’s disposable income for child support than for other garnishments (see federal Consumer Credit Protection Act).

- You must withhold payments for each pay period, and in most cases, send them to the state disbursement unit (SDU). In private cases (not enforced by the child support agency) with a support order issued on or after January 1, 1994, you must also send payments to the SDU.

There are exceptions to this rule.

There are exceptions to this rule.

- You must withhold payments for each pay period, and in most cases, send them to the state disbursement unit (SDU). In private cases (not enforced by the child support agency) with a support order issued on or after January 1, 1994, you must also send payments to the SDU.

- Anyone may send an IWO, including state, tribal, and territorial child support agencies; courts; tribunals; attorneys; and individuals.

- An IWO is valid throughout the country, including U.S. territories.

- Notify the sender if the person is not an employee. If you are an income withholder, you may notify the sender but are not required to do so.

Back to Top

Processing the Order/Notice

When you receive the IWO order, you should:

Check out the Income Withholding for Support Flowchart

- Document the date received.

- Determine if the noncustodial parent (NCP) listed on the IWO is employed by your company.

- If the NCP is no longer or has never been employed by your company, you must notify the child support agency by completing and returning page 3, Notification of Termination or Employment Status, to the sender or by using electronic interfaces, such as e-IWO or the Employer Services applications on the federal Office of Child Support Enforcement’s Child Support Portal.

- If the NCP is an employee, see step 3.

- If the NCP is no longer or has never been employed by your company, you must notify the child support agency by completing and returning page 3, Notification of Termination or Employment Status, to the sender or by using electronic interfaces, such as e-IWO or the Employer Services applications on the federal Office of Child Support Enforcement’s Child Support Portal.

- Determine if the order is “regular on its face.” See the “Note” box on page 1 of the IWO form (PDF).

- The IWO Instructions (PDF) have additional information about when to return an order that is not regular on its face.

- If the IWO is not regular on its face, check the “Return to Sender” box and return it to the sender.

- Get a copy of the underlying child support order that allows income withholding if anyone other than a court or child support agency sends the IWO because the form is a notice and not an order. If the underlying child support order is not attached to the notice, return the IWO to the sender.

- Give a copy of the IWO to the employee if the IWO has been issued by another state or if the appropriate check box is checked.

- Most importantly, follow the terms of the order.

Only the NCP has the right to dispute the terms of a child support IWO and should contact the issuing agency or tribunal. As an employer or income withholder, you cannot contest an income withholding order; however, you must contact the issuing agency if you cannot implement the withholding because a withholding for current support is already in place for the child and NCP. For more information about multiple orders, see the Special Situations.

As an employer or income withholder, you cannot contest an income withholding order; however, you must contact the issuing agency if you cannot implement the withholding because a withholding for current support is already in place for the child and NCP. For more information about multiple orders, see the Special Situations.

Back to Top

Intergovernmental/Interstate IWOs

When processing the IWO, you must consider the laws of both the order-issuing state and the employee's work state, depending on the action or circumstance. See the chart below to determine which state law prevails.

| Follow the law of | When dealing with |

|---|---|

| the issuing state |

|

| the employee’s work state |

|

Back to Top

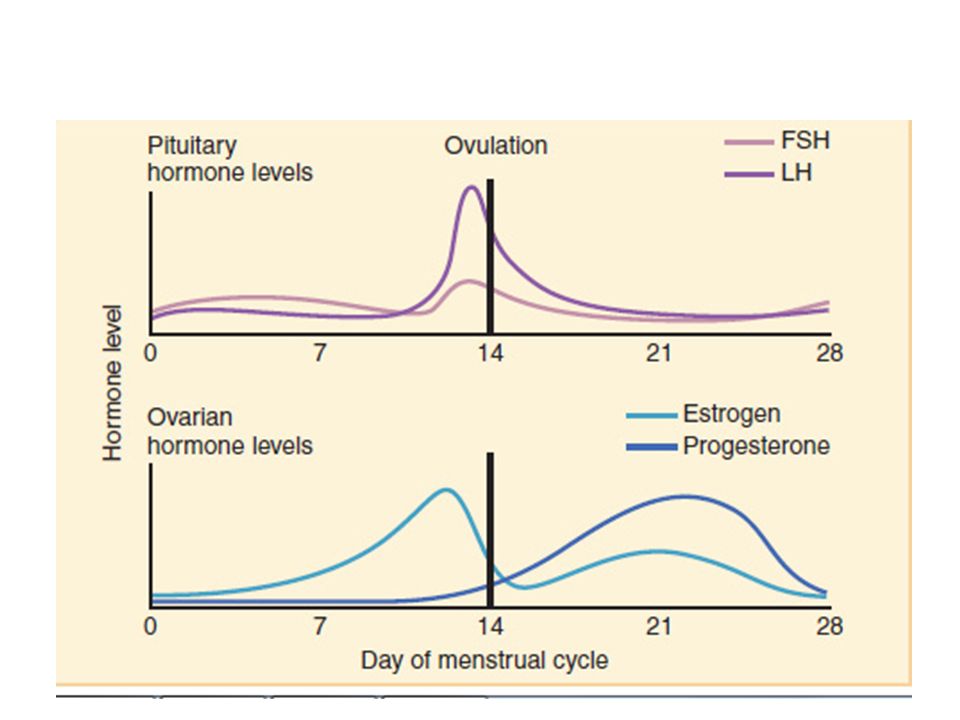

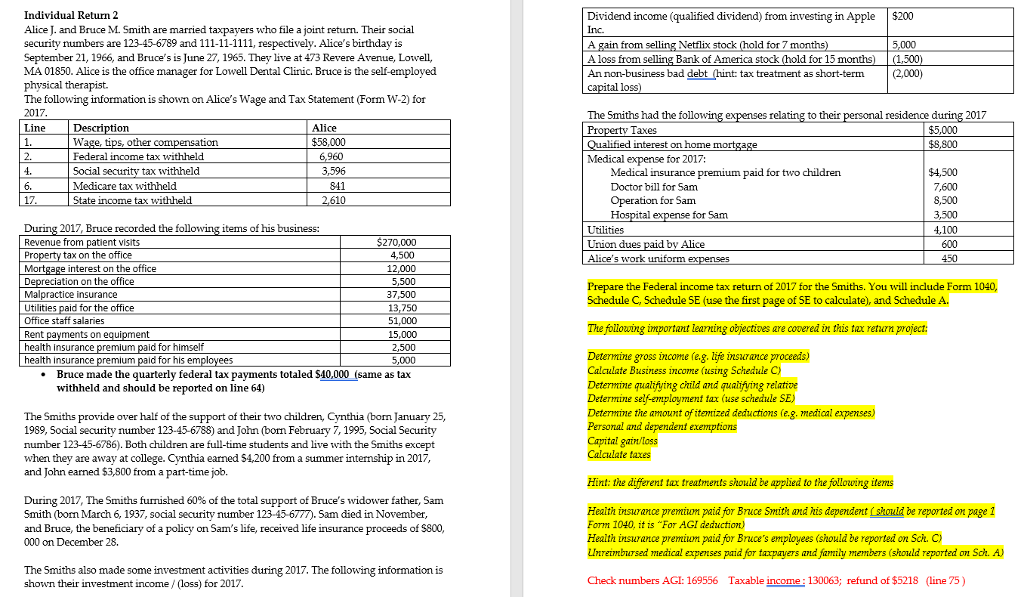

Withholding Calculations

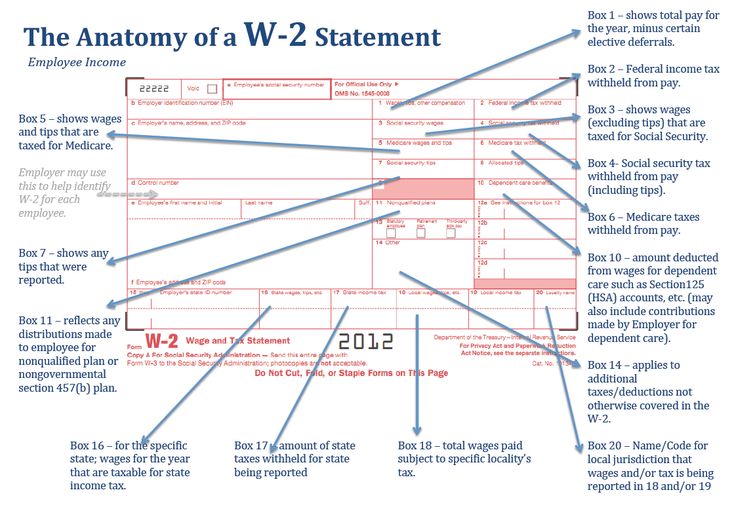

Income is any periodic form of payment due to an individual, regardless of source, including wages and salaries, commissions, bonuses, workers’ compensation, disability, payments pursuant to a pension or retirement program and interest.

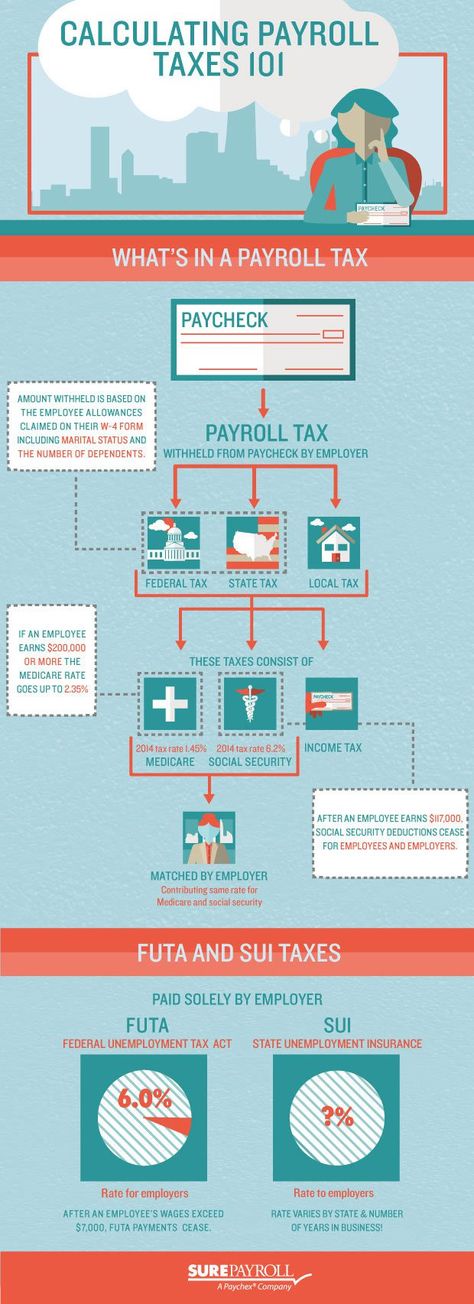

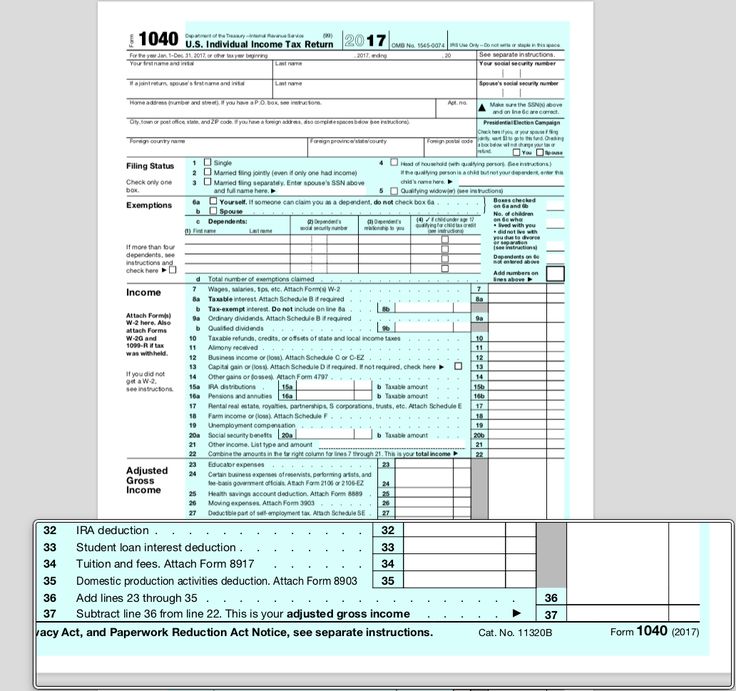

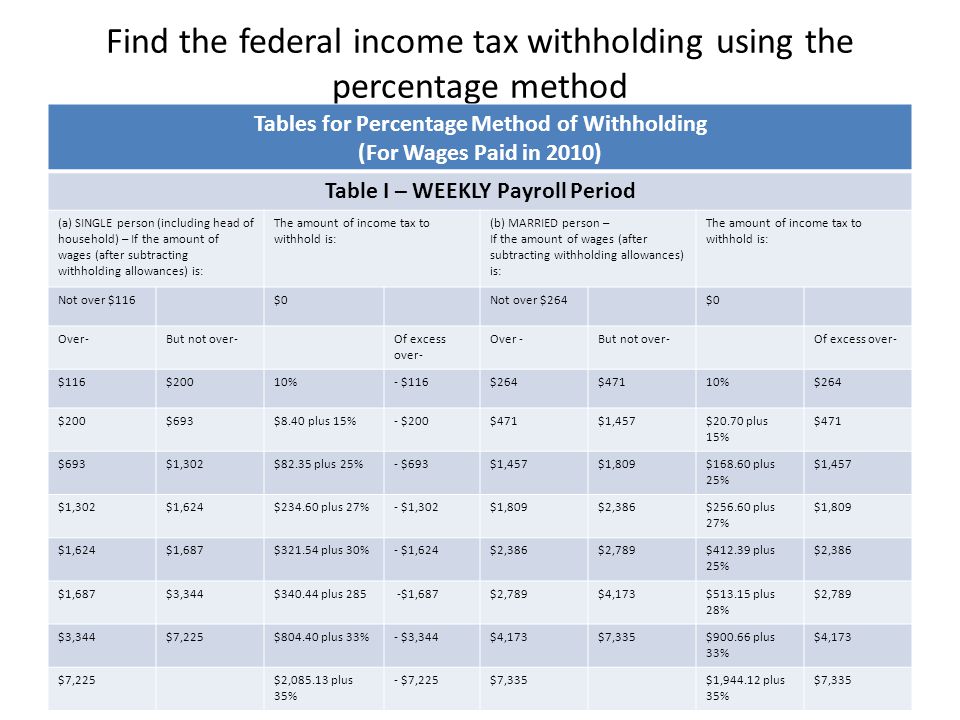

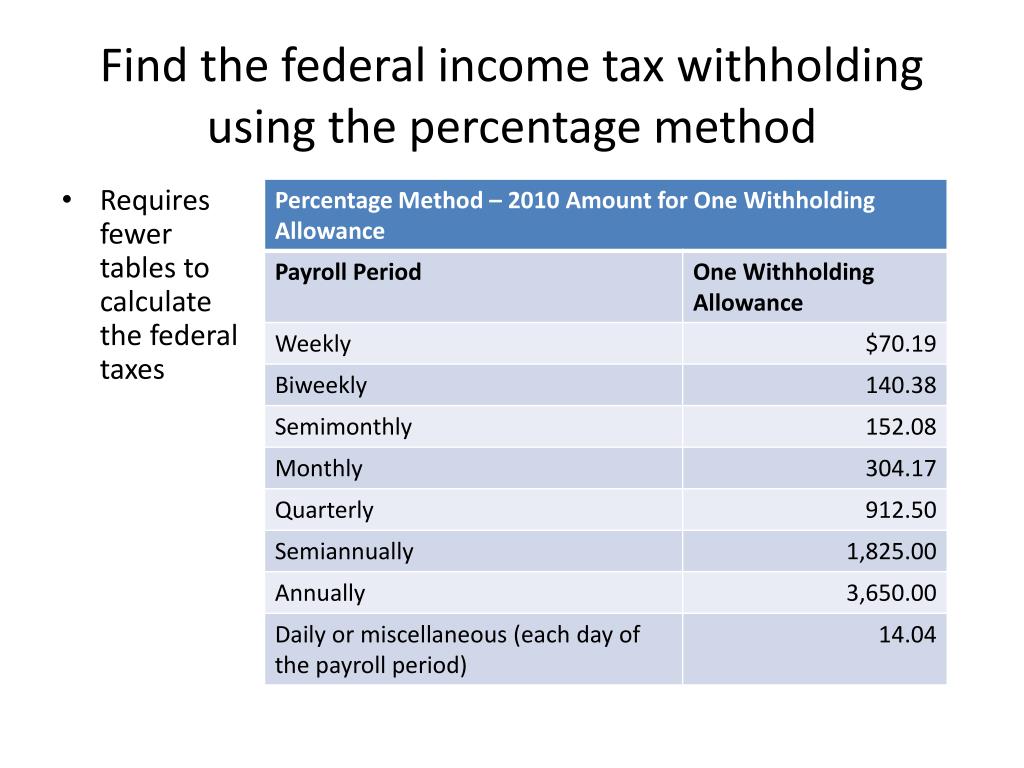

You must follow these steps to determine the maximum amount to withhold for child support from an employee’s or obligor’s income, if the payment is “earnings Visit disclaimer page (PDF)” as defined by the Consumer Credit Protection Act. Follow the information in Nonemployees/Independent Contractors, if you must withhold from your payment to an obligor who is not an employee.

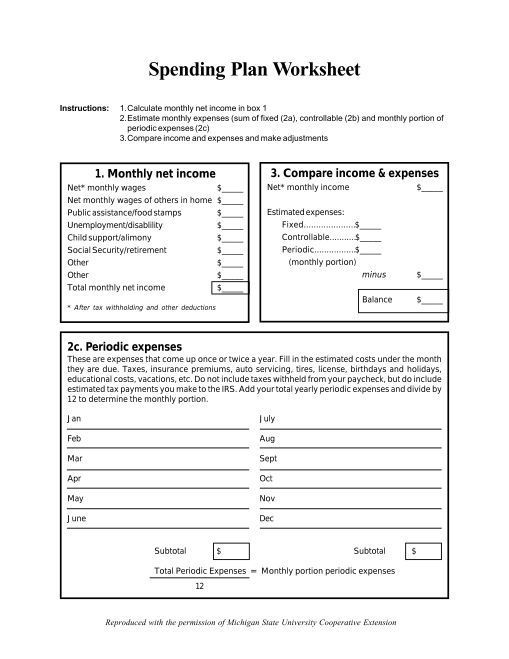

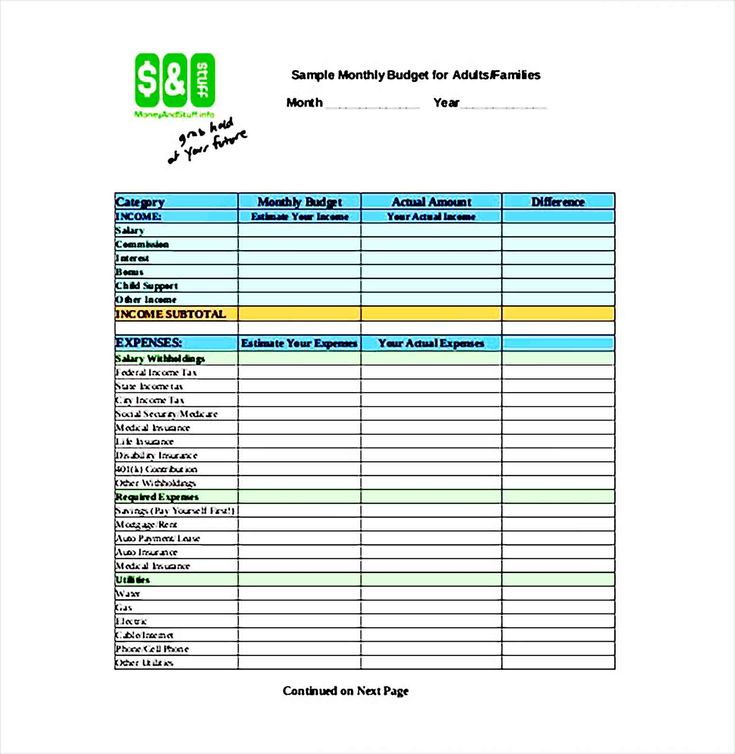

- Disposable income = gross pay - mandatory deductions.

- Disposable income is the amount that is left after subtracting mandatory deductions from gross pay.

- Mandatory deductions include federal, state, and local taxes; unemployment insurance; workers’ compensation insurance; state employee retirement deductions; and other deductions determined by state law. Health insurance premiums may be included in a state’s mandatory deductions; they are mandatory deductions for federal employees.

- Disposable income is not necessarily the same as net pay.

An employee may have a deduction taken from his or her pay that is not mandatory, such as union dues or a car loan payment.

An employee may have a deduction taken from his or her pay that is not mandatory, such as union dues or a car loan payment.

- Allowable disposable income = disposable income x CCPA % limit

- Allowable disposable income is the maximum available for child support withholding. Even if the withholding order specifies a higher payment, the allowable disposable income is the most you can withhold.

- The federal CCPA Visit disclaimer page (PDF) sets limits on withholding from an employee’s or obligor’s disposable income based on the current family situation and child support payment history. The CCPA protects an employee from having too much withheld. Some states have enacted laws that provide even more protection to the employee’s income.

- The withholding limits set by the federal CCPA are:

- 50 percent - Supports a second family with no arrearage or less than 12 weeks in arrears

- 55 percent - Supports a second family and more than 12 weeks in arrears

- 60 percent - Single with no arrearage or less than 12 weeks in arrears

- 65 percent - Single and more than 12 weeks in arrears

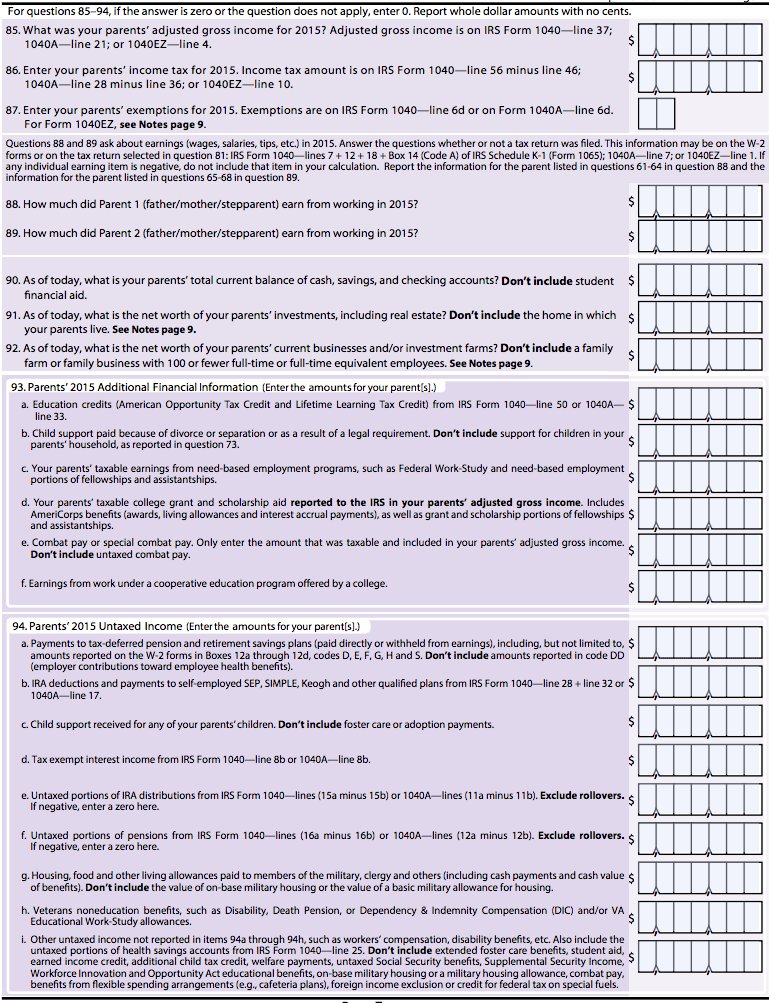

To decide how much to withhold, if then allowable disposable income ≥ ordered amount, withhold the ordered amount allowable disposable income < ordered amount, see Special Situations - Not Enough Money - Allowable disposable income is the maximum available for child support withholding. Even if the withholding order specifies a higher payment, the allowable disposable income is the most you can withhold.

Back to Top

Withholding Examples

- Weekly gross pay is $760

- Weekly child support due is $295

- Mandatory deductions total is $151

- Employee or obligor is single and does not owe back child support

The law of the state where the employee works, or the “principal place of employment,” determines which deductions are mandatory. In some states, the example below would change because deductions, such as health insurance and union dues are considered mandatory.

In some states, the example below would change because deductions, such as health insurance and union dues are considered mandatory.

Net pay and disposable income are not the same. The amount of disposable income, $609, is used to determine child support withholding limits, rather than the net pay, $469.

| Disposable Income | Net Pay | |

|---|---|---|

| Gross pay | $760.00 | $760.00 |

| Federal income tax | - 95.00 | - 95.00 |

| FICA | - 45.00 | - 45.00 |

| Medicare | - 11.00 | - 11.00 |

| Health insurance (pre-tax) | - 25.00 | |

| Union dues | - 10.00 | |

| Savings bonds | - 25.00 | |

| Union pension | - 30. 00 00 | |

| Credit union car loan | - 50.00 | |

| $609.00 | $469.00 |

- Gross pay - mandatory deductions = disposable income:

760 - $151 = $609 - Disposable income x CCPA % limit = allowable disposable income:

609 x 60% = $365.40- Note 60% is the applicable CCPA limit because the employee or obligor is not supporting a second family and does not owe any back child support. Allowable disposable income is the maximum available for child support withholding.

Allowable disposable income is $365.40.

- Note 60% is the applicable CCPA limit because the employee or obligor is not supporting a second family and does not owe any back child support. Allowable disposable income is the maximum available for child support withholding.

- $365.40 > $295.00, so the full $295 is withheld for child support

If you take the same example but increase the weekly child support payment to $400, you cannot withhold the full amount due. You may only withhold a maximum of $365.40. This means $34.60 will be overdue. The employee or obligor can pay this amount directly to the issuing agency to avoid increasing arrears.

Pre-Tax Deduction

Pre-tax deductions, such as 401(k) plan contributions, reduce taxable earnings for tax purposes, but they do not reduce disposable income for child support. Although the employee voluntarily elects to trade current disposable income for a future benefit, this income is still available for child support.

In calculating disposable income, pre-tax deductions must be added to the employee’s taxable wages before determining the obligated employee’s allowable disposable income.

| Gross pay | $1,000 |

| Deduct 401(k) contribution pre-tax deduction | - $100 |

| Taxable earnings | $900 |

| Deduct mandatory deductions | - $250 |

| Net pay | $650 |

| Add back pre-tax deduction | + $100 |

| Disposable income | $750 |

Value of Fringe/Noncash Benefits

The value of fringe benefits (such as a take-home vehicle, free parking space, or other noncash benefit) is taxable but is not considered “income” for the purpose of calculating disposable income.

To calculate disposable income, the value of fringe benefits is subtracted from the employee’s gross pay before determining the employee’s allowable disposable income.

| Gross pay | $1,000 |

| Add value of take-home vehicle | + $300 |

| Taxable earnings | $1,300 |

| Deduct mandatory deductions | - $350 |

| Net pay | $950 |

| Subtract value of take-home vehicle from net pay | - $300 |

| Disposable income | $650 |

Back to Top

Special Situations

Multiple Income Withholding Orders - Same Employee and Same Child

There can be only one withholding order for current support for a child, and duplicate orders must be resolved by the senders. Follow these steps if you receive a duplicate withholding order:

Follow these steps if you receive a duplicate withholding order:

- Continue to honor the first order received.

- Give a copy of the second order to your employee.

- Contact the agency, court, or party that sent the second withholding order to say that you are already sending current support payments for the same child to another jurisdiction. Provide payment information, such as the amount of the withholding and where the withholding is being sent.

- Contact the agency, court, or party that sent the first withholding order and inform them of the second order.

Multiple Income Withholding Orders - Same Employee and Different Children

You must withhold payments on each order for current support if there are multiple orders for the same employee or obligor. State laws define the method for allocating money toward current support for each order. Do not pay IWOs on a “first come, first served” basis.

Not Enough Money to Withhold Full Ordered Amount

If there is not enough allowable disposable income to pay the full amount on all orders, you must follow the allocation method of the employee’s work state or “principal state of employment” to determine how much to pay on each order.

Example:

- Order A current support owed: $90/month

- Arrears owed: $15/month

- Order B current support owed: $75/month

- Order C current support owed: $62/month

- Employee’s disposable income: $360/month

- Assume allowable disposable income: $180

Withholding:

- Total current support owed: $227/month

- Total arrears owed: $15/month

- The allowable disposable income ($180) is not enough to withhold the entire amount of current support due for these three orders ($227). You cannot withhold any money to pay the arrearage.

Allocation Methods:

States use one of two methods to allocate payments among multiple withholding orders: the proration method(used by 49 states/territories) or the equal method (used by 6 states/territories).

Proration Method:

Pro-rate by allocating a percentage to each order based on the total dollar amount of current support orders. Use the steps below:

Use the steps below:

- Add total current support due on all withholding orders.

- Divide each order’s current support due by the total of all orders to figure each order’s percentage of the total.

- Withhold the percentage of allowable disposable income for each order.

Order A $90.00 ÷ 227 = 39.65% Order B $75.00 ÷ 227 = 33.04% Order C $62.00 ÷ 227 = 27.31% Total $227.00 = 100.00% Allowable disposable income (maximum that may be withheld): $180

Order A $180 x 39.65% = $71.37 Order B $180 x 33.04% = $59.  47

47Order C $180 x 27.31% = $49.16 Total withheld $180.00

Equal Method:

Share equally by dividing the allowable disposable income by the total number of orders. Use the steps below:

- Allowable disposable income (maximum that may be withheld): $180

- Three orders for the same employee (Orders A, B, and C)

- 180 ÷ 3 = $60 paid to each order

Back to Top

IRS Tax Levy and Child Support

An IRS tax levy takes precedence over a child support withholding order only if the tax levy was entered before the child support order. Remember, the child support order is the underlying basis for the income withholding order.

Employers and income withholders do not usually know the date of the original order. We recommend the following actions:

- If you receive a child support IWO with an IRS tax levy in place, contact the issuing child support agency about this situation.

The child support agency can then contact the IRS to discuss an alternate payment plan.

The child support agency can then contact the IRS to discuss an alternate payment plan. - If you receive an IRS tax levy with a child support withholding order in place, contact the IRS and tell them a withholding order is already being honored. The IRS may then elect to contact the issuing child support agency.

- Contact the trustee if you have questions (if one has been appointed by the court).

An IRS tax levy is the only deduction that takes precedence over child support. Remember, child support should always be withheld before the following voluntary and involuntary deductions:

- Assignment of wages

- Nontax federal debt

- State and local taxes

- Creditor garnishments

Back to Top

Other Garnishments and Child Support

Guidelines:

A child support IWO must be paid before other garnishments. When you have a child support IWO and another garnishment for an employee or obligor, follow these steps:

- Deduct the child support withholding.

- Determine the lesser amount of:

- The difference between the weekly disposable income (before the child support withholding) and 30 times the federal minimum wage

[30 x $7.25 = $217.50]- If the income is paid biweekly, multiply the minimum wage times 60

[60 x $7.25 = $435] - If the biweekly disposable income is less than $435 or the weekly income is less than $217.50, no withholding for garnishment may be made.

- If the income is paid biweekly, multiply the minimum wage times 60

- 25% of the weekly disposable income.

- The difference between the weekly disposable income (before the child support withholding) and 30 times the federal minimum wage

- For the garnishment, you may withhold the amount remaining after the child support deduction up to the lesser amount of a) or b) figured above.

Example A: Tony’s child support withholding obligation is $180.00/week. His weekly disposable income is $700. Sears serves a garnishment against Tony for a $1,000 debt.

- Deduct $180 for child support from Tony’s $700 pay (Tony is single and is not in arrears, so up to 60%, or $420, may be withheld for child support.

)

) - Determine the lesser of:

- Disposable income minus 30 times minimum wage:

$700 - $217.50 = $428.50 - 25% of disposable income: 25% x $700 = $175

$175 is the lesser of these two amounts.

- Disposable income minus 30 times minimum wage:

- Difference between allowed amount for garnishment and the child support deduction taken:

$175 - $180 = -$5

The child support deduction of $180 has already exceeded the allowed amount for garnishment, so you cannot withhold for Tony’s Sears garnishment.

Example B: Tony’s child support withholding obligation is $140/week. His weekly disposable income is $1,000. Sears serves a garnishment against Tony for a $1,000 debt.

- Deduct $140 for child support from Tony’s $1,000 pay (Tony is single and is not in arrears, so up to 60%, or $600, may be withheld for child support)

- Determine the lesser of:

- Disposable income minus 30 times minimum wage:

$1000 - $217.50 = $752.50 - 25% of disposable income:

25% x $1000 = $250$250 is the lesser of these two amounts

- Disposable income minus 30 times minimum wage:

- Difference between allowed amount for garnishment and the child support deduction taken:

$250 - $140 = $110

You can withhold $110 for Tony’s Sears garnishment.

Back to Top

Terminations of Employment

If you are an employer and you receive an IWO for a person who is terminated or was never employed, you must report the termination by fax, mail, or online. Notify the sender by:

- Faxing or mailing the completed Notification of Employment Termination or Income Status section of the IWO to the sender

- Electronically using either e-IWO or Electronic Terminations, also called eTerm

If you are an income withholder, you may report voluntarily using the same methods described above.

Back to Top

Bankruptcy and Child Support

Even if an employee or obligor declares bankruptcy, he must still pay child support. Debts due for delinquent child support are not dischargeable in bankruptcy actions. If you receive a bankruptcy order, you should notify the child support agency or sender, the trustee if one is appointed, and the bankruptcy court that a child support IWO is in force. Always follow the payment instructions from the trustee and bankruptcy court.

If you receive notice about a bankruptcy filing for an employee, you should continue withholding amounts for domestic support obligations. A “domestic support obligation” is defined as a debt or an amount that is in the nature of alimony, maintenance or child support, even if not called that. Arrears are included in this definition.

A domestic support obligation includes amounts that are owed to a:

- Spouse

- Former spouse

- Child

- Parent of a child

- Legal guardian of a child

- Responsible relative of a child

- Governmental unit

If there is any doubt about whether a withholding order is a domestic support obligation, please contact the agency, court, or entity that issued the withholding order or the trustee.

You may be notified that you are no longer responsible for withholding the payments because a trustee of the bankruptcy court has taken over this task. Continue withholding until you receive official notification from the agency or bankruptcy court.

Back to Top

Nonemployees/Independent Contractors

If you receive an IWO for a nonemployee, and you make payments to that person, you must withhold child support from those payments. Because they are not employees, CCPA protections do not apply. You can find state-specific limits for nonemployees on the Income Withholding Requirements matrix.

Back to Top

Additional Information for Federal Agencies

Withhold From Regular Pay and Benefits

Child support is withheld from an employee’s regular pay, but it may also be withheld from income other than a paycheck. For federal employees, the benefits from which child support may be deducted are below.

Per Office of Personnel Management (OPM) regulations (5 CFR 581), cash awards, including performance-based cash awards, are considered income, as is any payment for accrued leave.

- Periodic benefits

- Pensions

- Retirement benefits

- Retired/retainer pay

- Annuities

- Dependents or survivors’ benefits when payable to the obligor

- Refunds of retirement contributions where an application has been filed

- Amounts received under any federal program for compensation for work injuries

- Benefits received under the Longshoremen’s and Harbor Workers’ Compensation Act

- Compensation for death under any federal program, including death gratuities

- Benefits from the Social Security Administration (but not Supplemental Security Income benefits), Veterans Affairs (any part of the Veterans Affairs payment that is in lieu of waived retired pay or waived retainer pay), Railroad Retirement Board, and Black Lung.

For more details, please refer to the OPM regulations Visit disclaimer page on processing garnishment orders for child support or alimony in Title 5 of the Code of Federal Regulations.

Regulations and Statutes for Income Allocation

Regulations and statutes on income allocation for federal agencies are helpful if needed by legal staff.

Back to Top

Questions

For questions about information of this resource, see our FAQs or contact the Employer Services Team at [email protected].

For case-specific questions, contact the state or tribal child support agency or the sender of the IWO.

What Does Income Withholding Order Mean?

In 2018, there were about 12.9 million custodial parents in the United States. Of those custodial parents, 49.4% had legal or informal child support agreements. As an employer, you might hire an employee at some point who has a child support agreement. If that happens, you might receive an income withholding order. If you do receive an order, you need to know what an income withholding order is and what to do with it. So, what does an income withholding order mean?

If you do receive an order, you need to know what an income withholding order is and what to do with it. So, what does an income withholding order mean?

What is an income withholding order?

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee’s wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

If the IWO is on an official Income Withholding for Support form, you must honor the requested withholding.

What does income withholding order mean for employers?

If you receive a wage withholding order for one of you employees, you must verify that the IWO is valid and contains all necessary information. After you verify the IWO, you must implement it and begin wage withholding.

Verifying and enacting the IWO

When you receive an IWO, follow these steps:

- Document the date you receive the IWO.

- Determine if the noncustodial parent works for you.

If the noncustodial parent doesn’t work for you, complete the fourth page of the order (Notification of Employment Termination or Income Status) and return it to the sender. Otherwise, move on to the next step.

If the noncustodial parent doesn’t work for you, complete the fourth page of the order (Notification of Employment Termination or Income Status) and return it to the sender. Otherwise, move on to the next step. - Make sure the IWO is “regular on its face.” If the order is not regular, return it to the sender.

- The IWO is irregular if it doesn’t include all the information needed for withholding or it instructs you to send the payment somewhere other than the state disbursement unit. For more examples of things that make an IWO irregular, read the IWO Instructions.

- If someone other than a court or child support agency sends the IWO to you, the IWO is considered a notice and not an order. If the underlying order is not attached, you should return the IWO to the sender.

- Give a copy of the IWO to your employee if the IWO was issued by another state or if the appropriate box is checked on the form.

- Finally, follow the terms of withholding and remittance on the IWO.

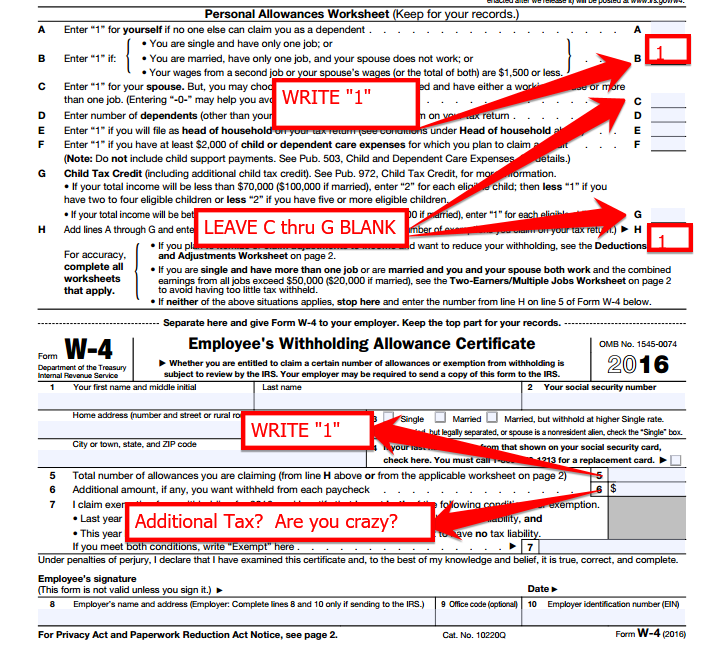

Withholding child support

You must begin child support withholding by the first pay period that begins 14 working days after the IWO was mailed. Some states require you to start withholding sooner. You must withhold child support until you are told otherwise.

You will use the amounts and percentages given on the income withholding order to calculate how much child support to withhold from the employee’s wages.

Once you withhold child support, you must submit the payment to the state disbursement unit within seven business days of the date you paid wages to the employee. Some states have laws that set a shorter time for submitting the payment.

You can charge the employee an administrative fee for processing the child support withholding. If you choose to do this, you will also withhold it from the employee’s wages. The maximum fee you can charge is set by your state. Also, the fee plus the child support withholding cannot be more than the maximum allowable child support withholding. This means you might withhold less child support to accommodate the fee. The employee would then owe arrearages for the unpaid child support.

This means you might withhold less child support to accommodate the fee. The employee would then owe arrearages for the unpaid child support.

If the employee complains about the withholding or says the order is incorrect, do not stop withholding. Tell your employee to contact the agency or court that issued the order. If the IWO does need to be corrected, the agency or court will send you a new IWO. Once you receive the new IWO, follow the instructions on that document.

You must withhold child support each pay period. If you do not withhold and submit an employee’s child support, you will face a penalty determined by your state, and your business will be responsible for the missing child support withholding.

Patriot Payroll is so easy, you may (gasp) enjoy doing it!

- Easy 3-step process

- Free and friendly USA-based support

- Accurate calculations

Learn More About Patriot Payroll

What if there are multiple withholding orders?

You can receive multiple IWOs for one employee. What you do with the IWOs depends on if they are for the same child or for different children.

What you do with the IWOs depends on if they are for the same child or for different children.

If the IWO is for a different child, you will withhold payments for each order. State laws determine how you withhold the payments.

There can only be one IWO per child. If the IWO is for the same child, follow these steps:

- Continue withholding based on the first IWO received.

- Give the employee a copy of the second IWO.

- Contact the agency, court, or party that sent the second IWO. Tell them that you are already sending payments for the child. Let them know how much you are withholding and where you are sending the money.

- Contact the agency, court, or party that sent the first IWO. Tell them that you received a second IWO for the child.

What if the noncustodial parent doesn’t work for you?

If you receive an IWO and the noncustodial parent does not work for you, you must notify the sender. Complete the fourth page of the IWO (Notification of Employment Termination or Income Status) and return it to the sender.

If an employee is terminated, you must also send notification by using the Notification of Employment Termination or Income Status section of the IWO. The deadline to report a terminated employee is determined by your state.

IWO don’ts

If you receive an income withholding order, there are some things you absolutely cannot do.

You cannot contest the IWO. As the employer, you simply must honor the IWO. Only the employee can contest an IWO.

You cannot fire an employee because you receive an IWO regarding their wages.

Patriot Software’s online payroll software makes calculating deductions easy. You only need to enter the deduction information once, and we’ll do the calculations for every paycheck. You just need to submit the child support withholding to the correct agency. Try out the software for free!

This article has been updated from its original publication date of February 20, 2017.

This is not intended as legal advice; for more information, please click here.

How alimony is withheld from wages in 2022: the procedure for withholding

Any father who leaves his family is obliged to financially help his minor children.

And for this, the legislation provides for mandatory payments - alimony, which the father of the child must regularly pay him.

How are alimony deducted from wages, in what amount?

What documents are needed to apply for this mandatory assistance?

What regulatory document governs the process of withholding alimony?

Issues regarding the payment of alimony are regulated by several regulations:

- Family Code, Chapter 13 . It describes the maintenance obligations of parents to children. This is general information, but it is the basis on which other legislative acts are based.

- Federal Law No. 229 with new retention rules dated December 5, 2017 “On Enforcement Proceedings” .

Chapter 11 of this law describes the procedure for collecting alimony, the amount of deductions from wages, etc.

Chapter 11 of this law describes the procedure for collecting alimony, the amount of deductions from wages, etc. - Government Decree No. 841 as amended on 04/09/2015. This document lists the types of income, salary, from which child support deductions are made.

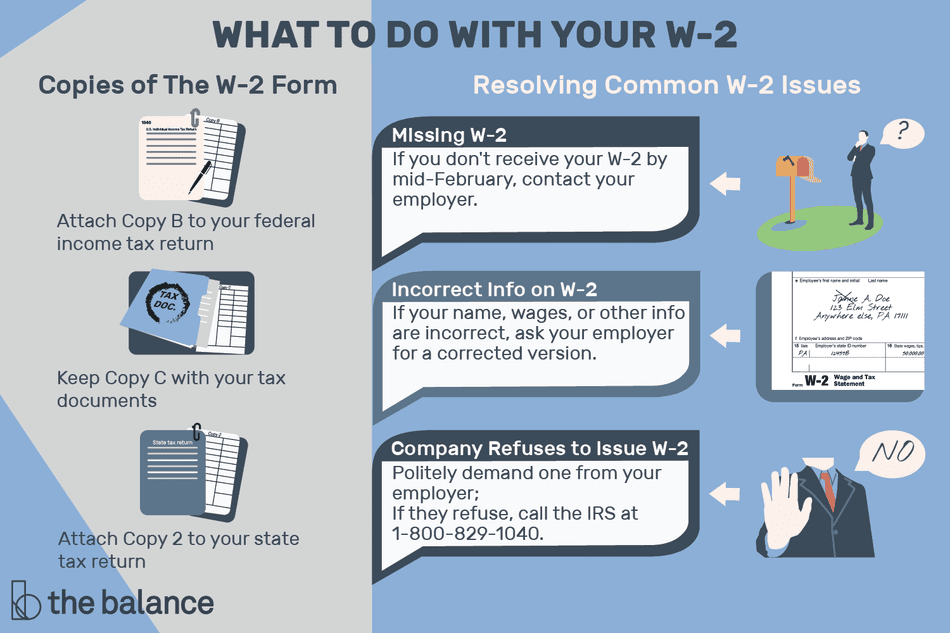

What documents are needed to withhold child support from wages?

The procedure for withholding a monetary recovery begins with the fact that a document arrives at the address of the enterprise where the alimony payer works.

This can be a writ of execution (a court order) or a voluntary agreement certified by a notary. Only on the basis of these documents, an accounting employee has the right to start the procedure for withholding payments from the employee's salary.

In this case, no order from the director of the enterprise or application of the employee is required. Payments begin to be collected immediately, as soon as one of the above documents enters the accounting department.

Procedure for withholding alimony from wages

When the document (writ of execution or voluntary agreement) is presented to the accountant of the enterprise, he must:

- Within 3 days after the salary is calculated, withhold alimony from the employee, in accordance with Art. 109 of the Family Code of the Russian Federation.

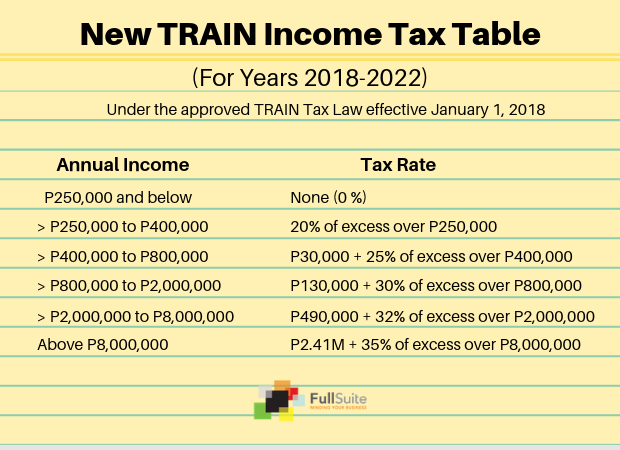

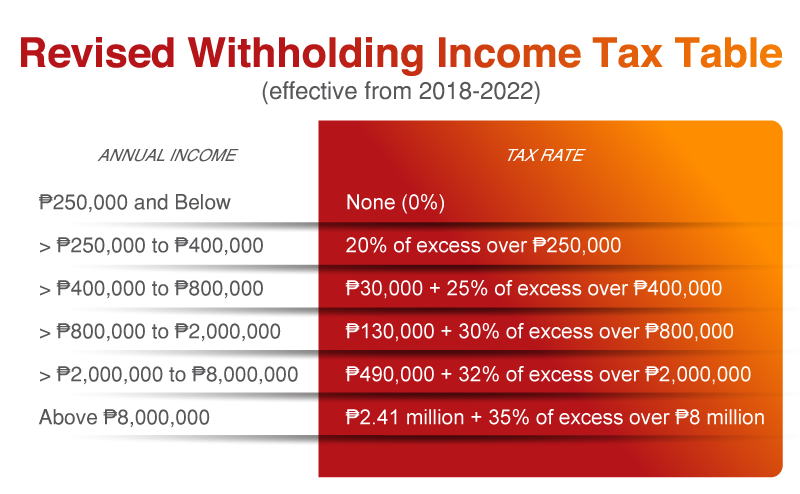

- Withhold child support from the employee in the amount of not more than 50% of the employee's salary , even if there are several executive documents. In some cases (death of the breadwinner, compensation for harm to health, compensation for damage in connection with the crime), according to paragraph 3 of Art. 99 of the Federal Law No. 229, the amount of deduction can be up to 70% of the employee's salary. Withholding maintenance for 1 child is 25% of the salary, for two children - 33%, for 3 children and more - 50%.

- Clean up child support from the amount left after taxes.

- Calculate alimony strictly in the form specified in the agreement or writ of execution (% of salary, fixed amount).

- Make payments monthly (on a writ of execution) or in the manner specified in the agreement of the parties (quarterly, annually, etc.).

- Index child support if funds are accrued in a fixed amount.

If the accountant of an enterprise evades the procedure for calculating alimony, makes mistakes regarding the percentage of alimony, and others, then both he and the director of the enterprise in this case are liable before the law (administrative, criminal).

A notarized alimony agreement can be transferred to the accounting department of the enterprise where the alimony payer works, by the employee himself, the recoverer of funds or the bailiff.

Application for voluntary support deduction: what does the law say?

Art. 109 No. 223 of the Russian Federation of the Family Code of the Russian Federation, as amended. dated December 29, 2017, the administration of the enterprise where the alimony payer works has the right to withhold alimony only on the basis of a written agreement, a writ of execution.

At the same time, nothing is said in the application for withholding alimony from wages.

This means that on the basis of a voluntary application, the company's accountant should not charge alimony.

Innovations

Law no. 229 was amended in 2017. According to him, if earlier an accountant could withhold alimony, only having the original document of execution in his hands, now a certified copy is also acceptable.

Each sheet of the document must be numbered and the pages stapled. On the reverse side of the last sheet of the writ of execution, the bailiff must put a note that a copy of the document was taken from the original. Be sure to mark “Correct”, indicate your position, sign, date, seal of the bailiffs department.

According to the law, the original writ of execution must be kept by the recipient of alimony . With the original, the recipient of the penalties also has the right to contact the organization where the alimony payer works.

After the original is transferred to the accounting department, the document will be stored there until the alimony is no longer withheld from the alimony payer, he resigns, or the exactor withdraws the application for withholding alimony, or the accounting department receives a decision from the bailiff to terminate enforcement proceedings.

Please note that under the old law, the only reason for returning a writ of execution was the dismissal of an employee.

Also, the new law establishes the deadline for the return of the writ of execution - no later than 1 business day from the date of receipt of the legal basis for the return of the document.

From what income can and cannot child support be withheld?

Monetary penalties can be withheld from wages at the main or additional place of work, from the fees of cultural workers, art workers, the media, allowances for skill, length of service, payments for special working conditions, bonuses and remuneration, payments for overtime work, sick leave.

Alimony cannot be deducted from maternity benefits, travel allowances, disaster relief, marriage, childbirth, funerals, or compensation when an employee is transferred to another location.

Procedure for withholding alimony under a writ of execution

According to Federal Law No. 229 Art. 9, the person providing the writ of execution must also submit his application to the accounting department (if a bailiff submits a court decision, the employee is called and writes a statement).

In the application, he does not write that he asks to recover money from the payer for the payment of alimony. In this document, he indicates the bank details of the recipient of alimony or the address to which funds must be transferred by postal order.

Also, the application must indicate the full name, passport details of the alimony payer, his TIN, as well as the legal address of the enterprise where the person works.

Upon receipt of a writ of execution, the accountant responsible for the payment of alimony must register the document in a special journal, fill out and send the spine to the bailiff, and familiarize the employee against receipt with the contents of the writ of execution.

The court order must be kept in the accounting safe, as it is a strictly accountable document.

The amount of alimony is calculated after personal income tax (income tax) has been deducted from the total amount (dirty salary).

Registration and receipt of alimony certificate

Alimony certificate is often requested by the social protection authorities after a woman who raises children on her own has submitted a corresponding application with a request to receive any state assistance - subsidies, benefits, benefits.

With this certificate in hand, government agencies calculate the total family income to determine the average monthly income per 1 family member.

You can get a certificate of deduction of alimony and their amount at the enterprise where the alimony payer works. To do this, the recipient of alimony (his representative) must apply to the accounting department of the enterprise with a corresponding request.

If the ex-husband works for a private entrepreneur, then he or his ex-wife has the right to take a certificate of 2 personal income tax.

The certificate of receipt of alimony should contain the following information: full name of the alimony payer, how much money was accrued, how much personal income tax was taken, how much alimony is paid monthly (by date). Also, at the end, the average monthly earnings of the employee should be indicated.

The certificate must be supported by the signatures of the director and chief accountant, the document must bear the seal of the organization.

Maintenance withholding maintenance

If an employee's salary increases, this should have a positive effect on the amount of alimony. If the accountant of the enterprise does not make changes, then he faces an administrative penalty.

The bailiff systematically controls the execution of a court order for the payment of alimony.

If the recipient of the alimony asks the bailiff to check the correctness and timeliness of the deductions, then he must do so.

In other cases, the bailiff conducts an inspection once a quarter.

Withholding alimony from wages in 2022 occurs only upon presentation to the organization where the alimony payer works, a writ of execution or a voluntary agreement.

An employee's application for the recovery of alimony is not the basis for withholding penalties.

Salary maintenance can be calculated either as a fixed sum of money or as a percentage. Alimony is withheld only after personal income tax is withheld.

Video: How to withhold child support from an employee's salary?

- previous entry What percentage of the salary goes to alimony?

- Next entry Where to apply and file for alimony?

Free legal advice online - ask a question in the legal social network 9111.

ru

ru 9111.ru - this is an online legal consultation, working 24 hours a day:

Here you can get qualified legal assistance around the clock and free of charge from 45934 lawyers and lawyers - both by phone and in text chat. From anywhere in the world, you can ask a question to lawyers and get help in solving problems in any area - from automotive to financial law.

On the site of the legal social network 9111.ru there are sections with publications of lawyers and users, a catalog of reviews about companies, products and services. After registration, you can publish your materials, add reviews, correspond with other project participants and subscribe to interesting lawyers and users.

How can I get legal advice?

Several methods are available, choose the most convenient for you:

-

Free legal advice by phone

Calls from landlines and mobile phones in Russia are free. Registration is not required, just call the multi-channel hotline 8(800)505-9111. Calls are accepted around the clock.

Calls are accepted around the clock. -

Online chat with a lawyer

From rating of lawyers choose a specialist from your city who provides a service for your problem, go to his profile and contact him through personal messages on the website or in the messenger. When choosing a lawyer, be guided by his rating and customer reviews. -

Written legal advice

Go to a special page where you can ask a lawyer a question online and be as specific as possible about your question. When writing a question, try to formulate it clearly and reliably - this will help you get a faster and more complete answer from one or more lawyers.

After receiving a response, do not forget to rate it - since the site's lawyers answer for free, customer reviews are important to them. Notifications of lawyers' answers are sent to the email address specified during registration on our social network.

-

Legal advice

Some legal issues may not be resolved within the site - for example, here you can get advice from a criminal lawyer.

Choose from 344 online services from the catalog of lawyers and lawyers in your city, first agree with a lawyer on the timing and cost and make an appointment at the phone number indicated by the lawyer in the questionnaire. -

Self-answer

Available on the site as publications of lawyers and users, and the archive 13 984 549 questions with answers received by lawyers over the 22 years of the existence of our online consultation site. Use the search form in the header of the site to find the answer to your question or an article by a lawyer, describing what steps you need to take to resolve your issue.

What does registration on 9111.ru give?

Lawyers, lawyers and law firms : placement of the questionnaire in the legal rating. Any specialist with a legal education can register in the directory. To participate in the work of the Legal Social Network 9111.ru must be passed registration procedure by filling in all the required fields of the questionnaire.