How do i pay child support

Electronic Payments | Office of the Attorney General

Child support payments can be made electronically online, over the phone, or at a kiosk. Here’s how it works.

When making an electronic payment, you will need the following information to complete your transaction:

- First and last name

- Social Security Number

- Address (first-time registration only)

- 10-digit case number and/or cause number

- Valid email address

Your cause number is the identification number found in your child support documents and/or the court order which established your child support amount.

Online Payment Options

You can make child support payments online through a secure online system called Smart e-Pay.

To pay online, visit tx.smartchildsupport.com.

New e-Payment Options Are Now Available!

To begin using these new options, click here to login to your payment account.

To pay by phone, call (855) 853-8286.

Smart e-Pay Fees

A convenience fee will be applied to payments made via Smart e-Pay both online and over the phone. For payments between $1.00 and $9,999.99, the fee is 2.55% of the total payment amount. All fees are subject to change.

Smart e-Pay Processing Times

When making a payment through Smart e-Pay, allow seven business days for the payment to post to your child support case.

Paying Via Moneygram

You can make child support payments with a credit or debit card through the secure MoneyGram website. To make a payment using MoneyGram, you will need the Child Support Division 10-digit case number and cause number.

Use Receive Code 14681.

To pay online, visit MoneyGram.

MoneyGram Fees

The below convenience fees will be applied to credit and debit card payments made via MoneyGram. All fees are subject to change.

| Payment Amount | Fee |

|---|---|

| $0.01 -$100.00 | $7.99 |

| $10.01 -$200.00 | $9.99 |

| $200.01 - $300.00 | $11.99 |

| $300.01 - $400.00 | $13.99 |

| $400.01 - $500.00 | $16.99 |

| $500.01 - $600.00 | $17.99 |

| $600.01 - $1800.00 | 2.7% |

| $1800.01 - $2500 | 2.6% |

*MoneyGram payment limit is $2500.00

MoneyGram Processing Times

When making a credit or debit card payment through MoneyGram, allow three business days for the payment to post to your child support case.

Paying Using a Kiosk

You can also make a child support payment at your local kiosk, click here to find one near you.

Touchpay Kiosk Locations

Other Child Support Payment Resources

How to Pay Child Support

Child Support Calculator

Having a Hard Time Paying Child Support?

If you are struggling to make your child support payments, you may be eligible for a modification.

Modify Child Support

Paying Child Support | DSHS

Please note:

Division of Child Support lobbies are now reopened. To provide a safe environment for customers and staff, we require everyone to self-screen against COVID-like symptoms, sign in on a log sheet, and practice social distancing. Wearing a mask is now optional for customers. Payments in Child Support offices have been suspended. We are always happy to help you by phone at 800-442-KIDS (5437).

Thank you for your patience as we continue to respond to the COVID-19 pandemic.

Most child support is paid by withholding wages, however there are also several other options for making payments.

Washington State Support Registry

PO Box 45868

Olympia, WA 98504-5868

Other ways to pay

The Division of Child Support (DCS) works with outside vendors to provide many ways to make a child support payment. The vendors below are private companies that have gone through a careful selection process and have met strict security requirements to contract with us. However, they may have different privacy or security policies than DCS. If you have concerns about those policies you should read the vendor's website or contact them for more information. As private companies, each of these vendors charge a fee for their service. Once we receive a payment from a vendor and match it to your account, we give you credit. These payments can take three to five days to process.

Pay with cash

PayNearMe

*Please have your social security number and your Division of Child Support (DCS) case number. In some instances, payers without a social security number may use this service; however the payer's full name, address, year of birth and DCS account number will still be required. If you have questions about how to make a payment without a social security number, please call the Division of Child Support at 800-468-7422.

Pay with credit or debit

ChildSupportBillPay

Phone Number for interactive voice response line 844-272-9468

Phone Number for call center 888-877-0450.

Use entity code 100499 when prompted to do so.

*Please have your social security number and your child support account number ready.

LexisNexis

Phone Number for interactive voice response line 866-229-0161.

Phone Number for call center 888-215-5925.

*Please have your social security number and your child support account number ready.

MyPaymentPortal.com

*Please have your social security number and your child support account number ready.

TouchPay

Phone Number: 877-778-7540

- Pay To: WA DCS

- Code City: WA DCS

- State: WA

*Please have your social security number and your child support account number ready.

How to pay child support

I am divorced, my ex-wife and I have three children. I want to open an account for them and transfer alimony there so that the children can use this money in the future. Can I not transfer alimony to my ex-wife?

Elizaveta Vasilyeva

lawyer

Author profile

Alimony can be transferred to the children's account if you agree on this with your ex-wife and formalize the agreement. I'll tell you how to do it.

I'll tell you how to do it.

How to get child support

Parents are required to support their minor children. They can determine the order and form of the content themselves and conclude an agreement. If you cannot reach an agreement, you will have to go to court.

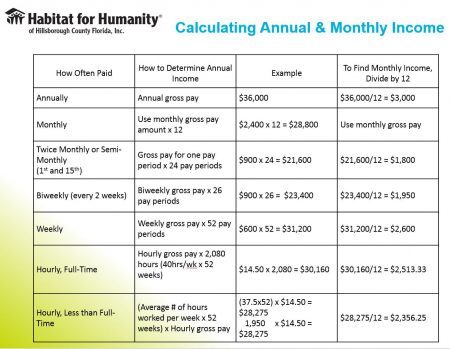

By law, a father or mother must give one quarter of their income to one child, and one third to two children. If there are three or more children, half of the income will have to be shared. A parent without a permanent income is assigned a fixed amount of alimony per month - Tinkoff Magazine talked about this in more detail in another article.

Clause 1 Art. 81 SK RF

If the financial or marital status of one of the parties has changed, the court may change the amount of alimony and even completely release the parent from payments.

Clause 1 of Art. 119 SK RF

When there are no disagreements, you can do without a court. In this case, they conclude a written agreement in an arbitrary form and certify it with a notary. This document has the force of a writ of execution. That is, if one of the parents stops paying child support, the bailiff will forcibly oblige to comply with the terms of the agreement.

This document has the force of a writ of execution. That is, if one of the parents stops paying child support, the bailiff will forcibly oblige to comply with the terms of the agreement.

The document can be changed or terminated at any time by mutual agreement. All changes must also be recorded in writing and certified by a notary. It is impossible to refuse the agreement or change its terms unilaterally.

/divorce-deti/

"The child must not be separated from the mother": 10 questions for a lawyer about the rights of parents in a divorce

When concluding an agreement, the parents themselves determine the amount of alimony. But in any case, this amount should not be less than the amount of alimony that they could receive in court.

item 2 art. 103 SK RF

How to transfer child support to the account of children

Usually, alimony goes to the account of the parent with whom the child lives. One of the former spouses must spend this money on the maintenance, upbringing and education of children.

Parents can prescribe in the agreement that the alimony will be transferred to the child's current account. To do this, the document must indicate the account number and the amount to be paid.

/prava/soderzhite-detei/

Rights when paying child support

The agreement must be registered with a notary, otherwise the money sent will be considered a gift. The amount that the father or mother will transfer to the child may be more than the alimony required by law - there are no restrictions unless the parties have agreed on this.

The bank account must be opened in the name of the minor. Parents will not be able to manage the child's money and withdraw it at will. The exception is emergency cases, for example, an illness of a child. In such a situation, you need to contact the guardianship authorities and get permission, otherwise the bank will not allow you to withdraw money. Also, guardianship officials will ask parents to report on expenses.

What to do if the other parent vs.

If the parent with whom the child lives does not want the child support to go to the child's account, the issue will have to be resolved in court. First you need to get a written refusal from the parent, as well as open a bank account in the name of the child.

But the court will satisfy the application only if the parent still receives part of the money - in your case, the ex-wife. The fact is that can be transferred to the children's account no more than half of the total amount that you are required to pay monthly. And if the part of the alimony that the ex-spouse receives is less than the subsistence minimum for each child, the court will not allow the money to be transferred to the children's accounts.

paragraph 2 of Art. 60 SK RF

At the same time, the Supreme Court considers that the high income of a parent who must pay alimony cannot in itself be a reason to transfer half of the amount to the child's account. For example, it is also necessary that the parent with whom the children live should spend payments for other purposes. And the amount that remains after the transfer of part of the alimony to the children's accounts should be enough for their food, education and upbringing.

For example, it is also necessary that the parent with whom the children live should spend payments for other purposes. And the amount that remains after the transfer of part of the alimony to the children's accounts should be enough for their food, education and upbringing.

In Ulyanovsk, the world court ordered a man to pay alimony to a minor child on a monthly basis. My father wanted to change the way and procedure for the execution of the court decision. He applied to the world court, referring to the fact that he has a high income.

The man thought that the amount he was obliged to pay monthly was also too large and that he would take better care of the future of the child by transferring half of the alimony to his account. But the world court left the application without satisfaction.

The complaint to the district court did not help either. They agreed that the man did not have enough grounds to transfer half of the alimony to the child.

para. 14, paragraph 1, section III of the review of the judicial practice of the Supreme Court of the Russian Federation dated May 13, 2015

Case No. 11-13 / 2015

11-13 / 2015

In order for the court to allow the transfer of the entire amount of alimony to the account, it is necessary to prove that the other parent spends money education and development of the child. If this is the case, you need to apply to the court that collected alimony, with a statement about changing the procedure for executing the decision.

paragraph 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of October 25, 1996 No. 9

We will have to collect evidence - testimony from witnesses, guardianship and guardianship authorities - that the ex-wife spends children's money, for example, to pay off loans.

What to do? Readers ask - experts answer

Ask your question

Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

The question arises: how can a self-employed person pay alimony? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony.

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it.

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim.

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- postal order.

It is better to keep the documents confirming the transfer of money. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it.

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child remains) can apply to bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer.

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of maintenance may be recalculated.