How do i get a ssn for my child

How to Get a Social Security Number For Your Child

A Social Security number is the federal government's way of identifying your child. Your child will need a Social Security number in order for you to claim child-related tax breaks—such as the dependent exemption and the child tax credit—on your income taxes. You will also need the number to add your new baby to your health insurance plan, to set up a college savings plan or bank account for your child, or to apply for government benefits that could help your little one.

Here's how to get a Social Security number for your baby.

How to Apply for a Social Security Number

The easiest way to apply for a Social Security number for your child is to complete a birth registration form, which has a box you can check to request a number for your child. To complete the form, you will need to provide both parents' Social Security numbers.

For most new parents, it's easy to obtain the birth registration form, because hospitals usually distribute them while the mother is still a patient.

But if you didn't deliver your baby in the hospital or if for some other reason you were never given a birth registration form to complete, you can visit your local Social Security Administration (SSA) office and request a number in person. This process requires you to do three things:

- Complete Form SS-5 (Application for Social Security Number) and provide both parents' Social Security numbers on the form. To save time, download and complete Form SS-5 from the SSA website (www.socialsecurity.gov/online/ss-5.pdf) before you go.

- Provide at least two documents proving your baby's age, identity, and citizenship status. One document should ideally be your child's birth certificate. The other document can be your child's hospital birth record or other medical record.

- Provide proof of your own identity. Your driver's license and passport are both acceptable.

Find the SSA office nearest you by logging on to the SSA's Office Locator at www. socialsecurity.gov/locator. If you'd prefer, you can send in a completed Form SS-5 along with your identification documents to your local SSA office by mail. Most people apply in person, however, because you'll need to provide the SSA with originals or certified copies of all identification documents.

socialsecurity.gov/locator. If you'd prefer, you can send in a completed Form SS-5 along with your identification documents to your local SSA office by mail. Most people apply in person, however, because you'll need to provide the SSA with originals or certified copies of all identification documents.

Once you've submitted your application, you should receive a Social Security card in six to 12 weeks. It may take substantially longer to process your application if your child is one year of age or older, because the SSA will contact your state's department of vital statistics to confirm that the birth certificate you have provided is valid.

If You Are Adopting a Child

If the child you are adopting is a United States citizen, your child may have a Social Security number already. But if you are adopting domestically and your child does not have one, you can obtain an Adoption Taxpayer Identification Number (ATIN) to claim child-related tax breaks while your child's adoption is pending. To apply for one, complete IRS Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions. The ATIN will be valid for only two years, at which point you can extend it if your child's adoption is still not final. Once the adoption is final, you must stop using the ATIN and get a Social Security number for your child following the process described above.

To apply for one, complete IRS Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions. The ATIN will be valid for only two years, at which point you can extend it if your child's adoption is still not final. Once the adoption is final, you must stop using the ATIN and get a Social Security number for your child following the process described above.

If you are adopting a child from another country, you will have to wait until the adoption is final and your child has entered the United States before you can obtain a Social Security number for your child. Once that happens, you can use the process described above.

To Learn More

To find out more about child-related tax breaks, see Tax Breaks Every Parent Should Know About.

How to get a social security card for a newborn

Getting a Social Security number for your newborn has many benefits. It allows you to claim your child on your taxes, enroll your baby in health insurance, and set up a college savings plan and/or bank account for your little one. The easiest way to get an SSN for your baby is to apply using birth registration forms at the hospital. If you don't give birth at a hospital, or if your child is older or adopted, you can fill out Social Security forms online and apply in person at your local Social Security office.

The easiest way to get an SSN for your baby is to apply using birth registration forms at the hospital. If you don't give birth at a hospital, or if your child is older or adopted, you can fill out Social Security forms online and apply in person at your local Social Security office.

A Social Security number (SSN) is the U.S. federal government's way of identifying you and your child. In the United States, registering your child for a Social Security number is voluntary, but it's necessary to obtain important services. You'll use your child's SSN to claim child-related tax breaks (such as the dependent exemption and the child tax credit), add your child to your health insurance plan, set up a college savings plan or bank account, and perhaps apply for government benefits for them.

The easiest way to apply for a Social Security card and number for a newborn is by completing a birth registration form at the hospital. You'll need to check the "yes" box where the form asks if you want to apply for a Social Security number for your baby.

You'll eventually need to provide both parents' Social Security numbers, but if you don't know both parents' SSNs, you can still fill out the form.

If you didn't deliver in a hospital, you weren't given the birth registration form, or you choose to wait to get an SSN for your child, your other option is to visit your local Social Security Administration Office (you can use the SSA's Office Locator) and request a number in person. This process requires you to do three things:

- Complete Form SS-5 (Application for Social Security Number) and provide both parents' Social Security numbers on the form. To save time, you can download, print, and complete the form before you go.

- Provide at least two documents proving your baby's age, identity, and citizenship status. One document should ideally be your child's birth certificate, and the other can be their hospital birth record or another medical record.

- Provide proof of your own identity and proof of your relationship to the child.

Your driver's license and passport are both acceptable.

Your driver's license and passport are both acceptable.

If you'd prefer not to make the trip, you can send a completed Form SS-5 along with your identification documents to your local SSA office by mail. However, you'll have to send originals or certified copies of all identification documents, which is why most people opt to apply in person.

Once you've submitted your application, you should receive your child's Social Security card in the mail in six to 12 weeks, but keep in mind that each state has slightly different processing times. Note as well that it could take longer than this to receive the card if your child is older than 1, because the SSA will contact your state's department of vital statistics to confirm that the birth certificate you've provided is valid.

You won't be able to find your child's SSN online due to the sensitivity of this information. You'll need to contact the Social Security Administration at ssa.gov and eventually visit your local SSA office in person with the proper identification to find out your child's SSN.

(Note: You can look up your baby's SSN on your tax return documents if you've declared your child as a dependent.)

Once your baby's SSN card arrives in the mail, keep it in a safe space at home with other important government-issued documents such as birth certificates and passports. This way, the card is less likely to be misplaced or stolen, and it's readily available when you need to reference your child's Social Security number (the digits are written clearly on the front of the card).

Figure out your state's approximate processing time for SSN applications for newborns, since it varies based on where you live. If you still haven't received your baby's card in the mail after the indicated length of time (and you're sure you submitted the application properly), you have two options:

- Visit your local SSA Office.

- Call the national SSA hotline at 1.800.772.1213. This phone number has automated services 24/7, or you can speak to a live person during business hours Monday through Friday.

Depending on your application status, someone at your local SSA office or an official on the hotline could ask you to refile your application; you can do so at ssa.gov. Keep in mind that you can't apply via phone or mail, so if you're asked to do this, report this immediately and consider it fraud.

Also, applying for a SSN and a Social Security card is free, so don't be tricked by scammers who may be trying to charge you a fee for your application.

If the child you're adopting is a United States citizen, the child's birth mother most likely filled out an application for an SSN for the baby at the hospital. However, you have the option to register them for a new SSN that bears the child's new legal name, no matter how old the child is at the time of the adoption.

You'll have to apply in person at your local Social Security Office. You must fill out the SS-5 application and provide proof of the child's citizenship and identity – you can present your Adoption Order, a certified copy of the child's birth certificate, or a hospital record – as well as your own identity and your relationship to them. This new number will override the child's old one.

This new number will override the child's old one.

If you're adopting a child from another country, you'll have to wait until the adoption is final and your child has entered the United States to obtain a Social Security number. To apply, fill out the application and bring the required paperwork described above, as well as other adoption paperwork such as immigration documents from the Department of Homeland Security, to your local Social Security Office. Then, follow the rest of the process described above to obtain your child's Social Security number and card.

If you want to file your child as a dependent on your tax return while the adoption is pending – before you receive the child's SSN card in the mail – you can obtain an Adoption Taxpayer Identification Number (ATIN). To apply for one, complete IRS Form W-7A.

What is SSN? - My America

By Oleg

|

February 10, 2017

An article about SSN (US Social Security Number) has long been brewing.

What is it? What does it look like? Who is supposed to? How to get a? What does she give? And so on.

Briefly

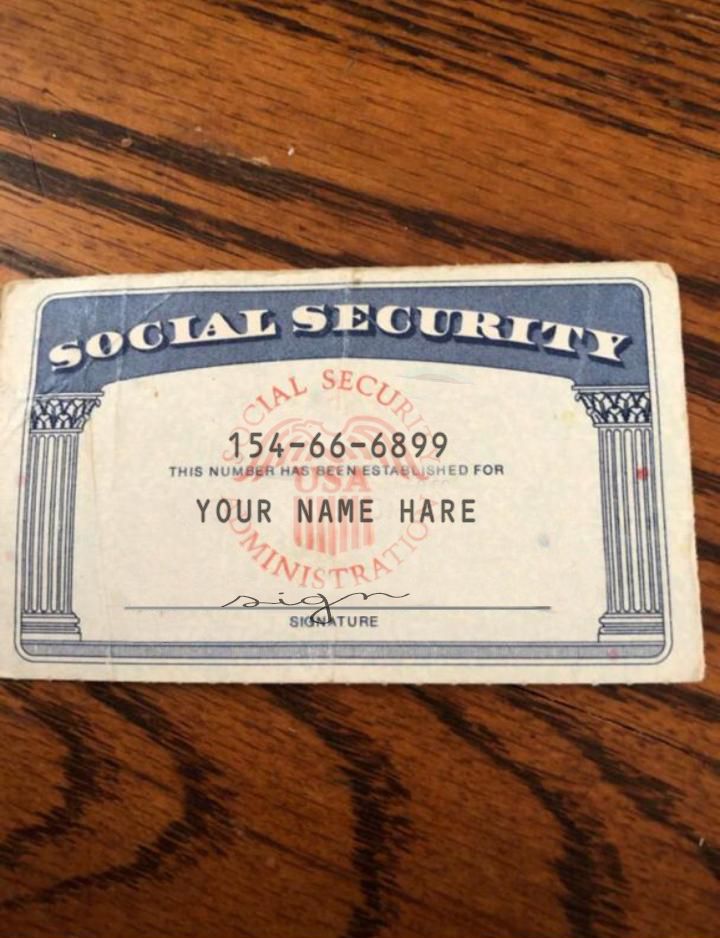

So, the SSN is a piece of paper with a social security number and the owner's name written on it.

All Americans have it, as well as legally residing foreigners. There is simply no more important document in America than it. The closest analogue of the “SSN card” in Russian is the “pension certificate”, although the analogy is not complete.

The SSN is issued once and for all - it never changes, and most US residents know these nine digits by heart, like a phone number. Because they have to use SSN much more often than, for example, a passport. It has to be reported when going to the doctor, when renting a house, in any operations with banks (opening accounts, loans, etc.), and many employees (for example, in the fast food industry) and in general - drive in their SSN number (the last 4 digits, for example) into the reporting machine, coming and going from work - a kind of “personal password”.

If you are just about to or have just moved to the US, getting your SSN as soon as possible will be on your to-do list.

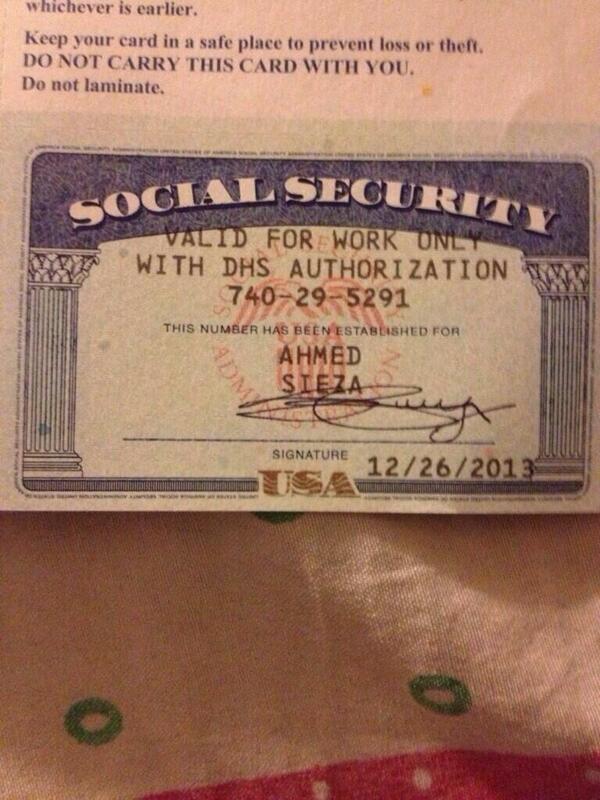

SSN card

SSN card - about the size of a credit card. They are printed simply on thick paper, it is easy to tear, wrinkle, or ruin it when wet. It's just such a ticket.

At the moment, the map looks something like this:

Since the appearance of the map in 1936, its design has changed more than once (already 34 times !!). An interesting detail: for as long as 26 years, it also had the inscription “Not For Identification” on it - although the SSNs were unique, it was not recommended to use it for identification purposes. At 19In 72, this inscription was removed - everyone was already so accustomed to doing this that the warning lost all meaning.

The SSN card looked like this at first (1936):

Types of SSN cards

There are three types of Social Security cards:

- “Regular” SSN card - issued to US citizens and Green Card holders.

Does not have any restrictions. Design - see image above. - “Temporary” SSN card - issued only for temporary employment, such as h2-B, L1 work visa holders, AU-PAIR, Work and Travel members, and so on.

Such a card is valid for employment only while the special status is valid (h2-B for example), as soon as the status is over (and you are in the USA, for example, on a tourist visit) - you won’t be able to get a job using it.

Her only difference in design is the inscription across the entire card: “VALID FOR WORK ONLY WITH DHS AUTHORIZATION”.

- The ITIN card is a special tax number for those who do not have the right to work in the United States. Contains ITIN number (Individual Taxpayer #).

Such a card is required, for example, by the spouse or children of foreigners who are in the United States on a work visa, or foreigners who need to file a tax return on unearned income (renting a house, selling a car). Holders of only an ITIN number are not allowed to work, but nevertheless, to fill out, for example, a tax return, their numbers are required.

In the absence of a valid SSN, an ITIN is required.

In the absence of a valid SSN, an ITIN is required.

Obtaining an SSN card

The SSN is the first document you need to obtain upon arrival in the US. I advise you to take care of this in the very first days upon arrival - after all, the card will arrive only 2 weeks after the application is submitted!

Without an SSN card, it will be difficult to rent a house and open a bank account. Not from the word impossible, but the presence of the SSN card magically speeds up everything.

Getting an SSN is easy. Americans themselves receive it immediately from birth. And you, upon arrival in America, find the nearest office Social Security Administration . Just type it into Google, or use the search service on the SSA website. You go there in person, with documents.

The list of required documents can be viewed on the same site, here. You will definitely need your passport, proof of your status (visa, I-94, your green card) and, depending on your status, your work permit (EAD).

Fill out a rather simple form for 1 page, give it to the window. You don't have to pay anything - it's free. Everything takes a maximum of 5 minutes. Your documents are checked, you put a couple of signatures and that's it, go home, wait for the SSN card to arrive by mail.

An important detail: after filling out an application for a personal visit to the SSA, the SSN itself appears in the system within a day or two. And if you really need it, and wait another 10-14 days for the envelope, then you can try to ask for a Verification Letter in the same office - it will just be a piece of paper with your number and details. But not every clerk will agree to issue such a paper, sometimes they can simply dictate the number over the phone, and sometimes send it home to wait for an envelope (the human factor works the same in any country). If there is such a need, I advise you to immediately ask about it at the SSA office, at the time of application.

The SSN card itself arrives within two weeks by regular mail, to the address that you indicated. Something like this:

Something like this:

It will only be necessary to carefully tear it off the cardboard along the perforation. Remember number. And hide well.

Why, you ask?

SSN and Security - Identity Theft

Using your SSN number, attackers can open bank accounts, buy anything on credit, call any authority (including tax and government) and, pretending to be you, cause all sorts of trouble and confusion to you.

This type of fraud is called “Identity Theft”, which can be translated as “identity theft”. This type of crime is a very big problem in the US and it is growing every year!

The number of victims in 2016 reached 13 million (this is 4% of the population, and this is only within one year!), for the same 2016, according to various estimates, from 15 to 50 billion US dollars were stolen!

It is also worth mentioning that according to statistics , most of the crimes (half!) are related to government organizations and social security. By comparison, credit card problems are only 15% of the picture.

By comparison, credit card problems are only 15% of the picture.

| Fraud types | Percentage |

|---|---|

| Documents and benefits (pensions, benefits, insurance) | 49.2% |

| Credit cards | 15.8% |

| Telephone and other bills | 9.9% |

| Bank fraud | 5.9% |

| Identity theft attempt | 3.7% |

| Opening a loan in your name | 3.5% |

| Fraud with employers | 3.3% |

| other | 19.2% |

In order not to become a victim of Identity Theft, try not to “shine” your SSN anywhere.

- It is best to keep the card at home, in a filing cabinet. Some even advise not to keep at home. And the number is to know by heart.

Never carry the SSN card itself with you. Some short-sighted people even laminate it and carry it in a purse or back pocket. This is silly. The card itself, physically, you may need 2-3 times in your life - in other cases, just knowing the SSN number by heart is enough.

This is silly. The card itself, physically, you may need 2-3 times in your life - in other cases, just knowing the SSN number by heart is enough. - Always be very suspicious when asked to provide your SSN. Do not enter it on various sites to “find out what kind of car you can afford”, and so on. If a clerk asks you for this number, be sure to ask for what purposes they need it. Even if you are not a victim of fraud on their part, having your SSN can make a Credit Pull request without asking, find out your credit history, and your credit scores will decrease.

- Check your Credit Report regularly and deal with any inaccuracies right away. I wrote how to check a credit report here, in a separate article Growing Credit Score .

The sooner you discover a problem, the faster and with less bloodshed you can get rid of it.

The most unlucky SSN in history

The year was 1938. The SSA program has been in existence for two years now. It was still new to everyone, and it was “fashionable” to have (and carry with you) an SSN card then.

A leather goods company (E. H. Ferree) in New York State decided to advertise their leather wallets by showing how well they fit an SSN card. In each wallet sold, they put a yellow SSN card with the number 078-05-1120 on it. In sheer negligence, it was the real SSN number of the secretary of the president of this company named Hilda Schroeder Whicher . Here she is Hilda, pictured on the right.

Despite the fact that the “model” card was half the height of the real one, and “SAMPLE” was written in large letters on its front side, nevertheless, buyers, no, no, and began to use this unfortunate SSN number when shopping.

According to various reports, this SSN number was used in various operations more than 40,000 times (!!!!!) This eventually led to Hilda's arrest and interrogation by the FBI, after which she was changed to a new number.

Interesting: it is assumed that many people did not have any bad intentions - unknowingly, many really thought that this was their SSN number!

This funny incident went down forever both in the history of SSA and in advertising textbooks :)

Well, now I'm afraid! Who can show your SSN?

So who can you safely reveal your SSN to?

- Your employer, of course.

He needs it for accounting documents, taxes, filing FICA payments, and so on.

He needs it for accounting documents, taxes, filing FICA payments, and so on. - Internal Revenue Service - IRS. Just be sure to make sure that it was you who contacted them (you went to the site, you dialed a phone number), and not vice versa - someone called you, introduced himself as an IRS employee and requires you to pronounce your SSN (quite a common scam, by the way)

- US Treasury, and other government programs (referring to unemployment benefits, financial assistance, etc.)

- Banks and other financial and insurance companies - if you open an account with them, or ask for a loan. For example, you want to buy a car. Of course, they need your SSN - without it, they will not know about your credit history, and they will not give you anything.

- Medical facilities - although not required, they usually require an SSN. You can give, although some prefer to refuse. Based on the SSN, the hospital can “punch” your insurance company history, find out all sorts of interesting things about you.

In some situations, knowing your SSN by heart can save your life - if you forgot your insurance card, but remember the SSN. On the other hand, it is generally accepted that medical clerks are the main source of leaking SSN numbers. You buy a car once every five years, and you go to the doctor once a month. That they should rewrite the number on a piece of paper, or even easier - take a picture? Here everyone chooses for himself

In some situations, knowing your SSN by heart can save your life - if you forgot your insurance card, but remember the SSN. On the other hand, it is generally accepted that medical clerks are the main source of leaking SSN numbers. You buy a car once every five years, and you go to the doctor once a month. That they should rewrite the number on a piece of paper, or even easier - take a picture? Here everyone chooses for himself - The owner of the apartment or house you intend to rent. They usually require an SSN to check your credit history so they know who is in front of them. You can give, but naturally you need to look at who is standing in front of you. If this is a granny cat lady, then it probably isn’t worth it. And if you are in the office of the apartment community, then it’s worth it, they often have such rules and without SSN - nothing.

And a little bit of history

It all started back in 1935, when the then US President Franklin D. Roosevelt signed the Social Security Bill (FICA), which promised to protect citizens from "life's vicissitudes" (in the then wording - " a safeguard against the hazards and vicissitudes of life ").

The bill was large at the time - 32 pages (compare with the Affordable Care Act “Obamacare” which has a total of over 20,000 pages!), but the essence of the program is simple: both employers and working citizens themselves pay a small percentage of their income to the program, and the program pays pensions, unemployment benefits, medical benefits for children and the poor, and the like.

At the same time, SSN cards appeared - the country is huge, people constantly moved, there were no computer databases then, and a person could only confirm his social security number with the help of it.

Alternative version

There is another popular version - in an era when there were no computers yet, and a huge number of people simply did not have any documents at all - the government issued SSN cards to keep track of the population, its income and movements around the country.

There is a whole category of people who believe that they are being watched: they have no bank accounts and cards, they have no insurance, they buy everything for cash and are treated by cheap private doctors. Such hermits have entire websites where they discuss how best to hide from the all-seeing eye of Big Brother - how it is more convenient to travel or where you can send your child to kindergarten in order to avoid paper questions.

Such hermits have entire websites where they discuss how best to hide from the all-seeing eye of Big Brother - how it is more convenient to travel or where you can send your child to kindergarten in order to avoid paper questions.

Some more interesting facts

- In total, over 420,000,000 SSN cards have been issued since 1936

- Over 5,500,000 new SSN cards issued each year

- The first three digits of the SSN are believed to reflect the geographical area where it is issued.

- Some believe that the next two numbers can determine a person's race. This is, of course, a myth.

- The first ever SSN (055-09-0001) was issued to John David Sweeney, who died of a heart attack at 1974 years old at the age of 61, and did not receive a penny as a result

- SSNs do not change and are never used again when a person dies. Someday they will end. The SSA claims that there will be “enough” numbers for “several generations” more, that is, until at least 2030.

The good old days...

By the way, it's fashionable in America now to sigh about the "good old days" because this wonderful Social Security program has undergone so many changes since then. In fact, almost everything has changed since then:0003

- Initially, participation in FICA payments was declared on a voluntary basis

Now: social payments are mandatory for both employers and employees - Employers only had to pay 1% of the first $1,400 of their annual income (old money)

Now: Employer pays 7.65% of the first $118,000 of salary. The employee also pays about the same. Here is how this figure has grown (the graph shows the total payments of both the employee and the employer) over the years. We are interested in the purple line: - Contributions paid were initially tax deductible.

Now: contributions are not included in tax deductions - Pension payments were not initially subject to income taxes

Now: up to 85% of social benefits (pensions) may be taxed

About this and much more - in one of the following articles!

Similar posts

About the author: My name is Oleg, I was born and raised in Moldova, but at the age of 30 I decided to move to America. This simple decision completely turned my life around and turned into the biggest adventure in it! In my blog, I write about my path to the USA, as well as about what America appeared before me.

olegblog.com - facebook- Twitter- vKontakte

WANT TO KNOW ALL THE MOST INTERESTING ABOUT AMERICA?

Immigrant

What to do if a Social Security Number (SSN) is provided

If your Social Security number is in a breach or leak, it is important to act quickly to prevent more damage being caused to attackers.

Tip: As you progress through this process, it is a good idea to keep documentation of any steps you take, call, fill out forms, or emails you send. If you need to poke fun at fraudulent payments or activities, having these records can help smooth the job by claiming you're dealing with actual identity theft.

An ID that has your social security number and other personal information can do a number of things with it, including:

-

Open new credit accounts, such as credit cards or car loans, in your name

-

Request a refund of taxes that are rightfully yours

-

Create a dummy identity to receive a job, department, or other services

-

Request fraudulent benefits in name

-

Receive benefits such as healthcare while pretending to be you

-

Create a bogus identity to decipher other people or capture other activities in your name

The first step is to post a temporary fraud alert on loan

Also known as an "Initial Security Alert", this alerts major credit providers that you have caused identity theft. If a business attempts to verify your credit, it is notified that a fraud alert has been placed on the account and that it must verify the identity of anyone attempting to open an account or obtain credit with a social security number.

If a business attempts to verify your credit, it is notified that a fraud alert has been placed on the account and that it must verify the identity of anyone attempting to open an account or obtain credit with a social security number.

You can place a temporary fraud alert on your account, it does not affect your credit score, and the temporary fraud alert will automatically expire after 1 year, although you can cancel earlier if necessary.

You want to do this right away to reduce the ability to open new accounts in your name.

Posting a Temporary Fraud Alert on Account

Go to the website of any of the three main credit windows and select that you want to add a fraud alert.

Note: This only needs to be done in one credit office. Once you place a fraud alert in any of the three controls, they automatically notify the other two.

-

Experian

-

TransUnion

-

Equivalence

Temporary fraud alert does not require a reason or any documentation other than proof of identity.

Removing a fraud alert is a little more difficult than placing one. To display an alert, you need to contact all three of them, and each of them will need to verify your identity. In most cases, it's probably easier to just let the alert expire after one year.

Extended Fraud Alert does the same thing as Temporary Fraud Alert, just for a longer period of time. It usually stays active for 7 years unless you cancel it sooner.

It usually stays active for 7 years unless you cancel it sooner.

Also, getting an extended alert is a bit more difficult than a temporary one. It usually requires a policy report showing that you have been the target of identity theft.

This does not prevent the consolidation of the loan, but complicates it. Any business that has been shown how to open an account in your name must take additional steps to verify the identity of the user opening the account. This means that you can still open accounts. You just need to take a few extra steps to confirm that you are the person you claim to be.

You could also open fraudulent accounts, but impersonation would require more effort.

Second step. Getting a copy of the credit report

Under US federal law, you are entitled to a free copy of your credit report every 12 months from each of the three credit report companies. To request a free copy of your credit report, go to https://annualcreditreport. com. It usually takes only a minute or two to get a report that you can save or print, so you can study it carefully.

com. It usually takes only a minute or two to get a report that you can save or print, so you can study it carefully.

Tip: You can request up to 3 copies of your credit report, but we recommend that you request only 1 first. Federal law allows you to receive 3 copies per year, and you will need to review your credit report once or twice in the coming weeks or months to see if new items have appeared.

When you check your credit report, you first look for any unfamiliar accounts or activities. These could be credit cards you didn't recognize, or loans for cars or properties you never applied for.

If you find unrecognized accounts

Fraud alert escalation prior to loan freeze

If there is fraudulent activity on your credit report, this means that scammers are trying to use your social security number to come in and secure your credit report. This will make it much harder for them to inflict any additional damage.

This will make it much harder for them to inflict any additional damage.

For more information about placing a credit freeze, see "Placing a Credit Freeze".

Report it to Federal Trade Commission (FTC)

If you have fraudulent activity in your name, the FTC wants to know about it. Go to https://IdentityTheft.gov and follow the steps to report fraudulent activity.

Contact companies with fraudulent accounts

Contact companies for accounts you don't recognize. Let them know that you have been the target of identity theft and suspect that the account is fraudulent. Find out when and how an account was opened, what information they can provide, when and how it was used. This information will be useful when creating a policy report.

Tips:

-

Always remember that the company you contacted does not understand that the account is fraudulent and they are almost as interested in resolving this problem as you are.

They are unlikely to get paid for a fraudulent account.

They are unlikely to get paid for a fraudulent account. -

If they're having trouble resolving fraudulent accounts, ask if it would make things easier if you have a policy report. If they agree that this is the case, write them down so you can refer back to them after step 3 (create a policy report).

Third step - generating a policy report

Even if you think a politician is unlikely to reveal his identity, it is still important to file a policy report to establish an official record of identity theft.

Contact your local policy department and let them know that your identity has been stolen and that you want to generate a report. They should give you a copy of the report when it's done, but if it's not offered to you, be sure to ask for it. This is an important tool to fix this problem and protect against any future fraudulent activity.

Fourth step. Submitting a Complaint to the Internet Attack Complaint Center

Internet Crime Complaint Center (IC3) is a division of the Federal Crisis Division (CEO) that handles reports of online theft such as identity theft. When filing a complaint, they may share this information with other relevant law enforcement agencies.

To file a complaint, go to https://www.ic3.gov.

Tip: Sometimes it's not very convenient to fill out so many reports, but if attackers open fraudulent accounts or work with your SSN that you need to work with, it can be very useful to show that you have submitted reports to all relevant authorities.

Fifth step. Internal Revenue Service (IRS) Notice

It is now common for scammers to file false tax refunds with a Social Security number and claim the tax refund themselves. There are two things you can do to reduce the risk of this. The first is as early as possible in the tax file, and the second is for iRS to know that your social security number has been stolen.

The first is as early as possible in the tax file, and the second is for iRS to know that your social security number has been stolen.

You will want to complete and complete Form 14039. This is a short form and will likely take no more than a minute or two to complete. Start here: https://www.irs.gov/individuals/how-irs-id-theft-victim-assistance-works

This alerts the IRS to any suspicious tax claims with a social security number, and if a bogus tax refund is filed in your name, it will be easier for you to protest and clear it.

Obtain a PIN from the IRS website.

The IRS offers a free six-digit identity protection PIN that can be obtained through the website. When submitting tax returns, you must provide this PIN (which only you and the IRS should know) for identity verification. This makes it much more difficult to send tax refunds in your name, because even if he has your social security number, he does not need to have a pin number.

To get a PIN, simply go to https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin. You will need to go through a short identity verification process and then you will receive a PIN.

It is not recommended to do this ahead of time, just to limit the damage that attackers can do later.

Moving on

Unfortunately, once your SSN already exists, attackers can use it at any time, so it pays to take some reasonable steps to protect itself from future problems.

Filing taxes

Sometimes scams spoof fake tax refunds with the name and social security number of an unintentional person, and then they request a tax refund associated with that person. When a real user later submits their taxes, they will have to go through a complex process to get a refund that would be the right way.

To reduce the risk of this, try filing your tax return as early as possible. If your legitimate return reaches the IRS before the fraudulent data is returned, it will be the scammers, not you.

If your legitimate return reaches the IRS before the fraudulent data is returned, it will be the scammers, not you.

Monitor credit rating

Unexpected changes in credit score may indicate unauthorized activity using a social security number. Most banks and credit card companies these days offer you a credit score as an additional metric for doing business with them. Log in to the website and write down your rating.

Small changes a few dots up or down are common, but if they suddenly change or suddenly stop working, you should get a new copy of your credit report to find out why it has changed.

View Social Security Application

One of the actions of attackers with a stolen social security number is to set a false name. This often happens if the attacker is not allowed to receive the job using their real identity, or if they are not allowed by US law.

Advice: It's also possible that someone is working under your social security number as an obvious mistake. They just wrongly influenced their social security number or overwritten several numbers and accidentally assigned their number to your employer.

If they are doing an assignment using your SSN, their employee must report their income to the Social Security Administration (SSA) and that income will appear on your Social Security application. Go to https://www.ssa.gov/myaccount/ and sign in (or create) a free account to check your Social Security claim. Creating an account can be a bit of a process, but after creating an account, it only takes a few seconds to view your social security application online.

All instructions show that you have earned total annual profit for a particular year, but if the displayed profit is significantly greater than what you know you have earned that year, this is probably good enough to contact SSA and investigate further. He takes identity theft seriously and is happy to work with you.

He takes identity theft seriously and is happy to work with you.

Check your Social Security application every year to make sure everything looks right.

Tip: If reported income looks too low, that's something else to look into. The income reported by your employees is a factor in the amount of Social Security payments you make on deregistration to make sure you get what you need.

Keep checking this credit report

Even if everything looks fine, it's a good idea to go to https://annualcreditreport.com every few months and request another copy of your credit report to make sure everything still looks the way it should.

Yes, you can, but it's a rather complicated process that requires you to personally apply at the Social Security office and provide a valid reason for changing your Social Security number. Identity theft is considered a valid reason, but only if the theft results in persistent and persistent problems and you need to provide documentation to support your claim.