How do i claim for child tax credit

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. Sabrina earned a master's degree in publishing at Portland State University.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

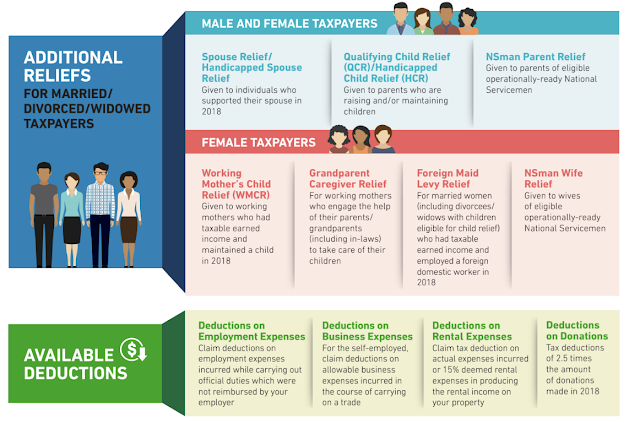

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

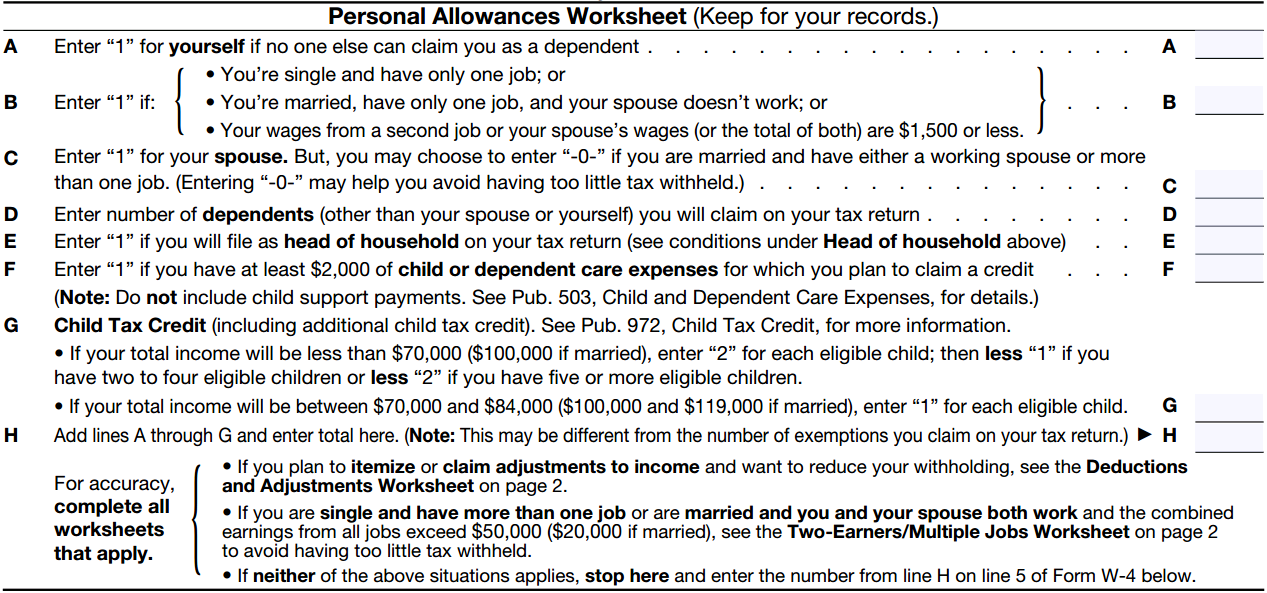

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

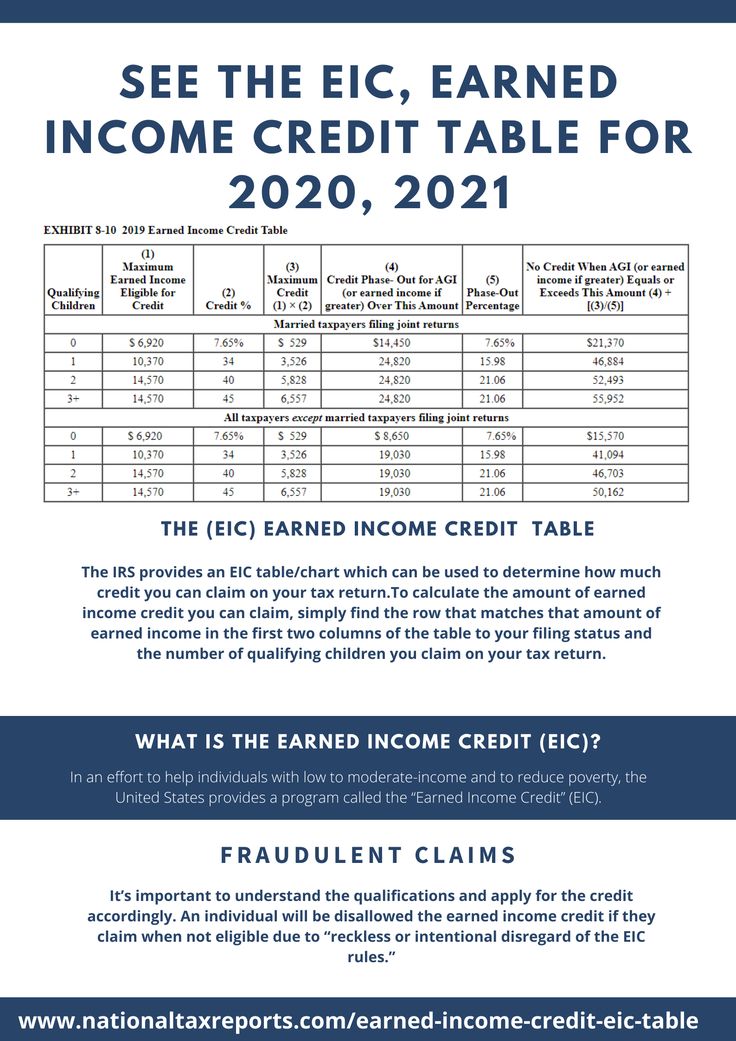

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

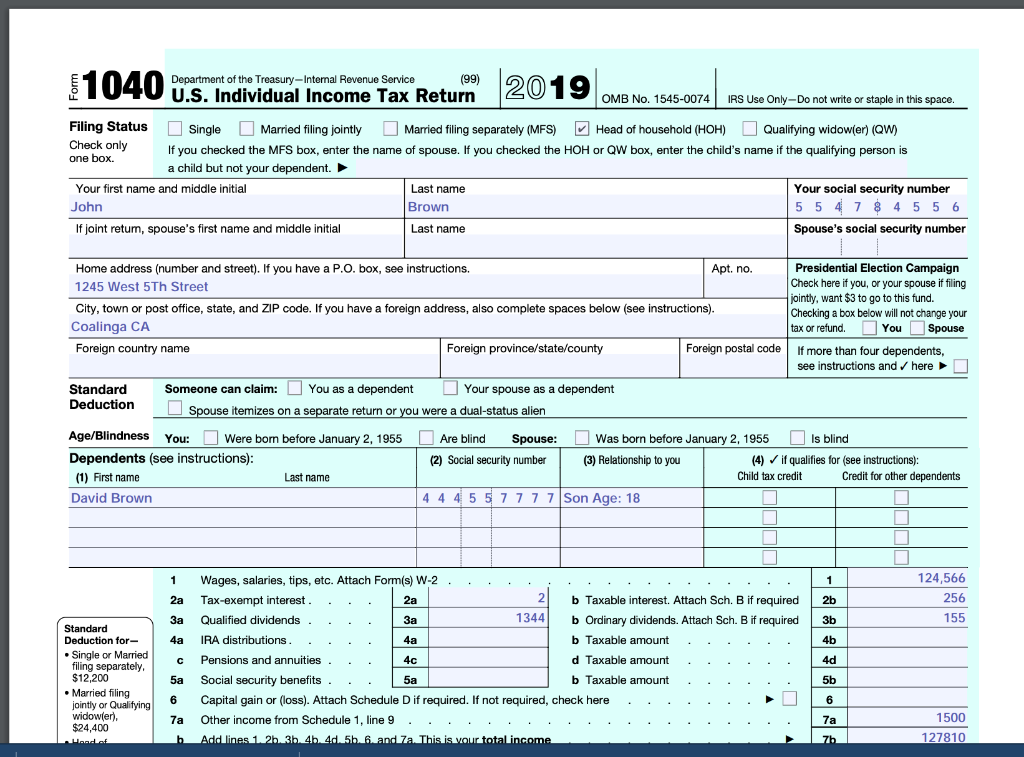

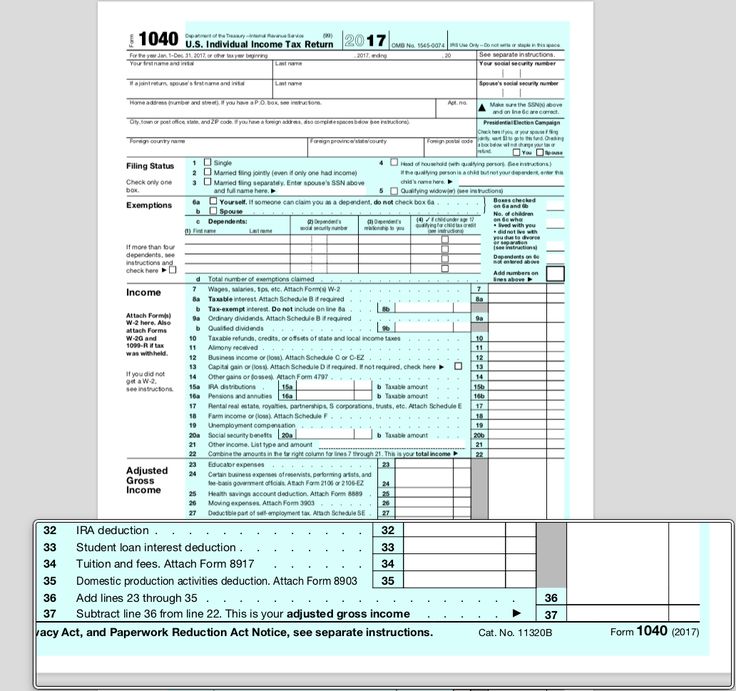

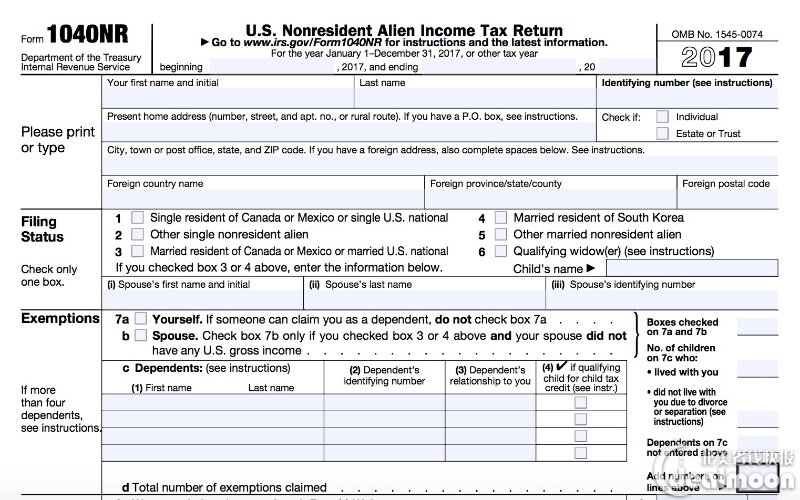

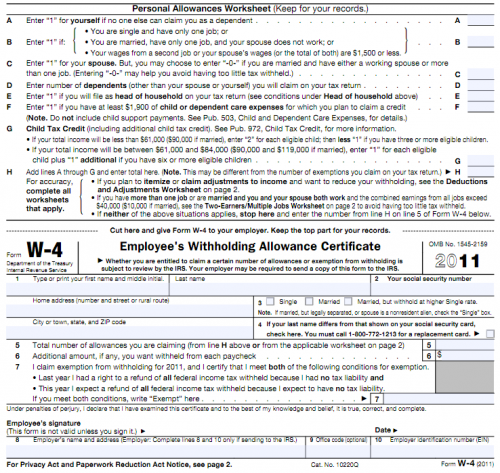

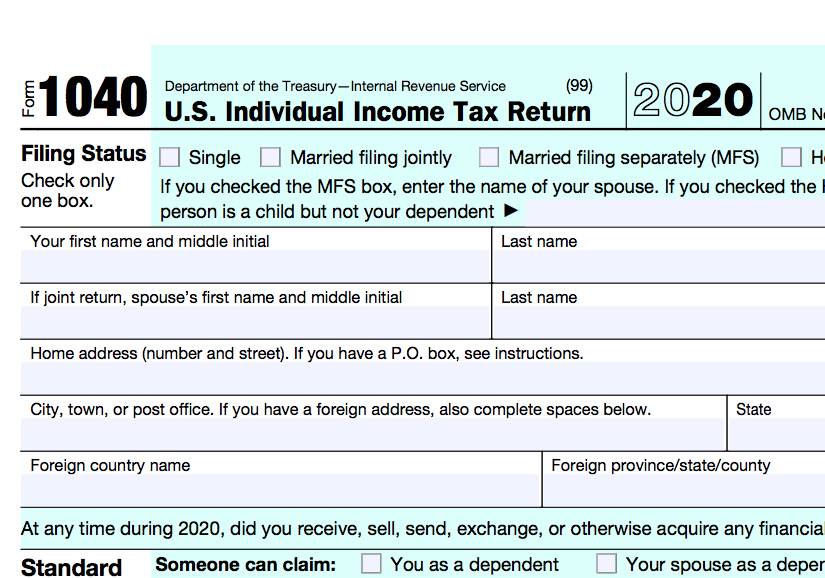

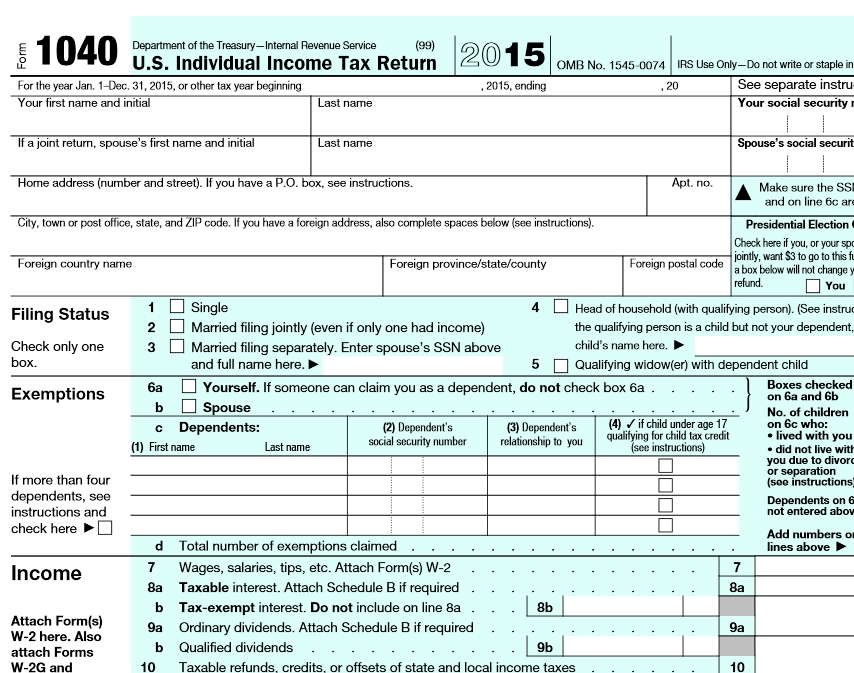

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

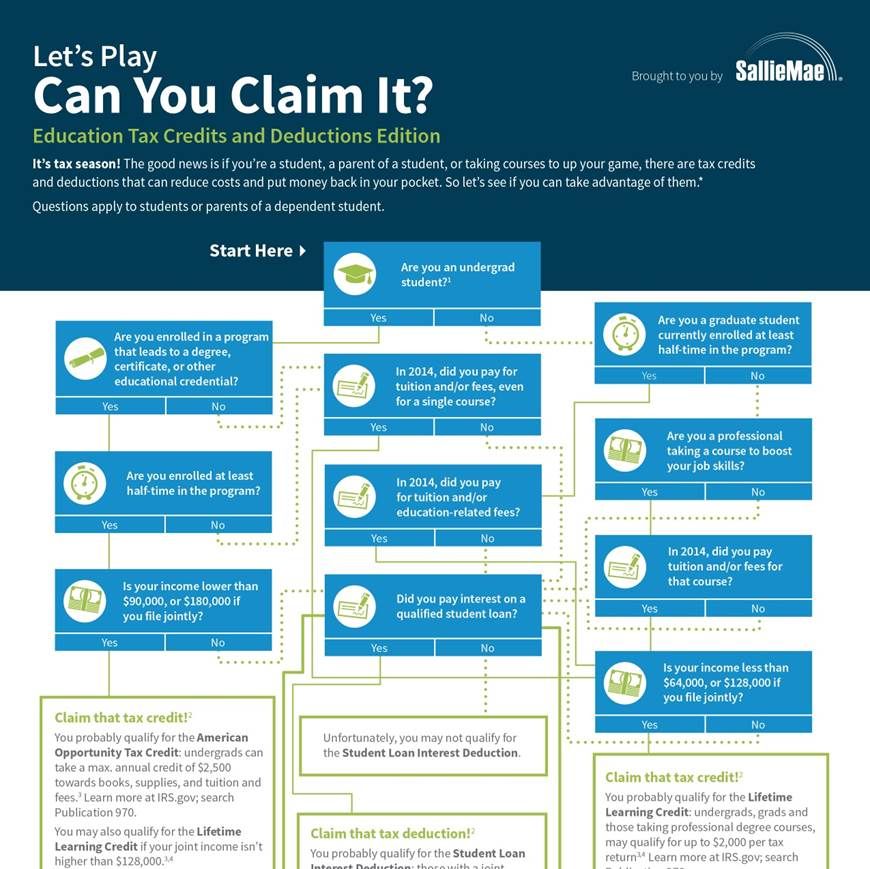

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U. S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

Can a stepfather receive a standard personal income tax deduction for a child if custody and adoption are not registered, and the biological father is indicated on the birth certificate?

- March 11, 2016

In accordance with paragraphs. 4 p. 1 art. 218 of the Code, the standard tax deduction for each month of the tax period applies, in particular, to the parent, spouse (wife) of the parent, on whose support the child is. nine0007 One of the conditions under which the right to use the specified tax deduction is granted is the fact that the child is supported by parents or the parent's spouse.

4 p. 1 art. 218 of the Code, the standard tax deduction for each month of the tax period applies, in particular, to the parent, spouse (wife) of the parent, on whose support the child is. nine0007 One of the conditions under which the right to use the specified tax deduction is granted is the fact that the child is supported by parents or the parent's spouse.

Thus, if the mother's child from the first marriage lives together with the stepfather, then regardless of his adoption the standard tax deduction can be granted to the stepfather, on whose support he is. nine0007 Eligibility documents for the standard tax credit may include, but are not limited to, a copy of a birth certificate, a marriage registration certificate, and, in the opinion of the Department, a written statement from the spouse that the child is jointly dependent on the spouses (mother and stepfather) .

Subscribe to legislation news

- News nine0004

- activity

- Event records

December 7, 2022

Where to do fitness in 2023 in order to receive a social deduction for personal income tax: we are studying the list of the Ministry of Sports nine0020

November 3, 2022

The employer received a notification to provide a property deduction to a former employee: how to be

September 9, 2022

Is it possible to reduce personal income tax when selling real estate for the services of a realtor

September 23, 2022

Is it possible to get a social deduction for studying with a private tutor? nine0020

September 2, 2022

How to confirm the cost of medicines for personal income tax deduction

January 12, 2023

We determine the place of sale for the purposes of calculating taxes on practical examples

February 9, 2023

Deduction rules: how to claim VAT without consequences nine0020

March 6, 2023

Wages, insurance premiums and personal income tax in 2023: new rules for calculating, paying, reporting

February 2, 2023

Payments under civil law contracts: typical mistakes and their consequences. Changes for 2023

Changes for 2023

January 30, 2023

Business trips in Russia and abroad: the nuances of registration, payment and taxation nine0020

- Popular

Education guide

You can be convinced of the quality of our products and services, because, as you know, it is better to see once than hear 100 times

Consultant Plus nine0006 get a free demo access to the SPS ConsultantPlus kit you are interested in and solve the actual problem for you

Webinarorder access to a recording of a webinar on a hot topic (optional for an accountant, personnel officer, lawyer, public procurement specialist, budget organization)

Seminar nine0006 attend a seminar on a topic of interest to you free of charge (to choose from the program of upcoming educational events for various specialists) Refresher courses IPBRAttend a free advanced training seminar (to choose from 11 IPBR special courses from zero level to IPBR certification)

sbis nine0006 order a free demonstration of the SBiS electronic reporting system and see how it will save you time and energy when working with documents By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. nine0025

By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. By clicking the "Submit" button, I accept the terms User Agreement and I give my consent to processing of my personal data. nine0025 Account activation

Forgot your password?

Forgot your password?

By clicking the "Register" button, I accept the terms User Agreement and I give my consent to the processing of my personal data.

nine0000 50% of Russians do not file a tax deduction, although it is not difficult to do so :: RBC Pro

nine0000 50% of Russians do not file a tax deduction, although it is not difficult to do so :: RBC Pro Pro Project partner*

TV channel

Pro

Investments

activity

RBC+

New economy nine0020

Trends

Real estate

Sport

Style

National projects

Town

Crypto

Debating club

Research nine0020

Credit ratings

Franchises

Newspaper

Special projects St. Petersburg

Petersburg

Conferences St. Petersburg

Special projects

Checking counterparties

RBC Library

Podcasts nine0020

ESG index

Politics

Economy

Business

Technology and media

Finance

RBC CompanyRBC Life

Section 9 material0173 Investments

Investments · Taxes

Instructions HeadHunter

Only 38% of working Russians make a tax deduction, the research service hh.