How can i get insurance for my child

Children's Health Insurance Program (CHIP) Eligibility Requirements

If your children need health coverage, they may be eligible for the Children's Health Insurance Program (CHIP).

CHIP provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid. In some states, CHIP covers pregnant women. Each state offers CHIP coverage, and works closely with its state Medicaid program.

See if your children qualify and apply for CHIP

Each state program has its own rules about who qualifies for CHIP. You can apply right now, any time of year, and find out if you qualify. If you apply for Medicaid coverage to your state agency, you’ll also find out if your children qualify for CHIP. If they qualify, you won't have to buy an insurance plan to cover them.

2 ways to apply for CHIP:

- Call 1-800-318-2596 (TTY: 1-855-889-4325).

- Fill out an application through the Health Insurance Marketplace®. If it looks like anyone in your household qualifies for Medicaid or CHIP, we’ll send your information to your state agency.

They’ll contact you about enrollment. When you submit your Marketplace application, you’ll also find out if you qualify for an individual insurance plan with savings based on your income instead. Create an account or log in to an existing account to get started.

FYI: Apply any time

You can apply for and enroll in Medicaid or CHIP any time of year. There’s no limited enrollment period for either Medicaid or CHIP. If you qualify, your coverage can start immediately.

What CHIP covers

CHIP benefits are different in each state. But all states provide comprehensive coverage, including:

- Routine check-ups

- Immunizations

- Doctor visits

- Prescriptions

- Dental and vision care

- Inpatient and outpatient hospital care

- Laboratory and X-ray services

- Emergency services

States may provide more CHIP benefits. Check with your state for information about covered services.

What CHIP costs

Routine "well child" doctor and dental visits are free under CHIP. But there may be copayments for other services. Some states charge a monthly premium for CHIP coverage. The costs are different in each state, but you won’t have to pay more than 5% of your family's income for the year.

More answers

- What if my children are eligible for CHIP, but I would rather buy a Marketplace insurance plan?

If your children are eligible for CHIP, they won't be eligible for any savings on Marketplace insurance. CHIP coverage will probably be more affordable. Remember, you and other family members may be eligible for savings on Marketplace insurance coverage.

- If my children can get CHIP but I don't qualify for Medicaid, how can I get insured?

You may be able to get an insurance plan through the Marketplace, with savings based on your income.

- Create an account or log in to an existing account to get started.

If it looks like anyone in your household qualifies for Medicaid or CHIP, we’ll send your information to your state agency. They’ll contact you about enrollment. When you submit your Marketplace application, you’ll also find out if you qualify for an individual insurance plan with savings based on your income instead.

If it looks like anyone in your household qualifies for Medicaid or CHIP, we’ll send your information to your state agency. They’ll contact you about enrollment. When you submit your Marketplace application, you’ll also find out if you qualify for an individual insurance plan with savings based on your income instead.

How to Shop for Health Insurance (for Parents)

Note: Some parts of the Affordable Care Act ("Obamacare") are being changed or eliminated via government policies and laws. It is likely that some of the rules and regulations affecting the health insurance marketplace will continue to change over time. To stay up to date on Obamacare and other health insurance issues, visit healthcare.gov and the website of the health commissioner's office in your state.

In America today, we all need health insurance. You do. Your kids do. It's not a "nice to have" anymore — it's a "must-have." And that's the law. In most cases, parents who aren't covered (or don't have their kids covered) by health insurance might have to pay a fine each year. Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

To help people get health insurance, the federal and state governments set up a health insurance marketplace (also called the health care exchange). This makes it easier than ever to get coverage, but the process can seem a bit confusing.

Here's what to do to get health insurance.

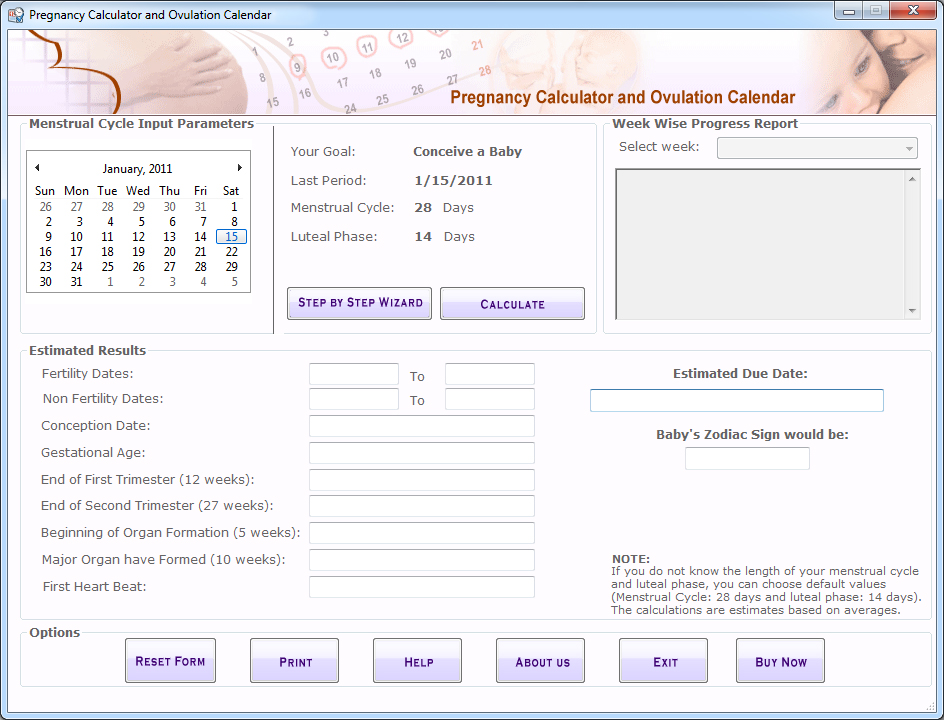

Getting Started

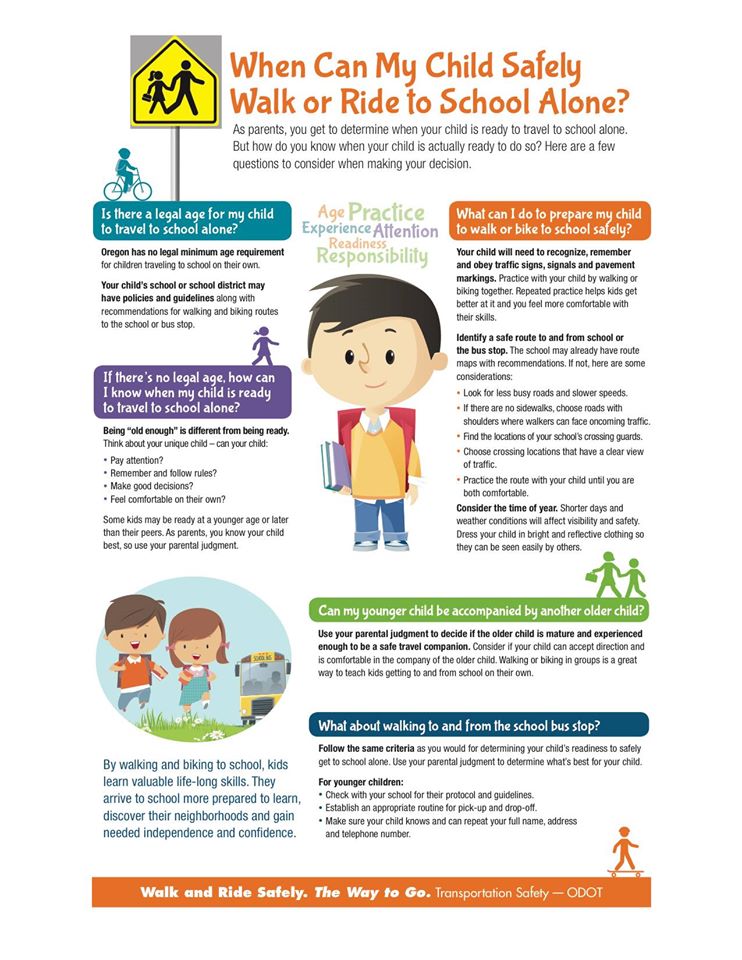

Before you look for a health insurance plan, check to see if you or your child can get coverage some other way. The government considers a person covered if they have Medicare, Medicaid, a state-run child health insurance plan (CHIP), or insurance they get through a parent or spouse's job. Your child could already be covered by or be eligible for free or low-cost coverage through a public program.

If you need to get insurance for yourself or your child, you can go online and visit the U. S. Government's comprehensive health care website (www.healthcare.gov). There, you can apply for CHIP or Medicaid or shop for a plan.

S. Government's comprehensive health care website (www.healthcare.gov). There, you can apply for CHIP or Medicaid or shop for a plan.

It's important to remember, however, that you can only buy insurance through the health care marketplace during the open enrollment period, which begins in mid-November and lasts until February. If the enrollment period is over, you or your child may have to get insurance through a private insurer to be covered for that year.

In some states, the health care exchange is run by healthcare.gov. Other states run it themselves. If you live in one of those states, you can visit your state's official marketplace website directly or link to it through healthcare.gov.

If you don't have regular access to a computer, you can call the U.S. Government's help line at 1-800-318-2596 to fill out an application, enroll, or compare plans.

p

How to Apply for a Plan

Applying for an insurance plan through the health care marketplace can be done online through healthcare. gov or a state site, over the phone, or through regular mail by filling out a form that can be mailed to you or downloaded from the Internet.

gov or a state site, over the phone, or through regular mail by filling out a form that can be mailed to you or downloaded from the Internet.

Before you fill out an online application, you'll need to create an account on either healthcare.gov or your state's marketplace.

You'll need to know a few things about each person applying for coverage. Be ready to provide:

- Social Security numbers (or document numbers for legal immigrants)

- information about employers and income

- policy numbers for any current health insurance plans

If you have a job that offers health insurance but you're not happy with it, you can choose to get coverage through healthcare.gov instead. But before you apply, you'll need to fill out a form called an Employer Coverage Tool that can be found on the healthcare.gov website.

The application will ask for standard information like your name, your child's name, your address, phone number, and email. You'll need to answer questions about citizenship, dependents, and whether you plan to file a federal income tax return the following year.

If you want help paying for insurance, you will have to provide information about your yearly income (and the income of anyone else applying for coverage). This includes income from jobs and other sources like:

- Social Security

- unemployment

- retirement accounts

- property rental

- alimony

If you pay alimony or interest on student loans, you can deduct the amount you pay when you fill out your application.

What Happens Next?

Once you've submitted an application, healthcare.gov or your state's site will determine if you or your children qualify for Medicare, Medicaid, or CHIP. It will also determine if you or your children are eligible to get insurance through the health care marketplace. For most people, if you're an American citizen or legal immigrant and you're not in jail, you'll be eligible.

Although it's unlikely, sometimes parents are eligible to buy insurance through the health care marketplace but their children aren't. Sometimes kids are eligible but their parents aren't. If either of these apply to you, you would have the right to appeal the decision, and you could still get private insurance for anyone needing coverage.

Sometimes kids are eligible but their parents aren't. If either of these apply to you, you would have the right to appeal the decision, and you could still get private insurance for anyone needing coverage.

If you're eligible for coverage but don't qualify for any publicly subsidized programs, the health care marketplace will present you with the insurance plans available in your state based on your income and family situation. It will be up to you to decide which policy to buy.

p

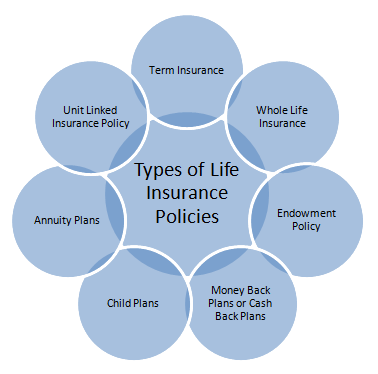

What to Look for When Choosing a Policy

The important words to remember when shopping for a policy are "premium" and "deductible." The premium is the amount you pay each month for coverage. The deductible is the amount you need to pay each year for medical services before your health insurance kicks in. As a general rule, insurance plans with low premiums have high deductibles, and plans with high premiums have low deductibles.

These are the basic levels of coverage:

- Catastrophic insurance is designed to protect an otherwise healthy person in the event of a major injury or illness.

It's available only to people under age 30 and those who are exempt from other plans due to hardship. This type of insurance can have low premiums but very high deductibles. Plans generally cover less than 60% of the costs of health care.

It's available only to people under age 30 and those who are exempt from other plans due to hardship. This type of insurance can have low premiums but very high deductibles. Plans generally cover less than 60% of the costs of health care. - Bronze plans also have low premiums and high deductibles, but they offer better coverage than catastrophic insurance, typically paying for 60% of costs.

- Silver plans and gold plans have average-sized premiums and average-sized deductibles. Silver plans cover 70% of costs. Gold plans pay 80% of costs.

- Platinum plans, the highest level of coverage, have high premiums and low deductibles. These plans cover 90% or more of health care costs.

All catastrophic, bronze, silver, gold, and platinum plans offer free or discounted visits to the doctor for things like routine checkups or vaccinations and some preventive care. Most plans also offer discounts on prescription drugs and other services. Specific benefits differ from plan to plan, though, so you'll need to learn what each plan offers. Think about what's important to you and your family and make a decision based on how well the plan meets your needs.

Specific benefits differ from plan to plan, though, so you'll need to learn what each plan offers. Think about what's important to you and your family and make a decision based on how well the plan meets your needs.

When Can I Start Using My Insurance?

Once you've signed up for a plan and paid the first month's premium, you or your child can start using the insurance. The insurance company should send you and everyone covered by your policy insurance cards with your policy number and other information. If you or your child need to see a doctor or go to a hospital before you receive your card, call your insurance company first to make sure your family has been entered into their system.

You should also make sure that any doctor you choose for you or your child is in your insurance plan's network. A network is made up of doctors, specialists, and other health care providers who have agreed to work with your insurance company when it comes to payments and services. If you take your child to a doctor who isn't in your plan's network, you may have to pay full price for some services.

Ask around and learn what you can about the primary care physicians in your plan's network, and then choose a doctor you like. Once you've done that, schedule checkups and use your insurance to help keep your family healthy.

Reviewed by: Steven Dowshen, MD

Date reviewed: July 2018

How to get an injury insurance payment

12/29/2021

When we buy an insurance policy, we hope that nothing will happen. But if trouble happened and you got injured, you need to do everything right. If you follow simple instructions, then receiving an insurance payment will not be a problem.

Contacting doctors

Your injury must be recorded in order to receive payment. Therefore, do not self-medicate. If the injury is mild, go to the nearest emergency room. According to the legislation of the Russian Federation, you are required to be accepted there, even if you do not have a policy or other documents with you. If the injury is serious and it is difficult to move, call an ambulance. It is important that your injury is officially registered and described. All examinations, including x-rays and MRI, must be prescribed by a doctor. Follow all doctor's orders during treatment. Getting an insurance payout is important, but recovering from an injury is a must.

If the injury is serious and it is difficult to move, call an ambulance. It is important that your injury is officially registered and described. All examinations, including x-rays and MRI, must be prescribed by a doctor. Follow all doctor's orders during treatment. Getting an insurance payout is important, but recovering from an injury is a must.

Insured event

Before applying for an insurance claim with a company, it is important to understand whether your injury relates to an insured event that is covered by your policy. You can specify this in your contract. If you do not have a policy on hand, then download a new copy from your Personal Account.

Insured event — an event that occurred during the period of insurance and is specified in the insurance policy. After an insured event, the obligation of the insurance company to pay compensation to the insured person, his representative or another person (the Beneficiary) appointed by the contract

If you find your injury on the list, it's time to apply for an insurance payment.

Procedure for receiving an insurance payment

Step 1: Notify the company

Contact us to report your injury.

How can this be done?

- Through Personal Account

- By phone 8 495 981-2-981

- Via notification on website

- Through your financial adviser

Important to know!

You must report the incident to the insurance company as soon as possible. Insured events have a statute of limitations. And if no one reported an injury in a certain period, the company may refuse to pay.

Step 2: Complete application

Application form for payment can be downloaded here Download form .

To make it easier to fill out, use the sample Application for payment

Step 3: Prepare the required documents

- A copy of the insurance contract;

- Application for insurance payment;

- Copy of the passport of the Russian Federation: all pages with marks and seals;

- A copy of the power of attorney confirming the authority to conduct business in the insurance company on behalf of a relative and another person or on the basis of a birth / adoption certificate, if the parents represent the interests of the children.

In the event that the guardian represents the interests of the client, documents from the guardianship authorities will be required;

In the event that the guardian represents the interests of the client, documents from the guardianship authorities will be required; - Original or copy of medical records certified by a polyclinic or hospital indicating the diagnosis, anamnesis of the disease and the period of treatment;

- Original or copies of sick leave certificates (including electronic ones), certified by a polyclinic or hospital;

- Copies of documents in case of temporary disability;

- A copy of the act of an accident at work in the form of H-1, certified by the seal of the employer organization.

Please note!

The list of documents may differ for different cases. You can clarify the documents required to receive an insurance payment in a special section on the website.

Also, the list of documents required for payment is specified in the insurance rules or policy conditions. You can always download a copy of it in your Personal Account.

Important to know!

The insurance company has the right to request information about the incident from medical institutions, law enforcement agencies and other institutions. And also organize a medical or other examination at your own expense.

Step 4. Send documents to us

You can send documents by mail or bring them yourself to the address: Russia, 115114, Moscow, Derbenevskaya embankment, 7, building 22, floor 4, room 13, com. eleven marked in "Department of insurance payments and expertise" You can also submit documents through employees of regional offices.

When is the payment due?

For each case, the period for consideration of the application is individual. We have already written that the company, before paying out money, can make requests to various government agencies to clarify the circumstances of the insured event. This may increase the duration of the insurance payment. The status of the application can be checked in the Personal Account. At the end of this period, you will be informed whether you will receive a payment.

At the end of this period, you will be informed whether you will receive a payment.

Under what conditions can an insurance payment be denied

There are a number of reasons why an injury claim may be denied, for example:

- Violation of the terms of the contract. This is the most common reason.

- Providing false information or forged documents.

- Late or incomplete payment of insurance premiums by the client.

The client can apply to the court, where he will have to prove that, according to the terms of the contract, he should receive compensation. Payment may be denied for good reasons, so before going to court, you need to get legal advice. You can also contact the financial ombudsman.

We are ready to answer your questions at any of the stages of processing the insurance payment. You can contact us in a way convenient for you:

Via Personal Account

WhatsApp+7 495 9812981

Telegram @renlife_bot

By phone: 8 (495) 981-2-981

Via the website contact form

404 Not Found

|