Child trust fund how much do you get

Child Trust Fund calculator | Foresters Financial

Are you wondering what happens to Child Trust Funds at age 18 – visit our Child Trust Fund information hub

Investment decisions made for you - Schroders

Our customers rate us 4.7 out of 5 stars

Taking care of family finances for nearly 150 years

Choose how you do business with us

The projections give an estimated fund value to help illustrate what could be available to the Planholder at age 18 with a Forester Life Child Trust Fund, Child Trust Fund – Stakeholder Options, Child Trust Fund – Shariah and Child Trust Fund –Options (invested in Aberdeen UK All Share Tracker and/or Foresters Stakeholder (Schroders) Managed 1 Fund only). At age 18 no contributions can be added to the Plan, therefore the calculator will not be able to provide a projection.

Important information:

- The amount shown by the calculator is only an estimate of what the savings could be worth on your child’s 18th birthday and assume an annual growth rate of 2%, 5% and 8% and an annual charge of 1.

5%. It is also assumed an annual increase in monthly payments of 2.5% per annum compound to keep pace with inflation, subject to allowable limits.

- These figures are only examples and are not guaranteed. The actual value could be more or less than shown, and could be less than has been paid in. What you will get back depends on how much your investment grows and on the tax treatment of the investment. Investments can go down as well as up.

- Inflation would reduce what you could buy in the future.

- There is an annual charge of 1.5% of the value of the funds you accumulate. If your fund is valued at £250 throughout the year, this means that we charge £3.75 that year. If your fund is valued at £500 throughout the year, this means that we charge £7.50 that year.

- These figures assume contributions and investment over 10 years. Top-ups to existing Plans may be invested for a shorter period depending on the age of the child at the time.

- These figures do not take into account any Government payments made into the Child Trust Fund.

- If the Plan has received any contribution in the birthday year, and the Plan value exceeds £300, we will send you a statement showing the payments received, the number of units held and the value of your child’s Plan. We will also issue statements on your child’s 11th and 16th birthdays.

- All payments are locked into the Plan until the child’s 18th birthday and cannot be reclaimed by the donor(s).

- For more information please read the Child Trust Fund Key Information Document and Brochure.

The calculation is based on:

- Potential investment annual growth rate of 5%.

- Potential annual increase in monthly payments of 2.5% per annum compound to keep pace with inflation, subject to allowable limits.

- Annual charge of 1.5%

What exciting milestones could you be saving towards a child’s future? Find out more

Manage your Plan online

If you are the Registered Contact you can activate your online MyPlans account to view your child’s savings online. MyPlans allows you to make payments online, view your Plan value, see the fund performance, investment information and contact your Financial Adviser.

MyPlans allows you to make payments online, view your Plan value, see the fund performance, investment information and contact your Financial Adviser.

Family and friends can also set up their own Gifters My Plans account after making a contribution.

Activate your MyPlans account Log in to MyPlans

Child trust funds | MoneyHelper

A Child Trust Fund is a savings account for children born between 1 September 2002 and 2 January 2011. They’ve since been replaced by Junior ISAs, but those with existing Child Trust Fund accounts or vouchers can still keep their accounts and pay in.

Find out more about how a Child Trust Fund works and what you could do with the funds in your account if you have one.

What’s in this guide

- What is a Child Trust Fund and who has one?

- Finding a Child Trust Fund account

- How a Child Trust Fund works

- Types of Child Trust Fund

- Adding money to the account and family member payments to a Child Trust Fund

- What about Child Trust Funds and young people with disabilities?

- If you want to change the Child Trust Fund account that HMRC set up for you

- What is a Junior ISA and should I switch my Child Trust Fund into one?

- I’m 18 or over and have a Child Trust Fund.

What should I do with the money in it?

What should I do with the money in it?

What is a Child Trust Fund and who has one?

A Child Trust Fund (CTF) isa long-term tax-free saving account for children. They were designed to encourage children to become savers for their future adult life. You cannot apply for a new CTF because this government scheme is now closed but you can keep an existing CTF. CTF’s were available to all children born in the UK whose parents were awarded Child Benefit between 1 September 2002 and 2 January 2011.

All money earned on the CTF is tax-free, including capital gains, interest payments and any other money earned on the account. This means all the money in the fund belongs to the account holder and none of it will be lost in tax deductions.

The first CTFs matured in September 2020, when the oldest account holders turned 18. The last CTFs will mature in 2029. On maturity, CTFs s can either be cashed in or transferred into an adult ISA.

On maturity, CTFs s can either be cashed in or transferred into an adult ISA.

If you’re 18 or over and have money in a Child Trust Fund, find out more about your options

Back to top

Finding a Child Trust Fund account

Child Trust Funds can be lost to the young person they were set up for. This can be because HMRC set up the account with a starter payment amount on their behalf (if the parents didn’t open one), or because it has been forgotten and the parents have not updated their address.

However, lost accounts can easily be located. You can find out where a lost Child Trust Fund, even if you don’t know the provider.

If you already have a Government Gateway user ID and password, you could fill in the HMRC online form at GOV.UK (Opens in a new window)

HMRC will send you details of the Child Trust Fund provider by post within three weeks of receiving your request.

Alternatively, you can use the Share Foundation to help you find your Child Trust Fund account for free (Opens in a new window). You might find this useful if your provider has changed or if you grew up in care.

Back to top

How a Child Trust Fund works

When CTF’s became available, HMRC sent the parents or guardians of qualifying children a starting payment voucher of £250 (or £500 if you were on a low income). This voucher could then be used to set up a Child Trust Fund account in the child’s name.

If you didn’t use the voucher within one year, HMRC would set up a Child Trust Fund account in your child’s name on your behalf.

Money in a Child Trust Fund account belongs to the child and is ‘locked in’ until they turn 18.

When a child or young person turns 16 years old, they can legally take over responsibility for their Child Trust Fund account and can make decisions about the fund (such as switching to another provider or transferring it to a Junior ISA). They can do this by contacting their Child Trust Fund provider.

They can do this by contacting their Child Trust Fund provider.

When the account-holder turns 18 years old, they can access and withdraw the money in their Child Trust Fund account.

Back to top

Types of Child Trust Fund

There were three types of account that could be opened with the voucher:

1. Cash Child Trust Fund

This is where you can make deposits just as you would for a bank or building society account, which can earn tax-free interest.

2. Stakeholder Child Trust Fund

This is where the savings in the account are put into a wide mix of stock market investments. There are a set of rules to reduce financial risk (including that the money would gradually be moved to lower-risk investments when the child reaches 13 and a cap on the annual charge).

Stakeholder Child Trust Funds are charged based on the value of the fund and capped at a maximum charge of 1.5% a year.

A child will have a stakeholder Child Trust Fund account, opened by HMRC on the child’s behalf, if their parent(s) failed to open a Child Trust Fund account within a year of receiving a payment voucher.

3. Shares-based Child Trust Fund

This is where most or all the money is invested in shares, but without the protections of a stakeholder account. The savings in the account could be put into the stock market via an investment fund of your choice or select your own investments.

Back to top

Adding money to the account and family member payments to a Child Trust Fund

Anyone can pay money in to a CTF including parents, family members and friends. This is up to a total limit of £9,000 (2022/23) each year, with the child’s birthday considered the start of the year.

The amount of money in a child’s Child Trust Fund doesn’t affect any benefits or tax credits the child’s parent/guardian receives.

Child Trust Funds for Children in Care

Some children looked after by local authorities have a Child Trust Fund account set up on their behalf.

If a child has been in the care of a local authority and was born between 1 September 2002 and 2 January 2011, they could have a Child Trust Fund account.

The Share Foundation acts as the registered contact for Child Trust Fund accounts for children and young people who are care-experienced and manages them for the child or young person. The Share Foundation run both the Child Trust Fund and the Junior ISA schemes for children and young people in care.

The Share Foundation will write to the account holder about two months before they turn 16, telling them how to become the registered contact for their Child Trust Fund account.

Back to top

What about Child Trust Funds and young people with disabilities?

Some young people with a disability might not have the mental capacity to manage the money in their Child Trust Fund.

If your child doesn’t have mental capacity, then you as their parent(s)/carer(s) will need to apply to the Court of Protection to act as your child’s Deputy.

A Deputy is someone, usually a family member, who is appointed by the court to manage and make day-to-day decisions about someone’s finances. Without this, you won’t be able to manage the account when your child turns 18. This is because they legally become an adult and the money belongs to them.

At the moment, applying to the Court of Protection can be expensive. This is because there’s a court fee of £365 – and legal costs, if a solicitor is used. There might also be delays to the process due to the coronavirus pandemic.

It’s important to get legal advice if you want to apply to the Court of Protection so you understand all of the options. Solicitors might provide you with a free initial discussion.

However, the government announced on 1 December 2020 that all parents or guardians of children or young people who lack mental capacity can ask for court fees to be waived or refunded when seeking access to a Child Trust Fund.

Back to top

If you want to change the Child Trust Fund account that HMRC set up for you

If HMRC set up a Child Trust Fund account for your child, you can change to a Child Trust Fund provider or account of your choice. You can do this at any time.

Make sure you ask providers about any fees charged for running the account. Also ask about making further contributions. You can pay as little as £10 into a stakeholder account, but some providers might require larger payments for other accounts.

If you’re looking to change your Child Trust Fund provider, also be wary of scams, which are designed to get hold of your money and can come in many forms.

Back to top

What is a Junior ISA and should I switch my Child Trust Fund into one?

An alternative to switching Child Trust Fund providers is to switch your Child Trust Fund into a Junior ISA.

If you have a Child Trust Fund you can’t have a Junior ISA at the same time. But you can transfer your Child Trust Fund into a Junior ISA.

You don’t have to transfer a Child Trust Fund into a Junior ISA. However, a Junior ISA can work out better for your child’s savings in the long term.

Junior ISAs generally offer more choice and better value, whether it’s higher interest rates on their cash accounts or lower annual fund management charges.

You can’t transfer back to a Child Trust Fund when you’ve switched to a Junior ISA. So it’s important to check that you’re getting the best possible deal in terms of investment returns and fees.

So it’s important to check that you’re getting the best possible deal in terms of investment returns and fees.

Back to top

I’m 18 or over and have a Child Trust Fund. What should I do with the money in it?

If you’re 18 years old or over, you can access the money in your Child Trust Fund account.

To access the money you will need to contact your Child Trust Fund provider. If you don't know who that is, read the section above on 'Finding a Child Trust Fund account'.

It’s your money, and it’s up to you what you do with it.

One option to consider is to continue saving your money. This could be by, for example, transferring your money into an adult savings account or an adult ISA. As your savings build up, they’ll grow faster – so your money makes money.

You might want to save regularly and build up your fund for a deposit towards a property purchase or a rental deposit.

The money in your Child Trust Fund could also provide an excellent foundation for building a ‘rainy day fund’ to make sure you have money available for emergencies or sudden expenses.

Putting money away now means you’re covered for an expense you didn’t see coming, reducing your need to borrow. For example, if you were to suddenly lose your job, need a new phone or need emergency dental treatment – that’s when a rainy day fund would be handy.

What happens when my Child Trust Fund matures?

If you have a Child Trust Fund but do not inform your provider what you would like to do with the money in it when it matures, the money will be held in a 'protected account' until you contact your provider.

Interest earned on funds in a 'protected account' will remain tax-free, and any terms and conditions that applied to your Child Trust Fund before it matured will still apply.

Back to top

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

how to open a trust fund bank account in 2021 - expert guidance

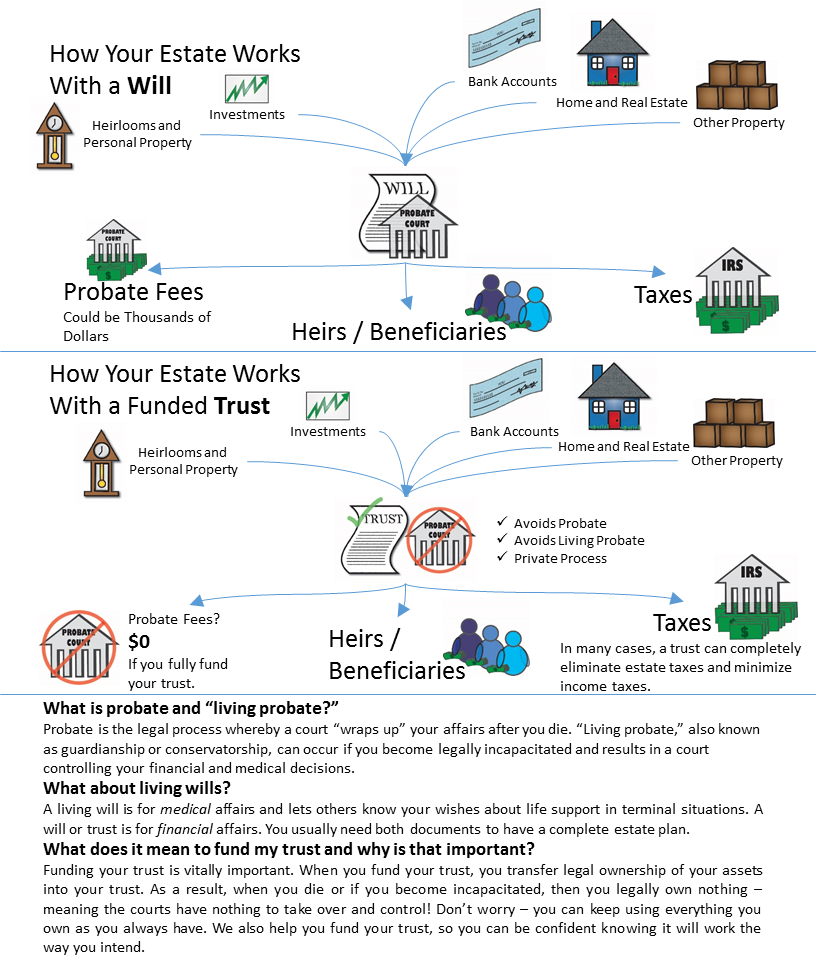

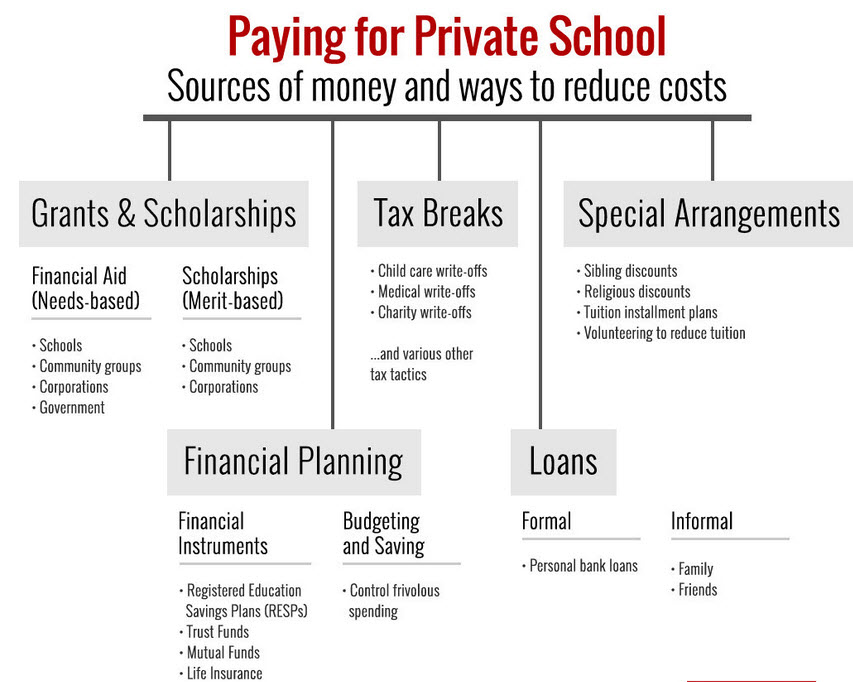

There are many ways to secure the financial future of your loved ones. Starting a trust fund is a great way to help your children and everyone you care about achieve financial success in the future.

A trust account is also not usually reserved for the very wealthy. In fact, regardless of your net worth, you can set up a trust fund to ensure that your loved ones manage and distribute your assets in a certain way. nine0003

Most banks have trust departments where consumers can open a trust account. A trust fund account allows an individual or entity to manage the account's assets on behalf of a third party or beneficiaries, such as for college tuition or property taxes.

One of the most significant benefits of a trust account is that it allows the settlor of the trust, known as the "grantor", to determine his own rules for handling his assets and disbursing them to beneficiaries. Wills, which can be costly and time-consuming, are often avoided with trust accounts. nine0003

Wills, which can be costly and time-consuming, are often avoided with trust accounts. nine0003

In this post, we'll look at what a trust is, who the parties to a trust are, why you might need one, and how to set up a trust.

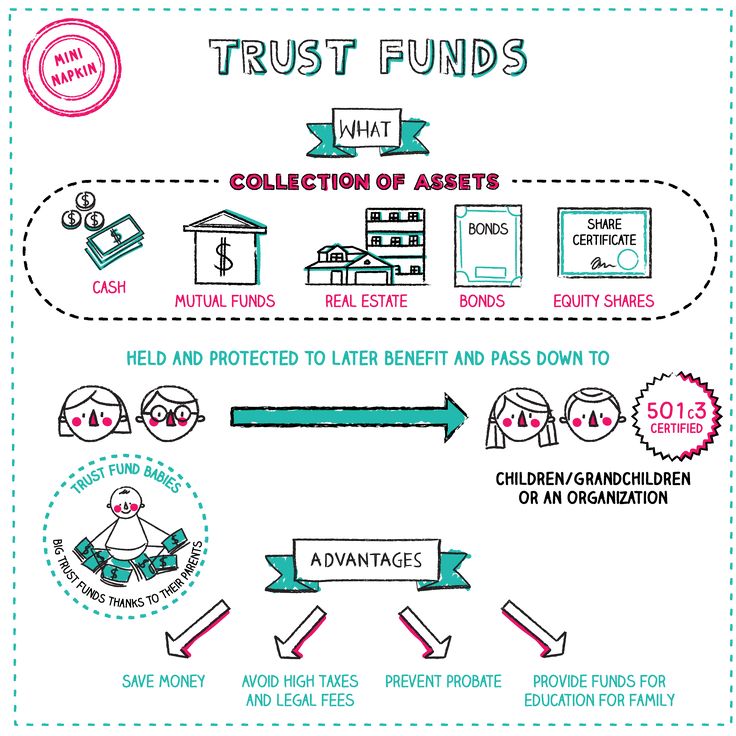

What does a trust fund mean?

A trust can be defined as a relationship arising whenever a person known as a trustee is compelled by equity and law to hold property received from the grantor for the benefit of other persons or some authorized entity known as the beneficiary . nine0003

A trust fund is also defined as an agreement in which a person gives the other party the legal authority to manage their assets for the benefit of another person. The instrument of a trust fund can be real estate, bonds, mutual funds, or even stocks.

The person creating the trust is called the settlor, and the person for whom it is created is called the beneficiary. Trust funds can be formed for charities or causes you care about, not just your children. nine0003

nine0003

Read also: What is a trust account? Overview and how it works

Is setting up a trust fund a good idea?

Yes. And this is because a trust fund is a tool to protect your assets and ensure the financial security of your loved ones in the future. More importantly, a trust can help you avoid heavy inheritance taxes and ensure the most efficient transfer of most of your money, stock, and capital.

How does a trust fund work? nine0013

There are three persons in a trust: the trustee, the trustee and the beneficiary. A trustee is a person who creates a trust fund and contributes his or her assets to it. A trustee is a person or organization in charge of assets.

The principal is working with a lawyer to set up a trust fund. You can also hire a financial advisor to help you allocate your assets properly. The trustee, who is usually a family member or financial institution, is appointed by the donor. nine0003

The grantor must additionally identify the beneficiary, such as their children or grandchildren, a business partner, or a charitable organization. The terms of the trust fund are also developed by the grantor and the lawyer. The grantor's assets will be included in the agreement, as well as how they will be divided.

The terms of the trust fund are also developed by the grantor and the lawyer. The grantor's assets will be included in the agreement, as well as how they will be divided.

Other estate planning instruments such as trust funds are not the same. They allow the grantor to specify how and when the assets of the trust will be distributed to the beneficiary. As a trustee, you can distribute funds to a recipient each year or as a lump sum when the recipient reaches a certain age. nine0003

The grantor may even indicate that the funds will be used for major expenses such as college tuition or a down payment on a house.

A waste clause is a common element of a trust fund. This prohibits the beneficiary from using the assets of the trust fund to pay off liabilities. Thus, even if the beneficiary spends all his money and goes into heavy debt, his creditors will not be able to touch his trust fund.

How are trusts paid? nine0013

The trust will indicate when the beneficiaries will be able to receive the funds. This may be after reaching a certain age, when the funds are used for a specific purpose or as part of a grant-making trust.

This may be after reaching a certain age, when the funds are used for a specific purpose or as part of a grant-making trust.

Beneficiaries cannot access money held in trustees' savings accounts and the trustees cannot give them permission to do so. Instead, the trustee must either transfer money from the trustee's savings account to an account in the name of the beneficiary, or transfer the entire account to a personal account in the name of the beneficiary. nine0003

Who is a trustee?

The term "trustee" refers to a person or entity that manages and maintains the ownership of assets for the benefit of another, otherwise known as the beneficiaries. Trustees have a fiduciary obligation to the beneficiaries, which means that they must treat the assets of the beneficiaries in a manner that is always in the interests of the beneficiaries.

What are the duties of a fiduciary? nine0013

Trustees invest and manage the beneficiary's money and assets on their behalf. They are the legal owners of any funds or assets held in trust, which allows them to manage them on behalf of the beneficiary. However, trustees are not allowed to spend this money for personal purposes.

They are the legal owners of any funds or assets held in trust, which allows them to manage them on behalf of the beneficiary. However, trustees are not allowed to spend this money for personal purposes.

They must represent the best interests of the beneficiary and must make judgments with the utmost care and precision. If there are multiple trustees, they each have equal status and access to the trust account. nine0003

Trustees must understand how the trust works and are prohibited from acting outside its rules and purposes; they have a legal obligation to handle the money in accordance with both the law and the provisions of the trust.

All trustees must keep accurate records and accounts for a minimum of six years (although preferably for the life of the trust). They must also ensure that the appropriate taxes are paid by the trust.

What happens when a trusted person passes away? nine0013

Company The trust deed usually states what happens if the trustee dies and how new trustees are appointed. Surviving trustees often gain the right to appoint new trustees.

Surviving trustees often gain the right to appoint new trustees.

Benefits of a trust fund

A trust fund has several benefits, but perhaps the most important is the control it gives you over the management of your assets. Trust funds can ensure that your assets are properly cared for until your beneficiaries reach the age of majority, as well as avoid probate. nine0003

Trust money can also be used to allocate funds for specific purposes, such as health care or education.

If you are a Trust Fund beneficiary, the most significant benefit will likely be the financial assistance you receive. While it's hard to think about inheriting anything from a loved one, a trust fund can be quite helpful for your financial circumstances.

Trust funds can also help you save time and money by avoiding the time and emotional stress associated with lengthy probate litigation. nine0003

See also: HEIR TRUSTEE

Other benefits of setting up a trust include:

Control over your wealth : You have full control over the terms of the trust, including when and to whom payments are made. Even in complex scenarios, such as children from multiple marriages, you can create a revocable trust so that the assets of the trust remain available to you for your entire life, while specifying who will receive the remaining assets. nine0003

Even in complex scenarios, such as children from multiple marriages, you can create a revocable trust so that the assets of the trust remain available to you for your entire life, while specifying who will receive the remaining assets. nine0003

Protecting your legacy : A well-formed trust can help protect your estate from creditors to your heirs or beneficiaries who may be financially insecure.

Confidentiality and Will Savings : Will is a public document; a trust can allow assets to go beyond the will and remain private, and potentially reduce the amount lost in legal fees and taxes in the process. nine0003

Types of Trust Funds

There are following types of Trust Funds:

- Blind Trust Fund

- Single Trust Fund

- General Trust Fund

No.1. Blind Trust Fund

The recipient of a blind trust fund does not know the identity of the trustee or responsible person. The blind trustee has full control over the management of the trust until the funds are paid. nine0003

The blind trustee has full control over the management of the trust until the funds are paid. nine0003

Blind trust funds are typically used when an individual wishes to avoid a conflict of interest, such as when the trust is related to a business or investment. Blind trusts can also be used to add an extra layer of privacy to the management of a trust.

No. 2. Single Trust Fund

A mutual trust fund is a form of mutual fund structure that allows income to be transferred directly to the client (who will be the beneficiary). Mutual trust investors can maximize their payout without reinvesting their earnings in the fund. nine0003

Mutual trust funds may invest in securities, stocks and bonds, among other things. Rather than being used as a real estate planning tool, they are more commonly used by investors as a tax shelter method.

No. 3 General Trust Fund

A financial institution administers a general trust fund on behalf of a group of individuals. General trust funds are similar to mutual funds in that they are only open to people who have trust accounts. nine0003

General trust funds are similar to mutual funds in that they are only open to people who have trust accounts. nine0003

General trust funds are no longer as popular as they once were, as other types of trusts and investments may offer more benefits. Now they are considered as a specialized investment structure.

Read also: LIVING TRUST: overview, cost, patterns, pros and cons (+ writing guide)

What is the purpose of a trust fund?

Here is a summary of what a trust fund is for. Let's imagine that you have been fine with your finances for a long time, and you realized that no one lives forever, so you want to provide your children or loved ones with a financial pillow. nine0003

However, you need something that won't ruin these people's lives; because wealth can destroy people if they are not held accountable.

Instead of giving them all at once, you consult with a lawyer and establish criteria that must be met before specific assets are distributed. Because you have worked so hard for this, the creation of a trust gives you the power to make those decisions.

Because you have worked so hard for this, the creation of a trust gives you the power to make those decisions.

How much does it cost to set up a trust fund?

A lawyer will likely charge between $5.00 and $7,000 to set up a trust, depending on the complexity of your financial situation. For example, some situations may require a revocable trust for some assets and an irrevocable trust for others.

A comprehensive estate plan (which may include a will, power of attorney, living will, power of attorney for health care, and changes in ownership of certain assets) will be more expensive than a single trust document. nine0003

While you can build trust yourself with self-help books or online instructions, it's usually tricky and complicated.

The right help, whether it's through online services or checking your trust with a lawyer, can give you the peace of mind you need to know you're doing the right thing.

Read also: Prosper Loans: An in-depth look at 2023 and how it works

How to open a trust fund bank account - an expert guide

Here is step -by -step instruction Guide to Creation Trust:

- Select the correct type of trust

- Describe the specifics of the trust

- Make the official

- TRUSTS (Register

- IRS)

No.

1. Choose the right type of trust

1. Choose the right type of trust Think about the purpose of a trust before you set it up. Once you have established your goals and objectives, you can decide what type of trust to base your decision on. nine0003

Once you have chosen the right type of trust, you will need to keep track of what assets you will place in the trust, how the assets will be managed and distributed, and who will be the beneficiaries and trustees. Consider how long the trust will last and under what conditions it will end.

No. 2. Describe the specifics of the trust

You must again create the four components of a trust fund. Here is a summary of what each of them entails:

Grant r: The grantor is the person whose name is held in trust.

Beneficiary: The person or persons who are to receive the assets of the trust.

Property and Assets: This is the contents of the trust that will eventually be distributed to the beneficiaries.

Trustee: The wishes of the grantor are carried out by the trustee, who is the trustee of the trust fund. As long as the donor is alive, it could be them. However, they should choose a new confidant to maintain their trust and fulfill their wishes if they become disabled or die. nine0003

#3. Make trust official

Several websites provide DIY trust services, but these are rarely secure. Because trusts can be complex, most trustees hire a competent real estate or trust attorney. If it's convenient for you, ask friends, family and colleagues for recommendations; if you are working with a financial advisor, he or she should also be able to point you in the right direction.

Lawyers familiar with state trust laws can be found in state bar associations and local governments. You should look into prices as well as reviews because fees can vary greatly. Check to see if your company provides low-cost property planning services as part of an employee benefits package. nine0003

nine0003

To establish the details of the trust you have settled on, your attorney will prepare a trust deed, trust deed, or trust deed.

An article can be simple or complex, short or long. This depends on the form of the trust, the assets in the trust and the number of beneficiaries named in the trust.

You must sign the deed of trust in front of a notary when your attorneys have completed it. Some states require trust papers to be filed with the state; a lawyer can advise you if you need to do this and how to do it. nine0003

No. 4. Trust must be funded

It's time to fund your trust once you've established it. Take your trust documents to a bank or financial institution and open a trust fund bank account in the name of the trust. Names and contact details of authorized persons will be required. You can make a one-time deposit or deposit funds in trust over a specified period of time. Eventually, the assets are transferred to the fund.

No. 5. Register your trust fund with the Internal Revenue Service (IRS).

nine0107

nine0107 You must register your trust fund for tax purposes after it has been created. Among other things, for tax returns and financial reporting, each trust often requires its own taxpayer identification number (TIN).

This is the same as EIN (Employer Identification Number) or SSN (Social Security Number) (SSN). The IRS website makes it easy to file online, but if you prefer printouts, you can download and mail Form SS-4. nine0003

As a child trust

There are usually a number of steps involved in setting up a children's trust.

Below is an example of some of the steps you need to take if you want to invest in a children's trust fund:

- Decide on the trust assets

- Choose a trustee

- Determine the beneficiaries

- Set up a trust agreement 9090 Settle the trust Settle the trust 900

- Sign a trust

- Pay stamp duty if you need to

- Create a name for your trust

- Apply for ABN and TFN

- Create a bank account

0

How are trust funds taxed?

Beneficiaries of trusts who receive payments from the main balance of the trust are exempt from paying taxes on the payments. The Internal Revenue Service (IRS) believes that this money was already taxed before it was transferred to the trust. nine0003

The Internal Revenue Service (IRS) believes that this money was already taxed before it was transferred to the trust. nine0003

Interest that accrues in a trust is taxed as income of either the beneficiary or the trust itself if money is invested in it.

The Trust is required to pay taxes on any interest income it earns and does not distribute after the end of the financial year. Interest income from a trust is taxed by the beneficiary who receives it.

The amount awarded to the beneficiary is calculated first using the current year's income and then the accumulated principal. nine0003

This is usually the initial deposit plus any additional contributions plus any income in excess of the amount provided. The trust or beneficiary may be liable for capital gains of this amount. To the extent of the trust distribution deduction, the entire amount given to and for the benefit of the beneficiary is taxable to him or her.

Will a trust fund bequeath

A living trust is often touted as a way to "avoid a will" after you die. A will is a court-controlled process of administering your estate and transferring your estate after your death in accordance with the terms of your will. nine0003

A will is a court-controlled process of administering your estate and transferring your estate after your death in accordance with the terms of your will. nine0003

A will is rarely the disaster its critics suggest. Also, even without the costs of setting up a living trust, many forms of ownership regularly fall outside the probate process.

Real estate, bank or brokerage accounts are held in a joint name with the right to inherit, and life insurance or pension plan assets pass to the designated beneficiary at the direction of, and not at your will.

Conclusion

Although it is very easy to set up trusts, it is very important that they are effective and that they are part of a broader financial strategy. While there is a wealth of information available online, it is a good idea to consult with a competent professional such as a lawyer, accountant, tax advisor, or estate planner before setting up any trust agency to ensure the best possible outcome for you and your family. or your business. nine0003

or your business. nine0003

Frequently asked questions about trust funds

Who benefits from a trust fund?

Among the many uses and benefits of trusts is ongoing professional asset management; reduction of tax liabilities and probate expenses; holding assets outside the surviving spouse's estate while providing income for life; caring for people with special needs; and protection against bad financial decisions.

Why don't we trust the foundation, baby?

A trust may be set up for a child by the parents, but in most cases such a trust can only be accessed by the beneficiary when he or she reaches a certain age. An infant trust fund is simply a fund set up by a parent to hold assets such as cash or investments.

Must a trust fund be capitalised?

Yes, the trust fund must be capitalized. Capitalization is an accounting approach in which costs are recognized as part of the cost of an asset and expensed over the useful life of the asset. nine0003

nine0003

Are trust funds a public record?

A trust fund is not a public record; it is not possible to obtain a trust document from a government official, agency, or anyone who is not a beneficiary and has no right to know the terms of your trust.

- Grantors Trust: A Simple Comprehensive Guide (Updated!)

- What is a Trust Account? Overview and how it works

- LIVING TRUST: overview, cost, patterns, pros and cons (+ writing guide)

- Beneficiary of a Trust: Definition, Laws and Best Practices in the United States.

- WHAT IS A TRUST FUND? How it works?

WHAT IS A TRUST FUND? How it works?

There are many options for securing a financially secure future for your loved ones. Trust funds are a great way to prepare your children or grandchildren for future financial success. Also, they are usually not meant for the very wealthy. In fact, regardless of your net worth, you can set up a trust fund to ensure that your loved ones manage and allocate your assets accurately. Consider consulting a financial expert for help with trust funds or other estate planning difficulties. nine0003

Consider consulting a financial expert for help with trust funds or other estate planning difficulties. nine0003

What is a trust fund?

A trust fund is a legal institution that holds assets until the intended recipient can receive them. When the beneficiary reaches a certain age, or when the previous owner of the assets dies, this happens.

To understand how a trust fund works, it is helpful to understand the following three terms:

- Grantor: This is the person in charge of transferring assets to the trust fund. If you are someone who wants to establish trust, this is you. nine0100

- Beneficiary: The beneficiary is the one who is legally entitled to the assets in the trust. It could be a family or a favorite charity.

- Trustee: The trustee is the decision maker responsible for the proper distribution of trust fund assets.

Trusts may contain assets such as real estate (such as heirlooms or jewelry), stocks, bonds, or even businesses. nine0003

nine0003

Cars and life insurance should not be placed in a trust without first consulting a tax professional or real estate attorney. Retirement accounts, for example, should not be placed in a trust because they usually already have a designated beneficiary, which keeps them out of probate, the sometimes lengthy legal process of validating a will, and distributing assets according to its instructions.

There are two ways to transfer assets to a trust fund. As a grantor, you can either transfer assets to a trust during your lifetime or use your succession plan to indicate that a trust should be created and certain assets will be transferred to it after your death. nine0003

How a trust fund works

Trust funds can hold a variety of assets, including cash, investments, real estate, and art. They can even contain entire businesses. In fact, anything of value can be placed in a trust fund.

Thus, trust funds are "entities". What does this entail in terms of understanding how trust funds work?

Putting money into a trust allows you to transfer property to someone in an organized manner where rules may be imposed. For example, you can specify that the beneficiary is not allowed to use the funds to pay off debts. Alternatively, you can set limits on the age of the beneficiary before they can take possession of the funds. nine0003

For example, you can specify that the beneficiary is not allowed to use the funds to pay off debts. Alternatively, you can set limits on the age of the beneficiary before they can take possession of the funds. nine0003

Reasons to set up a trust

While there are countless reasons to set up a trust, here are some of the more common ones, as well as the types of trusts best suited to them.

#1. Wills are avoided.

Trust fund assets are distributed to beneficiaries outside of the probate process. You can create a revocable living trust for this purpose.

No. 2. Beneficiaries are under protection.

If the beneficiary lacks the life skills necessary to manage the assets of the trust (for example, a minor who has inherited a large amount of money), you can create a conditional trust that transfers assets to him only when he reaches a certain age. nine0003

#3. Preservation of valuables.

If you want to keep some assets for your children in the event of a divorce, you can set up a trust trust to ensure that your child's ex-spouse does not claim the trust assets.

No. 4. Establishing a line of descent.

You can set up a spousal trust, also known as a bypass, loan shelter, family or A/B trust, if you want your surviving spouse to first purchase the assets in the trust and then distribute the remaining assets to selected beneficiaries when they are dying. nine0003

No. 5. Taxation.

You can place assets in an irrevocable trust to reduce your tax liability or prevent possible inheritance tax. Since the assets in this type of trust no longer belong to you, you will not have to pay income tax on them during your lifetime, and you can avoid paying inheritance tax after death.

№ 6. Creation of conditions for disabled beneficiary.

Some social services are only available to people with little wealth and income. You can set up a trust for additional needs or special needs so that a disabled person in your care continues to receive public assistance after your death, even if he inherits the money. nine0003

Most trust funds are also classified as revocable or irrevocable.

Revocable trust funds allow the settlor to change or revoke the trust during his life. Irrevocable trust funds are permanent and usually cannot be easily changed after they are created.

Advantages and disadvantages of trust funds

Each type of trust fund has its own advantages and disadvantages. This is how they differ between the two types of trust funds: revocable and irrevocable trusts. nine0003

Revocable Trust Fund Benefits

#1. Asset Management.

Revocable trusts allow for simple administration and control of assets, which can be very useful for older people with children living in remote cities. Since the assets transferred to the trust must be in the name of the trust, the trust can consolidate a variety of assets under one roof, and when the grantor dies, the assets can be controlled by the trustee. nine0003

No. 2. Keep Probate at bay.

If you live in a state where probate costs are high and probate periods are long, trust assets can easily pass to your heirs and save them the hassle of waiting for the state to settle your estate.

#3. Confidentiality.

A revocable trust allows you to keep your property private. Consider trust names that hide personal information, such as the JJS Revocable Trust rather than the John James Smith Revocable Trust, to maintain secrecy. nine0003

Drawbacks of revocable trust funds

#1. Expensive

Revocable trust fees vary depending on the complexity of your estate and the state in which you live. Among other things, one would expect legal fees, asset transfer fees, tax filing fees, and trustee fees.

Many people choose to create a revocable trust to avoid making a will after death. However, if they are not keeping track of any new asset acquisitions, their heirs may still have to go through probate. One helpful tip is to have your estate planning attorney contact you frequently to remind you that if you are buying new assets that have a title, make sure the revocable trust has that title. nine0003

#3. This is not a replacement for an estate plan.

Trust does not replace estate planning. However, it is one component of a comprehensive real estate plan that can potentially play a role in your tax strategy.

№ 4. Confidence in your proxies.

The appointment of a trustee, like the appointment of an executor in your will, is not a duty to be taken lightly. To ensure that the assets held in your trust will be managed ethically and distributed as you wish, you must have a high level of trust in the person you appoint as trustee. nine0003

In general, all the advantages and disadvantages of revocable trusts apply to irrevocable trusts, as well as some additional advantages and disadvantages.

Irrevocable Trust Fund Benefits

#1. tax administration.

People often create irrevocable trusts to deduct assets from their own capital and reduce future property taxes. Also, since the assets are no longer titled in the person's name, they can reduce their tax liability while still alive. nine0003

nine0003

No. 2. Responsible distribution of wealth.

An irrevocable trust can be used to educate youth on proper money management. For example, an irrevocable trust may require beneficiaries to meet certain conditions (such as attending college or working) in order to receive benefits.

#3. Asset protection

Since the assets in your trust are no longer held in your name, an irrevocable trust can protect your assets from litigation. nine0003

Disadvantages of irrevocable trust funds

Permanence.

The most significant disadvantage of irrevocable trusts is that they are permanent. Some state laws may allow minor changes after an asset is transferred to an irrevocable trust, but don't rely on it. Because of the permanence of an irrevocable trust, many trustees are hesitant to use it and reap its full benefits.

Will versus trust fund

A trust is in no way a substitute for a will. You can appoint an executor and legal guardian for your children only by will. In the absence of a will, the state in which you reside will divide your property and assets as it sees fit. nine0003

In the absence of a will, the state in which you reside will divide your property and assets as it sees fit. nine0003

A will is, in fact, the most important component of your inheritance strategy.

Having said that, having will and trust can help ensure that your money not only goes to who you want, but goes the way you want.

Since wills are probate, you can create a trust as soon as you have one. This means that creditors, other relatives, or even your children can dispute what it says during the probate process. nine0003

For example, suppose your will leaves 40% of your estate to your son, 40% to your daughter, and 20% to charity. Your children have the legal right to challenge the will and try to stop the charity. Alternatively, if your daughter believes she is entitled to more than 40%, she can sue your son.

Although it is more difficult to set up a trust, it can avoid the probate process in the long run.

Can the trustee withdraw money from the trust? nine0013

When considering trust funds, many people are concerned that the trustee raids the trust for personal gain. To be clear, this is illegal. Specific rules vary depending on where you live, but the trustee can never withdraw funds for personal purposes. Since the trustee has a fiduciary responsibility, he or she is required to act in the best financial interests of the beneficiary and must abide by the rules and regulations of the trust agreement. nine0443 The trustee is the only person (or persons) who can withdraw funds from the trust account.

To be clear, this is illegal. Specific rules vary depending on where you live, but the trustee can never withdraw funds for personal purposes. Since the trustee has a fiduciary responsibility, he or she is required to act in the best financial interests of the beneficiary and must abide by the rules and regulations of the trust agreement. nine0443 The trustee is the only person (or persons) who can withdraw funds from the trust account.

Types of trust funds

You have options in this area, as in many others in financial planning.

#1. Irrevocable Trust Fund

As the name suggests, this type of trust cannot be subsequently modified or destroyed. Once assets have been placed in trust, they are no longer yours. A trusted person is responsible for them. This may be a bank, a lawyer, or another institution set up specifically for this purpose. nine0003

The good news is that…because the assets are no longer under your direct control, you are exempt from income tax or wealth tax on any interest earned on them.

On the other hand, an irrevocable trust will protect your assets from creditors or lawsuits. If you have set up an irrevocable trust to donate your assets to charity, you can deduct the value of those assets from your taxable income. nine0003

Another benefit of an irrevocable trust is that the money is protected from nursing homes because it is "no longer yours". If you need long-term care, this money will not be spent on an expensive product. However, if you place most of your assets in an irrevocable trust, you may not have enough money to cover future living expenses!

While creating an irrevocable trust has its advantages, the most significant disadvantage is that it cannot be changed. Even if you really need the money, you won't be able to get it "back" later. nine0003

No. 2. Revocable Trust Fund

As you might guess from the name, this is the other side of an irrevocable trust. You can revoke it at any time and make changes. These trusts, often known as "living trusts", take effect while you are still alive.

Of course, you don't get the same tax benefits as an irrevocable trust, but you have a lot more flexibility. This type of trust still allows you to specify who should inherit your assets and how.

You can also plan expectations for a future trustee. For example, if you are worried that you will become physically or mentally incapacitated, you can manage your own assets with a trusted person ready to intervene if necessary.

#3. Trust Fund for Special Needs

If you have a child with special needs, you should consider starting a trust fund. Even if you die unexpectedly, you can ensure that he gets specialized help by setting up a trust. nine0003

You can name a special needs trust as the beneficiary of your life insurance policy, not as a dependent. This has several advantages. First, if your dependent is unable to manage the money, he/she entrusts someone else to do it. In addition, designating a trust as a beneficiary may allow you to continue to receive as many government benefits as possible.

(If you are caring for someone with special needs, you may want to hire a special needs estate planning attorney.)

No. 4. Charitable Residual Funds

These types of trust funds can save you money on taxes and also donate to charities you care about. With a charitable trust balance, you can donate your assets to a charitable organization that will act as trustee and manage those assets while you are still alive. When your investment makes a profit, the charity will provide you (or another beneficiary) with the proceeds. This will continue for a certain period of time, often for the lifetime of the grantor. nine0003

In other words, you can “pre-gift” a charitable donation now to receive an immediate tax benefit and also protect your assets from inheritance taxes by reducing your estate after your death (the funds will belong to the charity during this time). in full).

No. 5. Testamentary trusts

Testamentary - an analogue of the last will and testament. You can create a testamentary trust in your will to manage what happens to your assets and how your property is inherited. If you choose this method, the probate court will review your will after your death. If you have indicated that trusts must be created in the document, they will take effect after the court confirms your will and agrees to follow the instructions you set out. nine0003

You can create a testamentary trust in your will to manage what happens to your assets and how your property is inherited. If you choose this method, the probate court will review your will after your death. If you have indicated that trusts must be created in the document, they will take effect after the court confirms your will and agrees to follow the instructions you set out. nine0003

No. 6. Terminated Interest Qualified Trust (QTIP)

This type of trust ensures that the trustee's spouse can live in their home until he or she dies, but does not allow that spouse to sell property. This is especially useful for mixed households. Suppose you are married and have an adult child from a previous marriage. Let's say you want to leave your home to your child after death. You can use a QTIP trust to ensure that your spouse is not "kicked out" of the home you shared when you die. When your husband dies after a certain number of years, your child will be able to get a house. nine0003

No.

7. Extravagances Trusts

7. Extravagances Trusts This is a broad phrase for trust funds intended to allow the trustee to withhold money from the beneficiary if the trustee suspects that the beneficiary will squander it or return it to the creditor. For example, if you wanted to leave money to your kids but weren't sure they would be responsible enough to spend it wisely, this might be a good option. Or, for example, if you wanted to leave money to someone who suffers from substance abuse or compulsive spending. nine0003

No. 8. Retained Earnings Trust (GRIT)

This type of trust fund is mainly useful to the very wealthy. The purpose of this type of trust is to try to lower the amount of money the government values your property for inheritance tax purposes. If the value of your property exceeds a certain amount, you may have to pay inheritance taxes; This is why GRITs allow the trustee to earn interest on trust assets without including the value of that property in the total for estate tax purposes. nine0003

nine0003

No. 9 Qualified Personal Residence Trusts

Qualified Personal Residence Trusts serve the same purpose as GRIT in that they help reduce your tax liability. These are irrevocable trusts that can be used to keep your primary residence or vacation home "out" of your estate for tax reasons. Since this is an irrevocable trust, you cannot return it, but this step can be handy if you want to transfer ownership of the home to family members. nine0003

No. 10. Blind Trust Fund

The beneficiary of a trust fund for the blind does not know the identity of the trustee or responsible person. The Blind Trust Trustee is solely responsible for the management of the trust until the assets are paid.

Blind trust funds are often used when a person wants to avoid a conflict of interest, such as when the trust is related to a business or investment. Blind trusts can also be used to add an extra layer of privacy to trust management. nine0003

No. 11. Single trust fund

A mutual trust fund is a type of mutual fund structure that allows income to be transferred directly to the client (who will be the beneficiary). Mutual trust funds allow investors to maximize their dividend without having to reinvest their earnings in the fund.

Mutual trust funds allow investors to maximize their dividend without having to reinvest their earnings in the fund.

Mutual trusts can invest in a wide range of assets such as securities, stocks and bonds. They are most often used by investors as a tax haven approach rather than as a real estate planning tool. nine0003

No. 12 General Trust Fund

A financial institution administers a general trust fund on behalf of a group of individuals. General trust funds are similar in some ways to mutual funds, but their membership is limited to individuals holding trust accounts.

General trust funds are used less frequently than they once were because alternative trust and investment types may provide more benefits. Now they are considered as a specialized investment structure.

No. 13. Baby Trust Fund

A trust child is a person who, upon reaching a certain age, will receive money or assets from the trust. The formal word for this person is beneficiary, although "Trust Fund Baby" is widely used in popular culture. The phrase "Trust Fund Baby" can have a negative connotation as it indicates that someone is the beneficiary of ancestral wealth. It is often mentioned in TV dramas or movies.

The phrase "Trust Fund Baby" can have a negative connotation as it indicates that someone is the beneficiary of ancestral wealth. It is often mentioned in TV dramas or movies.

Why do rich people use trust funds? nine0013

Trusts are often used by wealthy people to create tax-free assets.

The government sets a limit on how much you can leave someone without paying federal gifts or inheritance taxes. The exemption in 2018 was $11.2 million per taxpayer. So, if you're really rich, a trust fund can be a great way to donate money without taxing your heirs a lot.

So, yes, there is a reason why many people associate trusts with the rich. Having said that, there are many applications for the rest of us as well. nine0003

How to set up a trust fund

To set up a trust fund, you will need the following information:

- Name of the trustee

- Name of the trust

- Description of the trust, why the trustee creates it

- Name of the trustee, and any instructions replacing the trustee if he or she is unable to serve.

- Name of beneficiary

- List of trust fund assets

- Duties and options of the trustee (for example, whether the trustee can buy or sell property held in the trust, or how the process works if the trustee wants to retire or transfer duties to whom something else)

- What should happen if the trustee, trustee or beneficiaries die or become incapacitated?

How much is required for a trust fund?

Setting up a trust is time consuming and costly. This is why many people get stuck at the "how to set up a trust fund" step. Many attorneys charge anywhere from $1,000 to $5,000 to set up a new trust. The cost will vary depending on where you live and the nuances of your circumstances. nine0003

To save money, you can also consider using online preparation services such as LegalZoom or Quicken. While this method may be less expensive, if you require legal advice, you should still speak with a professional attorney. A simple trust fund may consist of several pages of documents.

What is the value of a trust fund?

The amount of money in a trust fund varies depending on the originator of the trust, the type of trust, and how much the account has grown since it was established. In most cases, any interest earned from funds held in a trust fund is also distributed to the beneficiary. nine0003

There are many types of trusts that can allow you to invest your funds before distributing them to a beneficiary. The best option will be determined by your goals when setting it up.

What is the average trust fund size?

The exact average amount of the Trust Fund is not known, but according to the Consumer Finance Survey, it is approximately $4 million. It should be noted that this figure is based on a survey of approximately 2,017 households conducted in 6,482 and may therefore not represent the entire United States. Many people are relieved to learn that trust funds provide secrecy; however, this also means that there are no clear answers about average Trust Fund amounts or frequency of use. nine0003

nine0003

Are trust funds going up?

A trust fund is a vehicle that holds other assets, so no two trust funds are the same. You must place assets or property in a trust fund. So, yes, if the assets in the trust fund grow (for example, investments that grow over time or earn interest).

A trust account is just as simple as a bank account, except that the money belongs to the trust and not to the individual. Like other bank accounts, some trust accounts can also earn interest. Typically, this interest is paid to the beneficiary of the account. nine0003

How long have trust funds been in existence?

Trusts can exist for a long time, but the exact rules tend to vary by state. For example, in many places a trust cannot continue for more than 21 years after the death of a potential beneficiary who was alive at the time the trust was created. This is called the "anti-perpetuity rule" and is intended to restrict trusts that could theoretically last forever.

However, some states, such as California, have enacted their own but different laws. California, for example, has a variant of the rule that simply says that a trust can last for about 9 years.0 years old However, in Delaware, the trust lasts up to 300 years, and in some states the duration is not limited. These perpetual trusts are sometimes referred to as "dynastic trusts". They are mostly used by the super rich because of the tax breaks; you will only need to pay gift or inheritance taxes when you transfer money to a trust, but then many subsequent generations will be able to inherit the property without paying inheritance taxes.

California, for example, has a variant of the rule that simply says that a trust can last for about 9 years.0 years old However, in Delaware, the trust lasts up to 300 years, and in some states the duration is not limited. These perpetual trusts are sometimes referred to as "dynastic trusts". They are mostly used by the super rich because of the tax breaks; you will only need to pay gift or inheritance taxes when you transfer money to a trust, but then many subsequent generations will be able to inherit the property without paying inheritance taxes.

Trusts may be terminated early if they run out of property or if the probate court orders termination. (This is rare.)

Conclusion

The answer to the question "what is a trust fund" is simple: it is a way to financially support your loved ones throughout their lives.

A trust fund is a reliable estate planning tool for those who want more control over their assets than what a will can give. Trusts allow the settlor (the person establishing the trust) to set the terms of the trust. This basically includes how and when you want the contents of the trust to pass to your beneficiaries. Irrevocable trusts also provide some tax relief and protection for their assets from lawsuits. nine0003

This basically includes how and when you want the contents of the trust to pass to your beneficiaries. Irrevocable trusts also provide some tax relief and protection for their assets from lawsuits. nine0003

Trust funds can be an important aspect of people's property arrangements. However, you will likely have to do a lot more to ensure that your family is taken care of after you leave. Check out our estate planning and probate guide to learn more.

Trust Fund FAQ

How much money do you need for a trust fund?

A trust may suit you if you have a net worth of at least $100,000 and a large amount of real estate assets, or if you have very specific instructions on how and when you want your property to be transferred to your heirs after your death. nine0003

Do trusts earn interest?

A trust account is just as simple as a bank account, except that the money belongs to the trust and not to the individual. Some trust accounts, like other bank accounts, may earn interest.