Baby bonus australia

Abolishing the Baby Bonus – Parliament of Australia

Budget Review 2013–14 Index

Michael Klapdor

In its 2013–14 Budget, the Labor Government has again looked to tighten access and levels of family assistance to find some significant savings. One of the standout measures is the abolition of the Baby Bonus. The Government proposes to replace the Baby Bonus with a smaller supplementary payment added to a families’ Family Tax Benefit Part A (FTB-A) entitlement. The measure is expected to save $1.1 billion over five years and will be implemented from 1 March 2014.[1]

The Baby Bonus is a payment intended to help families with the costs of a newborn baby or adopted child (under the age of 16). It is payable to families who have not received Paid Parental Leave and whose estimated combined adjusted taxable income (ATI) is $75,000 or less in the six months after their child is born or adopted.[2] It is payable to parents whose baby is stillborn. The amount of Baby Bonus currently payable is $5,000 per eligible child and it is made in 13 fortnightly instalments. The first instalment is paid at a higher rate of $846.20 and the other 12 fortnights are paid at a rate of $346.15. The Baby Bonus is paid at the same rate to all families considered eligible.

The proposed replacement payment will be come in the form of an additional loading on an eligible families’ FTB-A payment with an additional $2,000 for a firstborn child (and all multiple births) and $1,000 for any subsequent children. It will be paid as an initial upfront instalment of $500 with the remaining amount paid fortnightly over a three month period. FTB-A is intended to help families with the costs of raising children and is paid to eligible carers who meet residency requirements and meet the income test. The income test for FTB-A reduces a person’s payment when their ATI is over $47,815. The impact of the test varies depending on the number of children in the family and their age: large families can still receive some FTB-A even with an ATI above $228,000 a year. It is not clear how the new ‘additional loading’ will be treated under the income test (such as whether higher income families will receive the full amount of the new payment).

Background

The payment now known as Baby Bonus was introduced by the Howard Government in 2004. It was then called ‘Maternity Payment’ and was a non-means tested lump sum replacement of the First Child Tax Rebate and the Maternity Allowance. The introduction of this new form of assistance for newborns was seen as an alternative to the introduction of government-funded paid parental leave which, unlike the payments it replaced, would provide the same level of assistance to all parents. Maternity Payment was formally renamed the Baby Bonus in 2007. From 1 January 2009, the $75,000 income limit was applied to the payment and it switched from being paid as a lump sum to being paid in mandatory fortnightly instalments. The introduction of Paid Parental Leave (PPL) in January 2011 provided much more generous support to working parents with newborn or newly adopted children and around half of new parents are now receiving support through this scheme.[3] To be eligible for PPL, which provides up 18 weeks’ pay at the minimum wage, the parent needs to meet a work test and have an ATI of $150,000 or less in the year prior to the birth/adoption.

The budget measure was a recommendation of the Henry Tax Review. The review noted that government-funded research had found that the actual direct costs of children for low-income families were closer to $2,000 for a first child and $1,000 for a second child and that the current Baby Bonus rates covers much more than these costs.[4]

Baby Bonus has been a regular target for savings

The Labor Government has frequently targeted the Baby Bonus as a source of savings by changing or freezing indexation arrangements, introducing the income limit and reducing the rate of payment. The 2012–13 Mid-Year Economic and Fiscal Outlook proposed further cuts to the amount of Baby Bonus paid for second and subsequent children but the Bill to implement this measure is still before the Parliament.[5]

Paying all eligible recipients the same $5,000 amount, regardless of relative differences in means and the actual cost of having children, means the Baby Bonus is a poorly targeted and, in many cases, particularly generous form of assistance compared to other family payments. The merging of the payment with FTB-A has benefits of reduced complexity and improved targeting. The new form of assistance will more closely reflect the costs of a new child for low-income families and, if FTB-A’s income test is applied, ensure a greater level of assistance goes to families with lesser means. The reduced rate of assistance compared to the Baby Bonus will, however, hurt those low-income and welfare-dependent families unable to access the PPL scheme.

The merging of the payment with FTB-A has benefits of reduced complexity and improved targeting. The new form of assistance will more closely reflect the costs of a new child for low-income families and, if FTB-A’s income test is applied, ensure a greater level of assistance goes to families with lesser means. The reduced rate of assistance compared to the Baby Bonus will, however, hurt those low-income and welfare-dependent families unable to access the PPL scheme.

Birth rates and early births

The behavioural impact of changes to Baby Bonus has been an ongoing issue. While it is unlikely that its abolition will have a significant impact on birth rates, there is a strong possibility that it will affect the timing of births, as occurred in 2004 when the payment began.[6] The timing and manner of the payment cut produces a financial incentive for a birth to occur earlier than it might otherwise. A gradual reduction in the rate of payment, a staged transition to the replacement payment, or a shortened time between announcement and implementation may have reduced this incentive.

[1]. J Macklin (Minister for Families, Community Services and Indigenous Affairs, Minister for Disability Reform), A more sustainable family payments system, media release, 14 May 2013, accessed 15 May 2013.

[2]. ATI includes taxable income, salary sacrificed into superannuation, employer provided fringe benefits, foreign income, negatively geared property or investment losses, tax free pensions/benefits but less any Child Support maintenance paid.

[3]. For more information see M Klapdor, Family Assistance and Other Legislation Amendment Bill 2013, Bills digest, 88, 2012–13, Parliamentary Library, Canberra, 2013, accessed 15 May 2013.

[4]. Australia’s Future Tax System Review, Australia’s future tax system: final report: part 2: detailed analysis, (Henry Tax Review), Commonwealth of Australia, 2009, chapter F3-2, accessed 15 May 2013.

[5]. M Klapdor, op. cit.

[6]. See M Klapdor, op. cit., for discussion of these issues.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to [email protected].

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Feedback is welcome and may be provided to: [email protected]. Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.

The Baby Bonus Generation - McCrindle

By McCrindle

10 years ago

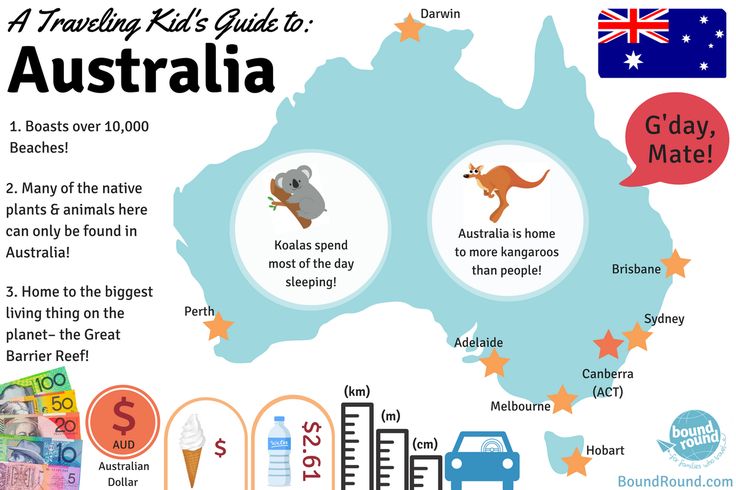

The Baby Bonus was introduced in the year after Australia’s population hit its lowest birth rate ever recorded (1.7) in 2001, with the aim to increase fertility rates and offset the peak of Australia’s ageing population.

The 2002 Federal Budget, delivered by Treasurer Peter Costello introduced the baby bonus scheme, aimed to lighten the financial load for new parents. The Baby Bonus Scheme initially granted $2,500 in tax cuts per year for parents of newborns, an amount which was amended to lump-sum payments of $3,000 from 1 July 2004 and progressively rising to its current amount of $5,000 (now paid in 13 instalments).

The Baby Bonus Scheme initially granted $2,500 in tax cuts per year for parents of newborns, an amount which was amended to lump-sum payments of $3,000 from 1 July 2004 and progressively rising to its current amount of $5,000 (now paid in 13 instalments).

Baby bonus stimulates birth rate

The baby bonus certainly had an influence on the birth rate, which increased significantly, hitting a peak of 2.0 in 2008. Births continued to grow, and 2011 saw Australian births exceed 300,000 (301,617), a record that is being broken year on year. In fact, we are amidst a bigger baby boom than even the original post-WWII baby boom incurred, which resulted in Australia’s largest-ever generation – the Baby Boomers.

The Baby Bonuses (the 3.1 million babies born since the introduction of the Baby Bonus Scheme in 2012) are Australia’s first generation paid simply for being born.

The Baby Bonus and the resulting surge in births over the last decade has eased the peak of the ageing population challenge and added to our population growth and the economic stimulus that has flowed from this.

Misconceptions on first-time mums

There are, however, some misconceptions about the baby bonus and the births that it facilitated.

When the 2002 Baby Bonus was first introduced, it was predicted by some that the incentive would encourage an increase in teenage, single and young mums. However, the ABS data shows that the fertility rate for mums aged between 16 and 19 has actually declined over the last decade. In fact, the fertility rate for teenagers has been declining for more than three decades now – for example, the fertility rate of sixteen year old women has decreased 55% since 1982.

The trend over the last decade has been increasing fertility rate amongst older women. Over the last decade, the fertility rate of women aged 35-39 has been greater than that of women in their early twenties. The fertility rate of a 32 year old woman is ten times greater than that of a 17 year old!

Baby bonus dissolution

On 1 March 2014, when the Baby Bonus Scheme is finally put to bed after more than 13 years and replaced changes to Family Tax Benefit Schedule A, it will have left a legacy in terms of the generation it created. The economic impact and productivity of the Baby Bonus Generation will shape this nation over the century ahead.

The economic impact and productivity of the Baby Bonus Generation will shape this nation over the century ahead.

With just over 9 months to go until its dissolution, there’s still time for prospective parents to gain a benefit from the Baby Bonus Scheme. We may well see a final surge of births that end this legacy of Australia’s baby bonus and the Baby Bonus Generation.

For media commentary contact us on 02 8824 3422 or at [email protected]

Baby Names 2022 report

The Top 100 baby names for boys and girls in Australia in 2021 revealed, as well as comprehensive analysis of naming trends

Download now

how Australia helps its own - Immigrant today

Hello again. Good to see you, and my next video will be about benefits. I noticed that many people are concerned about 2 main questions: how much does life cost in Australia and benefits. Very 2 big questions, which are very difficult to give an unambiguous answer, because there are so many factors that affect how much you spend and what benefits you get from the Australian government, but in general I have prepared some information. Benefits in Australia turned out to be such a huge list that if I start throwing these words, then many will not be interested. There are a lot of nuances that you now do not make sense to delve into. When you register with Centrallink, you fill out the required forms, and they calculate all the benefits themselves. So, to represent: an allowance, for people who earn little; for people who do not work or are looking for work; for people who have children.

Benefits in Australia turned out to be such a huge list that if I start throwing these words, then many will not be interested. There are a lot of nuances that you now do not make sense to delve into. When you register with Centrallink, you fill out the required forms, and they calculate all the benefits themselves. So, to represent: an allowance, for people who earn little; for people who do not work or are looking for work; for people who have children.

Benefits are quite high. Let's say if you work, do not get a very high income, and you have a child, the child benefit will be $400 for 2 weeks, that is, $800 per month, and the same amount for an adult, $800 per month. Because he has a small child, and he cannot fully work, earn such an amount of money that he has enough to live on. Or, for example, if you are a single parent (it doesn’t matter if you are a man or a woman, whether the child has a living second parent or not), and you have a small child under 8 years old, then the child and adult allowance will total $ 2,100 per month, which is very good. With this money you can exist here.

With this money you can exist here.

Don't think this is an absolute freebie, because many benefits are taxed. That is, you received the money, and you will pay tax on it. Taxes are also a bit difficult to understand here. The tax system in Australia is progressive, depending on how much you received, then how much you paid in taxes. This applies to all areas, including benefits. That is, what is your income, if you have less, then the state helps you more. If people who have received a visa and come, in my opinion, there are restrictions on benefits. He does not have the right to claim the first 2 years for some benefits, if it is a parent visa, then the parents do not have the right to claim any benefits for 10 years. I'm not sure what this covers, most likely it's unemployment benefit or low income benefit (for a low income family).

Rent Assistance. The government evaluates your income and pays a little extra, depending on how much you pay for rent, so much the state will transfer a certain amount to your account, which will partially cover your rental costs. Or a Health Care Card is given, which gives a lot of discounts: on electricity, on car registration, almost free dental care, cheaper medicines. In general, they make life easier for people who, for some reason, cannot earn more than others.

Or a Health Care Card is given, which gives a lot of discounts: on electricity, on car registration, almost free dental care, cheaper medicines. In general, they make life easier for people who, for some reason, cannot earn more than others.

How the state helps families with children. You have a child in your family. Since March 1, 2014, their payment rules have changed. Before that, we had a baby bonus, a one-time payment to 5,000 families with their first child. And what will happen after the first of March? This assistance will be called Newborn Upfront Payment and Newborn Supplement. This is a two-part payment. A total of $2,000 is paid for the first child, and $1,000 for the second and subsequent children.

Next Parental Leave. It is paid for the first 18 weeks. It depends if you have a family income of less than 150 thousand, and if you worked 10-13 months before the birth of the child. The site spells out what is meant by "work". Any job, hired by an employer or for yourself at least 1. 5 hours a day. We are not accustomed to such a concept of work. What happens if suddenly there is a misfortune in the family and the born child dies, or is born dead. In Russia, it seems to me, this is not provided. Here, in such a situation, the same benefits are paid as if a living, normal child was born, and he grows and gets stronger. As soon as you have completed all the documents, they begin to pay you a benefit called “Family Tax Benefit”, it also consists of two parts: A and B. These payments depend on how much time you spend with your child. For example, if the family broke up, and the child spends most of his time with his mother, but sometimes spends time with his father. So, if he spends 35% more time with dad, dad also gets some part of these payments. The second part of this Family Tax Benefit is not paid while you are on Parental Leave. Once 18 weeks have passed and Parental Leave ends, Family Tax Benefit B begins. The site says that this portion is paid to help families with low incomes.

5 hours a day. We are not accustomed to such a concept of work. What happens if suddenly there is a misfortune in the family and the born child dies, or is born dead. In Russia, it seems to me, this is not provided. Here, in such a situation, the same benefits are paid as if a living, normal child was born, and he grows and gets stronger. As soon as you have completed all the documents, they begin to pay you a benefit called “Family Tax Benefit”, it also consists of two parts: A and B. These payments depend on how much time you spend with your child. For example, if the family broke up, and the child spends most of his time with his mother, but sometimes spends time with his father. So, if he spends 35% more time with dad, dad also gets some part of these payments. The second part of this Family Tax Benefit is not paid while you are on Parental Leave. Once 18 weeks have passed and Parental Leave ends, Family Tax Benefit B begins. The site says that this portion is paid to help families with low incomes.

At the same time, they pay a little extra to an adult who looks after the child. Because he does not have the opportunity to work fully. If he had the opportunity, he would have had a good salary, if not, then there is not much money either. Therefore, depending on the income, it is called "eligibility" or not, that is, you are entitled to this benefit or not. Not the fact that you will be paid. All this is clarified in Centrallink, not on my video. It's called Parenting Payment. Single parents are paid until the child is 8 years old.

Next. You decide to send your child to a kindergarten, and go to work yourself. What happens in this situation? Kindergartens here are very expensive, from $65 a day. If this is a private kindergarten, somewhere in the center of the city, Masha went to one for me, and it cost $ 95 a day. This is an unaffordable price. I don’t know where such prices come from, but the state makes it easier for parents to pay for kindergarten. Child Care benefit - the state partially pays for kindergarten attendance, the amount depends on the family income. Parents who have income, but it is such that the state will not cover your kindergarten, sometimes it is more profitable for one of the parents to stay at home with the children than to go to work. You will go broke in this kindergarten. I had a time when I paid $500 a week for kindergarten. Further, the second part of assistance from the state is called “Child Care Rebate”, that is, you paid for the kindergarten, and then, half of the amount that you paid is returned to you every 3 months.

Parents who have income, but it is such that the state will not cover your kindergarten, sometimes it is more profitable for one of the parents to stay at home with the children than to go to work. You will go broke in this kindergarten. I had a time when I paid $500 a week for kindergarten. Further, the second part of assistance from the state is called “Child Care Rebate”, that is, you paid for the kindergarten, and then, half of the amount that you paid is returned to you every 3 months.

When a child reaches school age, then the state does not forget about you either. There is such a Schoolkids Bonus, it is issued once every six months. It is $400 for children in elementary school and $800 for children in high school. The fact is that many expenses can be declared when recalculating taxes, and then part of the money spent on tax is returned to you. And, probably, in order to avoid recalculations, the state decided that it would give a certain amount to the expenses for the child in order to buy some necessary things for the school.

Australia is a great country to live in, but we've moved away from that country and focused on Canada.

Pregnancy FAQ

Do you have questions about pregnancy mode in The Sims FreePlay?

Read our helpful FAQ section for answers!

Q: How do I access the Pregnancy Mode?

A: Complete the missions "Two and a Half Characters" and "Away with Belly" and build a store for expectant mothers.

Q: Where is the maternity store?

A: Between a real estate agency and a recording studio, next to the Zarya shopping complex.

Q: Who can get pregnant?

A: Any female character regardless of relationship status.

Q: How many characters can be pregnant at the same time?

A: There can only be one pregnant character in the Pregnancy event, but there can be as many pregnant characters as you like in the game, even though all the characters available to you.

Q: Why can't pregnant Sims do so many things?

A: Some actions are not available to pregnant Sims because The Sims FreePlay has a lot of animated moves. We have to adjust every animation movement for any new character type and we just couldn't cover them all!

We have to adjust every animation movement for any new character type and we just couldn't cover them all!

Q: Why is it necessary to achieve daily goals and tasks for assistants?

A: If you reach all the goals and complete all the tasks, the baby will receive a baby bonus at birth - he will perform actions faster and gain experience, and the level of the need scales will not fall below 50%. And you will also get more Pregnancy Tokens!

Q: What is a child bonus?

A: A special bonus that you will receive for completing all the daily goals and completing all the tasks for the assistants in the Pregnancy event! Characters with a child bonus will perform actions and gain experience faster, and the level of need scales will not fall below 50%.

Q: What happens if I don't complete all the tasks from the Pregnancy event?

A: Don't worry! The character will still give birth to a baby, but the baby will not receive the baby bonus.

Q: How many characters will be needed to complete the tasks in the Pregnancy event?

A: For maximum effectiveness during the Pregnancy event, you will need 13-15 available characters. Do not forget that several characters can simultaneously perform tasks for assistants. Select a group of characters who will help the pregnant character.

Q: This event is limited in time. Is this an interactive community event? I won't be able to do everything!

A: Don't worry. The event is limited in time so you know when the baby is due and when you can claim the baby bonus. Unlike interactive community events, the Pregnancy event is available all the time and you can participate whenever you want.

Q: Can I choose a less intense pregnancy regimen?

A: Yes! Once you have completed the Stomach Ride mission, you will be able to select Pregnancy from the crib action menu. This will put the selected character into pregnancy mode for 6 days, but will not receive any quests. Characters cannot earn pregnancy tokens during such a pregnancy. You can also select Add Child.

Characters cannot earn pregnancy tokens during such a pregnancy. You can also select Add Child.

Q: How can I earn more pregnancy tokens?

A: You can only earn Pregnancy Tokens in the Pregnancy event, which lasts 9 days. To earn tokens, complete tasks for assistants and complete the daily goals of a pregnant Sim.

Q: Will the pregnancy tokens disappear if I don't complete the Pregnancy event?

A: No way! You can visit the store for expectant mothers on the city map at any time and spend the earned tokens.

Q: Where are my pregnancy tokens when I am not participating in the Pregnancy event?

A: Your pregnancy tokens are in the maternity shop on the city map.

Q: Can I take part in the Pregnancy event again?

A: Yes, you can! The only condition: in the city and the house there must be a place for a new character! The new Pregnancy event will be slightly different from the previous one - no two pregnancies are the same!

● Gardening and baking to earn as many Simoleons as possible.