How to stop someone from claiming your child on taxes

Someone Claimed Your Child, Dependent; What Can You Do?

Did someone claim your dependent even though you have determined that you are the only person who should claim them? See the steps to take on wrongly claimed dependents. To further protect your family's identities, consider getting an IP-PIN for yourself and your dependents.

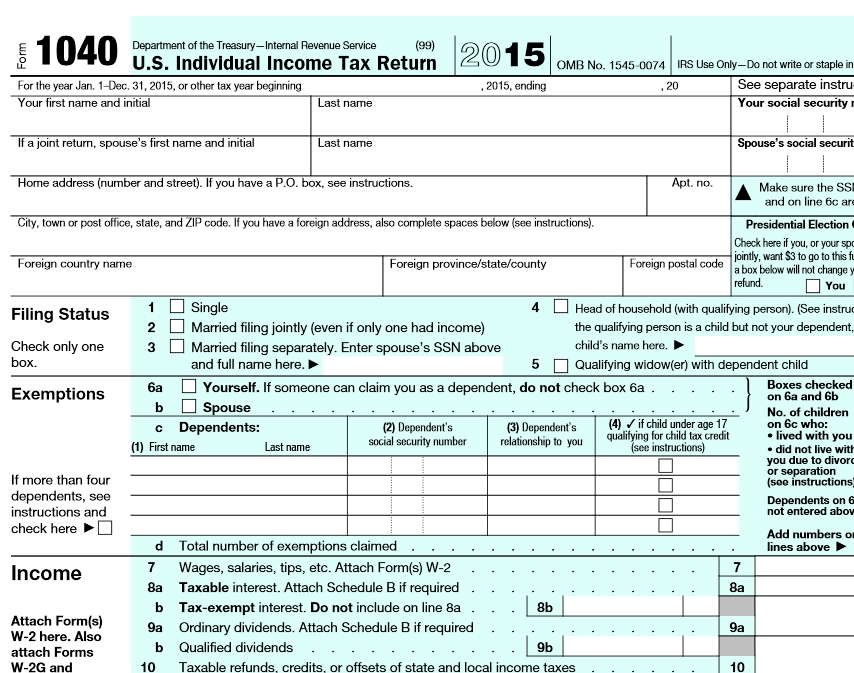

Claiming a dependent has many ways to save on taxes which is why there are many annual cases of wrongly claimed dependents. These tax benefits include:

- The Child Dependency Exemption (expired 2018 - 2025)

- The Earned Income Tax Credit

- The Child Tax Credit

- The Credit for Other Dependents

- The Child and Dependent Care Tax Credit

- The head of household tax return filing status

- The exclusion for employer-provided childcare benefits.

If someone claimed your dependent on your latest return, find out what you can do below. See also: What if I was wrongly claimed as a dependent?

Generally, only one taxpayer may claim any one person as a dependent on a tax return per tax year (except in the case of a married couple filing jointly). If you file your tax return and someone else has already claimed your dependent, then the IRS will apply the tiebreaker rules - see details below. To avoid any of this conflict, utilize the eFile.com DEPENDucator to determine if you are eligible to claim someone on your 2022 Tax Return, due on Tax Day. You can also eFileIT, including the Multiple Support Declaration Form 2120 - see below.

TaxTip: This is a good reason to e-file early. After a return claiming a particular dependent is accepted, any subsequent return that is electronically filed claiming the dependent will be rejected by the IRS. However, having an IRS accepted return with a dependent is not a confirmation that this taxpayer is qualified to claim this dependent. In other words, if you e-filed your return with the dependents listed on your return, anybody else e-filing their return after you claimed the same dependent(s) will have their return rejected. However, if another return claiming the same dependent(s) is filed manually (mailed in), then the IRS will apply the tie-breaker rules - see details below.

In other words, if you e-filed your return with the dependents listed on your return, anybody else e-filing their return after you claimed the same dependent(s) will have their return rejected. However, if another return claiming the same dependent(s) is filed manually (mailed in), then the IRS will apply the tie-breaker rules - see details below.

Here are a few key points regarding wrongly claimed dependents:

- When e-filing your return, be sure the SSN for your dependent is being entered correctly. This will prevent you from accidentally claiming someone's dependent - it does happen! - and it will make sure you are not trying to claim the wrong person.

- Additionally, double check your own SSN if your return is rejected by the IRS as a duplicate.

- Only one dependent's SSN can be claimed per tax year.

- The IRS cannot disclose which of your dependents has been claimed nor who claimed them.

- Once your dependent's SSN has been accepted on a return, you can no longer e-file your return and claim them, even if the other party amends their return.

- This is because by the time the IRS processes this amendment, the e-file season will be over.

- If both parties can cooperate, however, it is ideal that the party who wrongly claimed the dependent files an amendment and the second party mails in their return.

- The IRS will send you a notice CP87A, CP75A, or other letter explaining that there is a dispute with your dependent's SSN.

- Both you and the other party generally receive a CP87A. The wrongly claiming party will be asked to comply by amending their return while the correct party is instructed not to take any additional action. Receiving this notice is not the same as being audited by the IRS.

- If you received this notice even though you did not file a tax return claiming a dependent, contact the number listed on the notice - see more IRS contact numbers here.

- The entire process can take 8 - 12 weeks as the IRS gathers information to examine results from both returns.

- Determine who qualifies as your dependent and e-file your return early next year to secure your dependent's information.

Children of Divorced or Separated Parents

Due to the residency test for parents of dependents, generally a child of divorced or separated parents is the qualifying child of the custodial parent. However, the following exceptions might apply and a child will be treated as the qualifying child of the noncustodial parent if all four of the following statements are true.

A: The parents:

- Are divorced or legally separated under a decree of divorce or separate maintenance

- Are separated under a written separa- tion agreement; or

- Lived apart at all times during the last 6 months of the year, whether or not they are or were married.

2. The child received over half of the child’s support for the year from the parents.

3. The child is in the custody of one or both parents for more than half of the year.

4. Either of the following statements is true.

a. The custodial parent signs a written declaration, discussed later, that they won't claim the child as a dependent for the year, and the noncustodial pa- rent attaches this written declaration to their return. (If the decree or agreement went into effect after 1984 and before 2009, see Post-1984 and pre-2009 divorce decree or separation agreement, later. If the decree or agreement went into effect after 2008, see Post-2008 divorce decree or separation agreement, later.)

b. A decree of divorce or separate maintenance or written separation agreement prior to 1985 that applies to 2022 states that the noncustodial parent can claim the child as a dependent, the decree or agreement wasn't changed after 1984 to say the noncustodial parent can't claim the child as a dependent, and the noncustodial parent provides at least $600 for the child's support during the year If statements (1) through (4) are all true, only the noncustodial parent can:

Claim the child as a dependent; and

Claim the child as a qualifying child for the child tax credit, the credit for other dependents, or the additional child tax credit.

However, this doesn’t allow the noncustodial parent to claim head of household filing status, the credit for child and dependent care expenses, the exclusion for dependent care benefits, or the earned income credit. For more details see the IRS tiebreaker rules below.

What to Do If Your Dependent(s) Have Been Claimed

Wrongly claiming a dependent is not considered fraud or tax evasion if the guilty party does not demonstrate willfulness. In other words, if the wrongly claiming person knows they are breaking the law, then this could be fraud; if they mistakenly claim someone's dependent and want to fix this, the IRS does not consider this fraud.

Instead of trying to report this to the IRS, review these steps if you e-filed your tax return and it got rejected by the IRS because somebody, such as an ex-spouse or as a result of identity theft, has already claimed one or more of your dependents on a tax return. Keep in mind, an accepted tax return is not a guarantee to have the right to claim the dependents on that return.

While there are many cases of identity theft of dependents, most cases of wrongly claimed dependents are committed by family members, relatives, and ex-spouses. If your ex claimed your dependent on their return when you had the right to this year, this can lead to legal problems as the dependent benefits cannot be split.

If you and your ex alternate years, be sure you both only claim the child as a dependent when it is your year. Otherwise, you will both need to work with the IRS in order to settle the dispute by mailing forms and documents back and forth. When someone claims your dependent with malicious intent (i.e. to take advantage of dependent tax breaks and take them from you), then you are forced to rely on the IRS to handle this. You may be requested to send proof of dependency documents; communicate and work with the IRS to rightfully claim your dependent.

There is no direct way to report the person to the IRS; instead, you will need to file your return on paper to alert them of the matter.

Steps to Take After Somebody Incorrectly or Fraudulently Claimed Your Dependent(s)

Let's say you prepared and e-filed your tax return and the IRS rejected it with the message that one or more dependents have been claimed on another taxpayer's tax return. Or, you received IRS Notice CP87A or CP75A because the IRS received a tax return from somebody claiming a qualifying child as a dependent with the same social security number as a dependent listed on your tax return.

The steps below apply if someone incorrectly claimed your dependent(s) or if you claimed dependents incorrectly.

- Find out who qualifies as your dependent by using our free DEPENDucator tool.

- If you used eFile.com when you completed your taxes, a PDF copy of your return is stored in your eFile.com account. Sign in and click on My Account before you download, print, and sign your IRS and state tax returns.

- Gather dependent supporting documents about your dependent(s) and complete Form 866-H-Dep.

- Supporting documents might include daycare records, school records on official letterhead from a school, medical records from the medical provider, social service records from the social service agency, information from the place of worship that shows names, and common addresses and dates. Include a letter with any other information you think would assist the IRS and get any of these notarized if possible.

- If you have a divorce decree, attach the relevant pages of the decree (including the first and signature pages) to your mailed return.

- Gather your printed tax return, income and deduction forms (W-2, 1099, etc.), and Form 866-H-Dep. Then, mail in all your documents to the IRS based on the address on your tax return. If you also have to send your return to one or more state tax agencies, find the state mailing address here. TaxTip: It is best if you use a U.S. Postal Office tracker to confirm that the IRS has received your documents.

- If you only claimed the Earned Income Tax Credit for your child, but the IRS has sent you an audit letter requesting more information from you, you will need to mail Form 886-H-EIC and attach any documents in the form supporting your EITC claim. Use this EICucator tool.

- Once the IRS has received your documents, they will examine both returns - the return with the claimed dependent(s) and yours - and apply the tiebreaker rules based on the criteria listed below. The process might take 8-12 weeks or longer.

- If the IRS contacts you for additional information (CP78A, etc.), respond to their notices as soon as possible.

If you found out that you claimed a dependent incorrectly on an IRS accepted tax return, you will need to file a tax amendment or form 1040-X and remove the dependent from your tax return.

At any time, contact us here at eFile.com or call the IRS support line at 1-800-829-1040 and inform them of the situation. Or, take advantage of low-income tax clinics if this applies to you. Note: if you did not file your latest tax return with us, we will not have specific information regarding your situation.

Or, take advantage of low-income tax clinics if this applies to you. Note: if you did not file your latest tax return with us, we will not have specific information regarding your situation.

If you think you are a victim of identity theft, you can request a copy of a fraudulent return via Form 4506-F.

IRS Tiebreaker Rules

There are situations when multiple parties claim the same dependent. For example, in the case of divorced parents, a child may be claimed as a dependent by more than one person. You may alternate years, but you may not both claim the dependent in a single tax year. Generally, only one person (or a married couple filing jointly) may receive the tax benefits derived from claiming any one dependent.

Under the IRS tiebreaker rules, the child is generally considered a qualifying child if the following apply:

- A married couple or parents file a married joint tax return and claim the child a qualifying dependent.

- Only one parent of the couple, who is also the child's parent, claims the child as a qualifying child or dependent.

- If the child has two persons as parents and the two persons do NOT file a married joint return, then the parent with whom the child lived or resided with for the longer time period during a tax year will be qualified to claim the dependent.

- If the child lived or resided with each parent the same amount of time during the tax year, the parent with the highest adjusted gross income or AGI will be able to claim the dependent, if there is no married joint return and both parents claim the child on their respective return.

- If no parent claims the child as a qualifying child, then the person with the highest AGI qualifies over any parent who may have been able to claim the child, such as a qualifying step-parent or relative.

- Because of the second tiebreaker rule (residence), the parent who has legal custody of a child is generally the parent who gets to claim the child in cases of divorced or separated parents.

If you are the custodial parent and you wish to relinquish your dependency exemption and assign it to the non-custodial parent, you may do so by filing Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.

If you are the custodial parent and you wish to relinquish your dependency exemption and assign it to the non-custodial parent, you may do so by filing Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.

There may be an exception when the splitting of tax benefits for a dependent is detailed in a legal divorce decree. If you have such a decree that was issued after December 31, 2008, you will need to file your tax return on paper and attach the relevant pages of the divorce decree, including the first page and the signature page. If the decree was issued before January 1, 2009, the IRS will not accept it. However, if you are a noncustodial parent claiming the child as a dependent, you have two options:

- Multiple Support Declaration: To identify any other eligible person who can claim the dependent, you will need a signed statement from the eligible person waiving his or her right to claim that person as a dependent before you can add Form 2120, Multiple Support Declaration, when you prepare and eFile your tax return on eFile.

com. If you already filed your return, you may need to submit Form 2120 via postal mail to the IRS. For situations where the same child may be eligible to be claimed as a dependent or qualifying child by more than one person, the IRS will apply a set of tiebreaker rules to determine who has the right to claim the dependent. Once the IRS receives both returns claiming the same dependent, they will use the tie-breaker rules below.

com. If you already filed your return, you may need to submit Form 2120 via postal mail to the IRS. For situations where the same child may be eligible to be claimed as a dependent or qualifying child by more than one person, the IRS will apply a set of tiebreaker rules to determine who has the right to claim the dependent. Once the IRS receives both returns claiming the same dependent, they will use the tie-breaker rules below. - Release of Claim to Exemption for Child: You or the other party can transfer the right to claim a child as a dependent. To release a claim of a child as a dependent so that a non-custodial parent can claim the child, or to revoke a previous release to claim a child as a dependent, you can complete Form 8332, Release Revocation of Release of Claim to Exemption for Child by Custodial Parent. The Form 8332 can NOT be e-filed with your tax return on eFile.com. The non-custodial parent in this situation should also obtain a copy of the completed form from the custodial parent and attach it to their tax return, which they will need to paper file.

If you change your mind at any time and wish to revoke your release of claim, you can simply file another Form 8332. Include Form 8453, U.S. Individual Income Tax Transmittal when you mail in your tax return with Form 8332 to the IRS.

If you change your mind at any time and wish to revoke your release of claim, you can simply file another Form 8332. Include Form 8453, U.S. Individual Income Tax Transmittal when you mail in your tax return with Form 8332 to the IRS.

What if I was Falsely Claimed as a Dependent?

If you e-filed a return and it was rejected by the IRS who stated your social security number has been claimed on a tax return for that year, there are some steps to take, depending on the situation.

If you know who claimed you: You should get in contact with them as soon as possible. If a parent or guardian, for example, claimed you on their return when they were not supposed to, they would have to amend their return. The IRS will have to process their amended return before your SSN can be used on your own return. Likely, to meet the tax day deadline, you will have to prepare and mail your return so you do not face any late penalties. If they amend their return, this goes much quicker than if they refuse.

If you do not know who claimed you or they will not cooperate: You will have to paper file your return. Use your identity as normal and mail in your prepared return. You will want to gather documents that show you do not qualify as a dependent (rent payments showing you pay for your expenses, residency statements, etc.) because, once processed, the IRS will contact you via letter requesting additional information - they will also write to the taxpayer who claimed you. The IRS will request that the return(s) be amended to reflect the actual situation. If the wrongdoing party does not comply, this may result in an IRS audit for both returns. You and the taxpayer who claimed you will have to prove your dependency status.

The simplest way to prepare all your 2022 forms is by completing your 2022 Tax Return with eFile.com. You can eFile your return or mail it in case it got rejected due to another person claiming your dependents. Make sure you include the appropriate forms with your mail package to the IRS. TaxTip: It is best keep copies of all documents you send to the IRS and use a U.S. Postal Office tracker service to confirm that the IRS has received your documents.

TaxTip: It is best keep copies of all documents you send to the IRS and use a U.S. Postal Office tracker service to confirm that the IRS has received your documents.

Should you require further assistance, please contact eFile.com support or call the IRS at 1-800-829-1040. You might also be able to take advantage of a low income taxpayer clinic. More details on how low-income taxpayer clinics work.

Additional resources regarding dependents and alimony payments:

- How to claim a dependent on a tax return

- Qualifying for the Child Tax Credit and your personal tax situation

- Qualifying education tax deductions for your dependent

- Education tax credits for your dependent

- Alimony and taxes

- For state tax returns, select the respective state.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

What to Do If Someone Claimed Your Dependent

You may have tried to file your tax return and got an e-file rejection message.

Something like: “A dependent on your return has already been claimed (or claimed themselves) on another return.”

Assuming you entered your dependent’s information correctly, it looks like someone else claimed your dependent. Because the IRS processes the first return it receives, if another person claims your dependent first, the IRS will reject your return.

The IRS won’t tell you who claimed your dependent. Usually, you can identify the possibilities and ask (commonly, a former spouse). But if you don’t suspect anyone who could have claimed the dependent, your dependent may be a victim of tax identity theft. Learn how to handle tax identity theft.

If you don’t think that the other person was eligible to claim your dependent, you’ll need to take some steps to protect your right to claim the dependent and your refund.

Here’s what to do

Don’t panic. This doesn’t mean that you can’t correct the situation. First, double check that you meet all of the requirements to claim the dependent. Then, take these steps:

1. File a paper return.

Print out and mail your return, claiming your dependent, to the IRS. The IRS may delay your refund while the IRS looks into the issue, but you should still receive your refund. Note that when you file a paper return, it can take six to eight weeks for the IRS to process.

2. Document your case.

The IRS rules for claiming a dependent can get complicated.

The most important thing to remember is to prove with proper documentation that you are entitled to claim the dependent. This includes things like birth certificates and proof of identity, but also documents that show that your dependent lived with you at the same address for more than half of the year.

Examples are:

- School, medical, daycare, or social service records

- A letter on official letterhead from a school, medical provider, social service agency, or place of worship that shows names, common address and dates

The IRS will ask you to complete this document.

3. Answer when the IRS contacts you.

About two months after you file a paper return, the IRS will begin to determine who is entitled to claim the dependent.

You may receive a letter (CP87A) from the IRS, stating that your child was claimed on another return. It will tell you that if you made a mistake, to file an amended tax return, and if you didn’t make a mistake, do nothing.

The other person who claimed the dependent will get the same letter. If one of you doesn’t file an amended return that removes the child-related benefits, then the IRS will audit you and/or the other person to determine who can claim the dependent.

You’ll get a letter in a few months to begin the audit. In the audit, the IRS will require you to provide proof that you are entitled to claim the dependent. Be sure to reply completely and by the IRS deadline. After the IRS decides the issue, the IRS will charge (or, “assess”) any additional taxes, penalties, and interest on the person who incorrectly claimed the dependent.

You can appeal the decision if you don’t agree with the outcome, or you can take your case to U.S. Tax Court.

It’s always a good idea to discuss claiming children with your family members before a situation like this arises, if possible.

For any dependent dispute, know your options and your rights

Dependent disputes can cause many types of tax problems. Learn more about how to handle an IRS audit – or what to do about tax refund holds and other tax return problems resulting from dependent-related credits.

And for any IRS issue, remember that you have the right to representation. You can outsource the work to a tax pro, who can look into the cause of the issue and deal with the IRS for you.

Learn more about how to research your IRS account or get help from a trusted IRS expert. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

how to pay, how to find out the TIN of a child, make him a personal account in the tax office and link him to your own apartment.

Until the tax office sued her daughter.

Until the tax office sued her daughter. In 2012, my husband and I bought an apartment in St. Petersburg and, in order to use maternity capital, we registered shares for our daughters. They are twins, and then they were 3.5 years old. nine0003

For the next 8 years, I paid property tax through my personal account on the website of the Federal Tax Service. I thought that I was paying not only for my share, but also for children. I didn’t know that children, it turns out, have their own TIN from birth, and the tax on their shares is calculated separately. I didn't receive any letters from the tax office either.

As a result, in 2021, I myself accidentally reminded the Federal Tax Service of the shares of my daughters. After that, the tax office sued one of them and demanded to pay property tax for the previous three years. I'll tell you how it all happened and how not to turn a child into a debtor. nine0003

How the tax office remembered her daughter

In 2021, one of the daughters received a disability. By law, children with disabilities may not pay property tax for one apartment, room, house, garage of any size or for shares in them. I decided to apply for this benefit: I thought that the tax for my daughter's share was included in my amount, and I wanted to reduce it.

By law, children with disabilities may not pay property tax for one apartment, room, house, garage of any size or for shares in them. I decided to apply for this benefit: I thought that the tax for my daughter's share was included in my amount, and I wanted to reduce it.

sub. 3 p. 1 art. 407 of the Tax Code of the Russian Federation

On August 10, 2021, I wrote an application in the personal account of the Federal Tax Service Inspectorate for a property tax exemption. She attached her daughter's birth certificate and a certificate that she received a disability. nine0003

A few days later I was asked to send a scan of the back of the certificate. And a week later I received an answer: the IFTS refused the benefit, because it is due to children with disabilities, and not to their parents.

/zabral-dengi-za-imuschestvo/

How to save money on property taxes

The response of the IFTS was very brief, and at first I did not understand why my daughter was denied a legal benefit I was indignant - I wrote to the tax appeal and demanded to explain why the daughter cannot receive the benefit. A few days later, they answered me that she was still entitled to the benefit. But since disability appeared in 2021, it means that the benefit will be taken into account when they calculate the tax for 2021, that is, in 2022. nine0003

A few days later, they answered me that she was still entitled to the benefit. But since disability appeared in 2021, it means that the benefit will be taken into account when they calculate the tax for 2021, that is, in 2022. nine0003

I decided that the first time the tax office had just made a mistake, and calmed down. And the tax office, apparently, began to check her daughter's taxes.

This is an appeal where I asked to explain why my daughter was denied benefits. I wrote it through the usual form for appeals in the taxpayer's personal account. The answer of the tax inspectorate, which reassured me and lulled my vigilanceHow the Federal Tax Service filed a lawsuit against my daughter

On October 11, 2021, I received a registered letter from the Federal Tax Service. It contained a copy of the application that the tax office had already sent to the justice of the peace. The inspectorate asked for a court order in the name of my daughter to collect tax for 2017, 2018 and 2019years.

Taxes for minor children are paid by parents - Federal Tax Service

Meetings are not held in such cases. The tax office submits documents on the debt to the court, the judge considers them without calling the parties and, if he considers them convincing, issues a court order. The taxpayer must fulfill it or demand to cancel it. To do this, it is enough to submit objections to the court within 20 days from the date of receipt of a copy of the order. The judge will cancel it without a trial.

paragraph 1 of Art. 46 Tax Code of the Russian Federation

ch. 11.1, part 3 of Art. 123.5 CAS RF

When the taxpayer is a child, the parents or other legal representatives execute the order or send objections to him. If this is not done, money may be deducted from the accounts.

I still haven't received the order. But initially I planned to object to him: I never received notifications that my daughter should pay tax. Later, I learned that if a taxpayer or his representative - for example, a parent of a child - did not receive a tax notice before December 1, then on December 31 of the same year he is obliged to notify the IFTS about this. I didn't. nine0003

I didn't. nine0003

Section 2.1 Art. 23, paragraph 4 of Art. 397 NK RF

I also decided that in 2021 the debt should be considered only for 2018-2020. And according to the law, the tax office is not entitled to claim debts for more than three previous tax periods. Then I realized that three years are counted from the date of non-payment of tax.

Art. 113 NK RF

Let me explain with an example. Until December 1, 2021, I am obliged to pay property tax for 2020. If I do not do this, then from December 1, the countdown on non-payment for 2018, 2019 will beginand 2020 years. Until December 1, 2021 comes, the countdown starts from December 1, 2020. That is, non-payment is considered for the three years before 2020: for 2017, 2018 and 2019. It turns out that the tax office did not violate the law.

In addition, I was embarrassed that the tax inspector dated the application to the justice of the peace on April 29, 2020, and sent the letter with the notification only on October 1, 2021. I decided that he also filed an application for a court order retroactively. But then I found out from lawyers I knew that, most likely, the application was filed in April 2020, and they simply forgot to send me a notice. nine0003

I decided that he also filed an application for a court order retroactively. But then I found out from lawyers I knew that, most likely, the application was filed in April 2020, and they simply forgot to send me a notice. nine0003

/wrong-tax/

The tax office decided that I owe money for someone else's land

The IFTS sent me an application for a court order on October 1, 2021. But the statement itself was dated April 29, 2020. It confused me. At first, I generally decided that the tax office was trying to deceive us and demand tax not for three, but for the previous four years. It would be illegal. Later, I found out that the IFTS did not violate anything - it was I who incorrectly calculated the terms The letter from the inspection did not contain any calculations or full details for payment. Therefore, I wrote a new appeal: I requested details and receipts, and at the same time clarified why in October 2021 the IFTS filed an application dated April 2020 with the court.

Two weeks later, I received an answer: I was asked to come to the IFTS branch for receipts and promised to give me access to my daughter's personal account. There was no mention of the application to the court at all.

What to do? 12/18/19

My accounts were frozen, but I don’t know why

As a result, I paid property tax for children for four years: debt for 2017-2019 and accrued tax for 2020. And I figured out how to do it from the very beginning - I share my instructions. nine0003 In a letter to my new appeal, the Federal Tax Service did not answer the question why the application to the court from 2020 was sent in the fall of 2021. But the inspector told me how to get access to the child’s personal account

How I paid tax for children’s shares

It turned out that that as soon as I registered the children's shares in Rosreestr and registered my daughters in the apartment, the departments sent information about them to the tax office. And she assigned them a TIN and created personal taxpayer accounts.

And she assigned them a TIN and created personal taxpayer accounts.

p. 3 and 4 art. 85 Tax Code of the Russian Federation

I found out the TIN of my daughters on the website of the Federal Tax Service and then decided to order paper certificates of tax registration from the inspection. How to do this, Tinkoff Magazine has already written.

TIN became the login for entering the taxpayer's personal account. And in order to get the password, I came to the IFTS with a passport and birth certificates of children. The inspectorate immediately generated and printed passwords.

On the same day, I went to my daughters' personal accounts. There was no evidence that they owned any property - for some reason, the information appeared later. But there were five unread tax notices for 2016-2020. I paid the receipts for 2017-2020. nine0003

So what? 03.03.17

Tax debts can be collected even from those who owe nothing

To find out the TIN of a child, in the request form on the website of the Federal Tax Service, you must specify his data and the number of the birth certificate. The TIN will appear instantly. Such a sheet with a password was given to me by the tax office. When I came home, I immediately changed it. Here are the taxes that are in my daughter's personal account. I did not receive any email notifications

The TIN will appear instantly. Such a sheet with a password was given to me by the tax office. When I came home, I immediately changed it. Here are the taxes that are in my daughter's personal account. I did not receive any email notifications How to link personal accounts of children to my

While I was writing this article, functionality has expanded in the taxpayer's personal account. Now children's accounts can be linked to the parent's, and the parent will be able to pay their taxes from their account.

You can now pay taxes for minor children in the personal account of the parent's tax office - the Federal Tax Service

Here's what you need to do:

- Go to your personal taxpayer account.

- Click on your last name, first name and patronymic at the top. The Profile section will open. nine0100

- Find the "Family Sharing" tab there and click on it. A request form to add a child will appear.

- Enter the child's TIN on the form.

- Go to the child's personal account and open "Family Sharing" as well.

- Find a message with a request for access and click the "Confirm" button there.

After that, the child's personal account will be linked to yours, and you can easily and conveniently pay child taxes. To do this, click on the "Taxes" tab and select a child in the drop-down list. nine0003

When the child turns 18, his personal account will be automatically unlinked from the parent account.

Finding the Family Sharing tab is not easy. In the "Profile" section, it is on the far right and is not visible at first - you need to scroll through. And the access request form is quite simple - you only need to enter the child's TIN. A request for access will appear in the child's personal account. It needs to be approved. After that, you will appear on the list of legal representatives of the child. To untie your personal account, just click on the red crossWhat I understand about the tax on children's shares

- The IFTS assigns a TIN to a child from birth and creates a taxpayer's personal account.

- As soon as the child becomes the owner of a share in the apartment, he is charged property tax.

- Parents or other legal representatives must pay property tax for the child. If they do not know about the debt, this does not relieve them of responsibility.

- The tax office may collect the debt at any time, but not more than for three previous tax periods. nine0100

Page not found - portal Vashifinansy.rf

Moscow

Your city:

Moscow

PartnersFor media

Rus Eng

Financial Literacy Week

2021 Check your financial literacy level

Learn to drive

personal finance Learn

how to protect your

rights Financial

calculators How to

talk to children

about money

From October 1, 2021, you can read up-to-date materials on financial literacy on the website

MOIFINANCE.