How to set up a child savings account

Tips for opening a bank account for kids

It’s common for children to observe and model their parents’ behaviors. Smart money management is no different. Here are some helpful tips to jumpstart your children on the path to financial success.

These days, we’re all spending more time at home—especially our kids. This makes it an ideal time to start giving children a financial literacy foundation that can help keep them stable and successful for the rest of their lives. Teaching good financial habits can start sooner than you think.

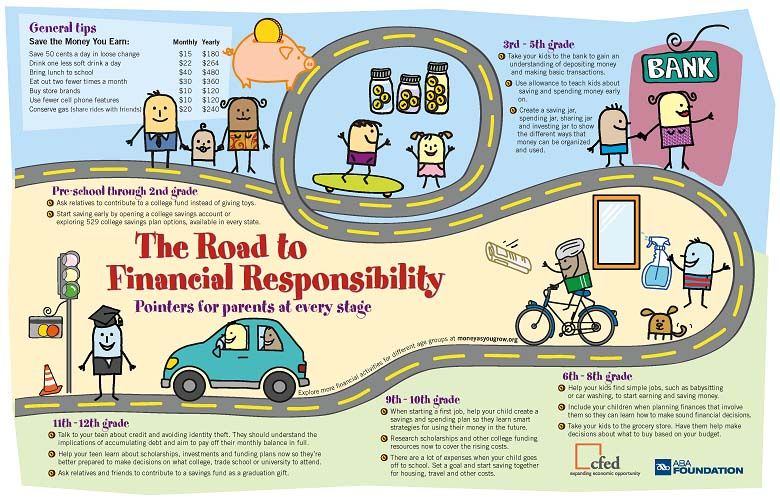

Children start to grasp the concept of saving when they’re old enough to slide coins into a piggy bank. Around kindergarten, they have a sense that money is important. When they ask for allowance or want to buy a coveted toy, it makes sense to open a bank account and start teaching them money management basics – and values around spending and saving.

Minor children by law can’t open a savings account. They need a parent or guardian to set up a custodial or joint account. A custodial account is the property of the child, but managed by the parent until the child turns 18. With a joint account, parent and child both have access, but the adult can supervise or limit activity, say, putting a cap on the amount the child can withdraw the account by actively monitoring the activity. Both types can later be converted to their own accounts.

As you shop around, look for a bank that encourages young savers with low (or no) fees and balance requirements. And just as with your money, make sure your child’s account is FDIC-protected.

Beyond those basics, here are five tips for getting your child excited about banking – and starting on a lifetime of sound financial habits.

1. Teach children why it’s important to save money.

Tie the concept of saving in a bank account to waiting for something that’s worthwhile. If you’re in line for an ice cream cone, remind them the result is a treat they really want. Saving is similar; you save for something you’ll want or need later on. With older kids, help them think of savings in terms of goals, achieved over time. For instance, they may want to plan for purchasing their own car, or be prepared to help with college costs.

With older kids, help them think of savings in terms of goals, achieved over time. For instance, they may want to plan for purchasing their own car, or be prepared to help with college costs.

2. Make opening a bank account a concrete, fun experience.

It’s tempting to look for online banking or to manage your child’s money yourself. But help kids participate in setting up an account. Call your bank in advance for an appointment, and have your child carry in necessary information (see Items to bring to the bank). Some kids are thrilled to participate in a business meeting where they’re center stage, but help out a shy child.

Also, ask if it’s possible to tour the bank; some allow kids a peek at their vault or room of safe deposit boxes, aka treasure chests. It never hurts, either, if tellers offer a lollipop after transactions, or if children can run the family’s change through a coin-sorting machine. These experiences make the bank feel welcoming and enjoyable, which helps a banking habit stick in future.

3. Add bank stops into your shared routine.

Incorporate a stop at the bank to deposit allowances, earnings and gifts part of your family’s regular routine. More broadly, remember you’re modeling financial behavior all the time, whether you intend to or not. Talk out loud about your spending and saving decisions, for instance, when you add money to a family vacation fund. Identify ways you save at the grocery store, and point out when something is a splurge. All this helps children learn the value and uses of money.

4. Give incentives.

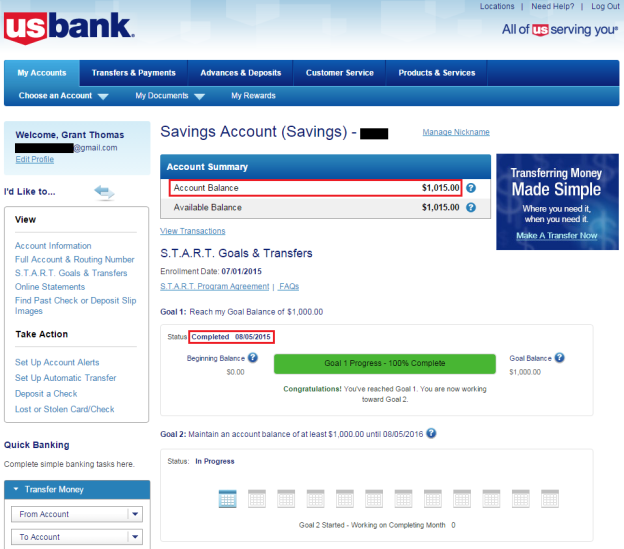

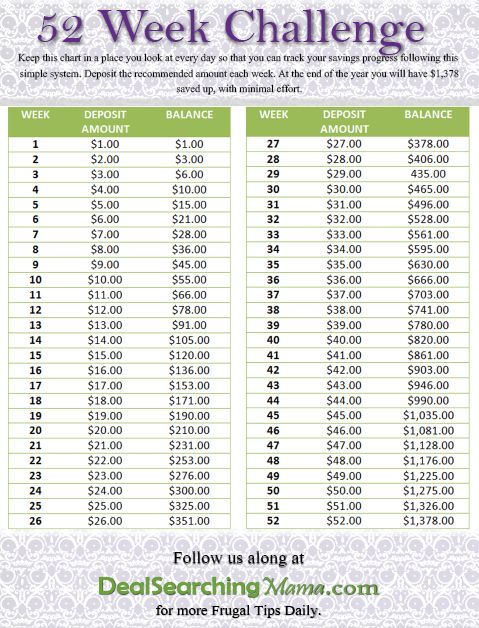

Nothing motivates financial awareness and a solid savings habit like interest or matching funds. Show your child how earning interest works: for simply leaving her money in the bank, she earns a bit more of it. If you want to reinforce saving even more, consider matching your child’s savings when, say he’s saving for a particular goal. “If you save $50 toward your ice skates this month, I will match that amount. ”

”

5. Add complexity as children grow.

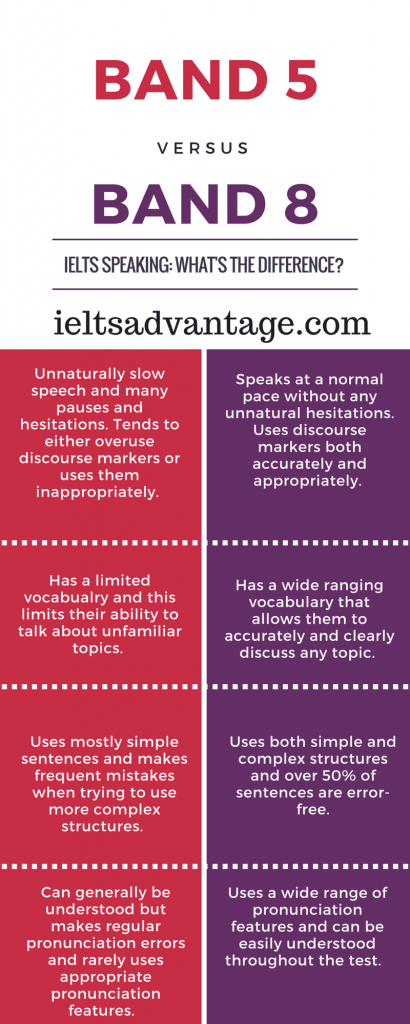

A six-year-old may not be ready to read her bank statement and reconcile her account, but by the time she’s 10, she could give it a try. By the time children get their first jobs, they will be learning about taxes. And by the time they have their first email accounts, they should be aware of financial scams and schemes that seem too good to be true. By starting their financial education when they’re young, they’ll gain both confidence and savvy when it comes to making sound decisions.

Items to bring to the bank

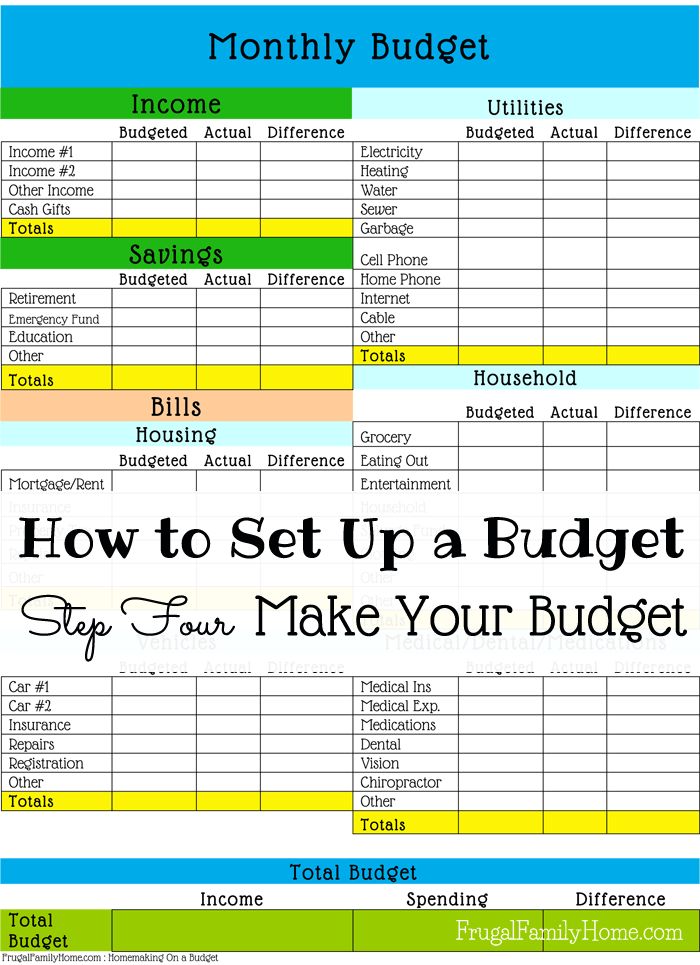

What you need to have to open a joint account with your child:

- Your child’s name, birthdate and social security number

- Your picture identification, such as a driver’s license or passport

- Your social security number

- Personal information such as address, phone number, email address

- An initial deposit (cash, checks) as required by the bank

Interested in opening a checking account for your children? Explore U. S. Bank options.

S. Bank options.

Kids Savings Accounts: Open a Savings Account for a Baby or a Child

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Opening a savings account for your child is a good way to introduce saving and budgeting concepts.

By

Spencer Tierney

Spencer Tierney

Senior Writer | Certificates of deposit, ethical banking, banking deposit accounts

Spencer Tierney is a consumer banking writer at NerdWallet. He has covered personal finance since 2013, with a focus on certificates of deposit and other banking-related topics. His work has been featured by The Washington Post, USA Today, The Associated Press and the Los Angeles Times, among others. He is based in Berkeley, California.

He has covered personal finance since 2013, with a focus on certificates of deposit and other banking-related topics. His work has been featured by The Washington Post, USA Today, The Associated Press and the Los Angeles Times, among others. He is based in Berkeley, California.

Updated

Edited by Yuliya Goldshteyn

Yuliya Goldshteyn

Assistant Assigning Editor | Banking

Yuliya Goldshteyn is a banking editor at NerdWallet. She previously worked as an editor, a writer and a research analyst in industries ranging from health care to market research. She earned a bachelor's degree in history from the University of California, Berkeley and a master's degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. She is based in Portland, Oregon.

Learn More

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

A child can generally have a savings account at any age.

The best savings accounts for kids earn interest and have no monthly fees.

A parent or guardian will likely need to open the account.

Compare top savings accounts

Find a high-yield savings account with a great rate. Compare rates side-by-side.

Opening a savings account for a baby or a child can be a good way to begin teaching good money habits. Your child might already know about bank accounts from books or TV. But if they ask where money comes from or how to have their own, they might also be ready for a savings account.

A savings account provides your child with a glimpse into how banks and credit unions work and gives them a place to stash allowance and birthday money. It also gives them the opportunity to grow their money with interest.

It also gives them the opportunity to grow their money with interest.

Here are answers to common questions about savings accounts for kids.

Is my child old enough for a savings account?

Your child is most likely old enough for a savings account. Kids’ savings accounts typically require a parent or guardian to have joint ownership or control. That means you can manage the finances until your child is ready to manage them. Because of that setup, your child probably won't have to meet a minimum age requirement to open an account. You could even open a savings account for a baby.

What makes a good kids' savings account?

The best kid savings accounts have a few features in common, including strong savings rates. Bank accounts typically require an adult to apply, so a standard account in a parent or guardian’s name — even if it isn’t marketed to kids — could be an option. Keep an eye out for the following:

No minimum balance requirement or monthly maintenance fees

Saving should be a good thing. Don’t let fees diminish what your child puts into their account.

Don’t let fees diminish what your child puts into their account.

An above-average interest rate

The national average savings rate is currently 0.35%. At some of the biggest national banks savings rates are even closer to zero. But many credit unions and online banks offer better yields. The more interest an account earns, the faster your child’s bank balance can grow.

Easy online access

Check for features such as mobile apps with high ratings in the app stores, electronic statements and a solid website where you can check your transactions. The ability to accept mobile check deposits and make transfers from linked accounts is also a plus.

Barclays Online Savings Account

APY

3.60%

Min. balance for APY

$0

Discover Bank Online Savings

APY

3.50%Advertised Online Savings Account APY is accurate as of 02/24/2023

Min. balance for APY

balance for APY

$0

How do I open a savings account for a baby or child?

Opening a savings account for your child isn't much different from getting a new account yourself. As the adult, you’ll need identifying information, such as a driver’s license, passport or other government-issued photo ID. You’ll also need to provide basic information for both of you, including your and your child’s birthdays and Social Security (or taxpayer identification) numbers.

Some banks will require a minimum opening deposit, such as $25. Others don’t have any minimum opening deposit.

Should my child also use a debit card or banking app?

There’s no need to rush to open additional accounts if you feel your child isn’t ready. But if your child is at a point where they to make regular purchases from merchants and can begin to practice budgeting, a kid-focused debit card or banking app could be a solid option. They have features similar to online checking accounts, such as the ability to track spending, set budget goals and set up transfers. Parents or guardians can open these accounts on behalf of their children, and are able to set spending limits and keep tabs on purchases.

Parents or guardians can open these accounts on behalf of their children, and are able to set spending limits and keep tabs on purchases.

Lifelong lessons

Learning good saving and spending habits are valuable life lessons, and they take time to learn. Opening a savings account for your child is one of the best ways to introduce these concepts at an early age.

About the author: Spencer Tierney is a writer and NerdWallet's authority on certificates of deposit. His work has been featured by USA Today and the Los Angeles Times. Read more

POPULAR ON NERDWALLET

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

At what age can a bank deposit be opened: deposits for minors

For life

Small business

Parents, caring about the future of their children, start saving money in advance for education, buying real estate, a car. For such cases, banks offer to open special children's accounts and deposits.

Become a client

Can a child open a bank deposit

Art. 26, 28 of the Civil Code of the Russian Federation provide for 3 categories of minors and assign to them a different scope of actions in terms of financial relations:

- Minors under 6 years of age. Deprived of legal capacity, transactions on their behalf are carried out by legal representatives - parents, adoptive parents, guardians.

- Minor citizens from 6 to 14 years old. Independently perform simple operations to pay for goods and services.

But contracts in their interests are concluded only by legal representatives.

But contracts in their interests are concluded only by legal representatives. - Minor citizens from 14 to 18 years old. The right to open accounts, deposits and partially dispose of funds on them.

Thus, only representatives can open a deposit for a child under 14 years old, from 14 to 18 years old - they, or the child does it on his own.

Account for children under 14 years old

Bank deposits and accounts for citizens under 14 years old have their own characteristics in terms of processing and using money. In some cases, to open and use an account, you may need permission from the guardianship and guardianship authorities.

Raiffeisen Bank does not currently open accounts for persons under 14 years of age.

Decoration.

- Savings accounts or deposits are opened for children of this age.

- The parent provides the bank with his passport, TIN, birth certificate of the child. If the representative is a foreigner or stateless person, a migration card will be required. Adoptive parents bring an agreement on the adoption of a child. The trustee attaches an act of the guardianship body confirming his status.

- A deposit is opened in a bank office, as a rule, online registration is not provided. The deposit is subject to insurance in the DIA separately from the accounts of the parents, in case of revocation of the license from the bank, compensation is paid on it.

Can a child under 14 manage a deposit

A minor is listed as the owner of a deposit, which can be replenished without restrictions by any person: parents, grandparents, acquaintances. A child, having reached the age of 14, has the right to independently deposit money and withdraw interest. When he turns 18, he can fully cash out the account. Statements on the movement of funds are issued by the bank to legal representatives.

A child, having reached the age of 14, has the right to independently deposit money and withdraw interest. When he turns 18, he can fully cash out the account. Statements on the movement of funds are issued by the bank to legal representatives.

Since such deposits are intended for children, debit transactions, even for representatives, are limited. To withdraw funds, you will need the written permission of the guardianship and guardianship authority.

Early closing of the deposit

If the parents want to withdraw all the money from the bank deposit ahead of schedule, the approval of the guardianship authority will also be required. In this case, accrued interest will be recalculated at the demand rate. If interest has not been withdrawn, the body of the deposit will not change. If the income was previously withdrawn, then the deposit will be reduced by the amount spent.

To close an account, you must provide the bank with the parent's passport, depositor's passbook, and written permission from the guardianship authority. If the child has reached the age of 14, money can be withdrawn only in his presence.

Account for children aged 14-18

A savings account or deposit for persons aged 14-18 has more permitted activities.

Registration

The set of documents is similar to the above, but instead of a birth certificate, a minor's passport is presented. In general, the procedure does not differ from the standard one.

Can a child over the age of 14 manage a deposit

A minor has the right to replenish and withdraw money from the deposit. If the account holder issues an order to a third party at a financial institution or a notary, that person will also be able to withdraw funds. However, parental and guardian consent is required.

If the account holder issues an order to a third party at a financial institution or a notary, that person will also be able to withdraw funds. However, parental and guardian consent is required.

If a minor plans to withdraw a salary, scholarship, financial assistance, unemployment benefit, bonus for participating in competitions, accrued interest or money deposited by him into the account, permission from the parents and guardianship authority is not required.

When it comes to issuing pensions, alimony, inheritance, insurance payments or funds contributed by others, the bank needs the written approval of the guardianship authority and one of the parents.

Account statements are issued to both parents and the depositor. When the child reaches the age of 18, the restrictions on withdrawing money from the deposit are removed.

Early closing of the deposit

The owner or his legal representatives can close the deposit ahead of schedule. It is necessary to present a passport, a deposit agreement, a passbook, the consent of the guardianship authority and one of the parents. Accrued interest will be recalculated by the bank at a nominal rate and issued minus previous withdrawals.

It is necessary to present a passport, a deposit agreement, a passbook, the consent of the guardianship authority and one of the parents. Accrued interest will be recalculated by the bank at a nominal rate and issued minus previous withdrawals.

Basic terms and conditions for child accounts and deposits

As of March 2021, credit institutions offer the following terms and conditions for savings accounts for minors:

rates — up to 6%;

minimum amount — 1 ₽;

terms - from 1 to 2160 days, prolongation is acceptable;

monthly capitalization;

can be replenished and partially withdrawn.

Open accounts mainly in rubles.

The following options are provided for popular deposits:

rates — up to 6.5%;

minimum amount — 10,000 ₽;

terms - from 90 to 1095 days, prolongation is rarely used;

monthly capitalization;

replenishment, withdrawal depending on the conditions.

Children's deposit is issued in rubles and dollars.

Raiffeisen Bank offers unique savings programs that include financial protection. You can open a child deposit for 25 years and enjoy the following privileges:

index investments to protect against inflation; diversify risks by opening accounts in different currencies; at the end of the term, receive the sum insured in the 100% volume and additional investment income.

If your goal is to receive a regular income from the deposit to increase the child's capital, you can consider the conditions for deposits for citizens over 18 years old. According to them, you have the right to transfer interest to another account or add it to the body of the deposit. The rates of many deposits are fixed for the entire term of the contract.

Is this page helpful? 100% of customers find the page useful blog

© 2003 – 2023 JSC Raiffeisenbank

General license of the Bank of Russia No. 3292 dated February 17, 2015

Information on interest rates under bank deposit agreements with individuals

RBI Group Code of Corporate Conduct

Corporate Information Disclosure Center

Information disclosure in accordance with Bank of Russia Ordinance No. 3921-U dated December 28, 2015

By continuing to use the site, I agree to the processing of my personal data

Follow us in social networks and blog

+7 495 777-17-17

For calls within Moscow

8 800 700-91-00

For calls from other regions of Russia

© 2003 – 2023 JSC Raiffeisenbank.

General license of the Bank of Russia No. 3292 dated February 17, 2015.

Information on interest rates under bank deposit agreements with individuals.

RBI Group Code of Conduct.

Corporate Information Disclosure Center.

Disclosure of information in accordance with Bank of Russia Directive No. 3921-U dated December 28, 2015.

By continuing to use the site, I agree to the processing of my personal data.

Deposits for a child under 18 in 2023, open a child deposit

- Is it possible to open a deposit for a child?

- At what age

- What deposit transactions can be made under the age of 18?

- In which bank should I open a deposit?

- What is the yield?

- How to make a deposit?

Every parent wants to help their child enter adulthood, which is why deposits for children are opened so often. This is a good tool to help protect children from financial problems at the start of adulthood. But some parents in Russia consider it dubious and do not believe in the reliability of the banks that offer them. Let's figure out if this can be done, if it is possible to withdraw money in an emergency, and how convenient it really is.

This is a good tool to help protect children from financial problems at the start of adulthood. But some parents in Russia consider it dubious and do not believe in the reliability of the banks that offer them. Let's figure out if this can be done, if it is possible to withdraw money in an emergency, and how convenient it really is.

Yes, children's deposits are available at almost every major bank. It became popular back in the days of the USSR, when parents issued passbooks in the name of their children.

This is not always a high-interest term deposit. In some cases, parents need a regular current account, which will be used equally actively by parents and children themselves. For example, if a child receives:

- scholarship;

- child support from a parent;

- pension or other social benefits.

Also, an account will be required if he is on training or practice in another city.

There are 2 types of accounts that can be opened for a child:

- Deposit for a minor under 14 years of age.

It can only be opened by adult capable citizens - parents, grandparents, aunts/uncles, guardians or other adults. To draw up a contract, you will need a passport and TIN from an adult, a birth certificate of a child. If the person is not related to the child, parental consent will be required.

It can only be opened by adult capable citizens - parents, grandparents, aunts/uncles, guardians or other adults. To draw up a contract, you will need a passport and TIN from an adult, a birth certificate of a child. If the person is not related to the child, parental consent will be required. - Deposit for a child from 14 to 18 years old. It can be opened both to parents and to the most partially capable child. You will need the passport of the future account holder and permission from the parents, as well as the passport of one of them. The teenager will be able to use his account himself, withdraw interest or replenish it if desired.

At what age

You can deposit money into your child's account from the first day of his life. As soon as he has a birth certificate.

What deposit transactions can be performed by under 18s?

Depending on which bank in Russia it is open and how old the child is, the set of operations that can be performed changes.

Basically it looks like this:

- Until the age of 14, only parents or guardians can make all incoming and outgoing transactions. The contract is kept only by the parents. To close an account or withdraw part of the money from the account, written permission from the guardianship authorities is required.

- From 14 to 18 years old, a child can manage the interest himself, make a deposit to the account. Scholarships, interest, all the money contributed by the child himself, he can withdraw himself, without permission. Pension, alimony, sums insured and inheritance up to 18 years old, he can withdraw only with the written permission of the guardianship authorities and parents.

After reaching the age of 18, the child will be able to withdraw the deposit or prolong it.

In which bank should I open a deposit?

When opening a bank account for a child, you need to determine several indicators in advance:

- Currency.

If the child will use the amount on the territory of our country, then it should be opened in rubles. It is not recommended to open a target deposit for a long period in dollars or euros, since it is impossible to predict what the situation will be like in a few years.

If the child will use the amount on the territory of our country, then it should be opened in rubles. It is not recommended to open a target deposit for a long period in dollars or euros, since it is impossible to predict what the situation will be like in a few years. - Possibility of replenishment. Of course, it is much more profitable to open a deposit for a large amount at once, but not everyone has such opportunities. Therefore, some savings deposits are replenishable. They can be replenished for any amount at a bank branch, ATM or online. And this can be done by parents, friends, relatives - anyone.

- Deadline. The longer the cash deposit is opened, the more interest will be charged, this increases its profitability. When choosing a product, remember that a child will be able to withdraw funds only after he becomes an adult and capable. But after the owner turns 14, he will be able to withdraw interest.

What is the yield?

To understand how profitable you are going to open a deposit, it should be compared with other similar deposits.

To do this, we recommend using the deposit calculator for bankers. It will help you calculate the profitability and understand how it is suitable for you.

To do this, we recommend using the deposit calculator for bankers. It will help you calculate the profitability and understand how it is suitable for you. On average, the yield is at the level of 3-5%, this is not much, but the term for which the deposit will be opened is also important.

How to make a deposit?

Several documents are required to open a deposit:

- passport of one of the parents;

- child's birth certificate/passport;

- parental consent if the deposit is opened by another person.

Frequently asked questions

What is a child contribution?

For children under 18, parents or third parties can open a special deposit. Thanks to this account, you can save money by adulthood. The account owner is a child, but he does not have the right to dispose of funds under the age of 18. Anyone can make a deposit. Such an account can be used to receive alimony or social payments from the state.

How to open an account for a minor child?

To open a deposit, you need to visit a bank branch or use remote services.