How to put a lien on property for back child support

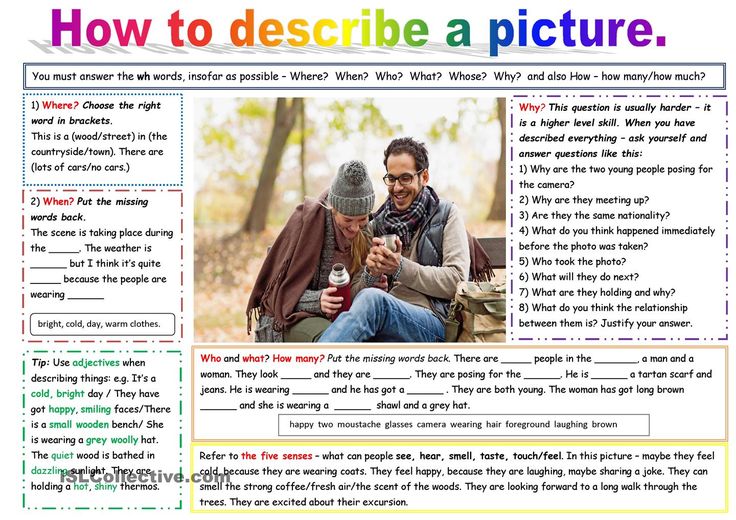

Understanding Child Support Liens in Texas

The Texas Family Code regulates everything to do with child support within the state, including enforcing child support payments. One of the enforcement tools the Office of Attorney General has to compel payment is the ability to place a lien on assets.

The state intentionally makes it difficult to skip child support payments. The best thing to do is to continue to pay until the child is legally an adult or a court orders payments to end. Otherwise, the ability to sell a home or other assets can be blocked or delayed.

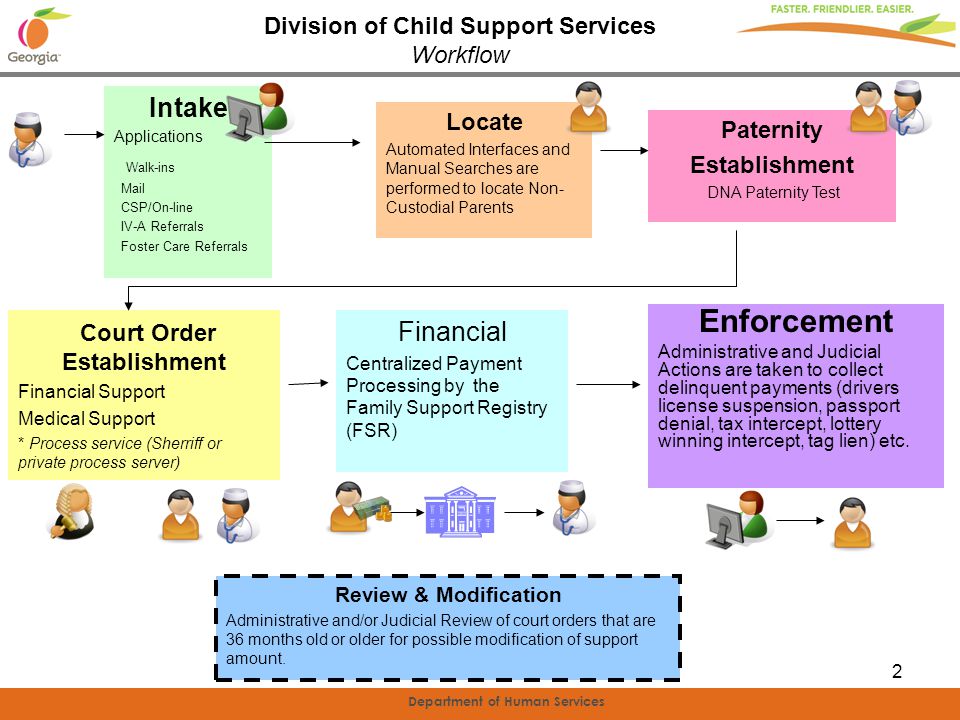

Child Support and the Texas Office of the Attorney General

The mission statement of the Office of the Attorney General says its Child Support Division “assists parents in obtaining the financial support necessary for the children to grow up and succeed in life. To encourage parental responsibility, the Office of the Attorney General establishes paternity of children, establishes court orders for financial and medical support, and enforces support orders. ”

The Child Support Division also locates absent parents and collects and distributes child support payments. Attorneys for the division do not represent either parent, and clients do not have the legal right to select the enforcement action taken in nonpayment cases.

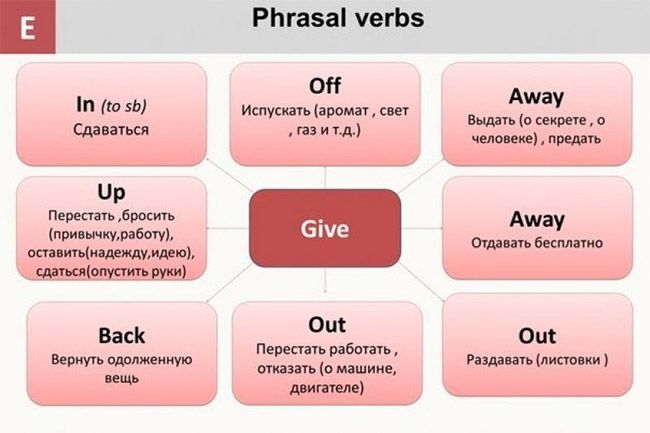

Besides placing a lien on property to enforce child support payment orders, the non-custodial parents may be subjected to one of the following enforcement actions:

- Deduction of support from a parent’s paycheck through income withholding.

- Interception of federal or state funds in the form of income tax refunds, lottery winnings, or other sources.

- Suspending a license, including driver’s, professional, and hunting and fishing.

- Filing a lawsuit asking the court to enforce the child support payment order, which could result in jail time or a monetary judgment.

Only the court can modify a child support order. No other party has the authority to do so, and any changes are bounded by other requirements.

Who Can Apply for Child Support in Texas?

The Attorney General’s Office accepts applications for child support from mothers, fathers, and other individuals. The child’s benefit is central to the case. Neither parent is favored or represented.

If a parent is a recipient of Temporary Assistance for needy Families (TANF) or if they are certain types of Medicaid recipients, they automatically receive child support services after certification for assistance. Otherwise, the custodial parent must apply for child support.

There is no charge to apply, and most other services are provided at no cost.

Services include locating non-custodial parents. The person applying must provide a current address for the non-custodial parent, as well as the name and address of that parent's current employer if known. If not known, then the name and address of the last employer are sufficient.

Other information, if known, may be added, including:

- Social security number and date of birth

- Names of banks or creditors

- Names and addresses of relatives or friends

- Names of organizations, clubs, or union the non-custodial parent belongs to

- Names of places where the non-custodial parent is known to spend time

Moreover, the custodial parent can hand over copies of the divorce decree, separation agreement, or court order for child support. The AOG can receive acknowledgment of paternity of it has been signed, birth certificates of children involved in the case, evidence of child support payment history, and all documents reflecting both parents’ income and assets.

The AOG can receive acknowledgment of paternity of it has been signed, birth certificates of children involved in the case, evidence of child support payment history, and all documents reflecting both parents’ income and assets.

Paternity

Even if an unmarried father is already providing support, he should establish paternity. It provides documentation in cases where the father may change his mind, die, or become disabled. It also offers the opportunity to share medical history with the child's healthcare provider, a right to inherit assets, and make a child eligible for other services and financial aid.

Responsibility for the child is not negated if the pregnancy wasn't planned, the father is still in school, or lives in another state. If the non-custodial parent has no income, the judge will determine how child support may be paid. The parent's income can be reviewed after completing school and beginning work.

How a Lien Works

A lien is a legal instrument that uses assets as leverage for the enforcement of debt payment. Child support is but one example of debt. Others include tax debt, court judgments, and mechanic’s liens.

Child support is but one example of debt. Others include tax debt, court judgments, and mechanic’s liens.

A child support lien may be placed against a house, boat, car, or other assets up to and including any settlements received for cases like an automobile accident.

A lien guarantees that a portion of the proceeds from a sale of the asset is directed toward paying the child support debt. If you are unable to pay off the debt, you may be able to negotiate with the custodial parent (through your attorneys) to remove the lien on a specific property to be free to sell it.

Selling a property with a child support lien against it is difficult. Most purchasers don’t care to become part of a family issue.

Lien vs. Qualified Domestic Relations Orders (QDRO)

A child support lien freezes the assets of the debtor, such as a house the debtor owns. Any proceeds from the sale of the frozen asset are applied to the debt with few exceptions. However, there is another tool that may be used to obtain back child support.

A Qualified Domestic Relations Order (QDRO) applies to specific types of employer-sponsored retirement plans. A QDRO is regulated by ERISA, a complicated federal law that governs retirement plans.

ERISA usually blocks payments from retirement plans to anyone not named as a plan participant or in a way that goes against plan rules. However, a QDRO is a crucial exception. So if you owe child support, your retirement account may be taken as well.

A lien may be applied to retirement funds, but will only keep them from being distributed. A QDRO can force a distribution.

Texas provides a range of child support services, including the enforcement of payments. One way the state enforces payment is through the placement of a lien on assets specifically for child support funding.

A child support lien functions like any lien. It freezes assets and prevents them from being sold without the intervention of the court. However, child support payments are often given priority over other debts when the asset is sold.

Child Support Liens in Texas

In Texas, a lien may be placed against your property if you fail to adhere to your support obligations.

If you're a parent in Texas and you're going through a divorce, or your relationship has ended, you should know that the courts are required to make sure your children receive enough financial support. In this situation, one of two things will happen: either you'll be named the "obligor" and ordered to pay child support, or you'll be deemed the "obligee," and you will be entitled to receive payments on behalf of your children.

If you're an obligor and you fail to make child support payments as ordered,you create a financial hardship for your children. For that reason, Texas law has a series of remedies designed to help obligee parents collect support and punish delinquent obligors. Many of these remedies are well-known to the general public, such as driver's license revocations, revenue recapture of tax returns and lottery winnings, and even jail time for contempt.

A lesser-known, but very effective remedy in Texas is called a "child support lien," which enables obligees to attach a claim for money to an obligor's property.

What Is a Lien?

Generally speaking, a "lien" is a legal claim that is lodged against real property (real estate or buildings) or personal property (all other kinds of movable property) because the property owner owes money to the lien holder.

It's important to know that in the eyes of the law, all property is either "exempt" or "nonexempt," but only nonexempt property can be subjected to a child support lien.

Exempt property consists of things like clothing, an automobile used for work, or a pension fund that the owner requires to meet basic life needs. Exempt property can't be garnished, taken in bankruptcy or tax proceedings, or made the subject of a lien, because that would strip the owner of the ability to meet essential needs.

Non-exempt properties, on the other hand, are things like valuable collections, second homes, and second cars. This kind of property is considered the legal equivalent of a luxury item, and for that reason it can be garnished, taken by creditors, or subjected to a child support lien.

This kind of property is considered the legal equivalent of a luxury item, and for that reason it can be garnished, taken by creditors, or subjected to a child support lien.

A lien holder is known as a "claimant" in Texas. A lien against property secures a claimant's debt, because the property owner can't just sell or dispose of it without paying back the amount owed to the claimant. Liens attach to property, not people. The claimant holds an interest in the property equal to the amount of money owed by the property owner, and can foreclose on that interest.

A lien must be "perfected" to be valid (see below). This means that the claimant must establish priority over anyone else who might also have a claim on the property by giving them proper notice.

What Is a Texas Child Support Lien?

Under Texas law, it's possible to obtain a lien for unpaid child support. There are four kinds of people and/or entities that can pursue a lien for unpaid child support and become formal claimants, including:

- the obligee parent, or a private attorney representing the parent

- any Texas agency providing federally funded ("IV-D") child support services (e.

g., cases where a Texas county is a party to the case, or someone is receiving public assistance)

g., cases where a Texas county is a party to the case, or someone is receiving public assistance) - a domestic relations office or local registry, and

- any attorney appointed as a "friend of the court" (a lawyer who is court-ordered to use informal methods, like telephone calls, to ensure the obligor complies with a child support order).

Texas child support liens can be filed against an obligor's real or personal property, in the amount of any child support that is "due and owing" (e.g., the total amount of child support plus accrued interest, whether it's been awarded by a court or not). It's important to know that any amounts—even accrued interest—are considered due and owing even if a court has not issued a judgment stating so. What matters is that the obligee could have taken the obligor through the legal process and obtained a judgment, because the amount was "presently enforceable" (meaning, supported by the law so that the obligee is entitled to use legal processes like court hearings or revenue recapture to recoup the money).

The State of Texas actively enforces child support liens that originate in other states. If you've moved to Texas and you're concerned about a child support lien you left behind in another state, you should contact the Texas Attorney General's office immediately for further assistance. The Texas Attorney General and the Texas courts will enforce child support liens from other states with the same force and authority as liens against property located in Texas.

Does a Child Support Lien Affect an Obligor's Wages?

If you're an obligor and you're concerned about a lien being filed against your wages, you should know that Texas law protects obligors. Obligees are not allowed to send liens to employers or attach them to disposable earnings. Self-employed obligors enjoy similar protections.

How is a Texas Child Support Lien Perfected?

If you're an obligee, you don't necessarily have to go to court to perfect your lien. A child support lien arises without any court action, as long as "notice" is proper. The notice is the legal paperwork that must be filed to establish why the obligor's lien is valid and complies with state law. The obligee does not need to go to court and can simply file the notice with the clerk of court in any of the following counties:

The notice is the legal paperwork that must be filed to establish why the obligor's lien is valid and complies with state law. The obligee does not need to go to court and can simply file the notice with the clerk of court in any of the following counties:

- the county where the obligor lives

- the county where the obligor is believed to own nonexempt personal or real property, or

- the county where the child support court has jurisdiction (meaning authority to hear the case).

A child support lien notice may also be delivered to a financial institution if the obligor has a bank account there. The bank must supply the obligee with the obligor's last known address and notify anyone else with an interest in the account about the lien, such as a joint account holder. The bank will then freeze the account in the amount of the lien.

To perfect the lien, the lien notice must contain many different elements, each of which must be precisely stated or the lien won't be effective. To ensure that your notice contains all the required elements, be sure to check the Texas Family Code, section 157.313.

To ensure that your notice contains all the required elements, be sure to check the Texas Family Code, section 157.313.

This area of the law can be very technical and a bit complicated; if you want to collect delinquent child support payments with a lien against property, you should contact an experienced family law attorney for help pursuing and perfecting a child support lien.

How is Priority Determined?

A child support lien filed against real property always has priority over any liens that are filed later. However, a child support lien does not necessarily have priority over liens that have already been filed. If you are an obligee and you have a child support lien against the obligor's property, but another lien preceded (came before) yours, you should contact an attorney right away to discuss this potentially complicated situation.

Helpful Resources

The Texas Attorney General's Child Support Manual

The Texas Statutes (see Family Code section)

The Child Support Lien Network, Texas Laws section

Arrest of the property of the debtor for alimony

By the way: We can collect maximum child support More Regardless of how the maintenance obligations were originally established - through the conclusion of a voluntary agreement by the couple or by applying to the judicial authority, the spouse obliged to pay the amounts of money may one day cease to voluntarily fulfill this obligation. Then the mother will have to initiate the debt collection procedure through the bailiff service. nine0003

Then the mother will have to initiate the debt collection procedure through the bailiff service. nine0003

The procedure for the forced collection of alimony can be conditionally divided into two situations:

- previously paid alimony voluntarily, but at some point the payer began to evade the obligation;

- , alimony was collected by the UFSSP service, but later the payer lost his job and no longer takes measures to repay, and a debt for alimony from the unemployed is accrued in relation to him.

In the first situation, the bailiff, having received the appropriate sheet for execution, opens the proceedings and provides the parent with the opportunity to voluntarily fulfill the obligation. At the same time, the bailiff finds out the sources of income of the subject, his place of work. nine0003

PLEASE NOTE: when the father is officially employed, the bailiff sends the executive document to his employer, after which the accounting department begins to deduct the required amounts from the salary every month.In this case, the recovery of property will not reach the seizure of property.

If there is no official place of work, sources of income are unknown, and the former spouse does not want to voluntarily fulfill obligations, the bailiff takes measures aimed at implementing the writ of execution. nine0003

Seizure of alimony debtor's property as an effective way of enforcement

The legislation on enforcement proceedings, as well as Article 112 of the Family Code, speak of such a method of enforcement as foreclosure on property objects registered in the name of the debtor.

How is the alimony debtor's property seized?

The recovery takes place by issuing by the bailiff of the relevant decision to collect the debt by alienating real estate in favor of the minor. nine0003

IMPORTANT: This procedure involves the seizure of the parent's property solely in the amount of the debt and its implementation for the purpose of subsequent transfer of funds to the recipient of alimony.If the amount received from the sale of property exceeds the debt, then after its repayment, the remaining funds are subject to return to the debtor.

First of all, the funds available on the accounts of the debtor, primarily in Russian currency, and if they are insufficient, in foreign currency, are subject to arrest. If there are few or no such funds, all property to which the parent has the right of ownership or other real right (for example, the right to lease a land plot or a share in the authorized capital of the company) falls under the collection procedure, except for objects withdrawn from circulation, as well as included in the list of exceptions provided by law. nine0003

Restrictions on attachment of property of a debtor for alimony

PLEASE NOTE: Article 446 of the Code of Civil Procedure of the Russian Federation contains a list of property that cannot be seized, for example, the only living quarters of the payer, an item of everyday use, tools for professional activities, etc.

The actions of the bailiff, performed during the arrest:

- Issues an appropriate decision indicating the grounds for arrest; nine0008

- Draws up an inventory of objects in the form prescribed by law, about which an act is signed;

- Seizes the described things, or leaves the debtor himself for storage, limiting the rights to use and dispose of this property.

From the moment when the act containing restrictions for the debtor parent is signed, a period of 10 days begins to run for appealing against the actions taken by the bailiff, as well as for presenting demands for the exclusion of certain things from the list of those arrested, for example, pledged property. Demand an exception to the right and the owner of property mistakenly arrested as belonging to the debtor. nine0003

Such an exception occurs only through the court, which suspends the sale of seized items.

After 10 days and the expiration of the deadline for appealing, the property is handed over for sale to the auction management body (Rosimuschestvo). The debtor has the right to determine the order of foreclosure on various types of property.

The debtor has the right to determine the order of foreclosure on various types of property.

Read on our blog: Alimony and the cost of living, how are they related?

However, do not think that if your property has been seized, this process is irreversible. The arrest of the property of the debtor for alimony can be lifted, provided that all the debts of the person are repaid, and the bailiffs receive information about this in a timely manner. nine0003

In any case, both when seizing the property of the alimony debtor on the part of the claimant and on the part of the debtor, one cannot do without competent legal assistance and detailed advice from a specialized specialist. Lawyers of the MCPI "Planet of the Law" will provide all the necessary legal assistance as part of a unique comprehensive legal support program "Alimony? - Elementary! Call right now + 7 (495) 722-99-33!

Seizure of the debtor's property \ Consultant Plus

Seizure of the debtor's property

40. Seizure as an enforcement action may be imposed by a bailiff in order to ensure the execution of an enforcement document containing claims for property recovery (paragraph 7 of part 1 of article 64, part 1 of article 80 of the Law on Enforcement Proceedings).

Seizure as an enforcement action may be imposed by a bailiff in order to ensure the execution of an enforcement document containing claims for property recovery (paragraph 7 of part 1 of article 64, part 1 of article 80 of the Law on Enforcement Proceedings).

As a compulsory enforcement measure, arrest is imposed upon execution of a judicial act on the seizure of the property of the defendant, administrative defendant (hereinafter referred to as the defendant, in enforcement proceedings - the debtor), which is with him or with third parties (part 1, paragraph 5 of part 3 of the article 68 of the said Law). nine0003

In pursuance of a judicial act on the attachment of the defendant's property, the bailiff makes an arrest and establishes only those restrictions and only in relation to that property that are indicated by the court.

If the court took an interim measure in the form of arrest of the defendant's property, establishing only its total value, then the specific composition of the property to be seized and the types of restrictions on it are determined by the bailiff according to the rules of Article 80 of the Law on Enforcement Proceedings. nine0003

nine0003

In cases where the debtor prevents the execution of a judicial act on the attachment of property under a judicial act on the attachment of the debtor's movable property, including by refusing to accept the arrested property for storage, the bailiff has the right to transfer the arrested property for safekeeping to members the debtor's family, the recoverer or the person with whom the territorial body of the FSSP of Russia has concluded a storage agreement, subject to the requirements established by Article 86 of the Law on Enforcement Proceedings. nine0003 90 002 does not release the bailiff from the obligation to further carry out actions to identify other property of the debtor, which may be levied in the previous turn. nine0003

At the same time, the bailiff is obliged to be guided by part 2 of article 69 of the said Law, which allows foreclosure of property in the amount of debt, that is, the arrest of the debtor's property, as a general rule, must be commensurate with the amount of claims of the recoverer.

For example, the arrest is disproportionate in the case when the value of the seized property significantly exceeds the amount of the debt under the executive document in the presence of other property, which can subsequently be levied. At the same time, such an arrest is admissible if the debtor has not provided the bailiff with information about the presence of other property that can be foreclosed on, or if the debtor has no other property, its illiquidity or low liquidity. nine0003

Identification, seizure and commencement of the procedure for the sale of other property of the debtor in itself cannot serve as a basis for removing the previously imposed seizure until the requirements of the executive document are fully fulfilled.

42. The list of enforcement actions provided in part 1 of article 64 of the Law on Enforcement Proceedings is not exhaustive, and the bailiff has the right to perform other actions necessary for the timely, complete and correct execution of executive documents (paragraph 17 of part 1 of the said article ), if they comply with the tasks and principles of enforcement proceedings (Articles 2 and 4 of the Law on Enforcement Proceedings), do not violate the rights of the debtor and other persons protected by federal law. Such actions include the establishment of a ban on the disposal of property belonging to the debtor (including a ban on registration actions against him). nine0003

Such actions include the establishment of a ban on the disposal of property belonging to the debtor (including a ban on registration actions against him). nine0003

The prohibition on the disposal of property is imposed in order to ensure the execution of the executive document and prevent the disposal of property, which may subsequently be levied, from the possession of the debtor in cases where the bailiff has reliable information about the debtor's individual property, but at the same time, it is difficult to find and / or make an inventory of such property for one reason or another (for example, when a vehicle belonging to the debtor is hidden by him from recovery). nine0003

The bailiff must send the decision to impose a ban on the disposal of property to the relevant registration authorities.

After the discovery of the actual location of the property and the possibility of its inspection and inventory in order to levy execution on it, the bailiff is obliged to take all necessary actions to seize the specified property of the debtor in accordance with the rules provided for in Article 80 of the Law on Enforcement Proceedings. nine0003

nine0003

43. An arrest as an interim measure or a ban on disposal may be imposed on the property listed in paragraphs two and three of Part 1 of Article 446 of the Code of Civil Procedure of the Russian Federation belonging to a debtor-citizen.

For example, the arrest as a security measure of a dwelling owned in whole or in part by a debtor-citizen, which is the only one suitable for permanent residence of the debtor himself and his family members, as well as the establishment of a ban on the disposal of this property, including a ban on moving in and registering other persons, by themselves cannot be declared illegal if these measures are taken by a bailiff in order to prevent the debtor from disposing of this property to the detriment of the interests of the recoverer. nine0003

Seizure or establishment of an appropriate prohibition should not prevent the citizen-debtor and members of his family from using such property.

44. In order to ensure the rights of the creditor on the basis of paragraphs 1 and 4 of Article 80 of the Law on Enforcement Proceedings, seizure or prohibition of disposal (prohibition of registration actions) is possible with respect to property that is in common joint ownership of the debtor and another person ( persons), until the share of the debtor is determined or until it is allocated. nine0003

nine0003

that will be credited to the accounts and deposits of the debtor in the future. In this case, the execution of the decision of the bailiff-executor on the arrest of funds is carried out as they are received on accounts and deposits, including those opened after the bank received this decision. nine0003

The arrest of funds in the debtor's bank accounts means a prohibition of their write-off within the amount specified in the executive document, as well as a prohibition for the bank (credit organization) to declare the set-off of its claim against the debtor who is its client, therefore, the court has the right, at the request of the bailiff - executor or recoverer to seize the funds received, as well as funds that will go to the name of the debtor in the future to the correspondent account of the bank servicing him, if other measures cannot ensure the execution of the adopted judicial act (for example, the presence of a seizure of funds on the client’s current account ).