How much to pay child for chores

Allowance for Kids - Types and How Much You Should Pay for Chores

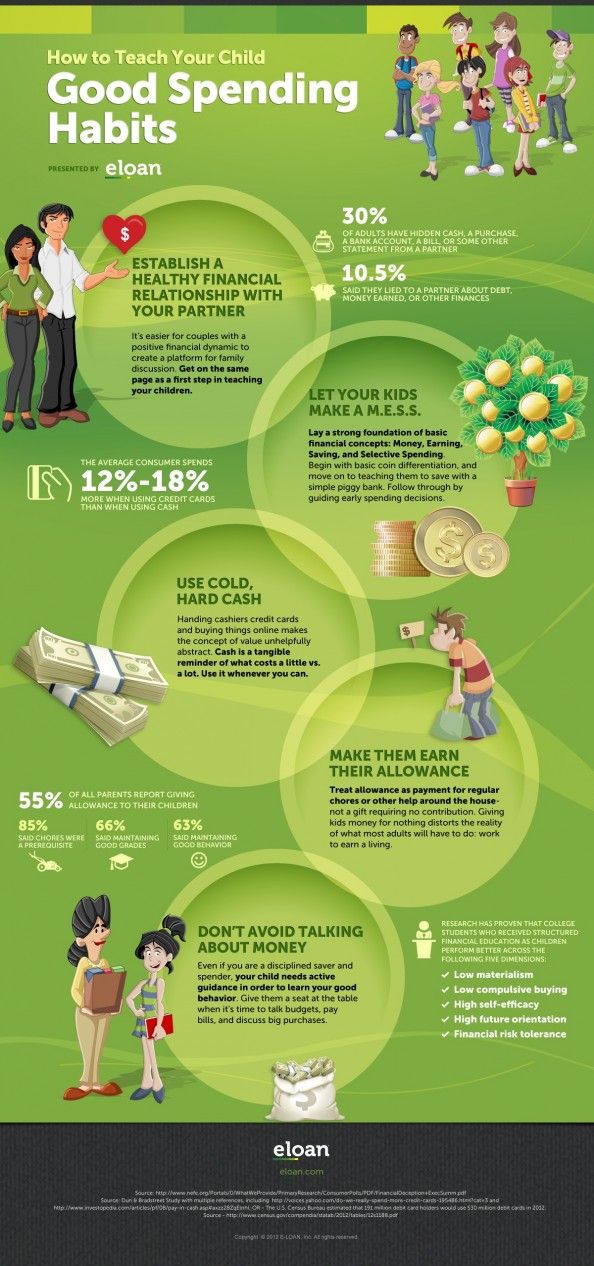

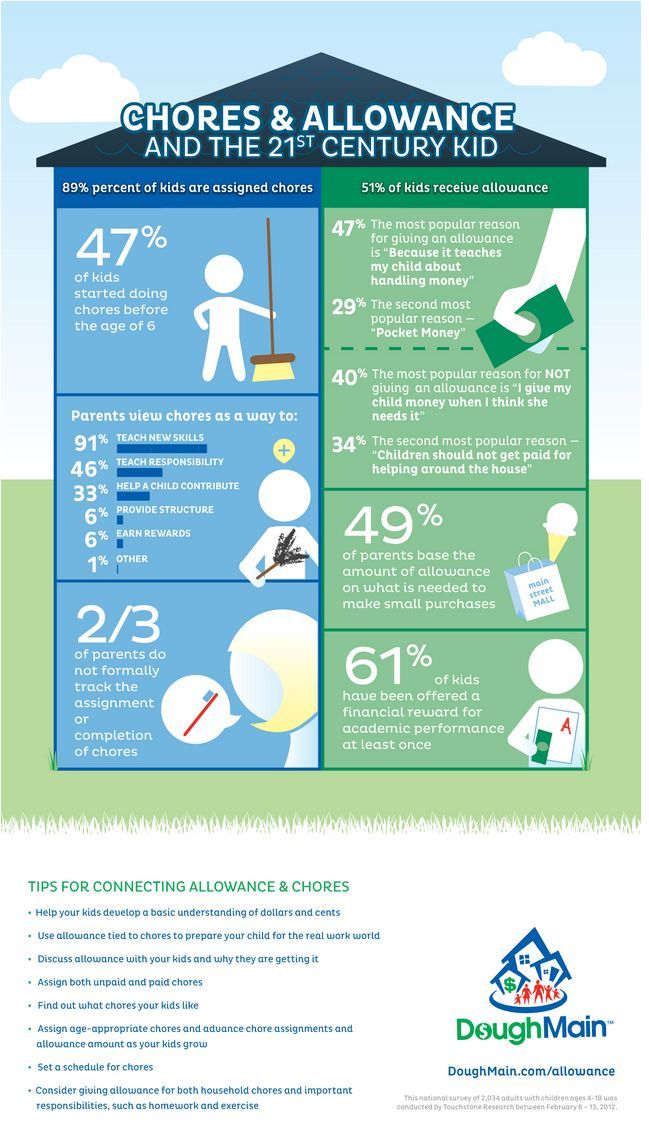

There are two general schools of thought on allowance. Some people believe children should earn money in exchange for doing chores. Others don’t think you should pay them for contributions every family member should make.

There are pros and cons to every method of administering an allowance to children. But in any case, the ultimate goal is to teach your kids money management skills.

The Role of Allowance in Teaching Kids Personal Finance

These days, many high schools offer financial literacy courses, and teens are certainly old enough to earn their own money to practice with. But it’s vital to teach financial literacy earlier with an allowance.

According to a 2016 survey by the American Institute of CPAs, 4 out 5 adults say receiving an allowance taught them financial responsibility.

Motley Fool Stock Advisor recommendations have an average return of 397%. For $79 (or just $1.52 per week), join more than 1 million members and don't miss their upcoming stock picks. 30 day money-back guarantee. Sign Up Now

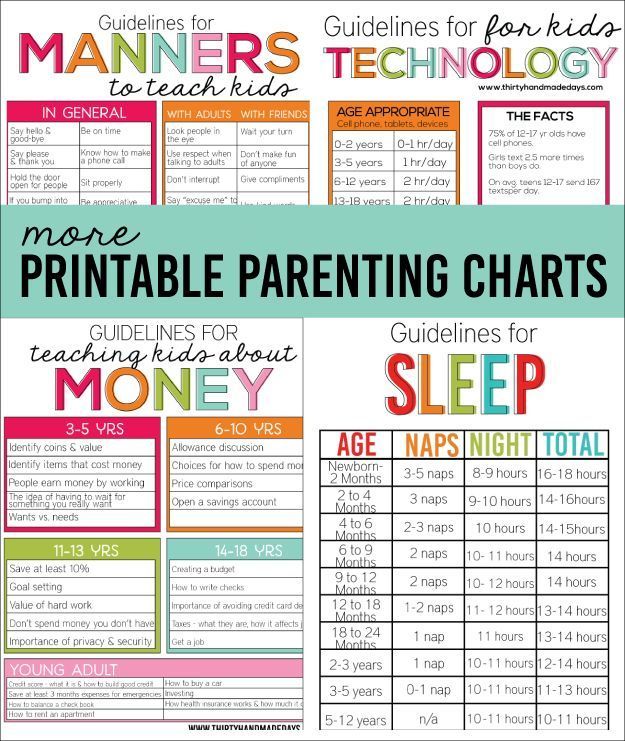

And a 2018 paper published in the Journal of Family Issues notes that kids learn more about money from their parents than any other source. Specifically, kids learn in two ways: from the example their parents set and what parents actively teach their kids.

But the paper notes that most research overlooks one of the most crucial modes of teaching — hands-on practice. Kids learn best through doing.

And it’s important to let them practice when they’re young and the stakes are low. The best time to learn is when they’re with you so you can monitor how they spend, save, and invest the money they earn.

Beth Kobliner, author of “Make Your Kid a Money Genius,” notes in an article for PBS that kids as young as 3 can understand basic money concepts. And by age 7, many of their money habits are set.

Thus, the earlier you start teaching kids about money — and letting them practice with the real thing — the better. Fortunately, that’s easier than ever with kid-friendly mobile apps and prepaid debit cards.

Fortunately, that’s easier than ever with kid-friendly mobile apps and prepaid debit cards.

Types of Allowances

Simply deciding an allowance is necessary is only half the battle. There are several options to consider.

Whichever one you choose, it’s crucial to allow yourself some flexibility. The method you end up using may not be what you started with, as your child may respond unexpectedly. Ultimately, you could find that you need to change your method to get the best results.

But you have to start somewhere. So just choose the option that makes the most sense to you.

1. The Unconditional Allowance

The unconditional allowance consists of giving a regular amount of money without requiring the child to earn it by doing chores.

That lets you maintain money lessons and chores as different issues. And since the money isn’t tied to chores, kids can’t decide they don’t need the money and refuse to work. Instead, they learn that chores are a part of life.

On the plus side, any weekly, biweekly, or monthly allowance gives your child the opportunity to manage money regularly in a way that’s similar to a paycheck. It’s easier to save for specific goals, and the child can make plans based on expected future income.

The downside is that this method doesn’t teach your child that pay is compensation for a job well done.

Additionally, an understanding of how money works can be lost on kids if parents don’t pair the allowance with financial lessons.

A 2008 study from student financial literacy foundation JumpStart Coalition found that kids who received an unconditional allowance had the lowest rates of financial literacy. But that doesn’t have to be the case.

Economist and author of the study, Lewis Mandell explains to Insider that allowances are only effective when they give families the opportunity to talk about money. So as long as you’re doing that, any method could work.

2. The Pay-as-Needed Allowance

With a pay-as-needed allowance, kids don’t regularly receive a set amount of money. Instead, they ask their parents for money as they need it.

Instead, they ask their parents for money as they need it.

On the negative side, the kids haven’t necessarily done anything to earn this money. And if it’s contingent on regularly doing chores, the correlation is neither immediate nor strong.

This allowance structure also provides money inconsistently, making it difficult for a child to save for future expenditures. However, it does necessitate frequent discussions about money, as you must evaluate each request on its merits.

Ideally, under this scenario, if your child wants an e-reader, an aquarium, or a new bike, and there is no major holiday or birthday in sight, they would ask you for the money and you would determine whether your child has earned the money or what they can do to earn it or a portion of it.

This scenario forces you both to consider money management each time a situation arises. This method may be suitable for parents who don’t feel kids should earn money for doing chores but should receive the funds simply by virtue of being a family member.

3. The Earn-Money-for-Chores Allowance

The most common type of allowance is one in which kids earn money for chores, according to the 2019 T. Rowe Price Parents, Kids, & Money survey.

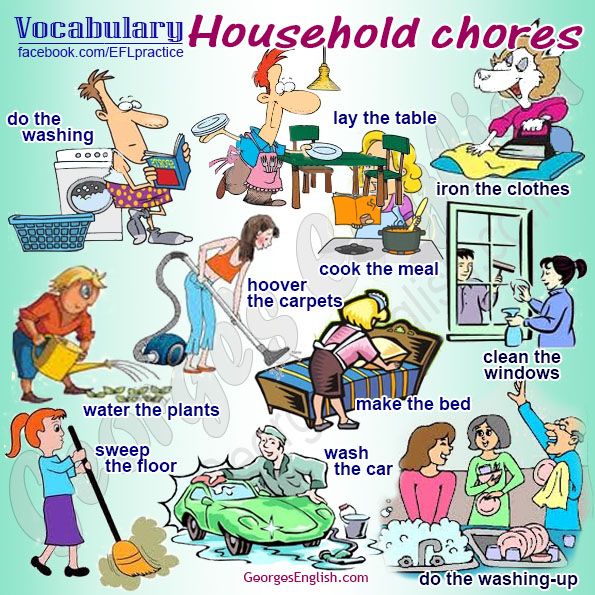

Under this structure, kids must do certain chores around the house in exchange for money. It’s often a set amount of money for a list of chores they must do each week.

The benefits are that the child sees a direct correlation between effort and the money they receive.

But for this to be effective, there must be consequences when the child doesn’t do the chores, which requires parents to keep track. And if there are several children in the household, that may be difficult.

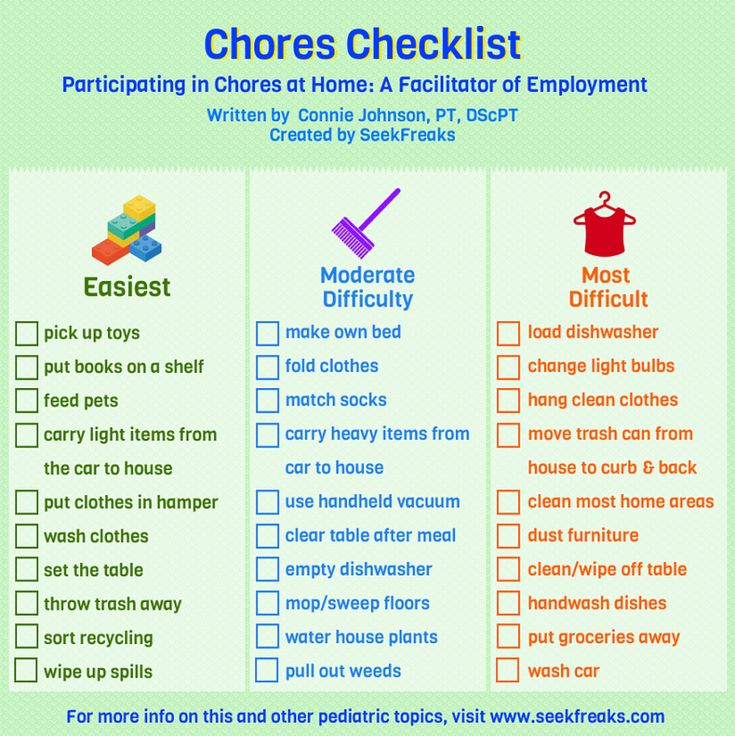

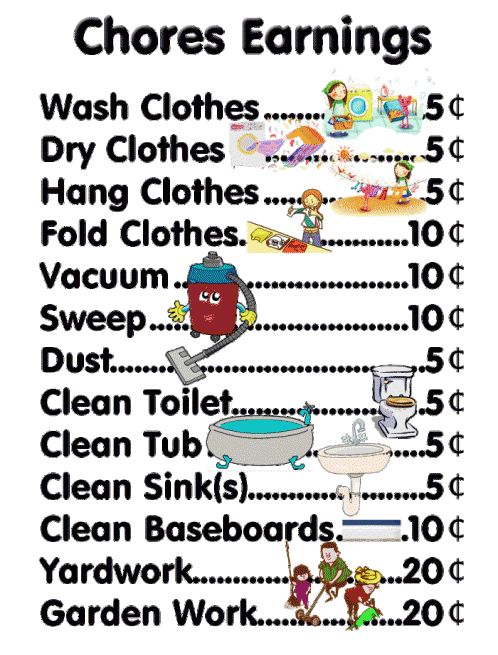

An alternative is to have a list of chores with a set price per chore. You might require your child to choose a minimum number of chores or leave it up to them. More involved work pays more money, while quick or easy tasks pay less.

If your child doesn’t do the work, they don’t receive spending money.

4. The Hybrid

Many parents, including me, use the hybrid method. As a contributing member of the family, my 6-year-old son is expected to do certain age-appropriate chores around the house for free, such as feeding the cat, picking up his toys, and putting away his laundry.

If he doesn’t do these chores, he loses privileges like TV or playtime. But he doesn’t lose allowance. He gets an unconditional base allowance (not tied to chores) just for being a member of the family.

He can earn additional money for tackling larger tasks. The amount he earns depends on the task’s difficulty or how long it takes. That forces us to discuss money each time he takes on a larger task.

Larger tasks are dependent on your child’s age but could include chores like raking leaves, shoveling snow, mowing the lawn, or cleaning the house.

I went with this method because the rationale for an unconditional allowance makes sense to me. Neither my husband nor I get an allowance when he does the dishes or I do the laundry. We simply do these things because they have to get done, and we each need to do our part.

We simply do these things because they have to get done, and we each need to do our part.

But I’ve also always had an entrepreneurial spirit. Today, I make my living as a part-time teacher and full-time freelance writer. But as a kid, I was always coming up with ideas for my own businesses.

And it all started with convincing my parents to let me take over for our then-housecleaner. I offered to do it for less than she did but more than my usual allowance. I eventually branched out into cleaning their friends’ houses. I had my own thriving cleaning business with flexible hours and better-than-minimum-wage pay.

I’d love to encourage a similar entrepreneurial drive in my son. And a hybrid model like this — where he chooses how much he can make based on the work he decides to take on — is one way to do that.

What’s the Going Rate?

If your child comes home from school with stories about the exorbitant amounts of money their friends get for an allowance, refer to this simple guideline before caving in to demands to keep up with the Joneses.

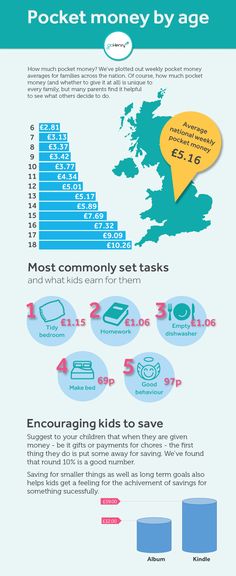

Generally, you should pay $1 to $2 per year of age weekly. So a 10-year-old would earn $10 to $20 per week, and a 14-year-old would earn $14 to $28 per week.

If this seems high (or low) to you, you can come up with whatever seems reasonable based on how much work gets done (if you link the allowance to chores), how many children you have, what your allowance budget is, and what type of allowance system you use.

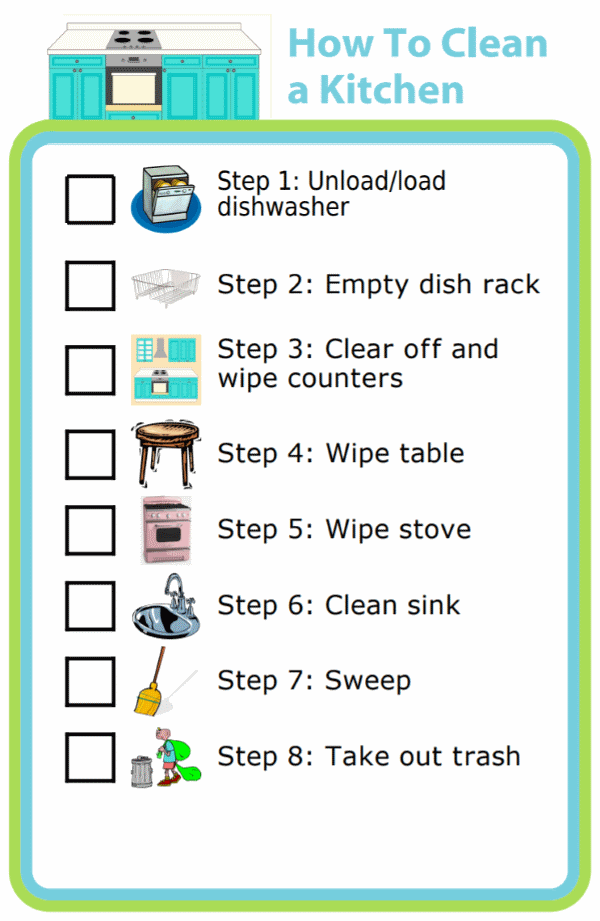

For example, you could assign each chore a particular figure. Taking out the garbage could be worth $1, and emptying the dishwasher could be worth $2.

Alternatively, consider the purpose of the allowance. For example, if you want your child to learn financial responsibility, what specifically do you want them to learn? How to spend or save wisely? If so, give them slightly less than they’d need to buy their favorite things so they have to practice saving.

But if you give them too much less, they may get discouraged. So figure out the right balance between teaching delayed gratification and the value of working for the things they want.

Regardless, getting clear on your motivations can help you decide on the right amount.

Where Does the Money Go?

A 2019 survey by the American Institute of CPAs found that the average American child makes around $1,500 per year from his or her allowance, or $125 per month.

However, only 3% of parents said their kids save any of their allowance. Instead, they spend most of the money on toys, digital devices and downloads, and while hanging out with their friends.

It isn’t enough to give kids their own money and expect them to learn responsibility. When left to their own devices, few kids will manage money well. We as parents must also teach them to manage it.

Teach Kids to Apportion Funds

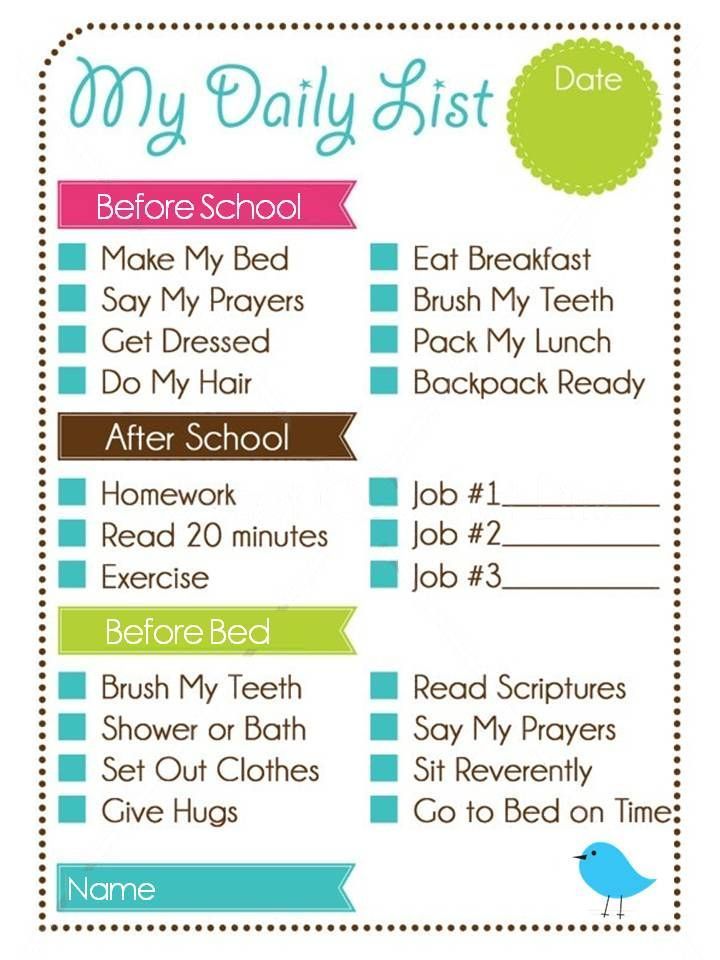

Just like we earmark a percentage of our paychecks toward savings and retirement, we should teach our kids not to blow all their money as soon as they get it.

It’s OK to spend a portion of each allotment immediately, but a portion should also go into savings. Teaching kids the importance of building a savings fund is extremely valuable.

Teaching kids the importance of building a savings fund is extremely valuable.

You may also want to encourage children to reserve a percentage of their earnings to donate to charity. Having them choose the charity makes them more likely to set aside the money.

A simple three-jar method can be an effective means of helping kids distribute their money and watch their savings grow. Get three large jars and label them “spending,” “saving,” and “charity.”

Older teens, especially those with part-time jobs, should also be encouraged to save some money for future expenses, such as college, a car, or a trip.

Allow Them to Spend

Part of teaching money management is allowing kids to spend their hard-earned money on something they truly want.

My son loves toys. And as long as he has the money to buy what he wants, it doesn’t matter if he spends the money he’s saved on a new Lego set or Batman action figure. Kids need to learn that work merits rewards.

Additionally, with age comes greater responsibility, and that includes being responsible for personal spending money.

Younger teens, especially those who might make money doing odd jobs like cutting grass, raking leaves, or babysitting, might be required to pay their own way at the movies or when they go out to eat with their friends. Older teens may have to pay for gas or contribute money toward the family cellphone plan as well as pay for some of their personal expenses.

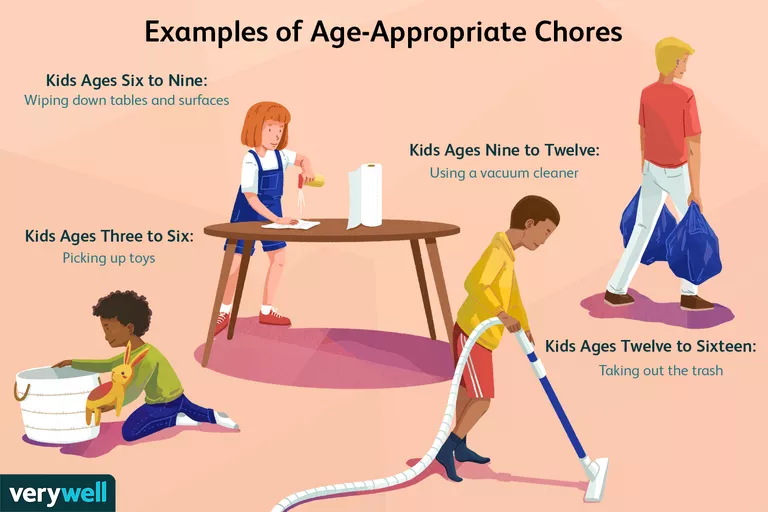

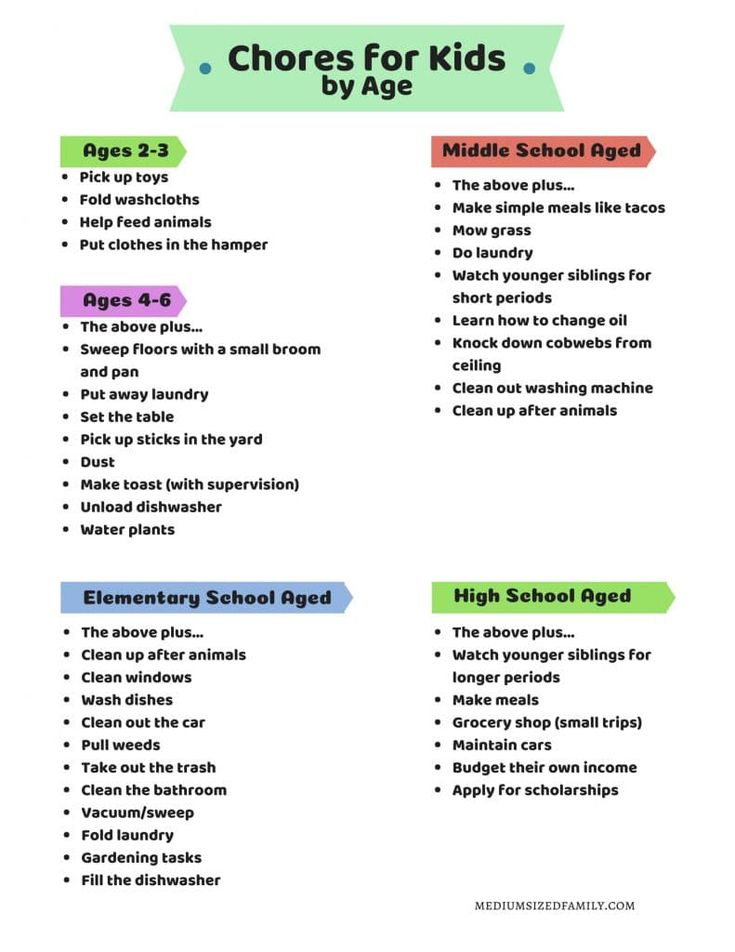

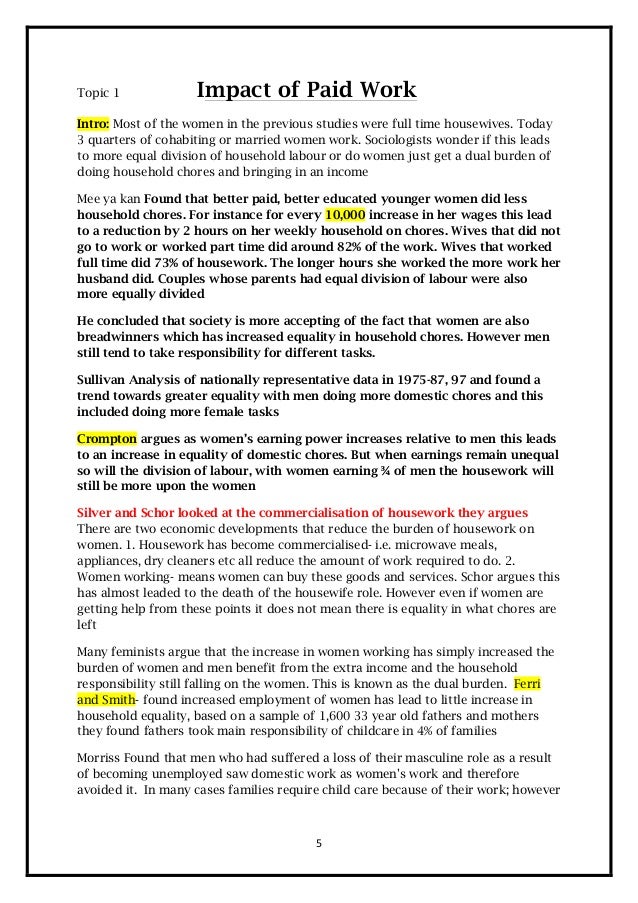

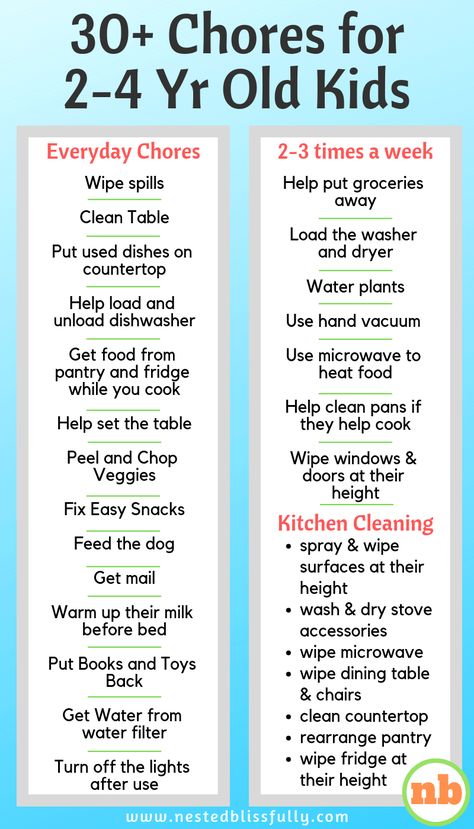

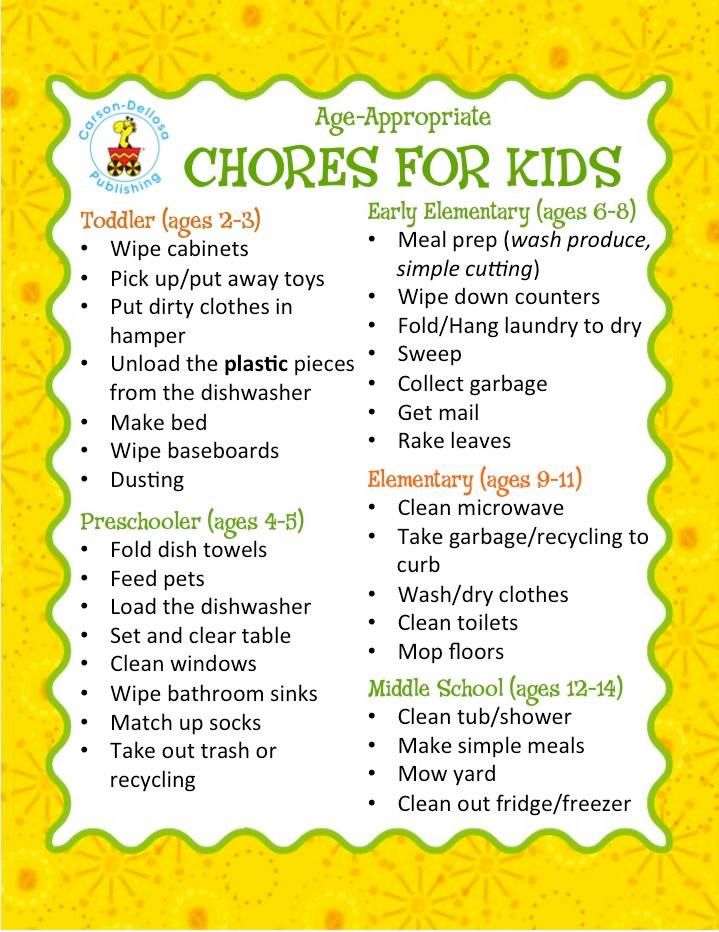

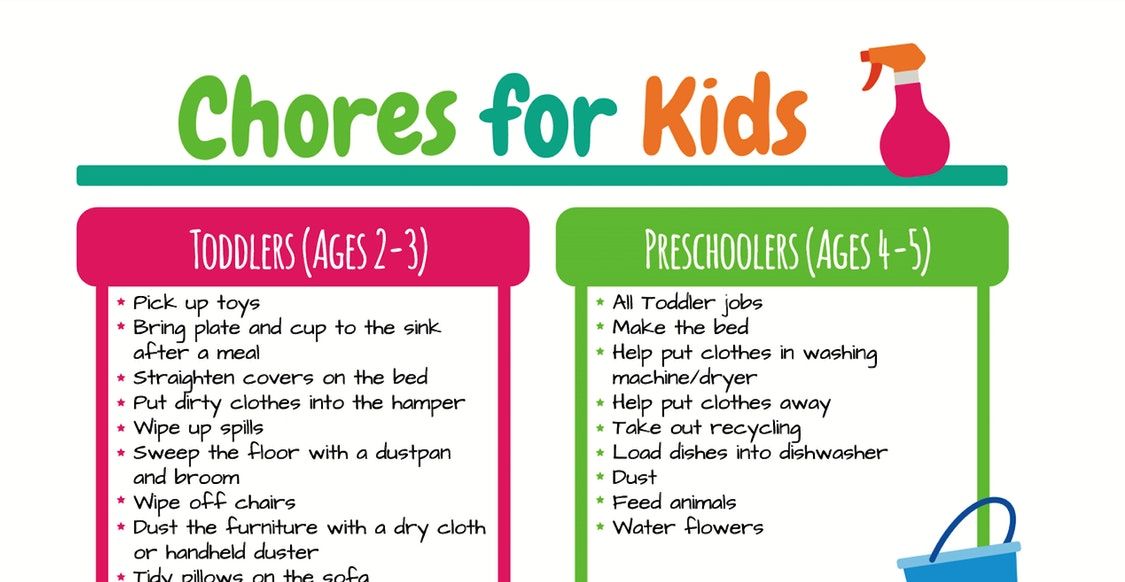

Different Chores for Different Ages

If you’d like to link your child’s allowance to chores, how early should you start? Kids as young as 3 may not fully grasp the concept of an allowance, but they can start learning family responsibility by performing a few easy tasks.

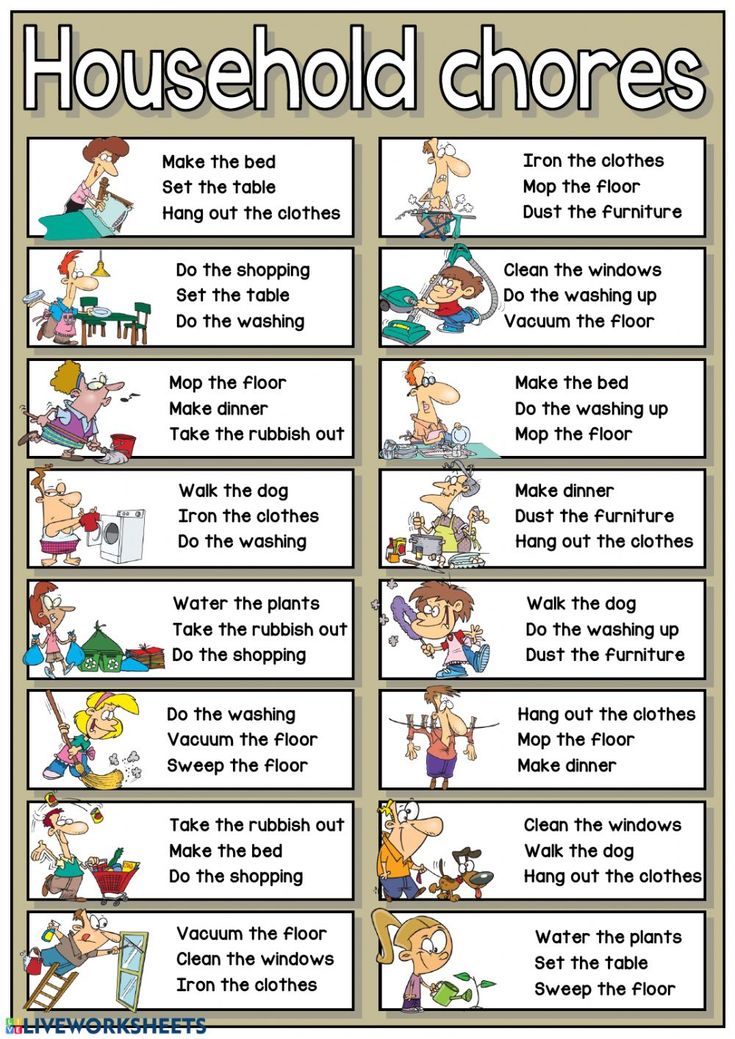

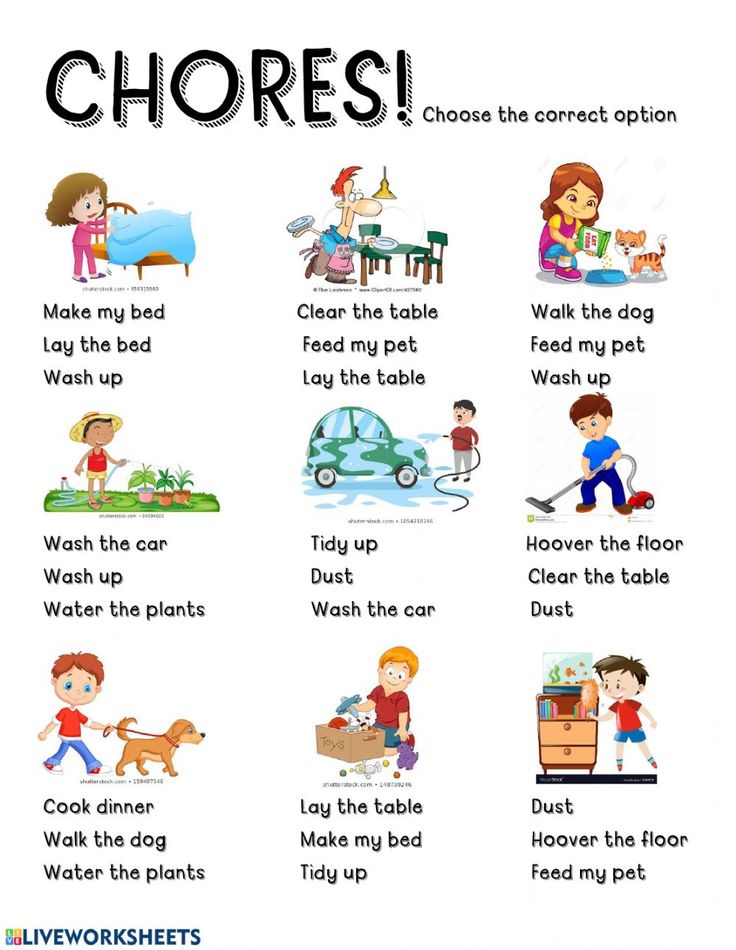

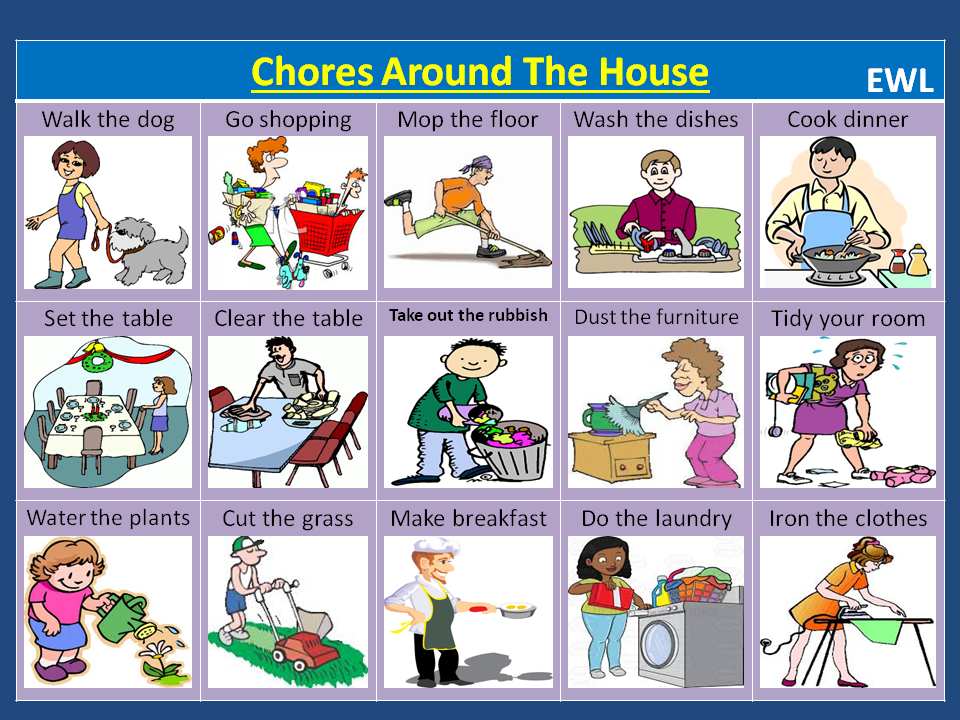

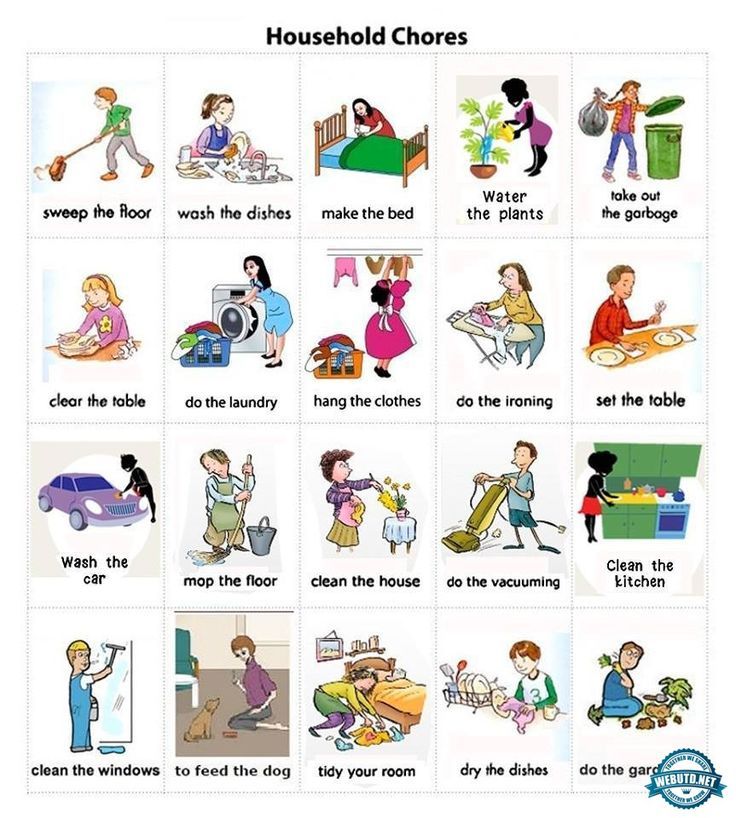

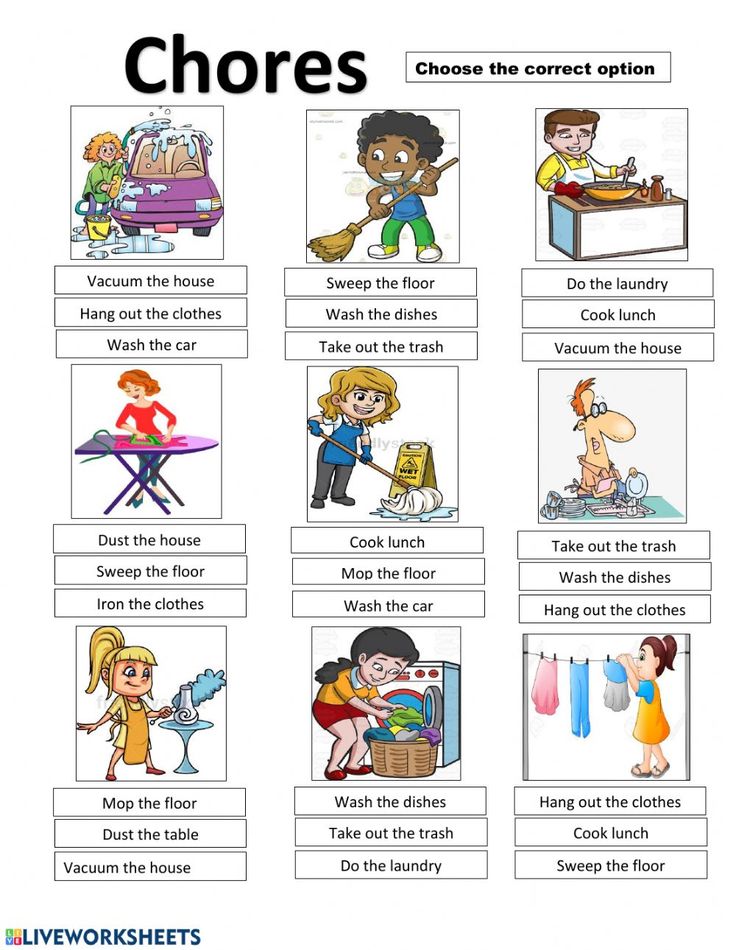

Some appropriate chores for kids of all ages include:

- 3 to 4: Young children can learn to fold washcloths, put napkins on the table, fill the pet’s food dish, put their toys away, and help sort laundry into different baskets.

- 5 to 7: By 5 to 7, they can handle slightly more complex tasks.

They can learn to fold laundry, do some light dusting, load or unload the dishwasher, help set the table, fill a pet’s water dishes, water outside flowers, and do some weeding in the garden.

They can learn to fold laundry, do some light dusting, load or unload the dishwasher, help set the table, fill a pet’s water dishes, water outside flowers, and do some weeding in the garden. - 8 to 10: Kids 8 to 10 years old can set and clear the table, vacuum, sweep, dust, take out the garbage, bring in the mail and newspaper, shovel snow, rake leaves, walk the dog, sweep out the garage, make their beds, and clean their rooms.

- 11 to 13: Older tweens and younger teens can learn to do laundry, wash the dishes, mow the lawn, trim hedges, help prepare meals, wash cars, clean bathrooms, and babysit younger siblings.

- 14 to 18: Older teens have the increasing capacity to earn money outside the home. Their reliance on an allowance diminishes, and they may have very little time to earn money for extra chores. They’re also likely to have less interest. You can decide when to discontinue the allowance for older kids.

While these are general guidelines, you are the best judge of your child’s maturity level. Don’t force kids to perform chores (such as lawn mowing) they aren’t capable of performing well or comfortable doing.

Don’t force kids to perform chores (such as lawn mowing) they aren’t capable of performing well or comfortable doing.

On the other hand, it doesn’t hurt to ask them for ideas. At 6, my son isn’t yet capable of chores like snow shoveling and lawn mowing. But he often surprises me with the things he can do, like pulling weeds and watering in the garden.

If kids are allowed to concentrate on chores they like or don’t mind doing, they’re more likely to be consistent with helping out. Of course, they must sometimes do chores they dislike, but I’ll often give my son a choice.

Knowing that he loves sweeping the floor but hates putting away laundry, I’ll let him choose one or the other. As long as work gets done and I have help around the house, I’m not too picky about which chores he does.

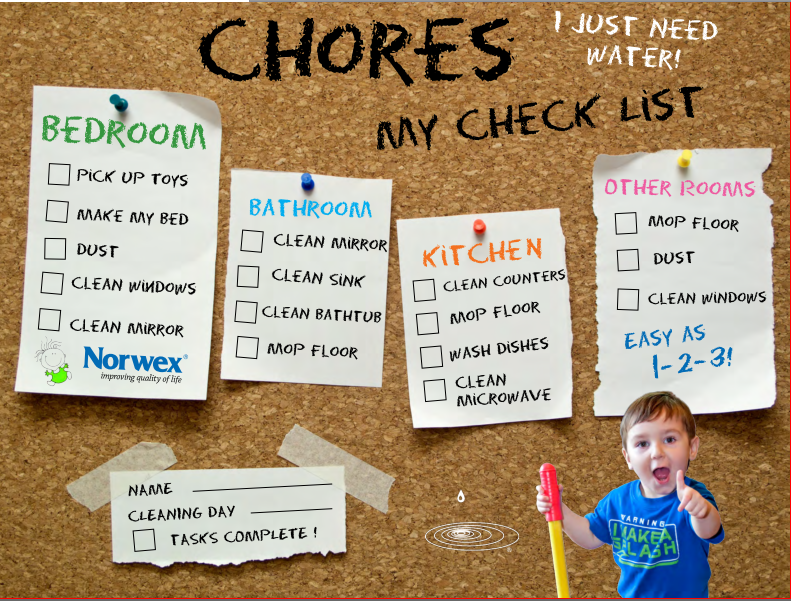

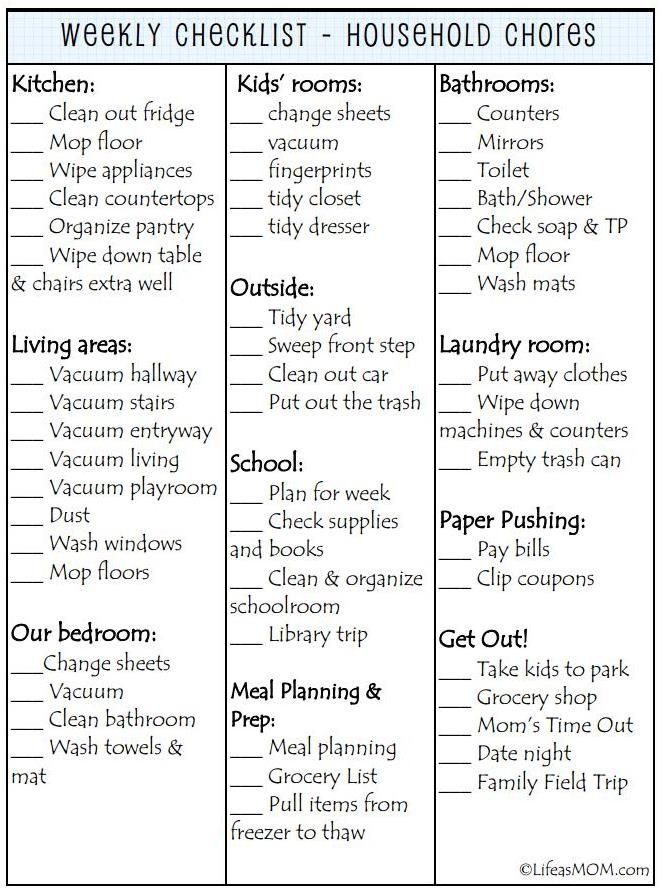

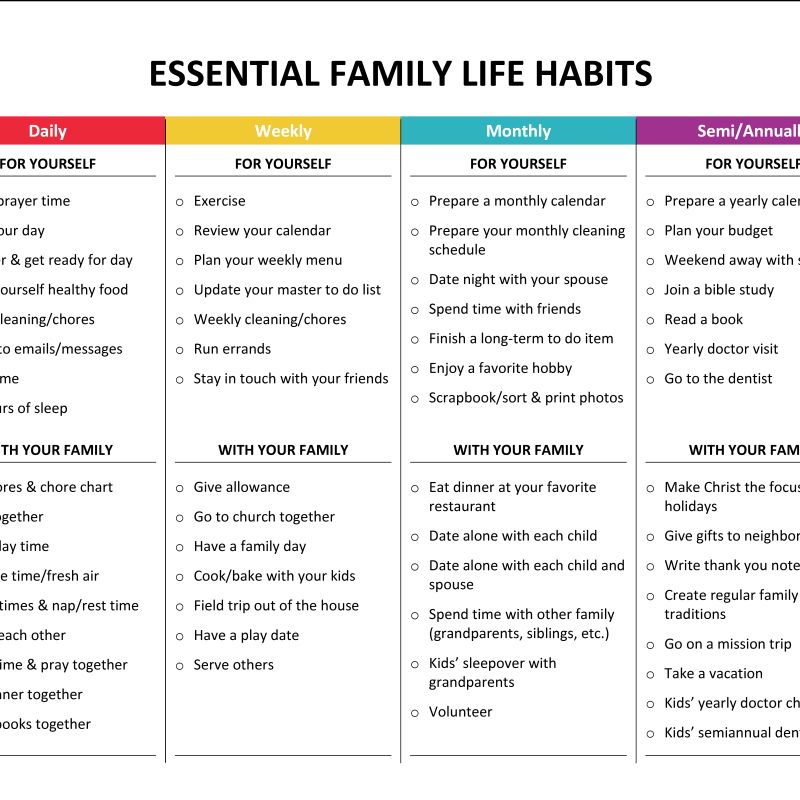

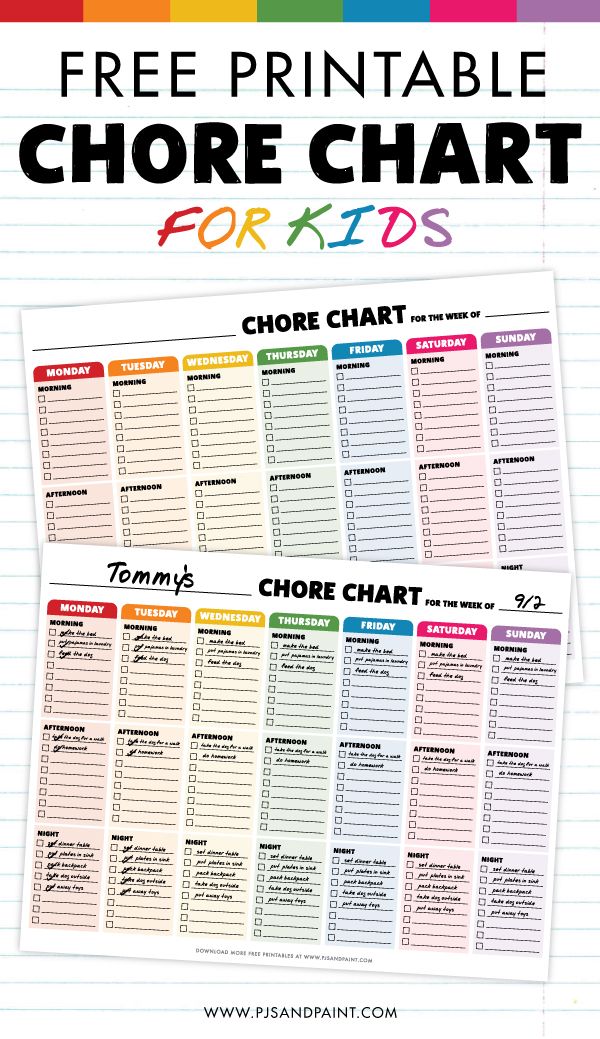

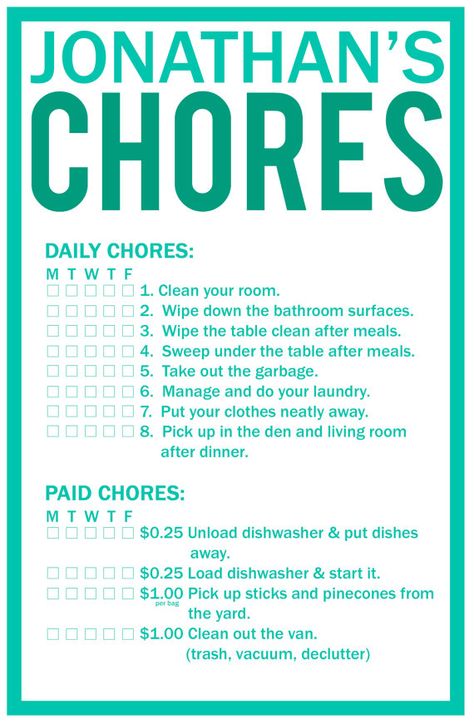

Allowance and Chore Tracking

If you’re going to use chores to keep track of what your kids earn, you might find it helpful to use a chore chart or house cleaning schedule. You can find many types of free charts on the Internet, such as those found on KidPointz.com.

You can find many types of free charts on the Internet, such as those found on KidPointz.com.

They’re especially handy if you must track chores for more than one child. You can also create your own chart.

A chart provides a good visual for kids of all ages. Young kids might like to put stickers on the chart once they’ve completed a chore, as it gives them a sense of pride and accomplishment.

Older kids can easily see which chores they have completed and which they haven’t and (if you pay per chore) how much money they can expect to receive for the week or month.

As a parent, a chart allows you to track what you owe, especially if your allowance system calls for subtracting from your child’s allowance for chores that went undone or adding payment for additional chores.

Whether you track chores or just allowance, there are also loads of money apps for kids. They let you track their allowance if you prefer to go the digital route.

Although kids typically learn best when they have something visual and tactile they can see and touch, like paper money, people rarely use real cash these days. So I keep track of my son’s weekly allowance using a smartphone app called Rooster Money.

So I keep track of my son’s weekly allowance using a smartphone app called Rooster Money.

It automatically adds his weekly amount every Friday. And whenever he buys something, I can deduct the amount from his total spending pot. It also allows him to sort money into separate buckets for saving, giving, and specific goals.

The premium version allows you to tie allowance to specific chores. You can assign tasks a dollar value. And whenever your child completes the task, you can mark it complete, which triggers the addition of money to their pot.

Rooster Money doesn’t tie to a bank account, so the money is hypothetical. But it does give kids a visual way to track their spending and saving. Bankaroo is another app that works similarly.

Other apps like Greenlight, BusyKid, and GoHenry tie to either a bank account or prepaid cards with real money. These may be more appropriate for older kids who need to access their cash when a parent isn’t around.

Other Ways to Teach Money Management

Giving an allowance isn’t the only way to teach your kids about money. And no rule says it can’t be fun.

And no rule says it can’t be fun.

You can also teach your kids money management skills by playing board games like Monopoly and The Game of Life. Kids can learn about money and investments, and it provides you with an opportunity to have financial discussions with them in a way that doesn’t turn them off or bore them to tears.

You can also use play to teach younger children about money. Set up a pretend store and show them how to pay for things and save for what they can’t afford.

Final Word

There are different schools of thought as to what type of allowance is appropriate. But regardless of the system you use to funnel money to your kids, the most critical component is frequent discussions about how they manage their money.

It’s so easy to get caught up in the bustle of our daily lives and forget the long-term consequences of our actions (or inaction).

As parents, our primary job is to prepare our children to successfully handle life as an adult by teaching them crucial skills, and money management is undoubtedly one of them.

Chores for Money Chart (& Chore Pay Scales to Choose from!)

1292 shares

Need chores for money charts? Not only do I have chores to help fill your kid's money chart out, but I offer chore pay scale examples.

So, you’ve decided that you want to pay your kids for chores.

Heck, you might even have purchased a money chart built for paying kids for chores – great going.

But…you’re wondering now how to fill everything in. I mean:

- what are good chores for money charts?

- what is a good chore pay scale?

We’re going to address all for this, with REAL and SPECIFIC examples of chore prices, chores vs. projects, and chore pay scales.

But first, there are a few decisions you’ve got to make, before picking chores for your money chart from the lists below.

Let me walk you through that.

Psst: Moving forward, I’m assuming that you’ve decided to pay your kids for chores.

BUT, if you need help with that decision – about whether or not pay for chores at all – then you can ready my article on should you pay for chores.

Article Content

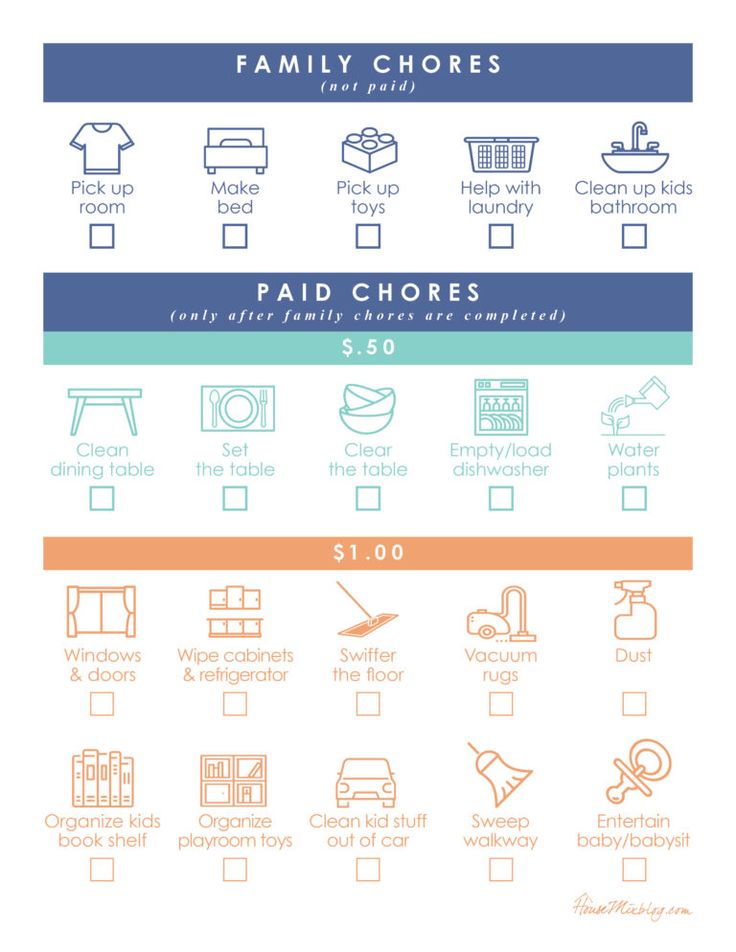

Decisions #1: Will you pay your kids for all chores, or just special ones?

You’ve decided to pay your kids for chores – great. But, which chores will you be paying for?

For example, you could:

- Pay for all chores.

- Pay only for chores that feel more like projects, and not pay for chores that are just expected of your child as a member of the household.

- Pay for kid-initiated chores, only.

- Pay only for special chores once they have completed the chores that are expected of them – so they can’t skip making their bed (a community/household/personal responsibility duty) and jump into an earning opportunity. They’d have to make their bed first, THEN they could choose a money-earning chore.

You’ll need to get clear on this before creating your chore system.

In our household, I’m never going to pay my child to make their bed. Or to pick up his toys from the den. Because to me, these types of chores are personal responsibilities that he just has to do because he’s part of the family.

BUT, I think there’s a real opportunity for what I liked to call “chore projects” that are definitely earning opportunities in my mind.

I’ll be giving you a list of chore project ideas, below. Also, here's 100 chores to do around the house (both paid, and unpaid).

Decision #2: How much will you pay for these chores?

I often get asked, “How much should you pay for chores?”

It’s a loaded question, to be honest.

There are several other questions you have to answer for yourself first.

Things like:

- How much buying power do I want my child to have at their age?

- How much can I afford to pay my kids each week?

You also need to take the “economy” into consideration – do you have a closed economy at home where they get to spend their money at your home store, or do you allow them to use their money in the real economy? If it’s at home, then you have a lot more control over how far their money will stretch. If your child can use their money in real places, then you have to sync up with prices in the real world.

If your child can use their money in real places, then you have to sync up with prices in the real world.

Or, do you only let them spend at the dollar store? Well, then $1 goes really far.

For example, you might want to teach your child to save up for something. If this is the case, then you need to think about how long you want them to have to wait to save their money in order to get it – which is contingent upon how much you’re paying them, and how much the things they want generally cost.

We’ll be going into three specific chore price systems below that you can choose from – so don’t worry if you feel overwhelmed at the moment.

Decision #3: Are paid chores expected, or kid-initiated (not mandatory)?

Do you see the chores on your chore money chart as expected, or are paid chores the type where your kid can take initiative to earn the money – meaning they can choose to do chores on that list, or not and their pay will reflect that choice?

This is purely a personal choice, as are many things with parenting. Remember, too, that if you choose to make a chore money chart where kids earn money, you can also make a rule that your kids can only do chores from that chart AFTER they complete some community or household duty chores that are not paid, but expected.

Remember, too, that if you choose to make a chore money chart where kids earn money, you can also make a rule that your kids can only do chores from that chart AFTER they complete some community or household duty chores that are not paid, but expected.

Whew…see what I mean about this being a loaded question? Lots involved here.

Lots of choices, but if you take the time to ask yourself these questions, then you’ll be able to set up your chore money chart and chore system much easier moving forward (and with intention, because it aligns with your family’s money values).

Psst: if you don't want to pay money, but still want to reward, then here are a bunch of free printable chore bucks you can use.

My Favorite Money Chore Charts

You also need a system that allows you to pay for chores, and can keep the whole thing organized so that you guys will actually stick with it.

I’ve reviewed several charts that are set up to allow you pay for chores, and I’m giving my favorites below.

Psst: looking for printable ones? Here are 12 free printable chore charts with money. And if you'd rather go with an app, here's the best paid chore and allowance apps, and the best free chore and allowance apps.

Lushleaf Design’s magnetic chore chart is one of my favorites. It’s great specifically if you want to use my idea below for the pay-for-chore pay scale system, as you can stick it on the fridge, and your kids can use both magnetic chore dots you write on, and/or a reusable/erasable marker it comes with to claim those paid chores.

Another favorite of mine – one that has the potential to grow with up to 3 of your kid – is the Neatlings Chore System. WOW is this one very customizable, but with guidance (yes, I’ve got a copy of my own!). You can use it whether you pay for certain chores, or not. Your kids can redeem completed chore cards (there are 54 of them, plus 3 decks of self-care cards) for rewards or money – your choice.

And if you want to go the semi-DIY route? A work-for-hire board could work for you. You just need a magnetic dry erase board, some magnetic clips, index cards to write the chores down on, and cash that you put with each chore. You clip the money and the chore that they need to do to earn it, one clip at a time. As your child completes the chore, they get the cash. Easy-peasy.

Psst: here’s my full article on the best chore charts for kids.

Next up? Let me help you pick out your chore pay scale.

Picking Out Your Chore Pay Scale

I’m going to give you several chore pay scales. The one that you choose will depend on your chore system, the way that you answered the questions above, and your gut feeling.

Because, let’s face it Mama – our guts usually don’t steer us wrong when it comes to parenting!

System #1: Pay-Per-Chore Pay Scale

With this system, you are going to create a tier of chores depending on their complexity and/or length of time that they take to complete. Then, you’ll create one price point for each of your tiers.

Then, you’ll create one price point for each of your tiers.

For example, you could have a Pay Per Chore Pay Scale with three tiers:

- Easy

- Medium

- Difficult

OR, you could divide them up by your expectation of how long they should take:

- 10-minute chores

- 20-minute chores

- 30-minute+ chores

Group chores together from the list I’ve provided (plus any of your own, specific to your own household and family’s needs), and take a few minutes to sort them into those three categories. Then, assign a chore price for each category.

You could pay the following, as an example:

- Easy: $2

- Medium: $4

- Difficult: $6

I’ve got three ways that you can organize this chore pay system.

- Basket System: Choose a color for each category, and then write down each chore on a sheet of paper with that color. Label three baskets with each of your categories, plus the amount they’re worth.

Your child can then choose freely or according with your rules (such as, you can choose 2 chores from the medium basket this week, and you need to complete two from the easy basket”). When payday comes around, they can be in charge of gathering their completed chore papers and bringing them to you.

Your child can then choose freely or according with your rules (such as, you can choose 2 chores from the medium basket this week, and you need to complete two from the easy basket”). When payday comes around, they can be in charge of gathering their completed chore papers and bringing them to you. - Magnetic Chore System: OR, you can use a magnetic chore chart, and create three categories of chore magnets on the fridge for your kids to choose from. Use these reusable, and completely blank magnetic strips to label each category. Then, use these reusable, and completely blank magnetic circles to write each chore on. If you want to assign certain paid chores? You can pluck those magnets off and put them in the row for the child you’d like to complete them. You can also create rules where they are only allowed to choose X number of paid chores per week.

- Dry Erase System: Stick a dry erase board on the fridge, and write down each week’s paid chore opportunities.

Your kids then get to write in which ones they want on their magnetic chore charts, and cross off from the list as they do (so that siblings know the jobs have been taken).

Your kids then get to write in which ones they want on their magnetic chore charts, and cross off from the list as they do (so that siblings know the jobs have been taken).

System #2: Unlock Allowance after All Chores are Complete

You may not want to pay per chore – maybe it sounds way too tedious for you. Instead, you could choose a set allowance amount that only gets unlocked when your child completes the weekly chores you’ve written down for them.

In this case, let’s say your child is expected to complete 4 chores this week, and their weekly allowance amount is $9. You would want to set up a chore chart with the chores they need to complete laid out, and have some sort of system where they cross off, or put the magnetic chore dots into a basket upon completion.

Come allowance day, they need to show you that those chores are completed before getting their $9.

You may or may not add an oversight system into things (which can be on a chore-by-chore completion basis as they do them throughout the week, or as part of your check-up before they get paid).

For this type of system, I love the Neatlings Chore System, or even their decks of chore oversight cards, because they offer a space for you to write in what you expect to see when that particular chore is “complete”.

System #3: Pay by the Chore Hour

Here's a radical idea: you could have your kid clock in and clock out each time they do chores, and then pay them an agreed-upon hourly rate. This method certainly drives home the lesson on whether or not things are worth buying with money they had to earn doing chores at $X.XX/hour.

Chore Rules You Can Use

Now that you’ve got a chore pay scale set up, let me share some chore rules you can build into your system. Remember – these are just suggestions. Use them, and/or make up your own!

Chore Rule #1: Chore Completion Consequences

You can choose to both add OR subtract it, depending on your chore system. In other words, if you want to charge your child for NOT completing a chore, that chore price is the amount you would charge.

Chore Rule #2: Paid Chores Upon Community Chore Completion

Have your child put an “x” through each community chore that they complete, and when they’re finished with each of those, they’re allowed to choose from the paid chore section.

Alright – we’ve finally come to the long list of chores and chore projects, with chore prices, for you to choose from.

Again, these are suggestions. They’re here to help you. Because if nothing else, you’ll get a gut feeling on a price or whether or not to pay for a certain chore, and that’s helpful too – you’ll know how to move forward.

Jobs to Do Around the House for Pocket Money

Now it’s time we get into the actual chores to do for money around the house, and example amounts you could pay for them.

Remember, though, that what you choose as your chore prices depends on lots of factors personal to you – the amount they are used to getting paid, the amount you can afford to pay, the places they’ll be using their money at, the prices of the things they want to buy, their age, etc.

Psst: for a list of age appropriate chores for kids that I created from 179 surveyed Moms, check out this article. Here's my review of the best allowance apps for kids.

Household Duties – Not Paid

- Walk the dog/pet care

- Make your bed

- Clear away your plate from dinner

- Unpack your lunchbox from school

- Put away toys at the end of the day

- Tidy your room

- Help carry in groceries

- Put away your laundry

Paid Chores (Pocket Money Chores List)

This category is all about regular, daily/weekly chores. Whether or not you see some of these as personal responsibilities/household duties rather than paid opportunities is completely up to you.

Also, remember that you can pick several chores that they need to complete each week in order to get their allowance, meaning you don’t need a per-chore price.

- Unload/load dishwasher: $3/week

- Weed the garden: $3/week

- Hang clothes to dry: $3/week

- Vacuum the house: $3/week

- Clip coupons: $3/week

- Take out trash and recycling: $3/week

- Gather household trash from different trash cans: $2/week

- Scrub your bathroom: $3-$5

- Mow the lawn: $5-$10/week

Chore Projects

Chore projects are what I like to call chores that are above-and-beyond the norm, and so they generally will earn more money than the regular paid chores from above.

- Cleaning the family car: $10-$15

- Reorganizing the family command center: $10-$15

- Wood pile clean-up: $10

- Organize the family hall closet: $10

- Clean the chicken house: $10

- Rake the yard: $5/week for maintenance, but $10-$15 for a big clean-up job

- Scrub baseboards: $5/room

- Clean inside windows: $15-$20 (depending on how many are in your home!)

- Scrub outside of kitchen cabinets: $5-$10

- Match all the socks: $5

- Organize all the DVDs/movies: $5

Psst: here are free printable chore cards to help with putting these chores into practice!

No matter how you move forward with your chore pay scale or reward system (here's 20 child reward system ideas), I would recommend that you include a special chore project every so often that is negotiable. Meaning, your child needs to negotiate a pay rate with you.

Meaning, your child needs to negotiate a pay rate with you.

Why is that?

Being able to confidently negotiate your payment is a directly transferable skill kids should be learning. It’s intimidating standing up to an adult and trying to negotiate a pay rate, and it can also be difficult to hear that your price is too high. Giving your child an opportunity to practice negotiating now, with you, will help them in the future.

The following two tabs change content below.

- Bio

- Latest Posts

Amanda L. Grossman is a writer and Certified Financial Education Instructor, a 2017 Plutus Foundation Grant Recipient, and founder of Money Prodigy. Her money work has been featured on Experian, GoBankingRates, PT Money, CA.gov, Rockstar Finance, the Houston Chronicle, and Colonial Life. Amanda is the founder and CEO of Frugal Confessions, LLC. Read more here.

Is it worth paying children for A's and help around the house

Understand

November 22

Is it worth paying children for A's and help around the house

Welcome to the world of capitalism, son

- Text:

- Irina Egorova

- Share:

Kato Trofimova / Tillanelli

On the one hand, the parent must teach the child how to handle money - to show that they are not taken out of thin air. On the other hand, is it necessary to pay for what children will do as adults, without any monetary reward - to keep order, engage in self-education, help parents. We learned from Ksenia Korsukova, a child psychologist, how to find the golden mean in rewarding with the ruble. nine0003

On the other hand, is it necessary to pay for what children will do as adults, without any monetary reward - to keep order, engage in self-education, help parents. We learned from Ksenia Korsukova, a child psychologist, how to find the golden mean in rewarding with the ruble. nine0003

Pros. When we motivate a child with money, he understands that good work can be rewarded. For example, if he diligently studies his lessons, the reward will not be long in coming. He solves this equation for himself like this: "labor = money". Then it will be easier for him to navigate in adult life, where people have to work in order to live.

Cons. When we pay for good grades, we destroy curiosity and the desire to learn. The child now goes to school not to learn something new and interesting, but to earn money. The same goes for the rest if he is paid to mop the floors, dust and walk the dog. The motivation to help parents because they are tired, or to try hard at school in order to get a profession in the future, is secondary. nine0003

nine0003

How it works in practice. Ksenia gives an example of a case where such an approach gave good results. Parents actively encouraged their son with money: they paid for help around the house and good behavior. He grew up responsible, studies for five and makes big plans for life. And his parents are very proud of him.

Most importantly, adults did not just give the boy money for being such a good fellow. First of all, they built trusting relationships in the family and spend a lot of time together. Plus, they encouraged their son in other ways - for example, they were allowed not to go to school when one of the relatives had a birthday. nine0003

💡 If you decide to motivate with money, check where your son or daughter spends their "salary" and direct them to the right path. Alas, there are examples when what is earned is spent on something that parents would not approve of. The most convenient way to control expenses on the card is to set a limit for withdrawing money and track which store he makes purchases in.

But here it is also important not to go too far: exactly how you will control the child's expenses, you need to discuss with him from the very beginning, so that later no one will be offended. Otherwise, the motivation to earn will also disappear. The child will have an attitude: I can’t manage my money myself, why did they give it to me at all. Therefore, control should not be total and intrusive. nine0003

Pros. We teach children that the main value in a family is close people, their interests and needs. Then a mercenary cynic will not grow out of a child, who is ready to tear his ass off his chair just for money.

Cons. The child may decide that the parents are pulling money out of their sleeves like magicians, and not earning it by their own labor. Some do not even know what their mothers and fathers do at work and what they get paid for. To prevent this from happening, let the children into your world, involve them in solving money issues - of course, within reasonable limits. nine0003

nine0003

An important point: with this approach, you can sometimes encourage the child with money. But only if he did something extraordinary - for example, he won a difficult olympiad or competition.

How it works in practice. Ksenia tells a case where parents paid their teenage son for housework. His whole life was reduced to monetary compensation for the slightest effort. And at every request of a parent, even for elementary help, he asked: "What will happen to me for this?" - meaning money. nine0003

The problem in the family has been brewing for a long time: parents disappeared at work and tried to make amends with money for not paying attention to their son. Children feel it and often begin to use it. It seems to them that the parental wallet is bottomless.

Now this family is correcting the situation. On the advice of a psychologist, a teenager periodically goes to work with his mom and dad - he sees how difficult it is to actually earn money. The son is involved in matters of the family budget - parents sometimes ask him for advice on what to do in this or that case related to finances. For example, when a major purchase is planned, the son studies this issue from the point of view of the law - he wants to become a lawyer. He was given a monthly amount of pocket money - and now it does not depend on behavior and grades. nine0003

The son is involved in matters of the family budget - parents sometimes ask him for advice on what to do in this or that case related to finances. For example, when a major purchase is planned, the son studies this issue from the point of view of the law - he wants to become a lawyer. He was given a monthly amount of pocket money - and now it does not depend on behavior and grades. nine0003

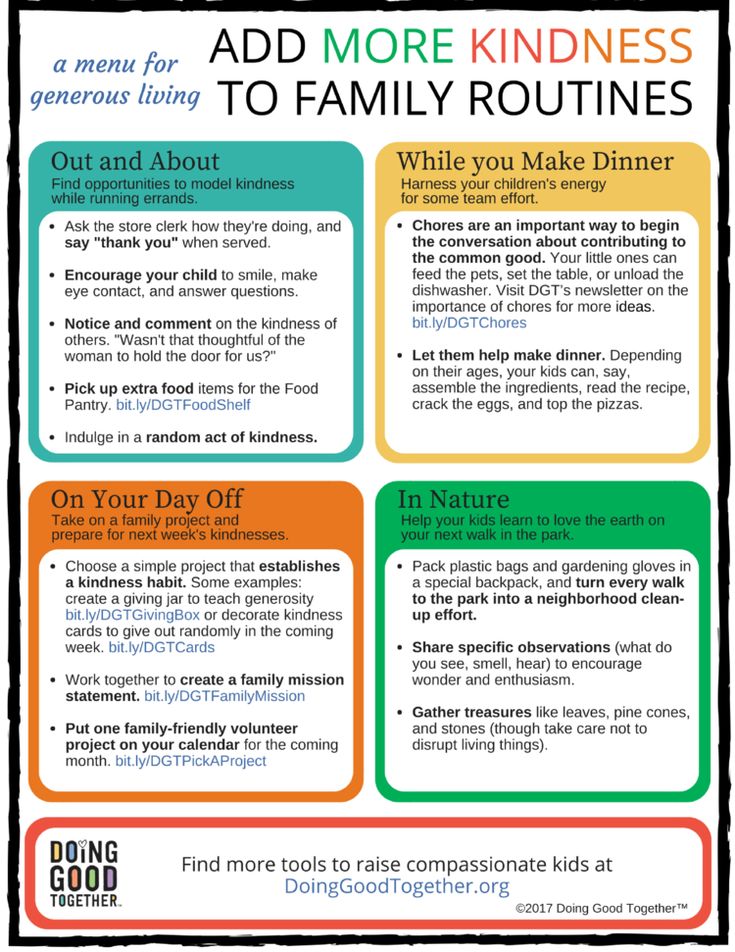

Build relationships on trust, and then you will be able to negotiate with the child without any money. Set up a democracy at home: gather for a family council and discuss who will be responsible for what. For example, a daughter cleans floors in the kitchen on weekends, and a son feeds a cat in the morning. Do not forget to assign responsibilities to yourself as well.

The best motivation for children is your praise, recognition of their achievements and joint activities. Especially now, when we are all either working or studying, and there is no time for ordinary human communication. Put gadgets aside and listen to your child: how was his day, what did he learn new, share your impressions with him. Then money will not interfere in your relationship. By the way, this also works with adults. nine0003

Put gadgets aside and listen to your child: how was his day, what did he learn new, share your impressions with him. Then money will not interfere in your relationship. By the way, this also works with adults. nine0003

It is possible to form the value of money and not go to extremes. There are several ways to do this:

- tell your children more often about the family budget: what and how much you spend;

- discuss large purchases with them;

- if a child wants, for example, a computer and a phone as a gift, ask him to choose one thing - this way you will teach him to compromise and negotiate expenses;

- let him try to earn money himself - for example, during the summer holidays he will work as a courier. nine0072

If you still decide to encourage your child with money, start doing it closer to the middle classes. At this age, children gradually lose interest in learning. But younger students are better motivated by something else: for example, joint entertainment. Even the simple prospect of watching a cartoon with mom and dad will give the right impetus.

At this age, children gradually lose interest in learning. But younger students are better motivated by something else: for example, joint entertainment. Even the simple prospect of watching a cartoon with mom and dad will give the right impetus.

Don't motivate with pocket money. Do not confuse cash incentives and out of pocket expenses - they are different things. Pocket money is issued every month for the personal expenses of the child. And, unlike paying for grades, a child may well receive pocket money already in the lower grades. nine0003

Decide on a budget in advance. Decide exactly how much to give based on the family income and the age of the student. But first, find out how much his world is "worth": a trip to the cinema, a cup of coffee, a snack in the canteen. The monthly amount is negotiated at the family council once and then does not change due to grades or behavior. That is, it is not necessary to punish with deprivation or reduction of pocket expenses. This will lead to a loss of trust - in adolescence, it is especially important to maintain contact between parents and children. nine0003

That is, it is not necessary to punish with deprivation or reduction of pocket expenses. This will lead to a loss of trust - in adolescence, it is especially important to maintain contact between parents and children. nine0003

Set the day in on which the child will receive money. To do this, it is better to determine a specific day of the month so that the child learns to plan his budget and not go beyond it. If you give the announced amount just like that, he will get the impression that your wallet is bottomless. So, you can ask at least every day.

💫 There are no universal approaches to education - each parent decides for himself. He knows his children better than others and can guess what will happen if you encourage or not encourage the child with money. nine0003

- Text:

- Irina Egorova

- Share:

Is it possible to pay a child for a good study and cleaning the room

Motivating your child for daily work, whether it is study or routine household chores, is not an easy task. Some parents decide to pay their children for good deeds. But is it right? If so, what amounts are involved and how should payment be made? For answers, we turned to a financial blogger, a mother of three children, and a girl who already has five mortgages, Ksenia Paderina. nine0003

Some parents decide to pay their children for good deeds. But is it right? If so, what amounts are involved and how should payment be made? For answers, we turned to a financial blogger, a mother of three children, and a girl who already has five mortgages, Ksenia Paderina. nine0003

Website editor

Tags:

Motherhood

Parenting

Parents and children

How to plan finances

Getty Images

Ksenia Paderina

journalist and financial blogger

Paying for grades

“Should children pay for school grades and cleaning the room?” - It would seem such a simple, but rather controversial question. So how is "correct"? nine0003

Most psychologists and educators agree that paying for grades is not worth it. Why? Going to school is the responsibility of the child. If motivation in this matter is bad, then many parents try to “buy” it.

Why? Going to school is the responsibility of the child. If motivation in this matter is bad, then many parents try to “buy” it.

But the problem is that it only helps temporarily. At first, there can be a cool effect - the child will be delighted, join this game. He will start doing homework without reminders and persuasion, get good grades. Parents will rejoice: the system works!

But one day the child will face really serious problems in studies - he will not understand a difficult topic, he will quarrel with the teacher. Or just get tired of this "race". And monetary motivation will stop working. The child in this situation argues like this: “So what if there will be no money. But now no one will force you to study.” nine0003

By and large, children do not need money the way adults do. It is we, the parents, who have to pay for housing, groceries, pay for the mortgage, if any. Children do not have such mandatory expenses, and rightly so. That is why they can easily refuse "earnings". No money - no big deal.

That is why they can easily refuse "earnings". No money - no big deal.

There is another important nuance: as soon as you start paying for grades, you make it clear to the child that this is the most important thing. He starts to work hard for them. Grades are prioritised. And this can give rise to an unhealthy attitude towards them. To get the coveted five, children go to any lengths - lie, get out, persuade teachers. nine0003

But in fact, children should go to school for knowledge, not for grades, so it is important to focus on this.

If you really want to financially reward your child, you can come up with something like a scholarship based on the results of a quarter or half a year, a year. Now that's a good story! Thus, the child will have time to maneuver. Received a bad grade - will have time to correct.

Household help fee

Household help is another topic to think about.