How to get the most child tax credit

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Our opinions are our own. Here is a list of our partners and here's how we make money.

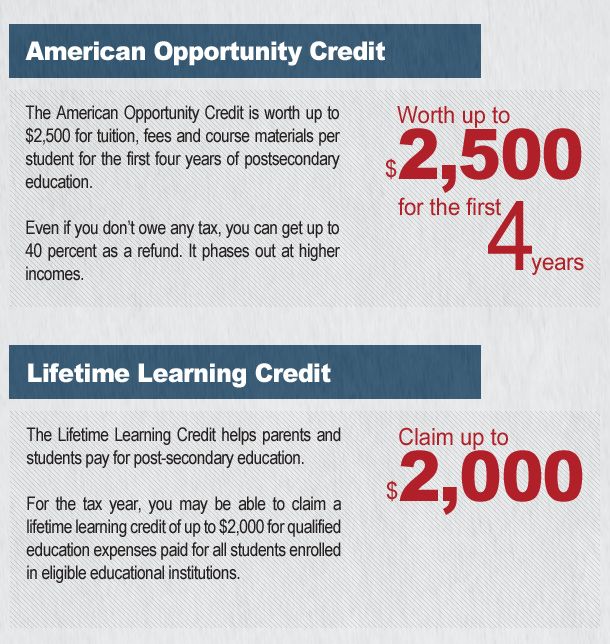

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents. " Check the IRS website for more information.

" Check the IRS website for more information.

How to calculate the child tax credit

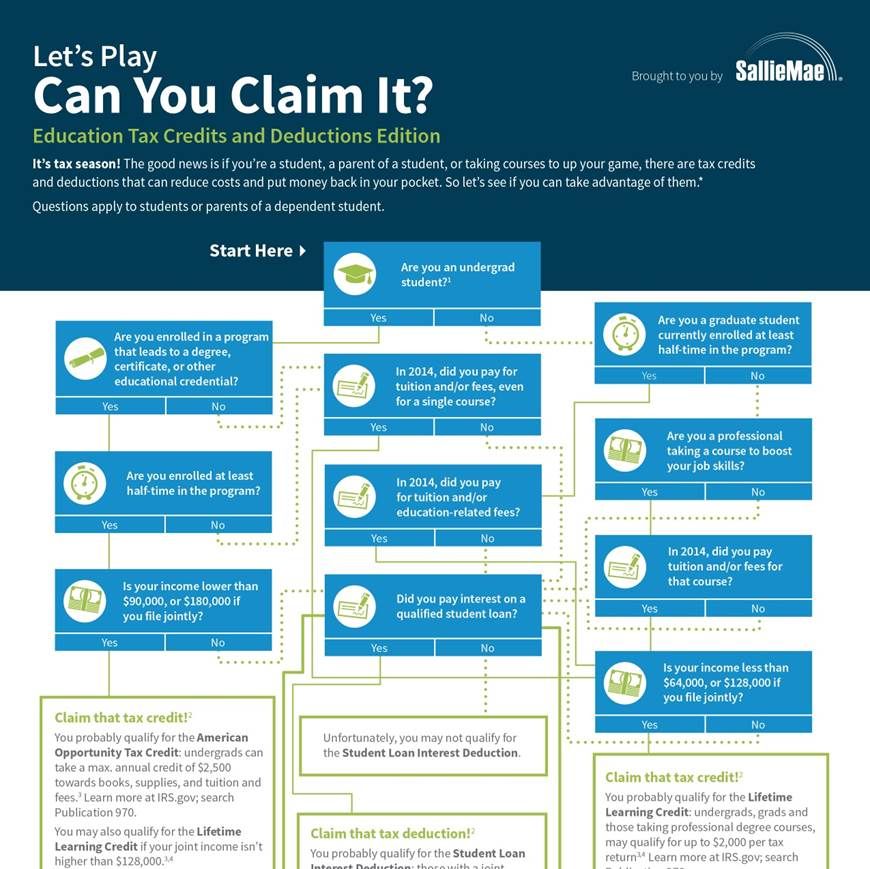

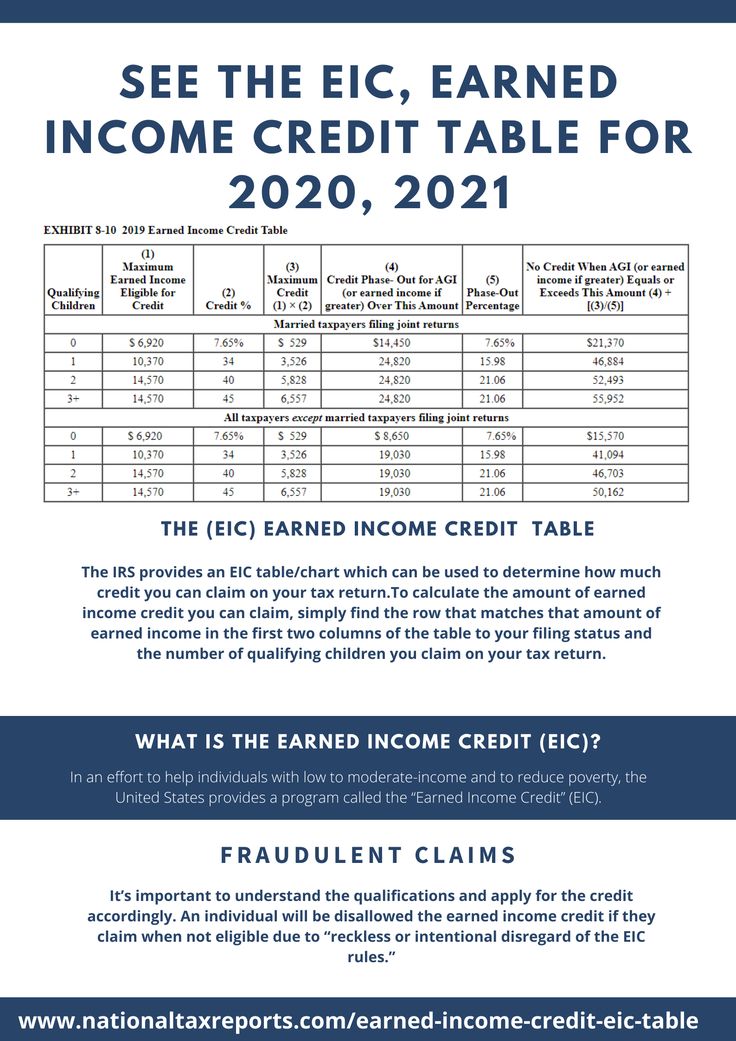

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

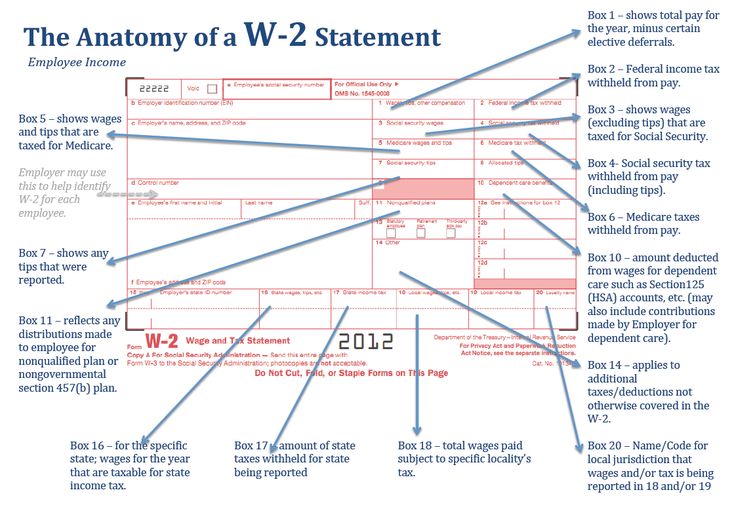

How to claim the credit

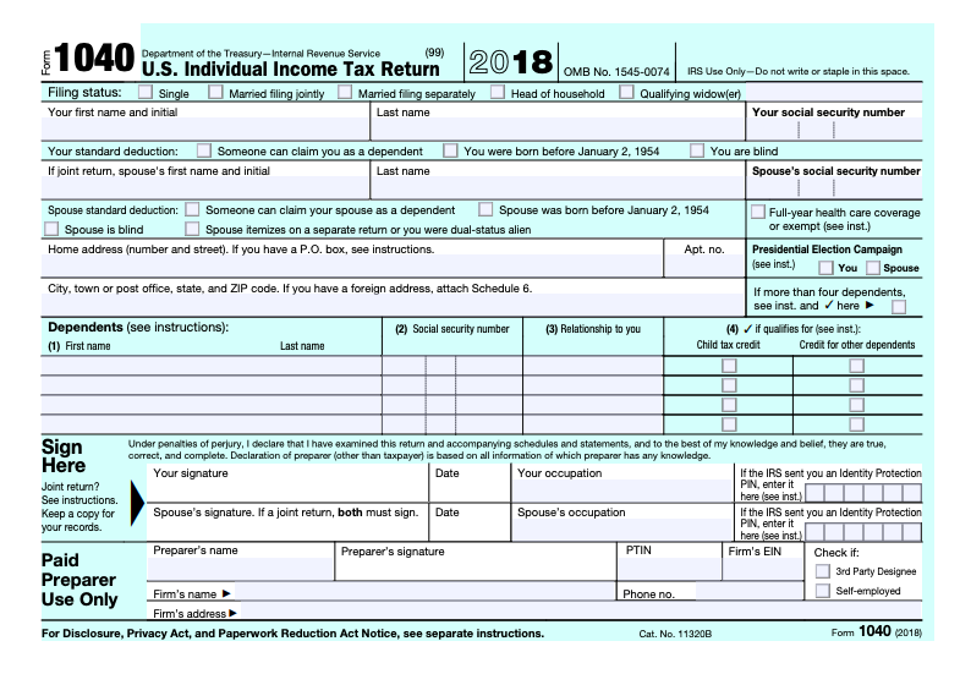

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

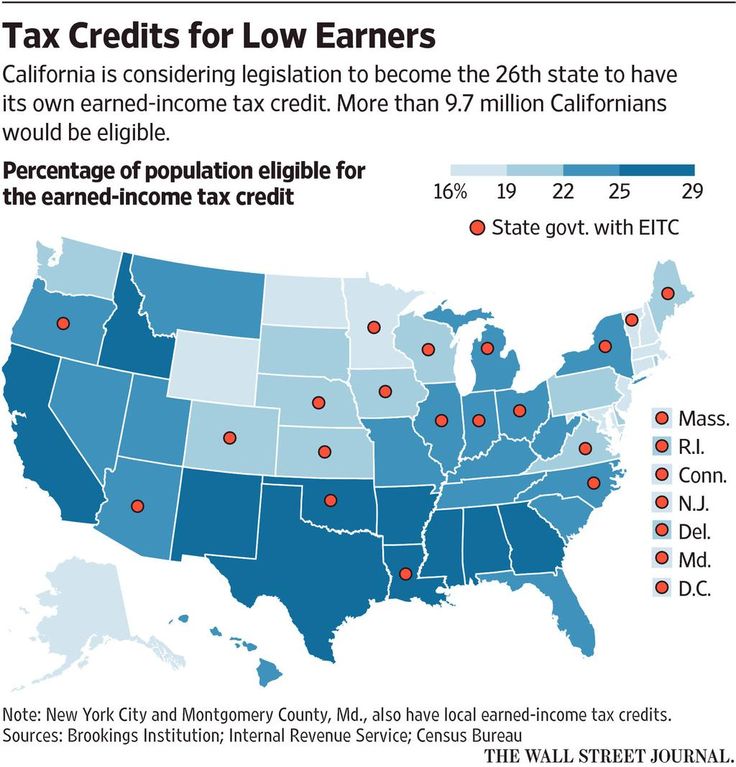

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

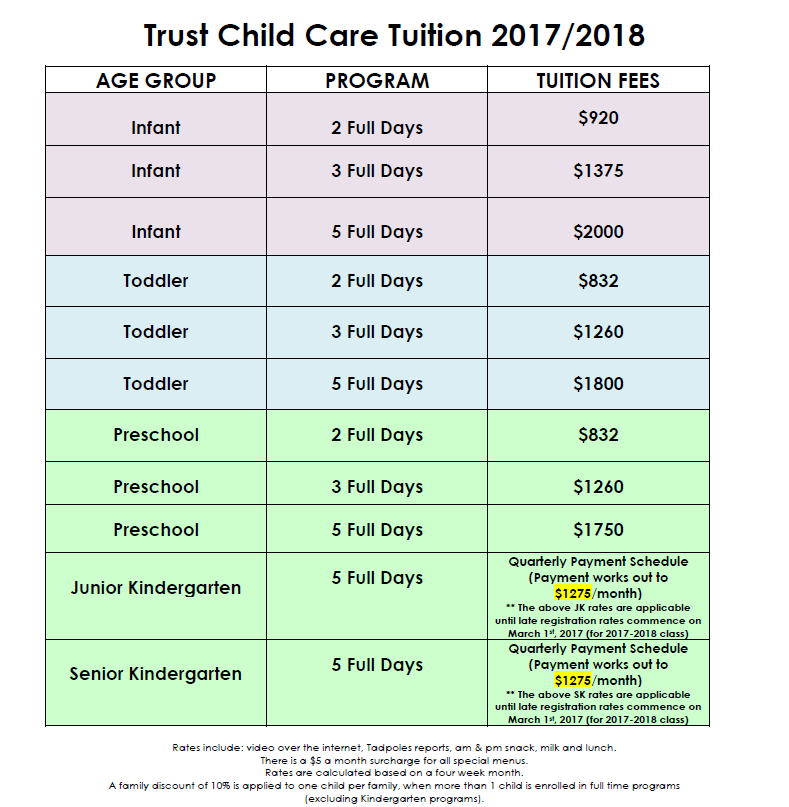

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll also need to make sure your child has a Social Security number by the due date of your 2022 return (including extensions).

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

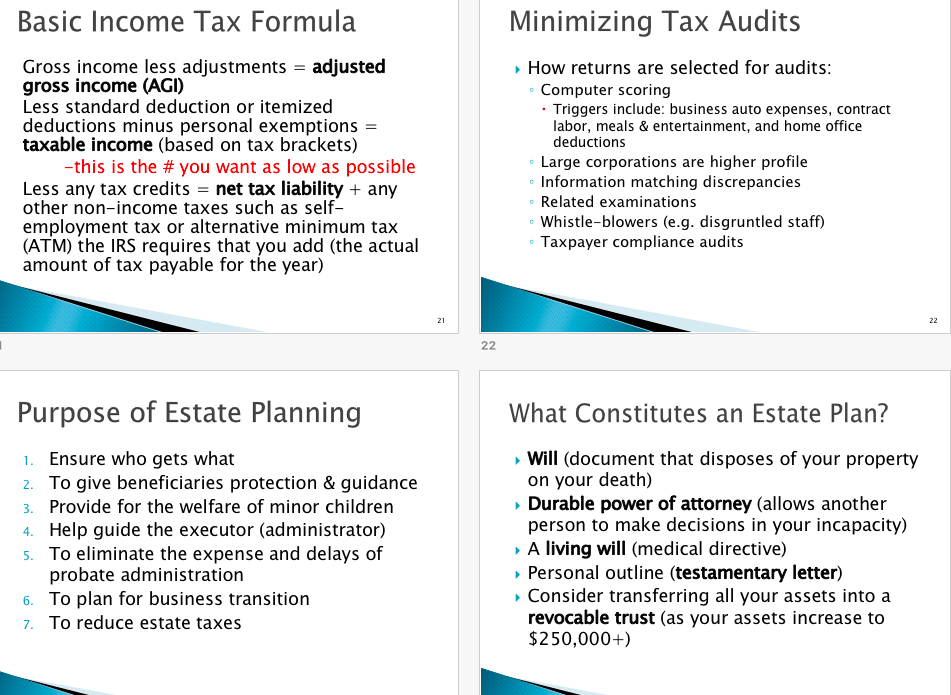

Tax Credits vs.

Tax Deductions

Tax DeductionsYou’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Tax deductions reduce your taxable income, but tax credits reduce your bill dollar for dollar.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

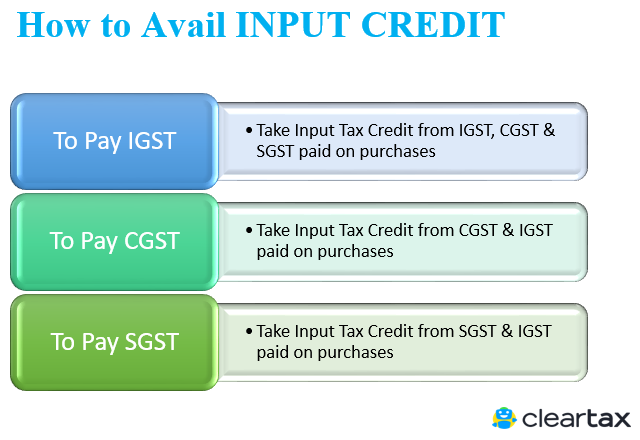

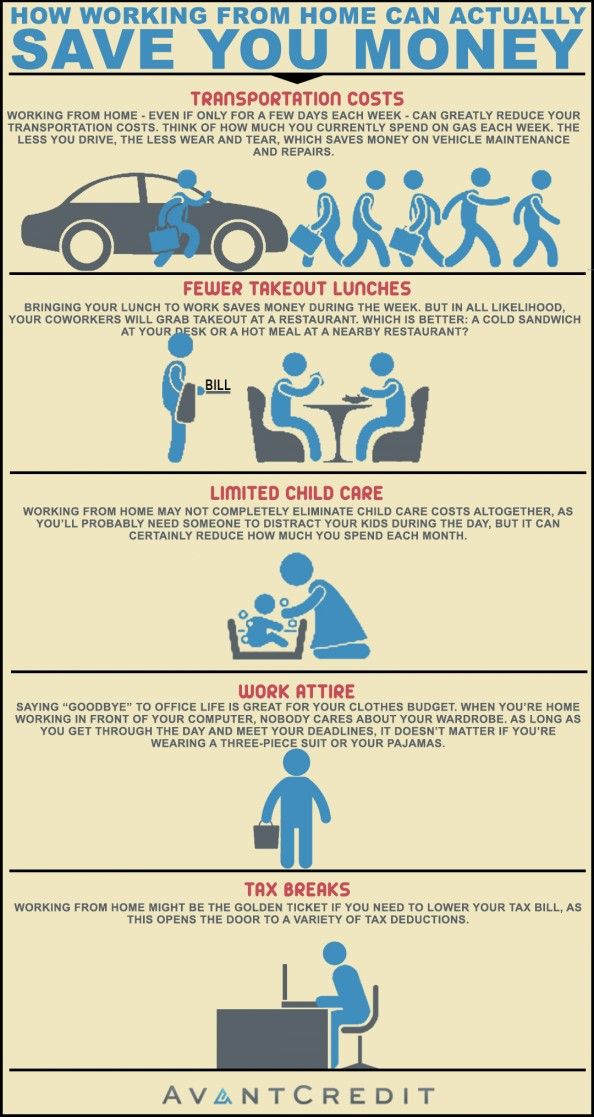

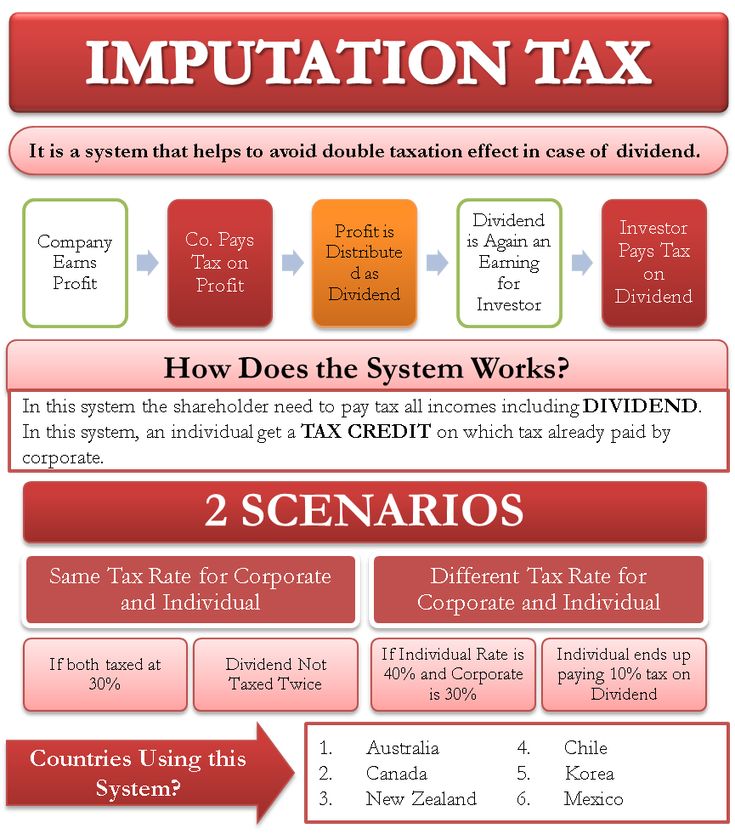

Tax credits and tax deductions may be the most satisfying part of preparing your tax return. Both reduce your tax bill, but in very different ways.

Tax credits directly reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. A tax credit valued at $1,000, for instance, lowers your tax bill by the corresponding $1,000.

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Would you rather have: | ||

A $10,000 tax deduction… | …or a $10,000 tax credit? | |

Your AGI | $100,000 | $100,000 |

Less: tax deduction | ($10,000) | |

Taxable income | $90,000 | $100,000 |

Tax rate* | ||

Calculated tax | $22,500 | $25,000 |

Less: tax credit | ($10,000) | |

Your tax bill | $22,500 | $15,000 |

The catch to tax credits

Some tax credits are nonrefundable.

That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.

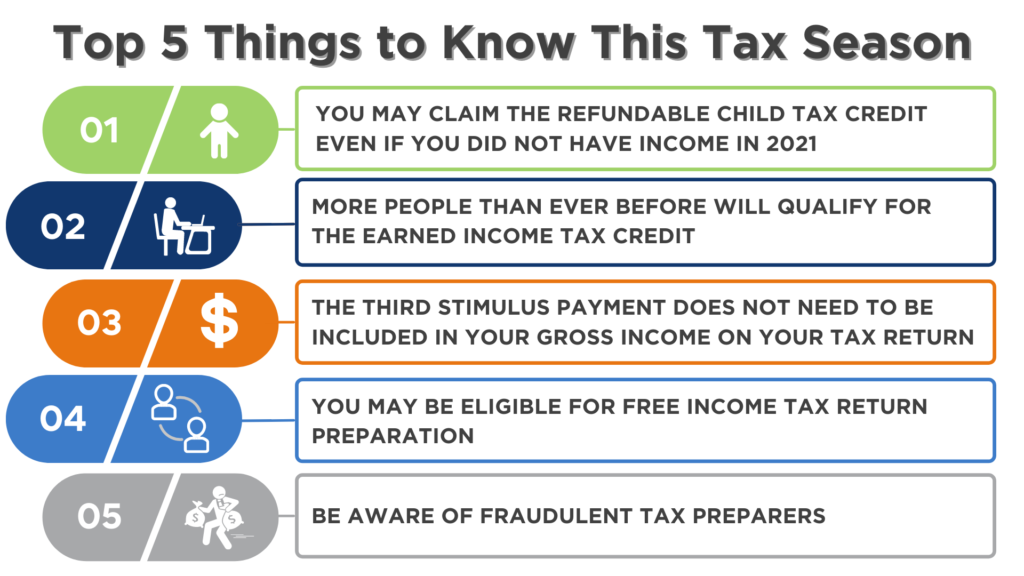

That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.Some tax credits are refundable. If you qualify to take refundable tax credits — things such as the earned income tax credit or the child tax credit — the value of the credit goes beyond your tax liability and can result in a refund check.

The IRS lays out specific criteria you must meet to qualify for both nonrefundable and refundable credits.

A big decision about tax deductions

There are two types of tax-deduction strategies: taking the standard deduction or itemizing.

The standard deduction

The standard deduction is a one-size-fits-all reduction in the amount of your income that’s subject to tax.

You don’t have to do anything to qualify for the standard deduction or provide any documentation.

You don’t have to do anything to qualify for the standard deduction or provide any documentation.You can claim the standard deduction on Form 1040. The amount varies depending on your filing status.

Filing status | 2021 tax year | 2022 tax year |

|---|---|---|

Single | $12,550 | $12,950 |

Married, filing jointly | $25,100 | $25,900 |

Married, filing separately | $12,550 | $12,950 |

Head of household | $18,800 | $19,400 |

Itemizing

Itemizing allows you to take advantage of deductions such as home mortgage interest, medical expenses or charitable donations. If together your itemized deductions exceed the value of the standard deduction, you'll want to itemize so you pay less tax.

You'll need to use the regular Form 1040 and Schedule A.

You'll need to use the regular Form 1040 and Schedule A.Just as with tax credits, taking certain deductions requires meeting certain qualifications based on your filing status, current life events and the amount of your income that’s taxable. Be sure you meet IRS criteria to qualify for both tax credits and deductions.

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

How Kazakhstanis can pay less taxes

Tax deduction (HB) is the amount by which the the amount of income subject to tax. Personal Income Tax (PIT) in Kazakhstan is 10%. An individual can apply tax deductions under paragraph 1, Art. 342 Tax of the Code of the Republic of Kazakhstan (NC RK) in the form of mandatory pension contributions (OPV), contributions to mandatory social health insurance (VOSMI), pension payments and accumulative insurance contracts (Article 345 of the Tax Code of the Republic of Kazakhstan), standard tax deductions (Article 346 of the Tax Code of the Republic of Kazakhstan) and other tax deductions. The latter include tax deductions. for medicine, remuneration and voluntary pension contributions (VPC). Business information center correspondent Kapital.kz has prepared an overview of other tax deductions under the Tax Code of the Republic of Kazakhstan.

The latter include tax deductions. for medicine, remuneration and voluntary pension contributions (VPC). Business information center correspondent Kapital.kz has prepared an overview of other tax deductions under the Tax Code of the Republic of Kazakhstan.

All NV, except for tax deductions in the form of OPV, VSHI and pension payments are made on the basis of application of an individual for the application of tax deductions in accordance with approved form , as well as copies of supporting documents. Originals such documents must be kept by an individual during the period of the claim prescription - 3 years (clause 2, art. 48 of the Tax Code of the Republic of Kazakhstan).

Guldana Mustafina, Senior Consultant of the Tax Department of KPMG Caucasus and Central Asia (Ed.) notes that if necessary, an employee has the right to request a recalculation of the PIT by applying to his employer and submitting supporting documents within the limitation period. nine0015

nine0015

Note that an individual resident of the Republic of Kazakhstan can apply tax deductions for expenses related to the payment of WPV, for medical expenses and for remunerations made only in their favor .

Medical tax deduction

This deduction does not apply for cosmetic expenses services. The amount of the tax deduction for medicine should not exceed 94 times the amount of monthly settlement indicator (MCI), defined for calendar year . In 2023, the maximum amount of this deduction is 324,300 tenge (with an MCI of 3450 tenge). This amount also takes into account the costs of the employer to pay insurance premiums in favor of an employee under voluntary insurance contracts in case diseases, if any.

Confirming documents for applying the tax deduction for medicine:

- contract for the provision of paid medical services with the allocation the cost of medical services, if it was concluded in writing; nine0015

- an extract containing information on the cost of medical services;

- a document that confirms the fact of payment for medical services.

This deduction applies in the tax period in which the latest of the two dates: date received medical services or their date of payment .

On payment medical services provided outside the Republic of Kazakhstan in foreign currency, recalculation of expenses in tenge is made at the official rate of the National Bank of the Republic of Kazakhstan to foreign currencies on the date of payment. nine0015

Senior Payroll Consultant PwC Kazakhstan Assel Auyezhanova reports that in the event of 90,003 births or deaths of loved ones, company employees relatives of may ask for financial assistance from the employer, and these income will also be exempt from taxes within the limits of 94 MCI in year .

Tax remuneration deduction

Tax deduction for remuneration is applied to expenses for payment of remuneration at mortgage housing loans (IZHZ) , received from the Housing Construction Savings Banks (HCSB) for holding measures to improve housing conditions in Kazakhstan.

Confirming documents for applying this tax deduction:

- contract mortgage housing loan with HCSB in accordance with the legislation of the Republic of Kazakhstan on housing construction savings;

- schedule repayment of a mortgage housing loan with the allocation of the amount of remuneration;

- document, confirming the repayment of interest on such a loan. nine0015

This deduction applies in the tax period in which the latest of the two dates: date redemption remuneration according to the IHL repayment schedule or remuneration payment date .

Tax deduction on voluntary pension contributions

In addition to mandatory pension contributions to the Unified accumulative pension fund (UAPF), there are also voluntary pension contributions in their favor or in favor of third parties. Citizens can independently set the amount and frequency of payments to the DPV or change them at your discretion. nine0015

See also

Economy

What makes up the pension of Kazakhstanis

Understanding the nuances of the pension system

To apply the tax deduction for the DPV, you must submit a document that which confirms the payment of voluntary pension contributions. However, this deduction does not apply to the unclaimed amount of the guarantee reimbursement , which is taken into account on the individual pension account for WPV accounting.

Recall that the tax deduction for voluntary pension contributions may be applied by an individual resident of the Republic of Kazakhstan for the costs of paying DPV, produced only in their favor . This also applies to tax deductions for medicine and benefits.

Guldana Mustafina, Senior Consultant of the Tax Department of KPMG Caucasus and Central Asia (Caucasus and Central Asia - Ed.), notes that in general, tax deductions are a great opportunity to reduce the liability for PIT. nine0015

nine0015

“It's not just about PIT, which is retained by the employer when calculating wages. it also applies to the IIT, which an individual calculates independently in relation to their personal income. Thus, persons who are not in an employment relationship but have a personal income, may also apply deductions - standard and other - in the IIT declaration. This is tax reporting form 240.00,” – speaker reports.

When working with the materials of the Business Information Center Kapital.kz it is allowed use of only 30% of the text with a mandatory hyperlink to the source. When using the full material requires editorial permission. nine0015

-

Taxation of mining will be introduced in Kazakhstan

-

The President signed amendments to the Tax Code

-

Taxes and customs fees for 107 billion tenge were additionally charged to 10 companies nine0015

Tax on deposits 2023 for individuals

Payment and cancellation of tax until 2023

Related article: Life insurance deposits: pros and cons More

Tax on interest on deposits (deposits, accounts) was introduced in 2020 (during the coronavirus pandemic and self-isolation). But the Russians did not have to pay it, because it was temporarily canceled (for 2021-2022). For this reason, investors who earned on interest in 2021-2022 do not have to pay personal income tax. Moreover, regardless of the amount of income received (be it 200 thousand, 300 thousand or any other amount). nine0015

But the Russians did not have to pay it, because it was temporarily canceled (for 2021-2022). For this reason, investors who earned on interest in 2021-2022 do not have to pay personal income tax. Moreover, regardless of the amount of income received (be it 200 thousand, 300 thousand or any other amount). nine0015

If personal income tax on deposits had not been abolished, the tax would have to be paid for the first time for 2022 (that is, from income received in 2021). Then the following rules were applied:

- The amount of interest income was taken into account, not the deposit.

- All depositors who earned more than 42,500 rubles on interest were subject to payment. (this limit is calculated taking into account the Central Bank rate as of 01/01/2021).

- It was assumed that 13% of the difference had to be paid.

So, for example, if a depositor received 45 thousand rubles in 2021, then he would have to pay 325 rubles to the budget. ((45,000 - 42,500) × 13%). That is, the non-taxable part of the income was calculated as 1 million rubles. × the key rate of the Central Bank as of 01.01 of the year in which interest was received from the deposit. As of January 1, 2021, the Central Bank rate = 4.25%, so the non-taxable part was 42,500 rubles. (1,000,000 × 4.25%). nine0015

((45,000 - 42,500) × 13%). That is, the non-taxable part of the income was calculated as 1 million rubles. × the key rate of the Central Bank as of 01.01 of the year in which interest was received from the deposit. As of January 1, 2021, the Central Bank rate = 4.25%, so the non-taxable part was 42,500 rubles. (1,000,000 × 4.25%). nine0015

Further, from 01/01/2022, the Central Bank rate was in effect, equal to 8.5%. Therefore, if personal income tax on deposits had not been canceled, then depositors who earned more than 85 thousand rubles in 2022 would have been subject to tax payment. (1,000,000 × 8.5%). So, for example, if the investor had earned 90 thousand rubles. for 2022, then in 2023 he would have to pay 650 rubles. ((90,000 – 85,000) × 13%).

Personal income tax exemption is valid only for interest on deposits for 2021–2022.

Changes from 2023

Thus, the established relaxation (abolition of the 2021–2022 tax) is temporary, and the payment of personal income tax on deposits is resumed from 2023. Those who receive interest income from deposits for 2023 will have to clarify whether it falls under payment of income tax or not. The taxable part of the income received from deposits is determined, by the way, with the application of new conditions. Although, as before, only the amount of interest income matters here, and not the amount of the contribution.

Those who receive interest income from deposits for 2023 will have to clarify whether it falls under payment of income tax or not. The taxable part of the income received from deposits is determined, by the way, with the application of new conditions. Although, as before, only the amount of interest income matters here, and not the amount of the contribution.

Depositors who are subject to the payment of personal income tax will for the first time have to pay tax on interest received for 2023.

Tax on deposits 2023 for individuals will be subject to other calculation rules, according to which the depositor (and the IFTS) will calculate the taxable part of income. That is, to determine whether his interest income received from deposits is subject to the payment of personal income tax or not.

How the non-taxable part of income will be determined

For the purposes of calculating the non-taxable part of interest income from 2023, the following formula will be used: × the maximum size of the COP from all valid rates on the 1st day of each month

NCPD - non-taxable part of interest income, CA - key rate of the Central Bank.

Actually, personal income tax will be calculated according to the previous formula: taxable part of interest income × 13% .

Please note:

1. All “interest-bearing” accounts (term, savings, etc.) will be taken into account, except for escrow accounts and deposits with a rate of no more than 1%. Income from ruble and foreign currency deposits is also subject to accounting. Foreign exchange income will be recalculated at the rate of the Central Bank, effective on the day the interest income is received. nine0015

2. The date of payment of interest income will be taken into account, but the period for which this amount was accrued is not taken into account. That is, if, for example, a deposit is opened in 2022, and the payment period for it falls on 2023 and the payment of income is subject to personal income tax, then you will have to pay tax on it.

Personal income tax applies to all active deposits. That is, open in past years, payments for which will be made in 2023 and subsequent years.

That is, open in past years, payments for which will be made in 2023 and subsequent years.

3. It is not required to declare personal income tax from deposits and independently calculate the amount of tax. Banks will transfer the necessary information to the IFTS (for 2023 - until 02/01/2024), which will calculate the tax. The amount of tax payable can be found through the payer's personal account on the website of the Federal Tax Service. In addition, it is expected that the IFTS will send notifications of tax payment. nine0015

The rules for paying personal income tax on deposits have not changed since 2023. Only the method of calculating the tax has changed. At the same time, the amount of the deposit, as before, does not matter, only the amount of income received from it is important.

An example of calculating personal income tax from a percentage deposit opened in 2022.

Suppose, relatively speaking, a citizen opened an annual deposit in 2022, putting 800 thousand rubles into the account. In 2023, he should be paid income of 110 thousand rubles on this contribution. If the maximum key rate for 2023 reaches (assume) 7.5%, then the non-taxable part of the income will be 75,000 rubles. nine0015

In 2023, he should be paid income of 110 thousand rubles on this contribution. If the maximum key rate for 2023 reaches (assume) 7.5%, then the non-taxable part of the income will be 75,000 rubles. nine0015

The depositor will have to pay personal income tax on interest income for 2023, calculated as follows: (110,000 - 75,000) × 13% = 4,550 rubles. As you can see, the amount (800 thousand rubles), which the depositor initially deposited into the account, did not affect the calculation process and did not appear in it in any way. The payment and size of the tax depended entirely on the amount of income that the depositor received.

Addition: The fact that in 2022 the depositors were exempted from paying personal income tax did not affect anything here either. Therefore, even if the depositor opened an account in 2022 for six months, and the payment on it was made in January 2023, then he would have to pay tax on it if the income fell under the payment of personal income tax under the new rules. nine0015

nine0015

Who will pay tax in 2024

Experts note that depositors who receive more than 1,000,000 rubles on deposits, less than half. But whether they pay personal income tax on interest income or not in 2024 will depend on the size of the maximum Central Bank rate for 2023.

There are no benefits for paying personal income tax on deposits. Everyone needs to pay, including large families, pensioners and the disabled!

Thus, every citizen of Russia, whether a resident or a non-resident of the Russian Federation, is subject to the rules for paying personal income tax on deposits if:

- all interest income (in aggregate) that he will receive for 2023 (on all deposits and balances on bank accounts in Russia) will exceed the established non-taxable limit;

- we are talking about a deposit opened by third parties, about one large deposit or several small deposits, and the income on them exceeds the tax-free limit.

Personal income tax for a minor person is paid by his parents (adoptive parents), and an adult can pay tax from the moment he acquires the rights of a depositor (opening a responsible account, deposit). nine0015

The non-taxable limit can only be calculated at the end of 2023, having learned and compared all fluctuations in the key rates of the Central Bank on the 1st day of each month of this year.

So, for example, if the Central Bank rate does not exceed 9% for the whole of 2023, and rises to 12% on December 1, 2023, then the non-taxable limit will be the amount of 120,000 rubles. (1,000,000 × 12%). Accordingly, if the interest income for 2023 exceeds 120 thousand rubles, the depositor will need to pay personal income tax (on the excess amount).

Personal income tax for 2023 must be paid before 02.12.2024 (the deadline has been postponed from Sunday 01.02 to working Monday - the 2nd day). nine0015

nine0015

How and within what period can the tax authority collect tax debts? The answer to this question is in "ConsultantPlus". If you don't have access to the legal help system, get a trial demo and jump to expert explanations for free.

The nuances of accruing personal income tax 2023 and the results

If the bank's license is revoked, then the Deposit Insurance Agency will notify the Federal Tax Service of the accrued interest on deposits. The date of receipt of interest income will be recognized as the date of payment of insurance. reimbursement or payment of interest during the period of bankruptcy proceedings (in liquidation). nine0015

It is assumed that the tax accrued on interest can be reduced by almost all types of deductions.

Totals

- There is no need to pay tax for 2022, as it has been cancelled.

- For 2023, personal income tax must be paid before 12/02/2024 at a rate of 13% (that is, for the past year they are paid before December 1 of the next year).

But if income exceeds (in aggregate) 5 million rubles. the rate rises to 15%. The indicated rates equally apply to both residents and non-residents, although since 2023 the mechanism for calculating the tax has changed. nine0132

But if income exceeds (in aggregate) 5 million rubles. the rate rises to 15%. The indicated rates equally apply to both residents and non-residents, although since 2023 the mechanism for calculating the tax has changed. nine0132 - No benefits - the tax must be paid by everyone (residents, non-residents) who have deposits (accounts, deposits) in banks in the Russian Federation and the interest received from them exceeds the limit calculated at the maximum rate of the corresponding year (interest payments).

- When calculating, the tax base includes interest that has exceeded the limit. It does not include interest on escrow accounts and deposits (accounts) with a rate of no more than 1% per annum. Income in foreign currency is subject to transfer into rubles at the exchange rate of the Central Bank on the date of receipt of income upon the fact. nine0132

- Banks transfer data for calculating personal income tax to the IFTS. In case of early termination of the deposit, the bank must submit updated data to the IFTS.