How to get child support statements

NYS DCSS | New York Child Support

Enable JavaScript to access your account

To access your account information, please enable JavaScript in your browser. Follow these instructions to enable JavaScript.

You can receive your payment information by phone at 1-888-208-4485 (TTY: 1-866-875-9975), Monday–Friday, 8:00 AM–7:00 PM.

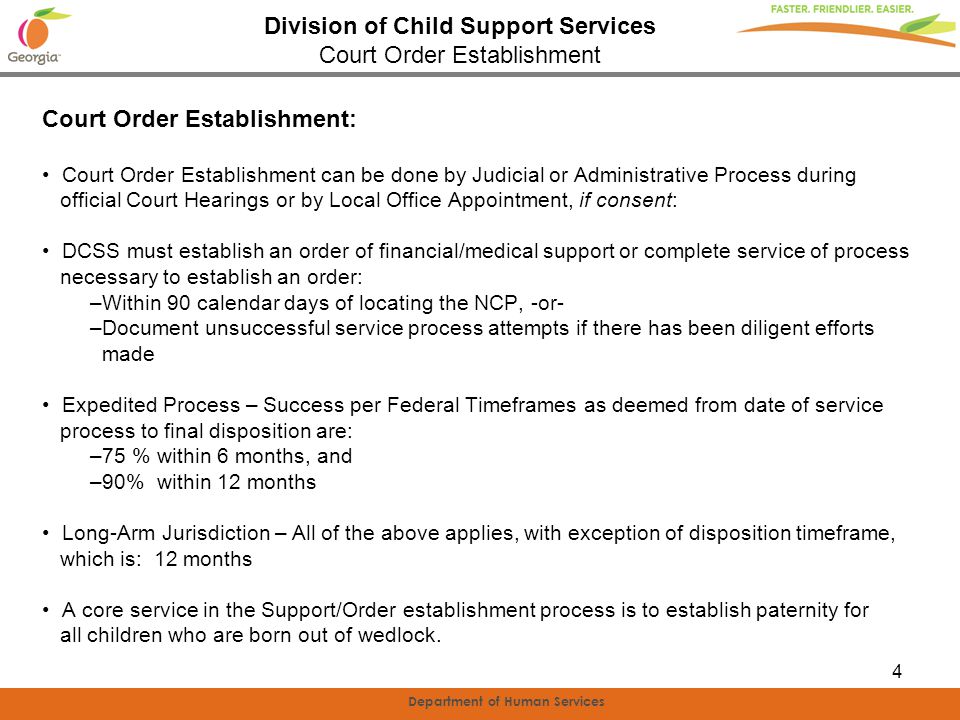

The Child Support Program provides custodial parents with

assistance in obtaining financial support and medical insurance

coverage for their children by locating parents, establishing

parentage, establishing or modifying support orders, and

collecting and distributing child support payments.

Make a payment

Please do not send cash. We encourage you to use an online payment service or pay by mail.

Check your payments

Log in with your NY.gov ID to check payments or disbursements.

If you do not have a NY.gov ID, you can create a NY.gov ID now.

Update case information

To report a change of address, change of employer, loss or reduction of employment, email your local child support office.

Computer use can be monitored, and usage is impossible to clear completely. If you are afraid your computer use will be monitored, please use a safer computer or call the NYS Domestic and Sexual Violence Hotline at 1-800-942-6906 for assistance.

To immediately leave this site, click the Exit button at the top of this warning.

The New York State Child Support Program is committed to helping survivors of family violence

access child support services safely.

العربية

বাঙালি

中文

Français

Kreyòl Ayisyen

Italiano

한국어

Polski

РУССКИЙ

ESPAÑOL

اردو

יידיש

If the form you need is not available in your language, please call

1-888-208-4485

(TTY: 1-866-875-9975).

Translated forms are available for REFERENCE ONLY. Complete and submit forms in English.

Please email or mail completed forms to your local child support office. Find contact information on the Local Offices page.

Apply for Child Support Services

- Application for child support services

- Additional Child information

- Information about Child Support Services

Enroll in Direct Deposit

- Direct Deposit Enrollment

Appeal or avoid an enforcement issue

- Affidavit of Net Worth

- Driver License Suspension Request or Challenge

- Mistake of Fact and/or Exempt Money Claim

- Request for Review of Additional Amount

- Statement of Income and Expenses

- Department of Taxation and Finance Challenge

- Professional License Suspension Claim

- Request for Administrative Review…for Tax Refund Offset/Passport Denial

If the form you need is not available in your language, please call 1-888-208-4485 (TTY: 1-866-875-9975).

Translated forms are available for REFERENCE ONLY. Complete and submit forms in English.

Please email or mail completed forms to your local child support office. Find contact information on the Local Offices page.

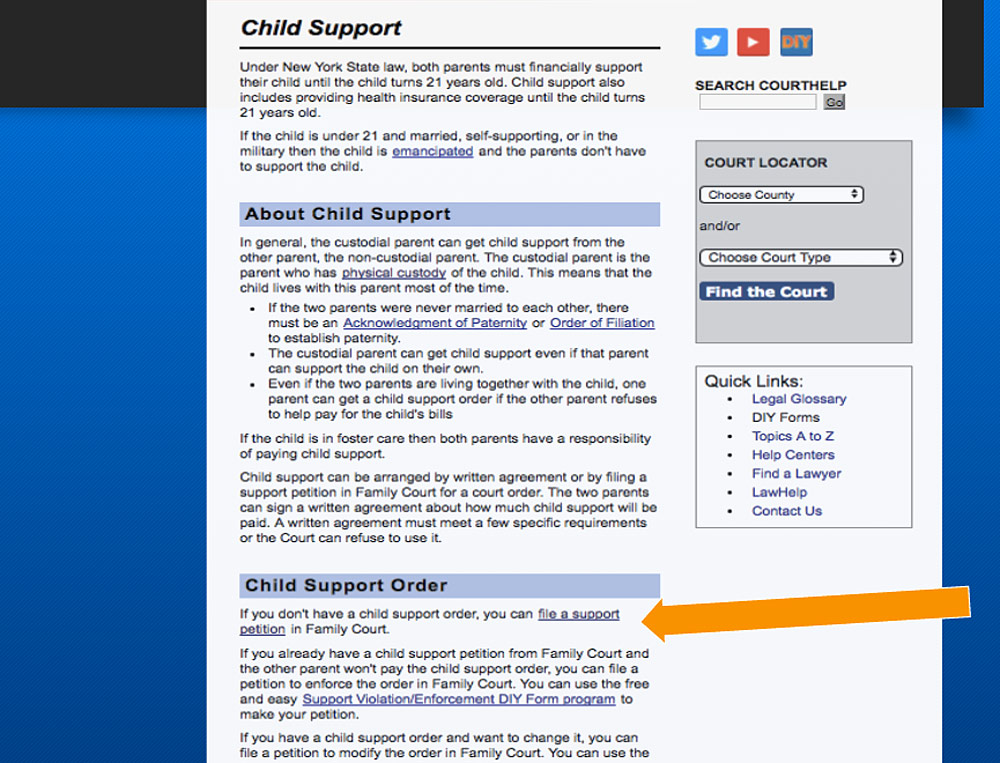

If you will be attending a court hearing soon, check court information for advice about how you can prepare in advance, what you may experience at the hearing, and how you may need to follow up afterwards.

To see current operating hours and procedures for the Family Court in your county, visit the New York State Unified Court System.

Report enforcement issues

Email your local child support office—RECOMMENDED—or

Call the New York State Child Support Helpline at 1-888-208-4485.

Child Support - Mississippi Department of Human Services

Skip to contentChild SupportMorgan Stewart2022-09-29T16:44:20+00:00

Child Support serves children and families that need help with financial, medical and emotional support.

Upload Documents Here

Payment Options

for Custodial Parents

for Non-Custodial Parents

- Payroll deduction

- this option must be discussed with your employer

- eCheck/bank account debit

- Cash

- PayNearMe

- (FAQ)

- MoneyGram

- all locations accept cash, and some locations accept a pin-based debit card.

- Visit www.MoneyGram.com/BillPayLocations to find a location.

- Quick Reference Guide

- PayNearMe

- Check, Money Order and/or cashier’s check

- Include Social Security Number AND Case Number

- Mail to: MDHS/SDU, P.

O. Box 23094, Jackson, MS 39225

O. Box 23094, Jackson, MS 39225

for Employers

eCheck/bank account debit

PayNearMe

Pay your child support in cash without leaving your neighborhood.

Find Nearest Location

It's convenient

Pay in less than 60 seconds at nearly 27,000 locations. Payment history and receipts are stored in the app and you can set reminders for next time.

It's guaranteed

You’ll get a receipt as proof of payment, just like buying something at the store. We’ve already processed over a million payments for customers just like you!

It's mobile

You can store everything you need to pay on your phone or in your wallet, so it’s always with you.

Visit Site

Parents HandbookApply for ServicesChild Support Brochure: English | Spanish | VietnameseClick here for the application: English | Spanish | VietnamesePlease mail your completed application and check to MDHS-Division of Child Support 950 E. County Line Road, Suite #G, Ridgeland, MS 39157

County Line Road, Suite #G, Ridgeland, MS 39157

If you are an employer who is receiving a monthly Child Support Income Withholding Bill for an employee, you may view and print these documents online.

These documents are available in Portable Document Format (PDF) only.

Click on here for the Child Support Web-based Bills/Notices.

NOW AVAILABLE ONLINE

- Download to print monthly

- Bills/Notices will ONLY be mailed out annually

- All other inquiries, please contact the Child Support Call Center at 877-882-4916.

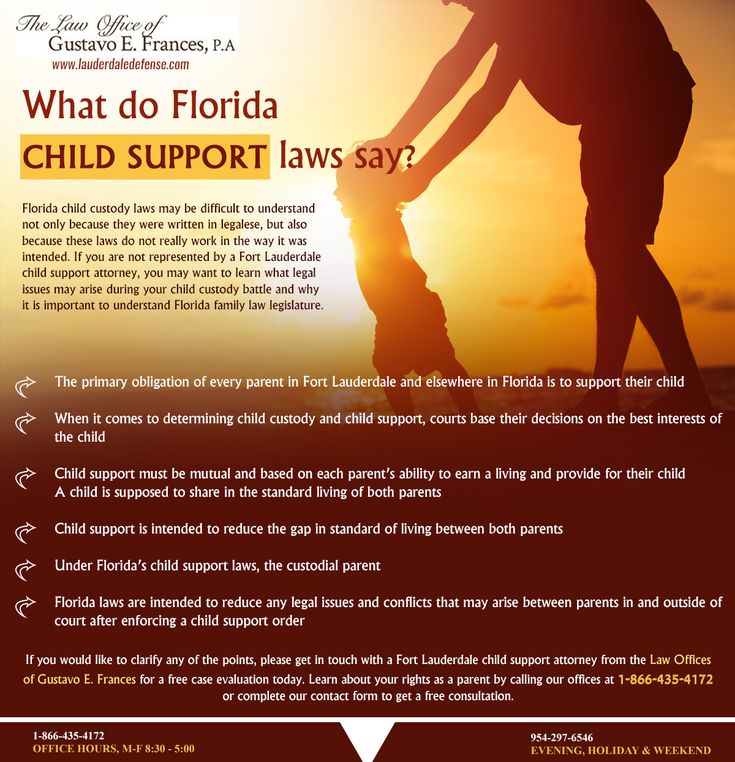

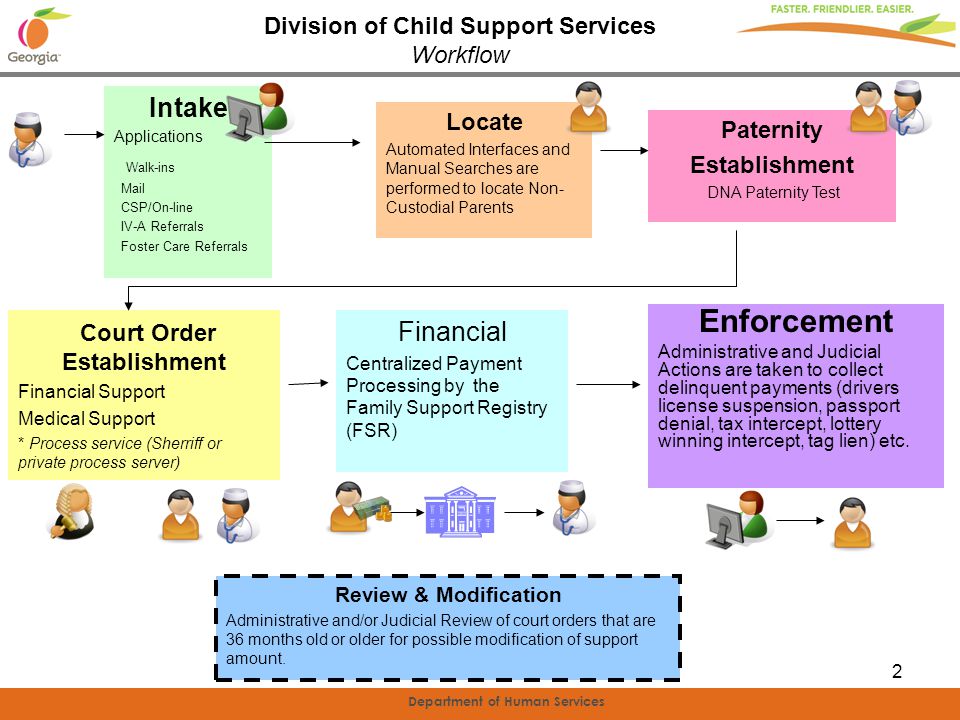

There are several methods used to collect and enforce child support:

-

- Income Withholding-The employer of a noncustodial parent who owes child support may have support withheld from their wages.

- Unemployment Intercept-A noncustodial parent who owes child support may have support withheld from their unemployment benefits.

- Tax Offset Intercept-A noncustodial parent who owes back child support may be subject to interception of any refund due from federal or state taxes

- Contempt Action-A noncustodial parent who owes back child support may be taken to court for contempt, which could result in the court ordering incarceration.

- Credit Bureau Reporting-A noncustodial parent who owes back child support will be reported to the Credit Bureau.

- Liens-A non custodial parent who owes back child support may have liens placed against their workers compensation or personal injury claims

- Accounts Frozen and Seized-A noncustodial parent who owes back child support may have their account(s) frozen and seized from financial institutions such as banks and credit unions.

- License Suspension-A noncustodial who owes back child support may have their license suspended.

- Passport revocation-A noncustodial parent who owes back child support of $2500 or more will have their passport revoked or application denied.

- Income Withholding-The employer of a noncustodial parent who owes child support may have support withheld from their wages.

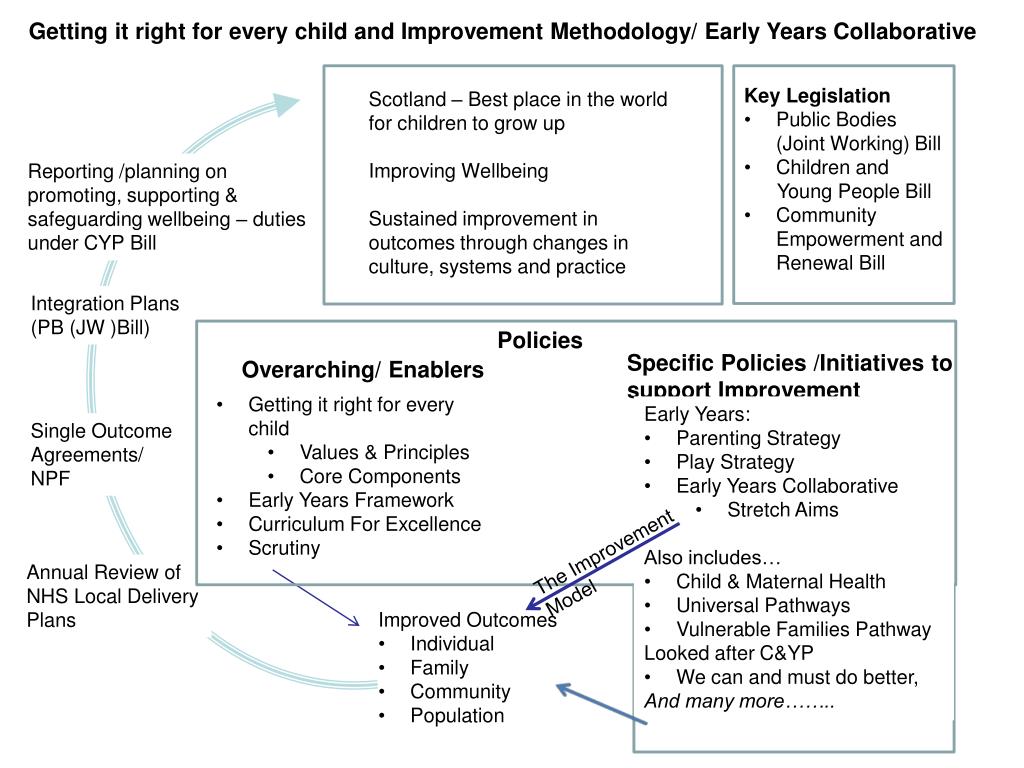

Paternity Establishment

A Simple Acknowledgment of Paternity (ASAP)

ASAP is Mississippi’s voluntary paternity establishment program. ASAP makes it possible for parents to establish paternity in hospitals and other birthing facilities, at the State Department of Health, County Health Departments, and the Division of Field Operations.

This procedure carries the same legal effect as if the father and the mother were married at the time between conception and birth. The program allows the father’s name to be added to the birth certificate.

PATERNITY

Paternity means fatherhood. Paternity is in question when a child is born of unmarried parents. If a child’s parents are not married, paternity can be established through voluntary acknowledgment or through court proceedings.

It is important to establish paternity for a myriad of reasons, such as identity, medical history, death, disability and insurance benefits, and support.

It is important for a child to know who he/she is and to feel the sense of belonging that knowing both parents brings.

A child also needs to know if he/she may have inherited any diseases or birth defects. Also, by knowing both parents, this could ensure against marriage between close relatives.

A child should have the right to possible benefits from both parents such as social security, medical and life insurance, as well as veteran’s benefits.

Also, a child has the right to food clothing and a home, which can be better provided when both parents are involved. Support that is provided by one parent only to a child is often not adequate to meet his/her needs.

Support that is provided by one parent only to a child is often not adequate to meet his/her needs.

Legal paternity can be established while the mother is still in the hospital when both parents sign an acknowledgment of paternity and return it to the hospital staff. There is no fee involved, when the acknowledgment of paternity is filed along with the birth certificate. (To establish paternity upon leaving the hospital, please contact the Division of Field Operations at the Mississippi Department of Human Services.)

If establishment of paternity is involuntary, a petition to establish paternity must be filed with the appropriate court with jurisdiction over the matter.

Establishing paternity is the first step needed in order to ask for visitation privileges. The father will need to seek legal counsel for advice on visitation and, or custody.

Adding a father’s name to the birth certificate

A father’s name will be added to the birth certificate, when he is legally established as the child’s father after completing the acknowledgment form.

If the alleged father refuses to sign the Acknowledgment of Paternity form, the mother can request assistance from the Division of Field Operations at Mississippi Department of Human Services in establishing paternity, and obtaining child support through the court system. There is a $25 fee for this service UNLESS the mother is receiving any state supported benefit such as Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families, (TANF) and, or Medicaid, in which case there is no charge for this service.

Employer InformationReference Guide for Employers and Income Withholders

Child Support Web-based Bills/Notices

https://ccis.mdhs.ms.gov/

Questions please contact the Child Support Call Center 877-882-4916

Electronic Reporting

Electronic Funds Transfer/Electronic Data Interchange (EFT/EDI) make child support income withholding easier for employers. At your option, child support funds can be electronically remitted via EFT from your bank to the State Disbursement Unit (SDU). All the necessary information (case identifiers, date of withholding, etc.) is sent along with the electronic payments via EDI.

At your option, child support funds can be electronically remitted via EFT from your bank to the State Disbursement Unit (SDU). All the necessary information (case identifiers, date of withholding, etc.) is sent along with the electronic payments via EDI.

For additional information concerning EFT/EDI, please click here for the PDF version of A Guide for Employers Electronic Funds Transfer/Electronic Data Interchange (EFT/EDI) or Email: [email protected] or phone: 769-777-6111

State Agencies in Mississippi

State agencies who deduct child support payments from employee checks to pay to the Mississippi Department of Human Services can make remittances electronically via electronic funds transfer (EFT). Remittances will need to be directed to Regions Bank CHILD SUPPORT METSS, vendor # V0001361941. For more information, contact 601-359-4500.

Mississippi New Hire Reporting

All employers (or independent contractors) are required to report basic information about newly-hired personnel to a designated state agency within 15 days. A penalty of $25 per case (incident), or up to $500 for collusion between employer and worker, shall be assessed for not reporting as directed by law. To obtain more information, go to the website: www.ms-newhire.com or contact us at the following address:

A penalty of $25 per case (incident), or up to $500 for collusion between employer and worker, shall be assessed for not reporting as directed by law. To obtain more information, go to the website: www.ms-newhire.com or contact us at the following address:

P. O. Box 437

Norwell, MA 02061

Telephone: 800-241-1330

Fax: 800-937-8668

State Disbursement Unit

All child support income withholdings are required to be paid through Mississippi’s state disbursement unit, the State Disbursement Unit (SDU) at the following address:

MDHS/SDU

P. O. Box 23094

Jackson, Mississippi 39225

Fax: 769-777-6132

Each payment remitted must include the noncustodial parent’s name, social security number, the amount withheld and employer name.

Withholding Orders/Notices from Other States

A direct income withholding order issued by any state may be sent across state lines directly to the noncustodial parent’s employer in another state.

-

-

- Upon receipt, if the Order/Notice appears “regular on its face,” you must honor it.

- You must provide a copy of the Order/Notice to the employee immediately.

- You must begin income withholding and send the payments to the address cited in the Withholding Order/Notice.

- You must continue to honor the Withholding Order/Notice until official notification is received from the child support enforcement agency/court to stop or modify the withholding.

- If you comply with these basic requirements, you will not be subject to civil liability to an individual or agency with regard to your withholding of child support from the employee’s income.

-

What is the maximum amount that can be withheld?

For child support income withholdings, the upper limit on what may be withheld is based on the Federal Consumer Credit Protection Act (CCPA). The Federal withholding limits for child support and alimony are based on the following disposable earnings of the obligor (i. e., the employee):

e., the employee):

-

-

-

-

- The Federal CCPA limit is 50 percent of the disposable earnings if the employee lives with and supports a second family, and 60 percent if the employee does not support a second family.

- This limit increases to 55 percent and 65 percent respectively if the employee owes arrears that are 12 weeks or more past due.

-

-

-

Lump Sum Payment Requirements for Employers

Pursuant to Mississippi Code Section 93-11-103(13), employers are required to report lump-sums paid to employees of over $500 to the Department of Human Services if the employer has been served with a withholding order that includes a provision for the payment of arrears. Lump-sums are defined in Mississippi Code Section 93-11-101(l). The employer shall notify the Department of Human Services of its intention to make a lump-sum payment at least 45 days before the planned date of the payment or as soon as the decision is made to make the payment, should that be less than 45 days. The employer shall not release the lump-sum to the obligor until 30 days after the intended date of the payment or until authorization is received from the Department of Human Services, whichever is earlier. The Department of Human Services shall provide the employer with a Notice of Lien specifying the amount of the lump-sum to be withheld for payment of child support arrears.

The employer shall not release the lump-sum to the obligor until 30 days after the intended date of the payment or until authorization is received from the Department of Human Services, whichever is earlier. The Department of Human Services shall provide the employer with a Notice of Lien specifying the amount of the lump-sum to be withheld for payment of child support arrears.

To report a lump-sum or for further lump-sum inquiries, please email or fax us at [email protected] or 800-937-8668.

Multiple Child Support Orders for the Same Employee

You must add together the court-ordered current support owed for each order and withhold that amount first. If this amount does NOT exceed the CCPA or appropriate State law, you may withhold additional earnings for any arrears obligation, provided the total amount withheld does not exceed the amount available under the CCPA or appropriate State law.

May we combine child support payments from several employees?

You may send one check for each pay period to cover all child support withholdings for that pay period if they are all to be sent to the Mississippi Department of Human Services, provided you itemize the amount withheld from each employee, the date each amount was withheld, and the noncustodial parent’s social security number.

Is medical insurance required to be provided when the child does not live in the service area?

Yes. By law, medical insurance coverage available to the parent-employee cannot be denied to a child even though:

-

-

-

-

- The child was born out of wedlock and paternity has been established

- The child is not claimed as a dependent on the parent’s income tax return

- The child does not live with the parent

- The child does not live in your insurer’s service area

-

-

-

Under which insurance plan should the child be enrolled?

Enroll the child under the same health benefit plan in which your employee is enrolled. If the employee is offered more than one health plan, the plan chosen by the employee must provide coverage for dependents.

License Suspension ProgramWhat licenses can be suspended?

-

-

-

-

- If the delinquent parent does nothing or can not reach an agreed payment schedule within the 90 day period, then a notice is sent to the license agency to suspend the license.

- If the delinquent parent does nothing or can not reach an agreed payment schedule within the 90 day period, then a notice is sent to the license agency to suspend the license.

-

-

-

-

- NOTE: A suspended license may be reinstated if the payments are made or a payment plan is agreed upon. Failure to pay under the agreement will result in immediate license suspension. Additionally, a judge may order license suspension in any contempt proceeding for failure to pay child support. Also note that any licensed attorney may apply through MDHS for license information in a non-MDHS case.

Due Process

A licensee may request a review by MDHS on issues of correct personal identification and the state of delinquency. License suspensions may be appealed to the Chancery Court.

Mississippi Access & Visitation Program (MAV-P)Mississippi’s Access and Visitation Program (MAV-P) is designed for noncustodial parents to have access to visit their children as specified in a court order or divorce decree. Assistance with voluntary agreements for visitation schedules is provided to parents who have a child support case.

For more information click here

Frequently Asked Questions Child Support ManualClick here to view

Tax Offset GuideChild Support Call Center

877-882-4916

Dollars of Child Support Collected

0%

Number of children born out of wedlock who had paternity established

Page load linkGo to Top

Get a certificate of alimony in 2022

Anyone who has at least something to do with this side of the legal relationship may need to issue a certificate of alimony. Questions for which a support certificate can be taken relate to confirming the amount of alimony payments or clarifying what part of the income this alimony represents. In addition, a certificate can be issued to find out the exact amount of the delay. Moreover, you can issue a document not only to the payer, but also to the recipient. Then, with this certificate, you can apply to both private and public organizations, receive various benefits, etc. The document does not have a standardized form, but there is a specific list of information that must be displayed.

Moreover, you can issue a document not only to the payer, but also to the recipient. Then, with this certificate, you can apply to both private and public organizations, receive various benefits, etc. The document does not have a standardized form, but there is a specific list of information that must be displayed.

In what cases will you need a certificate of maintenance

The essence of the alimony certificate is to show whether money for the maintenance of the child was transferred from a person who, by law, must pay for it. At the same time, the reference in question can be used in a number of different situations:

- A certificate can be taken by a woman who is trying to get some kind of state benefit, where the fact of insufficient income is important. For example, this certificate can be taken into account when a family becomes registered with the status of a low-income family. Also, women can bring a certificate if they apply for various regional or federal-type benefits for children.

- Not infrequently, a certificate is issued by men who pay alimony and must prove their legal purity. It is standard practice for a bank to request documents on the expenses of its customers. Especially when it comes to loans.

- Quite often, a maintenance certificate is issued at the request of a tax inspector, since the document in question is fundamentally important in order to adequately calculate the taxable base.

- If the alimony payer's employer conducts alimony through his database, he will need a certificate for record keeping.

- Bailiffs are also executors of alimony certificates, especially if they are involved in the opening or closing of enforcement proceedings.

Obtaining a certificate can be problematic in a situation where the payer does not work anywhere, and no benefits have been issued in his name. Even if he regularly transfers alimony, it is rather difficult to prove the fact of their receipt, which means that it will not be possible to issue a certificate.

Where to get a certificate of maintenance

Usually, alimony is assigned in three ways - through a writ of execution, through a court order and on the basis of a notary agreement. Hence, you need to build on the case of issuing a certificate.

For example, if the recoverer initiated enforcement proceedings through the FSSP, a certificate can be obtained from the bailiffs. You can also draw up documents from the employer if the writ of execution for withholding alimony was sent to the work of the payer. In the case of a notarial agreement, supporting documents are drawn up between the parties to the transaction.

Sometimes a child support certificate is used as part of a document confirming a person's income and expenses. But in this case it can be replaced by payment documents from the bank. A receipt for the transferred funds may also be suitable. But it is important to indicate the purpose for which the payment is made. So write that they transferred the money as child support.

So write that they transferred the money as child support.

Certificate of maintenance from the place of work

Employers often become unwitting participants in the “support war” between their employees and their families. For example, if an employer receives a writ of execution, he must by law withhold alimony from each salary of an employee and transfer them to the recipient of the alimony in question. And if he is asked for a certificate, he must provide it. And several persons can make a request at once, including the claimant, the payer and the bailiff.

The certificate issued by the employer contains a special list of information:

- Employee's personal data.

- Grounds on which payments are withheld. In this place, you can specify the parameters of the writ of execution.

- Exact amount of child support. Usually used decryption in the form of monthly payments.

- Period for which maintenance is withheld.

You can use both the entire period and the time that interests the applicant.

You can use both the entire period and the time that interests the applicant.

If the bailiff takes a certificate from the employer, you need the number of enforcement proceedings.

Certificate of alimony for social security: where to issue document

If the applicant wants to apply for social assistance measures, a statement of support is required, as it affects the amount of monthly income. You can request a certificate at the place of work of the debtor, if he works somewhere.

Where to get a certificate of alimony arrears

If there is a large debt for alimony and enforcement proceedings are opened to return the funds, ask for a certificate from the bailiffs. You can come to the FSSP and file an appeal there, or you can submit a request by mail.

Get a certificate from the State Services

The website of the State Services does not provide a special service for issuing certificates of alimony . But through the State Services, you can request a certificate from the FSSP about debts. And it will contain information about alimony. But this service is not available in all regions.

When a maintenance certificate is not issued

Sometimes a maintenance certificate cannot be issued. This usually happens because the person who has to pay child support does not work anywhere. At least officially. But at the same time, he was not registered with the Employment Center. Since alimony is paid by hand and without a receipt, there is simply no material on the basis of which a certificate can be issued.

You can get legal assistance on how to get certificates of alimony on our website.

How to order a child support certificate through the State Services, types of certificates

To receive benefits, you must provide information about income. Among other documents, you will need proof of receipt of funds from your ex-spouse. You can order a certificate of alimony through the "Gosuslugi".

Among other documents, you will need proof of receipt of funds from your ex-spouse. You can order a certificate of alimony through the "Gosuslugi".

Features of requesting documents online

The online portal of public services provides the ability to generate the necessary documents remotely. On the site you can also get an electronic certificate confirming the fact of receiving alimony.

To request information, you must create an account on the Gosuslug website. The initial registration procedure is quick: all you need is a phone number and email. However, please note that there are several types of account on the portal:

- simple;

- standard;

- confirmed.

Simplified registration does not require personal identification, but most services will not be available. Standard registration opens up more opportunities for using the service; for this, passport data, SNILS and TIN are indicated. A full range of documents is opened upon confirmation of identity at the Service Centers and the MFC.

Most services are provided free of charge by law, except in cases that require the payment of a government fee. You can get a sample receipt here, on the Gosuslug Internet portal, and pay online.

Ordering certificates of alimony at the "State Services"

Material maintenance of the child is a civil debt of one of the spouses after a divorce by a court decision. Certificates of its implementation may be required to be submitted to the social security authorities. To do this, you need to confirm the income of each of the family members, including minor children. You can get a certificate of alimony through the "State Services", which make a request to the FSSP.

After a request through the portal, within two weeks you will receive a notification in an SMS message about the readiness of the certificate. The document is issued in the personal account also in electronic PDF format with a confirmed signature of an authorized employee of the competent authority. After that, it remains only to print the official paper on the printer. If necessary, the document can also be notarized.

After that, it remains only to print the official paper on the printer. If necessary, the document can also be notarized.

If the readiness message does not arrive, it is necessary to clarify on the Gosuslug portal or in the FSSP why the delay occurs. If it is not possible to receive an answer in any instance, the citizen has the right to write a complaint to the prosecutor's office.

There are several types of certificates of maintenance, the choice depends on the specific purposes for which such a document may be needed:

- on payment;

- on receipt;

- about absence;

- about debt.

You can order a certificate of alimony through the "Gosuslugi" of any type for subsequent submission to social services.

Payment

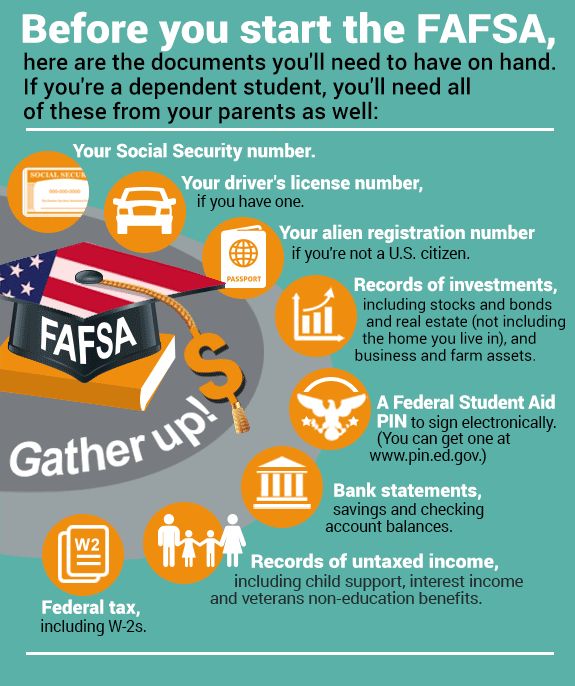

A proof of payment is required to show that the parent of a minor child does not evade obligations after a court-ordered divorce. To obtain an official paper, you will need a notarized agreement on the payment of alimony and a writ of execution.

After filling in the required fields on the Internet portal, you need to wait a few days. The paper will indicate the specific amounts of payments by months for the last six months. A certificate of alimony through the "Gosuslugi" for social protection, after confirmation by an electronic qualified signature, will be available in your personal account.

On receipt

The document is similar in form to the previous one, but its content is slightly different. A certificate of receipt of alimony is provided under certain conditions. A voluntary agreement on the material maintenance of minor children must be signed between parents. Reliable information about the former spouse is needed: his place of work or study, address.

If the parent is unemployed and not registered with the employment center, there is no agreement between the mother and father, it will not be possible to order a certificate of receipt. The same situation is with the document of non-payment of funds. If there are no obstacles, you can request a certificate of alimony through the "State Services".

If there are no obstacles, you can request a certificate of alimony through the "State Services".

On the absence of alimony

If the parent did not apply for payments from the former spouse, to confirm income and receive social benefits, you must order a certificate of the absence of alimony from the State Services. The document confirms the fact that the parent did not receive funds from the former spouse.

About debt on alimony

To obtain a loan or preferential charges, travel abroad, exchange a driver's license, a citizen needs confirmation of the absence of debt obligations. Such a document can serve as a certificate of debt on alimony, which is convenient to order through the "Gosuslugi". The official paper shows all the latest accruals for a six-month period.

Upon receipt through the Internet portal, a certificate of alimony debt is confirmed by a unique electronic signature of a civil servant. The certificate has a certain expiration date, since a citizen can pay the debt at any time.

Usually the document is valid for about a month.

Other documents

In addition to the above certificates, you can order a certificate of non-receipt of alimony through the "Gosuslugi". It is required when applying for child benefits, to recognize a family as poor and receive benefits. Also, a citizen is required to obtain a document when moving abroad for permanent residence.

A certificate of non-receipt of alimony through the "State Services" can be issued if there are related evidence: alimony agreement and a writ of execution. It is also important to consider that the validity of the official paper is limited. It must be submitted within one month from the date of issue.

A certificate of non-payment of alimony through the "Gosuslugi" is required for a citizen to receive a monthly allowance for a child. This applies to cases when the parent of a minor who is obliged to pay funds evades or hides, does not get in touch.