How to calculate child support when self employed

How Self-Employment Affects Child Custody And Support Obligations

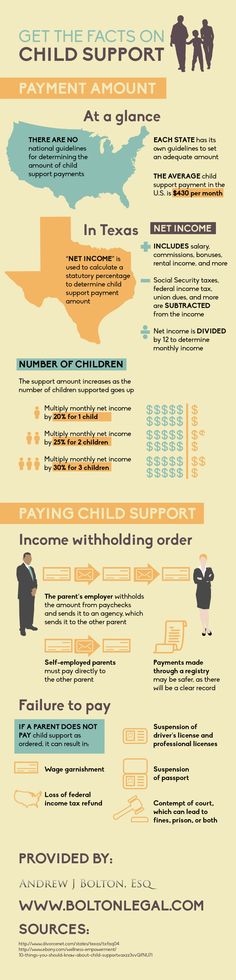

According to the latest U.S. Census Bureau report, 14.6 million Americans, or one-tenth of the nation’s workforce, identifies as self-employed. With more people working for themselves than ever, calculating child support payments is becoming more complicated. If you or your former spouse is self-employed, be aware of how the court will use employment information to calculate support payments.

Self-Employment Income

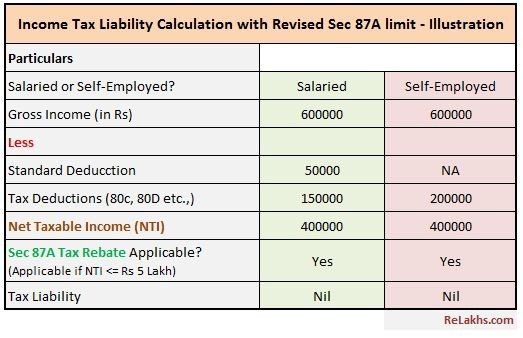

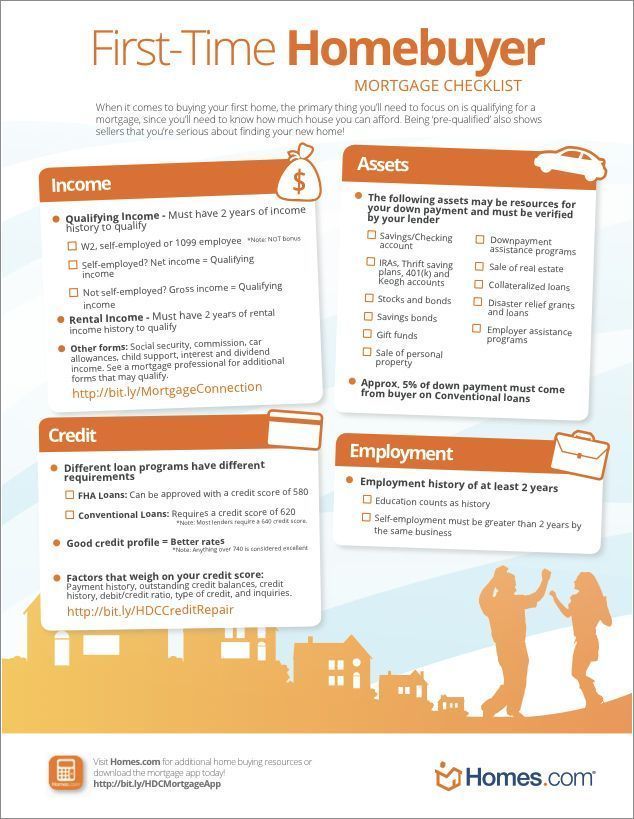

Child support and spousal support payments depend heavily on a person’s reported income. While it is easier to calculate the support requirements of a person who receives a regular salary, an accurate accounting of self-employment income is possible when the self-employed person is forthright about his or her income and expenses.

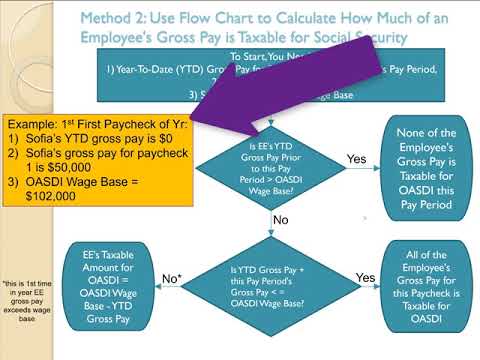

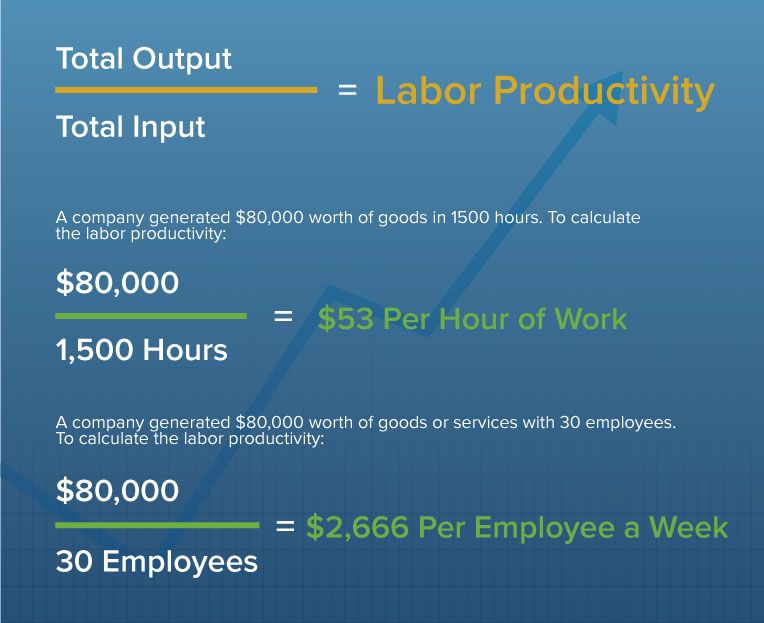

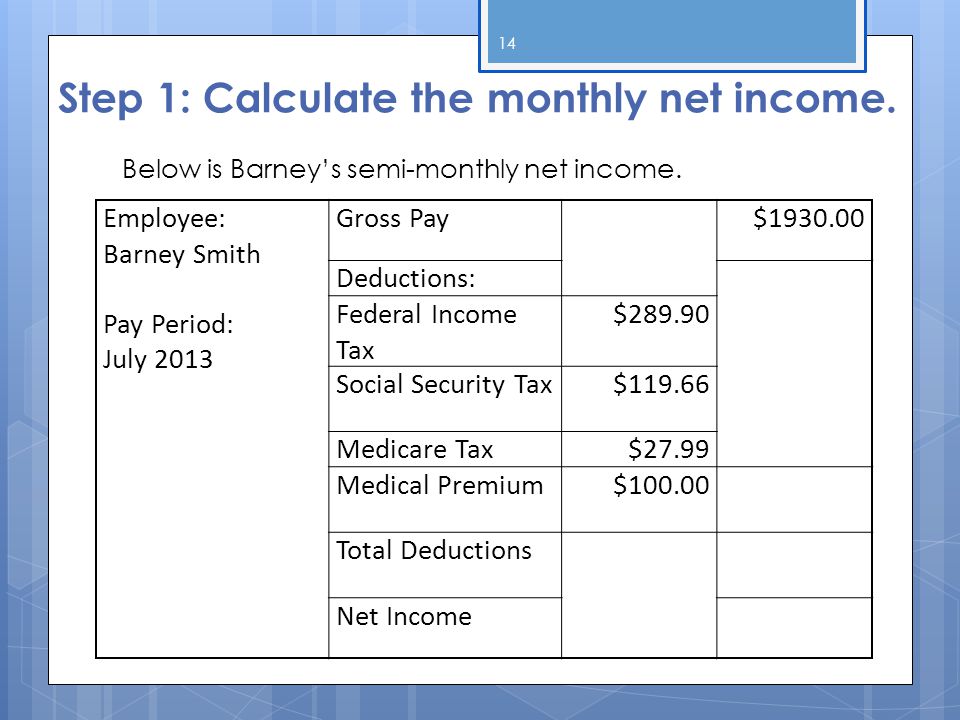

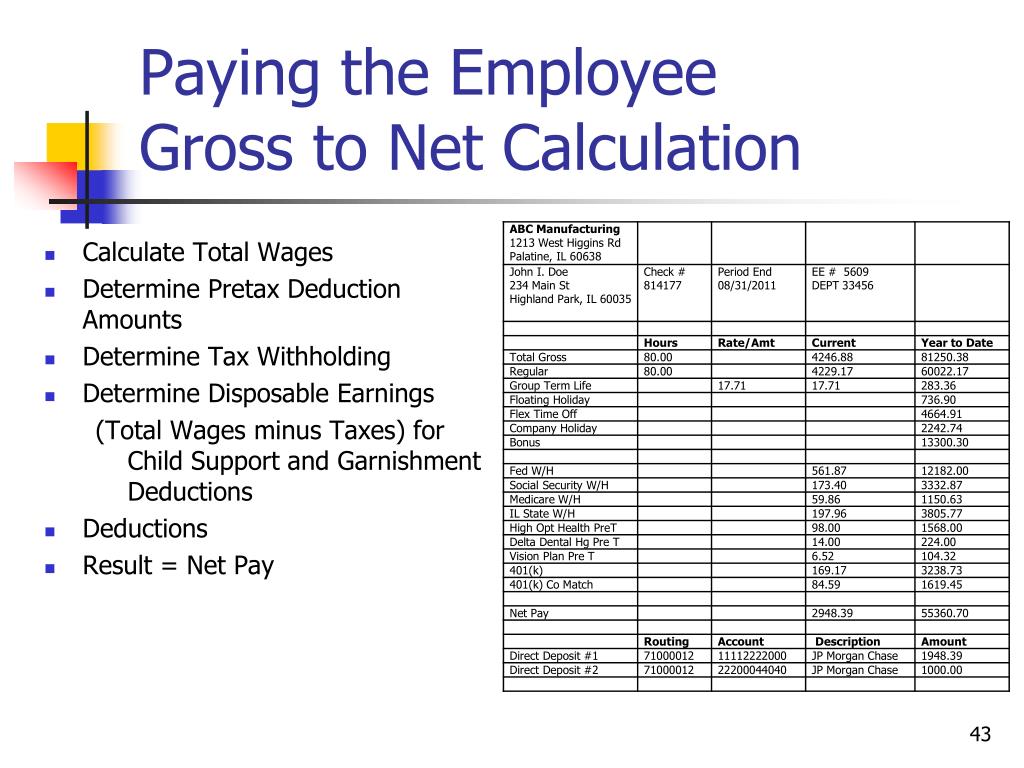

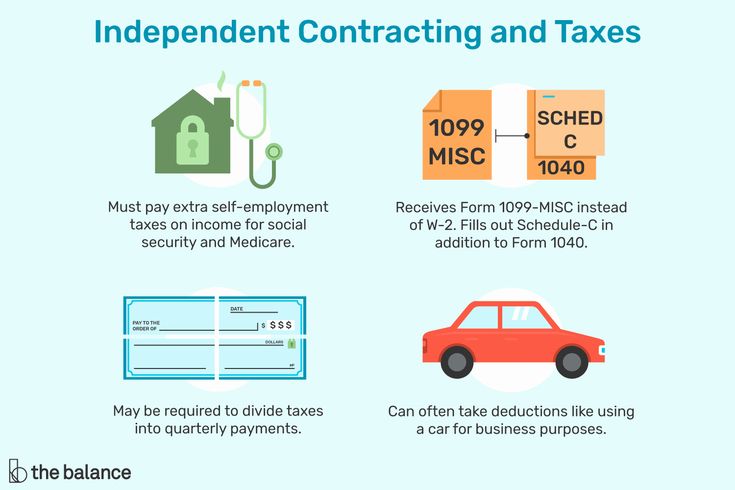

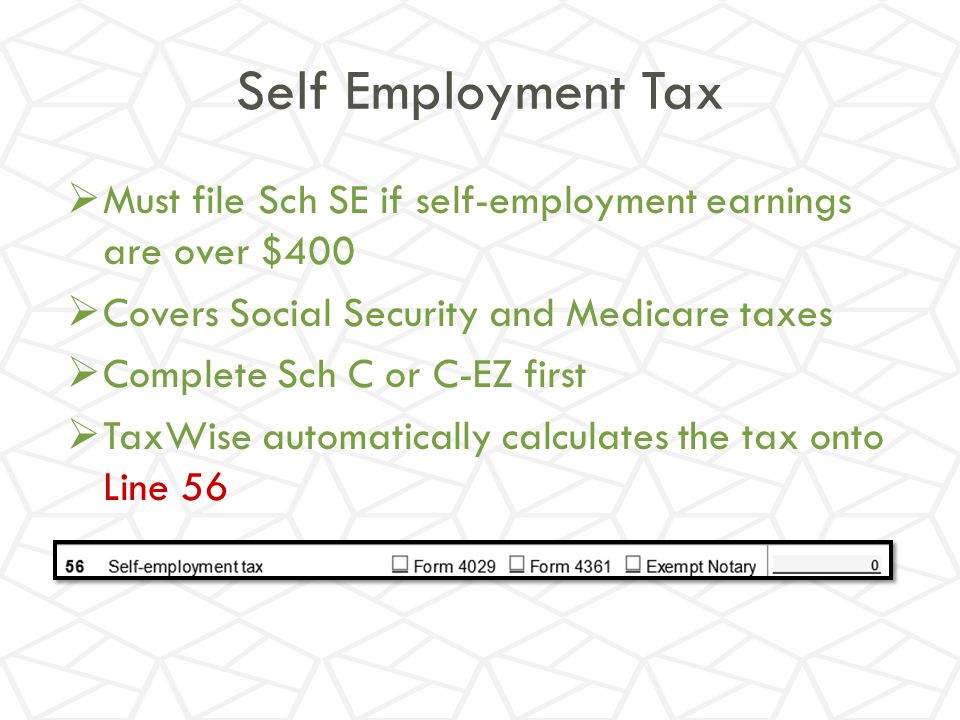

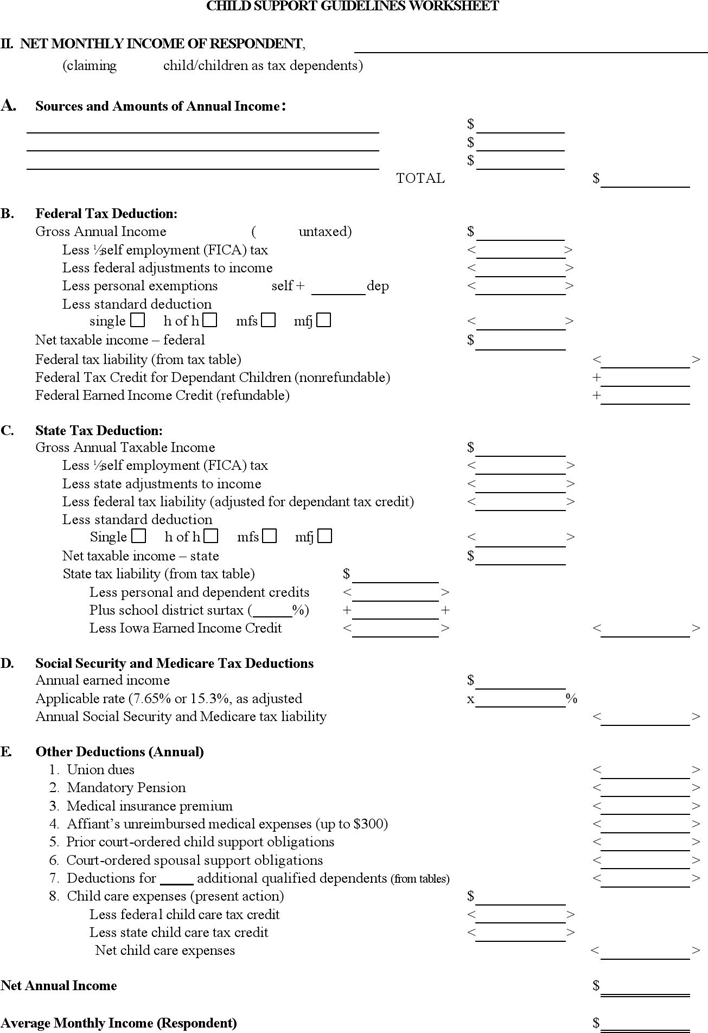

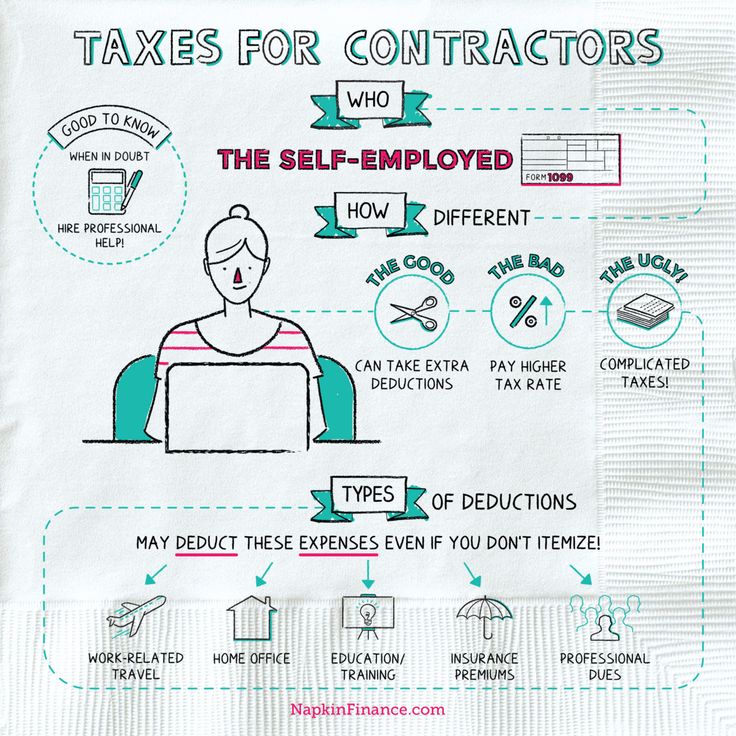

A person who owns a business or is in business for themselves is not required to pay support based solely on how much money he or she earns. Self-employed parents are allowed to deduct business expenses from their gross profits, and their income will be calculated based on their net earnings.

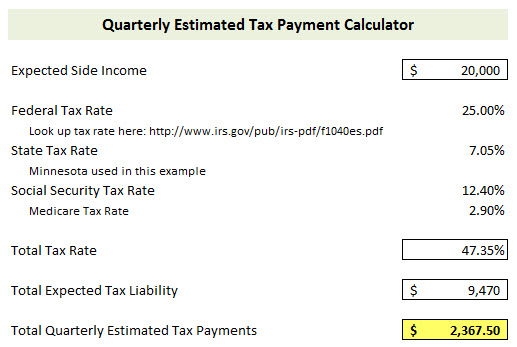

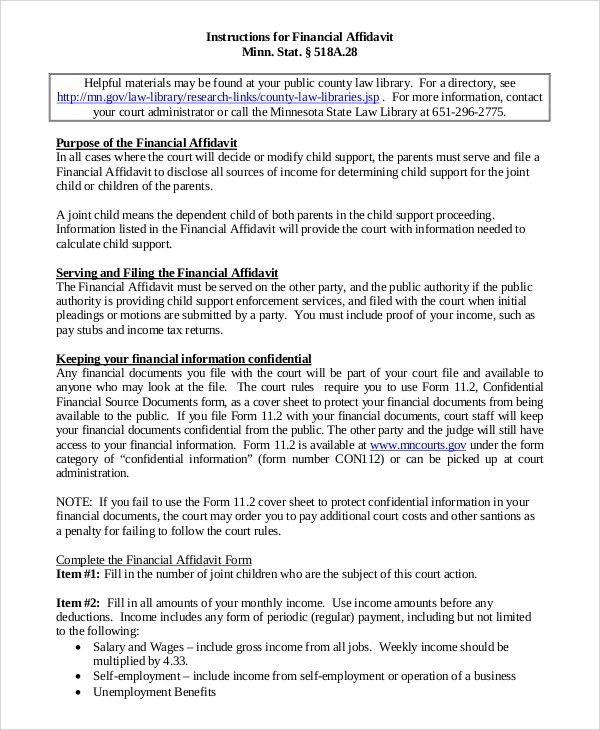

Usually, self-employment income will be calculated based on a person’s tax returns, which must list the amount of income and expenses a person’s business earns each year. Additional information, like bank account statements, profit and loss statements, business ledgers, or financial affidavits can be used to create an accurate financial picture for the court. Often, a person who is self-employed will have to submit to a deposition, and answer questions about his or her financial state of affairs.

Hidden Self-Employment Income

Unfortunately, some self-employed parents will manipulate their income in order to make it appear as if they earn less money than they actually do. For example, a person could inflate their business expenses to make it seem as if they earned less net profit than they should have; other times, a business owner may list personal assets or other expenses in the company’s name, which will also confuse the calculations.

When a self-employed person attempts to hide assets or income, often his or her former spouse is the best resource to uncover the deception. Most people have a good understanding of their spouse’s standard of living—if the numbers change drastically once the marriage ends, there is a good chance that income is being hidden or expenses are being padded.

Most people have a good understanding of their spouse’s standard of living—if the numbers change drastically once the marriage ends, there is a good chance that income is being hidden or expenses are being padded.

If a self-employed spouse is not being truthful about his or her income, there are multiple legal options which can be used to create accurate numbers. In some cases, the self-employed person may be required to turn over financial documents, bank statements, and tax returns in order to justify his or her income. In other cases, attorneys for the spouse seeking support may hire investigators to search for hidden assets, or forensic accountants to search for mistakes or omissions.

Help For Spouses

If you are self-employed, and are unsure about how to accurately report your income for child support purposes, it is important to speak with an attorney about your obligations. Failing to report all of your income could result in several serious consequences, like fines, contempt of court, or being ordered to pay attorneys’ fees.

Alternatively, if you think that your self-employed spouse is hiding assets or lying about his or her income, consult with your attorney as soon as possible. At Pacific Northwest Family Law, we believe that all parents have an obligation to support their children as fully as possible, and will help you hold your spouse responsible for his or her fair share.

At Pacific Northwest Family Law, our attorneys are experienced with high-conflict divorces, and know how to hold deceptive spouses accountable. If you are getting a divorce or are navigating a complicated child custody matter you need to know what your options are. Call us at 360-926-9112 to schedule your appointment.

Calculating Child Support if You’re Self-Employed

3 / 100

Powered by Rank Math SEO

Divorce is difficult. There’s no secret about it – and there’s no way around it. Even in the best of circumstances, it’s an emotionally stressful time – and often some of the most emotional issues involve those pertaining to children. It only makes sense. Most parents love their children far more than any property they own, more than any bank account, more than any pension or retirement fund. As a result, this fortunately means that even though parents can sometimes disagree on certain issues regarding their children, for the most part, parents what to do what is best for their children. They want to continue to love them, to spend time being an active part of their lives, and to provide for them.

It only makes sense. Most parents love their children far more than any property they own, more than any bank account, more than any pension or retirement fund. As a result, this fortunately means that even though parents can sometimes disagree on certain issues regarding their children, for the most part, parents what to do what is best for their children. They want to continue to love them, to spend time being an active part of their lives, and to provide for them.

It is this latter part – continuing to provide for children after a divorce that can, at times, be confusing for parents. While most parents want to continue to provide for their children, they often wonder how to determine exactly what that support should look like. Depending upon the particular job and salary schedule a parent has, there can be quite a few questions. One question often asked is – what about self-employed parents? How is child support calculated in those instances? It’s a good question, especially as, in our modern economy, more and more people are becoming self-employed all the time.

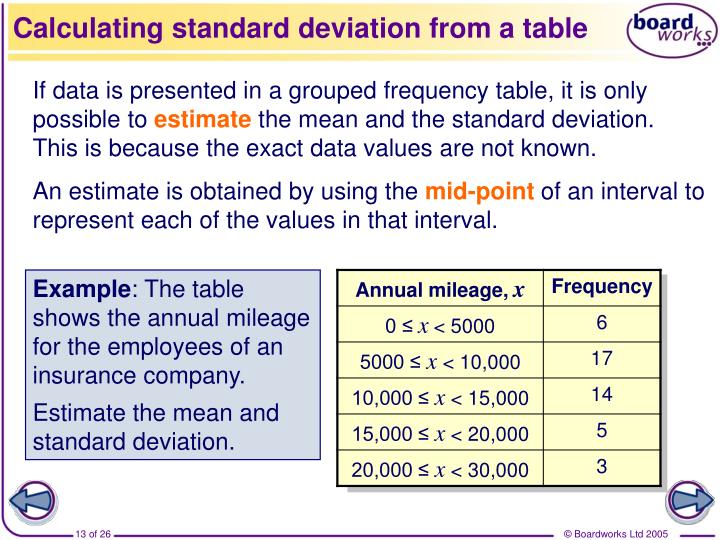

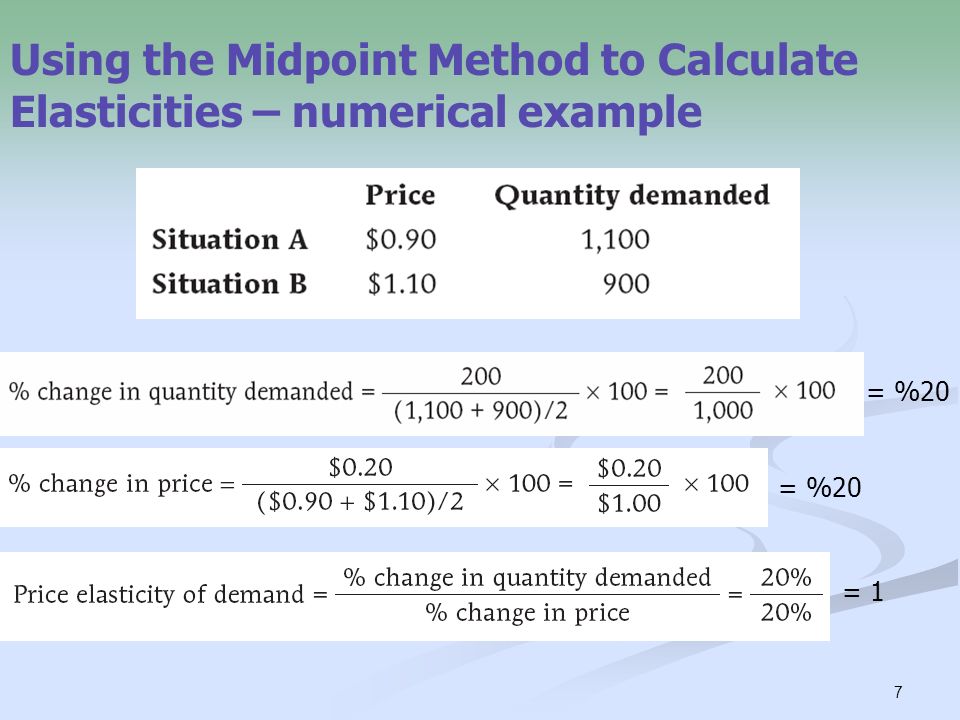

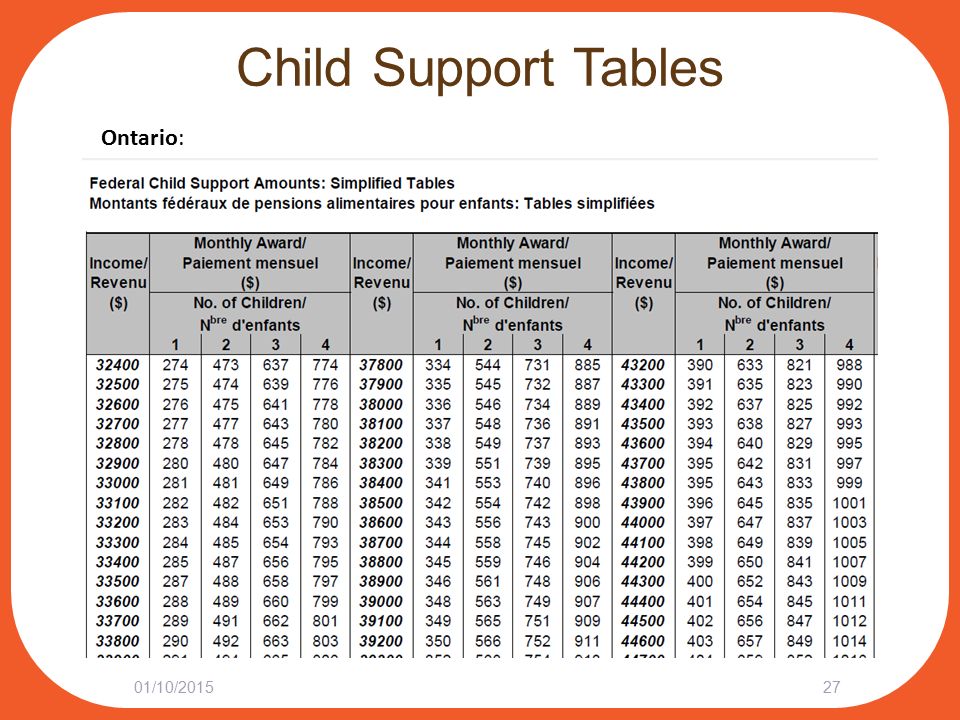

Fortunately for those wondering about potential child support obligations, the North Carolina Child Support Guidelines are fairly clear and straightforward in most circumstances. Generally, it requires inputting the income of each parent as well as the number of overnights that each parent has with a child to give a good idea of what the potential support obligation might be. Where self-employed individuals are concerned, however, calculating income on a regular schedule can, at times, be difficult to do.

Self-employment can take many forms. It may mean owning a solo legal or medical practice. It might mean owning a restaurant, or a hair salon, or starting a new IT business. Maybe it means doing freelance work. Whatever it looks like for you, it’s understandable to want to know how your income might be calculated for child support purposes. On the other hand, the other parent might be self-employed, and unfortunately, you may have concerns about whether or not that parent’s income might be easy to hide, or difficult to discern.

The North Carolina Child Support Guidelines address self-employment income by stating, “Gross income from self-employment, rent, royalties, proprietorship of a business, or joint ownership of a partnership or closely held corporation, is defined as gross receipts minus ordinary and necessary expenses required for self-employment or business operation.”

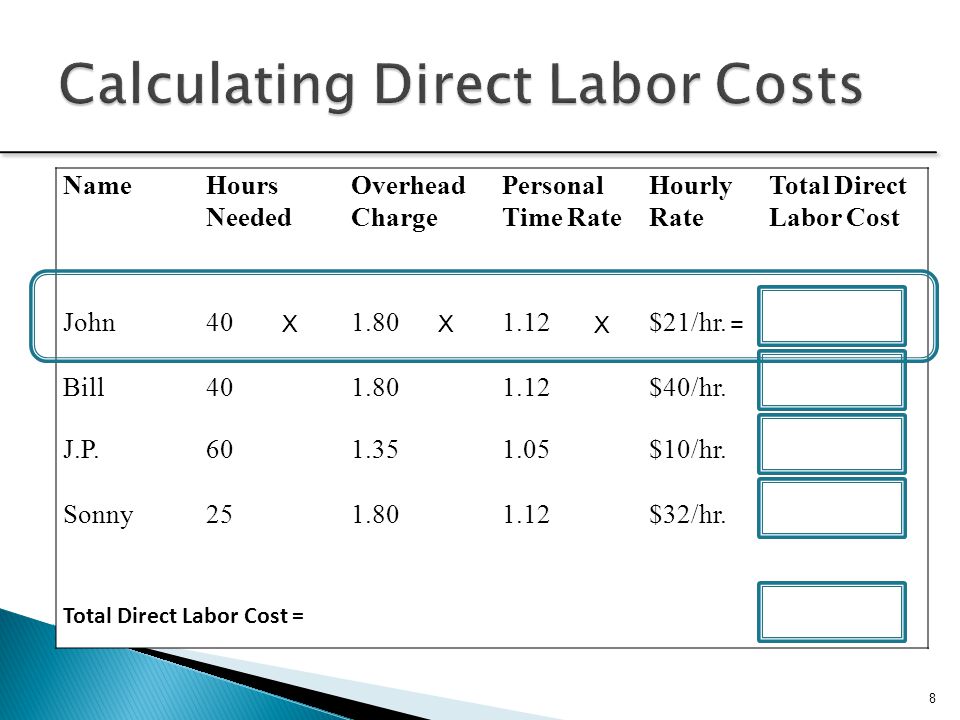

While that language may sound complex, essentially what it provides is a fairly basic formula – money made from a business venture should be subtracted from the money required to operate the business. Applying that formula will help you to arrive at the number utilized by the guidelines. Of course, sometimes, balancing revenue and expenses sounds easy, but isn’t in reality. In these cases, courts are usually given broad discretion in deciding which expenses are truly necessary expenses that should be deducted from the revenue of the employed parent.

This revenue versus expense method of calculation includes revenue and profits even if the income is not disbursed to the self-employed parent. In this way, it is more difficult for a self-employed parent to voluntarily depreciate his or her income. If you are the self-employed parent, it will be important to keep track of your revenue and expenses carefully. It will help you not only to determine what your potential child support obligation might be, but also to compile the information and provide it to the other parent, their attorney, or the court if necessary. Often the rules of civil procedure require these disclosures, so it’s important to have that information organized and available.

In this way, it is more difficult for a self-employed parent to voluntarily depreciate his or her income. If you are the self-employed parent, it will be important to keep track of your revenue and expenses carefully. It will help you not only to determine what your potential child support obligation might be, but also to compile the information and provide it to the other parent, their attorney, or the court if necessary. Often the rules of civil procedure require these disclosures, so it’s important to have that information organized and available.

Ultimately, whether you’re a self-employed parent who has questions about how child support will be calculated, or whether you’re the parent seeking child support from the self-employed parent, you’ll need the assistance of a knowledgeable and experienced attorney to help you through the process. At The Law Office of Dustin McCrary, that’s exactly why we’re here.

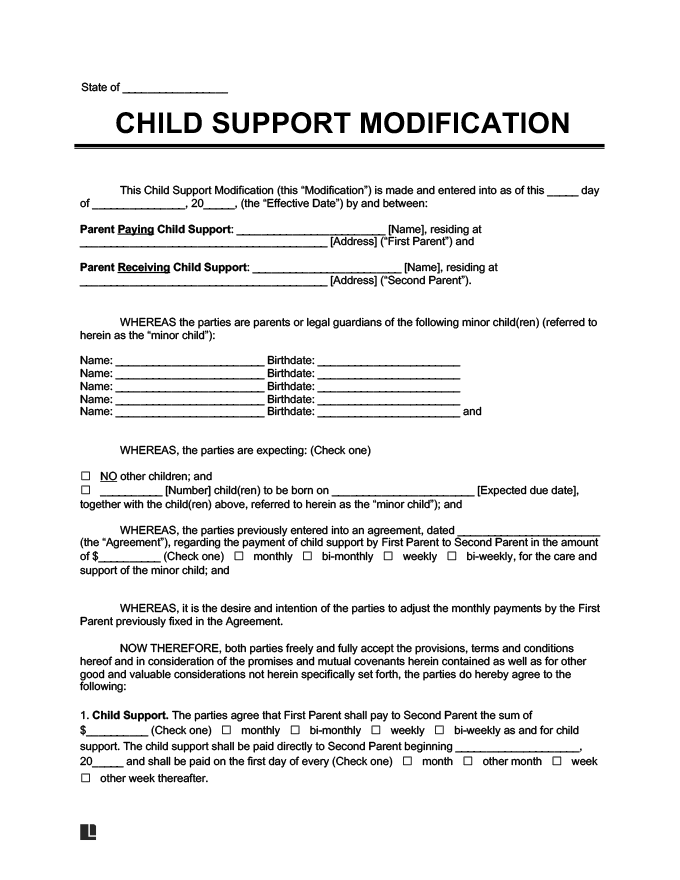

The Law Office of Dustin McCrary – Here for YouMaybe you find yourself contemplating divorce and unsure about what child support obligations might look like for your family. Or perhaps you’re in the midst of a divorce, and you aren’t sure how to determine what your obligations might be. It may be that you’re post-divorce, and circumstances have changed, and you’re wondering if support may need to be modified. Whatever your situation, and wherever you find yourself in the divorce process, at The Law Office of Dustin McCrary, we’re here for you. Divorce isn’t easy – but with the right legal assistance, it can be manageable. It won’t be free of pain – but it is possible to move forward toward a brighter, better chapter ahead. We’re here to help you do exactly that. Call us any time – we look forward to speaking with you soon.

Or perhaps you’re in the midst of a divorce, and you aren’t sure how to determine what your obligations might be. It may be that you’re post-divorce, and circumstances have changed, and you’re wondering if support may need to be modified. Whatever your situation, and wherever you find yourself in the divorce process, at The Law Office of Dustin McCrary, we’re here for you. Divorce isn’t easy – but with the right legal assistance, it can be manageable. It won’t be free of pain – but it is possible to move forward toward a brighter, better chapter ahead. We’re here to help you do exactly that. Call us any time – we look forward to speaking with you soon.

Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

The question arises: how can a self-employed person pay child support? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony.

The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony.

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it.

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the current situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim.

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- postal order.

Documents confirming the transfer of money should be kept. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it.

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child remains) can apply to the bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer.

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of alimony may be recalculated. The payout will be calculated in one of the following ways:

The payout will be calculated in one of the following ways:

- as a percentage of the payer's income - 25% for one child, 33% - for two children, 50% - for three or more children;

- by the combined method - part of the payment will be calculated as a percentage of the payer's permanent income, and part will be accrued as a fixed amount.

In order to recalculate, you will have to reapply to the court - it will take into account the circumstances that have arisen and establish a new procedure for calculating the amount of alimony.

Results

So, self-employed citizens do not have a permanent income, so the alimony they must pay is assigned in a fixed amount of money - for this you will have to go to court. If the parents of the child were able to agree on the amount of alimony on their own, you don’t have to go to court - it’s enough to conclude an agreement, fix the amount of the monthly payment in it and certify it with a notary.

- The Supreme Court of the Republic of Belarus

Issues related to the recovery of alimony are of great public interest and are always in the area of close attention of the judiciary. Conflict situations related to non-fulfillment of maintenance obligations are resolved in court. Consideration by the court of disputes on the recovery of alimony guarantees their quick and correct resolution, ensuring the protection of the rights and legitimate interests of children. The relevance of the topic raised is also due to the rather high number of disputes related to the recovery of alimony considered by the courts.

June 12 this year The program “Actual Microphone” of the First National Channel of the Belarusian Radio was devoted to this topic with the participation of the judge of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Belarus Vera Borisovna Krugova.

The program aroused great interest among the listeners, and we additionally publish an interview of the judge on such a socially important topic.

In the photo: Judge of the Supreme Court of the Republic of Belarus Vera Borisovna Krugova

- Vera Borisovna, tell us what is the procedure established by law when applying to the court for the recovery of alimony, can a citizen independently draw up an application without seeking legal advice?

- Alimony for minor children can be collected in order order and in order action proceedings . Recovery of alimony in the order of writ proceedings is carried out without holding a court session and calling the parties. By order, alimony can be recovered if this is not related to the establishment of paternity (maternity) or the need to involve third parties to participate in the case. In this case, the judge issues a ruling on a court order, which is also an executive document.

The statement of claim for the recovery of alimony is submitted in writing with a copy of the application to be sent to the defendant and must comply with the requirements of Art. Art. 109, 243 Code of Civil Procedure.

Art. 109, 243 Code of Civil Procedure.

By the way, on the information stands of the courts and on our Internet portal, there are samples of the most frequently filed statements of claim, including those on the recovery of child support in the order of action proceedings and on the recovery of alimony in the order of writ proceedings.

- Do I need to pay a state fee when applying to the court with an application for the recovery of alimony?

- No, you don't. In accordance with the requirements of the Tax Code, plaintiffs, applicants are exempted from paying the state fee when applying to the court with statements of claim and applications for initiating writ proceedings for the recovery of alimony. In this case, the obligation to pay the subsequent state duty rests with the defendant.

- As you know, one of the results of the judicial and legal reform was the creation of a unified system of bodies for the enforcement of court decisions and other executive documents. Where should I go to claim child support? Where does the competence of the court end and the bailiffs begin?

Where should I go to claim child support? Where does the competence of the court end and the bailiffs begin?

- Proceedings on the recovery of alimony ends with the issuance of a court decision (decision on the recovery of alimony, ruling on a court order on the recovery of alimony).

In cases of writ proceedings on the recovery of alimony, if the debtor does not object to the court within the prescribed period, the judge issues the exactor a ruling on the court order indicating the date of its entry into force for presenting it for execution. Business of action proceedings at the request of the recoverer, on the basis of a court decision on the recovery of alimony, a writ of execution is issued.

At the stage of issuing a court order to the recoverer, the competence of the court ends, and after presenting it for execution to the enforcement authorities, the competence of bailiffs begins.

- What if, in the opinion of the alimony collector, the bailiff is inactive or does not take all measures to collect alimony from the debtor?

- I believe that before appealing against the inaction of a bailiff, it is worth familiarizing yourself with the materials of the enforcement proceedings. It is likely that the bailiff is doing everything possible for this. But if the materials of the enforcement proceedings confirm the inaction of the bailiff, then the alimony collector has the right to appeal against the inaction of the bailiff in the manner prescribed by law. As for the procedure for appealing against the inaction of a bailiff directly to the court, it is regulated by Article 360-3 of the Code of Civil Procedure.

It is likely that the bailiff is doing everything possible for this. But if the materials of the enforcement proceedings confirm the inaction of the bailiff, then the alimony collector has the right to appeal against the inaction of the bailiff in the manner prescribed by law. As for the procedure for appealing against the inaction of a bailiff directly to the court, it is regulated by Article 360-3 of the Code of Civil Procedure.

- Can the parties voluntarily settle this issue without going to court, in addition to the court order for the recovery of alimony?

- Of course, it is possible. Alimony may be paid on a voluntary basis by a person obliged to pay alimony, or by deduction from wages at the place of work or at the place of receipt of a pension, allowance, stipend, or other payments. An employer paying wages, an organization that pays pensions, allowances, scholarships and makes other payments, are obliged, on the basis of a written application of the person paying alimony , to monthly withhold from his salary, pension, allowance, stipend and other payments monetary amounts of established amounts, taking into account the restrictions provided for by the legislative acts of the Republic of Belarus, and pay (transfer to an account, transfer according to mail at the expense of the person paying the alimony) no later than three days from the date of payment of wages, pensions, allowances, stipends and other payments to the person specified in the application.

- What if the alimony payer changes jobs?

- When a citizen, from whom alimony is withheld upon application, moves to another job or, for example, changes his place of residence, alimony is withheld on the basis of a newly submitted application. At the same time, alimony cannot be withheld on the basis of an application, if the total amount to be recovered on the basis of an application and executive documents exceeds 50 percent of the earnings and (or) other income due to the debtor, from which alimony is withheld, and also, if the debtor is recovered by a court order alimony for children from another mother, with the exception of the case of payment of alimony for minor children.

So, if alimony is paid for minor children, then on the basis of an application, alimony may be withheld and if the total amount of deductions on the basis of such an application and executive documents exceeds 50 percent of the earnings and (or) other income of the person obliged to pay alimony, but not more than 70 percent. That is, if the employee pays child support for minor children, which must be indicated in the application, the amount of alimony withheld can be more than 50 percent of earnings, but not more than 70 percent.

That is, if the employee pays child support for minor children, which must be indicated in the application, the amount of alimony withheld can be more than 50 percent of earnings, but not more than 70 percent.

At the same time, it should be noted that for able-bodied parents, the minimum amount of alimony per month should be at least 50 percent for one child, 75 percent for two children, 100 percent for three or more children of the living wage budget on average for per capita.

- Vera Borisovna, please explain how long it takes for alimony to be collected and is it possible to collect alimony for the past time? At the same time, alimony may also be collected for the past , but not more than for the previous three years, if the court establishes that before applying to the court, measures were taken to obtain funds for maintenance, but due to the evasion of the person obliged pay alimony, from their payment, alimony was not received.

- What can you say about the terms of consideration of cases of this category?

- Cases on claims for the recovery of alimony must be considered by the court of first instance no later than one month from the date of acceptance of the application. When considering cases by writ , the ruling on a court order for the recovery of alimony is issued within three days from the date of receipt of the application to the court. This means that by writ, alimony can be recovered more quickly than in a lawsuit, however, writ order is permissible only if this is not related to the establishment of paternity (maternity) or the need to involve third parties to participate in the case.

- How to collect alimony if the parent who is obliged to pay them lives and works outside of Belarus? Where can I apply for alimony?

- In this case, the plaintiff (collector) with an application for the recovery of alimony can apply to the court both at his place of residence and at the place of residence of the defendant (debtor).

The jurisdiction of the courts of the Republic of Belarus in civil cases in disputes involving foreign citizens, stateless persons, foreign legal entities, as well as in disputes in which at least one of the parties resides abroad, is determined by the legislation of the Republic of Belarus, unless otherwise established by international treaties of the Republic of Belarus or a written agreement of the parties.

For example, with regard to relations between the Republic of Belarus and the Russian Federation on the issue of recovery of alimony, the Convention on Legal Assistance and Legal Relations in Civil, Family and Criminal Matters applies, according to which cases on maintenance obligations fall within the competence of the court of the Contracting Party, in the territory in which parents and children have a permanent joint residence, and in the absence of a permanent joint residence of parents and children, the court of the Contracting Party of which the child is a citizen or, at the request of the claimant for maintenance obligations, the court of the Contracting Party in whose territory the child permanently resides.

It should be noted that on the issue of collecting alimony, the plaintiff can apply both to the Belarusian court at the place of his residence, and to the Russian court - at the place of residence of the defendant.

It is also important that on March 3, 2015, the Republic of Belarus and the Russian Federation signed an Agreement on the procedure for the mutual execution of court decisions in cases of recovery of alimony, by virtue of which no special procedure is required for the recognition and execution of court decisions.

As for other states, in each specific case it is necessary to proceed from the terms of an international agreement (if any).

- But what should a parent do if he does not have information about the place of residence of the other parent?

- A claim against a defendant whose place of residence is unknown or who does not have a place of residence in the Republic of Belarus may be brought at the location of his property or at his last known place of residence in the Republic of Belarus. If the place of residence of the defendant in claims for the recovery of alimony is unknown, the judge is obliged to announce the search for the defendant through the territorial bodies of internal affairs. In this case, the court may stay the proceedings on the recovery of alimony.

If the place of residence of the defendant in claims for the recovery of alimony is unknown, the judge is obliged to announce the search for the defendant through the territorial bodies of internal affairs. In this case, the court may stay the proceedings on the recovery of alimony.

- If the child's birth certificate does not contain information about the father or if the child is not recognized as the father, where should the mother go to collect maintenance?

- Mutual rights and obligations of parents and children (including the obligation of parents to support minor children) are based on the origin of children, certified in the prescribed manner.

The descent of a child from a father who is not married to the mother of the child is established on the basis of a joint application of the father and mother of the child for registration of the establishment of paternity, submitted to the civil registration authorities.

If the parents of the child are not married to each other and the civil registration authorities do not submit applications for registration of the establishment of paternity, and also if information about the father of the child is entered in the birth certificate at the direction of the unmarried mother, then paternity can be established in court.

Mutual rights and obligations between the father and the child, if the father and mother of the child are not married, arise from the moment the information about him as the father is entered in the record of the child's birth in the prescribed manner or from the moment the court decision on establishment of paternity, with the exception of the obligation to maintain, which may be imposed from the moment of filing a claim for the establishment of paternity.

Establishment of paternity in court is carried out at the request of one of the parents or guardian, guardian of the child, as well as the child himself upon reaching the age of majority.

Thus, if in the child's birth certificate information about the father is indicated from the words of the unmarried mother, then the question of establishing paternity should first be raised, and then - on the recovery of alimony. The plaintiff has the right to state such requirements in one statement of claim. In this case, alimony can be collected from the moment of filing a claim to establish paternity.

In this case, alimony can be collected from the moment of filing a claim to establish paternity.

For reference: with the decision in 2018, 20,625 cases on the recovery of alimony were considered, of which 20,227 cases (98%) were satisfied (in 2017, 20,670 cases on the recovery of alimony were considered, of which 20

- Quite often there are situations when a child lives in the summer or for another long time with a parent who is obliged to pay child support. alimony to pay for this period?0095

- Of course, a parent of a child who is obliged by a court order to pay child support must, in accordance with the requirements of the Code of Civil Procedure, execute the court decision. At the same time, the parents of the child in this case, already within the framework of enforcement proceedings, can conclude an amicable agreement, which is approved by the court, on the issue of the fulfillment of maintenance obligations by the father during the specified period.

- What to do in cases when alimony is forcibly collected from a parent, since he did not pay money for the maintenance of the child, but it turns out that at the same time he provided the child with food and clothes. Does this count towards child support?

- Let's analyze the provisions of Chapter 11 of the Code of the Republic of Belarus on Marriage and Family (CoBS). They point out that alimony is usually a cash payment. The possibility of paying alimony in a non-monetary form, for example, by transferring property to the ownership of a child, can only be provided for by a notarized Agreement on the payment of alimony or a marriage contract. I want to note that a parent who is obliged to pay alimony has the right to provide his child with material maintenance and more than the amount determined by the court.

- Continuing the topic of the Marriage Agreement, the Agreement on the payment of alimony and the Agreement on children. What is the procedure to be followed in order to enter into a Marriage Agreement, Support Agreement and Children Agreement? How often do parents conclude them, because many of the parents do not even know about such an opportunity provided by law?

What is the procedure to be followed in order to enter into a Marriage Agreement, Support Agreement and Children Agreement? How often do parents conclude them, because many of the parents do not even know about such an opportunity provided by law?

- Issues of maintenance, determination of the place of residence of children and other issues related to the upbringing of children can be settled by spouses in the Marriage Agreement, Agreement on Children. In the Agreement on the payment of alimony, only questions about the amount, methods and procedure for paying alimony can be resolved.

A marriage contract is concluded in writing and is subject to notarization. If the Marriage Agreement contains conditions that are or may become the basis for the emergence, transfer, termination of rights, restrictions (encumbrances) of rights to real estate, then also requires mandatory state registration of the Marriage Agreement in the organization for the state registration of real estate, rights to it and transactions with him. The legislator makes the same requirements for the Agreement on the payment of alimony. Spouses may conclude an agreement on children in accordance with the procedure established by the Code of Civil Procedure for amicable agreements upon dissolution of marriage in court.

The legislator makes the same requirements for the Agreement on the payment of alimony. Spouses may conclude an agreement on children in accordance with the procedure established by the Code of Civil Procedure for amicable agreements upon dissolution of marriage in court.

The legislator does not exclude the possibility of specifying in the Marriage Agreement, Agreement on the payment of alimony, Agreement on children the payment of alimony in a fixed amount of money, in basic values, as a percentage of earnings.

An agreement on the payment of alimony cannot be concluded if the alimony is paid in accordance with the Marriage Agreement or the Agreement on Children concluded in accordance with the procedure established by the legislation of the Republic of Belarus, as well as a court decision that has entered into force, which resolves the issues of paying alimony for minors and (or) disabled adult children in need of assistance (part 7 of article 91 KoBS).

- Can any amount of maintenance for minor children be determined by the parties in the Marriage Agreement, Alimony Agreement, Agreement on Children?

- The terms of the Marriage Agreement, the Agreement on the payment of alimony or the Agreement on children must not violate the rights and legitimate interests of other persons, and must not contradict the legislation of the Republic of Belarus. That is, the amount of alimony specified in the Marriage Agreement, the Agreement on the payment of alimony or the Children's Agreement must not be less than the amount established by Article 92 of the Code of Civil Procedure, from which the courts proceed when collecting alimony in court.

That is, the amount of alimony specified in the Marriage Agreement, the Agreement on the payment of alimony or the Children's Agreement must not be less than the amount established by Article 92 of the Code of Civil Procedure, from which the courts proceed when collecting alimony in court.

For reference: according to the Ministry of Justice of the Republic of Belarus, in 2018 notaries of the republic certified 3,923 marriage contracts and 191 agreements on the payment of alimony.

- The issue of the possibility of paying alimony by transferring real estate to the child's ownership is topical. How does it work in practice?

- Legislator allows the possibility of paying alimony by transferring real estate to the child's ownership. Such a procedure may be fixed in the Marriage Agreement or in the Agreement on the payment of alimony. If the alimony is collected by the court as a percentage of earnings or in a fixed amount of money or in basic units, then the issue of paying alimony for the future by transferring real estate to the child’s ownership can be resolved by the child’s parents by mutual agreement within the framework of enforcement proceedings by concluding a settlement agreement which is subject to court approval.

- There are cases when, according to several court decisions, child support was awarded from the defendant from different mothers or fathers, and in total the amount of child support exceeds the amount established by law. In this situation, is it possible to reduce the amount of alimony?

- Indeed, the legislator allows the possibility of reducing the amount of alimony by the court if the parent obliged to pay alimony has other minor children who, when collecting alimony, turned out to be less financially secure than children receiving alimony, and also if such parent is a disabled person of 1 or 2 groups. In the event of such circumstances, the parent paying child support for minor children under a court order has the right to file a claim for a reduction in the amount of child support established by the court and collected for the maintenance of children.

It is also important that in exceptional cases the court may release a parent who is a disabled person of group I or II from paying alimony, as well as reduce the minimum amount of alimony levied from an able-bodied parent who, for objective reasons, cannot pay them within the prescribed limits. sizes.

sizes.

- What financial support can a mother who is on leave to care for a child under the age of three receive from the child's father if the parents do not live together?

- A parent caring for a common child up to the age of three and in need of financial assistance has the right to receive maintenance from the other parent who has the necessary means for this, if they are married, and retains this right in case of divorce. In this case, the spouse in need of financial assistance and taking care of the child has the right to file a lawsuit against the second spouse (former spouse) for the recovery of funds for his maintenance until the child reaches the age of three. The amount of the amount awarded will depend on the need of the plaintiff, as well as take into account the financial and marital status of the other spouse who is obliged to provide material support, his obligations to other persons whom he is also obliged by law to help. If the conditions that are the basis for receiving maintenance have disappeared, and also if the divorced spouse receiving maintenance funds enters into a new marriage, then the spouse paying such funds by a court decision has the right to apply to the court to release him from their further payment .

- Is a parent obligated to support their child after they turn 18?

- The obligation to support children after they reach the age of 18 is enshrined in legislation in relation to disabled adult children in need of assistance. Also, the Marriage Agreement or the Agreement on the payment of alimony may provide for the payment of alimony for children even after they reach the age of majority (for example, until the child receives the first higher education after graduation from school).

- Vera Borisovna, could you explain what procedure a claimant must follow in order to directly execute a court decision after a court decision on the recovery of alimony has been issued?

- The exactor must obtain from the court that issued the court order on the recovery of alimony, a writ of execution or a ruling on a court order, and apply with it to the enforcement authority with an application to initiate enforcement proceedings. It should also be noted that if a party under the Marriage Agreement, the Agreement on the payment of alimony, the Agreement on children does not fulfill its obligations to pay alimony, the exactor has the right to apply to the court for the issuance of a writ of execution and present it to the enforcement authority for the enforcement of alimony.

- Parents often evade paying child support. What responsibility is provided by the legislation of the Republic of Belarus for parents evading the maintenance of their children?

- For parents evading for more than three months during a year from paying, by court order, funds for the maintenance of minors or adults, but disabled and in need of assistance, children are subject to criminal liability.

In particular, the sanction of Part 1 of Art. 174 of the Criminal Code provides for punishment in the form of community service or correctional labor for up to two years, or arrest, or restriction of liberty for up to three years, or imprisonment for up to one year.

In the event of the commission of the specified act by a person previously convicted of evading the maintenance of children, Part 3 of Art. 174 of the Criminal Code provides for punishment in the form of correctional labor for a term of one to two years, or arrest, or restriction of liberty for a term of one to three years, or imprisonment for a term of up to two years.

- Summarizing all of the above, it is necessary to once again emphasize the importance of the topic discussed today and the increased interest in it from the public. And how important is it for the judiciary?

- Consideration of cases related to the protection of children is one of the priorities of the courts. When considering marriage and family disputes, including the recovery of alimony, the courts take comprehensive measures aimed at reconciling spouses, preserving the family and, most importantly, protecting the rights and interests of children. After all, in a modern civilized society, a child is a specially protected value, universally recognized at the world level and has the right to such material support from the family and the state, which is necessary for his full physical and mental development, the realization of natural inclinations and talents, education in accordance with his abilities in order to promote the harmonious development of the individual and the education of a worthy member of society.