How to buy health insurance for child

How to Shop for Health Insurance (for Parents)

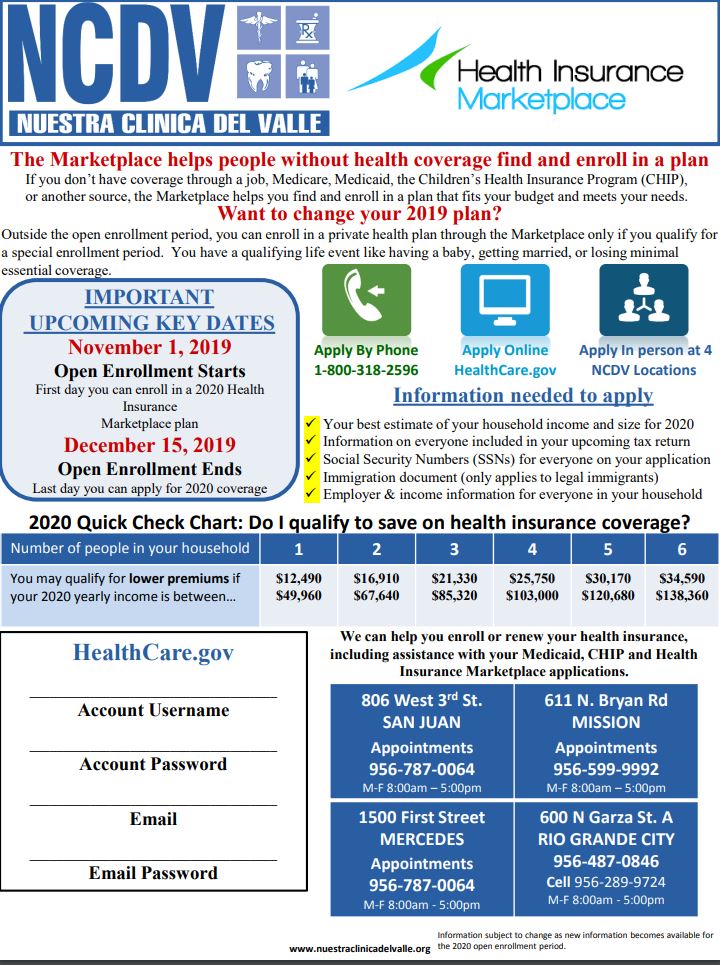

Note: Some parts of the Affordable Care Act ("Obamacare") are being changed or eliminated via government policies and laws. It is likely that some of the rules and regulations affecting the health insurance marketplace will continue to change over time. To stay up to date on Obamacare and other health insurance issues, visit healthcare.gov and the website of the health commissioner's office in your state.

In America today, we all need health insurance. You do. Your kids do. It's not a "nice to have" anymore — it's a "must-have." And that's the law. In most cases, parents who aren't covered (or don't have their kids covered) by health insurance might have to pay a fine each year. Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

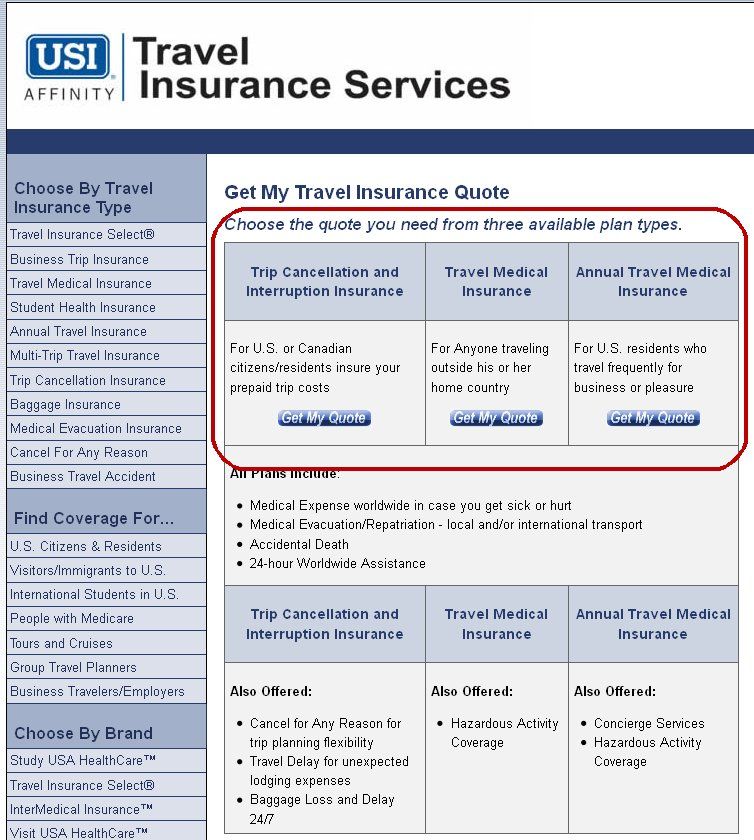

To help people get health insurance, the federal and state governments set up a health insurance marketplace (also called the health care exchange). This makes it easier than ever to get coverage, but the process can seem a bit confusing.

Here's what to do to get health insurance.

Getting Started

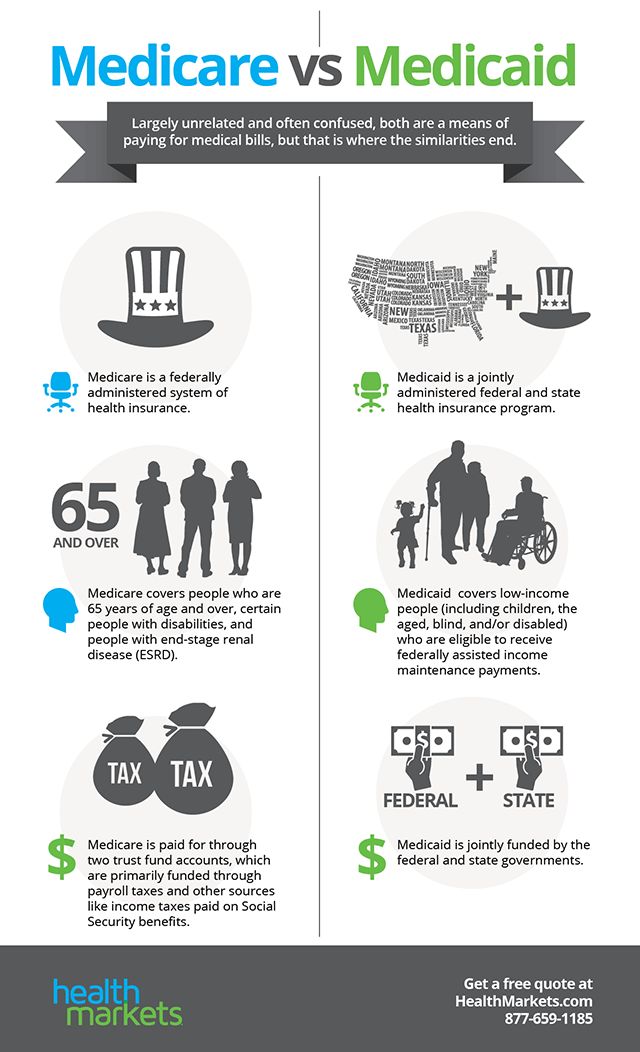

Before you look for a health insurance plan, check to see if you or your child can get coverage some other way. The government considers a person covered if they have Medicare, Medicaid, a state-run child health insurance plan (CHIP), or insurance they get through a parent or spouse's job. Your child could already be covered by or be eligible for free or low-cost coverage through a public program.

If you need to get insurance for yourself or your child, you can go online and visit the U.S. Government's comprehensive health care website (www.healthcare.gov). There, you can apply for CHIP or Medicaid or shop for a plan.

It's important to remember, however, that you can only buy insurance through the health care marketplace during the open enrollment period, which begins in mid-November and lasts until February. If the enrollment period is over, you or your child may have to get insurance through a private insurer to be covered for that year.

If the enrollment period is over, you or your child may have to get insurance through a private insurer to be covered for that year.

In some states, the health care exchange is run by healthcare.gov. Other states run it themselves. If you live in one of those states, you can visit your state's official marketplace website directly or link to it through healthcare.gov.

If you don't have regular access to a computer, you can call the U.S. Government's help line at 1-800-318-2596 to fill out an application, enroll, or compare plans.

p

How to Apply for a Plan

Applying for an insurance plan through the health care marketplace can be done online through healthcare.gov or a state site, over the phone, or through regular mail by filling out a form that can be mailed to you or downloaded from the Internet.

Before you fill out an online application, you'll need to create an account on either healthcare.gov or your state's marketplace.

You'll need to know a few things about each person applying for coverage. Be ready to provide:

Be ready to provide:

- Social Security numbers (or document numbers for legal immigrants)

- information about employers and income

- policy numbers for any current health insurance plans

If you have a job that offers health insurance but you're not happy with it, you can choose to get coverage through healthcare.gov instead. But before you apply, you'll need to fill out a form called an Employer Coverage Tool that can be found on the healthcare.gov website.

The application will ask for standard information like your name, your child's name, your address, phone number, and email. You'll need to answer questions about citizenship, dependents, and whether you plan to file a federal income tax return the following year.

If you want help paying for insurance, you will have to provide information about your yearly income (and the income of anyone else applying for coverage). This includes income from jobs and other sources like:

- Social Security

- unemployment

- retirement accounts

- property rental

- alimony

If you pay alimony or interest on student loans, you can deduct the amount you pay when you fill out your application.

What Happens Next?

Once you've submitted an application, healthcare.gov or your state's site will determine if you or your children qualify for Medicare, Medicaid, or CHIP. It will also determine if you or your children are eligible to get insurance through the health care marketplace. For most people, if you're an American citizen or legal immigrant and you're not in jail, you'll be eligible.

Although it's unlikely, sometimes parents are eligible to buy insurance through the health care marketplace but their children aren't. Sometimes kids are eligible but their parents aren't. If either of these apply to you, you would have the right to appeal the decision, and you could still get private insurance for anyone needing coverage.

If you're eligible for coverage but don't qualify for any publicly subsidized programs, the health care marketplace will present you with the insurance plans available in your state based on your income and family situation. It will be up to you to decide which policy to buy.

p

What to Look for When Choosing a Policy

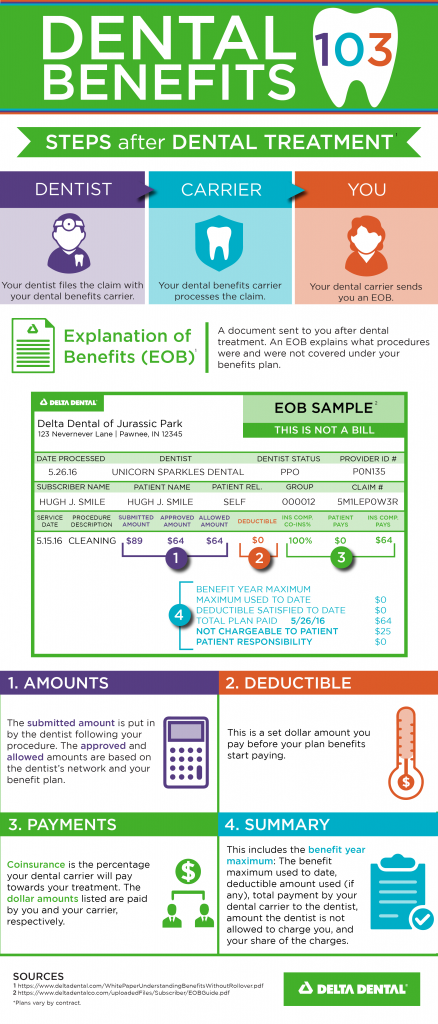

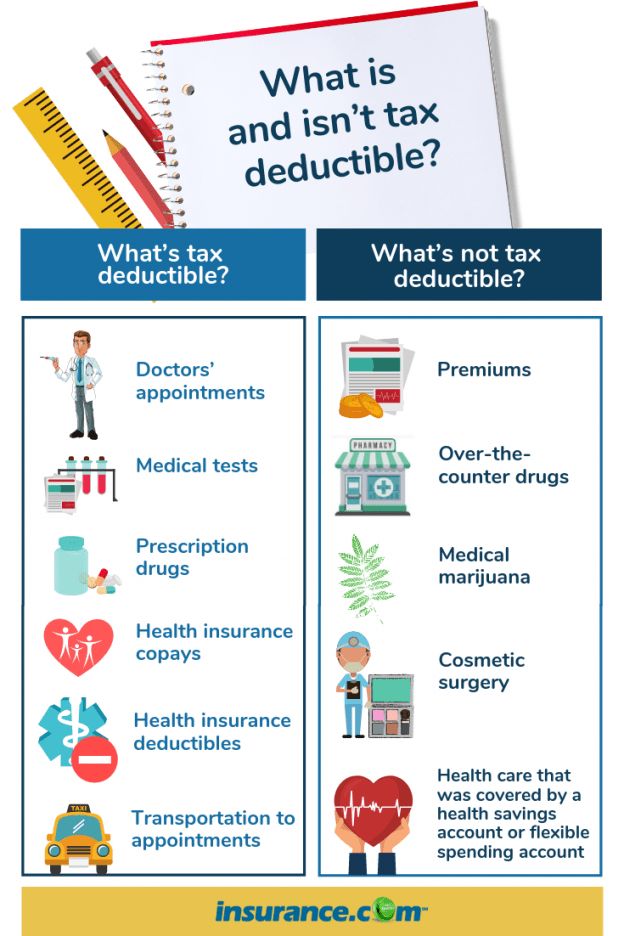

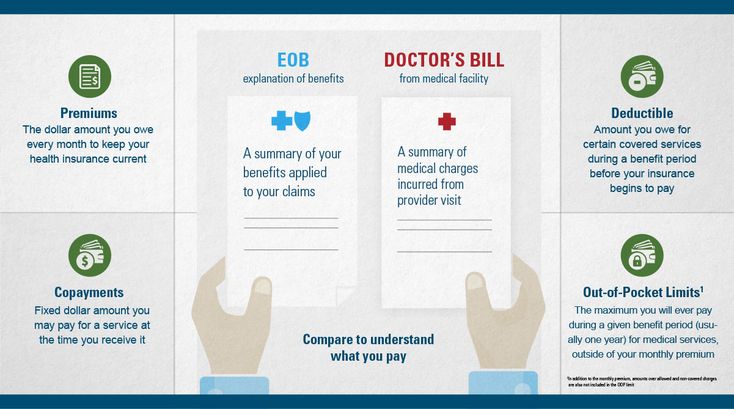

The important words to remember when shopping for a policy are "premium" and "deductible." The premium is the amount you pay each month for coverage. The deductible is the amount you need to pay each year for medical services before your health insurance kicks in. As a general rule, insurance plans with low premiums have high deductibles, and plans with high premiums have low deductibles.

These are the basic levels of coverage:

- Catastrophic insurance is designed to protect an otherwise healthy person in the event of a major injury or illness. It's available only to people under age 30 and those who are exempt from other plans due to hardship. This type of insurance can have low premiums but very high deductibles. Plans generally cover less than 60% of the costs of health care.

- Bronze plans also have low premiums and high deductibles, but they offer better coverage than catastrophic insurance, typically paying for 60% of costs.

- Silver plans and gold plans have average-sized premiums and average-sized deductibles. Silver plans cover 70% of costs. Gold plans pay 80% of costs.

- Platinum plans, the highest level of coverage, have high premiums and low deductibles. These plans cover 90% or more of health care costs.

All catastrophic, bronze, silver, gold, and platinum plans offer free or discounted visits to the doctor for things like routine checkups or vaccinations and some preventive care. Most plans also offer discounts on prescription drugs and other services. Specific benefits differ from plan to plan, though, so you'll need to learn what each plan offers. Think about what's important to you and your family and make a decision based on how well the plan meets your needs.

When Can I Start Using My Insurance?

Once you've signed up for a plan and paid the first month's premium, you or your child can start using the insurance. The insurance company should send you and everyone covered by your policy insurance cards with your policy number and other information. If you or your child need to see a doctor or go to a hospital before you receive your card, call your insurance company first to make sure your family has been entered into their system.

The insurance company should send you and everyone covered by your policy insurance cards with your policy number and other information. If you or your child need to see a doctor or go to a hospital before you receive your card, call your insurance company first to make sure your family has been entered into their system.

You should also make sure that any doctor you choose for you or your child is in your insurance plan's network. A network is made up of doctors, specialists, and other health care providers who have agreed to work with your insurance company when it comes to payments and services. If you take your child to a doctor who isn't in your plan's network, you may have to pay full price for some services.

Ask around and learn what you can about the primary care physicians in your plan's network, and then choose a doctor you like. Once you've done that, schedule checkups and use your insurance to help keep your family healthy.

Reviewed by: Steven Dowshen, MD

Date reviewed: July 2018

Home | InsureKidsNow.

gov

govRenew your Medicaid or CHIP coverage

As COVID-19 becomes less of a threat, states will restart yearly Medicaid and CHIP eligibility reviews. This means your state will use the information they have to decide if you or your family member(s) still qualify for Medicaid or CHIP coverage. If your state needs more information from you to make a coverage decision, they’ll send you a renewal letter in the mail. Go to Medicaid.gov/renewals, find a link to your state Medicaid office and confirm your contact information is up-to-date.

Millions of children and teens qualify for free or low-cost health and dental coverage through Medicaid & the Children's Health Insurance Program (CHIP).

Learn about coverage options for your family or help us spread the word about free or low-cost health insurance coverage!

Find a Dentist

Use the Dentist Locator to find a dentist in your community who sees children and accepts Medicaid and CHIP.

Required

Select a StateAlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareDistrict of ColumbiaFloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyoming

Benefit Plan

Find a Dentist In Your State

Find Coverage for Your Family

Medicaid and CHIP offer free or low-cost health insurance for kids and teens. Select your state to find information on health insurance programs in your state or call 1-877-KIDS-NOW (1-877-543-7669).

Select your state to find information on health insurance programs in your state or call 1-877-KIDS-NOW (1-877-543-7669).

Already enrolled? Don’t risk losing your coverage. Confirm your contact information is up-to-date with your state. And keep an eye out for an important renewal letter being mailed to you.

State Name Select Your StateAlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareDistrict of ColumbiaFloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyomingVaccine Outreach Materials Available!

COVID-19 vaccinations are recommended for children aged 6 months and up. Use these tools to remind families that vaccines are covered by Medicaid and CHIP.

Image

Download Materials

Mental and Behavioral Health Resources Available!

Use these resources to encourage parents and caregivers to enroll children and teens in Medicaid and CHIP to access important mental and behavioral health benefits. Coverage includes services to prevent, diagnose, and treat mental health symptoms and disorders. Learn more here.

How to apply for a VHI policy for a child

Ekaterina Ivanova

issued a VHI policy for a child

Author profile

I became disillusioned with ordinary children's clinics and decided to switch to voluntary medical insurance.

Before the birth of our son, we lived in one of the districts of St. Petersburg, where, by registration, we were served in a private clinic that provides compulsory medical insurance services. It replaced an ordinary state hospital for us, while maintaining all the advantages of private medicine: clean, tidy, polite staff, prompt medical care. nine0003

nine0003

With the advent of the child, we bought a larger apartment in one of the cities of the Leningrad region. Next to it was a state outpatient clinic - a branch of the district hospital. We wanted to be observed there, but faced a number of problems.

For example, the hospital was in poor condition, we had to go to a different place to see narrow specialists, there were huge queues everywhere, and sometimes we waited weeks for an appointment. And most importantly, the district pediatrician: relations with him did not work out from the first minute of our acquaintance, I did not want to torment either the child or myself. nine0003

I'll tell you how I took out a children's voluntary health insurance policy, what is included in voluntary health insurance for children and how to choose an insurance company.

Go see a doctor

Our articles are written with love for evidence-based medicine. We refer to authoritative sources and go to doctors with a good reputation for comments. But remember: the responsibility for your health lies with you and your doctor. We don't write prescriptions, we make recommendations. Relying on our point of view or not is up to you. nine0003

But remember: the responsibility for your health lies with you and your doctor. We don't write prescriptions, we make recommendations. Relying on our point of view or not is up to you. nine0003

Why I decided to take out a VHI policy for my child

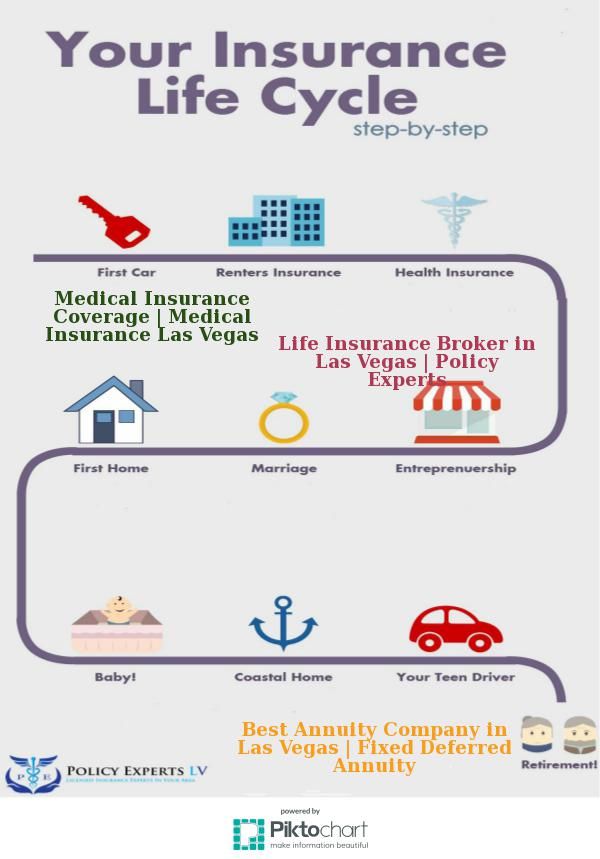

After problems at the public clinic, I decided that I would only go to private hospitals with my child. In this case, there are three options.

See a doctor if necessary. That is, do not pay anything in advance, but simply come to the clinic when necessary and pay for the services provided. In this case, I didn’t like that there would not be one pediatrician who leads the child and knows his medical history.

In addition, it is beneficial for private clinics to prescribe additional, non-strictly mandatory examinations and tests. It is difficult for a person who is not versed in medicine to understand which of them are really needed. The last thing in the world I wanted to go to a paid appointment and for my own money to experience distrust of the doctor and anxiety.

/super-dms-pros-cons/

Pros and cons: is it worth being treated under VHI

Buy a subscription. This is similar to voluntary health insurance, but differs from it in a number of ways. nine0003

In this case, you pay in advance for a certain set of services. It can be spelled out in detail, or possible services received according to indications can be indicated. For example, a children's program for a year may include monthly consultations with a pediatrician, several consultations of narrow specialists, vaccinations, and a certain number of diagnostic tests. The cost of such programs starts from 50,000 R per year.

What can be included in the simplest basic program for a children's subscription from a private clinic. Source: medi.spb.ru There are extended subscription programs, which may include appointments of various specialists. The more services in the subscription, the more expensive it is. Source: smdoctor. ru

ru VHI policy. This is insurance in case of illness or the need for an examination. That is, you are not buying a subscription to one private clinic with a list of specific services, but access to the services of the clinic for medical reasons.

You can visit clinics for an insured event — specific situations specified in the insurance contract. At the same time, the insurance company tries to ensure that its clients are admitted to partner clinics without queues and other delays.

Most voluntary insurance programs for adults do not include scheduled visits to the doctor, obtaining certificates, check-ups - only visits to the clinic due to diseases, injuries, and the like. Children's VHI programs include outpatient monitoring programs, which include scheduled visits to pediatricians and examinations, as well as routine vaccinations. nine0003

/dms/

What is VHI

I liked VHI more than a subscription, because insurance companies usually work with different clinics in one region, and not with one. That is, you can choose the one that is more suitable, or visit different ones, taking into account the circumstances: for example, in one clinic there is a good pediatrician, and in another - narrow specialists. And in the event of a disputable situation, the insurance company will join the process and try to resolve the conflict.

That is, you can choose the one that is more suitable, or visit different ones, taking into account the circumstances: for example, in one clinic there is a good pediatrician, and in another - narrow specialists. And in the event of a disputable situation, the insurance company will join the process and try to resolve the conflict.

On the other hand, a subscription may be more convenient for routine monitoring of a child. As a rule, children's programs include all required medical examinations, vaccinations and examinations. nine0003

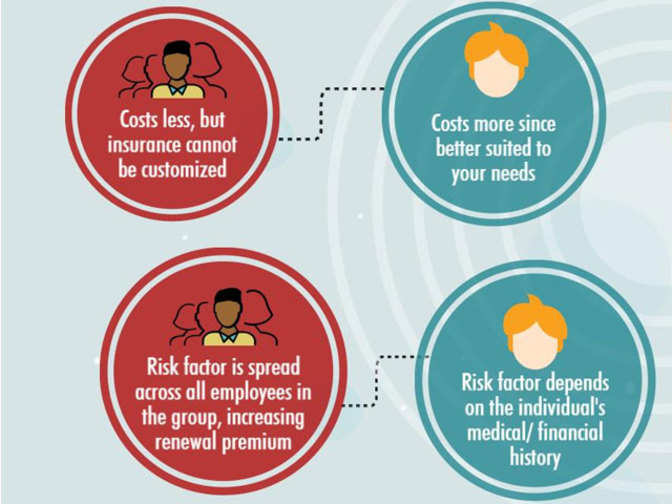

Comparison of the cost of visits to a private clinic as needed, subscription and VHI policy

| Parameter | Visits to a private clinic when needed | Subscription to a private clinic | Child health insurance policy |

|---|---|---|---|

| Cost | Depends on frequency | On average from 50,000 R per year | On average, from 25,000 R per year, depends, among other things, on the age of the child |

| What's in | One-time visits as needed | Specific services specified in the contract | Possibility to apply for help, when there is a need, within the insurance event |

| Visits to different clinics | Yes | No | Yes, of those that are among the partners of the insurance company |

| Help in conflict situations | No | No | You can contact an insurance agent |

Appeals in private clinico need

Cost

Depends on the incidence of

What includes

,One -time visits, Visiting various clinics

Yes

Subscription to a private clinic

Cost

On average from 50,000 R per year

What includes

specific services specified in the contract

Visiting different clinics

No

Assistance in conflict situations

No

Children's policy of DMS

Cost

on average from 25,000 r per year, depends, among other things, on the age of the child

What is included

The ability to apply for help, when there is a need, within the framework of an insured event

Visits to different clinics

Yes, from those that are among the partners of the insurance company

Help in conflict situations

You can contact an insurance agent

Which VHI policy to choose for a child

VHI policies for children, as well as for adults, are divided into type: with and without a franchise.

Franchise policy. Franchise can be of three types: conditional, unconditional and temporary.

The deductible itself is the amount within which the patient pays for the treatment himself. A conditional deductible means that if the cost of treatment exceeds this amount, the insurance will pay for everything in full. nine0003

For example, the deductible is 10,000 R. If the treatment cost 9999 R, it is paid by the patient, and if it costs 10,100 R, the insurance company.

Unconditional deductible means that if the cost of treatment exceeds a set amount, the insurance company will pay only this excess. For example, if the deductible is Rs 10,000 and the treatment cost Rs 15,000, the insurance company will pay only Rs 5,000. For example, after six months. nine0003

Most insurances have a two-week “cooling off period”: during this period, the client can return the money if he changes his mind, and many policies do not start working until two weeks later, when a refund is not possible. This does not always happen: I was able to use my child's policy in two days.

This does not always happen: I was able to use my child's policy in two days.

/dms-korporat/

How to competently use corporate VHI

Policy without franchise. This means that the client, upon purchase, pays the cost of the policy and uses all the services included in the contract without paying anything extra to the clinics. You only need to pay extra for what is not included in the insurance program. A VHI policy without a deductible is more expensive, but if there are no serious diseases that increase the price of the service, it can be more profitable. nine0003

I did not consider franchise policies. I wanted to pay once and not think about where to urgently look for money for doctors if the child gets sick. In addition, the son is growing up as a relatively healthy child, he does not need expensive treatment. And this means that, most likely, the cost of calling a doctor each time will fit into the size of the deductible, such a policy is useless for me.

How I chose an insurance company

When I was looking for a suitable VHI option, I did not have a list of insurance companies or a specific company that I would like to insure with. I have never come across this area before. Therefore, I searched the same way as any other information on the Internet.

When choosing, I paid attention to the following points.

Reviews. Of course, you cannot rely only on them, since the personal experience of acquaintances can be subjective, and reviews on the Internet can be paid. But if there are a lot of negative reviews, this is a reason to think and bypass the company. nine0003

Availability of a license to conduct insurance activities. You can check it in the Unified State Register of Insurance Business Entities.

Date of foundation. Companies that have been on the market for many years are more trustworthy. Although this, of course, does not mean that the young firm will necessarily be worse off.

Although this, of course, does not mean that the young firm will necessarily be worse off.

/turistmod/

How to choose insurance

Prices. Too low cost of insurance may indicate that the policy covers almost nothing. nine0003

In principle, not all insurance companies are suitable for applying for children's VHI. Some work only with corporate clients, that is, companies that want to buy VHI for employees, while others have services only for adult patients.

There are also insurance companies that offer only deductible policies, which didn't work for me either. Some insurance companies do not have partner clinics in the Leningrad region. And in a company from one large bank, I was offered to be served in the same district clinic where we went for free. nine0003

There are special aggregator sites, such as Sravni-ru, which select VHI policies based on user requests. You can see the ratings of specific insurers on them. For example, there I found a company that worked in my city and offered children's policies. But I didn’t like the overall rating of users, the reviews on the Internet were also negative, so I didn’t take a policy from them.

For example, there I found a company that worked in my city and offered children's policies. But I didn’t like the overall rating of users, the reviews on the Internet were also negative, so I didn’t take a policy from them.

As a result, I chose only between two insurance companies, although at the beginning of the search it seemed that there was a wide choice of VHI programs on the market. I bought a policy where there was the best ratio of price and set of services. nine0003 On aggregator sites, you can find offers from insurance companies for various requests. Source: sravni.ru You can also see the rating of insurers on Yandex Maps. Source: Yandex Maps At first, I chose from three insurance companies, but one did not like the large number of negative reviews on the Internet. Source: Yandex Maps

How to choose the right insurance program for your child

Decide what kind of medical care you need. The more services included in the program and the more comfortable the conditions, the more expensive the policy. nine0003

nine0003

For example, it was important for me that the insurance included scheduled medical examinations, that I could get a medical card for the kindergarten and call specialists at home, and that a nurse would come home to take the tests prescribed by the doctor.

To choose the right insurance program, just check two parameters.

What medical services are included in the program. For example, it may include only outpatient treatment or also inpatient treatment. Hospital services increase the cost of the policy. There are programs that include calling a private ambulance, usually they also cost more. nine0003

You can visit a doctor at the clinic, or you can call at home - such visits are not included in all insurance programs. It is important to pay attention to the number of consultations: somewhere it is limited, and somewhere you can visit doctors as much as you like, if there is a reason for it.

/save/dms-hack/

How to save money on non-VHI medical services?

VHI for children may include dentistry, routine vaccinations, various examinations, laboratory tests, and other services. Before choosing a program, it is worth making a list of what you will definitely need. nine0003

Before choosing a program, it is worth making a list of what you will definitely need. nine0003

Usually, each insurance company has several options for insurance programs, depending on the volume of services. Conventionally, they can be called as follows: basic, comfortable and luxury. The names of packages for different insurance companies may differ, but the essence is the same.

The basic set will include a standard set necessary for a relatively healthy person: specialists and tests as in the nearest clinic, a limited number of times. Comfort will contain either a little more services than the basic one, or the same, but more often. A suite usually means that everything is included and in unlimited quantities, including an ambulance with a dentist. nine0003

Which clinics are included in the policy. Insurance companies often work with many clinics and divide them into levels or categories. The higher the level, the more expensive the policy.

The difference between the service packages of one insurance company can be in the number of examinations and examinations, as well as in the level of clinics: different categories of insurance include different medical institutions. Source: reso-insurance.ru

Source: reso-insurance.ru The initial state of health of the client also affects the cost of the policy. Before concluding the contract, you need to fill out a detailed questionnaire. If a person hid from the insurance company a chronic disease that he knew about, and then demanded treatment, the company may terminate the contract unilaterally. nine0003

In addition, the age of the child affects the price of insurance. The most expensive insurance programs are for children under 3-5 years old, because they need to undergo more routine examinations, visits to doctors for illness are usually required more often.

Sometimes insurance companies allocate programs for children under one year old - these are also expensive, since they may include vaccination and a large number of scheduled visits to the clinic needed to monitor the development of the baby.

When I bought a policy for my child, he was almost two years old - all the services I needed were included in the basic package of one of the insurance companies for children under three years old. The clinic they collaborated with also suited me. The policy cost 56,100 R per year. nine0003

The clinic they collaborated with also suited me. The policy cost 56,100 R per year. nine0003

56,100 R

cost of an annual policy for a child

How to use the children's VHI policy

Choosing a clinic and doctor. The VHI policy usually provides for a choice of several clinics. In our case, this question did not arise, since we live in a small town where a suitable insurance company cooperated with only one private clinic.

But I could choose a doctor. I was immediately asked if there were any preferences, if I wanted to attach myself to a particular doctor. There was no such thing, but I said that I would like to be observed by a benevolent young woman. nine0003

The insurance company consulted with the clinic to find out who is more suitable. Then, even before the conclusion of the contract, a pediatrician came to our house and conducted an initial examination. I liked the doctor, and I signed a contract for a year. If something didn’t work out, the insurance company would have offered another doctor. I can also change the pediatrician at any time until the contract expires.

If something didn’t work out, the insurance company would have offered another doctor. I can also change the pediatrician at any time until the contract expires.

/list/pediatr-deti/

11 important questions for pediatrician Sergei Butriy

Appointment to the clinic. nine0028 Usually, for adults, there are only two options for interacting with clinics under the VHI policy:

- The patient calls one of the clinics specified in the contract and arranges an appointment, saying that he has insurance. After that, either the clinic or again the patient himself contacts the insurance company, receives consent or refusal to pay for the appointment. Accordingly, the record is either confirmed or canceled.

- The patient is booked through an insurance company. He leaves an application for an appointment by phone or online, and the company itself selects the best option. nine0300

Children's voluntary medical insurance may also have such rules, or there may be simpler options - all this is spelled out in the terms of the program.

For example, we have a pediatrician who takes care of a child. You need to sign up for appointments and examinations through it. I write to the doctor on WhatsApp, talk about the problem, and she answers when she can come or what to do if an in-person examination is not needed. It’s more convenient for me to call a pediatrician at home - there is such an opportunity under insurance, so we don’t visit him at the clinic. nine0003

I also inform the pediatrician about the desire to visit a narrow specialist or undergo an examination - the doctor herself forms an application and sends it to the database. When the application is approved by the insurance company, they call me back from the clinic and we agree on an appointment.

If I wish, I can make an appointment for any appointment myself by calling the clinic, but doing it through a pediatrician is much more convenient. I make an appointment on my own, only if I need to call a doctor at home on a day off, and not our pediatrician is on duty. When our pediatrician goes on vacation, I am informed in advance - for this time they are assigned to another doctor. nine0003

When our pediatrician goes on vacation, I am informed in advance - for this time they are assigned to another doctor. nine0003

When visiting the clinic for the first time under the VHI policy, you must go to the reception a few minutes before the appointment. The data of the child and the parent will be recorded there. Theoretically, you may need an individual patient number specified in the contract with the insurance company. But they never asked us for it: we were in three branches of the private clinic to which we are attached, and everywhere it was already in the database.

When a doctor arrives at home for the first time, he knows in advance who he is going to and that the insurance company will pay for the visit, no documents are needed. nine0003

/pediatrician/

“I dragged cards home with Ashanov bags”: how much does a district pediatrician earn

We were given such a card for a child when signing a VHI contract. You can put the results of analyzes and surveys there. But I don't use it, because all documents are sent to e-mail

But I don't use it, because all documents are sent to e-mail Disputes. They can occur when an insurance company has not approved a particular procedure, and the patient believes that it is included in the insurance and does not agree with the refusal. It may be that the clinic performed its duties poorly or there was a conflict with the pediatrician and the client wants to change him. nine0003

In all these cases, you need to contact the insurance agent with whom the contract was concluded. He must figure it out. For example, one day we had to urgently get to an examination with an ophthalmologist, because the child had conjunctivitis, and the clinic was delaying the appointment. I wrote to the insurance agent, an hour later they contacted me and agreed on an appointment time.

Communication with a doctor by phone. This is a very important point: I can always write to the doctor and ask exciting questions. According to the agreement, there is such an opportunity from 08:00 to 20:00 on any day, except for weekends and holidays. In fact, you can agree with the pediatrician on the possibility of writing at other times. Sometimes it happens that I write in the evening or on weekends, but I try not to abuse it. Judging by the chat on WhatsApp, I write to the doctor about once a month. nine0003

In fact, you can agree with the pediatrician on the possibility of writing at other times. Sometimes it happens that I write in the evening or on weekends, but I try not to abuse it. Judging by the chat on WhatsApp, I write to the doctor about once a month. nine0003

/list/pediatrics-2/

“Most often, a child does not need medicines”: 10 important questions to pediatrician Fedor Katasonov

How much I saved by taking out a VHI policy

At the time of buying a policy for a child, I was a little embarrassed by the price 56,100 R is a rather large amount. Then I considered that it was only 4675 R per month, which is quite acceptable.

If I paid for all the services myself, I would pay almost 3000 R more and would be left without the support of an insurance agent. I calculated the cost of services separately according to the price list of the clinic where we were observed under the VHI policy. nine0003

I never regretted that I took out a children's voluntary medical insurance policy: it saved not only money, but also time - there is no need to wait in lines and worry that there is no appointment with the necessary narrow specialists.

The child does not go to kindergarten yet, so he did not get sick very often. True, just after taking out insurance, he developed rashes on his face, which turned out to be allergies. To find out the diagnosis, I had to go to the doctors more often than usual and take several tests. Perhaps, for frequently ill children, voluntary insurance will be even more profitable. nine0003

Community 11/14/22

How can I get a certificate for the kindergarten that the child is healthy?

If I went to a private clinic on my own, I would spend 59,070 R for services under the policy

| Pediatrician consultations at home, 6 primary and 1 secondary | 25 650 Р |

| 7 consultations of narrow specialists in the clinic | 13 650 Р |

| 2 home visits of narrow specialists | nine0075 7500 Р|

| Nurse home visit + clinical blood test, 2 times | 4160 P |

| Nurse home visit + urinalysis, 2 times | 2620 Р |

| Fecal test for worm eggs at home | 1320 Р |

| Pediatric online consultations | 2300 Р |

| Nasal culture | 1300 Р |

| Scraping for enterobiasis | 360 R |

| Blood sugar test | 210 R |

Consultations of the pediatrician at home, 6 primary and 1 secondary

25 650 R

7 Consultations of narrow specialists in the clinic

13 650 R

2 departures of narrow specialists at home

7500 r

9000 + clinical blood test, 2 times4160 Р

Nurse home visit + urinalysis, 2 times

2620 r

Consultations of the pediatrician online

2300 r

Calais eggs for worms at home

1320 R

Buckpower from

9000 1300 RScrap for enterobiosis

9000 360 R 9000Blood test for sugar

210 R

How to return part of the money for a child's VHI policy using a tax deduction 120,000 R in total with deductions for fitness and training.

Thus, due to the deduction, you can return up to 15,600 R.

Thus, due to the deduction, you can return up to 15,600 R. My husband received the deduction because I am taking care of a child and not working. He submitted an application through his personal account on the website of the tax service, from the documents he needed only a scan of the contract with the insurance company and a document confirming the payment of the policy. As a result, we were returned 7923 R - 13% of 56 100 R. That is, we spent R 48 177 on insurance.

If you visit private clinics on your own, you can also get a deduction. But in this case, it may be more difficult to collect documents: in each clinic you need to get a certificate of payment for services. nine0003

What to do? 05/14/19

How to get a tax deduction for VMI expenses?

Remember

- VHI policy for a child can not be issued in every insurance company, especially if you live in a small town.

- VHI for a child may be more convenient than a subscription to a private clinic, as it often involves choosing clinics in the region where the insurance is issued, in addition, there is support from the insurance company in disputable situations.