How much to pay family for child care

This is how much child care costs in 2022

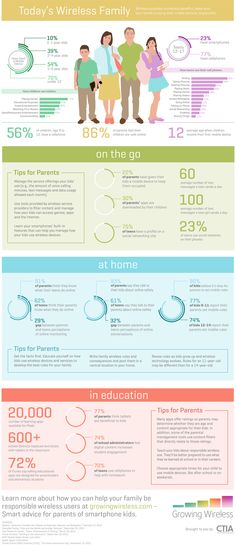

More than half — 59% — of parents say they’re more concerned about child care costs now than in years prior. That’s just one finding of many in the Care.com 2022 Cost of Care Survey that illustrate the uphill battle parents are facing when it comes to affording and accessing quality child care.

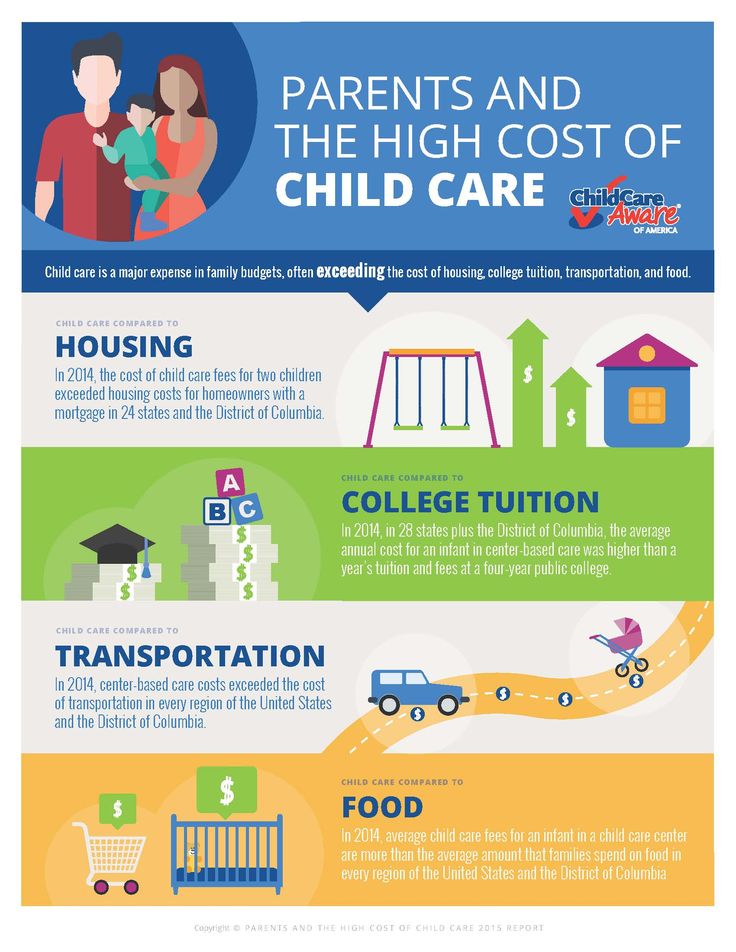

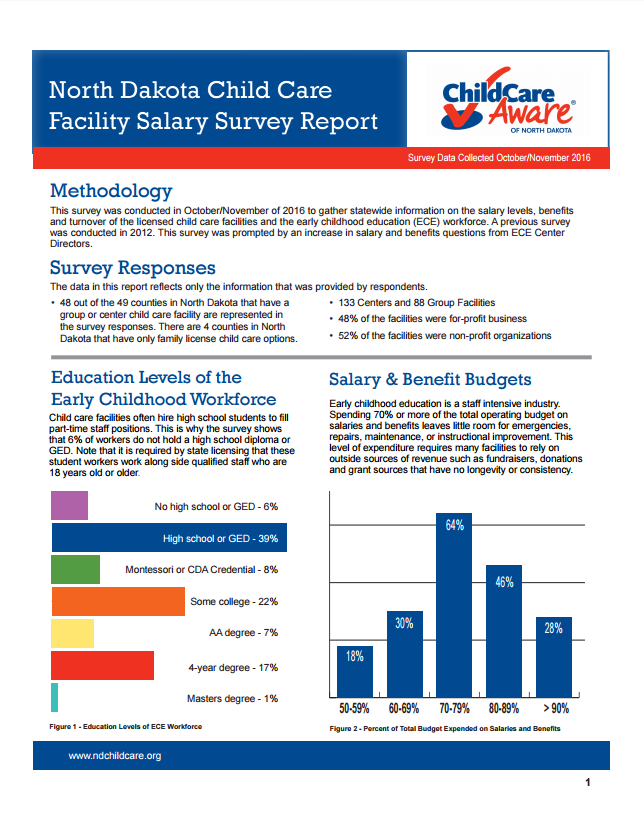

The world has changed immeasurably over the last two years due to the pandemic and economic struggles, and families have certainly felt the shift when it comes to the cost of child care. Making matters worse: Nearly 9,000 day cares closed in 37 states between December 2019 to March 2021, according to findings from a new 2022 survey by ChildCare Aware.

“When it comes to child care, there are three critical criteria – cost, quality and availability – and based on our research findings, we’ve not only failed to make progress as a country, we’ve actually gone backwards,” said Natalie Mayslich, President, Consumer, Care.com. “Costs are growing while availability is shrinking and that’s having a profound impact on the workforce and consumer spending. We’ve all seen what happens when parents can’t work; making child care more affordable and accessible has to be a priority for all.”

New data from the ninth annual Care.com 2022 Cost of Care Survey reveals:

- The cost of child care is higher for families in 2022. 51% of parents say they spend more than 20% of their household income on child care, and 72% of parents report spending 10% or more. This is up from 70%, according to Care.com data from pre-pandemic 2019, the most recent year that mirrors parents’ options today.

- Quality child care continues to be tough for parents to find. In fact, 43% of parents say it’s much harder to find child care over the past year.

- Parents continue to struggle to pay for child care. In fact, 59% are more concerned about child care costs now than in years prior, which is driving significant changes, such as taking on a second job (31%), reducing hours at work (26%), changing jobs (25%), and leaving the workforce entirely (21%), to foot the bill.

How much does child care cost?

The cost of child care is on the rise

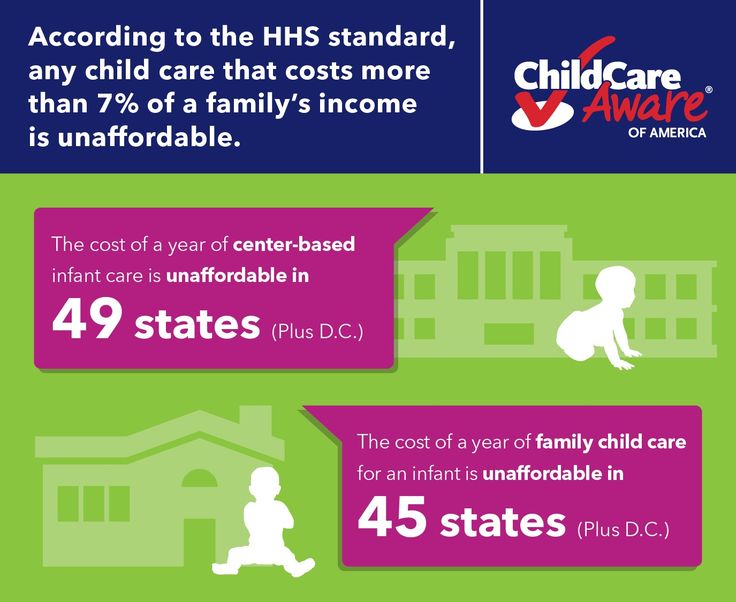

Based on the 2022 Cost of Care Survey, child care is not in the affordable range for most families. Of parents surveyed, 72% say they are spending 10% or more of their household income on child care, with a majority (51%) spending more than 20% or more. Yet according to the U.S. Department of Health and Human Services (HHS), child care is considered affordable when it costs families no more than 7% of their household income.

According to survey data, 63% report that child care is more expensive over the past year. The reasons parents say prices are skyrocketing include:

- Child care centers increased costs (46%).

- Inflation (41%).

- Child care centers taking fewer children (36%).

Interactive: Check out our Cost Calculator to figure out how much child care costs in your area.

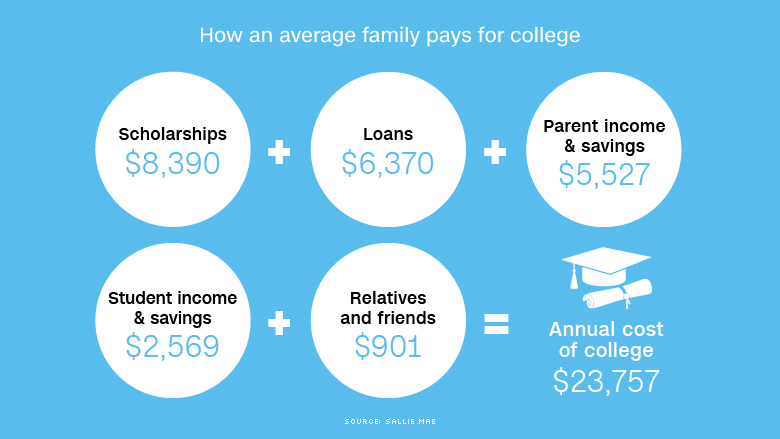

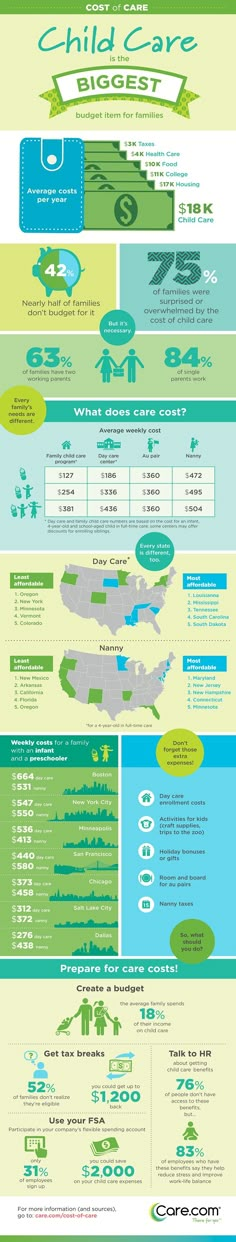

The cost of child care can exceed that of a college education

The survey also finds that more than half of families (58%) plan to spend more than $10,000 on child care this year, which is more than the average annual cost of in-state college tuition ($9,349) per EducationData. org.

org.

Every type of child care is pricier than it was pre-pandemic

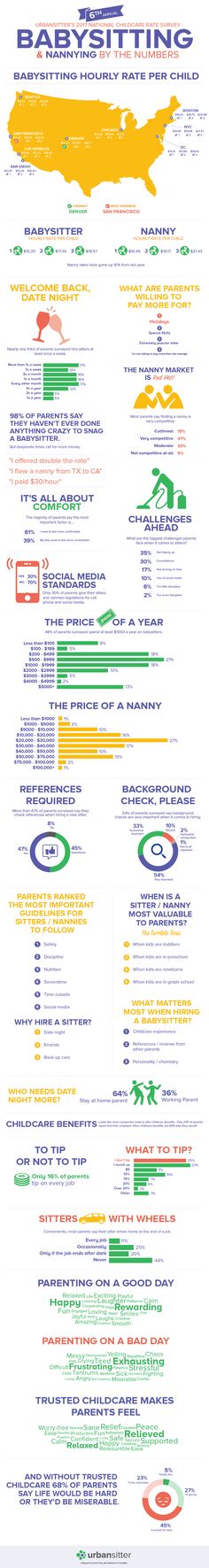

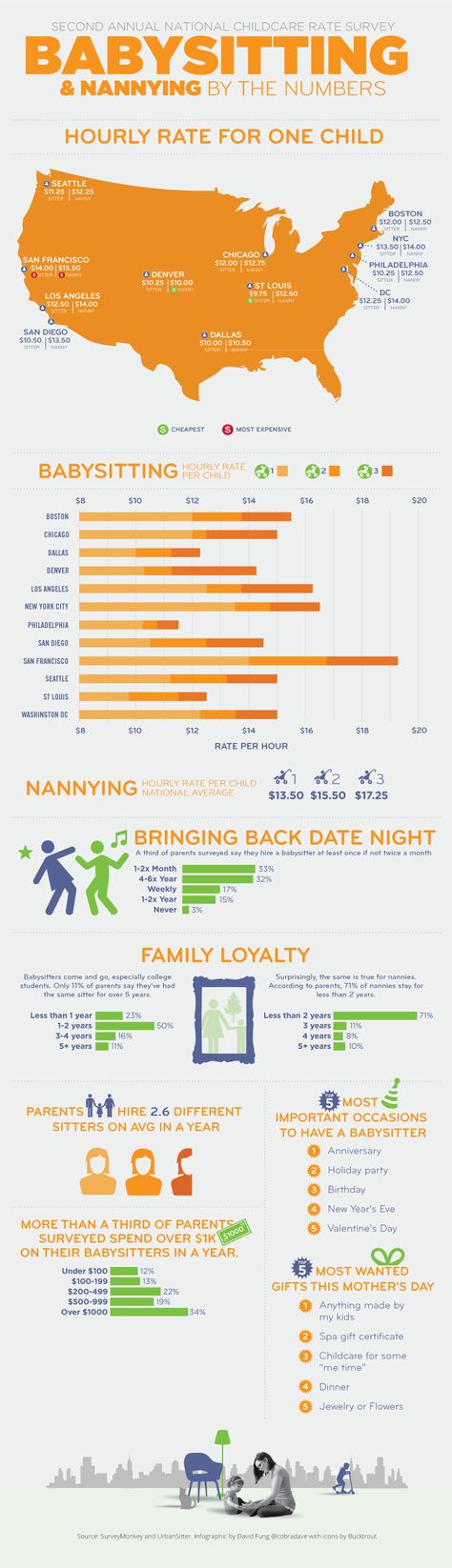

Overall, the average child care cost for one child in 2021 was $694/week for a nanny (up from $565/week in 2019), $226/week for a child care or day care center (up from $182/week) and $221/week for a family care center (up from $177/week).

Below are the 2021 national averages of weekly child care costs for each type of care, compared to costs in 2019.

National average weekly child care rates

| 2021 | 2019 | 2021 | 2019 | |

| One child | One child | Two children | Two children | |

| Nanny* | $694 | $565 | $715 | $585 |

| Child care center (toddler) | $226 | $215 | $429** | $409** |

| Family care center* | $221 | $201 | $420** | $382** |

| After-school sitter | $261 | $243 | $269 | $246 |

*Rates for infant children.

**Rates for two children calculated by adding the weekly rate for one child and the weekly rate for the second child with a national average sibling discount of 10%.

What’s the impact of rising child care costs on parents?

More than half — 59% — of parents say they’re more concerned about child care costs now than in years prior. The good news is that the majority (68%) budget for child care costs and nearly two-thirds (65%) say they will stay within or under budget.

Parents are cutting back on essentials

In turn, parents are making sacrifices to afford care and cutting back on budgets for:

- Vacations and travel (51%).

- Leisure activities (51%).

- Food, dining (45%).

- Clothing (41%).

- Extracurriculars (37%).

They’re also overhauling their work — and personal — lives

Many also plan to make the following work changes to adhere to rising care costs:

- 31% are considering taking on a second job.

- 26% are reducing hours at work.

- 25% are changing jobs.

- 21% leaving the workforce entirely.

Survey respondents are also adjusting their family plans to stay on track financially. 35% say they’re less likely to have more children with 43% listing the rising cost of child care as a major reason why.

How accessible is quality child care?

Parents say it’s harder to find child care providers than it was last year

Almost half of parents surveyed — 43% — say it’s much harder to find child care providers over the past year. According to our survey:

- 40% are having trouble finding a nanny.

- 39% are struggling to get care through a family care center.

- 37% find it challenging to book a babysitter.

- 36% are facing an uphill battle with finding a quality day care.

Child care providers are pricier to come by in some areas

Depending on where families live, the cost of hiring a nanny or paying for a day care can well exceed the national average. For example, in the District of Columbia, the cost of a nanny ($855 a week) is 23% above the national average, and the cost of day care ($419 a week) is 85% above the national average.

For example, in the District of Columbia, the cost of a nanny ($855 a week) is 23% above the national average, and the cost of day care ($419 a week) is 85% above the national average.

These are the priciest places to live if you’re hiring a nanny or sending kids to day care:

| State | Weekly Rate | $ Above National Avg | % Above National Avg |

| 1. District of Columbia | $855 | $161 | 23% |

| 2. Washington | $840 | $146 | 21% |

| 3. Massachusetts | $834 | $140 | 20% |

| 4. California | $829 | $135 | 19% |

| 5. Colorado | $763 | $69 | 10% |

| 6. Oregon | $741 | $47 | 7% |

| 7. New York | $736 | $42 | 6% |

| 8. Connecticut | $734 | $40 | 6% |

9. New Jersey New Jersey | $715 | $21 | 3% |

| 10. Vermont | $706 | $12 | 2% |

| State | Weekly Rate | $ Above National Avg | % Above National Avg |

| 1. District of Columbia | $419 | $193 | 85% |

| 2. Massachusetts | $324 | $98 | 44% |

| 3. Washington | $304 | $78 | 34% |

| 4. California | $286 | $60 | 26% |

| 5. Connecticut | $258 | $33 | 14% |

| 6. New York | $258 | $32 | 14% |

| 7. Arkansas | $255 | $29 | 13% |

| 8. Maryland | $254 | $28 | 12% |

| 9. Colorado | $254 | $28 | 12% |

| 10. Oregon | $249 | $23 | 10% |

How can you save money on child care?

As the cost of child care continues to rise, consider these steps to make the expense more affordable.

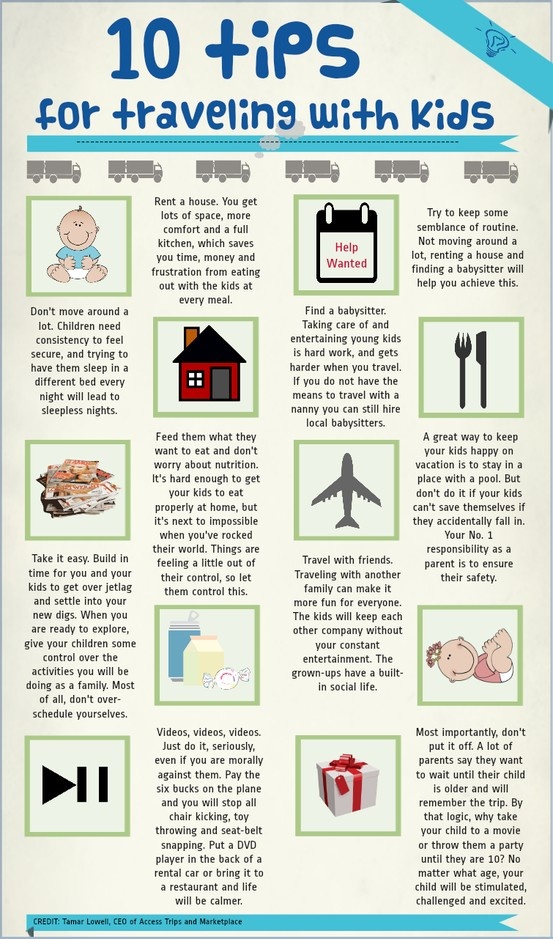

Find the best care for your budget

Once you’re clear on what you can afford, you can steer toward the child care option that’s the best fit for your family. The first step: Research current rates in your area. Care.com has free interactive tools you can use to identify the average costs of full-time child care, nanny and babysitter rates and nanny taxes in your region.

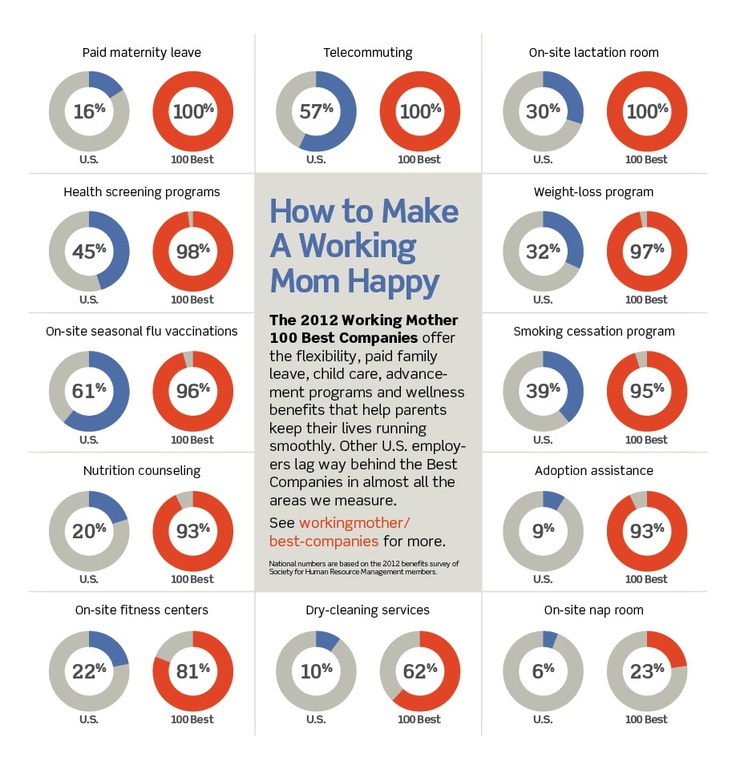

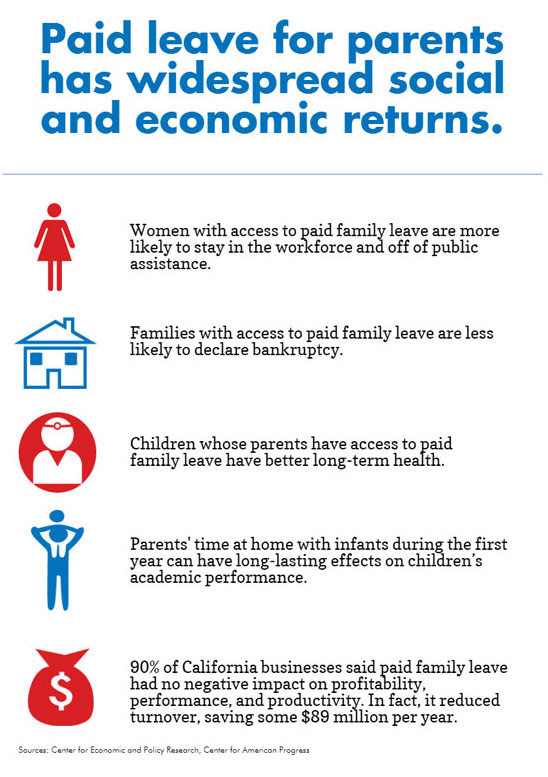

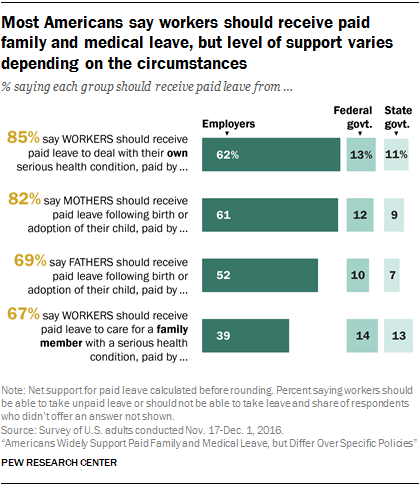

Discuss care benefits with your employer

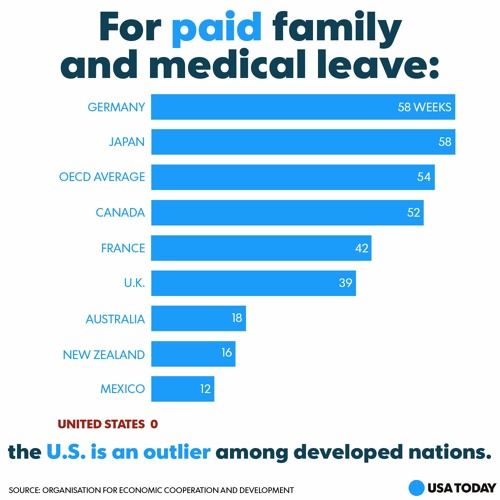

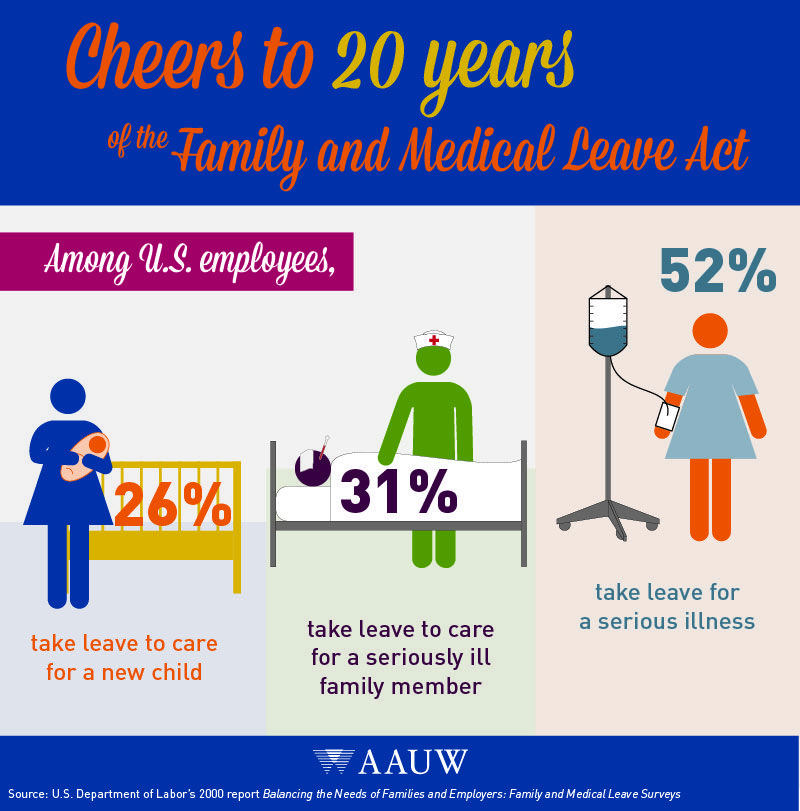

Whether you’re hoping to find backup child or adult care or utilize paid family leave, it can pay to investigate whether or not your employer offers family care benefits. And if they don’t, ask for them.

It’s quite possible that they’ll be open to the idea now more than ever. Due to the pandemic, 57% of employers are prioritizing child care benefits more this year, and 63% said they plan to increase their company’s already existing child care benefits, according to Care.com’s 2021 Future of Benefits Report.

Set aside pre-tax dollars to pay for care

Talk to your workplace Human Resources department to see if a Dependent Care Account (a type of flexible spending account, or FSA) is available to you and how you can get started. With this account, you can put aside up to $5,000 in pre-tax dollars in your Dependent Care Account to pay for dependent care expenses. (Generally, only one spouse can enroll.)

With this account, you can put aside up to $5,000 in pre-tax dollars in your Dependent Care Account to pay for dependent care expenses. (Generally, only one spouse can enroll.)

The savings you will ultimately see varies depending on what your marginal tax rate is. A good approximation is around $2,000 in tax savings, assuming the family uses the full $5,000.

Make the most of tax breaks and credits

By paying your caregiver on the books, you can take advantage of tax breaks and credits. For example, by itemizing care-related expenses on your federal income return, you could receive a Child and Dependent Care Tax Credit on up to $600 of care-related expenses if you have one child, or $1,200 of care-related expenses if you have two or more children.

This year’s Cost of Care survey concluded that just over 1/3 of parents (34%) did not claim the expanded child care tax credit on their 2021 taxes, and 43% say that’s because they were unaware of it.

In addition, parents can save $2,000 per child using the Child Tax Credit.

Research child care subsidies and programs

Depending on your income, employee benefits and other factors, your family might qualify for a variety of cost-cutting child care subsidies. We’ve rounded up various programs, resources and other options that could reduce how much you’re paying for quality care.

__________________________

2022 Cost of Care Survey methodology

This scientific sample of 3,003 US adults (18 years or older) who are all parents paying for professional child care was surveyed between March 24, 2022, and March 30, 2022. All respondents are parents of children 14 years or younger and currently pay for professional child care, confirmed by both consumer-matched data and self-confirmation. DKC Analytics conducted and analyzed this survey with a sample procured using the Pollfish survey delivery platform, which delivers online surveys globally through mobile apps and the mobile web along with the desktop web. No post-stratification has been applied to the results.

- The Care.com Cost of Child Care Survey: 2021 Report

- The Care.com Cost of Child Care and COVID-19 Child Care Surveys: 2020 Report

- The Care.com Cost of Child Care Survey: 2019 Report

- The Care.com Cost of Child Care Survey: 2018 Report

- The Care.com Cost of Child Care Survey: 2017 Report

- The Care.com Cost of Child Care Survey: 2016 Report

- The Care.com Cost of Child Care Survey: 2015 Report

- The Care.com Cost of Child Care Survey: 2014 Report

Average Cost of Child Care

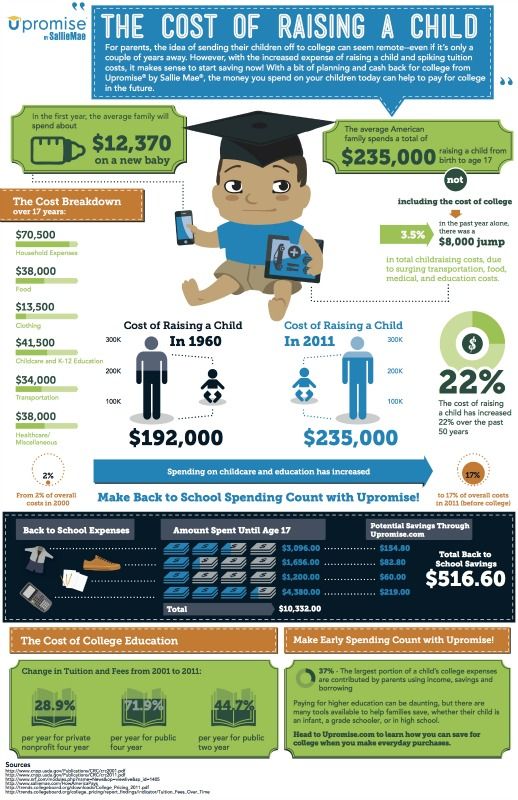

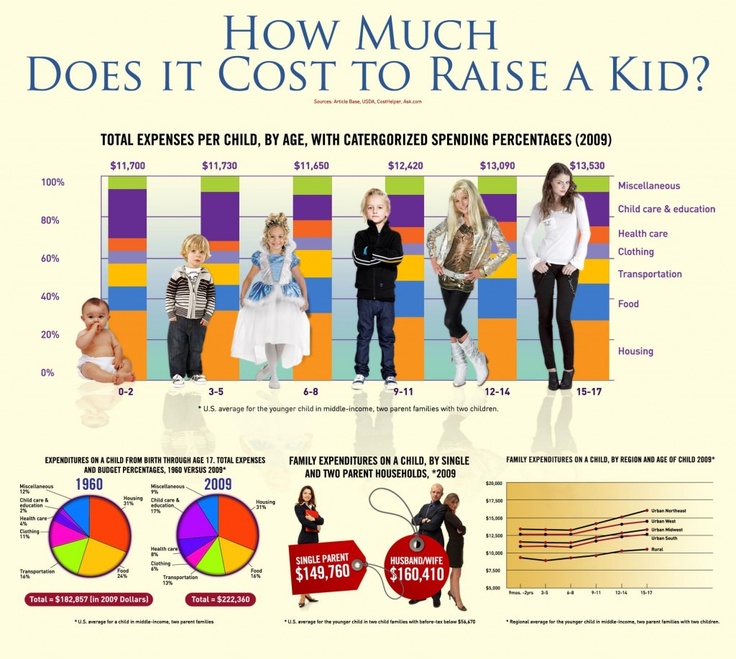

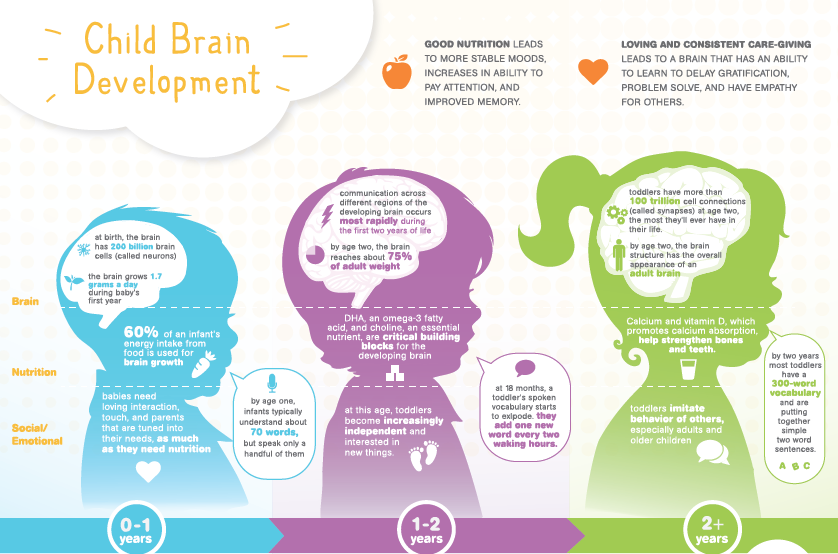

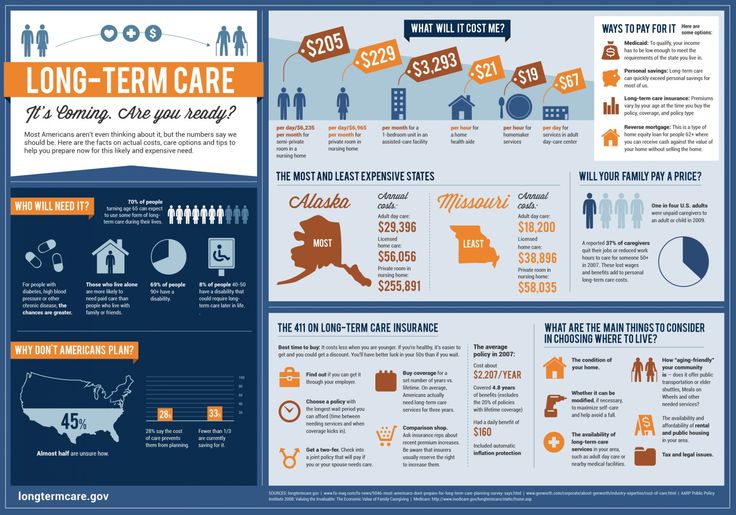

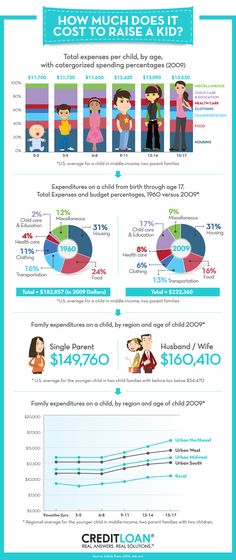

Many new parents realize they should start saving for college as soon as possible. But there’s an expense that can cost as much as college and starts much sooner: child care.

Shocking but true: In the U.S, the cost of child care at a day care center, full-time, is about as much as annual tuition and fees at a public college in the same state.

The day care costs range from a state average of $5,547 for an infant in Alabama to $16,549 for one in Massachusetts. A full-time nanny can cost as much as or more than tuition and fees at an Ivy League institution. Yet unlike college, for which almost all students can get subsidies and loans, child care is usually paid out of parents’ pockets.

A full-time nanny can cost as much as or more than tuition and fees at an Ivy League institution. Yet unlike college, for which almost all students can get subsidies and loans, child care is usually paid out of parents’ pockets.

- Average cost of child care

- How much families pay for child care

Average cost of child care

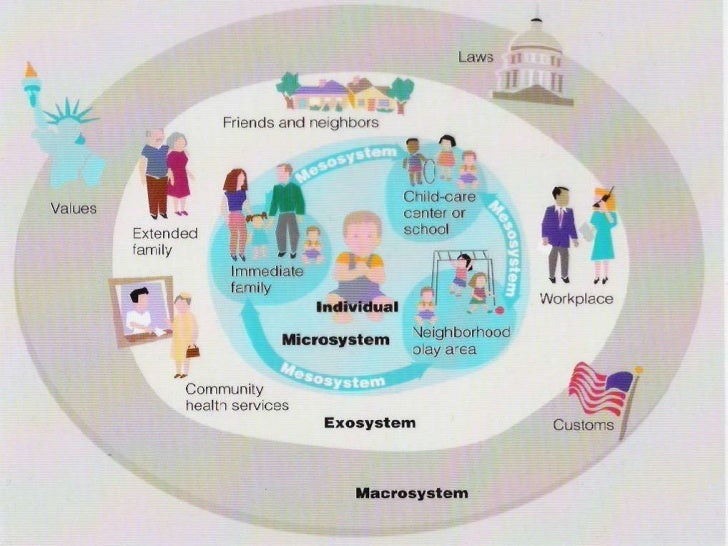

Child care costs can vary widely by type and by geographic location. And families may need different amounts depending on parents’ work schedules and other factors such as the child’s age and time spent in school. When parents can’t care for their children themselves, most patch together a variety of solutions from among the following:

| Extended family members or friends | $0 and up |

| Care in a day care center | 9,991 |

| Care in a home-based day care center | 7,431 |

| Nanny | 38,813 |

| Babysitters | 30,493 |

| Au pair | 18,000 |

| Baby nurse (helps with newborns, especially overnight) | $11 to $30 per hour (not typically employed on an annual basis) |

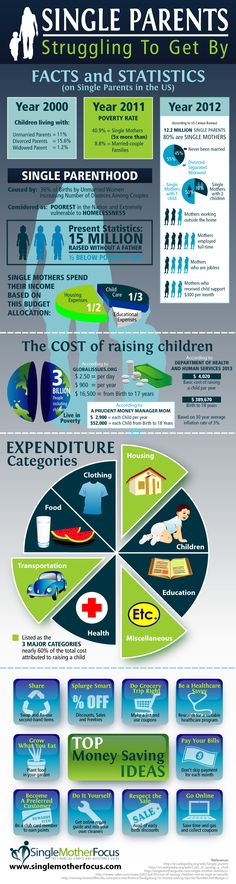

For families who must pay someone to watch their little ones at least some of the time, the annual average cost of child care in the U. S. is $3,863 for a middle-income, two-parent family with an infant. This figure includes a broad array of child care arrangements, from occasional babysitting to nanny care. Single parents with lower incomes pay about $1,948 on average, while high-earning couples pay about $11,000 per year on average. Unsurprisingly, families with more than one child pay higher costs for their care.

S. is $3,863 for a middle-income, two-parent family with an infant. This figure includes a broad array of child care arrangements, from occasional babysitting to nanny care. Single parents with lower incomes pay about $1,948 on average, while high-earning couples pay about $11,000 per year on average. Unsurprisingly, families with more than one child pay higher costs for their care.

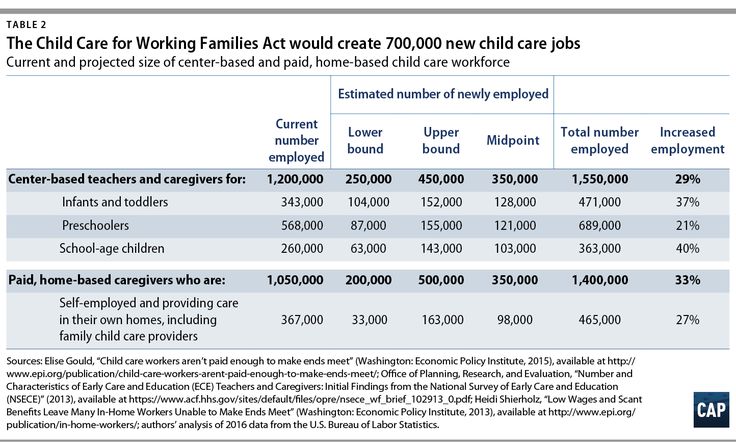

Why is child care so expensive? In a word: labor. While technology has helped workers in other industries to be more productive in recent years, it hasn’t changed child care much. We still need human hands to pick up, feed and diaper babies; and human eyes to keep toddlers from eating sand or wandering off.

Child care workers in the U.S. earn relatively low salaries. In 2012, the typical child care worker earned $9.38 per hour, or $19,510 per year. While the cost of child care is typically borne in full by the parents who need the care, low-income families are eligible for child care subsidies in many states.

How much does day care cost?

The average cost across all states in the U.S. for an infant in full-time child care is $9,991 annually.

Most states require child care providers to meet certain standards, like specific staff-to-child ratios. For example, Maryland day care centers must have one staffer for every three infants, while in Georgia that ratio is 1:6. As much as 80% of a day care center’s expenses cover employee salaries and payroll-related expenditures, like taxes and benefits.

Day care providers might also have to pay for space, equipment, utilities, facilities maintenance, food, insurance, training and background checks for staff and other general safety and administrative costs.

About 35% of children under the age of five who need child care go to a day care center. An additional 8% of young children go to a home-based day care. In these, caretakers tend to earn less, and may not have benefits like health care or retirement savings plans. They often have lower expenses for things like rent or mortgage, and so cost less for parents.

The average annual cost for an infant in full-time care in a home-based day care center is $7,431.

How much does a nanny cost?

An in-home babysitter, or nanny, may be a better solution for some families, especially those with multiple children. About 5% of young children with a child care arrangement are cared for in their home by a babysitter or nanny.

The nanny market is competitive, with more experienced workers demanding higher pay. Families also try to woo nannies with good benefits, like health insurance, paid vacation and guaranteed pay on days or weeks when he or she isn’t needed, like when the family goes on vacation or a grandparent is visiting.

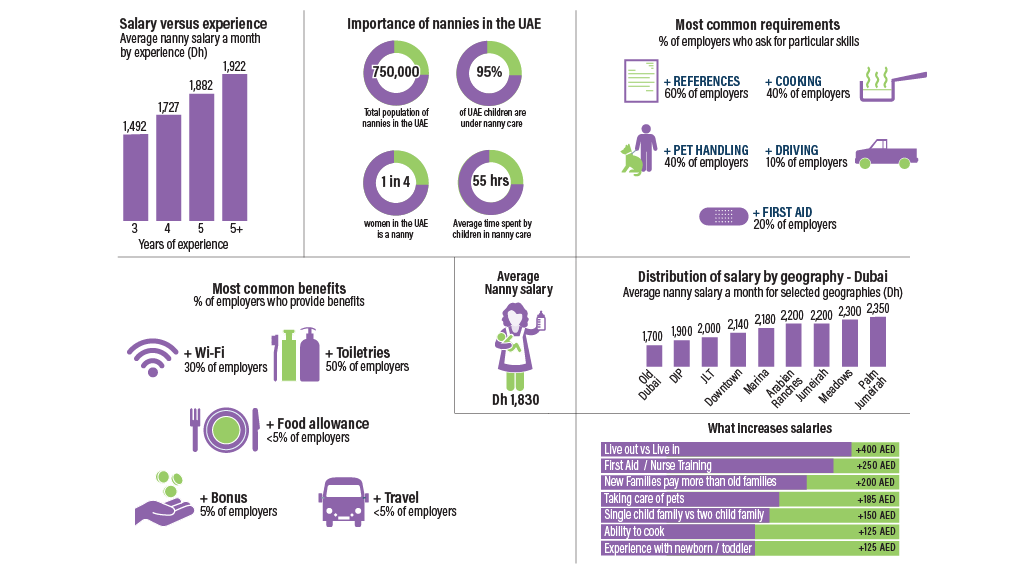

The average salary for a nanny is $19.14 per hour (that’s $39,811 annually for 40-hour weeks), according to a 2017 survey of mostly U.S.-based nannies done by the International Nanny Association. It ranges from an average of $14.08 per hour for a nanny with less than one year of experience to $21.98 per hour, on average, for those with 20-25 years of experience.

About 62% of nannies are compensated for overtime at time and a half, and 60% receive an annual bonus from their employer. More than 70% also get paid vacation and paid holidays. Only 17% of nannies get their health insurance costs paid either fully or partially.

U.S. families who pay a nanny (or any other domestic help) more than $2,300 per year are responsible for paying social security and Medicare taxes of 15.3% of the cash wages, according to the IRS. This amount can be split between the employer and the employee.

If your child’s caregiver earns more than $1,000 from you in any one quarter, you must also pay federal unemployment tax of 6% on the first $7,000 of their earnings. And depending on your state, you might also have to pay state unemployment taxes, workers’ compensation insurance and disability benefits.

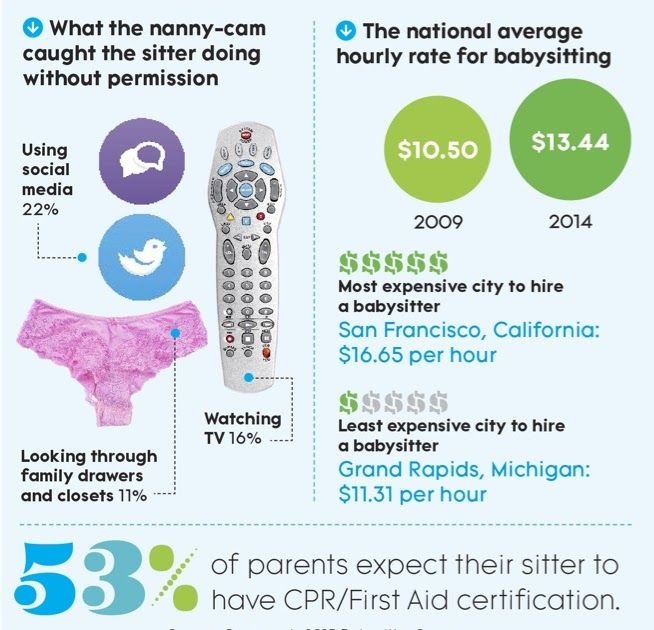

How much does a babysitter cost?

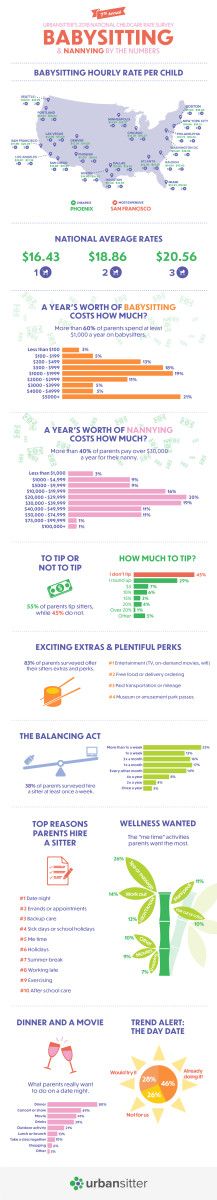

Parents who don’t work full time, or who have nontraditional schedules, can sometimes provide more child care themselves and use babysitters to fill in the gaps. Parents in U.S. cities generally pay babysitters between $15 and $23 per hour, averaging $17.50 per hour (or $36,400 for one year of full-time care), according to SitterCity. The rate is highest in expensive cities like San Francisco.

Parents in U.S. cities generally pay babysitters between $15 and $23 per hour, averaging $17.50 per hour (or $36,400 for one year of full-time care), according to SitterCity. The rate is highest in expensive cities like San Francisco.

Families with more children typically pay more per hour. And nannies or sitters with special qualifications, like a second language, many years of experience, CPR or First Aid certification, or who do some housework, such as laundry, might also charge more for their services. Most families provide food for the caregiver when he or she is in the home or offer a ride or taxi fare for travel to or from the home late at night.

Babysitter wages are also subject to the tax laws for domestic employees, as outlined above.

How much does a baby nurse cost?

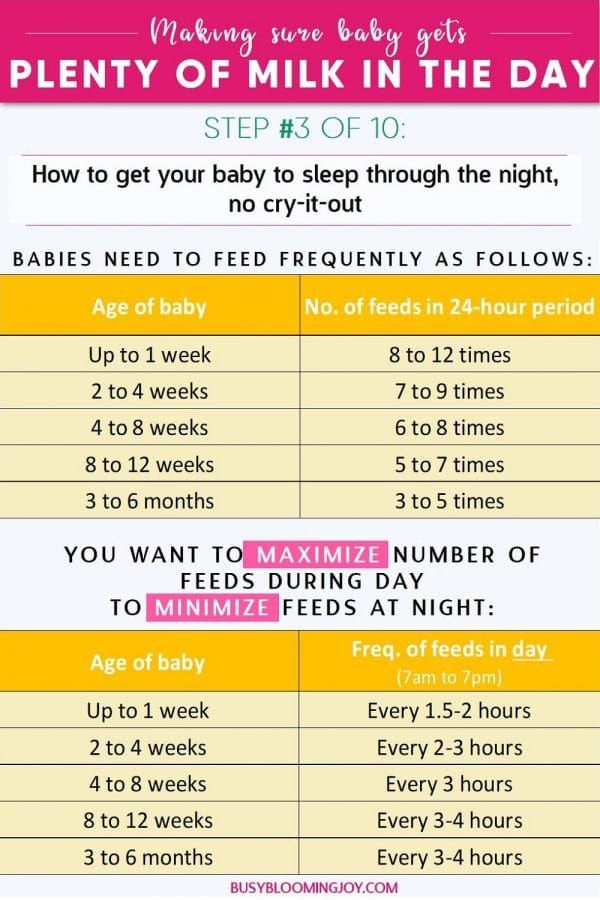

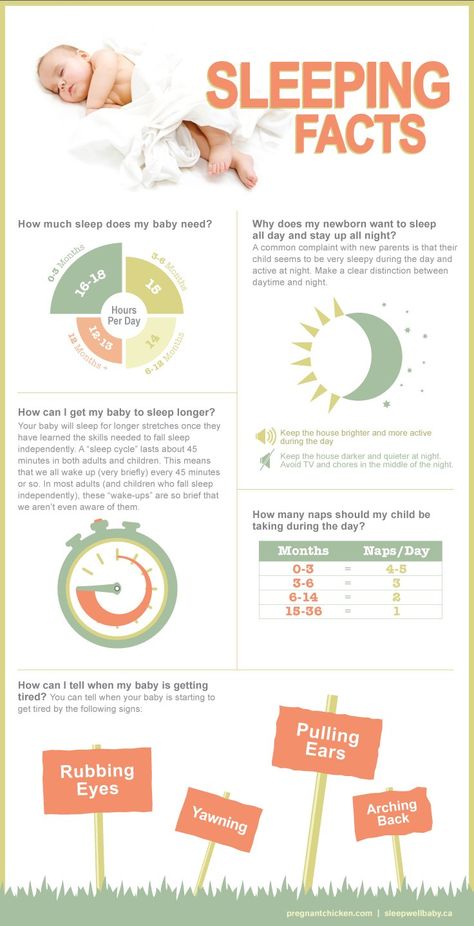

New parents without access to maternity or paternity leave benefits might have to go back to work when their newborn is still waking up every three hours. Others, with cash to spare, might also appreciate the assistance of an experienced newborn caregiver. Enter the baby nurse, who can come to your home for 12-hour shifts or even round-the-clock help during those early weeks of your baby’s life. Some stay for just a week or two, while others for up to six weeks or longer.

Enter the baby nurse, who can come to your home for 12-hour shifts or even round-the-clock help during those early weeks of your baby’s life. Some stay for just a week or two, while others for up to six weeks or longer.

New mothers report paying a baby nurse, or night nurse, rates that start at about $11 per hour in lower-cost-of-living parts of the U.S. Baby nurses hired through agencies tend to cost more. In some expensive cities, families pay up to $30 per hour.

How much does an au pair cost?

If you have a spare room in your home for a live-in caregiver for your child, you might consider hosting an au pair. Several agencies can help you connect with a young person from another country as well as coordinate their visa, travel, insurance and orientation. Several of these agencies include Cultural Care Au Pair and Au Pair in America, to name a few.

The average cost for an au pair for a full year is about $18,000, plus room and board. In return for this expense, you get about 45 hours of child care per week.![]() It breaks down to less than $8 per hour, alongside your extra costs for groceries and other family activities, like going out to restaurants or traveling for a ski trips or summer vacation, since au pairs are generally treated as members of the family.

It breaks down to less than $8 per hour, alongside your extra costs for groceries and other family activities, like going out to restaurants or traveling for a ski trips or summer vacation, since au pairs are generally treated as members of the family.

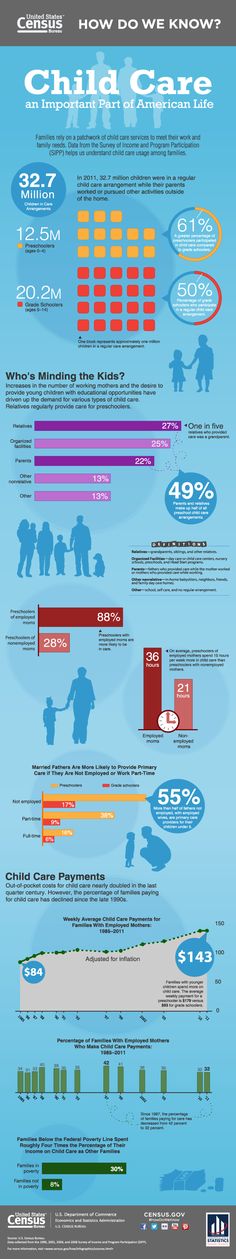

How much families pay for child care

The percentage of income paid for child care by a family with a working mother has ranged between 6% and 8% in the U.S. since 1985. In 2011, such families, including many who only require part-time or even occasional paid child care, paid an average of 7.2% of their income.

Those who require full-time child care tend to pay a much larger share of their income for the service. The U.S. Department of Health and Human Services considers child care to be affordable when it is 10% or less of a family’s income. However, in 38 states, the average annual cost of full-time care for an infant at a day care center is above this threshold.

The cost of full-time child care can be a huge burden for low income and single parent families, as well as those who live in high-cost-of-living parts of the country.

Throughout the country, the cost of full-time care at a day care center eats up 40% of the state median income for single mothers. And in New York State, where child care is least affordable as a percentage of income, the typical married couple must pay 16% of their income (on average, $14,500) for full-time care of an infant at a day care center.

The IRS allows families a tax credit for up to 35% of qualifying expenses up to $3,000 for one child under the age of 13, and up to $6,000 for two or more children. This translates to a maximum of $1,050 in tax savings for one child (i.e., 35% of $3,000) or $2,100 for two children. The actual credit depends on your adjusted gross income (AGI) and decreases to 20% of allowable expenses for parents with an AGI of more than $43,000 per year.

The cost of child care may be as challenging to many families as sleep deprivation is during their child’s early years. Fortunately, it’s necessary for a limited time, until the children go to school and become more self-sufficient. If it allows both parents to work, they can reap benefits both in terms of salary and experience, which might pay off in higher wages down the line.

If it allows both parents to work, they can reap benefits both in terms of salary and experience, which might pay off in higher wages down the line.

Methodology and sources

To find the average cost of childcare, we analyzed data provided by Childcare Aware of America, a nonprofit that provides childcare resources to parents. We also consulted other sources, including SitterCity and the IRS.

Child Care Aware® of America, Parents and the High Cost of Child Care

list of documents, detailed instructions for obtaining

By law, you can be on parental leave for three years.

Diana Shigapova

lawyer

Mothers, fathers or other relatives, while on such leave, receive benefits until the child reaches one and a half years.

We have already written how to calculate maternity payments. In this article I will tell you how benefits are calculated and assigned for a child up to three years old.

What laws govern the granting of allowance for a child up to three years of age

The right to a monthly allowance for child care is guaranteed by the federal law "On State Benefits for Citizens with Children".

The right to a monthly allowance for child care

The same law states that the allowance is paid from the day the leave is granted until the child reaches one and a half years. The law does not say anything about benefits from one and a half to three years.

Duration of payment of the monthly child care allowance

Instead of a benefit from one and a half to three years, mothers or other relatives who have taken parental leave are entitled to compensation - 50 R. But only for children born before 2020.

What has changed in 2020. Families with children born in 2020 and later are no longer paid monthly compensation in the amount of 50 R for children from one and a half to three years old: the presidential decree on the payment of such compensation has become invalid.

So what? 11/26/19

Payments for children under three years of age have been cancelled. What does it mean?

If you already receive 50 R for children under three years old, then you will continue to receive money until the children's third birthday.

Who is entitled to benefits up to three years

In this article, I will talk about mothers, because they are the ones who most often take parental leave.

Allowance up to one and a half years is due to all mothers who care for children. It doesn’t matter if a woman worked under an employment contract or not, she will receive a child care allowance. But the amount of the benefit is different. Here is what affects him:

- The salary that the mother received before pregnancy.

- Family status - for example, a family may be considered indigent.

- The status of the child - for example, a child with a disability.

/papa-mozhet/

How a man can go on maternity leave

A mother without work experience will receive the least, and a mother with a good salary and a special child will receive the most.

I will tell you more about the possible amounts of benefits for a child up to one and a half years below.

Compensation in the amount of 50 R is due only to those who are employed, and provided that the child was born before 2020. This amount is fixed.

Which family is considered poor

In Russia, a poor family is one whose average per capita income per family member is less than the subsistence minimum established in the region of residence.

Determine if the family is poor, as follows:

- Calculate the family income for the last three months from the date of application to social protection. Income includes all salaries, pensions, allowances, scholarships.

- The amount of income divided by 3 is the average monthly family income.

- Divide the average monthly income by the number of family members to get the average per capita family income. It is he who is compared with the subsistence minimum per capita in the region where the family lives.

st. 7 of the Federal Law No. 178 "On State Social Assistance"

For the poor, the state has developed a special program, according to which, in addition to the child care allowance, the mother receives additional money.

Types of allowances for a child up to three years old

A pregnant woman, and then a woman who has given birth, is entitled to a pregnancy and childbirth allowance, child care allowance and sometimes other payments - this depends on the situation in the family.

Maternity payments , or maternity allowance, are due to women who work under an employment contract, and also to those who were fired due to the liquidation of the organization or the termination of the individual entrepreneur.

What to do? 07/15/19

How can an individual entrepreneur receive maternity payments?

In addition to them, maternity payments can be received by individual entrepreneurs who pay contributions to the Social Insurance Fund, the Social Insurance Fund, as well as civil servants, full-time students of universities and colleges.

This money is paid once - before maternity leave.

Child allowance is a child care allowance that is paid by the FSS every month until the child reaches one and a half years.

Child allowance up to one and a half years for the unemployed is issued in the Pension Fund of the Russian Federation. A certificate is needed from the second parent that he does not receive such benefits.

If a parent applies for benefits through an employer or the Social Insurance Fund, then certificates from a spouse or other relatives are not needed. Since 2022, the Social Insurance Fund itself determines whether someone already receives an allowance for caring for this child.

Payments to parents of a disabled child . In addition to child care allowance, a mother can apply for a social pension, as well as monthly assistance.

Disability pension and caregiver's benefit are paid up to the age of 18.

Payments to low-income families are provided for by federal and regional legislation. At the federal level, this is a monthly allowance for the first or second child, the so-called Putin's payments. The allowance is not intended specifically for low-income families, but with a high degree of probability, it is the low-income family that will have the right to Putin's payments. This allowance is paid for up to three years.

The allowance is not intended specifically for low-income families, but with a high degree of probability, it is the low-income family that will have the right to Putin's payments. This allowance is paid for up to three years.

In some regions, support measures are provided directly to low-income families with small children. For example, in Moscow, children under three years old from low-income families are paid from 8,896 R to 17,791 R per month.

Other types . There are also additional payments to families in which fathers serve on conscription. They are paid until the child is three years old, but payments stop if the father has served and returned home.

/benefits/

Payments and child benefits in 2022

Who pays the benefits

The allowance for caring for a child up to one and a half years old is paid by the FSS or the PFR. Some employees who have become parents are also entitled to financial assistance from their employers.

FSS. Today, in all regions of the Russian Federation, there is a project for direct payments from the FSS - child care benefits are paid directly by the fund. But, if you are employed, you still need to apply for benefits to the employer: he will transfer the information to the FSS, and he will transfer the money.

PFR. The unemployed and women apply to the pension fund, who were fired during parental leave due to the liquidation of the organization.

/posobiya-roditelyam-bez-raboty/

What child benefits are due to parents without work

Employer. Some corporations and other large employers are developing a company's social policy: they think over when and how they will financially support their employees. Such programs operate, for example, in Gazprom and Tatneft.

Parental leave is often the case when an employer provides financial assistance to employees. That is, a woman receives both child care allowance and financial assistance from the employer.

That is, a woman receives both child care allowance and financial assistance from the employer.

Payments for a child with a disability come from the pension fund. To support low-income families, money is allocated from the federal and regional budgets, but these payments are processed in social security.

The procedure for assigning benefits

Most of the benefits are assigned on a declarative basis - that is, in order for a woman to receive them, she must write an application and provide documents.

Documents for receiving benefits

If a woman works under an employment contract, she needs to bring a child's birth certificate to the accounting department at work. A certificate from the father stating that he did not apply for child care allowance for up to one and a half years, from 2022, it is no longer necessary to submit for work.

You also need to bring a certificate from the previous employer about the amount of wages in order to calculate the allowance if the woman changed jobs during the previous two years.

/guide/moneyforborn/

How to receive payments at the birth of a child

If a woman is unemployed, then she needs to prepare a copy of her passport, a copy of the birth certificate of the child, a copy of the employment record, a certificate of non-receipt of unemployment benefits, as well as a certificate from her father that he did not take leave for child care. The FIU has no information about this, so it needs such a certificate.

If a woman wants to make payments for a low-income family, then in addition to the basic documents, she needs to prepare certificates of her and her husband's income.

Application for benefit is filled in in any form.

Application deadline for benefits up to one and a half years - up to two years of the child. Children up to three years of age can apply for Putin's payments.

Art. 12 of the Federal Law "On compulsory social insurance in case of temporary disability and in connection with motherhood"

Where to submit documents: to the accounting department at the place of work, to the Pension Fund of the Russian Federation, the Social Insurance Fund, social security or the MFC. In some regions, working parents can apply for benefits up to a year and a half through public services.

In some regions, working parents can apply for benefits up to a year and a half through public services.

Amount of benefits

Maternity allowance. The amount of maternity leave is calculated according to one of two formulas: based on salary or based on the minimum wage. The formula is chosen depending on the length of service and the amount of the woman's earnings two years before pregnancy.

Formulas for calculating maternity payments

Formula for calculating maternity payments based on salary in 2022: the woman was on sick leave, on maternity or childcare leave) × number of days of decree

Formula for calculating maternity payments based on the minimum wage from June 2022:

15,279 R × 24 months ÷ 730 days × number of days of the decree

Term of the decree and the amount of payments

| Term | Amount | |

|---|---|---|

| Ordinary decree | 140 days | 70,324. 8 R 8 R |

| Complicated labor | 156 days | 78,361.92 R |

| Multiple pregnancy | 194 days | 97450.08 Р |

Ordinary decree

term

140 days

sum Multiple pregnancy

Term

194 days

Amount

97,450.08 R

Child care allowance . How much they will be paid in 2022 is calculated according to the following formula:

Salary and other labor income for 2020-2021, but not more than 1,878,000 R ÷ 730 days (minus the number of days that a woman was on sick leave or on vacation for pregnancy or on parental leave) × 30.4 × by 40%

In 2022, you should get at least 7677.81 R and no more than 31 282.82 R per month. The maximum for the whole of Russia is the same.

The unemployed and those whose average salary for two years is less than the minimum wage are paid a fixed allowance - 7677. 81 R. This amount is increased by the regional coefficient, if it is applied in the locality.

81 R. This amount is increased by the regional coefficient, if it is applied in the locality.

Putin's payments depend on the subsistence minimum - PM. Families in which the average monthly income per family member is not higher than twice the regional subsistence level are entitled to the subsistence level per child. On average, this is 14,000-15,000 rubles.

Since June 1, 2022, the minimum wage and living wages have grown. As a result, social payments tied to the PM also increased.

Duration of payments

Child care allowance is paid strictly until the child reaches the age of 1 year and 6 months. If this date falls, for example, in the middle of the month, then the amount of the benefit is calculated in proportion to the days.

For example, the child of an unemployed mother turned one and a half years old on 15 June. The allowance will be calculated as follows: 7677.81 R ÷ 30 days × 15 days. The woman will receive 3838.91 rubles.

Putin's payments are paid for a year, after which they must be extended, but no longer than until the child is three years old.

Payments to low-income families continue as long as established in the regional law. For example, in Tatarstan they pay for six months, and then the applicant needs to confirm his need: re-write the application, bring income certificates.

When payments stop

Child care benefits stop in two cases:

- The child is one and a half years old.

- The parent refused the allowance.

All other benefits are terminated in the following cases:

- If the payment period has expired, and the family could no longer prove their need or comply with the conditions prescribed by law.

- If the social security authority found that the family's real income is higher than declared.

- If the child is 3 years old.

What parents say about the fairness of payments

Many people think that the principle by which they determine who and how much to pay is unfair. This is especially true of Putin's payments.

Date of birth . The resentment is connected with the fact that the date of birth of children is prescribed in the law, starting from which the family has the right to the allowance.

/money-for-baby/

How I got Putin's payments for a child

Putin payments can only be issued by families in which a child was born after January 1, 2018. That is, if the child was born on December 31, 2017 or earlier, the parents will not be able to apply for benefits.

There is also a second condition: the child must be the first or second. Parents of babies born after January 1, 2018, but no longer the first or second in a row, cannot issue Putin's payments either.

The criterion of need in the law is quite clear: no more than two living wages established in the region where the family lives. If the income in the family is at least 1 R more, you will not be able to apply for benefits.

Source of payments for the second child . If money is allocated for the first child from the federal budget, then money for payments for the second child is taken from maternity capital. Families have to choose: reduce the amount of maternity capital and receive benefits, or refuse benefits and spend maternity capital for other purposes.

If money is allocated for the first child from the federal budget, then money for payments for the second child is taken from maternity capital. Families have to choose: reduce the amount of maternity capital and receive benefits, or refuse benefits and spend maternity capital for other purposes.

What payments are due to a family with children of a different age

There are many child allowances and payments, the conditions for receiving them are even more - it is easy to get confused in all this. Our test will help you figure it out:

What a woman will receive for a child under three years old

- Pregnancy and childbirth allowance if she works under an employment contract or quit due to the liquidation of the organization or the termination of the individual entrepreneur. And also if he independently pays contributions to the FSS as an individual entrepreneur.

- Monthly allowance for caring for a child up to one and a half years.

- Monthly compensation in the amount of 50 R if employed and the child was born before 2020.

- Putin's payments - one subsistence minimum per child per month, if the average monthly income per family member is not higher than twice the regional subsistence level.

- Monthly allowance for low-income families, if the average per capita income for each family member is less than the subsistence minimum established in the region of residence. The amount of the allowance is set at the regional level.

- Social pension and monthly compensation if the child is disabled.

Types of family benefits | Sotsiaalkindlustusamet

You are here

Home Children, families Applicants for family benefits Types of family benefits

If a child is born dead or dies within 70 days

Parents have the right to a child's benefit and parental compensation if the child is born dead or die in within 70 days.

Childbirth allowance

One of the parents is also entitled to childbirth allowance in case of stillbirth from the 22nd week of pregnancy. The allowance is one-time, in the amount of 320 euros. The right to receive childbirth allowance arises on the day the child is born.

The allowance is one-time, in the amount of 320 euros. The right to receive childbirth allowance arises on the day the child is born.

Parental benefit

If the mother works and is entitled to temporary disability benefits

From April 1, 2022, a working mother is entitled to maternity leave and parental benefit to the mother for 100 consecutive calendar days starting from the 22nd week of pregnancy if the child is stillborn or dies within 70 calendar days. During this period, the mother is covered by health insurance.

If a mother started exercising her right to mother's parental benefit before the child was stillborn, she is entitled to mother's parental benefit and maternity leave for a total of 100 calendar days. For example, if a mother took maternity leave 70 calendar days before the birth of a child and started exercising her right to parental compensation to the mother after the birth of the child. dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

An exception is also made here for mothers who, by the day of the child's death, have already used the mother's parental benefit in the amount of more than 70 calendar days. In this case, the mother is entitled to the mother's parental benefit additionally within 30 consecutive calendar days from the day following the day of the child's death. This means that no matter how many days the mother managed to use the mother's parental benefit by the day of the child's death, 30 calendar days of parental leave and parental benefit are guaranteed from the day of the child's death.

If the child dies at the time when the mother has managed to start using the already distributed parental benefit, the mother is re-registered as a recipient of the mother's parental benefit.

If the mother is not working

From April 1, 2022, a non-working mother is entitled to receive mother's parental benefit within 30 consecutive calendar days from the day following the day of the child's death, i.e. parental benefit cannot be received distributed by day over a long period of time, but if desired, you must use all 30 days in a row. During this period, the mother is covered by health insurance.

Fathers

From April 1, 2022, the father is entitled to paternity leave and father's parental benefit for 30 consecutive calendar days after the death of the child, regardless of whether the father used the right to paternity leave and father's parental benefit before the estimated date of birth of the child or before the death of the child. Father's parental benefit cannot be received on a daily basis over a long period of time, but if desired, all 30 days in a row must be used. In the case of fathers, there is no difference between granting and paying parental benefit, regardless of whether the father is working or not.

In order to receive family benefits, parents do not need to contact us and apply themselves. The Department of Social Insurance automatically obtains stillbirth information by exchanging data between the health information system and the social protection information system so that it is also possible to proactively offer family benefits to bereaved parents.

Additional parental paternity benefit is a type of benefit paid to fathers to enable them to take more part in the upbringing of their children. For working fathers, this is also accompanied by a 30-day leave from the employer.

For how long is compensation paid and for how long should it be scheduled?

You can receive additional parental benefit for a father for a total of 30 days, and not necessarily in a row (that is, the benefit can be received in installments). Supplemental parental benefit to the father can be received both during the period when the mother receives the parental allowance or the birth allowance (30 days before the expected date of birth of the child), and later.

The father is entitled to additional parental benefit until the child reaches the age of 3 or until the father receives regular parental benefit. Paternity leave cannot be separated from the receipt of compensation. If the father wishes to receive regular parental benefit without receiving additional parental benefit but does not notify us of the waiver of paternity leave, the Social Insurance Board will not be able to grant parental benefit until the father confirms his wish to waive paternity leave or use his. To fully waive paternity leave, you must submit an application to us.

Employment during paternity leave

While on paternity leave, the father must take a break from work at all his employers. The period of vacation use is entered in the Employment Register. During paternity leave, the father should not work and receive income! The principle of regular parental benefit does not apply, so the amount of parental benefit is not reduced when a maximum of half of the compensation has been received.

In accordance with the Law on Employment Contracts, an employer may refuse to grant leave if the notice of the desire to receive it is less than 14 days in advance and for a period of less than 7 calendar days. Supplementary parental benefit to the father within the meaning of the Employment Contracts Act is a normal rest period, therefore, being on paternity leave does not adversely affect the calculation of annual leave and these days are considered working days when determining annual leave. Like being on vacation, parental leave does not reduce seniority.

Non-working fathers (including also individual entrepreneurs (FIE) or representatives of the so-called liberal professions (e.g. notaries, bailiffs, sworn translators, auditors, bankrupt bailiffs), as well as persons working on the basis of a contract assignments and work contracts, etc. under the law of obligations, or members of the governing body of a legal entity) also receive additional parental benefit to the father for 30 calendar days. It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

How to apply?

Be sure to talk to your child's mother and, if you have an employment relationship, also to your employer before you apply. It must be borne in mind that the employer may refuse to grant a vacation of less than 7 days if you notify him less than 14 days in advance. If the employer agrees, there are no restrictions on our part - you can go on vacation from any day.

The application for additional parental benefit is made through the self-service environment. If you wish to take advantage of the leave until the birth of the child, you must indicate the personal code of the child's mother and the expected date of his birth. After the baby is born, you will find a pre-filled offer in the self-service environment. If you are unable to use the self-service environment, please contact us at [email protected].

If you are registered in the Employment Register as a person with a valid employment relationship, you will need to provide your employer's email address. You should also include the email address of the mother of the child. The self-service system will send them a notice of your leave application and put it on hold for 5 days. You don't need to do anything else.

The employer and the child's mother have 5 working days to tell us if they disagree with your leave application. If your employer or the child's mother does not submit their objections, the system will automatically enter a leave note in the Employment Register after 5 working days.

We will calculate the amount of your compensation and pay it to you at the beginning of the next month (the payout date is the 8th of each month).

How is paternity leave calculated?

Additional parental benefit to the father is calculated according to the same rules as regular parental benefit.

To calculate the benefit, we first subtract the 9 full calendar months prior to the birth of the child (i. e., the average length of pregnancy, regardless of whether the child was born on time, premature, or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

e., the average length of pregnancy, regardless of whether the child was born on time, premature, or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

The amount of compensation depends on the amount of social tax paid on the income received. Since the income is calculated based on the social tax paid during the 12 months of the reporting period, the amount based on the reporting period may differ from the exact income received at that time, so it is worth paying attention to the social tax paid during this period. You can read more about how parental benefits are calculated here. You can also use the parental benefit calculator (informative).

The minimum rate of parental benefit is the minimum wage rate of the previous calendar year in effect on January 1 (in 2022: 584 euros). The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

Example 1: During the period taken as the basis for the calculation, the father earned 1,500 euros per month. He went on paternity leave from January 14, 2021 to February 13, 2021, thus being on paternity leave for 30 consecutive days. Consequently, he was on parental leave for 17 days in January and 13 days in February. In January, the amount of his additional parental benefit amounted to (1500/31×17) 822.58 euros, in February - (1500/28×13) 696.43 euros.

Example 2: During the period taken as the basis for the calculation, the father earned 1200 euros per month. He took one week of paternity leave in January 2021, two weeks in February and the remaining 9 days in March. Thus, the amount of his additional parental benefit amounted to (1200/31×7) 270.97 euros in January, (1200/28×14) 600 euros in February and (1200/31×9) 348. 39 euros in March .

39 euros in March .

Other things to remember:

If several children were born in a family after 1 July 2020 at short intervals, then the right to 30 days of paternity leave and / or additional parental benefit to the father arises in connection with each child. Compensation / leave for each child should be used at different times - leave cannot be received at one time for all children, nor can multiple compensation be received in one period.

Twins are subject to one period, regardless of the number of twins.

If the family wants the father to receive both regular parental allowance and additional parental benefit to the father in succession, the first 30 days are always considered to be the period of additional parental benefit to the father. The father can start receiving regular parental allowance from the day when the child is at least 70 days old and the mother's maternity sheet is closed.

If you are on sick leave, it is recommended that you interrupt your paternity leave by notifying the Social Insurance Board as soon as possible. If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

Starting on September 1, 2019 no longer assigned a child to leave

- due to children born from September 1, 2019, 66, child care fee is no longer charged for a newborn or for any other child growing up in the family . The state will gradually connect free funds with the new system of parental benefit in the period 2020-2022.

- For all families where a child is born no later than August 31, 2019, we assign and pay a child care fee on the previous basis.

- Also for those who have already been assigned a child care fee as of August 31, 2019, we will continue to pay benefits .

We will continue paying the child care allowance until it ends, but no later than August 31, 2024.

At the same time, only one parent in the family is entitled to child care allowance (after the end of receiving parental benefit), if the family grows:

- child under 3 years old – 38.36 euros per month for each child under 3 years old.

In addition, we pay a lower childcare allowance for children aged 3 to 8 if:

- from 3 to 8 years - 19.18 euros per month also for a child aged 3 to 8 years;

- There are 3 or more children in the family receiving child benefit – EUR 19.18 per month for each child aged 3 to 8 years.

If your child turns 8 in first grade, we will pay child care until the end of first grade, which is August 31st. If the child turns 8 in the second grade, or if the child is not in school, we will pay Child Care Allowance until the end of the month in which the child's birthday is.

Being on parental leave and receiving childcare allowance may be someone else instead of the child's parent. However, there is a rule that the amount of child care allowance paid to such a person cannot exceed 115.08 euros per month in total.

Example . The family has three children: aged 2 years, 3 years and 6 years. For a 2-year-old child, a child care allowance is paid in the amount of 38.36 euros per month. For a 3- and 6-year-old child, child care allowance is paid under the condition that in a family with three or more children, all children under the age of 8 will receive child care allowance. The amount of the child care allowance paid for both a 3-year-old and a 6-year-old child is 19,18 euros per child.

In total, the child care allowance is paid to the family in the amount of 38.36 + 19.18 + 19.18 = 76.72 euros per month.

In addition, such a family is paid a child allowance for each child, which is 60 euros for the first and second child, and 100 euros for the third child, for a total of 220 euros per month. Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

The right to receive child care allowance arises after the end of receipt of parental benefit . However, we still recommend that you apply for child care allowance or agree to receive it as soon as you submit your initial application for family benefits. In this way, after the end of the payment of the parental benefit, we will be able to immediately begin the payment of the child care allowance.

However, please note that if one of the parents has left his job for parental leave, he is also entitled to the childcare allowance. Parental leave can be obtained from the employer.

The state pays social tax for the recipient of the child care allowance, and thus health insurance is provided by the state to the parent to whom we pay the child care allowance! You can read more about health insurance HERE.

Parental benefit and child care allowance are not paid simultaneously to the same family.