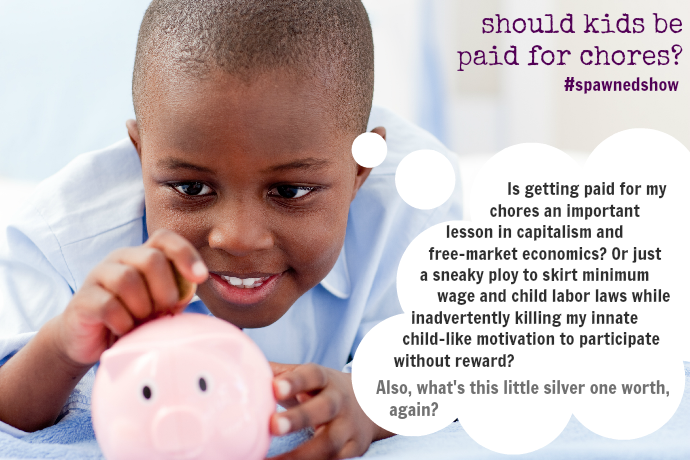

How much should i pay a family member for child care

This is how much child care costs in 2022

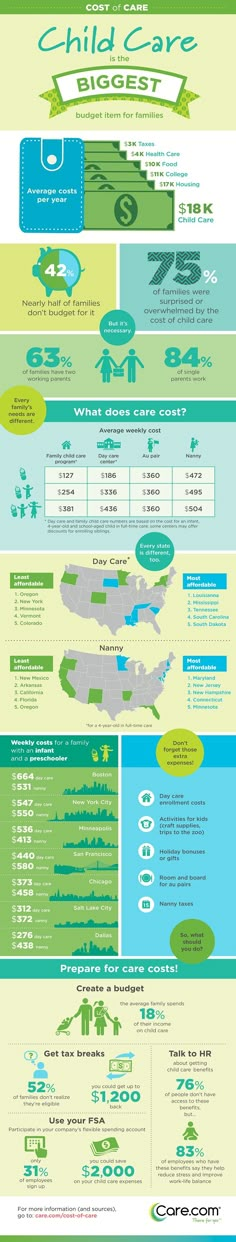

More than half — 59% — of parents say they’re more concerned about child care costs now than in years prior. That’s just one finding of many in the Care.com 2022 Cost of Care Survey that illustrate the uphill battle parents are facing when it comes to affording and accessing quality child care.

The world has changed immeasurably over the last two years due to the pandemic and economic struggles, and families have certainly felt the shift when it comes to the cost of child care. Making matters worse: Nearly 9,000 day cares closed in 37 states between December 2019 to March 2021, according to findings from a new 2022 survey by ChildCare Aware.

“When it comes to child care, there are three critical criteria – cost, quality and availability – and based on our research findings, we’ve not only failed to make progress as a country, we’ve actually gone backwards,” said Natalie Mayslich, President, Consumer, Care.com. “Costs are growing while availability is shrinking and that’s having a profound impact on the workforce and consumer spending. We’ve all seen what happens when parents can’t work; making child care more affordable and accessible has to be a priority for all.”

New data from the ninth annual Care.com 2022 Cost of Care Survey reveals:

- The cost of child care is higher for families in 2022. 51% of parents say they spend more than 20% of their household income on child care, and 72% of parents report spending 10% or more. This is up from 70%, according to Care.com data from pre-pandemic 2019, the most recent year that mirrors parents’ options today.

- Quality child care continues to be tough for parents to find. In fact, 43% of parents say it’s much harder to find child care over the past year.

- Parents continue to struggle to pay for child care. In fact, 59% are more concerned about child care costs now than in years prior, which is driving significant changes, such as taking on a second job (31%), reducing hours at work (26%), changing jobs (25%), and leaving the workforce entirely (21%), to foot the bill.

How much does child care cost?

The cost of child care is on the rise

Based on the 2022 Cost of Care Survey, child care is not in the affordable range for most families. Of parents surveyed, 72% say they are spending 10% or more of their household income on child care, with a majority (51%) spending more than 20% or more. Yet according to the U.S. Department of Health and Human Services (HHS), child care is considered affordable when it costs families no more than 7% of their household income.

According to survey data, 63% report that child care is more expensive over the past year. The reasons parents say prices are skyrocketing include:

- Child care centers increased costs (46%).

- Inflation (41%).

- Child care centers taking fewer children (36%).

Interactive: Check out our Cost Calculator to figure out how much child care costs in your area.

The cost of child care can exceed that of a college education

The survey also finds that more than half of families (58%) plan to spend more than $10,000 on child care this year, which is more than the average annual cost of in-state college tuition ($9,349) per EducationData. org.

org.

Every type of child care is pricier than it was pre-pandemic

Overall, the average child care cost for one child in 2021 was $694/week for a nanny (up from $565/week in 2019), $226/week for a child care or day care center (up from $182/week) and $221/week for a family care center (up from $177/week).

Below are the 2021 national averages of weekly child care costs for each type of care, compared to costs in 2019.

National average weekly child care rates

| 2021 | 2019 | 2021 | 2019 | |

| One child | One child | Two children | Two children | |

| Nanny* | $694 | $565 | $715 | $585 |

| Child care center (toddler) | $226 | $215 | $429** | $409** |

| Family care center* | $221 | $201 | $420** | $382** |

| After-school sitter | $261 | $243 | $269 | $246 |

*Rates for infant children.

**Rates for two children calculated by adding the weekly rate for one child and the weekly rate for the second child with a national average sibling discount of 10%.

What’s the impact of rising child care costs on parents?

More than half — 59% — of parents say they’re more concerned about child care costs now than in years prior. The good news is that the majority (68%) budget for child care costs and nearly two-thirds (65%) say they will stay within or under budget.

Parents are cutting back on essentials

In turn, parents are making sacrifices to afford care and cutting back on budgets for:

- Vacations and travel (51%).

- Leisure activities (51%).

- Food, dining (45%).

- Clothing (41%).

- Extracurriculars (37%).

They’re also overhauling their work — and personal — lives

Many also plan to make the following work changes to adhere to rising care costs:

- 31% are considering taking on a second job.

- 26% are reducing hours at work.

- 25% are changing jobs.

- 21% leaving the workforce entirely.

Survey respondents are also adjusting their family plans to stay on track financially. 35% say they’re less likely to have more children with 43% listing the rising cost of child care as a major reason why.

How accessible is quality child care?

Parents say it’s harder to find child care providers than it was last year

Almost half of parents surveyed — 43% — say it’s much harder to find child care providers over the past year. According to our survey:

- 40% are having trouble finding a nanny.

- 39% are struggling to get care through a family care center.

- 37% find it challenging to book a babysitter.

- 36% are facing an uphill battle with finding a quality day care.

Child care providers are pricier to come by in some areas

Depending on where families live, the cost of hiring a nanny or paying for a day care can well exceed the national average. For example, in the District of Columbia, the cost of a nanny ($855 a week) is 23% above the national average, and the cost of day care ($419 a week) is 85% above the national average.

For example, in the District of Columbia, the cost of a nanny ($855 a week) is 23% above the national average, and the cost of day care ($419 a week) is 85% above the national average.

These are the priciest places to live if you’re hiring a nanny or sending kids to day care:

| State | Weekly Rate | $ Above National Avg | % Above National Avg |

| 1. District of Columbia | $855 | $161 | 23% |

| 2. Washington | $840 | $146 | 21% |

| 3. Massachusetts | $834 | $140 | 20% |

| 4. California | $829 | $135 | 19% |

| 5. Colorado | $763 | $69 | 10% |

| 6. Oregon | $741 | $47 | 7% |

| 7. New York | $736 | $42 | 6% |

| 8. Connecticut | $734 | $40 | 6% |

9. New Jersey New Jersey | $715 | $21 | 3% |

| 10. Vermont | $706 | $12 | 2% |

| State | Weekly Rate | $ Above National Avg | % Above National Avg |

| 1. District of Columbia | $419 | $193 | 85% |

| 2. Massachusetts | $324 | $98 | 44% |

| 3. Washington | $304 | $78 | 34% |

| 4. California | $286 | $60 | 26% |

| 5. Connecticut | $258 | $33 | 14% |

| 6. New York | $258 | $32 | 14% |

| 7. Arkansas | $255 | $29 | 13% |

| 8. Maryland | $254 | $28 | 12% |

| 9. Colorado | $254 | $28 | 12% |

| 10. Oregon | $249 | $23 | 10% |

How can you save money on child care?

As the cost of child care continues to rise, consider these steps to make the expense more affordable.

Find the best care for your budget

Once you’re clear on what you can afford, you can steer toward the child care option that’s the best fit for your family. The first step: Research current rates in your area. Care.com has free interactive tools you can use to identify the average costs of full-time child care, nanny and babysitter rates and nanny taxes in your region.

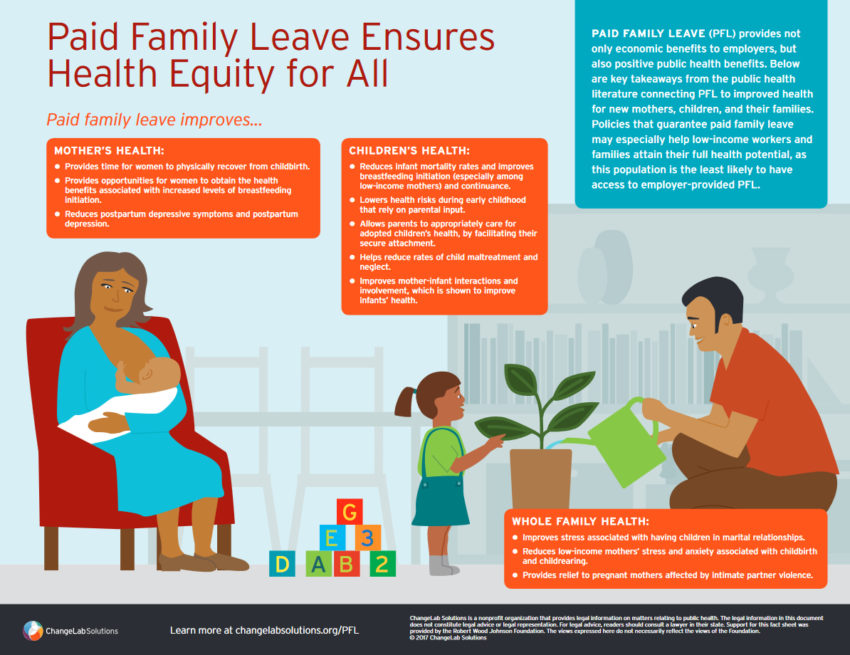

Discuss care benefits with your employer

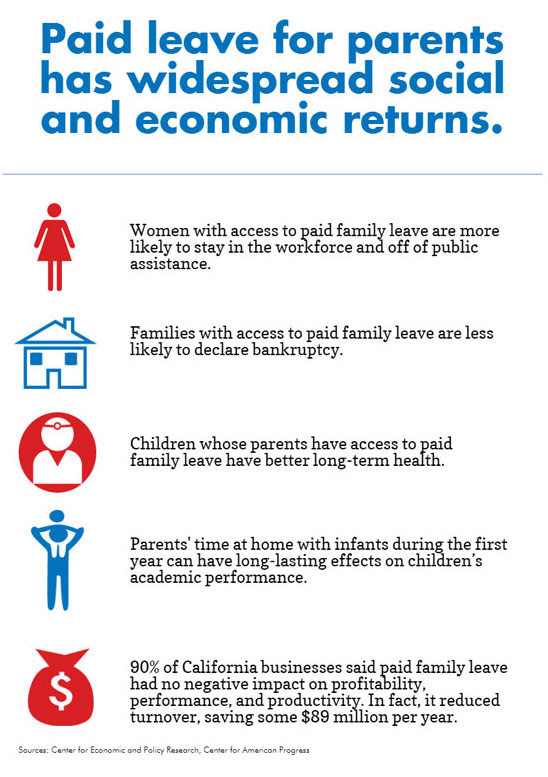

Whether you’re hoping to find backup child or adult care or utilize paid family leave, it can pay to investigate whether or not your employer offers family care benefits. And if they don’t, ask for them.

It’s quite possible that they’ll be open to the idea now more than ever. Due to the pandemic, 57% of employers are prioritizing child care benefits more this year, and 63% said they plan to increase their company’s already existing child care benefits, according to Care.com’s 2021 Future of Benefits Report.

Set aside pre-tax dollars to pay for care

Talk to your workplace Human Resources department to see if a Dependent Care Account (a type of flexible spending account, or FSA) is available to you and how you can get started. With this account, you can put aside up to $5,000 in pre-tax dollars in your Dependent Care Account to pay for dependent care expenses. (Generally, only one spouse can enroll.)

With this account, you can put aside up to $5,000 in pre-tax dollars in your Dependent Care Account to pay for dependent care expenses. (Generally, only one spouse can enroll.)

The savings you will ultimately see varies depending on what your marginal tax rate is. A good approximation is around $2,000 in tax savings, assuming the family uses the full $5,000.

Make the most of tax breaks and credits

By paying your caregiver on the books, you can take advantage of tax breaks and credits. For example, by itemizing care-related expenses on your federal income return, you could receive a Child and Dependent Care Tax Credit on up to $600 of care-related expenses if you have one child, or $1,200 of care-related expenses if you have two or more children.

This year’s Cost of Care survey concluded that just over 1/3 of parents (34%) did not claim the expanded child care tax credit on their 2021 taxes, and 43% say that’s because they were unaware of it.

In addition, parents can save $2,000 per child using the Child Tax Credit.

Research child care subsidies and programs

Depending on your income, employee benefits and other factors, your family might qualify for a variety of cost-cutting child care subsidies. We’ve rounded up various programs, resources and other options that could reduce how much you’re paying for quality care.

__________________________

2022 Cost of Care Survey methodology

This scientific sample of 3,003 US adults (18 years or older) who are all parents paying for professional child care was surveyed between March 24, 2022, and March 30, 2022. All respondents are parents of children 14 years or younger and currently pay for professional child care, confirmed by both consumer-matched data and self-confirmation. DKC Analytics conducted and analyzed this survey with a sample procured using the Pollfish survey delivery platform, which delivers online surveys globally through mobile apps and the mobile web along with the desktop web. No post-stratification has been applied to the results.

- The Care.com Cost of Child Care Survey: 2021 Report

- The Care.com Cost of Child Care and COVID-19 Child Care Surveys: 2020 Report

- The Care.com Cost of Child Care Survey: 2019 Report

- The Care.com Cost of Child Care Survey: 2018 Report

- The Care.com Cost of Child Care Survey: 2017 Report

- The Care.com Cost of Child Care Survey: 2016 Report

- The Care.com Cost of Child Care Survey: 2015 Report

- The Care.com Cost of Child Care Survey: 2014 Report

How much to charge for child care

Are you considering starting a career in child care but you’re not sure what you should charge? Or maybe you’ve been a child care provider for awhile and feel like you should be making more? Asking for or accepting a lower rate may land you the new job, but (of course) you also want to make a fair wage that you can live on. So when determining your pay, it’s important to know what your child care services are worth.

Pay rates for child care providers can vary significantly due to a number of factors: job type and expectations, your experience, number of children, your location and more. But there are definitely some pay ranges that are standard for each type of child care job. We did some research (so you don’t have to), and here’s what other caregivers are getting paid.

But there are definitely some pay ranges that are standard for each type of child care job. We did some research (so you don’t have to), and here’s what other caregivers are getting paid.

Pay rate by job type

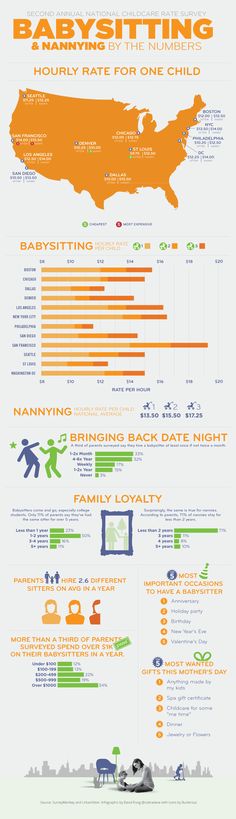

BabysittersSetting babysitting rates can be a challenge since you don’t always get to communicate with other sitters to compare notes. The good news is there’s some good, hard data on this.

According to the Care.com 2022 Cost of Care Survey, which used payment data from over 3,000 parents across the country, parents paid after-school babysitters — working about three hours a day, or a total of 15 hours per week — an average of $17.40 per hour (or $261 per week).

This rate can fluctuate depending on your skill level, education and experience, as well as the number of children who need care. The most notable factor, though, is the city and state you live in. For example, in Seattle, Washington, the going rate for sitter averages $20.00 per hour, but in San Antonio, Texas, it averages $14. 00 per hour, according to the Care.com babysitting rates calculator.

00 per hour, according to the Care.com babysitting rates calculator.

Aside from the location, what’s going to make you a little more dough? Education and training. Having an early childhood education degree or credits or training courses and certifications, including infant care certification, water safety certification and special needs care, can help boost your career — and hopefully your pay rate, too!

It’s important to note that you should be paid fairly. At the very least, you should make above the federal minimum wage ($7.25 per hour, as of August 2022) and above your state, city or county’s minimum wage, which may be even higher.

To find the going babysitter rate near you, enter your ZIP code into our babysitting rates calculator.

NanniesNannies provide personalized care, usually full time and in the family’s home. That may be why they’re among the highest paid child care providers.

Nannies caring for one infant and working 40 hours per week made an average of $17. 35 per hour (or $694 per week), according to the Care.com 2022 Cost of Care Survey. This means that full-time nannies can potentially make an average of about $36,088 per year, depending on the paid time off situation.

35 per hour (or $694 per week), according to the Care.com 2022 Cost of Care Survey. This means that full-time nannies can potentially make an average of about $36,088 per year, depending on the paid time off situation.

In general, a nanny caring for more than one child can expect to earn a little more than a nanny who’s in charge of just one kid. Experience and job expectations can play a factor in rates, too, as well as location. Currently, in Los Angeles, a full-time nanny earns an average of $21.00 per hour, and in Orlando, Florida, they average $15.50 per hour, according to current nanny pay rates for top cities via Care.com.

To find the going rate near you, enter your ZIP code, experience level, number of children and hours per week into our rates calculator.

Child care workers and administratorsInterested in a day care job? According to the U.S. Bureau of Labor Statistics, in 2021, child care workers earned an average annual income of $27,680 — which boiled down to an average rate of $13. 31 an hour. For child care administrators at preschools and day care centers, however, the average was at lot higher at an annual income of $53,800, or $25.87 per hour.

31 an hour. For child care administrators at preschools and day care centers, however, the average was at lot higher at an annual income of $53,800, or $25.87 per hour.

Nursery or preschool teachers’ salaries can depend significantly on their location, type of degree and the school’s set rates.

That said, the Bureau of Labor Statistics notes that preschool teachers (with the exception of special education teachers) earned an average annual income of about $36,460 in 2021 — at an average rate of $17.53 per hour. Nursery and preschool teachers can often boost their annual salaries by moving over to a private preschool, which usually has the means to offer better pay, or getting trained and certified to work with children with special needs. Special education teachers at the preschool level made $71,970 in 2021, or about $34.60 per hour for full-time, year-round positions.

Average child care pay rates by job type*

| Child care job type | Hourly | Weekly | Annually |

| Part-time babysitters (based on 15 hours per week) | $17. 40 40 | $261 | $13,572 |

| Full-time child care workers | $13.31 | $532 | $27,680 |

| Full-time nannies | $17.35 | $694 | $36,088 |

| Full-time nursery or preschool teachers | $17.53 | $701 | $36,460 |

| Full-time child care administrators | $25.87 | $1,035 | $53,800 |

| Full-time special education preschool teachers | $34.60 | $1,384 | $71,970 |

Reminder: The above rates are just averages, generalizations and general guidelines. You’re not going to make exactly what another child care provider does — and for a variety of different reasons. Just going from the suburbs to the city could mean a sitter makes up to double or even triple the pay. And of course, nannies and day care teachers with 10 years of experience are going to earn more than a newbie does.

And of course, nannies and day care teachers with 10 years of experience are going to earn more than a newbie does.

Keep all the factors of your employment, your experience and your job expectations in mind when setting your rates. Here are some of the most important ones to consider.

Geographical locationAs mentioned above, different cities have different costs of living (e.g., cost of food, housing, etc.). This means child care professionals may have to charge different pay rates so that they can cover their basic expenses — and, ideally, still make a profit afterward. For example, a babysitter living and working in a rural area will probably charge less than a babysitter who lives and works in a huge city.

If you’d like to find out what other child care providers are charging in your neck of the woods, check out our handy rates calculator.

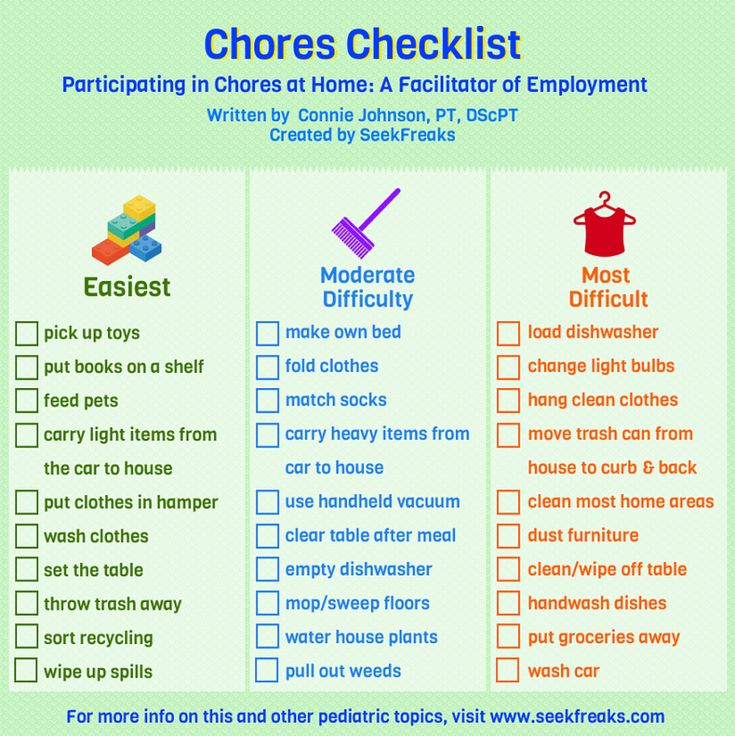

Job requirementsAnother factor that should influence your rates is the type of care a family expects you to provide. This includes the number of children they want you to care for, the number of hours they expect you to work and the time of day that they want you to be “on duty.”

This includes the number of children they want you to care for, the number of hours they expect you to work and the time of day that they want you to be “on duty.”

If a family expects you to perform additional services outside of the traditional realm of “child care duties” — such as housekeeping, pet care, tutoring or providing overnight care — that can also justify a higher rate.

So if you want to make more money, consider offering additional services that you’d be willing to perform. This strategy will enhance your “value-add” for prospective families and could even increase your likelihood of landing a job.

Level of skill and experienceMany families prefer to hire child care providers who have previous child care experience. Some look for certification in child development or a degree in early childhood education. Other families want a caregiver who speaks a second language or who has specialized experience — whether it’s caring for multiple children, children with ADHD or newborns.

Moral of the story: When setting your rates, take into account your previous work experience, your skills and any certifications and training you’ve received, as well as your education level. And don’t forget to list all of them in your online job profile and resume, so families can see what makes you worth your rates.

BenefitsFull-time household employees (e.g., nannies) should ask hiring families if they’d consider providing them with benefits like health insurance, paid time off and more. These benefits are often built into their salary and may be broken down into monthly or weekly rates.

Final tips for setting your child care ratesBy this point, you’ve familiarized yourself with the national averages for different types of child care jobs, you’ve scoped out your competition’s rates and you’ve figured out how much your skills and experience are worth. But you have a little more work to do in order to set your rate.

Ask yourself these final questions to make sure you’ve accounted for everything:

- How far do you have to commute for the job?

- How many children are you being asked to care for?

- Are you caring for kids overnight?

- Are you being offered benefits such as health and dental insurance, 401(k) and paid time off?

- Have you accounted for your added value services (e.

:max_bytes(150000):strip_icc()/understanding-family-medical-leave-act-4628330-v1-50804ec983ad4a15b7c3ee2a1c75ff83.png) g., more education or certifications, increased experience, etc.)?

g., more education or certifications, increased experience, etc.)? - Do you know how much tax you’ll have to pay and whether or not it will be withheld from your paycheck?

- Does this job fit your budget needs and will you bring home enough money every month to cover all your expenses?

Starting with what you need to make — and then breaking down what your services are worth — will help you find your pay “sweet spot.” That rate should be enough to cover your monthly expenses, pay your taxes and still have some fun with friends and family.

list of documents, detailed instructions for obtaining

By law, you can be on parental leave for three years.

Diana Shigapova

lawyer

Mothers, fathers or other relatives, while on such leave, receive benefits until the child reaches one and a half years.

We have already written how to calculate maternity payments. In this article I will tell you how benefits are calculated and assigned for a child up to three years old.

What laws govern the granting of allowance for a child up to three years of age

The right to a monthly allowance for child care is guaranteed by the federal law "On State Benefits for Citizens with Children".

The right to a monthly allowance for child care

The same law states that the allowance is paid from the day the leave is granted until the child reaches one and a half years. The law does not say anything about benefits from one and a half to three years.

Duration of payment of the monthly child care allowance

Instead of a benefit from one and a half to three years, mothers or other relatives who have taken parental leave are entitled to compensation - 50 R. But only for children born before 2020. nine0003

What has changed in 2020. Families with children born in 2020 and later are no longer paid monthly compensation in the amount of 50 R for children from one and a half to three years old: the presidential decree on the payment of such compensation has become invalid.

So what? 11/26/19

Payments for children under three years of age have been cancelled. What does it mean?

If you already receive 50 R for children under three years old, then you will continue to receive money until the children's third birthday.

Who is entitled to benefits up to three years

In this article, I will talk about mothers, because they are the ones who most often take parental leave.

Allowance up to one and a half years is due to all mothers who care for children. It doesn’t matter if a woman worked under an employment contract or not, she will receive a child care allowance. But the amount of the benefit is different. Here is what affects him:

- The salary that the mother received before pregnancy.

- Family status - for example, a family may be considered indigent. nine0044

- The status of the child - for example, a child with a disability.

/papa-mozhet/

How a man can go on maternity leave

A mother without work experience will receive the least, and a mother with a good salary and a special child will receive the most.

I will tell you more about the possible amounts of benefits for a child up to one and a half years below.

Compensation in the amount of 50 R is due only to those who are employed, and provided that the child was born before 2020. This amount is fixed. nine0003

Which family is considered poor

In Russia, a poor family is one whose average per capita income per family member is less than the subsistence minimum established in the region of residence.

Determine if the family is poor, as follows:

- Calculate the family income for the last three months from the date of application to social protection. Income includes all salaries, pensions, allowances, scholarships.

- The amount of income divided by 3 is the average monthly family income. nine0044

- Divide the average monthly income by the number of family members to get the average per capita family income. It is he who is compared with the subsistence minimum per capita in the region where the family lives.

st. 7 of the Federal Law No. 178 "On State Social Assistance"

For the poor, the state has developed a special program, according to which, in addition to the child care allowance, the mother receives additional money.

Types of allowances for a child up to three years old

A pregnant woman, and then a woman who has given birth, is entitled to a pregnancy and childbirth allowance, child care allowance and sometimes other payments - this depends on the situation in the family. nine0003

Maternity payments , or maternity allowance, are due to women who work under an employment contract, and also to those who were fired due to the liquidation of the organization or the termination of the individual entrepreneur.

What to do? 07/15/19

How can an individual entrepreneur receive maternity payments?

In addition to them, individual entrepreneurs who pay contributions to the Social Insurance Fund, the Social Insurance Fund, as well as civil servants, full-time students of universities and colleges can receive maternity payments. nine0003

This money is paid once - before maternity leave.

Child allowance is a child care allowance that is paid by the FSS every month until the child reaches one and a half years.

Child allowance up to one and a half years for the unemployed is issued in the Pension Fund of the Russian Federation. A certificate is needed from the second parent that he does not receive such benefits.

If a parent applies for benefits through an employer or the Social Insurance Fund, then certificates from a spouse or other relatives are not needed. Since 2022, the Social Insurance Fund itself determines whether someone already receives an allowance for caring for this child. nine0003

nine0003

Payments to parents of a disabled child . In addition to child care allowance, a mother can apply for a social pension, as well as monthly assistance.

Disability pension and caregiver's benefit are paid up to the age of 18.

Payments to low-income families are provided for by federal and regional legislation. At the federal level, this is a monthly allowance for the first or second child, the so-called Putin's payments. The allowance is not intended specifically for low-income families, but with a high degree of probability, it is the low-income family that will have the right to Putin's payments. This allowance is paid for up to three years. nine0003

In some regions, support measures are provided directly to low-income families with small children. For example, in Moscow, children under three years old from low-income families are paid from 8,896 R to 17,791 R per month.

Other types . There are also additional payments to families in which fathers serve on conscription. They are paid until the child is three years old, but payments stop if the father has served and returned home.

They are paid until the child is three years old, but payments stop if the father has served and returned home.

/benefits/

Payments and child benefits in 2022

Who pays the benefits

The allowance for caring for a child up to one and a half years old is paid by the FSS or the PFR. Some employees who have become parents are also entitled to financial assistance from their employers.

FSS. Today, in all regions of the Russian Federation, there is a project for direct payments from the FSS - child care benefits are paid directly by the fund. But, if you are employed, you still need to apply for benefits to the employer: he will transfer the information to the FSS, and he will transfer the money. nine0003

PFR. The unemployed and women apply to the pension fund, who were fired during parental leave due to the liquidation of the organization.

/posobiya-roditelyam-bez-raboty/

What child benefits are due to parents without work

Employer. Some corporations and other large employers are developing a company's social policy: they think over when and how they will financially support their employees. Such programs operate, for example, in Gazprom and Tatneft. nine0003

Some corporations and other large employers are developing a company's social policy: they think over when and how they will financially support their employees. Such programs operate, for example, in Gazprom and Tatneft. nine0003

Parental leave is often the case when an employer provides financial assistance to employees. That is, a woman receives both child care allowance and financial assistance from the employer.

Payments for a child with a disability come from the pension fund. To support low-income families, money is allocated from the federal and regional budgets, but these payments are processed in social security.

The procedure for assigning benefits

Most of the benefits are assigned on a declarative basis - that is, in order for a woman to receive them, she must write an application and provide documents. nine0003

Documents for receiving benefits

If a woman works under an employment contract, she needs to bring a child's birth certificate to the accounting department at work. A certificate from the father stating that he did not apply for child care allowance for up to one and a half years, from 2022, it is no longer necessary to submit for work.

A certificate from the father stating that he did not apply for child care allowance for up to one and a half years, from 2022, it is no longer necessary to submit for work.

You also need to bring a certificate from the previous employer about the amount of wages in order to calculate the allowance if the woman changed jobs during the previous two years.

/guide/moneyforborn/

How to receive payments at the birth of a child

If a woman is unemployed, then she needs to prepare a copy of her passport, a copy of the birth certificate of the child, a copy of the employment record, a certificate of non-receipt of unemployment benefits, as well as a certificate from her father that he did not take leave for child care. The FIU has no information about this, so it needs such a certificate.

If a woman wants to make payments for a low-income family, then in addition to the basic documents, she needs to prepare certificates of her and her husband's income. nine0003

nine0003

Application for benefit is filled in in any form.

Application deadline for benefits up to one and a half years - up to two years of the child. Children up to three years of age can apply for Putin's payments.

Art. 12 of the Federal Law "On compulsory social insurance in case of temporary disability and in connection with motherhood"

Where to submit documents: to the accounting department at the place of work, to the Pension Fund of the Russian Federation, the Social Insurance Fund, social security or the MFC. In some regions, working parents can apply for benefits up to a year and a half through public services. nine0003

Amount of benefits

Maternity allowance. The amount of maternity leave is calculated according to one of two formulas: based on salary or based on the minimum wage. The formula is chosen depending on the length of service and the amount of the woman's earnings two years before pregnancy.

Formulas for calculating maternity payments

Formula for calculating maternity payments based on salary in 2022: the woman was on sick leave, on maternity or childcare leave) × number of days of decree

Formula for calculating maternity payments based on the minimum wage from June 2022:

15,279 R × 24 months ÷ 730 days × number of days of the decree

Term of the decree and the amount of payments

| Term | Amount | |

|---|---|---|

| Ordinary decree | 140 days | 70,324.8 R |

| Complicated labor | 156 days | 78,361.92 R |

| Multiple pregnancy | 194 days | 97450.08 Р |

Ordinary decree

term

140 days

sum Multiple pregnancy

Term

194 days

Amount

97,450.08 R

Child care allowance . How much they will be paid in 2022 is calculated according to the following formula:

How much they will be paid in 2022 is calculated according to the following formula:

Salary and other labor income for 2020-2021, but not more than 1,878,000 R ÷ 730 days (minus the number of days that a woman was on sick leave or on vacation for pregnancy or on parental leave) × 30.4 × by 40%

In 2022, you should get at least 7677.81 R and no more than 31 282.82 R per month. The maximum for the whole of Russia is the same.

The unemployed and those whose average salary for two years is less than the minimum wage are paid a fixed allowance - 7677.81 R. This amount is increased by the regional coefficient, if it is applied in the locality. nine0003

Putin's payments depend on the subsistence minimum - PM. Families in which the average monthly income per family member is not higher than twice the regional subsistence level are entitled to the subsistence level per child. On average, this is 14,000-15,000 rubles.

Since June 1, 2022, the minimum wage and living wages have grown. As a result, social payments tied to the PM also increased.

As a result, social payments tied to the PM also increased.

Duration of payments

Child care allowance is paid strictly until the child reaches the age of 1 year and 6 months. If this date falls, for example, in the middle of the month, then the amount of the benefit is calculated in proportion to the days. nine0003

For example, the child of an unemployed mother turned one and a half years old on 15 June. The allowance will be calculated as follows: 7677.81 R ÷ 30 days × 15 days. The woman will receive 3838.91 rubles.

Putin's payments are paid for a year, after which they must be extended, but no longer than until the child is three years old.

Payments to low-income families continue as long as established in the regional law. For example, in Tatarstan they pay for six months, and then the applicant needs to confirm his need: re-write the application, bring income certificates. nine0003

When payments stop

Child care benefits stop in two cases:

- The child is one and a half years old.

- The parent refused the allowance.

All other benefits are terminated in the following cases:

- If the payment period has expired, and the family could no longer prove their need or comply with the conditions prescribed by law.

- If the social security authority found that the family's real income is higher than declared. nine0044

- If the child is 3 years old.

What parents say about the fairness of payments

Many people think that the principle by which they determine who and how much to pay is unfair. This is especially true of Putin's payments.

Date of birth . The resentment is connected with the fact that the date of birth of children is prescribed in the law, starting from which the family has the right to the allowance.

/money-for-baby/

How I got Putin's payments for a child

Putin payments can only be issued by families in which a child was born after January 1, 2018. That is, if the child was born on December 31, 2017 or earlier, the parents will not be able to apply for benefits.

That is, if the child was born on December 31, 2017 or earlier, the parents will not be able to apply for benefits.

There is also a second condition: the child must be the first or second. Parents of babies born after January 1, 2018, but no longer the first or second in a row, cannot issue Putin's payments either.

The criterion of need in the law is quite clear: no more than two living wages established in the region where the family lives. If the income in the family is at least 1 R more, you will not be able to apply for benefits. nine0003

Source of payments for the second child . If money is allocated for the first child from the federal budget, then money for payments for the second child is taken from maternity capital. Families have to choose: reduce the amount of maternity capital and receive benefits, or refuse benefits and spend maternity capital for other purposes.

What payments are due to a family with children of a different age

There are many child allowances and payments, the conditions for receiving them are even more - it is easy to get confused in all this. Our test will help you figure it out:

Our test will help you figure it out:

What a woman will receive for a child under three years old

- Pregnancy and childbirth allowance if she works under an employment contract or quit due to the liquidation of the organization or the termination of the individual entrepreneur. And also if he independently pays contributions to the FSS as an individual entrepreneur.

- Monthly allowance for caring for a child up to one and a half years.

- Monthly compensation in the amount of 50 R if employed and the child was born before 2020.

- Putin's payments - one subsistence minimum per child per month, if the average monthly income per family member is not higher than twice the regional subsistence level. nine0044

- Monthly allowance for low-income families, if the average per capita income for each family member is less than the subsistence minimum established in the region of residence. The amount of the allowance is set at the regional level.

- Social pension and monthly compensation if the child is disabled.

FAQ

Ask your own question

Cannot find 'faq' template with page 'detail'

Enter part of the name or address:

MFC Leninsky district

432017, Ulyanovsk region, Ulyanovsk, Goncharova street, 11MFC Zavolzhsky district

433000, Ulyanovsk region, Ulyanovsk, Sozidateley pr-kt, building 17aMFC Zasviyazhsky district 85)

432012, Ulyanovsk region, Ulyanovsk, Lokomotivnaya st., 85MFC Zheleznodorozhny district (Minaeva 6)

432017, Ulyanovsk region, Ulyanovsk, Minaeva st. , 16 AIFC Melekessky district

433505, Ulyanovsk region, Dimitrovgrad, Oktyabrskaya street, 64 MFC of Novomalyklinsky district

433560, Ulyanovsk region, Novomalyklinsky district, Novaya Malykla village, Kooperativnaya street, 26MFC of Staromayinsky district

433460, Ulyanovsk region, Staromayna district , Stroiteley st., 3MFC Cherdaklinsky district

433400, Ulyanovsk region, Cherdaklinsky district, Cherdakly rp, Sovetskaya st. 0348 433380, Ulyanovsk region, Sengileevsky district, Sengilei, Krasnoarmeyskaya street, 53MFC of the Ulyanovsk region

0348 433380, Ulyanovsk region, Sengileevsky district, Sengilei, Krasnoarmeyskaya street, 53MFC of the Ulyanovsk region

433310, Ulyanovsk region, Ulyanovsk region, Isheevka district, Lenina street, 32MFC of the Tsilninsky district

433610, Ulyanovsk region , Bolshoe Nagatkino s, Kuibyshev st., 10MFC of the Mainsky district

433130, Ulyanovsk region, Mainsky district, Maina rp, Chapaeva st., 1MFC of the Terengulsky district district

433700, Ulyanovsk region, Bazarnosyzgansky district, Bazarny Syzgan district, Sovetskaya pl, 1MFC of Inzensky district

433030, Ulyanovsk region, Inzensky district, Inza, Truda street, 28 AMFC of Baryshsky district

433750, Ulyanovsk region, city , Radishcheva street, 88 VMFTs Sursky district

433240, Ulyanovsk region, Sursky district, Surskoye district, Sovetskaya street, 25 , Ulyanovsk region, Veshkaymsky district, Veshkayma district, Komsomolskaya street, 8MFC Kuzovatovsky district

433760, Ulyanovsk region, Kuzovatovsky district, Kuzovatovo district, Zavodskoy lane, 16MFC Nikolaevsky district

433810, Ulyanovsk region, Nikolaevsky district, Nikolaevka district, Lenin Square, 3MFC Novospassky district

433870, Ulyanovsk region, Novospassky district , Novospasskoye district, Dzerzhinsky street, 2 DMFTS of Pavlovsky district

433970, Ulyanovsk region, Pavlovsky district, Pavlovka district, Kalinina street, 24MFC Radishevsky district Starokulatkinsky district

433940, Ulyanovsk region, Starokulatkinsky district, Staraya Kulatka rp, Pionerskaya street, 30GKU "Government for citizens" (administrative and managerial personnel)

432017, Ulyanovsk region, Ulyanovsk, Goncharova street, 11MFC for business Ulyanovsk

432072 , Ulyanovsk region, Ulyanovsk, Maksimova pr-d, 4MFC for business Dimitrovgrad

433000, Ulyanovsk region, Dimitrovgrad, Dimitrova pr-kt, 8-TOSP: Ulyanovsk, Metallistov st.