How much money can your child make and still be a dependent

When Does Your Child Have to File a Tax Return?

How much can a dependent child earn? Learn the rules about when a child must file a tax return because of earned and unearned income.

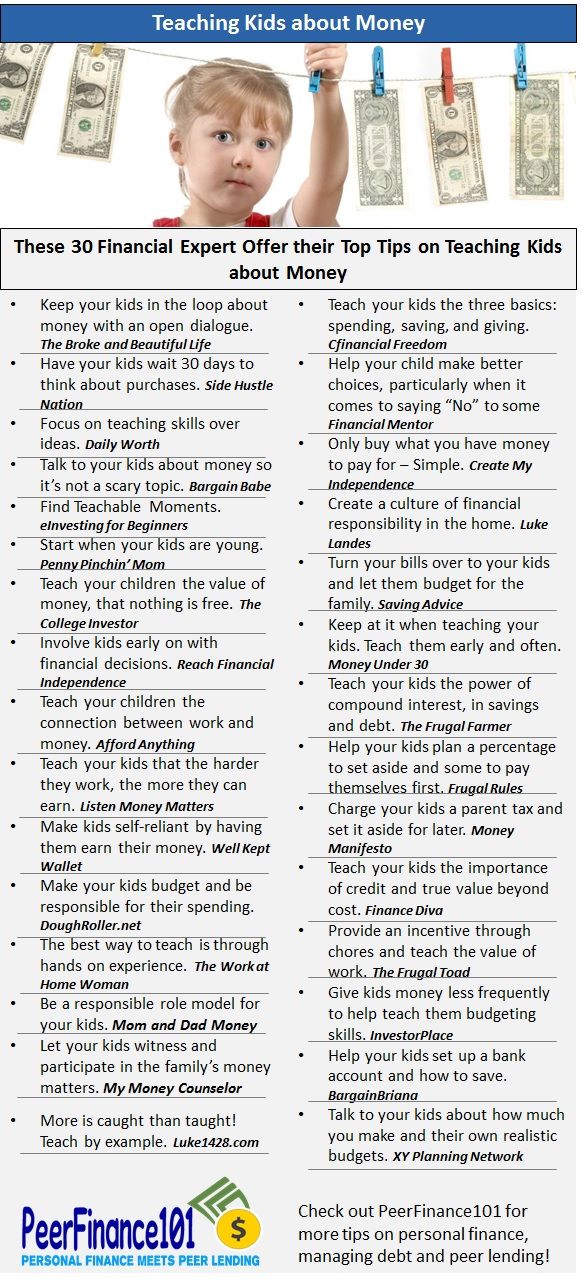

Say your dependent child is earning money from working, investments, or both. Great, but beware—your child might have to file a tax return. It might seem odd, but the IRS says dependent children who earn more than a threshold amount must file returns.

If a child fails to file, you (the parent) might be liable for the tax. Moreover, if your child can't file a return for any reason, such as age, you're legally responsible for filing one on your child's behalf.

For all these reasons it's vitally important to know how much your dependent child can earn before a tax return has to be filed. But how much can a dependent child earn? Read on to find out.

Types of Income for Dependents

Whether your child is required to file a tax return depends on the applicable standard deduction and how much earned and unearned income the child had during the year.

What is earned income? "Earned income" is income a child earns from working. It includes salary or wages, tips, professional fees, and taxable scholarship and fellowship grants.

What is unearned income? "Unearned income" is investment-type income. It includes taxable interest, dividends, capital gains, unemployment compensation, Social Security benefits, annuities, and distributions of unearned income from a trust.

If Your Child Has Earned Income OnlyA child who has only earned income must file a return only if the total is more than the standard deduction for the year. For 2022, the standard deduction for a dependent child is total earned income plus $400, up to a maximum of $12,950. So, a child can earn up to $12,950 without paying income tax.

If Your Child Has Unearned Income OnlyExample: William, a 16-year-old dependent child, worked part-time on weekends during the school year and full-time during the summer.

He earned $14,000 in wages during 2022. He didn't have any unearned income. He must file a tax return because he has earned income only, and his total income is more than the standard deduction amount for 2022.

A child who has only unearned income must file a return if the total is more than $1,150 for 2022.

Example: Sadie, an 18-year-old dependent child, received $1,900 of taxable interest and dividend income during 2022. She didn't work during the year. She must file a tax return because she has unearned income only, and her total income is more than the unearned income threshold for 2022.

However, if your child's interest and dividend income (including capital gain distributions) total less than $11,500, you can elect to include that income on your (the parents') return rather than file a return for the child. In this event, all income over $2,300 is taxed at your tax rates—you could end up paying more with this method.

If a child has both earned and unearned income, that child must file a return for 2022 if:

- unearned income is over $1,150

- earned income is over $12,950, or

- earned and unearned income together totals more than the larger of (1) $1,150, or (2) total earned income (up to $12,500) plus $400.

Should Your Child File a Return Even If Not Required?Example: Mike, a 19-year-old college student claimed as a dependent by his parents, received $200 taxable interest income (unearned income) and earned $2,800 from a part-time job during 2022 (earned income). He doesn't have to file a tax return. Both his earned and unearned income are below the thresholds, and his total income of $3,000 is less than his total earned income plus $400 ($3,200).

Even if your child doesn't meet any of the filing requirements discussed, that child should file a tax return if:

(1) income tax was withheld from that child's income, or

(2) that child qualifies for the earned income credit, additional child tax credit, health coverage tax credit, refundable credit for prior year minimum tax, first-time home buyer credit, adoption credit, or refundable American opportunity education credit.

See the tax return instructions to find out who qualifies for these credits. By filing a return, your child can get a refund.

What Is Your Child's Income Tax Rate?The first $1,150 of unearned income is covered by the kiddie tax standard deduction, so it isn't taxed. The next $1,150 in unearned income is taxed at the child's tax rate, which is ordinarily lower than the parent's. Income over $2,300 is taxed at the parent's maximum income tax rate.

Figuring the kiddie tax can be complex. For example, if a parent has more than one child subject to the kiddie tax, the net unearned income of all the children has to be combined, and a single kiddie tax calculated.

For federal income tax purposes, the income a child receives for personal services (labor) is the child's, even if, under state law, the parent is entitled to and receives that income. So, dependent children pay income tax on their earned income at their own individual tax rates.

For more on tax rules for children, see IRS Publication 929, Tax Rules for Children and Dependents.

How much money can a child make and still be claimed as a dependent?

For 2022, a child typically can have up to $12,950 of earned income without paying income tax. However, self-employment income and unearned income such as that from investments have different thresholds for children to file tax returns.

Takedown request | View complete answer on turbotax.intuit.com

Can I claim my daughter as a dependent if she made over $4000?

Gross income is the total of your unearned and earned income. If your gross income was $4,400 or more, you usually can't be claimed as a dependent unless you are a qualifying child. For details, see Dependents.

Takedown request | View complete answer on irs.gov

Can I still claim my child as a dependent if they work?

Can I claim them as dependents? You can usually claim your children as dependents even if they are dependents with income and no matter how much dependent income they may have or where it comes from.

| View complete answer on hrblock.com

Do I have to claim my child's income if I claim them as a dependent?

Your dependent's earned income doesn't go on your return. Filing tax returns for children is easy in that respect. If you're the dependent in question, you might be asking, “Do I file taxes if I'm a dependent?” Even if you're a child, filing a tax return might be necessary depending on your income and circumstances.

Takedown request | View complete answer on hrblock.com

How much can a dependent child earn without paying taxes?

A minor who may be claimed as a dependent must file a return if their income exceeds their standard deduction ($12,950 for tax year 2022). A minor who earns less than $12,950 will not owe taxes but may choose to file a return to receive a refund of withheld earnings.

| View complete answer on turbotax.intuit.com

How much money can my child make and still be claimed as a dependent?

How much can a dependent child earn in 2022 and still be claimed?

When does your child have to file a tax return? For 2022, a child typically can have up to $12,950 of earned income without paying income tax. However, self-employment income and unearned income such as that from investments have different thresholds for children to file tax returns.

Takedown request | View complete answer on turbotax.intuit.com

When should I stop claiming my child as a dependent?

You generally may do so as long as your child is either under age 19 (nonstudents) or under age 24 (students). But there is a reason to not claim your child as a dependent – and it has everything to do with higher education.

But there is a reason to not claim your child as a dependent – and it has everything to do with higher education.

| View complete answer on hawkinsash.cpa

Can I claim my son as a dependent if he is in college and works?

If your child meets these requirements and is a full-time college student, you can claim them as a dependent until they are 24. If they are working while in school, you must still provide more than half of their financial support to claim them.

Takedown request | View complete answer on taxslayer.com

What are the IRS rules for claiming dependents?

The child must be: (a) under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), (b) under age 24 at the end of the year, a full- time student, and younger than you (or your spouse, if filing jointly), or (c) any age if permanently and totally disabled.

| View complete answer on apps.irs.gov

Can you file taxes if you didn t work but have a child 2023?

Can you file taxes with no income but have a child or dependent? If you have no income but have a child/dependent, you can still file your taxes. This may allow you to get a refund if the tax credits you're eligible for are more than your income.

Takedown request | View complete answer on stilt.com

Does my child working affect my tax credits?

My child has a part-time job – does this affect my benefits? No, they are still classed as a dependant so any income they have won't affect your benefits.

Takedown request | View complete answer on gingerbread.org.uk

Can my parents claim me as a dependent if I file my own taxes?

Yes, your mother can claim you as a dependent and you can still file your taxes.

| View complete answer on ttlc.intuit.com

How do I prove my child's earned income?

Ideally your child should have a W2 or a Form 1099 to show evidence of the earned income. However, there are some instances where this may not be possible so it's important to keep records of the type of work, when the work was done, who the work was done for and how much your child was paid.

Takedown request | View complete answer on districtcapitalmanagement.com

How many hours can my child work if I claim tax credits?

If your child leaves education before they're 18 and registers with a careers service or joins the Armed Forces, you can get tax credits for 20 weeks if they're: 16 or 17 years old. working less than 24 hours a week. not getting benefits themselves, for example Income Support.

Takedown request | View complete answer on citizensadvice. org.uk

org.uk

How much is a dependent worth on taxes 2022?

The Child Tax Credit can reduce your taxes by up to $2,000 (tax year 2022) per qualifying child age 16 or younger. If you do not owe taxes, up to $1,500 of the child tax credit may be refundable through the Additional Child Tax Credit for 2022.

Takedown request | View complete answer on turbotax.intuit.com

Does the IRS check your dependents?

If one of you doesn't file an amended return that removes the child-related benefits, then the IRS will audit you and/or the other person to determine who can claim the dependent. You'll get a letter in a few months to begin the audit.

Takedown request | View complete answer on hrblock.com

Why doesn t my 17 year old qualify for Child Tax Credit?

17-Year-Old Children and the Child Tax Credit

Answer: No. Seventeen-year-olds qualified as eligible children for the child credit for 2021, but not for 2022. The qualifying age for children for 2022 is 16 and under.

Seventeen-year-olds qualified as eligible children for the child credit for 2021, but not for 2022. The qualifying age for children for 2022 is 16 and under.

| View complete answer on kiplinger.com

At what income level do dependents have to file taxes?

The minimum income requiring a dependent to file a federal tax return. 2021 filing requirements for dependents under 65: Earned income of at least $12,550, or unearned income (like from investments or trusts) of at least $1,100.

Takedown request | View complete answer on healthcare.gov

Can I claim my son if he made 10000?

Earned income only

A child must file a tax return if their earned income is more than the standard deduction. For this year's filing, the standard deduction for a dependent child is total earned income up to $12,550. Anything earned, as in worked, under this does not need to be registered, but anything over does.

Anything earned, as in worked, under this does not need to be registered, but anything over does.

| View complete answer on en.as.com

Is it better for a college student to file their own taxes?

The only way for you to receive credits and deductions on your tax returns is by filing independently as a college student providing more than half of your own financial support.

Takedown request | View complete answer on accoladefinancial.com

Can a full-time student claim themselves as a dependent?

If you don't meet the qualifications to be a qualifying child or qualifying relative, you may be able to claim yourself as a dependent. Think of a personal exemption as “claiming yourself.” You are not your own dependent, but you can potentially claim a personal exemption.

Takedown request | View complete answer on hrblock. com

com

What is the kiddie tax rule?

The tax applies to dependent children under the age of 18 at the end of the tax year (or full-time students younger than 24) and works like this: The first $1,150 of unearned income is covered by the kiddie tax's standard deduction, so it isn't taxed. The next $1,150 is taxed at the child's marginal tax rate.

Takedown request | View complete answer on schwab.com

Can I claim head of household if my child is 19?

A qualifying child can be your biological child, stepchild, foster child, sibling, step-sibling, half sibling or a descendant of one of the aforementioned relatives. The child also needs to be under the age of 19 (or under the age of 24 if a full-time student).

Takedown request | View complete answer on smartasset.com

How much does a kid get for income tax 2022?

It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6. For each child ages 6 to 16, it's increased from $2,000 to $3,000. It also now makes 17-year-olds eligible for the $3,000 credit. Previously, low-income families did not get the same amount or any of the Child Tax Credit.

For each child ages 6 to 16, it's increased from $2,000 to $3,000. It also now makes 17-year-olds eligible for the $3,000 credit. Previously, low-income families did not get the same amount or any of the Child Tax Credit.

| View complete answer on whitehouse.gov

What are red flags for the IRS?

Top 4 Red Flags That Trigger an IRS Audit

- Not reporting all of your income.

- Breaking the rules on foreign accounts.

- Blurring the lines on business expenses.

- Earning more than $200,000.

| View complete answer on turbotax.intuit.com

← Previous question

Did the Browns get charged with bigamy?

Next question →

Is Social security a right?

How much can a child earn and still be dependent? [Resolved]

For 2021, the standard deduction for a dependent child is total earned income plus $350, up to a maximum of $12,550. . So, a child can earn up to $12,550 without paying income tax. At $400, the standard deduction per dependent child is total earned income plus $400, up to $400,000.

. So, a child can earn up to $12,550 without paying income tax. At $400, the standard deduction per dependent child is total earned income plus $400, up to $400,000.

Similarly, how much can my child earn and be dependent on in 2021? For this year's filing, the standard deduction for a dependent child is total earned income. to $12,550 . Everything that worked, as it worked in the case, does not need to be registered for this, but everything that is in excess does.

Can dependents earn more than 4300? Answer: As long as your boyfriend is single (make sure to check your state's law on how to report your boyfriend or girlfriend as some states don't follow federal law), provides more than half of your allowance, and you lived with him. throughout the year and do not earn more than $4,300, you will qualify as...

Also, do I have to report my dependent child's income?

In general, you cannot include your dependent's income on your tax return, although there are exceptions. If your income dependents are required to file (or want to file to claim a tax refund or credit), they will need to file their own tax return, separate from yours.

If your income dependents are required to file (or want to file to claim a tax refund or credit), they will need to file their own tax return, separate from yours.

What if your dependent has an income?

You can still claim them as a dependent upon your return. Dependents who have unearned income such as interest, dividends, or capital gains will generally be required to file their own tax return if that income exceeds $1,100 for 2021. (income levels are higher for dependents aged 65 and over or who are blind).

How much can a dependent child earn in 2019 and still be in demand? For persons who may be claimed as dependents, the standard deduction cannot exceed the greater of $1,100 or $350 plus the person's earned income. but the total cannot exceed the applicable standard deduction for dependent filing status (including any additional amount for being aged 65 or over…

When should you stop claiming your child as a dependent? The federal government allows you to claim children - dependents until they are 19 . This age limit increases to 24 if they attend college

This age limit increases to 24 if they attend college

Will my child's income affect my tax credits? will most likely stop after he graduates from high school.0003 Your working tax credit will not be affected if you are still receiving the child tax credit. .

When should I stop calling my child a dependent?

The federal government allows you to claim dependent children as long as they are 19 . This age limit increases to 24 if they are attending college.

How much does a dependent have to earn to file taxes? Criteria for filing a tax return as a dependent in 2019

If you are a single or married dependent under age 65, you must file a tax return if any of the following is true: Unearned income over $1,100 . Earned income over $12,200. Gross income over $11,850 or earned income up to $350 – plus $350.

When should you stop claiming a child as a dependent?

The federal government allows you to claim dependent children until im 19 . This age limit increases to 24 if they are attending college.

This age limit increases to 24 if they are attending college.

Can I claim my daughter if she works? If she meets all the rules, you can still list her as a dependent on your joint income tax return. . You wouldn't include her income on your tax return. If her only income for the year was the income she earned, she is not required to file a tax return.

What if my dependent has income?

You can still claim them as a dependent upon your return. Dependents who have unearned income such as interest, dividends, or capital gains will generally be required to file their own tax return if that income exceeds $1,100 for 2021. (income levels are higher for dependents aged 65 and over or who are blind).

Why should a parent with a higher income claim a child?

As a rule, it is more profitable for a parent with a higher income to claim children. However, in case that parent's income is so high to prevent him/her from receiving an earned income credit or child tax credit , then the other parent must claim the children.

See also

How much child tax will you get back in 2021? In the 2021 tax year, the child tax credit increases from $2,000 per child to: $90,003 $3,600 for each eligible child under age 6 by the end of 2021, or $90,004. USD 3,000 for each child aged 6 to 17 at the end of 2021. .

Can I get tested for a child claim? If we review your loan application, it may be because: Your child is not eligible . Another person reported the same child .

How much does a dependent reduce your taxes?

For tax years 2018 to 2020, the dependency claim no longer provides for exemption of any income from taxation. However, each eligible dependent for the child tax credit will have your taxes reduced by $2,000. and those that don't can reduce your taxes by $500 each.

What is the tax deduction for children in 2021? In 2021, President Joe Biden passed the American Rescue Plan (ARP) Act, which significantly expanded the Child Tax Credit (CTC) for one year, making it the largest child tax credit in U. S. history and providing assistance to the majority of working families. USD 3,000 for a child under 18 and USD 3,600 for a child six years of age or younger. .

S. history and providing assistance to the majority of working families. USD 3,000 for a child under 18 and USD 3,600 for a child six years of age or younger. .

Can I consider my daughter a dependent if she files a tax return?

She can be claimed as a dependent if her 4200 taxable income is less than $2019 and you have provided more than half of her total support. . The stimulus payment will be recalculated on her 2020 tax return. Again, in 2020, if she can be claimed as a dependent, she should check that box.

How much can a dependent child earn in 2019year? For 2019 , the standard deduction for a dependent child with only investment income is $1,100. . If your child received income from summer work or anything else, the standard deduction is the lesser of: (1) earned income plus $350 or (2) $12,200.

employee rights, payments, job search, what to do if you are laid off

Albina Khasanshina

was made redundant

I did nothing and got paid for it. For some, this is a dream, for me it was a forced necessity.

For some, this is a dream, for me it was a forced necessity.

In September 2017, 20 of my colleagues and I received written notices of upcoming staff reductions. I heard that there were compensations for layoffs, but then I didn’t know what kind.

I was not too lazy to figure it out, so for another three months after the reduction in work, I was paid a full salary, and after that - unemployment benefits.

Everything according to the law

The events of this article are based on legal reduction. This is not always the case.

Sometimes employers use abbreviations to fire employees for no good reason. At the same time, they reduce one position and come up with another - formally new, but with the same responsibilities. After that, they simply hire the employee they like best for her.

For example, pregnant women, women on maternity leave or single mothers are so often fired because they do not want to pay them maternity leave or hire temporary employees to replace them. This is illegal, and if the case goes to court, the court will usually side with the employee.

This is illegal, and if the case goes to court, the court will usually side with the employee.

It is also different when an employee is legally laid off. If an employee received part of his earnings in an envelope, then after the reduction in payments, there will be less salary. And if he was not registered with the state, then when he is reduced, they will simply say goodbye to him and will not pay anything.

All these are topics for separate articles. In my case, the salary was whiter than snow, and the department was actually reduced. If this is not the case for you, then you will have to act differently.

How layoffs differ from layoffs

Downsizing is a process in which an employee is fired and his position is abolished. If, during a normal dismissal, the position can remain on the staff list and the company has the right to hire another specialist to replace the employee, then this will not work if the staff is reduced.

My company closed an entire department and warned them two months before layoffs. A week before the layoff, eight colleagues were offered to transfer to a new department.

A week before the layoff, eight colleagues were offered to transfer to a new department.

/vshtate/

How to correctly place an employee on the staff

Some employees are given a preferential right to stay at work, and someone cannot be fired at all even with a reduction in staff. I didn't get into their number. Until November 20, I worked as usual and was preparing for a layoff.

Every employee subject to redundancy must read the notice. If the employee is on vacation or on sick leave, then he will need to sign a document when he returns to workFeatures of dismissal due to reduction

There are some special cases when it is impossible to reduce employees.

Employees on sick leave. It is impossible to reduce a person who does not have a sick leave.

Dismissal of an employee due to staff reduction refers to dismissal at the initiative of the employer. Dismissing an employee during his period of temporary disability at the initiative of the employer is prohibited, except when the organization is being liquidated.

h. 6 art. 81 Labor Code of the Russian Federation

Employees during vacation. The same situation occurs when a person is on vacation. The employer does not have the right, on his own initiative, to dismiss employees during the vacation period.

Pensioners. The law does not establish a special procedure for the reduction of pensioners. Therefore, the dismissal of a pensioner who has fallen under a reduction is drawn up according to the standard procedure: they issue an order to reduce, check if there are any prohibitions on dismissal or a preferential right to remain in the state, notify the employee, the employment center and the trade union about the reduction, before dismissal they offer suitable vacancies.

There is an important feature in relation to pre-pensioners - people who are less than five years away from retirement. If a reduction is made in order to get rid of them, criminal liability arises: a fine or compulsory work.

Art. 144.1 of the Criminal Code of the Russian Federation

Large or single mothers. There is no direct ban on the dismissal of a mother of many children or a single mother, but it is necessary to check whether a mother of many children has children under three years old. And a single mother has children under 14 or a child with a disability under 18. In these cases, the worker cannot be laid off.

Part 4 261 of the Labor Code of the Russian Federation

If the children are older, such employees have the right of priority to remain at work. For example, when a position is reduced, but such a position is not the only one in the department. If a mother with many children or a single mother has the same labor productivity and qualifications as other workers and at the same time two or more children are dependent, she should be left.

Part 2 179 Labor Code of the Russian Federation

Part-time workers. There is no special procedure for reducing a part-time worker. A person can combine positions in one organization or in different ones - this does not give him additional rights upon dismissal, but it does not mean that one of his positions must be reduced in the first place.

A person can combine positions in one organization or in different ones - this does not give him additional rights upon dismissal, but it does not mean that one of his positions must be reduced in the first place.

Women on maternity leave or pregnant women cannot be laid off.

Part 1 261 of the Labor Code of the Russian Federation

Bypass sheet

Bypass sheet is a document that confirms that the company has no claims against the dismissed employee. When I got a job, the warehouse gave out furniture and overalls, the office gave out a computer, the system administrator created an account.

In order to protect themselves from unnecessary expenses and disclosure of trade secrets, the employer prescribes in the employment contract that the employee is responsible for the condition of the property and the consequences of the dissemination of information.

When I left, I returned everything to the same place where I took it. In some companies, employees fill out a bypass sheet through 1C or their own program. In our company, employees walk around the departments personally.

In some companies, employees fill out a bypass sheet through 1C or their own program. In our company, employees walk around the departments personally.

/prava/uvolnenie/

Your rights upon dismissal

The employees of the office and warehouse checked that I did not damage the property, the IT department deleted the account, and the certificate was taken away at the pass office. Each employee put a mark on receipt and signature in the bypass sheet. Then I took the work book.

On the day of dismissal, the personnel department makes an entry in the work book about the reason for terminating the employment contract. In my case, it was "a reduction in the staff of the organization." Under the record of the personnel officer, I signed that I had read the order and agreed with the changes made to the work book.

paragraph 2 of Art. 81 Labor Code of the Russian Federation

The rules for terminating an employment contract for downsizing work only for legal entities. If your employer is an entrepreneur, he is not required to follow this procedure. Under the contract, the warning period may be different, and, for example, there will be no payments at all - don’t blame me, there is no violation of the law.

If your employer is an entrepreneur, he is not required to follow this procedure. Under the contract, the warning period may be different, and, for example, there will be no payments at all - don’t blame me, there is no violation of the law.

Final settlement

On the day of dismissal, employees are paid wages for the days worked in the current month, compensation for unused vacation and severance pay in the amount of average monthly earnings. Money is credited to the card in one amount.

To figure out how much and for what I was paid, I turned to the accounting department. I was given a pay slip.

/guide/otpusknie/

How to calculate compensation for leave upon dismissal

What was on the payslip

| Payment | Amount |

|---|---|

| Severance pay in the amount of average monthly earnings | 62,475 R |

| Salary for days worked in the current month | 50,731 Р |

Compensation for unused vacation. I have accumulated 16 days I have accumulated 16 days | 23,942 Р |

| Surcharge for work in harsh climatic conditions | 3922 R |

| Total | 141 070 r |

Eatcounter allowance

62 475 R

Salary

50 731 R

Compensation for 16 days of vacation

23 942 R 9000 9000

141 070 R

Certificate of the amount of salary on which insurance premiums were accrued for the last three years will be needed to receive higher sick leave at a new place of work. Without a certificate in case of illness, the allowance will be calculated according to the minimum wage.

Statement of income for the current year is needed to receive a tax deduction for education, treatment or an apartment. Previously, this certificate was called "2-NDFL".

After bookkeeping, I went to the local job center.

Statement of the amount of salary on which insurance premiums were accrued for the last three years, is needed to calculate sick leave, maternity or childcare benefits at a new jobEmployment Center

Employment Center is a place where laid-off employees are helped find a job and not starve to death while looking. It looks like this: after being fired, you register with the center, and he makes sure that you receive compensation.

It looks like this: after being fired, you register with the center, and he makes sure that you receive compensation.

If you have been made redundant, your former employer pays them in the form of an average salary for the first three months. After that, the state pays unemployment benefits.

If you too are unemployed, take our short quiz to find out how much unemployment you are entitled to and how long it will be paid.

The employer issues the first compensation at the time of calculation, the second - two months later, the third - a month later. You will receive the second and third compensation only if you have not yet found a job: formally, this means that there is no entry in the work book.

In order to receive compensation for the third month, you need to have time to register with the employment center within two weeks after the reduction. If you come after 14 days, the service will register the application, but according to the Labor Code, the employer will not be able to pay compensation for the third month. In addition, in order to receive the last part of the compensation, the employer needs to bring a certificate from the employment center about the decision to keep it for you.

In addition, in order to receive the last part of the compensation, the employer needs to bring a certificate from the employment center about the decision to keep it for you.

Art. 178 Labor Code of the Russian Federation

Earnings for the third month - exceptional payment. To make a decision about it, the employment center needs iron reasons. It is paid if the employee is the only breadwinner in the family or, for example, supports elderly parents.

You can register with the employment service through public services and the Jobs in Russia portal. You don’t need to go anywhere, just a scan of your passport, diploma or high school diploma. You do not need to provide a copy of the work book, the dismissal order and a certificate of average monthly earnings from the previous employer: the employment center will receive this information itself through the system of interdepartmental interaction.

/guide/posobie-koronavirus/

How to receive unemployment benefits in 2022

Within 10 days of registering with the center, you will be given the status of unemployed. At this time, job offers may be received in your personal account at public services or on the Jobs in Russia website. This is equivalent to issuing a referral to paid work, as if you came to the EPC in person. You can look for options on your own.

At this time, job offers may be received in your personal account at public services or on the Jobs in Russia website. This is equivalent to issuing a referral to paid work, as if you came to the EPC in person. You can look for options on your own.

The prospective unemployed bypasses employer data. It is allowed to refuse a maximum of two times, otherwise the employment service will not issue a certificate or assign benefits.

In addition to helping you find a job, the Employment Service advises you on how to start your own business, participate in paid public works, apply for financial assistance, apply for early retirement and undergo vocational training. All this is at the expense of the state.

If you start receiving any money other than unemployment benefits or compensation from your former employer, the job center stops all payments and removes you from the register. This can be not only a new job, but also your own business, work under a civil law contract, study with a scholarship, pension and even community service.

Art. 35 of the law "On Employment in the Russian Federation>"

If you receive money for freelancing, payments will stop.

Employment Center is your friend in need. If you are no longer in trouble, there will always be someone who needs money more. If you try to deceive the center and do not say that you have started working, it will find out about it upon request to the Federal Tax Service and the pension fund, and the entire amount of benefits will have to be returned.

I registered with the employment center the next day after my dismissal. On the same day, the center took up my employment.

Vacancies

The specialists of the center try to take into account the average salary at the last place of work, if it was above the subsistence level.

The journalist or correspondent that I previously worked for was not required anywhere, other vacancies were not to my liking either. But I still had to choose some vacancies and go to interviews.

As explained to me at the employment center, if the dossier is empty, I will not be issued a certificate and I will not receive the third average monthly salary from my former employer. I was advised to attend interviews at least once every one and a half months.

/prava-uchebnik/

Course: how to protect your rights at work

Interviews

Within three days after you receive a referral, you need to pass an interview with a potential employer. The only situation where you can refuse to work and this will not affect your file in any way is if in your previous job you received more than the living wage, and in your new job the salary is below this level.

So what? 03/12/18

The minimum wage was equalized with the subsistence level

I was offered a job at a telecommunications company, a bank, and an MFC. But I don’t know how to sell, I didn’t work in state institutions and had no experience in the offered vacancies.

In parallel with the bypass of the vacancies of the employment center, I was looking for a job on my own - on Headhunter and in special channels in Telegram. I understood that the employment center would not find a job equivalent to the previous one, because there were no vacancies in the profession, and for the rest I did not have enough experience.

I recorded every response, phone call, letter and interview on a special tablet.

Self-searching for a job

Self-seeking is not mandatory, but employment center inspectors strongly recommend that anyone who wants to receive a third part of the redundancy payment from a former employer.

The fact is that the certificate is issued by lawyers of the employment center on the basis of a dossier. From the dossier, the lawyer should have the impression that you were actually looking for a job. There are no formal criteria in the law according to which a lawyer must issue this certificate to you, so the decision is at his discretion.

You can get the favor of a lawyer without looking for a job yourself, but if the vacancies offered by the employment center do not suit you, and employers want to hire you, you will have to refuse them yourself. Because of this, a lawyer may decide that you do not need a job and not issue a certificate.

Therefore, it is safer to look for a job yourself, and only go to those interviews that you are really interested in or where the employer is likely to refuse you.

Total: compensation from the employer

I did everything on time, so in three months I received 188,000 rubles from the employer.

The former employer paid me the first compensation upon dismissal. Two months later, I came to the accounting department for the second allowance. I took a work book with me, in which the accountant checked the absence of records about a new place of work.

A month later, before the last payment, I needed to get a certificate from the employment center.

188,000 R

I received compensation from my former employer for three months

Three referrals from the center and four interviews from an independent search were enough for the specialist. I was referred to a lawyer who checked if I had any income on the side. I was given a certificate, and I went to the accounting department to receive the last compensation.

My employer was responsible and did everything according to the law. You can't blame the company for having to cut staff. Sometimes this helps to maintain solvency in front of other employees: pregnant women, sole breadwinners, large families.

But there are companies that do not pay compensation in full and on time in the hope that employees do not know about the payments and will not demand anything. Or there is such a mess in the company that there is no time for compensation. In this case, you should not wait, but demand your own: first politely, then in court.

I know of a case where an employee was made redundant and compensation was paid for only a month. He didn't know what was due for two more. And he wouldn't have known if his wife hadn't figured everything out herself. Then they wrote a polite letter to their former employer, but mentally they were already preparing for the trial.

The letter was written without a lawyer — they wrote it in their own words. This helped almost instantly: the former employer immediately requested details and paid all the money a week later. They only requested a certificate from the employment center.

What threatens the employer in case of non-compliance with the law

If the employer does not meet halfway, you can demand payment, forfeit and compensation for moral damage through the court. It's practically a win-win case. Illegal dismissal can also be challenged in court.

You can file a claim with the district court at the employer's address, your place of residence, or at the place where you actually worked. An employee can, within a month from the day he was given a copy of the dismissal order, the day the work book or information about work activity was issued, or the day he refused to receive the dismissal order or work book, file a claim for reinstatement at work and recovery of average earnings for the time forced walk. We describe in detail what to pay attention to in a lawsuit in the course "How to protect your rights at work".

An employee can, within a month from the day he was given a copy of the dismissal order, the day the work book or information about work activity was issued, or the day he refused to receive the dismissal order or work book, file a claim for reinstatement at work and recovery of average earnings for the time forced walk. We describe in detail what to pay attention to in a lawsuit in the course "How to protect your rights at work".

As a result, the court will oblige the employer to reinstate the employee who was dismissed in violation of the procedure for dismissal due to staff reduction or headcount, to his previous job and to recover in favor of the employee the average earnings for the period of forced absenteeism. If the employee does not want to be reinstated, the court will oblige the employer to pay money for forced absenteeism and change the grounds for dismissal to voluntary dismissal.

Part 3, 4 Art. 394 of the Labor Code of the Russian Federation

For illegal dismissal, the employer will pay a fine:

- manager and individual entrepreneur - 1000-5000 R;

- legal entity — RUB 30,000—50,000

part 1, 2 art. 5.27 of the Code of Administrative Offenses of the Russian Federation

5.27 of the Code of Administrative Offenses of the Russian Federation

A repeated violation will cost more:

- head - 10,000-20,000 R or disqualification for a period of one to three years;

- IP - 10,000-20,000 R;

- legal entity - 50,000-70,000 R

For non-payment of compensation, the employer will receive a warning or pay a fine:

- manager - 10,000-20,000 R;

- IP - 1000-5000 R;

- legal entity — RUB 50,000—70,000

Part 6 Art. 5.27 of the Code of Administrative Offenses of the Russian Federation

Repeated violation is also more expensive:

- head - 20,000-30,000 R or disqualification for a period of one to three years;

- IP - 10,000-30,000 R;

- legal entity - 50,000-100,000 R.

Unemployment benefit

When compensation from the former employer ends, the employment center begins to pay unemployment benefits. Payments are due to everyone who is registered and worked for at least 26 weeks before leaving.

Payments are due to everyone who is registered and worked for at least 26 weeks before leaving.

Art. 33 of the Law "On Employment in the Russian Federation"

The Law "On Employment in the Russian Federation" specifies how unemployment benefits are calculated. Payments depend on the average salary for the last three months at the previous place of work. In 2022, in the first three months after receiving the last compensation from the employer, they pay 75% of the salary, but not more than 12,792 R, then - 60%, but not more than 5,000 R.

12,792 R

unemployment in Russia in 2022. There are also regional allowances, but not everywhere

In some regions, the benefit is slightly more than the maximum amount, because it is also multiplied by the regional coefficient. It depends on the climatic conditions in which a person lives and works. The more severe the weather, the higher the surcharge.

For example, in Moscow and St.