How much is the average child support payment

How much is child support?

If you’re preparing for divorce, you’re probably wondering – “How much is child support?”

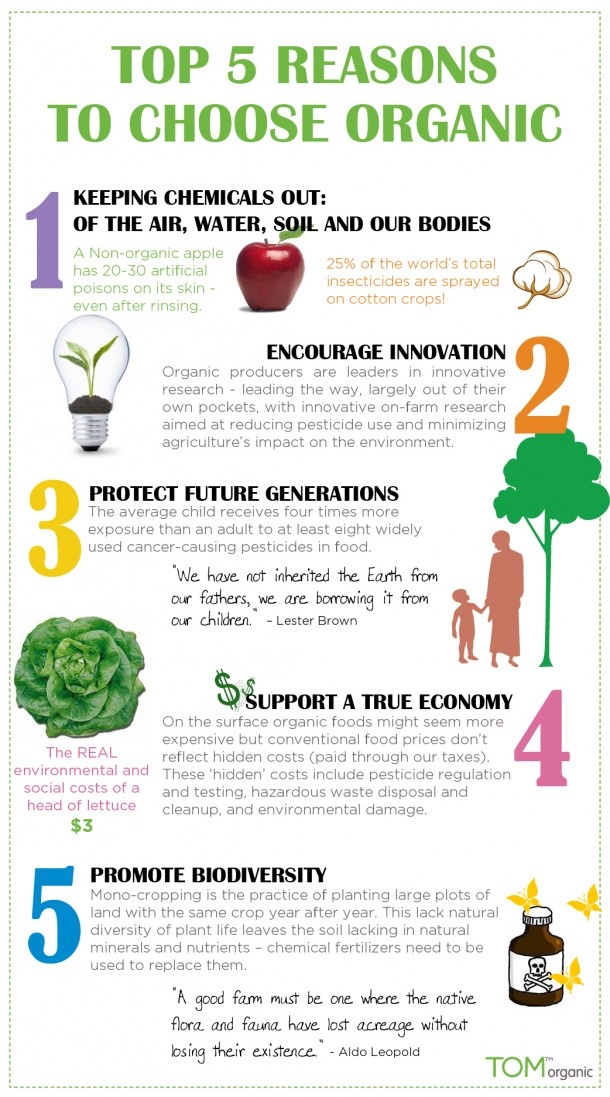

If you’re preparing for divorce or merely curious, you want to understand how child support is calculated. You might be surprised by the amount deducted from your paycheck. You may also wonder what a reasonable cost is for monthly payments, and which parent spends the most.

We have answers to those questions here.

The court will consult the child support guidelines for their state to determine your child support obligation before making an official support order. Like any average, there are quite a few variables. Parents who are in a lower income bracket might not have enough gross income for paying child support, while others who are more well-off end up paying a higher monthly amount. Every state calculation takes into account your total monthly net resources.

Parent’s Pro-Rata Share

How much child support you pay also takes into account whether you are the non-custodial parent, how much income the other parent makes compared to you, and other factors such as whether you or the other parent will provide health insurance coverage for the children, and who will pay for educational expenses and other child care expenses.

The general rule is that the child support obligation is shared by both parents in proportion to their incomes, but there are a lot of other factors that go into how much each parent will actually pay.

Custodial Parent’s Income

In some cases, the custodial parent’s income can be imputed (or assumed) for child support purposes. This usually happens when the custodial parent is not working or is not working to their full potential. The court will look at factors like education and work history to determine how much gross income the custodial parent could be earning, and base child support on that amount.

Other Factors Affecting Child Support

There are other factors that might affect how much child support you pay, such as whether you have other children to support, whether you are paying spousal support (alimony), and your personal expenses. Some states also factor in the cost of living in each parent’s household when determining how much child support to award in a court order.

Example Child Support Calculation

In our example, the court starts by determining your “adjusted” gross income – this is your total income minus deductions for state taxes and business expenses – and multiplies it by the guideline percentage for the number of children involved.

For example: if your yearly salary is $15,000 and you have one child, you would be paying 17% of your income per year in child support–this comes out monthly to $212.50 or annually as $2,550.

Average Child Support Order

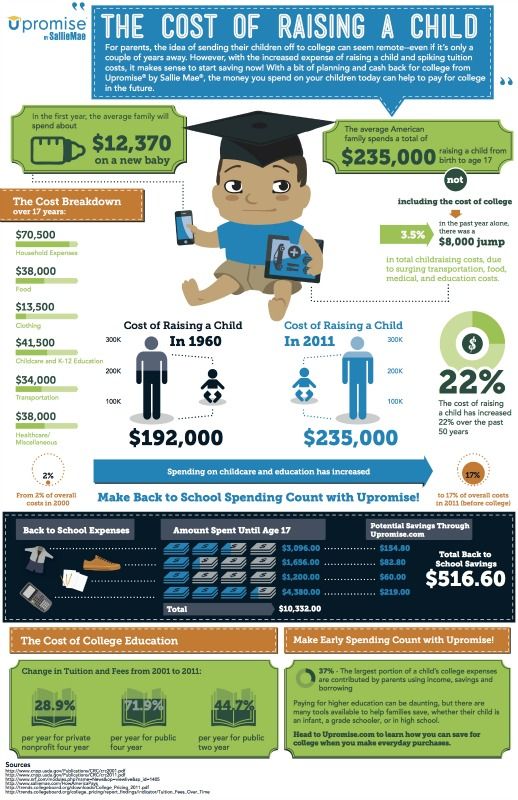

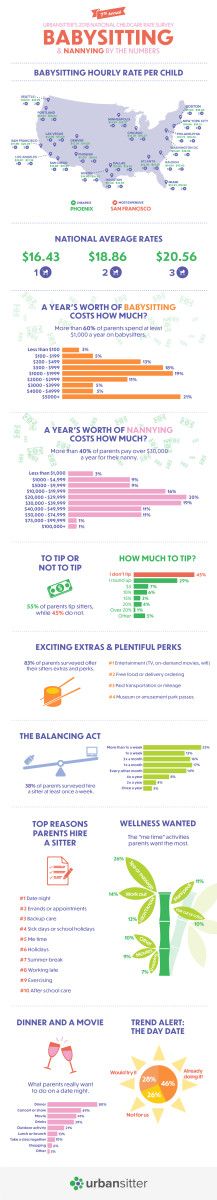

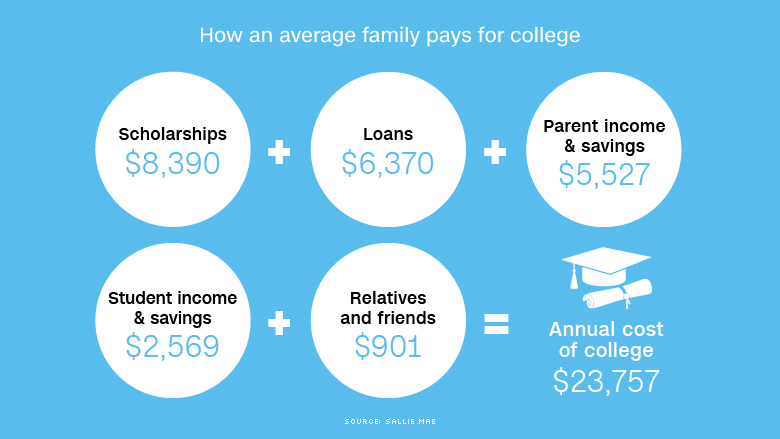

We have seen according to the 2010 Census Bureau Reports, the average monthly child support payment is $430. Again, this is just an average of the monthly amount of child support payments across the United States and should only be used as an estimate. Your situation is unique, and the amount the court determines will depend on your circumstances and financial resources.

To get a more accurate estimate of how much you might owe in child support, speak with an experienced family law attorney in your state. They will be familiar with how child support is calculated where you live and can help ensure you are paying (or receiving) the appropriate amount of support for your children.

They will be familiar with how child support is calculated where you live and can help ensure you are paying (or receiving) the appropriate amount of support for your children.

If you’re interested in an estimate of what your support payments should be, use our child support calculator.

And for more information on how you can better understand the child support laws and regulations in your state, visit our state resources section.

How much is child support in your state?

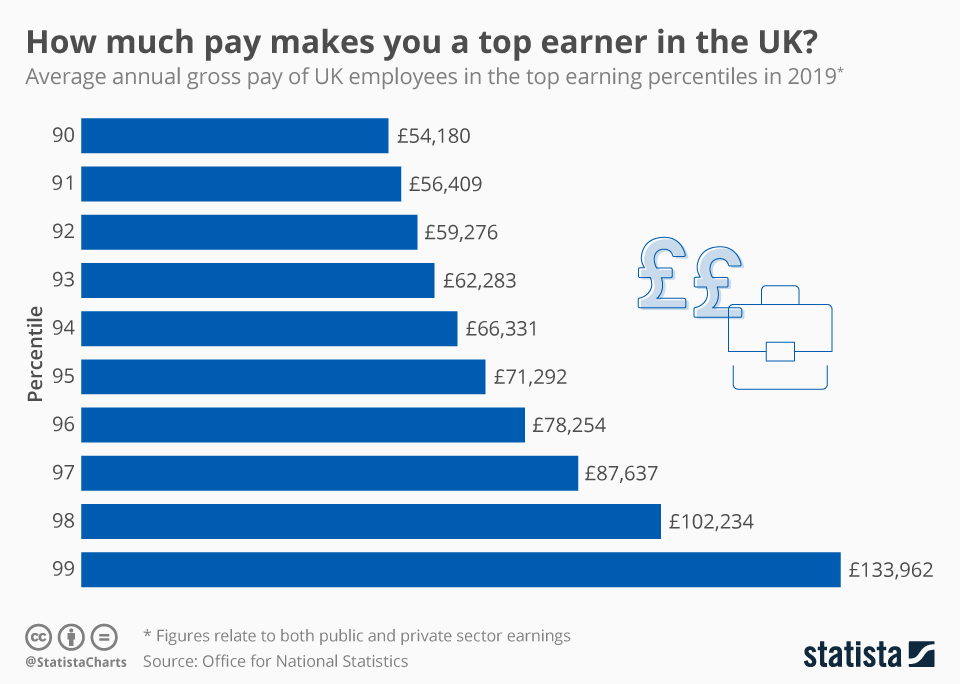

A typical parent's payment can vary by over $700 a month from state to state

June 10, 2019 — The size of your child support payment depends heavily on where you live, according to research from Custody X Change.

Download high resolution map: PNG | JPG Use image with attribution

A parent can pay three times as much as one who lives in a state just six hours away, despite their circumstances being otherwise equal. When a Virginia parent would pay $400 a month in child support, a Massachusetts parent in the same situation would pay nearly $1,200, per state guidelines.

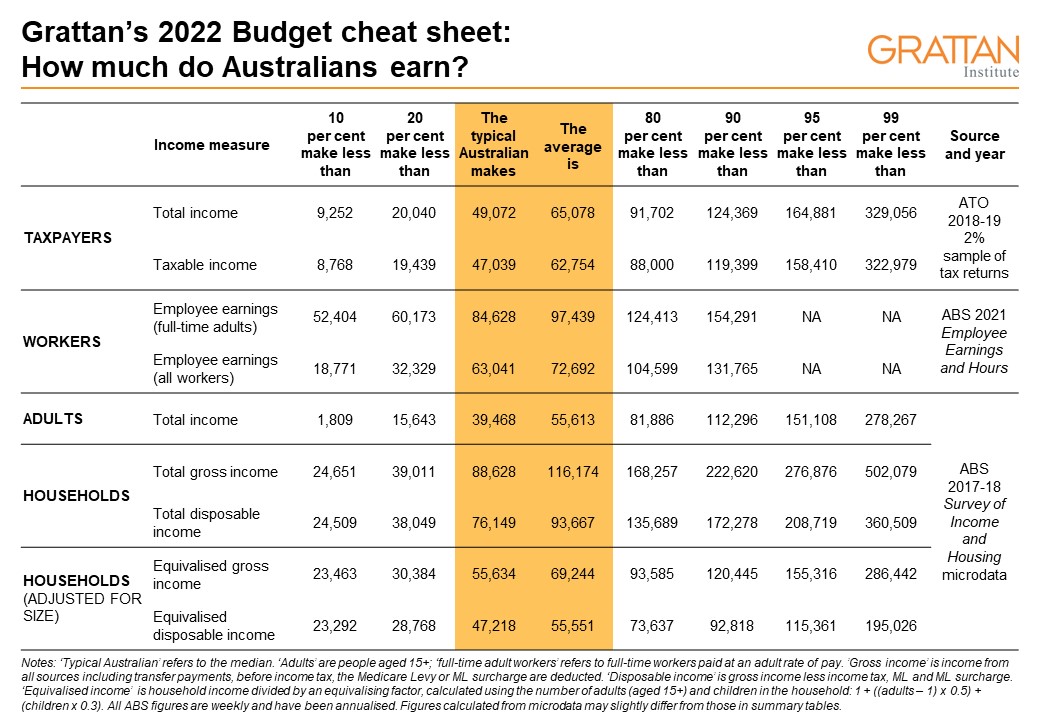

The study looks at a hypothetical family with two children, ages 7 and 10. The mother has 65 percent of parenting time (the most common timeshare awarded to a U.S. mother, according to previous research). She makes $45,000 a year, while the father makes $55,000 (based on data about typical parental incomes from Pew Research Center).

Researchers entered this information into each state's child support formula to discover that the father's payment could range from $402 a month to $1,187 a month. (See the full table of state rankings at the end of this page.) Nationally, he would pay an average of $721 monthly.

These totals reflect how much a state presumes the noncustodial parent should pay (the "guideline" amount), but judges have the discretion to award different amounts based on evidence. In some cases, parents can decide together how much support will be exchanged.

The study does not utilize any data from Custody X Change users.

"Child support is complex," said Ben Coltrin, Custody X Change co-founder and president. "States don't want to set a payment too low, leaving a child's needs unmet. At the same time, they don't want to set a payment so high that the parent can't afford it. We hope this data furthers dialogue about how to determine the right support for each family."

"States don't want to set a payment too low, leaving a child's needs unmet. At the same time, they don't want to set a payment so high that the parent can't afford it. We hope this data furthers dialogue about how to determine the right support for each family."

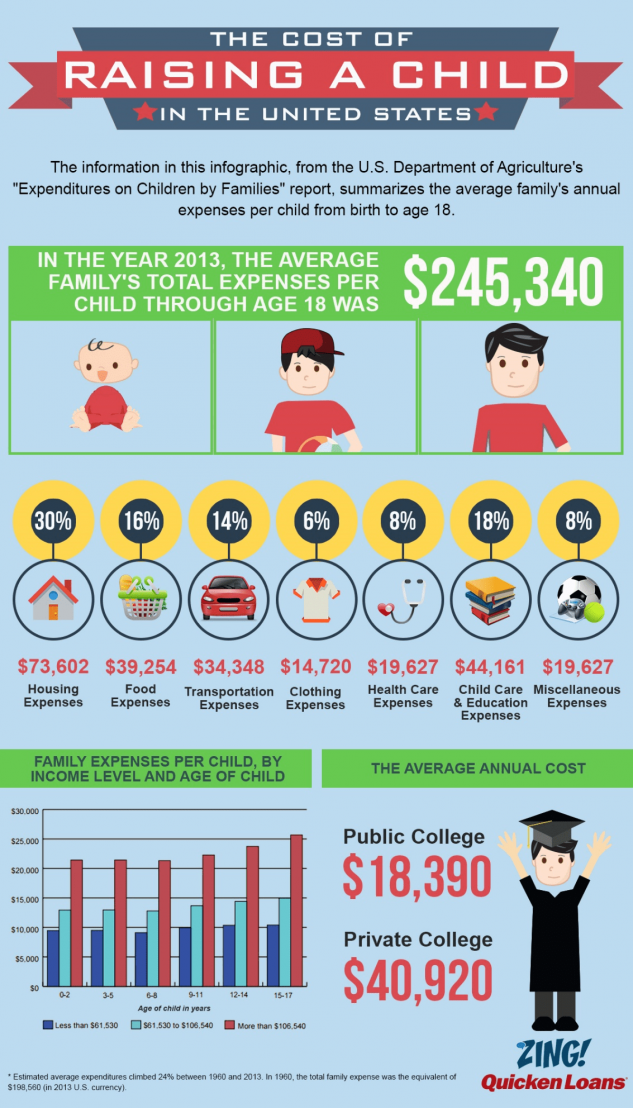

Cost of living, political leaning don't explain the variation

Perhaps surprisingly, the research revealed that child support rates don't significantly correlate with a state's cost of living.

Of the five most expensive states to live in — Hawaii, New York, California, New Jersey and Maryland — one (Hawaii) ranks among the 10 highest child support calculations in the study, but two (New Jersey and Maryland) rank among the lowest 10 calculations.

Meanwhile, Massachusetts, which awards the highest support payment for this family, has the seventh highest cost of living in the nation. Virginia has a comparable cost of living (12th highest in the U.S.), yet awards the least support.

Download high resolution graph: PNG | JPG Use image with attribution

Political leaning also fails to provide an explanation for the variation in support. Average awards from Republican and Democratic states for this mother are just $13 apart ($702 and $715 a month, respectively).

Average awards from Republican and Democratic states for this mother are just $13 apart ($702 and $715 a month, respectively).

Four states only consider one parent's income, award $100 more monthly

Only four states don't consider the mother's income when calculating this family's child support:

- Arkansas

- Mississippi

- North Dakota

- Texas

In these states, the family's child support payment is $100 higher than in the rest of the country, on average. Whereas these states award the family an average of $813 monthly, the other 46 states award $713 on average.

Historically, many states calculated child support by taking a percentage of money earned by the parent who spent less time with the child. As the number of working mothers has ballooned in recent decades, most states have moved to formulas that factor in both parents' incomes. Arkansas will become the latest state to make this move, by March.

For the family in the study, formulas that look only at the father's earnings produce high totals. This is because they don't consider that the hypothetical parents have similar income levels.

This is because they don't consider that the hypothetical parents have similar income levels.

If the mother's income were to drop, the presumed awards in the same four states could be among the lowest in the country; they would remain static while the awards in other states would increase.

Rocky Mountain region awards the lowest payment, New England the highest

The Rocky Mountain region awards this mother the least child support: $556 a month, on average.

New England awards the most; at $928 a month, its average is 67 percent higher than that of the Rocky Mountain region. Vermont is a New England outlier, with the 12th lowest payment in the nation ($519), but it's not enough to knock New England out of the top spot.

Download high resolution map: PNG | JPG Use image with attribution

For a full breakdown of calculations by region, visit the appendix.

Different approaches to setting guidelines may be behind variation

The federal government requires every state to develop child support guidelines, which help courts determine the appropriate award in any case. The government introduced this requirement in the 1980s after studies showed major inconsistencies in how judges were awarding support, both within and among states.

The government introduced this requirement in the 1980s after studies showed major inconsistencies in how judges were awarding support, both within and among states.

States choose how to set their guidelines. A few have worked with researchers to measure the cost of raising a child there. Others have used existing research (which may employ data from another state or at the national level), or they haven't referred specifically to any evidence. The difference in approaches likely contributes to the difference in awards across the country.

"We hope this data furthers dialogue about how to determine the right support for each family."

-Ben Coltrin, Custody X Change President

Even among states that point to research, the studies they consult vary in methodology and age. The most common source is the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics. Since it doesn't offer data at the state level, some states have adjusted its data to try to match their cost of living. Other state-specific modifications to data and models further add to the lack of uniformity in awards across the U.S.

Other state-specific modifications to data and models further add to the lack of uniformity in awards across the U.S.

By law, each state must convene a panel to review its guidelines every four years.

Child support debate continues to evolve

Most states have overhauled their child support formulas significantly as American families have changed. Guidelines once assumed mothers worked less than fathers, if at all. In addition, they were often based on the presumption that parents had at one point been married to each other.

Today, much of the debate around child support concentrates on finding an amount that provides for the child without leaving the paying parent destitute. Some states have found that lowering payments or forgiving outstanding payments can increase overall child support collection numbers, as the payers are better able to afford their obligation.

State by state rankings

| Rank | State | Award |

| # 1 | Massachusetts | $1,187 |

| # 2 | Nevada | $1,146 |

| # 3 | New Hampshire | $1,035 |

| # 4 | Rhode Island | $1,014 |

| # 5 | Hawaii | $1,014 |

| # 6 | Connecticut | $987 |

| # 7 | Nebraska | $975 |

| # 8 | Kansas | $955 |

| # 9 | North Dakota | $953 |

| # 10 | Washington | $901 |

| # 11 | New York | $895 |

| # 12 | South Dakota | $890 |

| # 13 | Illinois | $885 |

| # 14 | Pennsylvania | $875 |

| # 15 | Louisiana | $873 |

| # 16 | Georgia | $868 |

| # 17 | North Carolina | $840 |

| Rank | State | Award |

| # 18 | Arkansas | $824 |

| # 19 | Maine | $823 |

| # 20 | Ohio | $774 |

| # 21 | Kentucky | $767 |

| # 22 | South Carolina | $760 |

| # 23 | Texas | $759 |

| # 24 | Alabama | $758 |

| # 25 | New Mexico | $735 |

| # 26 | Iowa | $733 |

| # 27 | Utah | $729 |

| # 28 | Minnesota | $716 |

| # 29 | Mississippi | $715 |

| # 30 | Michigan | $666 |

| # 31 | Wisconsin | $623 |

| # 32 | Montana | $612 |

| # 33 | California | $566 |

| # 34 | Missouri | $556 |

| Rank | State | Award |

| # 35 | Florida | $544 |

| # 36 | Arizona | $534 |

| # 37 | Oklahoma | $532 |

| # 38 | Alaska | $527 |

| # 39 | Vermont | $519 |

| # 40 | Tennessee | $503 |

| # 41 | Colorado | $494 |

| # 42 | Wyoming | $484 |

| # 43 | Maryland | $480 |

| # 44 | Delaware | $463 |

| # 45 | Idaho | $463 |

| # 46 | Indiana | $425 |

| # 47 | New Jersey | $424 |

| # 48 | Oregon | $421 |

| # 49 | West Virginia | $403 |

| # 50 | Virginia | $402 |

*States that round to the same whole number are ranked based on their decimals.

For more information on the study, see the appendix.

Amount of maintenance per child \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Amount of maintenance for one child

A selection of the most important documents upon request The amount of maintenance per child (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more ...

Judicial practice : the amount of alimony per child

register and get test access to the survivor system ConsultantPlus free for 2 days

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 120 "Termination of maintenance obligations" of the RF IC

(R. B. Kasenov) The court satisfied the plaintiff's claims to invalidate the decision of the bailiff on the calculation of alimony arrears. As the court pointed out, by virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority or in the event that minor children acquire full legal capacity before they reach the age of majority. In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law.

B. Kasenov) The court satisfied the plaintiff's claims to invalidate the decision of the bailiff on the calculation of alimony arrears. As the court pointed out, by virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority or in the event that minor children acquire full legal capacity before they reach the age of majority. In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law.

Register and get the trial access to the ConsultantPlus system free for 2 days

Open the document in your ConsultantPlus system:

Selection of court decisions for 2019: Article 120 "Continuation of alimony obligations" of the IC of the Russian Federation

(R. B. Kasenov) By virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority. At the same time, the court order of the justice of the peace did not contain information that the collection of alimony in the amount of 1/3 of the share stops when one of the children reaches the age of majority and then the alimony is subject to collection in the amount of 1/4 of the share. To reduce the amount of alimony established by the court, the bailiff-executor is not entitled to reduce. The reference to the fact that the bailiff had to apply to the court for clarification of the court order, but did not do this, does not indicate the illegality of his actions, since this appeal is a right, and not an obligation, of the bailiff. On the contrary, the debtor, being an interested party of enforcement proceedings, being active, was not deprived of the opportunity to resolve this issue. In addition, the court order contained no ambiguities and did not require clarification.

B. Kasenov) By virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority. At the same time, the court order of the justice of the peace did not contain information that the collection of alimony in the amount of 1/3 of the share stops when one of the children reaches the age of majority and then the alimony is subject to collection in the amount of 1/4 of the share. To reduce the amount of alimony established by the court, the bailiff-executor is not entitled to reduce. The reference to the fact that the bailiff had to apply to the court for clarification of the court order, but did not do this, does not indicate the illegality of his actions, since this appeal is a right, and not an obligation, of the bailiff. On the contrary, the debtor, being an interested party of enforcement proceedings, being active, was not deprived of the opportunity to resolve this issue. In addition, the court order contained no ambiguities and did not require clarification. Thus, the court dismissed the claim of the administrative plaintiff to declare illegal the decision on the calculation of the alimony arrears, the obligation to determine the alimony arrears.

Thus, the court dismissed the claim of the administrative plaintiff to declare illegal the decision on the calculation of the alimony arrears, the obligation to determine the alimony arrears.

Articles, comments, answers to questions : the amount of alimony per child

Register and receive trial access to the consultantPlus system free 2 days

Open the Consultant Pluss:

Situation: Whoever Do I have to pay child support and how much?

("Electronic journal "Azbuka Prava", 2022) If an agreement on the payment of alimony for minor children has not been concluded, they can be collected in court. The amount of alimony that must be paid monthly will be determined by the court. As a general rule, the amount of alimony is: for one for a child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents. the court may increase or decrease the amount of these shares.

Regulations : Amount of maintenance per child

How is the amount of maintenance determined? | Juristaitab

From now on, the subsistence minimum is separated from the so-called minimum wage, which until now increased the subsistence minimum every year. HUGO lawyer Vahur Kõlvart explains the nature of the new system below.

In the future, minimum child support will have five different components.

A base amount of at least 200 euros per child, indexed annually to the previous year's consumer price index (which will be officially published by Statistics Estonia on 1 April). After indexation, the base amount resulting from indexation in the previous year is considered the base amount for the next year.

3% of the average monthly gross salary in the country for the previous year is added (which is also officially published by Statistics Estonia on 1 April).

Number of children supported in one family - in this case, the amount of maintenance for subsequent children is reduced by 15 percent compared to the amount of maintenance for the first child. The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years.

The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years.

Family allowances - as compared to the past, the law clearly states that the parent is not obliged to support the child to the extent that the needs of the child can be met by the child allowance and the allowance for a large family. If the benefit claimant receives these benefits, half of the benefit is deducted from the allowance for each child. However, if the recipient of the benefit is a payer, this amount is added to the alimony.

Child living together - if the child lives with the parent who pays support for an average of at least 7 days per month per year, the amount of support is reduced in proportion to the time spent with the obliging parent. Therefore, if the child lives equally with both parents, maintenance can only be collected if this is due to the greater needs of the child, a significant difference in the income of the parents, or an uneven distribution of expenses related to the child between the parents.

Example:

The child lives with the mother, stays with the father for an average of 10 days per month, and a child allowance of 60 euros is paid into the child's mother's bank account. The minimum allowance per child is 70.43 euros.

Base amount: 200 euros 3% of the average salary for the previous year: the average gross salary in 2020 was 1448 euros per month, of which 3% is 43.44 euros.

Family allowances: half of the child allowance is deducted from the parent's maintenance obligations (60/2=30), so the maintenance amount is 213.44 euros (243.44-30).

Co-habitation: If the child lives with the supporting parent between 7 and 15 days per month, the amount of support may be further reduced according to the number of those days. The basis is how many percent of the time the child spends with the parent responsible for child support. 15 days count as half a month. In this example, the child spends 10 days or 66.7% of the required time (10/15) with the parent responsible for child support.